JTH Holding, Inc. I n v e s t o r P r e s e n t a t i o n

Safe Harbor Statement This presentation may contain forward-looking statements within the meaning of the securities laws. Forward- looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variations of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “targets,” “would,” “will,” “should,” “could,” or “may” or other similar expressions. Forward-looking statements provide management’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, income, earnings per share, capital expenditures, dividends, liquidity, capital structure or other financial items, descriptions of management’s plans or objectives for future operations, products or services, or descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data or methods, future events or other changes, except as required by law. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond the Company’s control and that are described in our Annual Report on Form 10-K for the fiscal year ended April 30, 2013 in the section entitled “Risk Factors”, as well as additional factors we have described and may describe from time to time in other filings with the Securities and Exchange Commission. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties. 2

Agenda The Industry The Company Financial Overview Future Opportunities

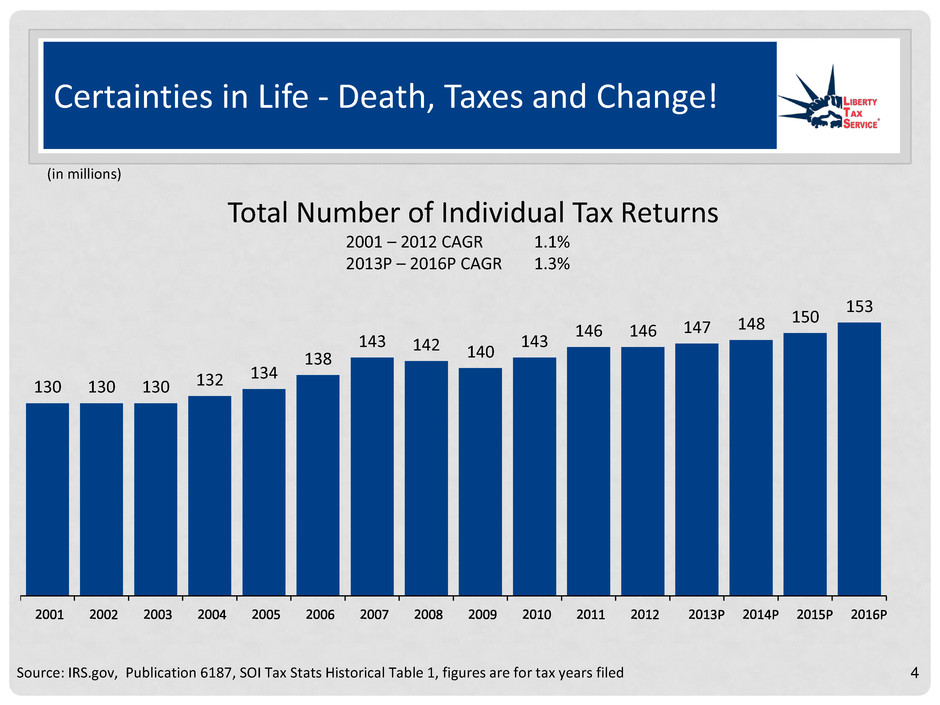

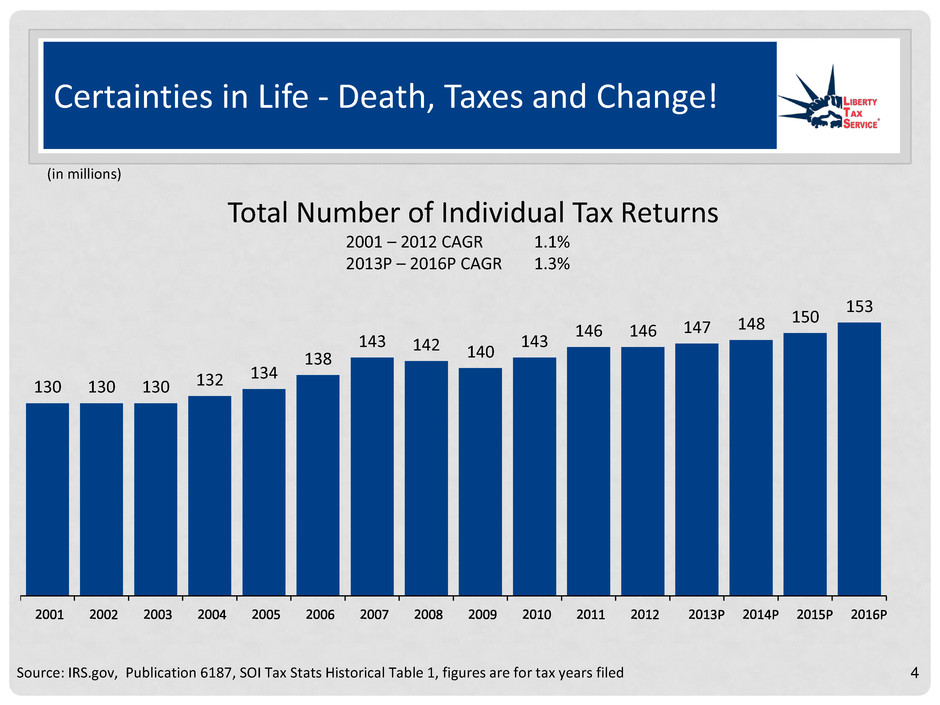

130 130 130 132 134 138 143 142 140 143 146 146 147 148 150 153 Certainties in Life - Death, Taxes and Change! Source: IRS.gov, Publication 6187, SOI Tax Stats Historical Table 1, figures are for tax years filed Total Number of Individual Tax Returns 2001 – 2012 CAGR 1.1% 2013P – 2016P CAGR 1.3% (in millions) 4

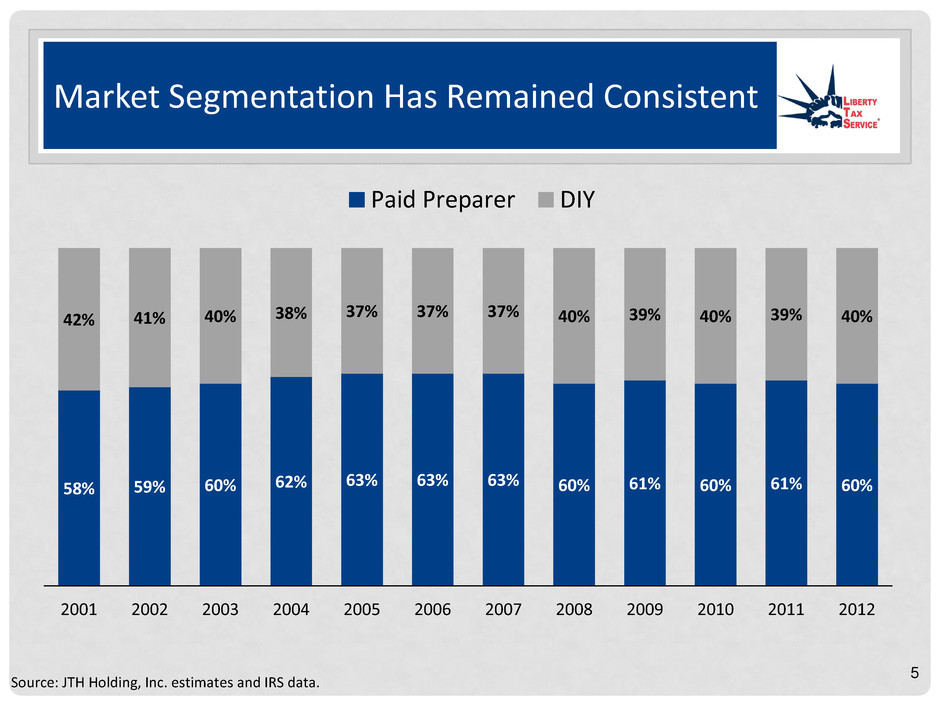

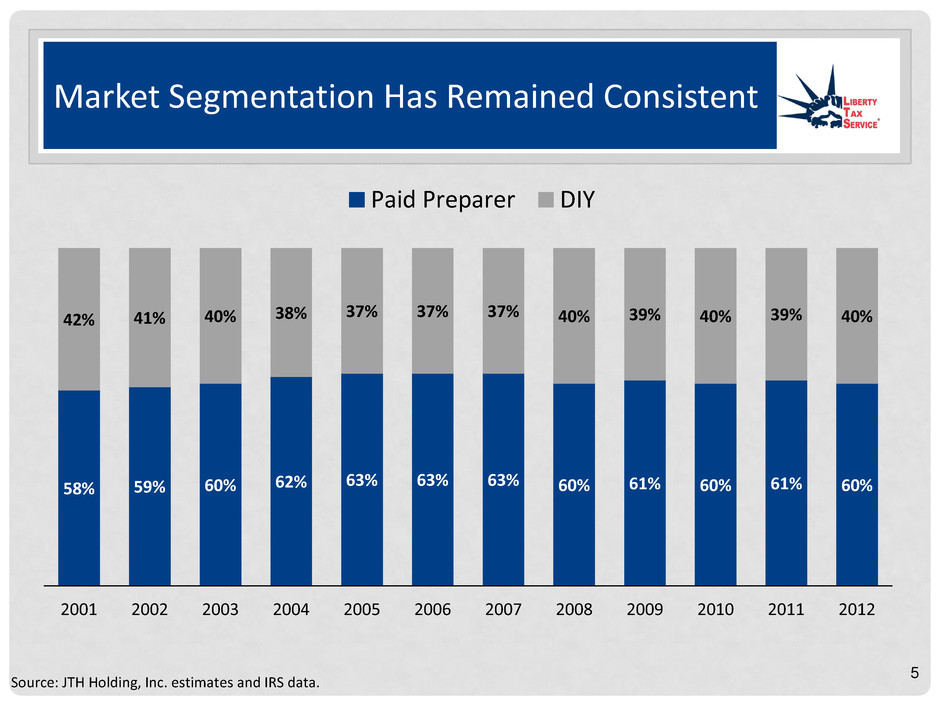

Market Segmentation Has Remained Consistent 58% 59% 60% 62% 63% 63% 63% 60% 61% 60% 61% 60% 42% 41% 40% 38% 37% 37% 37% 40% 39% 40% 39% 40% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Paid Preparer DIY Source: JTH Holding, Inc. estimates and IRS data. 5

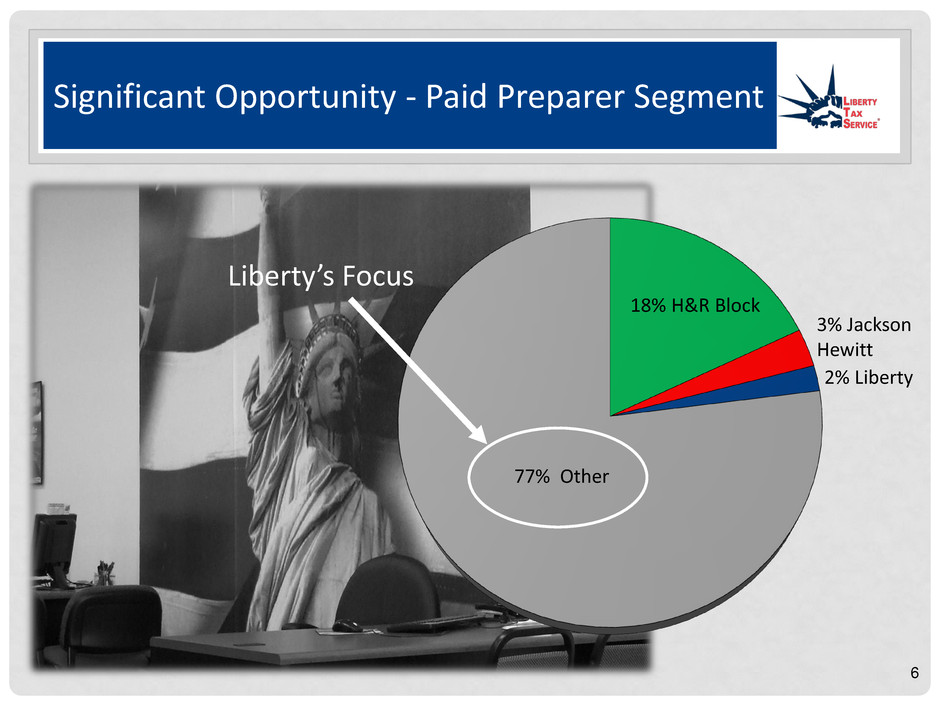

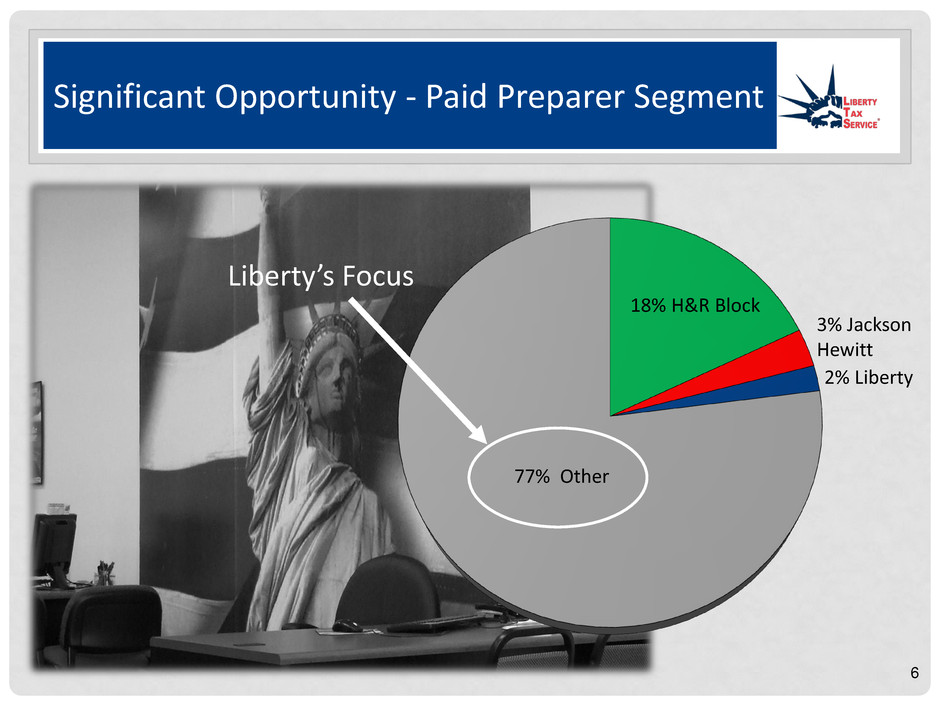

Significant Opportunity - Paid Preparer Segment 77% Other 2% Liberty 3% Jackson Hewitt 18% H&R Block Liberty’s Focus 6

5-Jan 12-Jan 19-Jan 26-Jan 2-Feb 9-Feb 16-Feb 23-Feb 1-Mar 8-Mar 15-Mar 22-Mar 29-Mar 5-Apr 12-Apr 19-Apr 26-Apr Two Tax Seasons Early Season - “Fastest Access to Refund” younger customer base lower income simple returns Late Season - “Delay & Minimize Tax Payment” older customer base higher income more complex returns FY 2012 Source: JTH Holding, Inc. 7

Agenda The Industry The Company Financial Overview Future Opportunities

Liberty’s Competitive Advantage Systematic approach and unique marketing strategies Three prong operational approach (Franchisee, Area Developer & Corporate) No CEO turnover During the 21st century, Liberty has grown by more returns than H&R Block and Jackson Hewitt combined In-house certification program for tax preparers Source: JTH Holding, Inc., IRS and public information. 9

Two Tier Franchise System Franchise Territories ~10,500 territories in the U.S., each targets ~30,000 people In fiscal 2014, Liberty had over 2,100 franchisees and over 4,400 offices in the U.S. and Canada ~$70,000 to open a franchise ($40,000 franchise fee, $30,000 other costs) Area Developer (AD) Areas AD area consists of multiple franchise territories ADs responsible for selling franchise territories and providing the first line of operational support to franchisees Receive 50% of franchise fees and 50% of ongoing royalty stream for their area Allows Liberty local representation in the area 10

Overview of Financial Products • Direct deposit of tax refund into a temporary bank account • Delivery via a paper check or a prepaid card • Prepaid cards are branded with Liberty logo Refund Transfer Product Liberty developed a proprietary processing system to handle these transactions • Loan-based • Available in 21 states Instant Cash Advance (ICA) ~50% of U.S. Customers Receive a Financial Product 11

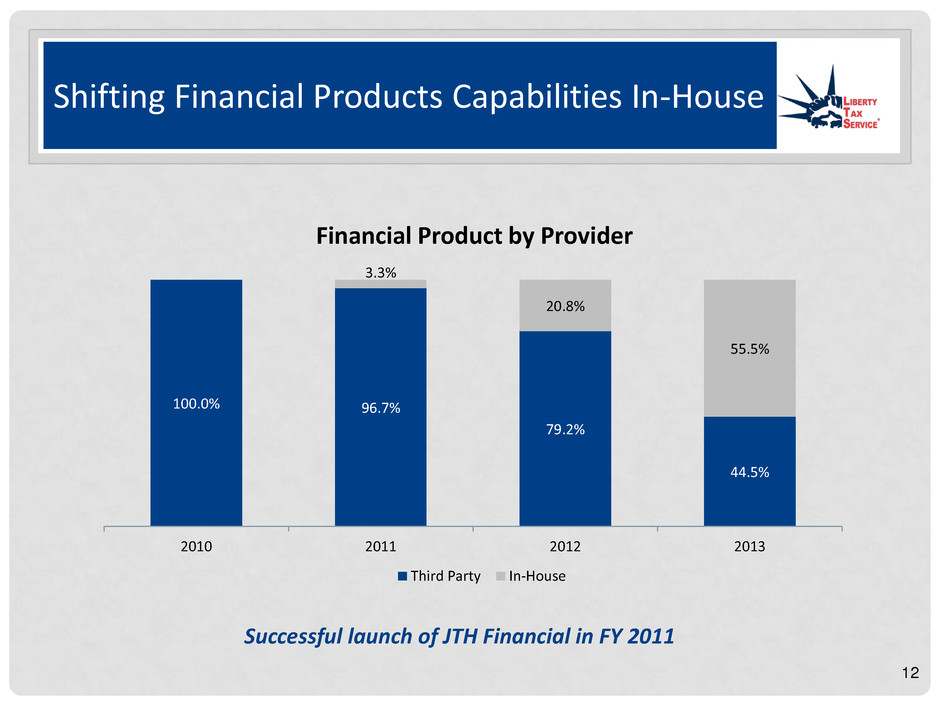

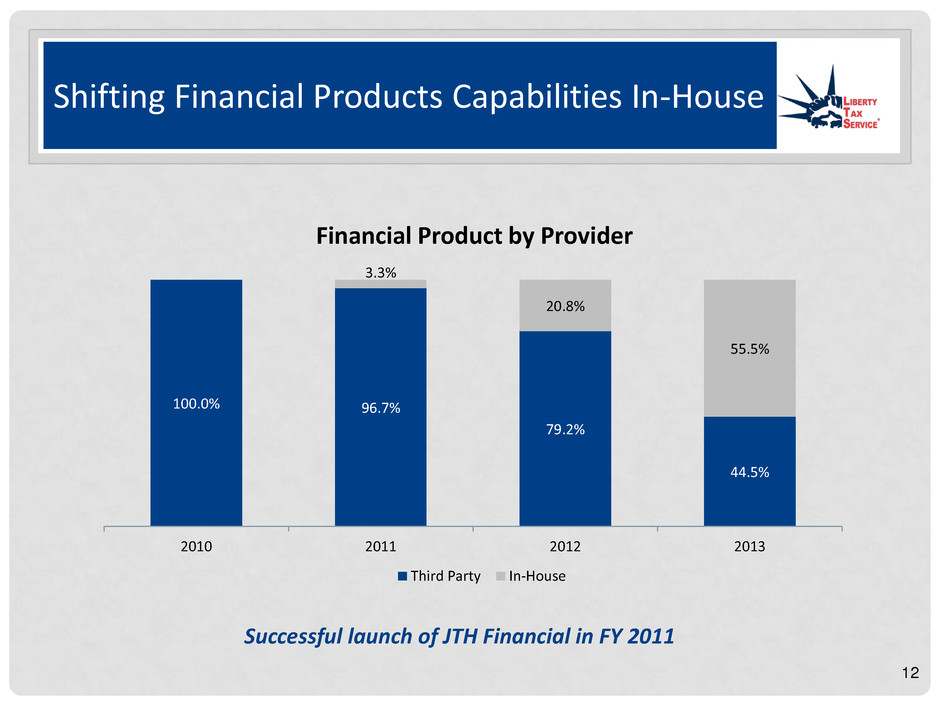

Shifting Financial Products Capabilities In-House Financial Product by Provider 100.0% 96.7% 79.2% 44.5% 3.3% 20.8% 55.5% 2010 2011 2012 2013 Third Party In-House Successful launch of JTH Financial in FY 2011 12

Calendar YTD U.S. Operational Highlights Total Tax Returns Prepared 1.16 M 1.25 M 7.7% Tax Returns Prepared in Offices 1.08 M 1.15 M 6.1% Tax Returns Prepared Online 79,000 102,000 29.1% 2/28/14 2/28/13 % change 13

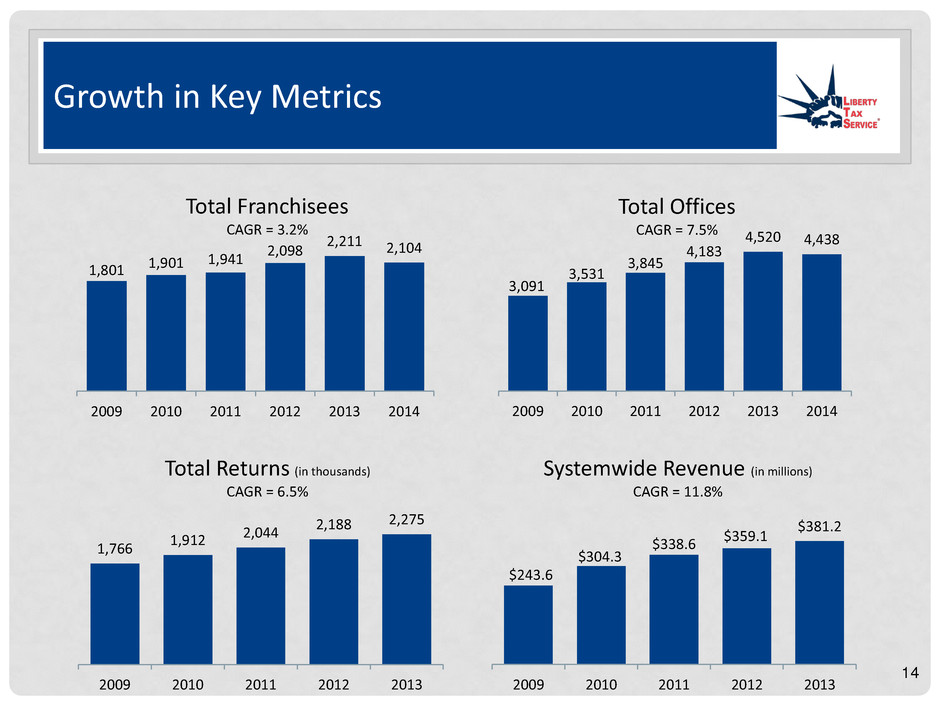

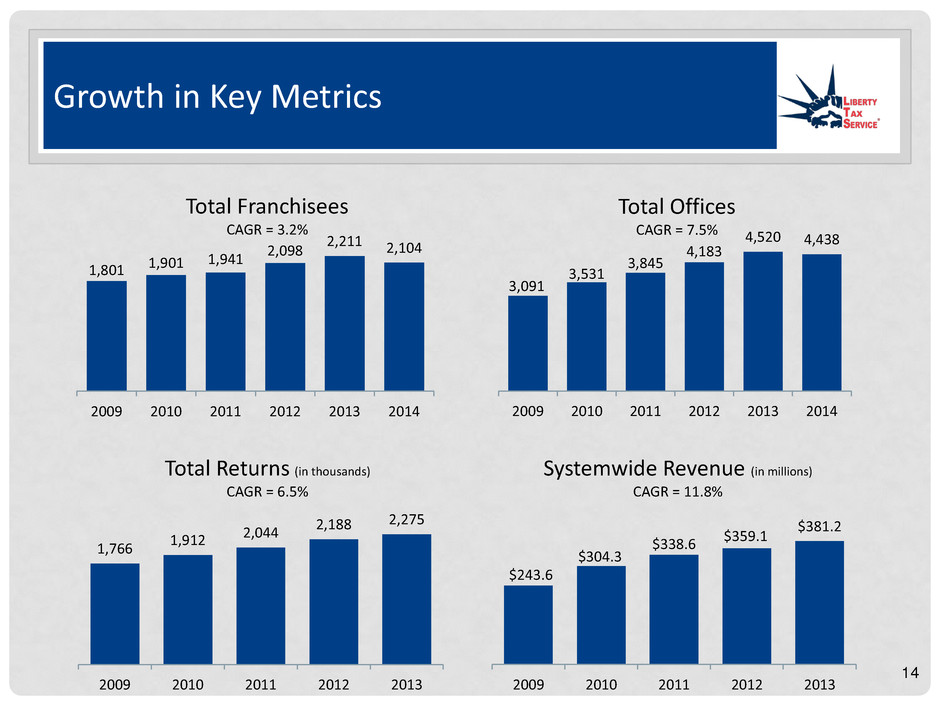

Growth in Key Metrics 1,801 1,901 1,941 2,098 2,211 2,104 2009 2010 2011 2012 2013 2014 Total Franchisees CAGR = 3.2% 3,091 3,531 3,845 4,183 4,520 4,438 2009 2010 2011 2012 2013 2014 Total Offices CAGR = 7.5% Total Returns (in thousands) CAGR = 6.5% 1,766 1,912 2,044 2,188 2,275 2009 2010 2011 2012 2013 Systemwide Revenue (in millions) CAGR = 11.8% $243.6 $304.3 $338.6 $359.1 $381.2 2009 2010 2011 2012 2013 14

Agenda The Industry The Company Financial Overview Future Opportunities

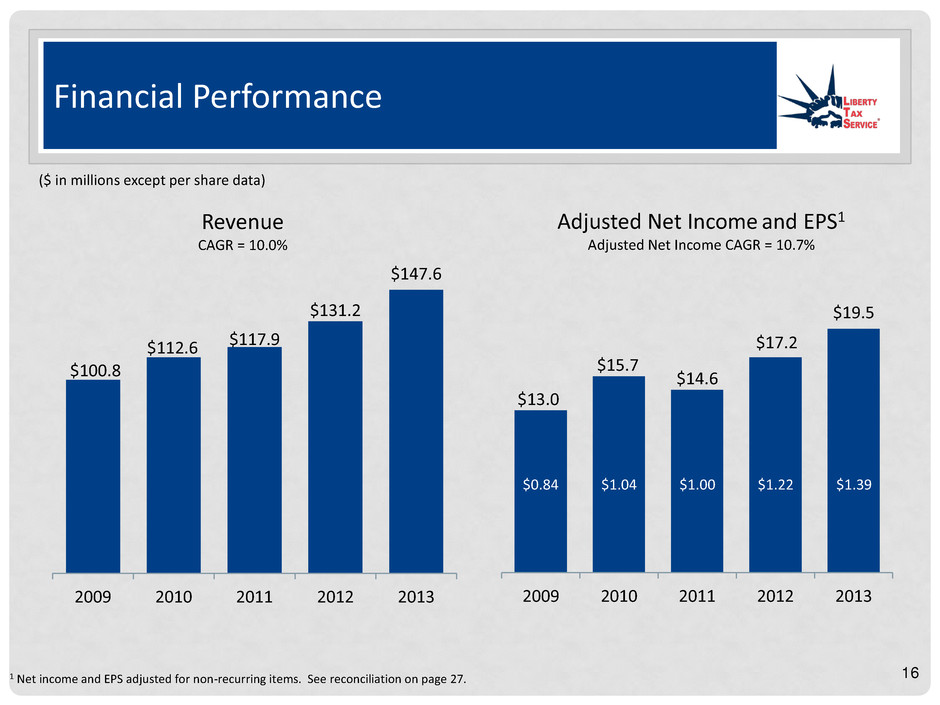

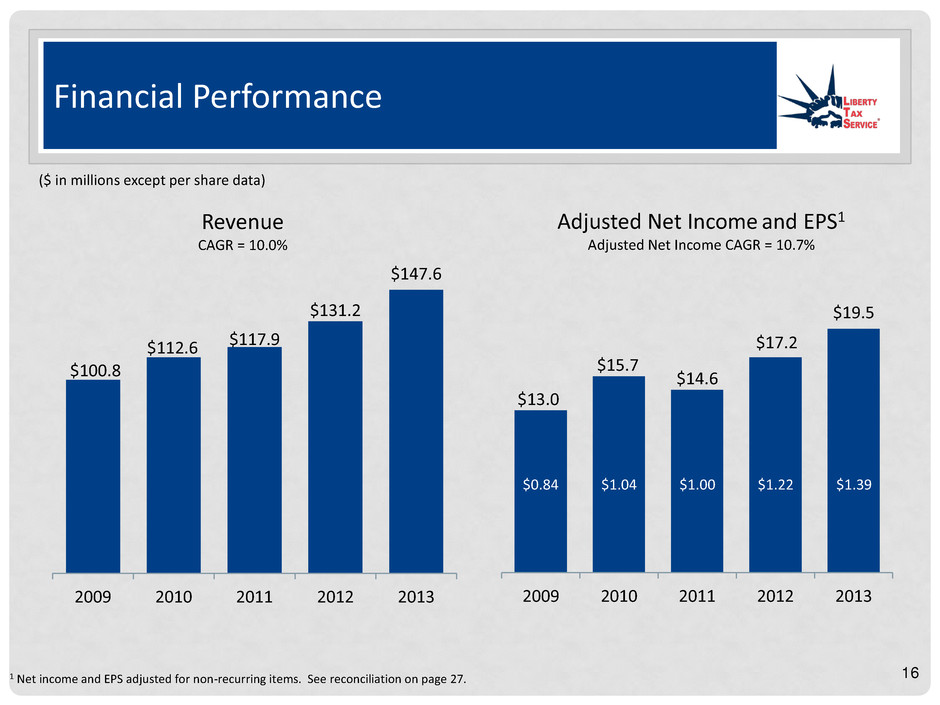

Financial Performance Adjusted Net Income and EPS1 Adjusted Net Income CAGR = 10.7% Revenue CAGR = 10.0% $100.8 $112.6 $117.9 $131.2 $147.6 2009 2010 2011 2012 2013 $13.0 $15.7 $14.6 $17.2 $19.5 2009 2010 2011 2012 2013 1 Net income and EPS adjusted for non-recurring items. See reconciliation on page 27. ($ in millions except per share data) $0.84 $1.04 $1.00 $1.22 $1.39 16

Other, 3% Tax Preparation, 7% Interest Income, 9% Financial Products, 21% Royalties and Advertising Fees, 49% Franchise and AD Fees, 11% Revenue Composition is Shifting to Recurring 2009 Revenue $100.8 Million 2013 Revenue $147.6 Million Other, 3% Tax Preparation, 5% Interest Income, 9% Financial Products, 18% Royalties and Advertising Fees, 48% Franchise and AD Fees, 17% Recurring revenue increasing as a percentage of revenue 17

Balance Sheet is Strong April 30, 2013 April 30, 2012 Cash and cash equivalents $19.0 Million $19.8 Million Receivables, net $71.3 Million $64.8 Million Debt $27.7 Million $29.0 Million Stockholders’ equity $81.8 Million $67.1 Million 18

Agenda The Industry The Company Financial Overview Future Opportunities

Growth Opportunities – ACA • New tax forms adding complexity • May cause shift from DIY to paid preparers • Price increase • Possibility of new filers • Possible partnerships to assist customers in obtaining insurance policies 20

NEXTGEN Launched Jan. 2, 2014 powering 3 DIY sites • Pilot in offices in FY 2015 • Allows for a single customer database – seamlessly move customers from DIY to office • Single tax application and content – decreased costs Growth Opportunities – NextGen 21

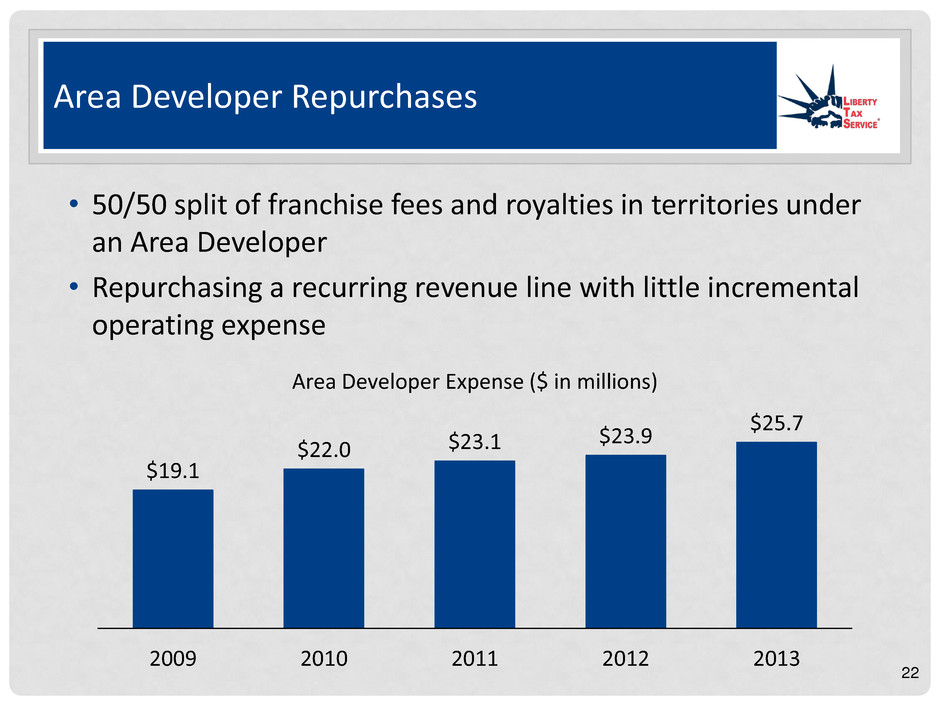

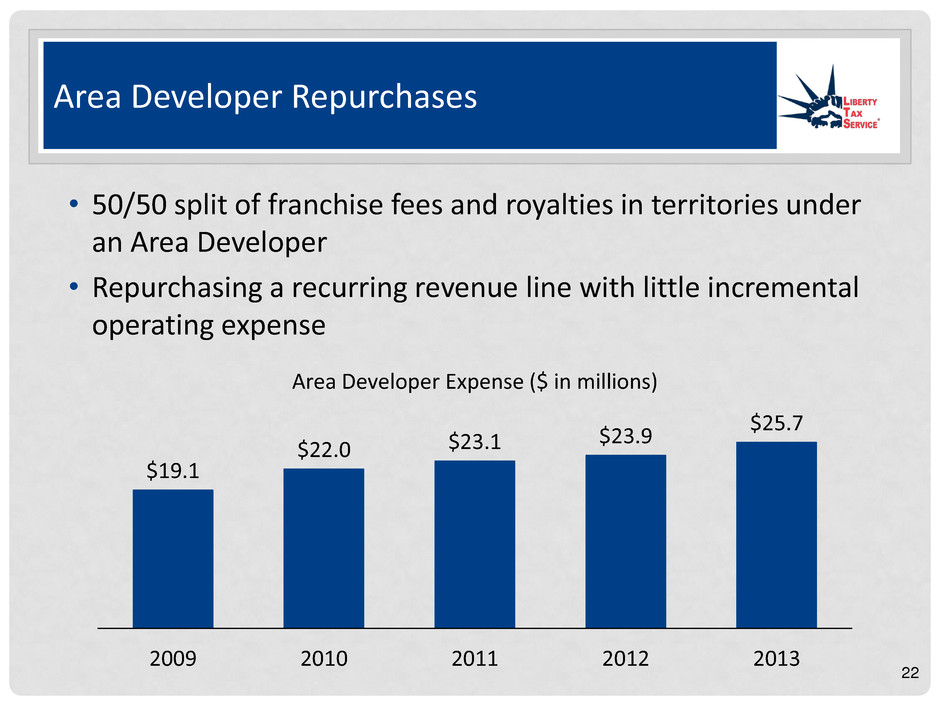

Area Developer Repurchases • 50/50 split of franchise fees and royalties in territories under an Area Developer • Repurchasing a recurring revenue line with little incremental operating expense $19.1 $22.0 $23.1 $23.9 $25.7 2009 2010 2011 2012 2013 Area Developer Expense ($ in millions) 22

Other Growth Opportunities • Possible Immigration Reform • Hispanic Certified offices with bilingual staff • Created Una Familia Sin Fronteras Foundation, a non-profit foundation, that focuses on educating new Hispanic immigrants • Spanish website with office locator • Conversion of Mom and Pops • Aging owners • Certification of preparers • Availability of financial products • Financial Products • In-house refund transfer capabilities • Loan-based settlement • Prepaid card 23

Long-term Goal Be the world’s largest tax preparation provider • Do one more return in offices than any other paid preparer in the U.S. by 2020 • Do one more return online than any other online DIY provider in the U.S. by 2025 24

JTH Holding, Inc. I n v e s t o r P r e s e n t a t i o n

Appendix

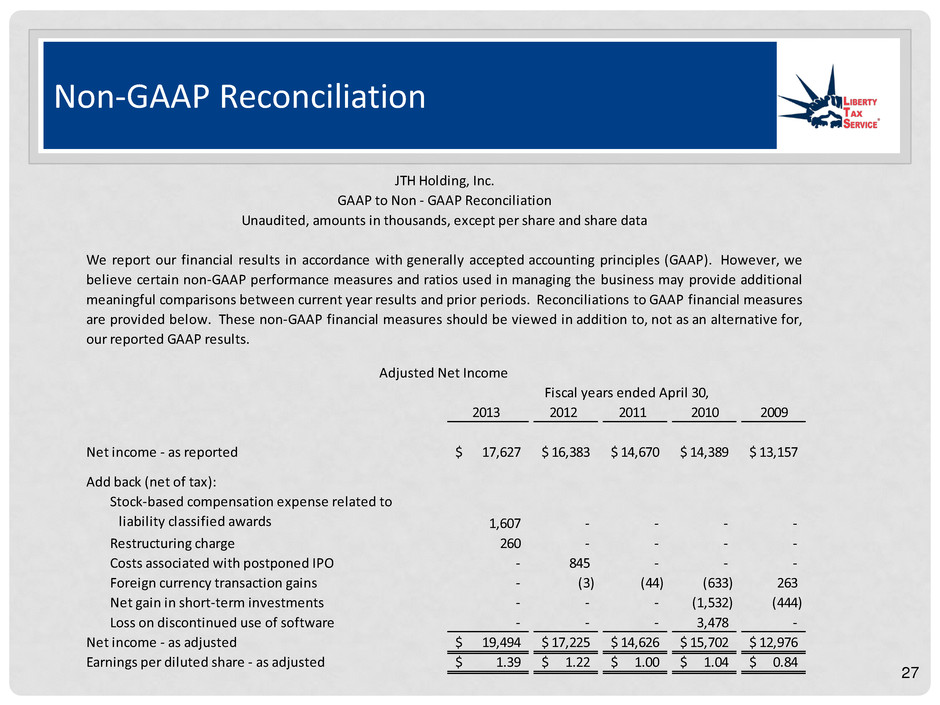

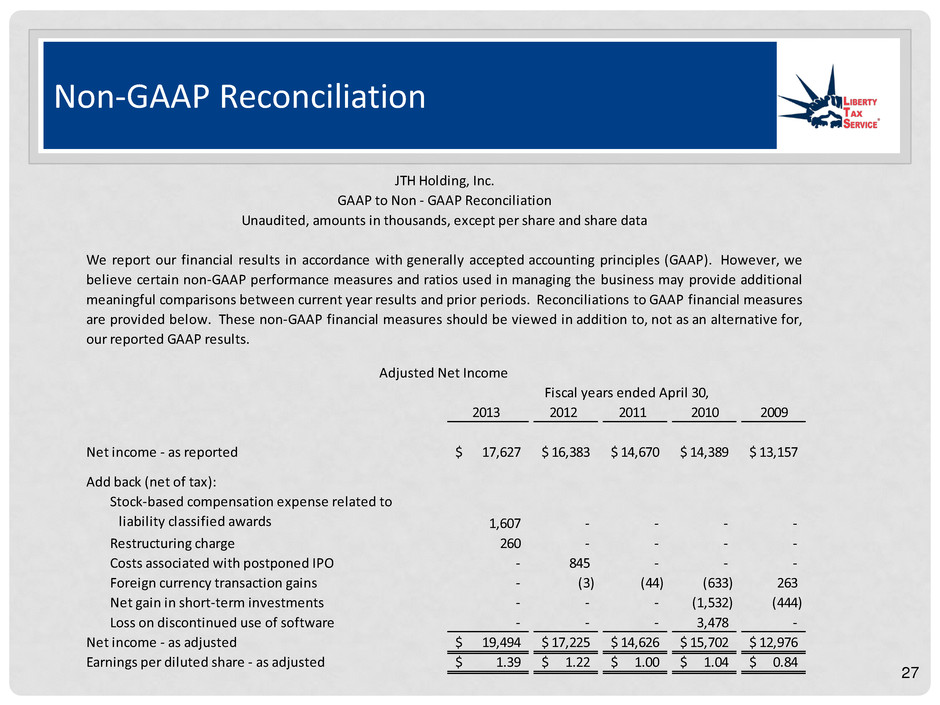

Non-GAAP Reconciliation 2013 2012 2011 2010 2009 Net income - as reported 17,627$ 16,383$ 14,670$ 14,389$ 13,157$ Add back (net of tax): 1,607 - - - - Restructuring charge 260 - - - - Costs associated with postponed IPO - 845 - - - Foreign currency transaction gains - (3) (44) (633) 263 Net gain in short-term investments - - - (1,532) (444) Loss on discontinued use of software - - - 3,478 - Net income - as adjusted 19,494$ 17,225$ 14,626$ 15,702$ 12,976$ Earnings per diluted share - as adjusted 1.39$ 1.22$ 1.00$ 1.04$ 0.84$ Fiscal years ended April 30, JTH Holding, Inc. GAAP to Non - GAAP Reconciliation Unaudited, amounts in thousands, except per share and share data We report our financial results in accordance with generally accepted accounting principles (GAAP). However, we believe certain non-GAAP performance measures and ratios used in managing the business may provide additional meaningful comparisons between current year results and prior periods. Reconciliations to GAAP financial measures are provided below. These non-GAAP financial measures should be viewed in addition to, not as an alternative for, our reported GAAP results. Adjusted Net Income Stock-based compensation expense related to liability classified awards 27