Dear Fellow Stockholder of Wheeler Real Estate Investment Trust, Inc.,

You may have recently received a letter from The Stilwell Group discussing its cursory analysis of a percentage increase in the Board of Directors (BOD) compensation from 2016 to 2017. Please do not be fooled by the Stilwell Group’s graphs and charts that present misleading statistics.

The percentage increase in BOD compensation depicted in the Stilwell Group’s letter is inaccurate for the following reason. The numbers Mr. Stilwell presented for BOD compensation show compensation earned in 2016 which was actually paid in February of 2017, thus understating the 2016 compensation number and overstating the 2017 compensation number. This resulted in an inaccurate percentage increase between the two years.

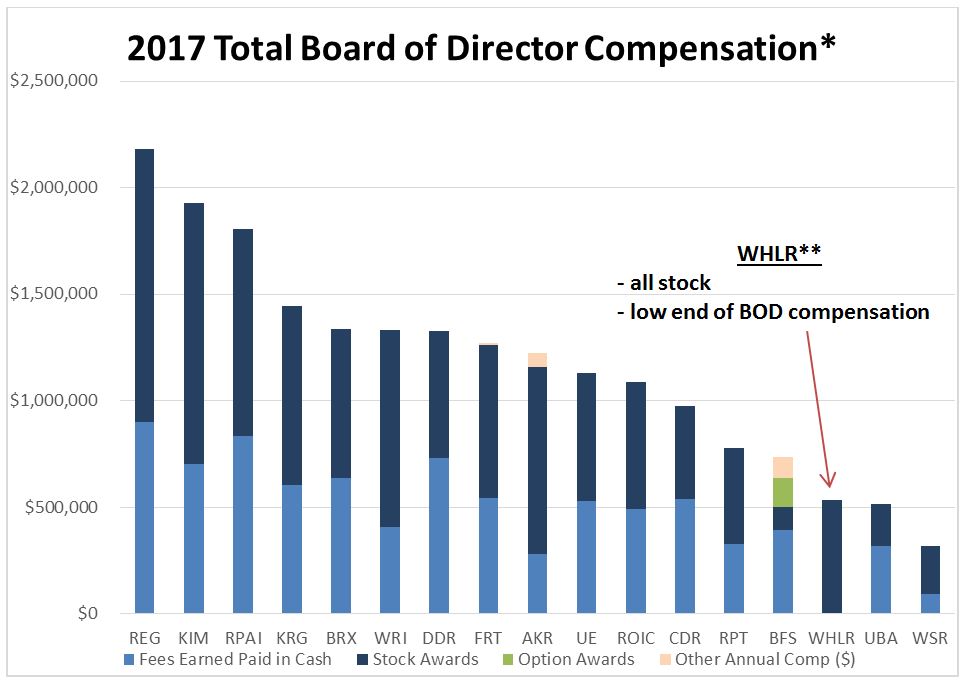

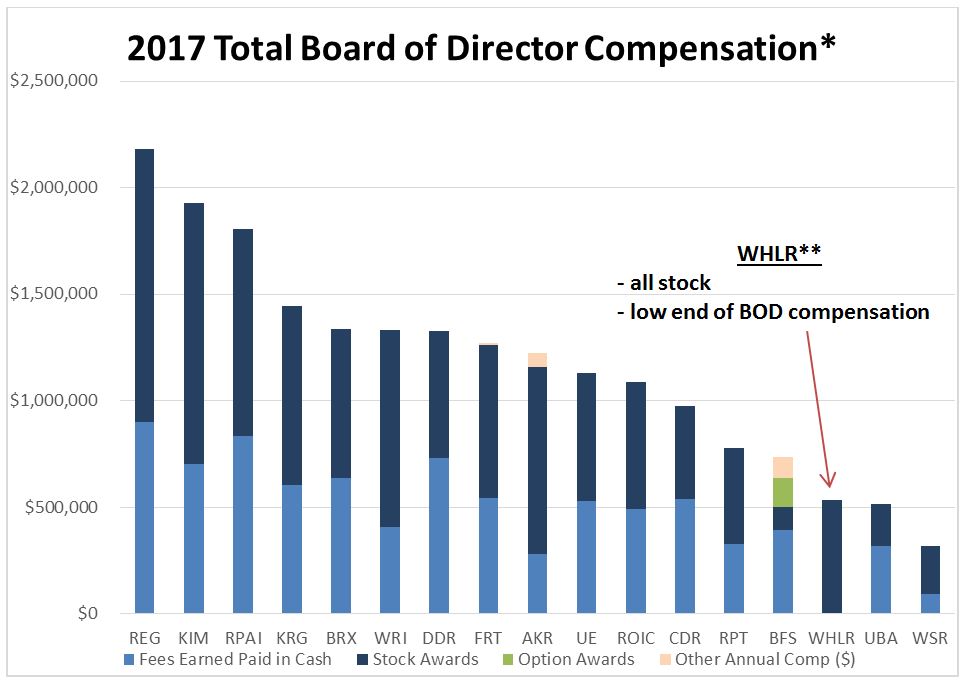

WHLR’s BOD accepted their total compensation in common stock during 2016 and 2017 and the total amount earned during 2017 is still very much at the low end of REIT BOD compensation, as demonstrated in the graph below.

* 2017 board compensation obtained from S&P Global Analytics

** WHLR 2017 board compensation adjusted for discrepancy noted above.

In fact, the Company has taken a number of measures to decrease executive and director compensation.

| |

| • | The Company opted to reduce the number of BOD seats from nine to eight this year. |

| |

| • | All BOD members have accepted the entirety of their 2016 and 2017 compensation in stock In lieu of cash. |

| |

| • | None of the BOD members have sold any of their shares for any purpose. In addition, I, as a non-independent member of the BOD, have not been compensated as a BOD member since 2015. |

| |

| • | In addition, through the restructuring of the executive management team, which included among other actions, the elimination of the Chief Investment Officer (CIO), Chief Accounting Officer (CAO) and Director of Investor Relations positions, WHLR has reduced executive compensation by 34% or approximately $600,000 in 2018. |

We believe that our BOD compensation is fair and entirely aligned with successfully achieving growth in shareholder value.

| |

| • | Our Board meets five to six times per year in person. |

| |

| • | In addition, the Board has numerous conference calls, committee meetings as well as unscheduled discussions to discuss the Company’s health and well-being. |

| |

| • | Our Board makes themselves available at a moment’s notice, particularly since the management restructuring in January of this year. |

| |

| • | These efforts are to ensure that WHLR is acting in a manner that is aligned with shareholders and committed to performance-based compensation. |

As shown in Mr. Stilwell’s 13D/A filing on September 5, 2018, you should be aware of the following:

On March 16, 2015, Stilwell Value LLC (“Value”) and Joseph Stilwell consented to the entry of a civil administrative SEC order (the “Order”) that, among other things, alleged violations of sections of the Investment Advisers Act of 1940 and certain rules promulgated thereunder for failing to adequately disclose conflicts of interest presented by inter-fund loans. The Order, among other things, (1) suspended Mr. Stilwell from March 2015 to March 2016 from association with any investment adviser, broker, dealer, or certain regulated organizations, and imposed upon him a $100,000 civil money penalty; and (2) censured Value, imposed upon it a $250,000 civil money penalty (as well as the repayment obligation of $239,157 in fees), and required it to retain an independent monitor for three years, which monitorship concluded on April 9, 2018.

WHLR’s Board of Directors does NOT endorse the election of any of the Stilwell Group’s nominees and strongly urges you NOT to sign and return any GREEN proxy card sent to you by or on behalf of the Stilwell Group. Please vote WITH WHLR and sign, date and mail the WHITE proxy card or WHITE voting instructions form. You may also submit a proxy to vote by telephone or Internet. Instructions for submitting a proxy over the Internet or by telephone are provided on the WHITE proxy card.

Thank you for your continued support,

/s/ David Kelly

David Kelly, President & CEO

FORWARD LOOKING STATEMENTS

This letter may contain “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. The Company’s expected results may not be achieved, and actual results may differ materially from expectations. Specifically, the Company’s statements regarding enhancing shareholder value and achieving growth are forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company's filings with the U.S. Securities and Exchange Commission, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

Important Additional Information

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s stockholders in connection with matters to be considered at the Company’s 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting”). The Company has filed a definitive proxy statement and WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies from the Company’s stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding the identities of the Company’s directors and executive officers, and their direct or indirect interests, by security holdings or otherwise, are set forth in the proxy statement and other materials filed with the SEC in connection with the 2018 Annual Meeting. Stockholders can obtain the proxy statement, any amendments or supplements to the proxy statement, and any other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. These documents are also available at no charge in the “SEC Filings” or “Proxy Materials” sections of the Company’s website at www.whlr.us.