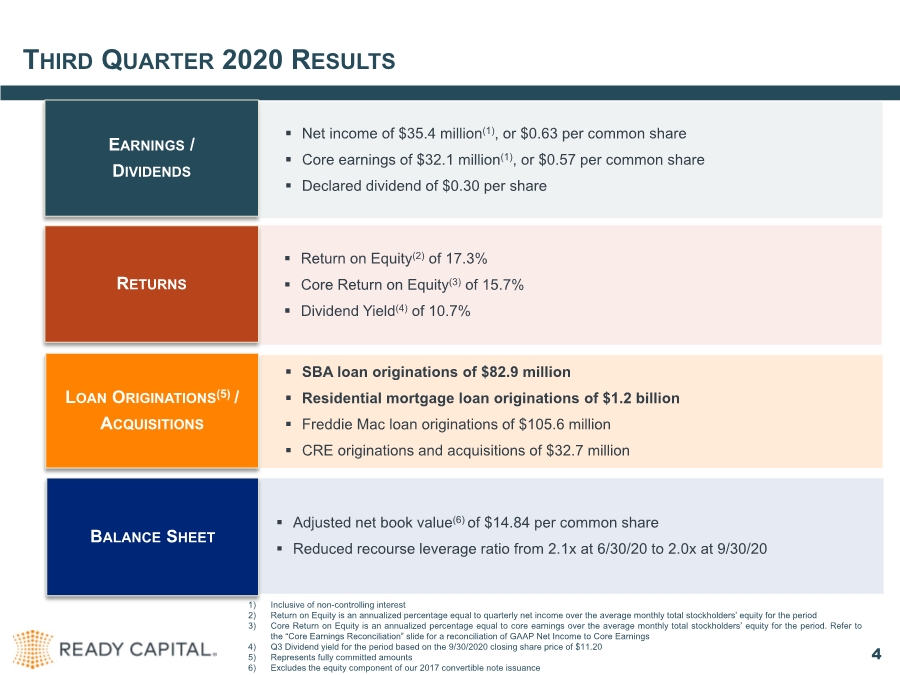

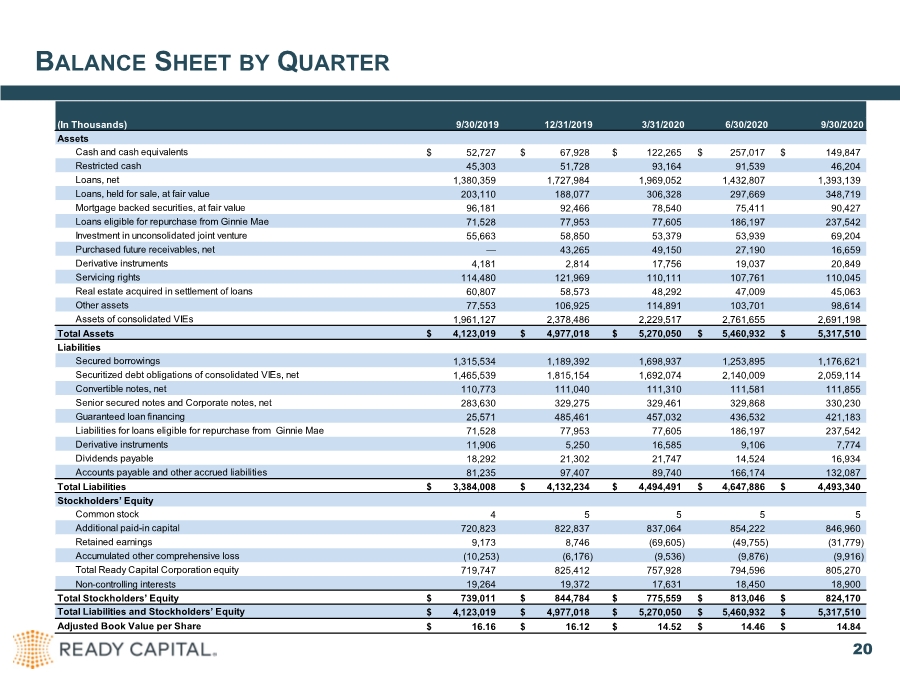

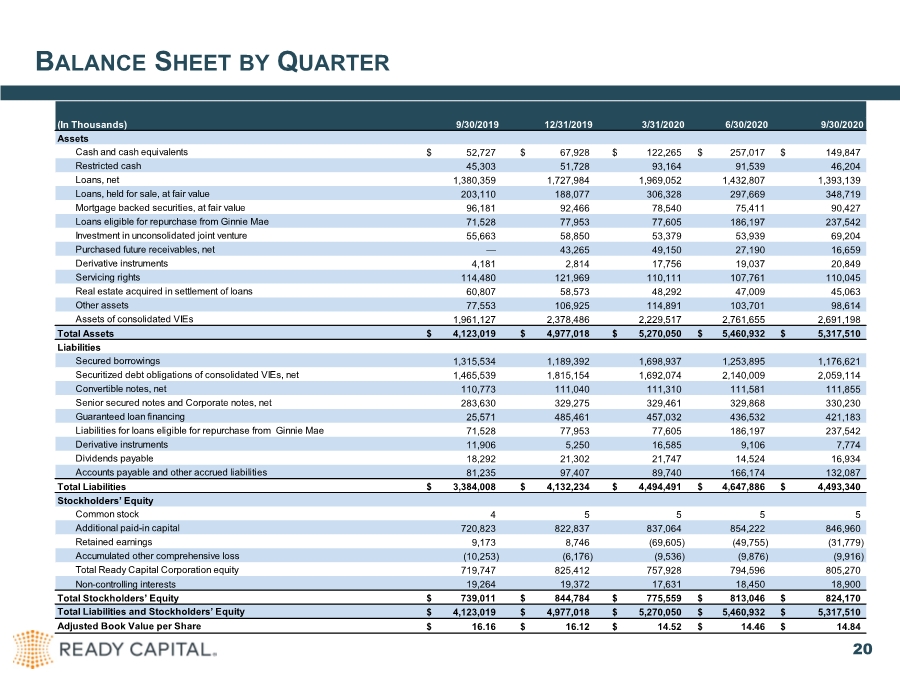

| BALANCE SHEET BY QUARTER 20 (In Thousands) Assets Cash and cash equivalents $ 52,727 $ 67,928 $ 122,265 $ 257,017 $ 149,847 Restricted cash 45,303 51,728 93,164 91,539 46,204 Loans, net 1,380,359 1,727,984 1,969,052 1,432,807 1,393,139 Loans, held for sale, at fair value 203,110 188,077 306,328 297,669 348,719 Mortgage backed securities, at fair value 96,181 92,466 78,540 75,411 90,427 Loans eligible for repurchase from Ginnie Mae 71,528 77,953 77,605 186,197 237,542 Investment in unconsolidated joint venture 55,663 58,850 53,379 53,939 69,204 Purchased future receivables, net — 43,265 49,150 27,190 16,659 Derivative instruments 4,181 2,814 17,756 19,037 20,849 Servicing rights 114,480 121,969 110,111 107,761 110,045 Real estate acquired in settlement of loans 60,807 58,573 48,292 47,009 45,063 Other assets 77,553 106,925 114,891 103,701 98,614 Assets of consolidated VIEs 1,961,127 2,378,486 2,229,517 2,761,655 2,691,198 Total Assets $ 4,123,019 $ 4,977,018 $ 5,270,050 $ 5,460,932 $ 5,317,510 Liabilities Secured borrowings 1,315,534 1,189,392 1,698,937 1,253,895 1,176,621 Securitized debt obligations of consolidated VIEs, net 1,465,539 1,815,154 1,692,074 2,140,009 2,059,114 Convertible notes, net 110,773 111,040 111,310 111,581 111,855 Senior secured notes and Corporate notes, net 283,630 329,275 329,461 329,868 330,230 Guaranteed loan financing 25,571 485,461 457,032 436,532 421,183 Liabilities for loans eligible for repurchase from Ginnie Mae 71,528 77,953 77,605 186,197 237,542 Derivative instruments 11,906 5,250 16,585 9,106 7,774 Dividends payable 18,292 21,302 21,747 14,524 16,934 Accounts payable and other accrued liabilities 81,235 97,407 89,740 166,174 132,087 Total Liabilities $ 3,384,008 $ 4,132,234 $ 4,494,491 $ 4,647,886 $ 4,493,340 Stockholders’ Equity Common stock 4 5 5 5 5 Additional paid-in capital 720,823 822,837 837,064 854,222 846,960 Retained earnings 9,173 8,746 (69,605) (49,755) (31,779) Accumulated other comprehensive loss (10,253) (6,176) (9,536) (9,876) (9,916) Total Ready Capital Corporation equity 719,747 825,412 757,928 794,596 805,270 Non-controlling interests 19,264 19,372 17,631 18,450 18,900 Total Stockholders’ Equity $ 739,011 $ 844,784 $ 775,559 $ 813,046 $ 824,170 Total Liabilities and Stockholders’ Equity $ 4,123,019 $ 4,977,018 $ 5,270,050 $ 5,460,932 $ 5,317,510 Adjusted Book Value per Share $ 16.16 $ 16.12 $ 14.52 $ 14.46 $ 14.84 9/30/2020 9/30/2019 12/31/2019 3/31/2020 6/30/2020 |