2021 ANNUAL STOCKHOLDERS MEETING DECEMBER 2, 2021 | 11:00 AM CST THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY. Exhibit 99.1

DISCLAIMER This material is neither an offer to sell nor the solicitation of an offer to buy any security, which can be made only by a prospectus that has been filed or registered with appropriate state and federal regulatory agencies and sold only by broker dealers and registered investment advisors authorized to do so. Past performance is not a guarantee of future results. The companies depicted in the photographs and logos in this presentation are tenants of Inland Real Estate Income Trust, Inc. (Inland Income Trust or the Company) and may have proprietary interests in their trademarks and trade names and nothing herein shall be considered an endorsement, authorization or approval of Inland Income Trust or its subsidiaries. The Inland name and logo are registered trademarks being used under license. Publication Date: 12/2/2021 2 | COMPANY UPDATE

RISK FACTORS We are subject to risks associated with a pandemic, epidemic or outbreak of a contagious disease, such as the ongoing global COVID-19 pandemic, including negative impacts on our tenants and their respective businesses, and we have agreed to defer a significant amount of rent owed to us, which tenants will be obligated to pay over time in addition to their regular rent but which they may not be able or willing to pay, particularly those whose results of operations or future prospects have been materially adversely affected by the COVID-19 pandemic or become so affected; Market disruptions resulting from the economic effects of the COVID-19 pandemic have adversely impacted many aspects of our operating results and financial condition, and ongoing or future disruptions from the pandemic or otherwise may again adversely impact our results and financial condition, including our ability to service our debt obligations, borrow additional monies or pay distributions; There is no established public trading market for our shares, our stockholders cannot currently sell their shares under our share repurchase program (as amended, “SRP”), which was suspended during the COVID-19 pandemic and may be suspended again, amended or terminated in our sole discretion, and even when repurchases are made pursuant to the SRP, the SRP is subject to limits, and stockholders may not be able to sell all of the shares they would like to sell; Even if our stockholders are able to sell their shares under the SRP, or otherwise, they may not be able to recover the amount of their investment in our shares; There is no assurance our board of directors will pursue a listing or other liquidity event at any time in the future, particularly in light of the COVID-19 pandemic; Our charter generally limits the total amount we may borrow to 300% of our net assets, equivalent to 75% of the costs of our assets; Inland Real Estate Investment Corporation (our “Sponsor”) may face a conflict of interest in allocating personnel and resources between its affiliates, our Business Manager (as defined below) and Inland Commercial Real Estate Services LLC, referred to herein as our “Real Estate Manager”; We do not have arm’s-length agreements with our Business Manager, our Real Estate Manager or any other affiliates of our Sponsor; We pay fees, which may be significant, to our Business Manager, Real Estate Manager and other affiliates of our Sponsor; Our Business Manager and its affiliates face conflicts of interest caused by, among other things, their compensation arrangements with us, which could result in actions that are not in the long-term best interests of our stockholders; Our properties may compete with the properties owned by other programs sponsored by our Sponsor or Inland Private Capital Corporation or other affiliates for, among other things, tenants; 3 | COMPANY UPDATE

RISK FACTORS Our Business Manager is under no obligation, and may not agree, to forgo or defer its business management fee; If we fail to continue to qualify as a REIT, our operations and distributions to stockholders, if any, will be adversely affected; and The Company’s strategic plan may continue to evolve or change over time, and there is no assurance we will be able to successfully achieve our board’s objectives under the strategic plan, including making strategic sales or purchases of properties, redeveloping properties or listing our common stock, within the timeframe we expect or would prefer or at all; We intend to pursue redevelopment activities, which are subject to a number of risks, including, but not limited to: expending resources to determine the feasibility of the project or projects that are then not pursued or completed; construction delays or cost overruns; failure to meet anticipated occupancy or rent levels within the projected time frame, if at all; exposure to fluctuations in the general economy due to the significant time lag between commencing and completing the project; and reduced rental income during the period of time we are redeveloping an asset or assets; The use of the internet by consumers to shop is expected to continue to expand, and this expansion has likely been accelerated by the effects of the COVID-19 pandemic, which would result in a further downturn in the business of our current tenants in their “brick and mortar” locations and could affect their ability to pay rent and their demand for space at our retail properties; and We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in credit markets of the United States from time to time, including disruptions and dislocations caused by the ongoing COVID-19 pandemic. 4 | COMPANY UPDATE

FORWARD-LOOKING STATEMENTS Certain statements in this presentation constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The statements may be identified by terminology such as “may,” “can,” “would,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “seek,” “appear,” or “believe.” Such statements reflect the current view of the Company with respect to future events and are subject to certain risks, uncertainties and assumptions related to certain factors including, without limitation, the uncertainties related to general economic conditions, the effects of the COVID-19 pandemic and measures taken to combat it, competition with our tenants from internet businesses, unforeseen events affecting the commercial real estate industry, retail real estate, or particular markets, and other factors detailed under Risk Factors in our most recent Form 10-K as of December 31, 2020, filed on March 18, 2021, and subsequent Form 10-Qs on file with the SEC. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. You should exercise caution when considering forward-looking statements and not place undue reliance on them. Based upon changing conditions, should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Except as required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason after the date of this presentation. We intend for forward-looking statements to be covered by the applicable safe harbor provisions created by Section 27A of the Securities Act and Section 21E of the Exchange Act. 5 | COMPANY UPDATE

* Data as of September 30, 2021 44 Properties 21 States 94.6% Economic Occupancy 707 Tenants 6.48 Million Sq. Ft. INLAND INCOME TRUST PORTFOLIO OVERVIEW 6 | COMPANY UPDATE

As of September 30, 2021, our primarily grocery-anchored portfolio consisted of 44 shopping centers located in 21 states, totaling approximately 6.48 million square feet. Our centers are currently occupied by 707 tenants, and our economic occupancy of 94.6% highlights that our centers are well-located. We continue to closely monitor the impact of the COVID-19 pandemic on all aspects of our business and locations, including how it is impacting our tenants and vendors. The Company entered into rent deferrals and abatements, and lease modifications, with a number of tenants early during the pandemic in order to maintain occupancy and maximize financial performance. These deferrals, modifications and rent abatements have proven effective helping our tenants endure the economic impacts of the pandemic. As of September 30, 2021, our deferred rent balance was $0.8 million, down from $4.5 million at December 31, 2020, due primarily to collections during the nine months ended September 30, 2021. While we are optimistic due to favorable retail real estate and retail sales trends, we, of course, cannot predict the future impact that the COVID-19 pandemic will have on our company. Prior to the pandemic, a mere 4% of grocery sales in the United States were transacted online in 2019.1 Now, with the pandemic accelerating consumers’ desires for digital grocery shopping services, that number jumped to approximately 10% of total grocery sales in 2020 – and that number is expected to continue to grow to more than 21% of total U.S. grocery sales by 2025.2 As a result of that trend, we will continue to work with industry leading grocers that are focused on online and in-store shopping trends, which will remain critical as the industry transforms. 1 - Google Trends. ` 2 - Supermarket News. Online grocery to more than double market share by 2025. September 18, 2021. https://www.supermarketnews.com/online-retail/online-grocery-more-double-market-share-2025 Slide 6 Notes

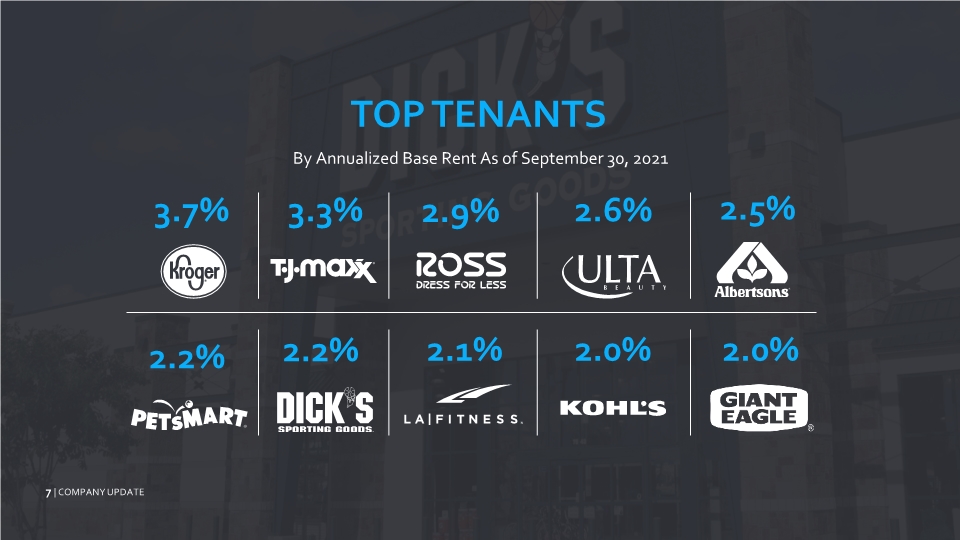

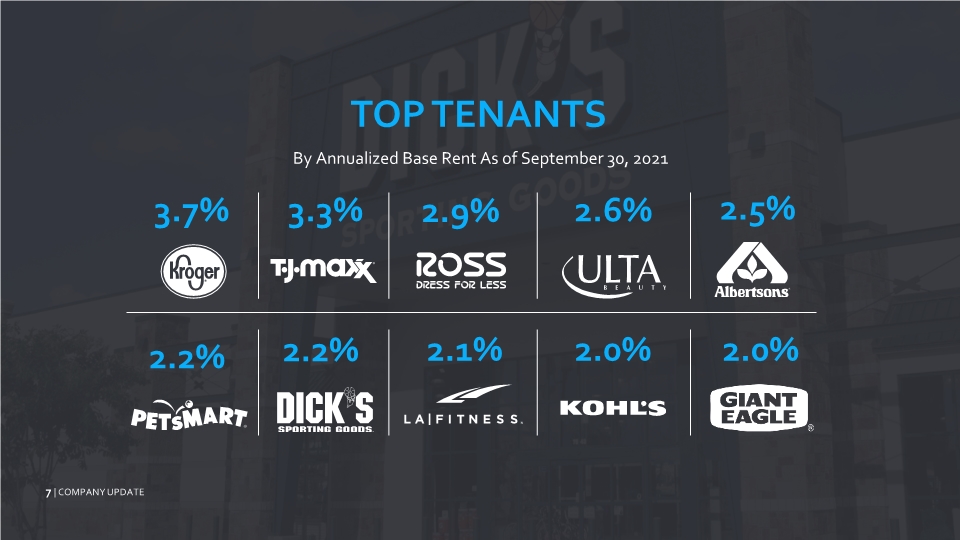

TOP TENANTS By Annualized Base Rent As of September 30, 2021 3.7% 3.3% 2.2% 2.9% 2.5% 2.1% 2.0% 2.0% 7 | COMPANY UPDATE 2.2% 2.6%

Through the third quarter, 2021 has been a year of solid operational performance. As of September 30, 2021, our geographic footprint based on annualized base rent, or ABR, is diversified across the United States. 13% of our properties are in the west, 28% in the south, 35% in the midwest, and 24% in the east. We have three leading grocers in our top tenant list, comprising 8.2% of the portfolio ABR. Our top five tenants, based on ABR, as of the third quarter of 2021, include: Kroger T.J. Maxx/HomeGoods/Marshalls Ross Dress for Less Ulta Beauty Albertsons Slide 7 Notes

LONG-TERM PLAN* Move toward a liquidity event, market conditions permitting, potentially through a listing on a public securities exchange * There can be no assurance that the Company’s long-term plan will not evolve or change over time or that the Company will be able to successfully implement the plan, including listing the Company’s common stock. 8| COMPANY UPDATE

The Inland Income Trust board of directors approved a strategic plan in February 2019, with the goals of providing future liquidity to investors and creating long-term stockholder value. In May 2020, we announced that because of the impact of COVID-19 and potential future impacts that we may choose not to make any acquisitions, dispositions or engage in any redevelopment projects until we can accurately assess the post-crisis market conditions. We also said: (1) we would revise the plan if we believe doing so is in the Company’s best interest and that the effects of COVID-19 and any such decisions we may make could have an impact on the timing of the execution of our strategic plan, including a future liquidity event, and (2) that our management team would be focused on navigating the pandemic and mitigating its effects on our portfolio. We disclosed in our most recent Quarterly Report that we believe increasing the size and profitability of the Company would enhance our ability to complete a successful liquidity event, and to that end we will, from time-to-time, seek and evaluate potential acquisitions and may, for example, opportunistically acquire a portfolio of retail properties that we believe complements our existing portfolio in terms of relevant characteristics such as tenant mix, demographics and geography and is consistent with our plan to own a portfolio substantially all of which is comprised of grocery-anchored or shadow-anchored properties. We may also consider other transactions, such as redeveloping certain of our properties or portions of certain of our properties, for example, big-box spaces, to repurpose them for alternative commercial uses. We expect to consider liquidity events, including listing our common stock on a national securities exchange, and have accordingly requested that stockholders approve changes to the Company’s corporate charter that are being voted upon today. However, given our intention to opportunistically grow the portfolio, consider redevelopment opportunities, and execute strategic sales and acquisitions in the context of fluid and rapidly changing retail market conditions resulting from the effects of the COVID-19 pandemic and other complex factors such as internet retail competition, the state of the commercial real estate markets and financial markets, and our ability to raise capital on terms that are acceptable to the Company, we cannot provide certainty as to when we will complete a liquidity event. Slide 8 Notes

RETAIL MARKET UPDATE Shoppers remained active at the end of summer 2021 with a boost from back-to-school sales1 Core retail sales increased by 0.7% in September, with an overall gain in core retail sales of 13.5% since September 20202 Total retail foot traffic is up 16% YOY2 Grocery stores have registered 7.5% in annual sales growth2 Retail is well-positioned for recovery1 9 | COMPANY UPDATE Marcus & Millichap Research Brief; Retail Sales. September 2021. Marcus & Millichap Research Brief; Retail Sales. October 2021.

Consumers remained active through the summer 2021, with a boost in retail sales from back-to-school buying as children across the country prepared to re-enter the classroom.1 Core retail sales increased by 0.7% in September, with an overall gain in core retail sales of 13.5% since September 2020.2 Year over year, total foot traffic is up 16%.2 Grocery stores have registered nearly equal gains in annual sales growth at 7.5% and grocery store visits at 8.3%.2 Macroeconomic hallmarks of 2021 to-date include growing inflation and increased prices for a wide range of goods and services, low unemployment with a significant number of companies looking to fill roles, wage gains and low interest rates. With that, I will turn it over to the Chief Financial Officer, to take a deep dive into our financials. 1 - Marcus & Millichap Research Brief; Retail Sales. September 2021. 2 - Marcus & Millichap Research Brief; Retail Sales. October 2021. Slide 9 Notes

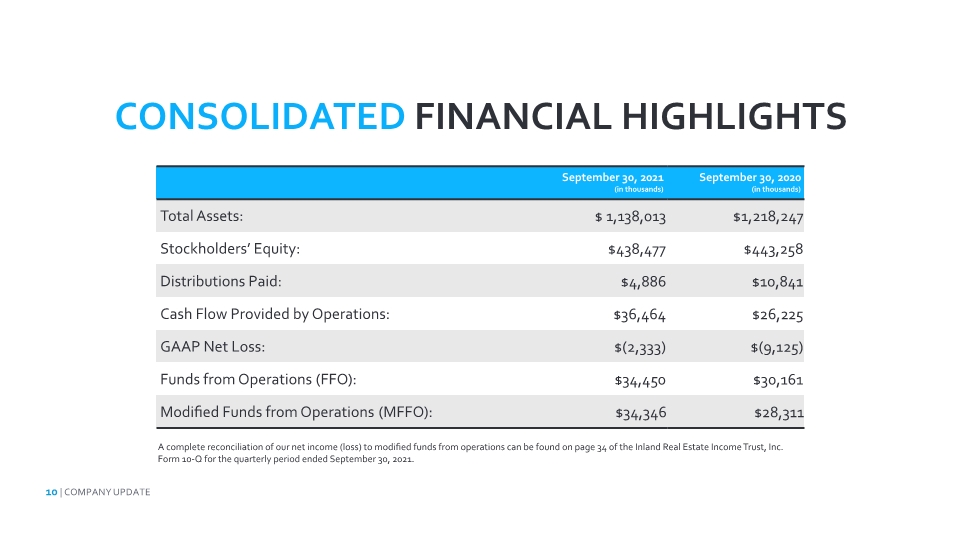

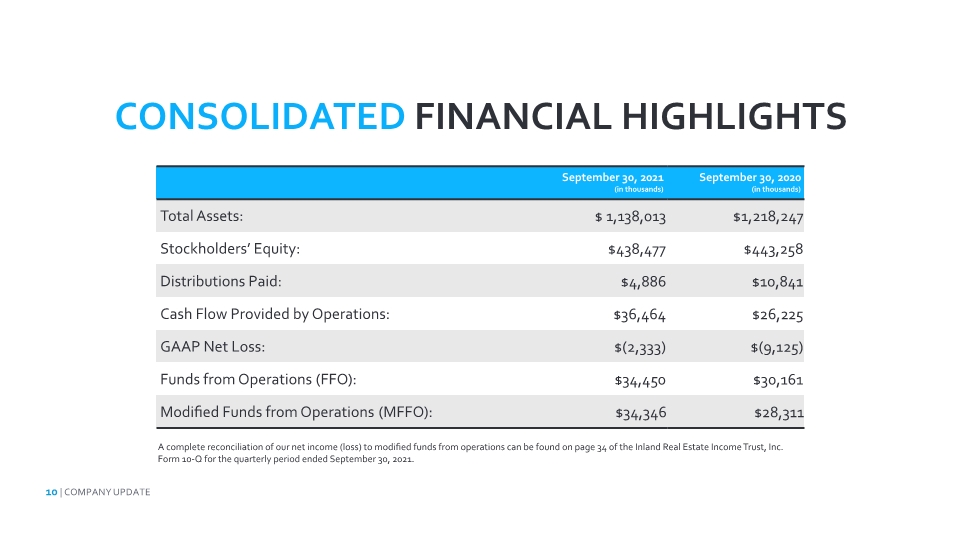

CONSOLIDATED FINANCIAL HIGHLIGHTS A complete reconciliation of our net income (loss) to modified funds from operations can be found on page 34 of the Inland Real Estate Income Trust, Inc. Form 10-Q for the quarterly period ended September 30, 2021. 10 | COMPANY UPDATE

Total assets as of September 30, 2021 were approximately $1.14 billion, which is comparable to September 30, 2020. Stockholders’ equity as of September 30, 2021 was approximately $438 million, again, comparable to the prior year. No distributions were paid during the majority of 2020 and the first six months of 2021 due to the uncertainty surrounding the COVID-19 pandemic and the need to preserve cash for the payment of operating and other expenses such as debt payments. The Company began paying quarterly distributions in July 2021, with approximately $4.9 million distributions paid in the third quarter of 2021. Funds from Operations, or FFO, for the 9 months ended September 30, 2021 were approximately $34.5 million. MFFO for the same period was approximately $34.4 million. Both FFO and MFFO increased in 2021 due to property operations continuing to stabilize from the impacts of the pandemic. Slide 10 Notes

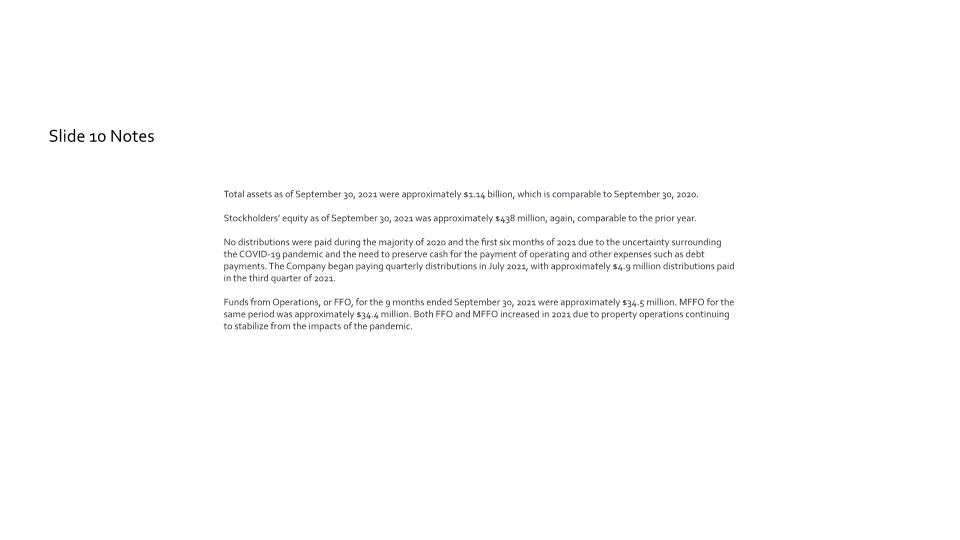

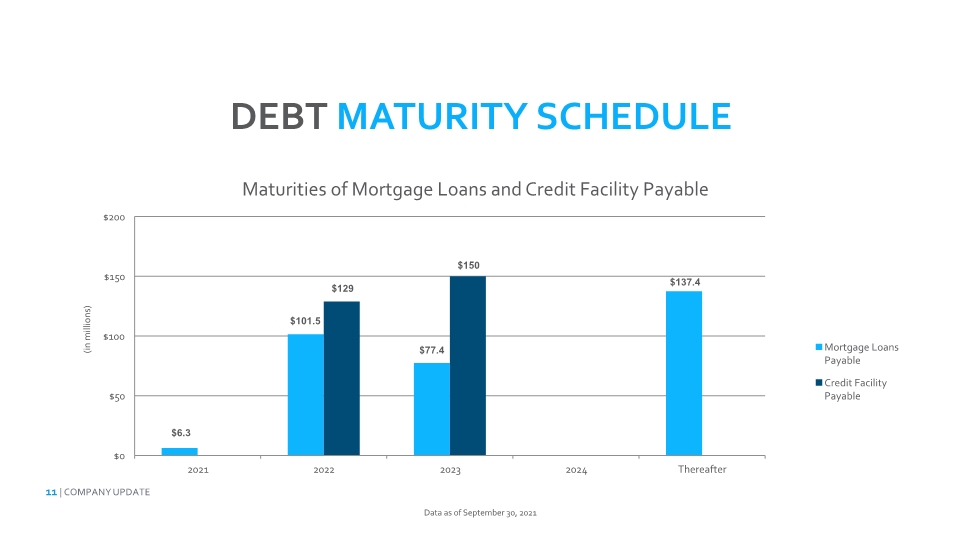

DEBT MATURITY SCHEDULE Maturities of Mortgage Loans and Credit Facility Payable (in millions) $6.3 $77.4 $137.4 $101.5 Data as of September 30, 2021 $129 $150 11 | COMPANY UPDATE

As of September 30, 2021, Inland Income Trust had outstanding mortgage loans comprised of both fixed and floating-rate debt and borrowings on our credit facility totaling approximately $603.6 million with a weighted average interest rate of 3.41%. The weighted average years to maturity for the Company’s mortgage loans and credit facility was approximately 2 years. Slide 11 Notes

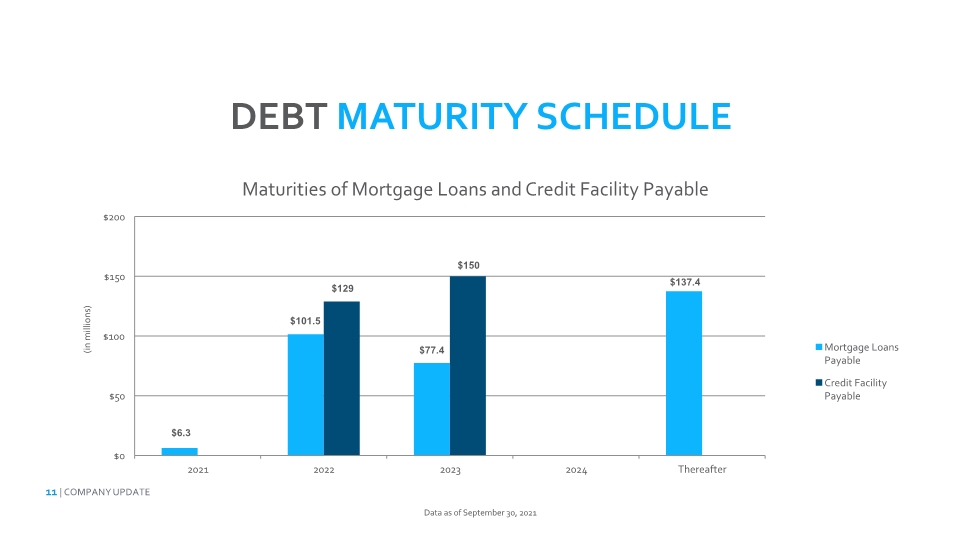

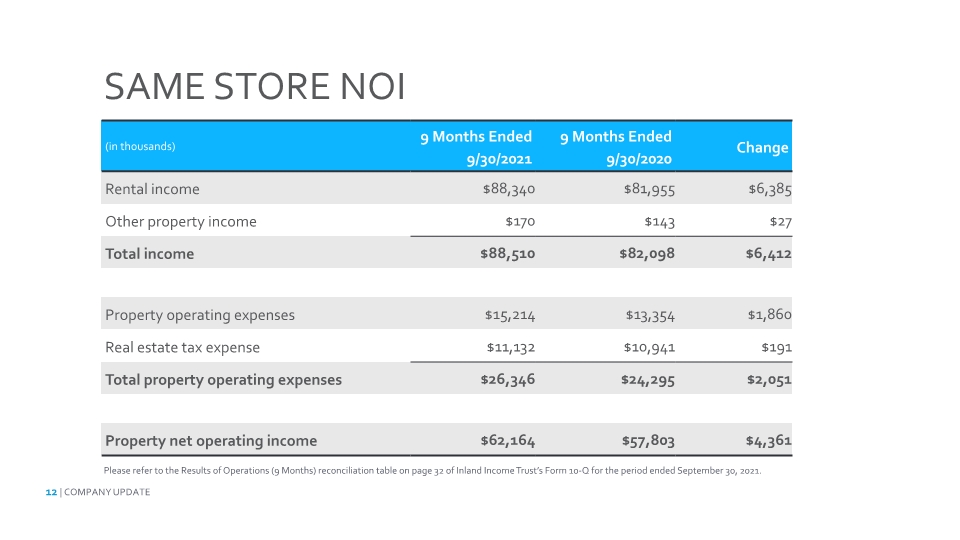

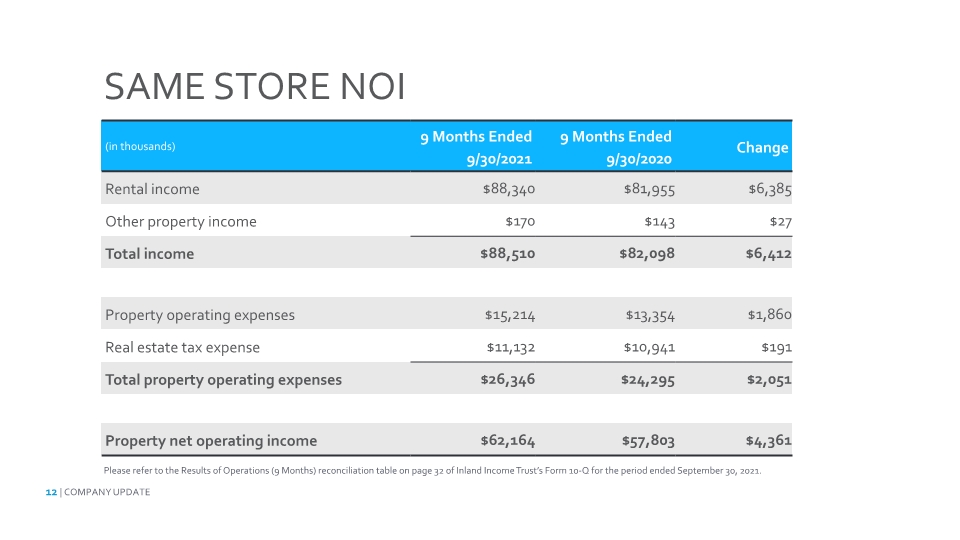

SAME STORE NOI Please refer to the Results of Operations (9 Months) reconciliation table on page 32 of Inland Income Trust’s Form 10-Q for the period ended September 30, 2021. 12 | COMPANY UPDATE

Net operating income, or NOI, realized from properties that we have owned and operated for the entire periods presented are referred to as “same store NOI”. A total of 44 investment properties that were acquired on or before January 1, 2020 represent our “same store” properties during the nine months ended September 30, 2021 and 2020. As our property operations continue to stabilize from the impacts of the coronavirus pandemic, our total property NOI was approximately $62 million as of September 30, 2021, an increase of approximately $4.4 million from the same time last year. I will now turn the presentation back over to the chairman of the board of directors. Slide 12 Notes