UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22603

Name of Fund: BlackRock Municipal Target Term Trust (BTT)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Municipal

Target Term Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 07/31/2015

Date of reporting period: 07/31/2015

Item 1 – Report to Stockholders

2

JULY 31, 2015

ANNUAL REPORT

|  |

BlackRock California Municipal Income Trust (BFZ)

BlackRock Florida Municipal 2020 Term Trust (BFO)

BlackRock Municipal Income Investment Trust (BBF)

BlackRock Municipal Target Term Trust (BTT)

BlackRock New Jersey Municipal Income Trust (BNJ)

BlackRock New York Municipal Income Trust (BNY)

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| Table of Contents | ||||

| Page | ||||

| 3 | ||||

Annual Report: | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| Financial Statements: | ||||

| 18 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 56 | ||||

| 57 | ||||

| 63 | ||||

| 75 | ||||

| 76 | ||||

| 81 | ||||

| 82 | ||||

| 85 | ||||

| 2 | ANNUAL REPORT | JULY 31, 2015 |

| The Markets in Review |

Diverging monetary policies and shifting economic outlooks between regions were the broader themes underlying market conditions during the 12-month period ended July 31, 2015. The period began with investors caught between the forces of low interest rates and an improving U.S. economy, high asset valuations, oil price instability and lingering geopolitical risks in Ukraine and the Middle East. As U.S. growth picked up considerably in the fourth quarter of 2014, the broader global economy showed signs of slowing. Investors favored the stability of U.S. assets despite uncertainty as to when the Federal Reserve (the “Fed”) would raise short-term interest rates. International markets continued to struggle even as the European Central Bank and the Bank of Japan eased monetary policy. Oil prices plummeted in late 2014 due to a global supply-and-demand imbalance, sparking a sell-off in energy-related assets and putting stress on emerging markets. Fixed income investors piled into U.S. Treasuries as their persistently low yields had become attractive as compared to the even lower yields on international sovereign debt.

Equity markets reversed in early 2015, with international markets outperforming the United States as global risks abated. Investors had held high expectations for the U.S. economy, but a harsh winter and west coast port strike brought disappointing first-quarter data and high valuations took their toll on U.S. stocks, while bond yields fell to extreme lows. (Bond prices rise as yields fall.) In contrast, economic reports in Europe and Asia easily beat investors’ very low expectations, and accommodative policies from central banks in those regions helped international equities rebound. Oil prices stabilized, providing some relief for emerging market stocks, although a stronger U.S. dollar continued to be a headwind for the asset class.

U.S. economic data regained momentum in the second quarter, helping U.S. stocks resume an upward path, although meaningful strength in the labor market underscored the likelihood that the Fed would raise short-term rates before the end of 2015 and bond yields moved swiftly higher. The month of June brought a sharp, but temporary, sell-off across most asset classes as Greece’s long-brewing debt troubles came to an impasse and investors feared the consequences should Greece leave the eurozone. Adding to global worries was a massive correction in Chinese equity prices despite policymakers’ attempts to stabilize the market. As these concerns abated in the later part of July, developed markets rebounded with the help of solid corporate earnings. Emerging markets, however, continued to slide as Chinese equities remained highly volatile and growth estimates for many emerging economies were revised lower. Bond markets moved back into positive territory as softer estimates for global growth and the return of falling commodity prices caused yields to move lower.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of July 31, 2015 | ||||||||

| 6-month | 12-month | |||||||

U.S. large cap equities | 6.55 | % | 11.21 | % | ||||

U.S. small cap equities | 6.98 | 12.03 | ||||||

International equities | 7.19 | (0.28 | ) | |||||

Emerging market equities | (4.76 | ) | (13.38 | ) | ||||

3-month Treasury bills Bill Index) | 0.00 | 0.01 | ||||||

U.S. Treasury securities | (3.64 | ) | 5.32 | |||||

U.S. investment-grade bonds | (1.47 | ) | 2.82 | |||||

Tax-exempt municipal | (0.97 | ) | 3.50 | |||||

U.S. high yield bonds | 1.27 | 0.37 | ||||||

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||||||

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

| Municipal Market Overview |

| For the Reporting Period Ended July 31, 2015 |

Municipal Market Conditions

Municipal bonds generated positive performance for the period, thanks to a favorable supply-and-demand environment and declining interest rates in the earlier half. (Bond prices rise as rates fall.) Interest rates moved lower in 2014 even as the U.S. Federal Reserve (the “Fed”) curtailed its open-market bond purchases. This, coupled with reassurance from the Fed that short-term rates would remain low for a considerable amount of time, resulted in strong demand for fixed income investments in 2014, with municipal bonds being one of the stronger performing sectors for the year. This trend continued into the beginning of 2015 until rate volatility ultimately increased in February as a result of uneven U.S. economic data and widening central bank divergence, i.e., rate cuts outside the United States while the Fed poised for normalizing U.S. rates. During the 12 months ended July 31, 2015, municipal bond funds garnered net inflows of approximately $24 billion (based on data from the Investment Company Institute).

For the same 12-month period, total new issuance remained relatively strong from a historical perspective at $406 billion (considerably higher than the $306 billion issued in the prior 12-month period). A noteworthy portion of new supply during this period was attributable to refinancing activity (roughly 60%) as issuers took advantage of low interest rates and a flatter yield curve to reduce their borrowing costs.

S&P Municipal Bond Index |

Total Returns as of July 31, 2015 |

6 months: (0.97)% |

12 months: 3.50% |

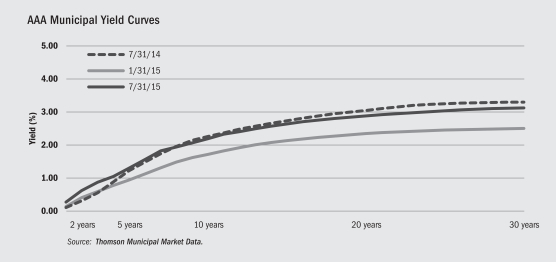

A Closer Look at Yields

From July 31, 2014 to July 31, 2015, yields on AAA-rated 30-year municipal bonds declined by 18 basis points (“bps”) from 3.30% to 3.12%, while 10-year rates fell by 7 bps from 2.26% to 2.19% and 5-year rates increased 8 bps from 1.22% to 1.30% (as measured by Thomson Municipal Market Data). Overall, the municipal yield curve remained relatively steep over the 12-month period even as the spread between 2- and 30-year maturities flattened by 49 bps and the spread between 2- and 10-year maturities flattened by 38 bps.

During the same time period, U.S. Treasury rates fell by 38 bps on 30-year bonds, 35 bps on 10-year bonds and 21 bps in 5-years. Accordingly, tax-exempt municipal bonds underperformed Treasuries across the yield curve, most notably in the intermediate part of the curve as a result of increased supply and tempered demand. In absolute terms, positive performance of muni bonds was driven largely by a supply/demand imbalance within the municipal market as investors sought income and incremental yield in an environment where opportunities had become scarce. More broadly, municipal bonds benefited from the greater appeal of tax-exempt investing in light of the higher tax rates implemented in 2014. The asset class is known for its lower relative volatility and preservation of principal with an emphasis on income as tax rates rise.

Financial Conditions of Municipal Issuers

The majority of municipal credits remain strong, despite well-publicized distress among a few issuers. The four largest states — California, New York, Texas and Florida — have exhibited markedly improved credit fundamentals during the slow national recovery. However, several states with the largest unfunded pension liabilities have seen their bond prices decline noticeably and remain vulnerable to additional price deterioration. On the local level, Chicago’s credit quality downgrade is an outlier relative to other cities due to its larger pension liability and inadequate funding remedies. BlackRock maintains the view that municipal bond defaults will remain minimal and in the periphery while the overall market is fundamentally sound. We continue to advocate careful credit research and believe that a thoughtful approach to structure and security selection remain imperative amid uncertainty in a modestly improving economic environment.

Investing involves risk including loss of principal. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may be subject to Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable.

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| 4 | ANNUAL REPORT | JULY 31, 2015 |

| The Benefits and Risks of Leveraging |

The Trusts may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, these objectives cannot be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Trust on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Trusts (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Trusts’ shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage is paid to shareholders in the form of dividends, and the value of these portfolio holdings is reflected in the per share NAV.

To illustrate these concepts, assume a Trusts’ Common Shares capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, the Trusts’ financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by the Trusts with the proceeds from leverage earn income based on longer-term interest rates. In this case, the Trusts’ financing cost of leverage is significantly lower than the income earned on the Trusts’ longer-term investments acquired from leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit Common Shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed the Trusts’ return on assets purchased with leverage proceeds, income to shareholders is lower than if the Trusts had not used leverage. Furthermore, the value of the Trusts’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the value of the Trusts’ obligations under its leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Trusts’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that a Trust’s intended leveraging strategy will be successful.

Leverage also generally causes greater changes in the Trusts’ NAVs, market prices and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the net asset value and market price of a Trusts’ Common Shares than if the Trusts were not leveraged. In addition, the Trusts may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Trusts to incur losses. The use of leverage may limit a Trusts’ ability to invest in certain types of securities or use certain types of hedging strategies. The Trusts incur expenses in connection with the use of leverage, all of which are borne by Common Shareholders and may reduce income to the Common Shares. Moreover, to the extent the calculation of the Trusts’ investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Trusts’ investment advisor will be higher than if the Trusts did not use leverage.

To obtain leverage, each Trust has issued Variable Rate Demand Preferred Shares (“VRDP Shares”), Variable Rate Muni Term Preferred Shares (“VMTP Shares”) or Remarketable Variable Rate Muni Term Preferred Shares (“RVMTP Shares”) (collectively, “Preferred Shares”) and/or leveraged its assets through the use of tender option bond trusts (“TOB Trusts”) as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Trust is permitted to issue debt up to 33 1/3% of its total managed assets or equity securities (e.g., Preferred Shares) up to 50% of its total managed assets. A Trust may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, a Trust may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by the Preferred Shares’ governing instruments or by agencies rating the Preferred Shares, which may be more stringent than those imposed by the 1940 Act.

If a Trust segregates or designates on its books and records cash or liquid assets having a value not less than the value of the Trusts’ obligations under the TOB Trust (including accrued interest), a TOB Trust is not considered a senior security and is not subject to the foregoing limitations and requirements under the 1940 Act.

| Derivative Financial Instruments | ||||

The Trusts may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Trusts’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Trust can realize on an investment and/or may result in lower distributions paid to shareholders. The Trusts’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| ANNUAL REPORT | JULY 31, 2015 | 5 |

| Trust Summary as of July 31, 2015 | BlackRock California Municipal Income Trust | |||

| Trust Overview | ||

BlackRock California Municipal Income Trust’s (BFZ) (the “Trust”) investment objective is to provide current income exempt from regular U.S. federal income and California income taxes. The Trust seeks to achieve its investment objective by investing primarily in municipal obligations exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and California income taxes. The Trust invests, under normal market conditions, at least 80% of its assets in municipal obligations that are investment grade quality. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

| Trust Information | ||

Symbol on New York Stock Exchange (“NYSE”) | BFZ | |

Initial Offering Date | July 27, 2001 | |

Yield on Closing Market Price as of July 31, 2015 ($14.65)1 | 5.91% | |

Tax Equivalent Yield2 | 12.04% | |

Current Monthly Distribution per Common Share3 | $0.0722 | |

Current Annualized Distribution per Common Share3 | $0.8664 | |

Economic Leverage as of July 31, 20154 | 39% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 50.93%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| Performance |

Returns for the 12 months ended July 31, 2015 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV7 | |||||||

BFZ5 | 7.66 | % | 5.96 | % | ||||

Lipper California Municipal Debt Funds6 | 7.67 | % | 6.36 | % | ||||

| 5 | All returns reflect reinvestment of dividends and/or distributions. |

| 6 | Average return. |

| 7 | The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Trust’s absolute performance based on NAV:

| • | The California municipal bond market delivered a gain during the 12-month period, as the combination of falling U.S. Treasury yields, the state’s improving economy and rising revenues for state and local governments provided firm support for the market. These factors enabled longer-term bonds to outperform their short-term counterparts, and the Trust was positioned for this trend via its exposure to the long end of the yield curve. The Trust also maintained a fully invested posture with a low level of cash reserves, which allowed it to capitalize fully on the market’s robust performance. |

| • | The Trust’s positions in AA-rated credits within the school district, transportation and health sectors outperformed as California’s improving credit profile enabled their valuations to rise. Positions in the utilities sector also aided performance. The Trust was further helped by having a zero weighting in Puerto Rico, where a deterioration of credit fundamentals led to a sharp downturn in prices. |

| • | Leverage on the Trust’s assets, which was achieved through the use of tender option bonds, amplified the positive effect of falling rates on performance. |

| • | The Trust’s use of U.S. Treasury futures contracts to manage interest rate risk had a slightly negative impact on performance given that bond yields declined during the period. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 6 | ANNUAL REPORT | JULY 31, 2015 |

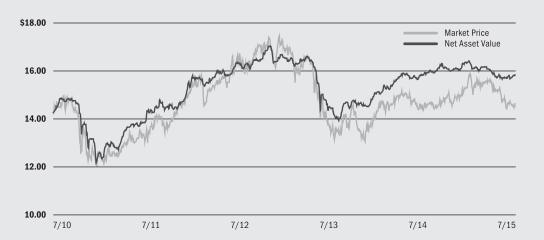

| BlackRock California Municipal Income Trust |

| Market Price and Net Asset Value Per Share Summary |

| 7/31/15 | 7/31/14 | Change | High | Low | ||||||||||||||||

Market Price | $ | 14.65 | $ | 14.41 | 1.67 | % | $ | 16.00 | $ | 14.37 | ||||||||||

Net Asset Value | $ | 15.84 | $ | 15.83 | 0.06 | % | $ | 16.43 | $ | 15.67 | ||||||||||

| Market Price and Net Asset Value History For the Past Five Years |

| Overview of the Trust’s Total Investments* |

| Sector Allocation | 7/31/15 | 7/31/14 | ||||||

County/City/Special District/School District | 37 | % | 33 | % | ||||

Utilities | 27 | 31 | ||||||

Education | 12 | 8 | ||||||

Health | 10 | 11 | ||||||

Transportation | 6 | 7 | ||||||

State | 6 | 8 | ||||||

Tobacco | 1 | — | ||||||

Corporate | 1 | 1 | ||||||

Housing | — | 1 | ||||||

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation1 | 7/31/15 | 7/31/14 | ||||||

AAA/Aaa | 7 | % | 11 | % | ||||

AA/Aa | 75 | 71 | ||||||

A | 17 | 18 | ||||||

BBB/Baa2 | — | — | ||||||

B | 1 | — | ||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | Representing less than 1% of the Trust’s total investments. |

| Call/Maturity Schedule3 | ||||

Calendar Year Ended December 31, | — | |||

2016 | 1 | % | ||

2017 | 9 | |||

2018 | 16 | |||

2019 | 33 | |||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| ANNUAL REPORT | JULY 31, 2015 | 7 |

| Trust Summary as of July 31, 2015 | BlackRock Florida Municipal 2020 Term Trust | |||

| Trust Overview | ||

BlackRock Florida Municipal 2020 Term Trust’s (BFO) (the “Trust”) investment objectives are to provide current income exempt from regular federal income tax and Florida intangible personal property tax and to return $15.00 per common share (the initial offering price per share) to holders of common shares on or about December 31, 2020. The Trust seeks to achieve its investment objectives by investing at least 80% of its assets in municipal bonds exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and Florida intangible personal property tax. The Trust invests at least 80% of its assets in municipal bonds that are investment grade quality at the time of investment. The Trust actively manages the maturity of its bonds to seek to have a dollar weighted average effective maturity approximately equal to the Trust’s maturity date. The Trust may invest directly in such securities or synthetically through the use of derivatives. Effective January 1, 2007, the Florida intangible personal property tax was repealed.

No assurance can be given that the Trust’s investment objective will be achieved.

| Trust Information | ||

Symbol on NYSE | BFO | |

Initial Offering Date | September 30, 2003 | |

Termination Date (on or about) | December 31, 2020 | |

Yield on Closing Market Price as of July 31, 2015 ($14.82)1 | 2.81% | |

Tax Equivalent Yield2 | 4.96% | |

Current Monthly Distribution per Common Share3 | $0.0347 | |

Current Annualized Distribution per Common Share3 | $0.4164 | |

Economic Leverage as of July 31, 20154 | 0% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal tax rate of 43.4%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Percentage is less than 1% which represents TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to TOB Trusts, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| Performance |

Returns for the 12 months ended July 31, 2015 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV7 | |||||||

BFO5 | 0.62 | % | 2.59 | % | ||||

Lipper Other States Municipal Debt Funds6 | 4.85 | % | 6.04 | % | ||||

| 5 | All returns reflect reinvestment of dividends and/or distributions. |

| 6 | Average return. |

| 7 | The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Trust’s absolute performance based on NAV:

| • | The Trust is scheduled to mature on or about December 31, 2020, and it therefore holds securities that will mature close to that date. Given that rates declined more for bonds on the long end of the yield curve, the Trust’s shorter maturity profile was a disadvantage in comparison to its Lipper category peers, which typically hold longer-dated issues. |

| • | Municipal bonds generally delivered gains during the 12-month period, with yields declining as prices rose. Long-term bonds outperformed short-term debt, due to a flattening of the yield curve for the full 12 months. Performance differed significantly during the two halves of the annual period. In the first half (August 2014 through January 2015), the market rallied significantly and the municipal yield curve flattened aggressively. During this time, long-term rates fell much more than intermediate rates, while two-year rates rose. In contrast, the second half (February 2015 through July 2015) brought weaker price performance and a steepening of the yield curve. |

| • | The Trust’s duration exposure (sensitivity to interest rate movements) contributed positively to performance as interest rates declined during the period. (Bond prices rise when rates fall.) The Trust’s exposure to the health sector made a strong contribution to total return, followed by its positions in the utilities and transportation sectors. Investments in zero-coupon bonds, which generated strong price performance, also aided returns. Income in the form of coupon payments made up a meaningful portion of the Trust’s total return for the period. |

| • | There were no detractors from performance on an absolute basis as all areas of the Trust’s investment universe appreciated during the period. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 8 | ANNUAL REPORT | JULY 31, 2015 |

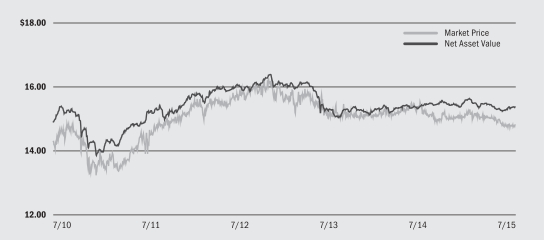

| BlackRock Florida Municipal 2020 Term Trust |

| Market Price and Net Asset Value Per Share Summary |

| 7/31/15 | 7/31/14 | Change | High | Low | ||||||||||||||||

Market Price | $ | 14.82 | $ | 15.16 | (2.24 | )% | $ | 15.48 | $ | 14.70 | ||||||||||

Net Asset Value | $ | 15.37 | $ | 15.42 | (0.32 | )% | $ | 15.64 | $ | 15.24 | ||||||||||

| Market Price and Net Asset Value History For the Past Five Years |

| Overview of the Trust’s Total Investments* |

| Sector Allocation | 7/31/15 | 7/31/14 | ||||||

County/City/Special District/School District | 38 | % | 32 | % | ||||

State | 16 | 14 | ||||||

Health | 15 | 16 | ||||||

Transportation | 11 | 20 | ||||||

Utilities | 11 | 10 | ||||||

Corporate | 4 | 4 | ||||||

Education | 4 | 3 | ||||||

Housing | 1 | 1 | ||||||

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation1 | 7/31/15 | 7/31/14 | ||||||

AAA/Aaa | 1 | % | 2 | % | ||||

AA/Aa | 52 | 47 | ||||||

A | 25 | 32 | ||||||

BBB/Baa | 13 | 9 | ||||||

N/R2 | 9 | 10 | ||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of July 31, 2015 and July 31, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade represents 4% and 2%, respectively, of the Trust’s total investments. |

| Call/Maturity Schedule3 | ||||

Calendar Year Ended December 31, | 3 | % | ||

2016 | — | |||

2017 | 12 | |||

2018 | 12 | |||

2019 | 14 | |||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| ANNUAL REPORT | JULY 31, 2015 | 9 |

| Trust Summary as of July 31, 2015 | BlackRock Municipal Income Investment Trust | |||

| Trust Overview | ||

BlackRock Municipal Income Investment Trust’s (BBF) (the “Trust”) investment objective is to provide current income exempt from regular federal income tax and Florida intangible personal property tax. The Trust seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds, the interest of which is exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax and Florida intangible personal property tax). The Trust invests at least 80% of its assets in municipal bonds that are investment grade quality at the time of investment. The Trust may invest directly in such securities or synthetically through the use of derivatives. Due to the repeal of the Florida intangible personal property tax, in September 2008, the Board gave approval to permit the Trust the flexibility to invest in municipal obligations regardless of geographical location since municipal obligations issued by any state or municipality that provides income exempt from regular federal income tax would now satisfy the foregoing objective and policy.

No assurance can be given that the Trust’s investment objective will be achieved.

| Trust Information | ||

Symbol on NYSE | BBF | |

Initial Offering Date | July 27, 2001 | |

Yield on Closing Market Price as of July 31, 2015 ($13.44)1 | 6.46% | |

Tax Equivalent Yield2 | 11.41% | |

Current Monthly Distribution per Common Share3 | $0.072375 | |

Current Annualized Distribution per Common Share3 | $0.868500 | |

Economic Leverage as of July 31, 20154 | 39% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal tax rate of 43.4%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| Performance |

Returns for the 12 months ended July 31, 2015 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV7 | |||||||

BBF5 | 6.09 | % | 6.76 | % | ||||

Lipper General & Insured Municipal Debt Funds (Leveraged)6 | 6.90 | % | 6.95 | % | ||||

| 5 | All returns reflect reinvestment of dividends and/or distributions. |

| 6 | Average return. |

| 7 | The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Trust’s absolute performance based on NAV:

| • | Municipal bonds generally delivered gains during the 12-month period, with yields declining as prices rose. Long-term bonds outperformed short-term debt, due to a flattening of the yield curve. In this environment, the Trust’s duration positioning contributed positively to performance. The Trust’s longer dated holdings in the transportation, health and utilities sectors experienced the best price performance on an absolute basis. Income in the form of coupon payments made up a meaningful portion of the Trust’s total return for the period. In addition, the Trust’s minimal cash balance and use of leverage allowed it to increase its income. |

| • | The Trust’s use of U.S. Treasury futures contracts to manage interest rate risk had a slightly negative impact on performance given that bond yields declined during the period. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | ANNUAL REPORT | JULY 31, 2015 |

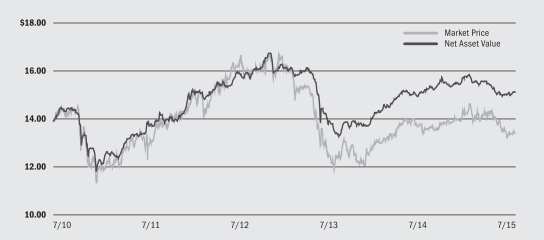

| BlackRock Municipal Income Investment Trust |

| Market Price and Net Asset Value Per Share Summary | ||

| 7/31/15 | 7/31/14 | Change | High | Low | ||||||||||||||||

Market Price | $ | 13.44 | $ | 13.48 | (0.30 | )% | $ | 14.73 | $ | 13.20 | ||||||||||

Net Asset Value | $ | 15.14 | $ | 15.09 | 0.33 | % | $ | 15.85 | $ | 14.95 | ||||||||||

| Market Price and Net Asset Value History For the Past Five Years |

| Overview of the Trust’s Total Investments* | ||

| Sector Allocation | 7/31/15 | 7/31/14 | ||||||

County/City/Special District/School District | 25 | % | 26 | % | ||||

Transportation | 22 | 21 | ||||||

Utilities | 15 | 16 | ||||||

Health | 14 | 15 | ||||||

State | 11 | 11 | ||||||

Education | 8 | 8 | ||||||

Tobacco | 3 | 1 | ||||||

Corporate | 1 | 1 | ||||||

Housing | 1 | 1 | ||||||

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation1 | 7/31/15 | 7/31/14 | ||||||

AAA/Aaa | 11 | % | 10 | % | ||||

AA/Aa | 56 | 56 | ||||||

A | 24 | 26 | ||||||

BBB/Baa | 6 | 6 | ||||||

BB/Ba | 1 | 1 | ||||||

B | 1 | — | 2 | |||||

N/R3 | 1 | 1 | ||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | Representing less than 1% of the Trust’s total investments. |

| 3 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. |

| Call/Maturity Schedule4 | ||||

Calendar Year Ended December 31, | — | |||

2016 | 1 | % | ||

2017 | 1 | |||

2018 | 16 | |||

2019 | 34 | |||

| 4 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| ANNUAL REPORT | JULY 31, 2015 | 11 |

| Trust Summary as of July 31, 2015 | BlackRock Municipal Target Term Trust | |||

| Trust Overview |

BlackRock Municipal Target Term Trust’s (BTT) (the “Trust”) investment objectives are to provide current income exempt from regular federal income tax (but which may be subject to the federal alternative minimum tax in certain circumstances) and to return $25.00 per common share (the initial offering price per share) to holders of common shares on or about December 31, 2030. The Trust seeks to achieve its investment objectives by investing at least 80% of its assets in municipal bonds exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax). The Trust invests at least 80% of its assets in municipal bonds that are investment grade quality at the time of investment. The Trust actively manages the maturity of its bonds to seek to have a dollar weighted average effective maturity approximately equal to the Trust’s maturity date. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

| Trust Information | ||

Symbol on NYSE | BTT | |

Initial Offering Date | August 30, 2012 | |

Termination Date (on or about) | December 31, 2030 | |

Current Distribution Rate on Closing Market Price as of July 31, 2015 ($20.80)1 | 4.62% | |

Tax Equivalent Rate2 | 8.16% | |

Current Monthly Distribution per Common Share3 | $0.08 | |

Current Annualized Distribution per Common Share3 | $0.96 | |

Economic Leverage as of July 31, 20154 | 37% |

| 1 | Current Distribution Rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. See the financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal tax rate of 43.4%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain at fiscal year end. |

| 4 | Represents RVMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to RVMTP Shares and TOB Trusts, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| Performance |

Returns for the 12 months ended July 31, 2015 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV7 | |||||||

BTT5 | 11.37 | % | 8.32 | % | ||||

Lipper General & Insured Municipal Debt Funds (Leveraged)6 | 6.90 | % | 6.95 | % | ||||

| 5 | All returns reflect reinvestment of dividends and/or distributions. |

| 6 | Average return. |

| 7 | The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Trust’s absolute performance based on NAV:

| • | Municipal bonds generally delivered gains during the 12-month period, with yields declining as prices rose. Long-term bonds outperformed short-term debt, leading to a flattening of the yield curve for the full 12 months. Performance differed significantly during the two halves of the annual period. In the first half (August 2014 through January 2015), the market rallied significantly and the municipal yield curve flattened aggressively. During this time, long-term rates fell much more than intermediate rates, while two-year rates rose. In contrast, the second half (February 2015 through July 2015) brought weaker price performance and a steepening of the yield curve. |

| • | The Trust’s duration exposure (sensitivity to interest rate movements) contributed positively to performance as interest rates declined during the period. (Bond prices rise when rates fall.) The Trust’s exposure to the healthcare sector made a strong contribution to total return, followed by its positions in the transportation sector. Investments in zero-coupon bonds, which generated strong price performance, also aided returns. Income in the form of coupon payments made up a meaningful portion of the Trust’s total return for the period. |

| • | The Trust’s use of U.S. Treasury futures contracts to manage interest rate risk had a slightly negative impact on performance given that bond yields declined during the period. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 12 | ANNUAL REPORT | JULY 31, 2015 |

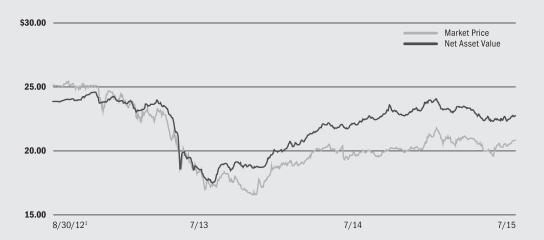

| BlackRock Municipal Target Term Trust |

| Market Price and Net Asset Value Per Share Summary | ||

| 7/31/15 | 7/31/14 | Change | High | Low | ||||||||||||||||

Market Price | $ | 20.80 | $ | 19.57 | 6.29 | % | $ | 21.75 | $ | 19.49 | ||||||||||

Net Asset Value | $ | 22.73 | $ | 21.99 | 3.37 | % | $ | 24.02 | $ | 21.99 | ||||||||||

| Market Price and Net Asset Value History Since Inception | ||

| 1 | Commencement of operations. |

| Overview of the Trust’s Total Investments* | ||

| Sector Allocation | 7/31/15 | 7/31/14 | ||||||

Transportation | 23 | % | 22 | % | ||||

Health | 19 | 17 | ||||||

County/City/Special District/School District | 13 | 13 | ||||||

Education | 11 | 12 | ||||||

Corporate | 11 | 11 | ||||||

Utilities | 8 | 8 | ||||||

State | 8 | 6 | ||||||

Housing | 5 | 9 | ||||||

Tobacco | 2 | 2 | ||||||

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation2 | 7/31/15 | 7/31/14 | ||||||

AAA/Aaa | 3 | % | 4 | % | ||||

AA/Aa | 25 | 31 | ||||||

A | 46 | 42 | ||||||

BBB/Baa | 15 | 12 | ||||||

BB/Ba | 5 | 3 | ||||||

B | — | 2 | ||||||

N/R3 | 6 | 6 | ||||||

| 2 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 3 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of July 31, 2015 and July 31, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade each represented less than 1% of the Trust’s total investments. |

| Call/Maturity Schedule4 | ||||

Calendar Year Ended December 31, | — | |||

2016 | 1 | % | ||

2017 | 1 | |||

2018 | 1 | |||

2019 | — | |||

| 4 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| ANNUAL REPORT | JULY 31, 2015 | 13 |

| Trust Summary as of July 31, 2015 | BlackRock New Jersey Municipal Income Trust | |||

| Trust Overview | ||

BlackRock New Jersey Municipal Income Trust’s (BNJ) (the “Trust”) investment objective is to provide current income exempt from regular federal income tax and New Jersey gross income tax. The Trust seeks to achieve its investment objective by investing primarily in municipal bonds exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and New Jersey gross income taxes. The Trust invests at least 80% of its assets in municipal bonds that are investment grade quality at the time of investment. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

| Trust Information | ||

Symbol on NYSE | BNJ | |

Initial Offering Date | July 27, 2001 | |

Yield on Closing Market Price as of July 31, 2015 ($14.61)1 | 6.17% | |

Tax Equivalent Yield2 | 11.98% | |

Current Monthly Distribution per Common Share3 | $0.0751 | |

Current Annualized Distribution per Common Share3 | $0.9012 | |

Economic Leverage as of July 31, 20154 | 39% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 48.48%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| Performance |

Returns for the 12 months ended July 31, 2015 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV7 | |||||||

BNJ5 | 5.69 | % | 5.79 | % | ||||

Lipper New Jersey Municipal Debt Funds6 | 6.31 | % | 4.64 | % | ||||

| 5 | All returns reflect reinvestment of dividends and/or distributions. |

| 6 | Average return. |

| 7 | The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Trust’s absolute performance based on NAV:

| • | Municipal bonds generally delivered gains during the 12-month period, with yields declining as prices rose. Long-term bonds outperformed short-term debt, due to a flattening of the yield curve. In this environment, the Trust’s duration positioning contributed positively to performance. The Trust’s longer dated holdings in the transportation, local tax-backed, education, and other industries sectors experienced the best price performance on an absolute basis. Income in the form of coupon payments made up a meaningful portion of the Trust’s total return for the period. In addition, the Trust’s minimal cash balance and use of leverage allowed it to increase its income. |

| • | The Trust’s use of U.S. Treasury futures contracts to manage interest rate risk had a slightly negative impact on performance given that bond yields declined during the period. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 14 | ANNUAL REPORT | JULY 31, 2015 |

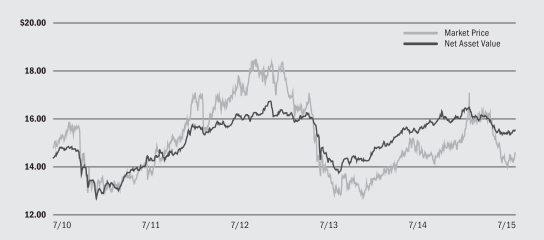

| BlackRock New Jersey Municipal Income Trust |

| Market Price and Net Asset Value Per Share Summary | ||

| 7/31/15 | 7/31/14 | Change | High | Low | ||||||||||||||||

Market Price | $ | 14.61 | $ | 14.68 | (0.48 | )% | $ | 17.10 | $ | 14.00 | ||||||||||

Net Asset Value | $ | 15.55 | $ | 15.61 | (0.38 | )% | $ | 16.50 | $ | 15.35 | ||||||||||

| Market Price and Net Asset Value History For the Past Five Years | ||

| Overview of the Trust’s Total Investments* | ||

| Sector Allocation | 7/31/15 | 7/31/14 | ||||||

Transportation | 33 | % | 33 | % | ||||

Education | 17 | 17 | ||||||

County/City/Special District/School District | 16 | 13 | ||||||

State | 16 | 15 | ||||||

Health | 7 | 8 | ||||||

Corporate | 7 | 8 | ||||||

Housing | 3 | 6 | ||||||

Utilities | 1 | — | ||||||

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation1 | 7/31/15 | 7/31/14 | ||||||

AAA/Aaa | 2 | % | 2 | % | ||||

AA/Aa | 42 | 40 | ||||||

A | 36 | 35 | ||||||

BBB/Baa | 10 | 9 | ||||||

BB/Ba | 8 | 4 | ||||||

B | — | 3 | ||||||

N/R2 | 2 | 7 | ||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of July 31, 2015 and July 31, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade represents 1% and 5%, respectively, of the Trust’s total investments. |

| Call/Maturity Schedule3 | ||||

Calendar Year Ended December 31, | 4 | % | ||

2016 | 1 | |||

2017 | 2 | |||

2018 | 12 | |||

2019 | 10 | |||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| ANNUAL REPORT | JULY 31, 2015 | 15 |

| Trust Summary as of July 31, 2015 | BlackRock New York Municipal Income Trust | |||

| Trust Overview | ||

BlackRock New York Municipal Income Trust’s (BNY) (the “Trust”) investment objective is to provide current income exempt from regular federal income tax and New York State and New York City personal income taxes. The Trust seeks to achieve its investment objective by investing primarily in municipal bonds exempt from federal income taxes (except that the interest may be subject to the federal alternative minimum tax) and New York State and New York City personal income taxes. The Trust invests at least 80% of its assets in municipal bonds that are investment grade quality at the time of investment. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

| Trust Information | ||

Symbol on NYSE | BNY | |

Initial Offering Date | July 27, 2001 | |

Yield on Closing Market Price as of July 31, 2015 ($14.54)1 | 5.69% | |

Tax Equivalent Yield2 | 11.52% | |

Current Monthly Distribution per Common Share3 | $0.069 | |

Current Annualized Distribution per Common Share3 | $0.828 | |

Economic Leverage as of July 31, 20154 | 39% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 50.59%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| Performance |

Returns for the 12 months ended July 31, 2015 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV7 | |||||||

BNY5 | 11.67 | % | 8.00 | % | ||||

Lipper New York Municipal Debt Funds6 | 8.00 | % | 6.41 | % | ||||

| 5 | All returns reflect reinvestment of dividends and/or distributions. |

| 6 | Average return. |

| 7 | The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. |

The following discussion relates to the Trust’s absolute performance based on NAV:

| • | Municipal bonds generally delivered gains during the 12-month period, with yields declining as prices rose. Longer-term bonds, which were aided by the backdrop of relatively slow economic growth and low inflation, outpaced shorter-term issues, which were pressured by the prospects of an interest rate hike by the U.S. Federal Reserve later in 2015. |

| • | In this environment, the Trust’s investments in longer duration and longer dated bonds generally provided the best returns. (Duration is a measure of interest rate sensitivity). Positions in the tax-backed (state and local), transportation and utilities sectors were positive contributors to performance. The Trust’s investments in zero-coupon bonds, which generated strong price performance, also aided returns. The Trust’s exposure to higher-yielding, lower-rated bonds in the investment grade category aided performance, as this market segment outperformed during the period. Income in the form of coupon payments made up a meaningful portion of the Trust’s total return for the period. The Trust’s leverage allowed it to increase its income. |

| • | The Trust’s use of U.S. Treasury futures contracts to manage interest rate risk had a slightly negative impact on performance given that bond yields declined during the period. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 16 | ANNUAL REPORT | JULY 31, 2015 |

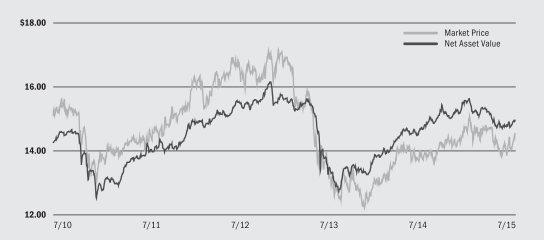

| BlackRock New York Municipal Income Trust |

| Market Price and Net Asset Value Per Share Summary | ||

| 7/31/15 | 7/31/14 | Change | High | Low | ||||||||||||||||

Market Price | $ | 14.54 | $ | 13.79 | 5.44 | % | $ | 15.09 | $ | 13.55 | ||||||||||

Net Asset Value | $ | 14.97 | $ | 14.68 | 1.98 | % | $ | 15.64 | $ | 14.68 | ||||||||||

| Market Price and Net Asset Value History For the Past Five Years | ||

| Overview of the Trust’s Total Investments* | ||

| Sector Allocation | 7/31/15 | 7/31/14 | ||||||

County/City/Special District/School District | 24 | % | 24 | % | ||||

Education | 20 | 19 | ||||||

Transportation | 15 | 14 | ||||||

Utilities | 12 | 13 | ||||||

Health | 10 | 10 | ||||||

State | 9 | 9 | ||||||

Corporate | 8 | 9 | ||||||

Housing | 2 | 2 | ||||||

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation1 | 7/31/15 | 7/31/14 | ||||||

AAA/Aaa | 18 | % | 16 | % | ||||

AA/Aa | 37 | 39 | ||||||

A | 27 | 29 | ||||||

BBB/Baa | 6 | 6 | ||||||

BB/Ba | 4 | 4 | ||||||

N/R2 | 8 | 6 | ||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of July 31, 2015 and July 31, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade was 2% and 1%, respectively, of the Trust’s total investments. |

| Call/Maturity Schedule3 | ||||

Calendar Year Ended December 31, | 4 | % | ||

2016 | 4 | |||

2017 | 12 | |||

2018 | 4 | |||

2019 | 6 | |||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| ANNUAL REPORT | JULY 31, 2015 | 17 |

BlackRock California Municipal Income Trust (BFZ) (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||

California — 96.0% | ||||||||

Corporate — 0.7% |

| |||||||

City of Chula Vista California, Refunding RB, San Diego Gas & Electric: | ||||||||

Series A, 5.88%, 2/15/34 | $ | 685 | $ | 787,682 | ||||

Series D, 5.88%, 1/01/34 | 2,500 | 2,874,750 | ||||||

|

| |||||||

| 3,662,432 | ||||||||

County/City/Special District/School District — 33.4% |

| |||||||

Butte-Glenn Community College District, GO, Election of 2002, Series C, 5.50%, 8/01/30 | 8,425 | 9,707,369 | ||||||

Cerritos Community College District, GO: | ||||||||

Election of 2004, Series C, 5.25%, 8/01/19 (a) | 3,000 | 3,495,900 | ||||||

Series A, 5.00%, 8/01/39 | 4,275 | 4,858,324 | ||||||

City of San Jose California Hotel Tax, RB, Convention Center Expansion & Renovation Project: | ||||||||

6.13%, 5/01/31 | 500 | 593,750 | ||||||

6.50%, 5/01/36 | 1,210 | 1,464,560 | ||||||

6.50%, 5/01/42 | 2,225 | 2,672,003 | ||||||

County of Kern California, COP, Capital Improvements Projects, Series A (AGC), 6.00%, 8/01/35 | 2,000 | 2,300,880 | ||||||

County of Orange California Water District, COP, Refunding, 5.25%, 8/15/34 | 2,000 | 2,292,560 | ||||||

County of San Joaquin California Transportation Authority, Refunding RB, Limited Tax, Measure K, Series A: | ||||||||

6.00%, 3/01/36 | 2,880 | 3,466,858 | ||||||

5.50%, 3/01/41 | 5,265 | 6,163,630 | ||||||

County of Santa Clara California Financing Authority, Refunding LRB, Series L, 5.25%, 5/15/36 | 20,000 | 21,869,200 | ||||||

Evergreen Elementary School District, GO, Election of 2006, Series B (AGC), 5.13%, 8/01/33 | 2,500 | 2,817,275 | ||||||

Grossmont California Healthcare District, GO, Election of 2006, Series B: | ||||||||

6.00%, 7/15/21 (a) | 3,235 | 4,050,705 | ||||||

6.13%, 7/15/21 (a) | 2,000 | 2,518,460 | ||||||

Long Beach Unified School District California, GO, Refunding, Election of 2008, Series A, 5.75%, 8/01/33 | 4,135 | 4,856,888 | ||||||

Los Alamitos Unified School District California, GO, School Facilities Improvement District No. 1, 5.50%, 2/01/19 (a) | 6,315 | 7,301,340 | ||||||

Los Angeles California Municipal Improvement Corp., Refunding RB, Real Property, Series B (AGC), 5.50%, 4/01/30 | 5,065 | 5,748,724 | ||||||

Modesto Irrigation District, COP, Capital Improvments, Series A, 5.75%, 10/01/29 | 3,035 | 3,449,793 | ||||||

Oak Grove School District California, GO, Election of 2008, Series A, 5.50%, 8/01/33 | 6,000 | 6,880,380 | ||||||

Pico Rivera Public Financing Authority, RB, 5.75%, 9/01/39 | 2,000 | 2,292,920 | ||||||

Pittsburg Unified School District, GO, Election of 2006, Series B (AGM), 5.50%, 8/01/34 | 2,000 | 2,239,720 | ||||||

California (continued) | ||||||||

County/City/Special District/School District (concluded) |

| |||||||

Sacramento Area Flood Control Agency, Special Assessment Bonds, Consolidated Capital Assessment District, 5.25%, 10/01/32 | $ | 4,865 | $ | 5,671,812 | ||||

San Diego Community College District California, GO, Election of 2002, 5.25%, 8/01/33 | 1,500 | 1,717,545 | ||||||

San Diego Regional Building Authority, RB, County Operations Center & Annex, Series A, 5.38%, 2/01/36 | 5,520 | 6,217,286 | ||||||

San Jose California Financing Authority, Refunding LRB, Civic Center Project, Series A, 5.00%, 6/01/32 | 3,375 | 3,830,355 | ||||||

San Leandro California Unified School District, GO, Election of 2010, Series A, 5.75%, 8/01/41 | 3,060 | 3,633,260 | ||||||

San Ramon Valley Unified School District, GO, Election of 2012, 4.00%, 8/01/40 | 1,665 | 1,695,270 | ||||||

Santa Ana College Improvement District #1 Rancho Santiago Community College District, GO, Election of 2012, Series A, 5.00%, 8/01/39 | 2,000 | 2,244,680 | ||||||

Santa Ana Unified School District, GO, Election of 2008, Series A: | ||||||||

5.50%, 8/01/30 | 6,525 | 7,325,226 | ||||||

5.13%, 8/01/33 | 10,000 | 11,051,500 | ||||||

Snowline Joint Unified School District, COP, Refunding, Refining Project (AGC), 5.75%, 9/01/38 | 2,250 | 2,589,075 | ||||||

Torrance Unified School District California, GO, Election of 2008, Measure Z, 6.00%, 8/01/19 (a) | 4,000 | 4,781,960 | ||||||

Tustin California School District, GO, Election of 2008, Series B, 5.25%, 8/01/31 | 3,445 | 4,023,967 | ||||||

West Contra Costa California Unified School District, GO, Series A: | ||||||||

Election of 2010 (AGM), 5.25%, 8/01/32 | 4,945 | 5,815,518 | ||||||

Election of 2012, 5.50%, 8/01/39 | 2,500 | 2,883,950 | ||||||

Yosemite Community College District, GO, Refunding, 5.00%, 8/01/32 (b) | 3,500 | 4,077,885 | ||||||

|

| |||||||

| 168,600,528 | ||||||||

Education — 3.6% |

| |||||||

California Educational Facilities Authority, RB, Chapman University, 5.00%, 4/01/45 | 2,375 | 2,609,697 | ||||||

California Educational Facilities Authority, Refunding RB, San Francisco University, 6.13%, 10/01/36 | 6,280 | 7,628,316 | ||||||

California Municipal Finance Authority, RB, Emerson College, 5.75%, 1/01/33 | 2,500 | 2,871,775 | ||||||

California State University, Refunding RB, Series A, 5.00%, 11/01/43 (b) | �� | 1,500 | 1,707,555 | |||||

University of California, Refunding RB, Series I, 5.00%, 5/15/32 | 3,000 | 3,486,210 | ||||||

|

| |||||||

| 18,303,553 | ||||||||

| Portfolio Abbreviations |

| ACA | American Capital Access Holding Ltd. | COP | Certificates of Participation | IDB | Industrial Development Board | |||||

| AGC | Assured Guarantee Corp. | EDA | Economic Development Authority | ISD | Independent School District | |||||

| AGM | Assured Guaranty Municipal Corp. | EDC | Economic Development Corp. | LRB | Lease Revenue Bonds | |||||

| AMBAC | American Municipal Bond Assurance Corp. | ERB | Education Revenue Bonds | M/F | Multi-Family | |||||

| AMT | Alternative Minimum Tax (subject to) | FHA | Federal Housing Administration | MRB | Mortgage Revenue Bonds | |||||

| ARB | Airport Revenue Bonds | GARB | General Airport Revenue Bonds | NPFGC | National Public Finance Guarantee Corp. | |||||

| BARB | Building Aid Revenue Bonds | GO | General Obligation Bonds | PILOT | Payment in Lieu of Taxes | |||||

| BHAC | Berkshire Hathaway Assurance Corp. | HDA | Housing Development Authority | RB | Revenue Bonds | |||||

| CAB | Capital Appreciation Bonds | HFA | Housing Finance Agency | S/F | Single-Family | |||||

| CIFG | CIFG Assurance North America, Inc. | IDA | Industrial Development Authority | SONYMA | State of New York Mortgage Agency |

See Notes to Financial Statements.

| 18 | ANNUAL REPORT | JULY 31, 2015 |

Schedule of Investments (continued) | BlackRock California Municipal Income Trust (BFZ) (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||

California (continued) | ||||||||

Health — 12.7% |

| |||||||

ABAG Finance Authority for Nonprofit Corps., Refunding RB, Sharp Healthcare, Series B, 6.25%, 8/01/39 | $ | 4,975 | $ | 5,806,870 | ||||

California Health Facilities Financing Authority, RB: | ||||||||

Adventist Health System West, Series A, 5.75%, 9/01/39 | 6,700 | 7,649,189 | ||||||

Children’s Hospital, Series A, 5.25%, 11/01/41 | 8,500 | 9,398,450 | ||||||

St. Joseph Health System, Series A, 5.75%, 7/01/39 | 375 | 428,629 | ||||||

Sutter Health, Series A, 5.25%, 11/15/46 | 5,195 | 5,410,333 | ||||||

Sutter Health, Series B, 6.00%, 8/15/42 | 6,015 | 7,131,023 | ||||||

California Health Facilities Financing Authority, Refunding RB, Catholic Healthcare West, Series A: | ||||||||

6.00%, 7/01/34 | 4,505 | 5,151,242 | ||||||

6.00%, 7/01/39 | 5,550 | 6,337,156 | ||||||

California Statewide Communities Development Authority, RB, Kaiser Permanente, Series B, 5.25%, 3/01/45 | 2,000 | 2,041,000 | ||||||

California Statewide Communities Development Authority, Refunding RB: | ||||||||

Catholic Healthcare West, Series B, 5.50%, 7/01/30 | 2,900 | 3,111,468 | ||||||

Catholic Healthcare West, Series E, 5.50%, 7/01/31 | 5,065 | 5,437,328 | ||||||

Trinity Health Credit Group Composite Issue, 5.00%, 12/01/41 | 4,000 | 4,409,640 | ||||||

Washington Township Health Care District, GO, Series B, 5.50%, 8/01/38 | 1,625 | 1,912,495 | ||||||

|

| |||||||

| 64,224,823 | ||||||||

State — 9.4% |

| |||||||

State of California, GO, Various Purposes: | ||||||||

6.00%, 3/01/33 | 2,000 | 2,413,940 | ||||||

6.00%, 4/01/38 | 15,875 | 18,500,566 | ||||||

State of California Public Works Board, LRB: | ||||||||

Department of Education, Riverside Campus Project, Series B, 6.50%, 4/01/34 | 9,000 | 10,642,770 | ||||||

Various Capital Projects, Series I, 5.50%, 11/01/33 | 4,940 | 5,872,573 | ||||||

Various Capital Projects, Sub-Series I-1, 6.38%, 11/01/34 | 5,025 | 6,046,281 | ||||||

State of California Public Works Board, RB, Department of Corrections & Rehabilitation, Series F, 5.25%, 9/01/33 | 3,335 | 3,882,974 | ||||||

|

| |||||||

| 47,359,104 | ||||||||

Tobacco — 1.2% |

| |||||||

Golden State Tobacco Securitization Corp., Refunding RB, Asset-Backed, Senior, Series A-1, 5.75%, 6/01/47 | 7,000 | 5,951,470 | ||||||

Transportation — 10.5% |

| |||||||

City & County of San Francisco California Airports Commission, ARB, Series E, 6.00%, 5/01/39 | 6,750 | 7,855,245 | ||||||

City of Los Angeles California Department of Airports, Refunding ARB, Los Angeles International Airport, Senior Series A: | ||||||||

5.00%, 5/15/34 | 6,650 | 7,502,530 | ||||||

5.00%, 5/15/40 | 4,750 | 5,361,515 | ||||||

City of San Jose California, Refunding ARB, Series A-1, AMT: | ||||||||

5.75%, 3/01/34 | 2,895 | 3,319,581 | ||||||

6.25%, 3/01/34 | 2,650 | 3,116,241 | ||||||

County of Orange California, ARB, Series B, 5.75%, 7/01/34 | 8,000 | 8,699,600 | ||||||

California (concluded) | ||||||||

Transportation (concluded) |

| |||||||

County of Sacramento California, ARB: | ||||||||

PFC/Grant, Sub-Series D, 6.00%, 7/01/35 | $ | 3,000 | $ | 3,373,290 | ||||

Senior Series B, 5.75%, 7/01/39 | 1,850 | 2,066,524 | ||||||

Senior Series B, AMT (AGM), 5.25%, 7/01/33 | 2,055 | 2,236,888 | ||||||

Port of Los Angeles California Harbor Department, RB, Series B, 5.25%, 8/01/34 | 5,580 | 6,324,205 | ||||||

Port of Los Angeles California Harbor Department, Refunding RB, Series A, AMT, 5.00%, 8/01/44 | 2,795 | 3,064,270 | ||||||

|

| |||||||

| 52,919,889 | ||||||||

Utilities — 24.5% |

| |||||||

Anaheim Public Financing Authority, RB, Electric System Distribution Facilities, Series A, 5.38%, 10/01/36 | 7,690 | 8,993,993 | ||||||

City of Chula Vista California, Refunding RB, San Diego Gas & Electric, Series D, 5.88%, 1/01/34 | 6,555 | 7,537,594 | ||||||

City of Los Angeles California Department of Water & Power, RB: | ||||||||

Power System, Sub-Series A-1, 5.25%, 7/01/38 | 9,000 | 9,933,840 | ||||||

Series A, 5.38%, 7/01/34 | 3,250 | 3,647,085 | ||||||

City of Los Angeles California Department of Water & Power, Refunding RB, Series A, 5.25%, 7/01/39 | 4,000 | 4,538,200 | ||||||

City of Los Angeles California Wastewater System, Refunding RB, Series A, 5.00%, 6/01/39 | 2,000 | 2,231,340 | ||||||

City of Petaluma California Wastewater, Refunding RB, 6.00%, 5/01/36 | 5,625 | 6,748,763 | ||||||

City of San Francisco California Public Utilities Commission Water Revenue, RB: | ||||||||

Series A, 5.00%, 11/01/35 | 10,625 | 12,010,500 | ||||||

Series A, 5.00%, 11/01/45 | 11,100 | 12,445,320 | ||||||

Sub-Series A, 5.00%, 11/01/37 | 5,000 | 5,731,850 | ||||||

County of Riverside California Public Financing Authority, RB, Capital Facility Project, 5.25%, 11/01/45 | 8,935 | 10,098,784 | ||||||

Cucamonga Valley Water District, Refunding RB, Series A (AGM), 5.25%, 9/01/31 | 4,320 | 5,104,944 | ||||||

Dublin-San Ramon Services District, Refunding RB, 6.00%, 8/01/41 | 2,425 | 2,883,859 | ||||||

East Bay California Municipal Utility District Water System Revenue, Refunding RB, Series A, 5.00%, 6/01/36 | 6,745 | 7,728,758 | ||||||

El Dorado Irrigation District / El Dorado County Water Agency, Refunding RB, Series A (AGM), 5.25%, 3/01/39 | 10,000 | 11,503,400 | ||||||

San Diego Public Facilities Financing Authority Sewer, Refunding RB, Senior Series A, 5.25%, 5/15/34 | 11,020 | 12,503,292 | ||||||

|

| |||||||

| 123,641,522 | ||||||||

| Total Municipal Bonds in California | 484,663,321 | |||||||

Multi-State — 0.4% | ||||||||

Housing — 0.4% |

| |||||||

Centerline Equity Issuer Trust (c)(d): | ||||||||

Series A-4-2, 6.00%, 5/15/19 | 1,000 | 1,132,480 | ||||||

Series B-3-2, 6.30%, 5/05/19 | 1,000 | 1,142,070 | ||||||

| Total Municipal Bonds in Multi-State | 2,274,550 | |||||||

| Total Municipal Bonds — 96.4% | 486,937,871 | |||||||

See Notes to Financial Statements.

| ANNUAL REPORT | JULY 31, 2015 | 19 |

Schedule of Investments (continued) | BlackRock California Municipal Income Trust (BFZ) (Percentages shown are based on Net Assets) |

| Municipal Bonds Transferred to Tender Option Bond Trusts (e) | Par (000) | Value | ||||||

California — 66.4% | ||||||||

County/City/Special District/School District — 26.2% |

| |||||||

California Health Facilities Financing Authority, RB, Sutter Health, Series A, 5.00%, 8/15/52 | $ | 9,695 | $ | 10,635,027 | ||||

Los Angeles Community College District California, GO, Election of 2008, Series A: | ||||||||

Election of 2001 (AGM), 5.00%, 8/01/17 (a) | 8,000 | 8,701,760 | ||||||

Series C, 5.25%, 8/01/39 (f) | 12,900 | 15,020,953 | ||||||

Los Angeles Community College District California, GO, Refunding, 6.00%, 8/01/19 (a) | 20,131 | 24,049,194 | ||||||

Los Angeles Unified School District California, GO, Series I, 5.00%, 1/01/34 | 5,000 | 5,621,600 | ||||||

Palomar California Community College District, GO, Election of 2006, Series C, 5.00%, 8/01/44 | 15,140 | 17,192,833 | ||||||

San Diego Community College District California, GO, Election of 2002, 5.25%, 8/01/33 | 10,484 | 12,004,986 | ||||||

San Joaquin California Delta Community College District, GO, Election of 2004, Series C, 5.00%, 8/01/39 | 14,505 | 16,387,449 | ||||||

San Jose Unified School District Santa Clara County California, GO: | ||||||||

Election of 2002, Series D, 5.00%, 8/01/32 | 14,625 | 16,109,429 | ||||||

Series C, 4.00%, 8/01/39 | 6,100 | 6,224,928 | ||||||

|

| |||||||

| 131,948,159 | ||||||||

Education — 16.0% |

| |||||||

California Educational Facilities Authority, RB, University of Southern California, Series B, 5.25%, 10/01/39 (f) | 10,395 | 11,579,718 | ||||||

Grossmont Union High School District, GO, Election of 2004, 5.00%, 8/01/33 | 13,095 | 14,266,988 | ||||||

University of California, RB: | ||||||||

Limited Project, Series D (AGM), 5.00%, 5/15/16 (a) | 2,600 | 2,723,448 | ||||||

Series AM, 5.25%, 5/15/44 | 5,000 | 5,775,500 | ||||||

Series O, 5.75%, 5/15/19 (a) | 12,300 | 14,451,229 | ||||||

University of California, Refunding RB: | ||||||||

Series AI, 5.00%, 5/15/38 | 14,225 | 16,050,280 | ||||||