March 2022 Investor Presentation EXHIBIT 99.1

This presentation, including any oral statements made regarding the contents of this presentation, contains forward-looking statements as defined under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, that address activities that Laredo Petroleum, Inc. (together with its subsidiaries, the “Company”, “Laredo” or “LPI”) assumes, plans, expects, believes, intends, projects, indicates, enables, transforms, estimates or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The forward- looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events. Such statements are not guarantees of future performance and involve risks, assumptions and uncertainties. General risks relating to Laredo include, but are not limited to, the decline in prices of oil, natural gas liquids and natural gas and the related impact to financial statements as a result of asset impairments and revisions to reserve estimates, the ability of the Company to execute its strategies, including its ability to successfully identify and consummate strategic acquisitions at purchase prices that are accretive to its financial results and to successfully integrate acquired businesses, assets and properties, oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries (“OPEC+”), the outbreak of disease, such as the coronavirus (“COVID-19”) pandemic, and any related government policies and actions, changes in domestic and global production, supply and demand for commodities, including as a result of the COVID-19 pandemic and actions by OPEC+, long-term performance of wells, drilling and operating risks, the increase in service and supply costs, tariffs on steel, pipeline transportation and storage constraints in the Permian Basin, the possibility of production curtailment, hedging activities, the impacts of severe weather, including the freezing of wells and pipelines in the Permian Basin due to cold weather, possible impacts of litigation and regulations, the impact of the Company’s transactions, if any, with its securities from time to time, the impact of new laws and regulations, including those regarding the use of hydraulic fracturing, the impact of new environmental, health and safety requirements applicable to the Company’s business activities, the possibility of the elimination of federal income tax deductions for oil and gas exploration and development and other factors, including those and other risks described in its Annual Report on Form 10-K for the year ended December 31, 2021, Current Report on Form 8-K, filed with the Securities and Exchange Commission ("SEC") on May 11, 2021, and those set forth from time to time in other filings with the SEC. These documents are available through Laredo’s website at www.laredopetro.com under the tab “Investor Relations” or through the SEC’s Electronic Data Gathering and Analysis Retrieval System at www.sec.gov. Any of these factors could cause Laredo’s actual results and plans to differ materially from those in the forward-looking statements. Therefore, Laredo can give no assurance that its future results will be as estimated. Any forward-looking statement speaks only as of the date on which such statement is made. Laredo does not intend to, and disclaims any obligation to, correct, update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. The SEC generally permits oil and natural gas companies, in filings made with the SEC, to disclose proved reserves, which are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. In this presentation, the Company may use the terms “resource potential,” “resource play,” “estimated ultimate recovery,” or “EURs,” “type curve” and “standardized measure,” each of which the SEC guidelines restrict from being included in filings with the SEC without strict compliance with SEC definitions. These terms refer to the Company’s internal estimates of unbooked hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling or recovery techniques. “Resource potential” is used by the Company to refer to the estimated quantities of hydrocarbons that may be added to proved reserves, largely from a specified resource play potentially supporting numerous drilling locations. A “resource play” is a term used by the Company to describe an accumulation of hydrocarbons known to exist over a large areal expanse and/or thick vertical section potentially supporting numerous drilling locations, which, when compared to a conventional play, typically has a lower geological and/or commercial development risk. “EURs” are based on the Company’s previous operating experience in a given area and publicly available information relating to the operations of producers who are conducting operations in these areas. Unbooked resource potential and “EURs” do not constitute reserves within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management System or SEC rules and do not include any proved reserves. Actual quantities of reserves that may be ultimately recovered from the Company’s interests may differ substantially from those presented herein. Factors affecting ultimate recovery include the scope of the Company’s ongoing drilling program, which will be directly affected by the availability of capital, decreases in oil, natural gas liquids and natural gas prices, well spacing, drilling and production costs, availability and cost of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, negative revisions to reserve estimates and other factors, as well as actual drilling results, including geological and mechanical factors affecting recovery rates. “EURs” from reserves may change significantly as development of the Company’s core assets provides additional data. In addition, the Company’s production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. “Type curve” refers to a production profile of a well, or a particular category of wells, for a specific play and/or area. The “standardized measure” of discounted future new cash flows is calculated in accordance with SEC regulations and a discount rate of 10%. Actual results may vary considerably and should not be considered to represent the fair market value of the Company’s proved reserves. This presentation includes financial measures that are not in accordance with generally accepted accounting principles (“GAAP”), such as Adjusted EBITDA and Free Cash Flow. While management believes that such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. For definitions of such non-GAAP financial measures, please see the Appendix. Unless otherwise specified, references to “average sales price” refer to average sales price excluding the effects of the Company’s derivative transactions. All amounts, dollars and percentages presented in this presentation are rounded and therefore approximate. 2 Forward-Looking / Cautionary Statements

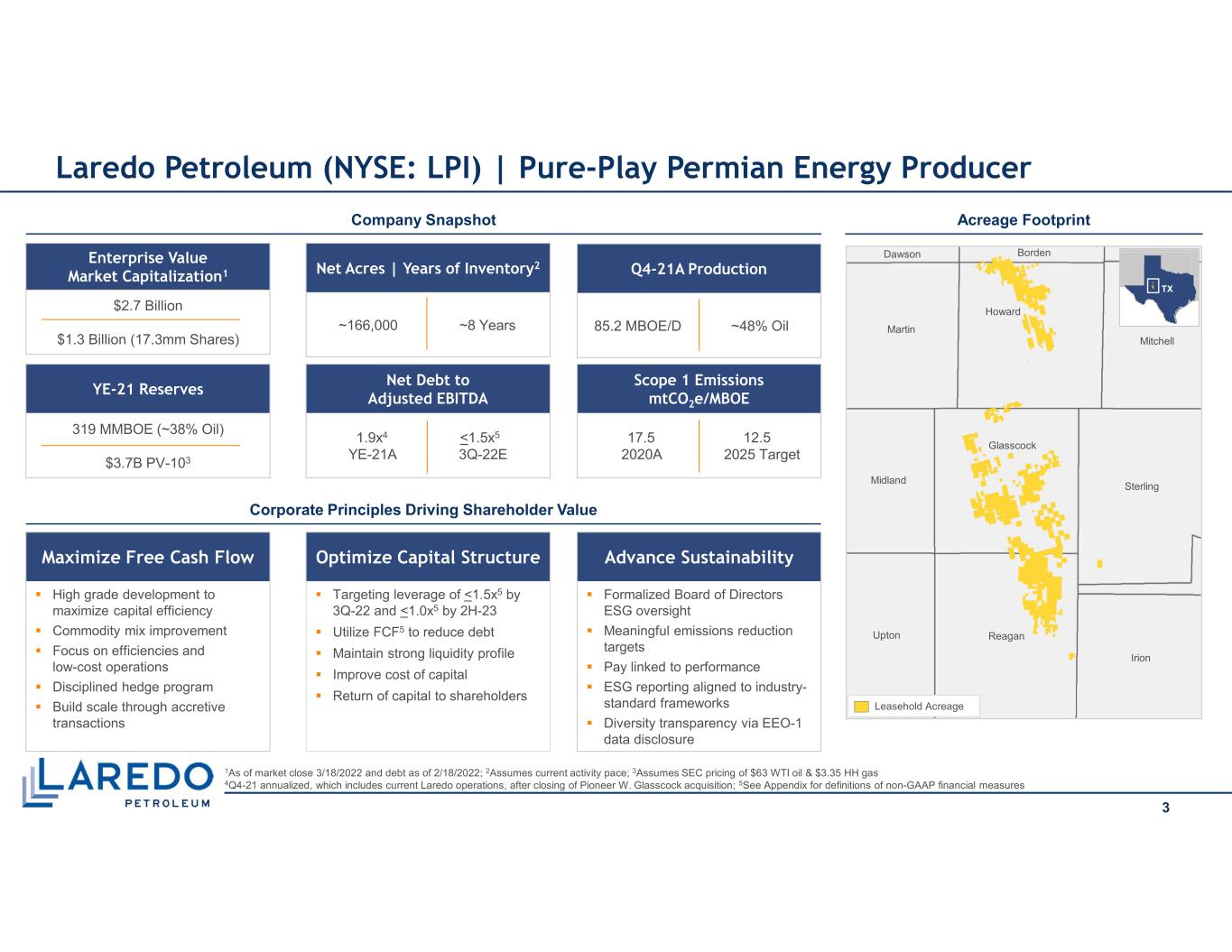

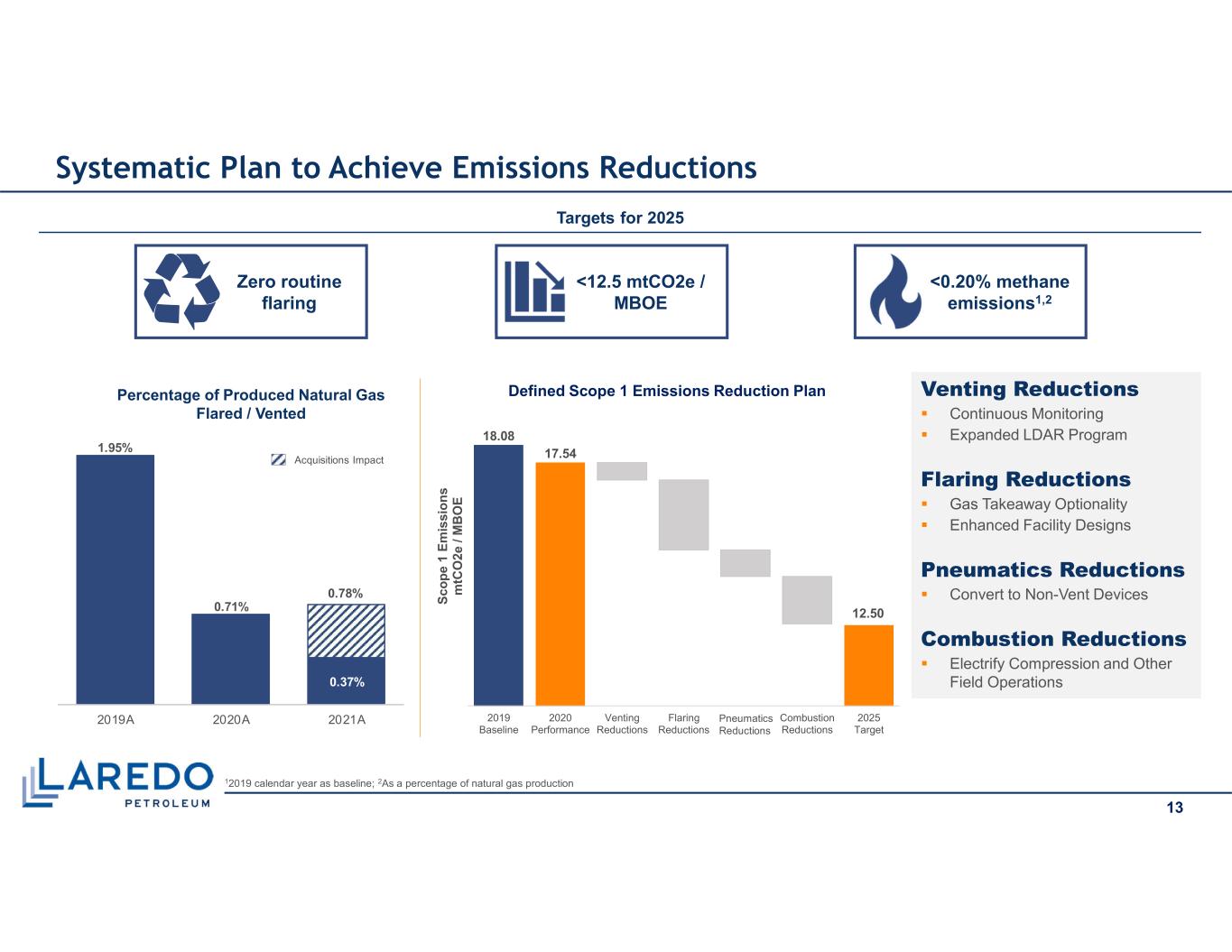

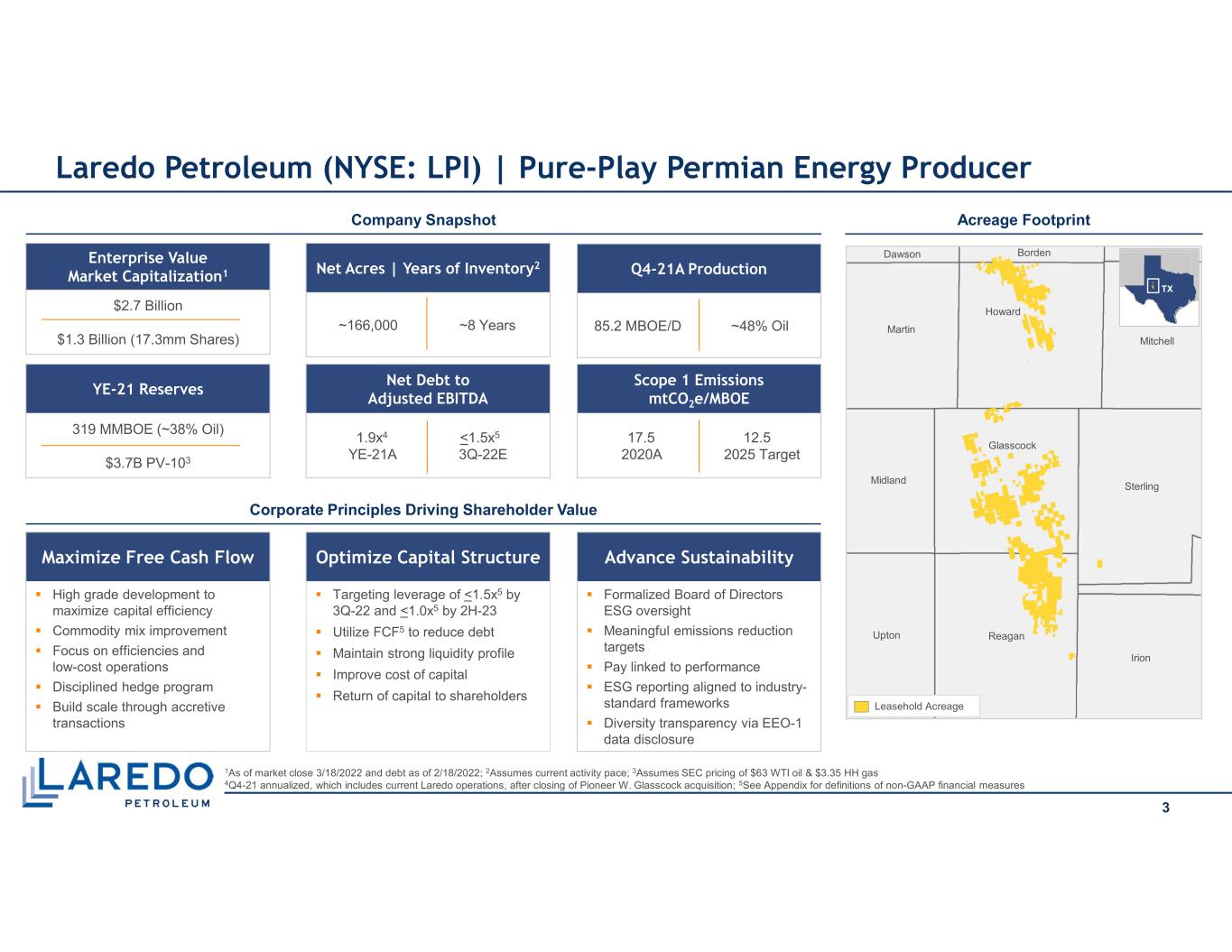

Optimize Capital Structure Targeting leverage of <1.5x5 by 3Q-22 and <1.0x5 by 2H-23 Utilize FCF5 to reduce debt Maintain strong liquidity profile Improve cost of capital Return of capital to shareholders YE-21 Reserves 319 MMBOE (~38% Oil) $3.7B PV-103 Enterprise Value Market Capitalization1 $2.7 Billion $1.3 Billion (17.3mm Shares) Laredo Petroleum (NYSE: LPI) | Pure-Play Permian Energy Producer 1As of market close 3/18/2022 and debt as of 2/18/2022; 2Assumes current activity pace; 3Assumes SEC pricing of $63 WTI oil & $3.35 HH gas 4Q4-21 annualized, which includes current Laredo operations, after closing of Pioneer W. Glasscock acquisition; 5See Appendix for definitions of non-GAAP financial measures Acreage FootprintCompany Snapshot Corporate Principles Driving Shareholder Value Net Acres | Years of Inventory2 ~166,000 ~8 Years Q4-21A Production 85.2 MBOE/D ~48% Oil Net Debt to Adjusted EBITDA 1.9x4 <1.5x5 YE-21A 3Q-22E Scope 1 Emissions mtCO2e/MBOE 17.5 12.5 2020A 2025 Target Leasehold Acreage Glasscock Howard Reagan Martin Midland Upton Sterling Irion Mitchell Dawson Borden TX Maximize Free Cash Flow High grade development to maximize capital efficiency Commodity mix improvement Focus on efficiencies and low-cost operations Disciplined hedge program Build scale through accretive transactions Advance Sustainability Formalized Board of Directors ESG oversight Meaningful emissions reduction targets Pay linked to performance ESG reporting aligned to industry- standard frameworks Diversity transparency via EEO-1 data disclosure 3

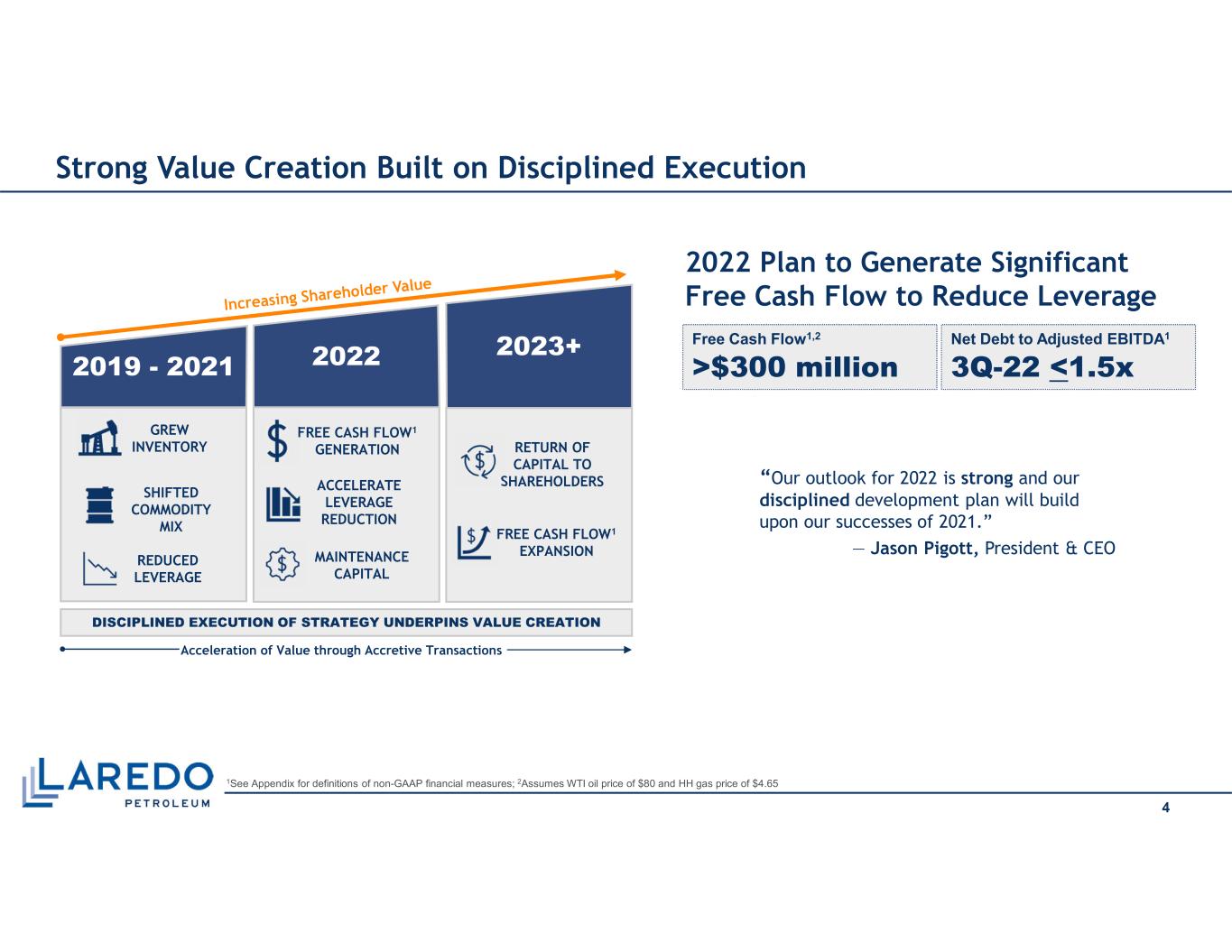

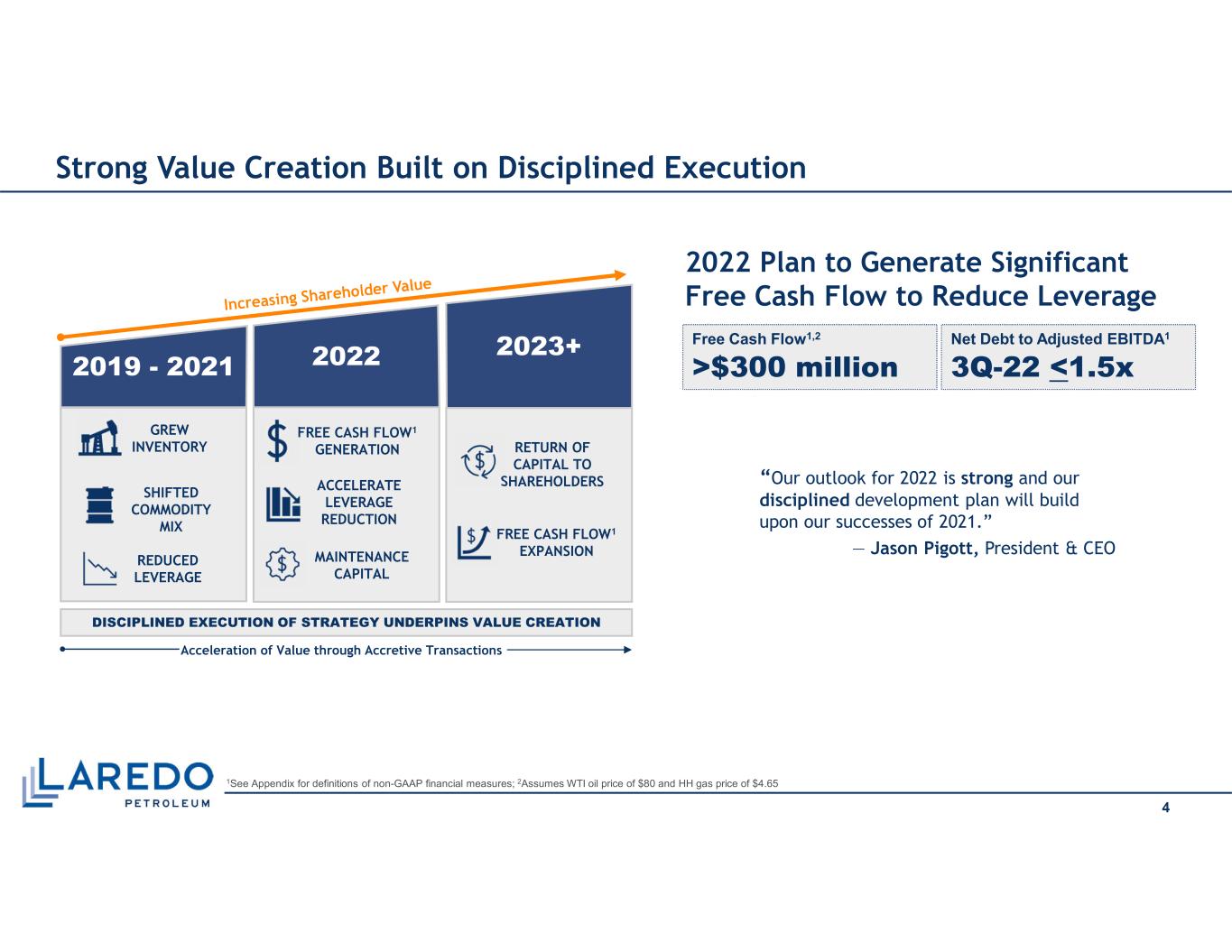

1See Appendix for definitions of non-GAAP financial measures; 2Assumes WTI oil price of $80 and HH gas price of $4.65 Strong Value Creation Built on Disciplined Execution 4 2022 Plan to Generate Significant Free Cash Flow to Reduce Leverage Free Cash Flow1,2 >$300 million Net Debt to Adjusted EBITDA1 3Q-22 <1.5x “Our outlook for 2022 is strong and our disciplined development plan will build upon our successes of 2021.” — Jason Pigott, President & CEO RETURN OF CAPITAL TO SHAREHOLDERS DISCIPLINED EXECUTION OF STRATEGY UNDERPINS VALUE CREATION FREE CASH FLOW1 EXPANSION 2019 - 2021 2022 2023+ GREW INVENTORY SHIFTED COMMODITY MIX REDUCED LEVERAGE FREE CASH FLOW1 GENERATION ACCELERATE LEVERAGE REDUCTION RETURN OF CAPITAL TO SHAREHOLDERS FREE CASH FLOW1 EXPANSION Acceleration of Value through Accretive Transactions MAINTENANCE CAPITAL

2.4x 1.9x <1.5x YE-20A YE-21A YE-22E 31% 39% ~49% FY-20A FY-21A FY-22E 1YE-20 & YE-21 represent Q4 annualized, which includes current Laredo operations, after closing of Pioneer W. Glasscock acquisition; 2See Appendix for definitions of non-GAAP financial measures Delivered on Value Creation Strategy in 2021 Shifting Production Mix Improving Leverage Ratio1,2 Expanded Oil-Weighted Acreage HOWARD ~33,500 total net acres ~21,000 added in 2021 W. GLASSCOCK ~33,000 total net acres ~20,000 added in 2021Reagan Martin Midland Glasscock Howard Upton Mitchell Sterling Irion2021 Acquisitions Oil Production % of Total Production Net Debt-to-Adjusted EBITDA 5 Inventory Growth through Accretive Transactions Acquired ~41,000 net acres in Howard and W. Glasscock counties ~250 high-margin, oil-weighted locations Incremental Inventory Unlocked with Appraisal Drilling ~125 locations added in Howard and W. Glasscock counties Middle Spraberry (~35 locations) and Wolfcamp D (~90 locations) Strong Oil Production and Reserve Growth Avg. daily oil production increased 19% FY-21 vs. FY-20 Exited 2021 with improved production mix of ~48% oil Grew proved oil reserves by 78% in 2021 Oil reserves now account for 38% of total reserves vs. 24% at YE-20 Improved Leverage through High-Margin Production Reduced leverage ratio by ~0.5x1 vs. YE-20 Enhanced ESG Processes and Transparency Issued two comprehensive ESG and Climate Risk Reports Established goals to reduce greenhouse gas and methane emissions Committed to eliminating routine flaring by 2025

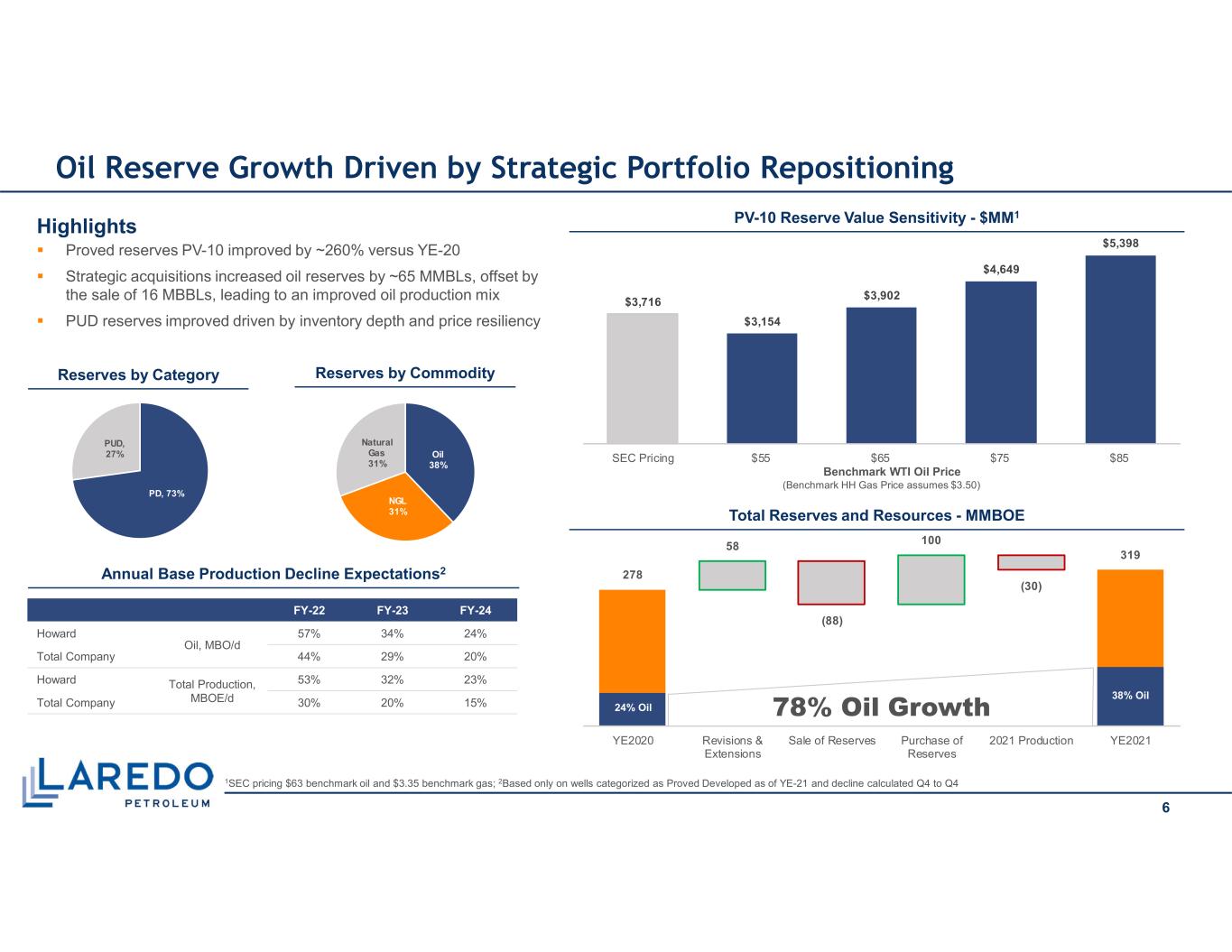

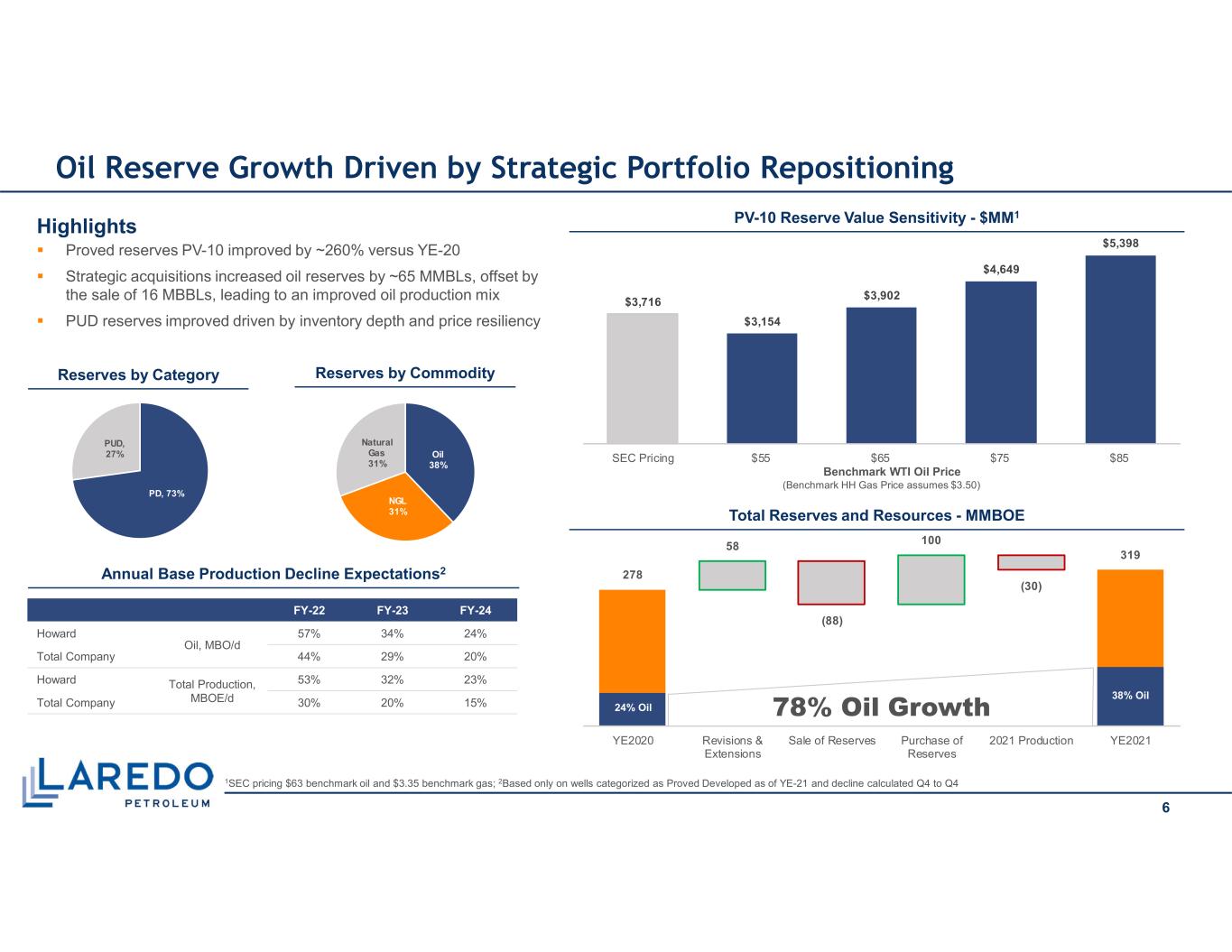

$3,716 $3,154 $3,902 $4,649 $5,398 SEC Pricing $55 $65 $75 $85Oil 38% NGL 31% Natural Gas 31% PD, 73% PUD, 27% 1SEC pricing $63 benchmark oil and $3.35 benchmark gas; 2Based only on wells categorized as Proved Developed as of YE-21 and decline calculated Q4 to Q4 Oil Reserve Growth Driven by Strategic Portfolio Repositioning Highlights Proved reserves PV-10 improved by ~260% versus YE-20 Strategic acquisitions increased oil reserves by ~65 MMBLs, offset by the sale of 16 MBBLs, leading to an improved oil production mix PUD reserves improved driven by inventory depth and price resiliency PV-10 Reserve Value Sensitivity - $MM1 278 58 (88) 100 (30) 319 YE2020 Revisions & Extensions Sale of Reserves Purchase of Reserves 2021 Production YE2021 78% Oil Growth24% Oil 38% Oil Total Reserves and Resources - MMBOE Benchmark WTI Oil Price (Benchmark HH Gas Price assumes $3.50) Reserves by Category Annual Base Production Decline Expectations2 Reserves by Commodity FY-22 FY-23 FY-24 Howard Oil, MBO/d 57% 34% 24% Total Company 44% 29% 20% Howard Total Production, MBOE/d 53% 32% 23% Total Company 30% 20% 15% 6

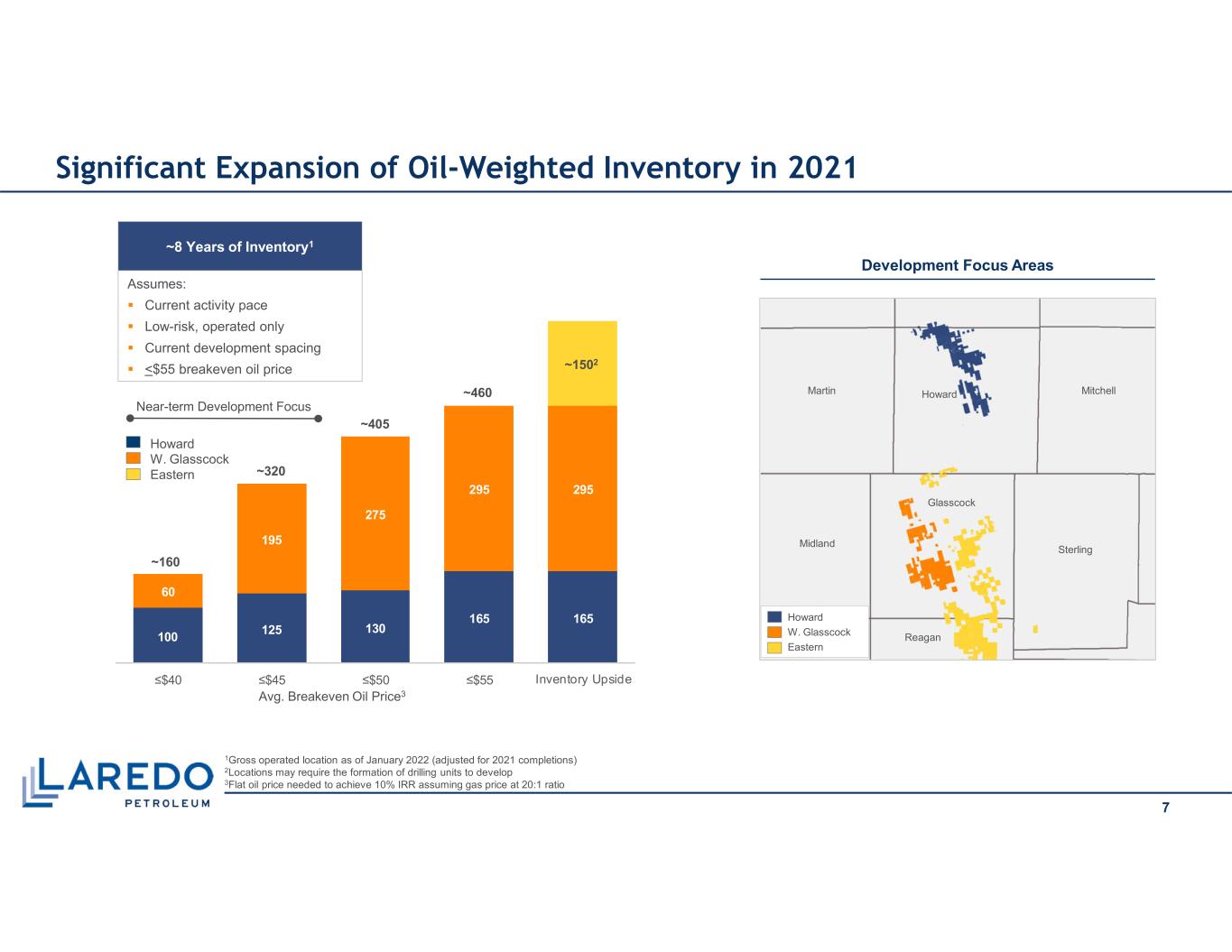

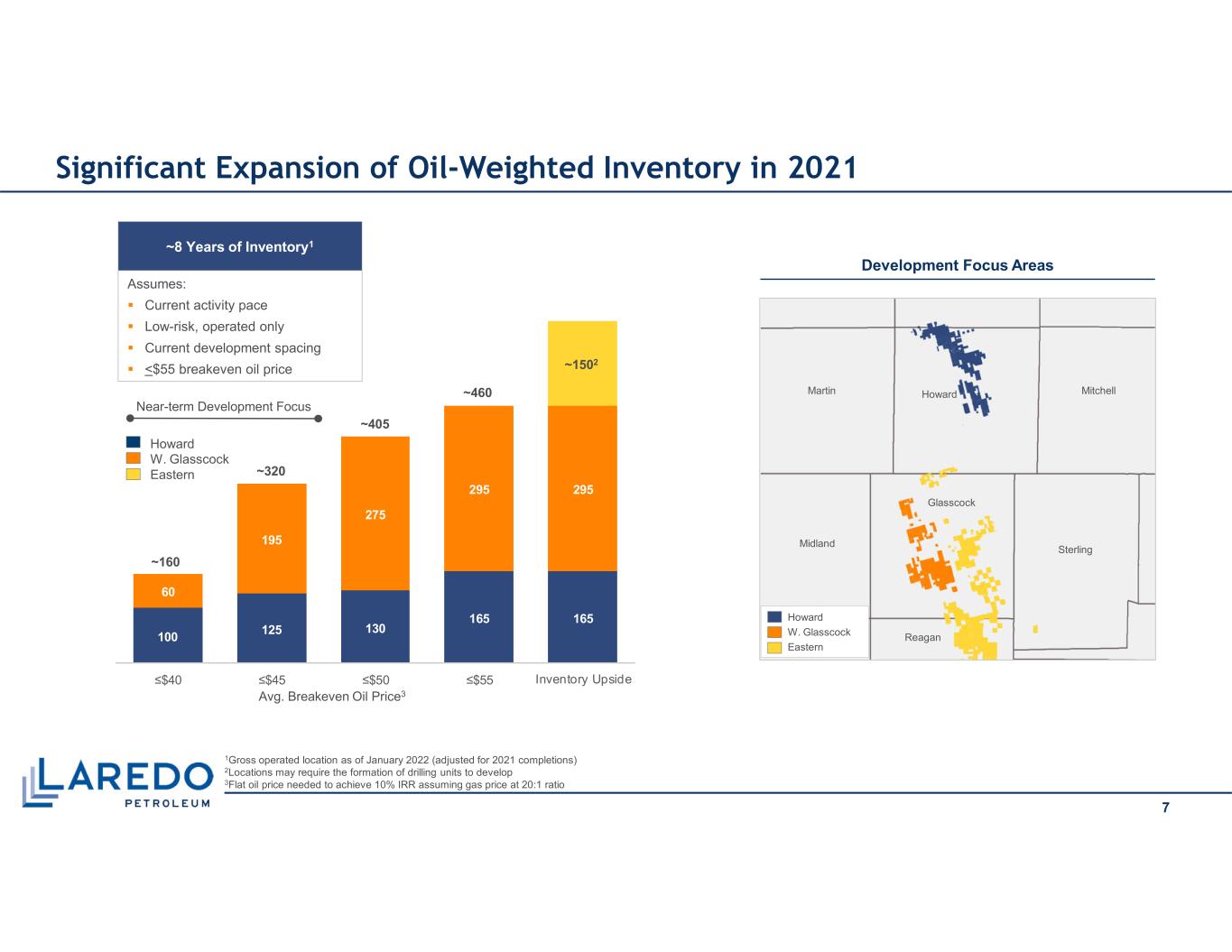

100 125 130 165 165 60 195 275 295 295 ≤$40 ≤$45 ≤$50 ≤$55 Inventory Upside Near-term Development Focus 1Gross operated location as of January 2022 (adjusted for 2021 completions) 2Locations may require the formation of drilling units to develop 3Flat oil price needed to achieve 10% IRR assuming gas price at 20:1 ratio Development Focus Areas ~460 ~320 ~1502 Avg. Breakeven Oil Price3 ~8 Years of Inventory1 Assumes: Current activity pace Low-risk, operated only Current development spacing <$55 breakeven oil price Howard Glasscock Howard W. Glasscock Eastern Reagan Midland Martin Sterling Mitchell ~160 Significant Expansion of Oil-Weighted Inventory in 2021 7 ~405 Howard W. Glasscock Eastern

0 20 40 60 80 100 0 15 30 45 60 75 90 105 C u m u la ti v e G ro s s O il P ro d u c ti o n p e r W e ll ( M B O ) Producing Days 0 25 50 75 100 125 150 175 200 0 90 180 270 360 C u m u la ti v e G ro s s O il P ro d u c ti o n p e r W e ll ( M B O ) Producing Days 1Gross operated location as of January 2022 (adjusted for 2021 completions); 2Production data normalized to 10,000’ lateral length, downtime days excluded Howard County Inventory and Well Performance Avg. LSS/WCA Well Performance2 Howard Borden North Howard Central Howard Middle Spraberry Performance2 Net Acres ~33,500 Q4-21A Net Production (MBOE/D) | % Oil 40.1 | 76% Producing Well Count 178 LSS / WCA Locations1 ~130 MS Locations1 ~35 Total Development Locations1 ~165 Avg. Lateral Length (ft.) ~11,500’ Avg. WI (%) ~92% Highlights Acquisition closed in July 2021 expanded acreage position by ~21,000 contiguous net acres 2022 development program entirely focused on Howard County Consolidated acreage position facilitates drilling of more capital efficient longer laterals Inventory further increased by ~35 locations, driven by appraisal drilling of Middle Spraberry, to which zero value was attributed in acquisition underwriting Thumper D 4MS Thumper B 2MS North Howard Central Howard (Wider-Spacing) Central Howard (Tighter-Spacing) Howard - Key Stats and Acreage Position 8

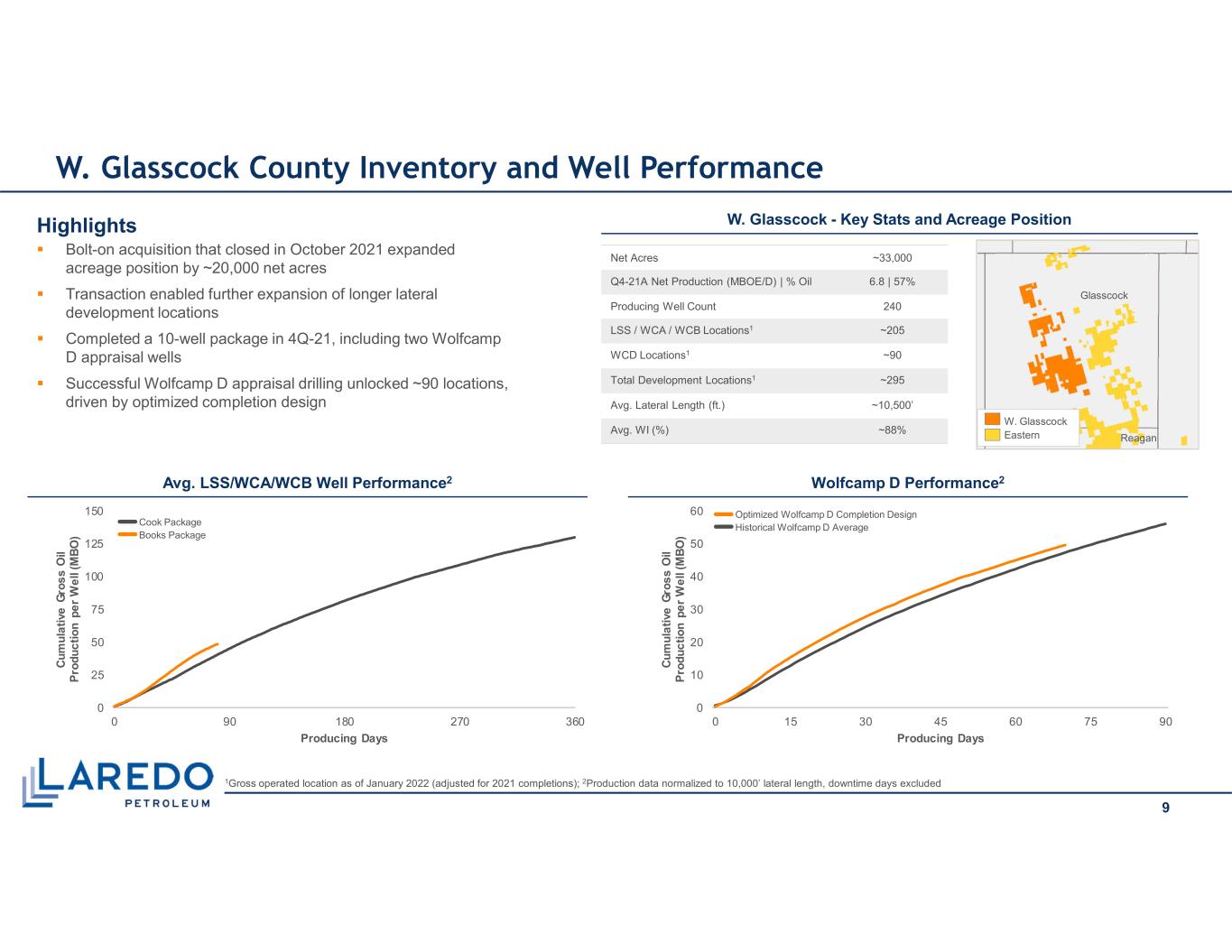

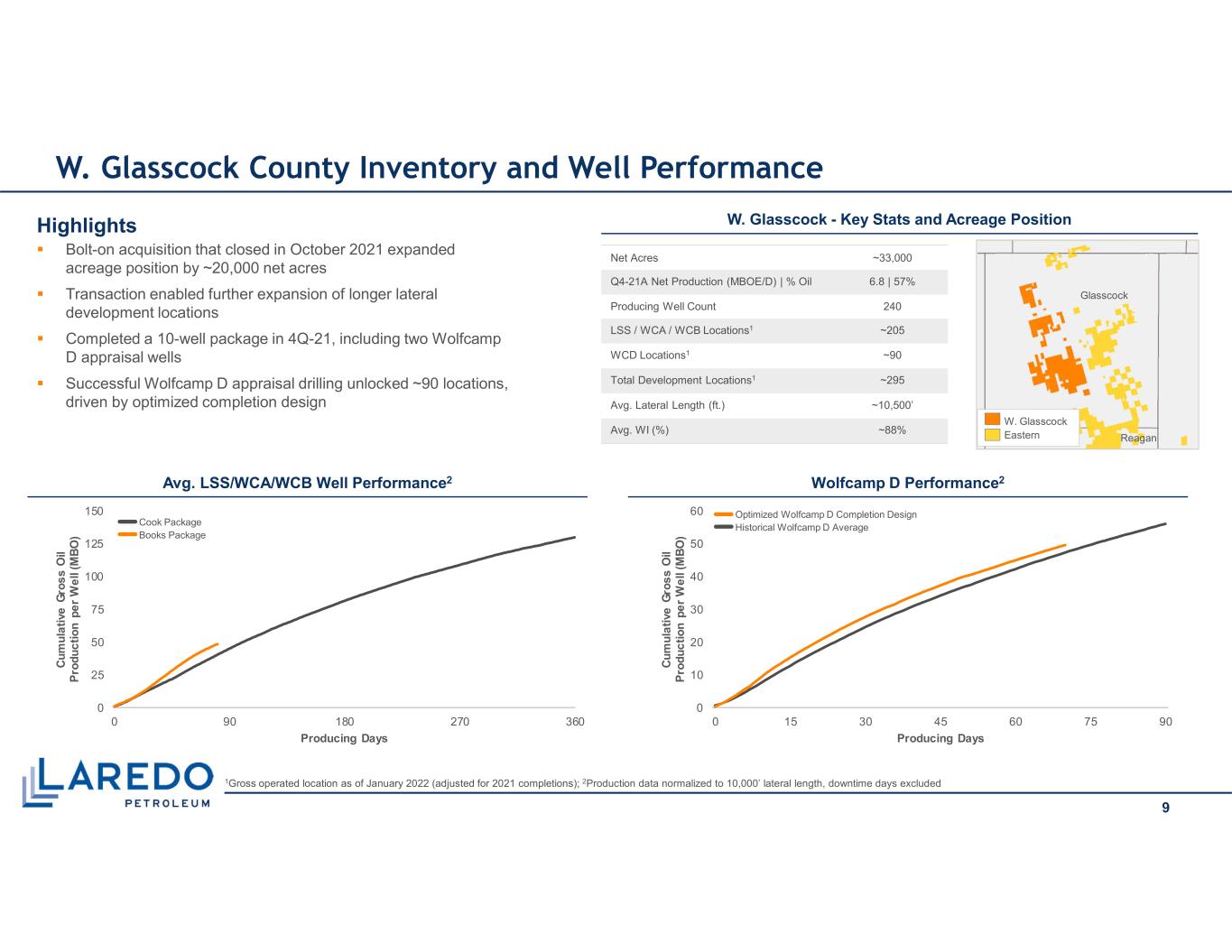

0 25 50 75 100 125 150 0 90 180 270 360 C u m u la ti v e G ro s s O il P ro d u c ti o n p e r W e ll ( M B O ) Producing Days 0 10 20 30 40 50 60 0 15 30 45 60 75 90 C u m u la ti v e G ro s s O il P ro d u c ti o n p e r W e ll ( M B O ) Producing Days Cook Package Books Package Glasscock Reagan W. Glasscock Eastern W. Glasscock County Inventory and Well Performance Avg. LSS/WCA/WCB Well Performance2 Wolfcamp D Performance2 Net Acres ~33,000 Q4-21A Net Production (MBOE/D) | % Oil 6.8 | 57% Producing Well Count 240 LSS / WCA / WCB Locations1 ~205 WCD Locations1 ~90 Total Development Locations1 ~295 Avg. Lateral Length (ft.) ~10,500’ Avg. WI (%) ~88% Highlights Bolt-on acquisition that closed in October 2021 expanded acreage position by ~20,000 net acres Transaction enabled further expansion of longer lateral development locations Completed a 10-well package in 4Q-21, including two Wolfcamp D appraisal wells Successful Wolfcamp D appraisal drilling unlocked ~90 locations, driven by optimized completion design Optimized Wolfcamp D Completion Design Historical Wolfcamp D Average W. Glasscock - Key Stats and Acreage Position 9 1Gross operated location as of January 2022 (adjusted for 2021 completions); 2Production data normalized to 10,000’ lateral length, downtime days excluded

Drilling & Completion Efficiencies ~$865 ~$925 ~$975 ~$1,015 $65 $75 $85 $95 80% 9% 7% 4% Disciplined, Efficient Capital Program Maintains Prior Year Activity Levels 2022E Capital Program FY-22 Guidance Capital Expenditures ($MM) ~$520 Avg. Rig Count (Op) ~2.3 Avg. Frac Crews (Op) ~1.2 Spuds 65 Gross (62.9 Net) Completions 55 Gross (53.1 Net) Turn-in-Lines 55 Gross (53.1 Net) Production (MBOE/d) 82.0 – 86.0 Oil Production (MBO/d) 39.5 – 42.5 Capital Expenditures by Category DC&E (op) Facilities & Land Corporate DC&E (non-op) 10 Benchmark WTI Oil Price (per BBL) (Benchmark HH Gas Price assumes $4.65/mcf) 2022E Operated Turn-in-Line Well Count 6 15 15 12 6 18 7 15 15 1Q-22E 2Q-22E 3Q-22E 4Q-22E N. Howard C. Howard 2022E EBITDA Sensitivity - $MM 1,117 1,314 1,439 1,274 1,408 1,653 FY-19A FY-20A FY-21A Drilling Ft./Day/Rig Fractured Ft./Day/Crew 10,750' 9,950' 10,000' 11,800' FY-19A FY-20A FY-21A FY-22E FY-19A FY-20A FY-21A FY-22E Avg. Completed Lateral Length

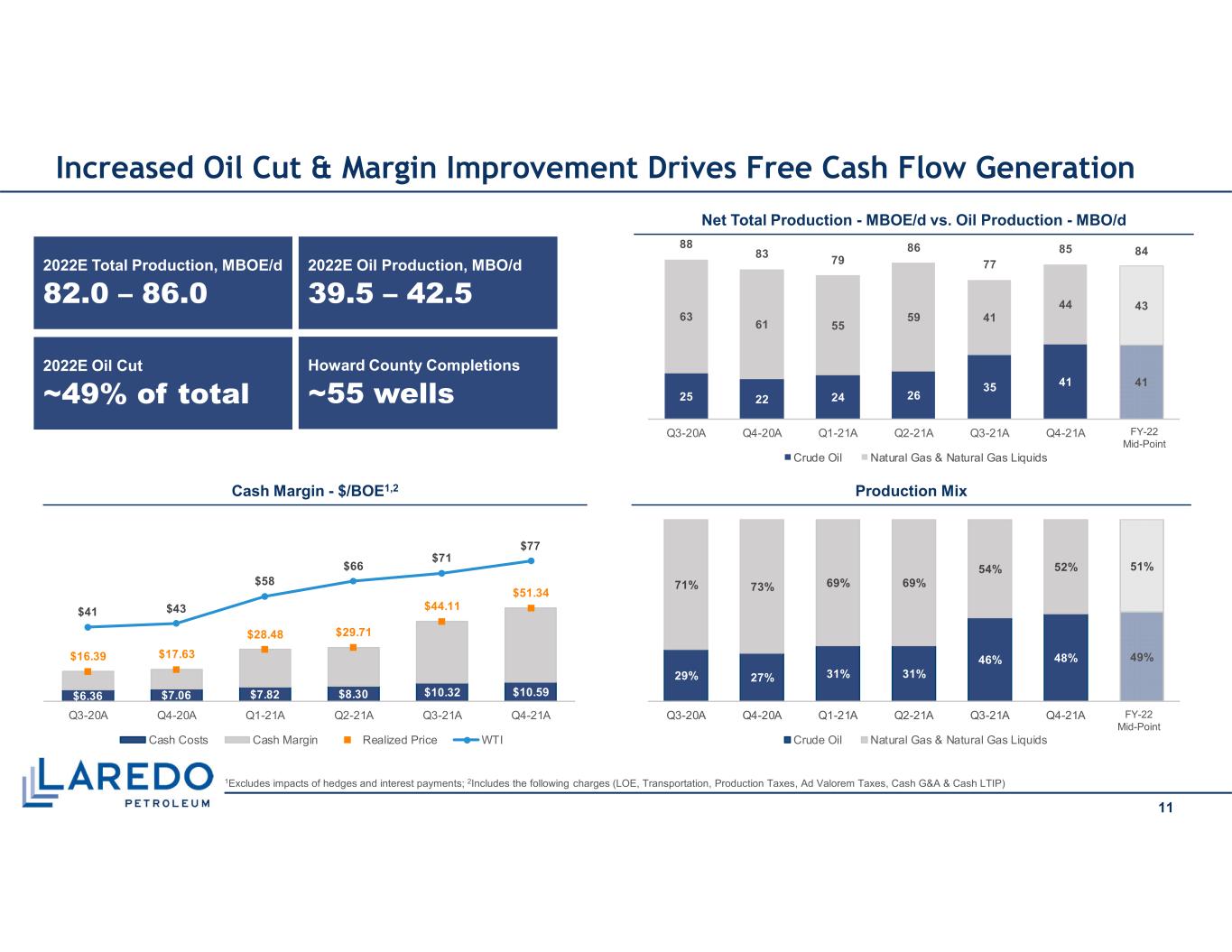

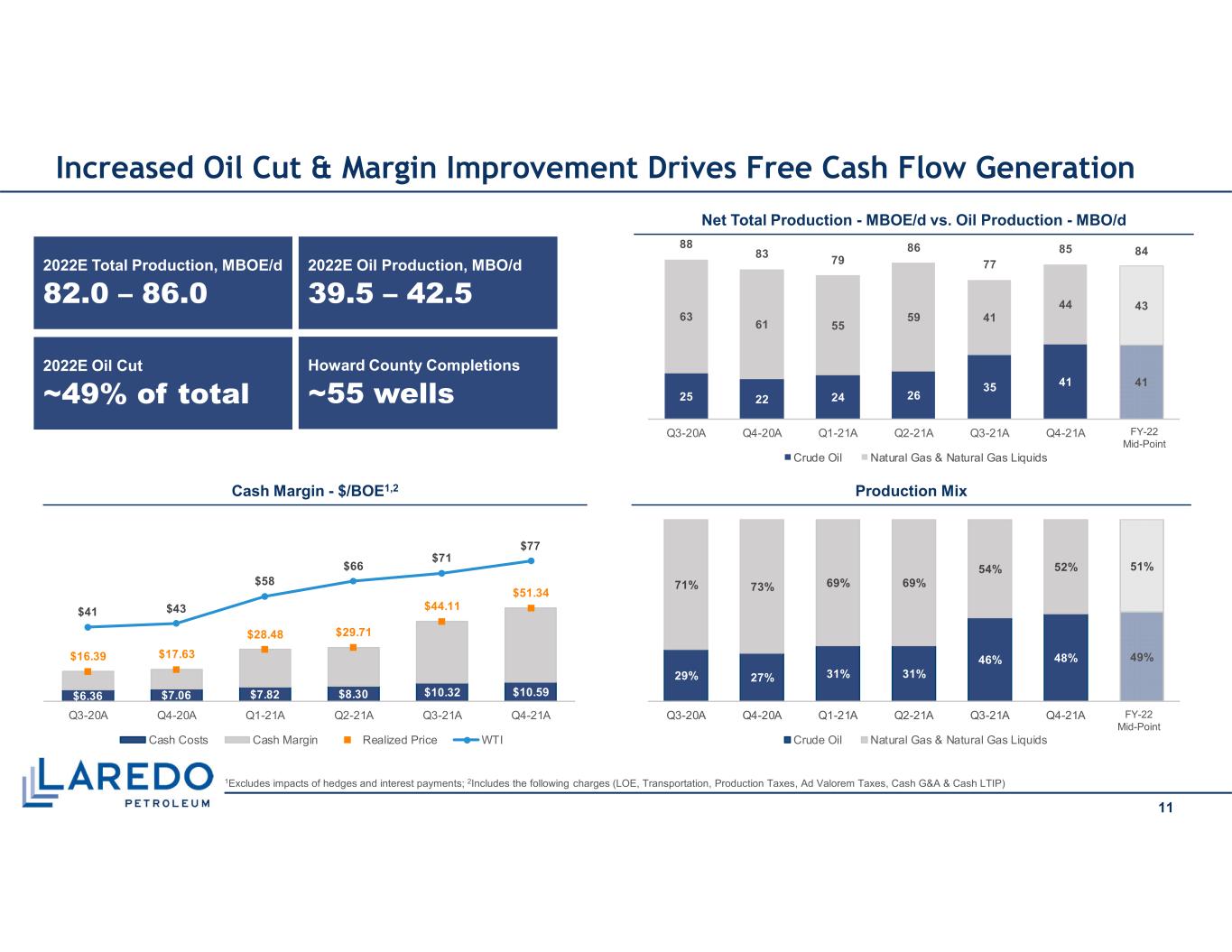

2022E Total Production, MBOE/d 82.0 – 86.0 2022E Oil Production, MBO/d 39.5 – 42.5 2022E Oil Cut ~49% of total Howard County Completions ~55 wells $6.36 $7.06 $7.82 $8.30 $10.32 $10.59 $16.39 $17.63 $28.48 $29.71 $44.11 $51.34 $41 $43 $58 $66 $71 $77 Q3-20A Q4-20A Q1-21A Q2-21A Q3-21A Q4-21A Cash Costs Cash Margin Realized Price WTI 1Excludes impacts of hedges and interest payments; 2Includes the following charges (LOE, Transportation, Production Taxes, Ad Valorem Taxes, Cash G&A & Cash LTIP) Increased Oil Cut & Margin Improvement Drives Free Cash Flow Generation 11 Net Total Production - MBOE/d vs. Oil Production - MBO/d Production MixCash Margin - $/BOE1,2 25 22 24 26 35 41 41 63 61 55 59 41 44 43 88 83 79 86 77 85 84 Q3-20A Q4-20A Q1-21A Q2-21A Q3-21A Q4-21A 2022E Crude Oil Natural Gas & Natural Gas Liquids 29% 27% 31% 31% 46% 48% 49% 71% 73% 69% 69% 54% 52% 51% Q3-20A Q4-20A Q1-21A Q2-21A Q3-21A Q4-21A 2022E Crude Oil Natural Gas & Natural Gas Liquids FY-22 Mid-Point FY-22 Mid-Point

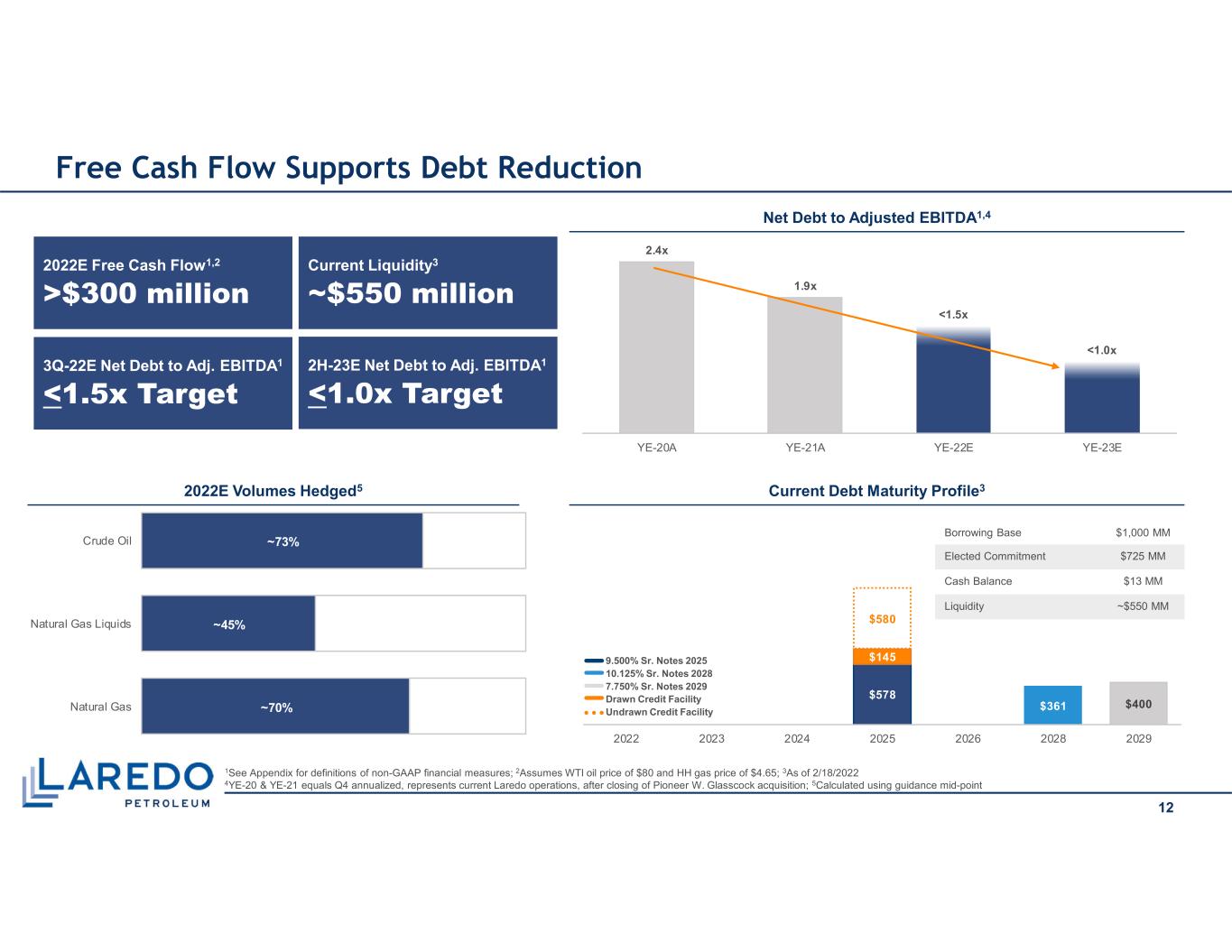

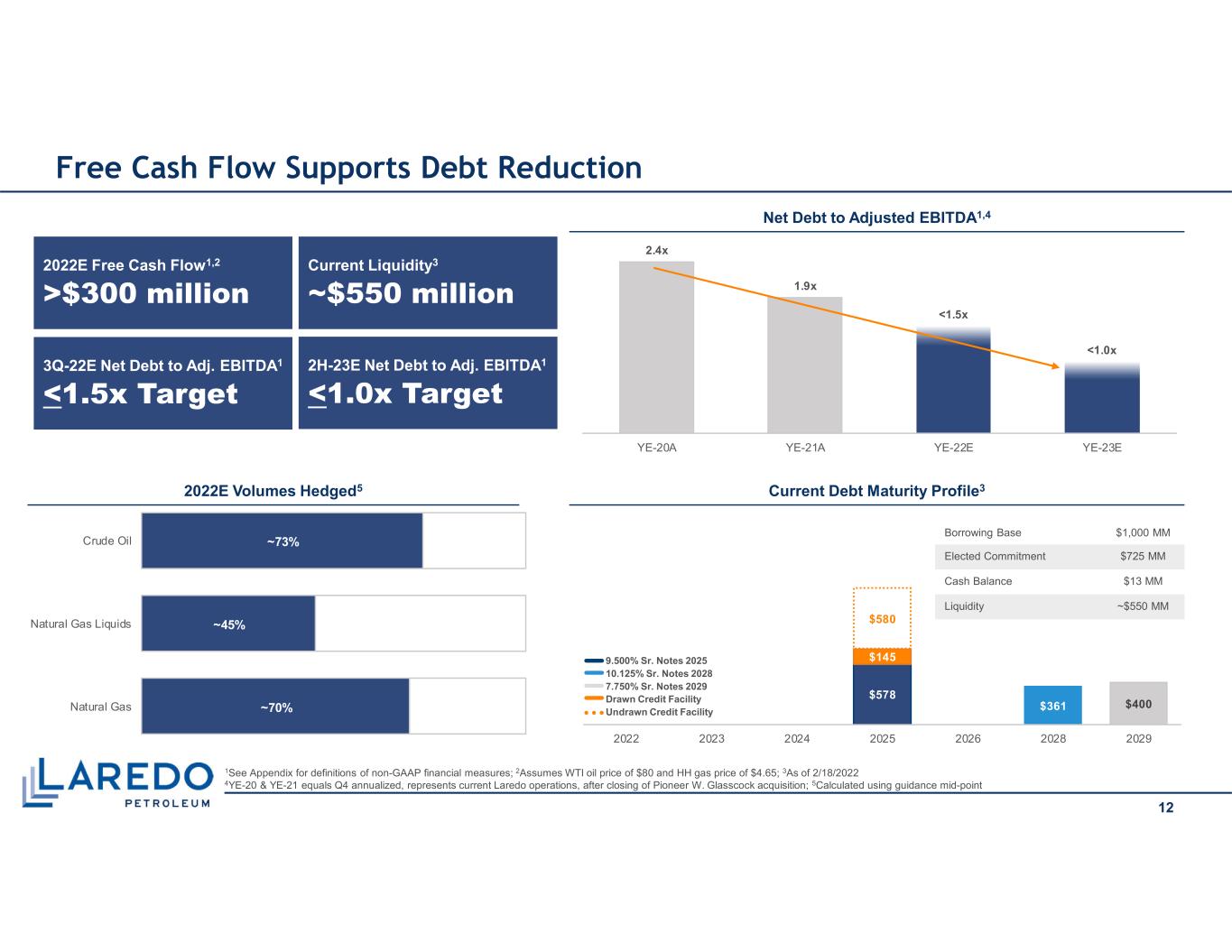

~70% ~45% ~73% Natural Gas Natural Gas Liquids Crude Oil 2.4x 1.9x <1.5x <1.0x YE-20A YE-21A YE-22E YE-23E $578 $361 $400 $145 $580 2022 2023 2024 2025 2026 2028 2029 1See Appendix for definitions of non-GAAP financial measures; 2Assumes WTI oil price of $80 and HH gas price of $4.65; 3As of 2/18/2022 4YE-20 & YE-21 equals Q4 annualized, represents current Laredo operations, after closing of Pioneer W. Glasscock acquisition; 5Calculated using guidance mid-point Free Cash Flow Supports Debt Reduction Net Debt to Adjusted EBITDA1,4 Current Debt Maturity Profile32022E Volumes Hedged5 Borrowing Base $1,000 MM Elected Commitment $725 MM Cash Balance $13 MM Liquidity ~$550 MM 9.500% Sr. Notes 2025 10.125% Sr. Notes 2028 7.750% Sr. Notes 2029 Drawn Credit Facility Undrawn Credit Facility 12 2022E Free Cash Flow1,2 >$300 million Current Liquidity3 ~$550 million 3Q-22E Net Debt to Adj. EBITDA1 <1.5x Target 2H-23E Net Debt to Adj. EBITDA1 <1.0x Target

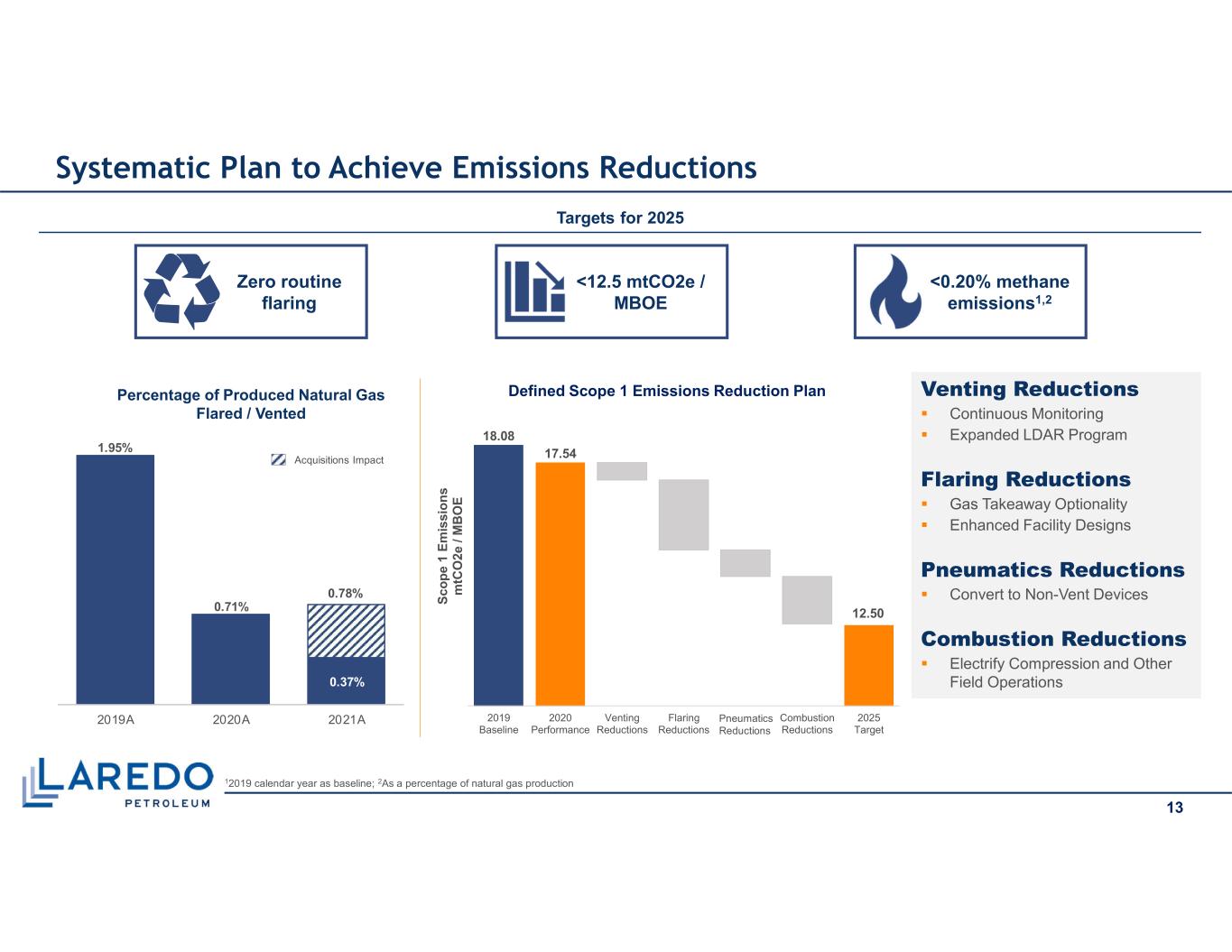

Zero routine flaring 13 <12.5 mtCO2e / MBOE <0.20% methane emissions1,2 18.08 17.54 12.50 2019 Baseline 2020 Performance Venting Reductions Flaring Reductions Pnuematics Reductions Combustion Reductions 2025 Target S c o p e 1 E m is s io n s m tC O 2 e / M B O E Defined Scope 1 Emissions Reduction Plan Systematic Plan to Achieve Emissions Reductions Venting Reductions Continuous Monitoring Expanded LDAR Program Flaring Reductions Gas Takeaway Optionality Enhanced Facility Designs Pneumatics Reductions Convert to Non-Vent Devices Combustion Reductions Electrify Compression and Other Field Operations Targets for 2025 12019 calendar year as baseline; 2As a percentage of natural gas production 1.95% 0.71% 0.37% 0.78% 2019A 2020A 2021A Percentage of Produced Natural Gas Flared / Vented Acquisitions Impact eu i

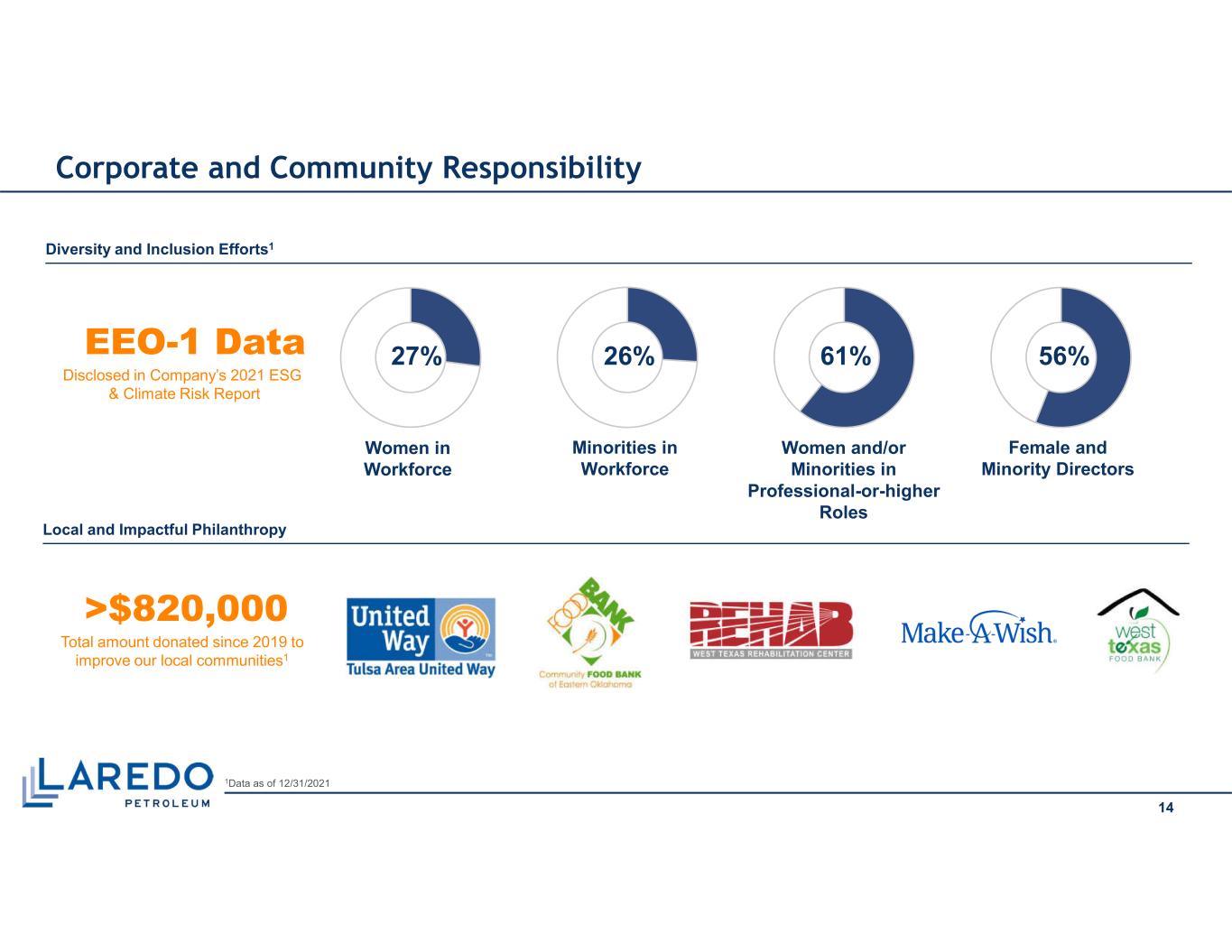

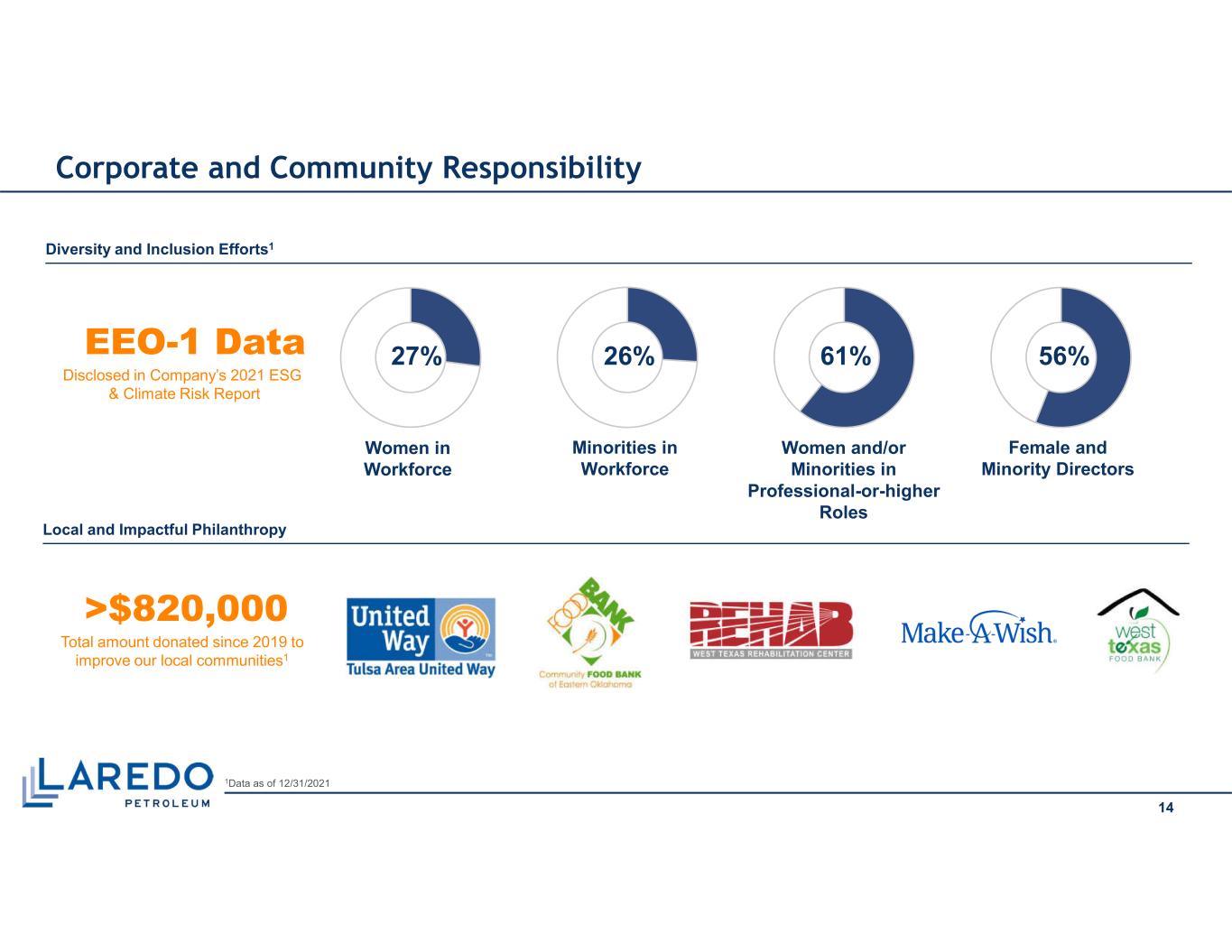

1Data as of 12/31/2021 Corporate and Community Responsibility Local and Impactful Philanthropy >$820,000 Total amount donated since 2019 to improve our local communities1 Diversity and Inclusion Efforts1 EEO-1 Data Disclosed in Company’s 2021 ESG & Climate Risk Report 27% 26% 61% 56% Women in Workforce Minorities in Workforce Women and/or Minorities in Professional-or-higher Roles Female and Minority Directors 14

Appendix

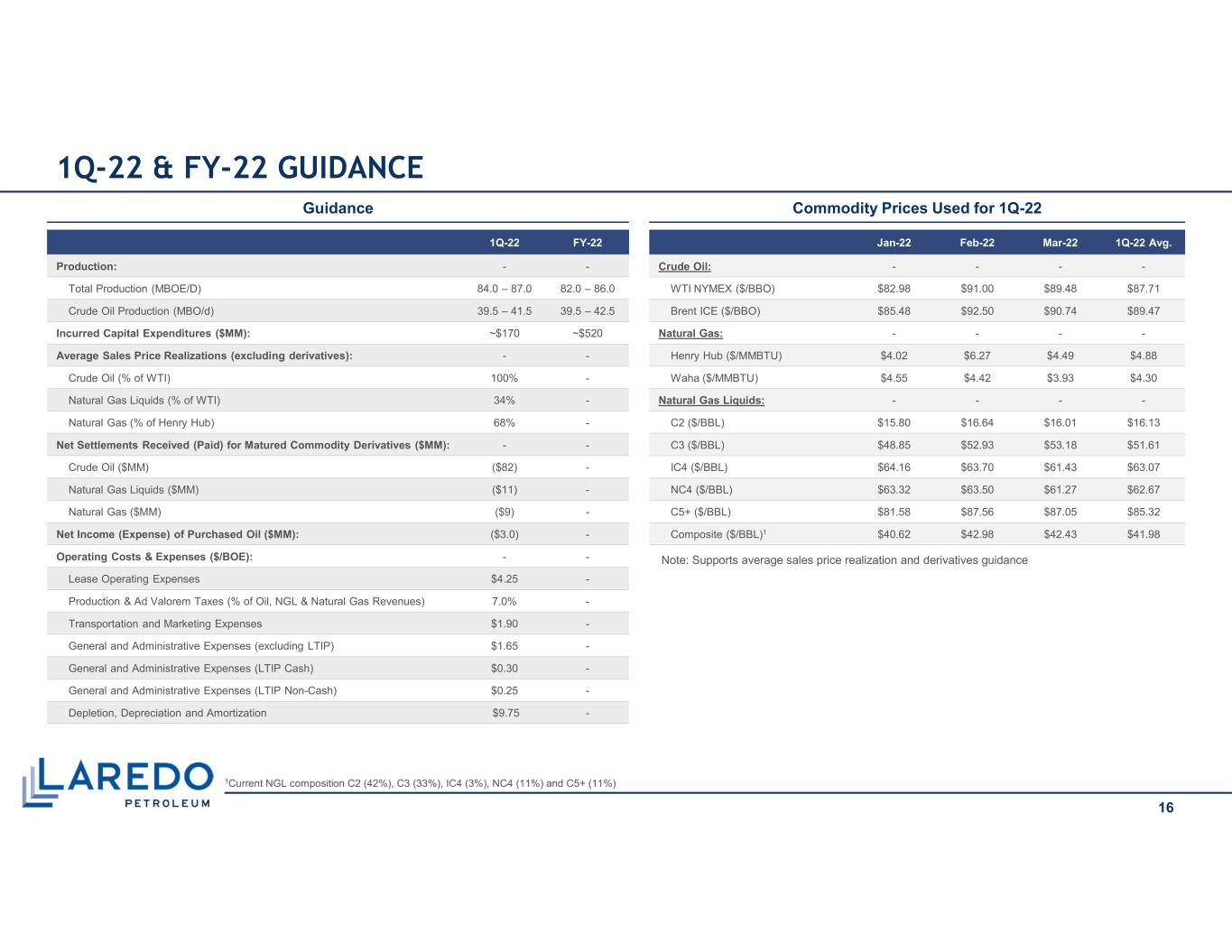

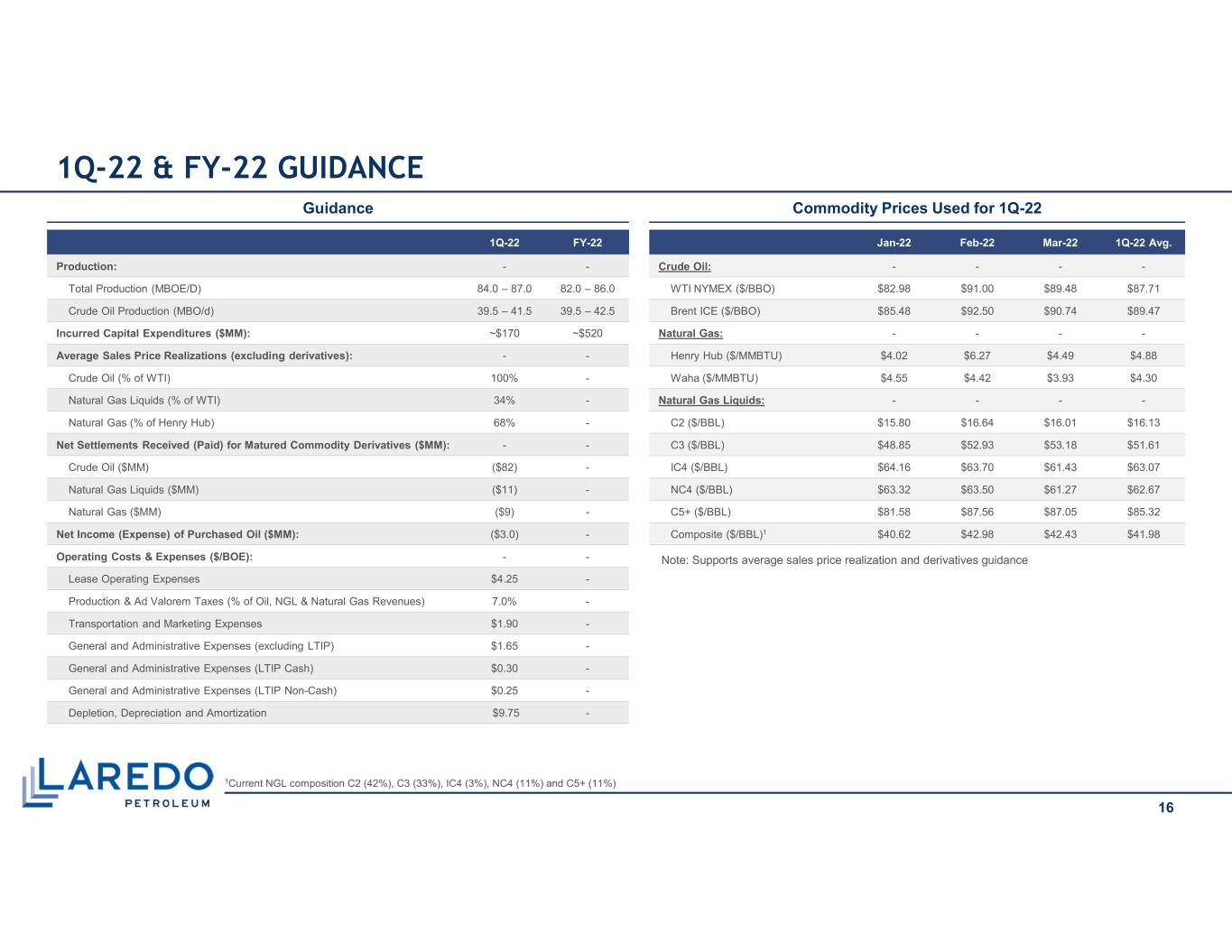

1Q-22 & FY-22 GUIDANCE Guidance Commodity Prices Used for 1Q-22 Jan-22 Feb-22 Mar-22 1Q-22 Avg. Crude Oil: - - - - WTI NYMEX ($/BBO) $82.98 $91.00 $89.48 $87.71 Brent ICE ($/BBO) $85.48 $92.50 $90.74 $89.47 Natural Gas: - - - - Henry Hub ($/MMBTU) $4.02 $6.27 $4.49 $4.88 Waha ($/MMBTU) $4.55 $4.42 $3.93 $4.30 Natural Gas Liquids: - - - - C2 ($/BBL) $15.80 $16.64 $16.01 $16.13 C3 ($/BBL) $48.85 $52.93 $53.18 $51.61 IC4 ($/BBL) $64.16 $63.70 $61.43 $63.07 NC4 ($/BBL) $63.32 $63.50 $61.27 $62.67 C5+ ($/BBL) $81.58 $87.56 $87.05 $85.32 Composite ($/BBL)1 $40.62 $42.98 $42.43 $41.98 1Q-22 FY-22 Production: - - Total Production (MBOE/D) 84.0 – 87.0 82.0 – 86.0 Crude Oil Production (MBO/d) 39.5 – 41.5 39.5 – 42.5 Incurred Capital Expenditures ($MM): ~$170 ~$520 Average Sales Price Realizations (excluding derivatives): - - Crude Oil (% of WTI) 100% - Natural Gas Liquids (% of WTI) 34% - Natural Gas (% of Henry Hub) 68% - Net Settlements Received (Paid) for Matured Commodity Derivatives ($MM): - - Crude Oil ($MM) ($82) - Natural Gas Liquids ($MM) ($11) - Natural Gas ($MM) ($9) - Net Income (Expense) of Purchased Oil ($MM): ($3.0) - Operating Costs & Expenses ($/BOE): - - Lease Operating Expenses $4.25 - Production & Ad Valorem Taxes (% of Oil, NGL & Natural Gas Revenues) 7.0% - Transportation and Marketing Expenses $1.90 - General and Administrative Expenses (excluding LTIP) $1.65 - General and Administrative Expenses (LTIP Cash) $0.30 - General and Administrative Expenses (LTIP Non-Cash) $0.25 - Depletion, Depreciation and Amortization $9.75 - Note: Supports average sales price realization and derivatives guidance 16 1Current NGL composition C2 (42%), C3 (33%), IC4 (3%), NC4 (11%) and C5+ (11%)

Crude Oil Hedge Book (1) (Volume in MBO; Price in $/BBO) Q1-22 Q2-22 Q3-22 Q4-22 FY-22 Q1-23 Q2-23 Q3-23 Q4-23 FY-23 Brent Swaps 1,017 1,028 1,040 1,040 4,125 - - - - - WTD Price $48.34 $48.34 $48.34 $48.34 $48.34 - - - - - Brent Collars 383 387 391 391 1,551 - - - - - WTD Floor Price $56.65 $56.65 $56.65 $56.65 $56.65 - - - - - WTD Ceiling Price $65.44 $65.44 $65.44 $65.44 $65.44 - - - - - WTI Swaps 810 884 92 92 1,878 - - - - - WTD Price $68.91 $85.14 $64.40 $64.40 $76.11 - - - - - WTI Collars 837 846 856 856 3,395 1,530 1,547 460 460 3,997 WTD Floor Price $58.23 $58.23 $58.23 $58.23 $58.23 $66.18 $66.18 $67.00 $67.00 $66.37 WTD Ceiling Price $69.39 $69.39 $69.39 $69.39 $69.39 $80.29 $80.29 $84.04 $84.04 $81.16 Total Swaps/Collars 3,047 3,145 2,378 2,378 10,948 1,530 1,547 460 460 3,997 WTD Floor Price $57.57 $62.36 $53.88 $53.88 $57.34 $66.18 $66.18 $67.00 $67.00 $66.37 Natural Gas Liquids Hedge Book(1) (Volume in MBBL; Price in $/BBL) Q1-22 Q2-22 Q3-22 Q4-22 FY-22 Q1-23 Q2-23 Q3-23 Q4-23 FY-23 Ethane Swaps 378 382 386 386 1,533 - - - - - WTD Price $11.42 $11.42 $11.42 $11.42 $11.42 - - - - - Propane Swaps 288 291 294 294 1,168 - - - - - WTD Price $35.91 $35.91 $35.91 $35.91 $35.91 - - - - - Butane Swaps 90 91 92 92 365 - - - - - WTD Price $41.58 $41.58 $41.58 $41.58 $41.58 - - - - - Isobutane Swaps 27 27 28 28 110 - - - - - WTD Price $42.00 $42.00 $42.00 $42.00 $42.00 - - - - - Pentane Swaps 90 91 92 92 365 - - - - - WTD Price $60.65 $60.65 $60.65 $60.65 $60.65 - - - - - Natural Gas Hedge Book(1) (Volume in MMBTU; Price in $/MMBTU) Q1-22 Q2-22 Q3-22 Q4-22 FY-22 Q1-23 Q2-23 Q3-23 Q4-23 FY-23 Henry Hub Swaps 900,000 910,000 920,000 920,000 3,650,000 - - - - - WTD Price $2.73 $2.73 $2.73 $2.73 $2.73 - - - - - Henry Hub Collars 7,200,000 7,280,000 7,360,000 7,360,000 29,200,000 900,000 910,000 920,000 920,000 3,650,000 WTD Floor Price $3.09 $3.09 $3.09 $3.09 $3.09 $3.00 $3.00 $3.00 $3.00 $3.00 WTD Ceiling Price $3.84 $3.84 $3.84 $3.84 $3.84 $4.45 $4.45 $4.45 $4.45 $4.45 Total Henry Hub Swaps/Collars 8,100,000 8,190,000 8,280,000 8,280,000 32,850,000 900,000 910,000 920,000 920,000 3,650,000 WTD Floor Price $3.05 $3.05 $3.05 $3.05 $3.05 $3.00 $3.00 $3.00 $3.00 $3.00 Waha Basis Swaps 7,155,000 7,234,500 7,314,000 7,314,000 29,017,500 - - - - - WTD Price ($0.36) ($0.36) ($0.36) ($0.36) ($0.36) - - - - - 1Hedges executed as of 3/18/2022 Active Hedge Program to Protect Free Cash Flow 17

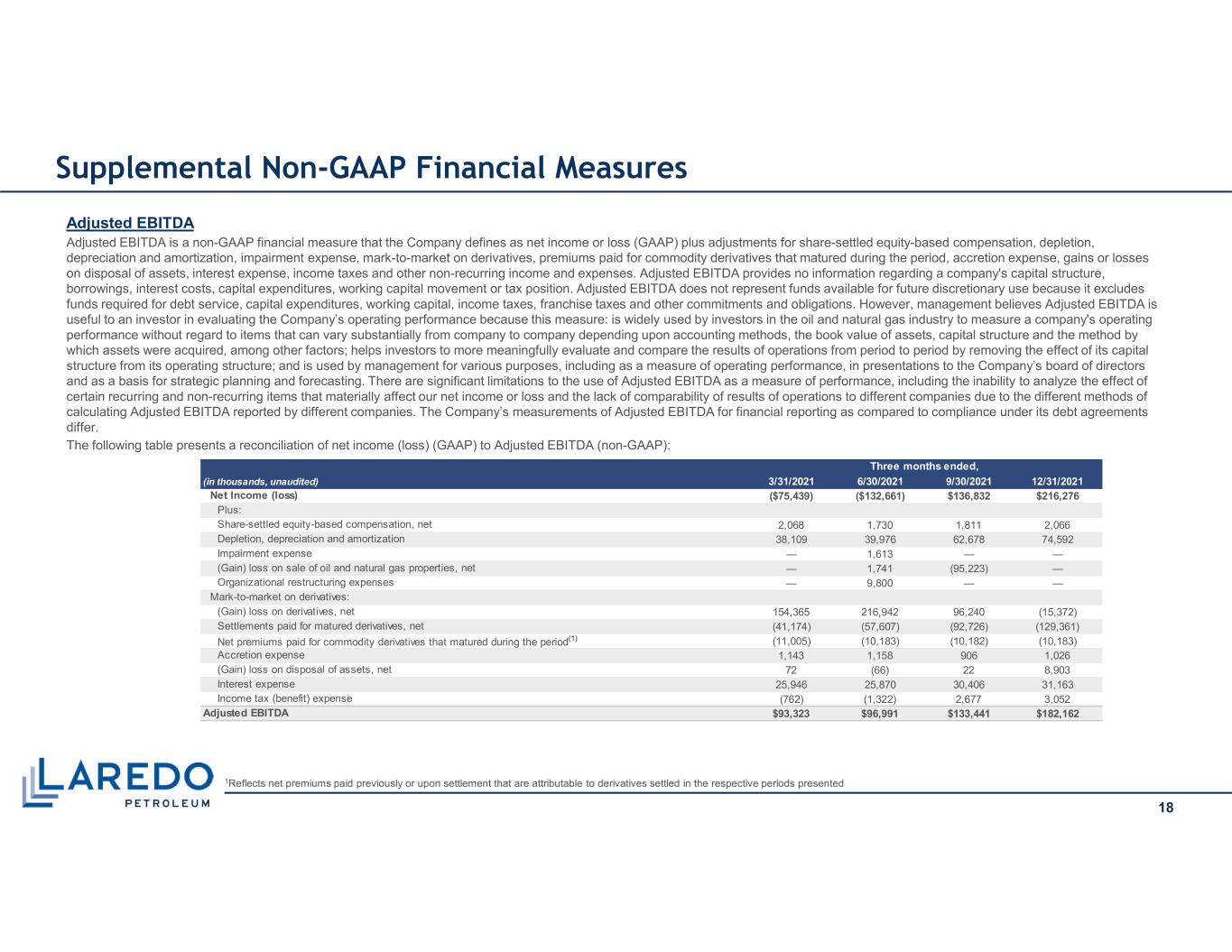

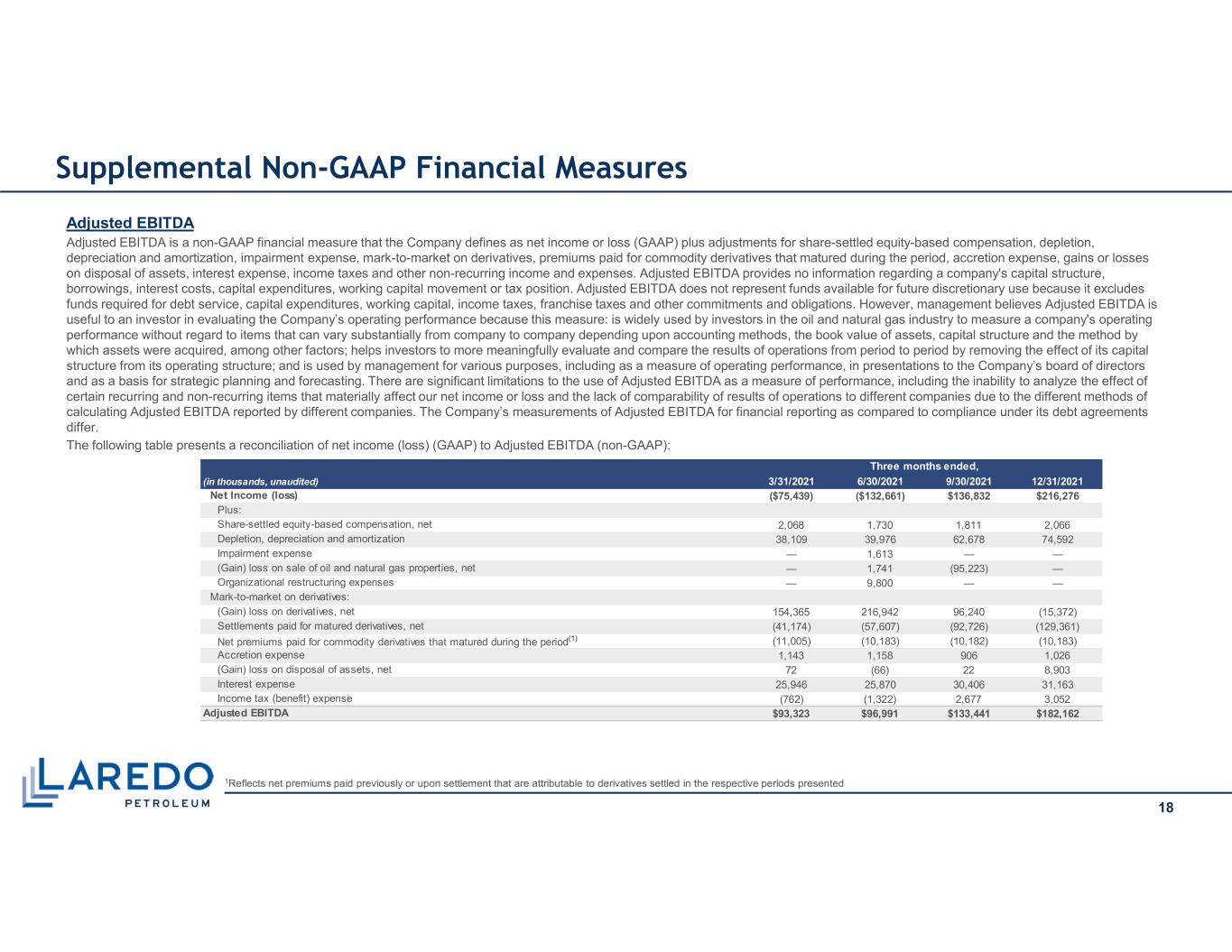

(in thousands, unaudited) 3/31/2021 6/30/2021 9/30/2021 12/31/2021 Net Income (loss) ($75,439) ($132,661) $136,832 $216,276 Plus: Share-settled equity-based compensation, net 2,068 1,730 1,811 2,066 Depletion, depreciation and amortization 38,109 39,976 62,678 74,592 Impairment expense — 1,613 — — (Gain) loss on sale of oil and natural gas properties, net — 1,741 (95,223) — Organizational restructuring expenses — 9,800 — — Mark-to-market on derivatives: (Gain) loss on derivatives, net 154,365 216,942 96,240 (15,372) Settlements paid for matured derivatives, net (41,174) (57,607) (92,726) (129,361) Net premiums paid for commodity derivatives that matured during the period(1) (11,005) (10,183) (10,182) (10,183) Accretion expense 1,143 1,158 906 1,026 (Gain) loss on disposal of assets, net 72 (66) 22 8,903 Interest expense 25,946 25,870 30,406 31,163 Income tax (benefit) expense (762) (1,322) 2,677 3,052 Adjusted EBITDA $93,323 $96,991 $133,441 $182,162 Three months ended, Supplemental Non-GAAP Financial Measures Adjusted EBITDA Adjusted EBITDA is a non-GAAP financial measure that the Company defines as net income or loss (GAAP) plus adjustments for share-settled equity-based compensation, depletion, depreciation and amortization, impairment expense, mark-to-market on derivatives, premiums paid for commodity derivatives that matured during the period, accretion expense, gains or losses on disposal of assets, interest expense, income taxes and other non-recurring income and expenses. Adjusted EBITDA provides no information regarding a company's capital structure, borrowings, interest costs, capital expenditures, working capital movement or tax position. Adjusted EBITDA does not represent funds available for future discretionary use because it excludes funds required for debt service, capital expenditures, working capital, income taxes, franchise taxes and other commitments and obligations. However, management believes Adjusted EBITDA is useful to an investor in evaluating the Company’s operating performance because this measure: is widely used by investors in the oil and natural gas industry to measure a company's operating performance without regard to items that can vary substantially from company to company depending upon accounting methods, the book value of assets, capital structure and the method by which assets were acquired, among other factors; helps investors to more meaningfully evaluate and compare the results of operations from period to period by removing the effect of its capital structure from its operating structure; and is used by management for various purposes, including as a measure of operating performance, in presentations to the Company’s board of directors and as a basis for strategic planning and forecasting. There are significant limitations to the use of Adjusted EBITDA as a measure of performance, including the inability to analyze the effect of certain recurring and non-recurring items that materially affect our net income or loss and the lack of comparability of results of operations to different companies due to the different methods of calculating Adjusted EBITDA reported by different companies. The Company’s measurements of Adjusted EBITDA for financial reporting as compared to compliance under its debt agreements differ. The following table presents a reconciliation of net income (loss) (GAAP) to Adjusted EBITDA (non-GAAP): 18 1Reflects net premiums paid previously or upon settlement that are attributable to derivatives settled in the respective periods presented

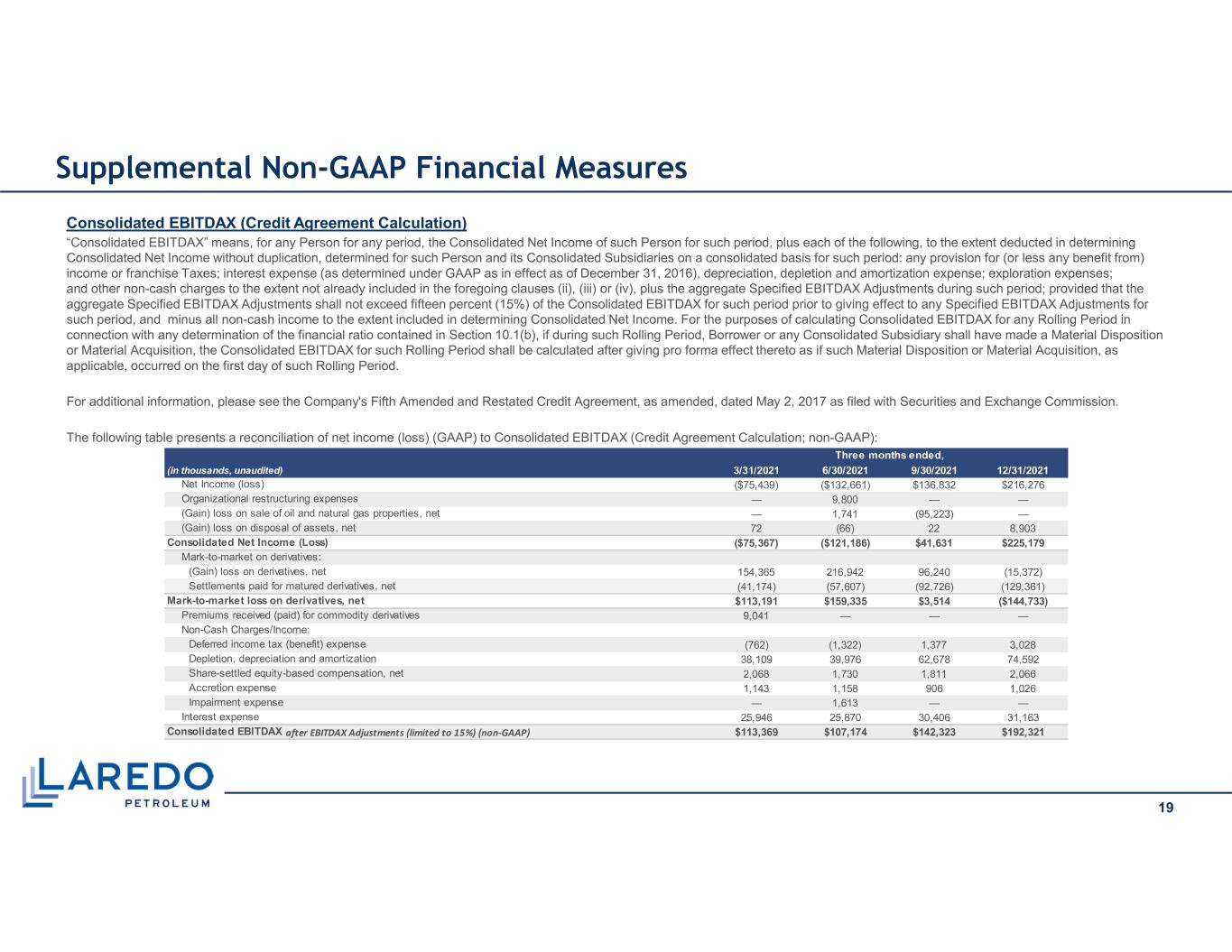

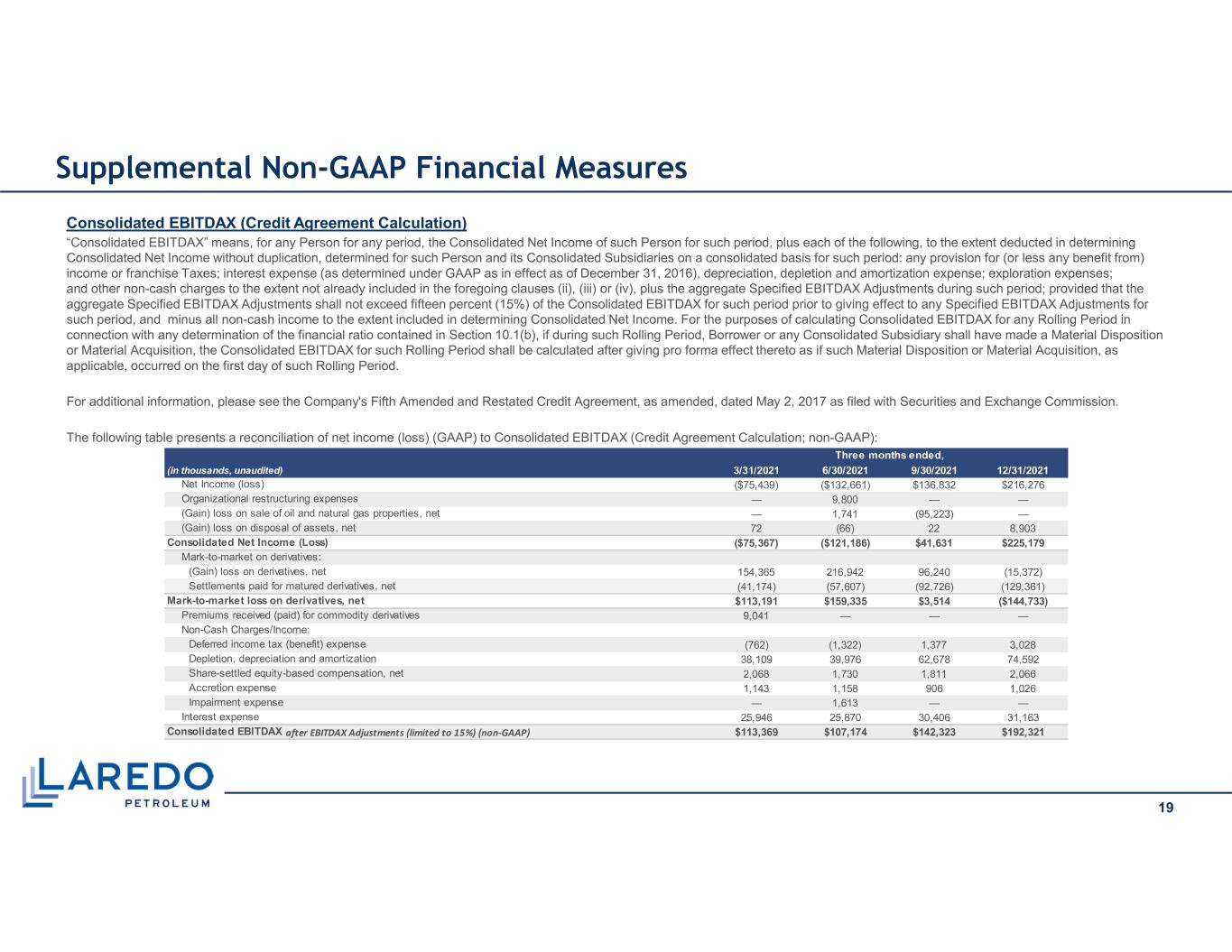

(in thousands, unaudited) 3/31/2021 6/30/2021 9/30/2021 12/31/2021 Net Income (loss) ($75,439) ($132,661) $136,832 $216,276 Organizational restructuring expenses — 9,800 — — (Gain) loss on sale of oil and natural gas properties, net — 1,741 (95,223) — (Gain) loss on disposal of assets, net 72 (66) 22 8,903 Consolidated Net Income (Loss) ($75,367) ($121,186) $41,631 $225,179 Mark-to-market on derivatives: (Gain) loss on derivatives, net 154,365 216,942 96,240 (15,372) Settlements paid for matured derivatives, net (41,174) (57,607) (92,726) (129,361) Mark-to-market loss on derivatives, net $113,191 $159,335 $3,514 ($144,733) Premiums received (paid) for commodity derivatives 9,041 — — — Non-Cash Charges/Income: Deferred income tax (benefit) expense (762) (1,322) 1,377 3,028 Depletion, depreciation and amortization 38,109 39,976 62,678 74,592 Share-settled equity-based compensation, net 2,068 1,730 1,811 2,066 Accretion expense 1,143 1,158 906 1,026 Impairment expense — 1,613 — — Interest expense 25,946 25,870 30,406 31,163 Consolidated EBITDAX after EBITDAX Adjustments (limited to 15%) (non-GAAP) $113,369 $107,174 $142,323 $192,321 Three months ended, Supplemental Non-GAAP Financial Measures Consolidated EBITDAX (Credit Agreement Calculation) “Consolidated EBITDAX” means, for any Person for any period, the Consolidated Net Income of such Person for such period, plus each of the following, to the extent deducted in determining Consolidated Net Income without duplication, determined for such Person and its Consolidated Subsidiaries on a consolidated basis for such period: any provision for (or less any benefit from) income or franchise Taxes; interest expense (as determined under GAAP as in effect as of December 31, 2016), depreciation, depletion and amortization expense; exploration expenses; and other non-cash charges to the extent not already included in the foregoing clauses (ii), (iii) or (iv), plus the aggregate Specified EBITDAX Adjustments during such period; provided that the aggregate Specified EBITDAX Adjustments shall not exceed fifteen percent (15%) of the Consolidated EBITDAX for such period prior to giving effect to any Specified EBITDAX Adjustments for such period, and minus all non-cash income to the extent included in determining Consolidated Net Income. For the purposes of calculating Consolidated EBITDAX for any Rolling Period in connection with any determination of the financial ratio contained in Section 10.1(b), if during such Rolling Period, Borrower or any Consolidated Subsidiary shall have made a Material Disposition or Material Acquisition, the Consolidated EBITDAX for such Rolling Period shall be calculated after giving pro forma effect thereto as if such Material Disposition or Material Acquisition, as applicable, occurred on the first day of such Rolling Period. For additional information, please see the Company's Fifth Amended and Restated Credit Agreement, as amended, dated May 2, 2017 as filed with Securities and Exchange Commission. The following table presents a reconciliation of net income (loss) (GAAP) to Consolidated EBITDAX (Credit Agreement Calculation; non-GAAP): 19

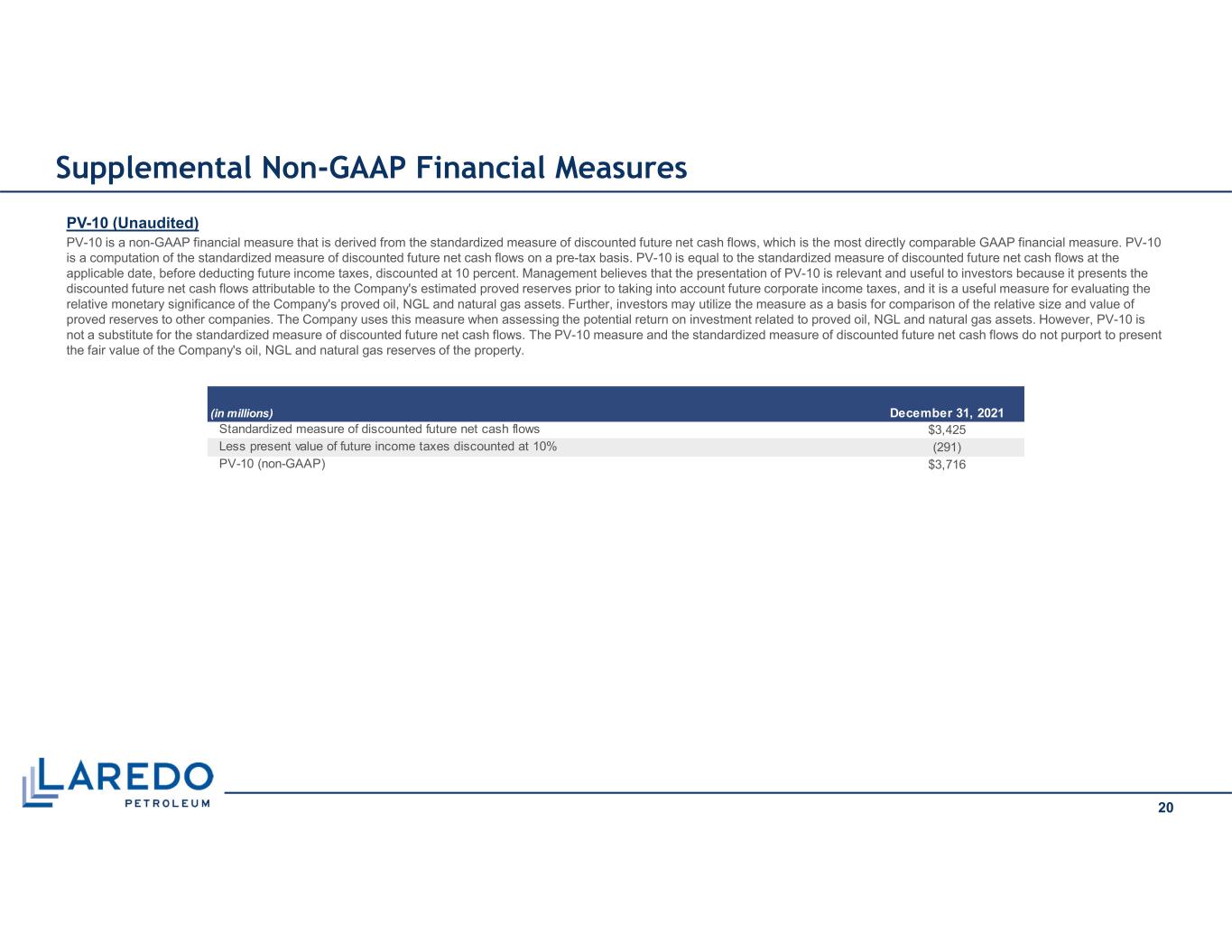

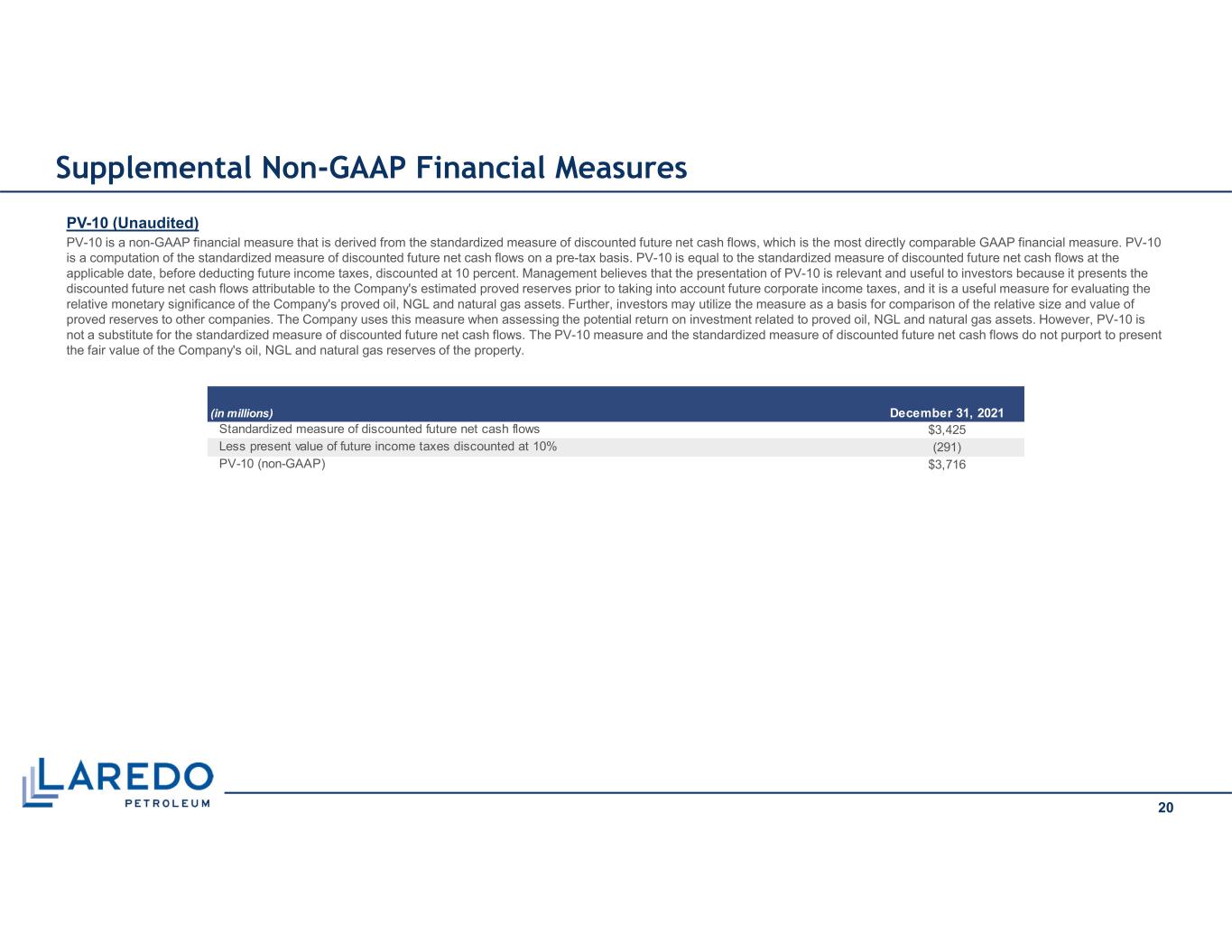

Supplemental Non-GAAP Financial Measures PV-10 (Unaudited) PV-10 is a non-GAAP financial measure that is derived from the standardized measure of discounted future net cash flows, which is the most directly comparable GAAP financial measure. PV-10 is a computation of the standardized measure of discounted future net cash flows on a pre-tax basis. PV-10 is equal to the standardized measure of discounted future net cash flows at the applicable date, before deducting future income taxes, discounted at 10 percent. Management believes that the presentation of PV-10 is relevant and useful to investors because it presents the discounted future net cash flows attributable to the Company's estimated proved reserves prior to taking into account future corporate income taxes, and it is a useful measure for evaluating the relative monetary significance of the Company's proved oil, NGL and natural gas assets. Further, investors may utilize the measure as a basis for comparison of the relative size and value of proved reserves to other companies. The Company uses this measure when assessing the potential return on investment related to proved oil, NGL and natural gas assets. However, PV-10 is not a substitute for the standardized measure of discounted future net cash flows. The PV-10 measure and the standardized measure of discounted future net cash flows do not purport to present the fair value of the Company's oil, NGL and natural gas reserves of the property. 20 (in millions) December 31, 2021 Standardized measure of discounted future net cash flows $3,425 Less present value of future income taxes discounted at 10% (291) PV-10 (non-GAAP) $3,716

Supplemental Non-GAAP Financial Measures Net Debt Net Debt, a non-GAAP financial measure, is calculated as the face value of long-term debt less cash and cash equivalents. Management believes Net Debt is useful to management and investors in determining the Company’s leverage position since the Company has the ability, and may decide, to use a portion of its cash and cash equivalents to reduce debt. Net Debt as of 12-31-2021 was $1.387 B. Net Debt to TTM Adjusted EBITDA Net Debt to TTM Adjusted EBITDA is calculated as Net Debt divided by trailing twelve-month Adjusted EBITDA. Net Debt to Adjusted EBITDA is used by the Company’s management for various purposes, including as a measure of operating performance, in presentations to its board of directors and as a basis for strategic planning and forecasting. Free Cash Flow Free Cash Flow is a non-GAAP financial measure, that the Company defines as net cash provided by operating activities (GAAP) before changes in operating assets and liabilities, net, less incurred capital expenditures, excluding non-budgeted acquisition costs. Free Cash Flow does not represent funds available for future discretionary use because it excludes funds required for future debt service, capital expenditures, acquisitions, working capital, income taxes, franchise taxes and other commitments and obligations. However, management believes Free Cash Flow is useful to management and investors in evaluating operating trends in its business that are affected by production, commodity prices, operating costs and other related factors. There are significant limitations to the use of Free Cash Flow as a measure of performance, including the lack of comparability due to the different methods of calculating Free Cash Flow reported by different companies. The Company is unable to provide a reconciliation of the forward-looking Free Cash Flow projection contained in this presentation to net cash provided by operating activities, the most directly comparable GAAP financial measure, because it cannot reliably predict certain of the necessary components of net cash provided by operating activities, such as changes in working capital, without unreasonable efforts. Such unavailable reconciling information may be significant. 21