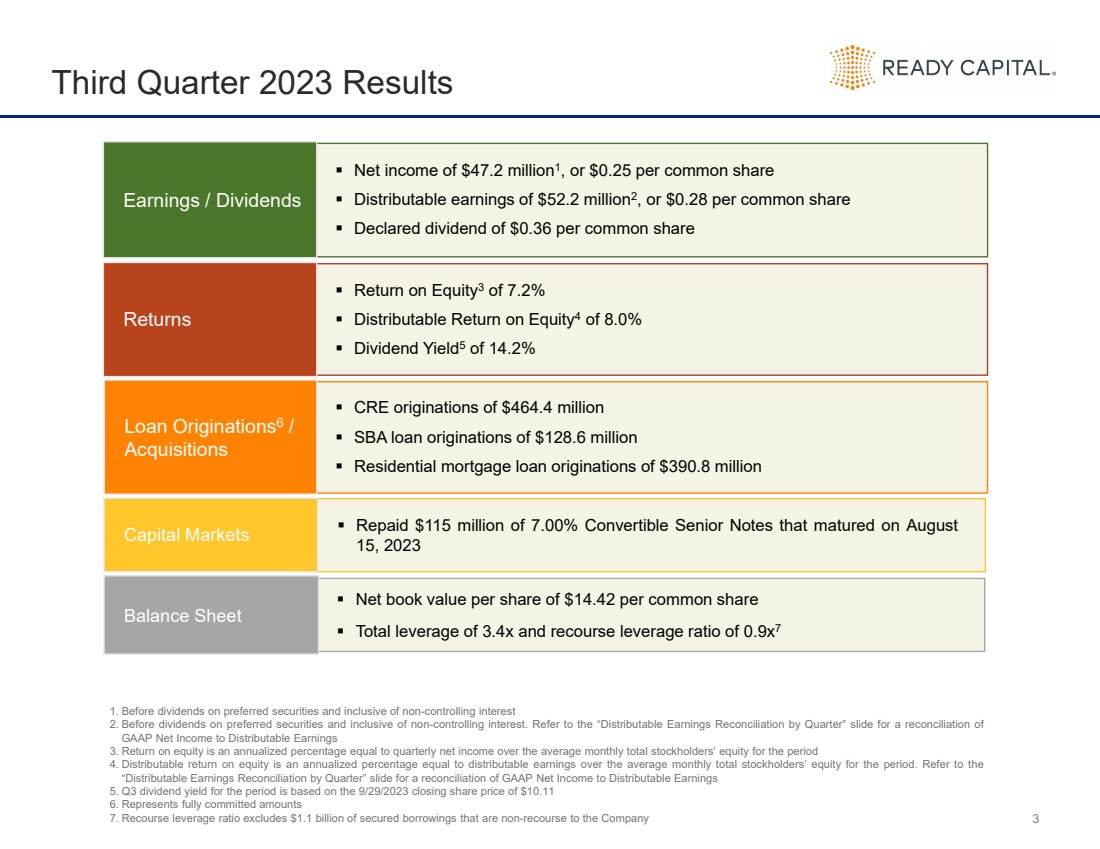

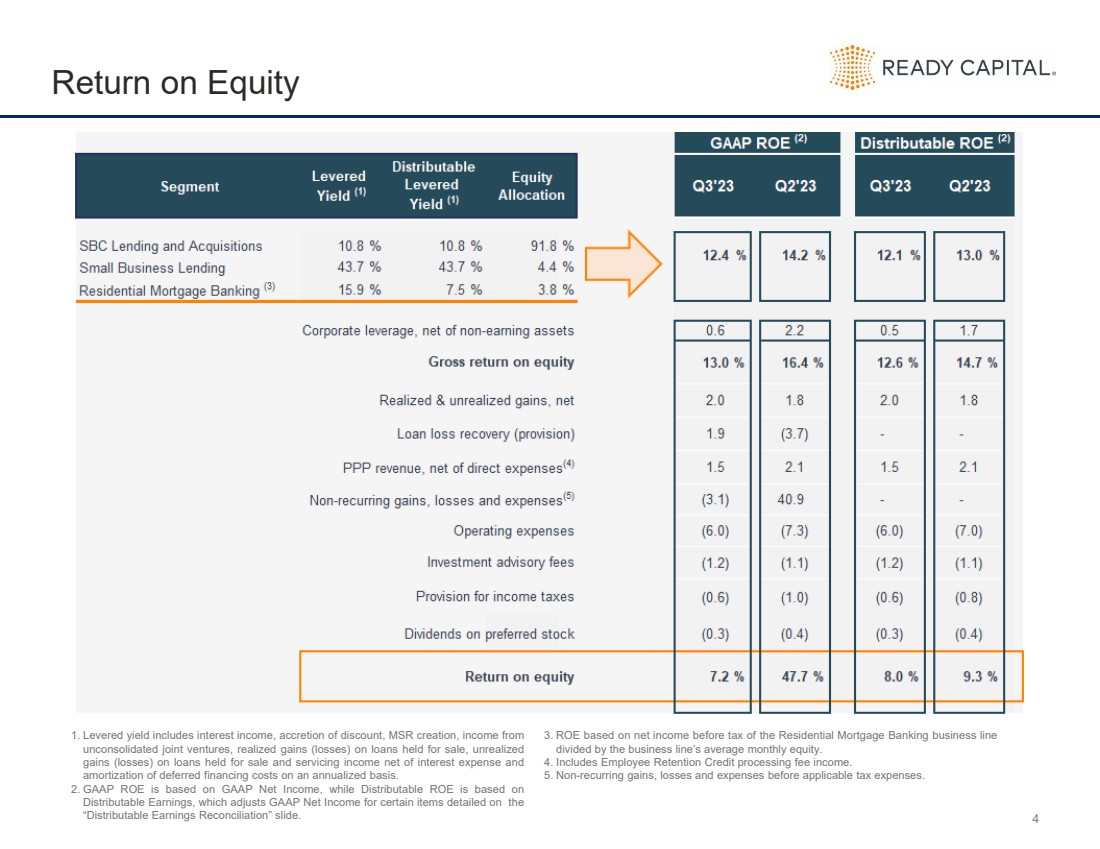

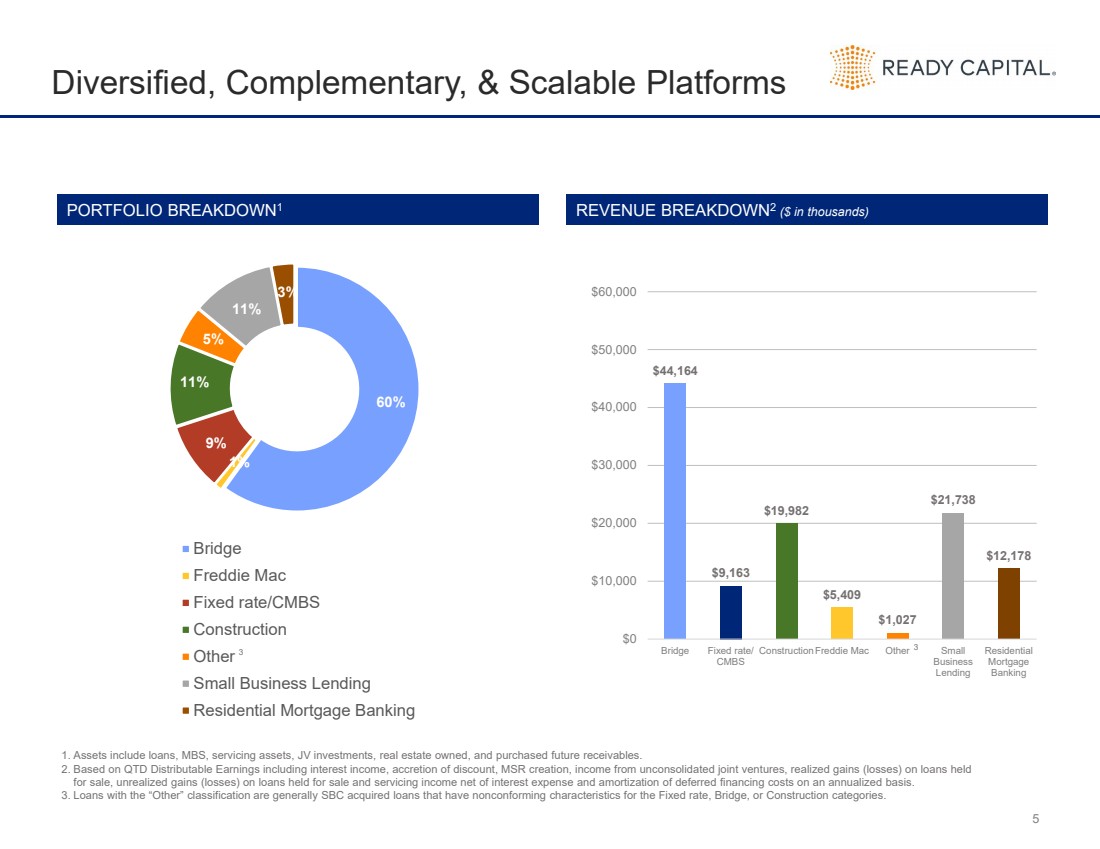

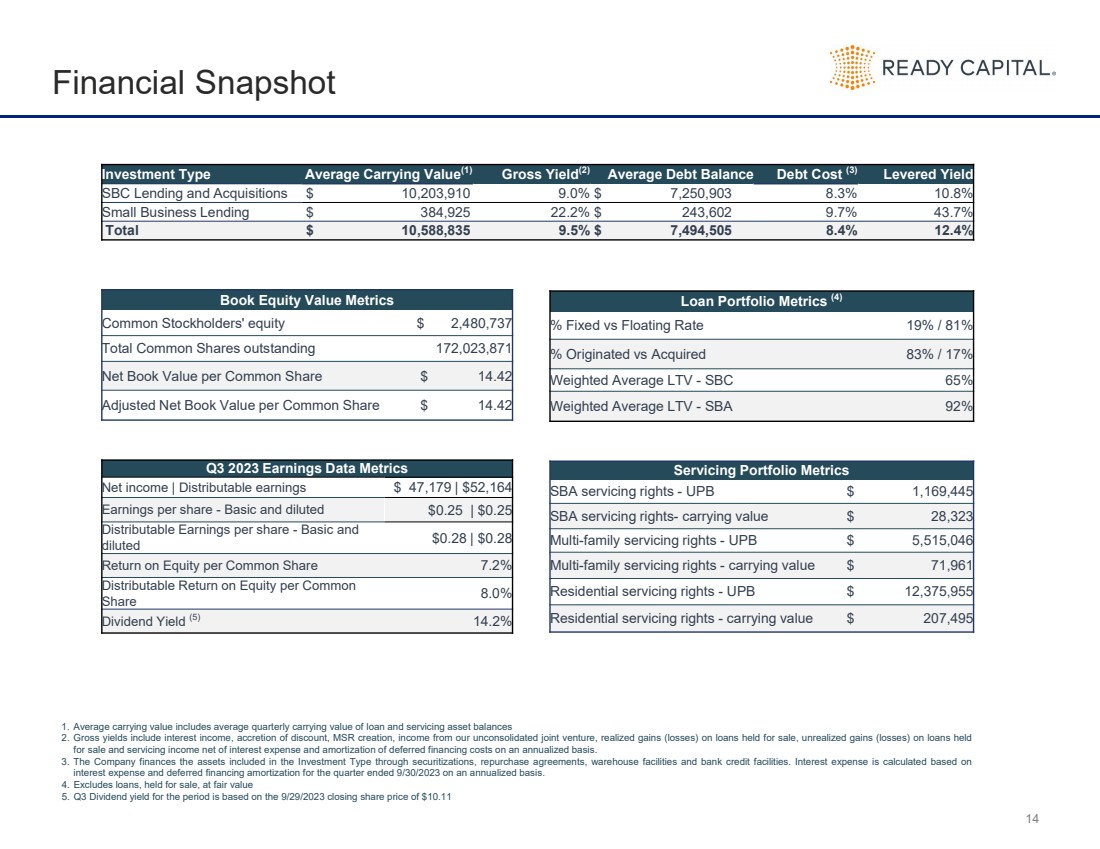

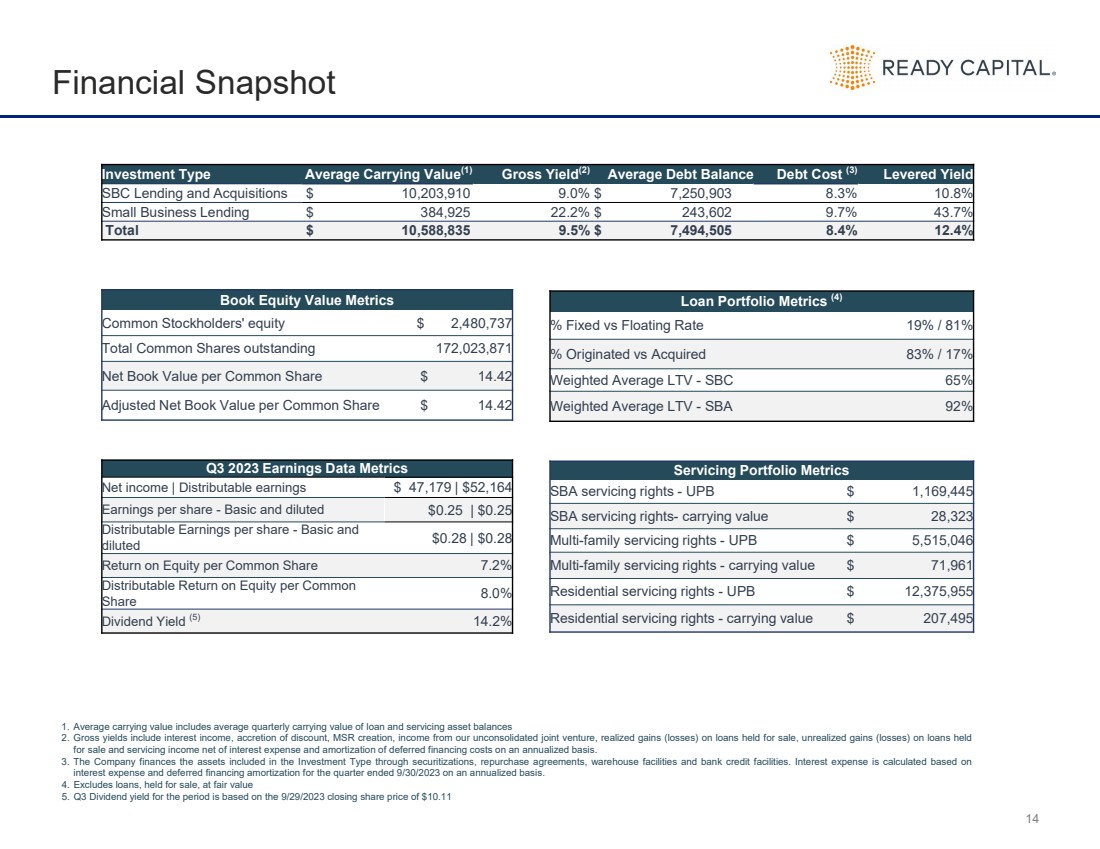

| 14 Financial Snapshot Investment Type Average Carrying Value(1) Gross Yield(2) Average Debt Balance Debt Cost (3) Levered Yield SBC Lending and Acquisitions $ 10,203,910 9.0% $ 7,250,903 8.3% 10.8% Small Business Lending $ 384,925 22.2% $ 243,602 9.7% 43.7% Total $ 10,588,835 9.5% $ 7,494,505 8.4% 12.4% Book Equity Value Metrics Common Stockholders' equity $ 2,480,737 Total Common Shares outstanding 172,023,871 Net Book Value per Common Share $ 14.42 Adjusted Net Book Value per Common Share $ 14.42 Loan Portfolio Metrics (4) % Fixed vs Floating Rate 19% / 81% % Originated vs Acquired 83% / 17% Weighted Average LTV - SBC 65% Weighted Average LTV - SBA 92% Q3 2023 Earnings Data Metrics Net income | Distributable earnings $ 47,179 | $52,164 Earnings per share - Basic and diluted $0.25 | $0.25 Distributable Earnings per share - Basic and diluted $0.28 | $0.28 Return on Equity per Common Share 7.2% Distributable Return on Equity per Common Share 8.0% Dividend Yield (5) 14.2% Servicing Portfolio Metrics SBA servicing rights - UPB $ 1,169,445 SBA servicing rights- carrying value $ 28,323 Multi-family servicing rights - UPB $ 5,515,046 Multi-family servicing rights - carrying value $ 71,961 Residential servicing rights - UPB $ 12,375,955 Residential servicing rights - carrying value $ 207,495 1. Average carrying value includes average quarterly carrying value of loan and servicing asset balances 2. Gross yields include interest income, accretion of discount, MSR creation, income from our unconsolidated joint venture, realized gains (losses) on loans held for sale, unrealized gains (losses) on loans held for sale and servicing income net of interest expense and amortization of deferred financing costs on an annualized basis. 3. The Company finances the assets included in the Investment Type through securitizations, repurchase agreements, warehouse facilities and bank credit facilities. Interest expense is calculated based on interest expense and deferred financing amortization for the quarter ended 9/30/2023 on an annualized basis. 4. Excludes loans, held for sale, at fair value 5. Q3 Dividend yield for the period is based on the 9/29/2023 closing share price of $10.11 |