Exhibit 99.2

For Immediate Release

February 10, 2016

The Carlyle Group Announces Fourth Quarter and Full Year 2015 Financial Results

Carlyle Announces a $200 Million Unit Repurchase Program

| |

| • | $923 million of Distributable Earnings on a pre-tax basis for 2015 or $2.73 per common unit on a post-tax basis; $145 million of Distributable Earnings in Q4 2015 or $0.38 per common unit on a post-tax basis |

| |

| • | Declared a quarterly distribution of $0.29 per common unit for Q4 2015; Aggregate distribution of $2.07 per common unit for 2015 |

| |

| • | $2.7 billion in net new capital raised in Q4 2015 and $16.4 billion in 2015; $22.5 billion of gross new capital raised during 2015, excluding redemptions |

| |

| • | $4.0 billion in realized proceeds in Q4 2015 and $18.1 billion realized in 2015 |

| |

| • | $4.0 billion in equity invested in Q4 2015 and $8.8 billion invested in 2015 |

| |

| • | Economic Net Income of $73 million and $397 million on a pre-tax basis, or $0.24 and $1.15 per Adjusted Unit on a post-tax basis, for Q4 2015 and 2015, respectively |

| |

| • | U.S. GAAP net income (loss) attributable to The Carlyle Group L.P. of $(3) million and $(17) million, or $(0.04) and $(0.28) per common unit on a diluted basis, for Q4 2015 and 2015, respectively |

Washington, DC – Global alternative asset manager The Carlyle Group L.P. (NASDAQ: CG) today reported its unaudited results for the fourth quarter and full year ended December 31, 2015.

Carlyle Co-CEO David M. Rubenstein said, “Carlyle had a strong 2015 amid challenging markets, delivering a full-year distribution of $2.07 to Carlyle common unitholders. Despite our history of strong results and significant future growth opportunities, the equity market currently ascribes little value to our diversified investment platform. We are announcing a $200 million repurchase program as we see great value in Carlyle units.”

Carlyle Co-CEO William E. Conway, Jr. said, “Recent market volatility has created a challenging but opportune investment environment for many of our fund teams. Our current pipeline is strong and we believe that good deals can be financed in the current market. As of early February, we already have signed contracts for approximately $4 billion of new investments and $4 billion of realized proceeds, which we expect to complete during the first half of the year.”

U.S. GAAP results for Q4 2015 and 2015 included income (loss) before provision for income taxes of $(151) million and $409 million, and net income (loss) attributable to the common unitholders through The Carlyle Group L.P. of $(3) million and $(17) million, or net income (loss) per common unit of $(0.04) and $(0.28), on a diluted basis. Total balance sheet assets were $32 billion as of December 31, 2015.

Announcement of a $200 Million Unit Repurchase Program

The Board of Directors of Carlyle's general partner, Carlyle Group Management L.L.C., has authorized the repurchase of up to $200 million of common units and/or Carlyle Holdings units. Under this unit repurchase program, units may be repurchased from time to time in open market transactions, in privately negotiated transactions or otherwise.Carlyle expects that the majority of repurchases under this program will be done via open market transactions. No units will be repurchased from Carlyle’s executive officers under this program. The timing and actual number of common units and/or Carlyle Holdings units repurchased will depend on a variety of factors, including legal requirements, price and economic and market conditions. This unit repurchase program may be suspended or discontinued at any time and does not have a specified expiration date.

Reserve for Litigation and Contingencies

Included in our Q4 2015 general, administrative and other expenses for both our U.S. GAAP financial results and Economic Net Income is a $50 million reserve for ongoing litigation and contingencies that is excluded from Fee Related Earnings and Distributable Earnings, as the timing of any payment remains uncertain, and therefore, is not reducing our Q4 2015 distribution per unit. This reserve has been allocated to our business segments in accordance with our allocation policies for overhead.

|

|

| |

| Fourth Quarter and Full Year Distribution |

The Board of Directors of Carlyle's general partner has declared a quarterly distribution of $0.29 per common unit to holders of record at the close of business on February 23, 2016, payable on March 2, 2016. For full year 2015, the Board of Directors declared $2.07 in aggregate distributions to common unitholders.

Distribution Policy

It is Carlyle’s intention to cause Carlyle Holdings to make quarterly distributions to its partners, including The Carlyle Group L.P.’s wholly owned subsidiaries, that will enable The Carlyle Group L.P. to pay a quarterly distribution of approximately 75% of Distributable Earnings per common unit, net of taxes and amounts payable under the tax receivable agreement, for the quarter. Carlyle’s general partner may adjust the distribution for amounts determined to be necessary or appropriate to provide for the conduct of its business, to make appropriate investments in its business and its funds or to comply with applicable law or any of its financing agreements, or to provide for future cash requirements such as tax-related payments, clawback obligations and distributions to unitholders for any ensuing quarter. The amount to be distributed could also be adjusted upward in any one quarter. The declaration and payment of any distributions is at the sole discretion of Carlyle’s general partner, which may change or eliminate the distribution policy at any time.

Carlyle evaluates the underlying performance of its business on four key metrics: funds raised, equity invested, carry fund returns and realized proceeds for fund investors. The table below highlights the results of these metrics for Q4 2015 and the full years of 2015 and 2014.

|

| | | | | | | | | | |

| Funds Raised | | Equity Invested |

| Q4 | $2.7 billion | | Q4 | $4.0 billion |

| | 2015: | $16.4 bn | 2014: | $24.3 bn | | | 2015: | $8.8 bn | 2014: | $9.8 bn |

| | | | | | | | | | | |

| Realized Proceeds | | Carry Fund Returns |

| Q4 | $4.0 billion | | Q4 | 2% |

| | 2015: | $18.1 bn | 2014: | $19.7 bn | | | 2015: | 7% | 2014: | 15% |

Note: Equity Invested and Realized Proceeds reflect carry funds only. Funds raised are shown net of any redemption activity.

During Q4 2015, Carlyle generated realized proceeds of $4.0 billion from 140 investments across 40 carry funds. Carlyle invested $4.0 billion of equity in 138 new or follow-on investments across 29 carry funds in Q4 2015. For 2015, Carlyle realized proceeds of $18.1 billion and invested $8.8 billion.

|

| | | | | | | | | | | | | |

| | | | Realized Proceeds | | Equity Invested |

| | Segment (Carry Funds Only) | | # of Investments | | # of Funds | | $ millions | | # of Investments | | # of Funds | | $ millions |

| Q4 | Corporate Private Equity | | 43 | | 19 | | $2,310 | | 26 | | 15 | | $2,743 |

| Global Market Strategies | | 24 | | 7 | | $82 | | 4 | | 3 | | $300 |

| Real Assets | | 75 | | 14 | | $1,635 | | 109 | | 11 | | $1,006 |

| Carlyle | | 140 | | 40 | | $4,027 | | 138 | | 29 | | $4,050 |

| 2015 | Corporate Private Equity | | 90 | | 26 | | $12,815 | | 58 | | 21 | | $5,191 |

| Global Market Strategies | | 43 | | 8 | | $502 | | 16 | | 5 | | $556 |

| Real Assets | | 158 | | 17 | | $4,789 | | 206 | | 18 | | $3,068 |

| Carlyle | | 287 | | 51 | | $18,107 | | 279 | | 44 | | $8,815 |

Note: The columns may not sum as some investments cross segment lines, but are only counted one time for Carlyle results.

|

|

| Carlyle All Segment Results |

| |

| • | Distributable Earnings (DE): $145 million for Q4 2015 and $923 million for 2015 |

| |

| ◦ | Distributable Earnings were $923 million for 2015, 5% lower than $973 million for 2014. Excluding a non-recurring French tax judgment in the first quarter, DE were $1.0 billion, up slightly from 2014. On a post-tax basis, Carlyle generated DE of $0.38 and $2.73 per common unit for Q4 2015 and 2015, respectively. |

| |

| ◦ | Fee-Related Earnings (FRE) were $43 million for Q4 2015, compared to $67 million for Q4 2014 primarily due to lower management fees, partially offset by lower general and administrative expense, excluding the impact of the reserve for litigation and contingencies. FRE of $199 million in 2015 was 19% lower than 2014 due to lower management and transaction fees, partially offset by higher catch-up management fees. We expect catch-up management fees to be lower in 2016 as compared to $73 million in 2015 as we expect to raise less new capital from funds in the market from prior years. |

| |

| ◦ | Realized Net Performance Fees were $100 million for Q4 2015, compared to $264 million for Q4 2014. For Q4 2015, realized net performance fees resulted primarily from exits in Booz Allen, CoreSite, Healthscope, Kbro Limited, and multiple U.S. Real Estate investments. Realized net performance fees were $789 million in 2015, 8% higher than 2014. |

| |

| ◦ | Realized Investment Income (Loss) was $2 million in Q4 2015 and $(65) million in 2015, compared to a realized investment loss of $(6) million for 2014. The loss in 2015 was driven primarily by a non recurring $80 million French tax judgment in Q1 2015. |

| |

| • | Economic Net Income (ENI): $73 million for Q4 2015 and $397 million for 2015 |

| |

| ◦ | Q4 2015 ENI was positively impacted by higher carry fund valuations in Corporate Private Equity and Real Estate, partially offset by lower valuations in Global Market Strategies, resulting in net performance fees of $109 million. For 2015, ENI of $397 million was 59% lower than 2014, primarily as a result of lower carry fund appreciation of 7% in 2015 compared to 15% in 2014. |

| |

| ◦ | Carlyle generated ENI per Adjusted Unit of $0.24 on a post-tax basis for Q4 2015. Post-tax ENI per Adjusted Unit was impacted by a tax benefit relating to the reserve for litigation and contingencies. |

|

| | | | | | | | | | | | | | | | | | | |

| The Carlyle Group L.P. - All Segments | | Quarter | | Annual | | % Change |

| $ in millions, except per unit data and where noted | | | | | | | | | | | | | | | | | | | |

| | Q4 2014 | | Q1 2015 | | Q2 2015 | | Q3 2015 | | Q4 2015 | | 2014 | 2015 | | QoQ | | YoY | | Annual |

| | | | | | | | | | | | | | | | | | | | |

| Revenues | | 649 | | 885 | | 663 | | 94 | | 491 | | 3,022 | 2,132 | | 425% | | (24)% | | (29)% |

| | | | | | | | | | | | | | | | | | | | |

| Expenses | | 468 | | 612 | | 484 | | 222 | | 418 | | 2,060 | 1,736 | | 88% | | (11)% | | (16)% |

| | | | | | | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | 181 | | 273 | | 180 | | (128) | | 73 | | 962 | 397 | | 157% | | (60)% | | (59)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Related Earnings | | 67 | | 51 | | 47 | | 57 | | 43 | | 247 | 199 | | (25)% | | (36)% | | (19)% |

| | | | | | | | | | | | | | | | | | | | |

| Net Performance Fees | | 138 | | 282 | | 149 | | (149) | | 109 | | 807 | 392 | | 174% | | (21)% | | (51)% |

| | | | | | | | | | | | | | | | | | | | |

| Realized Net Performance Fees | | 264 | | 178 | | 333 | | 177 | | 100 | | 733 | 789 | | (43)% | | (62)% | | 8% |

| | | | | | | | | | | | | | | | | | | | |

| Distributable Earnings | | 311 | | 148 | | 386 | | 244 | | 145 | | 973 | 923 | | (40)% | | (53)% | | (5)% |

| | | | | | | | | | | | | | | | | | | | |

| Distributable Earnings per common unit (after taxes) | | $0.91 | | $0.43 | | $1.18 | | $0.74 | | $0.38 | | $2.78 | $2.73 | | | | | | |

| Distribution per common unit | | $1.61 | | $0.33 | | $0.89 | | $0.56 | | $0.29 | | $2.09 | $2.07 | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Assets Under Management ($ in billions) | | 194.5 | | 192.7 | | 192.8 | | 187.7 | | 182.6 | | | | | (3)% | | (6)% | | (6)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Earning Assets Under Management ($ in billions) | | 135.6 | | 129.4 | | 130.0 | | 128.1 | | 131.0 | | | | | 2% | | (3)% | | (3)% |

| | | | | | | | | | | | | | | | | | | | |

Note: Totals may not sum due to rounding.

|

|

| Carry Fund Performance and Net Accrued Performance Fees |

Carlyle's carry fund portfolio valuation increased 2% during Q4 2015. In 2015, Carlyle's carry fund portfolio valuation increased 7%, compared to an increase of 15% in 2014. The public positions in our carry funds appreciated 7% during Q4 2015 while the private portfolio in our carry funds remained relatively flat.

For 2015, Buyout funds appreciated 13% and Real Estate funds appreciated 27%. Our Legacy Energy funds depreciated 26% in 2015 primarily owing to a decline in global oil and gas prices. Despite continued depreciation in Legacy Energy fund returns, lower fund valuations had limited impact on Q4 2015 ENI and performance fees as most Legacy Energy assets under management are either in full clawback or near full clawback. Within our Legacy Energy funds and fund coinvestments, our incremental potential future ENI loss is approximately $(9) million.

As of the end of Q4 2015, net accrued performance fees of $1.3 billion were flat from $1.3 billion at the end of Q3 2015, but lower compared to $1.8 billion at the end of Q4 2014. The decline compared to Q4 2014 is primarily due to strong exit activity during 2015 in Corporate Private Equity and Real Estate funds.

|

| | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | 2014 | | 2015 | | Net Accrued Performance Fees |

Fund Valuations ($ in millions) | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | | Q4 2015 |

Overall Carry Fund Appreciation/ (Depreciation) (1,2) | | 6% | | 6% | | 5% | | 3% | | 1% | | 6% | | 3% | | (4)% | | 2% | | |

| | | | | | | | | | | | | | | | | | | | | |

Corporate Private Equity (3) | | 9% | | 8% | | 5% | | 3% | | 7% | | 8% | | 5% | | (3)% | | 3% | | $1,145 |

| Buyout | | 9% | | 8% | | 5% | | 3% | | 7% | | 9% | | 4% | | (3)% | | 3% | | $1,070 |

| Growth Capital | | 20% | | 0% | | 13% | | 8% | | 1% | | 3% | | 11% | | 0% | | 0% | | $75 |

| | | | | | | | | | | | | | | | | | | | | |

Real Assets (3) | | (1)% | | 2% | | 3% | | 2% | | (8)% | | 2% | | 0% | | (5)% | | 0% | | $90 |

| Real Estate | | 0% | | 2% | | 4% | | 4% | | 8% | | 11% | | 4% | | 6% | | 6% | | $158 |

Natural Resources (4) | | | | | | | | 3% | | (8)% | | 1% | | 0% | | (4)% | | 0% | | $9 |

| Legacy Energy | | (3)% | | 1% | | 2% | | 0% | | (17)% | | (3)% | | (3)% | | (17)% | | (7)% | | $(76) |

| | | | | | | | | | | | | | | | | | | | | |

Global Market Strategies Carry Funds (3) | | 10% | | 3% | | 12% | | 6% | | (2)% | | 3% | | 2% | | (9)% | | (4)% | | $35 |

| | | | | | | | | | | | | | | | | | | | | |

Non-Carry Fund / Other (5) | | | | | | | | | | | | | | | | | | | | $45 |

| | | | | | | | | | | | | | | | | | | | | |

| Net Accrued Performance Fees | | | | | | | | | | | | | | | | | | | | $1,315 |

(1) Appreciation/(Depreciation) represents unrealized gain/(loss) for the period on a total return basis before fees and expenses. The percentage of return is calculated as: ending remaining investment fair market value plus net investment outflow (sales proceeds minus net purchases) minus beginning remaining investment fair market value divided by beginning remaining investment fair market value. Fund only, does not include co-investment.

(2) Carlyle’s “carry funds” refer to (i) those investment funds that we advise, including the buyout funds, growth capital funds, real estate funds, infrastructure funds, certain energy funds and opportunistic credit, distressed debt and mezzanine funds (but excluding our structured credit/other structured product funds, hedge funds, business development companies, mutual fund, and fund of funds vehicles), where we receive a special residual allocation of income, which we refer to as a carried interest, in the event that specified investment returns are achieved by the fund and (ii) those investment funds advised by NGP from which we are entitled to receive a carried interest.

(3) We generally earn performance fees (or carried interest) from our carry funds representing a 20% allocation of profits generated on third-party capital after returning the invested capital, the allocation of preferred returns of generally 8% or 9% and return of certain fund costs. Our net interest in the performance fees after allocations to our investment professionals or other parties varies based on each fund. For our Corporate Private Equity, Global Market Strategies, Real Estate and Natural Resources carry funds (excluding NGP) our net interest in performance fees is generally 55%. Our net interest in the performance fees from the NGP carry funds ranges from 40% to 47.5%. Our net interest in the performance fees from our Legacy Energy carry funds generally ranges from 16% to 40%, with a weighted average of 20% based on remaining fair value invested.

(4) Natural Resources is comprised of NGP, infrastructure, power, and international energy funds.

(5) Includes structured credit/other structured product funds, hedge funds, business development companies, mutual fund, and fund of funds vehicles.

|

|

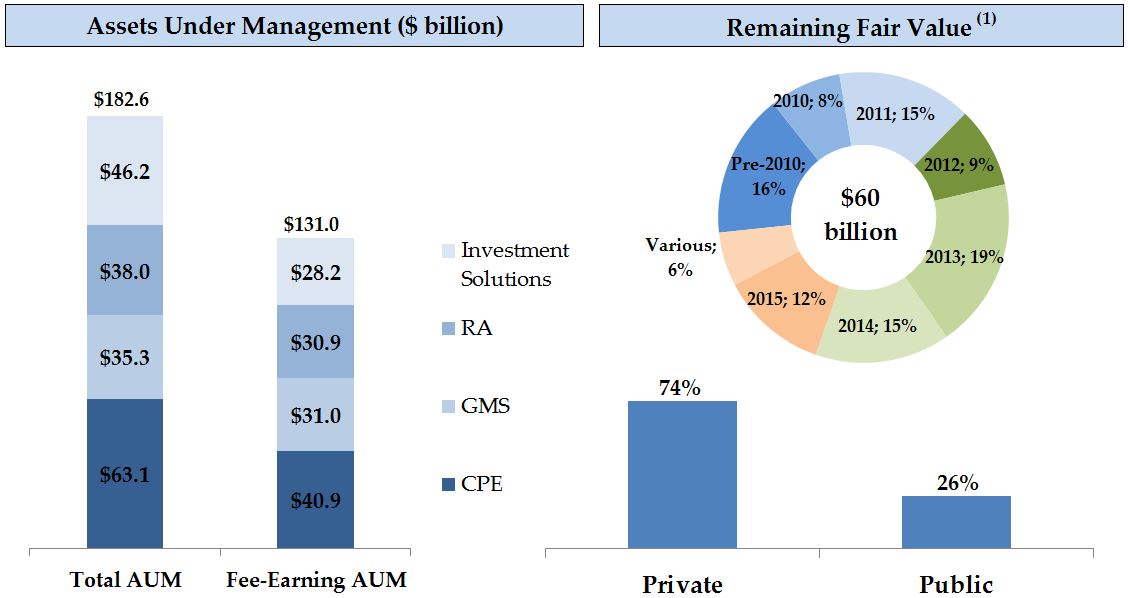

| Assets Under Management and Remaining Fair Value of Capital |

| |

| • | Total Assets Under Management: $182.6 billion as of Q4 2015 (-6% in 2015) |

| |

| ◦ | Major drivers of change versus Q3 2015: New capital commitments, net of expired capital (+$2.1 billion) and market appreciation (+$1.5 billion), offset by distributions (-$6.9 billion), the impact of foreign exchange (-$1.4 billion), and net redemptions (-$1.1 billion). |

| |

| ◦ | Total Dry Powder of $58.0 billion as of Q4 2015 was comprised of $24.2 billion in Corporate Private Equity, $3.8 billion in Global Market Strategies, $15.9 billion in Real Assets and $14.2 billion in Investment Solutions. |

| |

| • | Fee-Earning Assets Under Management: $131.0 billion as of Q4 2015 (-3% in 2015) |

| |

| ◦ | During Q4 2015, Fee-Earning AUM was positively impacted by approximately $8.0 billion at the end of the quarter in connection with the activation of management fees on Carlyle's second equity opportunities fund, second energy mezzanine fund, and the most recent vintage energy fund advised by NGP. |

| |

| ◦ | As of the end of Q4 2015, we had approximately $4.5 billion of capital for which we have not yet commenced charging management fees. Management fees on this capital largely will commence upon its deployment. Our hedge fund partnerships had outstanding redemption requests for $3.1 billion as of the beginning of Q1 2016. |

| |

| ◦ | Major drivers of change versus Q3 2015: Inflows, including fee-paying commitments (+$11.6 billion) and increases in our CLO collateral balances (+$0.6 billion), offset by distributions and outflows (-$6.9 billion), net redemptions (-$1.1 billion), and foreign exchange loss (-$0.9 billion). In 2015, the impact of foreign exchange on our non-U.S. dollar denominated funds has negatively impacted Fee-Earning AUM by $3.8 billion, or more than 80% of the total year-over-year change. |

| |

| • | Remaining Fair Value of Capital (carry funds only) as of Q4 2015: $59.7 billion |

| |

| ◦ | Current Multiple of Invested Capital (MOIC) of remaining fair value of capital: 1.2x. |

| |

| ◦ | Total Fair Value derived from investments made in 2010 or earlier: 24%. |

| |

| ◦ | AUM in-carry ratio as of the end of Q4 2015: 43%. The decline versus the Q3 2015 ratio of 50% is attributable to several factors, including investments in recent vintage funds that are not in a carry position and distributions from funds that are in a carry position. |

Note: Data as of December 31, 2015.

(1) Fair value of remaining carry fund capital in the ground, by vintage. Totals may not sum due to rounding.

|

|

| Non-GAAP Operating Results |

Carlyle’s non-GAAP results for Q4 2015 are provided in the table below:

|

| | | |

| Carlyle Group Summary | |

| $ in millions, except unit and per unit amounts | |

| | |

| Economic Net Income | Q4 2015 |

|

| |

| Economic Net Income (pre-tax) | $ | 72.7 |

|

Add: Benefit for income taxes (1) | (4.8 | ) |

| | |

| Economic Net Income, After Taxes | $ | 77.5 |

|

| | |

Adjusted Units (in millions) (2) | 326.1 |

|

| | |

| Economic Net Income, After Taxes per Adjusted Unit | $ | 0.24 |

|

| | |

| Distributable Earnings | |

| |

| Distributable Earnings | $ | 145.1 |

|

Less: Estimated foreign, state, and local taxes (3) | 4.6 |

|

| | |

| Distributable Earnings, After Taxes | $ | 140.5 |

|

| | |

| Allocating Distributable Earnings for only public unitholders of The Carlyle Group L.P. | |

| | |

| Distributable Earnings to The Carlyle Group L.P. | $ | 35.2 |

|

Less: Estimated current corporate income taxes (4) | 4.1 |

|

| | |

| Distributable Earnings to The Carlyle Group L.P. net of corporate income taxes | $ | 31.1 |

|

| | |

Units in public float (in millions)(5) | 81.3 |

|

| Distributable Earnings, net, per The Carlyle Group L.P. common unit outstanding | $ | 0.38 |

|

| |

(1) Represents the implied provision (benefit) for income taxes that was calculated using a similar methodology as that used in calculating the tax provision for The Carlyle Group L.P., without any reduction for non-controlling interests.

(2) For information regarding our calculation of Adjusted Units, please see page 31.

(3) Represents the implied provision for current income taxes that was calculated using a similar methodology as that used in calculating the current tax provision for The Carlyle Group L.P., without any reduction for non-controlling interests.

(4) Represents current corporate income taxes payable upon Distributable Earnings allocated to Carlyle Holdings I GP Inc. and estimated current period change in Tax Receivable Agreement payments owed.

(5) Includes 932,106 common units that we estimate will be issued in January/February 2016 in connection with the vesting of deferred restricted common units and an exchange of Carlyle Holdings partnership units. These newly issued units are included in this calculation because they will participate in the unitholder distribution that will be paid in March 2016.

|

|

| Corporate Private Equity (CPE) |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Funds Raised | | Equity Invested | | Realized Proceeds | | Carry Fund Returns |

| Q4 | $1.6 billion | | Q4 | $2.7 billion | | Q4 | $2.3 billion | | Q4 | 3% |

| 2015: | $8.0 bn | 2014: | $7.6 bn | | 2015: | $5.2 bn | 2014: | $6.8 bn | | 2015: | $12.8 bn | 2014: | $14.3 bn | | 2015: | 13% | 2014: | 23% |

| |

| • | Distributable Earnings (DE): $81 million for Q4 2015 and $798 million for 2015, compared to $790 million in 2014. |

| |

| ◦ | Fee-Related Earnings (FRE) were $17 million for Q4 2015 and $106 million for 2015, compared to $33 million for Q4 2014 and $129 million for 2014. The decline in Q4 2015 was due to nominal catch-up management fees in Q4 2015 compared to $7 million in Q4 2014, lower portfolio advisory and transaction fees, and higher quarterly compensation. For 2015, direct and indirect cash compensation in CPE of $316 million was $9 million lower than 2014. Catch up management fees were $49 million in 2015 compared to $26 million in 2014, and are expected to decline in 2016. |

| |

| ◦ | Realized Net Performance Fees were $62 million for Q4 2015 and $669 million for 2015, compared to $223 million and $644 million for Q4 2014 and 2014, respectively. Carlyle Partners IV and V and Carlyle Asia Partners II and III generated the majority of CPE's realized net performance fees in Q4 2015. |

| |

| ◦ | Realized Investment Income was $1 million for Q4 2015 and $23 million for 2015, compared to $7 million and $18 million for Q4 2014 and 2014, respectively. |

| |

| • | Economic Net Income (ENI): $63 million for Q4 2015 and $400 million for 2015, compared to $862 million for 2014. The decline in both periods from Q4 2014 and 2014 is due to lower fund appreciation and modestly lower Fee-Related earnings. Included in ENI in Q4 2015 is a $27 million allocation of the reserve for litigation and contingencies. |

| |

| ◦ | CPE carry fund valuations increased 3% in Q4 2015 and increased 13% for 2015, compared to an increase of 7% for Q4 2014 and 23% for 2014. |

| |

| ◦ | Net Performance Fees were $87 million for Q4 2015 and $367 million for 2015, compared to $208 million for Q4 2014 and $744 million for 2014. |

| |

| • | Total Assets Under Management (AUM): $63.1 billion as of Q4 2015 (-2% in 2015). |

| |

| ◦ | Funds Raised in Q4 2015 of $1.6 billion include the final closing of our latest vintage mid-cap U.S. buyout fund as well as closes on coinvestment opportunities related to our latest vintage Europe and U.S. buyout funds. |

| |

| ◦ | Fee-Earning Assets Under Management of $40.9 billion increased 2% versus Q4 2014. Major drivers of change in 2015: inflows, including fee-paying commitments (+$6.4 billion), offset by (-$4.9 billion) in outflows, including distributions and basis step downs. Our second mid-cap U.S. buyout fund, Carlyle Equity Opportunities Fund II, activated management fees in late Q4 2015. |

|

| | | | | | | | | | | | | | | | | | | |

| Corporate Private Equity | | Quarter | | Annual | | % Change |

| $ in millions, except per unit data and where noted | | | | | | | | | | | | | | | | | | | |

| | Q4 2014 | | Q1 2015 | | Q2 2015 | | Q3 2015 | | Q4 2015 | | 2014 | 2015 | | QoQ | | YoY | | Annual |

| | | | | | | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | 236 | | 289 | | 178 | | (130) | | 63 | | 862 | 400 | | 148% | | (74)% | | (54)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Related Earnings | | 33 | | 22 | | 38 | | 29 | | 17 | | 129 | 106 | | (42)% | | (49)% | | (17)% |

| | | | | | | | | | | | | | | | | | | | |

| Net Performance Fees | | 208 | | 274 | | 147 | | (141) | | 87 | | 744 | 367 | | 162% | | (58)% | | (51)% |

| | | | | | | | | | | | | | | | | | | | |

| Realized Net Performance Fees | | 223 | | 169 | | 299 | | 138 | | 62 | | 644 | 669 | | (55)% | | (72)% | | 4% |

| | | | | | | | | | | | | | | | | | | | |

| Distributable Earnings | | 263 | | 194 | | 345 | | 178 | | 81 | | 790 | 798 | | (55)% | | (69)% | | 1% |

| | | | | | | | | | | | | | | | | | | | |

| Total Assets Under Management ($ in billions) | | 64.7 | | 64.0 | | 63.6 | | 63.1 | | 63.1 | | | | | 0% | | (2)% | | (2)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Earning Assets Under Management ($ in billions) | | 40.2 | | 39.4 | | 40.3 | | 40.7 | | 40.9 | | | | | 0% | | 2% | | 2% |

| | | | | | | | | | | | | | | | | | | | |

Note: Totals may not sum due to rounding.

|

|

| Global Market Strategies (GMS) |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Funds Raised | | Equity Invested | | Realized Proceeds | | Carry Fund Returns |

| Q4 | $0.6 billion | | Q4 | $0.3 billion | | Q4 | $0.1 billion | | Q4 | (4)% |

| 2015: | $2.9 bn | 2014: | $6.9 bn | | 2015: | $0.6 bn | 2014: | $0.6 bn | | 2015: | $0.5 bn | 2014: | $0.7 bn | | 2015: | (8)% | 2014: | 20% |

Note: Funds Raised excludes acquisitions, but includes hedge funds, mutual fund and CLOs/other structured products. Equity Invested and Realized Proceeds are for carry funds only.

| |

| • | Distributable Earnings (DE): $11 million for Q4 2015 and $39 million for 2015, compared to $91 million in 2014. The decline in 2015 compared to 2014 is largely attributable to a decline in hedge fund related management fees and expenses associated with raising our latest vintage energy mezzanine fund, partially offset by lower compensation. |

| |

| ◦ | Fee-Related Earnings (FRE) were $3 million for Q4 2015 and $12 million for 2015, compared to $18 million for Q4 2014 and $64 million for 2014. The decline in Q4 2015 relative to Q4 2014 was driven by lower management fees from our hedge fund partnerships, partially offset by lower general and administrative expenses, excluding the impact of the reserve for litigation and contingencies. |

| |

| ◦ | Realized Net Performance Fees were $8 million for Q4 2015 and $21 million for 2015, compared to $5 million for Q4 2014 and $19 million for 2014. Realized net performance fees for Q4 2015 were driven primarily by gains in our niche hedge fund strategies, with our structured credit funds, commodity funds, and Business Development Companies also contributing to our full year results. |

| |

| ◦ | Realized Investment Income (Loss) was $(1) million for Q4 2015 and $5 million for 2015, compared to $2 million for Q4 2014 and $8 million for 2014. |

| |

| • | Economic Net Income (Loss) (ENI): $(22) million for Q4 2015 and $(40) million for 2015, compared to $115 million for 2014. Included in ENI in Q4 2015 is a $9 million allocation of the reserve for litigation and contingencies. |

| |

| ◦ | GMS carry fund valuations depreciated 4% in Q4 2015 compared to 2% depreciation in Q4 2014. For 2015, GMS carry funds depreciated 8% compared to 20% appreciation in 2014. The asset-weighted hedge fund performance of our reported funds was (0.1)% in Q4 2015 and (6.5)% for 2015. |

| |

| ◦ | Net Performance Fees of $(6) million for Q4 2015 and $(14) million for 2015, compared to $1 million for Q4 2014 and $60 million for 2014. |

| |

| • | Total Assets Under Management (AUM): $35.3 billion as of Q4 2015 (-4% in 2015). |

| |

| ◦ | Fee-Earning AUM of $31.0 billion decreased 9% versus Q4 2014. Our second energy mezzanine fund, CEMOF II, activated management fees towards the end of Q4 2015, contributing $2.3 billion to Fee-Earning AUM, but had limited impact on Q4 2015 management fee revenue in Q4 2015 due to the timing of the fee activation in the quarter. |

| |

| ◦ | Total hedge fund AUM ended Q4 2015 at $8.3 billion, versus $9.3 billion at Q3 2015 and $13.4 billion at Q4 2014. Our hedge fund partnerships had outstanding redemption requests of $3.1 billion as of the beginning of Q1 2016. |

| |

| ◦ | GMS carry fund AUM ended Q4 2015 at $6.2 billion. |

| |

| ◦ | Total structured credit/other structured product fund AUM ended Q4 2015 at $19.4 billion. |

|

| | | | | | | | | | | | | | | | | | | |

| Global Market Strategies | | Quarter | | Annual | | % Change |

| $ in millions, except per unit data and where noted | | | | | | | | | | | | | | | | | | | |

| | Q4 2014 | | Q1 2015 | | Q2 2015 | | Q3 2015 (1) | | Q4 2015 | | 2014 | 2015 | | QoQ | | YoY | | Annual |

| | | | | | | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | 13 | | 10 | | 0 | | (28) | | (22) | | 115 | (40) | | 24% | | NM | | NM |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Related Earnings | | 18 | | 5 | | (2) | | 6 | | 3 | | 64 | 12 | | (46)% | | (82)% | | (81)% |

| | | | | | | | | | | | | | | | | | | | |

| Net Performance Fees | | 1 | | 13 | | 6 | | (27) | | (6) | | 60 | (14) | | 79% | | NM | | NM |

| | | | | | | | | | | | | | | | | | | | |

| Realized Net Performance Fees | | 5 | | 2 | | 5 | | 6 | | 8 | | 19 | 21 | | 28% | | 74% | | 15% |

| | | | | | | | | | | | | | | | | | | | |

| Distributable Earnings | | 24 | | 9 | | 4 | | 15 | | 11 | | 91 | 39 | | (29)% | | (54)% | | (58)% |

| | | | | | | | | | | | | | | | | | | | |

| Total Assets Under Management ($ in billions) | | 36.7 | | 36.3 | | 36.4 | | 35.5 | | 35.3 | | | | | (1)% | | (4)% | | (4)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Earning Assets Under Management ($ in billions) | | 33.9 | | 32.0 | | 31.3 | | 29.5 | | 31.0 | | | | | 5% | | (9)% | | (9)% |

| | | | | | | | | | | | | | | | | | | | |

| Funds Raised, excluding hedge funds ($ in billions) | | 1.2 | | 2.5 | | 1.8 | | 1.5 | | 1.6 | | 5.9 | 7.3 | | | | | | |

| Hedge Fund Net Inflows ($ in billions) | | (0.1) | | (2.1) | | (0.6) | | (0.7) | | (0.9) | | 1.0 | (4.3) | | | | | | |

Note: Totals may not sum due to rounding.

(1) Effective July 1, 2015, Carlyle's economic interest in Carlyle Commodity Management L.L.C. (“Carlyle Commodity Management”) (formerly, “Vermillion Asset Management”) increased from 55% to approximately 83% as a result of a restructuring of the agreements relating to the original acquisition of Carlyle Commodity Management.

|

| | | | | | | | | | | | | | | | | | | | | | |

| Funds Raised | | Equity Invested | | Realized Proceeds | | Carry Fund Returns |

| Q4 | $0.3 billion | | Q4 | $1.0 billion | | Q4 | $1.6 billion | | Q4 | 0% |

| 2015: | $3.9 bn | 2014: | $9.2 bn | | 2015: | $3.1 bn | 2014: | $2.5 bn | | 2015: | $4.8 bn | 2014: | $4.7 bn | | 2015: | (3)% | 2014: | (2)% |

Note: Funds Raised excludes acquisitions. Equity Invested and Realized Proceeds are for carry funds only.

| |

| • | Distributable Earnings (DE): $51 million for Q4 2015 and, excluding the impact of the Q1 2015 French tax judgment, $153 million for 2015, compared to $48 million for 2014. |

| |

| ◦ | Fee-Related Earnings (FRE) were $22 million for Q4 2015 and $72 million for 2015, compared to $10 million for Q4 2014 and $22 million for 2014. The increase in Q4 2015 is due to lower cash compensation and general and administrative expenses, excluding the impact of the reserve for litigation and contingencies. Catch up management fees were $24 million in 2015 compared to $8 million in 2014, and are expected to decline in 2016. |

| |

| ◦ | Realized Net Performance Fees were $28 million for Q4 2015 and $95 million for 2015, compared to $31 million for Q4 2014 and $58 million for 2014. Carlyle Realty Partners III and VI generated the majority of realized net performance fees in Q4 2015. |

| |

| ◦ | Realized Investment Income (Loss) was $1 million for Q4 2015 and, excluding the impact of the Q1 2015 French tax judgment of $80 million,was $(14) million for 2015, compared to $(29) million for Q4 2014 and $(32) million for 2014. Net realized investment loss from our investment in Urbplan was $(21) million in 2015 compared to $(31) million in 2014. |

| |

| • | Economic Net Income (Loss) (ENI): $39 million for Q4 2015 and, excluding the impact of the Q1 2015 French tax judgment, $68 million for 2015, compared to $(59) million in 2014. Included in ENI in Q4 2015 is a $9 million allocation of the reserve for litigation and contingencies. |

| |

| ◦ | Real Assets carry fund valuations were flat in aggregate for Q4 2015 and depreciated 3% in 2015, compared to depreciation of 8% in Q4 2014 and 2% in 2014. During 2015, our real estate funds appreciated 27%, our natural resources funds depreciated 3%, and our Legacy Energy portfolio depreciated 26%. |

| |

| ◦ | Net Performance Fees were $26 million for Q4 2015 and $26 million for 2015, compared to $(72) million for Q4 2014 and $(13) million for 2014. |

| |

| • | Total Assets Under Management (AUM): $38.0 billion for Q4 2015 (-10% in 2015). |

| |

| ◦ | Funds Raised in Q4 2015 of $0.3 billion were driven largely by an additional closing in our latest vintage Power fund. |

| |

| ◦ | Fee-Earning AUM of $30.9 billion in Q4 2015 increased by 9% versus Q4 2014. Major drivers of change in 2015: inflows, including fee-paying commitments (+$8.4 billion), partially offset by outflows, including distributions (-$5.7 billion). The latest vintage NGP fund, NGP XI, ended its fee holiday on December 31, 2015, and contributed a net $4.2 billion to Fee-Earning AUM, though it had limited impact on Q4 2015 fee revenue due to the timing in the quarter. |

|

| | | | | | | | | | | | | | | | | | | |

| Real Assets | | Quarter | | Annual | | % Change |

| $ in millions, except per unit data and where noted | | | | | | | | | | | | | | | | | | | |

| | Q4 2014 | | Q1 2015 | | Q2 2015 | | Q3 2015 | | Q4 2015 | | 2014 | 2015 | | QoQ | | YoY | | Annual |

| | | | | | | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | (76) | | (33) | | 1 | | 26 | | 39 | | (59) | 33 | | 49% | | 151% | | 156% |

| | | | | | | | | | | | | | | | | | | | |

| Economic Net Income (excluding French tax) | | (76) | | 1 | | 1 | | 26 | | 39 | | (59) | 68 | | 49% | | 152% | | 243% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Related Earnings | | 10 | | 19 | | 12 | | 20 | | 22 | | 22 | 72 | | 12% | | 116% | | 233% |

| | | | | | | | | | | | | | | | | | | | |

| Net Performance Fees | | (72) | | (9) | | (7) | | 16 | | 26 | | (13) | 26 | | 66% | | 136% | | 296% |

| | | | | | | | | | | | | | | | | | | | |

| Realized Net Performance Fees | | 31 | | 6 | | 28 | | 32 | | 28 | | 58 | 95 | | (12)% | | (8)% | | 62% |

| | | | | | | | | | | | | | | | | | | | |

| Distributable Earnings | | 12 | | (62) | | 37 | | 47 | | 51 | | 48 | 73 | | 9% | | 341% | | 53% |

| | | | | | | | | | | | | | | | | | | | |

| Distributable Earnings (excluding French tax) | | 12 | | 18 | | 37 | | 47 | | 51 | | 48 | 153 | | 9% | | 341% | | 220% |

| | | | | | | | | | | | | | | | | | | | |

| Total Assets Under Management ($ in billions) | | 42.3 | | 42.9 | | 42.2 | | 40.2 | | 38.0 | | | | | (5)% | | (10)% | | (10)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Earning Assets Under Management ($ in billions) | | 28.4 | | 27.6 | | 28.1 | | 28.5 | | 30.9 | | | | | 8% | | 9% | | 9% |

| | | | | | | | | | | | | | | | | | | | |

Note: Totals may not sum due to rounding.

| |

| • | Distributable Earnings (DE): $3 million for Q4 2015 and $13 million for 2015, compared to $44 million in 2014 . |

| |

| ◦ | Fee-Related Earnings (FRE) were $1 million for Q4 2015 and $9 million for 2015, compared to $6 million for Q4 2014 and $32 million for 2014. The decrease in Q4 2015 relative to Q4 2014 was largely attributable to foreign currency impacts on management fees and reductions in Fee-Earning Assets Under Management caused by basis step downs, redemptions and realizations, partially offset by lower compensation. |

| |

| ◦ | Realized Net Performance Fees were $2 million for Q4 2015 and $4 million for 2015, compared to $5 million for Q4 2014 and $12 million for 2014. |

| |

| • | Economic Net Income (Loss) (ENI) was $(7) million for Q4 2015 and $5 million for 2015, compared to $45 million in 2014. Included in ENI in Q4 2015 is a $5 million allocation of the reserve for litigation and contingencies. |

| |

| ◦ | Net Performance Fees were $2 million for Q4 2015 and $13 million for 2015, compared to $2 million for Q4 2014 and $17 million for 2014. |

| |

| • | Total Assets Under Management (AUM): $46.2 billion for Q4 2015 (-9% in 2015). |

| |

| ◦ | Total AUM declined 9% from Q4 2014 due to distributions of $11.0 billion, negative foreign exchange impact of $3.9 billion, and net redemptions of $0.2 billion, partially offset by $7.7 billion in market appreciation and $3.2 billion in new commitments. |

| |

| • | Fee-Earning AUM of $28.2 billion in Q4 2015 was down 15% compared to Q4 2014. Major drivers of change in 2015: Inflows including fee-paying commitments (+$5.7 billion), more than offset by outflows including distributions and basis step downs (-$7.4 billion), a decrease in foreign exchange (-$2.8 billion) and net redemptions (-$0.2 billion). |

|

| | | | | | | | | | | | | | | | | | | |

| Investment Solutions | | Quarter | | Annual | | % Change |

| $ in millions, except per unit data and where noted | | | | | | | | | | | | | | | | | | | |

| | Q4 2014 | | Q1 2015 | | Q2 2015 | | Q3 2015 | | Q4 2015 | | 2014 | 2015 | | QoQ | | YoY | | Annual |

| | | | | | | | | | | | | | | | | | | | |

| Economic Net Income | | 7 | | 8 | | 0 | | 4 | | (7) | | 45 | 5 | | NM | | NM | | (90)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Related Earnings | | 6 | | 6 | | 0 | | 3 | | 1 | | 32 | 9 | | (60)% | | (84)% | | (72)% |

| | | | | | | | | | | | | | | | | | | | |

| Net Performance Fees | | 2 | | 4 | | 3 | | 4 | | 2 | | 17 | 13 | | (55)% | | (10)% | | (26)% |

| | | | | | | | | | | | | | | | | | | | |

| Realized Net Performance Fees | | 5 | | 1 | | 1 | | 1 | | 2 | | 12 | 4 | | 150% | | (72)% | | (68)% |

| | | | | | | | | | | | | | | | | | | | |

| Distributable Earnings | | 12 | | 7 | | 0 | | 3 | | 3 | | 44 | 13 | | (19)% | | (79)% | | (71)% |

| | | | | | | | | | | | | | | | | | | | |

| Total Assets Under Management ($ in billions) | | 50.8 | | 49.4 | | 50.7 | | 48.9 | | 46.2 | | | | | (6)% | | (9)% | | (9)% |

| | | | | | | | | | | | | | | | | | | | |

| Fee-Earning Assets Under Management ($ in billions) | | 33.1 | | 30.5 | | 30.3 | | 29.4 | | 28.2 | | | | | (4)% | | (15)% | | (15)% |

| | | | | | | | | | | | | | | | | | | | |

Note: Totals may not sum due to rounding.

The amounts presented below exclude the effect of U.S. GAAP consolidation eliminations on investments and accrued performance fees, as well as cash and debt associated with Carlyle’s consolidated funds. All data is as of December 31, 2015.

| |

| • | Cash and Cash Equivalents of $1.0 billion. |

| |

| • | On-balance sheet investments attributable to unitholders of $391 million, excluding the equity investment by Carlyle in NGP Energy Capital Management. |

| |

| • | Net accrued performance fees attributable to unitholders of $1.3 billion. These performance fees are comprised of $3.0 billion of gross accrued performance fees, less $0.3 billion in accrued giveback obligation and $1.4 billion in accrued performance fee compensation and non-controlling interest. |

| |

| • | Loans payable and senior notes totaling $1.1 billion. |

Conference Call

Carlyle will host a conference call at 8:30 a.m. EST on Wednesday, February 10, 2016, to announce its fourth quarter and full year 2015 financial results.

The call may be accessed by dialing +1 (800) 850-2903 (U.S.) or +1 (253) 237-1169 (international) and referencing “The Carlyle Group Financial Results Call.” The conference call will be webcast simultaneously via a link on Carlyle’s investor relations website at ir.carlyle.com and an archived replay of the webcast also will be available on the website soon after the live call.

About The Carlyle Group

The Carlyle Group (NASDAQ: CG) is a global alternative asset manager with $183 billion of assets under management across 126 funds and 160 fund of funds vehicles as of December 31, 2015. Carlyle’s purpose is to invest wisely and create value on behalf of its investors, many of whom are public pensions. Carlyle invests across four segments – Corporate Private Equity, Real Assets, Global Market Strategies and Investment Solutions – in Africa, Asia, Australia, Europe, the Middle East, North America and South America. Carlyle has expertise in various industries, including: aerospace, defense & government services, consumer & retail, energy, financial services, healthcare, industrial, real estate, technology & business services, telecommunications & media and transportation. The Carlyle Group employs more than 1,700 people in 36 offices across six continents.

Web: www.carlyle.com

Videos: www.youtube.com/onecarlyle

Tweets: www.twitter.com/onecarlyle

Podcasts: www.carlyle.com/about-carlyle/market-commentary

Contacts:

Public Market Investor Relations

Daniel Harris

Phone: 212-813-4527

daniel.harris@carlyle.com

Media

Elizabeth Gill

Phone: 202-729-5385

elizabeth.gill@carlyle.com

Forward Looking Statements

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. These statements are subject to risks, uncertainties and assumptions, including those described under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on February 26, 2015, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

This release does not constitute an offer for any Carlyle fund.

The Carlyle Group L.P.

GAAP Statement of Operations (Unaudited)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | Dec 31, 2014 | | Dec 31, 2015 | | Dec 31, 2014 | | Dec 31, 2015 |

| | | (Dollars in millions, except unit and per unit data) |

| Revenues | | | | | | | | |

| Fund management fees | | $ | 281.3 |

| | $ | 255.1 |

| | $ | 1,166.3 |

| | $ | 1,085.2 |

|

| Performance fees | | | | | | | | |

| Realized | | 484.8 |

| | 190.9 |

| | 1,328.7 |

| | 1,441.9 |

|

| Unrealized | | (160.7 | ) | | 12.7 |

| | 345.7 |

| | (617.0 | ) |

| Total performance fees | | 324.1 |

| | 203.6 |

| | 1,674.4 |

| | 824.9 |

|

| Investment income (loss) | | | | | | | | |

| Realized | | (5.7 | ) | | 8.7 |

| | 23.7 |

| | 32.9 |

|

| Unrealized | | (35.1 | ) | | — |

| | (30.9 | ) | | (17.7 | ) |

| Total investment income (loss) | | (40.8 | ) | | 8.7 |

| | (7.2 | ) | | 15.2 |

|

| Interest and other income | | 4.0 |

| | 2.7 |

| | 20.6 |

| | 18.6 |

|

| Interest and other income of Consolidated Funds | | 227.5 |

| | 232.8 |

| | 956.0 |

| | 975.5 |

|

| Revenue of a consolidated real estate VIE | | 43.0 |

| | 12.9 |

| | 70.2 |

| | 86.8 |

|

| Total revenues | | 839.1 |

| | 715.8 |

| | 3,880.3 |

| | 3,006.2 |

|

| | | | | | | | | |

| Expenses | | | | | | | | |

| Compensation and benefits | | | | | | | | |

| Base compensation | | 173.2 |

| | 160.0 |

| | 789.0 |

| | 632.2 |

|

| Equity-based compensation | | 81.1 |

| | 87.0 |

| | 344.0 |

| | 378.0 |

|

| Performance fee related | | | | | | | | |

| Realized | | 222.4 |

| | 88.8 |

| | 590.7 |

| | 650.5 |

|

| Unrealized | | (34.1 | ) | | 6.6 |

| | 282.2 |

| | (139.6 | ) |

| Total compensation and benefits | | 442.6 |

| | 342.4 |

| | 2,005.9 |

| | 1,521.1 |

|

| General, administrative and other expenses | | 156.4 |

| | 166.6 |

| | 526.8 |

| | 705.8 |

|

| Interest | | 14.6 |

| | 14.4 |

| | 55.7 |

| | 58.0 |

|

| Interest and other expenses of Consolidated Funds | | 285.6 |

| | 247.6 |

| | 1,042.0 |

| | 1,039.3 |

|

| Interest and other expenses of a consolidated real estate VIE | | 45.8 |

| | 20.2 |

| | 175.3 |

| | 144.6 |

|

| Other non-operating expense (income) | | (16.3 | ) | | 4.3 |

| | (30.3 | ) | | (7.4 | ) |

| Total expenses | | 928.7 |

| | 795.5 |

| | 3,775.4 |

| | 3,461.4 |

|

| | | | | | | | | |

| Other income | | | | | | | | |

| Net investment gains (losses) of Consolidated Funds | | (107.5 | ) | | (71.4 | ) | | 887.0 |

| | 864.4 |

|

| | | | | | | | | |

| Income (Loss) before provision for income taxes | | (197.1 | ) | | (151.1 | ) | | 991.9 |

| | 409.2 |

|

| Provision (Benefit) for income taxes | | 12.9 |

| | (10.3 | ) | | 76.8 |

| | 2.1 |

|

| Net income (loss) | | (210.0 | ) | | (140.8 | ) | | 915.1 |

| | 407.1 |

|

| Net income (loss) attributable to non-controlling interests in consolidated entities | | (261.9 | ) | | (119.6 | ) | | 485.5 |

| | 537.9 |

|

| Net income (loss) attributable to Carlyle Holdings | | 51.9 |

| | (21.2 | ) | | 429.6 |

| | (130.8 | ) |

| Net income (loss) attributable to non-controlling interests in Carlyle Holdings | | 35.6 |

| | (18.3 | ) | | 343.8 |

| | (114.1 | ) |

| Net income (loss) attributable to The Carlyle Group L.P. | | $ | 16.3 |

| | $ | (2.9 | ) | | $ | 85.8 |

| | $ | (16.7 | ) |

| | | | | | | | | |

| Net income (loss) attributable to The Carlyle Group L.P. per common unit | | | | | | | | |

Basic (1) | | $ | 0.24 |

| | $ | (0.04 | ) | | $ | 1.35 |

| | $ | (0.22 | ) |

Diluted (2) (3) | | $ | 0.23 |

| | $ | (0.04 | ) | | $ | 1.23 |

| | $ | (0.28 | ) |

| | | | | | | | | |

| Weighted-average common units | | | | | | | | |

| Basic | | 66,841,549 |

| | 79,601,269 |

| | 62,788,634 |

| | 74,523,935 |

|

| Diluted | | 298,047,512 |

| | 79,601,269 |

| | 68,461,157 |

| | 298,739,382 |

|

(1) Excluded from net income (loss) attributable to The Carlyle Group L.P. was approximately $0.3 million and $1.3 million that was allocable to participating securities under the two-class method for the three months and year ended December 31, 2014, respectively, and approximately $(0.1) million for the year ended December 31, 2015.

(2) Excluded from net income (loss) attributable to The Carlyle Group L.P. was approximately $0.3 million and $1.3 million that was allocable to participating securities under the two-class method for the three months and year ended December 31, 2014, respectively, and approximately $1.8 million for the year ended December 31, 2015.

(3) Included in net income (loss) attributable to The Carlyle Group L.P. on a fully diluted basis is incremental net loss from the assumed exchange of Carlyle Holdings partnership units of $51.1 million for the three months ended December 31, 2014 and $64.4 million for the year ended December 31, 2015.

Total Segment Information (Unaudited)

The following table sets forth information in the format used by management when making resource deployment decisions and in assessing the performance of our segments. The table below shows the aggregate results of our four segments.

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | Dec 31, 2014 | | Sep 30, 2015 | | Dec 31, 2015 | | Dec 31, 2014 | | Dec 31, 2015 |

| | | (Dollars in millions) |

| Segment Revenues | | | | | | | | | | |

| Fund level fee revenues | | | | | | | | | | |

| Fund management fees | | $ | 304.9 |

| | $ | 311.9 |

| | $ | 278.6 |

| | $ | 1,229.3 |

| | $ | 1,197.9 |

|

| Portfolio advisory fees, net | | 8.5 |

| | 3.0 |

| | 3.1 |

| | 20.1 |

| | 15.4 |

|

| Transaction fees, net | | 2.7 |

| | 1.0 |

| | 5.7 |

| | 53.2 |

| | 9.8 |

|

| Total fee revenues | | 316.1 |

| | 315.9 |

| | 287.4 |

| | 1,302.6 |

| | 1,223.1 |

|

| Performance fees | | | | | | | | | | |

| Realized | | 488.2 |

| | 333.1 |

| | 183.0 |

| | 1,323.7 |

| | 1,434.8 |

|

| Unrealized | | (158.4 | ) | | (554.2 | ) | | 14.2 |

| | 384.2 |

| | (525.1 | ) |

| Total performance fees | | 329.8 |

| | (221.1 | ) | | 197.2 |

| | 1,707.9 |

| | 909.7 |

|

| Investment income (loss) | | | | | | | | | | |

| Realized | | (20.2 | ) | | 9.2 |

| | 1.9 |

| | (6.1 | ) | | (64.8 | ) |

| Unrealized | | 18.2 |

| | (15.5 | ) | | (1.0 | ) | | (5.0 | ) | | 42.4 |

|

| Total investment income (loss) | | (2.0 | ) | | (6.3 | ) | | 0.9 |

| | (11.1 | ) | | (22.4 | ) |

| Interest income | | 0.6 |

| | 0.1 |

| | 3.4 |

| | 2.2 |

| | 4.8 |

|

| Other income | | 4.3 |

| | 4.9 |

| | 2.0 |

| | 20.4 |

| | 17.2 |

|

| Total revenues | | 648.8 |

| | 93.5 |

| | 490.9 |

| | 3,022.0 |

| | 2,132.4 |

|

| | | | | | | | | | | |

| Segment Expenses | | | | | | | | | | |

| Compensation and benefits | | | | | | | | | | |

| Direct base compensation | | 97.8 |

| | 121.7 |

| | 116.1 |

| | 494.0 |

| | 477.7 |

|

| Indirect base compensation | | 48.2 |

| | 42.8 |

| | 38.3 |

| | 188.5 |

| | 172.1 |

|

| Equity-based compensation | | 23.1 |

| | 30.8 |

| | 30.5 |

| | 80.4 |

| | 121.5 |

|

| Performance fee related | | | | | | | | | | |

| Realized | | 224.6 |

| | 155.9 |

| | 82.8 |

| | 590.9 |

| | 646.3 |

|

| Unrealized | | (33.2 | ) | | (228.4 | ) | | 5.1 |

| | 309.6 |

| | (128.3 | ) |

| Total compensation and benefits | | 360.5 |

| | 122.8 |

| | 272.8 |

| | 1,663.4 |

| | 1,289.3 |

|

| General, administrative, and other indirect expenses | | 87.3 |

| | 78.1 |

| | 124.0 |

| | 318.1 |

| | 362.8 |

|

| Depreciation and amortization expense | | 6.0 |

| | 6.6 |

| | 6.8 |

| | 22.4 |

| | 25.6 |

|

| Interest expense | | 14.5 |

| | 14.4 |

| | 14.6 |

| | 55.7 |

| | 58.1 |

|

| Total expenses | | 468.3 |

| | 221.9 |

| | 418.2 |

| | 2,059.6 |

| | 1,735.8 |

|

| | | | | | | | | | | |

| Economic Net Income (Loss) | | $ | 180.5 |

| | $ | (128.4 | ) | | $ | 72.7 |

| | $ | 962.4 |

| | $ | 396.6 |

|

| (-) Net Performance Fees | | 138.4 |

| | (148.6 | ) | | 109.3 |

| | 807.4 |

| | 391.7 |

|

| (-) Investment Income (Loss) | | (2.0 | ) | | (6.3 | ) | | 0.9 |

| | (11.1 | ) | | (22.4 | ) |

| (+) Equity-based Compensation | | 23.1 |

| | 30.8 |

| | 30.5 |

| | 80.4 |

| | 121.5 |

|

| (+) Reserve for Litigation and Contingencies | | — |

| | — |

| | 50.0 |

| | — |

| | 50.0 |

|

| (=) Fee Related Earnings | | $ | 67.2 |

| | $ | 57.3 |

| | $ | 43.0 |

| | $ | 246.5 |

| | $ | 198.8 |

|

| (+) Realized Net Performance Fees | | 263.6 |

| | 177.2 |

| | 100.2 |

| | 732.8 |

| | 788.5 |

|

| (+) Realized Investment Income (Loss) | | (20.2 | ) | | 9.2 |

| | 1.9 |

| | (6.1 | ) | | (64.8 | ) |

| (=) Distributable Earnings | | $ | 310.6 |

| | $ | 243.7 |

| | $ | 145.1 |

| | $ | 973.2 |

| | $ | 922.5 |

|

Total Segment Information (Unaudited), cont.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | | | | | | | | | Dec 31, 2015 vs. |

| | | Dec 31, 2014 | | Mar 31, 2015 | | Jun 30, 2015 | | Sep 30, 2015 | | Dec 31, 2015 | | Dec 31, 2014 | | Sep 30, 2015 |

| | | (Dollars in millions) |

| Economic Net Income (Loss), Total Segments | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | |

| Segment fee revenues | | | | | | | | | | | | | | |

| Fund management fees | | $ | 304.9 |

| | $ | 296.6 |

| | $ | 310.8 |

| | $ | 311.9 |

| | $ | 278.6 |

| | $ | (26.3 | ) | | $ | (33.3 | ) |

| Portfolio advisory fees, net | | 8.5 |

| | 5.8 |

| | 3.5 |

| | 3.0 |

| | 3.1 |

| | (5.4 | ) | | 0.1 |

|

| Transaction fees, net | | 2.7 |

| | 1.8 |

| | 1.3 |

| | 1.0 |

| | 5.7 |

| | 3.0 |

| | 4.7 |

|

| Total fee revenues | | 316.1 |

| | 304.2 |

| | 315.6 |

| | 315.9 |

| | 287.4 |

| | (28.7 | ) | | (28.5 | ) |

| Performance fees | | | | | | | | | | | | | | |

| Realized | | 488.2 |

| | 321.7 |

| | 597.0 |

| | 333.1 |

| | 183.0 |

| | (305.2 | ) | | (150.1 | ) |

| Unrealized | | (158.4 | ) | | 280.5 |

| | (265.6 | ) | | (554.2 | ) | | 14.2 |

| | 172.6 |

| | 568.4 |

|

| Total performance fees | | 329.8 |

| | 602.2 |

| | 331.4 |

| | (221.1 | ) | | 197.2 |

| | (132.6 | ) | | 418.3 |

|

| Investment income (loss) | | | | | | | | | | | | | | |

| Realized | | (20.2 | ) | | (82.0 | ) | | 6.1 |

| | 9.2 |

| | 1.9 |

| | 22.1 |

| | (7.3 | ) |

| Unrealized | | 18.2 |

| | 54.0 |

| | 4.9 |

| | (15.5 | ) | | (1.0 | ) | | (19.2 | ) | | 14.5 |

|

| Total investment income (loss) | | (2.0 | ) | | (28.0 | ) | | 11.0 |

| | (6.3 | ) | | 0.9 |

| | 2.9 |

| | 7.2 |

|

| Interest income | | 0.6 |

| | 0.8 |

| | 0.5 |

| | 0.1 |

| | 3.4 |

| | 2.8 |

| | 3.3 |

|

| Other income | | 4.3 |

| | 5.7 |

| | 4.6 |

| | 4.9 |

| | 2.0 |

| | (2.3 | ) | | (2.9 | ) |

| Total revenues | | 648.8 |

| | 884.9 |

| | 663.1 |

| | 93.5 |

| | 490.9 |

| | (157.9 | ) | | 397.4 |

|

| | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | |

| Compensation and benefits | | | | | | | | | | | | | | |

| Direct base compensation | | 97.8 |

| | 121.9 |

| | 118.0 |

| | 121.7 |

| | 116.1 |

| | 18.3 |

| | (5.6 | ) |

| Indirect base compensation | | 48.2 |

| | 51.0 |

| | 40.0 |

| | 42.8 |

| | 38.3 |

| | (9.9 | ) | | (4.5 | ) |

| Equity-based compensation | | 23.1 |

| | 32.3 |

| | 27.9 |

| | 30.8 |

| | 30.5 |

| | 7.4 |

| | (0.3 | ) |

| Performance fee related | | | | | | | | | | | | | | |

| Realized | | 224.6 |

| | 143.3 |

| | 264.3 |

| | 155.9 |

| | 82.8 |

| | (141.8 | ) | | (73.1 | ) |

| Unrealized | | (33.2 | ) | | 177.1 |

| | (82.1 | ) | | (228.4 | ) | | 5.1 |

| | 38.3 |

| | 233.5 |

|

| Total compensation and benefits | | 360.5 |

| | 525.6 |

| | 368.1 |

| | 122.8 |

| | 272.8 |

| | (87.7 | ) | | 150.0 |

|

| General, administrative, and other indirect expenses | | 87.3 |

| | 66.5 |

| | 94.2 |

| | 78.1 |

| | 124.0 |

| | 36.7 |

| | 45.9 |

|

| Depreciation and amortization expense | | 6.0 |

| | 5.5 |

| | 6.7 |

| | 6.6 |

| | 6.8 |

| | 0.8 |

| | 0.2 |

|

| Interest expense | | 14.5 |

| | 14.6 |

| | 14.5 |

| | 14.4 |

| | 14.6 |

| | 0.1 |

| | 0.2 |

|

| Total expenses | | 468.3 |

| | 612.2 |

| | 483.5 |

| | 221.9 |

| | 418.2 |

| | (50.1 | ) | | 196.3 |

|

| | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | $ | 180.5 |

| | $ | 272.7 |

| | $ | 179.6 |

| | $ | (128.4 | ) | | $ | 72.7 |

| | $ | (107.8 | ) | | $ | 201.1 |

|

| (-) Net Performance Fees | | 138.4 |

| | 281.8 |

| | 149.2 |

| | (148.6 | ) | | 109.3 |

| | (29.1 | ) | | 257.9 |

|

| (-) Investment Income (Loss) | | (2.0 | ) | | (28.0 | ) | | 11.0 |

| | (6.3 | ) | | 0.9 |

| | 2.9 |

| | 7.2 |

|

| (+) Equity-based Compensation | | 23.1 |

| | 32.3 |

| | 27.9 |

| | 30.8 |

| | 30.5 |

| | 7.4 |

| | (0.3 | ) |

| (+) Reserve for Litigation and Contingencies | | — |

| | — |

| | — |

| | — |

| | 50.0 |

| | 50.0 |

| | 50.0 |

|

| (=) Fee Related Earnings | | $ | 67.2 |

| | $ | 51.2 |

| | $ | 47.3 |

| | $ | 57.3 |

| | $ | 43.0 |

| | $ | (24.2 | ) | | $ | (14.3 | ) |

| (+) Realized Net Performance Fees | | 263.6 |

| | 178.4 |

| | 332.7 |

| | 177.2 |

| | 100.2 |

| | (163.4 | ) | | (77.0 | ) |

| (+) Realized Investment Income (Loss) | | (20.2 | ) | | (82.0 | ) | | 6.1 |

| | 9.2 |

| | 1.9 |

| | 22.1 |

| | (7.3 | ) |

| (=) Distributable Earnings | | $ | 310.6 |

| | $ | 147.6 |

| | $ | 386.1 |

| | $ | 243.7 |

| | $ | 145.1 |

| | $ | (165.5 | ) | | $ | (98.6 | ) |

Corporate Private Equity Segment Results (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | | | | | | | | | Dec 31, 2015 vs. |

| Corporate Private Equity | | Dec 31,

2014 | | Mar 31,

2015 | | Jun 30,

2015 | | Sep 30,

2015 | | Dec 31,

2015 | | Dec 31, 2014 | | Sep 30, 2015 |

| | | (Dollars in millions) |

| | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | |

| Segment fee revenues | | | | | | | | | | | | | | |

| Fund management fees | | $ | 136.3 |

| | $ | 134.3 |

| | $ | 156.7 |

| | $ | 152.5 |

| | $ | 133.9 |

| | $ | (2.4 | ) | | $ | (18.6 | ) |

| Portfolio advisory fees, net | | 7.8 |

| | 5.2 |

| | 3.3 |

| | 2.8 |

| | 3.0 |

| | (4.8 | ) | | 0.2 |

|

| Transaction fees, net | | 1.8 |

| | 1.5 |

| | 1.3 |

| | 0.9 |

| | 4.0 |

| | 2.2 |

| | 3.1 |

|

| Total fee revenues | | 145.9 |

| | 141.0 |

| | 161.3 |

| | 156.2 |

| | 140.9 |

| | (5.0 | ) | | (15.3 | ) |

| Performance fees | | | | | | | | | | | | | | |

| Realized | | 408.9 |

| | 306.0 |

| | 536.5 |

| | 258.6 |

| | 108.4 |

| | (300.5 | ) | | (150.2 | ) |

| Unrealized | | (40.3 | ) | | 200.7 |

| | (269.8 | ) | | (513.9 | ) | | 59.9 |

| | 100.2 |

| | 573.8 |

|

| Total performance fees | | 368.6 |

| | 506.7 |

| | 266.7 |

| | (255.3 | ) | | 168.3 |

| | (200.3 | ) | | 423.6 |

|

| Investment income (Loss) | | | | | | | | | | | | | | |

| Realized | | 7.4 |

| | 2.7 |

| | 8.3 |

| | 11.0 |

| | 1.3 |

| | (6.1 | ) | | (9.7 | ) |

| Unrealized | | 0.7 |

| | 7.4 |

| | 0.7 |

| | (12.7 | ) | | (0.6 | ) | | (1.3 | ) | | 12.1 |

|

| Total investment income (Loss) | | 8.1 |

| | 10.1 |

| | 9.0 |

| | (1.7 | ) | | 0.7 |

| | (7.4 | ) | | 2.4 |

|

| Interest income | | 0.4 |

| | 0.3 |

| | 0.2 |

| | 0.4 |

| | 0.6 |

| | 0.2 |

| | 0.2 |

|

| Other income | | 1.7 |

| | 2.9 |

| | 2.5 |

| | 2.7 |

| | 1.7 |

| | — |

| | (1.0 | ) |

| Total revenues | | 524.7 |

| | 661.0 |

| | 439.7 |

| | (97.7 | ) | | 312.2 |

| | (212.5 | ) | | 409.9 |

|

| | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | |

| Compensation and benefits | | | | | | | | | | | | | | |

| Direct base compensation | | 33.0 |

| | 53.7 |

| | 56.5 |

| | 59.1 |

| | 54.9 |

| | 21.9 |

| | (4.2 | ) |

| Indirect base compensation | | 28.4 |

| | 26.3 |

| | 21.5 |

| | 23.3 |

| | 20.4 |

| | (8.0 | ) | | (2.9 | ) |

| Equity-based compensation | | 12.4 |

| | 17.3 |

| | 15.3 |

| | 17.0 |

| | 15.5 |

| | 3.1 |

| | (1.5 | ) |

| Performance fee related | | | | | | | | | | | | | | |

| Realized | | 186.1 |

| | 137.0 |

| | 237.2 |

| | 120.6 |

| | 46.1 |

| | (140.0 | ) | | (74.5 | ) |

| Unrealized | | (25.0 | ) | | 95.7 |

| | (117.5 | ) | | (235.0 | ) | | 35.1 |

| | 60.1 |

| | 270.1 |

|

| Total compensation and benefits | | 234.9 |

| | 330.0 |

| | 213.0 |

| | (15.0 | ) | | 172.0 |

| | (62.9 | ) | | 187.0 |

|

| General, administrative, and other indirect expenses | | 42.5 |

| | 31.7 |

| | 37.8 |

| | 36.4 |

| | 66.5 |

| | 24.0 |

| | 30.1 |

|

| Depreciation and amortization expense | | 2.9 |

| | 2.7 |

| | 3.0 |

| | 3.3 |

| | 3.5 |

| | 0.6 |

| | 0.2 |

|

| Interest expense | | 8.0 |

| | 7.6 |

| | 7.7 |

| | 7.8 |

| | 7.7 |

| | (0.3 | ) | | (0.1 | ) |

| Total expenses | | 288.3 |

| | 372.0 |

| | 261.5 |

| | 32.5 |

| | 249.7 |

| | (38.6 | ) | | 217.2 |

|

| | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | $ | 236.4 |

| | $ | 289.0 |

| | $ | 178.2 |

| | $ | (130.2 | ) | | $ | 62.5 |

| | $ | (173.9 | ) | | $ | 192.7 |

|

| (-) Net Performance Fees | | 207.5 |

| | 274.0 |

| | 147.0 |

| | (140.9 | ) | | 87.1 |

| | (120.4 | ) | | 228.0 |

|

| (-) Investment Income (Loss) | | 8.1 |

| | 10.1 |

| | 9.0 |

| | (1.7 | ) | | 0.7 |

| | (7.4 | ) | | 2.4 |

|

| (+) Equity-based Compensation | | 12.4 |

| | 17.3 |

| | 15.3 |

| | 17.0 |

| | 15.5 |

| | 3.1 |

| | (1.5 | ) |

| (+) Reserve for Litigation and Contingencies | | — |

| | — |

| | — |

| | — |

| | 26.8 |

| | 26.8 |

| | 26.8 |

|

| (=) Fee Related Earnings | | $ | 33.2 |

| | $ | 22.2 |

| | $ | 37.5 |

| | $ | 29.4 |

| | $ | 17.0 |

| | $ | (16.2 | ) | | $ | (12.4 | ) |

| (+) Realized Net Performance Fees | | 222.8 |

| | 169.0 |

| | 299.3 |

| | 138.0 |

| | 62.3 |

| | (160.5 | ) | | (75.7 | ) |

| (+) Realized Investment Income | | 7.4 |

| | 2.7 |

| | 8.3 |

| | 11.0 |

| | 1.3 |

| | (6.1 | ) | | (9.7 | ) |

| (=) Distributable Earnings | | $ | 263.4 |

| | $ | 193.9 |

| | $ | 345.1 |

| | $ | 178.4 |

| | $ | 80.6 |

| | $ | (182.8 | ) | | $ | (97.8 | ) |

Global Market Strategies Segment Results (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | | | | | | | | | Dec 31, 2015 vs. |

| Global Market Strategies | | Dec 31,

2014 | | Mar 31,

2015 | | Jun 30,

2015 | | Sep 30,

2015 | | Dec 31,

2015 | | Dec 31, 2014 | | Sep 30, 2015 |

| | | (Dollars in millions) |

| | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | |

| Segment fee revenues | | | | | | | | | | | | | | |

| Fund management fees | | $ | 66.4 |

| | $ | 55.5 |

| | $ | 54.8 |

| | $ | 52.3 |

| | $ | 48.1 |

| | $ | (18.3 | ) | | $ | (4.2 | ) |

| Portfolio advisory fees, net | | 0.5 |

| | 0.5 |

| | — |

| | 0.1 |

| | 0.1 |

| | (0.4 | ) | | — |

|

| Transaction fees, net | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Total fee revenues | | 66.9 |

| | 56.0 |

| | 54.8 |

| | 52.4 |

| | 48.2 |

| | (18.7 | ) | | (4.2 | ) |

| Performance fees | | | | | | | | | | | | | | |

| Realized | | 9.7 |

| | 4.6 |

| | 8.6 |

| | 11.8 |

| | 13.0 |

| | 3.3 |

| | 1.2 |

|

| Unrealized | | (7.8 | ) | | 18.7 |

| | 3.6 |

| | (62.4 | ) | | (23.0 | ) | | (15.2 | ) | | 39.4 |

|

| Total performance fees | | 1.9 |

| | 23.3 |

| | 12.2 |

| | (50.6 | ) | | (10.0 | ) | | (11.9 | ) | | 40.6 |

|

| Investment income (loss) | | | | | | | | | | | | | | |

| Realized | | 1.6 |

| | 1.6 |

| | 1.2 |

| | 3.1 |

| | (0.5 | ) | | (2.1 | ) | | (3.6 | ) |

| Unrealized | | (2.4 | ) | | (4.2 | ) | | (1.5 | ) | | (5.0 | ) | | (5.0 | ) | | (2.6 | ) | | — |

|

| Total investment income (loss) | | (0.8 | ) | | (2.6 | ) | | (0.3 | ) | | (1.9 | ) | | (5.5 | ) | | (4.7 | ) | | (3.6 | ) |

| Interest income | | 0.1 |

| | 0.5 |

| | 0.1 |

| | (0.4 | ) | | 2.6 |

| | 2.5 |

| | 3.0 |

|

| Other income | | 1.0 |

| | 1.3 |

| | 1.3 |

| | 1.1 |

| | 0.2 |

| | (0.8 | ) | | (0.9 | ) |

| Total revenues | | 69.1 |

| | 78.5 |

| | 68.1 |

| | 0.6 |

| | 35.5 |

| | (33.6 | ) | | 34.9 |

|

| | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | |

| Compensation and benefits | | | | | | | | | | | | | | |

| Direct base compensation | | 26.9 |

| | 28.2 |

| | 24.7 |

| | 22.4 |

| | 25.9 |

| | (1.0 | ) | | 3.5 |

|

| Indirect base compensation | | 5.7 |

| | 8.8 |

| | 6.4 |

| | 6.9 |

| | 6.2 |

| | 0.5 |

| | (0.7 | ) |

| Equity-based compensation | | 4.0 |

| | 5.2 |

| | 4.3 |

| | 5.0 |

| | 4.5 |

| | 0.5 |

| | (0.5 | ) |

| Performance fee related | | | | | | | | | | | | | | |

| Realized | | 5.0 |

| | 2.3 |

| | 4.1 |

| | 5.4 |

| | 4.8 |

| | (0.2 | ) | | (0.6 | ) |

| Unrealized | | (3.6 | ) | | 8.2 |

| | 1.8 |

| | (28.6 | ) | | (9.1 | ) | | (5.5 | ) | | 19.5 |

|

| Total compensation and benefits | | 38.0 |

| | 52.7 |

| | 41.3 |

| | 11.1 |

| | 32.3 |

| | (5.7 | ) | | 21.2 |

|

| General, administrative, and other indirect expenses | | 14.3 |

| | 12.3 |

| | 22.8 |

| | 14.0 |

| | 20.7 |

| | 6.4 |

| | 6.7 |

|

| Depreciation and amortization expense | | 1.1 |

| | 1.1 |

| | 1.3 |

| | 1.3 |

| | 1.3 |

| | 0.2 |

| | — |

|

| Interest expense | | 2.5 |

| | 2.8 |

| | 2.7 |

| | 2.6 |

| | 2.7 |

| | 0.2 |

| | 0.1 |

|

| Total expenses | | 55.9 |

| | 68.9 |

| | 68.1 |

| | 29.0 |

| | 57.0 |

| | 1.1 |

| | 28.0 |

|

| | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | $ | 13.2 |

| | $ | 9.6 |

| | $ | — |

| | $ | (28.4 | ) | | $ | (21.5 | ) | | $ | (34.7 | ) | | $ | 6.9 |

|

| (-) Net Performance Fees | | 0.5 |

| | 12.8 |

| | 6.3 |

| | (27.4 | ) | | (5.7 | ) | | (6.2 | ) | | 21.7 |

|

| (-) Investment Income (Loss) | | (0.8 | ) | | (2.6 | ) | | (0.3 | ) | | (1.9 | ) | | (5.5 | ) | | (4.7 | ) | | (3.6 | ) |

| (+) Equity-based Compensation | | 4.0 |

| | 5.2 |

| | 4.3 |

| | 5.0 |

| | 4.5 |

| | 0.5 |

| | (0.5 | ) |

| (+) Reserve for Litigation and Contingencies | | — |

| | — |

| | — |

| | — |

| | 9.0 |

| | 9.0 |

| | 9.0 |

|

| (=) Fee Related Earnings (Loss) | | $ | 17.5 |

| | $ | 4.6 |

| | $ | (1.7 | ) | | $ | 5.9 |

| | $ | 3.2 |

| | $ | (14.3 | ) | | $ | (2.7 | ) |

| (+) Realized Net Performance Fees | | 4.7 |

| | 2.3 |

| | 4.5 |

| | 6.4 |

| | 8.2 |

| | 3.5 |

| | 1.8 |

|

| (+) Realized Investment Income (Loss) | | 1.6 |

| | 1.6 |

| | 1.2 |

| | 3.1 |

| | (0.5 | ) | | (2.1 | ) | | (3.6 | ) |

| (=) Distributable Earnings | | $ | 23.8 |

| | $ | 8.5 |

| | $ | 4.0 |

| | $ | 15.4 |

| | $ | 10.9 |

| | $ | (12.9 | ) | | $ | (4.5 | ) |

Real Assets Segment Results (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | | | | | | | | | Dec 31, 2015 vs. |

| Real Assets | | Dec 31,

2014 | | Mar 31,

2015 | | Jun 30,

2015 | | Sep 30,

2015 | | Dec 31,

2015 | | Dec 31, 2014 | | Sep 30, 2015 |

| | | (Dollars in millions) |

| | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | |

| Segment fee revenues | | | | | | | | | | | | | | |

| Fund management fees | | $ | 58.2 |

| | $ | 66.3 |

| | $ | 61.5 |

| | $ | 69.3 |

| | $ | 58.8 |

| | $ | 0.6 |

| | $ | (10.5 | ) |

| Portfolio advisory fees, net | | 0.2 |

| | 0.1 |

| | 0.2 |

| | 0.1 |

| | — |

| | (0.2 | ) | | (0.1 | ) |

| Transaction fees, net | | 0.9 |

| | 0.3 |

| | — |

| | 0.1 |

| | 1.7 |

| | 0.8 |

| | 1.6 |

|

| Total fee revenues | | 59.3 |

| | 66.7 |

| | 61.7 |

| | 69.5 |

| | 60.5 |

| | 1.2 |

| | (9.0 | ) |

| Performance fees | | | | | | | | | | | | | | |

| Realized | | 50.2 |

| | 7.7 |

| | 47.1 |

| | 57.7 |

| | 50.7 |

| | 0.5 |

| | (7.0 | ) |

| Unrealized | | (109.4 | ) | | 14.1 |

| | (43.1 | ) | | (9.3 | ) | | (4.2 | ) | | 105.2 |

| | 5.1 |

|

| Total performance fees | | (59.2 | ) | | 21.8 |

| | 4.0 |

| | 48.4 |

| | 46.5 |

| | 105.7 |

| | (1.9 | ) |

| Investment income (loss) | | | | | | | | | | | | | | |

| Realized | | (29.2 | ) | | (86.4 | ) | | (3.4 | ) | | (4.9 | ) | | 1.1 |

| | 30.3 |

| | 6.0 |

|

| Unrealized | | 19.8 |

| | 50.2 |

| | 6.1 |

| | 2.1 |

| | 4.7 |

| | (15.1 | ) | | 2.6 |

|

| Total investment income (loss) | | (9.4 | ) | | (36.2 | ) | | 2.7 |

| | (2.8 | ) | | 5.8 |

| | 15.2 |

| | 8.6 |

|

| Interest income | | 0.1 |

| | — |

| | 0.1 |

| | 0.1 |

| | 0.1 |

| | — |

| | — |

|

| Other income | | 1.3 |

| | 1.1 |

| | 0.5 |

| | 0.8 |

| | 0.2 |

| | (1.1 | ) | | (0.6 | ) |

| Total revenues | | (7.9 | ) | | 53.4 |

| | 69.0 |

| | 116.0 |

| | 113.1 |

| | 121.0 |

| | (2.9 | ) |

| | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | |

| Compensation and benefits | | | | | | | | | | | | | | |

| Direct base compensation | | 14.5 |

| | 18.5 |

| | 17.5 |

| | 20.4 |

| | 13.6 |

| | (0.9 | ) | | (6.8 | ) |

| Indirect base compensation | | 12.6 |

| | 12.3 |

| | 8.8 |

| | 9.7 |

| | 8.5 |

| | (4.1 | ) | | (1.2 | ) |

| Equity-based compensation | | 5.2 |

| | 7.1 |

| | 6.3 |

| | 6.2 |

| | 5.4 |

| | 0.2 |

| | (0.8 | ) |

| Performance fee related | | | | | | | | | | | | | | |

| Realized | | 19.5 |

| | 1.8 |

| | 18.7 |

| | 25.5 |

| | 22.5 |

| | 3.0 |

| | (3.0 | ) |

| Unrealized | | (7.1 | ) | | 28.9 |

| | (7.7 | ) | | 7.2 |

| | (2.1 | ) | | 5.0 |

| | (9.3 | ) |

| Total compensation and benefits | | 44.7 |

| | 68.6 |

| | 43.6 |

| | 69.0 |

| | 47.9 |

| | 3.2 |

| | (21.1 | ) |

| General, administrative, and other indirect expenses | | 19.9 |

| | 14.6 |

| | 20.8 |

| | 17.0 |

| | 22.2 |

| | 2.3 |

| | 5.2 |

|

| Depreciation and amortization expense | | 1.0 |

| | 0.9 |

| | 1.0 |

| | 1.2 |

| | 1.2 |

| | 0.2 |

| | — |

|

| Interest expense | | 2.6 |

| | 2.7 |

| | 2.6 |

| | 2.6 |

| | 2.7 |

| | 0.1 |

| | 0.1 |

|

| Total expenses | | 68.2 |

| | 86.8 |

| | 68.0 |

| | 89.8 |

| | 74.0 |

| | 5.8 |

| | (15.8 | ) |

| | | | | | | | | | | | | | | |

| Economic Net Income (Loss) | | $ | (76.1 | ) | | $ | (33.4 | ) | | $ | 1.0 |

| | $ | 26.2 |

| | $ | 39.1 |

| | $ | 115.2 |

| | $ | 12.9 |

|

| (-) Net Performance Fees | | (71.6 | ) | | (8.9 | ) | | (7.0 | ) | | 15.7 |

| | 26.1 |

| | 97.7 |

| | 10.4 |

|

| (-) Investment Income (Loss) | | (9.4 | ) | | (36.2 | ) | | 2.7 |

| | (2.8 | ) | | 5.8 |

| | 15.2 |

| | 8.6 |

|

| (+) Equity-based Compensation | | 5.2 |

| | 7.1 |

| | 6.3 |

| | 6.2 |

| | 5.4 |

| | 0.2 |

| | (0.8 | ) |

| (+) Reserve for Litigation and Contingencies | | — |

| | — |

| | — |