UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

Amendment No. 1

| þ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from _________________________________ to

Commission file number

ORIENTAL NONFERROUS METALS TECHNOLOGY CO., LTD.

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

1 Sun Street, High-Tech Development Zone CI-35, Daqing City, Heilongjiang Province

People's Republic of China, 163316

(Address of principal executive offices)

Yuhu Wang

Tel: +86 459 6284782

Fax: +86 459 6284782

Daqing High and New Technology Industrial Development District

Daqing, Heilongjiang

People’s Republic of China 163316

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | |

| None | | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares, $0.005 par value per share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by this registration statement.

10,000,000, par value $0.005 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes ¨ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

¨ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer þ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP þ | | International Financial Reporting | | Other ¨ |

| | | Standards as issued | | |

| | | by the International Accounting | | |

| | | Standards Board ¨ | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes ¨ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

ORIENTAL NONFERROUS METALS TECHNOLOGY CO., LTD.

FORM 20-F REGISTRATION STATEMENT

INTRODUCTION

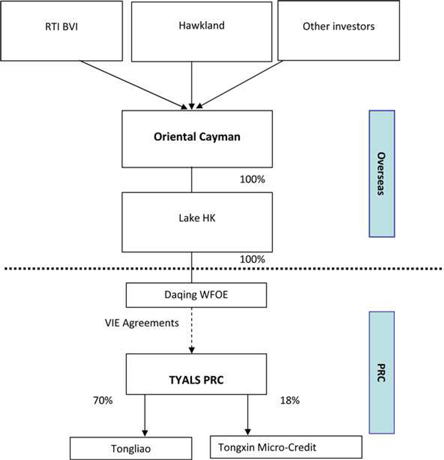

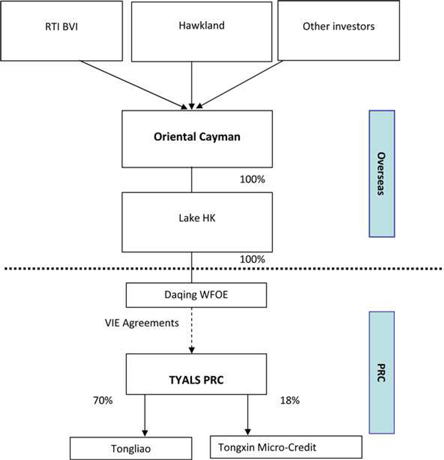

Oriental Nonferrous Metals Technology Co., Ltd. (“Company” or “Oriental Cayman”) was incorporated under the laws of the Cayman Islands on February 1, 2011. In this registration statement on Form 20-F (“Registration Statement”), the “Company”, “Oriental Cayman”, “we”, “our”, and “us” refer to Oriental Nonferrous Metals Technology Co., Ltd., its parent and consolidated subsidiaries, including RTI Investment Holdings, Inc., a company incorporated under the laws of the British Virgin Islands on January 20, 2011 (“RTI BVI”), Lake Intelligent International Co., Ltd., a Hong Kong limited liability company incorporated on February 24, 2011 (“Lake HK”); Daqing Zefang Intelligent Trading Co., Ltd., a People’s Republic of China (“PRC”) limited liability company incorporated on January 1, 2011 (“Daqing WFOE”); Heilongjiang TYALS Co., Ltd., a PRC limited liability company incorporated on February 8, 2002, (also known as Heilongjiang Tongyu Pride Aluminum Joint Stock Limited Company, “Tyals” or “Tyals PRC”) and its subsidiaries Tongliao Tongyu Pride Aluminum Joint Stock Co., Ltd., a PRC limited liability company incorporated on January 10, 2008 (“Tongliao”) and Daqing High-Tech Park Joint Stock Limited Company, a PRC limited liability company incorporated on October 21, 2009 (“Tongxin Micro-Credit”) (Tongliao and Tongxin Micro-Credit are referred to herein as “Subsidiaries”). We refer you to the documents filed as exhibits hereto for more complete information than may be contained in this Registration Statement. Our registered office is located at the offices of Offshore Incorporations (Cayman) Limited, Scotia Center, 4th Floor, P.O. Box 2804, George Town, Grand Cayman KYI-1112, Cayman Islands, British West Indies. Our principal executive offices are located at 1 Sun Street, High-Tech Development Zone CI-35, Daqing City, Heilongjiang Province People's Republic of China, 163316, and our telephone number is +86 459 6284782. Our website is www.cntyals.com. Information contained on our website does not constitute part of, and is not deemed incorporated by reference into, this registration statement. Our website is currently being completed.

Upon effectiveness, we will file reports and other information with the Securities and Exchange Commission (“SEC”) located at 100 F Street NE, Washington, D.C. 20549. You may obtain copies of our filing with the SEC by accessing their website located at www.sec.gov.

Business of Oriental Nonferrous Metals Technology Co., Ltd.

Our business has been conducted in the PRC through our variable interest arrangements with Tyals PRC, a company engaged in the production and sale of industrial and consumer semi-fabricated aluminum products, including aluminum rod, aluminum particle, aluminum wire, aluminum sheet, aluminum curtain wall and electronic aluminum foil. Tyals PRC’s principal business is conducted through its headquarters located in Daqing City, Heilongjiang Province in the northeast of the People’s Republic of China.

Financial and Other Information

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in US Dollars (“$”).

Currencies and Exchange Rates

Unless otherwise indicated, all conversions from Renminbi (RMB) to US dollars have been made at a rate of RMB 6.6018 to US$ 1.00, the noon buying rate on December 31, 2010 as set forth in the H. 10 statistical release of the U.S. Federal Reserve Board. We do not represent that Renminbi or US dollar amounts could be converted into US dollars or Renminbi, as the case may be, at any particular rate, the rates below or at all. On December 31, 2011, the noon buying rate was Renminbi 6.3523 to US$1.00.

The following table sets forth noon buying rate for US dollars in Renminbi for the periods indicated:

| | | Noon Buying Rate(1) | |

| Period | | End | | | Average (2) | | | High | | | Low | |

| | | (RMB per US$1.00) | |

| 2006 | | | 7.8041 | | | | 7.9723 | | | | 8.0702 | | | | 7.9723 | |

| 2007 | | | 7.2946 | | | | 7.5806 | | | | 7.8127 | | | | 7.2946 | |

| 2008 | | | 6.8225 | | | | 6.9193 | | | | 7.2946 | | | | 6.7800 | |

| 2009 | | | 6.8272 | | | | 6.8307 | | | | 6.8470 | | | | 6.8176 | |

| June 2010 | | | 6.7886 | | | | 6.8110 | | | | 6.8233 | | | | 6.7822 | |

| July 2010 | | | 6.7652 | | | | 6.7668 | | | | 6.7813 | | | | 6.7616 | |

| August 2010 | | | 6.7930 | | | | 6.7764 | | | | 6.7942 | | | | 6.7555 | |

| September 2010 | | | 6.6781 | | | | 6.7399 | | | | 6.8025 | | | | 6.6781 | |

| October 2010 | | | 6.6707 | | | | 6.6675 | | | | 6.6912 | | | | 6.6397 | |

| November 2010 | | | 6.6670 | | | | 6.6537 | | | | 6.6906 | | | | 6.6233 | |

| December 2010 | | | 6.6018 | | | | 6.6497 | | | | 6.6745 | | | | 6.6000 | |

| January 2011 | | | 6.6017 | | | | 6.5964 | | | | 6.6364 | | | | 6.5809 | |

| February 2011 | | | 6.5713 | | | | 6.5761 | | | | 6.5965 | | | | 6.5520 | |

| March 2011 | | | 6.5483 | | | | 6.5645 | | | | 6.5743 | | | | 6.5483 | |

| April 2011 | | | 6.4918 | | | | 6.5183 | | | | 6.5414 | | | | 6.4840 | |

| May 2011 | | | 6.4765 | | | | 6.4892 | | | | 6.5021 | | | | 6.4690 | |

| June 2011 | | | 6.4630 | | | | 6.4698 | | | | 6.4815 | | | | 6.4343 | |

| July 2011 | | | 6.4070 | | | | 6.4472 | | | | 6.4768 | | | | 6.4070 | |

| August 2011 | | | 6.3710 | | | | 6.3858 | | | | 6.4317 | | | | 6.3500 | |

| September 2011 | | | 6.3885 | | | | 6.3763 | | | | 6.4048 | | | | 6.3435 | |

| October 2011 | | | 6.3255 | | | | 6.3649 | | | | 6.3971 | | | | 6.3255 | |

| November 2011 | | | 6.3678 | | | | 6.3458 | | | | 6.3753 | | | | 6.3108 | |

| December 2011 | | | 6.3523 | | | | 6.3494 | | | | 6.3973 | | | | 6.3157 | |

(1) For the period prior to January 1, 2009, the exchange rates reflect the noon buying rates certified by the Federal Reserve Bank of New York. For the period after January 1, 2009, the exchange rates reflect those set forth in the H.10 statistical release of the U.S. Federal Reserve Board.

(2) Annual averages are determined by averaging the rates on the last business day of each month during the relevant period. Monthly averages are calculated using the average of the daily rates during the relevant period.

Note Regarding Forward-Looking Statements

This Registration Statement on Form 20-F contains certain forward-looking statements and forward-looking information, which are based upon the current internal expectations, estimates, projections, assumptions and beliefs of Oriental Cayman, as of the date of such statements or information. Words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur, are intended to identify forward-looking statements and forward-looking information. These statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in the forward-looking statements or forward-looking information. By its nature, forward-looking information involves numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will not occur. Such forward-looking statements and forward looking information in this Registration Statement speak only as of the date of this Registration Statement.

Although Oriental Cayman believes that the expectations reflected in the forward-looking statements and forward looking information are reasonable, there can be no assurance that such expectations will prove to be correct. Oriental Cayman cannot guarantee future results, levels of activity, performance or achievements. Some of the risks and other factors, some of which are beyond the control of Oriental Cayman which could cause results to differ materially from those expressed in the forward looking statements and forward-looking information contained in this Registration Statement, include, but are not limited to:

| · | future general economic conditions; |

| · | future conditions in the international and China capital markets; |

| · | future conditions in the financial and credit markets; |

| · | future prices and demand for our products; |

| · | future PRC tariff levels for aluminum fabricated products; |

| · | the extent and nature of, and potential for, future development; |

| · | production, consumption and demand forecasts of aluminum fabricated products; |

| · | expansion, consolidation or other trends in the manufacturing of aluminum fabricated products; |

| · | the effectiveness of our cost-saving measures; |

| · | future expansion plans and capital expenditures; |

| · | changes in legislation, regulations and policies; |

| · | our research and development plans; |

| · | our dividend policy; and |

| · | the other factors disclosed under the heading Item 3.D — Risk Factors in this Registration Statement. |

The above summary of assumptions and risks related to forward-looking statements and forward-looking information has been provided in this Registration Statement in order to provide readers with a more complete perspective on the future operations of the Company. Readers are cautioned that this information may not be appropriate for other purposes. The forward-looking statements and the forward-looking information contained in this Registration Statement are expressly qualified by the cautionary statements provided for herein. Oriental Cayman is not under any duty to update any of the forward-looking statements or forward-looking information after the date of this Registration Statement or to conform such statements or information to actual results or to changes in the expectations of Oriental Cayman except as otherwise required by applicable laws.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

1.A. Directors and Senior Management

The following table provides the names of Oriental Cayman’s directors and senior management, their position with the Company and their business address.

Table No. 1

Directors and Senior Management

| Name | | Position with the Company | | Business Address | | Country |

| Yuhu Wang | | Chairman, Chief Executive Officer, and Director | | Daqing High and New Technology Industrial Development District, Daqing, Heilongjiang, China 163316 | | People’s Republic of China |

| Zhiguo Wang | | Chief Technology Officer and Director | | Daqing High and New Technology Industrial Development District, Daqing, Heilongjiang, China 163316 | | People’s Republic of China |

| Eli Polatinsky | | Director | | 2 Nahal Iyun Street Modi'in 71703, Israel | | State of Israel and South Africa |

| Jianhua Sun | | Vice President/Acting Chief Financial Officer | | Daqing High and New Technology Industrial Development District, Daqing, Heilongjiang, China 163316 | | People’s Republic of China |

The functions of our directors and senior management, as well as their background are described below in ITEM 6.A. – Directors and Senior Management.

*On March 10, 2012, the Company’s Board of Directors passed a resolution to appoint Mr. Jianhua Sun as the Acting Chief Financial Officer of the Company and also agreed that the Company will find a permanent Chief Financial Officer as soon as possible. The Board Resolution has been filed as Exhibit 15.1 to the Registration Statement.

1.B. Advisors

The Company’s legal advisors in the People’s Republic of China are:

Deheng Law Firm

Room 1608, CBD International Mansion, No.16 Yong'an Dong Li

Chaoyang District

Beijing, China 100022

Tel.: +86 10 85219100

Fax.: +86 10 85219992

The Company’s legal advisors in the Cayman Islands are:

Ogier

89 Nexus Way

Camana Bay Grand Cayman

Cayman Islands KY1-9007

Tel +1 345 949 9876

Fax +1 345 949 9877

The Company’s legal advisors in the United States are:

Gersten Savage LLP

600 Lexington Avenue

New York, NY 10022

Tel: (212) 752-9700

Fax: (212) 980-5192

1.C. Auditors

The Company’s auditor is: Crowe Horwath LLP, independent registered public accounting firm, 488 Madison Avenue, Floor 3, New York, NY 10022-5722.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

3.A. Selected Financial Data

The selected financial data of the Company for the fiscal years ended December 31, 2009 and 2010 was derived from the audited annual consolidated financial statements of the Company which have been audited by Crowe Horwath LLP. The selected financial data of the Company for the years ended December 31, 2008, 2007, and 2006, and for the six months ended June 30, 2010 and 2011 was derived from the unaudited financial statements. The information contained in the selected financial data is qualified in its entirety by reference to the consolidated financial statements and related notes included in ITEM 17. – Financial Statements, and should be read in conjunction with such financial statements and with the information appearing in ITEM 5. – Operating and Financial Review and Prospects. The audited financial statements and the financial statements for the six months ending June 30, 2011 and 2010 have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”).

Oriental Cayman, through Daqing WFOE, consolidates the operating results of Tyals PRC and Subsidiary based on the contractual arrangements that were entered into between entities under common control, these transactions have been accounted for at their historical cost and as if they took place on January 1, 2005 in a manner similar to a pooling of interest. Accordingly, the Oriental Cayman’s historical financial statements have been prepared to give retroactive effect to the contractual arrangements, and represent the operations of Oriental Cayman in Table No. 2 below.

Table No. 2

Selected Financial Data(1)

| | | | | | | | | (in thousands of U.S. Dollars) | |

| | | Six months ended June 30, | | | Years ended December 31, | |

| | | Unaudited | | | | | | Unaudited(2) | |

| | | 2011 | | | 2010 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 13,289 | | | $ | 9,631 | | | $ | 20,028 | | | $ | 2,276 | | | $ | 1,948 | | | $ | 3,343 | | | $ | 2,413 | | | $ | 61 | |

| Cost of sales | | | 10,953 | | | | 7,667 | | | | 14,689 | | | | 2,187 | | | | 2,019 | | | | 3,403 | | | | 2,474 | | | | 131 | |

| Gross profit | | | 2,336 | | | | 1,964 | | | | 5,339 | | | | 89 | | | | (71 | ) | | | (60 | ) | | | (61 | ) | | | (70 | ) |

| Operating expenses | | | 811 | | | | 344 | | | | 765 | | | | 555 | | | | 494 | | | | 299 | | | | 322 | | | | 378 | |

| Income (loss) from operations | | | 1,525 | | | | 1,620 | | | | 4,574 | | | | (466 | ) | | | (565 | ) | | | (359 | ) | | | (383 | ) | | | (448 | ) |

| Other income (expense) | | | (132 | ) | | | (44 | ) | | | (32 | ) | | | 171 | | | | 437 | | | | 349 | | | | (3 | ) | | | (19 | ) |

| Income (loss) before income taxes | | | 1,393 | | | | 1,576 | | | | 4,542 | | | | (295 | ) | | | (128 | ) | | | (10 | ) | | | (386 | ) | | | (467 | ) |

| Income tax (expense) benefit | | | (266 | ) | | | (269 | ) | | | (870 | ) | | | 26 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Net income (loss) | | | 1,127 | | | | 1,307 | | | | 3,672 | | | | (269 | ) | | | (128 | ) | | | (10 | ) | | | (386 | ) | | | (467 | ) |

| Net income (loss) attributable to Oriental Nonferrous Metals Technology Co., Ltd. | | | 1,241 | | | | 1,372 | | | | 3,756 | | | | (200 | ) | | | (75 | ) | | | (10 | ) | | | (386 | ) | | | (467 | ) |

| Total assets | | | 27,302 | | | | 26,421 | | | | 26,608 | | | | 17,083 | | | | 10,532 | | | | 5,679 | | | | 4,086 | | | | 2,972 | |

| Net assets | | | 14,496 | | | | 6,132 | | | | 12,819 | | | | 4,752 | | | | 3,945 | | | | 2,404 | | | | 1,272 | | | | 1,612 | |

| Paid-in capital | | $ | 4,568 | | | $ | 3,349 | | | $ | 4,516 | | | $ | 3,336 | | | $ | 3,277 | | | $ | 3,167 | | | $ | 2,416 | | | $ | 2,416 | |

| Basic Earnings per share attributable to Oriental Nonferrous Metals Technology Co., Ltd. shareholders | | $ | 0.12 | | | $ | 0.14 | | | $ | 0.38 | | | $ | (0.02 | ) | | | | | | | | | | | | | | | | |

| Basic Weighted-average number of shares outstanding , basic | | | 10,000,000 | | | | 10,000,000 | | | | 10,000,000 | | | | 10,000,000 | | | | | | | | | | | | | | | | | |

| Earnings per share attributable to Oriental Nonferrous Metals Technology Co., Ltd. shareholders | | $ | 0.12 | | | $ | 0.13 | | | $ | 0.37 | | | $ | (0.02 | ) | | | | | | | | | | | | | | | | |

| Diluted Weighted-average number of shares outstanding , basic | | | 10,272,536 | | | | 10,272,536 | | | | 10,272,536 | | | | 10,272,536 | | | | | | | | | | | | | | | | | |

| (1) | The financial statement presentation in Table No. 2, is consistent with the presentation of entities under common control and is fully described in the notes to the audited financial statements. |

(2) The unaudited selected financial data were not prepared under US GAAP.

3.B. Capitalization and Indebtedness

The following table sets forth the Company’s indebtedness, capitalization and accumulated deficit as of December 31, 2011:

| | | (in thousands of U.S. Dollars) | |

| Indebtedness | | | | |

| Unguaranteed | | $ | 4,799 | |

| Guaranteed | | | | |

| Unsecured | | | - | |

| Secured | | | 3,462 | |

| Total Indebtedness | | $ | 8,261 | |

| | | | | |

| Stockholders’ equity | | | | |

| Paid-in capital | | $ | 5,038 | |

| Capital reserves | | | 7,919 | |

| Statutory reserves | | | 418 | |

| Retained earnings | | | 6,471 | |

| Accumulated other comprehensive income | | | 819 | |

| Non-controlling interests | | | 1,963 | |

| Total stockholders' equity | | $ | 22,628 | |

Since inception, the Company has financed its operation from private sales of common stock and debt, borrowings under its credit agreements, and cash flow from operations. While the Company believes it has sufficient capital and liquidity to finance current operations through the next twelve months, the Company’s long-term liquidity depends on its ability to access the capital markets. (See ITEM 3.D – Risk Factors).

The Company has not declared any dividends since inception and does not anticipate that it will do so in the foreseeable future.

3. C. Reasons for the Offer and Use of Proceeds

No offer of securities is made by this Registration Statement.

3.D. Risk Factors

Our business, financial condition and results of operations are subject to various changing business, competitive, economic, political and social conditions in China and worldwide. In addition to the factors discussed elsewhere in this Registration Statement, the following are some of the important factors that could cause our actual results to differ materially from those projected in any forward-looking statements.

Volatility in aluminum and other non-ferrous metal prices may adversely affect our business, financial condition and results of operations.

The prices of our key products have been historically volatile and have fluctuated in response to general economic conditions, supply and demand and the level of global inventories. We price our aluminum products by reference to domestic market prices, and domestic supply and demand, each of which may fluctuate beyond our control. From the fourth quarter of 2008 through early 2009, the demand for aluminum fabricated products decreased significantly as a result of the global financial crisis, and our average selling price of electrical aluminum rod decreased by 20% from RMB 20,373 ($3,087) per ton in 2008 to RMB 16,453 ($2,493) per ton in 2009. As the global economy started to recover in the second half of 2009, the demand for aluminum and aluminum fabricated products gradually increased. Our average selling price of electrical aluminum rod increased by 7% from RMB 16,453 ($2,493) per ton in 2009 to RMB 17,760 ($2,691) per ton in 2010. Because most of our costs are fixed, we may not be able to respond promptly to a sudden decrease in aluminum and aluminum fabricated products prices.

Demand for our products is sensitive to cyclical fluctuations and general economic conditions, and a reduction in demand could materially and adversely affect our business, financial condition and results of operations.

Demand for our products is sensitive to cyclical fluctuations and significantly affected by general economic conditions. From the fourth quarter of 2008 through the second quarter of 2009, demand for our products decreased significantly due to the global financial crisis, which resulted in a significant downturn in a number of our end-user markets. The global economy has been recovering since the second half of 2009 and continued to gain its momentum in 2010, and our production and sales volumes increased in 2010. However, there is no assurance that there will not be a renewed decline in the global market for our products or in the general economy. Uncertainty about future economic conditions makes it challenging for us to forecast our results of operations, make business decisions and identify risks that may affect our business. If we are not able to timely and appropriately adapt to changes resulting from the difficult macroeconomic environment, our business, financial condition and results of operations may be materially and adversely affected.

Our business requires substantial capital investments that we may be unable to fulfill.

We may need additional funding for debt servicing, working capital, other investments, potential acquisitions and joint ventures and other corporate requirements. We may seek external financing to satisfy our capital needs if cash generated from our operations is insufficient to fund our capital expenditures or if our actual capital expenditures and investments exceed our plans. Our ability to obtain external financing at reasonable costs and on acceptable terms is subject to a variety of uncertainties. There can be no assurance that additional financing can be obtained if needed or what the terms of such financing would be. Failure to obtain sufficient funding for our development plans could adversely affect our business and prospects.

Our failure to successfully manage our business expansion would have a material adverse effect on our results of operations and prospects.

We may not be able to adequately manage our business growth. Our expansion has created, and will continue to place, substantial demand on our resources. Managing our growth require, among other things:

| · | gaining market acceptance for new products and services and establishing relationships with new customers and suppliers; |

| · | achieving sufficient utilization of new production facilities to recover costs; |

| · | managing relationships with employees, customers and business partners during the course of our business expansion and integration of new businesses; |

| · | attracting, training and motivating members of our management and workforce; |

| · | accessing our debt, equity or other capital resources to fund our business expansion, which may divert financial resources otherwise available for other purposes; |

| · | diverting significant management attention and resources from our other businesses; and |

| · | strengthening our operational, financial and management controls, particularly those of our newly acquired subsidiaries, to maintain the reliability of our reporting processes. |

Any difficulty meeting the foregoing or similar requirements could significantly delay or otherwise constrain our ability to undertake our expansion plans, which in turn would limit our ability to increase operational efficiency, reduce marginal manufacturing costs or otherwise strengthen our market position. If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

Losses caused by disruptions in the supply of power could materially and adversely affect our business, financial condition, results of operations and cash flows.

The production of aluminum fabricated products requires a substantial and continuous supply of electricity. Interruptions in the supply of power can result in costly production shutdowns, increased costs associated with restarting production and the waste of production in progress. A sudden loss of power, if prolonged, can cause damage to or the destruction of production equipment and facilities. In such an event, we may need to expend significant capital and resources to repair or replace the affected production equipment to restore our production capacity. Various regions across China have experienced shortages and disruptions in electrical power, especially during peak demand in the summer or during severe weather conditions.

We may be unable to continue competing successfully in the markets in which we operate.

We face competition from both domestic aluminum processing enterprises, mainly aluminum processing enterprises located in Jiangsu, Henan, Zhejiang, Chongqing, Fujian, Shanghai, and Hebei, and international aluminum processing enterprises, mainly Aluminum Company of America and Aluminum Company of Canada. Our principal competitors are domestic aluminum processing enterprises, some of which are consolidating and expanding their production capacities. These manufacturers compete with our aluminum processing operations on the basis of cost, quality and pricing. We also face increasing competition from international aluminum processing enterprises. These companies have greater resources than us and have the monetary capability to directly compete with us, if they so choose, by providing similar products as those currently offered by us. Increasing competition in our markets may reduce our selling prices or sales volumes, which will have a material adverse effect on our financial condition and results of operations. If we are unable to price our products competitively, maintain or increase our current share of China's aluminum fabricated products markets or otherwise maintain our competitiveness, our financial condition, results of operations and profitability could be materially and adversely affected.

Our profitability and operations could be adversely affected if we are unable to obtain a steady supply of raw materials at competitive prices.

Historically, the price for aluminum ingot, our most important raw material for aluminum processing production, has been volatile. Even though we do not have agreements executed with any suppliers, we obtain aluminum ingot for our operations by placing orders from suppliers such as Toelke trading (Shanghai) Co., Ltd. and Baotou aluminum Co., Ltd. The extents to which we procure aluminum ingot from each of these sources affect the security of our supply or cost of aluminum ingot. Our results of operations will be affected by increases in the cost of other raw materials. If we cannot obtain a steady supply of key raw materials at competitive prices, our financial condition and results of operations could be materially adversely affected.

Transportation interruptions may affect our shipment of raw material and delivery of products.

Our operations require the reliable transportation of raw materials and supplies to our fabrication sites and the delivery of finished products to our customers. Our aluminum fabricated products are mainly transported by truck. If we are unable to make timely deliveries due to logistical and transportation disruptions, our production, reputation and results of operations may be adversely affected.

Our indebtedness could adversely affect our business, financial condition and results of operations.

We require a significant amount of cash to meet our capital requirements, including the expansion and upgrade of our production capacity, as well as to fund our existing operations. As of December 31, 2011, we had approximately RMB 52,500,000 (US$ 8,803,030) in outstanding debt. This level of debt could have significant consequences on our operations, including:

· making it more difficult for us to fulfill payment and other obligations under our outstanding debt, including repayment of our debt and credit facilities should we be unable to obtain extensions for any such debt or credit facilities before they mature;

· reducing the availability of cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes;

· exposing us to interest rates fluctuations on our borrowings and the risk of being unable to rollover, extend or refinance our borrowings as necessary; and

· potentially increasing the cost of additional financing and making it more difficult for us to conduct equity financings in the capital markets or obtain government approvals to seek additional financing.

Our ability to meet our payment and other obligations under our outstanding debt depends on our ability to generate cash flow in the future or to refinance such debt. We cannot assure you that our business will generate sufficient cash flow from operations to satisfy our obligations under our outstanding debt and to fund other liquidity needs. If we are not able to generate sufficient cash flow to meet such obligations, we may need to refinance or restructure our debt, reduce or delay capital investments, or seek additional equity or debt financing. The sale of additional equity securities could result in dilution to our shareholders. A shortage of financing could in turn impose limitations on our ability to plan for, or react effectively to, changing market conditions or to expand through organic and acquisitive growth, thereby reducing our competitiveness.

We may not realize the economic benefits of our expansion plans.

Cost savings and other economic benefits expected from our expansion plans may not materialize as a result of project delays, cost overruns, or changes in market conditions. Failure to obtain the intended economic benefits from these projects could adversely affect our business, financial condition and results of operations. We may also experience mixed results from our expansion plans in the short term.

We are subject to, and incur costs to comply with, environmental laws and regulations.

Because we operate fabrication plants we are subject to, and incur costs to comply with, environmental laws and regulations. We may incur significant additional costs if relevant laws and regulations change or enforcement of existing laws and regulations become more rigorous. Failure to comply with environmental laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements and the issuance of orders enjoining future operations, all of which may affect our business operations.

Our business is subject to significant accidents, natural disasters and unplanned business interruptions that may adversely affect our performance.

We may experience accidents in the course of our operations, which may cause significant property damage and personal injuries. Significant accidents and natural disasters may cause interruptions to our operations or result in property or environmental damage, an increase in operating expenses or loss of revenues. The occurrence of accidents, natural disasters and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third-party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than for our automobiles. Losses or payments incurred by us as a result of major accidents or natural disasters may have a material adverse effect on our results of operations if such losses or payments are not fully insured.

Our operations present risk of serious injury or death

The activities conducted at our facilities present significant risk of serious injury or death to our employees, customers or other visitors to our operations, notwithstanding our safety precautions, including our material compliance with PRC health and safety regulations. While we have in place policies and procedures to minimize those risks, we may be unable to avoid material liabilities for an injury or death.

We may be subject to product liability claims.

Some of the products we sell or manufacture may expose us to product liability claims relating to property damage or personal injury. The successful assertion of product liability claims against us could result in significant damage payments and harm to our reputation. A successful product liability claim or series of claims brought against us could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to adequately protect our proprietary technology, our competitors may develop products substantially similar to our products and use similar technologies, which may result in the loss of customers.

We rely on trademark and trade secret laws, as well as confidentiality, licensing and other contractual arrangements, to establish and protect the proprietary aspects of our business. Our efforts may result in only limited protection, and our competitors may develop, market and sell products substantially equivalent to our products, or utilize technologies similar to those used by us. If we are unable to adequately protect our proprietary technology, these third parties may be able to compete more effectively against us, which could result in the loss of customers and adversely affect our business.

In addition, the legal systems of many foreign countries do not protect or honor intellectual property rights to the same extent as the legal system of the U.S. For example, in China, the legal system in general and the intellectual property regime in particular, are still in the development stage. It may be very difficult, time-consuming and costly for us to attempt to enforce our intellectual property rights in such jurisdictions.

Our operations are affected by a number of risks relating to conducting business in the PRC.

As a significant majority of our assets and operations are located in the PRC, we are subject to a number of risks relating to conducting business in the PRC, including the following:

· The central and local PRC government continues to exercise a substantial degree of control and influence over the aluminum industry in China and shapes the structure and development of the industry through the imposition of industry policies governing major project approvals, preferential tax treatment and safety, environmental and quality regulations. If the PRC government changes its current policies or the interpretation of those policies that are currently beneficial to us, we may face pressure on profit margins and significant constraints on our ability to expand our business operations.

· Although China has been transitioning from a planned economy to a market-oriented economy, a substantial portion of productive assets in China are still owned by the PRC government. It also exercises significant control over China's economic growth through the allocation of resources, control of payments of obligations denominated in foreign currencies and monetary and tax policies. Some of these measures benefit the overall economy of China, but may have a materially adverse impact on us.

· Although the promulgation of laws and regulations covering general economic matters has increased since 1979, China has not developed an adequately comprehensive legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their non-binding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. The system of laws and the enforcement of existing laws in the PRC may not be as certain in implementation and interpretation as in the United States. The PRC judiciary is relatively inexperienced in enforcing corporate and commercial law, leading to a higher than usual degree of uncertainty as to the outcome of any litigation. The inability to enforce or obtain a remedy under any of our present or future agreements could result in a significant loss of business, business opportunities or capital.

Daqing WFOE’s contractual arrangements with Tyals PRC and its shareholders may not be as effective in providing control over Tyals PRC as direct ownership of Tyals PRC and the shareholders of Tyals PRC may have potential conflicts of interest with us.

Oriental Cayman has no ownership interest in Tyals PRC and conducts substantially all of its operations and generates substantially all its revenues through contractual arrangements that its indirect subsidiary, Daqing WFOE, has entered into with Tyals PRC and its shareholders, and such contractual arrangements are designed to provide Oriental Cayman with effective control over Tyals PRC. See item 4.A “History and Development of the Company” for a description of these contractual arrangements. Oriental Cayman depends on Tyals PRC which owns all of the necessary intellectual property, facilities and other assets relating to the operation of our business.

Although in the opinion of our PRC counsel, Deheng Law Offices, each of these contractual arrangements is valid, binding and enforceable, and will not result in any violation of PRC laws or regulations currently in effect, they may not be as effective in providing Oriental Cayman with control over Tyals PRC as direct ownership. If Oriental Cayman had direct ownership of Tyals PRC, it would be able to exercise its rights as a shareholder to effect changes in the board of directors of Tyals PRC, which in turn could affect changes, subject to any applicable fiduciary obligations, at the management level. Due to our contractual structure, Oriental Cayman has to rely on contractual rights to effect control and management of Tyals PRC, which exposes Oriental Cayman to the risk of potential breach of contract by the shareholders of Tyals PRC. In addition, as Tyals PRC is jointly owned by its shareholders, it may be difficult for Oriental Cayman to change Tyals PRC corporate structure if such shareholders refuse to cooperate with it.

The shareholders, officers and/or directors of Tyals PRC may breach, or cause Tyals PRC to breach, the contracts for a number of reasons. For example, the interests of the shareholders of Tyals PRC and the interests of Oriental Cayman may conflict and we may fail to resolve such conflicts; the shareholders may believe that breaching the contracts will lead to greater economic benefit for them; or the shareholders may otherwise act in bad faith. If any of the foregoing were to happen, we may have to rely on legal or arbitral proceedings to enforce our contractual rights, including specific performance or injunctive relief, and claiming damages. Such arbitral and legal proceedings may cost us substantial financial and other resources, and result in disruption of our business, and we cannot assure you that the outcome will be in our favor.

In addition, as all of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through either arbitration or litigation in the PRC, they would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal environment in the PRC is not as developed as in other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could further limit our ability to enforce these contractual arrangements. Furthermore, these contracts may not be enforceable in China if PRC government authorities or courts take a view that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event we are unable to enforce these contractual arrangements, we may not be able to exert effective control over Tyals PRC, and our ability to conduct our business may be materially and adversely affected.

Daqing WFOE and Tyals PRC contractual arrangements may result in adverse PRC tax consequences to us.

Under PRC laws implemented in 2001 and 2002, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. “Related parties” are defined as organizations or entities that (1) have a direct or indirect control relationship in terms of capital, operation or sales/purchase; (2) are directly or indirectly owned by a common third party; or (3) possess any other connected relationship based on equity. In the Tax Management Procedure on the Connected Transactions between Related Parties issued in 2004, it is further stated that the management fee payable between the related parties shall be determined on an arms-length basis. We could face material and adverse tax consequences if the PRC tax authorities determine that contractual arrangements between Daqing WFOE and Tyals PRC were not made on an arm’s length basis and adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. A transfer pricing adjustment could result in a reduction, for PRC tax purposes, of adjustments recorded by Tyals PRC, which could adversely affect us by (i) increasing Tyals PRC’s PRC tax liability without reducing Daqing WFOE’s PRC tax liability, which could further result in claims being made against us for underpaid PRC taxes; or (ii) limiting the ability of Daqing WFOE and Tyals PRC to maintain preferential PRC tax treatments and other financial incentives.

All of Oriental Cayman’s revenues have been, and will continue to be, generated through Tyals PRC, and Oriental Cayman relies on payments made by Tyals PRC to Daqing WFOE, our subsidiary, pursuant to contractual arrangements to transfer any such revenues to Daqing WFOE. Any restriction on such payments and any increase in the amount of PRC taxes applicable to such payments may materially and adversely affect our business and our ability to pay dividends to our shareholders.

We conduct substantially all of our operations through Tyals PRC, which generates all of our revenues. Tyals PRC does not anticipate paying dividends in the foreseeable future as it intends to retain future earnings, if any, to provide for the operational expenses of the Company’s business. Pursuant to certain contractual arrangements, Daqing WFOE is entitled to receive a service fee for certain services that Daqing WFOE provides to Tyals PRC, which is expected to approximate the residual returns of Tyals PRC and its subsidiary or may be in excess of residual returns. However, depending on the nature of services provided, certain of these payments are subject to PRC taxes at different rates, including business taxes and VAT, which effectively reduce the payments that Daqing WFOE may receive from Tyals PRC. We cannot assure you that the PRC government will not impose restrictions on such payments or change the tax rates applicable to such payments. Any such restrictions on such payments or increases in the applicable tax rates may materially and adversely affect our ability to receive payments from Tyals PRC or the amount of such payments, and may in turn materially and adversely affect our business, our net income and our ability to pay dividends to our shareholders.

We may rely on dividends and other distributions from our subsidiaries and variable interest arrangements in China to fund our cash and financing requirements, and any limitation on the ability of our subsidiaries and variable interest entity to make payments to us could materially adversely affect our ability to conduct our business.

As an offshore holding company, we may rely principally on dividends from our subsidiaries and variable interest arrangements in China for our cash requirements, including paying dividends or making other distributions to our shareholders or servicing our debt we may incur and paying our operating expenses. The payment of dividends by entities organized in China is subject to limitations. In particular, the PRC regulations permit our subsidiaries to pay dividends to us only out of their accumulated profits, if any, as determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside a certain amount of its after-tax profits each year, if any, to fund certain statutory reserves. These reserves are not distributable as cash dividends.

If our subsidiaries in China incur debt on their own behalf, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. Any limitation on the ability of our subsidiaries to distribute dividends or other payments to us could materially adversely limit our ability to grow, make investments or acquisitions, pay dividends and otherwise fund and conduct our business.

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Oriental Cayman is a holding company that was incorporated on February 1, 2011 in the Cayman Islands. Its principal shareholders are RTI BVI, Daqing Hi-tech Hawkland Venture Investment Co., Ltd., a limited liability company organized under the laws of PRC (“Hawkland”) and Mr. Yuhu Wang, a PRC citizen. Our business has been conducted in the PRC through our subsidiaries and operating company Tyals PRC, a limited liability company established in the People’s Republic of China in 2002. On February 24, 2011, we formed Lake HK, a wholly-owned subsidiary of Oriental Cayman, and on July 11, 2011, we formed Daqing WFOE, which is our indirect wholly-owned subsidiary that is a registered wholly foreign owned enterprise in the PRC and a wholly-owned subsidiary of Lake HK.

To comply with PRC laws, we operate our business in the PRC through the use of certain contractual arrangements between Daqing WFOE and Tyals PRC that enable us to effectively control Tyals PRC’s daily operations and financial affairs (variable interest entity agreements or “VIE Agreements”).

All of the issued and outstanding shares of Oriental Cayman are currently held by twenty-nine individuals, including our President and Director, Mr. Yuhu Wang, who owns a 12.55% equity interest, as well as by RTI BVI which owns 51% and Hawkland which owns 20.73% of equity interest in Oriental Cayman.

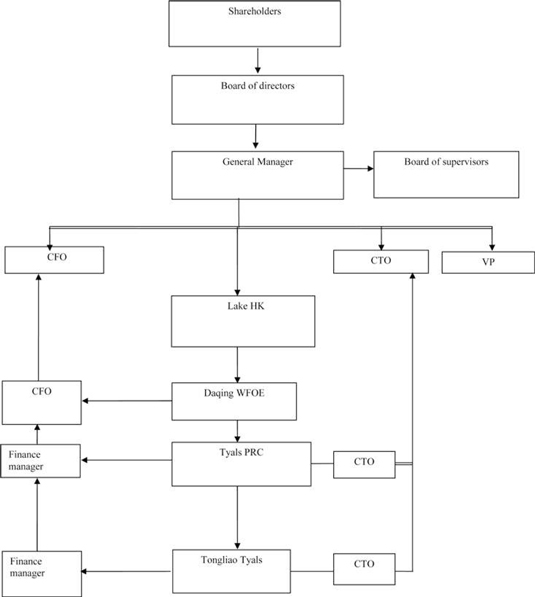

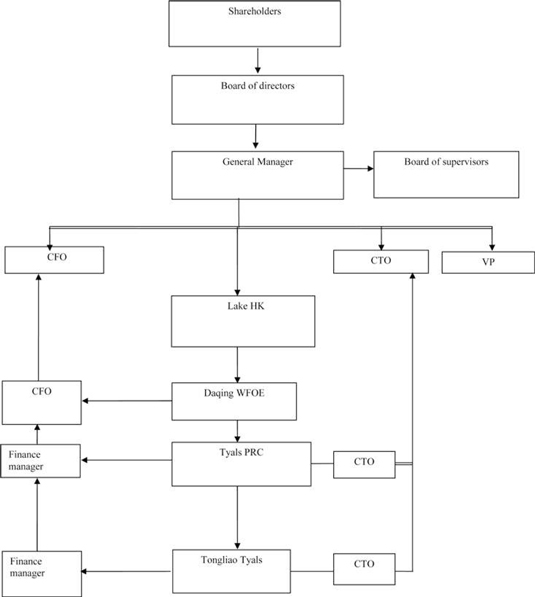

Our current ownership structure is presented under the above organization chart.

Contractual Arrangements with Tyals PRC and its equity owners

Under PRC law, each of Daqing WFOE and Tyals PRC is an independent legal person and neither of them is exposed to liabilities incurred by the other party. Other than pursuant to the contractual arrangements between Daqing WFOE and Tyals PRC, Tyals PRC does not transfer any other funds generated from its operations to Daqing WFOE. Daqing WFOE’s relationships with Tyals PRC and its equity owners are governed by the following contractual arrangements entered into on September 1, 2011.

Exclusive Service Agreement

Under the Exclusive Service Agreement executed among Daqing WFOE, the major shareholders of Tyals PRC - Mr. Yuhu Wang and Hawkland, Tyals PRC and its Subsidiaries, Daqing WFOE shall provide Tyals PRC with management and operation services on an exclusive basis in exchange for yearly service fees which will be determined based on what is the market price in light of the specifics of the services and the timing of such services and will be negotiated on January 1st of each year. Daqing WFOE will retain all the intellectual property rights associated with anything developed under the terms of this agreement. This agreement is effective until August 31, 2021. On January 1, 2012, the service fee was negotiated and agreed to be equal to Tyals PRC’s profits for the year of 2011. The retained profit of Tyals PRC as of January 1, 2012 is RMB 39,688,224 ($6,471,000). According to the Service Agreement, there is no cap for the service fee, which could exceed the retained profit of Tyals PRC. Daqing WOFE intends to direct that the service fee that was negotiated and agreed upon on January 1, 2012 not be paid and instead to direct how such amount should be utilized by Tyals PRC to further develop the operation of Tyals PRC.

Call Option Agreement

Under the call option agreement among the major shareholders of Tyals PRC - Mr. Yuhu Wang and Hawkland, Tyals PRC and Daqing WFOE, the major shareholders of Tyals PRC irrevocably granted Daqing WFOE or its designee an exclusive purchase option to acquire, at any time, the entire portion of Tyals PRC’s equity interest held by each shareholder, or any portion thereof, to the extent permitted by PRC law, and Tyals PRC irrevocably granted Daqing WFOE or its designee an exclusive purchase option to acquire, at any time, all assets and liabilities to the extent permitted by PRC Law. The purchase price for the shareholders’ equity interests in Tyals PRC shall be $1 as required by PRC law. The purchase price for Tyals PRC’s asset shall be $1 as required by PRC law. Daqing WFOE or its designee has sole discretion to decide when to exercise the option.

The major shareholders of Tyals PRC further agree that before Daqing WFOE acquires all the equity of Tyals PRC by exercising the option, the major shareholder of Tyals PRC shall not, without obtaining prior written consent of Daqing WFOE: (1) transfer or otherwise dispose of any equity or create any encumbrance or other third party rights on any equity; (2) increase or decrease Tyals PRC’s registered capital or cast affirmative vote regarding the increase or decrease in registered capital; (3) dispose of or cause the management of Tyals PRC to dispose of any of its assets; (4) terminate or cause the management of Tyals PRC to terminate any material agreements entered into by Tyals PRC, or enter into any other material agreements in conflict with the existing material agreements; or (5) individually or collectively cause Tyals PRC to conduct any transactions that may substantively affect the asset, liability, business operation, shares structure, shares of a third party and other legal rights (except those occurring during the arm's length operations or daily operation, or having been disclosed to and approved by Daqing WFOE in writing). Any of the shareholders shall not transfer to any third party any of its right and/or obligation without prior written consent by Daqing WFOE. Daqing WFOE shall have the right to transfer to any third party designated by it any of its right and/or obligation after notice to the shareholders of Tyals PRC.

Share Pledge Agreement

Under the share pledge agreement among the major shareholders of Tyals PRC – Mr. Yuhu Wang and Hawkland, Tyals PRC and Daqing WFOE, the shareholders of Tyals PRC pledged all of their equity interests in Tyals PRC to Daqing WFOE and Tyals PRC pledged all of its equity interests in its subsidiaries – Tongliao and Tongxin Micro-Credit - to Daqing WFOE, in order to guarantee Tyals PRC’s performance of its obligations under the Exclusive Service Agreement. Pursuant to the terms of this agreement, in the event that Tyals PRC is in breach of the Exclusive Service Agreement, then Daqing WFOE shall be entitled to require (i) the equity owners of Tyals PRC to transfer their equity interests in Tyals PRC to it and (ii) Tyals PRC to transfer its equity interests in its subsidiaries to it.

Shareholders’ Voting Rights Proxy Agreement

Under the shareholders’ voting rights proxy agreement, each of Mr. Yuhu Wang, Hawkland and Tyals PRC and its subsidiaries has executed an irrevocable power of attorney to appoint the authorized personnel of Daqing WFOE as their attorney-in-fact to exercise all of their rights as equity owners of Tyals PRC, including (1) the right to convene and attend shareholders meetings of Tyals PRC; (2) the voting rights at shareholders’ meetings; and (3) the right to appoint the director(s) and the senior management of Tyals PRC. The shareholders’ voting rights proxy agreement will remain in effect for twenty (20) years and shall automatically renew for another one (1) year when the term (whether original or extended, if applicable) of agreement is due, unless Daqing WOFE gives a thirty-day notice in writing to the other Parties of the cancellation of such renewal. The shareholders’ voting rights proxy agreement cannot be terminated unless and until all of the equity interests held by the shareholders of Tyals PRC have been transferred to Daqing WFOE or any third party designated by Daqing WFOE in writing.

According to the above mentioned structure, Oriental Cayman consolidates Tyals PRC financial results, assets and liabilities in its financial statements.

Contractual Arrangements between RTI BVI and Mr. Wang

On January 20, 2011, we formed RTI BVI, a holding company that owns a 51% equity interest in Oriental Cayman. On September 1, 2011, Ms. Meiyi Xia, a citizen of the United States and the sole shareholder of RTI BVI, entered into a call option agreement with Mr. Yuhu Wang, who is a PRC citizen and majority owner of Tyals PRC (“Call Option Beneficiary”). The call option agreement grants the Call Option Beneficiary the right to acquire up to 100% of Ms. Xia’s interest in RTI BVI for a nominal amount per share over the next five (5) years. According to the agreement, the Call Option Beneficiary is able to exercise the right to acquire up to 25% of Ms. Xia’s interest on October 1, 2014; up to 35% on October 1, 2015; and up to the remaining 40% on October 1, 2016. The option will vest and become effective and exercisable upon the dates set in the agreement and will expire five years from the effective date of the call option agreement.

In addition, under the call option agreement, Ms. Xia agreed that without the prior written consent of the Call Option Beneficiary, she will not and will procure RTI BVI not to: (i) issue or create any new shares, equity, registered capital, ownership interest, or equity-linked securities, or any options or warrants that are directly convertible into, or exercisable or exchangeable for, shares, equity, registered capital, ownership interest, or equity-linked securities of RTI BVI, or other similar equivalent arrangements, (ii) alter the shareholding structure of RTI BVI (other than as a result of the transfer of existing shares pursuant to this agreement), (iii) cancel or otherwise alter the shares, (iv) amend the register of members or the memorandum and articles of association of RTI BVI, (v) liquidate or wind up RTI BVI, or (vi) act or omit to act in such a way that would be detrimental to the interest of the Call Option Beneficiaries in the shares of RTI BVI.

Subsidiaries

On January 10, 2008, the Company, together with other investors, incorporated Tongliao. The Company contributed RMB 35,000,000, ($5,303,030) representing a 70% equity interest in Tongliao. Tongliao is principally engaged in processing and sale of aluminum products; sale of non-ferrous products; manufacture of aluminum processing equipment; the export of the enterprises produced products and technologies, the import of raw materials, machinery equipment, spare parts and technologies needed by enterprise.

On October 21, 2009, the Company, together with other investors, incorporated Tongxin Micro-Credit. The Company contributed RMB 4,000,000 ($585,892), representing a 20% equity interest in Tongxin Micro-Credit. During October 2009, the Company transferred a 2% equity interest to a third party at the cost, i.e., RMB 400,000 ($58,589). Through this transaction, the Company’s equity interest in Tongxin Micro-Credit is 18% and therefore does not have a significant influence over it. Tongxin Micro-Credit is principally engaged in lending services in the PRC.

On February 8, 2010, the Company, together with other investors, incorporated Tongyu Thermal Co., Ltd. in the PRC (“Tongyu Thermal”). The Company contributed RMB 1,750,000 ($265,152), representing a 35% equity interest in Tongyu Thermal. Tongyu Thermal is principally engaged in heating supply services. D uring the period the Company held its investment in Tongyu Thermal, it had no operations and therefore, the Company did not recognize any income or loss from its investment or gain or loss on disposal. On April 30, 2010, the Company disposed of the investment to a third party at a cash consideration of RMB 1,750,000 ($265,152).

On August 26, 2011 Oriental Cayman, Hawkland, Tyals PRC, and the major shareholders of Tyals PRC entered into a Master Investment Agreement according to which Hawkland invested RMB 30 million (US $ 4.5 million) in Tyals PRC, of which RMB 3 million was subscribed to Tyals PRC’s registered capital, accounting for 7.9% of Tyals PRC’s total share capital. Tyals PRC agreed to increase the Company’s registered capital from RMB 34.91 million to RMB 37.91 million as a result of the investment. The remaining RMB 27 million was accounted for as capital surplus of Tyals PRC. In addition, Hawkland received 2,072,539 ordinary shares or 20.73% ownership interest in Oriental Cayman according to the agreement.

On August 26, 2011 Hawkland (“Lender”), Mr. Yuhu Wang and Oriental Cayman (“Borrowers”) executed a one year $500,000 loan agreement, at a rate of 10% per annum, cumulative and compounding annually, payable quarterly. The Borrowers may prepay the Note at any time in whole or in part, provided that any prepayment shall include the amount of interest due at the end of the quarter in which the date of such prepayment falls. The loan is convertible at the Lender’s discretion into common stock of Oriental Cayman prior to the tenth anniversary of the execution date.

On August 26, 2011, Oriental Cayman, Hawkland, Tyals PRC, and the major shareholders of Tyals PRC entered into a Common Stock Purchase Warrant, according to which Hawkland is entitled to subscribe for and purchase from Oriental up to 916,118 shares of common stock at any time on or after the initial exercise date and on or prior to the close of business on the fourth year anniversary of the initial exercise date. The exercise price is $2.89, subject to certain price adjustments.

China’s M&A regulations were promulgated on August 8, 2006 by six Chinese regulatory agencies (including the PRC Ministry of Commerce, (“MOFCOM”), and the China Securities Regulatory Commission, (“CSRC”)). The M&A regulations, known as Circular 10 “Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors” became effective on September 8, 2006. Under Circular 10, an offshore special purpose vehicle, or SPV, formed for purposes of overseas listing of equity interests in China-based companies and controlled directly or indirectly by Chinese companies or individuals must obtain the approval of the CSRC prior to the listing of such SPV’s securities on an overseas stock exchange. Circular 10 also requires approval from MOFCOM for “round-trip” investment transactions in which a China-based company or a PRC resident, or Acquirer, using an offshore entity controlled by the Acquirer, acquires any PRC local company that is an affiliate of the Acquirer.

In the opinion of Deheng Law Firm, our PRC counsel, (i) the ownership structure and the business and operation model of each of Daqing WFOE and Tyals PRC are in compliance with all existing PRC laws and regulations, and (ii) each contract under Daqing WFOE and RTI BVI contractual arrangements with Tyals PRC and its shareholders is valid and binding, and will not result in any violation of PRC M&A Laws or other PRC laws or regulations currently in effect. However, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Accordingly, the PRC regulatory authorities may in the future take a view that our contractual arrangements are contrary to the above opinion of our PRC legal counsel. We have been further advised by our PRC counsel that if the PRC government finds that the agreements that establish the structure for operating our PRC business do not comply with PRC government restrictions on foreign investment, we could be subject to severe penalties including being prohibited from continuing operation.

Corporate Information

Our principal executive offices are located at Daqing High and New Technology Industrial Development District, Daqing, Heilongjiang, People’s Republic of China 163316 and our telephone number is +86 459 6284782.

4.B. Business Overview

Through our PRC entities, we are one of China’s leading domestic manufacturers of aluminum fabricated products with an annual production of 1,100,000 tons. We expect our annual production to increase to 3,000,000 tons by the end of 2015. Our principal operations are based in Daqing City, Heilongjiang Province, PRC. We have almost a decade of aluminum products manufacturing experience in both industrial and consumer semi-fabricated aluminum products, including aluminum rod, aluminum particle, aluminum wire, aluminum sheet, aluminum curtain wall and electronic aluminum foil. In addition, we are currently building one of Asia’s largest pharmaceutical packaging aluminum foil (PTP: Press-Through Packaging and PTBF: Press-Through Blister Foil) production centers which is expected to start operations in April 2012. At the end of August 2011, we received an investment of RMB 30 million ($4.5 million) from Hawkland in Tyals PRC. The proceeds will be used for the construction of the facilities and purchase of the major equipment of pharmaceutical foil product lines.

The table below shows the Company’s net revenues for aluminum products:

Table No. 4

Net Revenues by product

(In Thousands of US Dollars)

| | | Six Months Ended June 30, | | | Years Ended December 31, | |

| | | 2011 | | | 2010 | | | 2010 | | | 2009 | |

| Revenues: | | | | | | | | | | | | | | | | |

| Aluminum curtain wall | | $ | 5,070 | | | $ | 1,286 | | | $ | 9,092 | | | $ | - | |

| Electrical aluminum rod | | | 4,881 | | | | 3,769 | | | | 4,040 | | | | 1,829 | |

| Aluminum wire | | | 1,470 | | | | 2,928 | | | | 3,013 | | | | 404 | |

| Electronic aluminum foil | | | 748 | | | | 1,648 | | | | 2,961 | | | | - | |

| Aluminum sheet | | | 1,120 | | | | - | | | | 922 | | | | - | |

| Others | | | - | | | | - | | | | - | | | | 43 | |

| Total | | | 13,289 | | | | 9,631 | | | | 20,028 | | | | 2,276 | |

| | | | | | | | | | | | | | | | | |

| Cost of sales: | | | | | | | | | | | | | | | | |

| Aluminum curtain wall | | $ | 3,644 | | | $ | 803 | | | $ | 5,620 | | | $ | - | |

| Electrical aluminum rod | | | 4,331 | | | | 3,074 | | | | 3,345 | | | | 1,543 | |

| Aluminum wire | | | 1,334 | | | | 2,518 | | | | 2,573 | | | | 599 | |

| Electronic aluminum foil | | | 587 | | | | 1,272 | | | | 2,293 | | | | - | |

| Aluminum sheet | | | 1,057 | | | $ | 0 | | | | 858 | | | | - | |

| Others | | | - | | | | - | | | | - | | | | 45 | |

| Total | | | 10,953 | | | | 7,667 | | | | 14,689 | | | | 2,187 | |

| | | | | | | | | | | | | | | | | |

| Gross Profit: | | | | | | | | | | | | | | | | |

| Aluminum curtain wall | | $ | 1,426 | | | $ | 483 | | | $ | 3,472 | | | $ | - | |

| Electrical aluminum rod | | | 550 | | | | 695 | | | | 695 | | | | 286 | |

| Aluminum wire | | | 136 | | | | 410 | | | | 440 | | | | (195 | ) |

| Electronic aluminum foil | | | 161 | | | | 376 | | | | 668 | | | | - | |

| Aluminum sheet | | | 63 | | | | - | | | | 64 | | | | - | |

| Others | | | - | | | | - | | | | - | | | | (2 | ) |

| Total | | | 2,336 | | | | 1,964 | | | | 5,339 | | | | 89 | |

Corporate Strategy

Our corporate strategy consists of (i) expanding our market share in the aluminum alloy materials and aluminum deep processing products market by building new product lines such as aluminum foil for pharmaceutical packaging and expanding the production scale of existing product lines such as decorative plates; and (ii) increasing cold rolling equipment to meet the Company’s own needs for raw materials for decorative plates and aluminum foil and thus enhance the product structure.

Competitive Conditions

Geographically, aluminum processing enterprises are mainly located in the PRC provinces of Jiangsu, Henan, Zhejiang, Chongqing, Fujian, Shanghai, and Hebei. They account for 20.84%, 20.77%, 10.0%, 9.73%, 9.71%, 8.23%, and 7.15% of the total aluminum output in the PRC, respectively. Among our competitors, Aluminum Company of America (“Alcoa”) has aluminum processing enterprises in China (Bohai, Shanghai, Yunnan, and Kunshan). However, none of such locations and plants has an aluminum foil deep processing business, which is needed for the processing of pharmaceutical aluminum foil. In 2009, Alcoa sold its aluminum foil processing plants in Bohai and Shanghai to Yunnan Metallurgical Group, now Shanghai Huxin Aluminum Foil Co., Ltd., and consequently exited the local aluminum foil market. Another competitor of ours, Aluminum Company of Canada (“Alcan”) owns its major aluminum processing plant in China - Rio Tinto Alcan (Tianjin) Cable Co., Ltd. The plant started to operate in November 2009 and its products are high-end aluminum and aluminum alloy wire and cable.

We believe that we have several advantages over such competitors, including:

| · | Talents. Our company has a research and management team with extensive experience in the aluminum fabricated products industry. Our executives have an average of 20 years of related experience and have worked in several companies including the Northeast Light Alloy Co., Ltd. (China's first large-scale aluminum magnesium processing plant that sets national standards), Shandong Nanshan Group, Institute of Aluminum Processing of Original Metallurgical Industry Ministry and other enterprises and research institutes. They have a deep understanding of the market demand and the behavioral characteristics of downstream industries such as aluminum, petrochemical, transportation, power facilities, electronic appliances, building decoration, and packaging materials. In addition, Tyals PRC is located in China’s old northeast industrial base, adjacent to companies such as Northeast Light Alloy Co., Ltd. and the two renowned institutions, Harbin Institute of Technology and Harbin Engineering University. |

| · | Research and Development. Our research and development efforts over the years have helped expand our production capacity and reduce our unit production costs. We have successfully commercialized our research and development achievements in aluminum magnesium processing and related technologies. In addition, we own thirty two (32) proprietary technologies: ten (10) used in melting and casting, three (3) in adding rare earth elements into the aluminum alloy, nine (9) in the aluminum alloy plate processing, five (5) in surface processing of curtain walls, four (4) in PTP pharmaceutical aluminum foil and PTBF processing, and one (1) in electronic aluminum foil. Our "3003B-H18 high-strength, high-specific volume electronic aluminum foil" was included in the “National Key New Products Plan” by the PRC Ministry of Science and Technology and the Ministry of Commerce; it was awarded the "Heilongjiang Technical Innovation Project Orientation Program" by Heilongjiang Economic and Trade Commission, and approved as a "Heilongjiang High-tech Industrialization Demonstration Project" by Heilongjiang Planning Commission. Moreover, we own two (2) trademarks. The trademarks have a term of 10 years. In its current form, Chinese intellectual property law differs from United States intellectual property law in significant ways. For instance, Chinese trademark law is based on a first-to-register system as opposed to the United States' first-to-use system. Moreover, the PRC government and its courts have limited experience in enforcing its intellectual property laws. Modern PRC trademark laws have only existed for approximately 20 years. Courts in China have not reached the same level of experience in enforcing and interpreting intellectual property laws as have the courts in the United States. However, the PRC government has created administrative bureaus specifically for trademark infringement disputes as an alternative to judicial resolution. These administrative bureaus have the power to order an infringing party to stop and desist from such violations. We do not regard any single proprietary technology, license, or trademark to be material to our sales and operations as a whole. We have no material licenses, or trademarks the duration of which cannot, in the judgment of our management be extended as necessary. We are neither involved in any material intellectual property disputes against us nor are we pursuing any material intellectual property rights against any party. |

| · | Technology. We believe we employ more sophisticated and efficient technology than most of our domestic competitors. After years of exploration and experiments, we now have production technologies for various products and monitoring methods for all key equipments. We have also established management systems such as an operation staff training system and quality control system to achieve cost saving, high product quality and high yield. |

| · | Customized Products. We can develop and produce customized products in accordance with industry customers’ needs. Examples of such products include high-pressure foil, copper clad aluminum rods, rare earth aluminum alloy rods and others. We also provide customized aluminum curtain wall products catering to the needs of construction industry customers. With our ability to produce double-curved walls, multi-curved walls and shaped plates, we have undertaken a number of important interior and exterior decoration projects in the Heilongjiang province. |

| · | Cost control. The use of new technologies and equipment maximizes our profitability and brings obvious cost control advantages. Our products use domestic equipment with the same technical level of imported equipment. Through our operations in Tongliao City, the fourth largest logistics center in Northeast China and also an important transport hub as well as energy base in the Northeast and Inner Mongolia, we achieve an advantage over our competitors in terms of transportation and energy savings that helps us obtain stable and convenient raw materials. |

Environmental Protection

We are subject to PRC national environmental laws and regulations as well as environmental regulations promulgated by the local governments where we operate. These include regulations on waste discharge, land repair, emissions disposal and mining control. For example, national regulations promulgated by the PRC government set discharge standards for emissions into the air and water. National environmental protection enforcement authorities also promulgate discharge fees for various waste substances. These schedules usually provide for discharge fee increases for each incremental increase of the amount of discharge up to a specified level set by the PRC government or the local government. For any discharge exceeding the specified level, the relevant PRC government agencies may order any of our facilities to rectify certain behavior causing environmental damage, and subject to PRC government approval, the local government has the authority to order any of our facilities to close for failure to comply with existing regulations.

Our total environmental protection expense was RMB 250,000 ($37,879) for year ended December 31, 2010. We believe that our operations are substantially in compliance with currently applicable national and provincial environmental regulations.

Insurance

We currently maintain insurance coverage on our property, plants, equipment, transportation vehicles and various assets that we consider to be subject to significant operating risks. We paid a total of RMB 3,349 ($507) for our transportation vehicles insurance for the year ended December 31, 2010.

We are covered under the injury and accidental death insurance provided by the local government labor departments and therefore we do not purchase separate insurance policies from commercial insurers with respect to such risks.

Consistent with what we believe to be the customary practice in China, we do not generally carry any third party liability insurance to cover claims in respect of personal injury, environmental damage arising from accidents on our property or relating to our operations (other than our automobiles) or business interruption insurance. More extensive insurance is either unavailable in China or would impose a cost on our operations that would reduce our competitiveness with other producers.

Seasonality

Our business is not seasonal.

Regulatory Overview

Admission Conditions on Aluminum Industry