UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

Form 6-K

____________

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

August 13, 2020

Commission File Number: 333-177693

Reynolds Group Holdings Limited

(Translation of registrant’s name into English)

Reynolds Group Holdings Limited

Level Nine

148 Quay Street

Auckland 1010 New Zealand

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

QUARTERLY REPORT

For the three and six month periods ended June 30, 2020

REYNOLDS GROUP HOLDINGS LIMITED

New Zealand

(Jurisdiction of incorporation or organization)

Reynolds Group Holdings Limited

Level Nine

148 Quay Street

Auckland 1010 New Zealand

Attention: Joseph Doyle

Tel: +1 847 482 2409

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | |

| | Reynolds Group Holdings Limited |

| | (Registrant) |

| | |

| | By: | /s/ ALLEN HUGLI |

| | Allen Hugli |

| | Chief Financial Officer |

| | August 13, 2020 |

Table of Contents

|

| | | | | | | |

| PART I - FINANCIAL INFORMATION | |

| | ITEM 1. FINANCIAL STATEMENTS | |

| | ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| | | Overview | |

| | | Key Factors Influencing Our Financial Condition and Results of Operations | |

| | | Results of Operations | |

| | | Liquidity and Capital Resources | |

| | | Accounting Principles | |

| | | Critical Accounting Policies | |

| | | Recently Issued Accounting Pronouncements | |

| | ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| | ITEM 4. CONTROLS AND PROCEDURES | |

| PART II - OTHER INFORMATION | |

| | ITEM 1. LEGAL PROCEEDINGS | |

| | ITEM 1A. RISK FACTORS | |

| | ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

| | ITEM 3. DEFAULTS UPON SENIOR SECURITIES | |

| | ITEM 4. MINE SAFETY DISCLOSURE | |

| | ITEM 5. OTHER INFORMATION | |

| | ITEM 6. EXHIBITS | |

Introductory Note

In this quarterly report, references to “we,” “us,” “our” or the “RGHL Group” are to Reynolds Group Holdings Limited (“RGHL”) and its consolidated subsidiaries, unless otherwise indicated.

Certain financial information that is normally included in annual financial statements, including certain financial statement notes, is not required for interim reporting purposes and has been condensed or omitted in this quarterly report. Our annual report on Form 20-F for the year ended December 31, 2019 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 10, 2020 (the “Annual Report”) also includes certain other information about our business, including risk factors and more detailed descriptions of our businesses, which is not included in this quarterly report. This quarterly report should be read in conjunction with the Annual Report, including the consolidated financial statements and notes thereto included therein. The SEC maintains an internet site at https://www.sec.gov, from which interested persons can electronically access the Annual Report including the exhibits thereto. The Annual Report can also be found at www.reynoldsgroupholdings.com, or a copy will be provided free of charge upon written request to Mr. Joseph Doyle, RGHL Group Legal Counsel, 1900 West Field Court, Lake Forest, Illinois, 60045.

We have prepared this quarterly report pursuant to (i) the requirements of the indentures governing certain of our outstanding notes, and (ii) the credit agreement with our lenders governing our senior secured credit facilities (the “Credit Agreement”). Our outstanding notes include the 5.125% Senior Secured Notes due 2023 (the “Reynolds Senior Secured Notes”), the 7.000% Senior Notes due 2024 (the “Reynolds Senior Notes”, and together with the Reynolds Senior Secured Notes the “Reynolds Notes”), and the 7.950% Debentures due 2025 and the 8.375% Debentures due 2027 (together, the “Pactiv Debentures”).

The indentures governing these notes, as well as our Credit Agreement, are described more fully in our Annual Report. Additionally, refer to “Part I - Financial Information — Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations — Recent Developments” and notes 12 and 16 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for more information.

Non-GAAP Financial Measures

In this quarterly report, we utilize certain non-GAAP financial measures and ratios, including earnings before interest, tax, depreciation and amortization (“EBITDA”) and Adjusted EBITDA. Adjusted EBITDA, a measure used by our management to measure operating performance, is defined as EBITDA, adjusted to exclude certain items of a significant or unusual nature, including but not limited to acquisition costs, non-cash pension income or expense, restructuring costs, related party management fees, unrealized gains or losses on derivatives, gains or losses on the sale of non-strategic assets, asset impairments and write-downs, strategic review costs and equity method profit not distributed in cash. These measures are presented because we believe that they and similar measures are widely used in the markets in which we operate as a means of evaluating a company’s operating performance and financing structure and, in certain cases, because those measures are used to determine compliance with covenants in our debt agreements and compensation of certain management. They may not be comparable to other similarly titled measures of other companies and are not measurements under International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”), generally accepted accounting principles in the United States of America (“U.S. GAAP”), or other generally accepted accounting principles, are not measures of financial condition, liquidity or profitability and should not be considered as an alternative to profit from operations for the period or operating cash flows determined in accordance with IFRS, nor should they be considered as substitutes for the information contained in our financial statements prepared in accordance with IFRS included in this quarterly report. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow, as they do not take into account certain items such as interest and principal payments on our indebtedness, working capital needs, tax payments and capital expenditures. We believe that the inclusion of EBITDA and Adjusted EBITDA in this quarterly report is appropriate to provide additional information to investors about our operating performance and to provide a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. We believe that issuers of high yield debt securities present EBITDA and Adjusted EBITDA because investors, analysts and rating agencies consider these measures useful. For additional information regarding the segment performance measures used by management, refer to note 4 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Forward-Looking Statements

This quarterly report includes forward-looking statements. Forward-looking statements include statements regarding our goals, beliefs, plans or current expectations, taking into account the information currently available to our management. Forward-looking statements are not statements of historical fact. For example, when we use words such as “believe,” “anticipate,” “expect,” “estimate,” “plan,” “intend,” “should,” “would,” “could,” “may,” “might,” “will” or other words that convey uncertainty of future events or outcomes, we are making forward-looking statements. We have based these forward-looking statements on our management’s current view with respect to future events and financial performance and future business and economic conditions more generally. These views reflect the best judgment of our management, but involve a number of risks and uncertainties which could cause actual results to differ materially from those predicted in our forward-looking statements and from past results, performance or achievements. Although we believe that the estimates and the projections reflected in the forward-looking statements are reasonable, such estimates and projections may prove to be incorrect, and our actual results may differ from those described in our forward-looking statements as a result of the following risks, uncertainties and assumptions, among others:

| |

| • | risks related to the COVID-19 pandemic, including the associated effect of heightening many of the other risks disclosed in our Annual Report; |

| |

| • | risks related to future costs of raw materials, energy and freight, including the impact of tariffs, trade sanctions and similar matters affecting our importation of certain raw materials; |

| |

| • | risks related to economic downturns in our target markets; |

| |

| • | risks related to changes in consumer lifestyle, eating habits, nutritional preferences and health-related and environmental concerns that may harm our business and financial performance; |

| |

| • | risks related to complying with environmental, health and safety laws or as a result of satisfying any liability or obligation imposed under such laws; |

| |

| • | risks related to the impact of a loss of any of our key manufacturing facilities; |

| |

| • | risks related to our dependence on key management and other highly skilled personnel; |

| |

| • | risks related to the consolidation of our customer bases, loss of a significant customer, competition and pricing pressure; |

| |

| • | risks related to any potential supply of faulty or contaminated products; |

| |

| • | risks related to exchange rate fluctuations; |

| |

| • | risks related to dependence on the protection of our intellectual property and the development of new products; |

| |

| • | risks related to pension plans sponsored by us and others in our control group; |

| |

| • | risks related to strategic transactions, including completed and future acquisitions or dispositions; |

| |

| • | risks related to our hedging activities which may result in significant losses and in period-to-period earnings volatility; |

| |

| • | risks related to our suppliers of raw materials and any interruption in our supply of raw materials; |

| |

| • | risks related to information security, including a cybersecurity breach or a failure of one or more of our information technology systems, networks, processes or service providers; |

| |

| • | risks related to related party transactions entered into with Reynolds Consumer Products Inc. (“RCPI”) and its subsidiaries (“Reynolds Consumer Products”); |

| |

| • | risks related to the tax-free distribution of our interest in RCPI to our shareholder, Packaging Finance Limited (“PFL”); |

| |

| • | risks related to our substantial indebtedness and our ability to service our current and future indebtedness; |

| |

| • | risks related to restrictive covenants in certain of our outstanding notes and our other indebtedness which could adversely affect our business by limiting our operating and strategic flexibility; and |

| |

| • | risks related to increases in interest rates which would increase the cost of servicing our variable rate debt instruments. |

The risks described above and the risks disclosed in or referred to in “Part II - Other Information — Item 1A. Risk Factors” in this quarterly report and in “Part I — Item 3. Key Information — Risk Factors” of our Annual Report are not exhaustive. Other sections of this quarterly report describe additional factors that could adversely affect our business, financial condition or results of operations. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above and included elsewhere in this quarterly report.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

Refer to the attached F pages of this quarterly report for our interim unaudited condensed consolidated financial statements and notes thereto for the three and six month periods ended June 30, 2020 and June 30, 2019.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Recent developments

Separate financing of Graham Packaging

On August 4, 2020, the legal entities that comprise the Graham Packaging segment (“GPC”) were designated as unrestricted subsidiaries under the Credit Agreement and the Reynolds Notes and the relevant GPC entities were released as a borrower under, and guarantors of, the Credit Agreement and released as guarantors of the Reynolds Notes. The security granted by such entities was also released.

On August 4, 2020 GPC entered into a credit agreement (the “GPC Credit Agreement”), which provides for a $1,475 million senior secured term loan facility maturing in August 2027 and a $100 million revolving facility maturing in August 2025. The term loan was fully drawn on August 4, 2020 and bears interest at the LIBO Rate, subject to a 0.75% floor, plus a margin of 3.75%. The revolving facility has been utilized in the amount of approximately $4 million for letters of credit.

The obligations under the GPC Credit Agreement are guaranteed by certain subsidiaries in GPC and are secured by substantially all the assets of the borrower and the guarantors.

On August 4, 2020, GPC also issued $510 million of 7.125% senior notes maturing in August 2028 (together with the GPC term loans under the GPC Credit Agreement, the “GPC Borrowings”). The senior notes are guaranteed by the same entities that guarantee the obligations under the GPC Credit Agreement.

The terms of the GPC Borrowings restrict distributions of cash or assets from GPC to the rest of the RGHL Group. No entities outside of GPC have provided any guarantees or security in relation to the GPC Borrowings.

The net proceeds from the GPC Borrowings were distributed to certain non-GPC members of the RGHL Group and were partially used to repay certain of the borrowings described below.

Repayment of borrowings

Subsequent to June 30, 2020, we have repaid an aggregate of $2,094 million principal amount of borrowings, and we have issued a conditional notice of redemption to redeem an additional $150 million of senior notes as described below.

On July 31, 2020, we repaid the $380 million of principal outstanding under the Securitization Facility and terminated this facility.

On August 4, 2020, we: (i) satisfied and discharged the $749 million aggregate principal amount outstanding under the Floating Rate Senior Secured Notes due 2021 at par; (ii) repaid in full the €236 million ($265 million) of borrowings under the European Term Loan and all obligations under this tranche terminated; and (iii) repaid $700 million of borrowings under the U.S. Term Loans.

On July 30, 2020, we issued a conditional redemption notice to redeem $150 million aggregate principal amount of the 7.000% senior notes due 2024 at price of 101.750%. The conditions for the redemption were satisfied on August 4, 2020 with the redemption scheduled to occur on August 29, 2020.

On a pro forma basis, following the repayment of the borrowings described above we have $7,213 million of borrowings outstanding. This comprises $1,987 million of borrowings with Graham Packaging and $5,226 million in the rest of the RGHL Group.

Other

On August 4, 2020, we announced that we have confidentially submitted a draft registration statement on Form S-1 to the SEC relating to the proposed initial public offering of our common stock. The number of shares to be offered and the price range for the proposed offering have not yet been determined. The initial public offering is expected to commence after the SEC completes its review process, subject to market and other conditions. If the initial public offering proceeds, our present intention is to convert into a Delaware corporation with the name Pactiv Evergreen Inc. Furthermore, immediately prior to such initial public offering, we will distribute to our shareholder, PFL, our Graham Packaging business. There is no assurance that the initial public offering will be completed.

Overview

RGHL was incorporated on May 30, 2006 under the Companies Act 1993 of New Zealand. We are a leading global manufacturer and supplier of consumer and foodservice products and beverage containers. We sell our products to customers globally, including to a diversified mix of leading multinational companies, large national and regional companies, and small local businesses. We primarily serve the consumer food, beverage and foodservice market segments. On February 4, 2020, we distributed our former Reynolds Consumer Products segment to our shareholder. Following this transaction, we revised our segments on March 31, 2020. We operate through four reportable segments: Foodservice, Food Merchandising, Evergreen and Graham Packaging. Our previously reported Pactiv Foodservice segment is now two segments, Foodservice and Food Merchandising.

In addition to our four reportable segments, we have other operations which do not meet the quantitative threshold for reportable segments. These are reported as Other. We also have an Unallocated category that includes holding companies and certain debt issuer companies which support the entire RGHL Group and which are not part of a specific segment, as well as corporate functions such as finance, tax and legal, the impact of the Reynolds Group Pension Plan (“RGPP”) and eliminations of transactions between segments.

Our Segments

Foodservice

Foodservice manufactures a broad range of products that enable consumers to eat and drink where they want and when they want with convenience. Foodservice manufactures food containers, hot and cold cups and lids, dinnerware items and other products which make eating on-the-go more enjoyable and easy to do. Foodservice has a large customer base and operates in North America.

Food Merchandising

Food Merchandising manufactures products that protect and attractively display food while preserving freshness. Food Merchandising products include clear rigid-display containers, containers for prepared and ready-to-eat food, trays for meat and poultry and molded fiber cartons. Food Merchandising has a large customer base and operates primarily in North America.

Evergreen

Evergreen manufactures cartons for fresh refrigerated beverage products, primarily serving dairy (including plant-based, organic and specialties), juice and other specialty beverage end-markets. Evergreen manufactures and supplies integrated fresh carton systems, which include printed cartons, spouts and filling machinery. Evergreen also produces fiber-based liquid packaging board for its internal requirements and to sell to other fresh beverage carton manufacturers, as well as a range of paper-based products which it sells to paper and packaging converters. Evergreen has a large customer base and operates primarily in North America.

Graham Packaging

Graham Packaging is a designer and manufacturer of value-added, custom blow-molded plastic containers for consumer products. Graham Packaging has a large global customer base with its largest presence in North America.

Distribution of Reynolds Consumer Products

On February 4, 2020, we distributed our interest in the operations that represented the Reynolds Consumer Products segment to our shareholder, PFL. The distribution was effected in a manner that is intended to qualify as tax-free to us and to PFL. The distribution occurred prior to and in preparation for the initial public offering ("IPO") of shares of common stock of RCPI, which was completed on February 4, 2020. The distribution of Reynolds Consumer Products triggered the presentation of this operation as a discontinued operation in our interim unaudited condensed consolidated financial statements.

Repayment of Borrowings

On February 4, 2020, we repaid in full all of the $3.1 billion aggregate principal amount outstanding of our 5.750% Senior Secured Notes due 2020 at face value plus accrued and unpaid interest. During the six month period ended June 30, 2020, we also repaid an aggregate of $38 million of borrowings using the proceeds from the sale of our former North American and Japanese closures businesses and reduced the borrowings outstanding under the Securitization Facility by $40 million.

Key Factors Influencing Our Financial Condition and Results of Operations

The following discussion should be read in conjunction with “Key Factors Influencing Our Financial Condition and Results of Operations” in “Part I — Item 5. Operating and Financial Review and Prospects” of our Annual Report, which discusses further key factors influencing our financial condition and results of operations.

COVID-19

On March 11, 2020, the COVID-19 outbreak was declared a pandemic by the World Health Organization, which recommended containment and mitigation measures worldwide. Our business has been impacted by the pandemic, and we expect that impact to continue.

Although many jurisdictions implemented, for various periods of time, stay-at-home, closures or similar measures designed to limit the spread of COVID-19, resulting in the temporary closing of many businesses, these orders included exemptions for “essential businesses.” All of our operations fall within those exemptions and have remained open. We have implemented several policies designed to protect our employees and our customers including screening employees for symptoms of COVID-19 (including increased temperature checking), ensuring social distancing is observed, providing physical barriers and personal protective equipment where employees work closely together, tracking and tracing of COVID-19 positive employees and contractors to identify close contacts and locations frequented, engagement of third-party vendors to deep-clean and sanitize facilities, enhanced pay policies, and enhanced leave policies to ensure employees experiencing symptoms of COVID-19 stay at home. As the pandemic continues, we remain committed to adapting our policies and procedures to ensure the safety of our employees and compliance with federal, state and local regulations.

Some of our facilities operate in communities that have had high incident rates of COVID-19, resulting in many persons out sick or in quarantine, which has impacted production at some plants. Moreover, additional cleaning, implementation of employee screening processes and enhanced employee leave policies, and similar actions in response to the pandemic, have increased our costs. We have taken actions to reduce non-essential spending, including the furlough of certain of our employees, reducing working capital in areas affected by lower sales and reducing non-essential capital spending.

The COVID-19 pandemic had a significant impact on the results of operations in the second quarter, particularly in our Foodservice segment, with lesser impacts in our Food Merchandising, Evergreen and Graham Packaging segments. Our Foodservice segment has experienced a significant decline in revenue due to the closure or reduced activity of restaurants. Our Food Merchandising segment has experienced a decline in demand for the products typically used in many of the group gatherings that were either canceled or scaled back during the second quarter, while many of

our other Food Merchandising products, such as meat trays, continue to have strong market demand as people continue to eat more at home. Within our Evergreen segment, sales of fresh beverage cartons have remained relatively constant with declines in sales of school milk cartons being offset by higher demand in the retail segment, while sales in the paper markets have declined due to a decrease in demand of printed publications and advertising. Our Graham Packaging segment has experienced a minimal net positive impact with an increase in demand for containers used for food, beverages and disinfectants offset by a decrease in demand for containers used in the automotive markets as a result of people driving less. We expect that the COVID-19 pandemic will continue to impact our results of operations in future periods as the macroeconomic environment changes and consumer behavior continues to evolve.

In facilities that manufacture, warehouse and distribute products with softening demand, we have taken measures to reduce spending and production accordingly. To date, we have not experienced significant issues within our supply chain, including the sourcing of materials and logistics service providers. However, this may change the longer the pandemic continues.

We believe the increased demand for certain of our products results from more people eating at home and increased cleaning due to the pandemic. We cannot predict if, or for how long, such increased demand will continue. For those products with decreased demand, we do not expect to recover the sales lost during the pandemic, and certain industries we serve, primarily the restaurant industry, are experiencing severe impacts and may not return to pre-pandemic strength for a significant period of time. The duration of the COVID-19 pandemic remains unknown, and its ongoing impact on our operations may not be consistent with our experiences to date.

In addition, we have experienced volatility in the net liability for our pension plans, with the value of the plan assets and liabilities impacted by changes in financial markets in connection with the COVID-19 pandemic.

As of June 30, 2020, we had $1,609 million of cash on hand and $255 million available for drawing under the revolving facility of our Credit Agreement. Following the $2,094 million repayment of borrowings discussed above in “— Recent Developments,” our next significant near term maturity of outstanding borrowings are the U.S. Term Loans under our Credit Agreement which mature in February 2023. Our revolving credit facility, which is currently used for letters of credit, matures in August 2021. We do not currently anticipate that the COVID-19 pandemic will materially impact our liquidity over the next 12 months.

CARES Act

The Coronavirus Aid, Relief and Economic Security (“CARES”) Act was enacted in March 2020. Retroactive provisions of the CARES Act enable us to utilize additional allowable interest deductions, which lower our taxable income for the year ended December 31, 2019. The CARES Act also increases the allowable interest deductions for the year ending December 31, 2020. As a result of the CARES Act, we have recognized in the six month period ended June 30, 2020 a tax benefit of $90 million in respect of our taxable income for the year ended December 31, 2019. This estimate will be updated when the U.S. federal and state tax returns for the year ended December 31, 2019 are finalized and filed. For the year ending December 31, 2020, we expect further tax benefits from the CARES Act, including a tax benefit of approximately $31 million from the utilization of additional allowable interest deductions. This benefit has been recognized in the six month period ended June 30, 2020 at an amount higher than the expected result for the year ending December 31, 2020 because of the impact of the annualized effective tax rate. These estimates for 2019 and 2020 are also subject to further revision as result of regulations issued subsequent to June 30, 2020. For further information, refer to note 9 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Substantial Leverage

The four segments in which we operate have all been acquired through a series of transactions. Our results of operations, financial position and cash flows are significantly impacted by the effects of these acquisitions, which were financed primarily through borrowings. In addition, from time to time, we refinance our borrowings which also can have a significant impact on our results of operations.

As of June 30, 2020, on a pro forma basis after the financing transactions discussed above in “— Recent Developments,” the outstanding principal amount of our borrowings was $7,213 million. As reflected in our consolidated statement of financial position as of June 30, 2020, we had total borrowings of $7,441 million, consisting of total indebtedness net of unamortized transaction costs, original issue discounts and embedded derivatives. For more information regarding our external borrowings, including the transactions subsequent to June 30, 2020, refer to notes 12 and 16 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report. Our future results of operations, including our net financial expenses, will be significantly affected by our substantial indebtedness. The servicing of this indebtedness has had and will continue to have an impact on our cash flows and cash balance. For more information, refer to “— Liquidity and Capital Resources.”

Raw Materials and Energy Prices

Our results of operations, and the gross margins corresponding to each of our segments, are impacted by changes in the costs of our raw materials and energy prices. The primary raw materials used to manufacture our products are plastic resins, fiber (principally raw wood and wood chips) and paperboard (principally cartonboard and cupstock). We also use commodity chemicals, steel and energy, including fuel oil, electricity, natural gas and coal, to manufacture our products.

Principal raw materials used by each of our segments are as follows (in order of cost significance):

| |

| • | Foodservice — resin, paperboard |

| |

| • | Food Merchandising — resin |

| |

| • | Evergreen — fiber (principally raw wood and wood chips), resin |

| |

| • | Graham Packaging — resin |

The prices of raw wood and wood chips may fluctuate due to external conditions such as weather, product scarcity and commodity market fluctuations and changes in governmental policies and regulations. Resin prices can fluctuate significantly with fluctuations in crude oil and natural gas prices, as well as changes in refining capacity and the demand for other petroleum-based products.

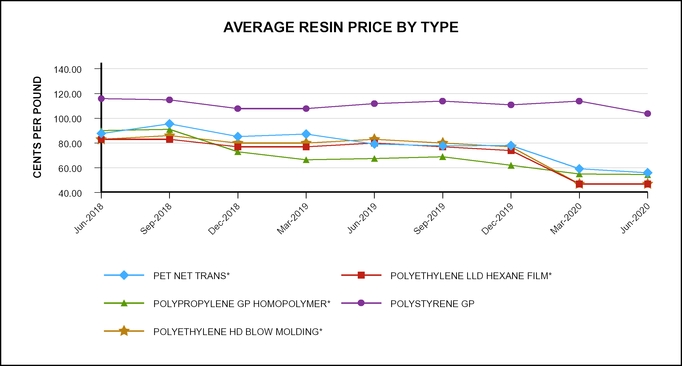

Historical index prices of resin for the past two years are shown in the chart below. The chart presents index prices and does not represent the prices at which we purchased resin.

Source: IHS Inc.

| |

| * | In Q1 2020, there was a non-market index price reduction due to a change in methodology. |

Results of Operations

The following discussion should be read in conjunction with our interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

The comparative information presented in the RGHL Group consolidated results reflects the classification of two businesses as discontinued operations. On December 20, 2019, we completed the sale of our North American and Japanese closures businesses. These operations represent substantially all of our former Closures segment. On February 4, 2020, we distributed our former Reynolds Consumer Products segment to PFL.

Three month period ended June 30, 2020 compared to the three month period ended June 30, 2019

RGHL Group

|

| | | | | | | | | | | | | | | | | | |

| | | For the three month period ended June 30, | | | | |

| (In $ million, except for %) | | 2020 | | % of revenue | | 2019(2) | | % of revenue | | Change | | % change |

| Total revenue | | 1,569 |

| | 100 | % | | 1,806 |

| | 100 | % | | (237 | ) | | (13 | )% |

| Cost of sales | | (1,337 | ) | | (85 | )% | | (1,503 | ) | | (83 | )% | | 166 |

| | 11 | % |

| Gross profit | | 232 |

| | 15 | % | | 303 |

| | 17 | % | | (71 | ) | | (23 | )% |

| Selling, marketing and distribution expenses/General and administration expenses | | (178 | ) | | (11 | )% | | (186 | ) | | (10 | )% | | 8 |

| | 4 | % |

| Net other income (expenses) | | 29 |

| | 2 | % | | (32 | ) | | (2 | )% | | 61 |

| | NM |

|

| Profit from operating activities | | 83 |

| | 5 | % | | 85 |

| | 5 | % | | (2 | ) | | (2 | )% |

| Financial income | | 4 |

| | — | % | | 13 |

| | 1 | % | | (9 | ) | | (69 | )% |

| Financial expenses | | (174 | ) | | (11 | )% | | (117 | ) | | (6 | )% | | (57 | ) | | (49 | )% |

| Net financial income (expenses) | | (170 | ) | | (11 | )% | | (104 | ) | | (6 | )% | | (66 | ) | | (63 | )% |

| Profit (loss) from continuing operations before income tax | | (87 | ) | | (6 | )% | | (19 | ) | | (1 | )% | | (68 | ) | | NM |

|

| Income tax (expense) benefit | | (128 | ) | | (8 | )% | | (9 | ) | | — | % | | (119 | ) | | NM |

|

| Profit (loss) from continuing operations | | (215 | ) | | (14 | )% | | (28 | ) | | (2 | )% | | (187 | ) | | NM |

|

| Profit (loss) from discontinued operations, net of income tax | | — |

| | NM |

| | 105 |

| | NM |

| | (105 | ) | | (100 | )% |

| Profit (loss) for the period | | (215 | ) | | NM |

| | 77 |

| | NM |

| | (292 | ) | | NM |

|

| Depreciation and amortization from continuing operations | | 155 |

| | 10 | % | | 147 |

| | 8 | % | | (8 | ) | | (5 | )% |

RGHL Group Adjusted EBITDA(1) from continuing operations | | 250 |

| | 16 | % | | 299 |

| | 17 | % | | (49 | ) | | (16 | )% |

| RGHL Group Adjusted EBITDA from discontinued operations | | — |

| | NM |

| | 222 |

| | NM |

| | (222 | ) | | (100 | )% |

| Total Adjusted EBITDA | | 250 |

| | NM |

| | 521 |

| | NM |

| | (271 | ) | | (52 | )% |

NM indicates that the calculation is not meaningful.

| |

| (1) | Refer to page 2 under the heading “Non-GAAP Financial Measures” for additional information related to this financial measure. |

| |

| (2) | The information presented has been revised to reflect the Reynolds Consumer Products business and the North American and Japanese closures businesses as discontinued operations. Refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for additional information. |

Revenue. Revenue decreased by $237 million, or 13%. The decrease was primarily due to lower sales volume in our Foodservice, Evergreen and Food Merchandising segments, including an unfavorable impact from the COVID-19 pandemic, as well as lower pricing, mainly due to lower raw material costs passed through to customers.

Cost of Sales. Cost of sales decreased by $166 million, or 11%. The decrease was primarily due to lower sales volume and lower raw material costs, partially offset by higher manufacturing costs.

Selling, Marketing and Distribution Expenses/General and Administration Expenses. Selling, marketing and distribution expenses and general and administration expenses decreased by $8 million, or 4%. The decrease was primarily due to lower employee-related costs, partially offset by higher strategic review costs. The strategic review costs have been included in the RGHL Group’s Adjusted EBITDA calculation.

Net Other. Net other changed by $61 million, resulting in net other income of $29 million. The change was primarily due to a $19 million favorable change in unrealized gains and losses on derivatives, lower asset impairment charges of $16 million, a favorable change of $14 million in gains and losses on sale of businesses and non-current assets and an increase of $5 million in income from providing transition services. All of these items, other than income from transition services, have been included in the RGHL Group’s Adjusted EBITDA calculation.

Net Financial Income (Expenses). Net financial expenses increased by $66 million to $170 million. The increase was primarily due to a $58 million unfavorable foreign currency impact and an unfavorable change of $24 million in the fair value of derivatives, partially offset by a $23 million decrease in interest expense. For more information regarding financial income (expenses) and borrowings, refer to notes 8 and 12, respectively, of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Income Tax. We recognized income tax expense of $128 million on a loss before income tax of $87 million in the three month period ended June 30, 2020, compared to income tax expense of $9 million on a loss before income tax of $19 million for the three month period ended June 30, 2019. Factors that have contributed to the effective tax rate include (i) the impact of revised forecasts on our U.S. annualized effective tax rate, (ii) the resulting impact of the change in annualized tax rate on previously recognized tax benefits from CARES Act legislative changes and (iii) the mix of book income and losses taxed at varying rates among the jurisdictions in which the RGHL Group operates. For further information, including a reconciliation of income tax expense, refer to note 9 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Profit (Loss) from Discontinued Operations, Net of Income Tax. Profit from discontinued operations, net of income tax, which represents the results of the Reynolds Consumer Products business and the results of the North American and Japanese closures businesses, decreased by $105 million. The current period result includes the finalization of the working capital adjustment on the sale of the closures business. The current period did not include any results from operations whereas the prior period includes three months of operations of both Reynolds Consumer Products and the sold closures businesses. For more information regarding discontinued operations, refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Impact of IFRS 16. The adoption of the lease accounting standard IFRS 16 “Leases” on January 1, 2019 has resulted in a portion of operating lease expense being classified as depreciation and interest expense. The following table sets out the benefit to Adjusted EBITDA by segment for the three month periods ended June 30, 2020 and 2019:

|

| | | | | | |

| | | For the three month period ended June 30, |

| (In $ million) | | 2020 | | 2019(1) |

| Foodservice | | 8 |

| | 6 |

|

| Food Merchandising | | 5 |

| | 4 |

|

| Evergreen | | 3 |

| | 2 |

|

| Graham Packaging | | 8 |

| | 8 |

|

| Other/Unallocated | | — |

| | 1 |

|

| Total impact of IFRS 16 on RGHL Group Adjusted EBITDA from continuing operations | | 24 |

| | 21 |

|

| Total impact of IFRS 16 on RGHL Group Adjusted EBITDA from discontinued operations | | — |

| | 4 |

|

| Total impact of IFRS 16 on RGHL Group Adjusted EBITDA | | 24 |

| | 25 |

|

| |

| (1) | The information presented has been revised to reflect the Reynolds Consumer Products business and the North American and Japanese closures businesses as discontinued operations. Refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for additional information. |

EBITDA/Adjusted EBITDA Reconciliation

The reconciliation of profit from operating activities to EBITDA and Adjusted EBITDA for the RGHL Group is as follows:

|

| | | | | | |

| | | For the three month period ended June 30, |

| (In $ million) | | 2020 | | 2019(2) |

| Profit from operating activities | | 83 |

| | 85 |

|

| Depreciation and amortization from continuing operations | | 155 |

| | 147 |

|

RGHL Group EBITDA(1) from continuing operations | | 238 |

| | 232 |

|

| Included in the RGHL Group EBITDA: | | | | |

| Asset impairment charges, net of reversals | | — |

| | 17 |

|

| (Gain) loss on sale of businesses and non-current assets | | — |

| | 14 |

|

| Non-cash pension expense | | 12 |

| | 18 |

|

| Operational process engineering-related consultancy costs | | 2 |

| | 6 |

|

| Restructuring costs, net of reversals | | 6 |

| | 6 |

|

| Strategic review costs | | 11 |

| | 1 |

|

| Unrealized (gain) loss on derivatives | | (20 | ) | | (1 | ) |

| Other | | 1 |

| | 6 |

|

RGHL Group Adjusted EBITDA(1) from continuing operations | | 250 |

| | 299 |

|

| | | | | |

| Segment detail of Adjusted EBITDA: | | | | |

| Foodservice | | 42 |

| | 107 |

|

| Food Merchandising | | 65 |

| | 57 |

|

| Evergreen | | 42 |

| | 52 |

|

| Graham Packaging | | 104 |

| | 95 |

|

| Other/Unallocated | | (3 | ) | | (12 | ) |

RGHL Group Adjusted EBITDA from continuing operations | | 250 |

| | 299 |

|

| RGHL Group Adjusted EBITDA from discontinued operations | | — |

| | 222 |

|

| Total Adjusted EBITDA | | 250 |

| | 521 |

|

| |

| (1) | Refer to page 2 under the heading “Non-GAAP Financial Measures” for additional information related to these financial measures. |

| |

| (2) | The information presented has been revised to reflect the Reynolds Consumer Products business and the North American and Japanese closures businesses as discontinued operations. Refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for additional information. |

Foodservice Segment

|

| | | | | | | | | | | | |

| | | For the three month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 405 |

| | 560 |

| | (155 | ) | | (28 | )% |

| Segment Adjusted EBITDA | | 42 |

| | 107 |

| | (65 | ) | | (61 | )% |

| Segment Adjusted EBITDA – % of segment revenue | | 10 | % | | 19 | % | | | | |

Revenue. Total segment revenue decreased by $155 million, or 28%. The decrease was primarily due to lower sales volume due to the impact of the COVID-19 pandemic, as well as lower pricing primarily due to lower raw material costs passed through to customers.

Adjusted EBITDA. Adjusted EBITDA decreased by $65 million to $42 million. The decrease was primarily due to lower sales volume due to the impact of the COVID-19 pandemic, higher manufacturing costs due to measures put in place to continue to operate during the pandemic and lower production, as well as an unfavorable impact from raw material hedges. These items were partially offset by lower logistics costs due to lower sales volume and favorable freight rates.

Food Merchandising Segment

|

| | | | | | | | | | | | |

| | | For the three month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 348 |

| | 346 |

| | 2 |

| | 1 | % |

| Segment Adjusted EBITDA | | 65 |

| | 57 |

| | 8 |

| | 14 | % |

| Segment Adjusted EBITDA – % of segment revenue | | 19 | % | | 16 | % | | | | |

Revenue. Total segment revenue increased by $2 million, or 1%. The increase was primarily due to favorable pricing and product mix, partially offset by lower sales volume in most product categories due to the impact of the COVID-19 pandemic, as well as an unfavorable foreign currency impact.

Adjusted EBITDA. Adjusted EBITDA increased by $8 million to $65 million. The increase was primarily due to favorable pricing and product mix, lower manufacturing costs driven by controlled spending and more efficient production and lower logistics costs due to favorable freight rates, partially offset by lower sales volumes largely from the impact of COVID-19 and an unfavorable foreign currency impact.

Evergreen Segment

|

| | | | | | | | | | | | |

| | | For the three month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 348 |

| | 389 |

| | (41 | ) | | (11 | )% |

| Segment Adjusted EBITDA | | 42 |

| | 52 |

| | (10 | ) | | (19 | )% |

| Segment Adjusted EBITDA – % of segment revenue | | 12 | % | | 13 | % | | | | |

Revenue. Total segment revenue decreased by $41 million, or 11%. The decrease was primarily due to lower sales volume and lower pricing due to the impact of the COVID-19 pandemic.

Adjusted EBITDA. Adjusted EBITDA decreased by $10 million to $42 million. The decrease was primarily due to lower sales volume and lower pricing due to the impact of the COVID-19 pandemic, as well as higher manufacturing costs due to mill production outage timing and production inefficiencies. These items were partially offset by lower raw material costs, driven by wood supply as markets have returned to historical normalized levels from prior year weather-related increases.

Graham Packaging Segment

|

| | | | | | | | | | | | |

| | | For the three month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 462 |

| | 499 |

| | (37 | ) | | (7 | )% |

| Segment Adjusted EBITDA | | 104 |

| | 95 |

| | 9 |

| | 9 | % |

| Segment Adjusted EBITDA – % of segment revenue | | 23 | % | | 19 | % | | | | |

Revenue. Total segment revenue decreased by $37 million, or 7%. The decrease was primarily due to lower pricing as a result of lower raw material costs passed through to customers and an unfavorable foreign currency impact.

Adjusted EBITDA. Adjusted EBITDA increased by $9 million to $104 million. The increase was primarily due to lower raw material costs, net of lower raw material costs passed through to customers, and lower manufacturing costs.

Six month period ended June 30, 2020 compared to the six month period ended June 30, 2019

RGHL Group

|

| | | | | | | | | | | | | | | | | | |

| | | For the six month period ended June 30, | | | | |

| (In $ million, except for %) | | 2020 | | % of revenue | | 2019(2) | | % of revenue | | Change | | % change |

| Total revenue | | 3,259 |

| | 100 | % | | 3,594 |

| | 100 | % | | (335 | ) | | (9 | )% |

| Cost of sales | | (2,761 | ) | | (85 | )% | | (3,028 | ) | | (84 | )% | | 267 |

| | 9 | % |

| Gross profit | | 498 |

| | 15 | % | | 566 |

| | 16 | % | | (68 | ) | | (12 | )% |

| Selling, marketing and distribution expenses/General and administration expenses | | (363 | ) | | (11 | )% | | (363 | ) | | (10 | )% | | — |

| | — | % |

| Net other income (expenses) | | 3 |

| | — | % | | (29 | ) | | (1 | )% | | 32 |

| | NM |

|

| Profit from operating activities | | 138 |

| | 4 | % | | 174 |

| | 5 | % | | (36 | ) | | (21 | )% |

| Financial income | | 47 |

| | 1 | % | | 85 |

| | 2 | % | | (38 | ) | | (45 | )% |

| Financial expenses | | (285 | ) | | (9 | )% | | (235 | ) | | (7 | )% | | (50 | ) | | (21 | )% |

| Net financial income (expenses) | | (238 | ) | | (7 | )% | | (150 | ) | | (4 | )% | | (88 | ) | | (59 | )% |

| Profit (loss) from continuing operations before income tax | | (100 | ) | | (3 | )% | | 24 |

| | 1 | % | | (124 | ) | | NM |

|

| Income tax (expense) benefit | | 174 |

| | 5 | % | | (35 | ) | | (1 | )% | | 209 |

| | NM |

|

| Profit (loss) from continuing operations | | 74 |

| | 2 | % | | (11 | ) | | — | % | | 85 |

| | NM |

|

| Profit (loss) from discontinued operations, net of income tax | | 7 |

| | NM |

| | 156 |

| | NM |

| | (149 | ) | | NM |

|

| Profit (loss) for the period | | 81 |

| | NM |

| | 145 |

| | NM |

| | (64 | ) | | (44 | )% |

| Depreciation and amortization from continuing operations | | 303 |

| | 9 | % | | 290 |

| | 8 | % | | (13 | ) | | (4 | )% |

RGHL Group Adjusted EBITDA(1) from continuing operations | | 514 |

| | 16 | % | | 561 |

| | 16 | % | | (47 | ) | | (8 | )% |

| RGHL Group Adjusted EBITDA from discontinued operations | | 36 |

| | NM |

| | 365 |

| | NM |

| | (329 | ) | | (90 | )% |

| Total Adjusted EBITDA | | 550 |

| | NM |

| | 926 |

| | NM |

| | (376 | ) | | (41 | )% |

NM indicates that the calculation is not meaningful.

| |

| (1) | Refer to page 2 under the heading “Non-GAAP Financial Measures” for additional information related to this financial measure. |

| |

| (2) | The information presented has been revised to reflect the Reynolds Consumer Products business and the North American and Japanese closures businesses as discontinued operations. Refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for additional information. |

Revenue. Revenue decreased by $335 million, or 9%. The decrease was primarily due to lower sales volume in our Foodservice, Evergreen and Food Merchandising segments, including an unfavorable impact from the COVID-19 pandemic, as well as lower pricing, mainly due to lower raw material costs passed through to customers.

Cost of Sales. Cost of sales decreased by $267 million, or 9%. The decrease was primarily due to lower sales volume and lower raw material costs, partially offset by higher manufacturing costs.

Selling, Marketing and Distribution Expenses/General and Administration Expenses. Selling, marketing and distribution expenses and general and administration expenses remained flat at $363 million, primarily due to higher strategic review costs of $18 million, which have been included in the RGHL Group’s Adjusted EBITDA calculation, offset by lower employee-related costs.

Net Other. Net other changed by $32 million, resulting in net other income of $3 million. The change was primarily due to lower asset impairment charges of $20 million, a favorable change of $13 million in gains and losses on sale of businesses and non-current assets and an increase of $9 million in income from providing transition services, partially offset by an unfavorable foreign currency impact. The asset impairment charges and gains and losses on sale of businesses and non-current assets have been included in the RGHL Group’s Adjusted EBITDA calculation.

Net Financial Income (Expenses). Net financial expenses increased by $88 million to $238 million. The increase was primarily due to an unfavorable change of $155 million in the fair value of derivatives, partially offset by a $38 million decrease in interest expense and a $34 million favorable foreign currency impact. For more information regarding financial income (expenses) and borrowings, refer to notes 8 and 12, respectively, of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Income Tax. We recognized an income tax benefit of $174 million on a loss before income tax of $100 million in the six month period ended June 30, 2020, compared to income tax expense of $35 million on income before income tax of $24 million for the six month period ended June 30, 2019. Factors that have contributed to the effective tax rate include (i) tax benefits from CARES Act legislative changes and (ii) the mix of book income and losses taxed at varying rates among the jurisdictions in which the RGHL Group operates. For further information, including a reconciliation of income tax expense, refer to note 9 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Profit (Loss) from Discontinued Operations, Net of Income Tax. Profit from discontinued operations, net of income tax, which represents the results of the Reynolds Consumer Products business and the results of the North American and Japanese closures businesses, decreased by $149 million

to a profit of $7 million. The results for the current period include approximately one month of operations for the Reynolds Consumer Products business whereas the prior period includes six months of operations of both Reynolds Consumer Products and the sold closures businesses. The profit from discontinued operations also includes the finalization of the working capital adjustment on the sale of the closures businesses. For more information regarding discontinued operations, refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Impact of IFRS 16. The adoption of the lease accounting standard IFRS 16 “Leases” on January 1, 2019 has resulted in a portion of operating lease expense being classified as depreciation and interest expense. The following table sets out the benefit to Adjusted EBITDA by segment for the six month periods ended June 30, 2020 and 2019:

|

| | | | | | |

| | | For the six month period ended June 30, |

| (In $ million) | | 2020 | | 2019(1) |

| Foodservice | | 15 |

| | 12 |

|

| Food Merchandising | | 9 |

| | 7 |

|

| Evergreen | | 6 |

| | 4 |

|

| Graham Packaging | | 16 |

| | 16 |

|

| Other/Unallocated | | 1 |

| | 1 |

|

| Total impact of IFRS 16 on RGHL Group Adjusted EBITDA from continuing operations | | 47 |

| | 40 |

|

| Total impact of IFRS 16 on RGHL Group Adjusted EBITDA from discontinued operations | | 1 |

| | 9 |

|

| Total impact of IFRS 16 on RGHL Group Adjusted EBITDA | | 48 |

| | 49 |

|

| |

| (1) | The information presented has been revised to reflect the Reynolds Consumer Products business and the North American and Japanese closures businesses as discontinued operations. Refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for additional information. |

EBITDA/Adjusted EBITDA Reconciliation

The reconciliation of profit from operating activities to EBITDA and Adjusted EBITDA for the RGHL Group is as follows:

|

| | | | | | |

| | | For the six month period ended June 30, |

| (In $ million) | | 2020 | | 2019(2) |

| Profit from operating activities | | 138 |

| | 174 |

|

| Depreciation and amortization from continuing operations | | 303 |

| | 290 |

|

RGHL Group EBITDA(1) from continuing operations | | 441 |

| | 464 |

|

| Included in the RGHL Group EBITDA from continuing operations: | | | | |

| Asset impairment charges, net of reversals | | (3 | ) | | 17 |

|

| (Gain) loss on disposal of businesses and non-current assets | | 1 |

| | 14 |

|

| Non-cash pension expense | | 25 |

| | 37 |

|

| Operational process engineering-related consultancy costs | | 9 |

| | 13 |

|

| Related party management fee | | 8 |

| | 8 |

|

| Restructuring costs, net of reversals | | 12 |

| | 8 |

|

| Strategic review costs | | 19 |

| | 1 |

|

| Unrealized (gains) losses on derivatives | | (2 | ) | | (7 | ) |

| Other | | 4 |

| | 6 |

|

RGHL Group Adjusted EBITDA(1) from continuing operations | | 514 |

| | 561 |

|

| | | | | |

| Segment detail of Adjusted EBITDA: | | | | |

| Foodservice | | 107 |

| | 186 |

|

| Food Merchandising | | 123 |

| | 113 |

|

| Evergreen | | 93 |

| | 100 |

|

| Graham Packaging | | 204 |

| | 190 |

|

| Other/Unallocated | | (13 | ) | | (28 | ) |

| RGHL Group Adjusted EBITDA from continuing operations | | 514 |

| | 561 |

|

| RGHL Group Adjusted EBITDA from discontinued operations | | 36 |

| | 365 |

|

| Total Adjusted EBITDA | | 550 |

| | 926 |

|

| |

| (1) | Refer to page 2 under the heading “Non-GAAP Financial Measures” for additional information related to these financial measures. |

| |

| (2) | The information presented has been revised to reflect the Reynolds Consumer Products business and the North American and Japanese closures businesses as discontinued operations. Refer to notes 2.2 and 7 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for additional information. |

Foodservice Segment

|

| | | | | | | | | | | | |

| | | For the six month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 878 |

| | 1,084 |

| | (206 | ) | | (19 | )% |

| Segment Adjusted EBITDA | | 107 |

| | 186 |

| | (79 | ) | | (42 | )% |

| Segment Adjusted EBITDA – % of segment revenue | | 12 | % | | 17 | % | | | | |

Revenue. Total segment revenue decreased by $206 million, or 19%. The decrease was primarily due to lower sales volume due to market contraction from the impact of the COVID-19 pandemic, as well as lower pricing primarily due to lower raw material costs passed through to customers.

Adjusted EBITDA. Adjusted EBITDA decreased by $79 million to $107 million. The decrease was primarily due to lower sales volume due to the impact of the COVID-19 pandemic, higher manufacturing costs due to measures put in place to continue to operate during the pandemic and lower production, as well as an unfavorable impact from raw material hedges. These items were partially offset by lower logistics costs due to lower sales volume and favorable freight rates.

Food Merchandising Segment

|

| | | | | | | | | | | | |

| | | For the six month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 692 |

| | 686 |

| | 6 |

| | 1 | % |

| Segment Adjusted EBITDA | | 123 |

| | 113 |

| | 10 |

| | 9 | % |

| Segment Adjusted EBITDA – % of segment revenue | | 18 | % | | 16 | % | | | | |

Revenue. Total segment revenue increased by $6 million, or 1%. The increase was primarily due to favorable pricing, partially offset by lower sales volume and an unfavorable foreign currency impact. The lower sales volume was primarily driven by lower demand from certain large customers that had increased inventory levels due to accelerated purchases in the fourth quarter of 2019 and an unfavorable net impact from the COVID-19 pandemic.

Adjusted EBITDA. Adjusted EBITDA increased by $10 million to $123 million. The increase was primarily due to favorable material costs, net of lower costs passed through to customers, and higher pricing, partially offset by an unfavorable foreign currency impact and lower sales volume.

Evergreen Segment

|

| | | | | | | | | | | | |

| | | For the six month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 745 |

| | 787 |

| | (42 | ) | | (5 | )% |

| Segment Adjusted EBITDA | | 93 |

| | 100 |

| | (7 | ) | | (7 | )% |

| Segment Adjusted EBITDA – % of segment revenue | | 12 | % | | 13 | % | | | | |

Revenue. Total segment revenue decreased by $42 million, or 5%. The decrease was primarily due to lower sales volume and lower pricing due to the impact of the COVID-19 pandemic.

Adjusted EBITDA. Adjusted EBITDA decreased by $7 million to $93 million. The decrease was primarily due to increased manufacturing costs due to production inefficiencies and mill production outage timing, as well as lower pricing and lower sales volume due to the impact of the COVID-19 pandemic. These items were partially offset by lower raw material costs, driven by wood supply as markets have returned to historical normalized levels from prior year weather-related increases.

Graham Packaging Segment

|

| | | | | | | | | | | | |

| | | For the six month period ended June 30, | | | |

| (In $ million, except for %) | | 2020 | | 2019 | | Change | | % change |

| Total segment revenue | | 940 |

| | 1,012 |

| | (72 | ) | | (7 | )% |

| Segment Adjusted EBITDA | | 204 |

| | 190 |

| | 14 |

| | 7 | % |

| Segment Adjusted EBITDA – % of segment revenue | | 22 | % | | 19 | % | | | | |

Revenue. Total segment revenue decreased by $72 million, or 7%. The decrease was primarily due to lower pricing, mainly due to lower raw material costs passed through to customers, an unfavorable foreign currency impact and the impact of business divestitures.

Adjusted EBITDA. Adjusted EBITDA increased by $14 million to $204 million. The increase was primarily due to lower raw material costs, net of lower raw material costs passed through to customers, and lower manufacturing costs, partially offset by a decline in pricing due to contractual price movements.

Liquidity and Capital Resources

Historical Cash Flows

The following table discloses the RGHL Group’s cash flows for the periods presented:

|

| | | | | | |

| | | For the six month period ended June 30, |

| (In $ million) | | 2020 | | 2019 |

| Net cash flows from (used in) operating activities | | 196 |

| | 271 |

|

| Net cash flows from (used in) investing activities | | (201 | ) | | (270 | ) |

| Net cash flows from (used in) financing activities | | 330 |

| | (57 | ) |

| Net increase (decrease) in cash and cash equivalents | | 325 |

| | (56 | ) |

Cash Flows from (used in) Operating Activities

Cash provided by operating activities was $196 million compared to $271 million in the prior year period. Cash flows from operating activities during the six month period ended June 30, 2020 include amounts associated with Reynolds Consumer Products through February 4, 2020. The comparative period reflects six months of operating cash flows associated with Reynolds Consumer Products and the closures operations sold in December 2019. The lower contribution from Reynolds Consumer Products was partially offset by a $74 million decrease in interest paid, primarily due to the repayment of various notes and a decrease in interest rates on our Credit Agreement, as well as a $33 million reduction in income taxes paid, primarily due to a decrease in U.S. taxes paid as a result of provisions in the CARES Act.

Cash Flows from (used in) Investing Activities

Cash used in investing activities was $201 million compared to $270 million in the prior year period. The current year period includes a decrease of $74 million in capital expenditures. Refer to “— Capital Expenditures” for additional information regarding expenditures on property, plant and equipment and intangible assets.

Cash Flows from (used in) Financing Activities

The net cash flows associated with financing activities during each respective period is summarized in the following table. Immediately prior to its distribution, Reynolds Consumer Products incurred borrowings and related transaction costs under its new facilities. Refer to notes 7, 12 and 16 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for additional information related to the Reynolds Consumer Products borrowings and our borrowings.

|

| | | | | | |

| | | For the six month period ended June 30, |

| (In $ million) | | 2020 | | 2019 |

| Drawdown of Reynolds Consumer Products borrowings | | 3,640 |

| | — |

|

| Repayment of borrowings | | (3,215 | ) | | (18 | ) |

| Repayment of lease liabilities | | (39 | ) | | (38 | ) |

| Payment of Reynolds Consumer Products debt transaction costs | | (24 | ) | | — |

|

| Cash held by Reynolds Consumer Products at the time of distribution | | (31 | ) | | — |

|

| Other | | (1 | ) | | (1 | ) |

| Net cash inflow (outflow) | | 330 |

| | (57 | ) |

Capital Expenditures

Capital expenditures were $214 million compared to $288 million in the prior year period. The decrease reflects lower investments made in the current year period. Capital expenditures incurred in the current and prior year periods include $5 million and $59 million, respectively, related to discontinued operations.

We incurred $624 million in capital expenditures in 2019, and we expect to incur approximately $475 million in capital expenditures during 2020 (excluding acquisitions) largely to support business growth, cost reduction and business maintenance. We expect to fund these expenditures with cash flows from operations. Actual capital expenditures may differ.

Liquidity and Capital Resources

We have substantial debt and debt service obligations. As of June 30, 2020, the total principal amount outstanding of our borrowings was $7,472 million. On a pro forma basis, after the financing transactions described above in “— Recent Developments,” the outstanding principal amount of our borrowings was $7,213 million.

Our sources of liquidity for the future are expected to be our existing cash resources and cash flows from operations. In addition, we may utilize borrowing capacity available under the revolving credit facility of our Credit Agreement and local working capital facilities. In addition to our cash and cash equivalents, as of June 30, 2020, we had $255 million available for drawing under our revolving credit facility. This facility matures in August 2021. We believe that these sources will be adequate to meet our future liquidity needs for the next 12 months. Following the $2,094 million repayment of borrowings discussed above in “— Recent Developments,” our next significant near term maturity of outstanding borrowings are the U.S. Term Loans under our Credit Agreement which mature in February 2023. Our revolving facility under our Credit Agreement, which is currently used for letters of credit, matures in August 2021. We do not currently anticipate that the COVID-19 pandemic will materially impact our liquidity over the next 12 months. We are currently in compliance with the covenants under the Credit Agreement, the indentures governing the Reynolds Notes and our other outstanding indebtedness. We expect to remain in compliance with our covenants.

Our ability to borrow under the revolving facility under our Credit Agreement or our other local working capital facilities may be limited by the terms of such indebtedness or other indebtedness (including the Reynolds Notes and Credit Agreement), including financial covenants.

On a pro forma basis, after the financing transactions described above in “— Recent Developments,” our annualized cash interest obligations on our outstanding indebtedness are expected to be approximately $343 million, assuming interest on our floating rate debt continues to accrue at the current applicable interest rates. We expect to meet our debt service obligations with our existing cash resources and cash flows from operations. Refer to notes 12 and 16 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report for details related to our borrowings and related repayment terms and transactions subsequent to June 30, 2020.

Under the indentures governing the Reynolds Notes, we may incur additional indebtedness either by satisfying certain incurrence tests or by incurring such additional indebtedness under certain specific categories of permitted debt. Indebtedness may be incurred under the incurrence tests if the fixed charge coverage ratio is at least 2.00 to 1.00 on a pro forma basis and (i) under the indenture governing the Reynolds Senior Secured Notes, the liens securing first lien secured indebtedness do not exceed a 4.50 to 1.00 senior secured first lien leverage ratio, and (ii) under the indenture governing our Reynolds Senior Notes, the liens securing any secured indebtedness do not exceed a 4.50 to 1.00 secured leverage ratio.

Under the Credit Agreement, we may incur additional indebtedness either by satisfying certain incurrence tests or by incurring such additional indebtedness under certain specific categories of permitted debt. Incremental senior secured indebtedness under the Credit Agreement and senior secured or unsecured notes in lieu thereof are permitted to be incurred up to an aggregate principal amount of $750 million subject to pro forma compliance with the Credit Agreement’s total secured leverage ratio covenant. In addition, we may incur incremental senior secured indebtedness under the Credit Agreement and senior secured notes in an unlimited amount so long as our total secured leverage ratio does not exceed 4.50 to 1.00 on a pro forma basis and (in the case of incremental senior secured indebtedness under the Credit Agreement only) we are in pro forma compliance with the Credit Agreement’s total secured leverage ratio covenant. The incurrence of unsecured indebtedness, including the issuance of senior notes, and unsecured subordinated indebtedness is also permitted if the fixed charge coverage ratio is at least 2.00 to 1.00 on a pro forma basis.

The Credit Agreement and the indentures governing the Reynolds Notes generally allow subsidiaries of RGHL to transfer funds in the form of cash dividends, loans or advances within the RGHL Group.

In January 2020, we completed the process to offer to certain lenders the net proceeds from the sale of our North American and Japanese closures businesses. As a result of this process, in January 2020 we repaid an aggregate of $38 million of borrowings, at face value plus accrued and unpaid interest. This repayment was comprised of: (i) $18 million of borrowings under the Credit Agreement; (ii) $18 million aggregate principal amount of 5.750% Senior Secured Notes due 2020; (iii) $1 million aggregate principal amount of Floating Rate Senior Secured Notes due 2021; and (iv) $1 million aggregate principal amount of 5.125% Senior Secured Notes due 2023.

Prior to the distribution of the Reynolds Consumer Products segment, all the legal entities within Reynolds Consumer Products were designated as “Unrestricted Subsidiaries” under the Credit Agreement and the indentures governing the Reynolds Notes. As a consequence, on February 4, 2020, the relevant legal entities within Reynolds Consumer Products were released as borrowers under the Credit Agreement and released as guarantors of the Credit Agreement and the Reynolds Notes. In connection with such releases, the security granted by such entities was also released. Prior to the distribution, Reynolds Consumer Products also ceased to participate in the Securitization Facility, and consequently in January 2020 the size of this facility was reduced from $600 million to $450 million.

Immediately prior to its distribution and the IPO, Reynolds Consumer Products incurred $2,475 million of term loan borrowings under its new credit facilities and $1,168 million of borrowings under an IPO settlement facility. We have not provided any guarantees or security in relation to Reynolds Consumer Products’ external borrowings. The cash proceeds from these new credit facilities, net of transaction costs and original issue discount, along with cash on-hand, were used to settle various intercompany balances between Reynolds Consumer Products and us. We contributed the remaining intercompany balance owing by Reynolds Consumer Products as additional paid-in capital without the issuance of shares.

On February 4, 2020, we repaid in full all of the remaining $3.1 billion aggregate principal amount outstanding of our 5.750% Senior Secured Notes due 2020 at face value plus accrued and unpaid interest.

Our future operating performance and our ability to service or refinance the Credit Agreement, our outstanding notes and other indebtedness are subject to economic conditions and financial, business and other factors, many of which are beyond our control.

We may from time to time seek to issue additional indebtedness depending on market conditions, our liquidity requirements and other considerations.

We or our affiliates may from time to time seek to retire or repurchase our outstanding indebtedness in open market purchases, privately negotiated transactions or otherwise. Such transactions, if any, will depend on prevailing market conditions, our liquidity requirements, contractual restrictions and other considerations.

Embedded Derivatives

We have separately recognized embedded derivative assets in relation to the early call feature on certain borrowings. Embedded derivatives are measured at fair value with changes in fair value recognized through net financial income (expenses) in the statement of comprehensive income

as a component of profit or loss. As of June 30, 2020, our non-current derivative asset associated with embedded derivatives was $78 million. The fair value of the embedded derivatives is calculated using industry standard models that consider various assumptions, such as quoted market prices, time value and volatility factors for the underlying instruments. Changes in any one or more of these assumptions could have a significant impact on the value of embedded derivatives. For further information, refer to note 3 of the RGHL Group’s interim unaudited condensed consolidated financial statements included elsewhere in this quarterly report.

Contractual Obligations

The following table summarizes our material contractual obligations as of June 30, 2020:

|

| | | | | | | | | | | | | | | |

| | | Payments, due by period, as of June 30, 2020 |

| (In $ million) | | Total | | Less than one year | | One to three years | | Three to five years | | Greater than five years |

| Trade and other payables | | 625 |

| | 625 |

| | — |

| | — |

| | — |

|

Financial liabilities(1)(3) | | 8,538 |

| | 735 |

| | 4,680 |

| | 2,602 |

| | 521 |

|

Lease liabilities(2) | | 468 |

| | 107 |

| | 176 |

| | 110 |

| | 75 |

|

| Unconditional capital expenditure obligations | | 160 |

| | 160 |

| | — |

| | — |

| | — |

|

| Total contractual obligations | | 9,791 |

| | 1,627 |

| | 4,856 |

| | 2,712 |

| | 596 |

|

| |

| (1) | Total repayments of financial liabilities consist of the principal amounts, fixed and floating rate interest obligations and the cash flows associated with commodity and other derivative instruments. The exchange rate on euro-denominated borrowings and non-U.S. dollar-denominated lease liabilities and the interest rates on the floating rate debt balances have been assumed to be the same as the respective rates in effect as of June 30, 2020. |

| |

| (2) | Total repayments of lease liabilities exclude short-term and low-value leases, which were not significant in the aggregate. |

| |

| (3) | Refer to “— Recent Developments” above for details regarding changes in our borrowings subsequent to June 30, 2020. |

As of June 30, 2020, our liabilities for pensions, post-employment benefits and uncertain tax positions totaled $1,160 million. We are unable to determine the ultimate timing of these liabilities; therefore, we have excluded these amounts from the contractual obligations table above. We expect to make a $121 million contribution to the Reynolds Group Pension Plan in 2020. Future contributions will be dependent on future plan asset returns and interest rates and are highly sensitive to changes.

The RGHL Group is required to make annual prepayments of term loans with up to 50% of excess cash flow (which will be reduced to 25% or 0% if specified senior secured first lien leverage ratios are met) as determined in accordance with the Credit Agreement. No excess cash flow prepayments are due in 2020 for the year ended December 31, 2019.

Contingent Liabilities