As filed with the Securities and Exchange Commission on April 17, 2015

Securities Act File No. 333- ________

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

¨ Pre-Effective Amendment No.

¨ Post-Effective Amendment No.

(Check appropriate box or boxes)

VII Peaks Co-Optivist Income BDC II Inc.

(Exact Name of Registrant as Specified in Articles of Incorporation)

4 Orinda Way, Suite 125-A

Orinda, CA 94563

(Address of Principal Executive Offices)

(877) 700-0527

(Area Code and Telephone Number)

Gurpreet S. Chandhoke

VII Peaks Co-Optivist Income BDC II, Inc.

4 Orinda Way, Suite 125-A

Orinda, CA 94563

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement becomes effective.

Title of Securities Being Registered: Shares of common stock, par value $0.01 per share.

Calculation of Registration Fee under the Securities Act of 1933:

Title of Securities

Being Registered | | Amount Being

Registered(1) | | | Proposed

Maximum

Offering Price Per

Unit | | | Proposed Maximum

Aggregate Offering

Price(2)(3) | | | Amount of

Registration Fee(3) | |

| Common Stock, par value $0.01 per share | | | 1,098,870 | | | $ | 7.31 | | | $ | 8,033,851 | | | $ | 933.53 | |

| (1) | Represents the estimated maximum number of shares of the Registrant’s common stock, par value $0.01 per share, to be issued upon completion of the mergers described herein. This number is based on the issuance of 1,098,870 shares of the Registrant at an estimated net asset value of $7.31 per share to acquire the net assets of VII Peaks Co-Optivist B Fund I, LLC, VII Peaks Co-Optivist B Fund II, LLC and VII Peaks Co-Optivist R Fund I, LLC (the “Target Funds”), which have an estimated aggregate net asset value of $8,033,851 under the terms of the Agreement and Plan of Reorganization between the Registrant and each Target Fund, which are attached to this Registration Statement as Annexes A, B and C. |

| | |

| (2) | The proposed maximum aggregate offering price of the registrant’s common stock was calculated based upon the estimated net asset value per share of the Registrant’s common stock in accordance with Rules 457(d) and 457(f) under the Securities Act as follows: the product of (A) $7.31 shares of the Registrant’s common stock that may be exchanged for the merger consideration. |

| | |

| (3) | Estimated solely for the purpose of calculating the registration fee required by Section 6(b) of the Securities Act and calculated pursuant to Rules 457(c) and 457(f) under the Securities Act, based on a rate of $116.20 per $1,000,000 of the proposed maximum aggregate offering price. |

EXPLANATORY NOTE

This Registration Statement is organized as follows:

Letter to Members of VII Peaks Co-Optivist B Fund I, LLC, VII Peaks Co-Optivist B Fund II, LLC and VII Peaks Co-Optivist R Fund I, LLC

VII Peaks Co-Optivist B Fund I, LLC

• Questions & Answers for Members of VII Peaks Co-Optivist B Fund I, LLC

• Notice of Special Meeting of Members of VII Peaks Co-Optivist B Fund I, LLC

• Prospectus/Proxy Statement Regarding Proposed Reorganization

VII Peaks Co-Optivist B Fund II, LLC

• Questions & Answers for Members of VII Peaks Co-Optivist B Fund II, LLC

• Notice of Special Meeting of Members of VII Peaks Co-Optivist B Fund II, LLC

• Prospectus/Proxy Statement Regarding Proposed Reorganization

VII Peaks Co-Optivist R Fund I, LLC

• Questions & Answers for Members of VII Peaks Co-Optivist R Fund I, LLC

• Notice of Special Meeting of Members of VII Peaks Co-Optivist R Fund I, LLC

• Prospectus/Proxy Statement Regarding Proposed Reorganization

Statement of Additional Information regarding the proposed Reorganizations

Part C Information

Exhibits

[VII PEAKS CAPITAL LETTERHEAD]

Dear Member:

VII Peaks Capital, LLC (“VII Peaks”) is asking that members of VII Peaks Co-Optivist B Fund I, LLC, VII Peaks Co-Optivist B Fund II, LLC and VII Peaks Co-Optivist R Fund I, LLC (the “Target Funds”) approve an Agreement and Plan of Reorganization (a “Reorganization”) between each Target Fund and VII Peaks Co-Optivist Income BDC II, Inc. (“Acquiring Fund”), under which the Acquiring Fund will acquire all of the assets and liabilities of each Target Fund in return for newly issued shares of common stock of the Acquiring Fund. The shares will be immediately distributed to the members (“Members”) of the Target Fund. The Target Fund would then be dissolved. For this purpose, you are invited to a Special Meeting of Shareholders of the Target Fund (the “Meeting”) to be held on ____, 2015. Each Reorganization is not dependent on the approval or consummation of the other Reorganizations, and will take place with respect to any Target Fund whose Members approve the Reorganization even if one or both of the Target Funds do not receive Member approval.

The proposed Reorganization for each Target Fund is described in more detail in the attached Proxy Statement/Prospectus. If the Members of the Target Fund approve the Reorganization by the Acquiring Fund, it is expected to be completed on or about within one week after the Meeting. Members of the Acquired Fund will not be assessed any sales charges or other individual fees in connection with the proposed Reorganization.

Each Target Fund has the same investment objective and investment strategies, and substantially similar investment policies, as the Acquiring Fund. The Target Fund's current portfolio managers – Gurpreet S. Chandhoke and Stephen Shea – are also officers and members of the investment committee of the Acquiring Fund. VII Peaks Capital LLC (“VII Peaks”) is the investment manager of the Acquiring Fund and the sole owner of the managers of the Target Funds. The Reorganization is expected to constitute a taxable exchange with respect to the Target Fund’s Members for federal income tax purposes; however, given the current valuations of the Target Fund’s assets, we expect that the exchange will not result in a taxable gain to the Target Fund’s Members. We anticipate that the proposed Reorganization will result in benefits to the Members of the Target Fund as discussed more fully in the Combined Proxy Statement/Prospectus.

VII Peaks recommends that you vote "FOR" the proposed Reorganization.

Your vote counts! You may vote quickly and easily in any one of these ways:

| | • | | Via internet: see the instructions on the enclosed proxy card. |

| | • | | Via telephone: see the instructions on the enclosed proxy card. |

| | • | | Via mail: use the enclosed proxy card and postage-paid envelope. |

| | • | | In person: attend the Member meeting on ___________, 2015 at the VII Peaks Capital, LLC’s corporate office at 4 Orinda Way, Suite 125-A, Orinda, CA 94563. |

If you’d like more information about the Acquiring Fund or the Target Fund in which you are a member, you may order a statement of additional information regarding the proposed Reorganization (request the “Reorganization SAI”) by:

| | • | | Telephone: 1-(855) 889-1778 |

| | • | | Mail: VII Peaks Co-Optivist Income BDC II, Inc., 4 Orinda Way, Suite 125-A, Orinda, CA 94563 |

| | • | | Internet: www.viipeaksbdc.com |

We welcome your attendance at the Meeting. If you are unable to attend, we encourage you to authorize proxies to cast your votes. No matter how many shares you own, your vote is important.

Sincerely,

Gurpreet S. Chandhoke

President

VII Peaks Co-Optivist Income BDC II, Inc.

Questions & Answers

For Members of VII Peaks Co-Optivist B Fund I, LLC

Although we recommend that you read the complete Prospectus/Proxy Statement, we have provided the following questions and answers to clarify and summarize the issues to be voted on.

Q: Why is a Member meeting being held?

A: A special meeting of Members (the “Meeting”) of VII Peaks Co-Optivist B Fund I, LLC (the “Target Fund”) is being held to seek Member approval of a reorganization (the “Reorganization”) of the Target Fund into VII Peaks Co-Optivist Income BDC II, Inc. (the “Acquiring Fund”), which pursues the same investment objective as the Target Fund. Please refer to the Prospectus/Proxy Statement for a detailed explanation of the proposed Reorganization and for a more complete description of the Acquiring Fund. The Acquiring Fund and the Target Funds are sometimes referred to herein individually as a “Fund” or collectively as the “Funds.”

Q: Why is the Reorganization being recommended?

A: After careful consideration, the manager of the Target Fund, VII Peaks-KBR B Fund I Management, LLC (the “Target Fund Manager”), has determined that the Reorganization will benefit its members (the “Members”) and recommends that you cast your vote “FOR” the proposed Reorganization. The Target Fund and the Acquiring Fund have the same investment objective, and the investment manager of the Acquiring Fund, VII Peaks Capital, LLC (“VII Peaks”), is the sole owner of the Target Fund Manager.

The Target Fund Manager believes that the Reorganization is in the best interests of Members because: (i) the Target Fund was established with a definite term of three years from the date the Target Fund first received an investment from an unaffiliated investor, and therefore if the Reorganization is not approved, it will be forced to liquidate in the near future, (ii) the Reorganization will allow Members to remain invested in a comparable portfolio of senior and subordinated, secured and unsecured debt securities of private companies without paying commissions on the reinvestment of the liquidation proceeds of the Target Fund, (iii) Members will become shareholders in an entity with a larger combined portfolio, which increases the potential of realizing economies of scale whereby administrative costs may be spread across the combined portfolio’s larger asset base, whereas the Target Fund has reached its limit on the number of investors, and therefore there are no opportunities for the Target Fund to realize economies of scale by raising additional capital; and (iv) the Acquiring Fund has a quarterly tender offer program that will enable Target Fund Members who do not want to participate in the Reorganization to liquidate their investment.

Q: Who can vote?

A: Each Member of the Target Fund is entitled to vote for each unit of ownership (referred to as an “Interest”) owned by the Member. The Target Fund Manager will cast your votes according to your voting instructions. If a voting instruction form is returned with no instructions, the shares of the Target Fund to which the form relates will be voted FOR the Reorganization.

Q: How will the Reorganization affect me?

A: Assuming Members approve the proposed Reorganization, the Acquiring Fund will issue its shares to acquire the assets and liabilities of the Target Fund. The shares will be issued at the most recently published net asset value per share of the Acquiring Fund (currently $7.31 per share). Immediately after the acquisition, the Target Fund will distribute the shares of the Acquiring Fund to the Members. As a result of the Reorganization, your Interests in the Target Fund will automatically be converted into shares of the Acquiring Fund. Following the Reorganization, the Target Fund will dissolve.

Q: Will I have to pay any commission or other similar fee as a result of the Reorganization?

A: No. You will not pay any commissions or other similar fees as a result of the Reorganization.

Q: Will the total annual operating expenses that my investment bears increase as a result of the Reorganization?

A: Yes, they will likely increase in the short-run, and the investment management fee, which comprises a portion of the annual operating expenses, will increase. In the long-run we expect that your annual operating expenses will decrease as the Acquiring Fund increases in size. For more information about how fund expenses may change as a result of the Reorganization, please see the comparative and pro forma table and related disclosures in the “COMPARISON OF THE ACQUIRING FUND AND TARGET FUND — Comparison of Expenses Incurred by Both Funds” section of the prospectus/proxy statement.

Q: Will I have to pay any U.S. federal income taxes as a result of the Reorganization?

A: The Reorganization is expected to constitute a taxable exchange with respect to the Target Fund’s Members for federal income tax purposes; however, given the current valuations of the Target Fund’s assets, we expect that the exchange will not result in a taxable gain to the Target Fund’s Members. The cost basis of each Member’s investment will be adjusted by the amount of such loss.

Q: If Members do not approve the Reorganization, what will happen to the Target Fund?

A: The Target Fund’s operating agreement provides that it must begin liquidation proceedings three years after the first sale of Interests to investors. As a result, the Target Fund will have to liquidate its portfolio, distribute the proceeds to Members, and dissolve, unless the Members vote to amend the operating agreement of the Target Fund to extend the term of the Target Fund.

Q: Who pays the costs of the Reorganization?

A: The expenses of the Reorganization, including the costs of the Meeting, will be paid by the Acquiring Fund and the Target Fund in the proportion to which each fund’s net asset value bears to the combined net asset value of both funds.

Q: How can I vote?

A: Members are invited to attend the Meeting and to vote in person. You may also vote by executing a proxy using one of three methods:

| | • | | By Internet: Instructions for casting your vote via the Internet can be found in the enclosed proxy voting materials. The required control number is printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

| | • | | By Telephone: Instructions for casting your vote via telephone can be found in the enclosed proxy voting materials. The toll-free number and required control number are printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

| | • | | By Mail: If you vote by mail, please indicate your voting instructions on the enclosed proxy card, date and sign the card, and return it in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. |

Members who execute proxies by Internet, telephone or mail may revoke them at any time prior to the Meeting by (i) filing with the Target Fund a written notice of revocation, (ii) executing another proxy bearing a later date, or (iii) attending the Meeting and voting in person. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

Q: When should I vote?

A: Every vote is important and the Board encourages you to record your vote as soon as possible. Voting your proxy now will ensure that the necessary number of votes is obtained without the time and expense required for additional proxy solicitation.

Q: Who should I call if I have questions about a Proposal in the proxy statement?

A: Call 1-(855) 889-1778 with your questions.

Q: How can I get more information about the Target Fund and Acquiring Funds?

A: You may obtain a statement of additional information regarding the Reorganization (request the “Reorganization SAI”) by:

| | • | | Telephone: 1-(855) 889-1778 |

| | • | | Mail: VII Peaks Co-Optivist Income BDC II, Inc., 4 Orinda Way, Suite 125-A, Orinda, CA 94563 |

| | • | | Internet: www.viipeaksbdc.com |

VII PEAKS CO-OPTIVIST B FUND I, INC.

4 Orinda Way, Suite 125-A

Orinda, CA 94563

(877) 700-0527

www.viipeakscapital.com

NOTICE OF SPECIAL MEETING

OF MEMBERS

To be Held on __________, 2015

NOTICE IS HEREBY GIVEN THAT a special meeting of members (the “Meeting”) of VII Peaks Co-Optivist B Fund I, LLC (the “Target Fund”), will be held at the offices of VII Peaks Capital, LLC, 4 Orinda Way, Suite 125-A, Orinda, CA 94563 on ______________, 2015 at 10:00 a.m. Pacific time for the following purposes:

| | 1. | To approve an Agreement and Plan of Reorganization (“Reorganization Agreement”) pursuant to which the Target Fund would (i) transfer all of its assets and liabilities to VII Peaks Co-Optivist Income BDC II, Inc. (the “Acquiring Fund”), in exchange for shares of the Acquiring Fund, (ii) distribute such shares of the Acquiring Fund to Members of the Target Fund, and (iii) dissolve. |

| | 2. | To transact such other business as may properly be presented at the Meeting or any adjournment thereof. |

VII Peaks-KBR B Fund I Management, LLC (the “Target Fund Manager”) has fixed the close of business on ______________, 2015 as the record date for the determination of members (a “Member”) of the Target Fund who are entitled to notice of, and to vote at, the Meeting and all adjournments thereof.

Members are invited to attend the meeting and vote in person. You may also vote by executing a proxy using one of three methods:

| | • | | By internet — Instructions for casting your vote via the Internet can be found in the enclosed proxy voting materials. The required control number is printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

| | • | | By telephone — Instructions for casting your vote via telephone can be found in the enclosed proxy voting materials. The toll-free number and required control number are printed on your enclosed proxy card. If this feature is used, there is no need to mail the proxy card. |

| | • | | By mail — If you vote by mail, please indicate your voting instructions on the enclosed proxy card, date and sign the card, and return it in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. |

Members who execute proxies by Internet, telephone, or mail may revoke them at any time prior to the Meeting by, (i) filing with the Target Fund a written notice of revocation, (ii) executing another proxy bearing a later date, or (iii) attending the Meeting and voting in person. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

The Board recommends that you cast your vote FOR the proposed Reorganization as described in the Prospectus/Proxy Statement.

| |

YOUR VOTE IS IMPORTANT Please return your proxy card or record your voting instructions by telephone or via the Internet promptly no matter how many shares you own. In order to avoid the additional expense of further solicitation, we ask that you mail your proxy card or record your voting instructions by telephone or via the Internet promptly regardless of whether you plan to be present in person at the Meeting. |

Date: ___________, 2015

Gurpreet S. Chandhoke

Chief Executive Officer

VII Peaks-KBR B Fund I Management, LLC

SUBJECT TO COMPLETION, DATED APRIL __, 2015

PROSPECTUS/PROXY STATEMENT

VII PEAKS CO-OPTIVIST INCOME BDC II, INC.

VII PEAKS CO-OPTIVIST B FUND I, LLC

TABLE OF CONTENTS

SUMMARY

The following is a summary of certain information contained elsewhere in this Prospectus/Proxy Statement and is qualified in its entirety by reference to the more complete information contained in this Prospectus/Proxy Statement. Members should read the entire Prospectus/Proxy Statement carefully.

The Target Fund Manager has approved the Reorganization Agreement on behalf of the Target Fund, subject to Member approval. The Reorganization Agreement provides for:

| | • | | the transfer of all of the assets and liabilities of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund; |

| | • | | the distribution by the Target Fund of such Acquiring Fund shares to Target Fund Members; and |

| | • | | the dissolution of the Target Fund. |

When the Reorganization is complete, Target Fund Members will hold Acquiring Fund shares. Under the Reorganization, each Member of the Target Fund will receive Acquiring Fund shares that have a net asset value equal to the net asset value of the Target Fund Interests owned by such Member immediately prior to the Reorganization, in both cases based on the most recently published financial statements of each. After the Reorganization, the Acquiring Fund will continue to operate with the investment objective and investment policies set forth in this Prospectus/Proxy Statement.

The Target Fund and the Acquiring Fund have the same investment objective. The Target Fund and the Acquiring Fund both seek current income and the potential for capital gains by investing in portfolios of senior and subordinated, secured and unsecured debt securities of private companies.

The Target Fund Manager believes that the Reorganization is in the best interests of Members because: (i) the Target Fund was established with a definite term of three years from the date the Target Fund first received an investment from an unaffiliated investor, and therefore if the Reorganization is not approved, it will be forced to liquidate in the near future, (ii) the Reorganization will allow Members to remain invested in a comparable portfolio of senior and subordinated, secured and unsecured debt securities of private companies without paying commissions on the reinvestment of the liquidation proceeds of the Target Fund, (iii) Members will become shareholders in an entity with a larger combined portfolio, which increases the potential of realizing economies of scale whereby administrative costs may be spread across the combined portfolio’s larger asset base, whereas the Target Fund has reached its limit on the number of investors, and therefore there are no opportunities for the Target Fund to realize economies of scale by raising additional capital; and (iv) the Acquiring Fund has a quarterly tender offer program that will enable Target Fund Members who do not want to participate in the Reorganization to liquidate their investment.

In determining whether to recommend approval of the Reorganization Agreement to Members, the Target Fund Manager considered a number of factors, including, but not limited to: (i) the expenses and advisory fees applicable to the Acquiring Fund and the Target Fund before the proposed Reorganization and the estimated expense ratios of the combined portfolio after the proposed Reorganization; (ii) the comparative investment performance of the Acquiring Fund and the Target Fund; (iii) the future growth prospects of the Acquiring Fund and the Target Fund; (iv) the terms and conditions of the Reorganization Agreement and whether the Reorganization would result in the dilution of Member Interests; (v) the compatibility of the Acquiring Fund’s and the Target Fund’s investment objectives, policies, risks and restrictions; (vi) the anticipated tax consequences of the proposed Reorganization; (vii) the costs and delays associated with the reinvestment of liquidation proceeds to those Members who wish to maintain an investment with the same objectives and returns; (viii) the Acquiring Fund’s periodic redemption program, which will enable Target Fund Members who desired to liquidate their investment to do so after the Reorganization is complete; and (ix) the fact that most of the costs of the Reorganization would be borne by the Acquiring Fund. The Target Fund Manager concluded that these factors supported a determination to approve the Reorganization Agreement.

The Target Fund Manager is asking Members to approve the Reorganization at a meeting to be held on ________, 2015. If Members of the Target Fund approve the proposed Reorganization, it is expected that the closing date of the transaction (the “Closing Date”) will be after the close of business on or about ________, 2015, but it may be at a different time as described herein. If Members do not approve the proposed Reorganization, the Board will consider alternatives to the Reorganization, including soliciting an amendment to the Target Fund’s operating agreement to extend its term.

The Target Fund Manager recommends that you vote “FOR” the Reorganization.

COMPARISON OF THE ACQUIRING FUND AND TARGET FUND

Comparison of Investment Objective and Principal Strategies

The Target Fund and the Acquiring Fund have identical investment strategies. The investment objective of each fund is to generate current income and capital appreciation. Both funds intend to meet its investment objectives by: (i) realizing income and capital appreciation through the acquisition, management and orderly liquidation of corporate debt securities, (ii) making distributions of available distributable cash to its equity holders, and (iii) the preservation of the capital investments of its equity holders.

Both the Target Fund and the Acquiring Fund invest in discounted corporate debt and equity-linked debt securities of public and private companies that trade on the secondary loan market for institutional investors and provide distributions to investors. Each fund also actively works with the management of the companies in which it invests to restructure the companies’ debt and improve the liquidity position of its balance sheet. Each fund employs the proprietary “Co-Optivist”TM approach (“cooperative activism”, Co-OptivistTM is a registered trademark of VII Peaks, and is being used with its permission) in executing its investment strategy.

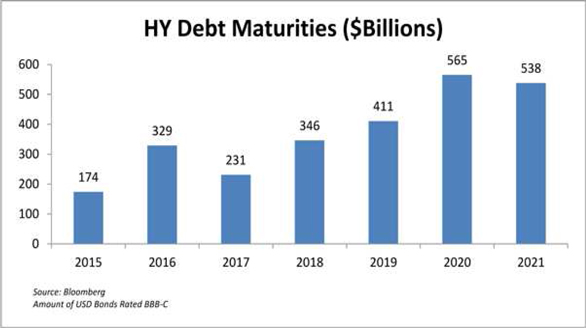

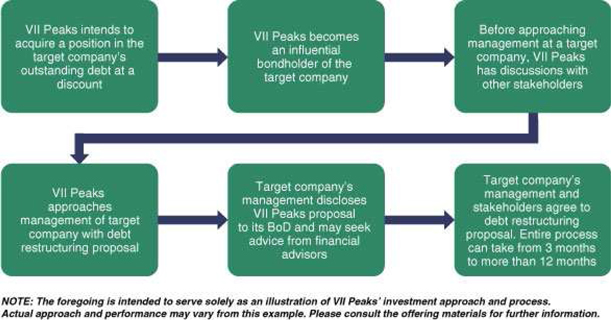

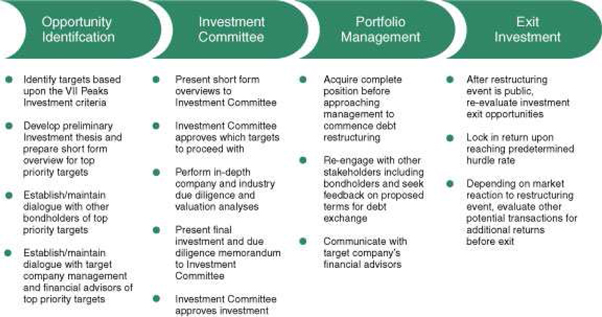

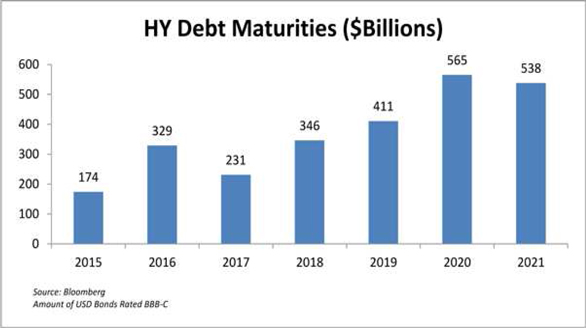

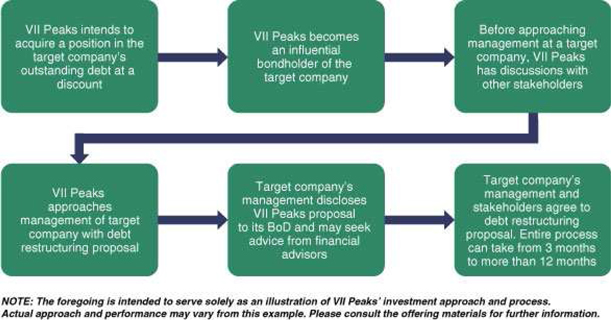

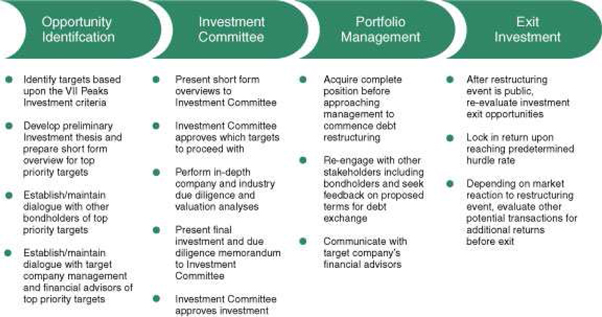

The proprietary “Co-Optivist” TM (cooperative activism) approach entails investment in the corporate debt and equity-linked debt securities of a target company (“Target Company”) in conjunction with proactive engagement of the management of these companies. Investments are made in debt securities of a Target Company that trade on the over-the-counter market for institutional loans at a discount to their par redemption value, and are subject to a “redemption event” within (on average) 24 months. A “redemption event” is defined as a maturity event or a put event (where investors in the target company’s debt security have a redemption right at a pre-determined price). Investments in such debt are held an average of 12 – 18 months, during which time the funds work actively with the Target Company’s management to effect and/or participate in a restructuring or exchange of the invested securities for new securities.

The size of an individual investment varies based on numerous factors, including the amount of funds available to invest. Generally, neither fund invests heavily in any one industry or in more than two different classes of debt of the same company. Investments are generally limited to the debt and equity-linked debt of Target Companies with a minimum enterprise value of $200 million and whose debt and equity-linked debt is actively traded in the secondary loan market. Although each fund’s portfolios are predominantly composed of fixed-rate high-yield and equity-linked corporate debt securities, the funds may also purchase senior secured corporate debt securities, which may have variable interest rates.

Comparison of Principal Risks

The Acquiring Fund and the Target Fund are subject to similar principal risks because they have essentially identical investment objectives and strategies. These risks are described below.

Principal risks to which both funds are subject

Market Risk. Over time, securities markets generally tend to move in cycles with periods when security prices rise and periods when security prices decline. The value of the fund’s investments may move with these cycles and, in some instances, increase or decrease more than the broad market index(es), like the S&P 500 index, or index(es) specific to corporate debt securities. The securities markets may also decline because of factors that affect a particular industry.

Credit Risk. Prices of bonds and other debt instruments can fall if the issuer’s actual or perceived financial health deteriorates, whether because of broad economic or issuer-specific reasons. In certain cases, the issuer could be late in paying interest or principal, or could fail to pay altogether.

Issuer Risk. Issuer risk is the possibility that factors specific to a company to which the fund’s portfolio is exposed will affect the market prices of the company’s securities and therefore the value of the fund. Some factors affecting the performance of a company include demand for the company’s products or services, the quality of management of the company, brand recognition and loyalty, regulatory actions, and the company’s capital structure. If a company becomes insolvent, debt securities issued by the company may suffer a loss.

Investment Adviser Risk. The fund is actively managed and the success of its investment strategy depends significantly on the skills of its respective adviser in assessing the potential of the investments in which the fund invests. This assessment of investments may prove incorrect, resulting in losses or poor performance, even in rising markets. The potential for the fund manager to earn incentive fees may create an incentive for the fund to enter into investments that are riskier or more speculative than would otherwise be in the best interests of investors.

Liquidity Risk. The equity interests of neither Fund are publicly traded, and the ability of a shareholder or Member to liquidate their shares or Interests, respectively, is subject to a tender offer program or early redemption program, which may be terminated by each fund at any time.

Interest Rate. With bonds and other fixed rate debt instruments, a rise in interest rates generally causes values to fall; conversely, values generally rise as interest rates fall. The higher the credit quality of the instrument, and the longer its maturity or duration, the more sensitive it is likely to be to interest rate risk. In the case of inverse securities, the interest rate generally will decrease when the market rate of interest to which the inverse security is indexed increases. As of the date of this Proxy Statement/Prospectus, interest rates in the United States are at or near historic lows, which may increase the funds’ exposure to risks associated with rising interest rates.

Liquidity. If a security is illiquid, the fund might be unable to sell the security at a time when the fund’s manager might wish to sell, and the security could have the effect of decreasing the overall level of the fund’s liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the fund could realize upon disposition. The fund may make investments that become less liquid in response to market developments or adverse investor perception. The fund could lose money if it cannot sell a security at the time and price that would be most beneficial to the fund.

Macroeconomic Risk. Economic activity in the United States was impacted by the global financial crisis of 2008 and has yet to fully recover. These conditions may make it more difficult for the fund achieve its investment objectives.

Small to Mid-Cap Risk. Small to medium-sized companies often have greater price volatility, lower trading volume, and less liquidity than larger, more-established companies. These companies tend to have smaller revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources, and less competitive strength than larger companies.

Additional risks to which Acquiring Fund is subject

Regulated Investment Company Risk. The Acquiring Fund has elected to be taxed as a “regulated investment company” or “RIC.” To satisfy the requirements for taxation as a RIC, the Acquiring Fund must meet certain diversification requirements and must distribute a percentage of any taxable income it generates in any year. Any failure to meet the requirements for taxation as a RIC would cause the Acquiring Fund to be taxed as an association, which would require the Acquiring Fund to pay taxes on any corporate income. In such case, taxes would also be payable by shareholders on any distributions from the Acquiring Fund.

Expense Ratio. The Acquiring Fund currently pays a higher management fee and has a higher operating expense ratio (excluding management fees) than the Target Fund. However, as the Acquiring Fund gets larger, its operating expense ratio should decline to the point that it is less than the Target Fund’s operating expense ratio. Furthermore, the Target Fund currently has an artificially low expense ratio because the Target Fund Manager covers certain expenses which are normally borne by an investment fund, and there is no assurance that the Target Fund Manager will agree to continue to manage the Target Fund on such favorable terms after its term expires.

Additional risks to which Target Fund is subject

Reinvestment Risk. The Target Fund was formed with a term of three years after the date the Target Fund first accepted capital from a third party, which term ended on July 29, 2014. If the Reorganization is not approved, and Target Fund Members do not approve an extension of the term of the Target Fund, the Target Fund will have to liquidate and distribute the proceeds to its Members. Target Fund Members will experience certain risks in reinvesting the liquidation proceeds in an investment that generates similar returns, including that Target Fund Members would likely have to pay commissions on any reinvestment of their liquidation proceeds.

Extension of Term. If the Reorganization is not approved, there is a risk that the Target Fund Manager may not agree to extend the term of the Target Fund unless the terms under which it is paid to manage the Target Fund are revised. The Target Fund currently has an artificially low expense ratio because the Target Fund Manager covers certain expenses which are normally borne by an investment fund. If the Target Fund Manager only agrees to extend the term if it is compensated for management services at market rates, the returns to investors will likely decrease.

Management of the Acquiring Fund

The Acquiring Fund’s Board of Directors (the “Board”) oversees the management of the business and affairs of the Acquiring Fund. The Acquiring Fund’s Board approves all significant agreements between the Acquiring Fund and persons or companies furnishing services to it, including the Acquiring Fund's agreements with its investment adviser, VII Peaks. The Board, in turn, elects the officers of the Fund, who are responsible for administering the day-to-day operations of the Fund. The Board is responsible for the overall supervision of the operations of the Acquiring Fund’s portfolio and performs the various duties imposed on the directors of investment companies by the 1940 Act and under applicable state law. Actual management of the Acquiring Fund’s portfolio is handled by an investment committee of three individuals.

The following table provides the name, address and principal occupation of the principal executive officers and Independent Directors of the Acquiring Fund. The current Independent Directors and officers of the Fund, their dates of birth, positions with the Fund, terms of office with the Fund and length of time served, their principal occupations for the past five years and other directorships are also set forth in the table below.

Independent Directors

Name, Address And Age | Position with the Fund | Term of Office

and Length of Time Served | Principal Occupation During Past Five Years | Other Directorships Held |

Jeya Kumar (59) | Director | Until 2016; Since January 2012. | Advisor at MediaLink Singapore since July 2013; CEO (Asia Pacific) for IPSoft Inc. from November 2011 to July 2013; Advisor at Patni Computer Systems, Ltd. from May 2011 to November 2011; CEO of Patni Computer Systems, Ltd. from February 2009 to May 2011; formerly Chief Executive Officer of MphasiS Limited (2008 to 2009) | None |

Amit Mahajan (38) | Director | Until 2015; Since March 2012. | Director at PineBridge Investments since 2005 | PineBridge Investments |

Robert Winspear (48) | Director | Until 2017; ; Since January 2012. | President of Winspear Investments, LLC since 2002 | Alpha Financial Technologies/EAM Corporation |

Interested Directors and Executive Officers

Name, Address And Age | Position with the Fund | Term of Office

and Length of Time Served | Principal Occupation During Past Five Years | Other Directorships Held |

Gurpreet S. Chandhoke (40) | Chairman of the Board, Chief Executive Officer | Until 2015; Since August 2011. | Managing Partner and Chief Investment Officer of VII Peaks Capital, LLC (April 2009 to present); Senior Vice President of Deutsche Bank Technology Investment Banking Group (August 2006 to February 2009) | None. |

Michelle Kleier (47) | Chief Financial Officer, Treasurer and Secretary | Indefinite Term, Since March 2015 | As Vice President of Compliance for VII Peaks Capital, LLC since August 2014; Chief Compliance Officer at KBR Capital Markets from April 2013 to September 2013; Chief Financing Officer of real estate fund manager from July 2012 to April 2013; Chief Operating Office of broker dealer from May 2006 to December 2012; instructor and tutor in securities licensing review courses since 1998. | None. |

Emily Silva (50) | Chief Compliance Officer | Indefinite Term; Since May 2014 | Director at Cipperman Compliance Services (February 2014 to present); Various positions at The Vanguard Group from 1999 to January 2014, including Advertising Compliance Manager. | None. |

| Garima Kakani (29) | Controller | Indefinite Term, Since March 2015 | Senior Analyst with VII Peaks Capital, LLC since December 2013; Manager of Reporting and Analytics with KBR Capital Markets from March 2011 to September 2013; Various positions at D.E. Shaw (Indian branch) from March 2007 to September 2009. | None |

The day-to-day management of, and investment decisions for, the Acquiring Fund are made by an investment committee composed of Gurpreet S. Chandhoke, Stephen F. Shea and Bhavin Shah. This same team will manage the Acquiring Fund following consummation of the Reorganization. Biographical information regarding the members of the investment committee is provided below.

Gurpreet (Gurprit) S. Chandhoke

Mr. Chandhoke has been the Acquiring Fund’s Chief Executive Officer and President since its inception. Mr. Chandhoke has also been a Managing Partner and Chief Investment Officer of VII Peaks since its inception in April 2009. From August 2006 to February 2009, Mr. Chandhoke was Senior Vice President of Deutsche Bank Technology Investment Banking Group in San Francisco. From August 2005 to August 2006, Mr. Chandhoke worked for UBS Investment Bank as an Associate Director.

Mr. Chandhoke has more than eleven years investment banking experience. Mr. Chandhoke led several different types of debt issuances and restructuring discussions and transactions with technology companies and financial sponsors while at Deutsche Bank and UBS Investment Bank. During his tenure at both institutions he also participated in diverse corporate finance and M&A transactions in the internet, enterprise software and infrastructure and communications technology sectors. Mr. Chandhoke’s responsibilities at Deutsche Bank and UBS Investment Bank also involved the issuance of debt securities ranging from bank debt, corporate debt, high yield and convertible debt securities. Mr. Chandhoke also worked on corporate finance transactions ranging from mergers and acquisitions, initial public offerings, follow-on offerings, debt issuances and recapitalizations at both Deutsche Bank and UBS Investment Bank.

Mr. Chandhoke received a Master of Business Administration in Finance and Entrepreneurship from the Wharton School of Business. Mr. Chandhoke also received a Master Degree of Science in Electrical Engineering and a Master Degree of Science in Mechanical Engineering from the University of Minnesota and a Bachelor’s Degree in Electrical Engineering from the Government College of Engineering, University of Pune, India. Mr. Chandhoke was chosen as a J.N. Tata Scholar to pursue his graduate studies in the United States.

Mr. Chandhoke’s broad and extensive investment banking experience and involvement in a number of diverse corporate finance and M&A transactions as well as his experience as Chief Investment Officer for VII Peaks supports his appointment to the board of directors.

Stephen F. Shea

Mr. Shea has been a Managing Partner of VII Peaks since August 2009. Prior to joining VII Peaks, Mr. Shea worked as a consultant with investment banking and venture/private equity teams and helped registered investment advisers integrate and build out offerings into distribution channels with his long standing connections at a number of wire houses. Mr. Shea also advised hedge funds on new seeding opportunities in the commodities/futures space. Prior to his consulting work, from October 2005 to March 2007, Mr. Shea was Vice President of Institutional Sales RIA Team for Fidelity Investments in San Francisco, spending the majority of his time as a director of sales for Institutional Investment Managers, RIA wealth management teams and banks and trust companies. In addition, Mr. Shea was responsible for the signing, business development and retention of SEC registered RIA relationship in San Francisco and the Pacific Northwest. Prior to working for Fidelity Investments, Mr. Shea worked for Wentworth, Hauser and Violich Investment Counsel. At Wentworth, Mr. Shea was a member of Stock Selection and Investment Policy committees. He co-developed an open architecture WRAP, Sub-Advised, RIA platform. Before that, from December 1999 to March 2001, Mr. Shea worked at Deutsche Bank/Alex Brown. At Deutsche Bank/Alex Brown, Mr. Shea acted as a lead broker for many of the top technology executives.

Mr. Shea holds a Bachelor of Science in Business and Finance from St. Mary’s College in California.

Bhavin Shah

Mr. Shah has spent the last 15 years in the investment management and private equity arenas. Mr. Shah's investments have ranged from publicly-traded debt securities and structured fixed income investments to purchases of hard and soft-asset portfolios and in- and/or out-of-court recapitalizations/buyouts. Prior to rejoining VII Peaks in April 2014, Mr. Shah previously served on the Investment Committee of VII Peaks from August 2012 to August 2013.

Mr. Shah was a Managing Director at Mount Kellett Capital Management from 2008 to 2010, a multi-strategy investment firm focused on global distressed, special situations and opportunistic investing. From 2010 to present, Mr. Shah has largely focused on personally investing in various special situations opportunities. From 2006 to 2008, Mr. Shah served as a Managing Director of Oak Hill Advisors, a $10 billion credit-oriented investment firm. Prior to this, Mr. Shah was a Principal/Vice President with the Carlyle Group's distressed and special situation arm, and led the firm's investment sourcing, structuring and execution efforts from 2002 to 2006.

Prior to earning his MBA from the Harvard Business School, Mr. Shah worked with Morgan Stanley's Princes Gate Investors. He also invested in cross-border infrastructure and technology opportunities at Soros Fund Management, and led engagements and helped open and grow the India offices at McKinsey and Company. In addition, Mr. Shah served at The White House as a Legislative Assistant to the President after graduating from the University of Michigan in Ann Arbor with Dual Bachelor of Arts degrees in Economics and Political Science with honors and distinction.

Management of the Target Fund

The Target Fund is managed by VII Peaks-KBR B Fund I Management, LLC (the “Target Fund Manager”), which is wholly owned by VII Peaks. VII Peaks is also the investment advisor to the Acquiring Fund. VII Peaks has been in the investment advisory business since 2009, and managed approximately $66.1 million in assets as of December 31, 2014, including approximately $48.6 million in assets of the Acquiring Fund and the Target Funds. VII Peaks is located at 4 Orinda Way, Suite 125-A, Orinda, CA 94563. Messrs. Chandhoke and Shea are the principal shareholders of VII Peaks.

Comparison of Fees Paid by Both Funds

Base Advisory Fees. The Acquiring Fund pays a base investment advisory fee to VII Peaks. The Target Fund pays a base investment advisory fee to the Target Fund Manager. The advisory contracts between the Target Fund and the Target Fund Manager, and between the Acquiring Fund and VII Peaks, provide for the following advisory fees, expressed as an annual percentage of net assets as of the end of each month:

| Target Fund |

| 1.5% on net assets, payable only after the Members have received distributions of 7.5% year-to-date on their original capital contributions. |

| Acquiring Fund |

| 2.00% of net assets up to $100 million |

| 1.75% of net assets greater than $100 million but not greater than $250 million |

| 1.50% of net assets greater than $250 million |

Fees Paid only by Acquiring Fund

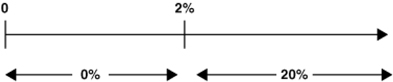

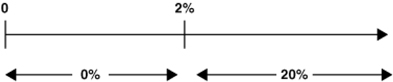

Incentive Fee on Net Investment Income. The Acquiring Fund pays VII Peaks an incentive fee on net investment income that is calculated and payable quarterly in arrears based upon the Acquiring Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter. This incentive fee is equal to 20% of the pre-incentive fee net investment income, but is subordinated to a return on adjusted capital equal to 2.0% per quarter (an annualized rate of 8.0%). No subordinated incentive fee on net investment income is payable in any calendar quarter in which pre-incentive fee net investment income does not exceed the preferred quarterly return of 2.0% on adjusted capital. For any calendar quarter in which the pre-incentive fee net investment income exceeds 2.0% of adjusted capital, the subordinated incentive fee on income equals 20.0% of pre-incentive fee net investment income, if any, that exceeds 2.0%. The Target Fund does not pay the Advisor an incentive fee in net investment income.

Incentive Fee on Capital Gains. The Acquiring Fund pays VII Peaks an annual incentive fee calculated based on any capital gains from liquidated investments. This incentive fee is determined and payable in arrears as of the end of each calendar year (or upon termination of VII Peak’s investment advisory agreement) in an amount equal to 20.0% of the Acquiring Fund’s incentive fee on capital gains, which will equal its realized capital gains on a cumulative basis from inception, calculated as of the end of each calendar year, less all realized capital losses and unrealized capital depreciation on a cumulative basis, and less the aggregate amount of any previously paid capital gains incentive fees. The Target Fund does not pay the Advisor an incentive fee in capital gains.

Fees Paid only by Target Fund

Performance Fee. The Target Fund pays the Target Fund Manager a performance fee as follows:

| · | 20% of any distributions after Members have received the return of their capital and a non-compounded, cumulative return of 10%; and |

| · | 40% of any distributions after Members have received the return of their capital and a non-compounded, cumulative return of 15%. |

VII Peaks and the Target Fund Manager may from time to time voluntarily waive all or a portion of their respective fees. Any such voluntary waiver of fees and/or expense reimbursements may be discontinued by the VII Peaks or the Target Fund Manager at any time.

Comparison of Expenses Incurred by Both Funds

The following tables are intended to assist you in understanding the costs and expenses that investors in the Acquiring Fund and the Target Fund bear directly or indirectly and, based on the assumptions set forth below, the pro forma costs and expenses estimated to be incurred by the Acquiring Fund in the first year assuming the Acquiring Fund acquires the Target Fund and also assuming the Acquiring Fund acquires at the same time VII Peaks Co-Optivist B Fund II, LLC, and VII Peaks Co-Optivist R Fund I, LLC (collectively referred to as the “Target Funds”). The Funds caution you that some of the percentages indicated in the table below are estimates and may vary. The percentages for the Acquiring Fund are based on its expected operating results for the fiscal year ended December 31, 2015 based upon expected growth in its net assets as a result of the issuance of common share in its continuous offering. The percentages for each Target Fund are based on its operating results for the year ended December 31, 2014.

| | | Actual | | | Pro Forma | |

| | | Target Fund | | | Acquiring

Fund (Est.)(1) | | | Acquiring

Fund

(assuming

merger with

Target

Fund)(1) | | | Acquiring Fund

(assuming

merger with the

Target

Funds)(1) | |

| Shareholder/Member Transaction Expenses | | | | | | | | | | | | | | | | |

| Sales Load (as a percentage of offering price) (2) | | | None | | | | None | | | | None | | | | None | |

| Offering Expenses (3) | | | None | | | | 1.5 | % | | | 1.5 | % | | | 1.5 | % |

| Dividend Reinvestment Plan Fees (4) | | | None | | | | None | | | | None | | | | None | |

| Total Shareholder/Member Transaction Expenses | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Annual Fund Operating Expenses As a Percentage of Net Assets (expenses that you pay each year as a percentage of the value of your investment) | | | | | | | | | | | | | | | | |

| Management Fees (5) | | | 1.7 | % | | | 2.0 | % | | | 2.0 | % | | | 2.0 | % |

| Incentive Fees (6) | | | - | | | | - | | | | - | | | | - | |

| Interest Payments on Borrowed Funds (7) | | | None | | | | None | | | | None | | | | None | |

| Other Expenses (8) | | | 2.1 | % | | | 2.1 | % | | | 2.1 | % | | | 2.1 | % |

| Total Annual Operating Expenses | | | 3.8 | % | | | 4.1 | % | | | 4.1 | % | | | 4.1 | % |

| | (1) | Estimates for the Acquiring Fund assume that its net assets are $50 million at the beginning of the 12 month period beginning on May 1, 2015, that it sells $22 million worth of its shares of common stock during the 12 month period beginning on May 1, 2015, that its net offering proceeds from such sales equal $20 million, that its ending net assets are $70 million, and that its average net assets during such period equal one-half of the difference between the beginning and ending net asset values for such 12 month period, or $60 million. Actual expenses will depend on the number of shares of common stock its sells in its continuous offering. For example, if it were to raise proceeds significantly less than this amount over the next twelve months, its expenses as a percentage of its average net assets would be significantly higher. There can be no assurance that the Acquiring Fund will sell $22 million worth of its shares during the twelve months following May 1, 2015. |

| | | |

| | (2) | On sales of shares in its continuous offering, the Acquiring Fund charges selling commissions of 7% of the gross proceeds from sales made by selected dealers and 3% for dealer manager fees. However, selling commissions and dealer manager fees are not paid in connection with the purchase of shares pursuant to the distribution reinvestment plan. The table does not include any sales load (underwriting discount or commission) that shareholders may have paid in connection with their purchase of Acquiring Fund shares or Target Fund Interests. |

| | | |

| | (3) | Under the Acquiring Fund’s investment advisory agreement with VII Peaks, VII Peaks incurs organization and offering expenses on the Acquiring Fund’s behalf and is entitled to reimbursement from the Acquiring Fund to the extent of 1.5% of the Acquiring Fund’s gross offering proceeds. |

| | | |

| | (4) | The expenses of the Acquiring Fund’s dividend reinvestment plan are included in "Other expenses." |

| | | |

| | (5) | The Acquiring Fund’s base management fee is calculated as a percentage of net assets as set forth below and payable monthly in arrears: · 2.00% if net assets are below $100 million; · 1.75% if net assets are between $100 million and $250 million; and · 1.50% if net assets are above $250 million. |

| | | For purposes of the “Fees and Expenses” Table, it is assumed that the Acquiring Fund’s net asset value at the end of the 12-month period following the Reorganizations is less than $100 million. As a result, we have estimated the Acquiring Fund’s base management fee to be 2.0% of net assets. |

| | | |

| | (6) | We have assumed that VII Peaks will be entitled to aggregate incentive fees of $0 over the 12-month period following the Reorganizations, based on the Acquiring Fund’s operating results for the nine months ended September 30, 2014 and the weighted average interest rate of investments in its investment portfolio. The incentive fee has two parts. The first part, which is referred to as the subordinated incentive fee on income, will be calculated and payable quarterly in arrears based upon the Acquiring Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter. The subordinated incentive fee on income will be 20% of pre-incentive fee net investment income subject to a quarterly return to investors, expressed as a rate of return on adjusted capital at the beginning of the most recently completed calendar quarter, of 2.0% (8.0% annualized). “Adjusted capital” shall mean cumulative gross proceeds generated from sales of its common stock (including its distribution reinvestment plan) reduced for distributions to investors of proceeds from non-liquidating dispositions of the Acquiring Fund’s investments and amounts paid for share repurchases pursuant to the Acquiring Fund’s tender offer program. |

| | | |

| | | The second part of the incentive fee, which is referred to as the incentive fee on capital gains, will be an incentive fee on capital gains earned on liquidated investments from the portfolio and will be determined and payable in arrears as of the end of each calendar year (or upon termination of the investment advisory agreement). This fee will equal 20.0% of the Acquiring Fund’s incentive fee capital gains, which will equal its realized capital gains on a cumulative basis from inception, calculated as of the end of each calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gains incentive fees. |

| | | |

| | (7) | The Acquiring Fund has no current intention to incur leverage until at least June 30, 2015. |

| | | |

| | (8) | Other Expenses, or expenses incurred in connection with administering the applicable Fund’s business, consist of accounting, legal and auditing fees, the reimbursement of its chief financial officer and related staff and expenses incurred in connection with hedging its investment portfolio, but do not include offering expenses or management and incentive fees due VII Peaks or the Target Fund Manager. We estimate that the Acquiring Fund’s Other Expenses will equal 2.12% as a percentage of average net assets, based on Other Expenses of approximately $1.27 million in the fiscal year ended December 31, 2014. The estimate of Other Expenses for each Target Fund is based on the operating expenses incurred by each Target Fund in the fiscal year ended December 31, 2014. |

Fees and Expenses Example

The following example, using the actual and pro forma operating expenses for the year ended December 31, 2014, is intended to help you compare the costs of investing in the Acquiring Fund pro forma after the Reorganization with the expected costs of investing in each of the Target Fund and the Acquiring Fund without the Reorganization. The example assumes that you invest $1,000 in each of the Target Fund and the Acquiring Fund for the time period indicated and that you redeem all of your shares at the end of each period. The example also assumes that your investments have a 5% return each year and that each of the Target Fund’s and the Acquiring Fund’s operating expenses remain the same each year. The example assumes that shareholders in the Target Funds do not pay any commission on the acquisition of shares in the Acquiring Fund. Although your actual returns may be higher or lower, based on these assumptions your costs would be:

| | | Actual | | | Pro Forma | | | Pro Forma | |

| | | Target Fund | | | Acquiring

Fund | | | Acquiring Fund

(assuming

merger with

Target Fund) | | | Acquiring Fund

(assuming

merger with all

Target Funds) | |

| Total operating expenses assuming redemption at the end of the period | | | | | | | | | | | | | | | | |

| One Year | | $ | 38 | | | $ | 42 | | | $ | 42 | | | $ | 42 | |

| Three Years | | $ | 117 | | | $ | 128 | | | $ | 127 | | | $ | 127 | |

| Five Years | | $ | 197 | | | $ | 215 | | | $ | 214 | | | $ | 213 | |

| Ten Years | | $ | 405 | | | $ | 438 | | | $ | 436 | | | $ | 436 | |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares or Interests are held in a taxable account. These costs, which are not reflected in Total Annual Operating Expenses or in the Example, affect the Funds’ performance. During the fiscal year ended December 31, 2014, the Acquiring Fund’s and the Target Fund’s portfolio turnover rates were 36.08% and 26%, respectively, of the average value of their portfolios.

Pricing of Shares

The price at which the Acquiring Fund’s shares will be issued in the Reorganization will be equal to the net asset value of its shares, as most recently published prior to the Closing Date.

The Acquiring Fund determines the net asset value of its investment portfolio each quarter. Securities that are publicly-traded are valued at the reported closing price on the valuation date. Securities that are not publicly-traded are valued at fair value as determined in good faith by its board of directors. In connection with that determination, VII Peaks prepares portfolio company valuations using relevant inputs, including, but not limited to, indicative dealer quotes, values of like securities, the most recent portfolio company financial statements and forecasts, and valuations prepared by third-party valuation services.

Investments are valued utilizing a market approach, an income approach, or both approaches, as appropriate. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities (including a business). The income approach uses valuation techniques to convert future amounts (for example, cash flows or earnings) to a single present value amount (discounted) calculated based on an appropriate discount rate. The measurement is based on the net present value indicated by current market expectations about those future amounts. In following these approaches, the types of factors that the Acquiring Fund may take into account in fair value pricing its investments include, as relevant: available current market data, including relevant and applicable market trading and transaction comparables, applicable market yields and multiples, security covenants, call protection provisions, information rights, the nature and realizable value of any collateral, the portfolio company’s ability to make payments, its earnings and discounted cash flows, the markets in which the portfolio company does business, comparisons of financial ratios of peer companies that are public, M&A comparables, the principal market and enterprise values, among other factors.

The Acquiring Fund has adopted Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, Topic 820, Fair Value Measurements and Disclosures (formerly Statement of Financial Accounting Standards No. 157, Fair Value Measurements ), which defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosures about fair value measurements.

ASC Topic 820 clarifies that the exchange price is the price in an orderly transaction between market participants to sell an asset or transfer a liability in the market in which the reporting entity would transact for the asset or liability, that is, the principal or most advantageous market for the asset or liability. The transaction to sell the asset or transfer the liability is a hypothetical transaction at the measurement date, considered from the perspective of a market participant that holds the asset or owes the liability. ASC Topic 820 provides a consistent definition of fair value which focuses on exit price and prioritizes, within a measurement of fair value, the use of market-based inputs over entity-specific inputs. In addition, ASC Topic 820 provides a framework for measuring fair value and establishes a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. The three levels of valuation hierarchy established by ASC Topic 820 are defined as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities, accessible by the Company at the measurement date.

Level 2: Quoted prices for similar assets or liabilities in active markets, or quoted prices for identical or similar assets or liabilities in markets that are not active, or other observable inputs other than quoted prices.

Level 3: Unobservable inputs for the asset or liability.

In all cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level of input that is significant to the fair value measurement.

The Target Fund has identical valuation policies as the Acquiring Fund. As a result, there will be no material change to the value of the Target Fund’s assets because of the Reorganization.

Comparison of Purchase Procedures and Exchange Rights

The Acquiring Fund is offering up to 75,000,000 shares of its common stock on a continuous basis at an initial offering price of $9.75 per share pursuant to a public offering registered under the Securities Act of 1933. The Acquiring Fund holds closings on a semi-monthly basis. The initial minimum permitted purchase is $5,000. Additional purchases must be made in increments of $500, except for purchases made pursuant to the distribution reinvestment plan.

The Acquiring Fund pays selling commissions of 7% of the gross proceeds from sales made by selected dealers and 3% for dealer manager fees to Axiom Capital Management, Inc., the dealer manager (“Axiom”). However, the Acquiring Fund may waive or reduce the fees and expenses in connection with any sale of its shares that will represent a discount to the price at which its securities are offered to the public, provided that the amount of net proceeds to the Acquiring Fund is not affected by these discounts.

For example, the selling commission and the dealer manager fee may be reduced or waived on the following categories of sales:

| · | sales to the Acquiring Fund’s executive officers and directors and their immediate family members, as well as officers and persons associated with VII Peaks and its members and their affiliates and their immediate family members (including spouses, parents, grandparents, children and siblings), |

| · | sales to joint venture partners, consultants and other service providers, |

| · | sales to investors who purchase more than $500,000 of shares, for which a volume discounts applies, |

| · | distribution reinvestment plan sales, |

| · | sales to certain institutional investors, |

| · | sales through investment advisers or banks acting as trustees or fiduciaries, |

| · | sales to employees of certain selected dealers, |

| · | sales made by certain selected dealers at the discretion of Axiom, |

| · | sales in wrap accounts managed by selected dealers or their affiliates, and sales in managed accounts that are managed by selected dealers or their affiliates. |

Subscriptions are effective only upon the Acquiring Fund’s acceptance, and the Acquiring Fund reserves the right to reject any subscription in whole or in part. Subscriptions will be accepted or rejected within 30 days of receipt and, if rejected, all funds or unexecuted transfer instructions will be returned to subscribers without deduction for any expenses within ten business days from the date the subscription is rejected. The Acquiring Fund is not permitted to accept a subscription for shares of its common stock until at least five business days after the date an investor receives the prospectus for the public offering.

The Target Fund is not currently offering its Interests for sale.

Neither the Acquiring Fund nor the Target Fund offer any exchange rights to their shareholders or Members, respectively.

Comparison of Redemption Procedures

Acquiring Fund

The Acquiring Fund does not currently intend to list its shares on any securities exchange and does not expect a public market for them to develop in the foreseeable future. Therefore, shareholders should not expect to be able to sell their shares promptly or at a desired price. Beginning with fourth calendar quarter of 2013, and on a quarterly basis thereafter, the Acquiring Fund began a quarterly program to offer to repurchase shares of its common stock at a price equal to 90% of its offering price on the date of repurchase. The Acquiring Fund currently intends to limit the number of shares to be repurchased during any calendar year to 20% of the weighted average number of shares outstanding in the prior calendar year, or 5.0% in each quarter.

The following table reflects certain information regarding the quarterly tender offers that it has conducted to date:

For the Three Months

Ended | | Repurchase Date | | Shares

Repurchased | | | Percentage of

Shares Tendered

That Were

Repurchased | | | Repurchase

Price

Per Share | | | Aggregate

Consideration for

Repurchased

Shares

(in thousands) | |

| December 31, 2013 | | December 12, 2013 | | | 548 | | | | 100 | % | | $ | 9.135 | | | $ | 5 | |

| March 31, 2014 | | March 14, 2014 | | | 550 | | | | 100 | % | | $ | 9.135 | | | $ | 5 | |

| June 30, 2014 | | June 27, 2014 | | | 34,025 | | | | 100 | % | | $ | 9.135 | | | $ | 319 | |

| September 30, 2014 | | September 30, 2014 | | | 38,482 | | | | 100 | % | | $ | 9.000 | | | $ | 346 | |

| December 31, 2014 | | December 30, 2014 | | | 6,061 | | | | 100 | % | | $ | 8.775 | | | $ | 55 | |

The Acquiring Fund’s quarterly repurchases will continue to be conducted on such terms as may be determined by its board of directors in its complete and absolute discretion unless, in the judgment of the independent directors of its board of directors, such repurchases would not be in the best interests of its stockholders or would violate applicable law. It will conduct such repurchase offers in accordance with the requirements of Rule 13e-4 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the 1940 Act. In months in which it repurchases shares, it will conduct repurchases on the same date that it holds a semi-monthly closing for the sale of shares in this offering.

Target Fund

The Target Fund Manager may, but is not obligated to, implement an early redemption program (the “Early Redemption Program”) on behalf of the Target Fund pursuant to which Target Fund Members who have held Interests for at least 12 months will be allowed to redeem their Interests, on a first-come, first-served basis, for cash at a price equal to the net asset value per Interest as of the date of the relevant redemption, minus (i) a redemption fee in an amount equal to 3% of the net asset value of the Interests so redeemed, plus (ii) in the event the Target Fund Members have not received, for the then-current fiscal year, a return on their Notional Capital Contributions (calculated as of the date of redemption) equal to or greater than 7.5%, an amount equal to the accrued but unpaid management fee attributable to such redeemed Interests. In the event the Target Fund Members have received, for the then-current fiscal year, a return on their Notional Capital Contributions (calculated as of the date of redemption) equal to or greater than 7.5%, an amount equal to the accrued but unpaid management fee attributable to such redeemed Interests shall be paid to the Target Fund Manager at the time of such redemption.

In the event the Target Fund Manager implements the Early Redemption Program, the Target Fund shall redeem Interests on a monthly basis beginning with the first calendar month following the one-year anniversary of the termination of the offering Interests by the Target Fund (the “Offering Termination Date”); provided, however, that the Target Fund Manager shall be authorized to limit redemptions in order to prevent the Target Fund from becoming a publicly traded partnership taxable as a corporation; and provided further, that the annual maximum amount of redemptions under the Early Redemption Program shall, unless approved by the Target Fund Manager in its discretion, be limited to 20% of the aggregate value of the Interests outstanding as of the anniversary of the Offering Termination Date that immediately precedes the relevant redemption request. Under the Early Redemption Program, if implemented by the Target Fund Manager, (i) the Target Fund Manager will not accept partial redemption requests, (ii) redemption requests must be provided in writing to the Target Fund Manager at least fifteen (15) days prior to the intended redemption date; and (iii) redemption payments for requests received within 15 days of the end of the month will be paid at the end of the month following the month in which the redemption request is received by the Target Fund Manager.

To date, the Target Fund Manager has not implemented the Early Redemption Program.

Comparison of Distribution Reinvestment Plans

The Acquiring Fund has adopted an “opt-in” distribution reinvestment plan pursuant to which its shareholders may elect to have the full amount of their cash distributions reinvested in additional shares of common stock. There will be no selling commissions, dealer manager fees or other sales charges to a shareholder who elects to participate in the distribution reinvestment plan. The Acquiring Fund pays the plan administrator’s fees under the plan. Under the plan, the distribution amount due a shareholder will purchase shares of the Acquiring Fund’s common stock at 95% of the price that the shares are sold in the offering at the closing immediately following the distribution date. Shares issued pursuant to its distribution reinvestment plan will have the same voting rights as all other shares of common stock.

The Target Fund does not have a distribution reinvestment plan.

Comparison of Distribution Policies

Acquiring Fund

Since it commenced operations, the Acquiring Fund initiated a policy of declaring semi-monthly distributions at an annual distribution rate of 7.35% per annum of its offering price. It has authorized, declared and paid distributions to its shareholders at that rate on a semi-monthly basis since July 2012. Its distributions historically have not been based on its investment performance. Prior to September 2013, its distributions were supported by its prior manager in the form of operating expense support payments, and a portion of its distributions constituted a return of capital. Since September 2013, the Acquiring Fund has not had an expense support agreement with VII Peaks, its current manager, and as a result a greater portion of its distributions have constituted a return of capital. A return of capital generally is a return of your investment rather than a return of earnings or gains derived from the Acquiring Fund’s investment activities, and constitutes the return of capital previously paid to the Acquiring Fund for shares of its common stock.

The following table shows the percentage of the Acquiring Fund’s distributions which have been funded from net investment income, realized capital gains and paid in capital since the inception of operations:

| Period | | Per Share | | | Net

Investment

Income | | | Realized

Gains

from

Investments | | | Return of

Capital | |

| July 12, 2012 – September 30, 2012 | | $ | 0.183750 | | | | 64 | % | | | 0 | % | | | 36 | % |

| October 1, 2012 – December 31, 2012 | | $ | 0.260750 | | | | 59 | % | | | 0 | % | | | 41 | % |

| January 1, 2013 – March 31, 2013 | | $ | 0.262586 | | | | 67 | % | | | 13 | % | | | 20 | % |

| April 1, 2013 – June 30, 2013 | | $ | 0.186504 | | | | 77 | % | | | 14 | % | | | 9 | % |

| July 1, 2013 – September 30, 2013 | | $ | 0.186504 | | | | 51 | % | | | 10 | % | | | 39 | % |

| October 1, 2013 – December 31, 2013 | | $ | 0.186504 | | | | 4 | % | | | 47 | % | | | 49 | % |

| January 1, 2014 – March 31, 2014 | | $ | 0.186504 | | | | 20 | % | | | 13 | % | | | 67 | % |

| April 1, 2014 – June 30, 2014 | | $ | 0.186504 | | | | 46 | % | | | 0 | % | | | 54 | % |

| July 1, 2014 – September 30, 2014 | | $ | 0.184668 | | | | 17 | % | | | 3 | % | | | 80 | % |

| October 1, 2014 – December 31, 2014 | | $ | 0.181450 | | | | 13 | % | | | 6 | % | | | 81 | % |

The Acquiring Fund expects to continue paying distributions at the same distribution rate, and that a substantial part of those distributions will constitute a return of capital for the foreseeable future. Its distributions will continue to constitute a return of capital until its net investment income is sufficient to support its distribution rate, which will probably not occur until VII Peaks enters into an expense support agreement with the Acquiring Fund, or its assets increase enough to lower its expense ratio, which it does not expect to occur until it has more than $100 million in assets, neither of which may ever occur.

There can be no assurance that the Acquiring Fund will be able to sustain distributions at any particular level.

Target Fund

The Target Fund has paid monthly distributions of 7.5% of the Notional Capital Contribution of each Member since its inception. A Member’s “Notional Capital Contribution” consists of its original capital contribution without giving effect to any sales commission paid by the Target Fund therefrom, plus the Other Discount offered to some Members. The “Other Discount” was a discount of 5% of the purchase price of Interests offered to some investors in the Target Fund. The distributions paid by the Target Fund have not been supported by its investment performance, and some portion has constituted a return of capital to investors.

Financial Highlights of Acquiring Fund

The following is a schedule of financial highlights for the years ended December 31, 2014 and 2013 for the Acquiring Fund:

| | | For the year

ended

December 31,

2014 | | | For the year

ended

December 31,

2013 | |

| | | | | | | |

| Per share data: | | | | | | | | |

| Net asset value, beginning of period | | $ | 8.69 | | | $ | 8.77 | |

| | | | | | | | | |

| Results of operations (1) | | | | | | | | |

| Net investment income | | | 0.17 | | | | 0.35 | |

| Net realized gain on investments | | | 0.04 | | | | 0.18 | |

| Net unrealized loss on investments | | | (1.46 | ) | | | (0.23 | ) |

| Net increase(decrease) in net assets resulting from operations | | | (1.25 | ) | | | 0.30 | |

| | | | | | | | | |

| Stockholder distributions (2) | | | | | | | | |

| Distributions from net investment income | | | (0.17 | ) | | | (0.35 | ) |

| Distributions from realized gains | | | (0.04 | ) | | | (0.18 | ) |

| Distributions from capital | | | (0.52 | ) | | | (0.26 | ) |

| Net decrease in net assets resulting from stockholder distributions | | | (0.73 | ) | | | (0.79 | ) |

| | | | | | | | | |

| Capital share transactions | | | | | | | | |

| Impact from issuance of common stock (3) | | | 0.60 | | | | 0.41 | |

| Net increase in net assets resulting from capital share transactions | | | 0.60 | | | | 0.41 | |

| Net asset value, end of period | | $ | 7.31 | | | $ | 8.69 | |

| Shares outstanding at end of period | | | 5,546,292 | | | | 3,151,376 | |

| Total return (5) | | | (9.10 | )% | | | 7.51 | % |

| Ratio/Supplemental data: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 40,549 | | | $ | 27,373 | |

| Average net assets (in thousands) | | $ | 36,568 | | | $ | 21,359 | |

| Ratio of net investment income to average net assets (4)(7) | | | 2.00 | % | | | 3.50 | % |

| Ratio of operating expenses to average net assets (4)(7) | | | 6.92 | % | | | 4.27 | % |

| Ratio of expenses reimbursed to average net assets (7) | | | - | | | | 3.63 | % |

| Portfolio turnover ratio (6) | | | 36.08 | % | | | 59.80 | % |

| | (1) | The per share amounts were derived by using the weighted average shares outstanding during the period. There was no expense waiver and reimbursement for the year ended December 31, 2014. Net investment income per share excluding the expense reimbursements equals ($0.06) for the year ended December, 31, 2013. |

| | (2) | The per share data for distributions reflects the actual amount of distributions declared per share during the period. |

| | (3) | The issuance of common stock on a per share basis reflects the incremental net asset value changes as a result of the issuance of shares of common stock in the Fund’s continuous offering. |