Inland Income Trust Portfolio Update & 2020 Valuation Webcast March 11, 2021 THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY. Exhibit 99.1

DISCLAIMER This material is neither an offer to sell nor the solicitation of an offer to buy any security, which can be made by us to the public only by a prospectus that has been filed or registered with appropriate state and federal regulatory agencies and may be sold only by broker dealers and registered investment advisors authorized to do so. Past performance is not a guarantee of future results. The companies depicted in the photographs and logos in this presentation may be tenants of Inland Real Estate Income Trust, Inc. (Inland Income Trust or the Company) and may have proprietary interests in their trademarks and trade names and nothing herein shall be considered an endorsement, authorization or approval of Inland Income Trust or its subsidiaries. The Inland name and logo are registered trademarks being used under license. Publication Date: 3/11/2021 2 | COMPANY UPDATE

RISK FACTORS Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; competition for retail tenants from Internet sales and deliveries; tenants’ inability to pay rent, including amounts deferred because of the effects of the COVID-19 pandemic; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing. An investment in Inland Income Trust’s shares involves significant risks , including risks related to the effects of the COVID-19 pandemic in general and in particular on many of our non-grocery tenants. If Inland Income Trust is unable to effectively manage these risks, it may not meet its investment objectives and investors may lose some or all of their investment. Some of the risks related to investing in Inland Income Trust include, but are not limited to: there is limited or no liquidity because shares are not bought and sold on an exchange; the Company’s Share Repurchase Program (SRP) may be modified or terminated and, even if investors are able to sell their shares under the SRP or otherwise, they may not be able to recover the amount of their investment in the Company’s shares; Inland Income Trust may not be able to successfully implement its long-term strategic plan described further in this presentation; there is no guarantee that a liquidity event will occur; distributions cannot be guaranteed and have been and may be paid from sources other than cash flow from operations or earnings, including borrowings and proceeds of the Company’s Distribution Reinvestment Plan; and failure to continue to qualify as a REIT and thus being subject to federal and state income tax on its taxable income at regular corporate rates. Please consult Inland Income Trust’s most recent Annual Report on Form 10-K as of December 31, 2019 filed on March 18, 2020 and any subsequent Quarterly Report on Form 10-Q for more information on the specific risks. The SRP is subject to numerous restrictions, may be amended, suspended or terminated by the Company’s board of directors at any time, and should not be relied upon as a source of liquidity. 3 | COMPANY UPDATE

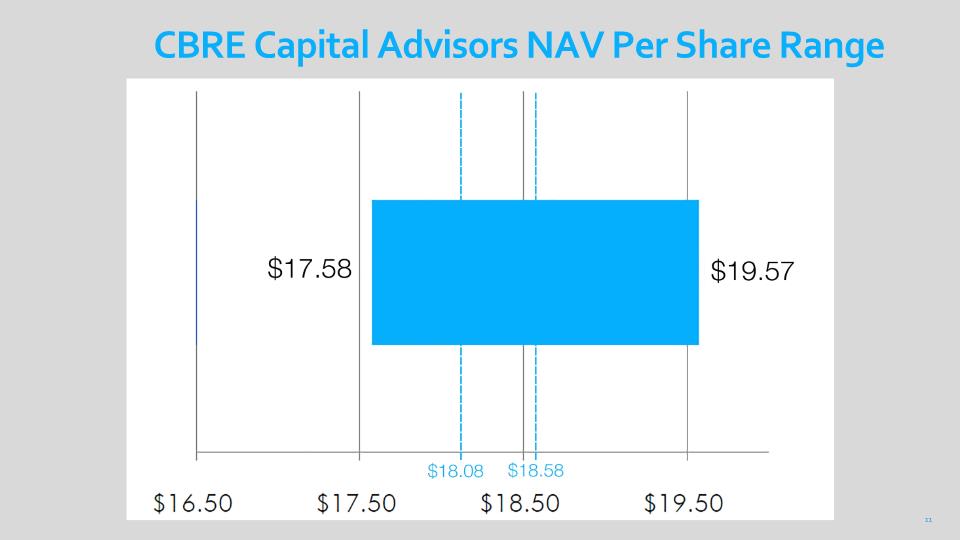

VALUATION DISCLOSURE 4 | COMPANY UPDATE Our estimated per share net asset value (NAV) represents a snapshot in time, will likely change, and does not necessarily represent the amount a stockholder would receive now or in the future for his or her shares of the Company’s common stock. Stockholders should not rely on the estimated per share NAV in making a decision to buy or sell shares of our common stock. The estimated per share NAV is based on a number of assumptions, estimates and data that are inherently imprecise and susceptible to uncertainty and changes in circumstances, including changes to the value of individual assets as well as changes and developments in the real estate and capital markets, changes in interest rates, and changes in the composition of the Company’s portfolio. Throughout the valuation process, the Company’s board of directors, business manager and senior members of management reviewed, confirmed and approved the processes and methodologies used by CBRE Capital Advisors, Inc., a FINRA registered broker dealer firm that specializes in providing real estate financial services, and their consistency with real estate industry standards and best practices. The board of directors then reviewed the valuation report provided by CBRE Capital Advisors and determined the estimated per share value NAV. CBRE Capital Advisors’ valuation materials were prepared on a confidential basis and were addressed solely to the Company to assist its board of directors in establishing the estimated per share NAV. CBRE Capital Advisors’ valuation materials were not addressed to the public and should not be relied upon by any other person to establish an estimated value of the Company’s common stock. CBRE Capital Advisors’ valuation materials do not constitute a fairness opinion for a potential or contemplated transaction and should not be represented as such. Neither CBRE Capital Advisors nor any of its affiliates is responsible for the board of directors’ determination of the estimated per share NAV, the repurchase price for shares under the Company’s share repurchase program (SRP) or the purchase price for shares under the Company’s distribution reinvestment plan (DRP). CBRE Capital Advisors assumed that the financial forecasts and other information and data provided to or otherwise reviewed by or discussed with CBRE Capital Advisors were reasonably prepared in good faith on bases reflecting the best then currently available estimates and judgments (including subjective judgments) of management of the Company and relied upon the Company to advise CBRE Capital Advisors promptly if any information previously provided became inaccurate or was required to be updated during its review. CBRE Capital Advisors assumes no obligation to update or otherwise revise these materials. CBRE Capital Advisors made numerous assumptions as of various points in time in its preparation of valuation materials. In the ordinary course of its business, CBRE Capital Advisors, its affiliates, directors and officers may trade or otherwise structure and effect transactions in the shares or assets of the Company for its own account or for the accounts of its customers and, accordingly, may at any time hold a long or short position, finance positions or otherwise structure and effect transactions in the Company’s shares or assets. CBRE Capital Advisors is an affiliate of CBRE Group, Inc. (CBRE), a parent holding company of affiliated companies that are engaged in the ordinary course of business in many areas related to commercial real estate and related services. Through CBRE's affiliates, CBRE may have in the past, and may from time to time in the future, perform one or more roles in a transaction related to the Company or its affiliates. CBRE Capital Advisors is not a legal, accounting or tax expert, and makes no representation or warranty as to the sufficiency or adequacy of its valuation materials with respect to such issues. Nothing contained therein should be construed as tax, accounting or legal advice.

FORWARD-LOOKING STATEMENTS In addition to historical information, this presentation contains "forward-looking statements" made under the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. The statements may be identified by terminology such as "may," “can,” "would," “will,” "expect," "intend," "estimate," "anticipate," "plan," "seek," "appear," or "believe." Such statements reflect the current view of Inland Income Trust with respect to future events and are subject to certain risks, uncertainties and assumptions related to certain factors described above and other factors detailed under Risk Factors in our most recent Form 10-K and subsequent Form 10-Qs on file with the Securities and Exchange Commission. Although Inland Income Trust believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. You should exercise caution when considering forward-looking statements and not place undue reliance on them. Based upon changing conditions, should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Except as required by federal securities laws, Inland Income Trust undertakes no obligation to publicly update or revise any written or oral forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason after the date of this presentation. 5 | COMPANY UPDATE

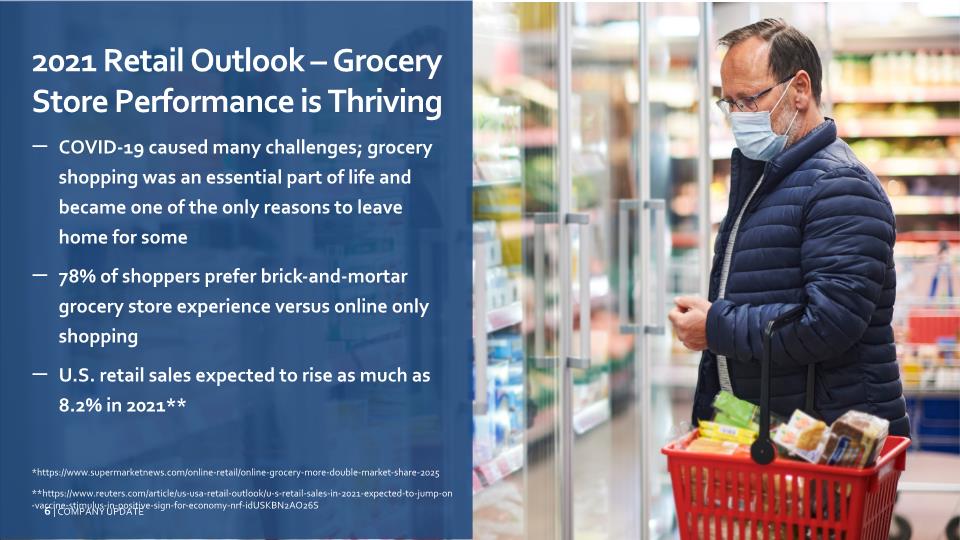

2021 Retail Outlook – Grocery Store Performance is Thriving COVID-19 caused many challenges; grocery shopping was an essential part of life and became one of the only reasons to leave home for some 78% of shoppers prefer brick-and-mortar grocery store experience versus online only shopping U.S. retail sales expected to rise as much as 8.2% in 2021** *https://www.supermarketnews.com/online-retail/online-grocery-more-double-market-share-2025 **https://www.reuters.com/article/us-usa-retail-outlook/u-s-retail-sales-in-2021-expected-to-jump-on-vaccine-stimulus-in-positive-sign-for-economy-nrf-idUSKBN2AO26S 6 | COMPANY UPDATE

* Data as of December 31, 2020 44 Properties 21 States 93.3% Economic Occupancy 691 Tenants 6.47 Million Sq. Ft. INLAND INCOME TRUST PORTFOLIO OVERVIEW 7 | COMPANY UPDATE

* Data as of December 31, 2020 36 new leases executed in 2020 INLAND INCOME TRUST PORTFOLIO HIGHLIGHTS 8 | COMPANY UPDATE +78% of tenants renewed leases in 2020 93.3% occupancy +85% of properties anchored or shadow-anchored by a grocer

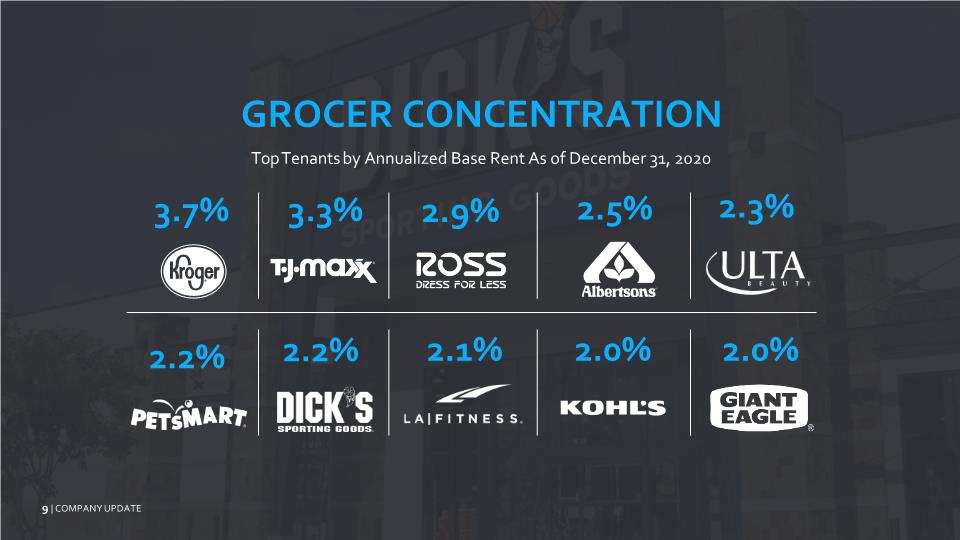

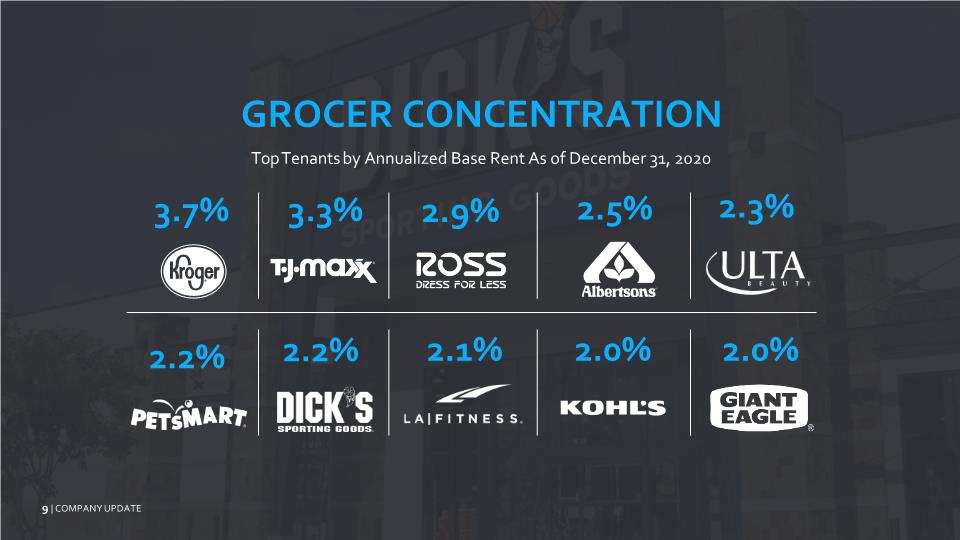

GROCER CONCENTRATION Top Tenants by Annualized Base Rent As of December 31, 2020 3.7% 3.3% 2.2% 2.9% 2.5% 2.3% 2.1% 2.0% 2.0% 9 | COMPANY UPDATE 2.2%

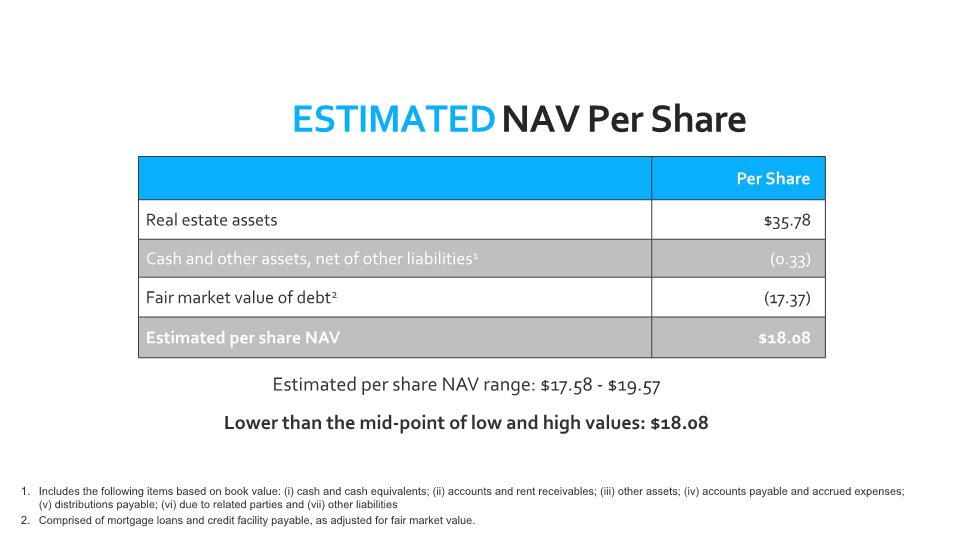

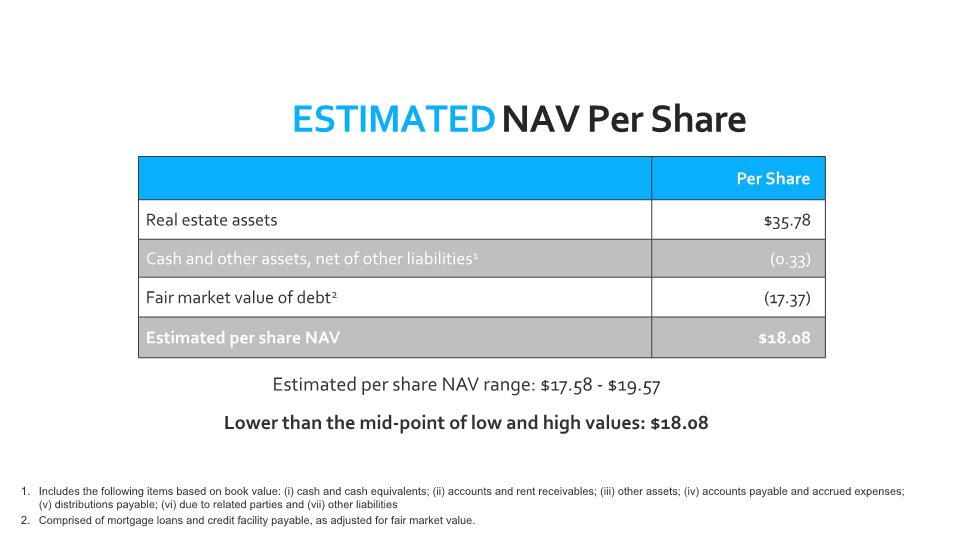

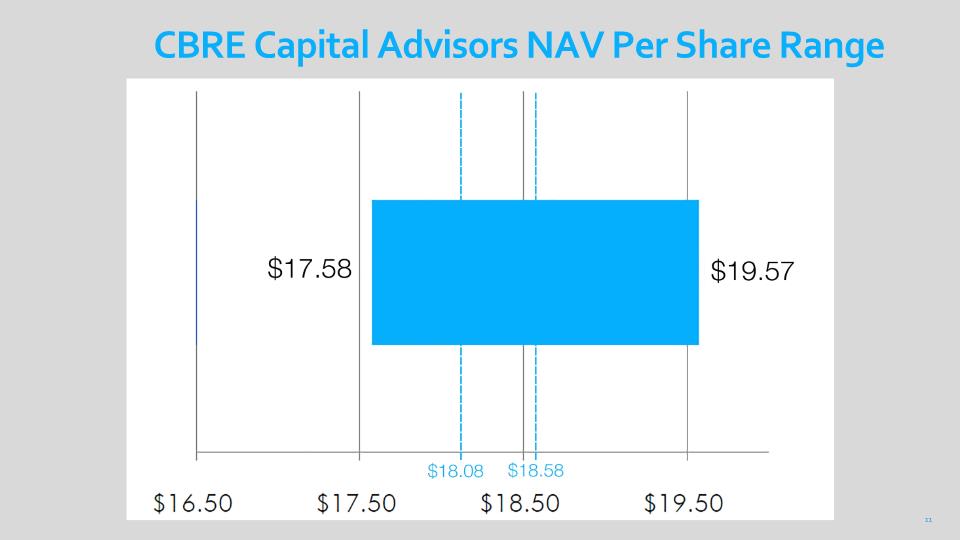

Estimated NAV Per Share Includes the following items based on book value: (i) cash and cash equivalents; (ii) accounts and rent receivables; (iii) other assets; (iv) accounts payable and accrued expenses; (v) distributions payable; (vi) due to related parties and (vii) other liabilities Comprised of mortgage loans and credit facility payable, as adjusted for fair market value. Estimated per share NAV range: $17.58 - $19.57 Lower than the mid-point of low and high values: $18.08 ESTIMATED NAV Per Share

11 CBRE Capital Advisors NAV Per Share Range

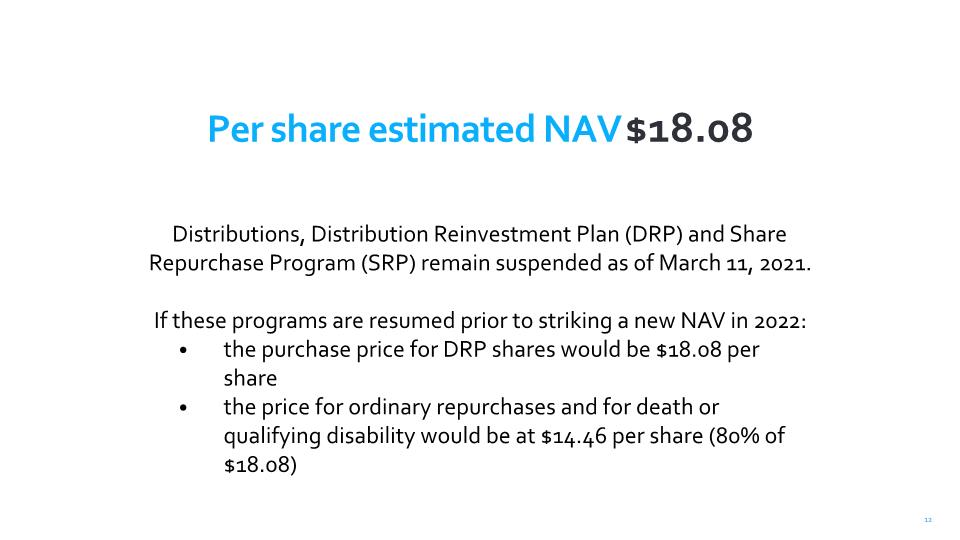

Repricing of Shares 12 Distributions, Distribution Reinvestment Plan (DRP) and Share Repurchase Program (SRP) remain suspended as of March 11, 2021. If these programs are resumed prior to striking a new NAV in 2022: the purchase price for DRP shares would be $18.08 per share the price for ordinary repurchases and for death or qualifying disability would be at $14.46 per share (80% of $18.08) Per share estimated NAV $18.08

LONG-TERM PLAN* Move toward a liquidity event, market conditions permitting, potentially through a listing on a public securities exchange * There can be no assurance that the Company’s long-term plan will not evolve or change over time or that the Company will be able to successfully implement the plan, including listing the Company’s common stock. No strategic asset sales or purchases have occurred since the onset of the pandemic, and none are expected or likely to occur until the full effects of the COVID-19 pandemic are known and begin to subside. We expect that no liquidity event will occur before the adverse effects of the COVID-19 pandemic on the economy and the retail commercial real estate market subside. 13 | COMPANY UPDATE

Thank you for joining us!