Exhibit 99.2

CONSOLIDATED FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS' REPORT BUDDY'S NEWCO, LLC AND SUBSIDIARIES December 31, 2018

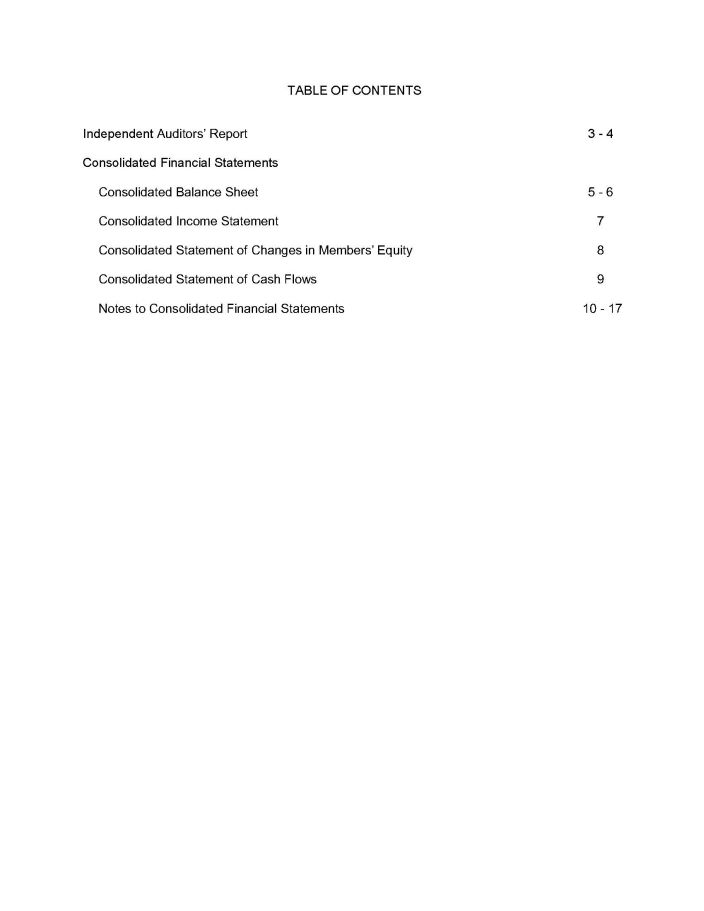

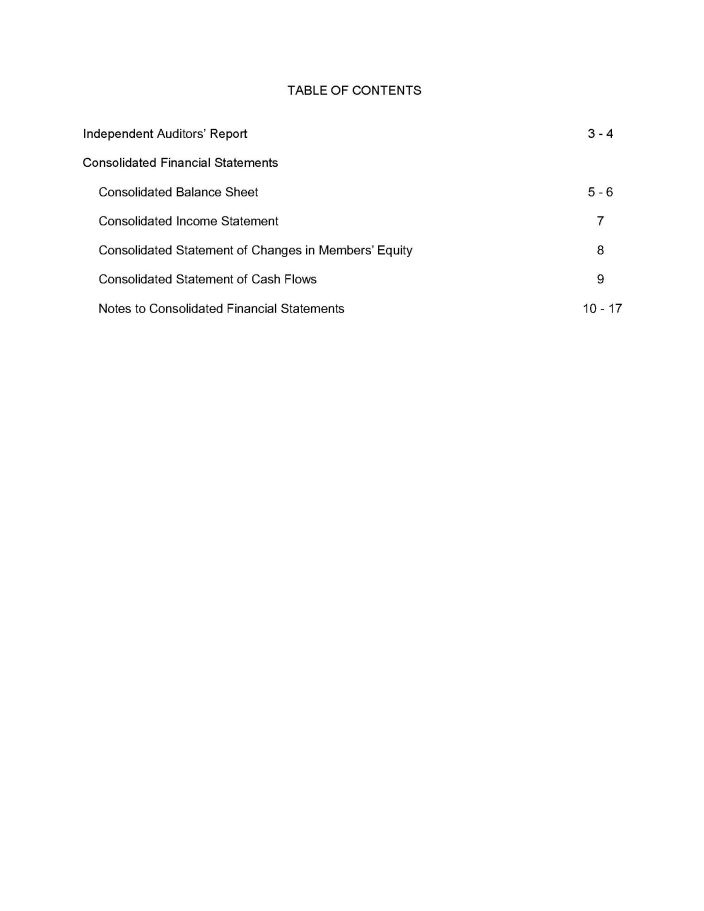

TABLE OF CONTENTS Independent Auditors' Report 3 - 4 Consolidated Financial Statements Consolidated Balance Sheet 5 - 6 Consolidated Income Statement 7 Consolidated Statement of Changes in Members' Equity 8 Consolidated Statement of Cash Flows 9 Notes to Consolidated Financial Statements 10 - 17

Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Buddy's Newco, LLC and Subsidiaries as of December 31 , 2018 , and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America . 4 Tampa, Florida May 2, 2019

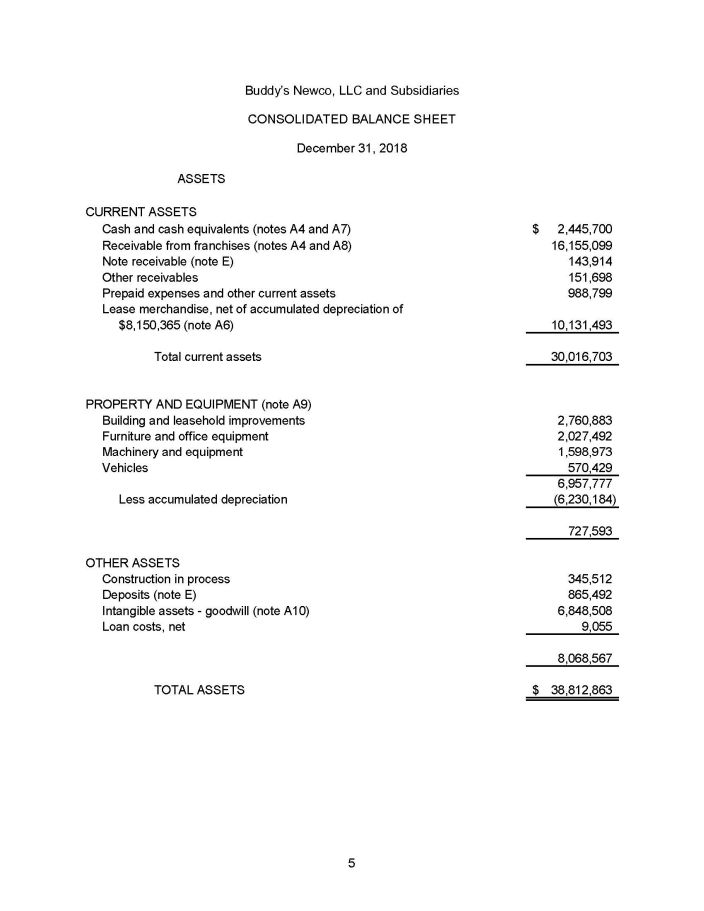

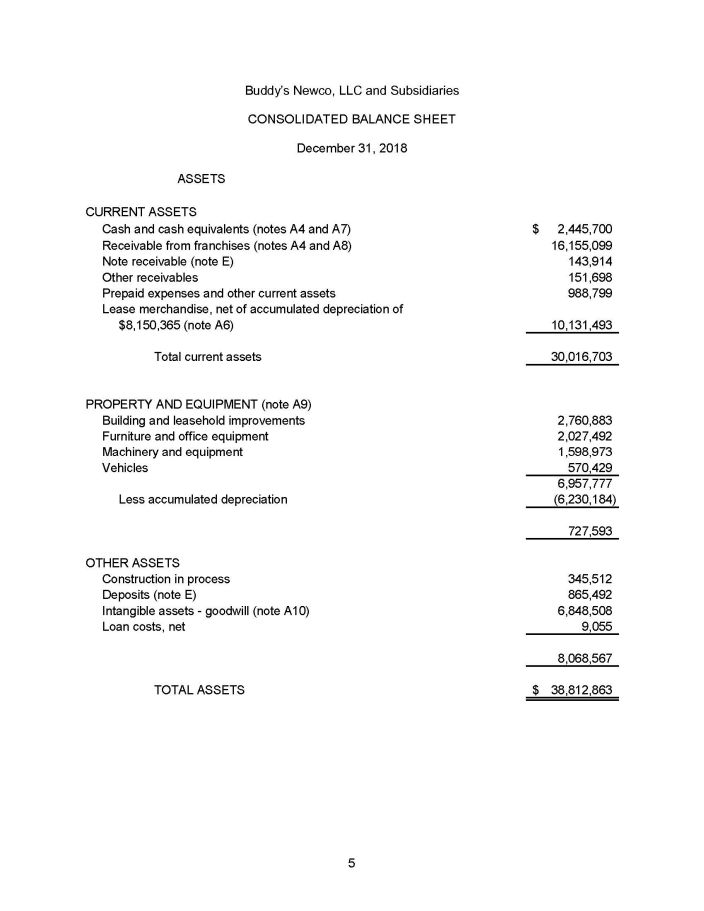

Cash and cash equivalents (notes A4 and A7) $ 2,445,700 Receivable from franchises (notes A4 and A8) 16,155,099 Note receivable (note E) 143,914 Other receivables 151,698 Prepaid expenses and other current assets 988,799 Lease merchandise, net of accumulated depreciation of $8,150,365 (note A6) 10,131,493 Total current assets 30,016,703 PROPERTY AND EQUIPMENT (note A9) Building and leasehold improvements 2 , 76 0 , 8 8 3 Furniture and office equipment 2 , 02 7 , 4 9 2 Machinery and equipment 1 , 59 8 , 9 7 3 Vehicles 570,429 6 , 95 7 , 7 7 7 Less accumulated depreciation (6,230,184) 727,593 OTHER ASSETS Construction in process 34 5 , 5 1 2 Deposits (note E) 86 5 , 4 9 2 Intangible assets - goodwill (note A10) 6 , 84 8 , 5 0 8 Loan costs, net 9,055 8,068,567 TOTAL ASSETS $ 38,812,863 Buddy's Newco, LLC and Subsidiaries CONSOLIDATED BALANCE SHEET December 31, 2018 A S SE TS CURRENT ASSETS 5

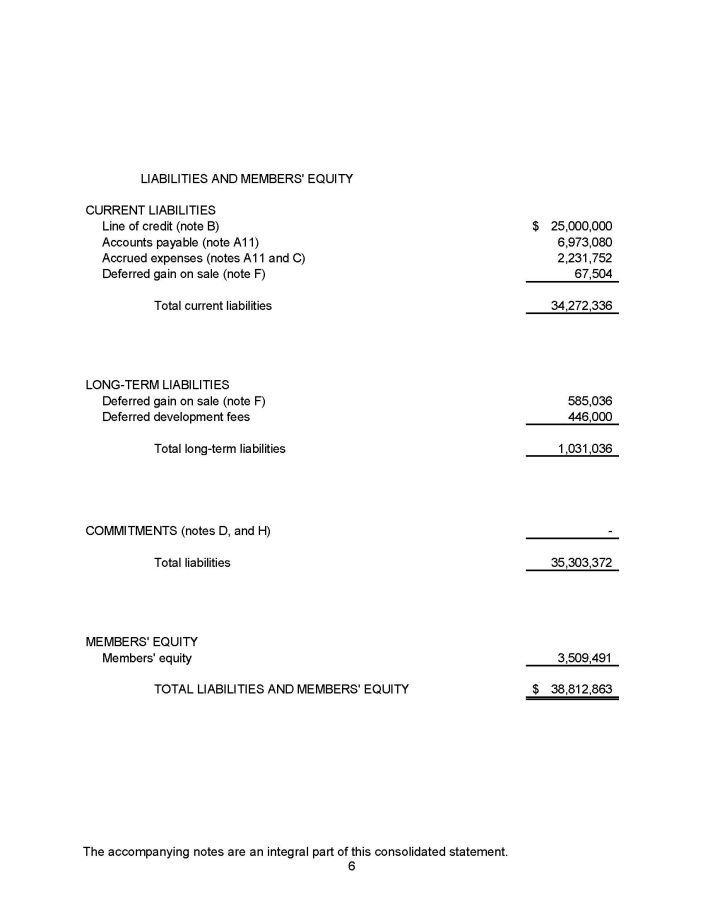

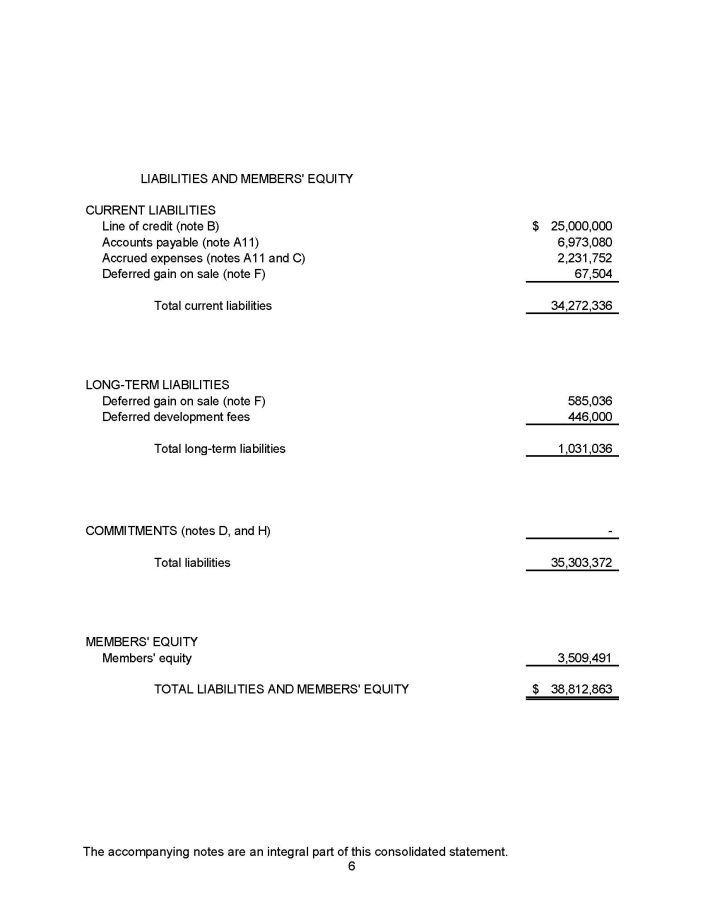

CURRENT LIABILITIES Line of credit (note B) $ 25,000,000 Accounts payable (note A11) 6 , 97 3 , 0 8 0 Accrued expenses (notes A11 and C) 2 , 23 1 , 7 5 2 Deferred gain on sale (note F) 67,504 Total current liabilities 34,272,336 LONG - TERM LIABILITIES Deferred gain on sale (note F) Deferred development fees 585,036 446,000 Total long - term liabilities 1,031,036 COMMITMENTS (notes D, and H) - Total liabilities 35,303,372 MEMBERS' EQUITY Members' equity 3,509,491 TOTAL LIABILITIES AND MEMBERS' EQUITY $ 38,812,863 LIABILITIES AND MEMBERS' EQUITY The accompanying notes are an integral part of this consolidated statement. 6

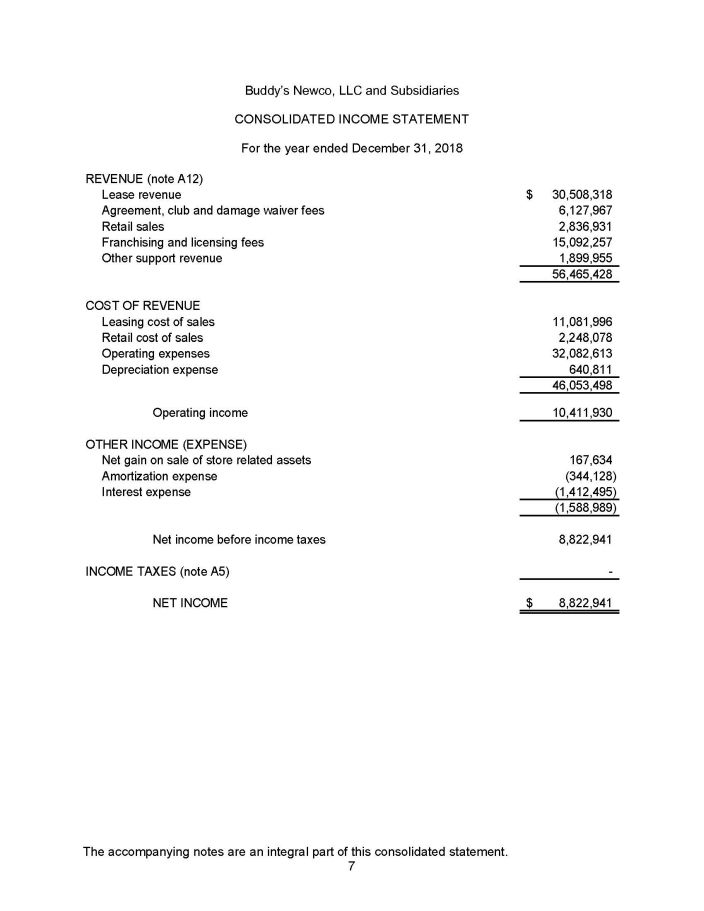

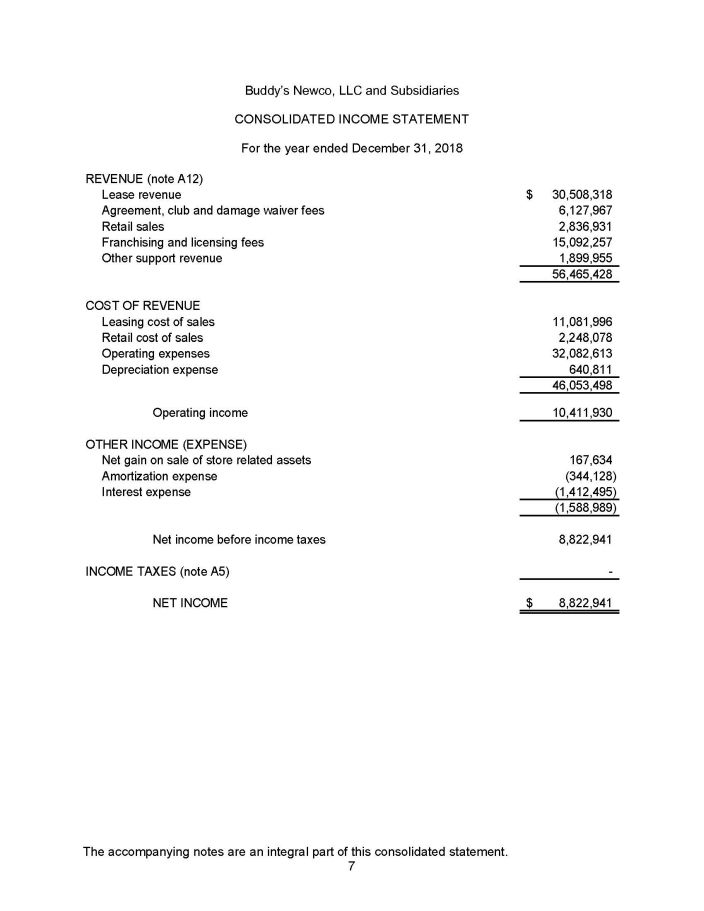

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED INCOME STATEMENT For the year ended December 31, 2018 REVENUE (note A12) Lease revenue $ 3 0 , 50 8 , 3 1 8 Agreement, club and damage waiver fees 6 , 1 2 7 , 9 6 7 Retail sales 2 , 8 3 6 , 9 3 1 Franchising and licensing fees 1 5 , 09 2 , 2 5 7 Other support revenue 1 , 8 9 9 , 9 5 5 5 6 , 46 5 , 4 2 8 COST OF REVENUE Leasing cost of sales 1 1 , 08 1 , 9 9 6 Retail cost of sales 2 , 2 4 8 , 0 7 8 Operating expenses 3 2 , 08 2 , 6 1 3 Depreciation expense 64 0 , 8 1 1 4 6 , 05 3 , 4 9 8 Operating income 1 0 , 41 1 , 9 3 0 OTHER INCOME (EXPENSE) Net gain on sale of store related assets 16 7 , 6 3 4 Amortization expense ( 34 4 , 1 2 8 ) Interest expense ( 1 , 4 1 2 , 4 9 5 ) ( 1 , 5 8 8 , 9 8 9 ) Net income before income taxes 8 , 8 2 2 , 9 4 1 INCOME TAXES (note A5) - NET INCOME $ 8 , 8 2 2 , 9 4 1 The accompanying notes are an integral part of this consolidated statement. 7

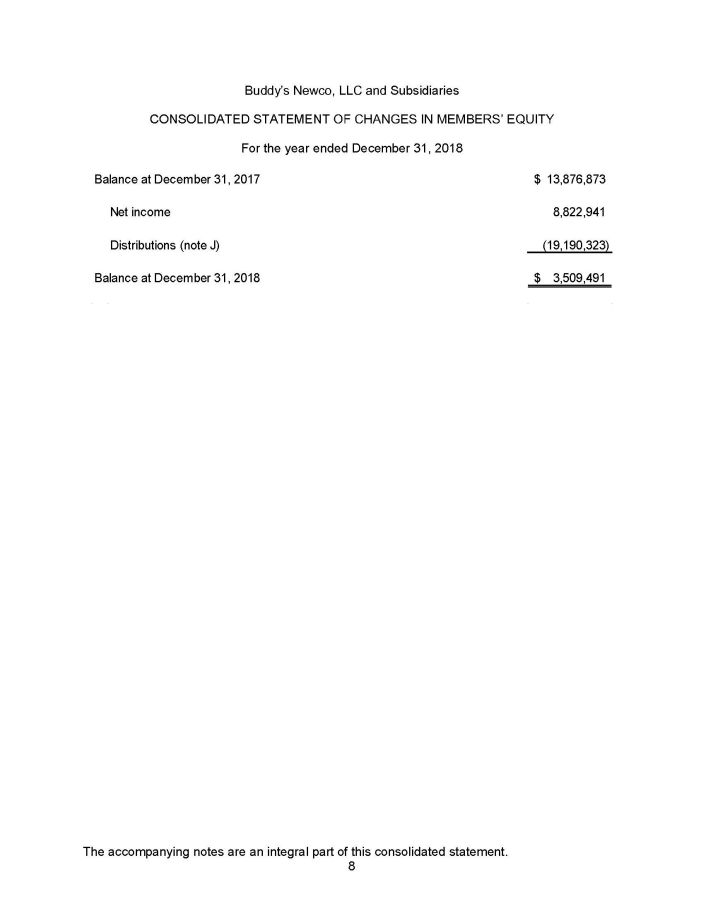

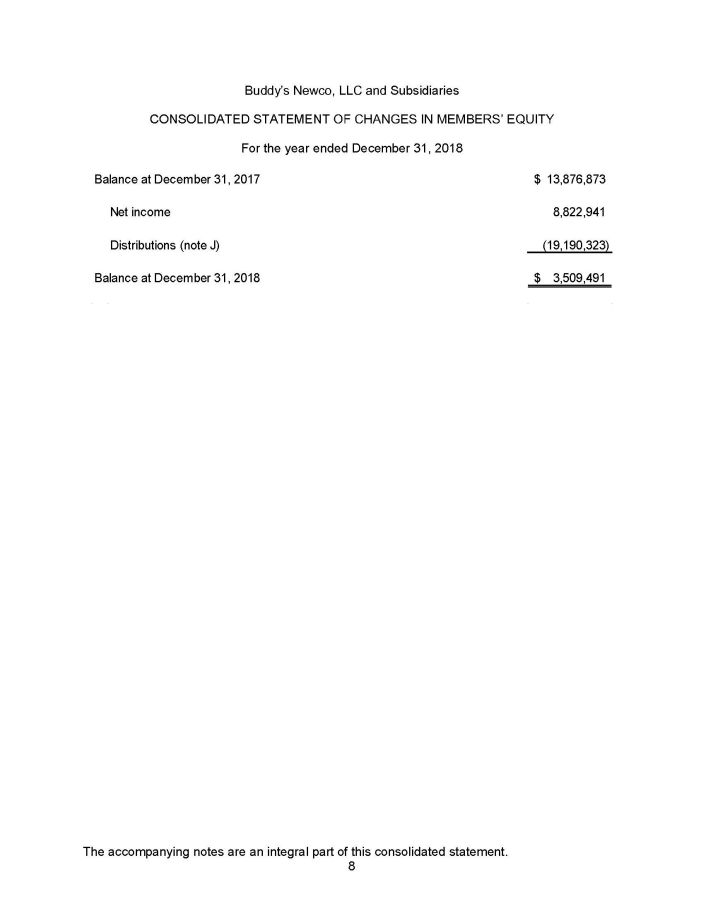

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED STATEMENT OF CHANGES IN MEMBERS' EQUITY For the year ended December 31, 2018 Balance at December 31, 2017 $ 13,876,873 Net income 8 , 8 2 2 , 9 4 1 Distributions (note J) ( 1 9 , 1 9 0 , 3 2 3 ) Balance at December 31, 2018 $ 3 , 5 0 9 , 4 9 1 The accompanying notes are an integral part of this consolidated statement. 8

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED STATEMENT OF CASH FLOWS For the year ended December 31, 2018 $ 8,822,941 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash Cash paid during the year Interest $ 1,432,676 T a x es $ - provided by operating activities Depreciation and amortization 984,939 Loss on sale of store related assets 17,860 Net purchases of operating leasing merchandise (12,439,974) Depreciation, sales and write - offs of operating leasing merchandise 12,747,992 Decrease in other receivables 505,591 Increase in due from related parties ( 1 ,8 2 3, 6 29 ) Increase in receivable from franchises ( 7 ,0 4 8, 3 22 ) Decrease in prepaid expenses and other assets 233,220 Increase in accounts payable and accrued expenses 1,421,965 Decrease in other deferred liabilities (52,504) Total adjustments (5,452,862) Net cash provided by operating activities 3,370,079 Cash flows from investing activities Net proceeds from sale of store related assets, property, and equipment 60,949 Purchase of operating property and equipment ( 6 6, 5 63 ) Net increase in construction in process ( 3 42 ,3 7 4) Net increase in notes receivable ( 3 21 ,0 0 7) Net acquisition of goodwill (226,635) Net cash used by investing activities (895,630) Cash flows from financing activities Distributions to members ( 3 90 ,2 8 6) Proceeds from notes payable 38,652 Net cash used by financing activities (351,634) Net increase in cash 2,122,815 Cash at beginning of year 322,885 Cash at end of year $ 2,445,700 Supplemental disclosures of cash flow information The accompanying notes are an integral part of this consolidated statement. 9

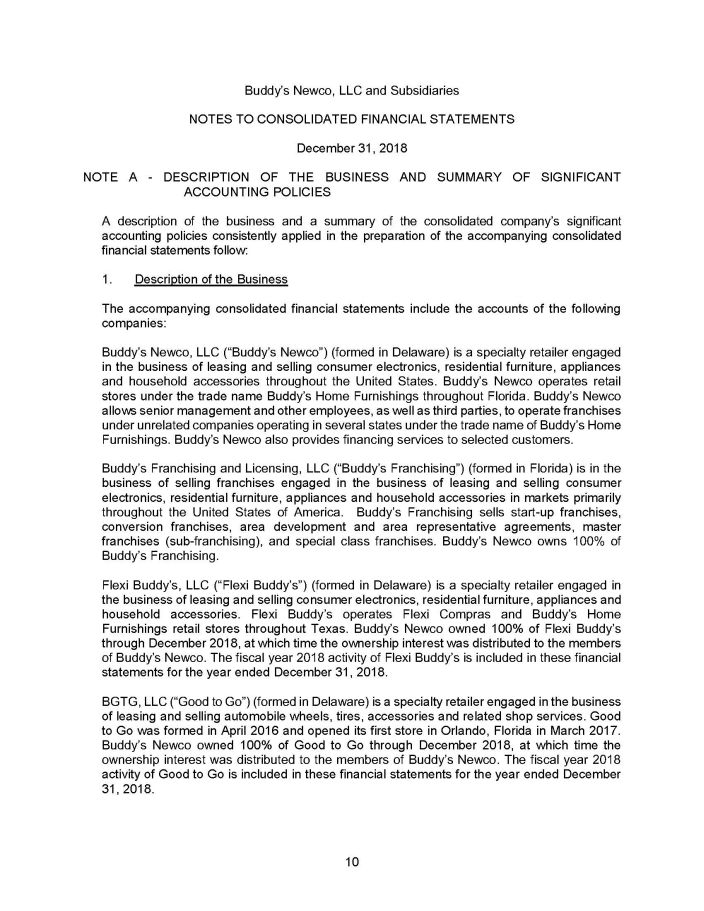

10 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2018 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES A description of the business and a summary of the consolidated company's significant accounting policies consistently applied in the preparation of the accompanying consolidated financial statements follow : 1 . Description of the Business The accompanying consolidated financial statements include the accounts of the following companies : Buddy's Newco, LLC ("Buddy's Newco") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories throughout the United States . Buddy's Newco operates retail stores under the trade name Buddy's Home Furnishings throughout Florida . Buddy's Newco allows senior management and other employees, as well as third parties, to operate franchises under unrelated companies operating in several states under the trade name of Buddy's Home Furnishings . Buddy's Newco also provides financing services to selected customers . Buddy's Franchising and Licensing, LLC ("Buddy's Franchising") (formed in Florida) is in the business of selling franchises engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories in markets primarily throughout the United States of America . Buddy's Franchising sells start - up franchises, conversion franchises, area development and area representative agreements, master franchises (sub - franchising), and special class franchises . Buddy's Newco owns 100 % of Buddy's Franchising . Flexi Buddy's, LLC ("Flexi Buddy's") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories . Flexi Buddy's operates Flexi Compras and Buddy's Home Furnishings retail stores throughout Texas . Buddy's Newco owned 100 % of Flexi Buddy's through December 2018 , at which time the ownership interest was distributed to the members of Buddy's Newco . The fiscal year 2018 activity of Flexi Buddy's is included in these financial statements for the year ended December 31 , 2018 . BGTG, LLC ("Good to Go") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling automobile wheels, tires, accessories and related shop services . Good to Go was formed in April 2016 and opened its first store in Orlando, Florida in March 2017 . Buddy's Newco owned 100 % of Good to Go through December 2018 , at which time the ownership interest was distributed to the members of Buddy's Newco . The fiscal year 2018 activity of Good to Go is included in these financial statements for the year ended December 31 , 2018 .

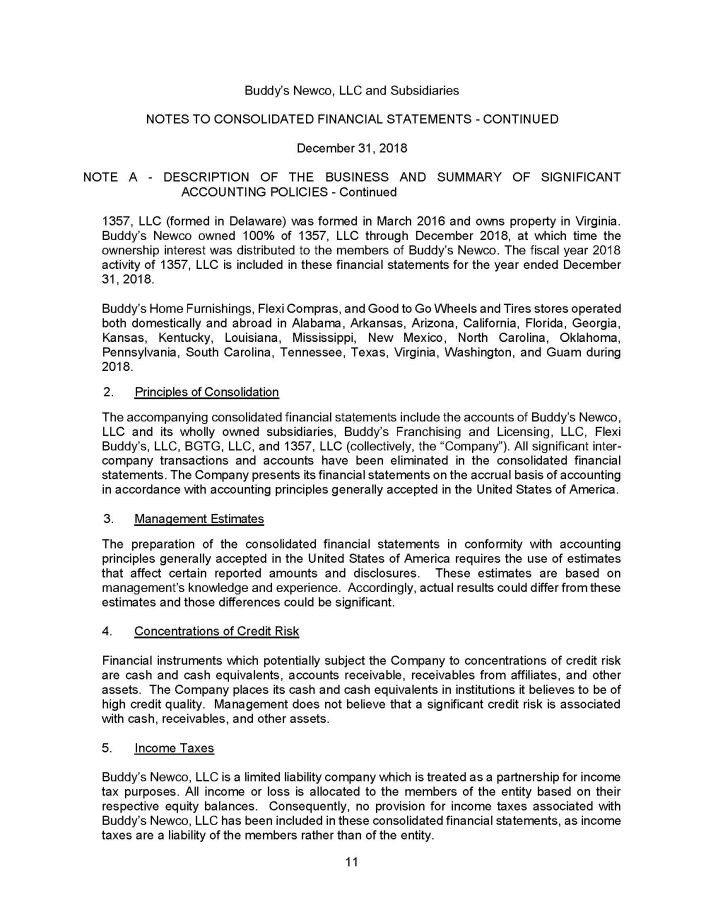

11 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2018 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued 1357 , LLC (formed in Delaware) was formed in March 2016 and owns property in Virginia . Buddy's Newco owned 100 % of 1357 , LLC through December 2018 , at which time the ownership interest was distributed to the members of Buddy's Newco . The fiscal year 2018 activity of 1357 , LLC is included in these financial statements for the year ended December 31 , 2018 . Buddy's Home Furnishings, Flexi Compras, and Good to Go Wheels and Tires stores operated both domestically and abroad in Alabama, Arkansas, Arizona, California, Florida, Georgia, Kansas, Kentucky, Louisiana, Mississippi, New Mexico, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, and Guam during 2018 . 2. Principles of Consolidation The accompanying consolidated financial statements include the accounts of Buddy's Newco, LLC and its wholly owned subsidiaries, Buddy's Franchising and Licensing, LLC, Flexi Buddy's, LLC, BGTG, LLC, and 1357 , LLC (collectively, the "Company") . All significant inter - company transactions and accounts have been eliminated in the consolidated financial statements . The Company presents its financial statements on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America . 3. Management Estimates The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates that affect certain reported amounts and disclosures . These estimates are based on management's knowledge and experience . Accordingly, actual results could differ from these estimates and those differences could be significant . 4. Concentrations of Credit Risk Financial instruments which potentially subject the Company to concentrations of credit risk are cash and cash equivalents, accounts receivable, receivables from affiliates, and other assets . The Company places its cash and cash equivalents in institutions it believes to be of high credit quality . Management does not believe that a significant credit risk is associated with cash, receivables, and other assets . 5. Income Taxes Buddy's Newco, LLC is a limited liability company which is treated as a partnership for income tax purposes . All income or loss is allocated to the members of the entity based on their respective equity balances . Consequently, no provision for income taxes associated with Buddy's Newco, LLC has been included in these consolidated financial statements, as income taxes are a liability of the members rather than of the entity .

12 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2018 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued Buddy's Franchising and Licensing, LLC, is a wholly - owned subsidiary of Buddy's Newco, LLC, and is considered a disregarded entitiy for tax purposes and is included on its parent's tax return . Flexi Buddy's, LLC, BGTG, LLC, and 1357 , LLC were wholly - owned subsidiaries of Buddy's Newco, LLC, and were considered disregarded entities for tax purposes and were included on Buddy's Newco, LLC tax return . The Company is not aware of any tax positions it has taken that are subject to a significant degree of uncertainty . Tax years since 2015 remain subject to examination by federal and state taxing authorities . 6 . Lease Merchandise Lease merchandise consists primarily of new, previously rented, or currently rented consumer electronics, computers, residential furniture, appliances, and household accessories and is recorded at cost, including shipping and handling fees . Lease merchandise is maintained in retail stores as available to rent, and within customers' possession when currently on - rent . Through September 2016 , lease merchandise was depreciated using the straight - line method over their estimated service lives of twenty - four months whether leased or non - leased, with a 0 % salvage value . Depreciation of rent - to own units commences on the earlier of the first day rented or six months after purchase, and once started, continued until the item is fully depreciated or sold . When lease merchandise is sold to a customer, any remaining non - amortized value is immediately charged to cost of goods sold . In October 2016 , the Company implemented the "Modified Cost Recovery Method" for depreciation of lease merchandise purchased after the implementation date . The Modified Cost Recovery Method was implemented to more accurately match both the revenues generated by the inventory and the natural wear and tear involved in the leasing process . As implemented, when lease merchandise is purchased it is not initially depreciated until either it is contracted for lease or a period of three months has lapsed . When the period of three months has lapsed, and the lease merchandise has not been leased, the lease merchandise starts to be depreciated daily over a 24 - month period . When the lease merchandise is leased, it's net book value or cost basis is depreciated daily over the lease term of the rental agreement . If the lease merchandise is returned prior to the end of the lease term, it will continue to be depreciated daily over a 24 - month period until it is leased again . All lease merchandise is available for lease or sale . On a weekly basis, all damaged, lost, stolen, or unsalable merchandise identified is written off . Maintenance and repairs of lease merchandise are charged to operations as incurred .

13 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2018 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued 7. Cash and Cash Equivalents The Company considers cash and cash equivalents to include highly liquid financial instruments with original maturities of three months or less . 8. Receivable from Franchises The Company provides full administrative, purchasing and marketing services related to the day - to - day operations of franchisee owned stores operating throughout the United States of America under the name of Buddy's Home Furnishings . These unconsolidated affiliated businesses owe the Company approximately $ 16 , 155 , 000 for administrative services, inventory purchases and franchise fees at December 31 , 2018 . Generally, these costs and fees are due within 60 days of being incurred . The Company maintains a program to help facilitate purchasing for its franchisees . The Company takes advantage of its purchasing power to negotiate better terms for participants in the program by paying for the inventory purchased through the plan for its participants and then billing the participants . The Company never takes possession of the inventory and the participants are primarily liable . 9. Property and Equipment The Company follows the practice of capitalizing at cost all payments for property and equipment in excess of $ 5 , 000 . Depreciation is provided in amounts sufficient to relate the cost of depreciable assets other than lease merchandise over their estimated service lives . Equipment is depreciated over estimated useful lives ranging from three to ten years . Leasehold improvements are amortized over the lesser of their estimated useful lives or the remaining lease terms . The Company's policy is to test equipment and improvements for impairment when events or changes in circumstances indicate that their carrying amounts may not be recoverable . There were no events or circumstances at December 31 , 2018 indicating that the carrying amounts may not be recoverable . 10. Intangible Assets Intangible assets consist of goodwill . The Company chooses to evaluate goodwill annually for impairment . Since the addition of goodwill, the Company has recognized no impairment . Goodwill totaled $ 6 , 848 , 508 at December 31 , 2018 . Goodwill increased approximately $ 404 , 000 during 2018 as a result of Buddy's Newco's store and contract acquisitions . Goodwill was reduced by approximately $ 520 , 000 as a result of adjustments due to store sales and closures . Additionally, goodwill was reduced by approximately $ 1 , 310 , 000 as a result of the distribution of Flexi Buddy's ownership interest during 2018 (see also note J) .

14 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2018 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued 11. Accounts Payable and Accrued Expenses The Company records a liability when goods or services are received and charges the expense in the period the liability is incurred . 12. Revenue Recognition The Company provides merchandise, consisting of consumer electronics, computers, residential furniture, appliances, and household accessories, to its customers for lease under certain terms agreed to by the customer . Generally, lease terms require weekly, bi - weekly, or monthly payments . Customers have the option to purchase the goods off the lease at any point in the lease term . The typical lease term is twelve to eighteen months with the option for the customer to cancel at any time with no penalty . The Company does not require deposits upon inception of customer agreements . The Company's customer agreements are considered operating leases under the provisions of ASC 840 , leases . As such, lease revenues are recognized as revenue in the month they are due . Until all payment obligations are satisfied under sales and lease ownership agreements, the Company maintains ownership of the lease merchandise . The Company franchises Buddy's Home Furnishings stores . Franchisees typically pay a non - refundable initial franchise fee of $ 25 , 000 and typically an ongoing royalty of 6 % of gross revenues . Franchise fee revenue from area franchise sales is recognized when all material services or conditions relating to the sale have been substantially performed or satisfied by the franchisor . Generally, these services include training personnel and delivery of certain products, supplies, other materials, and operating assets for use in the operations of the franchise . The Company provides full administrative, purchasing and marketing services related to the day - to - day operations of franchisee owned stores operating throughout the United States of America under the name of Buddy's Home Furnishings . These unconsolidated affiliated businesses owe the Company approximately $ 2 , 924 , 000 for administrative services and franchise fees and $ 13 , 231 , 000 for inventory purchases at December 31 , 2018 . There are no repayment terms for these amounts receivable from affiliated franchises, but are considered due within 60 days after incurred . Failure by a franchisee to pay their administrative fees, franchise fees, or inventory purchasing costs would result in the Company discontinuing services to the franchisee until paid . 13. Advertising and Marketing Costs The Company's policy is to expense advertising and marketing costs as they are incurred . Advertising and marketing costs for the year ended December 31 , 2018 approximated $ 2 , 023 , 000 .

Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2018 NOTE B - LINE OF CREDIT Buddy's Newco has a secured, working capital bank line of credit of up to $ 25 , 000 , 000 subject to a borrowing base calculation . The line of credit bears interest at the one - month LIBOR rate plus 3 . 25 % for an effective rate of 5 . 72 % at December 31 , 2018 , (subject to a minimum rate of 4 . 00 % ) is secured by all of Buddy's Newco's and other related companies assets, and has a maturity date of November 6 , 2019 . The outstanding balance borrowed against the line of credit totaled $ 25 , 000 , 000 at December 31 , 2018 . Management of the Company expects to renew the line of credit, under similar terms, prior to the due date . NOTE C - ACCRUED EXPENSES Following is a summary of accrued expenses at December 31 , 2018 : Acquisition costs payable $ 393,332 Customer advance payments 8 6 , 8 6 6 Deferred tenant allowances 4 9 , 8 5 2 Health insurance reserve 25 3 , 3 0 5 Payroll expenses 39 7 , 9 3 7 Sales and tangible taxes payable 49 1 , 5 5 8 Consulting fees 26 8 , 8 9 7 Other 29 0 , 0 0 5 $ 2 , 23 1 , 7 5 2 NOTE D - OPERATING LEASES The Company conducts its operations in leased retail space and leases vehicles and computer equipment under leases classified as operating leases . Approximate future minimum rental payments for such operating leases expiring at various dates through 2028 are as follows : Year ending December 31, 2019 $ 2,787,000 2020 2,116,000 2021 1,571,000 2022 9 8 1 , 00 0 2023 8 2 8 , 00 0 2024 and thereafter 4 , 0 9 6 , 00 0 $ 12,379,000 Rental expenses for property and vehicles approximated $4,329,000 for the year ended December 31, 2018. 15

16 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2018 NOTE E - RELATED PARTY TRANSACTIONS During 2015 , as an incentive for franchisee ownership groups to open additional stores, the Company executed an agreement with a financial institution whereby the Company guaranteed $ 500 , 000 on a $ 5 , 000 , 000 Line of Credit facility that will be made available to certain franchisee ownership groups . The Company was required to deposit $ 500 , 000 in a reserve account held by the financial institution to secure the guarantee . In the case of default by any franchisee groups that have utilized the line of credit, the lender may draw on the funds held in the reserve account to cover its losses . No amounts have been drawn in relation to the guarantee and no amounts are expected to be drawn . Buddy's Newco held a note receivable from a franchisee totaling $ 143 , 914 at December 31 , 2018 . The note receivable was fully paid by the franchisee in April 2019 . NOTE F - DEFERRED GAIN ON SALE In September 2014 , the Company entered into a sale - leaseback agreement under which a retail store location was sold to a third party for $ 1 , 200 , 000 and simultaneously leased back by the Company pursuant to a fourteen - year operating master lease . The Company recognized a gain on the sale of the store of approximately $ 945 , 000 which was deferred in order to be recognized on a straight - line basis over the lease term of fourteen years . The unamortized deferred gain of the sale was $ 652 , 540 at December 31 , 2018 , of which $ 67 , 504 will be recognized in the next fiscal year . NOTE G - LEGAL MATTERS In the ordinary course of business, the Company becomes involved in various legal actions and claims with employees, customers and vendors . Management does not believe the outcome of any legal matters will have a significant effect on the Company's financial statements . NOTE H - EMPLOYEE BENEFIT PLAN The Company has a retirement savings 401 (k) plan in which substantially all employees may participate . The Company matches employees' contributions based on a percentage of salary contributed by participants . The Company's expense for the plan was approximately $ 150 , 000 for the year ended December 31 , 2018 . NOTE I - FRANCHISING In general, the Company's franchise agreements provide for continuing fees of 6 % , or less, of sales from the franchise stores . A total of 1 new franchise store was added during 2018 , resulting in 259 total franchise stores in operation at December 31 , 2018 . There is a total of 36 franchisor - owned stores at December 31 , 2018 , which reflects no change from the prior year . There is a total of 295 retail stores operating under the Company's brand names at December 31 , 2018 .

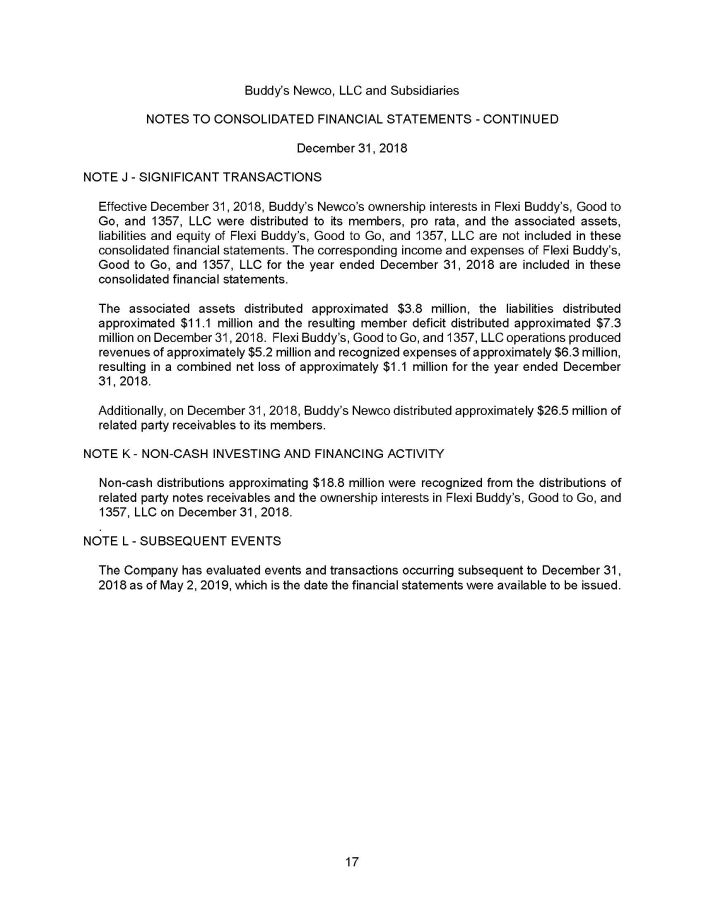

17 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2018 NOTE J - SIGNIFICANT TRANSACTIONS Effective December 31 , 2018 , Buddy's Newco's ownership interests in Flexi Buddy's, Good to Go, and 1357 , LLC were distributed to its members, pro rata, and the associated assets, liabilities and equity of Flexi Buddy's, Good to Go, and 1357 , LLC are not included in these consolidated financial statements . The corresponding income and expenses of Flexi Buddy's, Good to Go, and 1357 , LLC for the year ended December 31 , 2018 are included in these consolidated financial statements . The associated assets distributed approximated $ 3 . 8 million, the liabilities distributed approximated $ 11 . 1 million and the resulting member deficit distributed approximated $ 7 . 3 million on December 31 , 2018 . Flexi Buddy's, Good to Go, and 1357 , LLC operations produced revenues of approximately $ 5 . 2 million and recognized expenses of approximately $ 6 . 3 million, resulting in a combined net loss of approximately $ 1 . 1 million for the year ended December 31 , 2018 . Additionally, on December 31 , 2018 , Buddy's Newco distributed approximately $ 26 . 5 million of related party receivables to its members . NOTE K - NON - CASH INVESTING AND FINANCING ACTIVITY Non - cash distributions approximating $ 18 . 8 million were recognized from the distributions of related party notes receivables and the ownership interests in Flexi Buddy's, Good to Go, and 1357 , LLC on December 31 , 2018 . . NOTE L - SUBSEQUENT EVENTS The Company has evaluated events and transactions occurring subsequent to December 31 , 2018 as of May 2 , 2019 , which is the date the financial statements were available to be issued .

CONSOLIDATED FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS' REPORT BUDDY'S NEWCO, LLC AND SUBSIDIARIES December 31, 2017

TABLE OF CONTENTS Independent Auditors' Report 3 - 4 Consolidated Financial Statements Consolidated Balance Sheet 5 - 6 Consolidated Income Statement 7 Consolidated Statement of Changes in Members' Equity 8 Consolidated Statement of Cash Flows 9 Notes to Consolidated Financial Statements 10 - 17

Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Buddy's Newco, LLC and Subsidiaries as of December 31 , 2017 , and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America . 4 Tampa, Florida May 8, 2018

Cash and cash equivalents (notes A4 and A7) $ 322,885 Receivable from franchises (notes A4 and A8) 9,111,170 Notes receivable - current portion (note E) 6,127,540 Other receivables 847,099 Prepaid expenses and other assets 1,258,137 Lease merchandise, net of accumulated depreciation of $9,065,759 (note A6) 11,644,675 Total current assets 29,311,506 PROPERTY AND EQUIPMENT (note A9) Land 18 1 ,7 7 5 Building and leasehold improvements 3 ,29 1 ,1 3 3 Furniture and office equipment 2 ,23 3 ,2 0 8 Machinery and equipment 1 ,67 3 ,6 5 0 Vehicles 612,189 7 ,99 1 ,9 5 5 Less accumulated depreciation (5,992,612) OTHER ASSETS 1 ,99 9 ,3 4 3 Construction in process 3 , 1 3 8 Deposits (note E) 89 8 ,5 4 5 Due from related parties (note E) 8 ,18 6 ,0 8 5 Intangible assets - goodwill (note A10) 8 ,27 5 ,1 8 2 Loan costs, net 9 , 9 9 2 Notes receivable - long term (note E) 70 5 ,4 1 1 1 8 ,0 7 8,3 5 3 TOTAL ASSETS $ 49,389,202 Buddy's Newco, LLC and Subsidiaries CONSOLIDATED BALANCE SHEET December 31, 2017 A S S E T S CURRENT ASSETS 5

Lines of credit (note B) $ 25,000,000 Accounts payable (note A11) 6 ,3 6 7, 3 5 3 Accrued expenses (notes A11 and C) 2 ,5 6 3, 8 2 1 Deferred gain on sale (note F) 6 7,5 0 4 Total current liabilities 33,998,678 LONG - TERM LIABILITIES Note payable (note E) 4 3 0, 1 1 1 Deferred gain on sale (note F) 6 5 2, 5 4 0 Deferred development fees 4 3 1, 0 0 0 Total long - term liabilities 1,513,651 COMMITMENTS (notes E, F, and H) - Total liabilities 35,512,329 MEMBERS' EQUITY Members' equity 13,876,873 TOTAL LIABILITIES AND MEMBERS' EQUITY $ 49,389,202 LIABILITIES AND MEMBERS' EQUITY CURRENT LIABILITIES The accompanying notes are an integral part of this consolidated statement. 6

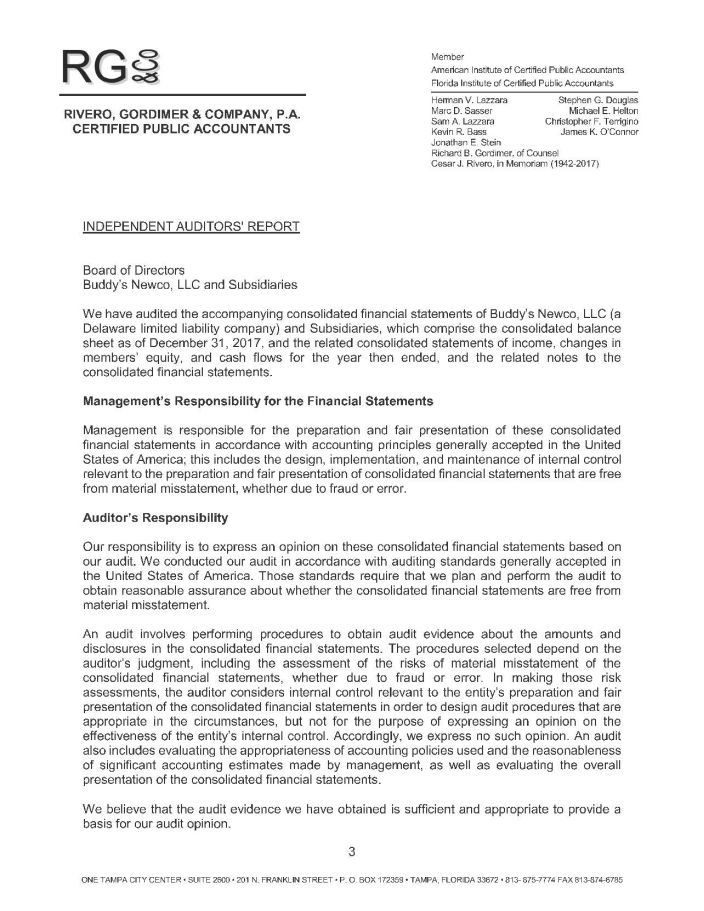

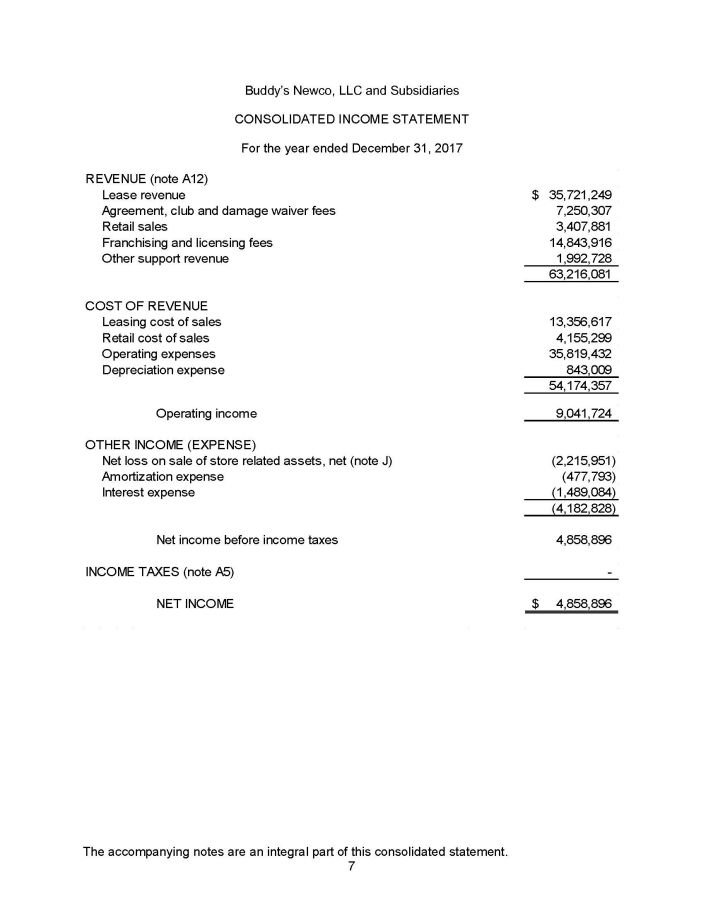

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED INCOME STATEMENT For the year ended December 31, 2017 REVENUE (note A12) Lease revenue $ 35,721,249 Agreement, club and damage waiver fees 7, 2 5 0 , 3 0 7 Retail sales 3, 4 0 7 , 8 8 1 Franchising and licensing fees 14 , 84 3, 9 1 6 Other support revenue 1, 9 9 2 , 7 2 8 63 , 21 6, 0 8 1 COST OF REVENUE Leasing cost of sales 13 , 35 6, 6 1 7 Retail cost of sales 4, 1 5 5 , 2 9 9 Operating expenses 35 , 81 9, 4 3 2 Depreciation expense 8 4 3 , 0 0 9 54 , 17 4, 3 5 7 Operating income 9, 0 4 1 , 7 2 4 OTHER INCOME (EXPENSE) Net loss on sale of store related assets, net (note J) ( 2, 2 1 5 , 9 51 ) Amortization expense ( 4 7 7 , 7 9 3 ) Interest expense ( 1, 4 8 9 , 0 84 ) ( 4, 1 8 2 , 8 28 ) Net income before income taxes 4, 8 5 8 , 8 9 6 INCOME TAXES (note A5) - NET INCOME $ 4, 8 5 8 , 8 9 6 The accompanying notes are an integral part of this consolidated statement. 7

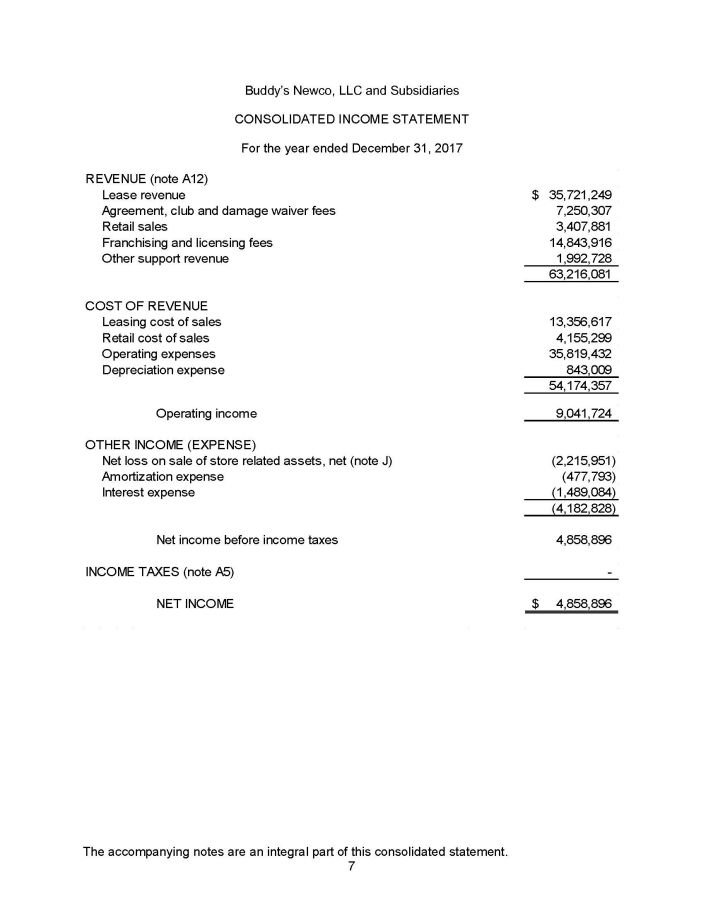

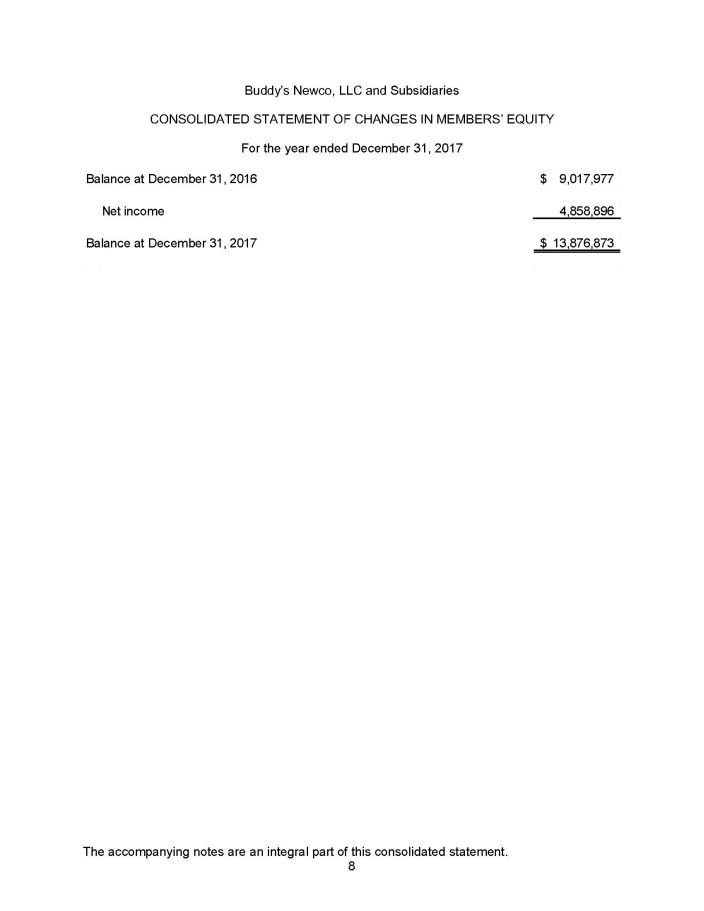

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED STATEMENT OF CHANGES IN MEMBERS' EQUITY For the year ended December 31, 2017 Balance at December 31, 2016 $ 9,017,977 Net income 4,858,896 Balance at December 31, 2017 $ 13,876,873 The accompanying notes are an integral part of this consolidated statement. 8

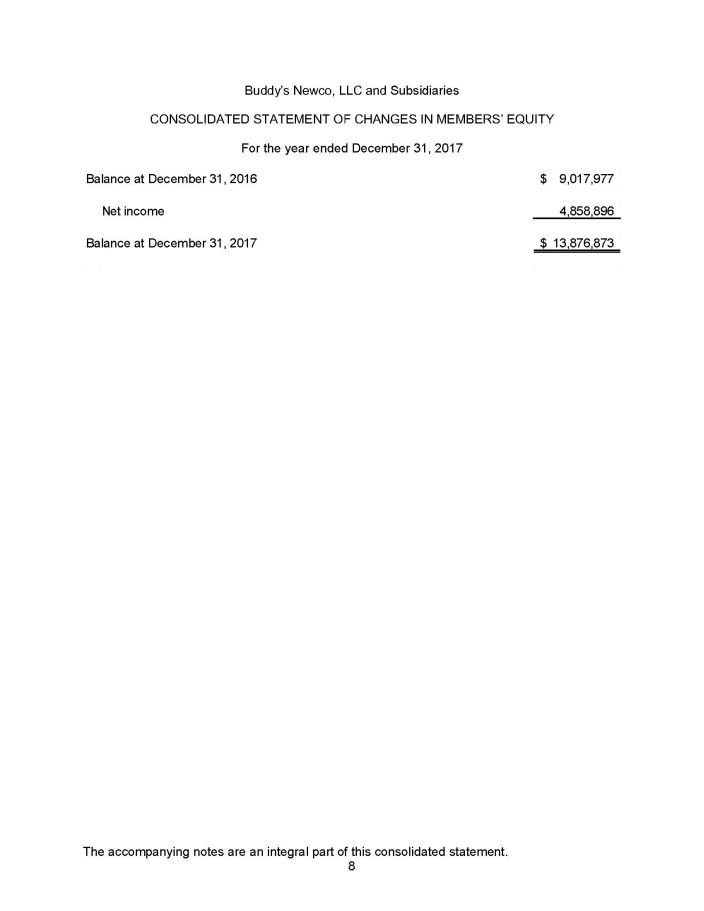

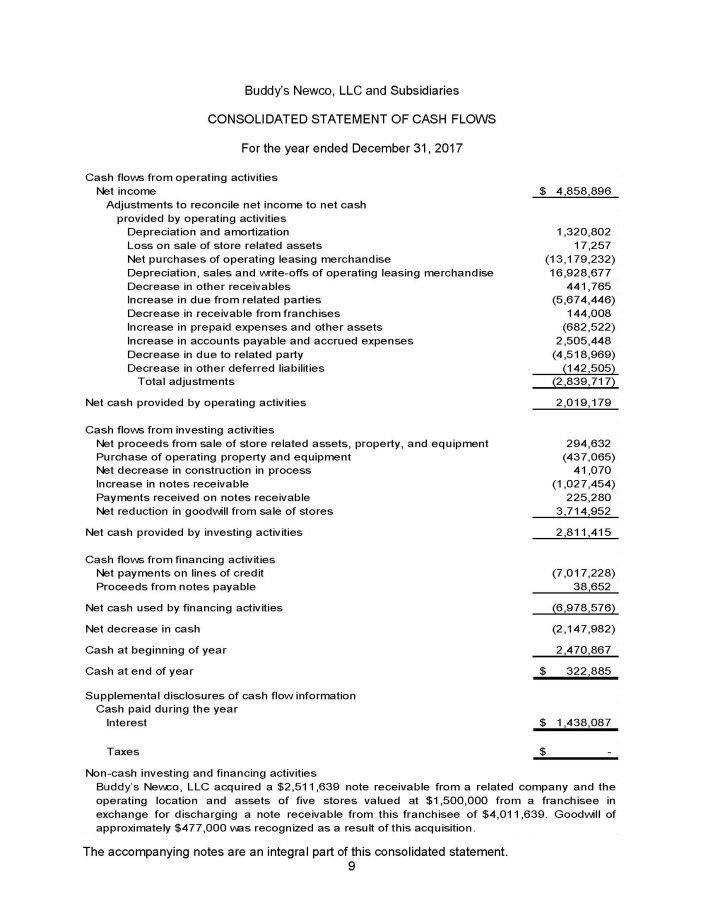

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED STATEMENT OF CASH FLOWS For the year ended December 31, 2017 $ 4,858,896 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash Cash paid during the year Interest $ 1,438,087 $ - Taxes Non - cash investing and financing activities Buddy's Newco, LLC acquired a $ 2 , 511 , 639 note receivable from a related company and the operating location and assets of five stores valued at $ 1 , 500 , 000 from a franchisee in exchange for discharging a note receivable from this franchisee of $ 4 , 011 , 639 . Goodwill of approximately $ 477 , 000 was recognized as a result of this acquisition . provided by operating activities Depreciation and amortization 1,320,802 Loss on sale of store related assets 1 7 , 25 7 Net purchases of operating leasing merchandise ( 13 , 1 79 , 232 ) Depreciation, sales and write - offs of operating leasing merchandise 16,928,677 Decrease in other receivables 441 , 7 6 5 Increase in due from related parties ( 5 , 674 , 446 ) Decrease in receivable from franchises 144 , 0 0 8 Increase in prepaid expenses and other assets ( 682 , 5 22 ) Increase in accounts payable and accrued expenses 2,505,448 Decrease in due to related party ( 4 , 518 , 969 ) Decrease in other deferred liabilities ( 142 , 5 05 ) Total adjustments ( 2 , 839 , 717 ) Net cash provided by operating activities 2 , 019 , 17 9 Cash flows from investing activities Net proceeds from sale of store related assets, property, and equipment 294 , 6 3 2 Purchase of operating property and equipment ( 437 , 0 65 ) Net decrease in construction in process 4 1 , 07 0 Increase in notes receivable ( 1 , 027 , 454 ) Payments received on notes receivable 225 , 2 8 0 Net reduction in goodwill from sale of stores 3 , 714 , 95 2 Net cash provided by investing activities 2 , 811 , 41 5 Cash flows from financing activities Net payments on lines of credit ( 7 , 017 , 228 ) Proceeds from notes payable 3 8 , 65 2 Net cash used by financing activities ( 6 , 978 , 576 ) Net decrease in cash ( 2 , 147 , 982 ) Cash at beginning of year 2 , 470 , 86 7 Cash at end of year $ 322 , 8 8 5 Supplemental disclosures of cash flow information The accompanying notes are an integral part of this consolidated statement. 9

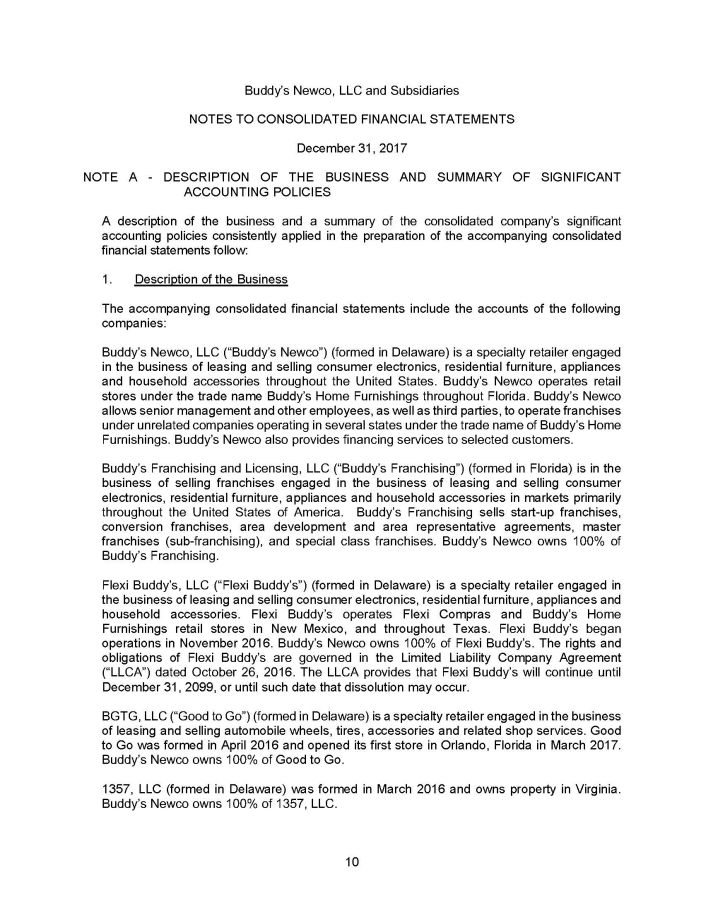

10 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2017 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES A description of the business and a summary of the consolidated company's significant accounting policies consistently applied in the preparation of the accompanying consolidated financial statements follow : 1 . Description of the Business The accompanying consolidated financial statements include the accounts of the following companies : Buddy's Newco, LLC ("Buddy's Newco") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories throughout the United States . Buddy's Newco operates retail stores under the trade name Buddy's Home Furnishings throughout Florida . Buddy's Newco allows senior management and other employees, as well as third parties, to operate franchises under unrelated companies operating in several states under the trade name of Buddy's Home Furnishings . Buddy's Newco also provides financing services to selected customers . Buddy's Franchising and Licensing, LLC ("Buddy's Franchising") (formed in Florida) is in the business of selling franchises engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories in markets primarily throughout the United States of America . Buddy's Franchising sells start - up franchises, conversion franchises, area development and area representative agreements, master franchises (sub - franchising), and special class franchises . Buddy's Newco owns 100 % of Buddy's Franchising . Flexi Buddy's, LLC ("Flexi Buddy's") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories . Flexi Buddy's operates Flexi Compras and Buddy's Home Furnishings retail stores in New Mexico, and throughout Texas . Flexi Buddy's began operations in November 2016 . Buddy's Newco owns 100 % of Flexi Buddy's . The rights and obligations of Flexi Buddy's are governed in the Limited Liability Company Agreement ("LLCA") dated October 26 , 2016 . The LLCA provides that Flexi Buddy's will continue until December 31 , 2099 , or until such date that dissolution may occur . BGTG, LLC ("Good to Go") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling automobile wheels, tires, accessories and related shop services . Good to Go was formed in April 2016 and opened its first store in Orlando, Florida in March 2017 . Buddy's Newco owns 100 % of Good to Go . 1357 , LLC (formed in Delaware) was formed in March 2016 and owns property in Virginia . Buddy's Newco owns 100 % of 1357 , LLC .

11 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2017 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued There is a total of 305 corporate and franchised Buddy's Home Furnishings, Flexi Compras, and Good to Go Wheels and Tires stores operating both domestically and abroad in Alabama, Arkansas, Arizona, California, Florida, Georgia, Kansas, Kentucky, Louisiana, Mississippi, New Mexico, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, and Guam at December 31 , 2017 . 2. Principles of Consolidation The accompanying consolidated financial statements include the accounts of Buddy's Newco, LLC and its wholly owned subsidiaries, Buddy's Franchising and Licensing, LLC, Flexi Buddy's, LLC, BGTG, LLC, and 1357 , LLC (collectively, the "Company") . All significant inter - company transactions and accounts have been eliminated in the consolidated financial statements . The Company presents its financial statements on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America . 3. Management Estimates The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates that affect certain reported amounts and disclosures . These estimates are based on management's knowledge and experience . Accordingly, actual results could differ from these estimates and those differences could be significant . 4. Concentrations of Credit Risk Financial instruments which potentially subject the Company to concentrations of credit risk are cash and cash equivalents, accounts receivable, receivables from affiliates, and other assets . The Company places its cash and cash equivalents in institutions it believes to be of high credit quality . Management does not believe that a significant credit risk is associated with cash, receivables, and other assets . 5. Income Taxes Buddy's Newco, LLC is a limited liability company which is treated as a partnership for income tax purposes . All income or loss is allocated to the members of the entity based on their respective equity balances . Consequently, no provision for income taxes associated with Buddy's Newco, LLC has been included in these consolidated financial statements, as income taxes are a liability of the members rather than of the entity . Buddy's Franchising and Licensing, LLC, Flexi Buddy's, LLC, BGTG, LLC, and 1357 , LLC are wholly - owned subsidiaries of Buddy's Newco, LLC, and are considered disregarded entities for tax purposes and are included on its parent's return .

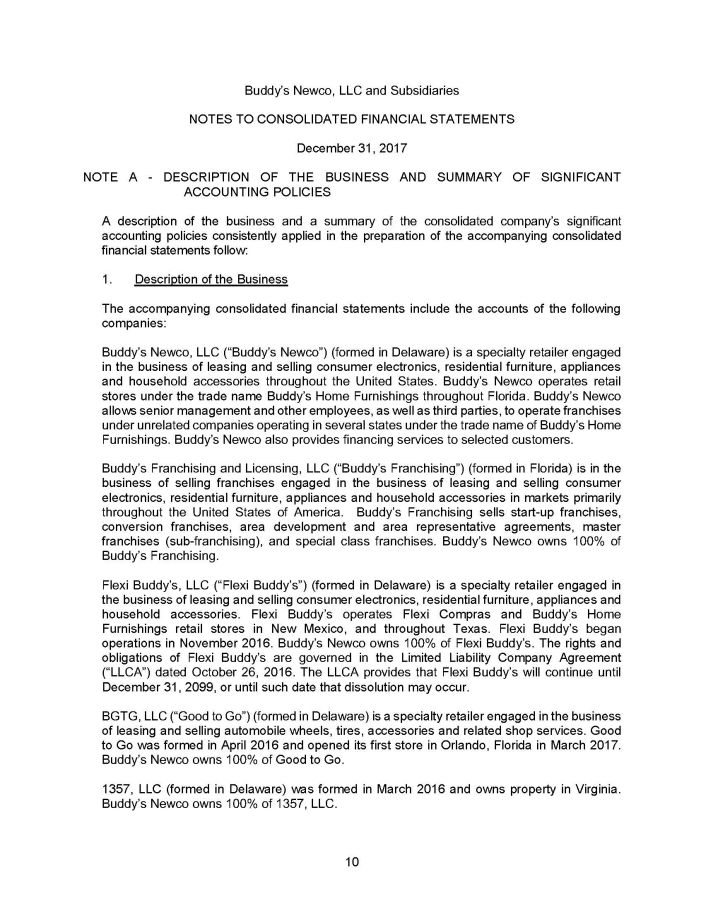

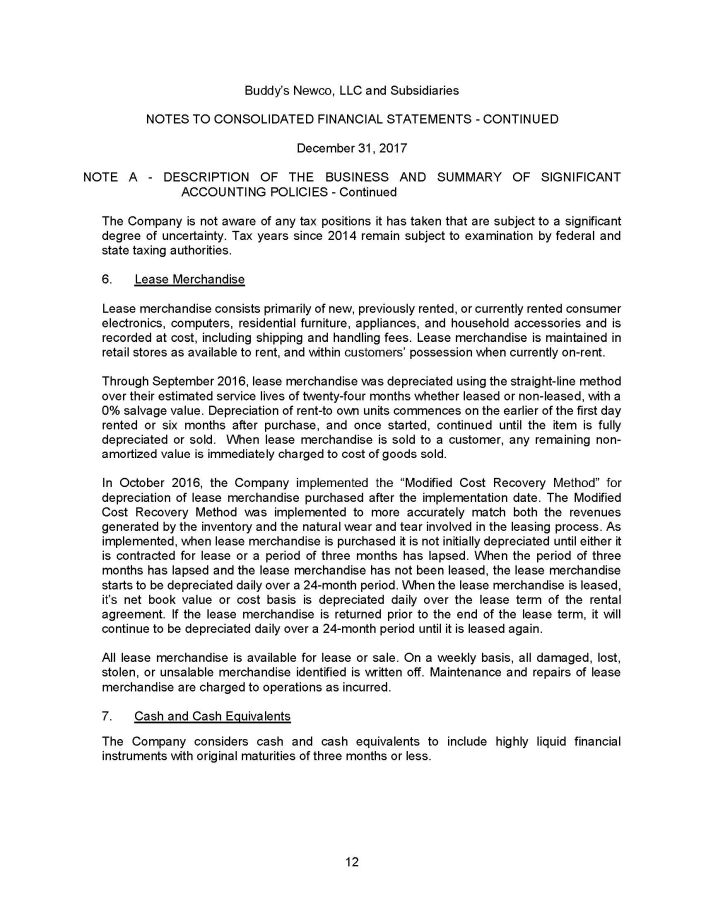

12 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2017 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued The Company is not aware of any tax positions it has taken that are subject to a significant degree of uncertainty . Tax years since 2014 remain subject to examination by federal and state taxing authorities . 6. Lease Merchandise Lease merchandise consists primarily of new, previously rented, or currently rented consumer electronics, computers, residential furniture, appliances, and household accessories and is recorded at cost, including shipping and handling fees . Lease merchandise is maintained in retail stores as available to rent, and within customers' possession when currently on - rent . Through September 2016 , lease merchandise was depreciated using the straight - line method over their estimated service lives of twenty - four months whether leased or non - leased, with a 0 % salvage value . Depreciation of rent - to own units commences on the earlier of the first day rented or six months after purchase, and once started, continued until the item is fully depreciated or sold . When lease merchandise is sold to a customer, any remaining non - amortized value is immediately charged to cost of goods sold . In October 2016 , the Company implemented the "Modified Cost Recovery Method" for depreciation of lease merchandise purchased after the implementation date . The Modified Cost Recovery Method was implemented to more accurately match both the revenues generated by the inventory and the natural wear and tear involved in the leasing process . As implemented, when lease merchandise is purchased it is not initially depreciated until either it is contracted for lease or a period of three months has lapsed . When the period of three months has lapsed and the lease merchandise has not been leased, the lease merchandise starts to be depreciated daily over a 24 - month period . When the lease merchandise is leased, it's net book value or cost basis is depreciated daily over the lease term of the rental agreement . If the lease merchandise is returned prior to the end of the lease term, it will continue to be depreciated daily over a 24 - month period until it is leased again . All lease merchandise is available for lease or sale . On a weekly basis, all damaged, lost, stolen, or unsalable merchandise identified is written off . Maintenance and repairs of lease merchandise are charged to operations as incurred . 7. Cash and Cash Equivalents The Company considers cash and cash equivalents to include highly liquid financial instruments with original maturities of three months or less .

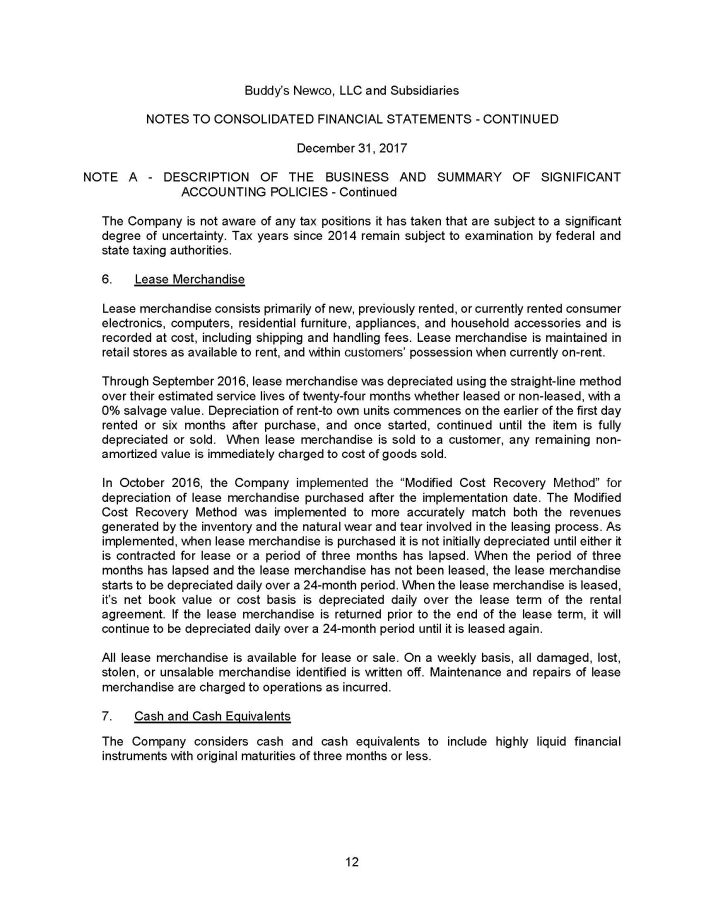

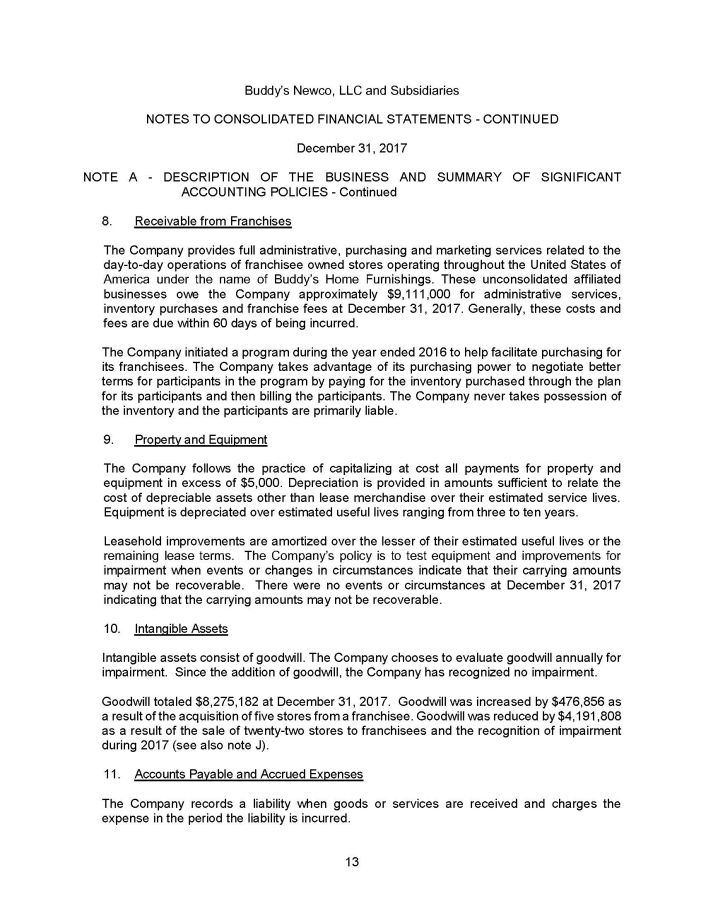

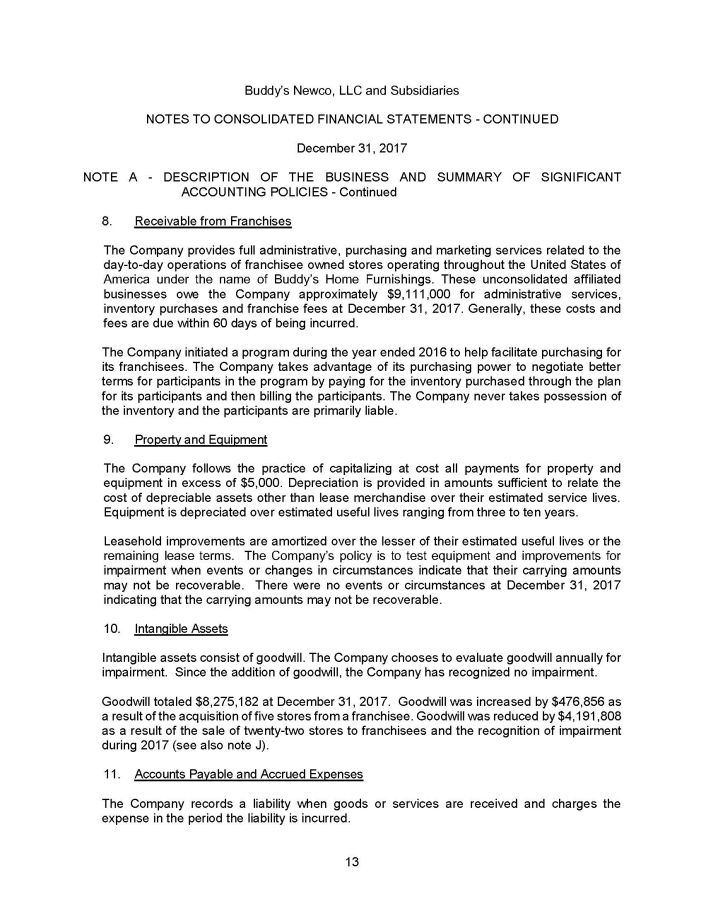

13 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2017 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued 8. Receivable from Franchises The Company provides full administrative, purchasing and marketing services related to the day - to - day operations of franchisee owned stores operating throughout the United States of America under the name of Buddy's Home Furnishings . These unconsolidated affiliated businesses owe the Company approximately $ 9 , 111 , 000 for administrative services, inventory purchases and franchise fees at December 31 , 2017 . Generally, these costs and fees are due within 60 days of being incurred . The Company initiated a program during the year ended 2016 to help facilitate purchasing for its franchisees . The Company takes advantage of its purchasing power to negotiate better terms for participants in the program by paying for the inventory purchased through the plan for its participants and then billing the participants . The Company never takes possession of the inventory and the participants are primarily liable . 9. Property and Equipment The Company follows the practice of capitalizing at cost all payments for property and equipment in excess of $ 5 , 000 . Depreciation is provided in amounts sufficient to relate the cost of depreciable assets other than lease merchandise over their estimated service lives . Equipment is depreciated over estimated useful lives ranging from three to ten years . Leasehold improvements are amortized over the lesser of their estimated useful lives or the remaining lease terms . The Company's policy is to test equipment and improvements for impairment when events or changes in circumstances indicate that their carrying amounts may not be recoverable . There were no events or circumstances at December 31 , 2017 indicating that the carrying amounts may not be recoverable . 10. Intangible Assets Intangible assets consist of goodwill . The Company chooses to evaluate goodwill annually for impairment . Since the addition of goodwill, the Company has recognized no impairment . Goodwill totaled $ 8 , 275 , 182 at December 31 , 2017 . Goodwill was increased by $ 476 , 856 as a result of the acquisition of five stores from a franchisee . Goodwill was reduced by $ 4 , 191 , 808 as a result of the sale of twenty - two stores to franchisees and the recognition of impairment during 2017 (see also note J) . 11. Accounts Payable and Accrued Expenses The Company records a liability when goods or services are received and charges the expense in the period the liability is incurred .

14 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2017 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued 12. Revenue Recognition The Company provides merchandise, consisting of consumer electronics, computers, residential furniture, appliances, and household accessories, to its customers for lease under certain terms agreed to by the customer . Generally, lease terms require weekly, bi - weekly, or monthly payments . Customers have the option to purchase the goods off the lease at any point in the lease term . The typical lease term is twelve to eighteen months with the option for the customer to cancel at any time with no penalty . The Company does not require deposits upon inception of customer agreements . The Company's customer agreements are considered operating leases under the provisions of ASC 840 , leases . As such, lease revenues are recognized as revenue in the month they are due . Until all payment obligations are satisfied under sales and lease ownership agreements, the Company maintains ownership of the lease merchandise . The Company franchises Buddy's Home Furnishings stores . Franchisees typically pay a non - refundable initial franchise fee of $ 25 , 000 and typically an ongoing royalty of 6 % of gross revenues . Franchise fee revenue from area franchise sales is recognized when all material services or conditions relating to the sale have been substantially performed or satisfied by the franchisor . Generally, these services include training personnel and delivery of certain products, supplies, other materials, and operating assets for use in the operations of the franchise . The Company provides full administrative, purchasing and marketing services related to the day - to - day operations of franchisee owned stores operating throughout the United States of America under the name of Buddy's Home Furnishings . These unconsolidated affiliated businesses owe the Company approximately $ 3 , 184 , 000 for administrative services and franchise fees and $ 5 , 927 , 000 for inventory purchases at December 31 , 2017 . There are no repayment terms for these amounts receivable from affiliated franchises, but are considered due within 60 days after incurred . Failure by a franchisee to pay their administrative fees, franchise fees, or inventory purchasing costs would result in the Company discontinuing services to the franchisee until paid . 13. Advertising and Marketing Costs The Company's policy is to expense advertising and marketing costs as they are incurred . Advertising and marketing costs for the year ended December 31 , 2017 approximated $ 1 , 891 , 000 .

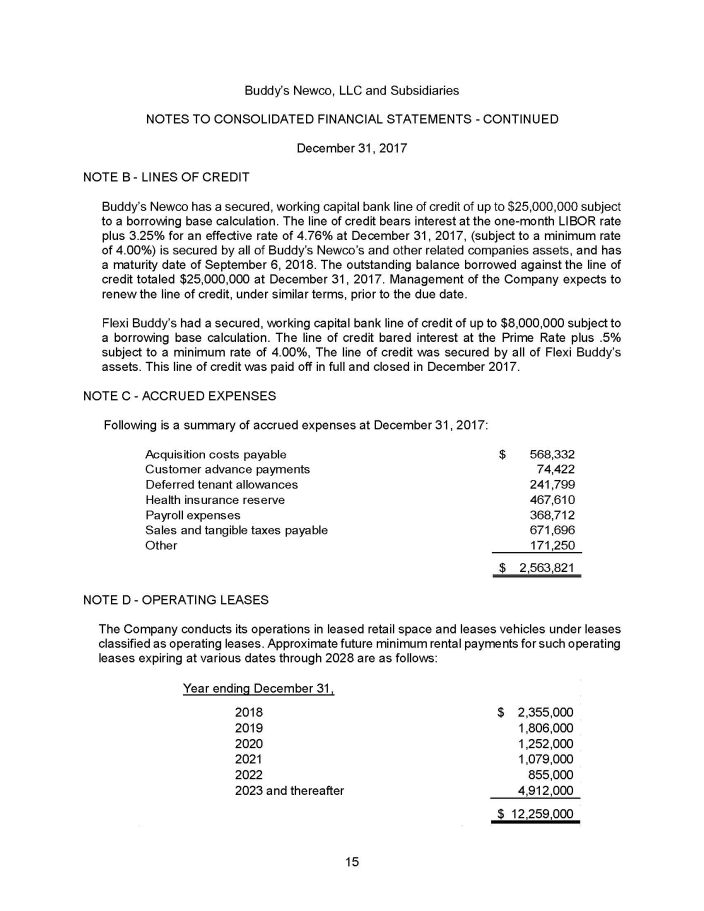

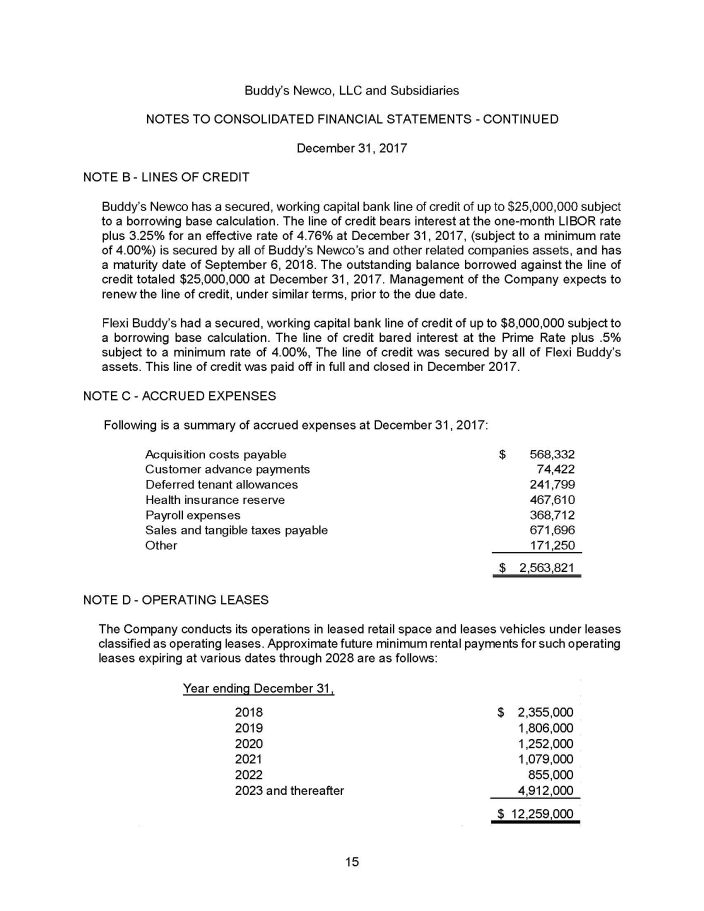

Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2017 NOTE B - LINES OF CREDIT Buddy's Newco has a secured, working capital bank line of credit of up to $ 25 , 000 , 000 subject to a borrowing base calculation . The line of credit bears interest at the one - month LIBOR rate plus 3 . 25 % for an effective rate of 4 . 76 % at December 31 , 2017 , (subject to a minimum rate of 4 . 00 % ) is secured by all of Buddy's Newco's and other related companies assets, and has a maturity date of September 6 , 2018 . The outstanding balance borrowed against the line of credit totaled $ 25 , 000 , 000 at December 31 , 2017 . Management of the Company expects to renew the line of credit, under similar terms, prior to the due date . Flexi Buddy's had a secured, working capital bank line of credit of up to $ 8 , 000 , 000 subject to a borrowing base calculation . The line of credit bared interest at the Prime Rate plus . 5 % subject to a minimum rate of 4 . 00 % , The line of credit was secured by all of Flexi Buddy's assets . This line of credit was paid off in full and closed in December 2017 . NOTE C - ACCRUED EXPENSES Following is a summary of accrued expenses at December 31 , 2017 : Acquisition costs payable $ 56 8 , 33 2 Customer advance payments 7 4 , 42 2 Deferred tenant allowances 24 1 , 79 9 Health insurance reserve 46 7 , 61 0 Payroll expenses 36 8 , 71 2 Sales and tangible taxes payable 67 1 , 69 6 Other 17 1 , 25 0 $ 2 , 5 6 3 , 82 1 NOTE D - OPERATING LEASES The Company conducts its operations in leased retail space and leases vehicles under leases classified as operating leases . Approximate future minimum rental payments for such operating leases expiring at various dates through 2028 are as follows : Year ending December 31, 2018 $ 2 , 3 5 5 , 00 0 2019 1 , 8 0 6 , 00 0 2020 1 , 2 5 2 , 00 0 2021 1 , 0 7 9 , 00 0 2022 8 5 5 , 00 0 2023 and thereafter 4 , 9 1 2 , 00 0 $ 12,259,000 15

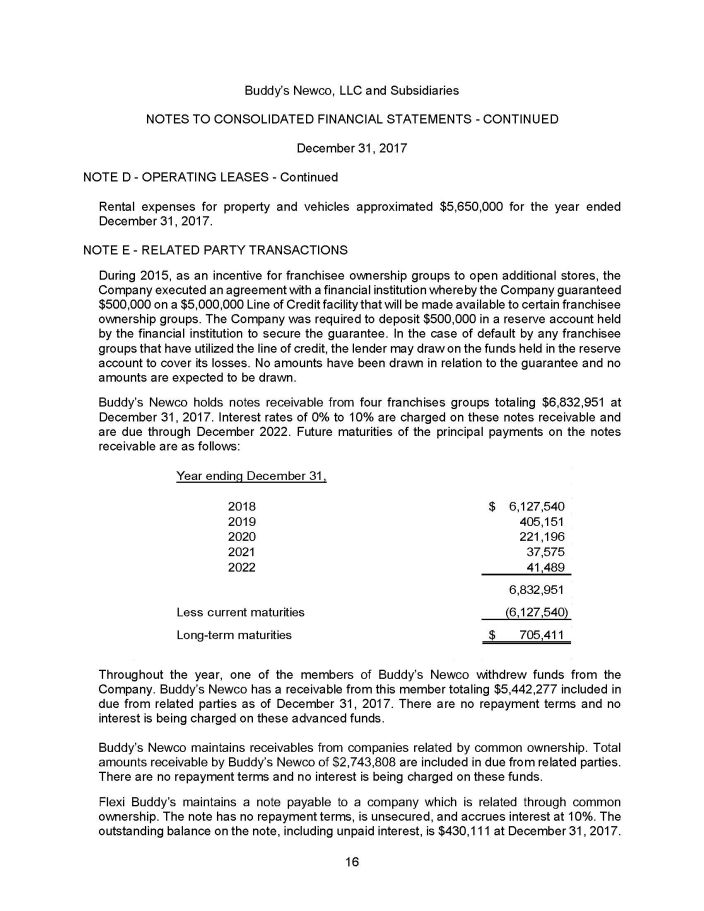

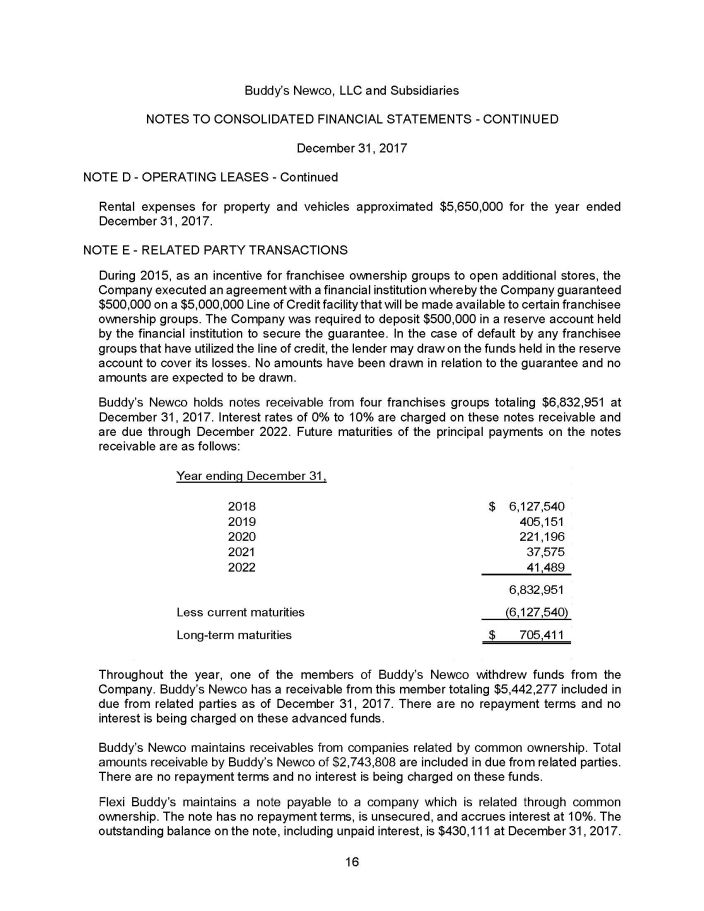

Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2017 NOTE D - OPERATING LEASES - Continued Rental expenses for property and vehicles approximated $ 5 , 650 , 000 for the year ended December 31 , 2017 . NOTE E - RELATED PARTY TRANSACTIONS During 2015 , as an incentive for franchisee ownership groups to open additional stores, the Company executed an agreement with a financial institution whereby the Company guaranteed $500,000 on a $5,000,000 Line of Credit facility that will be made available to certain franchisee ownership groups . The Company was required to deposit $ 500 , 000 in a reserve account held by the financial institution to secure the guarantee . In the case of default by any franchisee groups that have utilized the line of credit, the lender may draw on the funds held in the reserve account to cover its losses . No amounts have been drawn in relation to the guarantee and no amounts are expected to be drawn . Buddy's Newco holds notes receivable from four franchises groups totaling $ 6 , 832 , 951 at December 31 , 2017 . Interest rates of 0 % to 10 % are charged on these notes receivable and are due through December 2022 . Future maturities of the principal payments on the notes receivable are as follows : Year ending December 31, 2018 $ 6 , 1 27 , 54 0 2019 4 0 5 , 15 1 2020 2 2 1 , 19 6 2021 3 7 , 57 5 2022 4 1 , 48 9 6 , 8 32 , 95 1 Less current maturities ( 6,127 , 540 ) Long - term maturities $ 7 0 5 , 41 1 Throughout the year, one of the members of Buddy's Newco withdrew funds from the Company . Buddy's Newco has a receivable from this member totaling $ 5 , 442 , 277 included in due from related parties as of December 31 , 2017 . There are no repayment terms and no interest is being charged on these advanced funds . Buddy's Newco maintains receivables from companies related by common ownership . Total amounts receivable by Buddy's Newco of $ 2 , 743 , 808 are included in due from related parties . There are no repayment terms and no interest is being charged on these funds . Flexi Buddy's maintains a note payable to a company which is related through common ownership . The note has no repayment terms, is unsecured, and accrues interest at 10 % . The outstanding balance on the note, including unpaid interest, is $ 430 , 111 at December 31 , 2017 . 16

2017 as of May 8, 2018, which is the date the financial statements were available to be issued. 17 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2017 NOTE F - DEFERRED GAIN ON SALE In September 2014 , the Company entered into a sale - leaseback agreement under which a retail store location was sold to a third party for $ 1 , 200 , 000 and simultaneously leased back by the Company pursuant to a fourteen - year operating master lease . The Company recognized a gain on the sale of the store of approximately $ 945 , 000 which was deferred in order to be recognized on a straight - line basis over the lease term of fourteen years . The unamortized deferred gain of the sale was $ 720 , 044 at December 31 , 2017 , of which $ 67 , 504 will be recognized in the next fiscal year . NOTE G - LEGAL MATTERS In the ordinary course of business, the Company becomes involved in various legal actions and claims with employees, customers and vendors . Management does not believe the outcome of any legal matters will have significant effect on the Company's financial statements . NOTE H - EMPLOYEE BENEFIT PLAN The Company has a retirement savings 401 (k) plan in which substantially all employees may participate . The Company matches employees' contributions based on a percentage of salary contributed by participants . The Company's expense for the plan was approximately $ 125 , 000 for the year ended December 31 , 2017 . NOTE I - FRANCHISING In general, the Company's franchise agreements provide for continuing fees of 6 % , or less, of sales from the franchise stores . There was a net increase of 4 franchised stores during 2017 , resulting in 260 total franchise stores in operation at December 31 , 2017 . There is a total of 45 franchisor - owned stores at December 31 , 2017 , which is a decrease of 15 stores from the prior year . There is a total of 305 retail stores operating under the Company's brand names at December 31 , 2017 . NOTE J - SIGNIFICANT ACQUISITIONS AND DISPOSALS On March 1 , 2017 , Buddy's Newco acquired the operating location and assets of five stores from a franchisee for $ 1 , 500 , 000 . Goodwill of approximately $ 477 , 000 was recognized on this purchase . During 2017 , Flexi Buddy's sold the operating location and assets of twenty - one stores to franchisees . The total combined sales price for the stores was approximately $ 6 , 192 , 000 and a net loss of approximately $ 2 , 248 , 000 was recognized on the sales . NOTE K - SUBSEQUENT EVENTS The Company has evaluated events and transactions occurring subsequent to December 31 ,

CONSOLIDATED FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS' REPORT BUDDY'S NEWCO, LLC AND SUBSIDIARIES December 31, 2016

TABLE OF CONTENTS 3 - 4 Independent Auditors' Report Consolidated Financial Statements Consolidated Balance Sheet 5 - 6 Consolidated Income Statement 7 Consolidated Statement of Changes in Members' Equity 8 Consolidated Statement of Cash Flows 9 Notes to Consolidated Financial Statements 10 - 18

Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Buddy's Newco, LLC and Subsidiaries as of December 31 , 2016 , and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America . Tampa, Florida August 31, 2017

Cash and cash equivalents (notes A4 and A7) $ 2,470,867 Receivable from franchises (notes A4 and A8) 9,255,178 Notes receivable - current portion (note F) 9,358,178 Other receivables 1,288,864 Prepaid expenses and other assets 515,666 Lease merchandise, net of accumulated depreciation of $7,731,035 (note A6) 14,488,827 Total current assets 37,377,580 PROPERTY AND EQUIPMENT (note A9) Buddy's Newco, LLC and Subsidiaries CONSOLIDATED BALANCE SHEET December 31, 2016 A S SE TS CURRENT ASSETS Land 1 8 1, 7 7 5 Building and leasehold improvements 3 , 2 97, 5 0 8 Furniture and office equipment 2 , 3 58, 4 7 9 Machinery and equipment 1 , 6 37, 7 9 5 Vehicles 504,084 7 , 9 79, 6 4 1 Less accumulated depreciation (5,380,316) 2 , 5 99, 3 2 5 OTHER ASSETS Construction in process 4 4, 2 0 8 Deposits (note F) 9 5 8, 4 9 4 Intangible assets - goodwill (note A10) 11,990,134 Loan costs, net 1 0, 9 2 9 Notes receivable - long term (note F) 684,238 13,688,003 TOTAL ASSETS $ 53,664,908 5

Lines of credit (note B) $ 32,017,228 Accounts payable (note A11) 4 , 3 37, 4 0 1 Accrued expenses (notes A11 and C) 2 , 0 88, 3 2 5 Due to related party (note F) 4 , 5 18, 9 6 9 Deferred gain on sale (note G) 67,504 Total current liabilities 43,029,427 LONG - TERM LIABILITIES Note Payable (note F) 3 9 1, 4 5 9 Deferred gain on sale (note G) 7 2 0, 0 4 5 Deferred development fees 506,000 Total long - term liabilities 1,617,504 COMMITMENTS (notes E, F, and H) - Total liabilities 44,646,931 MEMBERS' EQUITY Members' equity 9,017,977 TOTAL LIABILITIES AND MEMBERS' EQUITY $ 53,664,908 LIABILITIES AND MEMBERS' EQUITY CURRENT LIABILITIES The accompanying notes are an integral part of this consolidated statement. 6

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED INCOME STATEMENT For the year ended December 31, 2016 REVENUE (note A12) Lease revenue $ 27,772,333 Agreement, club and damage waiver fees 6,0 8 1 , 1 3 9 Retail sales 2,8 9 2 , 8 7 7 Franchising and licensing fees 1 3,7 7 2 , 7 1 3 Other support revenue 7 8 7 , 6 7 4 5 1,3 0 6 , 7 3 6 COST OF REVENUE Leasing cost of sales 9,2 8 2 , 5 5 1 Retail cost of sales 2,8 7 6 , 1 8 0 Operating expenses 2 8,5 2 6 , 3 5 0 Depreciation expense 7 9 3 , 1 9 6 4 1,4 7 8 , 2 7 7 Operating income 9,8 2 8 , 4 5 9 OTHER INCOME (EXPENSE) Gain on sale of store related assets, net (note K) 1 6 5 , 9 8 3 Amortization expense ( 7 2 6 ) Interest expense ( 1,4 4 2 , 0 3 0 ) ( 1,2 7 6 , 7 7 3 ) Net income before income taxes 8,5 5 1 , 6 8 6 INCOME TAXES (note A5) - NET INCOME $ 8,5 5 1 , 6 8 6 The accompanying notes are an integral part of this consolidated statement. 7

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED STATEMENT OF CHANGES IN MEMBERS' EQUITY For the year ended December 31, 2016 Balance at December 31, 2015 Net income $ 466,291 8,551,686 Balance at December 31, 2016 $ 9,017,977 The accompanying notes are an integral part of this consolidated statement. 8

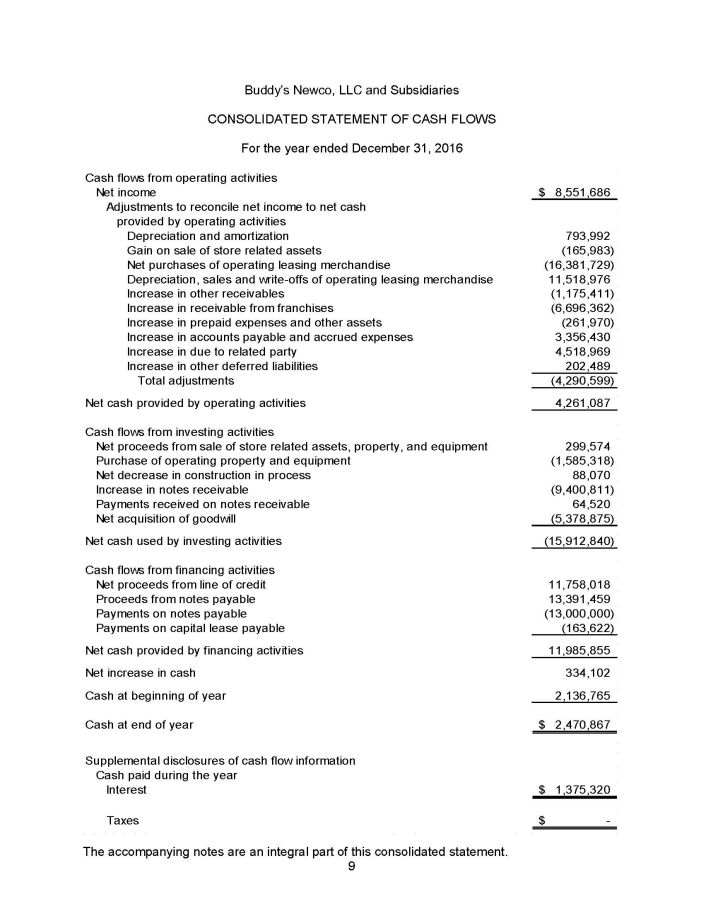

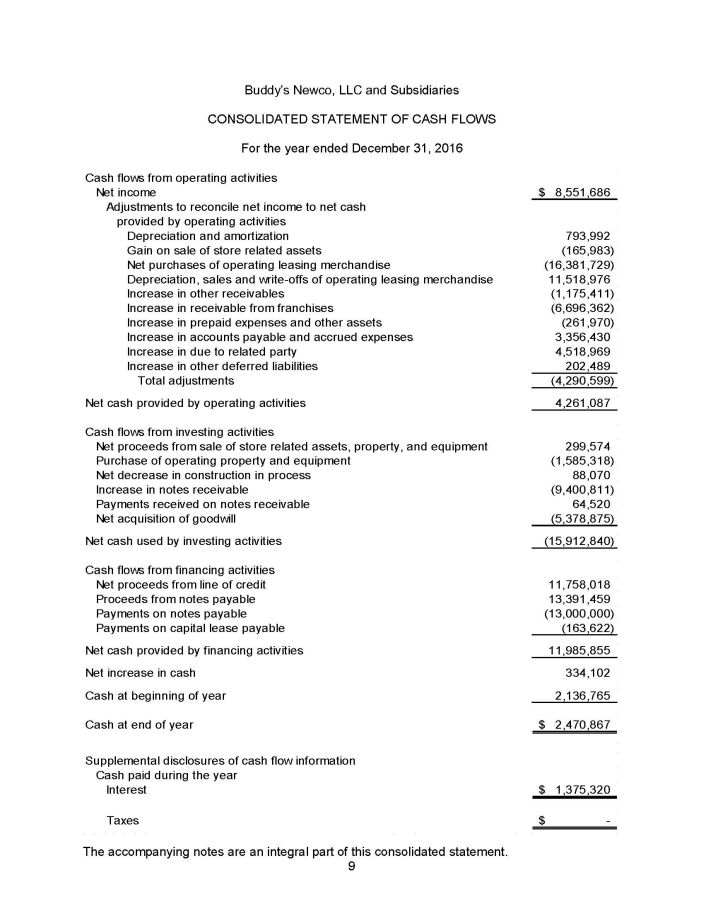

Buddy's Newco, LLC and Subsidiaries CONSOLIDATED STATEMENT OF CASH FLOWS For the year ended December 31, 2016 $ 8,551,686 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash Cash paid during the year Interest $ 1,375,320 T a x e s $ - provided by operating activities Depreciation and amortization 793 , 99 2 Gain on sale of store related assets ( 165 , 983 ) Net purchases of operating leasing merchandise ( 16 , 381 , 7 2 9 ) Depreciation, sales and write - offs of operating leasing merchandise 11,518,976 Increase in other receivables ( 1 , 17 5 , 411 ) Increase in receivable from franchises ( 6 , 69 6 , 362 ) Increase in prepaid expenses and other assets ( 261 , 970 ) Increase in accounts payable and accrued expenses 3 , 3 56 , 43 0 Increase in due to related party 4 , 5 18 , 96 9 Increase in other deferred liabilities 202 , 48 9 Total adjustments ( 4 , 29 0 , 599 ) Net cash provided by operating activities 4 , 2 61 , 08 7 Cash flows from investing activities Net proceeds from sale of store related assets, property, and equipment 299 , 57 4 Purchase of operating property and equipment ( 1 , 58 5 , 318 ) Net decrease in construction in process 88 , 07 0 Increase in notes receivable ( 9 , 40 0 , 811 ) Payments received on notes receivable 64 , 52 0 Net acquisition of goodwill ( 5 , 37 8 , 875 ) Net cash used by investing activities ( 15 , 912 , 8 4 0 ) Cash flows from financing activities Net proceeds from line of credit 11,758,018 Proceeds from notes payable 13,391,459 Payments on notes payable ( 13 , 000 , 0 0 0 ) Payments on capital lease payable ( 163 , 622 ) Net cash provided by financing activities 11 , 9 8 5 , 85 5 Net increase in cash 334 , 10 2 Cash at beginning of year 2 , 1 36 , 76 5 Cash at end of year $ 2,470,867 Supplemental disclosures of cash flow information The accompanying notes are an integral part of this consolidated statement. 9

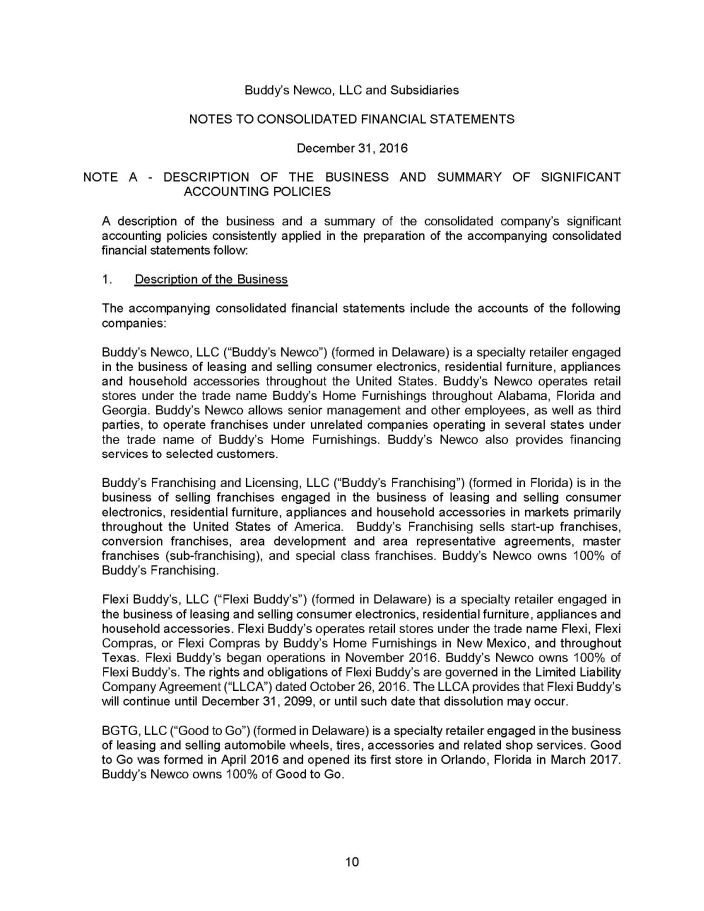

10 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2016 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES A description of the business and a summary of the consolidated company's significant accounting policies consistently applied in the preparation of the accompanying consolidated financial statements follow : 1 . Description of the Business The accompanying consolidated financial statements include the accounts of the following companies : Buddy's Newco, LLC ("Buddy's Newco") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories throughout the United States . Buddy's Newco operates retail stores under the trade name Buddy's Home Furnishings throughout Alabama, Florida and Georgia . Buddy's Newco allows senior management and other employees, as well as third parties, to operate franchises under unrelated companies operating in several states under the trade name of Buddy's Home Furnishings . Buddy's Newco also provides financing services to selected customers . Buddy's Franchising and Licensing, LLC ("Buddy's Franchising") (formed in Florida) is in the business of selling franchises engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories in markets primarily throughout the United States of America . Buddy's Franchising sells start - up franchises, conversion franchises, area development and area representative agreements, master franchises (sub - franchising), and special class franchises . Buddy's Newco owns 100 % of Buddy's Franchising . Flexi Buddy's, LLC ("Flexi Buddy's") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling consumer electronics, residential furniture, appliances and household accessories . Flexi Buddy's operates retail stores under the trade name Flexi, Flexi Compras, or Flexi Compras by Buddy's Home Furnishings in New Mexico, and throughout Texas . Flexi Buddy's began operations in November 2016 . Buddy's Newco owns 100 % of Flexi Buddy's . The rights and obligations of Flexi Buddy's are governed in the Limited Liability Company Agreement ("LLCA") dated October 26 , 2016 . The LLCA provides that Flexi Buddy's will continue until December 31 , 2099 , or until such date that dissolution may occur . BGTG, LLC ("Good to Go") (formed in Delaware) is a specialty retailer engaged in the business of leasing and selling automobile wheels, tires, accessories and related shop services . Good to Go was formed in April 2016 and opened its first store in Orlando, Florida in March 2017 . Buddy's Newco owns 100 % of Good to Go .

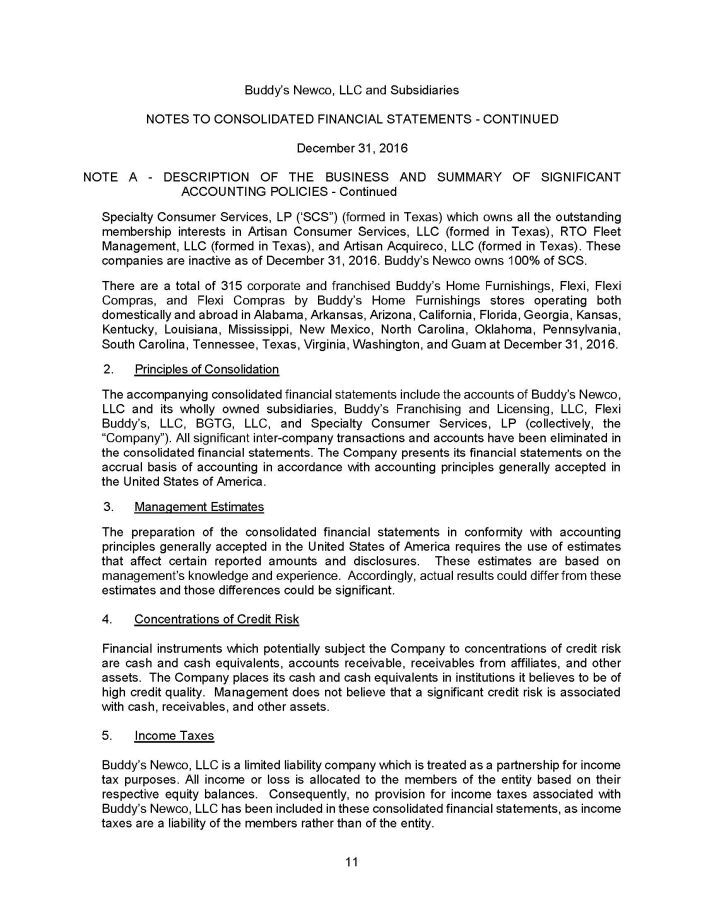

11 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2016 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued Specialty Consumer Services, LP ('SCS") (formed in Texas) which owns all the outstanding membership interests in Artisan Consumer Services, LLC (formed in Texas), RTO Fleet Management, LLC (formed in Texas), and Artisan Acquireco, LLC (formed in Texas) . These companies are inactive as of December 31 , 2016 . Buddy's Newco owns 100 % of SCS . There are a total of 315 corporate and franchised Buddy's Home Furnishings, Flexi, Flexi Compras, and Flexi Compras by Buddy's Home Furnishings stores operating both domestically and abroad in Alabama, Arkansas, Arizona, California, Florida, Georgia, Kansas, Kentucky, Louisiana, Mississippi, New Mexico, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, and Guam at December 31 , 2016 . 2. Principles of Consolidation The accompanying consolidated financial statements include the accounts of Buddy's Newco, LLC and its wholly owned subsidiaries, Buddy's Franchising and Licensing, LLC, Flexi Buddy's, LLC, BGTG, LLC, and Specialty Consumer Services, LP (collectively, the "Company") . All significant inter - company transactions and accounts have been eliminated in the consolidated financial statements . The Company presents its financial statements on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America . 3. Management Estimates The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires the use of estimates that affect certain reported amounts and disclosures . These estimates are based on management's knowledge and experience . Accordingly, actual results could differ from these estimates and those differences could be significant . 4. Concentrations of Credit Risk Financial instruments which potentially subject the Company to concentrations of credit risk are cash and cash equivalents, accounts receivable, receivables from affiliates, and other assets . The Company places its cash and cash equivalents in institutions it believes to be of high credit quality . Management does not believe that a significant credit risk is associated with cash, receivables, and other assets . 5. Income Taxes Buddy's Newco, LLC is a limited liability company which is treated as a partnership for income tax purposes . All income or loss is allocated to the members of the entity based on their respective equity balances . Consequently, no provision for income taxes associated with Buddy's Newco, LLC has been included in these consolidated financial statements, as income taxes are a liability of the members rather than of the entity .

12 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2016 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued Buddy's Franchising and Licensing, LLC, Flexi Buddy's, LLC, BGTG, LLC, and Specialty Consumer Services, LP are wholly - owned subsidiaries of Buddy's Newco, LLC, and are considered disregarded entities for tax purposes and are included on its parent's return . The Company is not aware of any tax positions it has taken that are subject to a significant degree of uncertainty . Tax years since 2013 remain subject to examination by federal and state taxing authorities . 6 . Lease Merchandise Lease merchandise consists primarily of new, previously rented, or currently rented consumer electronics, computers, residential furniture, appliances, and household accessories and is recorded at cost, including shipping and handling fees . Lease merchandise is maintained in retail stores as available to rent, and within customers' possession when currently on - rent . Through September 2016 , lease merchandise was depreciated using the straight - line method over their estimated service lives of twenty - four months whether leased or non - leased, with a 0 % salvage value . Depreciation of rent - to own units commences on the earlier of the first day rented or six months after purchase, and once started, continued until the item is fully depreciated or sold . When lease merchandise is sold to a customer, any remaining non - amortized value is immediately charged to cost of goods sold . As of October 2016 , the Company implemented the "Modified Cost Recovery Method" for depreciation of lease merchandise purchased after the implementation date . The Modified Cost Recovery Method was implemented to more accurately match both the revenues generated by the inventory and the natural wear and tear involved in the leasing process . As implemented, when lease merchandise is purchased it is not initially depreciated until either it is contracted for lease or a period of three months has lapsed . When the period of three months has lapsed and the lease merchandise has not been leased, the lease merchandise starts to be depreciated daily over a 24 - month period . When the lease merchandise is leased, it's net book value or cost basis is depreciated daily over the lease term of the rental agreement . If the lease merchandise is returned prior to the end of the lease term, it will continue to be depreciated daily over a 24 - month period until it is leased again . The effect of this change in the depreciation method for lease merchandise was to increase depreciation expense and reduce net income by approximately $ 250 , 000 . All lease merchandise is available for lease or sale . On a weekly basis, all damaged, lost, stolen, or unsalable merchandise identified is written off . Maintenance and repairs of lease merchandise are charged to operations as incurred .

13 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2016 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued 7. Cash and Cash Equivalents The Company considers cash and cash equivalents to include highly liquid financial instruments with original maturities of three months or less . 8. Receivable from Franchises The Company provides full administrative, purchasing and marketing services related to the day - to - day operations of franchisee owned stores operating throughout the United States of America under the name of Buddy's Home Furnishings . These unconsolidated affiliated businesses owe the Company approximately $ 9 , 255 , 000 for administrative services, inventory purchases and franchise fees at December 31 , 2016 . Generally, these costs and fees are due within 60 days of being incurred . The Company initiated a program during the year ended 2016 to help facilitate purchasing for its franchisees . The Company takes advantage of its purchasing power to negotiate better terms for participants in the program by paying for the inventory purchased through the plan for its participants and then billing the participants . The Company never takes possession of the inventory and the participants are primarily liable . 9. Property and Equipment The Company follows the practice of capitalizing at cost all payments for property and equipment in excess of $ 5 , 000 . Depreciation is provided in amounts sufficient to relate the cost of depreciable assets other than lease merchandise over their estimated service lives . Equipment is depreciated over estimated useful lives ranging from three to ten years . Leasehold improvements are amortized over the lesser of their estimated useful lives or the remaining lease terms . The Company's policy is to test equipment and improvements for impairment when events or changes in circumstances indicate that their carrying amounts may not be recoverable . There were no events or circumstances at December 31 , 2016 indicating that the carrying amounts may not be recoverable . 10. Intangible Assets Intangible assets consist of goodwill . The Company chooses to evaluate goodwill annually for impairment . Since the addition of goodwill, the Company has recognized no impairment . Goodwill totaled $ 11 , 990 , 134 at December 31 , 2016 . Goodwill was increased by $ 5 , 378 , 875 during 2016 as a result of the acquisition of Specialty Consumer Services, LP (see also note K) .

14 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2016 NOTE A - DESCRIPTION OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued 11. Accounts Payable and Accrued Expenses The Company records a liability when goods or services are received and charges the expense in the period the liability is incurred . 12. Revenue Recognition The Company provides merchandise, consisting of consumer electronics, computers, residential furniture, appliances, and household accessories, to its customers for lease under certain terms agreed to by the customer . Generally, lease terms require weekly, bi - weekly, or monthly payments . Customers have the option to purchase the goods off the lease at any point in the lease term . The typical lease term is twelve to eighteen months with the option for the customer to cancel at any time with no penalty . The Company does not require deposits upon inception of customer agreements . The Company's customer agreements are considered operating leases under the provisions of ASC 840 , leases . As such, lease revenues are recognized as revenue in the month they are due . Until all payment obligations are satisfied under sales and lease ownership agreements, the Company maintains ownership of the lease merchandise . The Company franchises Buddy's Home Furnishings stores . Franchisees typically pay a non - refundable initial franchise fee of $ 25 , 000 and typically an ongoing royalty of 6 % of gross revenues . Franchise fee revenue from area franchise sales is recognized when all material services or conditions relating to the sale have been substantially performed or satisfied by the franchisor . Generally, these services include training personnel and delivery of certain products, supplies, other materials, and operating assets for use in the operations of the franchise . The Company provides full administrative, purchasing and marketing services related to the day - to - day operations of franchisee owned stores operating throughout the United States of America under the name of Buddy's Home Furnishings . These unconsolidated affiliated businesses owe the Company approximately $ 1 , 680 , 000 for administrative services and franchise fees and $ 7 , 575 , 0000 for inventory purchases at December 31 , 2016 . There are no repayment terms for these amounts receivable from affiliated franchises, but are considered due within 60 days after incurred . Failure by a franchisee to pay their administrative fees, franchise fees, or inventory purchasing costs would result in the Company discontinuing services to the franchisee until paid . 13. Advertising and Marketing Costs The Company's policy is to expense advertising and marketing costs as they are incurred . Advertising and marketing costs for the year ended December 31 , 2016 approximated $ 1 , 300 , 000 .

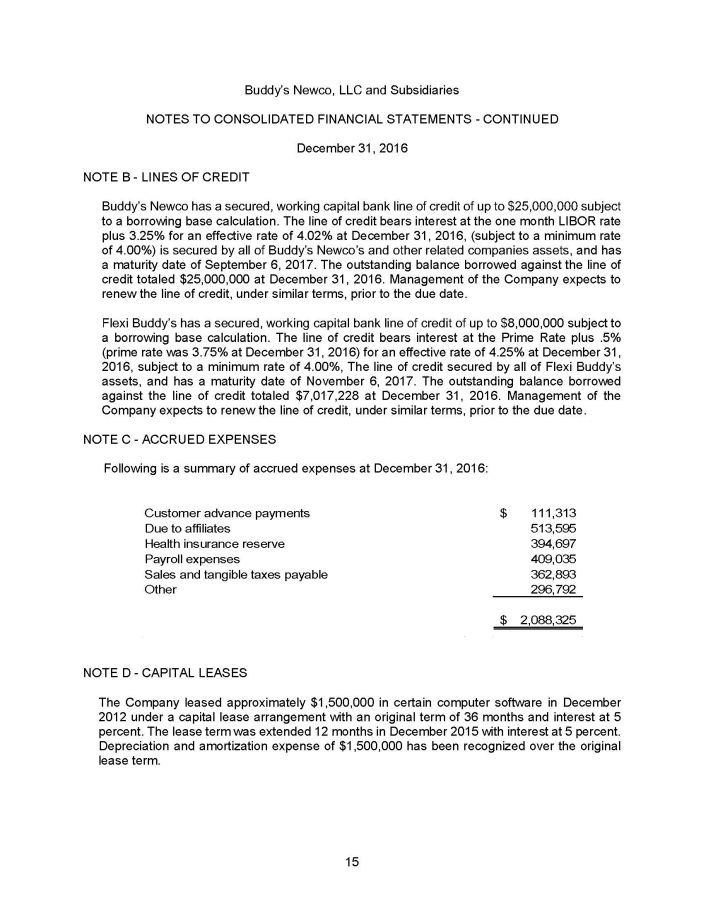

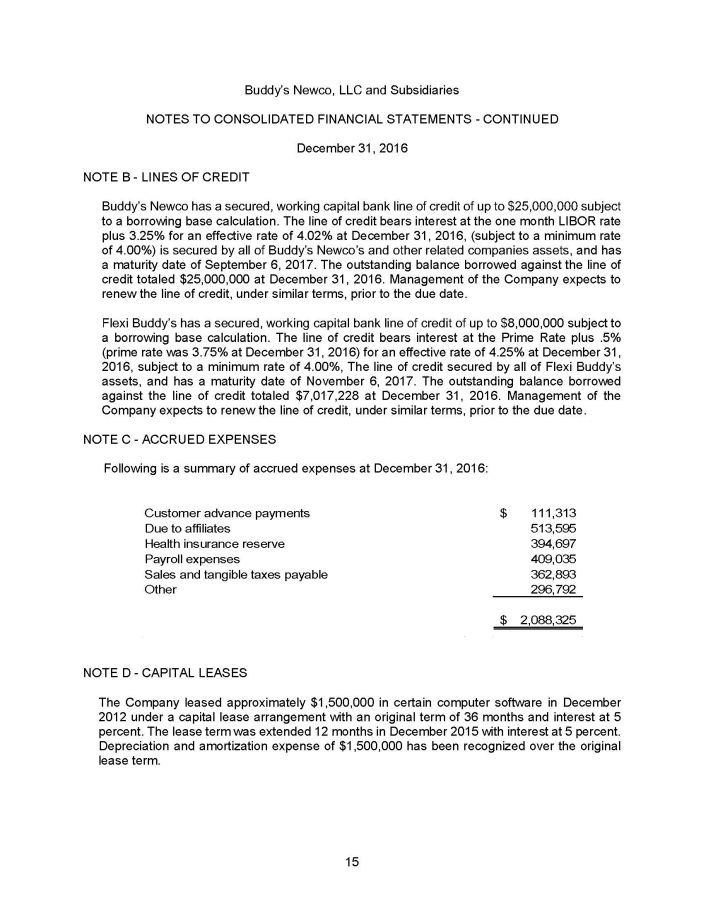

Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2016 NOTE B - LINES OF CREDIT Buddy's Newco has a secured, working capital bank line of credit of up to $ 25 , 000 , 000 subject to a borrowing base calculation . The line of credit bears interest at the one month LIBOR rate plus 3 . 25 % for an effective rate of 4 . 02 % at December 31 , 2016 , (subject to a minimum rate of 4 . 00 % ) is secured by all of Buddy's Newco's and other related companies assets, and has a maturity date of September 6 , 2017 . The outstanding balance borrowed against the line of credit totaled $ 25 , 000 , 000 at December 31 , 2016 . Management of the Company expects to renew the line of credit, under similar terms, prior to the due date . Flexi Buddy's has a secured, working capital bank line of credit of up to $ 8 , 000 , 000 subject to a borrowing base calculation . The line of credit bears interest at the Prime Rate plus . 5 % (prime rate was 3 . 75 % at December 31 , 2016 ) for an effective rate of 4 . 25 % at December 31 , 2016 , subject to a minimum rate of 4 . 00 % , The line of credit secured by all of Flexi Buddy's assets, and has a maturity date of November 6 , 2017 . The outstanding balance borrowed against the line of credit totaled $ 7 , 017 , 228 at December 31 , 2016 . Management of the Company expects to renew the line of credit, under similar terms, prior to the due date . NOTE C - ACCRUED EXPENSES Following is a summary of accrued expenses at December 31 , 2016 : Customer advance payments $ 111,313 Due to affiliates 513 , 5 9 5 Health insurance reserve 394 , 6 9 7 Payroll expenses 409 , 0 3 5 Sales and tangible taxes payable 362 , 8 9 3 Other 296 , 7 9 2 $ 2 , 088 , 3 2 5 NOTE D - CAPITAL LEASES The Company leased approximately $ 1 , 500 , 000 in certain computer software in December 2012 under a capital lease arrangement with an original term of 36 months and interest at 5 percent . The lease term was extended 12 months in December 2015 with interest at 5 percent . Depreciation and amortization expense of $ 1 , 500 , 000 has been recognized over the original lease term . 15

Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2016 NOTE E - OPERATING LEASES The Company conducts its operations in leased retail space and leases vehicles under leases classified as operating leases . Approximate future minimum rental payments for such operating leases expiring at various dates through 2028 are as follows : Year ending December 31, 2017 $ 3,313,000 2018 2,546,000 2019 1,804,000 2020 1,185,000 2021 1,042,000 2022 and thereafter 5,732,000 $ 15,622,000 Rental expenses for property and vehicles December 31, 2016. approximated $4,000,000 for the year ended NOTE F - RELATED PARTY TRANSACTIONS During 2015 , as an incentive for franchisee ownership groups to open additional stores, the Company executed an agreement with a financial institution whereby the Company guaranteed $ 500 , 000 on a $ 5 , 000 , 000 Line of Credit facility that will be made available to certain franchisee ownership groups . The Company was required to deposit $ 500 , 000 in a reserve account held by the financial institution to secure the guarantee. In the case of default by any franchisee groups that have utilized the line of credit, the lender may draw on the funds held in the reserve account to cover its losses . No amounts have been drawn in relation to the guarantee and no amounts are expected to be drawn . Buddy's Newco holds notes receivable from five franchises groups totaling $ 10 , 042 , 416 at December 31 , 2016 . Interest rates of 0 % to 10 % are charged on these notes receivable and are due through December 2022 . Future maturities of the principal payments on the notes receivable are as follows : Year ending December 31, 2017 $ 9 , 3 58 , 17 8 2018 27 8 , 66 2 2019 8 6 , 85 6 2020 9 5 , 90 3 2021 10 5 , 89 3 2022 11 6 , 92 4 $ 10,042,416 16

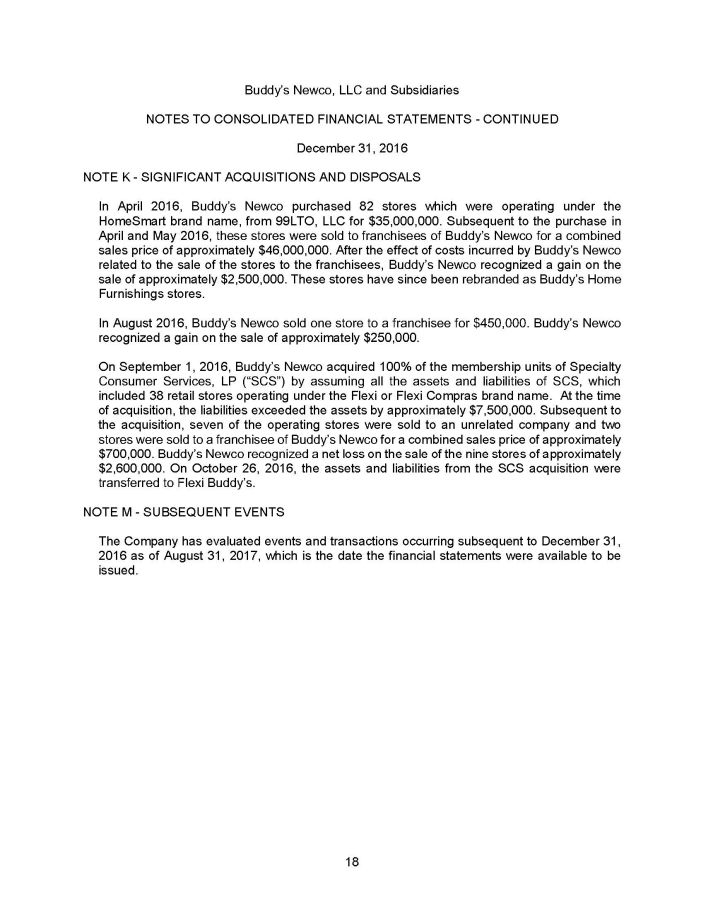

17 Buddy's Newco, LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2016 NOTE F - RELATED PARTY TRANSACTIONS - Continued Throughout the year, one of the members of Buddy's Newco advanced funds to the Company to assist with the sale of stores to a franchisee . Buddy's Newco has net payables to this member totaling $ 4 , 518 , 969 as of December 31 , 2016 . Flexi Buddy's maintains a note payable to a company which is related through common ownership . The note has no repayment terms, is unsecured, and accrues interest at 10 % . The outstanding balance on the note, including unpaid interest, is $ 391 , 459 at December 31 , 2016 . NOTE G - DEFERRED GAIN ON SALE In September 2014 , the Company entered into a sale - leaseback agreement under which a retail store location was sold to a third party for $ 1 , 200 , 000 and simultaneously leased back by the Company pursuant to a fourteen - year operating master lease . The Company recognized a gain on the sale of the store of approximately $ 945 , 000 which was deferred in order to be recognized on a straight - line basis over the lease term of fourteen years . The unamortized deferred gain of the sale was $ 787 , 549 at December 31 , 2016 , of which $ 67 , 504 will be recognized in the next fiscal year . NOTE H - LEGAL MATTERS In the ordinary course of business, the Company becomes involved in various legal actions and claims with employees, customers and vendors . Management does not believe the outcome of any legal matters will have significant effect on the Company's financial statements . NOTE I - EMPLOYEE BENEFIT PLAN The Company has a retirement savings 401 (k) plan in which substantially all employees may participate . The Company matches employees' contributions based on a percentage of salary contributed by participants . The Company's expense for the plan was approximately $ 112 , 000 for the year ended December 31 , 2016 . NOTE J - FRANCHISING In general, the Company's franchise agreements provide for continuing fees of 6 % , or less, of sales from the franchise stores . A total of 70 new franchise stores were added during 2016 , resulting in 255 total franchise stores in operation at December 31 , 2016 . There are a total of 60 franchisor - owned stores at December 31 , 2016 , which is an increase of 27 stores from the prior year . There are a total of 315 retail stores operating under the Company's brand names at December 31 , 2016 .