Table of Contents

As filed with the Securities and Exchange Commission on December 3, 2012

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Basic Energy Services, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1389 | 54-2091194 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Co-Registrants

(see next page)

801 Cherry Street, Suite 2100 Fort Worth, Texas 76102 (817) 334-4100 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | Kenneth V. Huseman President 801 Cherry Street, Suite 2100 Fort Worth, Texas 76102 (817) 334-4100 (Name, address, including zip code, and telephone number, including area code of agent for service) |

Copy to:

David C. Buck

Andrews Kurth LLP

600 Travis, Suite 4200

Houston, Texas 77002

(713) 220-4200

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable following the effectiveness of this registration statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||

7 3/4% Senior Notes due 2022 | $300,000,000 | 100% | $300,000,000 | $40,920(1) | ||||

Guarantees by certain subsidiaries of Basic Energy Services, Inc.* | — | — | — | —(2) | ||||

| ||||||||

| ||||||||

| (1) | The registration fee was calculated pursuant to Rule 457(f) under the Securities Act of 1933. For purposes of this calculation, the offering price per note was assumed to be the stated principal amount of each original note that may be received by the registrant in the exchange transaction in which the notes will be offered. |

| (2) | Pursuant to Rule 457(n) under the Securities Act of 1933, no separate fee for the guarantees is payable because the guarantees relate to other securities that are being registered concurrently. |

| * | The guarantor subsidiaries of Basic Energy Services, Inc. are identified on the following page. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

SUBSIDIARY GUARANTOR CO-REGISTRANTS

Exact Name of Additional Registrant as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | Primary Standard Industrial Classification Code Number | I.R.S. Employer Identification No. | |||||||

Basic Energy Services GP, LLC(1) | Delaware | 1389 | 54-2091197 | |||||||

Basic Energy Services LP, LLC(1) | Delaware | 1389 | 54-2091195 | |||||||

Basic Energy Services, L.P.(1) | Delaware | 1389 | 75-2441819 | |||||||

Basic ESA, Inc.(1) | Texas | 1389 | 75-1772279 | |||||||

Chaparral Service, Inc.(1) | New Mexico | 1389 | 85-0206424 | |||||||

Basic Marine Services, Inc.(1) | Delaware | 1389 | 20-2274888 | |||||||

First Energy Services Company(1) | Delaware | 1389 | 84-1544437 | |||||||

Hennessey Rental Tools, Inc.(1) | Oklahoma | 1389 | 73-1435063 | |||||||

Oilwell Fracturing Services, Inc.(1) | Oklahoma | 1311 | 73-1142826 | |||||||

Wildhorse Services, Inc.(1) | Oklahoma | 1389 | 06-1641442 | |||||||

LeBus Oil Field Service Co.(1) | Texas | 4214 | 75-2073125 | |||||||

Globe Well Service, Inc.(1) | Texas | 1389 | 75-1634275 | |||||||

SCH Disposal, L.L.C.(1) | Texas | 1389 | 75-2788335 | |||||||

JS Acquisition LLC(1) | Delaware | 1389 | 26-2529500 | |||||||

JetStar Holdings, Inc.(1) | Delaware | 1389 | 74-3144248 | |||||||

Acid Services, LLC(1) | Kansas | 1389 | 48-1180455 | |||||||

JetStar Energy Services, Inc.(1) | Texas | 1389 | 68-0605237 | |||||||

Sledge Drilling Corp.(1) | Texas | 1381 | 20-4223140 | |||||||

Permian Plaza, LLC(1) | Texas | 6512 | 26-0753425 | |||||||

Xterra Fishing & Rental Tools Co.(1) | Texas | 1389 | 76-0647818 | |||||||

Taylor Industries, LLC(1) | Texas | 3533 | 27-2417037 | |||||||

Platinum Pressure Services, Inc.(1) | Texas | 1389 | 26-1338379 | |||||||

Admiral Well Service, Inc.(1) | Texas | 1389 | 26-3164899 | |||||||

Maverick Coil Tubing Services, LLC(1) | Colorado | 1389 | 84-1563281 | |||||||

Maverick Solutions, LLC(1) | Colorado | 1389 | 20-0122876 | |||||||

Maverick Stimulation Company, LLC(1) | Colorado | 1389 | 84-1354572 | |||||||

Maverick Thru-Tubing Services, LLC(1) | Colorado | 1389 | 27-1501902 | |||||||

MCM Holdings, LLC(1) | Colorado | 1389 | 84-1520949 | |||||||

MSM Leasing, LLC(1) | Colorado | 1389 | 27-0629182 | |||||||

The Maverick Companies, LLC(1) | Colorado | 1389 | 20-5244170 | |||||||

| (1) | The address for such Subsidiary Guarantor is 801 Cherry Street, Suite 2100, Fort Worth, Texas 76102. |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion Dated December 3, 2012

Basic Energy Services, Inc.

Offer to exchange up to

$300,000,000 of 7 3/4% Senior Notes due 2022

that have been registered under the Securities Act of 1933

for

$300,000,000 of 7 3/4% Senior Notes due 2022

that have not been registered under the Securities Act of 1933

THE EXCHANGE OFFER WILL EXPIRE AT 5:00 P.M., NEW YORK

CITY TIME, ON , 2013, UNLESS WE EXTEND THE DATE

Terms of the Exchange Offer:

| • | We are offering to exchange up to $300.0 million aggregate principal amount of registered 7 3/4% Senior Notes due 2022, which we refer to as the new notes, for any and all of our $300.0 million aggregate principal amount of unregistered 7 3/4% Senior Notes due 2022, which we refer to as the old notes. |

| • | We will exchange all outstanding old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for an equal principal amount of new notes. |

| • | The terms of the new notes will be substantially identical to those of the outstanding old notes, except that the transfer restrictions, registration rights and liquidated damages provisions relating to the old notes will not apply to the new notes. |

| • | You may withdraw tenders of old notes at any time prior to the expiration of the exchange offer. |

| • | The exchange of new notes for old notes will not be a taxable transaction for U.S. federal income tax purposes. |

| • | We will not receive any cash proceeds from the exchange offer. |

| • | The old notes are, and the new notes will be, guaranteed on a senior unsecured basis by each of our material restricted subsidiaries that guarantees our other indebtedness. |

| • | There is no established trading market for the new notes or the old notes. |

| • | We do not intend to apply for listing of the new notes on any national securities exchange or for quotation through any quotation system. |

See “Risk Factors” beginning on page 12 for a discussion of certain risks that you should consider prior to tendering your outstanding old notes in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, if requested by a participating broker-dealer, we will use our reasonable best efforts to keep the exchange offer registration statement continuously effective for a period necessary to comply with applicable law for a period of up to 180 days after the date on which such registration statement is declared effective (or such longer period if extended pursuant to any Delay Period (as described herein)), and we will make this prospectus available to any broker-dealer for use in connection with any such resale. Please read “Plan of Distribution.”

Prospectus dated , 2012

Table of Contents

| Page | ||||

| i | ||||

| iii | ||||

| iv | ||||

| 1 | ||||

| 12 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 20 | ||||

| 23 | ||||

| 32 | ||||

| 79 | ||||

| 80 | ||||

| 81 | ||||

| 81 | ||||

INDEXTO CONSOLIDATED FINANCIAL STATEMENTSOF THE MAVERICK COMPANIES | F-1 | |||

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission, referred to in this prospectus as the SEC. You should read this prospectus together with the registration statement, the exhibits thereto and the additional information described under the heading “Where You Can Find More Information.” In making your decision to participate in the exchange offer, you should rely only on the information contained in this prospectus and in the accompanying letter of transmittal. We have not authorized anyone to provide you with any other information. If you received any unauthorized information, you must not rely on it. We are not making an offer to sell these securities in any state or jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we use the terms “Basic Energy Services,” “we,” “us” and “our” to refer to Basic Energy Services, Inc. together with its subsidiaries, unless the context otherwise requires.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-4, including exhibits and schedules, under the Securities Act with respect to the offer to exchange our senior notes. The registration statement, including the attached exhibits, contains additional relevant information about us. The rules and regulations of the SEC allow us to omit some information included in the registration statement from this prospectus.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public on the SEC’s web site athttp://www.sec.gov. You may also read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the operation of the Public Reference Room.

These reports and other information may be inspected and copied at the public reference facilities maintained by the SEC or obtained from the SEC’s website as provided above. In addition, we make available on our web site athttp://www.basicenergyservices.com, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10 Q and current reports on Form 8-K (and any amendments to those reports) filed pursuant to

i

Table of Contents

Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as amended, and other information filed with or furnished to the SEC, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC.Unless otherwise specified, information contained on, or available by hyperlink from, our web site or contained on the SEC’s web site is not incorporated into this prospectus.You may also request a copy of these filings at no cost, by writing or telephoning us at the following address: Basic Energy Services, Inc., Attention: Chief Financial Officer, 801 Cherry Street, Suite 2100, Fort Worth, Texas 76102, (817) 334-4100.

ii

Table of Contents

We are incorporating by reference the information that we file with the SEC, which means that we are disclosing important information to you in those documents. The information incorporated by reference is an important part of this prospectus, and the information that we subsequently file with the SEC will automatically update and supersede information in this prospectus and in our other filings with the SEC. We incorporate by reference the documents listed below, which we have already filed with the SEC, and any future filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act (other than information furnished pursuant to Items 2.02 or 7.01 of any Current Report on Form 8-K) until the exchange offer described in this prospectus is completed or is otherwise terminated.

| • | Our annual report on Form 10-K for the year ended December 31, 2011, filed with the SEC on February 24, 2012, which we refer to as our 2011 Form 10-K; |

| • | Our quarterly reports on Form 10-Q for the three months ended March 31, 2012, filed with the SEC on April 24, 2012, for the three months ended June 30, 2012, filed with the SEC on July 30, 2012, and for the three months ended September 30, 2012, filed with the SEC on October 30, 2012; and |

| • | Our current reports on Form 8-K and 8-K/A, filed with the SEC on January 30, 2012, March 14, 2012, April 10, 2012, May 23, 2012, May 25, 2012, October 4, 2012, October 15, 2012 and October 22, 2012 (as amended October 26, 2012). |

Any statement contained in a document all or a portion of which is incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any future filings that we incorporate by reference herein modifies or supersedes the statement. Any such statement or document so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You may request a copy of these filings, at no cost, by writing or telephoning us at the following address and telephone number:

Basic Energy Services, Inc.

801 Cherry Street, Suite 2100

Fort Worth, Texas 76102

(817) 334-4100

Attn: Investor Relations

iii

Table of Contents

This prospectus contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of the U.S. federal securities laws. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, among other things, the risk factors discussed in this prospectus under the caption “Risk Factors” and in our most recent annual report on Form 10-K and quarterly reports on Form 10-Q and other factors, most of which are beyond our control.

The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect” and similar expressions are intended to identify forward-looking statements. All statements other than statements of current or historical fact contained in this prospectus are forward looking-statements. Although we believe that the forward-looking statements contained in this prospectus are based upon reasonable assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Important factors that may affect our expectations, estimates or projections include:

| • | a decline in, or substantial volatility of, oil or natural gas prices, and any related changes in expenditures by our customers; |

| • | the effects of future acquisitions on our business; |

| • | changes in customer requirements in markets or industries we serve; |

| • | competition within our industry; |

| • | general economic and market conditions; |

| • | our access to current or future financing arrangements; |

| • | our ability to replace or add workers at economic rates; and |

| • | environmental and other governmental regulations. |

Our forward-looking statements speak only as of the date of this prospectus. Unless otherwise required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This prospectus and the information incorporated herein by reference include market share data, industry data and forecasts that we obtained from internal company surveys (including estimates based on our knowledge and experience in the industry in which we operate), market research, consultant surveys, publicly available information, industry publications and surveys. These sources include Baker Hughes Incorporated, the Association of Energy Service Companies, and the Energy Information Administration of the U.S. Department of Energy. Industry surveys and publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe such information is accurate and reliable, we have not independently verified any of the data from third-party sources cited or used for our management’s industry estimates, nor have we ascertained the underlying economic assumptions relied upon therein. For example, the number of onshore well servicing rigs in the U.S. could be lower than our estimate to the extent our two larger competitors have continued to report as stacked rigs equipment that is not actually complete or subject to refurbishment. Statements as to our position relative to our competitors or as to market share refer to the most recent available data.

iv

Table of Contents

The following is a summary of some of the information contained elsewhere in this prospectus. It is not complete and may not contain all the information that you should consider before making a decision to participate in the exchange offer. To understand this offering fully, you should read carefully the entire prospectus, including the risk factors beginning on page 12 and the consolidated financial statements and the notes thereto incorporated by reference into this prospectus.

Basic Energy Services, Inc.

We provide a wide range of well site services to oil and natural gas drilling and producing companies, including completion and remedial services, fluid services, well servicing and contract drilling. These services are fundamental to establishing and maintaining the flow of oil and natural gas throughout the productive life of a well. Our broad range of services enables us to meet multiple needs of our customers at the well site. Our operations are managed regionally and are concentrated in major United States onshore oil and natural gas producing regions located in Texas, New Mexico, Oklahoma, Arkansas, Kansas, Louisiana, Wyoming, North Dakota, Colorado, Utah, Montana, West Virginia and Pennsylvania. Our operations are focused on liquid rich basins that currently exhibit strong drilling and production economics as well as natural gas-focused shale plays characterized by prolific reserves and attractive economics. Specifically, we have a significant presence in the Permian Basin and the Bakken, Eagle Ford, Haynesville and Marcellus shales. We provide our services to a diverse group of over 2,000 oil and gas companies.

Our four operating segments are Completion and Remedial Services, Fluid Services, Well Servicing and Contract Drilling. The following is a description of these segments:

| • | Completion and Remedial Services. Our completion and remedial services segment (43% of our revenues in 2011 and 44% of our revenues in the first nine months of 2012) currently operates our fleet of pressure pumping units, an array of specialized rental equipment and fishing tools, coiled tubing units, snubbing units, thru-tubing, air compressor packages specially configured for underbalanced drilling operations, cased-hole wireline units, nitrogen units, and water treatment. The largest portion of this business segment consists of pumping services focused on cementing, acidizing and fracturing services in niche markets, and as of September 30, 2012, we own approximately 277,000 hydraulic horsepower of pumping capacity. |

| • | Fluid Services. Our fluid services segment (27% of our revenues in 2011 and 25% of our revenues in the first nine months of 2012) utilizes our fleet of 951 fluid service trucks and related assets, including specialized tank trucks, storage tanks, water wells, disposal facilities and construction and other related equipment. These assets provide, transport, store and dispose of a variety of fluids, as well as provide well site construction and maintenance services. These services are required in most workover, completion and remedial projects and are routinely used in daily producing well operations. |

| • | Well Servicing. Our well servicing segment (27% of our revenues in 2011 and 27% of our revenues in the first nine months of 2012) operates our fleet of 431 well servicing rigs and related equipment. This business segment encompasses a full range of services performed with a mobile well servicing rig, including the installation and removal of downhole equipment and elimination of obstructions in the well bore to facilitate the flow of oil and natural gas. These services are performed to establish, maintain and improve production throughout the productive life of an oil and natural gas well and to plug and abandon a well at the end of its productive life. Our well servicing equipment and capabilities also facilitate most other services performed on a well. |

| • | Contract Drilling. Our contract drilling segment (3% of our revenues in 2011 and 4% of our revenues in the first nine months of 2012) operates 12 drilling rigs and related equipment. We use these assets to penetrate the earth to a desired depth and initiate production from a well. |

1

Table of Contents

Our primary executive offices are located at 801 Cherry Street, Suite 2100, Fort Worth, Texas 76102, and our telephone number is (817) 334-4100. Our Internet website iswww.basicenergyservices.com. The information contained on our website or that can be accessed through our website does not constitute a part of this prospectus.

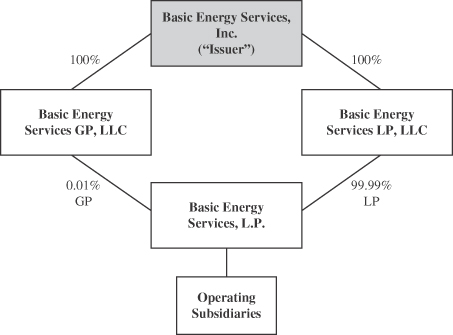

Corporate Structure

Below is a chart that illustrates our corporate structure.

2

Table of Contents

The Exchange Offer

On October 16, 2012, we completed a private offering of $300,000,000 aggregate principal amount of our 7 3/4% Senior Notes due 2022, which we refer to in this prospectus as our old notes. As part of the private offering, we entered into a registration rights agreement with the initial purchasers of the old notes in which we agreed, among other things, to deliver this prospectus to you and to use our reasonable best efforts to consummate the exchange offer within 270 days after October 16, 2012. The following is a summary of the exchange offer.

Old Notes | 7 3/4% Senior Notes due October 15, 2022, which were issued on October 16, 2012. |

New Notes | 7 3/4% Senior Notes due October 15, 2022. The terms of the new notes are substantially identical to the terms of the outstanding old notes, except that the transfer restrictions, registration rights and liquidated damages provisions relating to the old notes will not apply to the new notes. |

Exchange Offer | We are offering to exchange up to $300.0 million aggregate principal amount of our new notes that have been registered under the Securities Act for an equal amount of our outstanding old notes that have not been registered under the Securities Act to satisfy our obligations under the registration rights agreement. |

| The new notes will evidence the same debt as the old notes and will be issued under, and be entitled to the benefits of, the same indenture that governs the old notes. Holders of the old notes do not have any appraisal or dissenter’s rights in connection with the exchange offer. Because the new notes will be registered, the new notes will not be subject to transfer restrictions, and holders of old notes that have tendered and had their old notes accepted in the exchange offer will have no registration rights. |

| Old notes tendered in the exchange offer must be in denominations of principal amount of $2,000 and any integral multiple of $1,000 in excess of $2,000. |

Expiration Date | The exchange offer will expire at 5:00 P.M., New York City time, on , 2013, unless we decide to extend it. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may waive. Please read “The Exchange Offer — Conditions to the Exchange Offer” for more information regarding the conditions to the exchange offer. |

Procedures for Tendering Old Notes | If you wish to accept the exchange offer, you must deliver to Wells Fargo Bank, National Association, as registrar and the exchange agent: |

| • | either a completed and signed letter of transmittal or, for old notes tendered electronically, an agent’s message from The Depository |

3

Table of Contents

Trust Company, or DTC, stating that the tendering participant agrees to be bound by the letter of transmittal and the terms of the exchange offer; |

| • | your old notes, either by tendering them in certificated form or by timely confirmation of book-entry transfer through DTC; and |

| • | all other documents required by the letter of transmittal. |

| These actions must be completed before the expiration of the exchange offer. If you hold old notes through DTC, you must comply with its standard for electronic tenders, by which you will agree to be bound by the letter of transmittal. |

| There is no procedure for guaranteed late delivery of the old notes. |

| By signing, or by agreeing to be bound by, the letter of transmittal, you will be representing to us that: |

| • | you will be acquiring the new notes in the ordinary course of your business; |

| • | you are not participating in, and you have no arrangement or understanding with any person or entity to participate in, the distribution of the new notes within the meaning of the Securities Act; |

| • | you are not an affiliate of ours, as such term is defined in Rule 405 under the Securities Act; and |

| • | you are not engaged in, and do not intend to engage in, a distribution of the new notes. |

| See “The Exchange Offer — Terms of Exchange” and “The Exchange Offer — Procedures for Tendering.” |

Special Procedures for Beneficial Owners | If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the exchange offer, you should promptly contact the person in whose name the old notes are registered and instruct that person to tender on your behalf. |

| If you wish to tender in the exchange offer on your own behalf, prior to completing and executing the letter of transmittal and delivering the certificates for your old notes, you must either make appropriate arrangements to register ownership of the old notes in your name or obtain a properly completed bond power from the person in whose name the old notes are registered. |

Withdrawal; Non-Acceptance | You may withdraw any old notes tendered in the exchange offer at any time prior to 5:00 P.M., New York City time, on , 2013. If we decide for any reason not to accept any old notes tendered for exchange, the old notes will be returned to the registered holder at |

4

Table of Contents

our expense promptly after the expiration or termination of the exchange offer. In the case of old notes tendered by book-entry transfer into the exchange agent’s account at The Depository Trust Company, any withdrawn or unaccepted old notes will be credited to the tendering holder’s account at The Depository Trust Company. For further information regarding the withdrawal of tendered old notes, please read “The Exchange Offer — Withdrawal Rights.” |

Certain United Stated Federal Income Tax Consequences | The exchange of new notes for old notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please read the discussion under the caption “Certain United States Federal Income Tax Consequences” for more information regarding the tax consequences to you of the exchange offer. |

Use of Proceeds | The issuance of the new notes will not provide us with any new proceeds. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement. |

Fees and Expenses | We will pay all of our expenses incident to the exchange offer. |

Exchange Agent | We have appointed Wells Fargo Bank, National Association as exchange agent for the exchange offer. For the address, telephone number and fax number of the exchange agent, please read “The Exchange Offer — Exchange Agent.” |

Resales of New Notes | Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties that are not related to us, we believe that the new notes you receive in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act so long as: |

| • | the new notes are being acquired in the ordinary course of business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate in the distribution of the new notes issued to you in the exchange offer; |

| • | you are not our affiliate or an affiliate of any of our subsidiary guarantors; and |

| • | you are not a broker-dealer tendering old notes acquired directly from us for your account. |

The SEC has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the SEC would make similar determinations with respect to this exchange offer. If any of these conditions are not satisfied, or if our belief is not accurate, and you transfer any new notes issued to you in the exchange offer without delivering a resale prospectus meeting the requirements of the Securities Act or without an exemption from registration of your new |

5

Table of Contents

notes from those requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. Each broker-dealer that receives new notes for its own account in exchange for old notes, where the old notes were acquired by such broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. Please read “Plan of Distribution.” |

| Please read “The Exchange Offer — Resales of New Notes” for more information regarding resales of the new notes. |

Consequences of Not Exchanging Your Old Notes | If you do not exchange your old notes in this exchange offer, you will no longer be able to require us to register your old notes under the Securities Act, except in the limited circumstances provided under the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer your old notes unless we have registered the old notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. |

| For information regarding the consequences of not tendering your old notes and our obligation to file a registration statement, please read “The Exchange Offer — Consequences of Failure to Exchange Outstanding Securities” and “Description of the New Notes.” |

6

Table of Contents

Description of the New Notes

The terms of the new notes and those of the outstanding old notes will be substantially identical, except that the transfer restrictions, registration rights and liquidated damages provisions relating to the old notes will not apply to the new notes. As a result, the new notes will not bear legends restricting their transfer and will not have the benefit of the registration rights and special interest provisions contained in the old notes. The new notes represent the same debt as the old notes for which they are being exchanged. The new notes are governed by the same indenture as the old notes are.

The following summary contains basic information about the new notes and is not intended to be complete. For a more complete understanding of the new notes, please refer to the section in this prospectus entitled “Description of the New Notes.” When we use the term “notes” in this prospectus, unless the context requires otherwise, the term includes the old notes and the new notes.

Issuer | Basic Energy Services, Inc. |

Securities Offered | $300,000,000 aggregate principal amount of our 7 3/4% Senior Notes due 2022. |

Interest | The new notes will accrue interest from the date of their issuance at the rate of 7.75% per year. Interest on the new notes will be payable semi-annually in arrears on each April 15 and October 15, commencing on April 15, 2013. We have agreed to make additional interest payments to holders of the new notes under certain circumstances if we do not comply with our obligations under the registration rights agreement. |

Maturity Date | October 15, 2022. |

Guarantees | The new notes will be guaranteed by all of our current subsidiaries, other than three immaterial subsidiaries. The new notes will be guaranteed by all of our current and certain material future restricted subsidiaries that guarantee any of our other indebtedness. |

Ranking | The new notes will be our senior indebtedness. Both the new notes and the subsidiary guarantees will rank: |

| • | equally in right of payment with any of our and the subsidiary guarantors’ existing and future senior indebtedness, including our existing senior notes and the related guarantees; and |

| • | effectively junior to all existing or future liabilities of our subsidiaries that do not guarantee the notes and to our and the subsidiary guarantors’ existing or future secured indebtedness to the extent of the value of the collateral therefor. |

Optional Redemption | As of September 30, 2012, after giving effect to the offering of the old notes and the use of the net proceeds from the offering, (i) we and our subsidiaries had approximately $98.0 million of secured indebtedness outstanding under our capital lease obligations and (ii) we and our subsidiary guarantors had $775.0 million of unsecured senior indebtedness outstanding, including the notes. We may redeem |

7

Table of Contents

the notes, in whole or in part, at any time on or after October 15, 2017 at a redemption price equal to 100% of the principal amount thereof, plus a premium declining ratably to par and accrued and unpaid interest to the date of redemption. |

| At any time before October 15, 2015, we may redeem up to 35% of the aggregate principal amount of the notes issued under the indenture with the net cash proceeds of one or more qualified equity offerings at a redemption price equal to 107.750% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to the date of redemption; provided that: |

| • | at least 65% of the aggregate principal amount of the notes issued under the indenture remains outstanding immediately after the occurrence of such redemption; and |

| • | such redemption occurs within 90 days of the date of the closing of any such qualified equity offering. |

| In addition, at any time before October 15, 2017, we may redeem some or all of the notes at a redemption price equal to 100% of the principal amount of the notes, plus an applicable premium and accrued and unpaid interest to the date of redemption. |

Change of Control | Upon a change of control, if we do not redeem the notes, each holder of notes will be entitled to require us to purchase all or a portion of its notes at a purchase price equal to 101% of the principal amount thereof, plus accrued and unpaid interest to the date of repurchase. Our ability to purchase the notes upon a change of control will be limited by the terms of our then outstanding debt agreements. We cannot assure you that we will have the financial resources to purchase the notes in such circumstances. |

Certain Covenants | The indenture contains covenants that, among other things, limit our ability and the ability of certain of our subsidiaries to: |

| • | incur additional indebtedness; |

| • | pay dividends or repurchase or redeem capital stock; |

| • | make certain investments; |

| • | incur liens; |

| • | enter into certain types of transactions with our affiliates; |

| • | limit dividends or other payments by our restricted subsidiaries to us; and |

| • | sell assets or consolidate or merge with or into other companies. |

| These and other covenants that are contained in the indenture are subject to important exceptions and qualifications, which are described under “Description of the New Notes.” |

8

Table of Contents

Absence of a Public Market for the New Notes | There is no public trading market for the new notes, and we do not intend to apply for listing of the new notes on any national securities exchange or for quotation of the new notes on any automated dealer quotation system. See “Risk Factors — Risks Relating to the Exchange Offer and the New Notes — An active trading market may not develop for the new notes.” |

Risk Factors | See “Risk Factors” beginning on page 12 for discussion of factors you should carefully consider before deciding to participate in the exchange offer. |

9

Table of Contents

Summary Historical Financial Information

The following summary historical consolidated financial data as of December 31, 2011 and 2010 and for the years ended December 31, 2011, 2010 and 2009 is derived from our audited consolidated financial statements incorporated by reference into this prospectus. The following summary historical consolidated financial data as of September 30, 2012 and for the nine months ended September 30, 2012 and 2011 is derived from our unaudited interim financial statements incorporated by reference into this prospectus. The financial data as of and for the nine months ended September 30, 2012 and 2011 includes, in management’s opinion, all adjustments necessary for the fair presentation of our financial position and results of operations as of such dates and for such periods, but may not be indicative of results to be expected for the full year.

The data set forth below is qualified by reference to, and should be read in conjunction with, (i) “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2011 Form 10-K incorporated by reference into this prospectus and (ii) our consolidated financial statements and the notes thereto incorporated by reference into this prospectus. In addition, please see the historical consolidated financial statements of The Maverick Companies beginning on page F-1, which financial statements are included with this prospectus in accordance with Rule 3-10(g) of Regulation S-X under the Exchange Act.

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

| 2011 | 2010 | 2009 | 2012 | 2011 | ||||||||||||||||

| (Dollars in thousands) | (Unaudited) | |||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Revenues: | ||||||||||||||||||||

Completion and remedial services | $ | 537,134 | $ | 261,436 | $ | 134,818 | $ | 464,328 | $ | 376,435 | ||||||||||

Fluid services | 332,010 | 241,164 | 214,822 | 270,339 | 241,204 | |||||||||||||||

Well servicing | 333,057 | 204,872 | 160,614 | 292,127 | 242,738 | |||||||||||||||

Contract drilling | 41,054 | 20,767 | 16,373 | 46,021 | 28,519 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total revenues | 1,243,255 | 728,239 | 526,627 | 1,072,815 | 888,896 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Expenses: | ||||||||||||||||||||

Completion and remedial services | 297,276 | 156,573 | 95,287 | 277,111 | 208,230 | |||||||||||||||

Fluid services | 211,959 | 178,152 | 159,079 | 178,479 | 154,647 | |||||||||||||||

Well servicing | 228,723 | 156,885 | 121,618 | 207,063 | 168,016 | |||||||||||||||

Contract drilling | 28,154 | 15,250 | 13,604 | 30,080 | 19,850 | |||||||||||||||

General and administrative(1) | 142,264 | 107,781 | 104,253 | 130,961 | 103,528 | |||||||||||||||

Depreciation and amortization | 154,341 | 135,001 | 132,520 | 137,792 | 109,112 | |||||||||||||||

(Gain) loss on disposal of assets | 447 | 2,856 | 2,650 | 3,123 | (698 | ) | ||||||||||||||

Goodwill impairment | — | — | 204,014 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total expenses | 1,063,164 | 752,498 | 833,025 | 964,609 | 762,685 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating income (loss) | 180,091 | (24,259 | ) | (306,398 | ) | 108,206 | 126,211 | |||||||||||||

Other income (expense): | ||||||||||||||||||||

Net interest expense | (52,299 | ) | (46,368 | ) | (32,386 | ) | (45,102 | ) | (37,015 | ) | ||||||||||

Loss on early extinguishment of debt | (49,366 | ) | — | (3,481 | ) | — | (49,366 | ) | ||||||||||||

Gain on bargain purchase | — | 1,772 | — | — | — | |||||||||||||||

Other income (expense) | 525 | 499 | 1,198 | 624 | 442 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) from continuing operations before income taxes | 78,951 | (68,356 | ) | (341,067 | ) | 63,728 | 40,272 | |||||||||||||

Income tax benefit (expense) | (31,788 | ) | 24,793 | 87,529 | (22,896 | ) | (15,620 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net Income (loss) | $ | 47,163 | $ | (43,563 | ) | $ | (253,538 | ) | $ | 40,832 | $ | 24,652 | ||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Statement of Cash Flow Data: | ||||||||||||||||||||

Cash flows from operating activities | $ | 279,455 | $ | 49,383 | $ | 89,205 | $ | 233,571 | $ | 202,508 | ||||||||||

Cash flows from investing activities | (419,967 | ) | (97,879 | ) | (62,864 | ) | (164,772 | ) | (364,330 | ) | ||||||||||

Cash flows from financing activities | 171,052 | (28,943 | ) | (12,119 | ) | (43,695 | ) | 185,516 | ||||||||||||

Capital expenditures: | ||||||||||||||||||||

Acquisitions, net of cash acquired | 218,347 | 50,278 | 7,816 | 43,117 | 215,948 | |||||||||||||||

Property and equipment | 221,839 | 63,579 | 43,367 | 126,694 | 167,114 | |||||||||||||||

10

Table of Contents

| As of December 31, | As of September 30, | |||||||||||||||||||

| 2011 | 2010 | 2009 | 2012 | 2011 | ||||||||||||||||

| (Dollars in thousands) | (Unaudited) | |||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 78,458 | $ | 47,918 | $ | 125,357 | $ | 103,562 | $ | 71,612 | ||||||||||

Property and equipment, net | 856,412 | 625,702 | 666,642 | 914,293 | 834,185 | |||||||||||||||

Total assets | 1,459,928 | 1,029,813 | 1,039,541 | 1,523,256 | 1,396,401 | |||||||||||||||

Long-term debt, including current portion | 783,091 | 498,859 | 501,812 | 799,764 | 773,675 | |||||||||||||||

Stockholders’ equity | 359,703 | 301,923 | 340,149 | 394,641 | 339,958 | |||||||||||||||

| (1) | Includes approximately $7,955,000, $5,666,000, $5,152,000, $8,365,000 and $5,920,000 of non-cash expenses for the years ended December 31, 2011, 2010 and 2009, and for the nine months ended September 30, 2012 and 2011, respectively. |

Ratio of Earnings to Fixed Charges

The following table sets forth our consolidated ratio of earnings to fixed charges for the periods shown:

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | 2012 | |||||||||||||||||||

Ratio of earnings to fixed charges | 2.3x | (a | ) | (a | ) | 4.7x | 5.2x | 2.3x | ||||||||||||||||

For these ratios, “earnings” means the sum of income before income taxes and fixed charges exclusive of capitalized interest, and “fixed charges” means interest expensed and capitalized, amortized premiums, discounts and capitalized expenses relating to indebtedness and an estimate of the portion of annual rental expense on capital leases that represents the interest factor.

| (a) | Earnings were inadequate to cover fixed charges for the years ended December 31, 2010 and December 31, 2009 by $33.1 million and $266.3 million, respectively. |

11

Table of Contents

An investment in the new notes involves various material risks. Prior to making a decision about investing in the new notes, and in consultation with your own financial and legal advisors, you should carefully consider, among other matters, the following risk factors, as well as those described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” under the heading “Risk Factors” in our most recent annual report on Form 10-K, our most recent quarterly reports on Form 10-Q and in other filings we may make from time to time with the SEC and all of the other information included in, or incorporated by reference into, this prospectus or any prospectus supplement.

Risks Relating to the Exchange Offer and the New Notes

The notes are unsecured and are effectively subordinated to our existing and future secured debt and other secured obligations, and the guarantees of the notes will be effectively subordinated to the guarantors’ secured debt and other secured obligations.

The notes are not secured by any of our or our subsidiaries’ assets. As a result, the notes and the guarantees are effectively subordinated to all of our and the guarantors’ secured obligations to the extent of the value of the assets securing such obligations. In the event of any distribution or payment of our or any guarantor’s assets in any foreclosure, dissolution, winding-up, liquidation, reorganization or other bankruptcy proceeding, holders of secured debt will have a prior claim to the assets that constitute their collateral. Holders of the notes will participate ratably with all holders of our and the guarantors’ unsecured senior debt, and potentially with all of their other general creditors, based upon the respective amounts owed to each holder or creditor, in or the guarantors’ respective remaining assets. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of notes may receive less, ratably, than holders of secured debt. As of September 30, 2012, we and the guarantors had approximately $98.0 million of secured debt under our capital leases and $22.5 million in letters of credit issued under our revolving credit facility. The indenture governing the notes permits us and our subsidiaries to incur secured debt, including pursuant to our revolving credit facility, purchase money instruments and other forms of secured debt.

Our indebtedness could restrict our operations and make us more vulnerable to adverse economic conditions.

We now have, and will continue to have, a significant amount of indebtedness. As of September 30, 2012, pro forma as adjusted for the issuance of the $300.0 million aggregate principal amount of notes and the use of proceeds therefrom, our total debt was $874.8 million. For the nine months ended September 30, 2012, we made cash interest payments totaling $47.5 million.

Our current and future indebtedness could have important consequences. For example, it could:

| • | impair our ability to make investments and obtain additional financing for working capital, capital expenditures, acquisitions or other general corporate purposes; |

| • | limit our ability to use operating cash flow in other areas of our business because we must dedicate a substantial portion of these funds to make principal and interest payments on our indebtedness; |

| • | make us more vulnerable to a downturn in our business, our industry or the economy in general as a substantial portion of our operating cash flow will be required to make principal and interest payments on our indebtedness, making it more difficult to react to changes in our business and in industry and market conditions; |

| • | limit our ability to obtain additional financing that may be necessary to operate or expand our business; |

| • | put us at a competitive disadvantage to competitors that have less debt; and |

| • | increase our vulnerability to interest rate increases to the extent that we incur variable rate indebtedness. |

12

Table of Contents

If we are unable to generate sufficient cash flow or are otherwise unable to obtain the funds required to make principal and interest payments on our indebtedness, or if we otherwise fail to comply with the various covenants in instruments governing any existing or future indebtedness, we could be in default under the terms of such instruments. In the event of a default, the holders of our indebtedness could elect to declare all the funds borrowed under those instruments to be due and payable together with accrued and unpaid interest, secured lenders could foreclose on any of our assets securing their loans and we or one or more of our subsidiaries could be forced into bankruptcy or liquidation. If our indebtedness is accelerated, or we enter into bankruptcy, we may be unable to pay all of our indebtedness in full. Any of the foregoing consequences could restrict our ability to grow our business and cause the value of our common stock to decline.

Our revolving credit facility and the indentures governing our 2019 Notes and the notes each impose restrictions on us that may affect our ability to successfully operate our business.

Our revolving credit facility and the indentures governing our 7 3/4% Senior Notes due 2019 (the “2019 Notes”) and the notes each impose limitations on our ability to take various actions, such as:

| • | limitations on the incurrence of additional indebtedness; |

| • | restrictions on mergers, sales or transfers of assets without the lenders’ consent; and |

| • | limitations on dividends and distributions. |

In addition, our revolving credit facility requires us to maintain certain financial ratios and to satisfy certain financial conditions, some of which become more restrictive over time and may require us to reduce our debt or take some other action in order to comply with them. The failure to comply with any of these financial conditions, including the financial ratios or covenants, would cause a default under our revolving credit facility. A default under any of our indebtedness, if not waived, could result in the acceleration of such indebtedness or other indebtedness, in which case the debt would become immediately due and payable. In addition, a default or acceleration of any of our indebtedness under our 2019 Notes, the notes or our revolving credit facility could result in a default under or acceleration of other indebtedness with cross-default or cross-acceleration provisions. In the event of any acceleration of our indebtedness, we may not be able to pay our debt or borrow sufficient funds to refinance it, and any holders of secured indebtedness may seek to foreclose on the assets securing such indebtedness. Even if new financing is available, it may not be available on terms that are acceptable to us. These restrictions could also limit our ability to obtain future financings, make needed capital expenditures, withstand a downturn in our business or the economy in general, or otherwise conduct necessary corporate activities. We also may be prevented from taking advantage of business opportunities that arise because of the limitations imposed on us by the restrictive covenants under our revolving credit facility or existing limitations on the incurrence of additional indebtedness, including in connection with acquisitions. Please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Revolving Credit Facility” in our quarterly report on Form 10-Q for the quarter ended September 30, 2012 incorporated by reference into this prospectus for a discussion of our revolving credit facility.

We will require a significant amount of cash to service our debt. Our ability to generate cash depends on many factors beyond our control.

Our ability to make payments on and to refinance our debt, including the notes, and to fund planned capital expenditures will depend on our ability to generate cash in the future. This is subject to general economic, financial, competitive, legislative, regulatory and other factors that may be beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us under our revolving credit facility or otherwise in an amount sufficient to enable us to pay our debt, including the notes, or to fund our other liquidity needs. We may need to refinance all or a portion of our debt, including the notes, at or before maturity. We cannot assure you that we will be able to refinance any of our debt, including our revolving credit facility, lease facilities, the 2019 Notes or the notes, on commercially reasonable terms or at all.

13

Table of Contents

In addition to our current indebtedness, we may incur substantially more debt, including additional secured debt. This could further exacerbate the risks associated with our substantial debt.

We and our subsidiaries may be able to incur substantial additional debt in the future. Although the indenture governing the notes contains restrictions on the incurrence of additional debt, these restrictions are subject to a number of qualifications and exceptions and, under certain circumstances, debt incurred in compliance with these restrictions could be substantial. If new debt is added to our current debt levels, the substantial risks described above would intensify. See “Summary Historical Consolidated Financial Data” and “Description of Other Indebtedness.”

We are a holding company with no direct operations.

We are a holding company with no direct operations. Our principal assets are the equity interests and investments we hold in our subsidiaries. As a result, we depend on dividends and other payments from our subsidiaries to generate the funds necessary to meet our financial obligations, including the payment of principal of and interest on our outstanding debt. Our subsidiaries are legally distinct from us and have no obligation to pay amounts due on our debt or to make funds available to us for such payment except as provided in the note guarantees or pursuant to intercompany notes.

Federal and state statutes may allow courts, under specific circumstances, to void the guarantees and require noteholders to return payments received from guarantors.

Under federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee could be deemed a fraudulent transfer if the guarantor received less than a reasonably equivalent value in exchange for giving the guarantee and

| • | was insolvent on the date that it gave the guarantee or became insolvent as a result of giving the guarantee, or |

| • | was engaged in business or a transaction, or was about to engage in business or a transaction, for which property remaining with the guarantor was an unreasonably small capital, or |

| • | intended to incur, or believed that it would incur, debts that would be beyond the guarantor’s ability to pay as those debts matured. |

A guarantee could also be deemed a fraudulent transfer if it was given with actual intent to hinder, delay or defraud any entity to which the guarantor was or became, on or after the date the guarantee was given, indebted.

The measures of insolvency for purposes of the foregoing considerations will vary depending upon the law applied in any proceeding with respect to the foregoing. Generally, however, a guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, is greater than all its assets, at a fair valuation, or |

| • | the present fair saleable value of its assets is less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature, or |

| • | it could not pay its debts as they become due. |

The indenture contains a provision intended to limit each subsidiary guarantor’s liability under its guarantee to the maximum amount that it could incur without causing the guarantee to be a fraudulent transfer. This provision may not be effective to protect the subsidiary guarantees from being voided under fraudulent transfer law.

14

Table of Contents

If a guarantee is deemed to be a fraudulent transfer, it could be voided altogether, or it could be subordinated to all other debts of the guarantor. In such case, any payment by the guarantor pursuant to its guarantee could be required to be returned to the guarantor or to a fund for the benefit of the creditors of the guarantor. If a guarantee is voided or held unenforceable for any other reason, holders of the notes would cease to have a claim against the subsidiary based on the guarantee and would be creditors only of Basic Energy Services, Inc. and any guarantor whose guarantee was not similarly voided or otherwise held unenforceable.

We may not have the ability to raise funds necessary to finance any change of control offer required under the indenture.

If a change of control (as defined in the indenture) occurs, we will be required to offer to purchase your notes at 101% of their principal amount plus accrued and unpaid interest. If a purchase offer obligation arises under the indenture governing the notes, a change of control may also occur under our revolving credit facility, which could result in the acceleration of the indebtedness outstanding thereunder. In addition, our revolving credit facility will contain restrictions on our ability to repay the notes upon a change in control. Any of our future debt agreements may contain similar restrictions and provisions. If a purchase offer were required under the indenture for our debt, we may not have sufficient funds to pay the purchase price of all debt, including your notes, that we are required to purchase or repay.

If you do not properly tender your old notes, you will continue to hold unregistered outstanding notes and your ability to transfer outstanding notes will be adversely affected.

We will only issue new notes in exchange for old notes that you timely and properly tender. Therefore, you should allow sufficient time to ensure timely delivery of the old notes, and you should carefully follow the instructions on how to tender your old notes. Neither we nor the exchange agent is required to tell you of any defects or irregularities with respect to your tender of old notes. Please read “The Exchange Offer — Procedures for Tendering” and “Description of the New Notes.”

If you do not exchange your old notes for new notes in the exchange offer, you will continue to be subject to the existing transfer restrictions on your old notes. In general, you may only offer or sell the old notes if they are registered under the Securities Act and applicable state securities laws, or offered and sold under an exemption from these requirements. We do not plan to register any sale of the old notes under the Securities Act. For further information regarding the consequences of failing to tender your old notes in the exchange offer, please read “The Exchange Offer — Consequences of Failure to Exchange Outstanding Securities.”

Some holders who exchange their old notes may be deemed to be underwriters.

If you exchange your old notes in the exchange offer for the purpose of participating in a distribution of the new notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

An active trading market may not develop for the new notes.

The new notes are a new issue of securities. There is no active public trading market for the new notes, and the new notes will not be listed on any securities exchange.

We cannot assure you that an active trading market will develop for the new notes or that the new notes will trade as one class with the old notes. In addition, the liquidity of the trading market in the new notes and the market prices quoted for the new notes may be adversely affected by changes in the overall market for high yield securities and by changes in our financial performance or prospects or in the prospects for companies in our industry generally. As a consequence, an active trading market may not develop for your notes, you may not be able to sell your notes, or, even if you can sell your notes, you may not be able to sell them at an acceptable price.

15

Table of Contents

Certain covenants contained in the indenture will not be applicable during any period in which the notes are rated investment grade by both Moody’s and S&P.

The indenture provides that certain covenants will not be applicable during any period in which the notes are rated investment grade by both Moody’s and S&P. The covenants that may be suspended restrict, among other things, our ability to pay dividends, incur debt, sell assets, enter into transactions with affiliates, enter into business combinations and enter into other transactions. There can be no assurance that the notes will ever be rated investment grade, or that if they are rated investment grade, the notes will maintain such rating. However, suspension of these covenants would allow us to engage in certain transactions that would not be permitted while these covenants were in force, and any such actions that we take while these covenants are not in force will effectively be “grandfathered” even if the notes are subsequently downgraded below investment grade. See “Description of the New Notes — Certain Covenants — Covenant Suspension.”

16

Table of Contents

The exchange offer is intended to satisfy our obligations under the registration rights agreement we entered into in connection with the private offering of the old notes. We will not receive any proceeds from the issuance of the new notes in the exchange offer. In consideration for issuing the new notes as contemplated in this prospectus, we will receive, in exchange, outstanding old notes in like principal amount. We will cancel all old notes surrendered in exchange for new notes in the exchange offer. As a result, the issuance of the new notes will not result in any increase or decrease in our indebtedness.

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our consolidated ratio of earnings to fixed charges for the periods shown:

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | 2012 | |||||||||||||||||||

Ratio of earnings to fixed charges | 2.3x | (a | ) | (a | ) | 4.7x | 5.2x | 2.3x | ||||||||||||||||

For these ratios, “earnings” means the sum of income before income taxes and fixed charges exclusive of capitalized interest, and “fixed charges” means interest expensed and capitalized, amortized premiums, discounts and capitalized expenses relating to indebtedness and an estimate of the portion of annual rental expense on capital leases that represents the interest factor.

| (a) | Earnings were inadequate to cover fixed charges for the years ended December 31, 2010 and December 31, 2009 by $33.1 million and $266.3 million, respectively. |

17

Table of Contents

SELECTED HISTORICAL FINANCIAL DATA

The following selected historical consolidated financial data as of December 31, 2011 and 2010 and for the years ended December 31, 2011, 2010 and 2009 is derived from our audited consolidated financial statements incorporated by reference into this prospectus. The following selected historical consolidated financial data as of December 31, 2009, 2008 and 2007 and for the years ended December 31, 2008 and 2007 is derived from our audited consolidated financial statements not included in this prospectus. The following selected historical consolidated financial data as of September 30, 2012 and for the nine months ended September 30, 2012 and 2011 is derived from our unaudited interim financial statements incorporated by reference into this prospectus. The financial data as of and for the nine months ended September 30, 2012 and 2011 includes, in management’s opinion, all adjustments necessary for the fair presentation of our financial position and results of operations as of such dates and for such periods, but may not be indicative of results to be expected for the full year.

The data set forth below is qualified by reference to, and should be read in conjunction with, (i) “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our 2011 Form 10-K and our quarterly report on Form 10-Q for the quarter ended September 30, 2012 incorporated by reference into this prospectus and (ii) our consolidated financial statements and the notes thereto incorporated by reference into this prospectus. In addition, please see the historical consolidated financial statements of The Maverick Companies beginning on page F-1, which financial statements are included with this prospectus in accordance with Rule 3-10(g) of Regulation S-X under the Exchange Act.

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | 2012 | 2011 | ||||||||||||||||||||||

| (Dollars in thousands) | (Unaudited) | |||||||||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||||||

Completion and remedial services | $ | 537,134 | $ | 261,436 | $ | 134,818 | $ | 304,326 | $ | 240,692 | $ | 464,328 | $ | 376,435 | ||||||||||||||

Fluid services | 332,010 | 241,164 | 214,822 | 315,768 | 259,324 | 270,339 | 241,204 | |||||||||||||||||||||

Well servicing | 333,057 | 204,872 | 160,614 | 343,113 | 342,697 | 292,127 | 242,738 | |||||||||||||||||||||

Contract drilling | 41,054 | 20,767 | 16,373 | 41,735 | 34,460 | 46,021 | 28,519 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total revenues | 1,243,255 | 728,239 | 526,627 | 1,004,942 | 877,173 | 1,072,815 | 888,896 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Expenses: | ||||||||||||||||||||||||||||

Completion and remedial services | 297,276 | 156,573 | 95,287 | 165,574 | 125,948 | 277,111 | 208,230 | |||||||||||||||||||||

Fluid services | 211,959 | 178,152 | 159,079 | 203,205 | 165,327 | 178,479 | 154,647 | |||||||||||||||||||||

Well servicing | 228,723 | 156,885 | 121,618 | 215,243 | 205,132 | 207,063 | 168,016 | |||||||||||||||||||||

Contract drilling | 28,154 | 15,250 | 13,604 | 28,629 | 22,510 | 30,080 | 19,850 | |||||||||||||||||||||

General and administrative(a) | 142,264 | 107,781 | 104,253 | 115,319 | 99,042 | 130,961 | 103,528 | |||||||||||||||||||||

Depreciation and amortization | 154,341 | 135,001 | 132,520 | 118,607 | 93,048 | 137,792 | 109,112 | |||||||||||||||||||||

Loss (gain) on disposal of assets | 447 | 2,856 | 2,650 | 76 | 477 | 3,123 | (698 | ) | ||||||||||||||||||||

Goodwill impairment | — | — | 204,014 | 22,522 | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total expenses | 1,063,164 | 752,498 | 833,025 | 869,175 | 711,484 | 964,609 | 762,685 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating income (loss) | 180,091 | (24,259 | ) | (306,398 | ) | 135,767 | 165,689 | 108,206 | 126,211 | |||||||||||||||||||

Other income (expense): | ||||||||||||||||||||||||||||

Net interest expense | (52,299 | ) | (46,368 | ) | (32,386 | ) | (24,630 | ) | (25,136 | ) | (45,102 | ) | (37,015 | ) | ||||||||||||||

Loss on early extinguishment of debt | (49,366 | ) | — | (3,481 | ) | — | (230 | ) | — | (49,366 | ) | |||||||||||||||||

Gain on bargain purchase | — | 1,772 | — | — | — | — | — | |||||||||||||||||||||

Other income (expense) | 525 | 499 | 1,198 | 12,235 | 176 | 624 | 442 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income (loss) from continuing operations before income taxes | 78,951 | (68,356 | ) | (341,067 | ) | 123,372 | 140,499 | 63,728 | 40,272 | |||||||||||||||||||

Income tax benefit (expense) | (31,788 | ) | 24,793 | 87,529 | (55,134 | ) | (52,766 | ) | (22,896 | ) | (15,620 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) | $ | 47,163 | $ | (43,563 | ) | $ | (253,538 | ) | $ | 68,238 | $ | 87,733 | $ | 40,832 | $ | 24,652 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Other Financial Data: | ||||||||||||||||||||||||||||

Cash flows from operating activities | $ | 279,455 | $ | 49,383 | $ | 89,205 | $ | 212,827 | $ | 198,591 | $ | 233,571 | $ | 202,508 | ||||||||||||||

Cash flows from investing activities | (419,967 | ) | (97,879 | ) | (62,864 | ) | (197,302 | ) | (294,103 | ) | (164,772 | ) | (364,330 | ) | ||||||||||||||

Cash flows from financing activities | 171,052 | (28,943 | ) | (12,119 | ) | 3,669 | 136,088 | (43,695 | ) | 185,516 | ||||||||||||||||||

Capital expenditures: | ||||||||||||||||||||||||||||

Acquisitions, net of cash acquired | 218,347 | 50,278 | 7,816 | 110,913 | 199,673 | 43,117 | 215,948 | |||||||||||||||||||||

Property and equipment | 221,839 | 63,579 | 43,367 | 91,890 | 98,536 | 126,694 | 167,114 | |||||||||||||||||||||

18

Table of Contents

| As of December 31, | As of September 30, | |||||||||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | 2012 | 2011 | ||||||||||||||||||||||

| (Dollars in thousands) | (Unaudited) | |||||||||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 78,458 | $ | 47,918 | $ | 125,357 | $ | 111,135 | $ | 91,941 | $ | 103,562 | $ | 71,612 | ||||||||||||||

Property and equipment, net | 856,412 | 625,702 | 666,642 | 740,879 | 636,924 | 914,293 | 834,185 | |||||||||||||||||||||

Total assets | 1,459,928 | 1,029,813 | 1,039,541 | 1,310,711 | 1,143,609 | 1,523,256 | 1,396,401 | |||||||||||||||||||||

Long-term debt, including current portion | 783,091 | 498,859 | 501,812 | 480,323 | 423,719 | 799,764 | 773,675 | |||||||||||||||||||||

Stockholders’ equity | 359,703 | 301,923 | 340,149 | 595,004 | 524,821 | 394,641 | 339,958 | |||||||||||||||||||||

| a) | Includes approximately $7,955,000, $5,666,000, $5,152,000, $4,149,000 and $3,964,000 of non-cash expenses for the years ended December 31, 2011, 2010, 2009, 2008 and 2007, respectively, and $8,365,000 and $5,920,000 for the nine months ended September 30, 2012 and 2011, respectively. |

19

Table of Contents

DESCRIPTION OF OTHER INDEBTEDNESS

2019 Notes

On February 15, 2011, we issued $275.0 million of 7 3/4% Senior Notes due 2019. On June 13, 2011, we issued an additional $200.0 million of 2019 Notes. The 2019 Notes are jointly and severally, and unconditionally, guaranteed on a senior unsecured basis initially by all of our current subsidiaries other than three immaterial subsidiaries. The 2019 Notes and the guarantees rank (i) equally in right of payment with any of our and the subsidiary guarantors’ existing and future senior indebtedness, including the 7 3/4% Senior Notes due 2022 and the related guarantees, and (ii) effectively junior to all existing or future liabilities of our subsidiaries that do not guarantee the 2019 Notes and to our and the subsidiary guarantors’ existing or future secured indebtedness to the extent of the value of the collateral therefor.

The 2019 Notes and the guarantees were issued pursuant to an indenture dated as of February 15, 2011 (the “2019 Notes Indenture”), by and among us, the guarantors party thereto and Wells Fargo Bank, National Association, as trustee. Interest on the 2019 Notes accrues at a rate of 7.75% per year. Interest on the 2019 Notes is payable semi-annually in arrears on February 15 and August 15 of each year. The 2019 Notes mature on February 15, 2019.

The 2019 Notes Indenture contains covenants that, among other things, limit our ability and the ability of certain of our subsidiaries to:

| • | incur additional indebtedness; |

| • | pay dividends or repurchase or redeem capital stock; |

| • | make certain investments; |

| • | incur liens; |

| • | enter into certain types of transactions with affiliates; |

| • | limit dividends or other payments by restricted subsidiaries to us; and |

| • | sell assets or consolidate or merge with or into other companies. |

These limitations are subject to a number of important qualifications and exceptions.

These and other covenants that are contained in the 2019 Notes Indenture are subject to important exceptions and qualifications. As of September 30, 2012, we were in compliance with the restrictive covenants under the 2019 Notes Indenture.

Additionally, during any period of time that the 2019 Notes have a Moody’s rating of Baa3 or higher or a Standard & Poor’s rating of BBB- or higher and no default has occurred and is then continuing, certain of the restrictive covenants contained in the 2019 Notes Indenture will cease to apply.

We may, at our option, redeem all or part of the 2019 Notes, at any time on or after February 15, 2015, at a redemption price equal to 100% of the principal amount thereof, plus a premium declining ratably to par and accrued and unpaid interest to the date of redemption.