Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

RC similar filings

- 27 Jun 17 Submission of Matters to a Vote of Security Holders

- 19 Jun 17 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

- 15 Jun 17 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

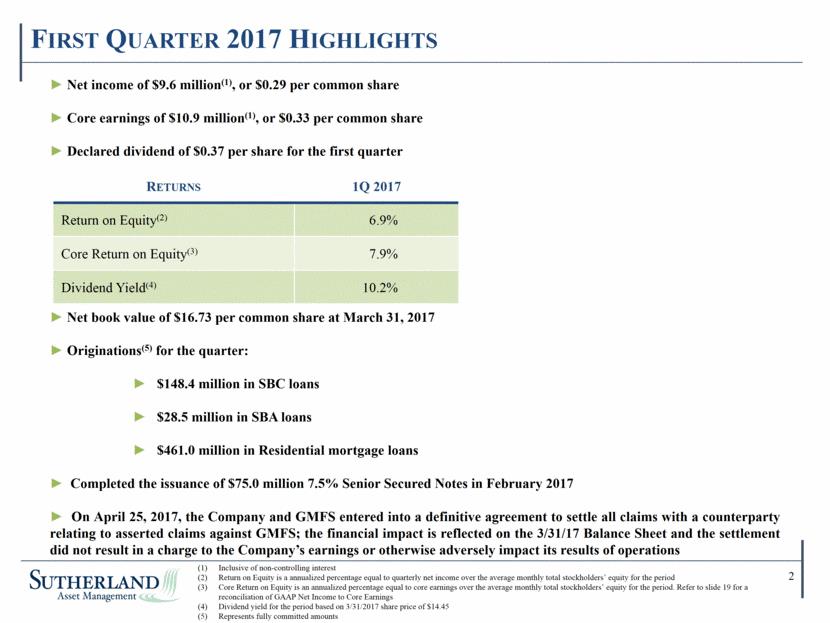

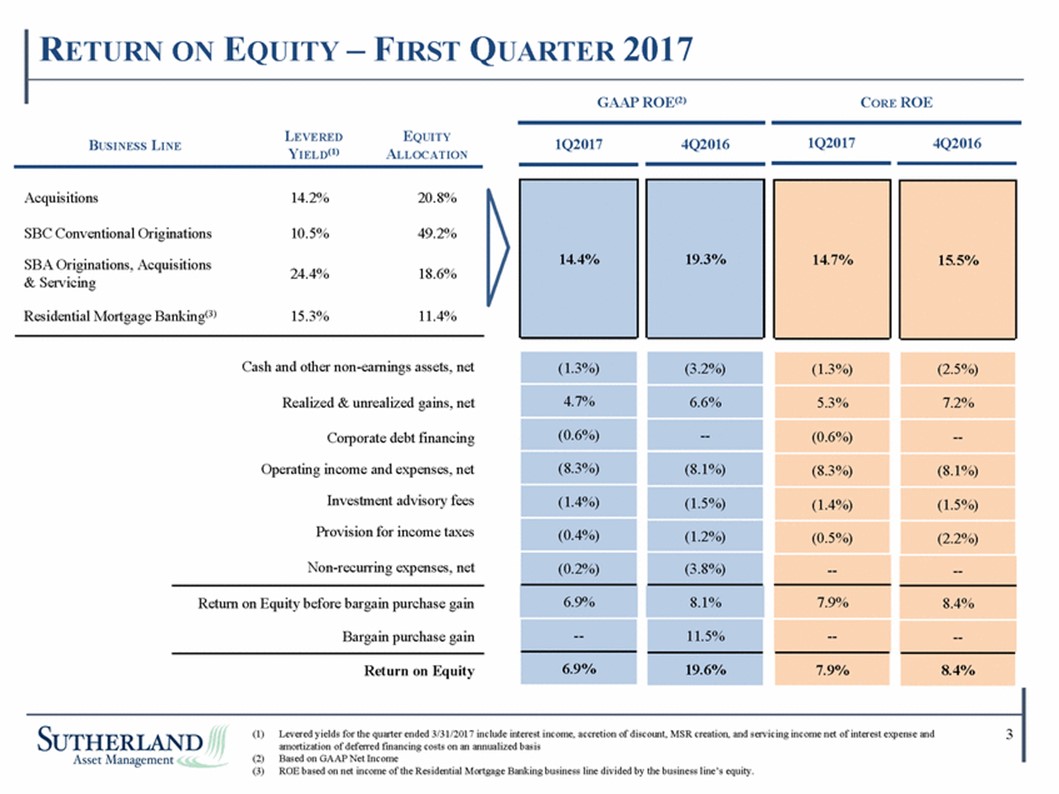

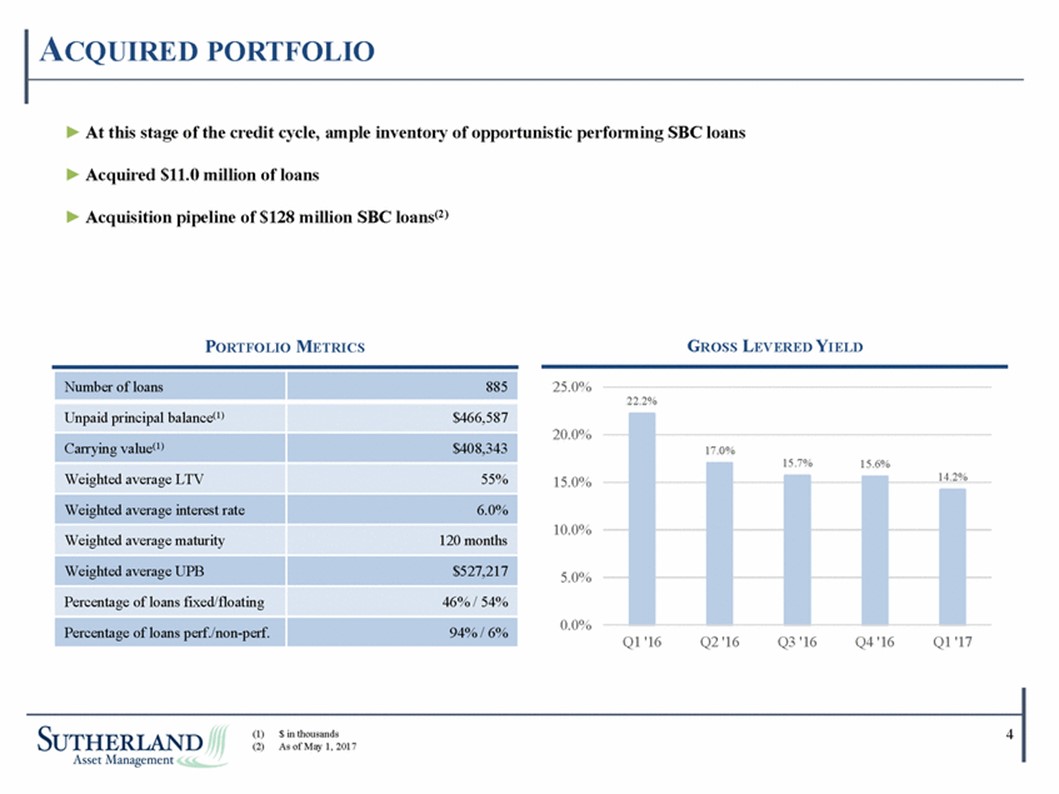

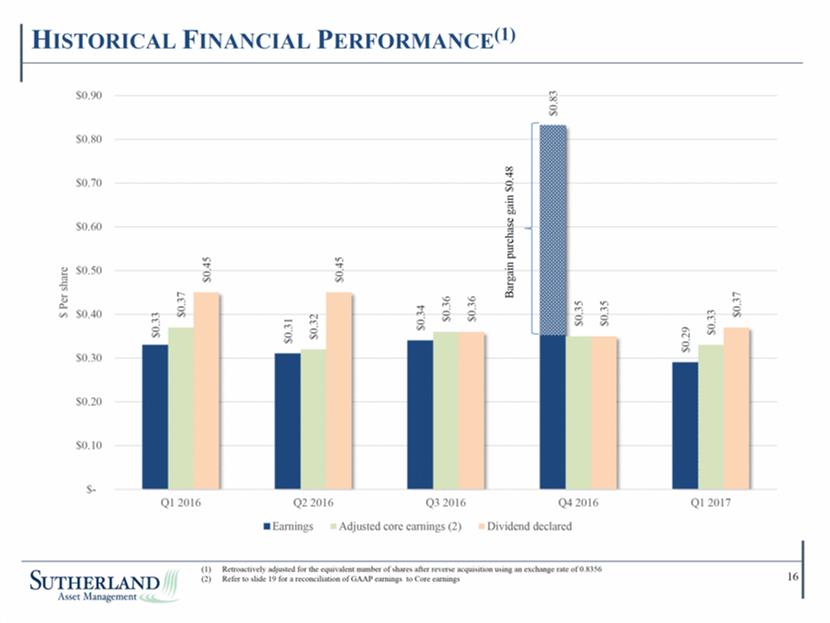

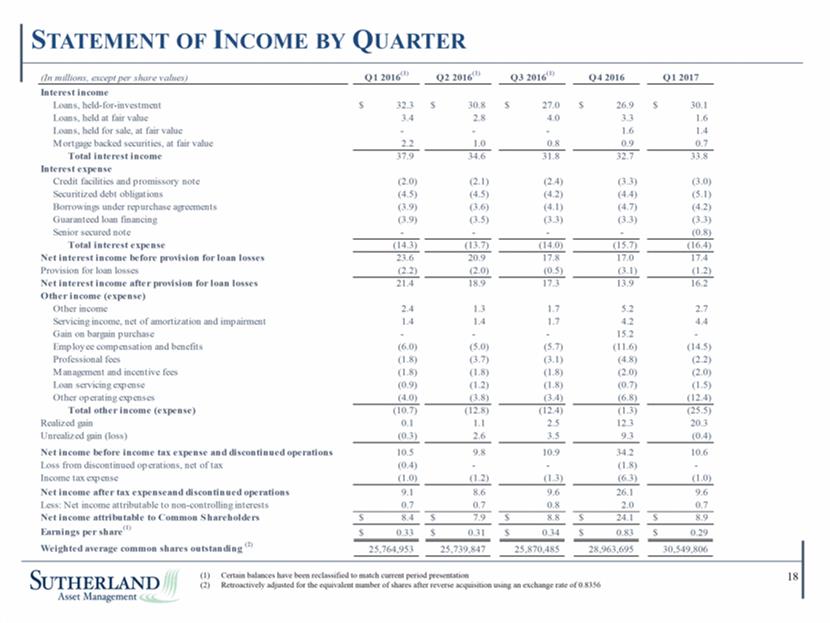

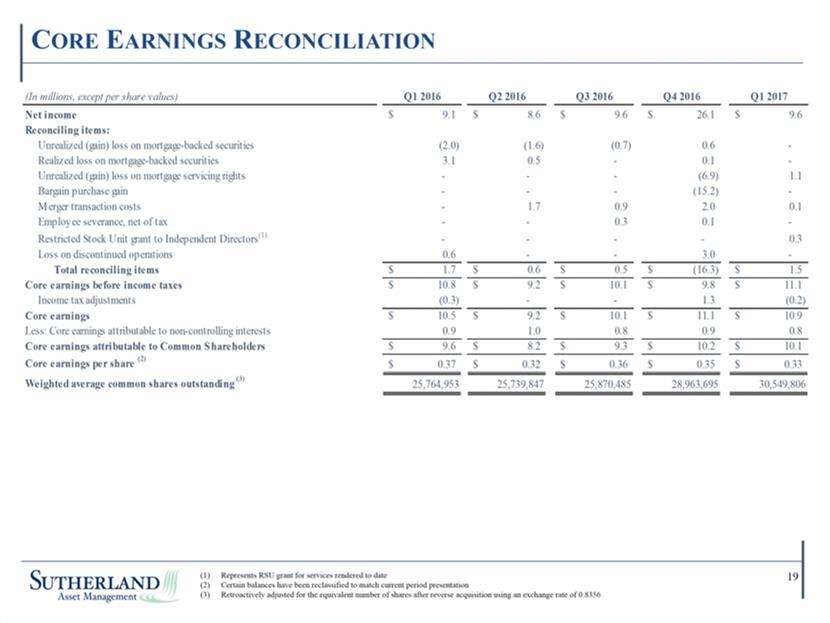

- 9 May 17 Sutherland Asset Management Corporation Announces First Quarter 2017 Results

- 1 May 17 Unregistered Sales of Equity Securities

- 14 Mar 17 Sutherland Asset Management Corporation Announces Fourth Quarter 2016 Results

- 21 Feb 17 Entry into a Material Definitive Agreement

Filing view

External links