Exhibit 5.2

DEHENG SHANGHAI LAW OFFICE

LEGAL OPINION

OF

THE RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC.

DEHENG SHANGHAI LAW OFFICE

23/F, Sinar Mas Plaza, 501 East Daming Road, Hongkou District, Shanghai

Tel: 86-21-5598 9888 FAX: 86-21-5598 9898 Post Code: 200080

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

To:

Mercurity Fintech Holding Inc

1330 Avenue of Americas, Fl 33,

New York, 10019,

United States

26th, May, 2023

RE: LEGAL OPINION OF THE RESALE BY THE SELLING SHAREHOLDERS OF MFH

Dear Sir(s)/Dear Madam(s),

| 1.1 | We have acted as the PRC legal counsel to the MFH and have taken instruction solely from the MFH to provide this Opinion in connection with the analysis that whether MFH shall fulfill the filing procedure with the CSRC in overseas offering and listing hereby render this legal opinion as per your request. |

| 1.2 | Terms used in this legal opinion have the meaning ascribed to such terms in the Annex or this legal opinion. |

This legal opinion is limited the PRC laws in effect as the date of this legal opinion and is, together with all terms used in it, to be construed in accordance with PRC law. This Opinion will be governed by and construed in accordance with the PRC Laws. There is no assurance that such laws and regulations will not be repealed, amended, or replaced in the immediate future or in the long term with or without retrospective effect. We do not express any opinions (factual or legal) on any matters not expressed set out in this legal opinion.

| 3. | DOCUMENTS AND CONFIRMATIONS FORMING THE BASIS OF THE LEGAL OPINION |

| 3.1 | We have examined (prints of electronic) copies of the following Documents for purposes of the issue of the legal opinion: |

| 3.1.1 | Business License of Lianji Future; |

| 3.1.2 | Certificate of Incorporation of MFH; |

| 3.1.3 | The selected consolidated financial data of MFH in 2022; |

| 3.1.4 | The unaudited consolidated financial data of Lianji Future in 2022; |

| 3.1.5 | Form of Register of directors and officers of MFH; |

| 3.1.6 | Passports or Identified Card of all directors and executive officers of MFH; |

| 3.1.7 | The 20-F Form (annual and transition report of foreign private issuers[section 13 or 15(d)](Acc-no:0001410578-23-000790); |

| 3.1.8 | The F-1 Form (Registration Statement Under the Securities Act of 1933-Mercurity Fintech Holding Inc.); |

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

| 3.1.9 | The written statement of MFH. |

| 3.2 | In addition, we have received the Confirmations and have relied on the confirmations contained in the written statement. |

| 3.3 | Our examination has been limited to the literal text of the Documents and we have not had regard to any matters no expressly set out in the Documents. |

This Opinion is provided on the basis of the following assumptions and statements:

| 4.1 | All signatures, seals and chops are genuine, that all documents submitted to us as originals are authentic and complete and that all documents submitted to us as copies are complete and conform to the originals and that such originals are themselves authentic; |

| 4.2 | All factual statements made in the Reviewed Documents are correct and complete; |

| 4.3 | The income derived by other subsidiaries of the Company (except for the PRC Subsidiaries) does not directly relate to the offices or premises established by MFH within the territory of the PRC (if any); |

| 4.4 | All confirmations (as well as all confirmations included in the written statement) are true and correct. |

Based upon our review of the above referenced Company documents, our law firm has ascertained the following facts of the Company:

| 5.1 | MFH Cayman is a Cayman Islands incorporated company, and the ordinary shares of MFH currently trade on the NASDAQ, under the symbol “MFH”. MFH distributes computing and storage services (including cryptocurrency mining) and digital consultation services business. MFH plans to develop online and traditional brokerage services. |

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

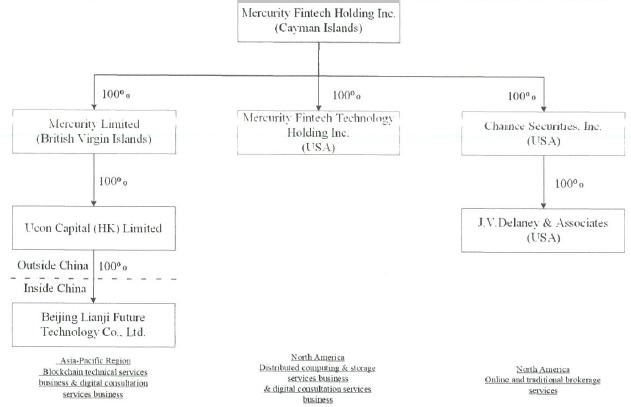

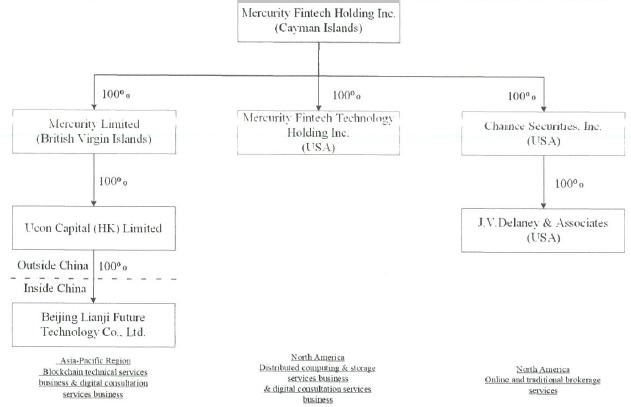

| 5.2 | The following diagram illustrates the current corporate structure of MFH. |

Mercurity Limited (British Virgin Islands), Mercurity Fintech Technology Holding Inc. and Chaince Securities, Inc. are consolidated subsidiaries of the Company, and MFH Cayman is the ultimate controlling shareholder of Lianji Future which is the only one subsidiary entity incorporated and established in PRC.

| 6. | PERTINENT LAW AND EXPLANATION |

| 6.1 | CSRC Released Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, which effected on 31st March, 2023 (the Trial Administrative Measures) ( ). According to the trial administrative measures, a domestic company that seeks to offer and list securities in overseas markets shall fulfill the filing procedure with the CSRC as per requirement of this measures, submit relevant materials that contain a filing report and a legal opinion, and provide truthful, accurate and complete information on the shareholders etc. Where a domestic company seeks to directly offer and list securities in overseas markets, the issuer shall file with the CSRC. Where a domestic company seeks to indirectly offer and list securities in overseas markets, the issuer shall designate a major domestic operating entity, which shall, as the domestic responsible entity, file with the CSRC. ). According to the trial administrative measures, a domestic company that seeks to offer and list securities in overseas markets shall fulfill the filing procedure with the CSRC as per requirement of this measures, submit relevant materials that contain a filing report and a legal opinion, and provide truthful, accurate and complete information on the shareholders etc. Where a domestic company seeks to directly offer and list securities in overseas markets, the issuer shall file with the CSRC. Where a domestic company seeks to indirectly offer and list securities in overseas markets, the issuer shall designate a major domestic operating entity, which shall, as the domestic responsible entity, file with the CSRC. |

| 6.2 | In the article 2 of the Trial Administrative Measures, direct overseas offering and listing by domestic companies refers to such overseas offering and listing by a joint-stock company incorporated domestically. Indirect overseas offering and listing by domestic companies refers to such overseas offering and listing by a company in the name of an overseas incorporated entity, whereas the company’s major business operations are located domestically, and such offering and listing is based on the underlying equity, assets, earnings, or other similar rights of a domestic company. |

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

| 6.3 | Article 15 of the Trial Administrative Measures provides that any overseas offering and listing made by an issuer that meets both the following conditions will be determined as indirect: (1) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by domestic companies; and (2) the main parts of the issuer's business activities are conducted in the Chinese Mainland, or its main places of business are located in the Chinese Mainland, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in the Chinese Mainland. The determination as to whether or not an overseas offering and listing by domestic companies is indirect, shall be made on a substance over form basis. |

Based on the foregoing, and subject to any further assumptions and qualifications set forth below, we are of the opinion that on the date hereof:

| 7.1 | The resale by the selling shareholders of MFH is not referred as direct overseas offering and listing. |

| 7.1.1 | Article 2 of the Trial Administrative Measures provides direct overseas offering and listing by domestic companies refers to such overseas offering and listing by a joint-stock company incorporated domestically. |

| 7.1.2 | Upon our review of the relevant corporate documents, it is our opinion that MFH Cayman is a Cayman Islands holding company, and it is not a joint-stock company incorporated domestically. Therefore, pursuant to the article 2 of the Trial Administrative Measures, the resale by the selling shareholders of MFH is not referred as direct overseas offering and listing. |

| 7.2 | The resale by the selling shareholders of MFH is not deemed as indirect overseas offering and listing. |

| 7.2.1 | In the Article 15 of the Trial Administrative Measures ,any overseas offering and listing made by an issuer that meets both the following conditions will be determined as indirect: (1) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by domestic companies; and (2) the main parts of the issuer’s business activities are conducted in the Chinese Mainland, or its main places of business are located in the Chinese Mainland, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in the Chinese Mainland. The determination as to whether or not an overseas offering and listing by domestic companies is indirect, shall be made on a substance over form basis. |

| 7.2.2 | The following chart compared the selected consolidated financial data of MFH in 2022 with the unaudited financial data of Lianji Future in the same accounting year. |

| Balance sheet data(in U.S. Dollars): | | MFH | | | Lianji Future | |

| Total assets | | $ | 18,893,081.33 | | | $ | 816,465.39 | |

| Total shareholders’ equity(deficit) | | $ | 16,828,862.60 | | | $ | (464,955.77 | ) |

| Total revenues | | $ | 863,437.85 | | | | 0 | |

| (Loss)/income before provision for income taxes | | $ | (5,883,682.56 | ) | | $ | (177,052.99 | ) |

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

According to the financial data above, less than 50% of the MFH operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by Lianji Future.

| 7.2.3 | According to the 20-F Form and written statement of MFH, the operation of MFH’s business depends on the performance and reliability of the Internet and mobile telecommunication infrastructures in the United States and Hong Kong. Since December 2021, MFH has not operated business in China. And the principal executive offices are in New York, United States. |

The following chart illustrates where resources of revenues of MFH came from in Year 2021 and Year 2022.

| | | Chinese Mainland | | HONGKONG | | | U.S | |

| 2021 | | $120,000

(Gains from discontinued operations) | | $ | 664,307 | | | | 0 | |

| 2022 | | $0 | | $ | 783,089 | | | $ | 80,348 | |

| 7.2.4 | The following chart sets for certain information relating to MFH’s directors and executive officers as of the disclosure date of 20-F form.. |

Directors and

Executive Officers | | Nationality | | Age | | Position/Title |

| Shi Qiu | | CHINA | | 32 | | Chief Executive Officers and Director |

| Lynn Alan Curtis | | U. S | | 80 | | Chairperson of the Board of Directors |

| Daniel Kelly Kennedy | | U. S | | 39 | | Director |

| Zheng Cui | | U. S | | 37 | | Director |

| Qian Sun | | CHINA | | 35 | | Chief Operating Officer and Director |

| Hui Cheng | | CHINA | | 31 | | Director |

| Xiang Qu | | CHINA | | 36 | | Independent Director |

| Er-Yi Toh | | SINGAPROE | | 39 | | Independent Director |

| Cong Huang | | CHINA | | 41 | | Independent Director |

| Keith Tan Jun Jie | | MALAYSIA | | 30 | | Director |

| Yukuan Zhang | | CHINA | | 35 | | Chief Financial Officer |

As shown in the table above, the Chief Executive Officers, the Chief Operating Officers and the Chief Financial Officer are all Chinese citizens.

| 7.2.5 | Based upon the documents provided by the Company and our review of the applicable securities law, although all the senior managers in charge of its business operation and management are Chinese citizens, less than 50% of the MFH operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by Lianji Future. Therefore, as defined in the article 15 of the Trial Administrative Measures, MFH does not satisfy one of conditions of the measures. We have reasons to believe that the resale by the selling shareholders of MFH is not referred as indirect overseas offering and listing. |

In conclusion, it is our opinion that MFH is not subjected to fulfill the filing procedure for the resale by the selling shareholders with the CSRC in accordance with the Trial Administrative Measures.

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

| 8. | CONFIDENTIALITY AND RELIANCE |

| | In issuing this opinion, we acknowledge that each shareholder of the Company and the securities broker/dealers through whom such shareholders may seek to sell their Company shares may rely upon this opinion. It or any of its copies shall not be transmitted to anyone else nor shall it be relied upon by anyone else or for any other purpose without our prior written permission except as may be required in connection with any actual or potential regulatory, investigatory or legal process or the actual or potential inquiry or demand of any regulatory, investigatory or governmental authority with jurisdiction over any of the foregoing or to the extent required by any applicable law or regulation. |

(The remaining is intentionally left blank)

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

(Signature Page)

Yours faithfully,

DEHENG SHANGHAI LAW OFFICE

| DEHENG SHANGHAI LAW OFFICE | LEGAL OPINION OF THE

RESALE BY THE SELLING SHAREHOLDERS OF

MERCURITY FINTECH HOLDING INC. |

Annex

In this legal opinion, unless otherwise indicated or the context otherwise requires, references to:

“Company”, “MFH” refers to Mercurity Fintech Holding Inc., and its consolidated subsidiaries, including Mercurity Fintech Technology Holding Inc., Mercurity Limited, Ucon Capital (HK) Limited, Beijing Lianji Future Technology Co., Ltd. and Chaince Securities, Inc.;

“MFH Cayman” refers to Mercurity Fintech Holding Inc;

“Lianji Future” refers to Beijing Lianji Future Technology Co., Ltd, the consolidated subsidiary of MFH;

“CSRC” refers to China Securities Regulatory Commission;

“SEC” refers to United States Securities and Exchange Commission;

“NASDAQ” refers to National Association of Securities Dealers Automated Quotations;

“China”or the “PRC” refers to the mainland the People’s Republic of China, excluding, for the purpose of this legal opinion only and references to the specific laws and regulations, Hong Kong, Macau and Taiwan;

“PRC Laws” refers to the laws of the China which are directly applicable and as they exist and interpreted at the date of the legal opinion;

“RMB” or “Renminbi” refers to the legal currency of China;

“$”, “US$”, “U.S dollar”refers to the legal currency of the United States.

). According to the trial administrative measures, a domestic company that seeks to offer and list securities in overseas markets shall fulfill the filing procedure with the CSRC as per requirement of this measures, submit relevant materials that contain a filing report and a legal opinion, and provide truthful, accurate and complete information on the shareholders etc. Where a domestic company seeks to directly offer and list securities in overseas markets, the issuer shall file with the CSRC. Where a domestic company seeks to indirectly offer and list securities in overseas markets, the issuer shall designate a major domestic operating entity, which shall, as the domestic responsible entity, file with the CSRC.

). According to the trial administrative measures, a domestic company that seeks to offer and list securities in overseas markets shall fulfill the filing procedure with the CSRC as per requirement of this measures, submit relevant materials that contain a filing report and a legal opinion, and provide truthful, accurate and complete information on the shareholders etc. Where a domestic company seeks to directly offer and list securities in overseas markets, the issuer shall file with the CSRC. Where a domestic company seeks to indirectly offer and list securities in overseas markets, the issuer shall designate a major domestic operating entity, which shall, as the domestic responsible entity, file with the CSRC.