Filed Pursuant to Rule 424(b)(5)

Registration No. 333-253792

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement is not an offer to sell the securities and is not soliciting offers to buy the securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 2, 2021

Preliminary Prospectus Supplement

(To Prospectus dated March 2, 2021)

Autohome Inc.

30,291,200 Ordinary Shares

This prospectus supplement relates to an offering of an aggregate of 30,291,200 ordinary shares, par value US$0.0025 per share, of Autohome Inc. We are offering 20,194,400 ordinary shares, par value US$0.0025 per share, and the selling shareholder identified in this prospectus supplement, or the Selling Shareholder, is offering 10,096,800 ordinary shares, as part of a global offering, or the Global Offering, which consists of an international offering of 27,262,000 ordinary shares offered hereby, and a Hong Kong public offering of 3,029,200 ordinary shares. The public offering price for the international offering and the Hong Kong public offering is HK$ per ordinary share, or approximately US$ per ordinary share based on an exchange rate of HK$7.7531 to US$1.00. We will not receive any proceeds from the sale of the ordinary shares to be offered by the selling shareholder.

Our ADSs are listed on the New York Stock Exchange, or NYSE, under the symbol “ATHM.” On March 1, 2021, the last reported trading price of our ADSs on NYSE was US$116.51 per ADS, or HK$225.83 per ordinary share, based upon an exchange rate of HK$7.7531 to US$1.00. Each ADS represents four ordinary shares.

We will determine the offer price for both the international offering and the Hong Kong public offering by reference to, among other factors, the closing price of our ADSs on the last trading day before the pricing of the Global Offering, which is expected to be on or about March 9, 2021. The maximum offer price for the Hong Kong public offering is HK$251.8 or US$32.5 per ordinary share (equivalent to US$129.9 per ADS).

The allocation of ordinary shares between the international offering and the Hong Kong public offering is subject to reallocation. For more information, see “Underwriting” beginning on page S-38 of this prospectus supplement. The public offering price in the international offering may differ from the public offering price in the Hong Kong public offering. See “Underwriting—Pricing.” The international offering contemplated herein consists of a U.S. offering and a non-U.S. offering made outside the United States in compliance with applicable law. We are paying a registration fee for ordinary shares sold in the United States, as well as for ordinary shares initially offered and sold outside the United States in the Global Offering that may be resold from time to time into the United States.

This prospectus supplement, the accompanying prospectus and the documents referred to herein are not to be issued, circulated or distributed to the public in Hong Kong and do not constitute an offer to sell nor a solicitation of an offer to buy any securities to the public in Hong Kong. Neither this document nor anything referred to herein forms the basis for any contract or commitment whatsoever. For the avoidance of doubt, the publication of this prospectus supplement and the document referred to herein shall not be deemed to be an offer of securities made pursuant to a prospectus issued by or on behalf of the issuer for the purposes of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong nor shall it constitute an advertisement, invitation or document containing an invitation to the public to enter into or offer to enter into an agreement to acquire, dispose of, subscribe for or underwrite securities for the purposes of the Securities and Futures Ordinance (Cap. 571) of Hong Kong. A copy of this prospectus supplement and the document referred to herein may, however, be issued in Hong Kong only to “professional investors” within the meaning as defined in the Securities and Futures Ordinance (Cap. 571) and any rules made thereunder.

We have applied to list our ordinary shares on the Hong Kong Stock Exchange pursuant to Chapter 19C of the Hong Kong Stock Exchange Listing Rules under the stock code “2518.”

See “Risk Factors” beginning on page S-13 for a discussion of certain risks that should be considered in connection with an investment in our ordinary shares.

Neither the United States Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined that this prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

PRICE HK$ PER ORDINARY SHARE

| | | | | | | | |

| | | Per Ordinary Share | | | Total | |

Public offering price | | HK$ | | (1) | | HK$ | | |

Underwriting discounts and commissions(2) | | HK$ | | | | HK$ | | |

Proceeds, before expenses, to us(3) | | HK$ | | | | HK$ | | |

Proceeds, before expenses, to the selling shareholders | | HK$ | | | | HK$ | | |

| (1) | Equivalent to US$ per ADS, based upon each ADS representing four ordinary shares and an exchange rate of HK$7.7531 to US$1.00 as of February 19, 2021, per the noon buying rate set forth in the H.10 statistical release of the U.S. Federal Reserve Board. |

| (2) | See “Underwriting” beginning on page S-38 of this prospectus supplement for additional information regarding total underwriting compensation. |

| (3) | Includes estimated net proceeds of HK$ from the sale of 3,029,200 ordinary shares in the Hong Kong public offering. |

We have granted the international underwriters the option, exercisable by China International Capital Corporation Hong Kong Securities Limited, Goldman Sachs (Asia) L.L.C. and Credit Suisse (Hong Kong) Limited, or the Joint Representatives, on behalf of the international underwriters, to purchase up to an additional 4,544,000 ordinary shares at the public offering price until 30 days after the last day for the lodging of applications under the Hong Kong public offering. Goldman Sachs (Asia) L.L.C. expects to enter into a borrowing arrangement with Yun Chen Capital Cayman to facilitate the settlement of over-allocations. Goldman Sachs (Asia) L.L.C. is obligated to return ordinary shares to Yun Chen Capital Cayman by exercising the option to purchase additional ordinary shares from us or by making purchases in the open market. No fees or other remuneration will be paid by the underwriters to us or Yun Chen Capital Cayman for the loan of these ordinary shares.

The underwriters expect to deliver the ordinary shares against payment therefor through the facilities of the Central Clearing and Settlement System on or around , 2021.

Joint Sponsors, Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers

| | | | |

| CICC | | Goldman Sachs | | Credit Suisse |

| (in alphabetical order with no ranking assigned) | | |

Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager

HSBC

Joint Bookrunners and Joint Lead Managers

| | | | | | | | |

| Deutsche Bank | | Haitong International | | PAC Securities | | ABCI | | Tiger Brokers |

The date of this prospectus supplement is , 2021.

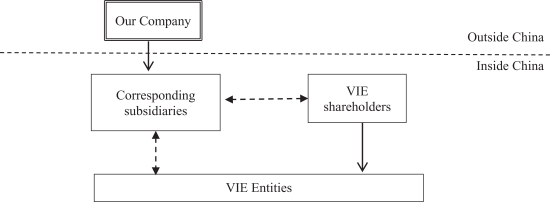

” denotes the direction of legal and beneficial ownership.

” denotes the direction of legal and beneficial ownership. ” denotes the contractual arrangements among the VIE Entities, VIE shareholders, and our subsidiaries.

” denotes the contractual arrangements among the VIE Entities, VIE shareholders, and our subsidiaries.