iQSTEL, Inc.

Company - Summary – Extended Version

August 20th, 2024

IMPORTANT CAUTIONS REGARDING FORWARD-LOOKING STATEMENTS

This presentation has been prepared by iQSTEL Inc. (“we,” “us,” “our,” “iQSTEL” or the “Company”). This presentation does not constitute an offer of any securities for sale. Any securities offered privately will not be or have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements, nor shall there be any offer or sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains forward-looking statements. These forward-looking statements should not be used to make an investment decision. The words ‘believe,’ ‘expect,’ ‘may,’ ‘strategy,’ ‘future,’ ‘likely,’ ‘goal,’ ‘plan,’ 'estimate,' 'possible' and 'seeking' and similar expressions identify forward-looking statements, which speak only as to the date the statement was made. All statements other than statements of historical facts included in this presentation regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements.

Examples of forward-looking statements include, among others, statements we make regarding our recent acquisitions and joint venture projects, the plans and objectives of management for future operations, including plans relating to the development of new products or services, and our future financial performance. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions.

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, competition within the industries in which we operate, the timing, cost and success or failure of new product and service introductions and developments, our ability to attract and retain qualified personnel, maintaining our intellectual property rights and litigation involving intellectual property rights, legislative, regulatory and economic developments, and the other risks and uncertainties described in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of our most recently filed Annual Report on Form 10-K and any subsequently filed Quarterly Report(s) on Form 10-Q.

Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Content

| I. Introduction | 6 |

| II. Mission | 9 |

| III. Vision | 9 |

| IV. Business Units | 9 |

| A. Core Business Enhance Telecommunications Division | 13 |

| A1. Telecommunications Subsidiaries | 14 |

| A2. Telecommunications Subsidiaries Ownership | 14 |

| A3. Telecommunications Products and Services | 15 |

| A4. Main Customers and Vendors | 16 |

| A5. Wholesale Voice and SMS intermediation business explanation | 17 |

| A6. IoTLabs – Proprietary Technology: IoTSmartgas | 17 |

| A7. itsBchain - Proprietary Technology: MNPA | 18 |

| B. The Fintech Division | 19 |

| C. The Electric Vehicles (EV) Division | 20 |

| D. The Artificial Intelligence (AI)-Enhanced Metaverse Division | 21 |

| V. Revenue Growth and Diversification | 24 |

| VI. Company Business and Corporate plan | 27 |

| VII. 2025 Time to Double Our Business Size | 28 |

| VIII. Overview of Company on OTCQX Market | 28 |

| IX. Capital Raising and Structure Management | 30 |

| X. Current Capital Requirements and Use of Proceeds | 34 |

| XI. Nasdaq Uplisting | 34 |

| XII. Management | 34 |

| XIII. Final Summary | 39 |

I. Introduction

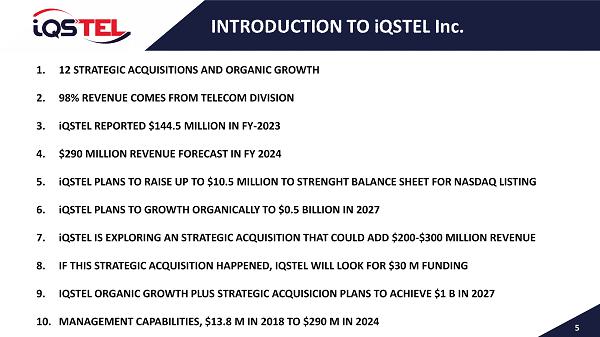

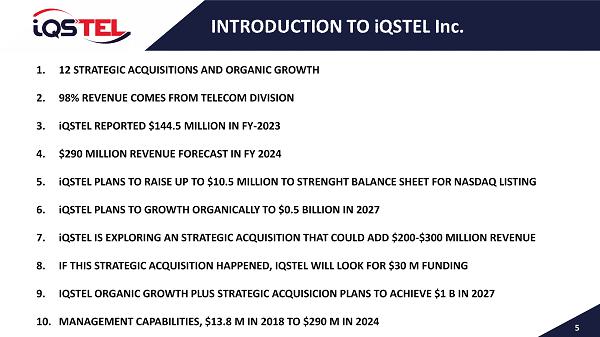

iQSTEL Inc. (OTCQX: IQST) (www.iQSTEL.com) is a multinational telecommunications and technology company, incorporated in the State of Nevada, on June 24, 2011. It is an SEC reporting company and is quoted on the OTCQX under the ticker symbol IQST. The company, if qualified, intends to uplist to a national exchange.

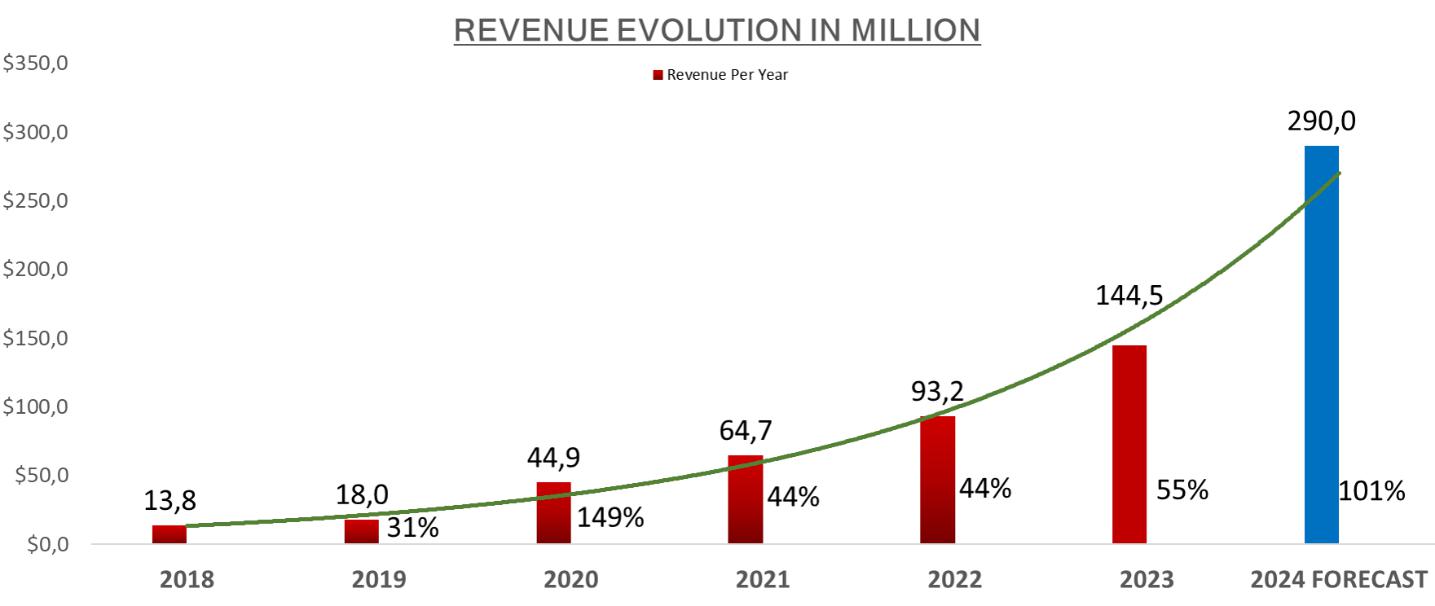

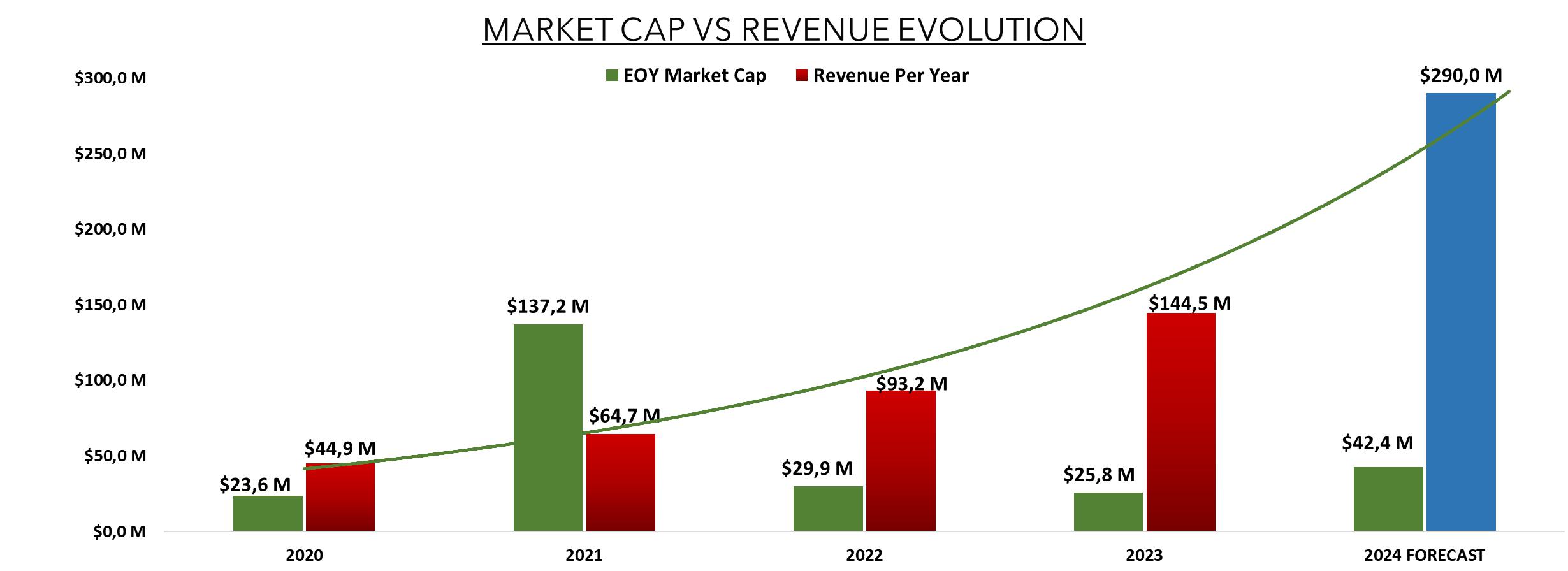

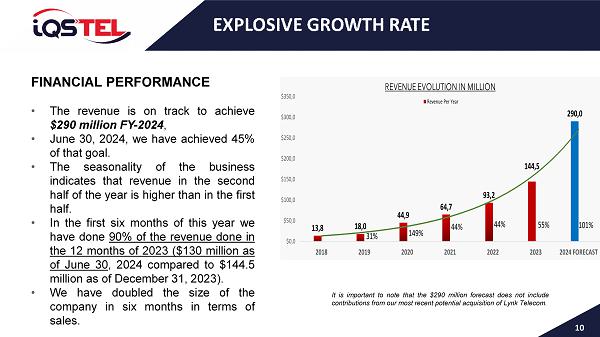

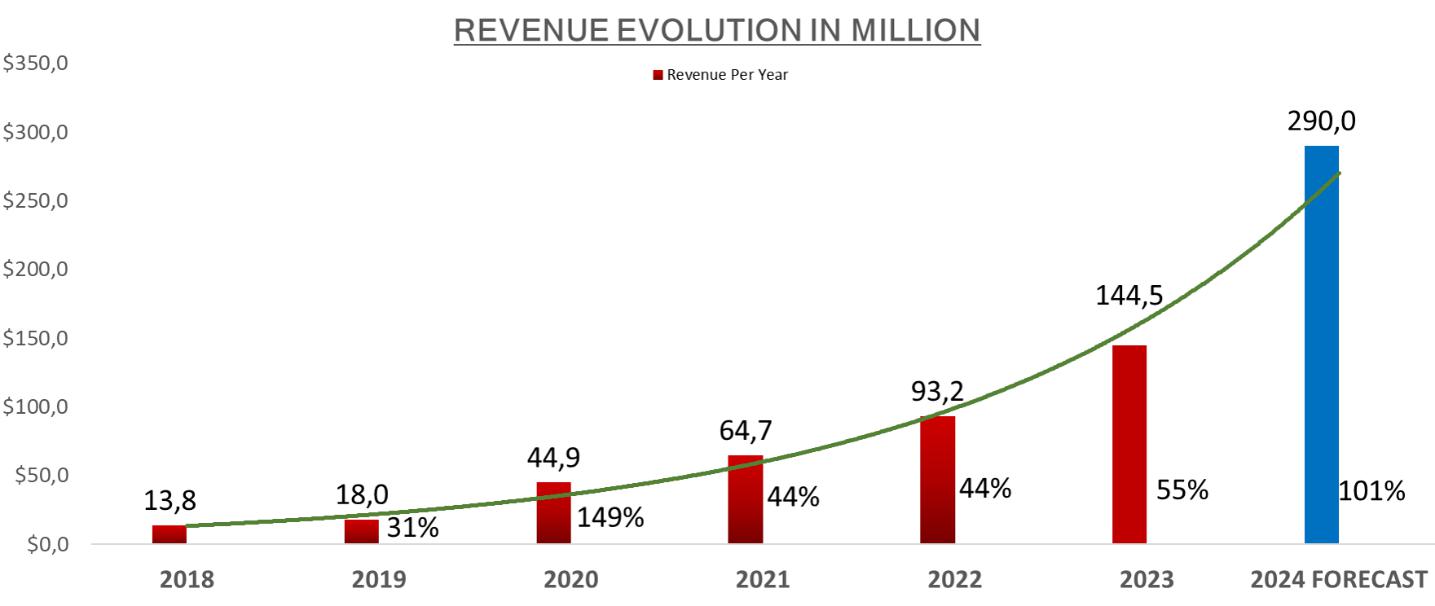

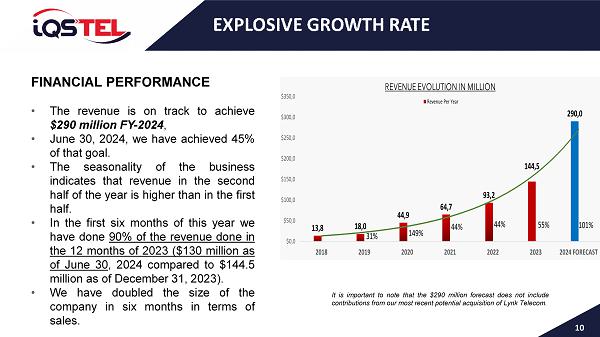

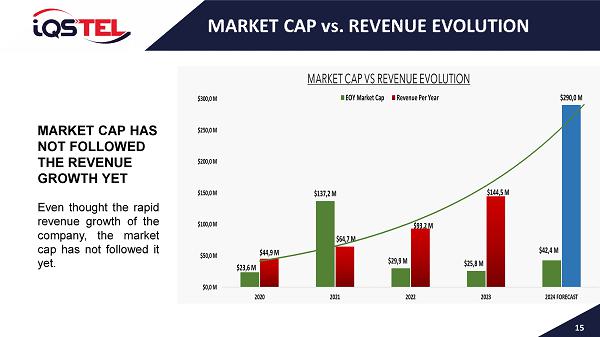

For the fiscal year 2023, iQSTEL reported full-year revenue of $144.5 million. The company is on track to achieve $290 million revenue for FY-2024, averaging $700,000 per day, with an anticipated $7.5 million in gross profit and a seven-digit positive operating income for FY-2024.

iQSTEL is a global telecommunications company serving Tier-1 global carriers, corporations, and international enterprises with high-quality communication and connectivity value-added services. The Company is recognized as a leader in the sector, offering an extensive network of interconnections and top-tier services. Its primary market is the United States. iQSTEL employs over 100 individuals and maintains a global commercial presence in 20 countries, with offices in Miami, Florida; Caracas, Venezuela; Buenos Aires, Argentina; London, UK; Zürich, Switzerland; Istanbul, Turkey; and Dubai, UAE, ensuring comprehensive 24/7 business operations.

iQSTEL operations are a combination of organic growth and 12 strategic acquisitions. Each acquisition was selected for its potential to expand the company’s product line, increase market penetration, and enhance customer relations. A corporate culture that aligns with iQSTEL values was the most important acquisition criteria.

The telecom division currently accounts for more than 98% of the company’s revenue and serves as the foundation of a multitiered follow on strategy for iQSTEL to achieve its business goals.

iQSTEL plans to implement a marketing strategy to transition from the several brand names of its subsidiaries to a one strong brand name to increase customer recognition.

Currently, the company’s robust telecommunications business is on track to generate $290 million in revenue in FY-2024 with 7-digits in positive operating income.

The company intends to raise $10.5 million utilizing a portion of the funds to redeem existing debts and the balance to fund growth following a FY-2024 listing on Nasdaq.

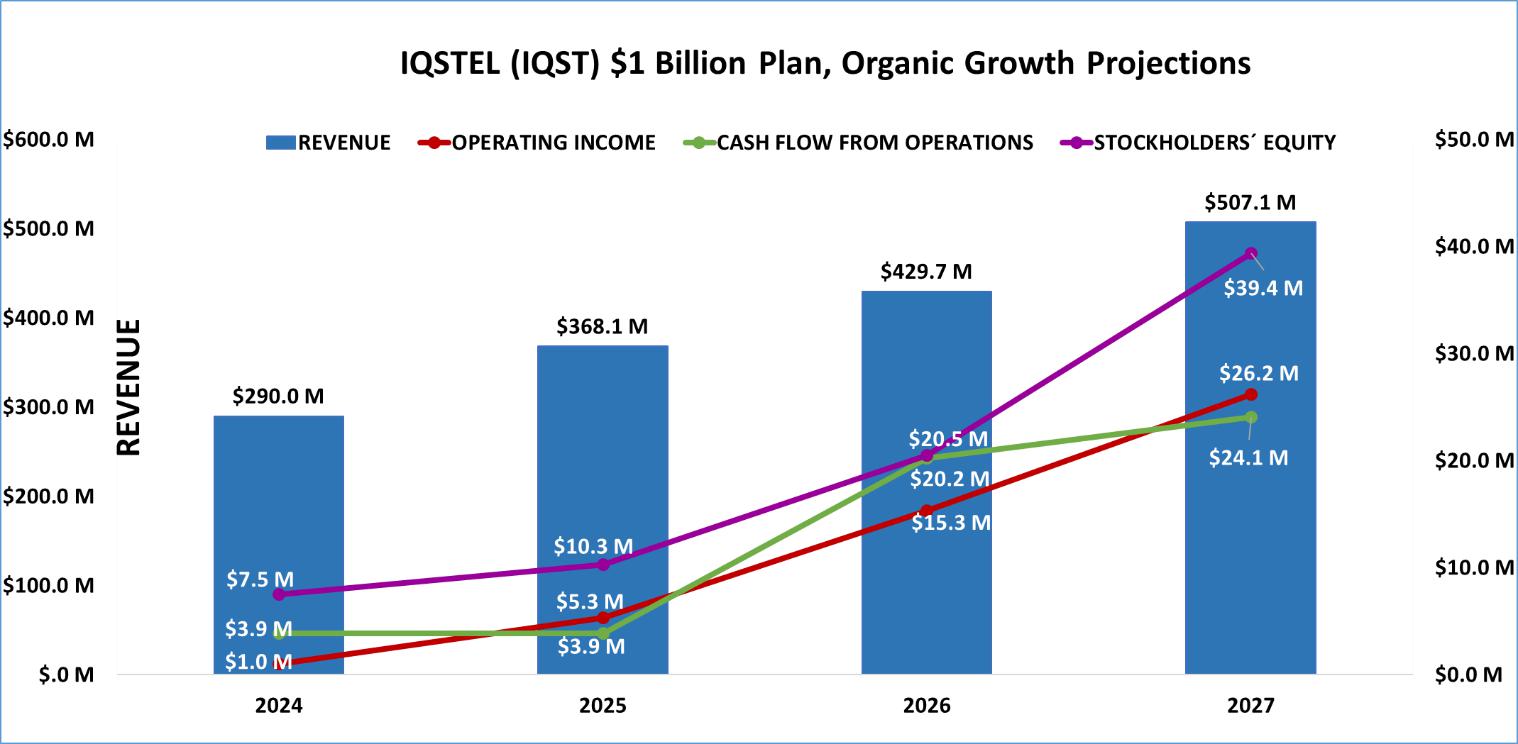

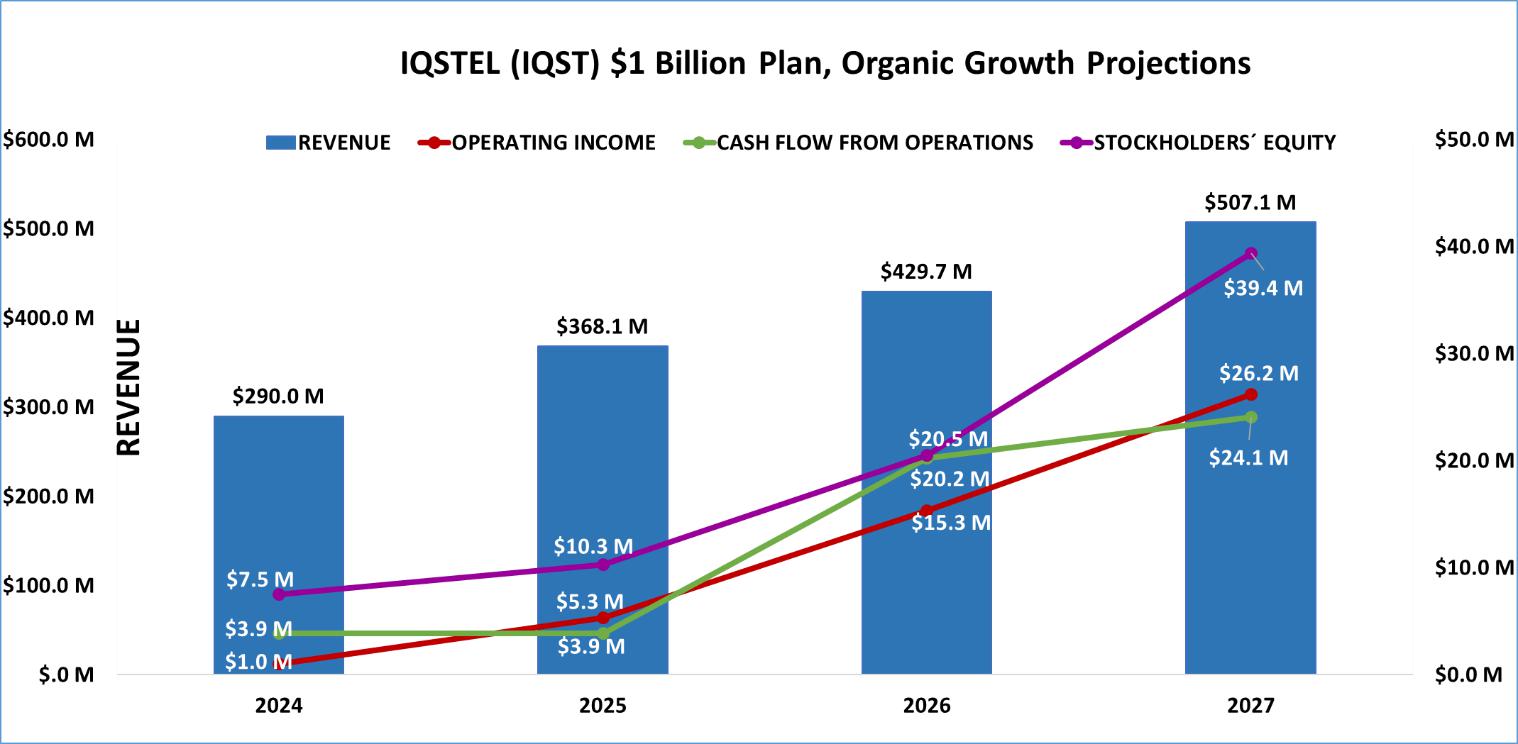

The company has a detailed plan to confidently grow organically to $0.5 billion in revenue by FY-2027. At the same time, iQSTEL is exploring one strategic acquisition of a specific company forecasted to produce $200-300 million revenue in FY-2024. We currently do not have a target for this plan. If ever consummated, with the combination of organic growth and the execution of this acquisition, the company expects to reach $1 billion in revenue in FY-2027.

In conjunction with this strategic acquisition, the company intends to raise $30 million concurrently with or just post its Nasdaq listing.

iQSTEL has used a roll up strategy to achieve accelerated growth. The company continues to consolidate and integrate acquired operations into one single, seamless operating corporation. The ongoing streamlining process has already reduced costs and facilitated organic growth through cross selling synergies with more cost reduction and cross selling growth yet in store. With the further bottom line telecommunications improvements achieved, the company then plans to implement a next phase of higher margin sales growth. iQSTEL intends to then invest in the rapid expansion of its portfolio of high margin, value added technology solutions including Fintech, EV and AI-Enhanced Metaverse.

Current management of iQSTEL has a proven track record having grown the company from $13.8 million revenue in FY-2018 to a projected $290 million in revenue for FY-2024. As part of the acquisition process, we have benefited from the management teams of our subsidiaries, creating a unique reserve of talented executives responsible for our amazing organic growth.

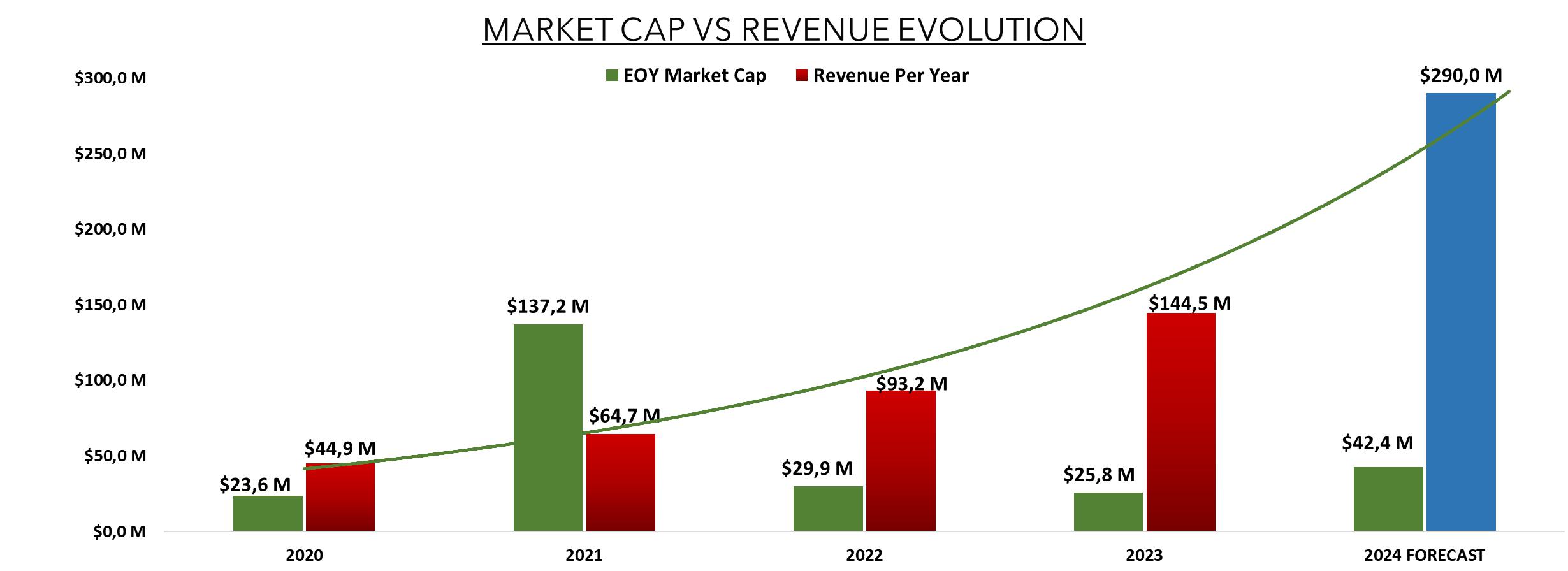

Management believes that the current market valuation of iQSTEL does not fairly reflect the -current business value, let alone the very tangible potential to reach $1 billion in revenue by FY-2027. In summary, management contends iQSTEL is undervalued and as such, an exceptional investment opportunity.

History and evolution

Our journey began in 2008, when engineer Leandro Jose Iglesias, formerly the International Business Manager at Verizon's Venezuelan subsidiary Cantv, founded Etelix.com USA LLC, specializing in the exchange of international voice (VoIP) services.

A significant milestone for Etelix.com USA LLC was achieved in 2013 with its participation in the upgrade of the Maya-1 submarine cable system. During this project, Etelix acquired 10 Gbps of international capacity between Miami and Costa Rica, subsequently reselling these services to Millicom (Tigo, Costa Rica). This acquisition continues to generate annual revenue from the operation and maintenance of this capacity.

On June 25, 2018, PureSnax International Inc., a publicly traded company in the United States, completed an 80% reverse merger with Etelix.com USA LLC, resulting in Etelix assuming control of the public entity.

Following the merger, the company was renamed iQSTEL Inc., received a new CUSIP number (46265G107) and new ticker symbol (IQST). Additionally, the Standard Industrial Classification (SIC) code was updated to 4813, reflecting its focus on telephone communications.

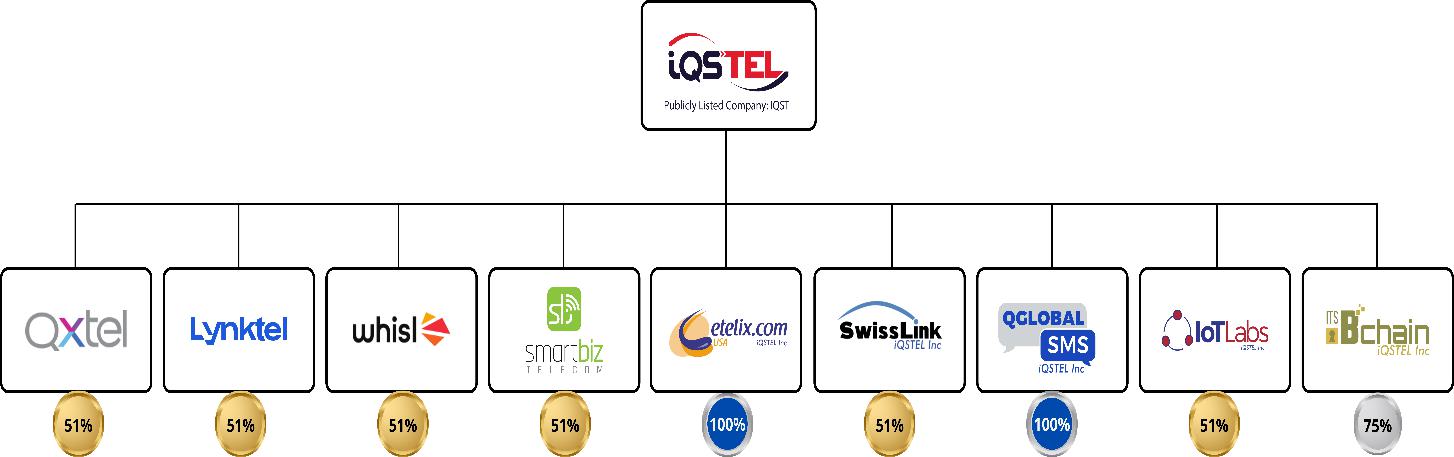

From 2018 to date, iQSTEL has carried out 12 acquisitions and ventures, which are detailed in the following graph.

Notice: The acquisition of Lynktel is in process. iQSTEL is actively conducting due diligence. While we expect to close this deal during the Q3 FY-2024, there are no assurances that the deal will close as planned.

II. Mission

At iQSTEL, we understand that in today's society, fulfilling the human hierarchy of needs, including physiological, safety, relationship, esteem, and self-actualization, requires access to ubiquitous communications, the freedom of virtual banking, affordable mobility, and information and content. We are committed to bridging these gaps and providing equal opportunities for all.

III. Vision

To become a global industry leader and achieve at least $1 Billion in revenue by 2027.

IV. Business Units

iQSTEL has 4 Business Divisions delivering accessibly to the necessary tools in today's pursuit of basic human needs: Telecommunications, Fintech, Electric Vehicles and Metaverse. Currently, most of our revenue comes from the Telecommunications Division. We intend to grow both our Telecommunications Division as well as our other developing Divisions, expanding our product and service lines to current and future customers with higher margin offerings.

| · | The Enhanced Telecommunications Services Division (Communications) includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Number Portability Blockchain Platform. |

| · | The Fintech Division (Financial Inclusion) includes remittances services, top up services, Master Card Debit Card, a US Bank Account (No SSN required), and a Mobile App. |

| · | The Electric Vehicles (EV) Division (Mobility) offers Electric Motorcycles and plans to launch a Mid-Speed Car. |

| · | The Artificial Intelligence (AI)-Enhanced Metaverse Division (information and content) includes an enriched and immersive white label proprietary AI-Enhanced Metaverse platform to access products, services, content, entertainment, information, customer support, and more in a virtual 3D interface. |

The company continues to grow and expand its suite of products and services both organically and through mergers and acquisitions.

| Page 10 of 39 | August, 2024 |

| Page 11 of 39 | August, 2024 |

Notice: The acquisition of Lynktel is in process. iQSTEL is actively conducting due diligence. While we expect to close this deal during the Q3 FY-2024, there are no assurances that the deal will close as planned.

A. Core Business Enhance Telecommunications Division

The International Long-Distance traffic market size is estimated at $10.7 Billion in annual revenue, with 257 billion Minutes exchanged yearly, according to Telegeography International Voice Report of 2023. The report estimates that Wholesale Carriers have a 72% total market share, carrying over 185 billion Minutes per year. The Company’s current market share is around 2%. Consequently, as an International Wholesale carrier the Company has plenty of space to grow to several times its current size, provided it can outpace competition and capture market share.

The Global A2P SMS Market is expected to grow at a CAGR of 4.9% through the year 2030, reaching US$78 billion in 2030 from the current size of $58.01 billion, according to Transparency Market Research. Based on these figures, the Company’s current market share is estimated at 0.2%.

With a methodical execution of the business plan and an adequate level of capitalization, the Company believes it can maintain a steady growth rate of two-digits year over year well beyond 2024, as it has done over the last five years.

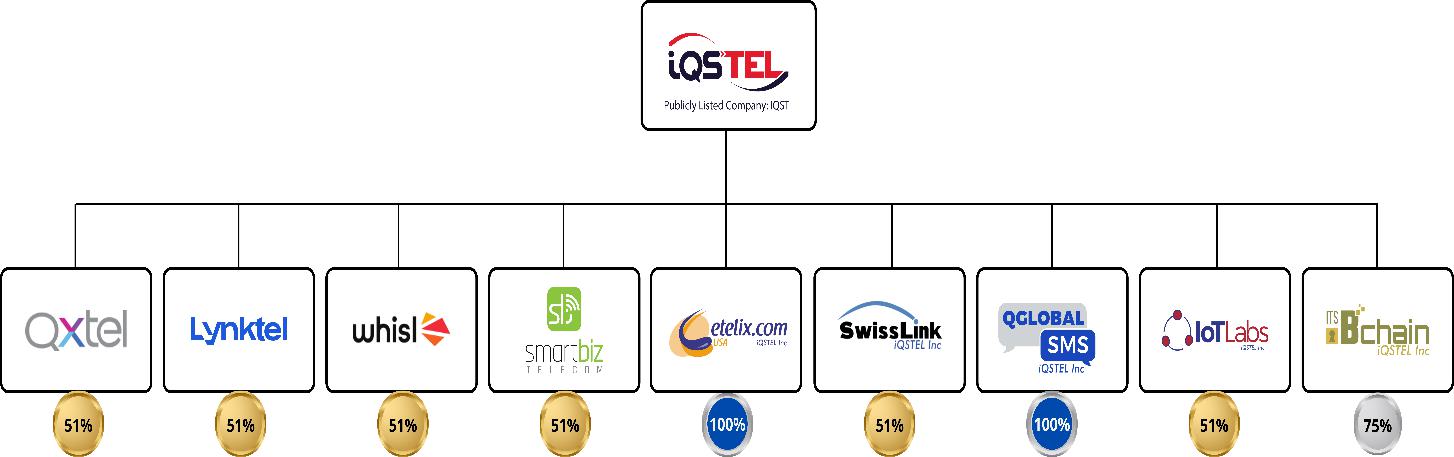

The iQSTEL Telecommunications Division is the cornerstone of the Company, generating over 98% of its revenue. This division comprises nine subsidiaries that provide a diverse array of products and services tailored to operators, corporations, and small to medium-sized enterprises. With a robust global commercial presence, the Telecommunications Division ensures comprehensive market coverage and delivers high-quality solutions across multiple regions.

| Page 12 of 39 | August, 2024 |

| A1. | Telecommunications Subsidiaries |

Notice: The acquisition of Lynktel is in process. iQSTEL is actively conducting due diligence. While we expect to close this deal during the Q3 FY-2024, there are no assurances that the deal will close as planned.

| Page 13 of 39 | August, 2024 |

| A2. | Telecommunications Subsidiaries Ownership |

| A3. | Telecommunications Products and Services |

The voice (VoIP) business represents around 70% of our telecom revenue stream and the SMS business accounts for the rest. Roughly 30% of our corporate gross profit comes from the US voice termination. The Company has implemented a professional US telecom compliance department lead by one of our co-founders to protect our US Telecom Business and to ensure the compliance of all the FCC regulations.

By combining the technological capabilities of these nine subsidiaries, we believe iQSTEL has brought together a complete portfolio of value-added and enhanced services which include:

| Page 14 of 39 | August, 2024 |

Wholesale Products:

Retail and Corporate Services:

| Page 15 of 39 | August, 2024 |

| A4. | Main Customers and Vendors |

Our primary customers and vendors are large operators and telecommunications companies with over 500 interconnections globally. These relationships are business-to-business (B2B).

Our commercial strategy relies on direct sales facilitated by our dedicated sales force. This team leverages long-standing commercial relationships to engage with customers and vendors effectively.

Over 50% of our business is conducted through bilateral commercial agreements (SWAPs) which establish mutual commitments to exchange calls and/or SMS between our customers/vendors and iQSTEL.

Some of our key clients include:

| Page 16 of 39 | August, 2024 |

| A5. | Wholesale Voice and SMS intermediation business explanation |

To illustrate iQSTEL's core business in Voice (VoIP) and SMS wholesale intermediation, consider the following hypothetical example:

When telecommunications operators in Spain need to send calls (VoIP) or SMS to China, rather than negotiating directly with Chinese operators, they engage with iQSTEL. iQSTEL aggregates traffic to China not only from Spanish operators but also from other clients. This aggregation enhances iQSTEL's negotiating power with Chinese operators, enabling it to secure better pricing. These cost advantages are then passed on to customers in Spain like Telefonica de España (Movistar). iQSTEL earns a gross profit from managing the process.

Conversely, iQSTEL also negotiates with Spanish operators to handle Voice (VoIP) and SMS termination in Spain, offering these services to Chinese clients and others.

More than 50% of iQSTEL's business is conducted through bilateral agreements involving commitments to exchange Voice and SMS traffic (SWAP deals) on a monthly or quarterly basis.

| A6. | IoTLabs – Proprietary Technology: IoTSmartgas |

As a part of our Enhanced Telecommunications Division, IoT Labs, LLC (www.iotlabs.mx) specializes in the development of innovative Internet of Things (IoT) solutions. IoT Labs offers a proprietary technology suite that includes both devices and a front-end platform designed for the efficient monitoring of liquid and gas levels in tanks of various sizes (www.iotsmartgas.com). This integrated system supports comprehensive inventory management and facilitates the timely procurement, delivery and refill of tank contents.

Currently, IoT Labs has implemented its solutions within the propane and liquid gas distribution sectors, marketed under the brand IoTSmartgas.com.

| Page 17 of 39 | August, 2024 |

Our product has gained significant traction, evidenced by several received purchase orders and ongoing device tests in Panama, the Dominican Republic, and the USA. These trials have been instrumental in identifying and addressing design improvements, particularly in enhancing device performance under extreme humidity conditions prevalent in regions such as Latin America.

| A7. | itsBchain - Proprietary Technology: MNPA |

Under our subsidiary itsBchain (www.itsbchain.com), we have developed a Phone Number Portability Application that facilitates number portability between cell phone providers in just three clicks. Utilizing the advanced capabilities of blockchain technology and smart contracts, our proprietary platform is designed to streamline the number portability process efficiently and securely between mobile carriers.

The Number Portability Application has now reached the commercial stage, and we are actively offering this innovative solution to regulatory agencies in various countries. We are committed to continuing our commercial efforts until we secure our first customer.

| Page 18 of 39 | August, 2024 |

B. The Fintech Division

iQSTEL Inc.’s fintech division and offering consists of a comprehensive Fintech ecosystem accessible through our proprietary web portal www.maxmo.vip. This client portal and App gives clients access to a MasterCard debit card, a US bank account that does not require a social security number (SSN), and a mobile app/wallet for tracking mobile recharges and international remittances. Our primary objective is to facilitate and democratize access to US banking services, international remittances, US telecommunications services, and international recharges thereby simplifying financial management and enhancing connectivity.

| Page 19 of 39 | August, 2024 |

All our fintech services are conveniently accessible through the iQSTEL mobile money, Global Money One application and ATM services.

Currently, the Company is in the process of redefining the final product following the release of its beta version and extensive testing with over 1,000 users.

C. The Electric Vehicles (EV) Division

Our Electric Vehicle Division provides environmentally friendly and cost-effective transportation options, including electric motorcycles and mid-speed electric cars through a direct-to-consumer marketing strategy in alliance with key marketing partners. We have successfully registered the TuVolten trademark with the European Union Intellectual Property Office and are in the process of securing TuVolten as a registered trademark in the United States through the United States Patent and Trademark Office (USPTO). Additionally, we are pursuing E-mark certification for our 550 Elite motorcycles.

Our team has completed the selection of a manufacturer to produce the mid-speed electric car prototype units. The chosen model already holds E-Mark certification. Production of the initial batch for testing purposes is planned to commence in the second half of FY-2024. This mid-speed vehicle is specifically designed to serve as an optimal secondary family vehicle.

Notice: All the pictures about the EV division are testing units they could change in their final version, there are no assurances that they will be produced as planned. Even though this business line is important for iQSTEL, once we reach certain development, we may, after weighing all of the relevant factors and relevant laws, decide to spin off this business as an independent public company with a new capital structure, board of directors, and management team.

| Page 20 of 39 | August, 2024 |

iQSTEL has conducted extensive market research for our EV Division, including:

| | 1. | Electric Motorcycles industry in Spain, Portugal, Venezuela, Mexico, Colombia, Panama, USA, Guatemala, and Malta. |

| | 2. | Mid-Speed Cars industry in Spain and the EU in general. |

| | 3. | Current Market Size of Electric Motorcycles (April 2022). |

| | 4. | Comparative analysis between Dacia and TuVolten Mid-Speed Product. |

| | 5. | Cost structure analysis for Electric Motorcycles and Mid-Speed Cars. |

| | 6. | Procedure and checklist for TuVolten in Spain. |

| | 7. | Economy size comparison between American countries vs. Portugal and Spain. |

| | 8. | Procedure and checklist to obtain EU Certification and License Plates for Electric Motorcycles and Mid-Speed Cars. |

iQSTEL has also executed several strategic purchase agreements with Chinese manufacturers for Electric Motorcycles and Mid-Speed Cars and has produced multiple testing batches for Electric Motorcycles. TuVolten plans to introduce its motorcycles and electric cars in Spain, Portugal, the United States, and select Latin American countries.

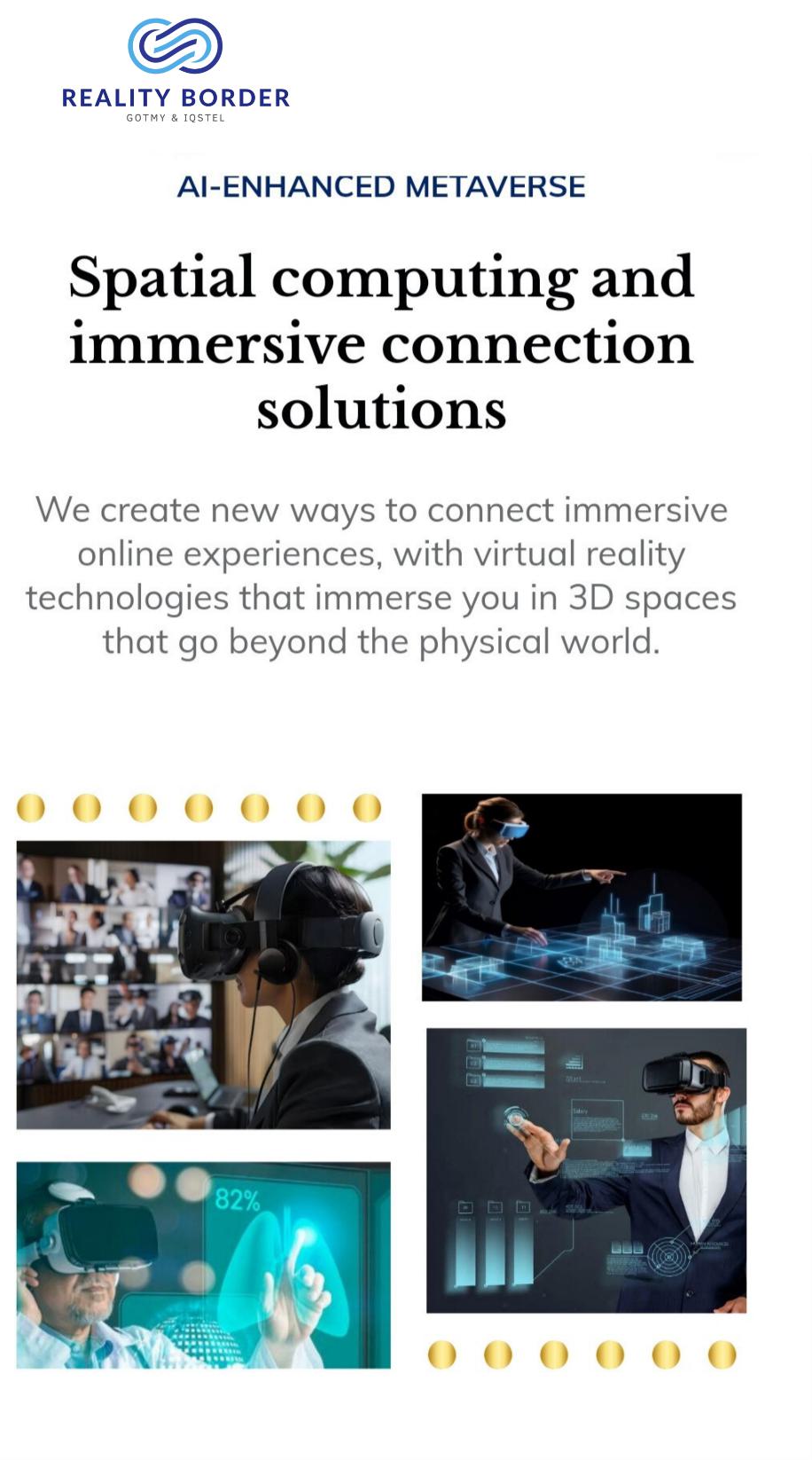

D. The Artificial Intelligence (AI)-Enhanced Metaverse Division

Our proprietary AI-enhanced Metaverse technology platform offers a white-label solution enabling clients to engage with their end users through an immersive and customizable experience. Accessible via web browsers on desktop computers, as well as iOS and Android devices, this platform provides a versatile and comprehensive virtual environment.

Key features of the platform include:

| | • | Digital Character Creation: Users can create and personalize their digital avatars, enhancing user engagement and identity. |

| | • | Real-Time Social Interactions: Facilitates individual and group communication through robust live video streaming features, making it ideal for hosting virtual events, webinars, or presentations. |

| | • | 3D Environment: Incorporates spatial audio to create a 3D environment, allowing multiple audiovisual streams for a more immersive experience. |

| | • | AI-Based Virtual Assistant: Enhances user interaction with setup and content deployment, including access restrictions to improve security and exclusivity. |

| Page 21 of 39 | August, 2024 |

The Company plans to launch a new product in the second half of FY-2024 that leverages AI and Metaverse technology, targeting millions of potential customers worldwide.

THIS PAGE IS INTENTIONALLY EMPTY

| Page 22 of 39 | August, 2024 |

| Page 23 of 39 | August, 2024 |

V. Revenue Growth and Diversification

iQSTEL's growth strategy is built on two key components: acquisitions and organic growth.

Our organic growth is mostly a function of integrating acquired subsidiaries into our portfolio, implementing cross-selling initiatives, and optimizing operational costs. This strategy forms the foundation of our expansion efforts.

Our plan now is to scale our proven revenue and profit growth strategies by levering our current growth and access to financing on better terms. iQSTEL reported audited revenue of $13.8 million for the fiscal year 2018, its first year as a publicly listed company. By FY-2023, the company achieved significant growth, reaching $144.5 million, a nearly tenfold growth in just five years.

Looking ahead to fiscal year 2024, our growth strategy continues to yield successful results. The company is currently on an annual revenue run-rate of $290 million, reflecting a remarkable year-over-year growth exceeding 100%. This projected growth is attributed to anticipated organic expansion and revenue addition from the recent acquisition of QXTEL. It is important to note that the $290 million forecast does not include contributions from our most recent potential acquisition of Lynk Telecom.

iQSTEL has a history of meeting and often surpassing financial forecasts.

Organic Growth Driving Overall Revenue Growth

While acquisitions contribute to our revenue growth, it is the organic growth that fuels more substantial overall expansion. In FY-2022 and FY-2021, iQSTEL executed acquisitions and reported annual revenue growth of approximately 44% each year. In 2023, without any acquisitions, the company reported an impressive organic revenue growth of $51 million, marking a 55% increase compared to FY-2022.

The increased organic growth in FY-2023 highlights our effective integration and proven operating synergy effectively created between our acquired targets. By incorporating these businesses into iQSTEL's product portfolio, we drive organic growth through cross-selling and sales efficiencies, as well as cost cutting and enhanced inventory acquisition and arbitration power.

| Page 24 of 39 | August, 2024 |

Our FY-2024 sales forecast of $290 million reflects not only the addition of approximately $60 million from the QXTEL acquisition but also an expected $90 million in organic revenue growth, resulting from the successful integration of acquired operations.

Given our track record of effectively integrating acquired businesses and driving organic growth, we are confident in the soundness of our current organic growth projections.

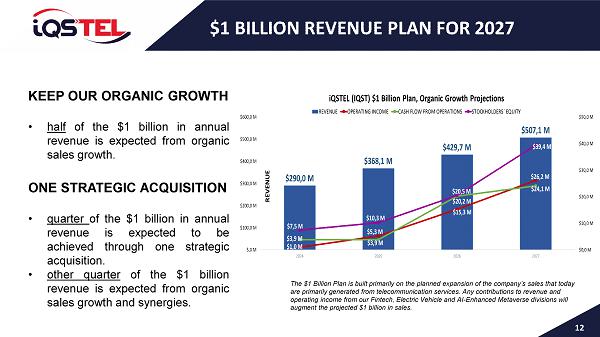

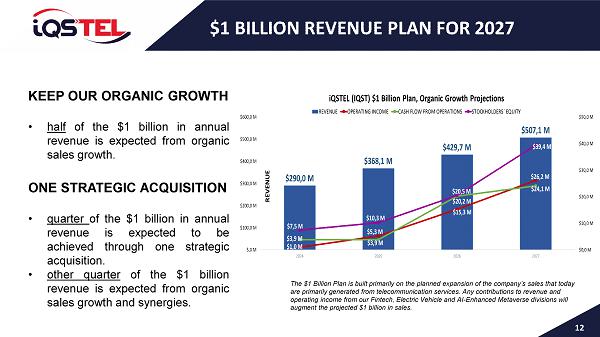

$1 Billion Revenue Plan for 2027 ($1 Billion Plan)

Under the direction of the company’s CFO, Alvaro Quintana, IQSTEL has developed a detailed plan to grow the company’s annual revenue to $1 billion for FY 2027. The plan includes a detailed analysis of each subsidiary using several dynamic variables. The comprehensive plan with dynamic forecasts is available to be presented to investment banks and institutional investors.

To simplify the $1 Billion Plan, financial projections only entail the anticipated performance of the company’s Enhanced Telecommunications Division. Any contributions to revenue and operating income from our Fintech, Electric Vehicle and AI-Enhanced Metaverse divisions will augment the projected $1 billion in sales.

The $1 Billion Plan is built primarily on the planned expansion of the company’s sales that today are primarily generated from telecommunication services. The FY 2027 planned $1 billion in annual sales is expected to be derived from telecom services alone.

| Page 25 of 39 | August, 2024 |

The plan to grow to $1 billion in annual sales consists of two major components:

a) Organic Growth: Approximately half of the $1 billion in annual revenue is expected from organic sales growth generated by existing operations.

b) One Strategic Acquisition: Approximately one quarter of the $1 billion in annual revenue is expected to be achieved through acquisition. The remaining one quarter of the $1 billion in annual revenue is expected from organic sales growth, and synergies with IQSTEL generated by the acquired operations.

IQSTEL has targeted a specific acquisition opportunity, described in the section “XII 2025 time to Double Our Business Size”, with the potential to add from $200 million to $300 million in annual revenue in FY-2025. This acquisition plan includes an initiative to expand the annual sales of the target operation to $500 million by year end FY 2027. The acquisition is being coordinated to close contemporaneously with our intended Nasdaq uplisting and plan to raise upwards of $30m for the transaction.

Here is a detailed breakdown of the $1 Billion Plan - Organic Growth Projections:

| Page 26 of 39 | August, 2024 |

The overall $1 Billion Plan includes the initiatives described in the section “XI Company Business and Corporate Plan”.

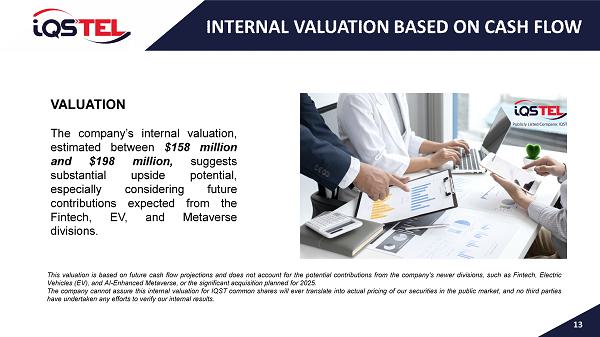

Telecommunications Business Valuation

Based on the net present value of the company’s current and anticipated cash generation from 2024 through 2027, and the anticipated residual cash generation after 2027, we internally calculated iQSTEL’s current business valuation to be between $158 million and $198 million. This valuation does not include any contribution from Fintech, EV and AI-Enhanced Metaverse business divisions and the strategic acquisition described above.

VI. Company Business and Corporate plan

The company has a clearly defined business plan, built upon the vision we have created. We have summarized steps to execute our business and realize our corporate plans as follows:

| A. | Transformation to Telecommunications Corporation: iQSTEL is transitioning from a holding company to a unified corporation. This involves unifying commercial messages, simplifying brands, and reducing departmental redundancies. |

| B. | Lynk Telecom Acquisition: We aim to complete the acquisition of Lynk Telecom, which is expected to boost annual revenue by $20 million and increase operating income by $1 million. |

| C. | Technological Platform Consolidation: We plan to acquire or partner with a single switching platform for all our telecom subsidiaries to improve synergies and reduce technological costs. |

| D. | Revenue Growth: Our strategy focuses on expanding both retail and corporate business segments to increase revenue from end users, which offer higher margin contributions. |

| E. | Margin Increase: The company is improving margins within the Enhanced Telecommunications Division through operational streamlining following acquisitions. Further margin improvements within the Enhanced Telecommunications Division are expected to come from the introduction of new corporate and retail services. Substantial margin increases are expected as we leverage the Enhanced Telecommunications Division customer base to introduce higher margin products through the Fintech, EV, and AI Metaverse divisions. |

| Page 27 of 39 | August, 2024 |

| F. | Marketing Enhancement: We plan to revamp all marketing materials and corporate messages to align with our new corporate identity. |

| G. | Capital Raising: We intend to raise up to $10.5 million to optimize our capital structure, leaving approximately $5 million of free cash after debt redemption. |

All these initiatives are designed to further streamline expenses and improve operating margins. An improved operating profit in turn improves the bottom line, and in so doing, enhances the company’s potential for an improved market valuation.

VII. 2025 Time to Double Our Business Size

As a culmination of the first step of our strategic acquisition strategy, and as we prepare the Company for an exchange listing, iQSTEL will pursue the acquisition or merger with a private or public company, aiming to elevate iQSTEL to a business size of at least $500 million in consolidated revenues per year. Upon identifying a suitable target, the company plans to raise an additional $30 million, on top of the current capital raising plan discussed above, to complete this strategic acquisition. The amount is based on preliminary search of potential targets.

We plan to seek financing to redeem debt, fund our operations and our growth through acquisitions. There can be no assurance that we will be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our business plan will be impaired.

VIII. Overview of Company on OTCQX Market

Since its initial listing on OTCMarkets as a Pink Sheet stock in 2018, our company has undergone significant transformation under new management. Our unwavering focus on enhancing corporate governance and meeting the stringent requirements of higher-quality capital markets has allowed us to progress to both OTCQB and OTCQX tiers, with our QX certification being achieved over two years ago.

| Page 28 of 39 | August, 2024 |

As part of our commitment to regulatory compliance, our company has consistently undergone PCAOB audits, ensuring the timely filing of all necessary documentation and disclosures. Since the end of 2022, we have actively collaborated with a Nasdaq account manager to identify and address any corporate governance gaps required for a potential Nasdaq listing.

Today, we have successfully closed all identified governance gaps, meeting all Nasdaq listing requirements except for the minimum share price. Key achievements include:

| | • | Shareholders: 20,000+ |

| | • | Stockholder Equity: > $8 million |

| | • | Board of Directors: Majority of independent members |

| | • | Committees: Audit, Compensation and Nominating Committees established |

| | • | Ethics and Governance: Code of Ethics, Annual Shareholders Meeting, Annual Board Members Ratification, and Annual Audit Firm Ratification |

Currently, we have 183.5 million common shares issued and outstanding, with an authorized share count of 300 million. Our management team, led by founders Leandro Jose Iglesias (CEO) and Alvaro Quintana (CFO), are the largest shareholders, collectively holding over 30 million common shares and all Series B Preferred Shares. Through Series A Preferred Shares, they also control 51% of the voting rights, effectively safeguarding the company from hostile takeovers.

| Page 29 of 39 | August, 2024 |

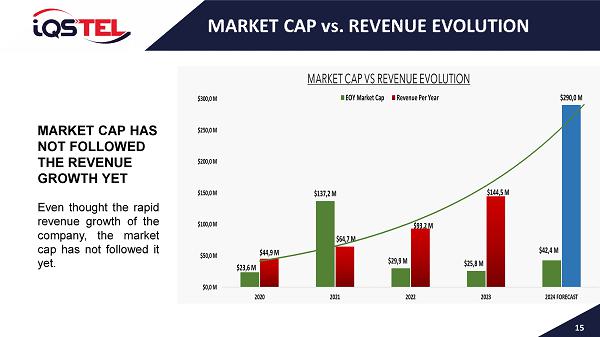

Analyzing the Market Cap in relation to annual revenue, management believes that the current IQST stock price does not accurately reflect the intrinsic value of our business. As our improved financial results become evident, we are confident that the stock price will more closely align with the value expected of a company with $290 million in projected revenue. While a reverse stock split remains a viable option to meet the Nasdaq minimum share price requirement, our preference is for the stock price to rise organically.

IX. Capital Raising and Structure Management

Since 2018, iQSTEL has successfully raised over $20 million through various financial instruments, including Merchant Cash Advances, Promissory Notes, Convertible Notes, Regulation A offerings, and registered offerings.

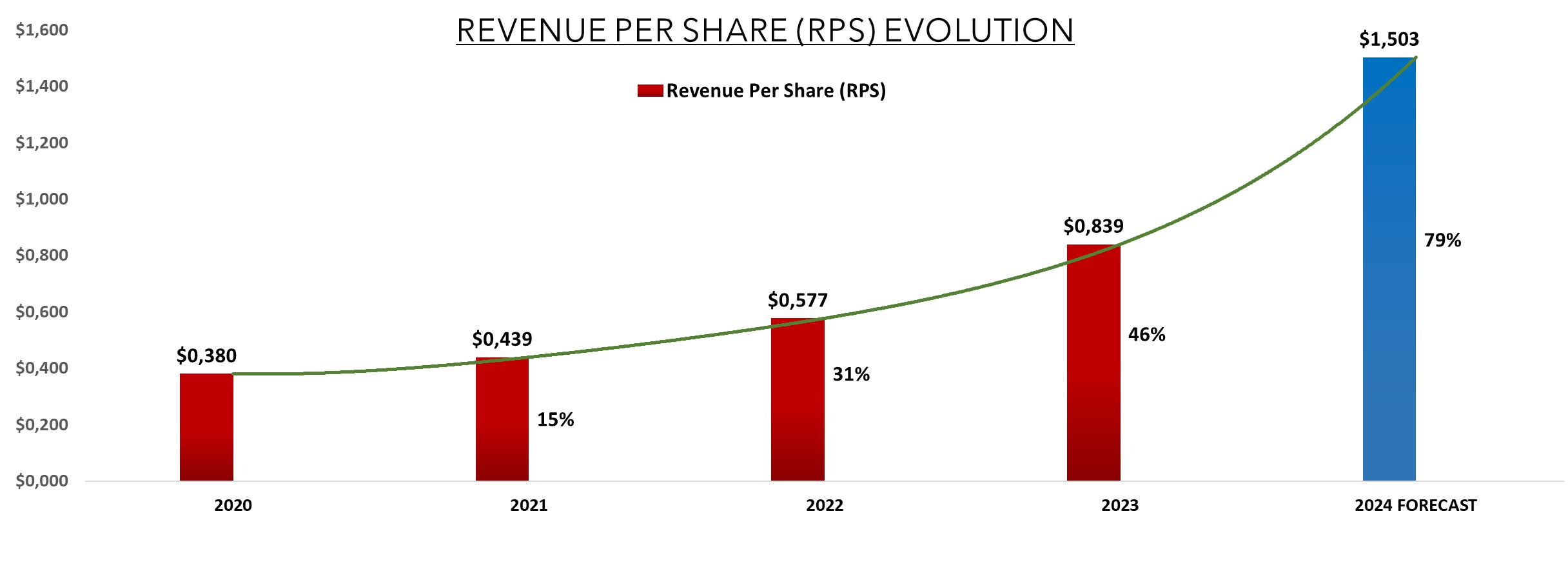

Management’s disciplined approach to capital structure has been pivotal in maintaining a total issued and outstanding share count of 183.5 million common shares, demonstrating our commitment to responsible capital management. This approach ensures that each share issuance directly contributes to enhancing the intrinsic value of the company.

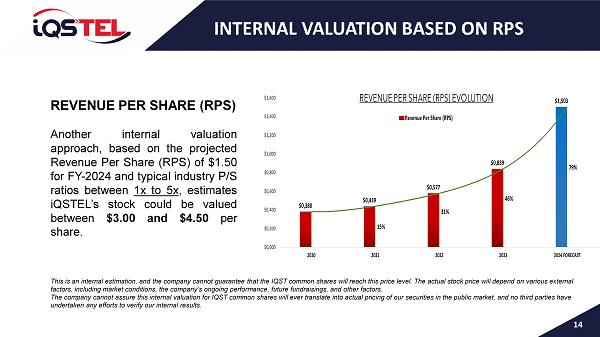

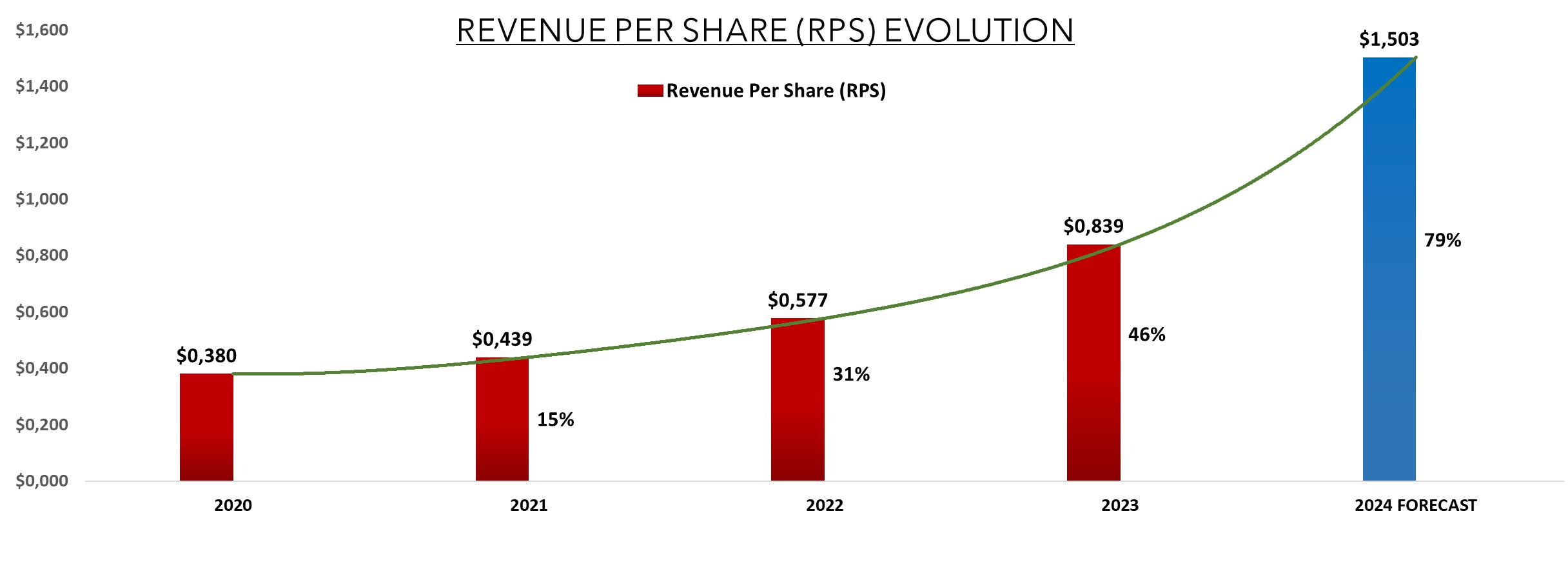

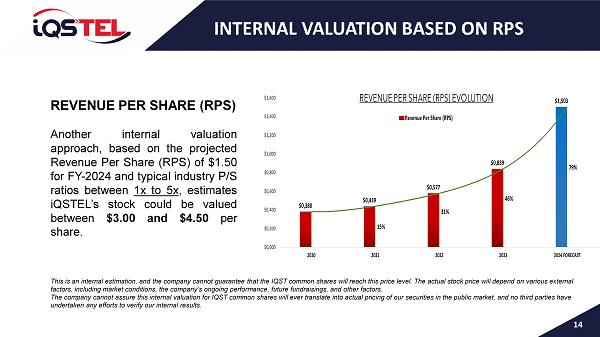

The success of this strategy is reflected in our Revenue Per Share (RPS) performance. From FY-2020 to FY-2024, our RPS has shown consistent growth, with a projected RPS of approximately $1.50 for FY-2024, based on forecasted revenue of $290 million and an outstanding share count of 193 million shares. This represents a 79% increase from the $0.84 RPS achieved in FY-2023, underscoring our ability to effectively utilize raised capital to drive value creation and deliver tangible returns to our shareholders.

Notice: the estimation of 193 million shares for 2024, does not include any additional dilution related with the fundraising of $10.5 million and the eventual $30 million.

| Page 30 of 39 | August, 2024 |

Notice: the 2024 figures are based on projections; there are no assurances that the RPS will be the final figures for FY-2024.

Internally, we have estimated the value of iQSTEL's stock based on our Revenue Per Share (RPS) and typical price-to-revenue (P/S) ratios. In the telecommunications and technology sectors, P/S ratios generally range from 1x to 5x, depending on factors such as growth prospects, profitability, and prevailing market conditions.

For our valuation, we adopted a conservative approach using a P/S ratio of 2x to 3x, which is typical for growing tech companies. Based on this, and our projected RPS, we believe that the estimated stock price would range between $3.00 and $4.50 per share.

It is important to note that this is an internal estimation, and the company cannot guarantee that the IQST common shares will reach this price level. The actual stock price will depend on various external factors, including market conditions, the company’s ongoing performance, future fundraisings, and other factors.

The company cannot assure this internal valuation for IQST common shares will ever translate into actual pricing of our securities in the public market, and no third parties have undertaken any efforts to verify our internal results.

| Page 31 of 39 | August, 2024 |

Cap Table (Not Fully Diluted) & Current Outstanding Debt as August 1st, 2024

| Common Shares | |

| Total Authorized | 300,000,000 |

| Total Outstanding | 183,535,742 |

| Restricted | 6,514,999 |

| Free Trading Shares | 177,020,743 |

| | |

| Preferred Shares | |

| Authorized | 1,200,000 |

| | |

| Preferred Series A | |

| Authorized | 10,000 |

| Outstanding | 10,000 |

| | |

| Preferred Series B | |

| Authorized | 200,000 |

| Outstanding | 31,080 |

| | |

| Preferred Series C | |

| Authorized | 200,000 |

| Outstanding | - |

| | |

| Preferred Series D | |

| Authorized | 75,000 |

| Outstanding | - |

| Page 32 of 39 | August, 2024 |

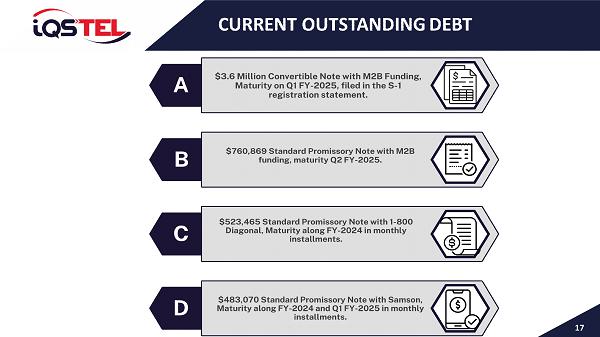

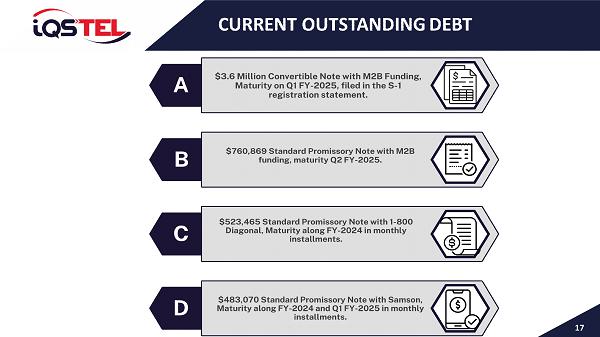

Current Outstanding Debt:

The company has recently raised funds to complete the acquisition of QXTEL and to support the organic growth, and the following lists the more relevant debts summarized of the company:

| A. | $3.6 Million Convertible Note with M2B Funding, Maturity on Q1 FY-2025. |

| B. | $760,869 Standard Promissory Note with M2B funding, maturity Q2 FY-2025. |

| C. | $523,465 Standard Promissory Note with 1-800 Diagonal, Maturity along FY-2024 in monthly installments. |

| D. | $483,070 Standard Promissory Note with Samson, Maturity along FY-2024 and Q1 FY-2025 in monthly installments. |

| Page 33 of 39 | August, 2024 |

X. Current Capital Requirements and Use of Proceeds

The intention of the company is to raise up to $10.5 Million to redeem all the debts, and have around $5 Million available to support the M&A campaign and organic growth.

It is important to state that the company, over the last 5 years, has built trusting and committed relationships with its debt investors. In particular, the company has built a great relationship with our biggest investor, M2B Funding. We believe this history attests to the potential for a smooth process with all future funders and lenders for a prompt return on investment and repayment of debts.

We have been working with funders and lenders to structure potential financing that accomplishes our goals, and we are continually exploring options and different instruments available in the current capital markets.

XI. Nasdaq Uplisting

For the past two years, the company has been actively engaged in an information exchange with our Nasdaq analyst and FINRA. These efforts are focused on preparing the Company for a potential uplisting to the Nasdaq stock exchange.

Management believes that FY-2024 is the optimal time for the Company to get listed on the NASDAQ exchange and is actively working towards this goal.

As part of the preparation for the NASDAQ listing, the company plans to participate in key investor conferences and explore engagement with investment banks and underwriters. These activities are expected to complement our efforts to achieve this significant milestone within the established time frame and with the technical and financial requirements in place.

XII. Management

Leandro Jose Iglesias, President & CEO, Chairman of the Board

Mr. Leandro Iglesias, with over 20 years of experience in the telecommunications industry, founded Etelix in 2008 and served as its President and CEO until final merger and renaming to IQSTEL, Inc. Before establishing Etelix, Mr. Iglesias was the International Business Manager at CANTV/Movilnet, the largest telecommunications provider in Venezuela, from January 2003 to July 2008, during its period under Verizon's control. Prior to his role at CANTV/Movilnet, he served as Executive Vice President, overseeing the Latin America marketing division of American Internet Communications from August 1998 to December 2002.

| Page 34 of 39 | August, 2024 |

Mr. Iglesias has specialized in international long-distance traffic business, submarine cables, satellite communications, and international roaming services. He holds an Electronic Engineering degree from Universidad Simon Bolivar, has completed the Management Program at IESA Business School, and earned an MBA from Universidad Nororiental Gran Mariscal de Ayacucho.

Mr. Iglesias's extensive experience and expertise in the telecom industry make him a valuable asset to our Board of Directors.

Alvaro Quintana Cardona, CFO and Secretary of the Board

Alvaro Quintana brings over twenty years of experience in the telecommunications industry, specializing in regulatory affairs, strategic planning, value-added services, and international interconnection agreements. Since joining Etelix in 2013, he has served as Chief Operating Officer and Chief Financial Officer. Prior to Etelix, Mr. Quintana was the Interconnection and Value-Added Services Manager at Digitel, a Venezuelan mobile service provider and former subsidiary of Telecom Italia Mobile, from June 2004 to May 2013.

Mr. Quintana holds a Bachelor’s Degree in Business Administration and a Specialist Degree in Economics from Universidad Catolica Andres Bello. Additionally, he earned a Master’s in Telecommunications from the EOI Business School in Spain.

We believe Mr. Quintana’s extensive experience and expertise in the telecommunications industry make him a valuable addition to our Board of Directors.

Raul A Perez, Independent Member of the Board, and Head of Audit Committee

Mr. Perez brings over 40 years of experience in finance, holding various positions since 1970 to our company. He currently serves as CFO of Deerbrook Family Dentistry, PC, in Humble, Texas, a role he has held since December 1, 2014. Previously, he was a Senior Accountant at Principrin School, PC, in Houston, Texas, from November 1, 2017, to January 31, 2019.

| Page 35 of 39 | August, 2024 |

Throughout his career, Mr. Perez has held numerous finance roles, including Corporate Treasurer for major corporations. He spent five years at Sudamtex of Venezuela, C.A., and ten years at Polar Brewery in Caracas, Venezuela. In 2000, he became a Director of the Securities and Exchange Commission of Venezuela, overseeing the country's stock market participants. In 2004, he earned certification as a Venezuelan Investment Advisor. As an independent contractor, he served as Corporate Compliance Officer for Activalores Casa de Bolsa, developing compliance units and manuals in accordance with anti-money laundering laws. He also taught Corporate Finance and Managerial Accounting at the Advanced Institute of Finance (IAF) in Caracas for five years.

Mr. Perez holds a Bachelor's degree in Accounting (1976) and an MBA in Finance (1982), providing him with comprehensive knowledge of finance and business operations.

Mr. Perez is a valuable independent director due to his extensive education, skills, and experience in finance, as well as his regulatory expertise.

Jose Antonio Barreto, Independent Member of the Board & Head of the Ethic Code Committee

Mr. Barreto has been the Chief Business Development Officer at Xpectra Remote Management in Mexico since 2006. In this role, he has directed all aspects of account development and sales efforts, targeting private and government opportunities, and developing strategic accounts across Mexico and the LATAM region. Since 2020, he has also served as an advisor to our Board of Directors.

With over 30 years of experience in telecommunications and technology, Mr. Barreto has led business development and operational activities, including technical, operational, and financial analyses for several telecommunications and technology company acquisitions. Over the last 14 years, he has been a leader in North and Central America, driving commercial processes in technology security, artificial intelligence, Internet of Things (IoT) platforms, and cutting-edge technology solutions and software systems.

He holds a degree in Electronic Engineering from Universidad Simón Bolivar, a Master of Science in Electrical and Computer Engineering from Rice University, and a Master's in Telecommunications Management from Universidad Simón Bolivar and Telecom SudParis Institute.

Mr. Barreto is a valuable independent director due to his extensive education, skills, and experience in technology companies.

| Page 36 of 39 | August, 2024 |

Italo R. Segnini, Independent Board of Director and Head of the Compensation Committee

From March 2020 to the present, Mr. Segnini has served as the Global Carrier Partnership Director at Sierra Wireless. Prior to this, he was an Independent Telecom Consultant from June 2019 to February 2020. From 2017 to 2019, he served as Director of International Carrier Business for Televisa Telecom, and from 2012 to 2019, he was the Director of International Carrier Business for Millicom.

Mr. Segnini is a seasoned professional in the telecommunications industry with over 20 years of high-level experience at Global Tier One companies, including Telefonica, Millicom, Televisa, and Sierra Wireless. He has extensive executive experience in various telecom areas such as Voice, A2P, SMS, Data, Roaming, Mobility Services, B2B, MNO, MVNO, IoT, and Interconnection. He has a solid track record in international commercial negotiations, management, sales, business development, regulatory, and operations.

Mr. Segnini holds a Juris Doctor degree from Andres Bello Catholic University, a Master’s Degree in Telecommunications from Madrid Pontificia Comillas University, and an MBA from IESA Business School.

Mr. Segnini is a valuable independent director because of his extensive education, skills, and experience in the telecommunications industry.

XIII. Final Summary

iQSTEL Inc. (OTCQX: IQST) is a US-based, multinational publicly held company, currently in the process of preparing for a Nasdaq listing. In FY2023, the company achieved $144.5 million in revenue and is projecting a significant increase in FY2024 to $290 million with a seven digit positive operating income.

iQSTEL has achieved an annualized revenue run rate in excess of $300 million dollars with a trailing twelve months over $200 million. We believe the company is well on track to reach its billion-dollar revenue milestone by 2027 and is evolving into a telecommunications and technology powerhouse.

iQSTEL is a capable company with a proven record of strong performance:

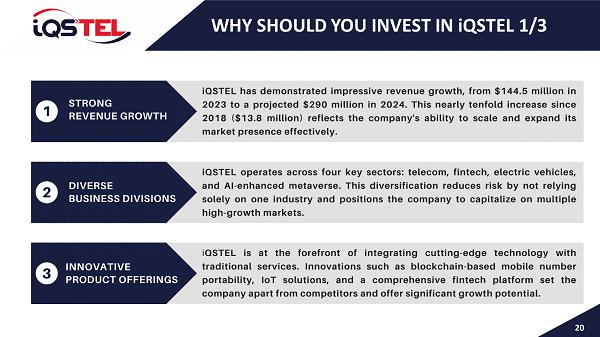

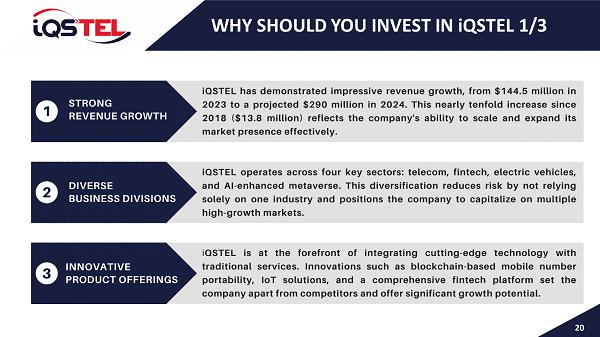

| · | Strong Revenue Growth: iQSTEL has demonstrated impressive revenue growth, from $144.5 million in 2023 to a projected $290 million in 2024. This nearly tenfold increase since 2018 reflects the company's ability to scale and effectively expand its market presence. |

| Page 37 of 39 | August, 2024 |

| · | Diverse Business Divisions: iQSTEL operates across four key sectors: telecommunications, fintech, electric vehicles (EV), and AI-enhanced metaverse. This diversification reduces risk by not relying solely on one industry and positions the company to capitalize on multiple high-growth markets. |

| · | Innovative Product Offerings: iQSTEL is at the forefront of integrating cutting-edge technology with traditional services. Innovations such as blockchain-based mobile number portability, IoT solutions, and a comprehensive fintech platform set the company apart from competitors and offer significant growth potential. |

| · | Strategic Growth Plans: The company has a well-defined growth strategy that combines organic expansion with strategic acquisitions. The planned acquisition in 2025, expected to add up to $300 million in revenue, underscores iQSTEL’s commitment to aggressive expansion. |

| · | Experienced Leadership: iQSTEL’s management team is composed of seasoned professionals with extensive experience in telecommunications, finance, and technology. Their leadership has been instrumental in driving the company’s growth and navigating complex market challenges. |

| · | Upcoming Nasdaq Uplisting: iQSTEL is preparing for an uplisting to a national exchange, with Nasdaq as the primary target. This move is likely to increase the company’s visibility, attract institutional investors, and improve liquidity, which could drive the stock price higher. |

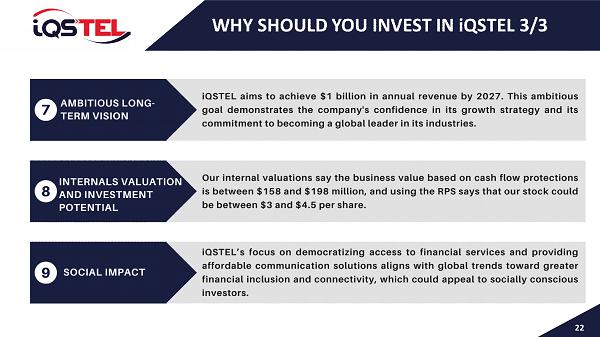

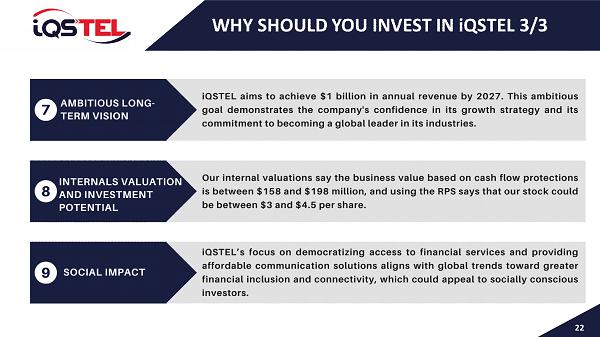

| · | Ambitious Long-Term Vision: iQSTEL aims to achieve $1 billion in annual revenue by 2027. This ambitious goal demonstrates the company's confidence in its growth strategy and its commitment to becoming a global leader in its industries. |

| o | Based on the net present value of the company’s current and anticipated cash generation from 2024 through 2027, and the anticipated residual cash generation after 2027, we internally calculated iQSTEL’s current business valuation to be between $158 million and $198 million, this valuation suggests substantial upside potential, especially considering future contributions expected from the fintech, EV, and metaverse divisions. |

| o | Another internal valuation approach, based on the projected Revenue Per Share (RPS) of $1.50 for FY-2024 and typical industry P/S ratios between 1x to 5x, estimates iQSTEL’s stock could be valued between $3.00 and $4.50 per share. This is a rough estimate, and the actual market value may vary depending on investor sentiment, broader market conditions, future fundraisings, the company’s financial performance, and other factors. The company cannot assure this internal valuation for IQST common shares will ever translate into actual pricing of our securities in the public market, and no third parties have undertaken any efforts to verify our internal results. |

| Page 38 of 39 | August, 2024 |

| · | Social Impact: iQSTEL’s focus on democratizing access to financial services and providing affordable communication solutions aligns with global trends toward greater financial inclusion and connectivity, which could appeal to socially conscious investors. |

In summary, iQSTEL offers exposure to multiple high-growth industries, supported by a strong growth trajectory, innovative technologies, and a strategic plan aimed at significant long-term value creation.

We have used and continue to use a roll-up strategy to achieve the rapid growth of our telecommunications and value-added technology businesses. We believe the consistent organic growth and synergies that we have achieved following acquisitions will continue to improve our bottom line and increase shareholder value by increasing the company’s overall market valuation. We also believe our $1 Billion Plan is ideally timed with our Nasdaq up-listing initiative.

For additional inquiries, please contact:

Leandro José Iglesias (CEO) and Alvaro Quintana (CFO) at investors@iqstel.com.

| Page 39 of 39 | August, 2024 |

on has been prepared by iQSTEL Inc . (“we,” “us,” “our,” “ iQSTEL ” or the “Company”) . This presentation does not constitute an offer of any securities for sale . Any securities offered privately will not be or have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements, nor shall there be any offer or sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction . The information set forth herein does not purport to be complete or to contain all of the information you may desire . Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof . This presentation contains forward - looking statements . These forward - looking statements should not be used to make an herefore, you should not rely on any of these forward - looking statements . Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward - looking statements include, among others, competition within the industries in which we operate, the timing, cost and success or failure of new product and service introductions and developments, our ability to attract and retain qualified personnel, maintaining our intellectual property rights and litigation involving intellectual property rights, legislative, regulatory and economic developments, and the other risks and uncertainties described in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of our most recently filed Annual Report on Form 10 - K and any subsequently filed Quarterly Report(s) on Form 10 - Q . Any forward - looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made . We undertake no obligation to publicly update any forward - looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise . 2

3. Agenda 4. Snapshot 5. Introduction 6. Corporate Strategy 7. Business Divisions 8. Innovate Product Offering 9. Global Footprint 10. Explosive Growth Rate 11. Growth Strategy 12. $1 Billion Revenue Plan for 2027 3 13. Internal Valuation Based on Cash Flow 14. Internal Valuation Based on RPS 15. Market Cap vs. Revenue Evolution 16. Company Ownership Cap Table 17. Current Outstanding Debt 18. Leadership Team 19. Current Capital Requirements 20. Why Should You Invest in iQSTEL 23. Final Message 24. Contact the Founders

FOUNDED June 2018 US - Based Telecom and Technology Company REVENUE $144.5 million in FY - 2023 Projected $290 million for FY - 2024 . TRADED ON OTCQX iQSTEL is traded on OTCQX under the ticker symbol IQST. GLOBAL PRESENCE Operations in 20 countries with offices in Miami, Caracas, Buenos Aires, London, Zurich, Istanbul, and Dubai 4

5 1. 12 STRATEGIC ACQUISITIONS AND ORGANIC GROWTH 2. 98 % REVENUE COMES FROM TELECOM DIVISION 3. iQSTEL REPORTED $ 144 . 5 MILLION IN FY - 2023 4. $ 290 MILLION REVENUE FORECAST IN FY 2024 5. iQSTEL PLANS TO RAISE UP TO $ 10 . 5 MILLION TO STRENGHT BALANCE SHEET FOR NASDAQ LISTING 6. iQSTEL PLANS TO GROWTH ORGANICALLY TO $ 0 . 5 BILLION IN 2027 7. iQSTEL IS EXPLORING AN STRATEGIC ACQUISITION THAT COULD ADD $ 200 - $ 300 MILLION REVENUE 8. IF THIS STRATEGIC ACQUISITION HAPPENED, IQSTEL WILL LOOK FOR $ 30 M FUNDING 9. IQSTEL ORGANIC GROWTH PLUS STRATEGIC ACQUISICION PLANS TO ACHIEVE $ 1 B IN 2027 10. MANAGEMENT CAPABILITIES, $ 13 . 8 M IN 2018 TO $ 290 M IN 2024

To deliver high - quality communication, connectivity, and financial services globally To become a global leader in telecommunications and technology, aiming for $1 billion in annual revenue by 2027 MISSION VISION 6

7 Notice : Even though this business line is important for iQSTEL , once we reach certain development, we may, after weighing all of the relevant factors and relevant laws, decide to spin off this business as an independent public company with a new capital structure, board of directors, and management team .

8 The company’s robust growth strategy, innovative product offerings . Notice : The acquisition of Lynktel is in process, and the company is actively conducting due diligence . While we expect to close this deal during the Q 3 FY - 2024 , there are no assurances that the deal will close as planned .

9 iQSTEL is on a clear path to becoming a major player in the global telecom and technology sectors .

10 FINANCIAL PERFORMANCE • The revenue is on track to achieve $ 290 million FY - 2024 , • June 30 , 2024 , we have achieved 45 % of that goal . • The seasonality of the business indicates that revenue in the second half of the year is higher than in the first half . • In the first six months of this year we have done 90 % of the revenue done in the 12 months of 2023 ( $ 130 million as of June 30 , 2024 compared to $ 144 . 5 million as of December 31 , 2023 ) . • We have doubled the size of the company in six months in terms of sales . It is important to note that the $ 290 million forecast does not include contributions from our most recent potential acquisition of Lynk Telecom .

ORGANIC GROWTH Driven by integrating acquired subsidiaries, cross - selling, and cost optimization . ACQUISITIONS Improving our portfolio of products and customer relations ACQUISITIONS AND VENTURES 12 in Total 11 Notice: The acquisition of Lynktel is in process, and the company is actively conducting due diligence. While we expect to close this deal during the Q3 FY - 2024, there are no assurances that the deal will close as planned.

12 KEEP OUR ORGANIC GROWTH • half of the $ 1 billion in annual revenue is expected from organic sales growth . ONE STRATEGIC ACQUISITION • quarter of the $ 1 billion in annual revenue is expected to be achieved through one strategic acquisition . • other quarter of the $ 1 billion revenue is expected from organic sales growth and synergies . The $1 Billion Plan is built primarily on the planned expansion of the company’s sales that today are primarily generated from telecommunication services. Any contributions to revenue and operating income from our Fintech, Electric Vehicle and AI - Enhanced Metaverse divisions will augment the projected $1 billion in sales.

13 This valuation is based on future cash flow projections and does not account for the potential contributions from the company's newer divisions, such as Fi ntech, Electric V ehicles (EV), and AI - Enhanced Metaverse, or the significant acquisition planned for 2025 . The company cannot assure this internal valuation for IQST common shares will ever translate into actual pricing of our securities in the public market, and no third parties have undertaken any efforts to verify our internal results . VALUATION The company’s internal valuation, estimated between $ 158 million and $ 198 million, suggests substantial upside potential, especially considering future contributions expected from the Fintech, EV, and Metaverse divisions .

REVENUE PER SHARE (RPS) Another internal valuation approach, based on the projected Revenue Per Share (RPS) of $ 1 . 50 for FY - 2024 and typical industry P/S ratios between 1 x to 5 x , estimates iQSTEL’s stock could be valued between $ 3 . 00 and $ 4 . 50 per share . 14 This is an internal estimation, and the company cannot guarantee that the IQST common shares will reach this price level. The ac tual stock price will depend on various external factors, including market conditions, the company’s ongoing performance, future fundraisings, and other factors. The company cannot assure this internal valuation for IQST common shares will ever translate into actual pricing of our secur iti es in the public market, and no third parties have undertaken any efforts to verify our internal results.

15 MA

RKET CAP HAS NOT FOLLOWED

16 As of August 1 st , 2024

17

18

19 ▪ $ 10 . 5 million to strength balance sheet in combination to NASDAQ uplisting ▪ IF the company decided to acquire a strategic acquisition to double the business size once be in Nasdaq the company will seek to raise additional $ 30 million . ▪ Over the past 5 years, the company has built strong, trusting relationships with debt investors, especially with its largest investor/lender, M 2 B Funding .

20

21

22

23 iQSTEL has an explosive growth rate, the imminent Nasdaq listing, with the mid term and long term plans to growth the company from $ 290 million revenue this year to $ 1 billion revenue in FY - 2027 , in conjunction with the market cap has not followed the revenue growth yet .

CEO & Chairman Leandro Jose Iglesias CFO Alvaro Quintana

THE REVENUE GROWTH YET Even thought the rapid revenue growth of the company, the market cap has not followed it yet.