November 8, 2019

Dear Fellow WHLR Shareholder,

The Board of Directors of Wheeler Real Estate Investment Trust, Inc. (“WHLR” or the “Company”) has taken bold and critical steps to restructure the company’s management team and put WHLR in a significantly stronger position to deliver value to all shareholders.

In January 2018, we took the decisive step to terminate Jon Wheeler as CEO. Since that time, the new management team, under the leadership of CEO Dave Kelly, has developed a transformative plan designed to enhance shareholder value. To date, we have successfully accomplished several goals that we laid out at that time.

|

| | | | | |

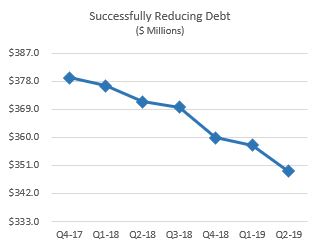

| | | Reducing Debt by $30 Million: We have successfully reduced our debt by $30 million and eliminated non-property level debt from our balance sheet. We have done this primarily with non-core asset sales. We believe this debt reduction reflects a measured and prudent approach where we are making strides toward our goals while preserving cash flows from our stabilized real estate portfolio. Selling Non-Core Assets: Since February of 2018, we have listed six income producing properties for sale, sold five non-core assets and are under contract to sell one remaining asset. Additionally, we have sold two undeveloped, non-income producing land parcels. We expect to continue to selectively sell assets when it is strategically beneficial to the company.

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | | | | |

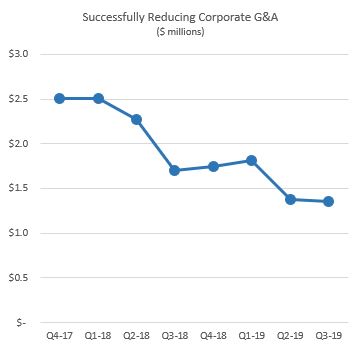

| | Reducing General and Administrative (“G&A”) Expenses by 30%: We have reduced total G&A five of the last eight quarters, representing a 30% reduction from the first three quarters of 2018. Current G&A expenses include litigation costs related to the termination of our former CEO, the cost of the contested proxy battles initiated by the Stilwell Group and the fees associated with the ongoing strategic alternatives process. Even inclusive of these costs, WHLR’s G&A expenses, as a percent of its net operating income, are in line with its peers. Delivering Consistent Cash Flows: Our stabilized real estate portfolio produces consistent and reliable cash flows, which are supported by a diversified tenant base secured under longer term leases. Even during the Southeastern Grocers bankruptcy, we proactively replaced associated leases with higher quality tenants and created more diversity across the portfolio – all with the goal of ensuring our portfolio’s stability.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Vote the Enclosed WHITE Proxy Card Today “FOR” ALL WHLR’s Highly Qualified Director Nominees Discard Any Green Card You Receive from the Stilwell Group

|

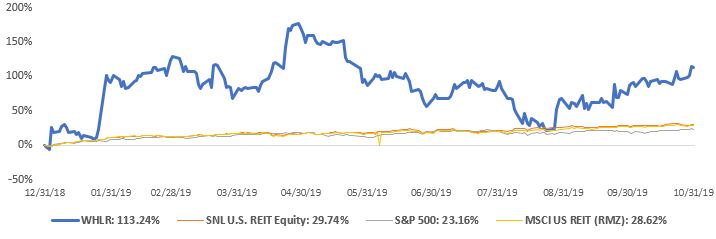

Delivering Strong Total Shareholder Returns (TSR) of 113.24%:

When the Company began its transformation, WHLR’s common stock dropped as the company was reset. As the Company has stabilized, the stock has outperformed the major market indices with a total return of 113.24% on a year-to-date basis as of October 31, 2019:

COMMITMENT TO TRANSPARENCY AND ACCOUNTABILITY

We are committed to transparency and will hold management accountable for delivering results. We believe we have the right strategy and team to deliver results for our shareholders.

YOUR BOARD’S EXPERTISE

We continue to make progress toward our goals. You have an important decision to make at our upcoming Annual Meeting of Shareholders on December 19, 2019. WHLR has eight highly qualified director nominees up for election, 50% of whom are new nominees or joined the Board within the last two years. They possess extensive expertise and experience in areas critical to WHLR’s business, including in real estate, strategic transactions, capital allocation, finance, and corporate governance.

STILWELL’S DISRUPTION TO WHLR TRANSFORMATION

The Stilwell Group, a hedge fund run by Joseph Stilwell, has nominated a slate of 3 individuals, including Mr. Stilwell, to stand for election at the Annual Meeting of Shareholders on December 19, 2019. Electing his nominees would result in the removal of individuals from the Board that possess critical operating and industry experience necessary for successful execution of our strategy to drive long-term shareholder value. Mr. Stilwell has no evident relevant real estate experience and has not articulated any detailed plan for your Company.

Mr. Stilwell tried to have himself and his handpicked nominees elected at last year’s meeting. However, both leading independent proxy advisors, ISS and Glass Lewis made recommendations in favor of management.

|

| | |

“For its part, the dissident [Joe Stilwell] has failed to publicly articulate a detailed case for change that specifies how its nominees would contribute to these ongoing changes. On balance, this precludes direct support for the dissident slate.” – 2018 ISS Report | “We believe Stilwell's campaign, placed in full context, falls short here. In particular, we note Stilwell -- whose background relates almost entirely to community banking contests -- has not presented what we consider to be a meaningfully cogent alternative strategy for Wheeler.” -- 2018 Glass Lewis Report | “In lieu of taking what seems to have been a comparable, low risk opportunity to obtain a board seat, Stilwell has pressed forward with a campaign very light on strategic intention and backed predominantly by candidates who have little to no relevant experience in Wheeler's industry. Given the expansiveness of Wheeler's changes, we do not see cause to support a campaign carrying, at best, a very loosely defined impact on the status quo.” -- 2018 Glass Lewis Report

|

Now, after that unsuccessful campaign, he is again running a proxy contest that will be costly to the Company and highly distracting to the management team at a critical time in the execution of our plan.

Please Note:

On March 16, 2015, the United States Securities and Exchange Commission (SEC) entered an order finding that Mr. Stilwell and Stilwell Value, LLC willfully violated the Investment Advisers Act of 1940. Among other actions, the SEC:

| |

| (1) | suspended Mr. Stilwell for a period of 12 months from association with any investment adviser, broker, dealer, or certain regulated organizations and imposed a $100,000 civil monetary penalty upon him; and |

| |

| (2) | censured Stilwell Value, LLC and imposed a $250,000 civil monetary penalty (as well as the repayment obligation of $239,157 in fees). |

YOUR BOARD OF DIRECTORS STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY OR ON BEHALF OF THE STILWELL GROUP

As evidenced by our refreshment of the Board, we are open-minded to solutions that enhance shareholder value, and we welcome constructive input from our shareholders. We have engaged in numerous conversations with Mr. Stilwell to better understand his views and come to a resolution to avoid going through another costly and distracting proxy contest. We have carefully reviewed his nominees, as we would any director candidates, and believe he and his candidates fall short of the necessary public company and/or real estate experience required to help WHLR through a successful transformation. We believe seven of our nominees are 100% independent and that all of our nominees are proven leaders within their fields, with expertise and track records that provide greater public company and real estate expertise to drive value for ALL WHLR shareholders.

WE BELIEVE THAT WHLR IS WELL-POSITIONED WITH STRONG CORE ASSETS AND HAS THE RIGHT STRATEGY FOR DRIVING LONG-TERM SHAREHOLDER VALUE

LOOKING FORWARD

Moving into 2020, we are in line with our stated goals and understand that we still have some significant headwinds facing us. We will continue to execute on our strategic priorities. We believe we have raised the bar to a higher standard in a short time and continue to strengthen our organization and culture, which should result in balanced growth and value creation.

HIGHLY QUALIFIED BOARD WITH THE EXPERTISE AND EXPERIENCE TO DRIVE SHAREHOLDER VALUE

We believe that WHLR has a diverse, experienced, best-in-class Board that is actively engaged in overseeing WHLR’s transformation. We hold management accountable for delivering continued growth and success. We work closely with management and will continue to be the change agents to drive performance. We have overseen the most significant transformation in the company’s history and are committed to continued adaptation to the changing environment and delivering on our stated plans.

Our rigorous selection criteria have produced nominees for a diverse Board that possess specific skills and experience that are aligned with WHLR’s long-term strategy. We have a slate of eight highly qualified board members up for election this year. Seven are independent, and four are new nominees or joined the Board within the last two years. We strive to drive change and act as a powerful advocate for all shareholders by delivering value.

WHLR’S PROPOSED BOARD SLATE

|

| | | | | | | | |

Proposed WHLR Board | REITS/Real Estate | Public Company Board | Risk Management | Financial/ Accounting | Legal | Academia | Investment Management | Strategic Planning |

| David Kelly | | | | | | | | |

| Carl B McGowan, Jr. | | | | | | | | |

| Jeffrey M. Zwerdling | | | | | | | | |

| John McAuliffe | | | | | | | | |

| Andrew R. Jones | | | | | | | | |

| Stefani D. Carter (NEW) | | | | | | | | |

| Clayton Andrews (NEW) | | | | | | | | |

| Deborah Markus (NEW) | | | | | | | | |

THE WHLR BOARD IS COMMITTED TO DELIVERING FOR ITS SHAREHOLDERS

Prior to last year’s annual shareholders’ meeting and the beginning of this transformative time:

| |

| • | WHLR’s Board dismissed the former CEO and appointed a new management team to begin its transformation |

Since last year’s annual shareholders’ meeting, WHLR has achieved several important milestones:

| |

| • | WHLR reduced its debt by $30 million |

| |

| • | WHLR reduced its corporate G&A 30% |

| |

| • | WHLR’s common stock has outperformed the major indices by 113% |

| |

| • | WHLR has selected a slate designed to further enhanced the skills and diversity of its Board |

DO NOT LET STILWELL MISLEAD YOU

We have held several in-person meetings with Mr. Stillwell with the intention to arrive at a resolution, yet Mr. Stilwell has refused to accept a reasonable compromise:

| |

| • | May 10, 2018, Virginia Beach, VA:

In a meeting with Mr. Stilwell where he congratulated us on the company’s transformation plans, he stated he would like to be on the Board but would not be an obstacle if he were not nominated. |

| |

| • | October 3, 2018, WHLR Annual Meeting:

Mr. Stilwell was given an opportunity to make his positions heard. He lost the shareholder vote. |

| |

| • | October 8, 2019, Stillwell Offices in New York:

After significant effort to find a solution, we met with Mr. Stilwell in New York to discuss our position. We told Mr. Stillwell that based on our due diligence we believed his past actions, performances and associations were lacking in the expertise, abilities and character that we require of a Board member leading WHLR’s transformation. At that point, Mr. Stilwell stopped the conversation and terminated the meeting without resolution. |

WHLR is committed to acting in the best interests of ALL WHLR shareholders.

WHLR’s Board and Management Team are Focused on Continuing to Deliver Value

We evaluate all opportunities to create value with a strong pursuit of constructive ideas that support our stated goals. We look forward to further engagement with our shareholders and will continue to act in the best interests of WHLR and its shareholders. We believe our operating plan is working, and we are laser-focused on our commitment to executing on this strategy.

Your Vote Is Extremely Important!

Vote the White Proxy Card Today in Order to Vote “FOR” the Board’s Nominees

Vote Today!

Even if you have already voted on the green proxy card, you can still change your vote by telephone, Internet, or signing and dating the enclosed WHITE proxy card or following the voting instruction form and returning it in the postage-paid envelope provided. Please disregard any green proxy card you get from the Stilwell Group.

We DO NOT endorse the Stilwell Group Nominees

We strongly and unanimously recommend that you NOT sign or return any green proxy card sent to you by or on behalf of the Stilwell Group. If you have previously voted using a green proxy card sent to you by the Stilwell Group, you can revoke it and support WHLR’s nominees by following the instructions on the enclosed WHITE proxy card.

Only your latest dated proxy will count.

If you have any questions about how to vote your shares, or need additional assistance, please contact our proxy solicitor, MacKenzie Partners, Inc. toll-free at (800) 322-2885 or at (212) 929-5500 or via email to proxy@mackenziepartners.com.

Thank you for your continued support and patience. We believe we are doing everything necessary to transform WHLR and delivering shareholder value in the years ahead.

On behalf of the Board of Directors,

Andrew R. Jones

Chairman of the Board

FORWARD-LOOKING STATEMENTS

This letter may contain “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. The Company’s expected results may not be achieved, and actual results may differ materially from expectations. Specifically, the Company’s statements regarding (i) the Company’s ability to identify and pursue various options designed to maximize shareholder value; (ii) the Company’s ability to reduce operating costs, including general and administrative expenses; (iii) the timing of any reduction in operating costs, including general and administrative expenses; (iv) the Company’s ability to sell non-core assets and to reduce its debt with proceeds from the sales; (v) the Company’s ability to implement a disposition strategy for its assets to create shareholder value; and (vi) the Company’s ability to produce reliable cash flows from its real estate portfolio are forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company's filings with the U.S. Securities and Exchange Commission, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

IMPORTANT ADDITIONAL INFORMATION

The Company, its directors, director nominees and certain of its executive officers are participants in the solicitation of proxies from the Company’s shareholders in connection with matters to be considered at the Company’s 2019 Annual Meeting of Shareholders (the “2019 Annual Meeting”). The Company has filed a definitive proxy statement and WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies from the Company’s shareholders. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding the identities of the Company’s directors and executive officers, and their direct or indirect interests, by security holdings or otherwise, are set forth in the proxy statement and other materials filed with the SEC in connection with the 2019 Annual Meeting. Shareholders can obtain the proxy statement, any amendments or supplements to the proxy statement, and any other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. These documents are also available at no charge in the “SEC Filings” or “Proxy Materials” sections of the Company’s website at www.whlr.us.