Exhibit 99.2 Personalized, data-driven treatment for epilepsy 1 J ANUAR Y 2 0 2 2

| 2 Disclaimer In addition to background and historical information, this presentation contains “forward-looking statements” based on NeuroPace’s current expectations, estimates, forecasts and beliefs, including preliminary unaudited fourth quarter 2021 revenue and preliminary unaudited full-year 2021 revenue, information about NeuroPace's market opportunity, growth drivers and market penetration, commercial strategy, future pipeline, indication and TAM Expansion Opportunities, clinical trial timelines, and the statements under the captions NeuroPace Summary, “RNS Platform Provides Significant TAM Expansion Opportunities,” Continued Execution Amidst Pandemic, and Strategy to Drive Long-Term Growth in the slides that follow. The preliminary projections set forth in this presentation reflect NeuroPace’s current preliminary projections, are subject to the completion of NeuroPace’s audit process and are subject to change. NeuroPace’s fourth quarter 2021 revenue and its full-year 2021 revenue could differ materially from the preliminary projections provided in this presentation. These forward-looking statements are subject to inherent uncertainties, risks, and assumptions that are difficult to predict. Actual outcomes and results could differ materially due to a number of factors, including the ongoing uncertainty of the impact of the COVID-19 pandemic, as well as COVID recovery impact, on NeuroPace's business. Factors that could cause NeuroPace’s actual results to vary from the preliminary projections noted here include variances between NeuroPace’s preliminary revenue accruals and its actual results and NeuroPace’s ability to execute its standard processes for booking results. Additional risks and uncertainties include those described more fully in the section titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and elsewhere in NeuroPace's public filings with the U.S. Securities and Exchange Commission (the “SEC”), including our quarterly report on Form 10-Q filed with the SEC for the period ended September 30, 2021 as well as any reports that we may file with the SEC in the future. Forward-looking statements contained in this presentation are based on information available to NeuroPace as of the date hereof. NeuroPace undertakes no obligation to update such information except as required under applicable law. These forward-looking statements should not be relied upon as representing NeuroPace’s views as of any date subsequent to the date of this press release and should not be relied upon as prediction of future events. In light of the foregoing, investors are urged not to rely on any forward-looking statement in reaching any conclusion or making any investment decision about any securities of NeuroPace. This presentation contains statistical data, estimates, and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on NeuroPace’s internal sources. While NeuroPace believes the industry and market data included in this presentation are reliable and are based on reasonable assumptions, these data involve many assumptions and limitations, and investors are cautioned not to give undue weight to these estimates. NeuroPace has not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of such products or services. 2 J ANUAR Y 2 0 2 2

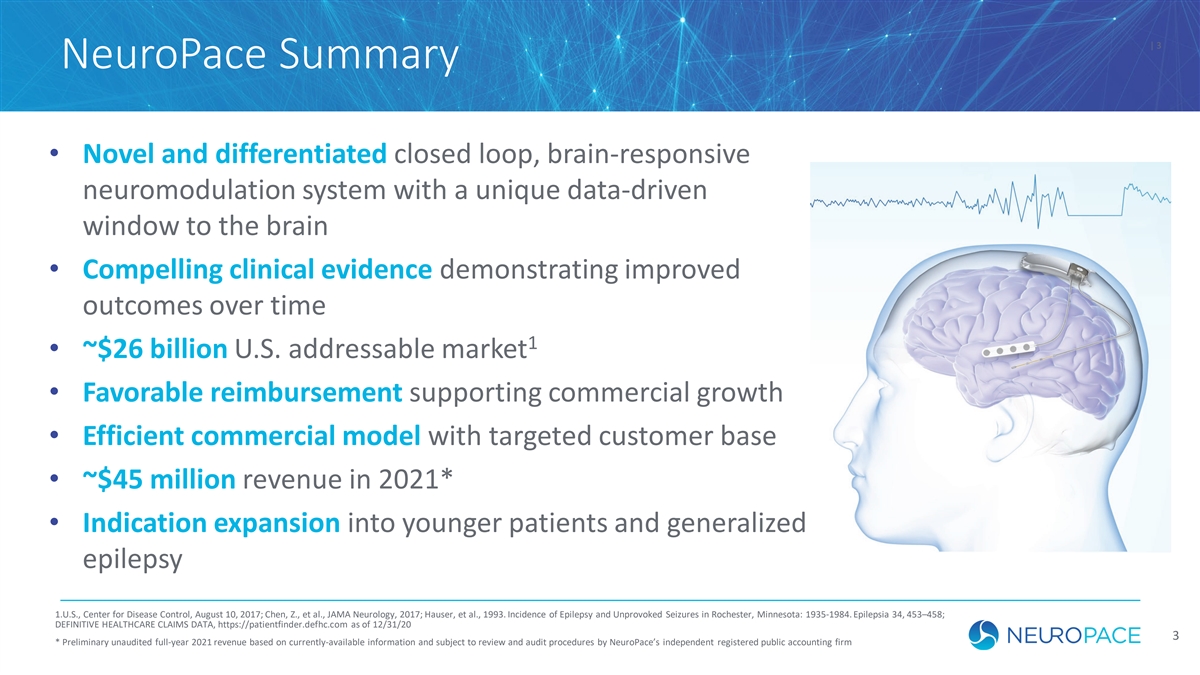

| 3 NeuroPace Summary • Novel and differentiated closed loop, brain-responsive neuromodulation system with a unique data-driven window to the brain • Compelling clinical evidence demonstrating improved outcomes over time 1 • ~$26 billion U.S. addressable market • Favorable reimbursement supporting commercial growth • Efficient commercial model with targeted customer base • ~$45 million revenue in 2021* • Indication expansion into younger patients and generalized epilepsy 1.U.S., Center for Disease Control, August 10, 2017; Chen, Z., et al., JAMA Neurology, 2017; Hauser, et al., 1993. Incidence of Epilepsy and Unprovoked Seizures in Rochester, Minnesota: 1935-1984. Epilepsia 34, 453–458; DEFINITIVE HEALTHCARE CLAIMS DATA, https://patientfinder.defhc.com as of 12/31/20 3 J ANUAR Y 2 0 2 2 * Preliminary unaudited full-year 2021 revenue based on currently-available information and subject to review and audit procedures by NeuroPace’s independent registered public accounting firm

3.4 Million People in the U.S. 1 Living with Epilepsy th 2 4 Most Common Neurological Disorder in the U.S. Impact on Society 2 • ~$28 billion direct medical costs in the U.S. • 2-3X higher unemployment among 3 epilepsy patients Impact on Drug-Resistant Patients • Increased risk of mortality • Reduced quality of life • Social stigmatization • Loss of independence 1. U.S. Center for Disease Control, August 10, 2017. 2. Examining the Economic Impact and Implications of Epilepsy, AJMC, February 13, 2020 3. Epilepsy Across the Spectrum 12.4.26: https://www.ncbi.nlm.nih.gov/books/NBK100603/ 4 4 J ANUAR Y 2 0 2 2

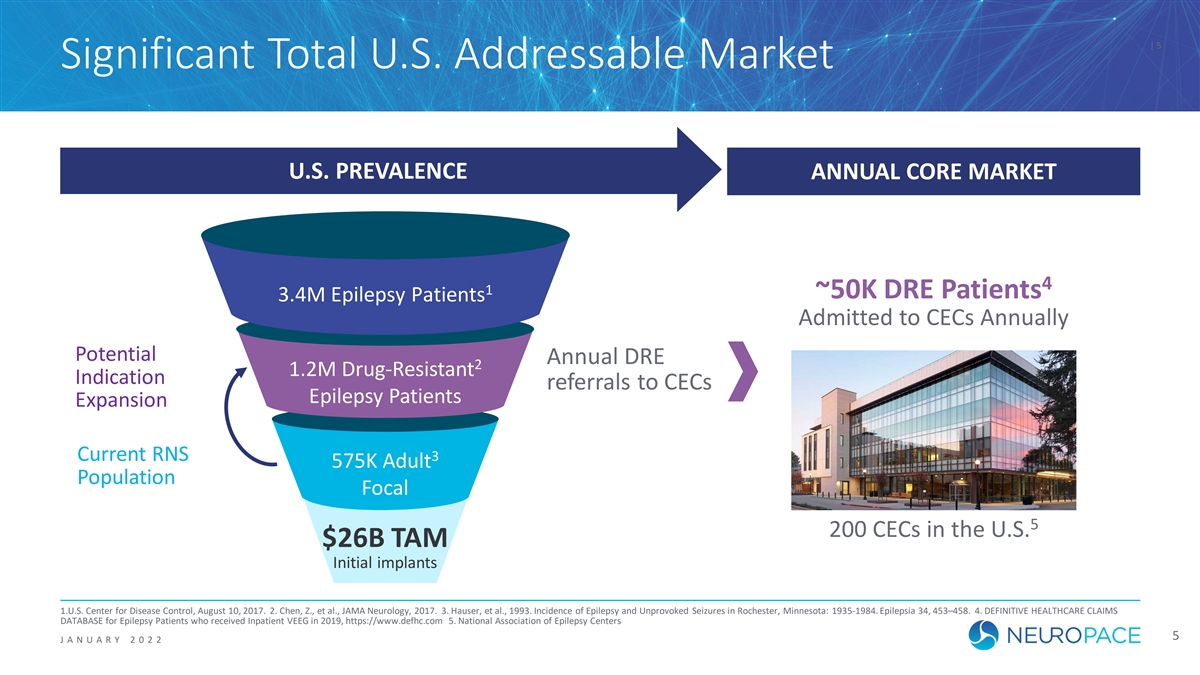

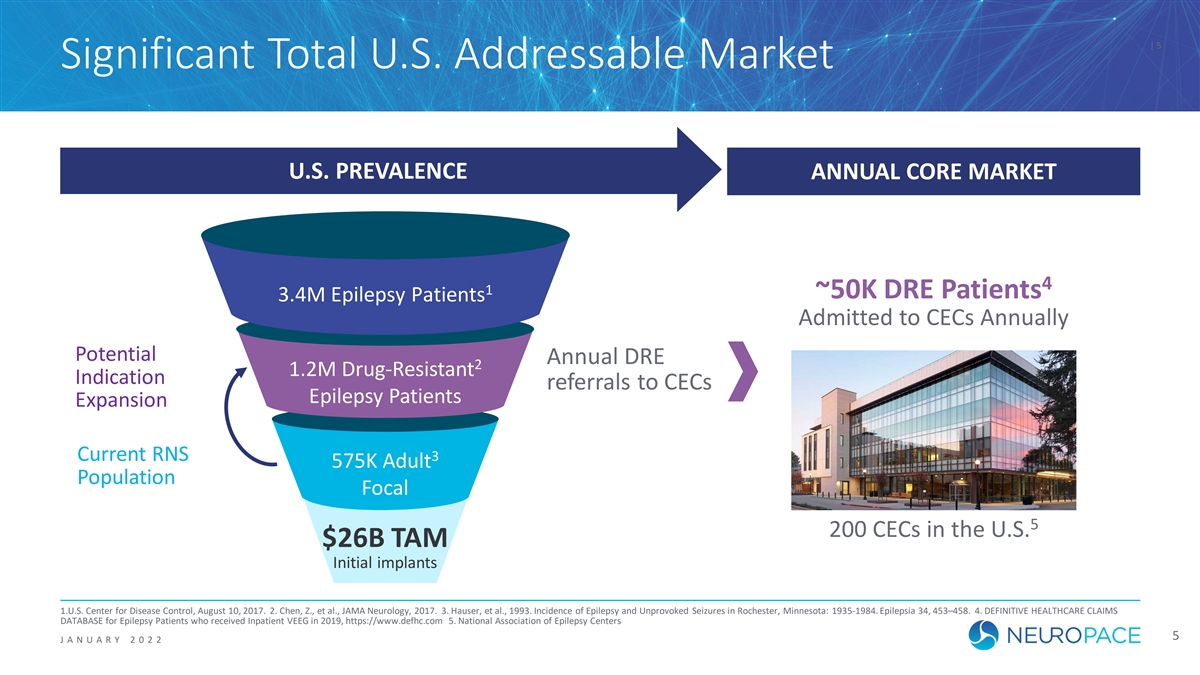

| 5 Significant Total U.S. Addressable Market U.S. PREVALENCE ANNUAL CORE MARKET 4 1 ~50K DRE Patients 3.4M Epilepsy Patients Admitted to CECs Annually Potential Annual DRE 2 1.2M Drug-Resistant Indication referrals to CECs Epilepsy Patients Expansion Current RNS 3 575K Adult Population Focal 5 200 CECs in the U.S. $26B TAM Initial implants 1.U.S. Center for Disease Control, August 10, 2017. 2. Chen, Z., et al., JAMA Neurology, 2017. 3. Hauser, et al., 1993. Incidence of Epilepsy and Unprovoked Seizures in Rochester, Minnesota: 1935-1984. Epilepsia 34, 453–458. 4. DEFINITIVE HEALTHCARE CLAIMS DATABASE for Epilepsy Patients who received Inpatient VEEG in 2019, https://www.defhc.com 5. National Association of Epilepsy Centers 5 J ANUAR Y 2 0 2 2

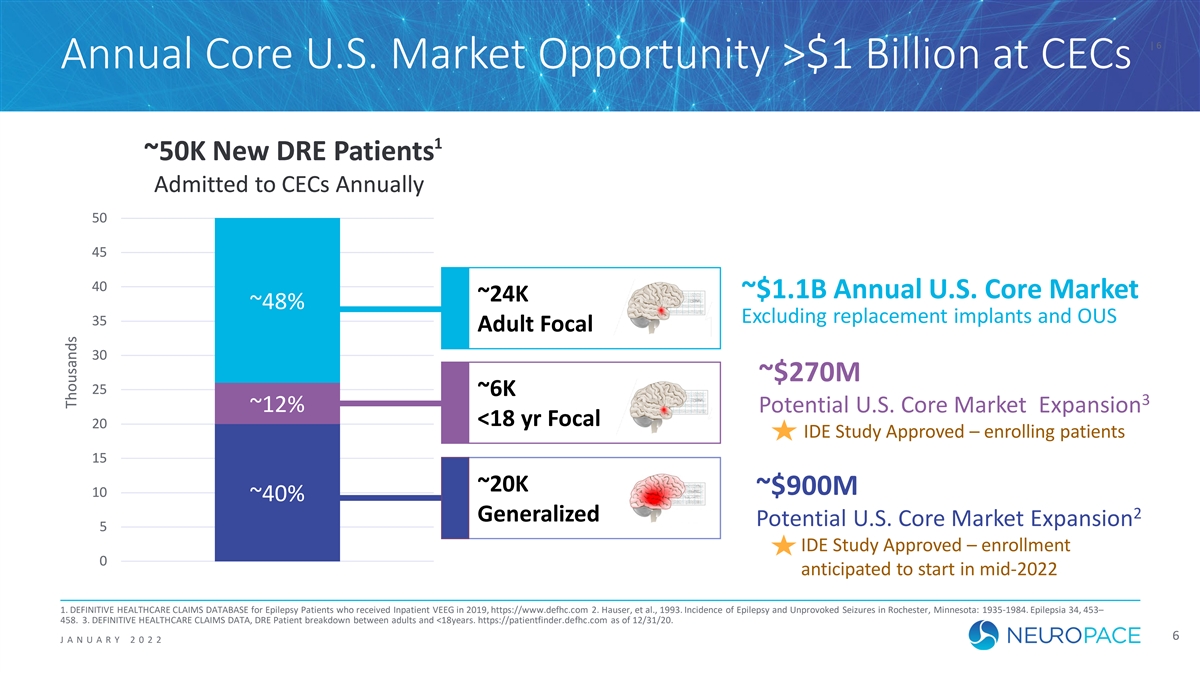

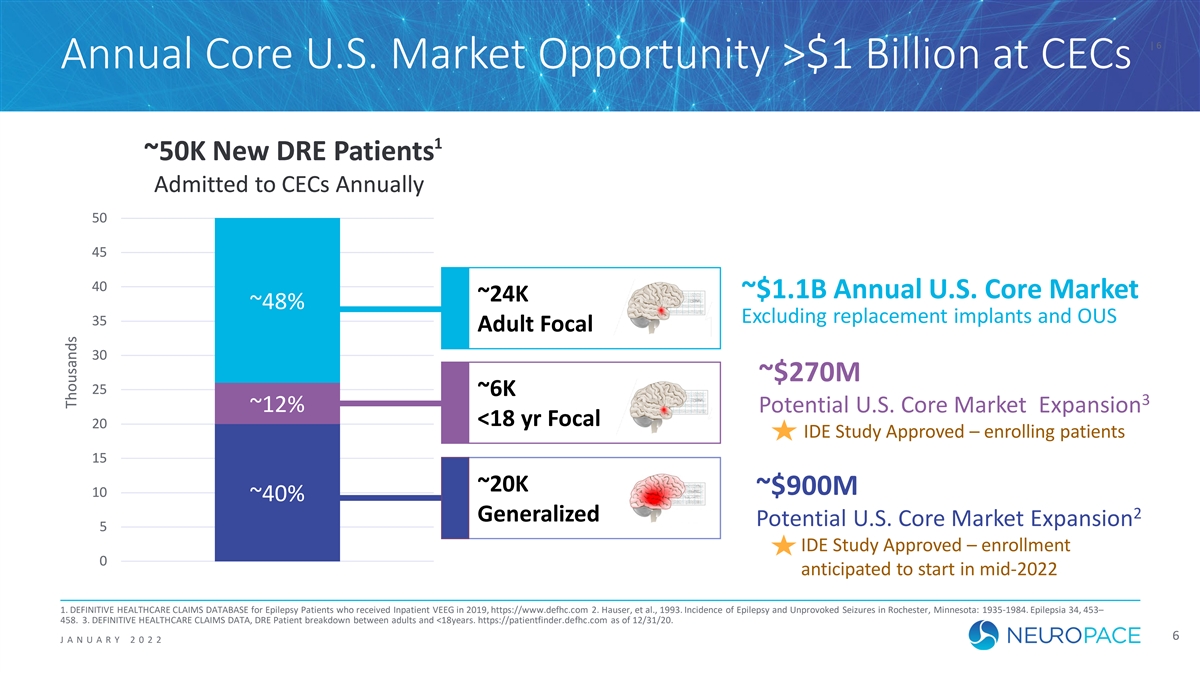

| 6 Annual Core U.S. Market Opportunity >$1 Billion at CECs 1 ~ ~50K N 50K Ne ew w D DR RE E P Pa ati tie en nts ts A Adm dmiit tt te ed t d to o C CE EC Cs s A Annua nnualllly y 50 50 45 45 40 40 ~$1.1B Annual U.S. Core Market ~ ~24K 24K ~ ~48% 48% Excluding replacement implants and OUS 35 35 A Ad du ul lt t F Fo oc ca al l 30 30 ~$270M 25 25 ~ ~6 6K K 3 ~ ~12% 12% Potential U.S. Core Market Expansion < <18 18 yr yr Fo Foc ca al l 20 20 IDE Study Approved – enrolling patients 15 15 ~ ~20K 20K ~$900M 10 10 ~ ~40% 40% 2 G Gen ener era al li iz zed ed Potential U.S. Core Market Expansion 5 5 IDE Study Approved – enrollment 0 0 anticipated to start in mid-2022 1. DEFINITIVE HEALTHCARE CLAIMS DATABASE for Epilepsy Patients who received Inpatient VEEG in 2019, https://www.defhc.com 2. Hauser, et al., 1993. Incidence of Epilepsy and Unprovoked Seizures in Rochester, Minnesota: 1935-1984. Epilepsia 34, 453– 458. 3. DEFINITIVE HEALTHCARE CLAIMS DATA, DRE Patient breakdown between adults and <18years. https://patientfinder.defhc.com as of 12/31/20. 6 J ANUAR Y 2 0 2 2 T Tho hous usa ands nds

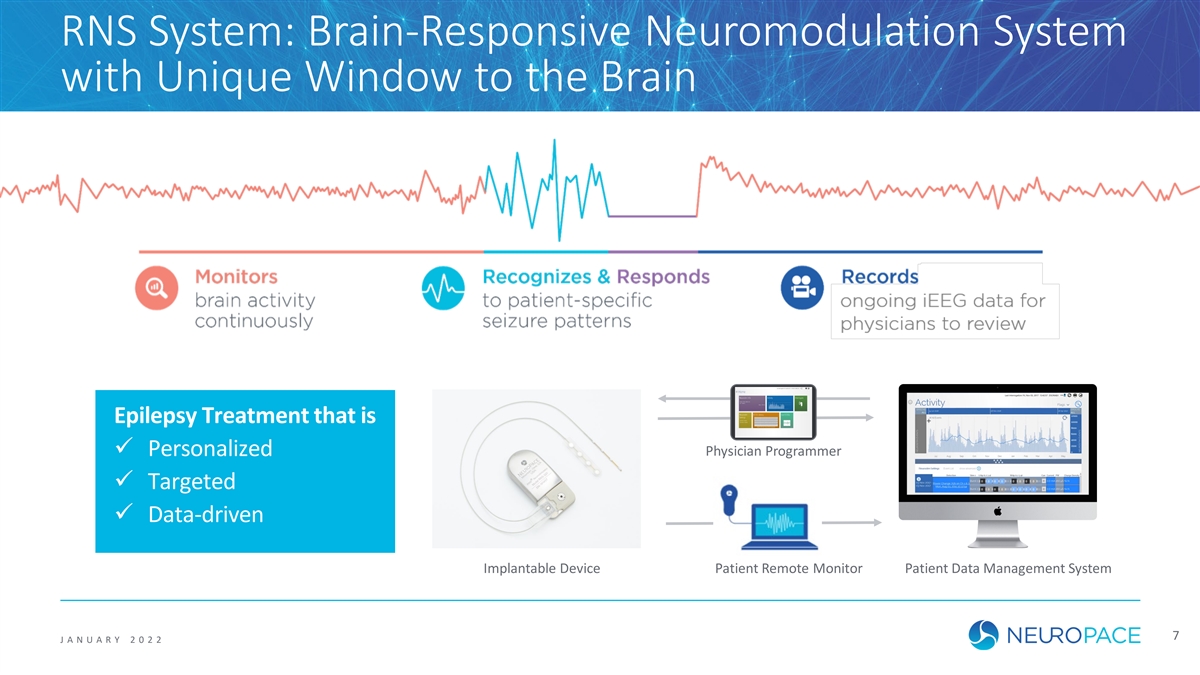

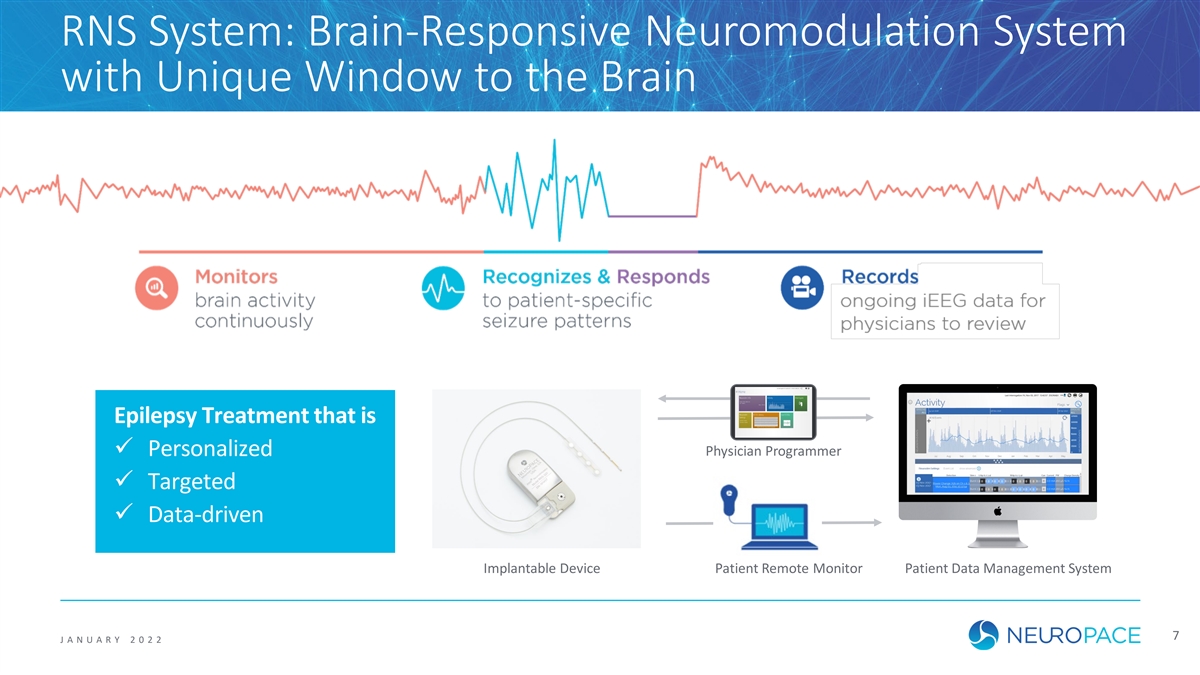

RNS System: Brain-Responsive Neuromodulation System with Unique Window to the Brain Epilepsy Treatment that is ü Personalized Physician Programmer ü Targeted ü Data-driven Implantable Device Patient Remote Monitor Patient Data Management System 7 J ANUAR Y 2 0 2 2

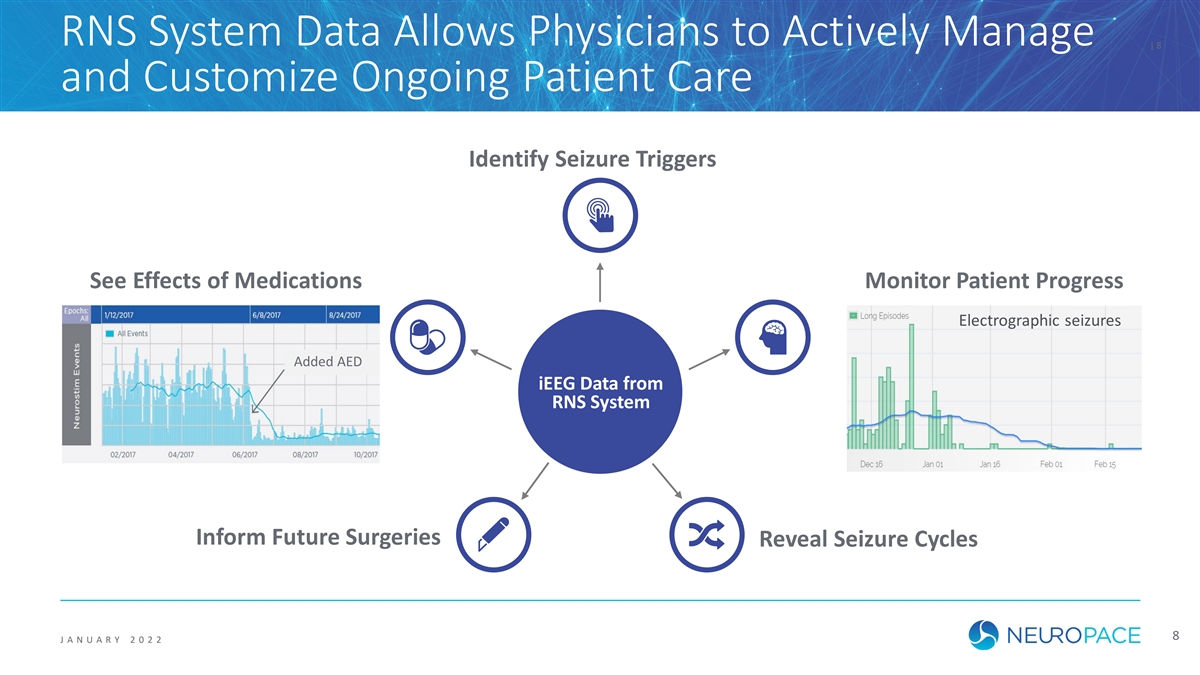

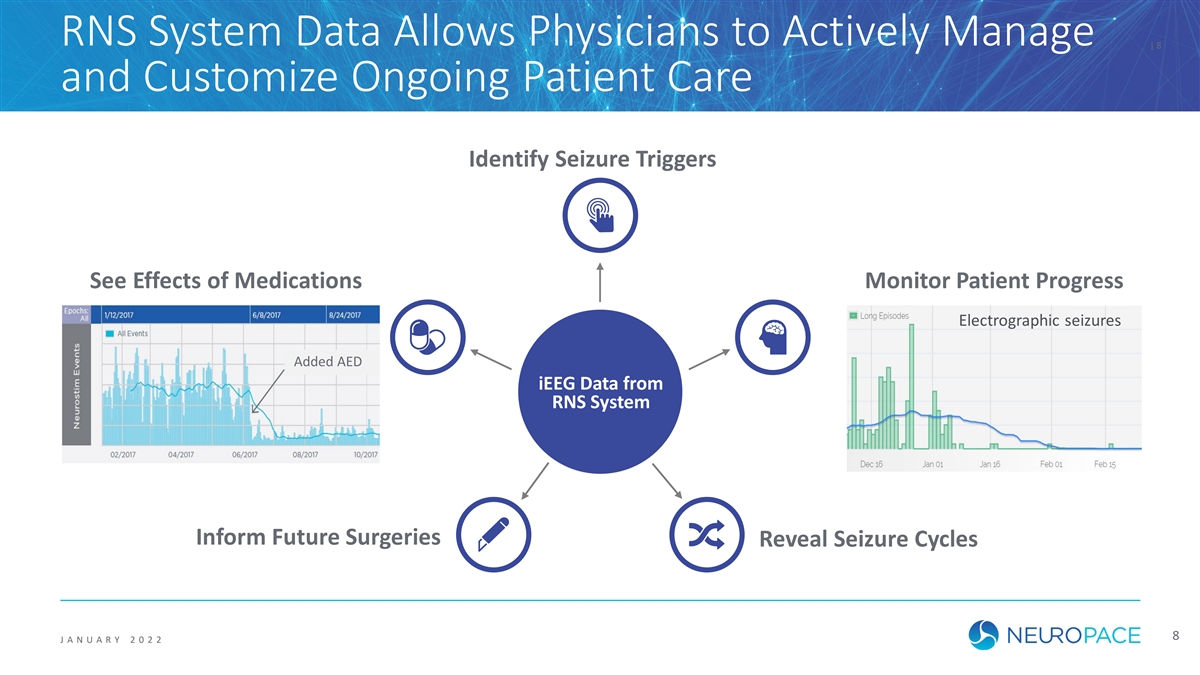

RNS System Data Allows Physicians to Actively Manage | 8 and Customize Ongoing Patient Care Identify Seizure Triggers See Effects of Medications Monitor Patient Progress Electrographic seizures Added AED iEEG Data from RNS System Inform Future Surgeries Reveal Seizure Cycles 8 J ANUAR Y 2 0 2 2

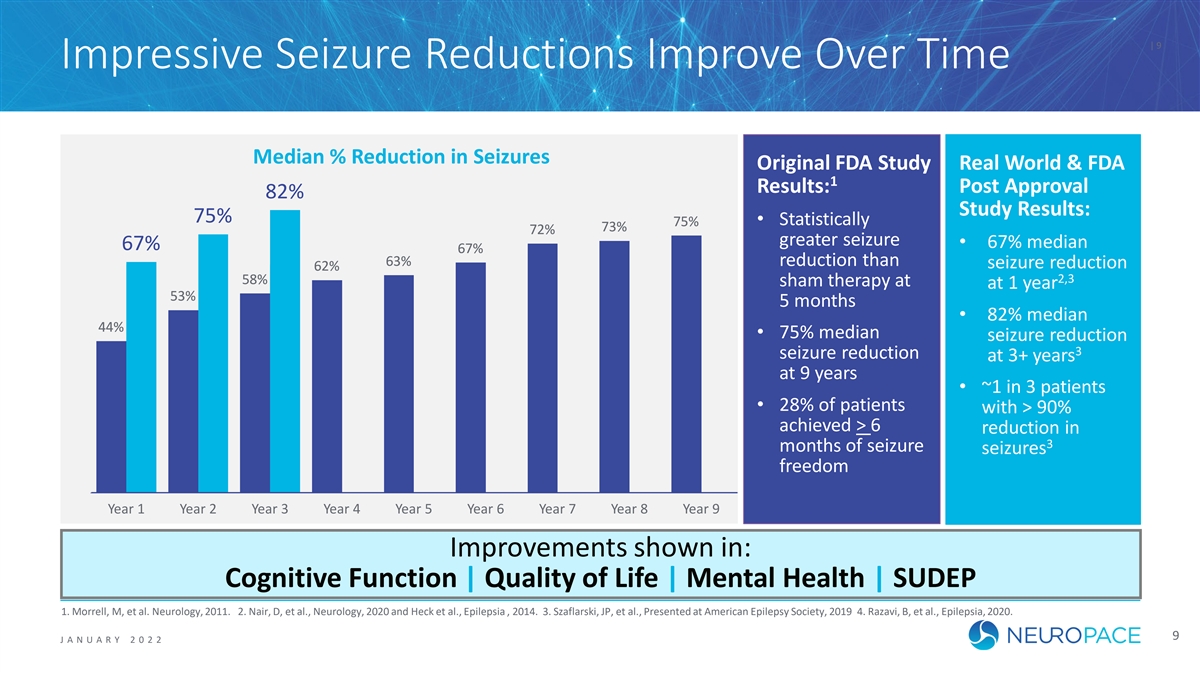

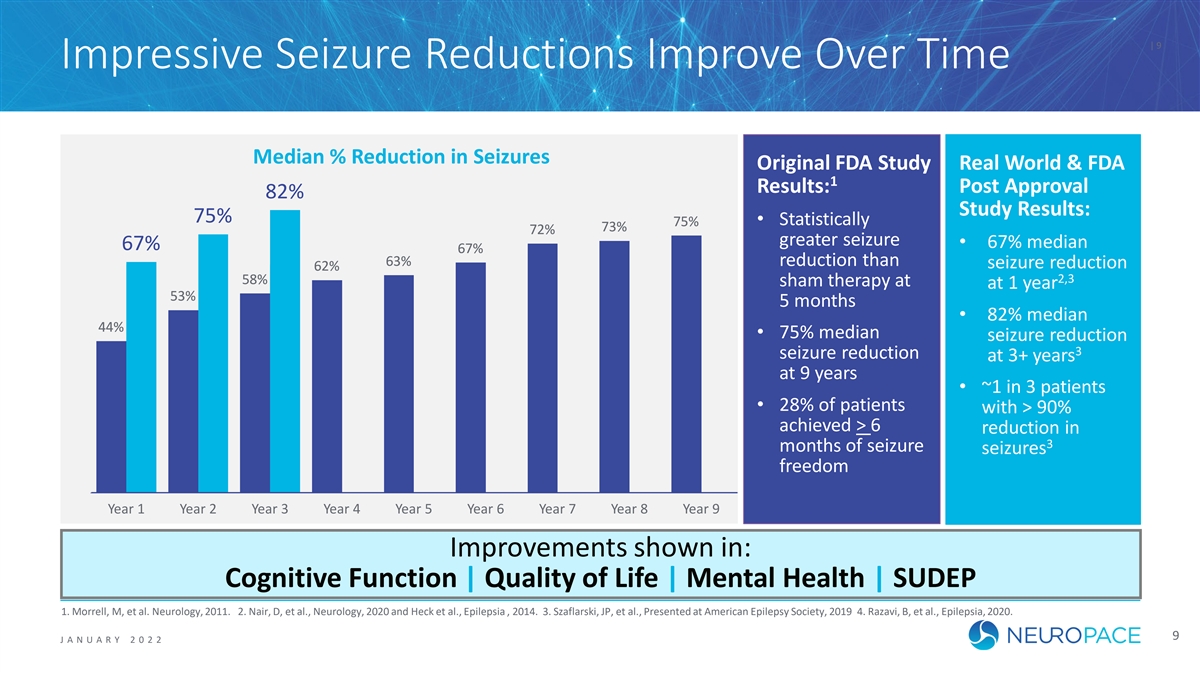

| 9 Impressive Seizure Reductions Improve Over Time Median % Reduction in Seizures Original FDA Study Real World & FDA 1 Results: Post Approval 82% 82% Study Results: 75% 75% • Statistically 75% 75% 73% 73% 72% 72% greater seizure • 67% median 67% 67% 67% 67% 63% 63% reduction than seizure reduction 62% 62% 2,3 58% 58% sham therapy at at 1 year 53% 53% 5 months • 82% median 44% 44% • 75% median seizure reduction 3 seizure reduction at 3+ years at 9 years • ~1 in 3 patients • 28% of patients with > 90% achieved > 6 reduction in 3 months of seizure seizures freedom Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Improvements shown in: Cognitive Function | Quality of Life | Mental Health | SUDEP 1. Morrell, M, et al. Neurology, 2011. 2. Nair, D, et al., Neurology, 2020 and Heck et al., Epilepsia , 2014. 3. Szaflarski, JP, et al., Presented at American Epilepsy Society, 2019 4. Razavi, B, et al., Epilepsia, 2020. 9 J ANUAR Y 2 0 2 2

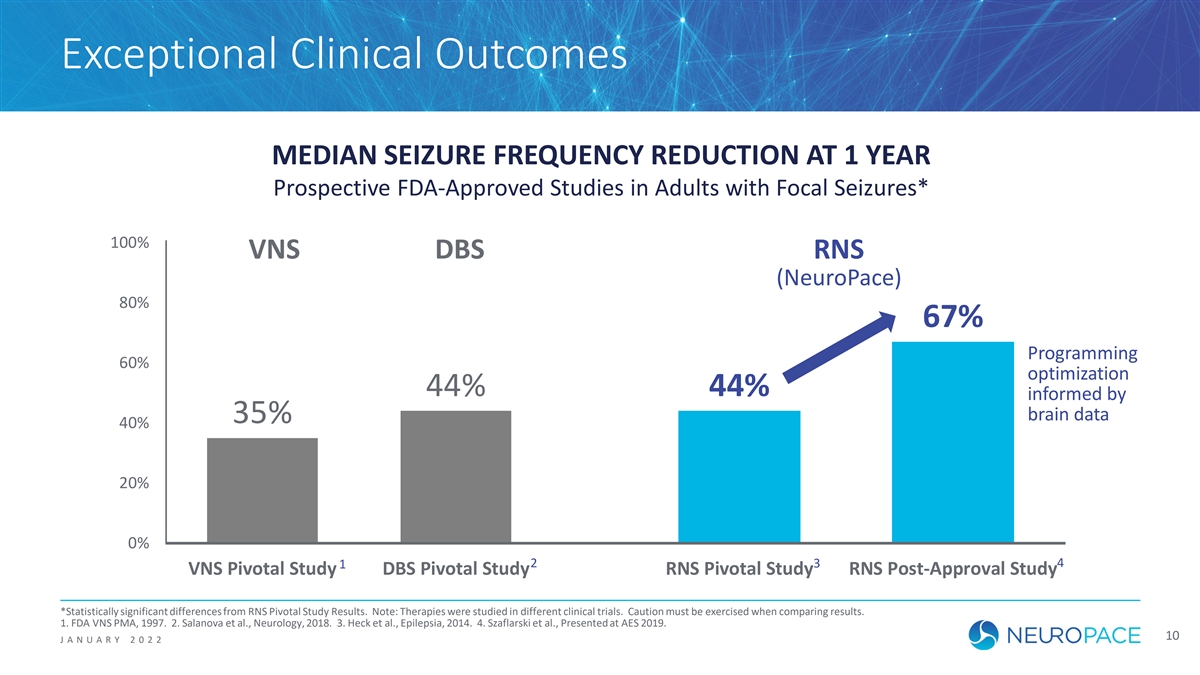

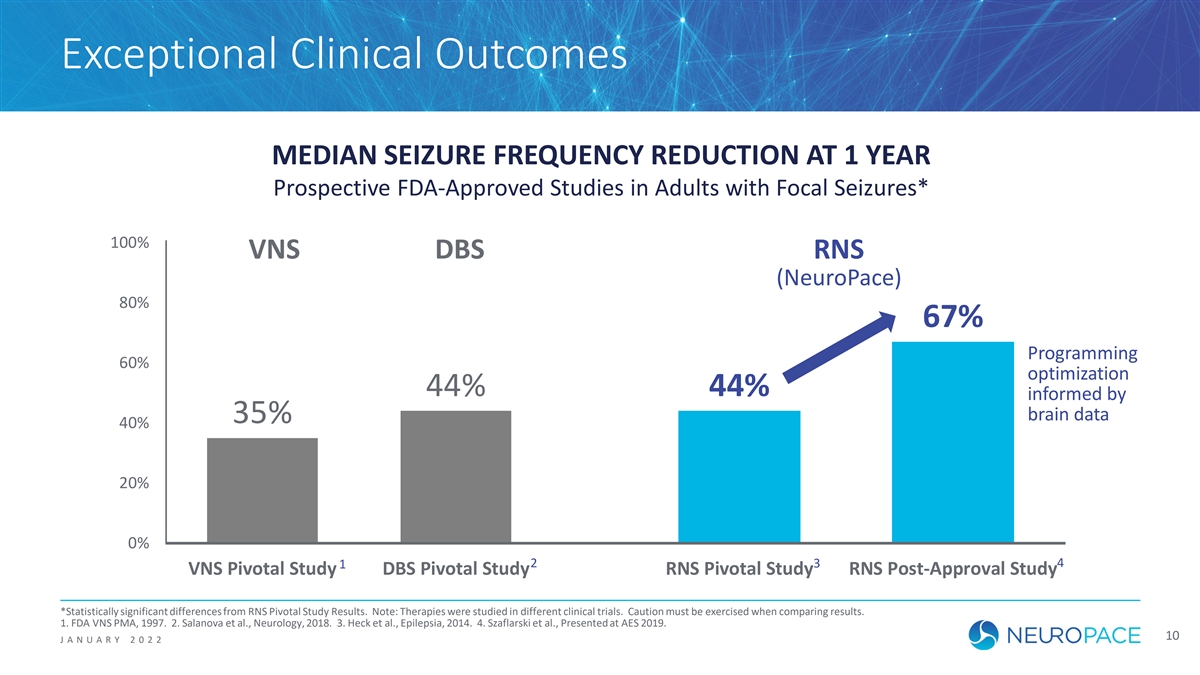

Exceptional Clinical Outcomes MEDIAN SEIZURE FREQUENCY REDUCTION AT 1 YEAR Prospective FDA-Approved Studies in Adults with Focal Seizures* 100% VNS DBS RNS (NeuroPace) 80% 67% Programming 60% optimization 44% 44% informed by brain data 35% 40% 20% 0% 2 3 4 1 VNS Pivotal Study DBS Pivotal Study RNS Pivotal Study RNS Post-Approval Study *Statistically significant differences from RNS Pivotal Study Results. Note: Therapies were studied in different clinical trials. Caution must be exercised when comparing results. 1. FDA VNS PMA, 1997. 2. Salanova et al., Neurology, 2018. 3. Heck et al., Epilepsia, 2014. 4. Szaflarski et al., Presented at AES 2019. 10 J ANUAR Y 2 0 2 2

11 The RNS System Addresses a Current Unmet Need EPILEPSY SURGERY NEUROMODULATION COMPETITORS Irreversible & invasive Fixed anatomical target Carries neurocognitive risks Not responsive to brain activity 1 ~20% of patients are ideal candidates Lengthy stimulation cycles result in side effects No detailed iEEG recordings VNS DBS Resection Laser Ablation 1. Schiltz, et al., Temporal trends in pre-surgical evaluations and epilepsy surgery in the U.S. from 1998 to 2009, Epilepsy Research, Volume 103, Issues 2–3,2013,Pages 270-278; Dugan, et al., Derivation and initial validation of a surgical grading scale for the preliminary evaluation of adult patients with drug-resistant focal epilepsy. Epilepsia, (2017) 58: 792-800. 11 J ANUAR Y 2 0 2 2

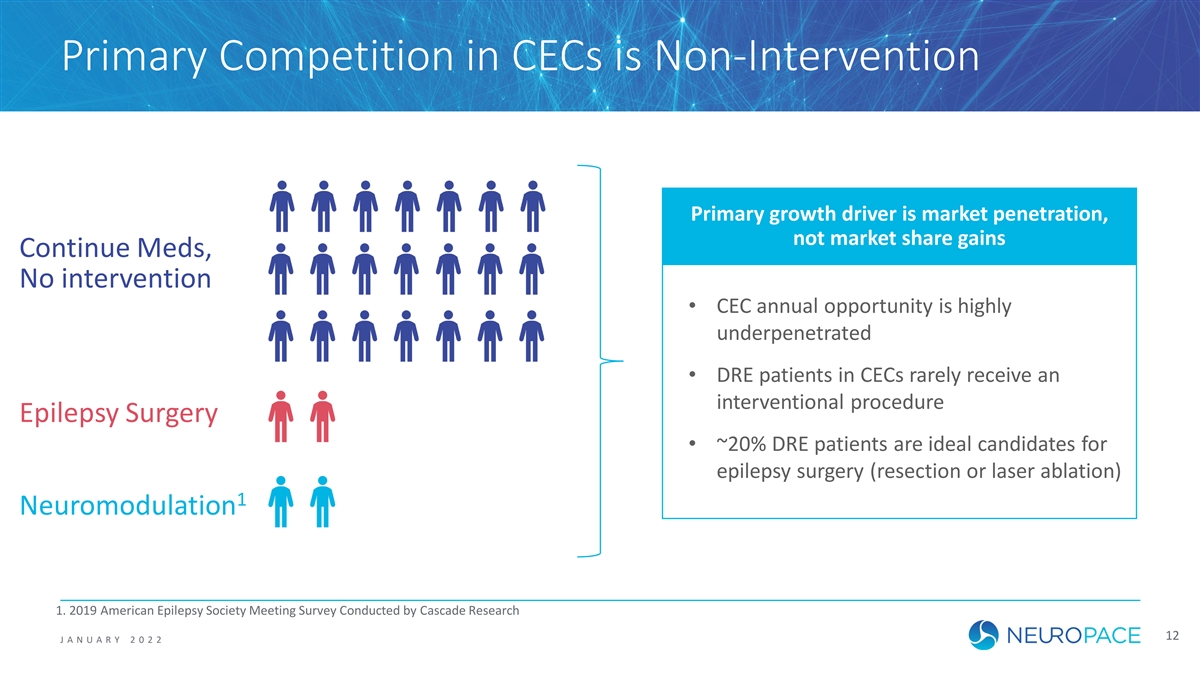

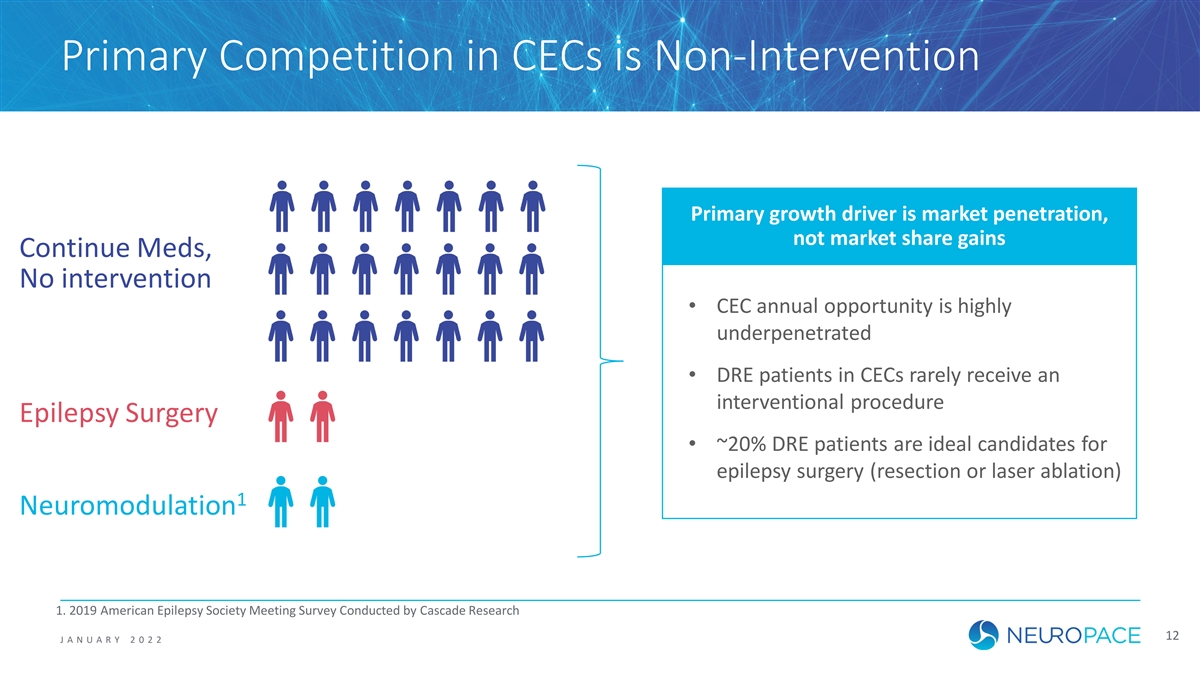

Primary Competition in CECs is Non-Intervention Primary growth driver is market penetration, not market share gains Continue Meds, No intervention • CEC annual opportunity is highly underpenetrated • DRE patients in CECs rarely receive an interventional procedure Epilepsy Surgery • ~20% DRE patients are ideal candidates for epilepsy surgery (resection or laser ablation) 1 Neuromodulation 1. 2019 American Epilepsy Society Meeting Survey Conducted by Cascade Research 12 J ANUAR Y 2022

Commercial Strategy Focused on Capturing | 13 >$1 Billion Annual CEC Market Opportunity Own the CEC Channel 1 2 3 4 Capture Increase Number Expand Prescriber Drive Referrals Level 4 CECs of Prescribers Utilization to CECs Small, Focused Customer Footprint Maximizes Efficiency of Commercial Investment 13 J ANUAR Y 2 0 2 2

| 14 Continued Execution Amidst Pandemic Accomplishments COVID-19 Headwinds Commercial Execution Clinical & Product Delayed scheduling or First patient enrolled in Expected initial implant postponed implant adolescent study revenue growth of ~20% procedures over 2020 IDE approval for primary Reduced EMU generalized epilepsy 150 total implanting admissions study centers in 2021 Released nSight Platform Increased number of prescribing physicians Labeling for increased device longevity submitted to FDA 14 J ANUAR Y 2 0 2 2

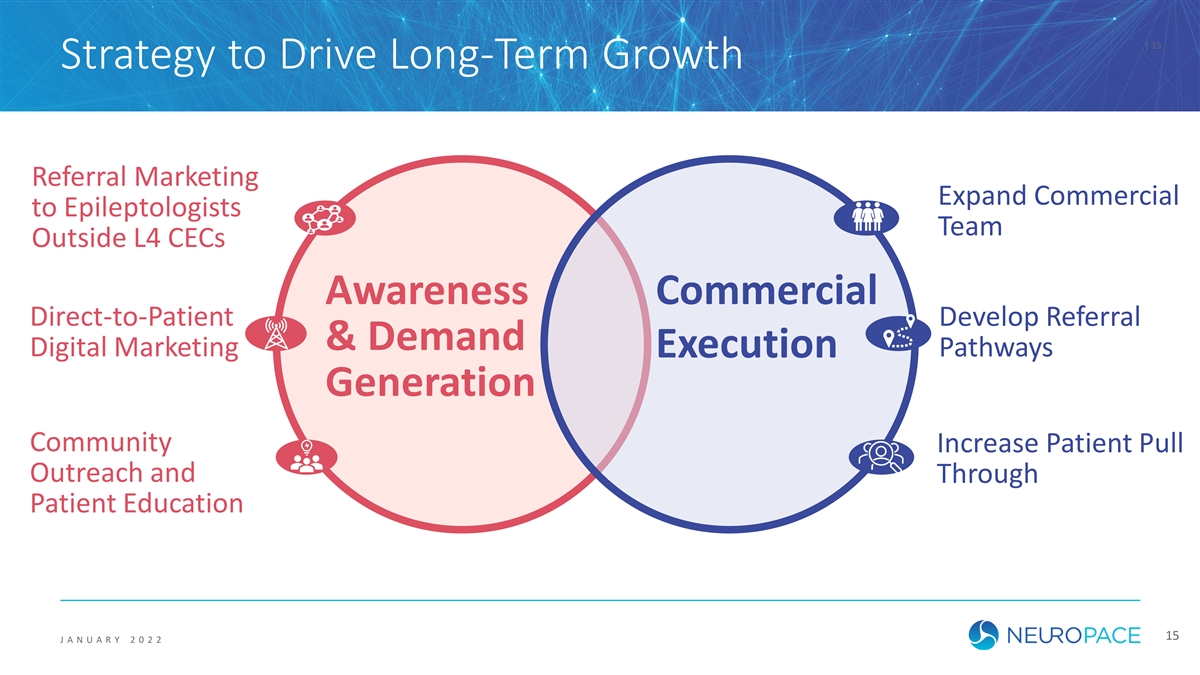

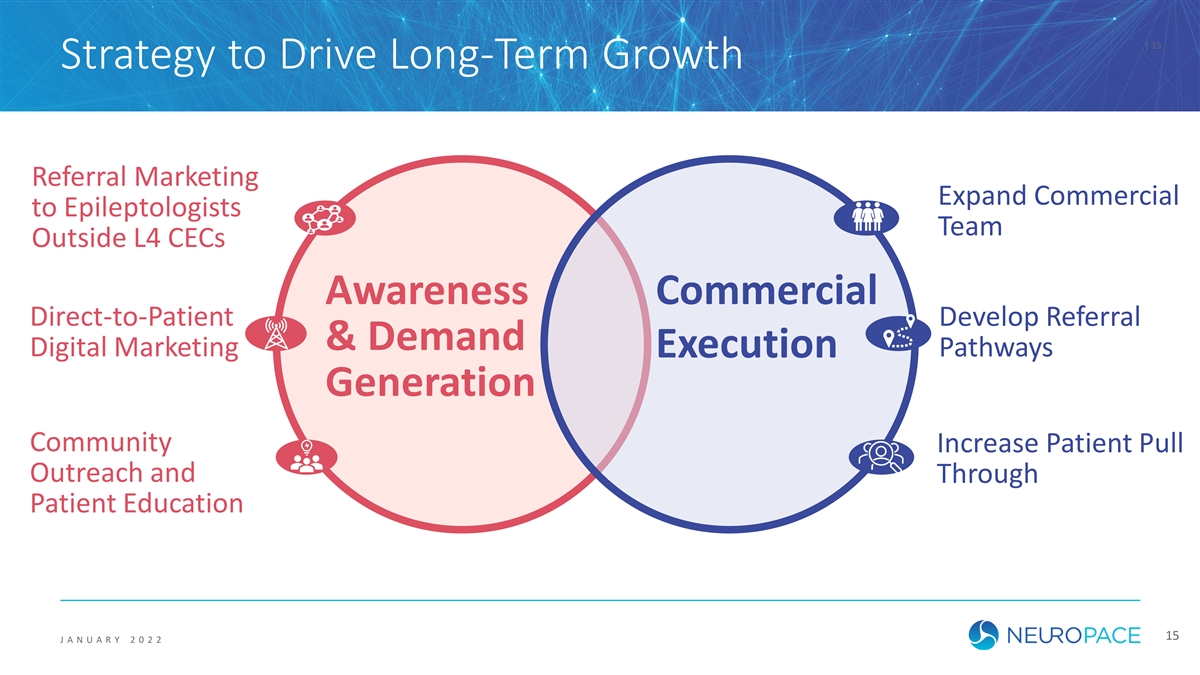

| 15 Strategy to Drive Long-Term Growth Referral Marketing Expand Commercial to Epileptologists Team Outside L4 CECs Awareness Commercial Direct-to-Patient Develop Referral & Demand Digital Marketing Pathways Execution Generation Community Increase Patient Pull Outreach and Through Patient Education 15 J ANUAR Y 2 0 2 2

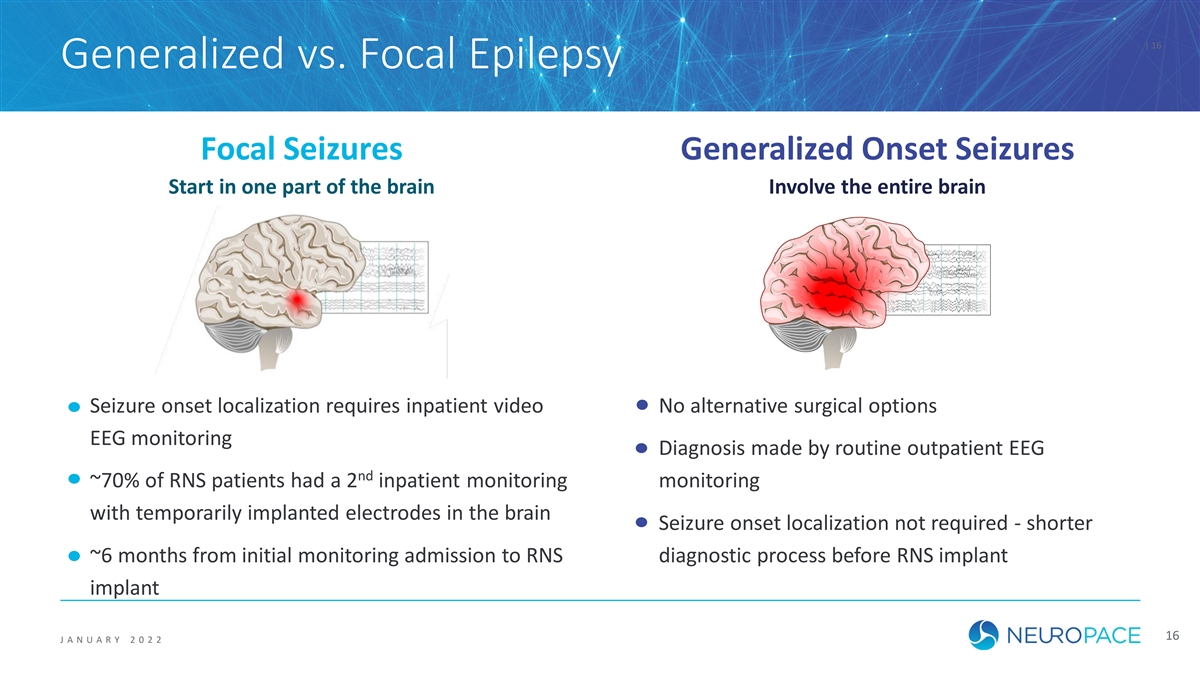

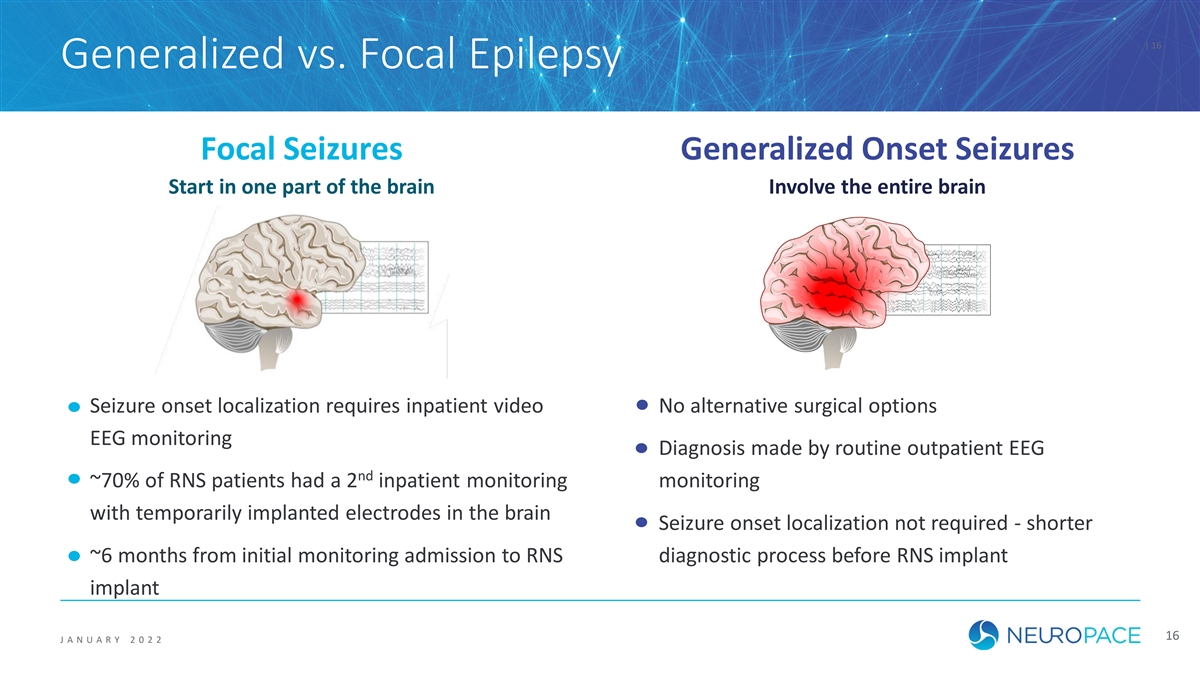

| 16 Generalized vs. Focal Epilepsy Focal Seizures Generalized Onset Seizures Start in one part of the brain Involve the entire brain Seizure onset localization requires inpatient video No alternative surgical options EEG monitoring Diagnosis made by routine outpatient EEG nd ~70% of RNS patients had a 2 inpatient monitoring monitoring with temporarily implanted electrodes in the brain Seizure onset localization not required - shorter ~6 months from initial monitoring admission to RNS diagnostic process before RNS implant implant 16 J ANUAR Y 2 0 2 2

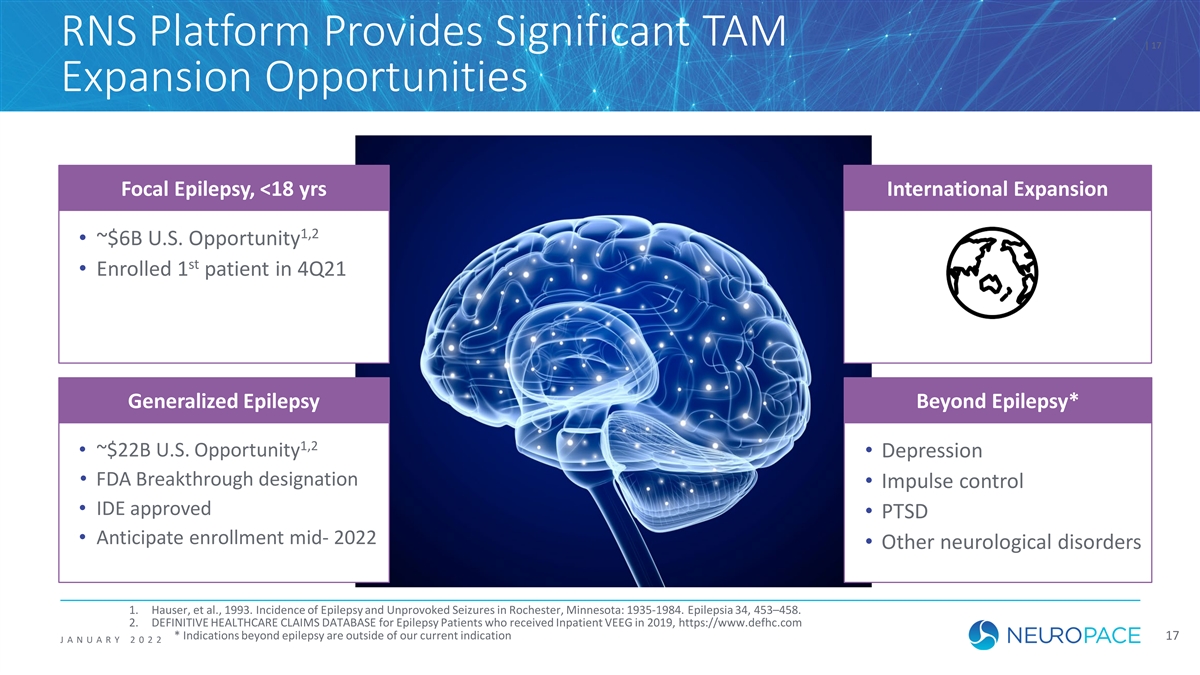

RNS Platform Provides Significant TAM | 17 Expansion Opportunities Focal Epilepsy, <18 yrs International Expansion 1,2 • ~$6B U.S. Opportunity st • Enrolled 1 patient in 4Q21 Generalized Epilepsy Beyond Epilepsy* 1,2 • ~$22B U.S. Opportunity • Depression • FDA Breakthrough designation • Impulse control • IDE approved • PTSD • Anticipate enrollment mid- 2022 • Other neurological disorders 1. Hauser, et al., 1993. Incidence of Epilepsy and Unprovoked Seizures in Rochester, Minnesota: 1935-1984. Epilepsia 34, 453–458. 2. DEFINITIVE HEALTHCARE CLAIMS DATABASE for Epilepsy Patients who received Inpatient VEEG in 2019, https://www.defhc.com * Indications beyond epilepsy are outside of our current indication 17 J ANUAR Y 2022

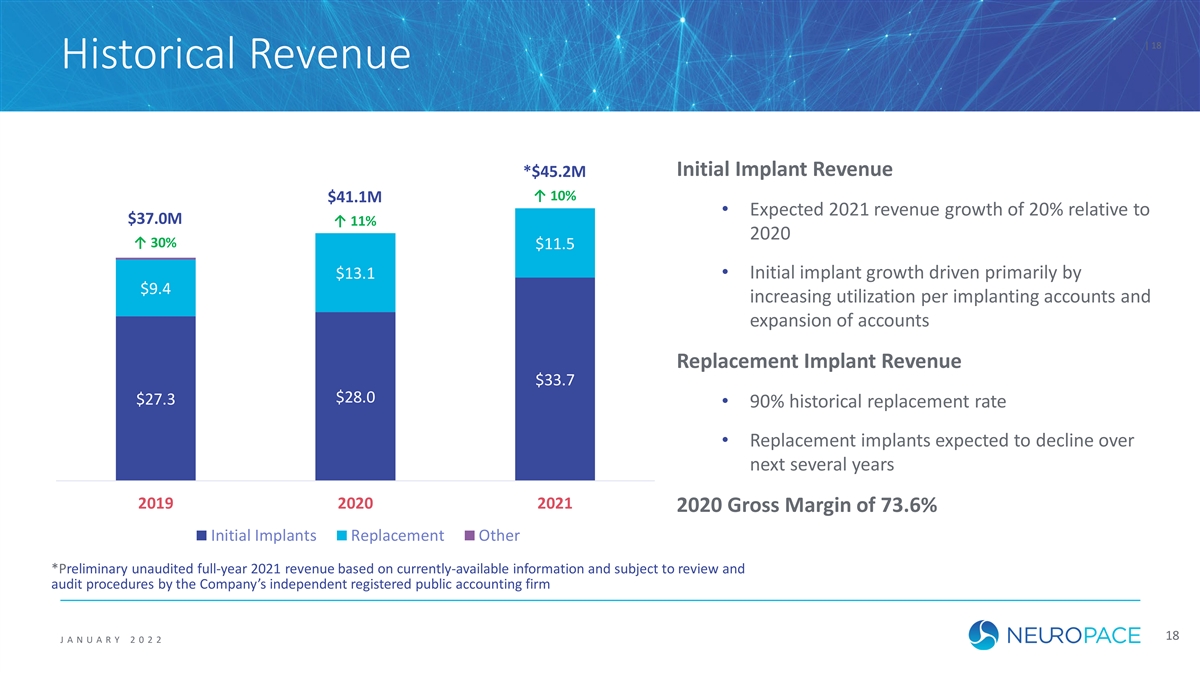

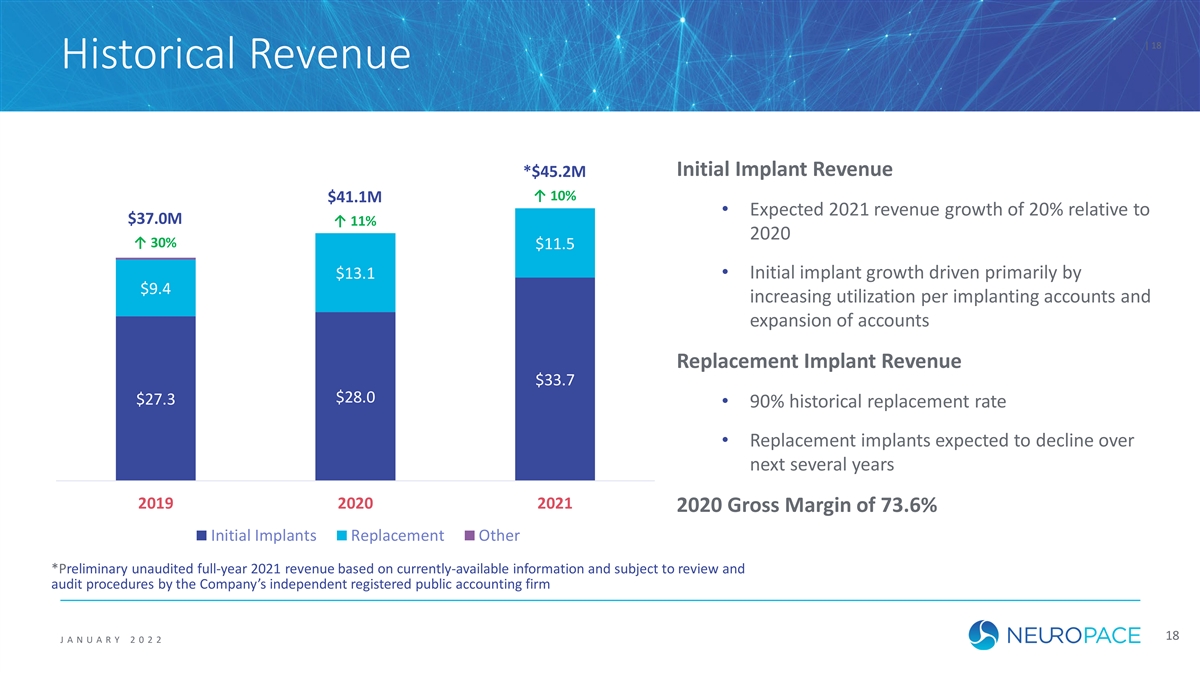

| 18 Historical Revenue Initial Implant Revenue *$45.2M ↑ 10% $41.1M • Expected 2021 revenue growth of 20% relative to $37.0M ↑ 11% 2020 ↑ 30% $11.5 $13.1 • Initial implant growth driven primarily by $9.4 increasing utilization per implanting accounts and expansion of accounts Replacement Implant Revenue $33.7 $28.0 $27.3 • 90% historical replacement rate • Replacement implants expected to decline over next several years 2019 2020 2021 2020 Gross Margin of 73.6% Initial Implants Replacement Other *Preliminary unaudited full-year 2021 revenue based on currently-available information and subject to review and audit procedures by the Company’s independent registered public accounting firm 18 J ANUAR Y 2 0 2 2

| 19 NeuroPace Summary • Novel and differentiated closed loop, brain-responsive neuromodulation system with a unique data-driven window to the brain • Compelling clinical evidence demonstrating improved outcomes over time 1 • ~$26 billion U.S. addressable market • Favorable reimbursement supporting commercial growth • Efficient commercial model with targeted customer base • ~$45 million revenue in 2021* • Indication expansion into younger patients and generalized epilepsy 1.U.S., Center for Disease Control, August 10, 2017; Chen, Z., et al., JAMA Neurology, 2017; Hauser, et al., 1993. Incidence of Epilepsy and Unprovoked Seizures in Rochester, Minnesota: 1935-1984. Epilepsia 34, 453–458; DEFINITIVE HEALTHCARE CLAIMS DATA, https://patientfinder.defhc.com as of 12/31/20 19 J ANUAR Y 2 0 2 2 * Preliminary unaudited full-year 2021 revenue based on currently-available information and subject to review and audit procedures by NeuroPace’s independent registered public accounting firm