October 11, 2011

BY EDGAR

Anne Nguyen Parker, Branch Chief

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street NE

Washington, DC 20549-4628

| Re: | Response to your letter to New Source Energy Corporation dated September 27, 2011 regarding: |

New Source Energy Corporation

Registration Statement on Form S-1

Filed August 30, 2011

File No. 333-176548

Dear Ms. Parker:

On behalf of New Source Energy Corporation (the “Company”, “we” or “us”), enclosed are the Company’s responses to the comments of the staff (the “Staff”) of the Securities and Exchange Commission in its comment letter dated September 27, 2011. Concurrently with the delivery of this letter, the Company is submitting (via EDGAR) an amended registration statement, which reflects changes made to our registration statement in response to the Staff’s comments. Courtesy copies of this letter and the amended registration statement (specifically marked to show the changes thereto) are being submitted to the Staff. We have repeated each of the Staff’s comments in italics below in the order in which they were raised in the comment letter (with page references unchanged) and have included the Company’s response to each such comment immediately below the comment (with page references to the amended registration statement). All terms used but not defined herein have the meanings assigned to such terms in the amended registration statement.

General

| | 1. | Where comments on a section also relate to disclosure in another section, please make parallel changes to all affected disclosure. This will eliminate the need for us to repeat similar comments. Also, your response letter should include page number references keying each response to the page of the filing where the responsive disclosure can be found. This will expedite our review of filing. |

Response: We have endeavored to update applicable disclosure in every place it appears and have included page references to each such change.

| | |

| | PO Box 1218 Oklahoma City, OK 73101 |

|

| | tel 405.272.3028 fax 405.272.3034 newsource.com |

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 2 |

| | 2. | We will process your amendment without price ranges. Since the price range you select will affect disclosure in several sections of the documents, we will need sufficient time to process your amendments once a price range is included. We will also need sufficient time to process the material information now appearing blank throughout the document has been provided, as well as any missing exhibits such as the legal opinion. |

Response: We will provide updates on items dependent on price range when the price range is determined and update our filings to include missing exhibits when such exhibits are available.

| | 3. | Please advise us regarding the status of your application to list on the NYSE. |

Response: We are on the agenda for the NYSE clearing meeting scheduled for October 20, 2011. Once cleared, we plan to file a listing application which we expect will be approved within 3-5 days of filing.

| | 4. | Prior to the effectiveness of your registration statement, please be sure that we receive a copy of the letter, or a telephone call, from FINRA, stating that FINRA has completed its review and has no additional concerns with respect to the proposed underwriting arrangements. |

Response: Our underwriters’ counsel has initiated the FINRA review process, and we will be sure that you receive an indication of FINRA approval prior to requesting that our registration statement be declared effective.

| | 5. | Please explain to us the relationship between New Source Energy Corporation and New Source Energy Group, Inc. |

Response: New Source Energy Group, Inc. (“NSE Group”) is a public company formerly known as Ametrine Capital, Inc. that currently conducts no active business, often referred to as a “public shell.” It was originally identified as a potential vehicle for acquisition of the Acquired Assets described in our registration statement, and certain steps were taken in order to position NSE Group to become the acquirer of the Acquired Assets, including its name change to its current name. However, upon further consideration, it was decided not to use a public shell for this acquisition and instead to form a new issuer, and our

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 3 |

Company was then formed for this purpose. Presently, the only relationship between NSE Group and us is that Kristian B. Kos is a director and stockholder of both companies. Mr. Kos and certain of our other directors and officers were at one time appointed directors and officers of NSE Group, but all of them resigned from those positions with NSE Group (other than Mr. Kos as its director) when the decision was made not to use the public shell for the acquisition. NSE Group is exploring other business opportunities, but we do not anticipate that NSE Group will have any material relationship with us going forward. We have been advised that NSE Group is in the process of changing its name again to a name that does not include “New Source Energy” in order to avoid confusing investors with respect to the two companies. We are further advised that the change of name should occur prior to October 31, 2011.

| | 6. | Please monitor your need to update your financial statements and provide an updated auditor’s consent. |

Response: We understand our obligations to update our financial statements and auditor’s consent and will do so when required.

Prospectus Summary, page 1

| | 7. | The first time you mention your “specialized processes” and “low cost access,” please provide an expanded explanation of what these are, or a cross-reference to more detailed explanations found elsewhere in the filing. |

Response: We have revised this disclosure on page 1 to cross reference the more detailed explanations of “specialized processes” and “low cost access” contained in the Business section of the amended registration statement filed concurrently with this letter on pages 1 and 68.

| | 8. | Where you state at page 2 that pursuant to your right of refusal, “New Dominion and Scintilla will prove up this additional leasehold before offering [you] the opportunity to acquire interests in these projects,” please clarify what you mean by “prove up.” |

Response: We have revised the disclosure on pages 2 and 68 of the amended registration statement filed concurrently with this letter to clarify the meaning of “prove up.”

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 4 |

Summary Reserve and Operations Data, page 14

| | 9. | Please provide the disclosure required by Item 1202(a)(2) of Regulation S-K in the exact tabular format called for in the items requirement. |

Response: We have revised the disclosure on page 14 of the amended registration statement filed concurrently with this letter to conform with the disclosure required by Item 1202(a)(2) in the tabular format required thereby.

Use of Proceeds, page 41

| | 10. | Once you know the expected size of the offering, and no later than when you provide the price range for the offering, you will need to provide the estimated amounts you intend to allocate to each of the identified uses. In addition, please revise the sentence that reads “The remaining proceeds will be used to fund our development program, to fund acquisitions and for general corporate purposes.” Provide necessary detail for each intended use, such as what you intend to pursue with your development program, or what activities “general corporate purposes” encompasses, and include an estimated amount of proceeds to be allocated to each item. Present your use of proceeds information in tabular form to facilitate clarity. If you have no specific plan for a significant portion of the proceeds that you will retain, state this explicitly, and discuss the principal reasons for the offering at this time. See Item 504 of Regulation S-K. |

Response: We have revised the disclosure on page 40 of the amended registration statement filed concurrently with this letter in a manner responsive to this request.

| | 11. | We note your disclosure at page 62 that you plan to meet your cash needs, in part, by a combination of additional borrowings under your credit facility. Please disclose in your “Use of Proceeds” section whether you have any current plans to borrow under your credit facility. |

Response: We have revised the disclosure on page 40 of the amended registration statement filed concurrently with this letter in a manner responsive to this request.

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 5 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Contractual Obligations, page 64

| | 12. | Please amend your filing to provide your contractual obligations in a tabular format as required by Item 303(a)(5) of Regulation S-K. |

Response: We have revised the disclosure on page 64 of the amended registration statement filed concurrently with this letter in order to provide the table of contractual obligations in the form required by Item 303(a)(5) of Regulation S-K.

Business, page 69

| | 13. | Please provide substantiation of your statement on page 69 regarding your “low average finding, developing and operating costs.” |

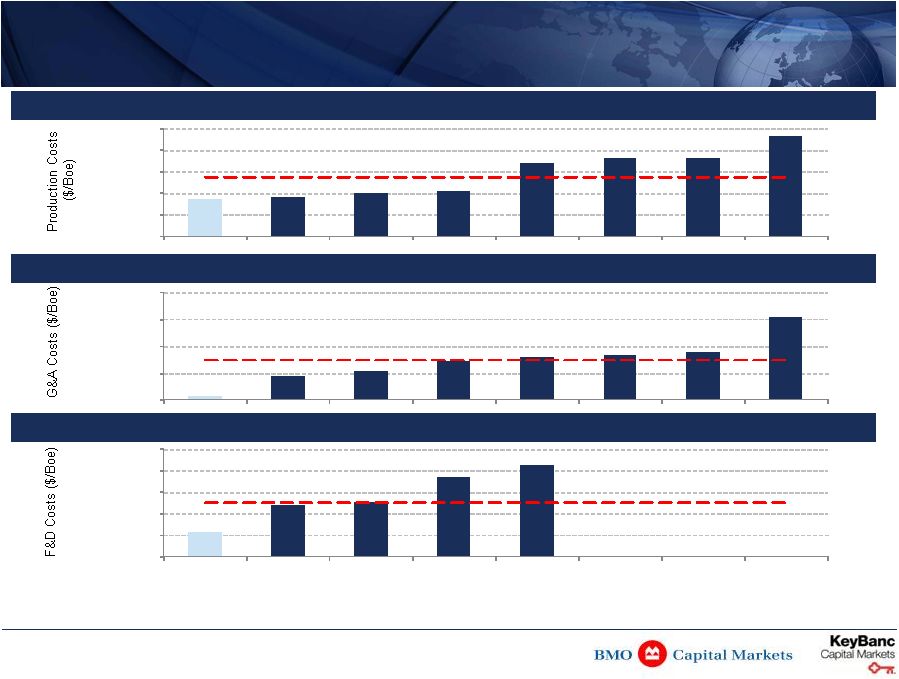

Response: Based on market research provided by our underwriters, BMO Capital Markets and KeyBanc Capital Markets, and compiled from publicly available information, our three-year average finding and development costs of $5.77 per Boe are lower than the median of $12.68 per Boe for our exploration and production peer group. Likewise, each of our three-year average production costs of $8.56 per Boe and three-year average general and administrative expense of $0.62 per Boe is lower than the median expenses of our exploration and production peer group, which are $13.75 per Boe and $7.49 per Boe, respectively. The exploration and production peer group contained in this research is the same as the peer group reviewed for the purposes of comparing executive compensation as detailed on page 95 of the amended registration statement. A summary of this market research, including the companies included in our exploration and production peer group, is attached to this response letter asAppendix A.

Productive Wells, page 79

| | 14. | Please revise your disclosure regarding your total gross and net productive wells to express separately for oil and gas. |

Response: We have revised the disclosure on page 78 of the amended registration statement filed concurrently with this letter to separately show oil and gas wells both on a total gross and net basis.

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 6 |

| | 15. | Please tell us whether you have any material minimum remaining terms of leases and concessions. If so, please disclose these. See Item 1208(b) of Regulation S-K. |

Response: We have revised the disclosure on page 79 of the amended registration statement filed concurrently with this letter to show material minimum remaining terms of leases and concessions.

Hedging Activity, page 80

| | 16. | In this section or in your MD&A, please disclose what percentage of your production you hedge. |

Response: We have revised the disclosure on page 79 of the amended registration statement filed concurrently with this letter in order to disclose the percentage of our production that we hedge.

Management, page 89

| | 17. | Please revise your executives’ biographical sketches to provide greater specificity regarding the dates of prior employment. For instance, where you state that “[f]rom 2007-2008, Mr. Thompson served as senior vice president and general counsel of SandRidge Energy, Inc.,” please indicate the month he began and the month he departed. The same goes for the term of Ms. Bryant’s employment at Pinnacle Energy Services. |

Response: We have revised the disclosure on pages 90 and 91 of the amended registration statement filed concurrently with this letter to provide greater specificity with regard to the dates of our executives’ prior employment.

| | 18. | Please disclose your executives’ affiliations with New Source Energy Group, Inc., or alternatively tell us why you have chosen not to disclose the information. |

Response: We have revised the disclosure on page 90 of the amended registration statement filed concurrently with this letter in order to note Mr. Kos’ status as a director of NSE Group. We have left the name of NSE Group in this amended registration statement blank as we expect that its name will change prior to our registration statement becoming effective. We do not believe it is

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 7 |

necessary to include disclosure regarding our other executives who previously were officers or directors of NSE Group as all of those individuals have resigned from such positions, NSE Group did not conduct any business during their brief affiliation, and any previous affiliation was solely in anticipation of utilizing NSE Group to acquire the Acquired Assets, which were subsequently acquired by us.

| | 19. | To clarify the interrelationships between the issuer, Scintilla, New Dominion and any other affiliates, please disclose in Mr. Chernicky’s biographical sketch that Mr. Chernicky owns Scintilla and New Dominion, and disclose in Mr. Kos’ biographical sketch that he served as a consultant for New Dominion from May 2010 through July 2011. |

Response: We have revised the disclosure on page 90 of the amended registration statement filed concurrently with this letter in order to comply with this request.

Certain Relationships and Related Party Transaction, page 103

| | 20. | Where you discuss the entities that contributed the Acquired Assets, please clarify which assets were contributed by Scintilla and which assets were contributed by Deylau and other parties. |

Response: We have revised the disclosure on page 80 of the amended registration statement filed concurrently with this letter in order to clarify the respective contributors of the assets.

| | 21. | Please expand on your statement that “our board of directors believes these transactions were fair and were in our best interests.” Discuss whether this determination was made taking into account the factors that will be adopted and considered pursuant to your future related party transactions policy, as discussed on page 105. In addition, move the first full paragraph on page 104 that starts “In negotiating the agreements…” so that it is part of the first paragraph on page 103. |

Response: We have revised the disclosure on pages 104 of the amended registration statement filed concurrently with this letter in order to comply with this request.

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 8 |

| | 22. | Expand your discussion of the transaction with Scintilla to discuss how the consideration for the Acquired Assets was determined. Provide similar disclosure with respect to the transaction with Deylau. |

Response: We have revised the disclosure on page 80 of the amended registration statement filed concurrently with this letter in order to comply with this request. A summary of precedent transactions supporting our statement that the aggregate consideration we paid for the Acquired Assets compares favorably to the price others have recently paid is attached hereto asAppendix B.

| | 23. | Please expand to discuss the material terms of the contract governing your relationship with New Dominion, such as how New Dominion will be compensated by you in its role as operator of your assets, and how your required contribution with respect to capital for drilling and to pay expenses is determined. |

Response: We have revised the disclosure on page 81 of the amended registration statement filed concurrently with this letter in order to comply with this request.

Financial Statements – Oil and Natural Gas Properties Transferred to New Source Energy Corporation

Notes to Financial Statements

1. Summary of Significant Accounting Policies

Basis of Presentation and Nature of Operations, page F-7

| | 24. | Please clarify whether the oil and natural gas properties transferred from Scintilla on August 12, 2011 representsubstantially all of Scintilla’s key operating assets and provide to us an analysis supporting your conclusion. In your response, please also tell us whether you have considered the requirements to provide full audited financial statements of Scintilla and eliminate the specified assets and liabilities not transferred in pro forms financial statements. If substantially all of Scintilla’s key operating assets and liabilities were not transferred from Scintilla, please also explain to us how the financial statements on a “carve-out” basis reflect all of the assets, liabilities and operations of the acquired business, tell us how they comply with the guidance in SAB Topic 1B.1, and explain whether all assets and liabilities of the acquired business were transferred to you. |

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 9 |

Response: The oil and natural gas properties transferred from Scintilla on August 12, 2011 do not represent substantially all of Scintilla’s key operating assets. Prior to filing, we considered the propriety of providing full audited financial statements of Scintilla and eliminating the specified assets and liabilities not transferred in pro forma financial statements and concluded that this approach was not appropriate. We consulted available guidance in the area and concluded that providing “carve out” financial statements would provide the most meaningful presentation to potential investors of the financial condition and the results of operations of the Company.

The Division of Corporation FinanceFinancial Reporting Manual,Section 2, provides guidance regarding the financial statements to be presented when a registrant acquires selected assets of an entity and sets forth the conditions under which less than “full financial statements” may be appropriate. Specifically, item 2065.2 states:

In some circumstances, a registrant does not acquire or succeed to substantially all of the assets and liabilities of another entity. For example, the selling entity may retain significant operating assets, or significant operating assets that comprised the seller may continue to be operated by an entity other than the registrant. In these circumstances, financial statements of the larger entity of which the acquired business was a part may not be informative. In that case, audited financial statements usually should be presented for the acquired component business, excluding the continuing operations retained by the larger entity.

This is precisely the circumstance of the Company. Scintilla continues to exist and to operate substantial assets which were not transferred to us as explained more fully below.

Prior to the transfer, Scintilla had classified its properties into five major projects. The classification of the properties was based on various considerations, including: maturity (proved/producing, developing, and unevaluated), location (fields), and geological formation. The projects listed below were acquired by the Company and consequently included in the Company’s pre-formation date carve-out financial statements presented in the registration statement:

| | 1) | Golden Lane field (Hunton formation) – The Company acquired 90% of the working interest in the Hunton formation owned by Scintilla. Scintilla retained 10% of its working interest in the Hunton formation and all of its rights to other formations within the Golden Lane field. The Company has been advised by Scintilla that it believes these retained formations may contain large amounts of |

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 10 |

| | hydrocarbons and represent substantial assets to Scintilla. It is anticipated the retained assets will be owned and operated by Scintilla and its affiliates for the foreseeable future. The Hunton formation is the only developed formation in this field. There are 236 Hunton formation wells in this field, in each of which we hold an interest. |

| | 2) | Luther field (Hunton formation) – The Company acquired a 50% working interest in the Hunton formation from Scintilla. Scintilla retained a 40% working interest in the Hunton formation and all of its rights to other formations within the Luther field. There are 13 Hunton formation wells in this field, in each of which we hold an interest. |

In addition to the retained working interests in the Golden Lane and Luther fields described above, the following assets were retained by Scintilla and consequently excluded from the carve-out financial statements:

| | 3) | Southern Dome field (Arbuckle formation) – Production in this field is from the Arbuckle formation, which is deeper than the Hunton formation. While this field is currently producing, Scintilla has advised us that it plans to expend considerable additional resources to demonstrate the viability of this area through the development of proved reserves. Scintilla and its operator, New Dominion, have advised us that they will devote significant staff time, engineering resources and field operation personnel to the development of this field. |

| | 4) | Luther field (Cleveland formation) – Scintilla advises that production in this field is from the Cleveland formation, which is more shallow than the Hunton formation. Similar to the Southern Dome assets mentioned above, while this field is currently producing, Scintilla has advised that it will likely devote additional resources to developing this field. |

| | 5) | Willizetta, Passage, PW Passage, and Paradise fields (Hunton formation) – These are older wells in the Hunton formation. However, they are located in fields that are outside of the geographic boundaries covered by the Luther and Golden Lane field agreements. In other words, they are located outside the area in which the Company’s operations will focus. There are 13 wells in this project. |

For the year ended December 31, 2010, Scintilla derived approximately 67% of its revenues from the working interests in projects #1 and #2 that were transferred to the Company, and the remaining 33% of its revenues from the working interests in projects #1 and #2 that were retained by Scintilla together with projects #3, #4 and #5. For the seven months ended July 31, 2011, Scintilla derived approximately 66% of its revenues from the transferred projects and the remaining 34% of its revenues from the retained projects. At July 31, 2011, approximately 62% of the net book value of Scintilla’s oil and natural gas properties consisted of amounts associated with the working interests in projects #1 and #2 that were transferred to the Company. Approximately 38% of the net

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 11 |

book value of Scintilla’s oil and natural gas properties consisted of amounts associated with the working interests in projects #1 and #2 that were retained by Scintilla together with projects #3, #4 and #5.

Based on the foregoing facts, the Company concluded that substantially all of Scintilla’s assets were not transferred to the Company. Accordingly, it would not be informative to provide full historical financial statements of Scintilla and present the Acquired Assets only through pro forma adjustments. Rather, inclusion of the retained assets would confuse or perhaps mislead the reader of the financial statements.

The financial statements prepared on a “carve-out” basis reflect all of the assets, liabilities, revenues and expenses attributable to the working interests in the Golden Lane and Luther fields that were acquired by the Company, as required by SAB Topic 1B.1 and explained in Note 1 to the financial statements. The approach used to arrive at this result is discussed further below. All of the assets and liabilities associated with these working interests were transferred to the Company except for the debt, which was refinanced. The allocation of the debt is explained in Note 5 to the “carve-out” financial statements.

Most of the assets, liabilities, revenues and expenses reflected in the financial statements are directly attributable to the working interests acquired. Additionally, certain assets, liabilities, revenues and expenses that were common to the acquired and retained working interests have been included in the financial statements on an allocated basis. Items directly attributable include revenues, cost of production expenses, most elements of the full cost pool of oil and gas properties, accounts receivable and accounts payable in direct proportion to the working interest and net revenue interest of the properties acquired. Certain historic amounts of assets, liabilities and expenses were allocated to arrive at the amounts reported in the financial statements. Allocations of historic amounts were made for certain elements of the full cost pool of oil and gas properties, derivative contracts and settlements, debt and interest, and general and administrative expenses.

The Company believes the financial statements reflect all of the expenses that Scintilla incurred on behalf of the assets acquired. The amounts were determined based on direct proportion to the working interest acquired or allocated primarily in relative book value of assets, among other factors. We believe that appropriate methods of allocation were used, and we believe the allocation of costs is adequately disclosed in the financial statements. We also believe the agreements and costs paid to related party entities are also adequately disclosed and reflect the cost that would have been incurred if the agreements and costs were with an unaffiliated party.

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 12 |

We believe that the methodology of compiling the financial statements on a “carve-out” basis as described above fully complies with the guidance in SAB Topic 1B.1.

Exhibits

| | 25. | Please file your form of underwriting agreement and your legality opinion as soon as practicable. |

Response: We will file each of these by amendment as soon as they are available.

Exhibit 99.1

| | 26. | Please obtain and file a revised reserves report that includes all of the information Item 1202(a)(8) requires to be included. See, in particular, subsections -(iii), -(v), -(viii) and -(ix). In addition, the report should disclose the oil and gas prices actually used, as adjusted for location and grade. |

Response: We have filed a revised reserves report with the amended registration statement filed concurrently with this letter, which we believe includes all of the information required by Item 1202(a)(8).

Engineering Comment

Prospectus Summary, page 3

| | 27. | Please furnish to us on flash drive or compact disk the petroleum engineering reports you used as the basis for your December 31, 2010 proved reserve disclosures. The report should include: |

| | a) | One-line recaps inspreadsheet format for each property sorted by field within each proved reserve category including the dates of first booking and estimated first production for your proved undeveloped properties; |

| | b) | Total company summary income forecast schedules for each proved reserved category with proved developed segregated into producing and non-producing properties; |

| | c) | Individual income forecasts for all the wells/locations in the proved developed and proved undeveloped categories; |

| | |

| | New Source Energy Corporation |

| |

| Anne Nguyen Parker, Branch Chief | | October 11, 2011 |

| Securities and Exchange Commission | | Page 13 |

| | d) | Engineering exhibits (e.g. maps, rate/time plots, volumetric calculations, analogy well performance) for each of the three largest wells/locations in the proved developed and prove undeveloped categories (six entities in all) as well as the AFE for each of the three PUD properties. Please ensure that the decline parameters, EURs and cumulative production figures are presented on the rate/time plots. |

Please indicate your preferred method of return and direct these engineering items to:

U.S. Securities and Exchange Commission

100 F. Street NE

Washington, DC 20549-4628

Attn: Ronald M. Winfrey

Response: We expect to deliver the requested information to Mr. Winfrey via courier on or about October 13, 2011 on a flash drive.

Please feel free to contact me at (405) 272-3028 if you have any questions or need additional information.

|

| Sincerely, |

|

/s/ Kristian B. Kos |

|

| Kristian B. Kos |

| Chief Executive Officer |

| New Source Energy Corporation |

Appendix A

Cost Comparison (New Source Energy Corporation vs. E&P Peer Group)

|

3-Year Average Production Costs (1) (2) 3-Year Average G&A Costs (2) 3-Year Average F&D Costs (2) (3) $8.56 $8.90 $9.96 $10.53 $16.97 $17.96 $18.08 $23.20 - $5.00 $10.00 $15.00 $20.00 $25.00 NSE DBLE CPE CXPO GEOI WRES RAM REXX Median = $13.75 $0.62 $4.36 $5.27 $7.13 $7.86 $8.22 $8.82 $15.49 - $5.00 $10.00 $15.00 $20.00 NSE DBLE GEOI CPE CXPO RAM WRES REXX Median = $7.49 $5.77 $12.08 $12.68 $18.49 $21.37 - $5.00 $10.00 $15.00 $20.00 $25.00 NSE REXX DBLE CXPO GEOI CPE RAME WRES NM NM NM Median = $12.68 Cost Comparison (New Source Energy Corp. vs. E&P Peer Group) Source: Company filings Note: E&P peer group includes: Callon Petroleum (CPE), Crimson Exploration (CXPO), Double Eagle Petroleum (DBLE), GeoResources (GEOI), RAM Energy Resources (RAM), Rex Energy (REXX) and Warren Resources (WRES) (1) Includes reported lease operating expense and production taxes (2) 3-year average based on 2008-2010 reported figures (3) Includes revisions. NM represents companies that have negative F&D costs |

Appendix B

Precedent Oklahoma Transactions

|

Precedent Oklahoma Transactions Source: IHS Herold – 2010 & 2011 Oklahoma asset transactions with proved reserves disclosed. Transaction Reserve Proved Proved Daily Valuation Metrics Value Value Reserves Developed Production Proved Proved Developed Daily Date Buyers Sellers % Gas $MM $MM (Mmboe) (Mmboe) (boe) ($/boe) ($/boe) ($/boe) Key Assets 9/12/11 QR Energy LP Quantum Resources Management LLC 59.0% 577.0 577.0 37.1 24.1 8,000.0 $15.55 $23.93 $72,125.00 Gas weighted Mid-Continent producing assets 5/9/11 Linn Energy LLC Panther Energy Company LLC; Red Willow Mid-Continent LLC 55.0% 220.0 220.0 10.0 3.7 2,700.0 $22.00 $59.46 $81,481.48 Producing Anadarko Basin Cleveland Play assets 4/26/11 Equal Energy Ltd Petroflow Energy Ltd 58.0% 87.7 87.7 8.7 8.5 3,100.0 $10.08 $10.29 $28,290.32 Producing interest in Hunton Play 3/31/11 Legacy Reserves LP Undisclosed (Various) 32.9% 2.7 2.7 0.2 0.1 34.0 $17.30 $21.72 $80,000.00 Various U.S. producing assets 8/10/10 EV Energy Partners LP Petrohawk Energy Corporation 86.0% 119.9 119.9 12.4 8.6 2,583.3 $9.66 $13.94 $46,412.89 Producing oil and gas assets 6/30/10 Unit Corporation Undisclosed private company 12.7% 75.0 21.0 0.9 0.9 1,016.7 $22.90 $22.90 $20,655.76 Producing wells and acreage in Marmation horizontal oil play 5/25/10 NextEra Energy Resources LLC PetroQuest Energy Incorporated 100.0% 74.0 74.0 4.2 0.0 0.0 $17.83 NA NA Woodford shale reserves 3/1/10 Undisclosed private company Petrohawk Energy Corporation 63.0% 155.0 151.4 14.1 0.0 2,000.0 $10.74 NA $75,715.00 Producing West Edmond Hunton Lime Unit Field in Oklahoma Median 59% $103.80 $103.80 9.35 2.31 2,291.67 $16.42 $22.31 $72,125.00 Average 58% $163.92 $156.72 10.94 5.75 2,429.25 $15.76 $25.37 $57,811.49 |