UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. ____)

| Filed by the Registrant[X] | Filed by a Party other than the Registrant☐ |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

| Inland Real Estate Income Trust, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of person(s) filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

|

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

INLAND REAL ESTATE INCOME TRUST, INC.

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

AND

PROXY STATEMENT

| | Date: | June 16, 2016 |

| | Time: | 10:00 a.m. central time |

| | Place: | 2901 Butterfield Road |

| | | Oak Brook, Illinois 60523 |

Inland Real Estate Income Trust, Inc.

2901 Butterfield Road

Oak Brook, Illinois 60523

(800) 826-8228

Notice of Annual Meeting of Stockholders

to be held

June 16, 2016

Dear Stockholder:

Our annual stockholders’ meeting will be held on June 16, 2016, at 10:00 a.m. central time, at our principal executive offices located at 2901 Butterfield Road in Oak Brook, Illinois 60523. At our annual meeting, we will ask you to consider and vote upon:

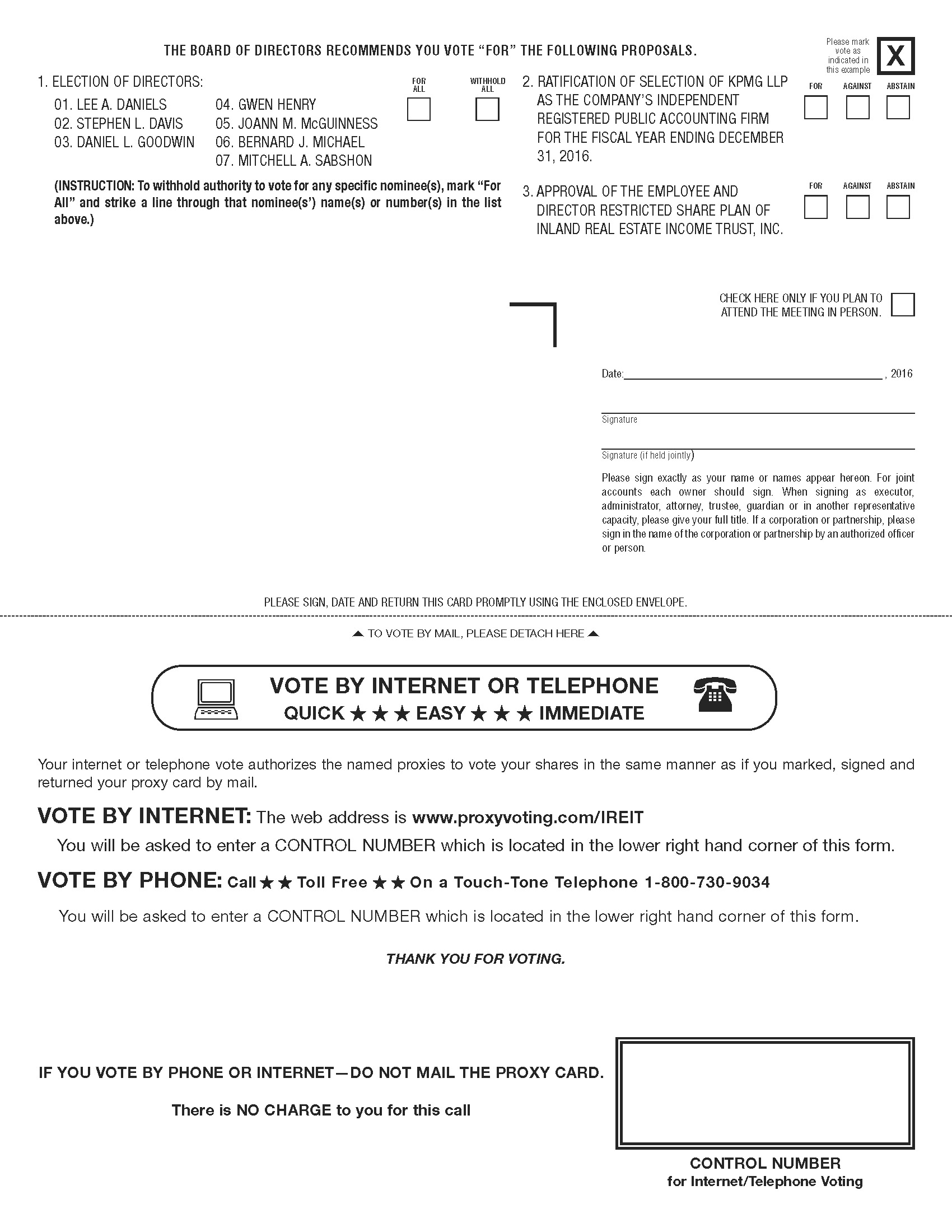

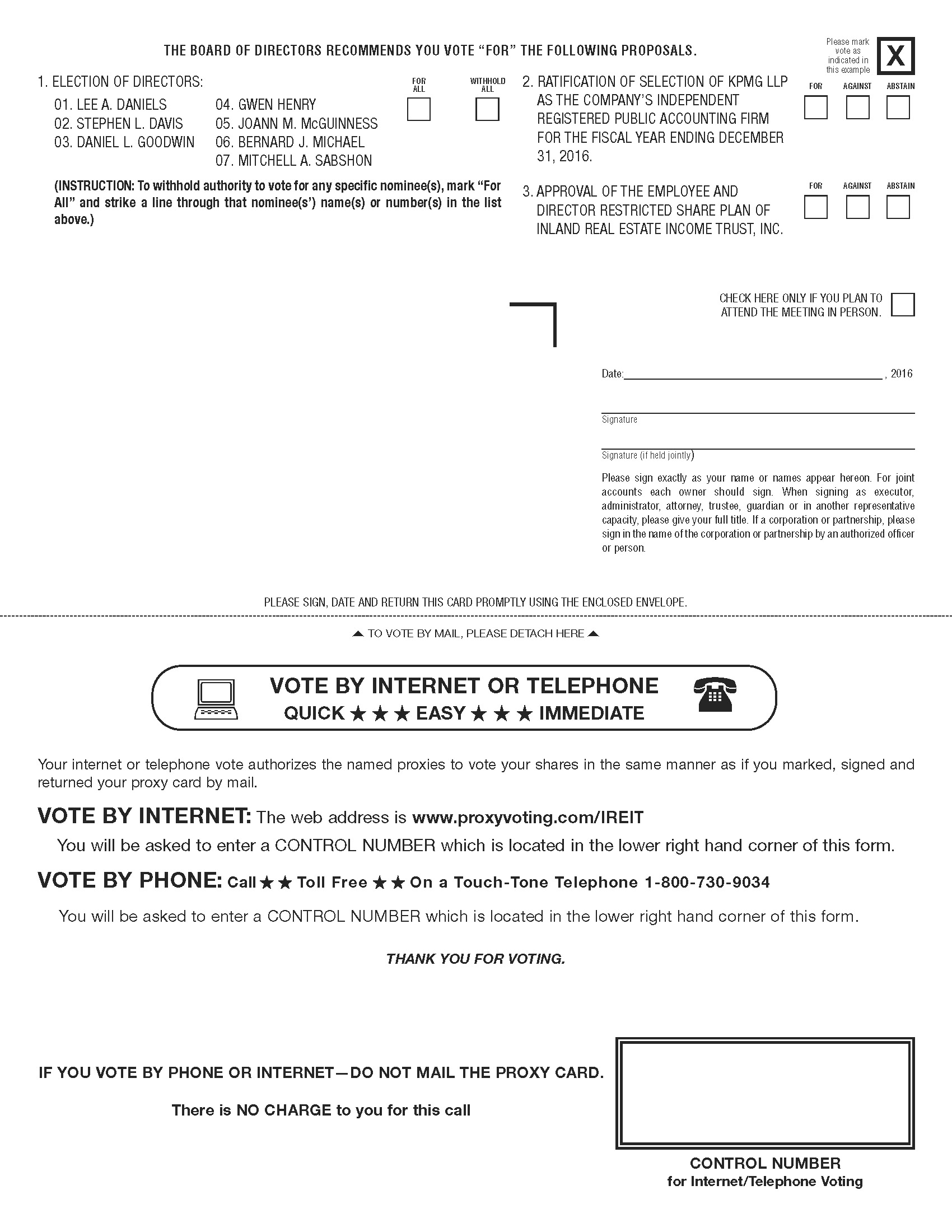

| 1. | A proposal to elect seven directors; |

| 2. | A proposal to ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| 3. | A proposal to approve the Employee and Director Restricted Share Plan of Inland Real Estate Income Trust, Inc.; and |

| 4. | Any other business that may be properly presented at the annual meeting and any postponement or adjournment thereof. |

If you were a stockholder of record at the close of business on March 28, 2016, you may vote in person at the annual meeting and any postponements or adjournments of the meeting.

Please sign, date and promptly return the enclosed proxy card in the enclosed envelope, or authorize a proxy by telephone or Internet (instructions are on your proxy card), so that your shares will be represented whether or not you attend the annual meeting.

By order of the Board of Directors,

Cathleen M. Hrtanek

Secretary

April 4, 2016

Table of Contents

Page

| INFORMATION ABOUT THE ANNUAL MEETING | 2 |

| Information About Attending the Annual Meeting | 2 |

| Information About Voting | 2 |

| Information Regarding Tabulation of the Vote | 3 |

| Quorum Requirement | 3 |

| Information About Vote Necessary for Action to be Taken | 3 |

| Broker Non-Votes | 4 |

| Costs of Proxies | 4 |

| Other Matters | 5 |

| Important Notice Regarding the Availability of Proxy Materials | 5 |

| STOCK OWNERSHIP | 6 |

| Stock Owned by Certain Beneficial Owners and Management | 6 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 7 |

| Interest of Certain Persons in Matters to Be Acted On | 7 |

| CORPORATE GOVERNANCE PRINCIPLES | 8 |

| Independence | 8 |

| Board Leadership Structure and Risk Oversight | 9 |

| Communicating with Directors | 9 |

| Committees of our Board of Directors | 10 |

| Code of Ethics | 11 |

| PROPOSAL NO. 1 – ELECTION OF DIRECTORS | 12 |

| Independent Director Compensation | 18 |

| Meetings of the Board of Directors, Committees and Stockholders | 18 |

| EXECUTIVE COMPENSATION | 19 |

| Executive Officers | 19 |

| Compensation of Executive Officers | 21 |

| Certain Relationships and Related Transactions | 21 |

| Policies and Procedures with Respect to Related Party Transactions | 27 |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 27 |

| AUDIT COMMITTEE REPORT | 28 |

| PROPOSAL NO. 2 – RATIFY SELECTION OF KPMG LLP | 30 |

| Fees to Independent Registered Public Accounting Firm | 30 |

| Approval of Services and Fees | 31 |

| PROPOSAL NO. 3 – APPROVE EMPLOYEE AND DIRECTOR RESTRICTED SHARE PLAN | 32 |

| STOCKHOLDER PROPOSALS FOR 2017 ANNUAL MEETING | 40 |

| Recommendations for Director Candidates | 40 |

| Other Stockholder Proposals | 40 |

This proxy statement contains information related to the annual meeting of stockholders to be held June 16, 2016, beginning at 10:00 a.m. central time, at our principal executive offices located at 2901 Butterfield Road, Oak Brook, Illinois 60523, and at any postponements or adjournments thereof. This proxy statement is being mailed to stockholders on or about April 8, 2016.

INFORMATION ABOUT THE ANNUAL MEETING

Information About Attending the Annual Meeting

The board of directors of Inland Real Estate Income Trust, Inc. (referred to herein as the “Company,” “we,” “our” or “us”), a Maryland corporation, is soliciting your vote for the 2016 annual meeting of stockholders. At the meeting, you will be asked to consider and vote upon:

| 1. | A proposal to elect seven directors; |

| 2. | A proposal to ratify the selection of KPMG LLP (sometimes referred to herein as “KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| 3. | A proposal to approve the Employee and Director Restricted Share Plan of the Company; and |

| 4. | Any other business that may be properly presented at the annual meeting and any postponement or adjournment thereof. |

The board of directors recommends that you vote “FOR” each proposal. If you own shares of common stock in more than one account, such as individually and jointly with your spouse, you may receive more than one set of these materials. Please make sure to vote all of your shares. This proxy statement summarizes information we are required to provide to you under the rules of the Securities and Exchange Commission (the “SEC”). If you plan on attending the annual meeting of stockholders in person, please contact Ms. Roberta S. Matlin, our vice president, at (800) 826-8228, so that we can arrange for sufficient space to accommodate all attendees.

Information About Voting

Holders of our common stock at the close of business on March 28, 2016 (the “Record Date”) are entitled to receive this notice and to vote their shares at the annual meeting. As of the Record Date, there were 86,808,619.24 shares of our common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the meeting.

Your vote is needed to ensure that the proposals can be acted upon.Your vote is very important, even if you own a small number of shares. Your immediate response will help avoid potential delays and may save us significant additional expense associated with soliciting stockholder votes. We welcome your attendance at the meeting.

You may vote in person or by granting us a proxy to vote on the proposals. You may authorize a proxy in any of the following ways:

| • | by mail:sign, date and return the proxy card in the enclosed envelope; |

| • | via telephone: dial (800) 730-9034 and follow the instructions provided on the proxy card; or |

| • | via the Internet: go towww.proxyvoting.com/ireit and follow the instructions provided on the proxy card. |

If you return your proxy card but do not indicate how your shares should be voted, they will be voted “FOR” each proposal in accordance with the board’s recommendation.

If you grant us a proxy, you may nevertheless revoke your proxy at any time before it is exercised by: (1) sending written notice to us, Attention: Ms. Roberta S. Matlin, vice president; (2) providing us with a later-dated proxy; or (3) attending the annual meeting in person and voting your shares. Merely attending the annual meeting, without further action, will not revoke your proxy.

Information Regarding Tabulation of the Vote

We have hired Morrow & Co., LLC (“Morrow”), 470 West Ave., Stamford, CT 06902, to solicit proxies on our behalf. In addition, Morrow will tabulate all votes cast at the annual meeting and will act as the inspector of election.

Quorum Requirement

The presence, in person or by proxy, of stockholders holding a majority of the shares of our common stock outstanding is necessary to constitute a “quorum.” There must be a quorum present in order for the annual meeting to be a duly held meeting at which business can be conducted. If you submit a properly executed proxy card, even if you abstain from voting or do not give instructions for voting, then your shares will be considered present for purposes of establishing a quorum.

Information About Vote Necessary for Action to be Taken

Proposal No. 1. With regard to the election of directors, you may vote “FOR ALL” of the nominees, you may withhold your vote for all of the nominees by voting “WITHHOLD ALL,” or you may vote for all of the nominees except for certain nominee(s) by voting “FOR ALL” and striking a line through that nominee(s’) name(s) or number(s) on the proxy card. The affirmative vote of a majority of the shares of common stock present in person or by proxy at the annual meeting, assuming a quorum is present, is required to elect each nominee for director. Withheld votes will be counted for purposes of establishing a quorum, but will have the effect of a vote against each nominee for director for which authority is withheld. Broker non-votes (discussed below) will be counted for purposes of establishing a quorum, but will have the effect of a vote against each nominee for director.

Proposal No. 2. With regard to the proposal relating to the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016, you may vote “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. A majority of the votes cast at the annual meeting, assuming a quorum is present, is required to ratify the selection of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2016. Abstentions will not be counted as votes cast; however, a properly executed proxy card marked “ABSTAIN” will be counted for purposes of establishing a quorum. Because brokers are entitled to vote on Proposal No. 2, we do not anticipate any broker non-votes with regard to Proposal No. 2.

Proposal No. 3. With regard to the proposal relating to the approval of the Employee and Director Restricted Share Plan of the Company, you may vote “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. A majority of the votes cast at the annual meeting, assuming a quorum is present, is required to approve the Employee and Director Restricted Share Plan of the Company. Abstentions will not be counted as votes cast; however, a properly executed proxy card marked “ABSTAIN” will be counted for purposes of establishing a quorum. Broker non-votes (discussed below) will be counted for purposes of establishing a quorum but will not be considered votes cast with regard to Proposal No. 3.

Broker Non-Votes

A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a particular proposal because the broker does not have discretionary power with respect to that particular proposal and has not received instructions from the beneficial owner. The election of directors and the approval of the Employee and Director Restricted Share Plan of the Company are proposals for our stockholders’ consideration at the annual meeting on which brokers do not have discretionary voting power. Thus, beneficial owners of shares held in broker accounts are advised that, if they do not timely provide instructions to their broker, their shares will not be voted in connection with such proposals.

Costs of Proxies

We will bear all costs and expenses incurred in connection with soliciting proxies. Our directors and executive officers, as well as certain employees of our business manager, IREIT Business Manager & Advisor, Inc. (sometimes referred to herein as the “Business Manager”), also may solicit proxies by mail, personal contact, letter, telephone, telegram, facsimile or other electronic means. These individuals will not receive any additional compensation for these activities, but may be reimbursed by us for their reasonable out-of-pocket expenses. In addition, we have hired Morrow to solicit proxies on our behalf. We will pay Morrow a fee of $5,500 plus a fee equal to $6.50 for each stockholder solicited by telephone and any out-of-pocket expenses for soliciting proxies.

Other Matters

We are not aware of any other matter to be presented at the annual meeting. Generally, no business aside from the items discussed in this proxy statement may be transacted at the meeting. If, however, any other matter properly comes before the annual meeting as determined by the chairman of the meeting, your proxies are authorized to act on the proposal at their discretion.

Important Notice Regarding the Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 16, 2016. This proxy statement, the proxy card and our annual report to stockholders for the year ended December 31, 2015 are available on our website atwww.inlandincometrust.com. Additional copies of this proxy statement, our annual report to stockholders or our Annual Report on Form 10-K for the year ended December 31, 2015 will be furnished to you, without charge, by writing us at 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Investor Services. If requested by stockholders, we also will provide copies of exhibits to our Annual Report on Form 10-K for the year ended December 31, 2015 for a reasonable fee.

All of the reports, proxy materials and other information that we file with the SEC also can be inspected and copied at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Copies also can be obtained by mail from the Public Reference Room at prescribed rates. Please call the SEC at (800) SEC-0330 for further information on the operation of the Public Reference Room. In addition, the SEC maintains an Internet website (www.sec.gov) that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC.

STOCK OWNERSHIP

Stock Owned by Certain Beneficial Owners and Management

Based on a review of filings with the SEC, the following table reflects the amount of common stock beneficially owned (unless otherwise indicated) by (1) persons that beneficially own more than 5% of the outstanding shares of our common stock; (2) our directors and each nominee for director; (3) our executive officers; and (4) our directors and executive officers as a group. All information is as of March 25, 2016.

| Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2) | | Percent of Class |

| Daniel L. Goodwin, Director and Chairman of the Board(3) | 278,858 | | * |

| Lee A. Daniels, Independent Director(4) | 3,894 | | * |

| Stephen Davis, Independent Director(5) | 2,100 | | * |

| Gwen Henry, Independent Director(6) | 888 | | * |

| Bernard J. Michael, Independent Director | – | | – |

| Mitchell A. Sabshon, Director and Chief Executive Officer(7) | 11,110 | | * |

| JoAnn M. McGuinness, Director, President and Chief Operating Officer(8) | 4,995 | | * |

| Catherine L. Lynch, Chief Financial Officer(9) | 1,742 | | * |

| Roberta S. Matlin, Vice President(10) | 988 | | * |

| David Z. Lichterman, Vice President, Treasurer and Chief Accounting Officer(11) | 3,219 | | * |

| Cathleen M. Hrtanek, Secretary(12) | 556 | | * |

| All Directors and Officers as a group (11 persons) | 308,350 | | * |

* Less than 1% (1) The business address of each person listed in the table is c/o Inland Real Estate Income Trust, Inc., 2901 Butterfield Road, Oak Brook, Illinois 60523. (2) All fractional ownership amounts have been rounded to the nearest whole number. (3) Mr. Goodwin shares voting and dispositive power with his wife over 13,889 shares. Mr. Goodwin’s beneficial ownership includes 264,969 shares directly owned by the Goodwin 2012 Descendants Trust pursuant to which his wife, Carol Goodwin, as trustee has sole voting and investment power over the shares. (4) Mr. Daniels has sole voting and investment power over all of the shares that he beneficially owns. (5) Mr. Davis has sole voting and investment power over all of the shares that he beneficially owns. (6) Ms. Henry shares voting and dispositive power with her husband over all of the shares that they own. (7) Mr. Sabshon shares voting and dispositive power with his wife over all of the shares that they own. (8) Ms. McGuinness has sole voting and investment power over all of the shares that she beneficially owns. (9) Ms. Lynch shares voting and dispositive power with her husband over all of the shares that they own. (10) Ms. Matlin has sole voting and investment power over all of the shares that she beneficially owns. (11) Mr. Lichterman has sole voting and investment power over all of the shares that he beneficially owns. (12) Ms. Hrtanek has sole voting and investment power over all of the shares that she beneficially owns. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires each director, officer and individual beneficially owning more than 10% of our common stock to file initial statements of beneficial ownership (Form 3) and statements of changes in beneficial ownership (Forms 4 and 5) of our common stock with the SEC. Directors, officers and greater than 10% beneficial owners are required by SEC rules to furnish us with copies of all forms they file. Based solely on a review of the copies of these forms furnished to us during, and with respect to, the fiscal year ended December 31, 2015, or written representations that no additional forms were required, we believe that all of our officers and directors and persons that beneficially owned more than 10% of the outstanding shares of our common stock complied with these filing requirements during the fiscal year ended December 31, 2015.

Interest of Certain Persons in Matters to Be Acted On

No director, executive officer, nominee for election as a director or associate of any director, executive officer or nominee has any substantial interest, direct or indirect, through security holdings or otherwise, in any matter to be acted upon at the annual meeting.

CORPORATE GOVERNANCE PRINCIPLES

Independence

Our business is managed under the direction and oversight of our board. The members of our board are Lee A. Daniels, Stephen Davis, Daniel L. Goodwin, Gwen Henry, JoAnn M. McGuinness, Bernard J. Michael and Mitchell A. Sabshon. As required by our charter, a majority of our directors must be “independent.” As defined by our charter, an “independent director” is a director who is not, and within the last two years has not been, directly or indirectly associated with our sponsor, Inland Real Estate Investment Corporation (“IREIC” or the “Sponsor”), or the Business Manager by virtue of (1) an ownership of an interest in the Sponsor, Business Manager or any of their affiliates, (2) employment by the Sponsor, Business Manager or any of their affiliates, (3) service as an officer or director of the Sponsor, Business Manager or any of their affiliates, (4) performance of services, other than as a director, for the Company, (5) service as a director or trustee of more than three REITs sponsored by the Sponsor or managed by the Business Manager, or (6) a material business or professional relationship with the Sponsor, Business Manager or any of their affiliates. For purposes of this definition, an indirect affiliation shall include circumstances in which a director’s spouse, parents, children, siblings, mothers- or fathers-in-law, sons- or daughters-in-law or brothers- or sisters-in-law have any of the relationships identified in the immediately preceding sentence of this definition with the Company, the Sponsor, the Business Manager or any of their affiliates during the applicable two year period. For purposes of determining whether or not the business or professional relationship is material, the aggregate gross revenue derived by the prospective independent director from the Company, the Sponsor, the Business Manager and their affiliates shall be deemed material per se if it exceeds five percent (5.0%) of the prospective independent director’s: (i) annual gross revenue, derived from all sources, during either of the prior two years; or (ii) net worth, on a fair market value basis during the prior two years.

Although our shares are not listed for trading on any national securities exchange and therefore our board of directors is not subject to the independence requirements of the New York Stock Exchange (“NYSE”) or any other national securities exchange, our board has evaluated whether our directors are “independent” as defined by the NYSE. The NYSE standards provide that to qualify as an independent director, among other things, the board of directors must affirmatively determine that a director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company).

After reviewing all relevant transactions or relationships between each director, or any of his or her family members, and the Company, our management and our independent registered public accounting firm, and considering each director’s direct and indirect association with IREIC, the Business Manager or any of their affiliates, the board has determined that Messrs. Daniels, Davis and Michael and Ms. Henry qualify as independent directors.

Board Leadership Structure and Risk Oversight

We have separated the roles of the president, who serves as our principal executive officer, and chairman of the board in recognition of the differences between the two roles. Ms. McGuinness, in her role as both our president and chief operating officer and the president and chief operating officer of the Business Manager, is responsible for setting the strategic direction for the Company and for providing the day-to-day leadership of the Company. Mr. Goodwin, as chairman of the board, organizes the work of the board and ensures that the board has access to sufficient information to carry out its functions. Mr. Goodwin presides over meetings of the board of directors and stockholders, establishes the agenda for each meeting and oversees the distribution of information to directors.

Although we do not have a lead independent director, our board believes that it is able to effectively provide independent oversight of our business and affairs, including risks facing the Company, without a lead independent director through the composition of our board of directors, the strong leadership of the independent directors and the independent committees of our board. Our full board of directors, including our independent directors, is responsible for approving all material transactions, and each transaction between us and the Business Manager or its affiliates must be approved by the affirmative vote of a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction. In addition, each board member is kept apprised of our business and developments impacting our business and has complete and open access to the members of our management team, the Business Manager and our real estate managers, Inland National Real Estate Services, LLC and Inland Commercial Real Estate Services LLC (collectively, our “Real Estate Managers”).

Our board is actively involved in overseeing risk management for the Company. Our board of directors oversees risk through: (1) its review and discussion of regular periodic reports to the board of directors and its committees, including management reports and studies on existing market conditions, leasing activity and property operating data, as well as actual and projected financial results, and various other matters relating to our business; (2) the required approval by the board of directors of material transactions, including, among others, acquisitions and dispositions of properties, financings and our agreements with the Business Manager, our Real Estate Managers and the ancillary service providers; (3) the oversight of our business by the audit committee; and (4) its review and discussion of regular periodic reports from our independent registered public accounting firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to the qualification of the Company as a REIT for tax purposes and our internal control over financial reporting.

Communicating with Directors

Stockholders wishing to communicate with our board and the individual directors may send communications by letter, e-mail or telephone, in care of our corporate secretary, who will review and forward all correspondence to the appropriate person or persons for a response.

Our non-retaliation policy, also known as our “whistleblower” policy, prohibits us from retaliating or taking any adverse action against our employees, or the employees of the Business Manager or its affiliates, for raising a concern, including concerns about accounting, internal controls or auditing matters. Employees preferring to raise their concerns in a confidential or anonymous manner may do so by contacting our compliance officer at (630) 218-8000. A complete copy of our non-retaliation policy may be found on our website atwww.inlandincometrust.com under the “Corporate Information – Governance Documents” tab.

Committees of our Board of Directors

Audit Committee.Our board has formed a separately-designated standing audit committee, comprised of Ms. Henry and Messrs. Daniels, Davis and Michael, each of whom is an independent director. Ms. Henry serves as the chairperson of this committee, and our board has determined that Ms. Henry qualifies as an “audit committee financial expert” as defined by the SEC. The audit committee assists the board in fulfilling its oversight responsibility relating to, among other things: (1) the integrity of our financial statements; (2) our compliance with legal and regulatory requirements; (3) the qualifications and independence of our independent registered public accounting firm; (4) the adequacy of our internal controls; and (5) the performance of our independent registered public accounting firm. The report of the committee is included in this proxy statement.

Our board has adopted a written charter under which the audit committee operates. A copy of the charter is available on our website atwww.inlandincometrust.com under the “Corporate Information – Governance Documents” tab.

Nominating and Corporate Governance Committee. Our board has formed a nominating and corporate governance committee consisting of three of our independent directors, Ms. Henry and Messrs. Daniels and Davis. Mr. Daniels serves as the chairman of this committee. The nominating and corporate governance committee is responsible for, among other things: (1) identifying individuals qualified to serve on the board and the Nominating and Corporate Governance Committee and recommending that the board select a slate of director nominees for election by the stockholders at the annual meeting; (2) developing and recommending to the board a set of corporate governance policies and principles and periodically reevaluating such policies and principles for the purpose of suggesting amendments to them if appropriate; and (3) overseeing an annual evaluation of the board. The nominating and corporate governance committee is also responsible for considering director nominees submitted by stockholders.

The committee considers all qualified candidates identified by members of the committee, by other members of the board of directors, by the Business Manager and by stockholders. In recommending candidates for director positions, the committee takes into account many factors and evaluates each director candidate in light of, among other things, the candidate’s knowledge, experience, judgment and skills such as an understanding of the real estate industry or brokerage industry or accounting or financial management expertise. Other considerations include the candidate’s independence from conflict with the Company, the Business Manager and the Sponsor and the ability of the candidate to devote an appropriate amount of effort to board duties. The committee also focuses on persons who are actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional or academic community. A majority of our directors must be “independent,” as defined in our charter. Moreover, as required by our charter, at least one of our independent directors must have at least three years of relevant real estate experience, and each director, other than the independent directors, must have at least three years of relevant experience demonstrating the knowledge and experience required to successfully acquire and manage the type of assets we acquire. The committee also considers diversity in its broadest sense, including persons diverse in geography, gender and ethnicity as well as representing diverse experiences, skills and backgrounds. The committee evaluates each individual candidate by considering all of these factors as a whole, favoring active deliberation rather than the use of rigid formulas to assign relative weights to these factors.

Our board has adopted a written charter under which the nominating and corporate governance committee operates. A copy of the charter is available on our website atwww.inlandincometrust.com under the “Corporate Information – Governance Documents” tab.

Other Committees. Our board does not have a compensation committee or charter that governs the compensation process. Instead, the full board of directors performs the functions of a compensation committee, including reviewing and approving all forms of compensation for our independent directors. In addition, our independent directors determine, at least annually, that the compensation that we contract to pay to the Business Manager is reasonable in relation to the nature and quality of services performed or to be performed, and is within the limits prescribed by our charter and applicable law. Our board does not believe that it requires a separate compensation committee at this time because we neither separately compensate our executive officers for their service as officers, nor do we reimburse either the Business Manager or our Real Estate Managers for any compensation paid to their employees who also serve as our executive officers.

Code of Ethics

Our board has adopted a code of ethics applicable to our directors, officers and employees which is available on our website atwww.inlandincometrust.com. In addition, printed copies of the code of ethics are available to any stockholder, without charge, by writing us at 2901 Butterfield Road, Oak Brook, Illinois 60523, Attention: Investor Services.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Our board has nominated the seven individuals set forth below to serve as directors. Messrs. Daniels, Davis and Michael and Ms. Henry have been nominated to serve as independent directors. Messrs. Goodwin and Sabshon and Ms. McGuinness also have been nominated to serve as directors. The board nominated these seven individuals to serve as members of the board on February 9, 2016.

If you return a proxy card but do not indicate how your shares should be voted, they will be voted “FOR” each of the nominees. We know of no reason why any nominee will be unable to serve if elected. If any nominee is unable to serve, your proxy may vote for another nominee proposed by the board, or the board may reduce the number of directors to be elected. If any director resigns, dies or is otherwise unable to serve out his or her term, or if the board increases the number of directors, the board may fill the vacancy until the next annual meeting of stockholders.

The following sets forth each nominee’s principal occupation and business, as well as the specific experience, qualifications, attributes and skills that led to the conclusion by the board that the nominee should serve as a director of the Company. All ages are stated as of January 1, 2016. As used herein, “Inland” refers to some or all of the entities that are a part of The Inland Real Estate Group of Companies, Inc., which is comprised of a group of independent legal entities, some of which may be affiliates, share some common ownership or have been sponsored and managed by IREIC or its subsidiaries.

Lee A. Daniels, 73. Independent director since February 2012. Mr. Daniels serves as Chairman of the Nominating and Corporate Governance Committee and a member of the Audit Committee. Mr. Daniels joined the Kite Realty Group (“Kite”) Board of Trustees in 2014 and is a member of the Kite Corporate Governance and Nominating Committee. Mr. Daniels served on the board of directors of Inland Diversified Real Estate Trust, Inc. from its inception in 2008 to its merger with Kite in 2014.

In February 2007, Mr. Daniels founded Lee Daniels & Associates, LLC, a consulting firm for government and community relations. Prior to that, Mr. Daniels was an equity partner at the Chicago law firm of Bell Boyd & Lloyd from 1992 to 2006, an equity partner at Katten, Muchin & Zavis from 1982 to 1991, and an equity partner at Daniels & Faris from 1967 to 1982. Mr. Daniels served as Special Assistant Attorney General for the State of Illinois from 1971 to 1974. He served as a member of the Illinois House of Representatives from 1975 to 2007, was the Republican Leader from 1983 to 1995 and 1998 to 2003, and was Speaker of the Illinois House of Representatives from 1995 to 1997.

Mr. Daniels currently serves as Chairman of the Board of Directors of Haymarket Center, a not for profit drug and alcohol treatment center located in Chicago, Illinois. He also serves as the Chairman of the Presidential Search Committee for the College of DuPage. He has previously served on the Elmhurst Memorial Healthcare Board of Trustees from 1981 to 2013, the Board of Governors from 1990 to 2013, and the Elmhurst Memorial Hospital Foundation Board from 1980 to 1984 and 2013. Other boards Mr. Daniels has served on include the Suburban Bank and Trust Company of Elmhurst Board of Directors from 1994 to 1996, the Elmhurst Federal Savings and Loan Association Board of Directors from 1991 to 1994, and the DuPage Easter Seals Board of Directors from 1970 to 1973.

Mr. Daniels received his bachelor degree from the University of Iowa and his law degree from The John Marshall Law School in Chicago. He received a Distinguished Alumni Award from both The John Marshall Law School and the University of Iowa, and an Honorary Doctor of Laws from Elmhurst College. Along with his other corporate and not-for-profit work, Mr. Daniels also serves as a Distinguished Fellow in the Political Science Department of Elmhurst College and as Senior Advisor to the President.

We believe that Mr. Daniels’ depth of knowledge and experience, based on his more than forty-five years of legal practice and experience in commercial real estate, make him well qualified to serve as a member of our board of directors.

Stephen Davis, 58.Independent director since February 2012. Mr. Davis has over thirty years of experience in real estate development. Mr. Davis has been the president of The Will Group, Inc., a construction company, since founding the company in 1986. In his position with The Will Group, Mr. Davis was instrumental in the construction of Kennedy King College campus, located in Chicago, Illinois, and the coordination of the "Plan For Transformation" for Altgeld Gardens, a public housing development located in Chicago, Illinois. Since October 2003, Mr. Davis has also overseen property management operations for several properties owned by a family-owned real estate trust.

Since November 2005, Mr. Davis has served as a director of the Wheaton Bank & Trust, where he is a member of the loan committee, which is responsible for reviewing and analyzing residential and commercial loan portfolios, developer credentials and viability, home builders and commercial and industrial loans. Since March 2004, Mr. Davis also has served as a director and the commissioner of aviation for the DuPage County Airport Authority, in DuPage County, Illinois, which oversees management of the DuPage County Airport, Prairie Landing Golf Course and the 500-acre DuPage County Business Park. Mr. Davis obtained his bachelor degree from University of Tennessee, located in Knoxville.

We believe that Mr. Davis’ prior real-estate development experience and his leadership qualities make him well qualified to serve as a member of our board of directors.

Daniel L. Goodwin, 72.Director and the chairman of our board since July 2012. Mr Goodwin has also served as a director of the Business Manager since August 2011. Mr. Goodwin is the Chairman and CEO of Inland, headquartered in Oak Brook, Illinois. Inland is comprised of separate real estate investment and financial companies with managed assets with a value of approximately $7.5 billion, doing business nationwide with a presence in 43 states. Inland owns and manages properties in all real estate sectors, including Retail, Office, Industrial and Apartments. Mr. Goodwin also serves as a director or officer of entities wholly owned or controlled by The Inland Group, Inc. In addition, Mr. Goodwin has served as the chairman of the board and chief executive officer of Inland Mortgage Investment Corporation since March 1990 and chairman and chief executive officer of Inland Bancorp, Inc., a bank holding company, since January 2001. Mr. Goodwin also served as a director of Inland Real Estate Corporation (“IRC”) from 2001 until its merger in March 2016, and served as its chairman of the board from 2004 to April 2008. Mr. Goodwin has served as a director and the chairman of the board of Inland Residential Properties Trust, Inc. (“IRPT”) since December 2013 and as a director and the chairman of the board of the IRPT business manager since December 2013.

Housing. Mr. Goodwin is a member of the National Association of Realtors, the Illinois Association of Realtors, the Northern Illinois Commercial Association of Realtors, and was inducted into the Hall of Fame of the Chicago Association of Realtors in 2005. He is also the author of a nationally recognized real estate reference book for the management of residential properties. Mr. Goodwin served on the Board of the Illinois State Affordable Housing Trust Fund. He served as an advisor for the Office of Housing Coordination Services of the State of Illinois, and as a member of the Seniors Housing Committee of the National Multi-Housing Council. He has served as Chairman of the DuPage County Affordable Housing Task Force. Mr. Goodwin also founded New Directions Affordable Housing Corporation, a not for profit entity.

Education. Mr. Goodwin obtained his bachelor degree from Northeastern Illinois University, in Chicago, and his master’s degree from Northern Illinois University, in DeKalb. Following graduation, he taught for five years in the Chicago Public Schools. Over the past twenty years, Mr. Goodwin served as a member of the Board of Governors of Illinois State Colleges and Universities, vice chairman of the Board of Trustees of Benedictine University, vice chairman of the Board of Trustees of Springfield College, and chairman of the Board of Trustees of Northeastern Illinois University.

We believe that Mr. Goodwin’s over 40 years of experience in real estate investing, commercial real estate brokerage, real estate securities, land development, construction and mortgage banking and lending, make him well qualified to serve as a member of our board of directors.

Gwen Henry, 75. Independent director since February 2012. Ms. Henry currently serves as the Treasurer of DuPage County, Illinois, a position she has held since December 2006. In this position, Ms. Henry is responsible for the custody and distribution of DuPage County funds. In addition, since April 1981, Ms. Henry has been partner in Dugan & Lopatka, a regional accounting firm based in Wheaton, Illinois, and a member of the firm’s controllership and consulting services practice, where she specializes in financial consulting and tax and business planning for privately-held companies. Since December 2009, Ms. Henry has also served as a member of the Illinois Municipal Retirement Fund, a $35 billion fund which has in excess of $1.2 billion allocated to real estate investments. She has served as Board president of the fund, and is currently vice chair of the investment committee, chairs the audit committee and serves on the legislative committee.

Ms. Henry previously served as DuPage County Forest Preserve Commissioner (from December 2002 to November 2006) and as chair to the special committee responsible for the DuPage County Budget (from December 2002 to November 2004), and was a member of the DuPage County Finance Committee (from November 1996 to November 2002). Ms. Henry also has held a number of board and chair positions for organizations such as the Marianjoy Rehabilitation Hospital (as treasurer from June 2002 to May 2008), the Central DuPage Health System (as chairperson of the board from October 1995 to September 1999), and the Central DuPage Hospital Foundation (as director from October 2002 to the present). She was elected Mayor of the City of Wheaton, Illinois from March 1990 to December 2002.

Ms. Henry received her bachelor degree from the University of Kansas, located in Lawrence. She is a certified public accountant, a designated certified public funds investment manager and a certified public finance administrator.

We believe that Ms. Henry’s over thirty years of public accounting experience makes her well qualified to serve as a member of our board of directors.

JoAnn M. McGuinness, 41.Director and our president and chief operating officer since August 2011. Ms. McGuinness has also served as director, president and chief operating officer for the Business Manager since August 2011. She has also served as executive vice president – portfolio strategy for IREIC since November 2015. She has served as the chief operating officer of IRPT and the IRPT business manager since October 2014 and served as chief executive officer of the IRPT real estate manager from April 2014 to October 2015. She was the chief executive officer of Inland Investment Real Estate Services, an entity responsible for all asset management, property management, leasing, marketing and operations for all of Inland’s real estate assets and funds from April 2013 to October 2015. Ms. McGuinness was a director of The Inland Group, Inc. from August 2012 to June 2015. Ms. McGuinness served as the president and chief executive officer of the entities owning the real estate manager for Inland Diversified from November 2009 through July 2014, and served as a director of those entities from September 2008 through July 2014. She also served as senior vice president of the entities owning the real estate manager for InvenTrust Properties Corp. (“InvenTrust”) from February 2007 to November 2009, and as president of real estate management for the portfolio of Inland Retail Real Estate Trust, Inc. (“IRRETI”) from December 2001 to February 2007. She was responsible for the management, leasing, marketing and operations of Inland Diversified’s properties and also oversaw the department that performs due diligence, including financial modeling, property inspection, capital projections and all other processes involved with purchasing an asset, for Inland. Ms. McGuinness joined Inland in 1992, in the multifamily/residential management division of Mid-America Management and began overseeing the management of retail, office and industrial properties in June 1995. She has experience with residential, student housing, hotels, retail, office and industrial properties.

Ms. McGuinness holds SCSM, SCLS, SCMD, SDCP and CDX accreditations with the International Council of Shopping Centers. Ms. McGuinness received her bachelors of science in business from Elmhurst College in Elmhurst, Illinois.

We believe that Ms. McGuinness’ extensive experience with Inland and her leadership qualities make her well qualified to serve as a member of our board of directors.

Bernard J. Michael, 56.Independent director since September 2014. Mr. Michael is a managing partner and founding member of AWH Partners, LLC, a privately held real estate investment, development and management firm. Since 2010, AWH has completed in excess of $400 million of hotel investments, and is managing or has completed hotel redevelopment projects totaling more than $100 million. In early 2012, AWH acquired Lane Hospitality, which it rebranded as Spire Hospitality, a top-tier national hospitality platform formed in 1980.

Mr. Michael has over 25 years of experience as a real estate attorney working on sophisticated real estate transactions across all asset classes for some of the world's largest property owners, developers and lenders. Prior to founding AWH Partners, Mr. Michael was the founder and senior partner of Michael, Levitt & Rubenstein, LLC, a law firm focusing on real estate sales, acquisitions, development, leasing and financing. Mr. Michael and his team worked on some of the largest transactions in New York City, including the development of Time Warner Center and the Hudson Yards projects for The Related Companies. In addition, Mr. Michael and his firm represented developers on major multi-family, retail, office and hospitality projects in China, Saudi Arabia, and in most major cities across the United States.

Prior to forming Michael Levitt, Mr. Michael was a partner in the Real Estate Group at Proskauer Rose, LLP. Prior to that Mr. Michael was an attorney at Weil, Gotschal & Manges and Shea & Gould. Mr. Michael is a graduate of Brown University and New York University School of Law.

We believe that Mr. Michael’s prior business experience and his leadership qualities make him well qualified to serve as a member of our board of directors.

Mitchell A. Sabshon, 63.Director since September 2014 and our chief executive officer since April 2014. Mr. Sabshon has also served as a director of the Business Manager since October 2013. Mr. Sabshon is also currently the chief executive officer, president and a director of IREIC, positions he has held since August 2013, January 2014 and September 2013, respectively. He is a director and the president and chief executive officer of IRPT and the IRPT business manager, positions he has held since December 2013. Mr. Sabshon has also served as a director of Inland Private Capital Corporation (“IPCC”) since September 2013 and a director of Inland Securities Corporation (“Inland Securities”) since January 2014.

Prior to joining Inland, Mr. Sabshon served as Executive Vice President and Chief Operating Officer of Cole Real Estate Investments. As Chief Operating Officer, Mr. Sabshon oversaw the company's finance, property management, asset management and leasing operations. Prior to joining Cole, Mr. Sabshon held several senior executive positions at leading financial services firms. He spent almost 10 years at Goldman, Sachs & Co. in various leadership positions including President and CEO of Goldman Sachs Commercial Mortgage Capital. He also served as a Senior Vice President in Lehman Brothers' real estate investment banking group. Prior to joining Lehman Brothers, Mr. Sabshon was an attorney in the corporate and real estate structured finance practice groups at Skadden, Arps, Slate, Meagher and Flom in New York. Mr. Sabshon is the Chair-Elect of the Investment Program Association for 2016. He is also a member of the Real Estate Roundtable, the International Council of Shopping Centers, the Urban Land Institute, the Commercial Real Estate Finance Council, the Mortgage Bankers Association, and The Chicago Council on Global Affairs. Mr. Sabshon is a member of the New York State Bar. He also holds a real estate broker license in New York. He received his undergraduate degree from George Washington University and his law degree at Hofstra University School of Law.

We believe that Mr. Sabshon’s extensive finance and real-estate experience make him well qualified to serve as a member of our board of directors.

RECOMMENDATION OF THE BOARD: The board recommends that you vote “FOR” the election of all seven nominees.

Independent Director Compensation

Effective June 1, 2015, we pay our independent directors an annual fee of $30,000 plus $1,250 for each in-person meeting of the board and $750 for each meeting of the board attended by telephone; we pay our independent directors $750 for each in-person meeting of each committee of the board and $500 for each meeting of each committee of the board attended by telephone; and we also pay the chairperson of the nominating and corporate governance committee of our board an annual fee of $7,500 and the chairperson of the audit committee of our board an annual fee of $10,000. Prior to June 1, 2015, we paid our independent directors an annual fee of $20,000 plus $1,000 for each in-person meeting of the board and $500 for each meeting of the board attended by telephone; we paid our independent directors $500 for each in-person meeting of each committee of the board and $350 for each meeting of each committee of the board attended by telephone; and we also paid the chairpersons of any committee of our board an annual fee of $5,000.

We reimburse all of our directors for any out-of-pocket expenses incurred by them in attending meetings. We do not compensate any director that also is an employee of the Business Manager or its affiliates.

The following table further summarizes compensation earned by the independent directors for the year ended December 31, 2015.

| | | Fees Earned in Cash ($) | All Other Compensation ($) | Total ($) |

| | Lee A. Daniels | 53,542 | - | 53,542 |

| | Stephen Davis | 48,583 | - | 48,583 |

| | Gwen Henry | 55,500 | - | 55,500 |

| | Bernard J. Michael | 39,583 | - | 39,583 |

Meetings of the Board of Directors, Committees and Stockholders

During the year ended December 31, 2015, our board met 17 times, the audit committee met four times and the nominating and corporate governance committee met four times.Each of our directors attended at least 75% of the aggregate amount of the meetings of the board during the period for which he or she was a director, and any committee on which he or she served, in 2015. We encourage our directors to attend our annual meeting of stockholders, and in 2015, each director, with the exception of Mr. Michael, did so attend.

EXECUTIVE COMPENSATION

Executive Officers

The board of directors annually elects our executive officers. These officers may be terminated at any time. Information about each of our executive officers, with the exception of Ms. McGuinness and Mr. Sabshon, whose biographies are included above, follows. All ages are stated as of January 1, 2016.

Catherine L. Lynch, 57.Our chief financial officer since April 2014, and a director of the Business Manager since August 2011. Ms. Lynch joined Inland in 1989 and has been a director of The Inland Group, Inc. since June 2012. She serves as the treasurer and secretary (since January 1995), the chief financial officer (since January 2011) and a director (since April 2011) of IREIC and as a director (since July 2000) and chief financial officer and secretary (since June 1995) of Inland Securities. She has also served as the chief financial officer of IRPT and the IRPT business manager since December 2013. She also served as the treasurer of the IRPT business manager from December 2013 to October 2014. Ms. Lynch also has served as treasurer of Inland Capital Markets Group, Inc. since January 2008 and as a director of IPCC since May 2012. Ms. Lynch served as a director and treasurer of Inland Investment Advisors, Inc. from June 1995 to December 2014 and as a director and treasurer of Inland Institutional Capital Partners Corporation from May 2006 to December 2014. Ms. Lynch worked for KPMG Peat Marwick LLP from 1980 to 1989. Ms. Lynch received her bachelor degree in accounting from Illinois State University in Normal. Ms. Lynch is a certified public accountant and a member of the American Institute of Certified Public Accountants and the Illinois CPA Society. Ms. Lynch also is registered with the Financial Industry Regulatory Authority, Inc. (“FINRA”) as a financial operations principal.

David Z. Lichterman, 55.Our treasurer and chief accounting officer, and the treasurer and chief accounting officer of the Business Manager, since July 2012. In addition, Mr. Lichterman has served as our vice president since April 2014. Mr. Lichterman has served as vice president and the treasurer and chief accounting officer of IRPT and the IRPT business manager since October 2014. Prior to joining Inland in June 2012, Mr. Lichterman was a consultant for Resources Global Professionals. Mr. Lichterman served as a senior vice president of accounting and financial reporting of Lillibridge Healthcare Services, Inc. until July 2011. Prior to joining Lillibridge in January 2003 as vice president, he owned and operated Lichterman Consulting from August 2001 until January 2003. Mr. Lichterman served as vice president/controller for the National Equity Fund, Inc. from July 1999 until May 2001, served as vice president of JMB Realty Corporation (JMB) from October 1998 to July 1999, as Partnership Accounting Manager at JMB from October 1991 to October 1998 and as senior partnership accountant at JMB from August 1989 to October 1991. In addition, from December 1986 to August 1989 he was a staff accountant at Levy Restaurant Corporation and from November 1984 to December 1986 he was a staff accountant at a local CPA firm, Hechtman & Associates. Mr. Lichterman has volunteered his time and efforts on the board of directors, as former treasurer, of the Leafs Hockey Club, Inc. and Firewagon Hockey, Inc., both registered 501(c)(3) organizations. He received a Bachelor of Science degree in Accounting and Business Administration from Illinois State University in Normal, Illinois. He is a member of the American Institute of Certified Public Accountants and the Illinois CPA Society, and is a Certified Public Accountant.

Roberta S. Matlin, 71. Our vice president, and the vice president of the Business Manager, since August 2011. Ms. Matlin joined IREIC in 1984 as director of investor administration and currently serves as a director and senior vice president of IREIC and senior vice president of The Inland Real Estate Group, Inc. Ms. Matlin also has been a director of IPCC since May 2001, a vice president of Inland Institutional Capital Partners Corporation since May 2006 and a director since August 2012. She also has served as a director and president of Inland Investment Advisors, Inc. since June 1995 and Intervest Southern Real Estate Corporation since July 1995, and a director and president of Inland Securities from July 1995 to March 1997 and director and vice president since April 1997. Ms. Matlin has served as a director of Pan American Bank since December 2007. She has served as vice president of administration of the IRPT business manager since December 2013. Ms. Matlin served as vice president of administration of Inland Diversified from June 2008 through July 2014 and also served as the president of Inland Diversified Business Manager & Advisor, Inc. from June 2008 through May 2009. Since April 2009 she has served as president of Inland Opportunity Business Manager & Advisor, Inc. She served as vice president of administration of InvenTrust since its inception in October 2004 through February 2014. She served as president of Inland American Business Manager & Advisor, Inc. from October 2004 until January 2012. Ms. Matlin served as vice president of administration of Inland Western Retail Real Estate Trust, Inc. from 2003 until 2007, vice president of administration of IRRETI from 1998 until 2004, vice president of administration of IRC from 1995 until 2000 and trustee and executive vice president of Inland Mutual Fund Trust from 2001 until 2004.

Prior to joining Inland, Ms. Matlin worked for the Chicago Region of the Social Security Administration of the United States Department of Health and Human Services. Ms. Matlin is a graduate of the University of Illinois in Champaign. She holds Series 7, 22, 24, 39, 63, 65, 79 and 99 licenses from FINRA and is a member of the Real Estate Investment Securities Association.

Cathleen M. Hrtanek,39. Our corporate secretary, and the secretary of the Business Manager, since August 2011. Ms. Hrtanek joined Inland in 2005 and is an associate counsel and vice president of The Inland Real Estate Group, Inc. In her capacity as associate counsel, Ms. Hrtanek represents many of the entities that are part of The Inland Real Estate Group of Companies on a variety of legal matters. She is also a member of the audit committee for a public partnership sponsored by IREIC. Ms. Hrtanek also has served as the secretary of IRPT and its business manager since December 2013, as the secretary of Inland Diversified from September 2008 through July 2014, and its business manager since September 2008, as the secretary of Inland Opportunity Business Manager & Advisor, Inc. since April 2009 and as the secretary of IPCC since August 2009. Prior to joining Inland, Ms. Hrtanek had been employed by Wildman Harrold Allen & Dixon LLP in Chicago, Illinois since September 2001. Ms. Hrtanek has been admitted to practice law in the State of Illinois and is a licensed real estate broker. Ms. Hrtanek received her bachelor degree from the University of Notre Dame in South Bend, Indiana and her law degree from Loyola University Chicago School of Law.

Compensation of Executive Officers

All of our executive officers are officers of IREIC or one or more of its affiliates and are compensated by those entities, in part, for services rendered to us. We neither compensate our executive officers nor reimburse either the Business Manager or Real Estate Managers for any compensation paid to individuals who also serve as our executive officers, or the executive officers of the Business Manager, our Real Estate Managers or their respective affiliates; provided that, for these purposes, a corporate secretary is not considered an “executive officer.” As a result, we do not have, and our board of directors has not considered, a compensation policy or program for our executive officers and has not included a “Compensation Discussion and Analysis,” a report from our board of directors with respect to executive compensation, a non-binding stockholder advisory vote on compensation of executives or a non-binding stockholder advisory vote on the frequency of the stockholder vote on executive compensation. The fees we pay to the Business Manager and Real Estate Managers under the business management agreement or the real estate management agreements, respectively, are described in more detail under “Certain Relationships and Related Transactions.”

In the future, our board may decide to pay annual compensation or bonuses or long-term compensation awards to one or more persons for services as officers. We also may, from time to time, grant restricted shares of our common stock to one or more of our officers. If we decide to pay our named executive officers in the future, the board of directors will review all forms of compensation and approve all stock option grants, warrants, stock appreciation rights and other current or deferred compensation payable to the executive officers with respect to the current or future value of our shares. In addition, the board will include the non-binding stockholder advisory votes on executive compensation and on the frequency of stockholder votes on executive compensation in the relevant proxy statement as required pursuant to Section 14A of the Exchange Act.

Certain Relationships and Related Transactions

Set forth below is a summary of the material transactions between the Company and various affiliates of IREIC, including the Business Manager and Real Estate Managers, during the year ended December 31, 2015. IREIC is an indirect wholly owned subsidiary of The Inland Group, Inc. Please see the biographical information of our directors and executive officers elsewhere in this proxy statement for information regarding their relationships to Inland, including IREIC and The Inland Group, Inc.

Business Management Agreement

We have entered into a business management agreement with IREIT Business Manager & Advisor Inc., which serves as the Business Manager with responsibility for overseeing and managing our day-to-day operations. Subject to satisfying the criteria described below, we pay the Business Manager an annual business management fee equal to 0.65% of our “average invested assets,” payable quarterly in an amount equal to 0.1625% of our average invested assets as of the last day of the immediately preceding quarter; provided that the Business Manager may decide, in its sole discretion, to be paid an amount less than the total amount to which it is entitled in any particular quarter, and the excess amount that is not paid may, in the Business Manager’s sole discretion, be waived permanently or deferred or accrued, without interest, to be paid at a later point in time. For the year ended December 31, 2015, the Business Manager was entitled to a business management fee of approximately $5.5 million, of which $0 was permanently waived.

As used herein, “average invested assets” means, for any period, the average of the aggregate book value of our assets, including all intangibles and goodwill, invested, directly or indirectly, in equity interests in, and loans secured by, properties, as well as amounts invested in securities and consolidated and unconsolidated joint ventures or other partnerships, before reserves for amortization and depreciation or bad debts, impairments or other similar non-cash reserves, computed by taking the average of these values at the end of each month during the relevant calendar quarter.

If the business management agreement is terminated, including in connection with the internalization of the functions performed by the Business Manager, the obligation to pay this business management fee will terminate.

We pay the Business Manager or its affiliates an acquisition fee equal to 1.5% of the “contract purchase price” of each real estate asset (excluding marketable securities) we acquire, including any incremental interest therein, including by way of exchanging a debt interest for an equity interest (excluding the contribution of an asset owned, directly or indirectly, by us to a joint venture) or developing, constructing, renovating, or otherwise physically improving an asset, including but not limited to major tenant upgrades, whether pursuant to allowances, concessions or rent abatements provided for at the time the asset is acquired. In the case of an asset acquired through a joint venture, the acquisition fee payable is proportionate to our ownership interest in the venture. For the year ended December 31, 2015, we incurred acquisition fees in an aggregate of approximately $12.1 million, of which $2.5 million was permanently waived.

For the purpose of calculating acquisition fees, the “contract purchase price” is equal to the amount of monies or other consideration paid or contributed by us either to acquire, directly or indirectly, any real estate asset or an incremental interest in the real estate asset, and including, without duplication, any indebtedness for money borrowed to finance the purchase, indebtedness secured by the real estate asset, which is assumed, or indebtedness that is refinanced or restructured, all in connection with the acquisition, and which is or will be secured by the real estate asset at the time of the acquisition, or to develop, construct, renovate or otherwise physically improve that real estate asset. The contract purchase price excludes acquisition fees and acquisition expenses.

If the business management agreement is terminated, including in connection with the internalization of the functions performed by the Business Manager, the obligation to pay this acquisition fee will terminate.

For substantial assistance in connection with the sale of properties, we will pay the Business Manager or its affiliates a real estate sales commission equal to the lesser of one-half of the customary commission which would be paid to a third party broker for the sale of a comparable property or 1% of the contract price of the property sold, provided that the amount, when added to all other real estate commissions paid to unaffiliated parties in connection with a sale, may not exceed the lesser of a competitive real estate commission or 3% of the sales price of the property. We did not sell any properties, and thus did not incur any real estate sales commissions, during the year ended December 31, 2015.

If the business management agreement is terminated, including in connection with the internalization of the functions performed by the Business Manager, the obligation to pay these commissions will terminate.

Upon a “triggering event,” we will pay the Business Manager a subordinated incentive fee equal to 10% of the amount by which (1) the “liquidity amount” (as defined below) exceeds (2) the “aggregate invested capital,” plus the total distributions required to be paid to our stockholders in order to pay them a 7% per annum cumulative, pre-tax non-compounded return on the aggregate invested capital, all measured as of the triggering event. If we have not satisfied this return threshold at the time of the applicable triggering event, the fee will be paid at the time of any future triggering event, provided that we have satisfied the return requirements. We did not experience a “triggering event,” and thus did not incur a subordinated incentive fee, during the year ended December 31, 2015.

As used herein, a “triggering event” means any sale of assets (excluding the sale of marketable securities) in which the net sales proceeds are specifically identified and distributed to our stockholders, or any liquidity event, such as a listing or any merger, reorganization, business combination, share exchange or acquisition, in which our stockholders receive cash or the securities of another issuer that are listed on a national securities exchange. “Aggregate invested capital” means the aggregate original issue price paid for the shares of our common stock, before reduction for organization and offering expenses, reduced by any distribution of sale or financing proceeds.

For purposes of this subordinated incentive fee, the “liquidity amount” will be calculated as follows:

| • | In the case of the sale of our assets, the net sales proceeds realized by us from the sale of assets since inception and distributed to stockholders, in the aggregate, plus the total amount of any other distributions paid by us from inception until the date that the liquidity amount is determined. |

| • | In the case of a listing or any merger, reorganization, business combination, share exchange, acquisition or other similar transaction in which our stockholders receive cash or the securities of another issuer that are listed on a national securities exchange, as full or partial consideration for their shares, the “market value” of the shares, plus the total distributions paid by us from inception until the date that the liquidity amount is determined. “Market value” means the value determined as follows: (1) in the case of the listing of our shares, or the common stock of our subsidiary, on a national securities exchange, by taking the average closing price over the period of thirty consecutive trading days during which our shares, or the shares of the common stock of our subsidiary, as applicable, are eligible for trading, beginning on the 180th day after the applicable listing, multiplied by the number of our shares, or the shares of the common stock of our subsidiary, as applicable, outstanding on the date of measurement; or (2) in the case of the receipt by our stockholders of securities of another entity that are trading on a national securities exchange prior to, or that become listed concurrent with, the consummation of the liquidity event, as follows: (a) in the case of shares trading before consummation of the liquidity event, the value ascribed to the shares in the transaction giving rise to the liquidity event, multiplied by the number of those securities issued to our stockholders in respect of the transaction; and (b) in the case of shares which become listed concurrent with the closing of the transaction giving rise to the liquidity event, the average closing price over the period of thirty consecutive trading days during which the shares are eligible for trading, beginning on the 180th day after the applicable listing, multiplied by the number of those securities issued to our stockholders in respect of the transaction. In addition, any distribution of cash consideration received by our stockholders in connection with any liquidity event will be added to the market value determined in accordance with clause (1) or (2). |

If the business management agreement is terminated pursuant to an internalization in accordance with the transition process set forth in that agreement, the Business Manager, or its successor or designee, will continue to be entitled to receive the subordinated incentive fee, on a prorated basis based on the duration of the Business Manager’s service to us. Specifically, in this case, the Business Manager, or its successor or designee, will be entitled to a fee equal to the product of: (1) the amount of the fee to which the Business Manager otherwise would have been entitled had the agreement not been terminated; and (2) the quotient of the number of days elapsed from the effective date of the agreement through the closing of the internalization, and the number of days elapsed from the effective date of the agreement through the date of the closing of the applicable triggering event.

Real Estate Management Agreements

We have entered into a real estate management agreement with Inland National Real Estate Services, LLC (“Inland National”) under which our Real Estate Managers and their affiliates manage or oversee each of our real properties. Inland National, an indirect wholly-owned subsidiary of our Sponsor, is transitioning its management responsibilities and personnel to Inland Commercial Real Estate Services LLC (“Inland Commercial”), which is also an indirect wholly-owned subsidiary of our Sponsor, and assigned its interest in the master real estate management agreement with us to Inland Commercial on January 1, 2016. Certain of our properties are managed by Inland Commercial, effective as of January 1, 2016. The remaining properties are still managed by Inland National, and their property management functions are expected to be transferred to Inland Commercial by July 1, 2016. For each property that is managed directly by our Real Estate Managers or their affiliates, we pay the applicable Real Estate Manager a monthly management fee of up to 1.9% of the gross income from any single-tenant, net-leased property, and up to 3.9% of the gross income from any other type of property. Each Real Estate Manager determines, in its sole discretion, the amount of the management fee payable in connection with a particular property, subject to these limits. For each property that is managed directly by one of our Real Estate Managers or its affiliates, we pay the Real Estate Manager a separate leasing fee based upon prevailing market rates applicable to the geographic market of that property. If we engage our Real Estate Managers to provide construction management services for a property, we also pay a separate construction management fee based upon prevailing market rates applicable to the geographic market of that property. We also reimburse our Real Estate Managers and their affiliates for property-level expenses that they pay or incur on our behalf, including the salaries, bonuses and benefits of persons performing services for our Real Estate Managers and their affiliates (excluding the executive officers of our Real Estate Managers). For the year ended December 31, 2015, we incurred real estate management fees in an aggregate amount equal to approximately $2.8 million.

Dealer Manager Agreement

We were a party to a dealer manager agreement with Inland Securities, the dealer manager for our “best efforts” offering which concluded on October 16, 2015. Inland Securities was entitled to receive a selling commission equal to 7% of the sale price for each share sold in the “best efforts” offering and a marketing contribution equal to 3% of the gross offering proceeds from shares sold in the “best efforts” offering. We also reimbursed Inland Securities for bona fide out-of-pocket, itemized and detailed due diligence expenses, in amounts up to 0.5% of the gross offering proceeds. These expenses were reimbursed from amounts paid or reallowed (paid) to Inland Securities or soliciting dealers as a marketing contribution, and thus there were no additional costs to us. For the year ended December 31, 2015, we incurred selling commissions and a marketing contribution totaling approximately $28.4 million and $12.4 million, respectively, both of which did not include payments for any bona fide out-of-pocket, itemized and detailed due diligence expenses. Inland Securities reallowed, in the aggregate, approximately $34.0 million of these fees to soliciting dealers.

In addition, we reimbursed IREIC, its affiliates and third parties for any issuer costs that they paid on our behalf, including any bona fide out-of-pocket, itemized and detailed due diligence expenses not reimbursed from amounts paid or reallowed as a marketing contribution, in an amount not to exceed 1.5% of the gross offering proceeds from shares sold in our “best efforts” offering over the life of the offering. For the year ended December 31, 2015, these costs totaled approximately $0.4 million. The Business Manager or its affiliates were to pay or reimburse any organization and offering expenses, including any “issuer costs,” that exceed 11.5% of the gross offering proceeds from shares sold in our “best efforts” offering over the life of the offering. However, total organization and offering expenses, including any “issuer costs,” did not exceed 11.5% of the gross offering proceeds from shares sold in our “best efforts” offering over the life of the offering.

Other Fees and Expense Reimbursements

We reimburse the Business Manager, Real Estate Managers and entities affiliated with each of them, such as Inland Real Estate Acquisitions, Inc. (“IREA”), Inland Institutional Capital Partners Corporation and their respective affiliates, as well as third parties, for any investment-related expenses they pay in connection with selecting, evaluating or acquiring any investment in real estate assets, regardless of whether we acquire a particular real estate asset, subject to the limits in our charter. Examples of reimbursable expenses include but are not limited to legal fees and expenses, travel and communications expenses, costs of appraisals, accounting fees and expenses, third-party broker or finder’s fees, title insurance expenses, survey expenses, property inspection expenses and other closing costs. We do not reimburse acquisition expenses in connection with an investment in marketable securities, except that we may reimburse expenses incurred on our behalf and payable to a third party, such as third-party brokerage commissions. For the year ended December 31, 2015, we incurred approximately $1.4 million in acquisition expenses.