SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.___)

Filed by the registrant x

Filed by a party other than the registrant [ ]

Check the appropriate box:

Preliminary proxy statement

| [ ] | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)). |

| X | Definitive proxy statement. |

| [ ] | Definitive additional materials. |

| [ ] | Soliciting material under Rule 14a-12. |

FSI Low Beta Absolute Return Fund(Name of Registrant as Specified in Its Charter)

(Names of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

FSI Low Beta Absolute Return Fund

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

September 12, 2018

Dear Unitholder,

Please take a moment to read this letter and the attached proxy statement which asks Unitholders to vote to approve a New Sub-Advisory Agreement (the “New Agreement”) among Financial Solutions, Inc. (the “Adviser”), Meritage Capital, LLC (the “Sub-Adviser”) and the FSI Low Beta Absolute Return Fund (the “Fund”). After consideration, the Fund’s Board of Directors (the “Board”) has approved the New Agreement and we recommend that you vote to approve the New Agreement.

You are being asked to approve a new investment sub-advisory agreement with the Sub-Adviser so that the Sub-Adviser may continue to serve as sub-adviser to the Fund. The Sub-Adviser previously served the Fund under a prior sub-advisory agreement (the “Prior Agreement”). As explained in further detail below, the Prior Agreement terminated as a result of a “change of control” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Sub-Adviser that occurred when the Sub-Adviser became a wholly owned subsidiary of Brown Advisory Group Holdings, LLC (“Brown”) on May 3, 2018. This transaction is referred to herein as the “Transaction”. The New Agreement is substantially similar to the Prior Agreement.

The Sub-Adviser’s change of control will have no impact on the portfolio management and other services provided by the Sub-Adviser to the Fund as the same personnel will be providing services to the Fund. In addition, the Adviser, not the Fund, pays the Sub-Adviser’s fees, which will not change as a result of the change of control.

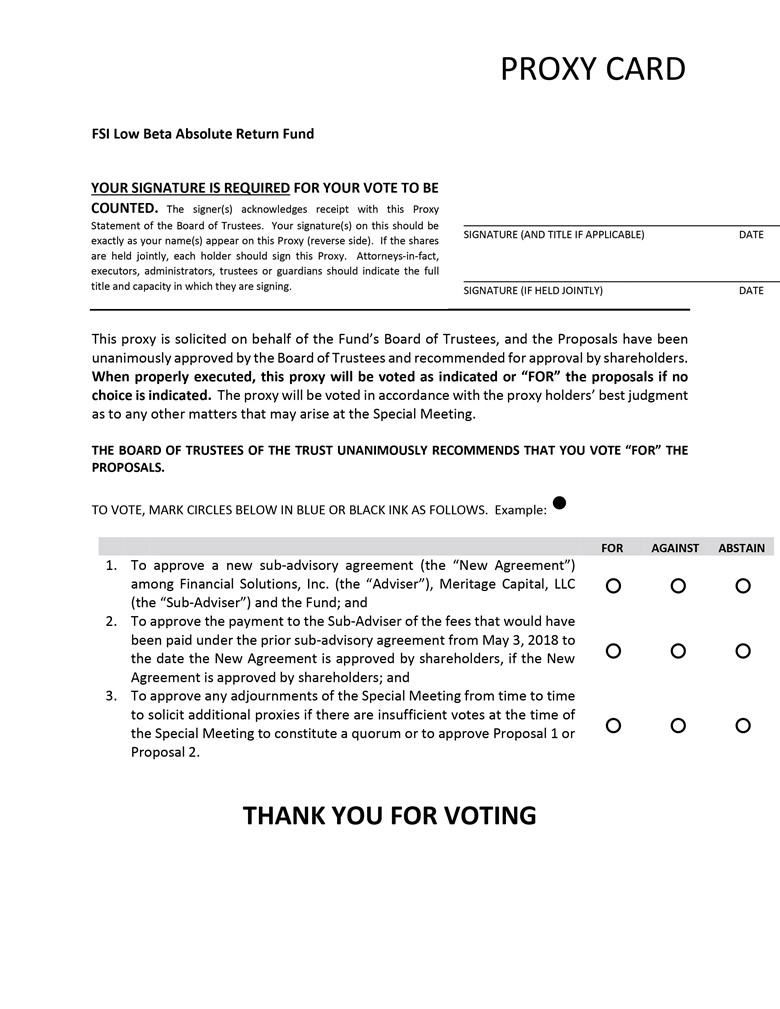

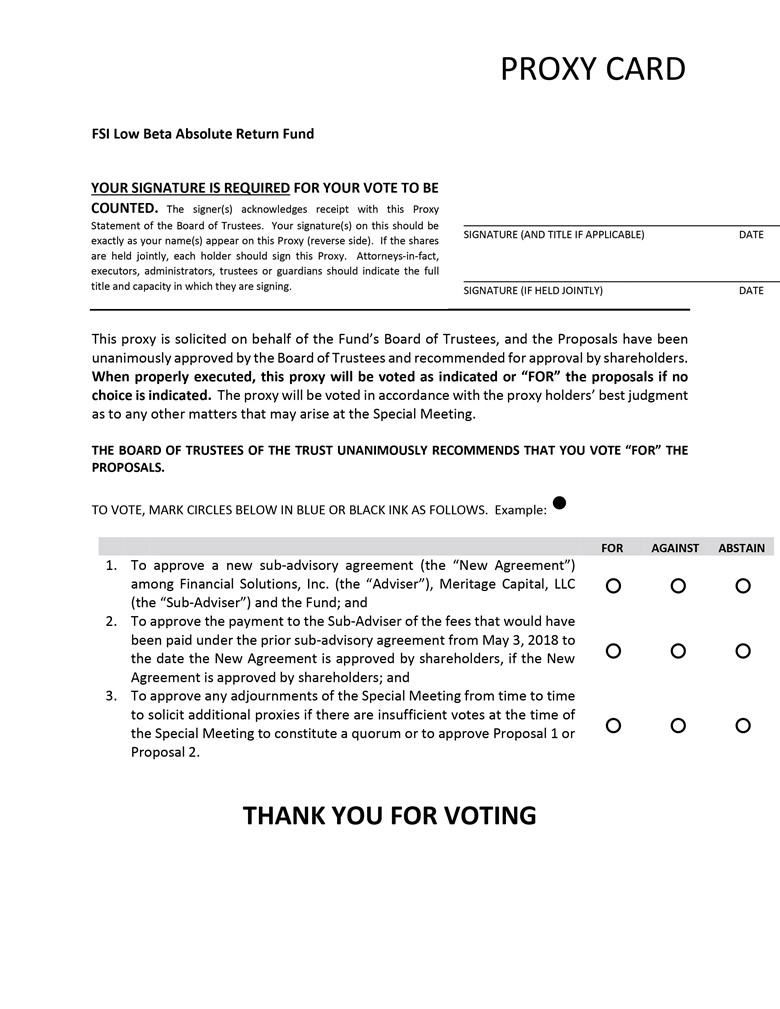

Holders of Units (the “Units”) of the Fund at the close of business on July 30, 2018 (the “Unitholders”) may vote on the matters set forth in the accompanying notice. You can vote by returning your properly executed proxy card in the envelope provided. When you complete and sign your proxy card, the proxies named will vote on your behalf at the special meeting of Unitholders scheduled for September 28, 2018 (the “Meeting”) (or any adjournments thereof) exactly as you have indicated. If no choice is specified, your Units will be voted IN FAVOR OF the New Agreement. If any other matters are properly presented at the Meeting for action, the persons named as proxies will vote in accordance with the views of management of the Funds. Any Unitholder who has returned a properly executed proxy card has the right to revoke it at any time prior to its exercise by attending the Meeting and voting his or her Units in person, by submitting a letter of revocation to the Fund at the above address prior to the date of the Meeting or by submitting a later-dated and properly executed proxy card to the Fund at the above address prior to the date of the Meeting.

The Fund’s Declaration of Trust provides that the holders of one-third of the Units issued and outstanding shall constitute a quorum for the Meeting. Votes may be cast IN FAVOR OF or AGAINST a proposal or you may ABSTAIN from voting. Abstentions will count for purposes of determining whether a quorum is present and will have the effect of a vote against the proposal.

The approval of Proposal 1 requires the affirmative vote of the lesser of (a) 67% or more of the Units of the Fund present at the Meeting, if more than 50% of the outstanding Units of the Fund are present (in person or by proxy) at the Meeting, or (b) more than 50% of the outstanding Units of the Fund.

In the event a quorum is not present at the Meeting or a quorum is present but sufficient votes to approve a proposal are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any adjournment may be held within a reasonable time without further notice. Abstentions and broker non-votes will not be voted on a motion to adjourn.

The Sub-Adviser or one of its affiliates will bear the costs associated with this proxy statement. Proxy solicitations will be made primarily by mail, but proxy solicitations may also be made by telephone, through the Internet or personal solicitations conducted by officers and employees of the Adviser (who will not be paid for their soliciting activities).

In addition to the approval of the New Agreement, we are asking investors to approve the retroactive payment of fees by the Adviser to the Sub-Adviser. No payments have been made to the Sub-Adviser since the Prior Agreement terminated on May 3, 2018. Since the Sub-Adviser has continued to manage a portion of the Fund’s assets subsequent to termination of the Prior Agreement, we believe it would be fair for the Sub-Adviser to be compensated for the services that it provides while no agreement was in place. The compensation would be the amount of fees that the Sub-Adviser would have received had the Prior Agreement remained in effect. This would be at no cost to the Fund as the Adviser, not the Fund, pays the Sub-Adviser.

We are also asking Unitholders to approve an additional proposal allowing for any adjournments of the Meeting that may be necessary. This would allow more time to solicit additional proxies in the event that there are insufficient votes to approve the New Agreement at the time of the Meeting.

You can vote by returning your properly executed proxy card in the envelope provided. We request that you carefully consider these items and vote in a timely manner before the Meeting scheduled for September 28, 2018.

We thank you again for your support of the Fund.

Questions and Answers

While we encourage you to read the full text of the enclosed proxy statement, for your convenience we have provided a brief overview of the proposals that requires a Unitholder vote.

| Q. | Why am I receiving this proxy statement? |

| A. | We are sending this document to you for your use in connection with the solicitation of your vote to approve the New Agreement among the Adviser, the Sub-Adviser and the Fund. The 1940 Act requires that sub-advisory agreements terminate automatically when there is a change of control of the sub-adviser. Retention of the sub-adviser following a change of control must be approved by the fund’s board of directors and Unitholders. At a Board meeting held on May 18, 2018, the Board approved the New Agreement, subject to approval by the Unitholders of the Fund. |

| Q. | What am I being asked to vote on? |

| A. | You are being asked to vote to approve (1) the New Agreement among the Adviser, the Sub-Adviser and the Fund, on behalf of the Fund; (2) the payment of fees by the Adviser to the Sub-Adviser that would have been paid under the Prior Agreement between May 3, 2018 (the date of the termination of the Prior Agreement) and the date of the approval of the New Agreement; and (3) any adjournments of the special meeting of Unitholders (the “Meeting”) needed from time to time to solicit additional proxies if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve Proposals 1 or 2. |

| Q. | How does the Fund’s Board of Trustees recommend that I vote? |

| A. | After careful consideration, the Board unanimously recommends that Unitholders vote FOR the proposals. |

| Q. | Who is eligible to vote? |

| A. | Any person who owned Units of the Fund on the “record date,” which is July 30, 2018 (even if that person has since sold those Units). |

| Q. | Who is paying for this proxy mailing and for the other expenses and solicitation costs associated with this Unitholder meeting? |

| A. | The expenses incurred in connection with preparing the proxy statement and its enclosures and all related legal and solicitation expenses will be paid by the Sub-Adviser or its affiliates. |

| Q. | Why am I being asked to approve adjournments of the Meeting to solicit additional proxies? |

| A. | It may become necessary from time to time to adjourn the Meeting in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the meeting to constitute a quorum or to approve the New Agreement. If the proposal to approve adjournments of the Meeting is approved and a quorum is not present at the meeting, it is expected that the holder of proxies will vote to authorize the adjournment of the Meeting in order to solicit additional proxies. Even if a quorum is present at the meeting, but there are insufficient votes to approve the New Agreement or the payment of fees, it is also expected that the holder of proxies will vote to authorize the adjournment of the Meeting to solicit additional proxies. |

| Q. | What vote is required to approve the proposals? |

| A. | Approval of the New Agreement requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon. So long as quorum is present, a majority of the votes cast, either in person or by proxy, at the Meeting is required to approve Proposal 2. A majority of the votes cast, either in person or by proxy, at the Meeting is required to approve any adjournment(s) of the Meeting, even if the number of votes cast is fewer than the number required for a quorum. |

| Q. | How can I cast my vote? |

| A. | You may vote in one of two ways: |

•By mailing in your signed and voted proxy card in the postage paid envelope provided.

•In person at the meeting at the Fund’s offices in Cincinnati.

If you would like to change your previous vote, you may vote again using either of the methods described above.

IMPORTANT INFORMATION FOR UNITHOLDERS

FSI LOW BETA ABSOLUTE RETURN FUND

NOTICE OF SPECIAL MEETING OF UNITHOLDERS

To be held September 28, 2018

Notice is hereby given thatFSI Low Beta Absolute Return Fund(the “Fund”) will hold a special meeting of Unitholders (the “Meeting”) on September 28, 2018, at the offices of the Fund’s administrator,Ultimus Fund Solutions, LLC,225 Pictoria Drive, Suite 450, Cincinnati, OH 45246at 10:00 am Eastern time.

The purpose of the Meeting is to consider and act upon the following proposals and to transact such other business as may properly come before the Meeting or any adjournments thereof:

1. To approve a New Sub-Advisory Agreement (the “New Agreement”) among Financial Solutions, Inc. (the “Adviser”), Meritage Capital, LLC (the “Sub-Adviser”) and the FSI Low Beta Absolute Return Fund (the “Fund”); and

2. To approve the payment to the Sub-Adviser of the fees that would have been paid under the prior sub-advisory agreement (the “Prior Agreement”) from May 3, 2018 to the date the New Agreement is approved by Unitholders, if the New Agreement is approved by Unitholders.

3. To approve any adjournments of the Meeting from time to time to solicit additional proxies if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve Proposal 1 or Proposal 2.

The Board of Trustees of the Fund unanimously recommends that you vote in favor of the proposals.

Unitholders of record of the Fund at the close of business on the record date, July 30, 2018, are entitled to notice of and to vote at the meeting and any adjournment (s) or postponements thereof. The Notice of Special Meeting of Unitholders, proxy statement and proxy card are being mailed on or about September 13, 2018, to such Unitholders of record.

| | By Order of the Board of Trustees, | |

| |  | |

| | Simon Berry | |

| | Secretary | |

| | FSI Low Beta Absolute Return Fund | |

| | Cincinnati, OH | |

| | September 12, 2018 | |

IMPORTANT - WE NEED YOUR PROXY VOTE IMMEDIATELY

Unitholders are invited to attend the Meeting in person. Any Unitholder who does not expect to attend the Meeting is urged to indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

FSI Low Beta Absolute Return Fund

PROXY STATEMENT

c/o Ultimus Fund Solutions, LLC

P.O. Box 46707

Cincinnati, OH 45246-0707

SPECIAL MEETING OF UNITHOLDERS September 28, 2018

Introduction

This proxy statement is being provided to you on behalf of the Board of FSI Low Beta Absolute Return Fund in connection with the solicitation of proxies to be used at the special meeting of Unitholders of the Fund to be held on September 28, 2018. The purpose of the Meeting is to seek Unitholder approval of a new investment sub-advisory agreement among the Adviser, the Sub-Adviser and the Fund; to approve the payment to the Sub-Adviser of the accrued sub-advisory fees from May 3, 2018 to the date the New Agreement is approved by Unitholders, if the new Agreement is approved by Unitholders and to transact such other business as may be properly brought before the Meeting.

Unitholders of record at the close of business on the record date, established as July 30, 2018, are entitled to notice of, and to vote at, the Meeting. We anticipate that the Notice of Special Meeting of Unitholders, this proxy statement and the proxy card (collectively, the “proxy materials”) will be mailed to Unitholders beginning on or about September 13, 2018.

Important Notice Regarding the Availability of Proxy Materials for the Unitholder Meeting to be Held on September 28, 2018:

Please read the proxy statement before voting on the proposal. If you need additional copies of this proxy statement or proxy card, please contact the Adviser at 918-585-5858. Representatives are available to answer your call Monday through Friday, 9:00 a.m. to 5:00 p.m., Eastern Time. Additional copies of this proxy statement will be delivered to you promptly upon request.

For a free copy of the Fund’s annual report for the fiscal year ended August 31, 2017, or the most recent semi-annual report, please contact the Fund at877-379-7380or write to the Fund,c/o Ultimus Fund Solutions, LLC, P.O. Box 46707, Cincinnati, OH 45246-0707.

DESCRIPTION OF PROPOSAL 1: APPROVAL OF NEW SUBADVISORY AGREEMENT

Background

The Meeting is being called to consider a proposal to approve the New Agreement. Meritage Capital, LLC, 515 Congress Avenue, Suite 2200, Austin, TX 78701 has served as a sub-adviser to the Fund since the Fund’s inception. On May 3, 2018, the Sub-Adviser became a wholly owned subsidiary of Brown Advisory Group Holdings, LLC. Because the Transaction resulted in Brown acquiring more than 25% of the membership interests of the Sub-Adviser, it constitutes a “change of control” under the 1940 Act. A change of control of the Sub-Adviser constituted an assignment of the Prior Agreement among the Sub-Adviser, the Adviser and the Fund. Under the 1940 Act, a sub-advisory agreement automatically terminates in the event of its assignment. Therefore, the Prior Agreement terminated on May 3, 2018. The 1940 Act also requires that retention of a sub-adviser following a change of control must be approved by both the fund’s board of directors and Unitholders.

The Transaction will not result in any change in the Sub-Adviser’s personnel providing services to the Fund, nor will it result in any change to the fees or services provided to the Fund. At a meeting of the Board held on May 18, 2018, the Board approved the New Agreement, subject to approval by the Unitholders of the Fund.

The form of the New Agreement is attached asExhibit A. The terms of the New Agreement are substantially similar to the terms of the Prior Agreement except for the changes discussed below. The New Agreement will have no impact on the operations of the Fund and will not affect the Fund’s investment strategies. The management fee being paid to the Sub-Adviser is not changing. The material terms of the New Agreement and the Prior Agreement are compared below in “Material Differences between the Prior Agreement and the New Agreement.”

Information About the Fund

The Fund is a closed-end management investment company organized as a Delaware statutory trust.Ultimus Fund Distributors, LLC(“Distributor”) is the distributor of the Fund’s Units. The Distributor is located at225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. The Fund’s administrator isUltimus Fund Solutions, LLC, located at225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45249.

Information About the Adviser

Financial Solutions, Inc., 320 South Boston, Suite 1130, Tulsa, Oklahoma 74103, serves as the investment adviser to the Fund. Established in 1984, the Adviser is an SEC-registered investment adviser that provides investment advisory services to private clients and institutions. The Fund is the first registered investment company to be managed by the Adviser. As of June 30, 2018, the Adviser had approximately $84.5 million in assets under management. The Adviser is wholly-owned and controlled by Gary W. Gould, the Fund’s portfolio manager.

Information About the Sub-Adviser

Meritage Capital, LLC, 515 Congress Avenue, Suite 2200, Austin, TX 78701 has served as a sub-adviser to the Fund since the Fund’s inception. The Sub-Adviser was initially formed through the merger of Meritage Capital, L.P., which had provided investment advisory services since 2003, and Centennial Partners LLC, which had provided investment advisory services since 2000. On May 3, 2018, Brown acquired control over the Sub-Adviser. As of June 30, 2018, the Sub-Adviser had approximately $1.2 billion in assets under management. Mr. Joe Wade, a founder of Centennial Partners LLC, is the Sub-Adviser’s Chief Investment Officer and has over 37 years of investment experience. The Sub-Adviser uses an investment team approach to identify and evaluate new managers and is designed to challenge investment ideas by drawing on the team’s market and trading experience.

The Sub-Adviser has organized an Investment Committee. Messrs. Alex Smith (Senior Adviser), Joseph Wade (Chief Investment Officer and Portfolio Manager), and Glen Stotts (Deputy Chief Investment Officer) are currently the sole voting members of the Sub-Adviser’s Investment Committee. All Investment Committee members work in the Austin office at 515 Congress Avenue, Suite 2200, Austin, TX 78701.

On May 3, 2018, the Sub-Adviser became a wholly-owned subsidiary of Brown, 901 South Bond Street, Suite 400, Baltimore, MD 21231. As part of this transition, the employees of the Sub-Adviser will become employees and equity owners of Brown.

Information About the Fund’s Portfolio Manager

The Fund’s portfolio is managed by Gary W. Gould, who has served as Managing Principal of the Adviser for the past fifteen years. Mr. Gould has a B.S. in Finance from Oklahoma State University. Mr. Gould has over thirty years of investment advisory experience, which has included providing investment advisory services to Fortune 100 companies, Banking, Insurance, Endowments and Foundations and High Net Worth clients. Mr. Gould has managed Alpha exposure strategies since October 1, 1998. He has twenty-one years of experience in analyzing and investing in hedge fund and hedge fund of funds strategies. In addition, Mr. Gould has seventeen years of experience utilizing financial futures to provide Beta exposure.

Terms of the Prior and New Agreements

A copy of the New Agreement is attached asExhibit A. The following description is only a summary. You should refer toExhibit A for the New Agreement, and the description set forth in this proxy statement of the New Agreement is qualified in its entirety by reference toExhibit A. The terms of the New Agreement are substantially similar to the terms of the Prior Agreement. The fees paid to the Sub-Adviser under the New Agreement are the same as they were under the Prior Agreement. The provisions of the New Agreement concerning liability are the same as what was in the Prior Agreement.

The Adviser determines the portion of the Fund’s assets to be allocated to the Sub-Adviser for investment (the “Allocated Assets”). The Sub-Adviser has full investment discretion and makes all investment determinations with respect to the Allocated Assets, subject to the general supervision of the Adviser and the Board.

For portfolio management services rendered to the Fund pursuant to the Prior Agreement, the Adviser (and not the Fund) paid to Meritage a fee calculated at an annual rate equal to 0.75% of the Fund’s average annual monthly net assets managed by the Sub-Adviser (i.e., the average of the Fund’s net assets managed by the Sub-Adviser as of the last Business Day of each month of the Fund’s fiscal year). Since May 3, 2018, the Sub-Adviser has been voluntarily managing the Allocated Assets until the New Agreement is approved by Unitholders.

The New Agreement provides that in the absence of (i) bad faith, willful misfeasance, or gross negligence in the performance of its obligations and duties under the New Agreement; or (ii) reckless disregard of its obligations and duties under the New Agreement, the Sub-Adviser is not subject to any liability to the Fund, the Adviser or any Unitholder for any for any mistake of judgment or mistake of law, for any loss arising out of any investment, or for any act or omission taken or in any event whatsoever. In addition, it provides that the Adviser may act as investment adviser for any other person, firm or corporation.

If the New Agreement is not approved by Unitholders of the Fund, the Fund will continue to operate in the same manner as it currently does while the Board considers an appropriate course of action. The Board may decide to have the Adviser manage the Allocated Assets, may decide to have the Fund’s other sub-adviser manage the Allocated Assets, or could hire a new sub-adviser to manage the Allocated Assets (Unitholders would need to approve a sub-advisory agreement with the new sub-adviser).

The Prior Agreement, dated as of February 26, 2013, was last approved by the Board on November 3, 2017 and was last approved by the initial Unitholder of the Fund on April 24, 2013 as required by the 1940 Act.

Material Differences between the Prior Agreement and the New Agreement

The terms of the Prior Agreement and the New Agreement are substantially similar except that additional provisions were added to the New Agreement requiring the Sub-Adviser to notify the Fund of any data breach or information security event that could have a material adverse impact on the Fund or its Unitholders.

Other Information

For the last fiscal year, the advisory fees accrued, waived and retained by the Sub-Adviser were as follows:

Fiscal Year Ended August 31 | Sub-Advisory Fee Accrued | Sub-Advisory Fee Waived | Sub-Advisory Fee Retained |

| 2017 | $98,886 | $0 | $98,886 |

For the fiscal year ended August 31, 2017, the Fund did not pay any commissions to an affiliated broker. Due to the nature of its investments, the Sub-Adviser did not receive any benefits under a soft dollar arrangement.

Board Approval and Recommendation

The Board, including the Trustees who are not “interested persons” (as that terms is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) (the “Independent Trustees”) voting separately, has reviewed and approved the New Agreement by and among the Adviser, the Fund and the Sub-Adviser for a term of two years. Approval took place at an in person meeting held on May 18, 2018, at which a majority of the Trustees, including a majority of the Independent Trustees, were present.

In the course of their deliberations, the Board was advised by legal counsel. The Board received and reviewed a substantial amount of information provided by the Sub-Adviser in response to requests of the Board and counsel.

In considering the New Agreement for the Fund and reaching their conclusion with respect thereto, the Board reviewed and analyzed various factors that it determined were relevant, including the factors described below. In their deliberations, the Board did not identify any particular information that was all-important or controlling.

Nature, Extent and Quality of Services

The Trustees reviewed the nature, extent and quality of the services the Sub-Adviser provides to the Fund under the New Agreement and the Prior Agreement (the “Sub-Adviser Services”) including, without limitation, the management of the Fund’s assets allocated to the Sub-Adviser (the “Sub-Adviser Assets”). The Trustees also considered information regarding the Transaction including, but not limited to, the organizational structure of the Sub-Adviser following the Transaction and the resources newly available to the Sub-Adviser as a result of the Transaction. The Trustees noted that the Sub-Adviser’s personnel and investment process for managing the Sub-Adviser Assets will not change following the Transaction. The Trustees further considered the experience of the Sub-Adviser’s personnel servicing the Fund, changes in personnel over the past year, the Sub-Adviser’s compliance environment as well as the performance of the Sub-Adviser Assets. The Trustees also noted the Sub-Adviser’s clean regulatory history and the absence of the Sub-Adviser’s involvement in litigation. The Trustees concluded that they are satisfied with the quality, extent, and nature of the services provided by the Sub-Adviser.

Performance of the Sub-Adviser Assets.

The Trustees compared the performance of the Sub-Adviser Assets with the performance of the HFRI Fund of Funds Diversified Index and another similarly managed pooled investment vehicle managed by the Sub-Adviser, with the Sub-Adviser Assets slightly underperforming the HFRI Index since inception for the period ended February 28, 2018, while outperforming the pooled investment vehicle. The Board concluded that they were satisfied with the performance of the Sub-Adviser Assets.

Cost of Advisory Services and Profitability.

The Trustees considered the advisory fees paid to the Sub-Adviser by the Adviser during a twelve-month period and the Sub-Adviser’s expenses to provide the Sub-Adviser Services over that period as well as an estimate of the Sub-Adviser’s operational overhead allocable to the Sub-Adviser Services.

The Trustees considered the Fund’s investment in Centennial Global Macro Fund (the “Centennial Fund”), a private fund managed by the Sub-Adviser. In this regard, the Trustees noted that neither the Fund nor the Adviser pay any fees directly to the Sub-Adviser with respect to the Fund’s investment in the Centennial Fund and that the Adviser, not the Sub-Adviser, is responsible for investing Fund assets in the Centennial Fund. The Trustees also acknowledged that the Centennial Fund provides the Fund access to certain managers that it is not otherwise able to access directly and noted the Adviser’s representation that the Fund’s investment in Centennial Fund is not related to the Sub-Adviser’s service as a sub-adviser to the Fund (i.e., the Fund would still invest in Centennial Fund absent the Sub-Adviser’s service as sub-adviser). The Trustees also considered the Adviser’s representation that the investment advisory fee paid by the Centennial Fund, and indirectly born by the Fund through its investment therein, was consistent with the investment advisory fees charged by similar hedge funds.

The Trustees then reviewed the Sub-Adviser’s financial statements and insurance arrangements. They noted that the Transaction provides the Sub-Adviser with more resources. The Trustees concluded that the Sub-Adviser’s profitability was reasonable and that the Sub-Adviser’s assets, insurance coverage, and additional resources following the Transaction were sufficient to cover potential liabilities incurred under the New Agreement.

Comparative Fee and Expense Data; Economies of Scale.

The Trustees considered that the Adviser, not the Fund, is responsible for paying the advisory fees due to the Sub-Adviser under the New Agreement. The Trustees noted the proposed fee arrangement between the Adviser and Sub-Adviser involves an advisory fee of 0.75% (the “Sub-Adviser Fee”) and that the proposed fee arrangement is identical to the fee arrangement under the Prior Agreement. The Trustees compared the Sub-Adviser Fee and the fees and expenses of the Fund to those of a peer group of closed-end funds (the “Peer Group”), noting that the Sub-Adviser Fee is lower than the median and average advisory fee of the Peer Group. The Trustees noted that advisory fees paid by the funds comprising the peer group do not include breakpoints, while the advisory fees payable to the Sub-Adviser by most other similarly managed unregistered investment vehicles are higher than or equivalent to the Sub-Adviser Fee. The Trustees concluded that the fees to be paid by the Adviser to the Sub-Adviser under the New Agreement are reasonable.

Other Benefits.

The Trustees discussed the Fund’s investment in the Centennial Fund and, noting the facts related thereto as summarized above, concluded that the Sub-Adviser does not receive any additional financial or other benefits from its relationship with the Fund.

For the reasons set forth above, the Board unanimously recommends that Unitholders of the Fund vote in favor of the New Agreement with the Sub-Adviser.

APPROVAL OF PAYMENT TO SUB-ADVISER OF ACCRUED SUB-ADVISORY FEES FROM MAY 3, 2018

The purpose of this proposal is to obtain Unitholder approval for the Adviser to pay sub-advisory fees to the Sub-Adviser for the period from May 3, 2018 (when the Prior Agreement terminated) until the date Unitholders approval the New Agreement. At the Board meeting on May 18, 2018, the Board approved the payment of the sub-advisory fees that would have been paid under the Prior Agreement, subject to Unitholder approval. The Sub-Adviser will not be paid unless the Unitholders approve the payment.

At the Board meeting, after the Board determined to recommend the approval of the New Agreement, the Board considered whether to approve the payment of the accrued advisory fees from May 3, 2018 to the date the New Agreement is approved, subject to Unitholder approval. The Board noted that the Adviser has not paid the Sub-Adviser since the May 3, 2018 termination of the Prior Agreement.

Counsel to the Fund then advised the Board that under some circumstances, a rule under the Investment Company Act of 1940 permits the accrual and later payment of advisory fees under an interim advisory contact, if a new advisory contract is subsequently approved by Unitholders. He advised the Board that, although the current facts and circumstances do not permit the Adviser to take advantage of the rule, an analogy could be drawn to support the Board's approval of the payment of the accrued fees, subject to approval by Unitholders.

The Board then discussed the appropriateness of approving the payment of the fees. The Board noted that it is the Adviser, not the Fund that pays the Sub-Adviser. Ultimately, the Board determined it would be equitable for both the Adviser and the Sub-Adviser if the Sub-Adviser is paid the sub-advisory fees from May 3, 2018 to the date the New Agreement is approved by Unitholders.

If the retroactive payment of fees to the Sub-Adviser is not approved by Unitholders of the Fund, the Fund will continue to operate in the same manner as it currently does while the Board considers an appropriate course of action. One course of action that the Board could consider would be for the Board to ask the Adviser to determine if there is another method by which the Adviser can lawfully make the payment without Unitholder approval. Another course of action that the Board could consider is for the Adviser to simply retain the fees that would otherwise be paid to the Sub-Adviser.

Accordingly, the Board, including the Independent Trustees, unanimously recommends that Unitholders of the Fund vote “FOR” the payment to the Sub-Adviser of the sub-advisory fees from May 3, 2018 to the date the New Agreement is approved by Unitholders, if the New Agreement is approved by Unitholders.

DESCRIPTION OF PROPOSAL 3: APPROVAL OF ADJOURNMENTS OF THE MEETING

The purpose of this Proposal 3 is to authorize the holder of proxies solicited under this proxy statement to vote the Units represented by the proxies in favor of the adjournment of the Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve Proposal 1 or Proposal 2.

One or more adjournments may be made without notice other than an announcement at the Meeting, to the extent permitted by applicable law and the Fund’s governing documents. Any adjournment of the Meeting for the purpose of soliciting additional proxies will allow the Fund’s Unitholders who have already sent in their proxies to revoke them at any time before their use at the Meeting, as adjourned.

INFORMATION ABOUT OWNERSHIP OF UNITS OF THE FUND

Outstanding Units

Only Unitholders of record at the close of business on July 30, 2018, the record date, will be entitled to notice of, and to vote at, the meeting. On July 30, 2018, there were 305,708.285 Units of the Fund outstanding and entitled to vote.

Security Ownership of Management, Trustees and Principal Unitholders

As of the Record Date, to the best of the knowledge of the Fund, no Trustee or officer of the Fund beneficially owned 1% or more of the outstanding Units of the Fund, and the Trustees and the officers of the Fund, as a group, beneficially owned less than 1% of the outstanding Units of the Fund. The Board is aware of no arrangements, the operation of which at a subsequent date may result in a change in control of the Fund. As of the Record Date, the Independent Trustees, and their respective immediate family members, did not own any securities beneficially or of record in the Adviser, Ultimus Fund Solutions, LLC, the parent company of the distributor, or any of their respective affiliates.

The following list indicates the Unitholders who, to the best knowledge of the Fund, were the owners of more than 5% of the outstanding Units of the Fund on the Record Date:

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Outstanding Units of the Fund |

Harry and Mary K. Chapman Charitable Trust 6100 S Yale Ave, Suite 1816 Tulsa, OK 74136 | 95,708.994 Units | 31.31% |

Vernon Investment Fund, LLC A 110 W 7th Street, Suite 1000 Tulsa, OK 74119 | 78,037.193 Units | 25.53% |

Vernon Investment Fund, LLC B 110 W 7th Street, Suite 1000 Tulsa, OK 74119 | 37,675.6630 Units | 12.32% |

Alta Trust Company 9380 Station Street, Suite 450 Littleton, CO 80124 | 36,172.955 Units | 11.83% |

Capital Management Corporation 110 W 7th Street, Suite 1000 Tulsa, OK 74119 | 30,983.244 Units | 10.13%% |

VOTING INFORMATION

Who is Eligible to Vote

Unitholders of record of the Fund as of the close of business on July 30, 2018 (the “Record Date”), are entitled to vote at the meeting and any adjournments thereof. Each whole unit is entitled to one vote on each matter on which it is entitled to vote, and each fractional unit is entitled to a proportionate fractional vote.

Quorum

In order for a vote on Proposal 1 and Proposal 2 to occur at the Meeting, there must exist a quorum of Unitholders of the Fund. The presence at the Meeting, in person or by proxy, of Unitholders representing one-third of the Units outstanding and entitled to vote as of the Record Date constitutes a quorum for the Meeting. For purposes of determining the presence of a quorum, abstentions and broker “non-votes” will be counted as present. Broker “non-votes” occur when a nominee holding Units for a beneficial owner does not vote on a proposal because the nominee does not have discretionary voting powers with respect to that proposal and has not received instructions from the beneficial owner.

In the event that the necessary quorum to transact business is not present at the Meeting, or the vote required to approve Proposal 1 or Proposal 2 is not obtained, the chairman of the Meeting, in order to permit the further solicitation of proxies, may adjourn the Meeting, subject to approval of Proposal 3, from time to time to a date not more than 90 days after the original date of the meeting without further notice other than announcement at the Meeting. Alternatively, if a Unitholder vote is called on any proposal to adjourn, the persons named as proxies, or their substitutes, will vote on such adjournment in their discretion.

Vote Requiredto Passthe Proposals

As provided under the 1940 Act, approval of the New Agreement will require the vote of a majority of the outstanding voting securities of the Fund. In accordance with the 1940 Act, a “majority of the outstanding voting securities” of the Fund means the lesser of (a) 67% or more of the Units of the Fund present at a Unitholder meeting if the owners of more than 50% of the Units of the Fund then outstanding are present in person or by proxy, or (b) more than 50% of the outstanding Units of the Fund entitled to vote at the meeting. Abstentions and broker “non-votes” will have the effect of a “no” vote for purposes of obtaining the requisite approval of the proposal.

An affirmative vote of the majority of the Units present at the meeting, if a quorum is present, is required for the approval of the payment of the sub-advisory fees to the Sub-Adviser.

Proposal 3 requires the vote of a majority of the votes cast, either in person or by proxy, at the Meeting to approve any adjournment(s) of the Meeting, even if the number of votes cast is fewer than the number required for a quorum.

Proxies and Voting at the Meeting

Unitholders may use the proxy card provided if they are unable to attend the meeting in person or wish to have their Units voted by a proxy even if they do attend the meeting. Any Unitholder of the Fund giving a proxy has the power to revoke it prior to its exercise by mail (addressed to the Secretary at the principal executive office of the Fund shown at the beginning of this proxy statement), or in person at the meeting, by executing a superseding proxy or by submitting a notice of revocation to the Fund. In addition, although mere attendance at the meeting will not revoke a proxy, a Unitholder present at the meeting may withdraw a previously submitted proxy and vote in person. To obtain detailed information on how to attend the meeting and vote in person, please call 918-585-5858.

All properly executed proxies received in time for the meeting will be voted as specified in the proxy or, if no specification is made, FOR the proposals referred to in the proxy statement and in the discretion of the persons named as proxies on such procedural matters that may properly come before the meeting. If any other business comes before the meeting, your Units will be voted at the discretion of the persons named as proxies.

Method of Solicitation and Expenses

The solicitation of proxies will occur principally by mail, but proxies may also be solicited by telephone, e-mail or other electronic means, facsimile or personal interview. Any solicitation will be conducted by the Adviser.

The cost of preparing, printing and mailing the enclosed proxy card and this proxy statement, and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by letter, telephone, facsimile or telegraph, will be paid by the Sub-Adviser or its affiliates. In addition to the solicitation by mail, officers and employees of the Adviser and /or its affiliates, who will receive no extra compensation for their services, may solicit proxies by telephone, e-mail or other electronic means, letter or facsimile. The Fund will not bear any expenses in connection with the Transaction, including any costs of soliciting Unitholder approval. All such expenses will be borne by the Sub-Adviser and/or its affiliates.

Unitholder Proposals for Subsequent Meetings

The Fund does not hold annual Unitholder meetings except to the extent that such meetings may be required under the 1940 Act or state law. Unitholders who wish to submit proposals for inclusion in the proxy statement for a subsequent Unitholder meeting should send their written proposals to the Fund’s Secretary at its principal office within a reasonable time before such meeting. The timely submission of a proposal does not guarantee its inclusion.

Other Matters to Come Before the Meeting

No business other than the matter described above is expected to come before the meeting, but should any other matter requiring a vote of Unitholders arise the persons named as proxies will vote thereon in their discretion according to their best judgment in the interests of the Fund and its Unitholders.

Dated: September 12, 2018

Please complete, sign and return the enclosed proxy card in the enclosed envelope. No postage is required if mailed in the United States.

EXHIBIT A

FORM OF NEW AGREEMENT

SUBADVISORY AGREEMENT

AMONG

FSI LOW BETA ABSOLUTE RETURN FUND

FINANCIAL SOLUTIONS, INC.

AND

MERITAGE CAPITAL, LLC

AGREEMENTmade as of _________, by and among FSI Low Beta Absolute Return Fund, a statutory trust organized under the laws of the State of Delaware with its principal place of business at 225 Pictoria Drive, Suite 450 Cincinnati, OH (the “Fund”), Financial Solutions, Inc., an Oklahoma corporation, with its principal office and place of business at 320 South Boston Ave., Suite 1130, Tulsa, Oklahoma, 74103 (the “Adviser”) and Meritage Capital, LLC , a Delaware limited liability company, with its principal office and place of business at 515 Congress Avenue, Suite 2200, Austin, Texas, 78701 (the “Subadviser”).

WHEREAS, the Adviser and the Subadviser are registered investment advisers under the Investment Advisers Act of 1940, as amended (the “Advisers Act”);

WHEREAS,the Fund is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a closed-end, management investment company and has issued units of beneficial interest, no par value;

WHEREAS, the Fund’s Board of Trustees (the “Board”) has engaged the Adviser to perform investment advisory services for the Fund under the terms of an investment advisory agreement, dated February 26, 2013, between the Adviser and the Fund (the “Advisory Agreement”); and

WHEREAS, the Adviser, acting pursuant to the Advisory Agreement, desires to retain the Subadviser, and the Board has approved the retention of the Subadviser, to perform investment advisory services to the Fund for that portion, if any, of the Fund’s assets that the Adviser allocates to the Subadviser from time to time on or after the date of this Agreement as set forth above (“Allocated Assets”) and the Subadviser is willing to provide such services on the terms and conditions set forth in this Agreement;

NOW THEREFORE, for and in consideration of the mutual covenants and agreements contained herein, the Fund, the Adviser, and the Subadviser hereby agree as follows:

SECTION 1. APPOINTMENT; DELIVERY OF DOCUMENTS

(a) The Fund and the Adviser hereby appoint Subadviser, subject to the direction and control of the Board and subject to the oversight of the Adviser, to manage the investment and reinvestment of Allocated Assets and to provide other services as specified herein. The Subadviser accepts this appointment and agrees to render its services for the compensation set forth herein. The Adviser and the Subadviser shall mutually agree, in writing, to the amount of notice required prior to any material reallocation of assets away from the Subadviser.

(b) In connection therewith, the Adviser shall deliver to the Subadviser copies of (i) the Fund’s Agreement and Declaration of Trust and By-laws (collectively, as currently in effect and as amended from time to time, the “Organic Documents”), (ii) the Fund’s current Registration Statement filed with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”) and the 1940 Act (collectively, as currently in effect and as amended from time to time, the “Registration Statement”), (iii) the Fund’s current Prospectus and Statement of Additional Information (collectively, as currently in effect and as amended or supplemented, the “Prospectus”), (iv) any shareholder service plan or similar documents adopted by the Fund (collectively, as currently in effect and as amended from time to time); and (v) all policies and procedures adopted by the Fund (e.g., repurchase agreement procedures, Rule 17a-7 Procedures and Rule 17e-1 Procedures, collectively, as currently in effect and as amended from time to time, the “Procedures”). The Adviser shall promptly furnish the Subadviser with all amendments of or supplements to the foregoing.

The Adviser shall also deliver to the Subadviser: (vi) a certified copy of the resolution of the Board, including a majority of the Trustees who are not interested persons (as defined in the 1940 Act) appointing the Adviser and Subadviser and approving the Advisory Agreement and this Agreement; (vii) a certified copy of the resolution of the Fund’s unitholder(s), if applicable, appointing the Adviser and Subadviser; (viii) a copy of all proxy statements and related materials relating to the Fund; and (ix) a certified copy of the resolution from the Fund electing the officers of the Fund; and (x) any other documents, materials or information that the Subadviser shall reasonably request to enable it to perform its duties pursuant to this Agreement.

(c) The Subadviser has delivered to the Adviser and the Fund a copy of its: (i) Form ADV as most recently filed with the SEC, (ii) code of ethics complying with the requirements of Rule 17j-1 under the 1940 Act (the “Code”) and (iii) compliance manual adopted and implemented pursuant to Rule 206(4)-7 under the Advisers Act (the “Compliance Manual”). The Fund and the Adviser acknowledge receipt of the Subadviser’s Form ADV, Code, and Compliance Manual.

The Subadviser shall promptly furnish the Adviser and Fund with all amendments of or supplements to the foregoing.

SECTION 2. DUTIES OF THE ADVISER

In order for the Subadviser to perform the services required by this Agreement, the Adviser shall (i) cause all service providers to the Fund to furnish information to the Subadviser and to assist the Subadviser as may be reasonably requested by the Subadviser; (ii) ensure that the Subadviser has reasonable access to all records and documents maintained by the Fund, the Adviser or any service provider to the Fund; (iii) deliver to the Subadviser all materials it provides to the Board in accordance with the Advisory Agreement; and (iv) provide oversight of the Subadviser.

SECTION 3. DUTIES OF THE SUBADVISER

(a) The Subadviser shall assume all investment duties and have full discretionary power and authority with respect to the investment of the Allocated Assets. Without limiting the generality of the foregoing, the Subadviser shall, with respect to the Allocated Assets: (i) obtain and evaluate such information and advice relating to the economy, securities markets, and securities and other investments as it deems necessary or useful to discharge its duties hereunder; (ii) continuously invest the Allocated Assets in a manner reasonably consistent with the directions and policies set from time to time by the Board and any amendments thereto (“Board Policies”), the Organic Documents, the Prospectus, the Procedures (the Board Policies, the Organic Documents, the Prospectus, and the Procedures, collectively, the “Governing Documents”), any written guidelines or restrictions agreed to in writing between the Adviser and the Fund, and any amendments thereto, that are not inconsistent with the Governing Documents (“Adviser Guidelines”), and any other written guidelines or restrictions agreed to in writing by the Adviser and the Subadviser, any amendments thereto, that are not inconsistent with the Governing Documents and the Adviser Guidelines (“Subadviser Guidelines”), each as promptly provided to the Subadviser by the Adviser; (iii) determine the securities and other investments to be purchased, sold or otherwise disposed of and the timing of such purchases, sales and dispositions; (iv) consistent with the disclosure in the Prospectus, invest all or a portion of the Allocated Assets in unregistered and registered investment funds (“Investment Funds”); (v) to the extent applicable, vote all proxies for securities and exercise all other voting rights with respect to such securities in accordance with such proxy voting policies as approved by the Board; (vi) promptly issue settlement instructions to custodians designated by the Fund, where applicable; (vii) evaluate the credit worthiness of securities dealers, banks and other entities with which the Fund may engage in repurchase agreements and monitor the status of such agreements, where applicable; and (viii) take such further action, including, to the extent applicable, the placing of purchase and sale orders, selecting broker-dealers to execute such orders on behalf of the Fund, negotiating commission rates to be paid to broker-dealers, opening and maintaining trading accounts in the name of the Fund, and executing for the Fund, as its agent and attorney-in-fact, standard institutional customer agreements with broker-dealers, each as the Subadviser shall deem necessary or appropriate, in its sole discretion, to carry out its duties under this Agreement.

(b) In effecting transactions on behalf of the Fund with respect to the Allocated Assets, the Subadviser’s primary consideration shall be to seek best execution, where applicable. In selecting broker-dealers to execute transactions (where applicable), the Subadviser may take the following, among other things, into consideration: the best net price available; the reliability, integrity and financial condition of the broker-dealer; the size of and the difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the investment performance of the Allocated Assets on a continuing basis. The execution price of a transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the execution services offered.

Consistent with Section 28(e) of the Securities Exchange Act of 1934, as amended (“1934 Act”) and applicable regulations and interpretations, the Subadviser may allocate brokerage on behalf of the Fund and in connection with the Allocated Assets, to a broker-dealer who provides research services. Subject to compliance with Section 28(e) and where applicable, the Subadviser may cause the Fund, in connection with the Allocated Assets, to pay to a broker-dealer who provides research services a commission that exceeds the commission the Fund might have paid to a different broker-dealer for the same transaction if the Subadviser determines, in good faith, that such amount of commission is reasonable in relation to the value of such brokerage or research services provided viewed in terms of that particular transaction or the Subadviser’s overall responsibilities to the Fund or its other advisory clients.

The Subadviser may aggregate sales and purchase orders of the Allocated Assets, where applicable, with similar orders being made simultaneously for other accounts advised by the Subadviser or its affiliates. Whenever the Subadviser simultaneously places orders to purchase or sell the same asset on behalf of the Fund and one or more other accounts advised by the Subadviser, the Subadviser shall allocate the order as to price and amount among all such accounts in a manner believed to be equitable and consistent with its fiduciary obligations to the Fund and such other accounts.

(c) The Subadviser shall report to the Board at each meeting thereof as reasonably requested by the Adviser or the Board all material changes in the Allocated Assets since the prior report, and shall also keep the Board informed of important developments affecting the Allocated Assets and the Subadviser, and on its own initiative, or as reasonably requested by the Adviser or the Board, shall furnish the Board from time to time with such information as the Subadviser may believe appropriate for this purpose, whether concerning the individual investments comprising the Allocated Assets, including but not limited to the Investment Funds, the performance of the Allocated Assets and the underlying Investment Funds, the investment strategies and holdings of the Investment Funds, or otherwise. The Subadviser shall also furnish the Board with such statistical and analytical information with respect to investments of the Allocated Assets, including but not limited to the underlying Investment Funds, as the Subadviser may believe appropriate or as the Adviser or the Board reasonably may request. In providing investment advisory services pursuant to this Agreement, the Subadviser shall comply with: (i) the Board Policies, the Organic Documents, the objective, investment policies, and investment restrictions as set forth in the Prospectus, the Adviser and Subadviser Guidelines, and the Procedures, each as promptly provided to the Subadviser by the Adviser; (ii) the 1940 Act; (iii) the Securities Act; (iv) the 1934 Act; (v) the Internal Revenue Code of 1986, as amended; (v) and other applicable laws. In making purchases and sales of securities and other investment assets for the Fund, the Subadviser is prohibited from consulting with other subadvisers to the Fund or to any other registered investment company advised by the Adviser.

(d) The Subadviser shall from time to time employ or associate with such persons as the Subadviser believes to be particularly fitted to assist in the execution of the Subadviser's duties hereunder, the cost of performance of such duties to be borne and paid by the Subadviser. No obligation may be incurred on the Fund’s or Adviser’s behalf in any such respect.

(e) The Subadviser shall report to the Board and the Adviser all matters related to the Subadviser that are material to the Subadviser’s performance of this Agreement. The Subadviser shall notify the Adviser and the Fund, as soon as reasonably practicable, and where possible, in advance of any change of control of the Subadviser and any changes in the key personnel who are either the portfolio manager(s) of the Allocated Assets or senior management of the Subadviser.

(f) The Subadviser shall maintain a Compliance Manual that includes policies and procedures relating to the services it provides to the Fund that are reasonable designed to prevent violations of the federal securities laws as defined in Rule 38a-1 under the 1940 Act (“Federal Securities Laws”) as they relate to the Fund, and shall employ personnel to administer the policies and procedures who have the requisite level of skill and competence required to effectively discharge its responsibilities.

(g) The Subadviser shall provide the Fund’s chief compliance officer (the “Fund CCO”) and/or the Adviser’s chief compliance officer (the “Adviser CCO”), upon reasonable request, direct access to the Subadviser’s chief compliance officer and, upon reasonable request, shall provide the Fund CCO and the Adviser CCO, at its own expense, with information he/she reasonably believes is required to administer the Fund’s compliance program under Rule 38a-1 of the 1940 Act or the Adviser’s compliance program under Rule 204(4)-7, respectively, including, without limitation: (i) periodic reports/certifications regarding the Subadviser’s compliance with the Federal Securities Laws and the Subadviser’s compliance program as set forth in the Compliance Manual; (ii) special reports in the event of any Material Compliance Matter (as defined in Rule 38a-1 under the 1940 Act); and (iii) a completed quarterly information questionnaire regarding the Subadviser’s compliance program as set forth in the Compliance Manual. Upon the reasonable written request of the Fund and the Adviser, the Subadviser shall also permit the Fund, the Adviser, or their representatives to examine the reports required to be made to the Subadviser under the Code.

(h) The Subadviser shall maintain records relating to its portfolio transactions and placing and allocation of brokerage orders, where applicable, with respect to the Allocated Assets as are required to be maintained by the Fund under the 1940 Act. The Subadviser shall prepare and maintain, or cause to be prepared and maintained, in such form, for such periods and in such locations as may be required by applicable law, all documents and records relating to the services provided by the Subadviser pursuant to this Agreement required to be prepared and maintained by the Subadviser or the Fund pursuant to applicable law. To the extent required by applicable law, the books and records pertaining to the Allocated Assets, which are in possession of the Subadviser, shall be the property of the Fund (the “Fund Records”). The Adviser and the Fund, or their respective representatives, shall have access to such books and records at all times during the Subadviser's normal business hours. Upon the reasonable request of the Adviser or the Fund, copies of any such books and records shall be provided promptly by the Subadviser to the Adviser and the Fund, or their respective representatives.

(i) The Subadviser shall cooperate with the Fund’s independent public accountants and shall take reasonable action to make all necessary information available to the accountants for the performance of the accountants’ duties.

(j) The Subadviser shall provide the Fund and the Fund’s custodian and fund accountant, where applicable, on each business day with such information relating to all transactions concerning the Allocated Assets as the Fund, the Adviser, and the Fund’s custodian and fund accountant may reasonably require, including but not limited to information required to be provided under the Fund’s Portfolio Securities Valuation Procedures; provided however the Subadviser is only assisting the Fund in its pricing responsibilities and shall not be deemed the pricing agent for the Fund.

(k) Except as permitted by the Procedures, the Subadviser shall not disclose and shall treat confidentially all information relating specifically to the Fund’s investments including, without limitation, the identification and market value or other pricing information of any and all portfolio securities or other investments held by the Fund, and any and all trades effected for the Fund (including past, pending and proposed trades). The foregoing shall not in any way restrict the Subadviser’s ability to disclose information relating to assets comprising the Allocated Assets to the extent that such assets are held in other accounts managed or advised by the Subadviser.

(l) The Subadviser shall have no duties or obligations pursuant to this Agreement (other than the continuation of its preexisting duties and obligations) during any period that the Adviser has not allocated any portion of the Fund’s assets to the Subadviser for management.

(m) The Subadviser shall, consistent with the Procedures: (i) cooperate with and provide reasonable assistance to the Adviser, the Fund’s administrator, custodian, fund accountant, transfer agent, pricing agents, and all other agents and representatives of the Fund; (ii) provide such persons Fund data as they may reasonably deem necessary to the performance of their obligations to the Fund; and (iii) maintain any appropriate interfaces with each so as to promote the efficient exchange of information.

SECTION 4. COMPENSATION

(a) In consideration of the foregoing, the Adviser shall pay the Subadviser, with respect to the Allocated Assets, a fee at an annual rate as listed in Appendix A hereto. Such fees shall be accrued by the Adviser monthly and shall be payable monthly in arrears no later than the fifteenth day of each calendar month for services performed hereunder during the prior calendar month. If the Subadviser commences the provision of services to the Fund under this Agreement in the middle of a month or if this Agreement terminates before the end of any month, all fees for the period from that date to the end of that month or from the beginning of that month to the date of termination, as the case may be, shall be prorated according to the proportion that the period bears to the full month in which the effectiveness or termination occurs.

(b) No fee shall be payable hereunder with respect to that portion of the Allocated Assets which are invested in investment companies for which the Subadviser serves as investment adviser or subadviser and for which the Subadviser already receives an advisory fee.

SECTION 5. EXPENSES

(a) The Subadviser shall pay its own expenses in connection with rendering the services to be provided by it pursuant to this Agreement. In addition, the Subadviser shall be responsible for the costs associated with: (i) any special Board meetings or shareholder meetings convened for the primary benefit of, and specifically requested by, the Subadviser (unless such cost is otherwise allocated by the Board); (ii) amendments to the Registration Statement (other than amendments implemented in connection with the annual Registration Statement update) or supplements to the Prospectus as specifically requested by the Subadviser (collectively, “Updates”) (unless such cost is otherwise allocated by the Board); and (iii) the dissemination of such Updates (unless such cost is otherwise allocated by the Board).

(b) The Fund shall be responsible for and assumes the obligation for payment of all of its expenses not specifically waived, assumed or agreed to be paid by the Adviser or the Subadviser including but not limited to those items set forth in Section 5(b) of the Advisory Agreement.

SECTION 6. STANDARD OF CARE

(a) The Subadviser shall be responsible for the accuracy and completeness (and shall be liable for any material lack thereof) of any information with respect to the Subadviser, its personnel, or the strategies it employs to manage the Allocated Assets as provided in writing by the Subadviser to the Fund or the Adviser for inclusion in the Fund’s offering materials (including the Prospectus and advertising and sales materials) or proxy statements.

(b) The Fund and the Adviser shall expect of the Subadviser, and the Subadviser shall give the Fund and the Adviser the benefit of, the Subadviser's best judgment and reasonable efforts in rendering its services hereunder. In performing its duties under this Agreement, the Subadviser shall also act at all times in the best interests of the Fund. The Subadviser shall not be liable hereunder to the Adviser, the Fund, or the Fund’s unitholders, for any mistake of judgment or mistake of law, for any loss arising out of any investment, or for any act or omission taken or in any event whatsoever in the absence of: (i) bad faith, willful misfeasance or gross negligence in the performance of the Subadviser’s duties or obligations under this Agreement or (ii) the Subadviser’s reckless disregard of its duties and obligations under this Agreement. The Subadviser acknowledges that federal and state securities laws impose liabilities under certain circumstances on persons who act in good faith and, therefore, nothing herein shall in any way constitute a waiver or limitation of any rights which the Adviser or the Fund may have under applicable federal or state securities laws.

(c) The Subadviser shall not be liable for the errors of other service providers to the Fund, including the errors of pricing services, the administrator, the fund accountant, the custodian or transfer agent of the Fund. The Subadviser shall not be liable to the Adviser, the Fund, or the Fund’s unitholders, for any action taken or failure to act in good faith reliance upon: (i) information, instructions or requests, whether oral or written, with respect to the Fund made to the Subadviser by a duly authorized officer of the Adviser or the Fund; (ii) the advice of counsel to the Fund; and (iii) any written instruction or certified copy of any resolution of the Board or any agent of the Board.

(d) The Subadviser shall not be responsible or liable for any failure or delay in performance of its obligations under this Agreement arising out of or caused, directly or indirectly, by circumstances beyond its reasonable control including, without limitation, acts of civil or military authority, national emergencies, labor difficulties (other than those related to the Subadviser’s employees), fire, mechanical breakdowns, flood or catastrophe, acts of God, insurrection, war, riots or failure of the mails, transportation, communication or power supply.

SECTION 7. INDEMNIFICATION

(a) The Subadviser shall indemnify the Fund, the Adviser, and their respective officers, directors, employees, affiliates, and agents (each, a “Fund Indemnitee”) for, and shall defend and hold each Fund Indemnitee harmless from, all losses, costs, damages and expenses (including reasonable legal fees) (collectively, “Losses”) incurred by the Fund Indemnitee and arising from or in connection with the Subadviser’s bad faith, willful misfeasance, or gross negligence in the performance of its duties under this Agreement, the Subadviser’s reckless disregard of its duties or obligations under this Agreement, or the Subadviser’s breach of its fiduciary duty to the Fund under federal securities laws or state laws; provided, however, the Subadviser shall not be required to indemnify a Fund Indemnitee to the extent that Losses result from the Fund or the Adviser’s bad faith, willful misfeasance, or gross negligence in the performance of their respective duties under this Agreement, the Fund’s or the Adviser’s reckless disregard of their respective duties or obligations under this Agreement, or the Adviser’s breach of its fiduciary duty to the Fund under federal securities laws or state laws.

(b) The Fund shall indemnify the Subadviser, its officers, directors, partners, employees, affiliates, and agents (each, a “Subadvisory Indemnitee”) for, and shall defend and hold each Subadvisory Indemnitee harmless from all Losses incurred by the Subadvisory Indemnitee and arising from or in connection with the performance of its duties under this Agreement; provided, however, the Fund shall not be required to indemnify a Subadvisory Indemnity to the extent that Losses result from the Subadviser’s bad faith, willful misfeasance, or gross negligence in the performance of its duties under this Agreement, the Subadviser’s reckless disregard of its duties or obligations under this Agreement, or the Subadviser’s breach of its fiduciary duty to the Fund under federal securities laws and state law.

(c) The Adviser shall indemnify each Subadvisory Indemnitee for, and shall defend and hold each Subadvisory Indemnitee harmless from all Losses incurred by the Subadvisory Indemnitee and arising from or in connection the Adviser’s bad faith, willful misfeasance, or gross negligence in the performance of its duties under this Agreement, the Adviser’s reckless disregard of its duties or obligations under this Agreement, or the Adviser’s breach of fiduciary duty under federal securities laws or state laws; provided, however, the Adviser shall not be required to indemnify a Subadvisory Indemnitee to the extent that Losses result from the Subadviser’s bad faith, willful misfeasance, or gross negligence in the performance of its duties under this Agreement, the Subadviser’s reckless disregard of its duties or obligations under this Agreement, or the Subadviser’s breach of its fiduciary duty to the Fund under federal securities laws and state law.

(d) Upon the assertion of a claim for which a party may be required to indemnify a Fund Indemnitee or Subadvisory Indemnitee (each, an “Indemnitee”), the Indemnitee must promptly notify the indemnifying party of such assertion, and shall keep the indemnifying party advised with respect to all developments concerning such claim. The indemnifying party shall have the option to participate with the Indemnitee in the defense of such claim or to defend against said claim in its own name or in the name of the Indemnitee. The Indemnitee shall in no case confess any claim or make any compromise in any case in which the indemnifying party may be required to indemnify it except with the indemnifying party’s prior written consent, which shall not be unreasonably withheld, conditioned or delayed; notwithstanding Sections 7(a), 7(b), and 7(c) hereof, in the event the Indemnitee has not secured such consent from the indemnifying party, the indemnifying party shall have no obligation to indemnify the Indemnitee.

SECTION 8. EFFECTIVENESS, DURATION AND TERMINATION

(a) This Agreement shall become effective as of the date first written above after approval (i) by a vote of the majority of those Trustees of the Fund who are not parties to this Agreement or interested persons of such party cast in person at a meeting called for the purpose of voting on the Agreement, and (ii) if required by the 1940 Act or applicable staff interpretations thereof, by vote of a majority of the Fund's outstanding voting securities of the Fund.

(b) This Agreement shall remain in effect for a period of two years from the date of its effectiveness and shall continue in effect for successive annual periods; provided that such continuance is specifically approved at least annually: (i) by the Board or by vote of a majority of the outstanding voting securities of the Fund, and, in either case, (ii) by a majority of the Fund’s Trustees who are not interested persons (as defined in the 1940 Act) by votes cast in person at a meeting called for the purpose of voting on such approval; provided, however, that if the continuation of this Agreement is not approved as to the Fund, the Subadviser may continue to render to the Fund the services described herein in the manner and to the extent permitted by the 1940 Act and the rules and regulations thereunder.

(c) This Agreement may also be terminated at any time, without the payment of any penalty, (i) by the Board, by a vote of a majority of the outstanding voting securities of the Fund or by the Adviser on 60 days' written notice to the Subadviser or (ii) by the Subadviser on 60 days' written notice to the Adviser. This Agreement shall terminate immediately upon its assignment or upon termination of the Advisory Agreement.

SECTION 9. ACTIVITIES OF THE SUBADVISER

Except to the extent necessary to perform its obligations hereunder, nothing herein shall be deemed to limit or restrict the Subadviser's right, or the right of any of the Subadviser's partners, directors, officers or employees to engage in any other business or to devote time and attention to the management or other aspects of any other business, whether of a similar or dissimilar nature, or to render services of any kind to any other entity.

SECTION 10. REPRESENTATIONS OF SUBADVISER.

The Subadviser represents and warrants to the Fund and the Adviser that:

(a) It is registered as an investment adviser under the Advisers Act (and shall continue to be so registered for so long as this Agreement remains in effect);

(b) It is not prohibited by the 1940 Act or the Advisers Act from performing the services contemplated by this Agreement;

(c) It has met, and shall seek to continue to meet for so long as this Agreement remains in effect, any other applicable federal or state requirements, or the applicable requirements of any self-regulatory agency, necessary to be met by the Subadviser in order to perform its services contemplated by this Agreement;

(d) It shall promptly notify the Adviser and the Fund of the occurrence of any event that would disqualify the Subadviser from serving as an investment adviser of an investment company pursuant to Section 9(a) of the 1940 Act or other applicable law, rule or regulation;

(e) It has adopted and implemented a Code that complies with the requirements of Rule 17j-1 under the 1940 Act; and

(f) It has adopted and implemented a Compliance Manual that is reasonably designed to prevent violations of Federal Securities Laws by the Adviser, its employees, officers, and agents.

SECTION 11. LIMITATION OF UNITHOLDER AND TRUSTEE LIABILITY

The Trustees of the Fund and the unitholders of the Fund shall not be personally liable for any obligations of the Fund under this Agreement, and the Subadviser agrees that, in asserting any rights or claims under this Agreement, it shall look only to the assets and property of the Fund to which the Subadviser's rights or claims relate in settlement of such rights or claims, and not to the Trustees of the Fund or the unitholders of the Fund.

SECTION 12. AFFILIATIONS OF PARTIES

Subject to and in accordance with the Organic Documents, the Limited Liability Agreement of the Adviser, and the 1940 Act, the Trustees, officers, agents or shareholders of the Fund are or may be Adviser Representatives as directors, officers, shareholders, agents, or otherwise and Adviser Representatives are or may be interested persons of the Fund as Trustees, officers, agents, shareholders, or otherwise. The Adviser and its affiliates may be interested persons of the Fund. Such relationships shall be governed by the aforementioned governing instruments.

SECTION 13. CONFIDENTIALITY

(a) “Confidential Information” includes Fund Records and all tangible and intangible information and materials being disclosed in connection with this Agreement by one of the parties (“Disclosing Party”) to another party (“Receiving Party”), in any form or medium (and without regard to whether the information is owned by a party to this Agreement (each, a “Party”) or by a third party), that satisfy at least one of the following criteria:

(i) information related to a Disclosing Party’s, its respective affiliates’ or its third party licensors’ or vendors’ trade secrets, customers, business plans, procedures, strategies, forecasts or forecast assumptions, operations, methods of doing business, records, finances, assets, technology, software, systems data or other proprietary or confidential business or technical information;

(ii) information designated as confidential in writing by the Disclosing Party or information that the Receiving Party should reasonably know to be information that is of a confidential or proprietary nature; or

(iii) any information derived from, or developed by reference to or use of, any information described in the preceding clauses (i) and (ii);

provided,however, that, notwithstanding the foregoing, the following shall not be considered Confidential Information: (iv) information that is disclosed to the Receiving Party without any obligation of confidentiality by a third person who has a right to make such disclosure; (v) information that is or becomes publicly known without violation of this Agreement by the Receiving Party; or (vi) information that is independently developed by the Receiving Party or its employees or affiliates without reference to the Disclosing Party’s information.