Washington, D.C. 20549

Stacy L. Fuller

Item 1. Reports to Stockholders.

Cambria Investment Management

Table of Contents

| Manager’s Discussion and Analysis of Fund Performance | 2 |

| Schedules of Investments | 7 |

| Statements of Assets and Liabilities | 14 |

| Statements of Operations | 15 |

| Statements of Changes in Net Assets | 16 |

| Financial Highlights | 17 |

| Notes to Financial Statements | 18 |

| Report of Independent Registered Public Accountants | 26 |

| Disclosure of Fund Expenses | 27 |

| Trustees and Officers of the Cambria ETF Trust | 28 |

| Board Consideration of the Investment Advisory Agreement | 30 |

| Notice to Shareholders | 32 |

| Supplemental Information | 33 |

The Fund files its complete schedule of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the trading sub-adviser, Cambria Investment Management L.P., the Funds’ investment advisor, uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling (855)-383-4636; and (ii) on the Commission’s website at www.sec.gov.

Cambria Investment Management

Manager’s Discussion and Analysis of Fund Performance

Dear Shareholder:

We are pleased to present the first annual report for the Cambria ETF Trust.

The Trust launched its first series, the Cambria Shareholder Yield ETF (“SYLD”) on May 13, 2013. SYLD seeks income and capital appreciation with an emphasis on income from investments in the U.S. equity market.

The Trust’s next two series, the Cambria Foreign Shareholder Yield ETF (“FYLD”) and Cambria Global Value ETF (“GVAL,” and together with SYLD and FYLD, the “Funds”) launched on December 2, 2013 and March 11, 2014, respectively. FYLD seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Cambria Foreign Shareholder Yield Index (the ‘‘FYLD Index’’). GVAL seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Cambria Global Value Index (the “GVAL Index”).

Since inception through April 30, 2014, the Funds posted returns as follows:

| SYLD | 21.8% |

| FYLD | 7.0% |

| GVAL | 2.9% |

Performance of Funds vs. Benchmark Indexes

We have been pleased with each Fund’s performance since its inception as the Funds have outperformed their benchmarks, in some cases by a significant margin.

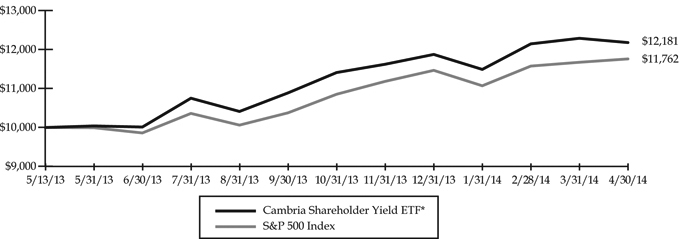

Since inception, as reported above, SYLD returned 21.8% whereas its benchmark index, the S&P 500 returned 17.6% over the same time period. In addition, in calendar year 2014 (through April 30, 2014), SYLD returned 2.6% and the S&P 500 returned 2.6%. We believe that the S&P 500 serves as a suitable benchmark for SYLD, and the table and line graph below show the performance of the Fund vs. the S&P 500 since inception through April 30, 2014.

Since inception, FYLD returned 7.0% whereas its benchmark index, the MSCI EAFE Index, returned 4.6% over the same period. Further, from January 1 through April 30, 2014, FYLD returned 4.0% and its benchmark index returned 2.3%. We believe that the MSCI EAFE Index serves as a suitable benchmark for FYLD. The table and line graph below show the performance of FYLD vs. the MSCI EAFE Index since inception of FYLD through April 30, 2014.

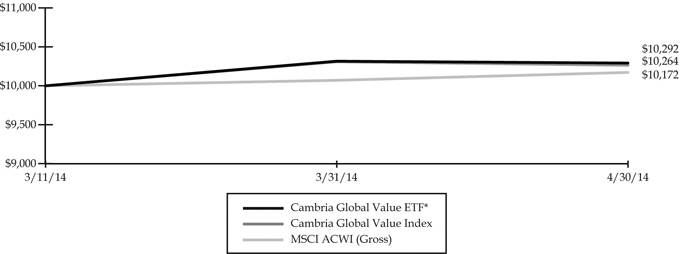

GVAL — which was only recently launched — has returned 2.9% since its inception, and its benchmark index, the MSCI ACWI, has returned 1.7% over the same period. We believe that the MSCI ACWI Index serves as a suitable benchmark for GVAL and, the table and line graph below show the performance of GVAL vs. the MSCI ACWI Index for the period of launch through April 30, 2014.

The returns of the Funds since inception have been aided by both the broad market increasing in value and by the Funds successfully executing their strategies. The overall upward movement of the broad marked is evidenced by the S&P 500 moving up 20.44% and the MSCI EAFE Index moving up over 13.88% over the 12-month period ended April 30, 2014.

Cambria Investment Management

Manager’s Discussion and Analysis of Fund Performance (Continued)

Performance of Funds vs. Competitor Universe

We are very excited about the shareholder yield strategy fueling the performance of SYLD and FYLD. Each of these two Funds targets investments in issuers that are providing significant “shareholder yield,” by paying dividends to shareholders, engaging in share buybacks and/or paying down debt. While other funds, including other ETFs, in the market target one or more of these shareholder yield characteristics, we continue to believe that the mix of characteristics targeted by the SYLD active strategy and the FYLD index strategy optimize returns for investors, and in this regard we have been heartened by the performance of the Funds overall. In SYLD, we have seen the Fund’s positions in AerCap Holdings NV and Endo International Plc (up 152% and 80%, respectively) in particular contribute to the Fund’s positive performance, while the Fund’s holdings in Abercrombie & Fitch Co. Class A and h.h.gregg, Inc. (down 30% and 41%, respectively) have been somewhat of a drag on performance. In FYLD, the Fund’s holdings in Centerra Gold Inc. and AstraZeneca PLC (advancing 68% and 41%, respectively) have been notable contributors to the Fund’s positive performance, while its positions in ENCE Energia Celulosa SA (down 27%) and Adastria Holdings Co., Ltd. (down 46%) have detracted from performance.

We are also optimistic about the strategy of GVAL, which targets investments in issuers in countries that are undervalued based on various valuation metrics. These metrics currently identify as components of GVAL’s target index, and therefore as holdings in GVAL’s portfolio, issuers in countries such as Russia, Greece, Portugal and Spain. Since the Fund’s inception, investments in Spain and Brazil have been particularly profitable for the Fund, while investments in Greece and Ireland have detracted somewhat from the Fund’s overall performance.

At the period ended April 30, 2014, SYLD had grown to approximately $205 million in assets under management (“AUM”). FYLD had grown to approximately $67 million in AUM. And, GVAL had grown to approximately $23 million in AUM.

In general, we believe market conditions have been favorable for US and foreign equities. We further believe that US equities may currently be trading at prices that above their fair valuation — although not in “bubble” territory. Nevertheless, we expect valuations to be a headwind in the years ahead and we appreciate your continuing confidence in us as asset managers.

Sincerely,

| Mebane Faber | Eric Richardson |

The MSCI EAFE Index is a free float-adjusted market capitalization weighted index, designed to measure developed market equity performance excluding the U.S. and Canada, consisting of 21 stock markets in Europe, Australasia, and the Far East.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indexes comprising 23 developed and 23 emerging market country indexes.

The S&P 500 Index is a diverse index that includes 500 American companies that represent over 70% of the total market capitalization of the U.S. stock market.

Cambria Investment Management

Comparison of Change in the Value of a $10,000 Investment in the

Cambria Shareholder Yield ETF versus the S&P 500 Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED APRIL 30, 2014 |

| | Cumulative Inception to Date* |

| Cambria Shareholder Yield ETF | |

| S&P 500 Index | |

* The Fund commenced operations on May 13, 2013.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636). As stated in the Fund’s prospectus, the annual fund operating expenses are estimated to be 0.59%.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The indexes are unmanaged and are not available for investment.

There are no assurances that the Fund will meet its stated objectives.

S&P 500 Index is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the Index proportionate to its market value.

Cambria Investment Management

Comparison of Change in the Value of a $10,000 Investment in the Cambria Foreign Shareholder

Yield ETF versus the Cambria Foreign Shareholder Yield Index and the MSCI EAFE Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED APRIL 30, 2014 |

| | Cumulative Inception to Date* |

| Cambria Foreign Shareholder Yield ETF | |

| Cambria Foreign Shareholder Yield Index | |

| MSCI EAFE Index | |

* The Fund commenced operations on December 2, 2013.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636). As stated in the Fund’s prospectus, the annual fund operating expenses are estimated to be 0.59%.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The indexes are unmanaged and are not available for investment.

There are no assurances that the Fund will meet its stated objectives.

Cambria Foreign Shareholder Yield Index represents issuers with strong cash flows, highest dividends paid to shareholders, net stock buybacks and net debt paydowns. The initial screening universe for this Index includes issuers in foreign developed countries with marketing capitalizations of at least $200 million. The Index is comprised of the 100 issuers with high rankings across a composite of the aforementioned factors.

MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

Cambria Investment Management

Comparison of Change in the Value of a $10,000 Investment in the Cambria Global

Value ETF versus the Cambria Global Value Index and the MSCI ACWI Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED APRIL 30, 2014 |

| | Cumulative Inception to Date* |

| Cambria Global Value ETF | |

| Cambria Global Value Index | |

| MSCI ACWI Index | |

* The Fund commenced operations on March 11, 2014.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636). As stated in the Fund’s prospectus, the annual fund operating expenses are estimated to be 0.69%.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The indexes are unmanaged and are not available for investment.

There are no assurances that the Fund will meet its stated objectives.

Cambria Global Value Index consists of equity securities of issuers that are domiciled in, trade in, or have exposure to a market that is undervalued according to various valuation metrics. The initial screening universe for this Index includes issuers having a market capitalization of at least $200 million.

MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Cambria Investment Management

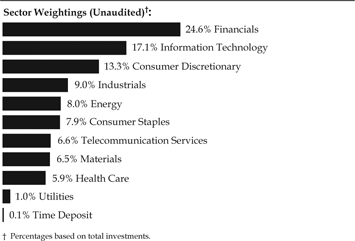

Schedule of Investments • Cambria Shareholder Yield ETF

| | | | | | |

| COMMON STOCK — 98.1% | | | | |

| Consumer Discretionary — 13.0% | | | | | | |

CBS, Cl B | | | 35,894 | | | $ | 2,073,238 | |

GameStop, Cl A | | | 29,480 | | | | 1,169,767 | |

Gannett | | | 79,167 | | | | 2,150,967 | |

Gap | | | 47,840 | | | | 1,880,112 | |

Harte-Hanks | | | 169,335 | | | | 1,361,453 | |

Home Depot | | | 24,879 | | | | 1,978,129 | |

Kohl's | | | 37,719 | | | | 2,066,624 | |

Lear | | | 25,202 | | | | 2,093,278 | |

Lowe's | | | 42,470 | | | | 1,949,798 | |

Macy's | | | 39,470 | | | | 2,266,762 | |

O'Reilly Automotive* | | | 15,481 | | | | 2,303,418 | |

Six Flags Entertainment | | | 50,535 | | | | 2,028,475 | |

Smith & Wesson Holding* | | | 151,858 | | | | 2,331,020 | |

Target | | | 17,884 | | | | 1,104,337 | |

| | | | | | | | 26,757,378 | |

| Consumer Staples — 7.8% | | | | | | | | |

China Nepstar Chain Drugstore ADR | | | 160,616 | | | | 406,358 | |

Coca-Cola Enterprises | | | 45,621 | | | | 2,073,018 | |

CVS Caremark | | | 29,318 | | | | 2,132,005 | |

Dr Pepper Snapple Group | | | 34,661 | | | | 1,920,913 | |

JM Smucker | | | 9,240 | | | | 893,323 | |

Kimberly-Clark | | | 17,940 | | | | 2,013,765 | |

Medifast* | | | 81,246 | | | | 2,571,436 | |

Reynolds American | | | 35,894 | | | | 2,025,499 | |

Wal-Mart Stores | | | 23,783 | | | | 1,895,743 | |

| | | | | | | | 15,932,060 | |

| Energy — 7.9% | | | | | | | | |

BP ADR | | | 36,000 | | | | 1,822,320 | |

Cameron International* | | | 33,981 | | | | 2,207,406 | |

Chesapeake Granite Wash Trust | | | 170,000 | | | | 1,871,700 | |

HollyFrontier | | | 38,039 | | | | 2,000,471 | |

LinnCo | | | 65,000 | | | | 1,791,400 | |

Marathon Petroleum | | | 20,961 | | | | 1,948,325 | |

| | | | | | | | | |

| Description | | | Shares | | | | Value | |

Western Refining | | | 53,692 | | | $ | 2,335,602 | |

Whiting USA Trust II | | | 157,094 | | | | 2,147,475 | |

| | | | | | | | 16,124,699 | |

| Financials — 24.1% | | | | | | | | |

AllianceBernstein Holding (A) | | | 93,566 | | | | 2,379,383 | |

Allstate | | | 39,008 | | | | 2,221,506 | |

Ameriprise Financial | | | 20,557 | | | | 2,294,778 | |

Aspen Insurance Holdings | | | 44,114 | | | | 2,019,539 | |

Axis Capital Holdings | | | 48,667 | | | | 2,226,515 | |

Comerica | | | 45,210 | | | | 2,180,930 | |

Compass Diversified Holdings (A) | | | 114,494 | | | | 2,116,994 | |

Cullen | | | 24,399 | | | | 1,864,328 | |

Everest Re Group | | | 14,443 | | | | 2,282,427 | |

Fifth Third Bancorp | | | 97,818 | | | | 2,016,029 | |

Gladstone Capital | | | 216,136 | | | | 2,090,035 | |

Hanover Insurance Group | | | 32,145 | | | | 1,878,875 | |

Huntington Bancshares | | | 207,098 | | | | 1,897,018 | |

Legg Mason | | | 53,688 | | | | 2,517,430 | |

LPL Financial Holdings | | | 45,718 | | | | 2,164,747 | |

Montpelier Re Holdings | | | 71,506 | | | | 2,186,654 | |

PartnerRe | | | 18,221 | | | | 1,920,493 | |

Platinum Underwriters Holdings | | | 31,781 | | | | 1,992,987 | |

Primerica | | | 48,361 | | | | 2,219,286 | |

RenaissanceRe Holdings | | | 18,495 | | | | 1,871,879 | |

State Street | | | 31,233 | | | | 2,016,403 | |

Travelers | | | 25,461 | | | | 2,306,257 | |

Unum Group | | | 61,239 | | | | 2,034,360 | |

Xinyuan Real Estate ADR | | | 195,852 | | | | 801,035 | |

| | | | | | | | 49,499,888 | |

| Health Care — 5.8% | | | | | | | | |

Chemed | | | 26,254 | | | | 2,186,171 | |

Eli Lilly | | | 36,129 | | | | 2,135,224 | |

HealthSouth | | | 54,843 | | | | 1,899,761 | |

Mylan* | | | 35,619 | | | | 1,808,733 | |

Omnicare | | | 32,368 | | | | 1,918,451 | |

Pfizer | | | 64,047 | | | | 2,003,390 | |

| | | | | | | | 11,951,730 | |

| Industrials — 8.9% | | | | | | | | |

AECOM Technology* | | | 65,044 | | | | 2,108,726 | |

Babcock & Wilcox | | | 64,101 | | | | 2,230,074 | |

Flowserve | | | 30,239 | | | | 2,208,959 | |

L-3 Communications Holdings, Cl 3 | | | 20,413 | | | | 2,355,048 | |

Northrop Grumman | | | 20,524 | | | | 2,493,871 | |

Raytheon | | | 26,193 | | | | 2,500,908 | |

Southwest Airlines | | | 86,985 | | | | 2,102,427 | |

SPX | | | 21,805 | | | | 2,220,621 | |

| | | | | | | | 18,220,634 | |

| Information Technology — 16.8% | | | | | | | | |

Apple | | | 3,440 | | | | 2,029,910 | |

CA | | | 61,650 | | | | 1,858,131 | |

Celestica* | | | 216,766 | | | | 2,406,103 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Shareholder Yield ETF

April 30, 2014 (Concluded)

| | | | | | |

Computer Sciences | | | 34,286 | | | $ | 2,029,045 | |

Conversant* | | | 85,926 | | | | 2,100,031 | |

CoreLogic* | | | 60,828 | | | | 1,705,009 | |

Flextronics International* | | | 225,367 | | | | 2,026,049 | |

Lexmark International, Cl A | | | 56,718 | | | | 2,438,874 | |

Marvell Technology Group | | | 150,724 | | | | 2,390,483 | |

NVIDIA | | | 113,750 | | | | 2,100,962 | |

SanDisk | | | 26,201 | | | | 2,226,299 | |

Seagate Technology | | | 40,415 | | | | 2,125,021 | |

TE Connectivity | | | 35,567 | | | | 2,097,742 | |

Texas Instruments | | | 46,169 | | | | 2,098,381 | |

Western Digital | | | 28,179 | | | | 2,483,415 | |

Xerox | | | 193,165 | | | | 2,335,365 | |

| | | | | | | | 34,450,820 | |

| Materials — 6.3% | | | | | | | | |

Calgon Carbon* | | | 104,635 | | | | 2,095,839 | |

Cytec Industries | | | 23,244 | | | | 2,215,618 | |

E.I. du Pont de Nemours | | | 31,373 | | | | 2,112,030 | |

PetroLogistics (A) | | | 168,336 | | | | 2,302,837 | |

PPG Industries | | | 11,234 | | | | 2,175,127 | |

Rockwood Holdings | | | 29,593 | | | | 2,102,583 | |

| | | | | | | | 13,004,034 | |

| Telecommunication Services — 6.5% | | | | | | | | |

AT&T | | | 57,158 | | | | 2,040,541 | |

CenturyLink | | | 67,425 | | | | 2,353,807 | |

Frontier Communications | | | 445,675 | | | | 2,651,766 | |

Nippon Telegraph & Telephone ADR | | | 73,541 | | | | 2,047,381 | |

TELUS | | | 59,740 | | | | 2,107,030 | |

USA Mobility | | | 125,492 | | | | 2,149,678 | |

| | | | | | | | 13,350,203 | |

| Utilities — 1.0% | | | | | | | | |

Ameren | | | 47,402 | | | | 1,958,176 | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

(Cost $183,350,805) | | | | | | | 201,249,622 | |

| | | | | | | | | |

| TIME DEPOSIT — 0.1% | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 05/01/2014 | | $ | 283,218 | | | | 283,218 | |

| | | | | | | | | |

| Total Time Deposit | | | | | | | | |

(Cost $283,218) | | | | | | | 283,218 | |

| | | | | | | | | |

| Total Investments — 98.2% | | | | | | | | |

(Cost $183,634,023) | | | | | | $ | 201,532,840 | |

Other Assets and Liabilities — 1.8% | | | | | | | 3,623,361 | |

Net Assets — 100.0% | | | | | | $ | 205,156,201 | |

Percentages based on Nets Assets.

| * | Non-income producing security. |

| (A) | Security considered to be a Master Limited Partnership. At April 30, 2014, these securities amounted to $6,799,214 or 3.31% of net assets. |

ADR — American Depositary Receipt

The following is a summary of the inputs used as of April 30, 2014 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | |

Common Stock | | $ | 201,249,622 | | | $ | — | | | $ | — | | | $ | 201,249,622 | |

Time Deposit | | | — | | | | 283,218 | | | | — | | | | 283,218 | |

Total Investments in Securities | | $ | 201,249,622 | | | $ | 283,218 | | | $ | — | | | $ | 201,532,840 | |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been no transfers between Level 1 & Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Foreign Shareholder Yield ETF

| | | | | | |

| COMMON STOCK — 97.7% | | | | |

| Australia — 12.7% | | | | | | |

ALS | | | 77,968 | | | $ | 543,240 | |

BC Iron | | | 133,312 | | | | 541,209 | |

Bradken | | | 146,896 | | | | 577,251 | |

Cabcharge Australia | | | 167,198 | | | | 602,666 | |

Cardno | | | 96,488 | | | | 625,666 | |

GUD Holdings | | | 117,646 | | | | 584,716 | |

Insurance Australia Group | | | 107,988 | | | | 575,840 | |

Metcash | | | 212,884 | | | | 549,797 | |

OZ Minerals | | | 203,184 | | | | 694,626 | |

Premier Investments | | | 83,518 | | | | 769,673 | |

Regis Resources | | | 276,184 | | | | 623,475 | |

Skilled Group | | | 197,222 | | | | 502,019 | |

SMS Management & Technology | | | 164,748 | | | | 573,939 | |

WorleyParsons | | | 45,664 | | | | 713,109 | |

| | | | | | | | 8,477,226 | |

| Belgium — 1.0% | | | | | | | | |

Ageas | | | 14,616 | | | | 628,297 | |

| | | | | | | | | |

| Canada — 17.4% | | | | | | | | |

Agrium | | | 6,858 | | | | 658,676 | |

AuRico Gold | | | 170,198 | | | | 708,091 | |

Canadian Oil Sands | | | 32,036 | | | | 694,471 | |

Celestica* | | | 61,152 | | | | 678,444 | |

Centerra Gold | | | 207,384 | | | | 1,063,362 | |

Davis + Henderson | | | 23,066 | | | | 667,957 | |

Genworth MI Canada | | | 19,166 | | | | 672,353 | |

IGM Financial | | | 11,958 | | | | 595,582 | |

Loblaw | | | 2,952 | | | | 128,336 | |

Longview Oil | | | 122,104 | | | | 746,405 | |

Magna International | | | 7,600 | | | | 744,572 | |

Metro, Cl A | | | 10,408 | | | | 641,544 | |

Rogers Sugar | | | 123,312 | | | | 551,278 | |

Suncor Energy | | | 17,616 | | | | 679,535 | |

| | | | | | | | | |

| Description | | | Shares | | | | Value | |

Surge Energy | | | 103,238 | | | $ | 652,743 | |

Teck Resources, Cl B | | | 25,278 | | | | 576,109 | |

Transcontinental, Cl A | | | 39,836 | | | | 580,431 | |

WestJet Airlines | | | 23,078 | | | | 518,179 | |

| | | | | | | | 11,558,068 | |

| Denmark — 2.0% | | | | | | | | |

FLSmidth | | | 12,158 | | | | 649,707 | |

Topdanmark* | | | 23,316 | | | | 681,712 | |

| | | | | | | | 1,331,419 | |

| Finland — 1.7% | | | | | | | | |

Fortum | | | 26,728 | | | | 603,308 | |

Ramirent | | | 47,994 | | | | 536,670 | |

| | | | | | | | 1,139,978 | |

| France — 4.0% | | | | | | | | |

AXA | | | 23,999 | | | | 625,113 | |

CNP Assurances | | | 32,278 | | | | 743,809 | |

Metropole Television | | | 27,678 | | | | 592,880 | |

Total | | | 10,108 | | | | 721,920 | |

| | | | | | | | 2,683,722 | |

| Germany — 4.8% | | | | | | | | |

E.ON | | | 32,128 | | | | 614,435 | |

Freenet | | | 21,716 | | | | 750,630 | |

Hannover Rueck | | | 7,408 | | | | 689,721 | |

QSC | | | 108,546 | | | | 557,337 | |

Software | | | 15,966 | | | | 600,165 | |

| | | | | | | | 3,212,288 | |

| Greece — 1.1% | | | | | | | | |

OPAP | | | 43,698 | | | | 697,180 | |

| | | | | | | | | |

| Hong Kong — 0.9% | | | | | | | | |

Television Broadcasts | | | 98,438 | | | | 613,892 | |

| | | | | | | | | |

| Israel — 1.9% | | | | | | | | |

| Harel Insurance Investments & Financial Services | | | 93,298 | | | | 531,398 | |

Teva Pharmaceutical Industries | | | 15,158 | | | | 755,601 | |

| | | | | | | | 1,286,999 | |

| Italy — 1.2% | | | | | | | | |

Cairo Communication | | | 88,930 | | | | 771,105 | |

| | | | | | | | | |

| Japan — 18.1% | | | | | | | | |

Autobacs Seven | | | 40,986 | | | | 633,823 | |

Citizen Holdings | | | 83,116 | | | | 609,742 | |

COMSYS Holdings | | | 43,694 | | | | 715,875 | |

Fujikura | | | 129,012 | | | | 555,243 | |

Itoham Foods | | | 141,332 | | | | 640,062 | |

Japan Tobacco | | | 20,337 | | | | 667,589 | |

Kinden | | | 55,302 | | | | 508,474 | |

Kirin Holdings | | | 39,386 | | | | 545,128 | |

Kyokuto Securities | | | 33,178 | | | | 519,243 | |

Kyowa Exeo | | | 52,402 | | | | 677,610 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Foreign Shareholder Yield ETF

April 30, 2014 (Continued)

| Description | | | Shares | | | | Value | |

| | | | | | | | | |

Kyudenko | | | 80,738 | | | $ | 695,752 | |

Marusan Securities Ltd. | | | 73,010 | | | | 509,895 | |

Meisei Industrial | | | 150,982 | | | | 716,254 | |

Nichirei | | | 116,854 | | | | 566,925 | |

Nippon Telegraph & Telephone | | | 11,880 | | | | 657,824 | |

Sanki Engineering | | | 99,788 | | | | 612,969 | |

Sanshin Electronics | | | 85,480 | | | | 535,949 | |

Shizuoka Bank | | | 53,444 | | | | 510,210 | |

SKY Perfect JSAT Holdings | | | 120,283 | | | | 645,917 | |

Yokohama Rubber | | | 60,602 | | | | 541,201 | |

| | | | | | | | 12,065,685 | |

| Netherlands — 4.0% | | | | | | | | |

BinckBank | | | 60,302 | | | | 681,158 | |

Koninklijke Ahold | | | 31,140 | | | | 600,724 | |

Royal Dutch Shell, Cl A | | | 18,316 | | | | 725,347 | |

| Royal Dutch Shell, Cl A (London shares) | | | 17,272 | | | | 684,430 | |

| | | | | | | | 2,691,659 | |

| New Zealand — 1.1% | | | | | | | | |

SKYCITY Entertainment Group | | | 197,614 | | | | 720,802 | |

| | | | | | | | | |

| Norway — 4.4% | | | | | | | | |

Statoil | | | 27,028 | | | | 820,257 | |

Telenor | | | 25,278 | | | | 593,221 | |

TGS Nopec Geophysical | | | 23,866 | | | | 823,062 | |

Yara International | | | 14,466 | | | | 682,866 | |

| | | | | | | | 2,919,406 | |

| Portugal — 0.8% | | | | | | | | |

Portucel | | | 116,135 | | | | 550,223 | |

| | | | | | | | | |

| South Korea — 1.0% | | | | | | | | |

Daeduck Electronics | | | 90,544 | | | | 666,834 | |

| | | | | | | | | |

| Spain — 2.0% | | | | | | | | |

Duro Felguera | | | 96,638 | | | | 659,627 | |

Endesa | | | 17,435 | | | | 660,706 | |

| | | | | | | | 1,320,333 | |

| Sweden — 4.3% | | | | | | | | |

Dios Fastigheter | | | 95,388 | | | | 773,848 | |

Duni | | | 49,694 | | | | 829,227 | |

JM | | | 21,766 | | | | 736,446 | |

TeliaSonera | | | 73,568 | | | | 533,584 | |

| | | | | | | | 2,873,105 | |

| Switzerland — 1.0% | | | | | | | | |

Zurich Insurance Group | | | 2,200 | | | | 630,178 | |

| | | | | | | | | |

| United Kingdom — 12.3% | | | | | | | | |

Amlin | | | 84,480 | | | | 638,578 | |

AstraZeneca | | | 11,058 | | | | 870,779 | |

BP | | | 77,660 | | | | 654,553 | |

Cape | | | 141,520 | | | | 717,420 | |

| | | | | | |

Carillion | | 128,462 | | | $ | 802,074 | |

Centrica | | 112,346 | | | | 625,957 | |

Chesnara | | 128,062 | | | | 712,441 | |

De La Rue | | 41,286 | | | | 571,248 | |

Homeserve | | 145,832 | | | | 831,736 | |

Ladbrokes | | 213,292 | | | | 552,064 | |

Tullett Prebon | | 117,404 | | | | 630,154 | |

WM Morrison Supermarkets | | 176,310 | | | | 598,040 | |

| | | | | | | 8,205,044 | |

| Total Common Stock | | | | | | | |

(Cost $62,175,895) | | | | | | 65,043,443 | |

| | | | | | | | |

| TIME DEPOSITS — 1.7% | | | | | | | |

| Brown Brothers Harriman, 0.067%, 05/01/2014 | GBP | 16,706 | | | $ | 28,207 | |

| Brown Brothers Harriman, 0.000%, 05/01/2014 | DKK | 15,977 | | | | 2,970 | |

| Brown Brothers Harriman, 2.000%, 05/01/2014 | NZD | 15,118 | | | | 13,036 | |

| Brown Brothers Harriman, 0.005%, 05/01/2014 | JPY | 990,205 | | | | 9,686 | |

| Brown Brothers Harriman, 0.001%, 05/01/2014 | CHF | 34,408 | | | | 39,095 | |

| Brown Brothers Harriman, 1.752%, 05/01/2014 | AUD | 164,030 | | | | 152,384 | |

| Brown Brothers Harriman, 0.030%, 05/01/2014 | | 663,536 | | | | 663,536 | |

| Brown Brothers Harriman, 0.054%, 05/01/2014 | EUR | 100,851 | | | | 139,915 | |

| Brown Brothers Harriman, 0.238%, 05/01/2014 | CAD | 104,359 | | | | 95,214 | |

| | | | | | | | |

| Total Time Deposits | | | | | | | |

(Cost $1,144,043) | | | | | | 1,144,043 | |

| | | | | | | | |

| Total Investments — 99.4% | | | | | | | |

(Cost $63,319,938) | | | | | $ | 66,187,486 | |

Other Assets and Liabilities — 0.6% | | | | | | 384,736 | |

Net Assets — 100.0% | | | | | $ | 66,572,222 | |

Percentages based on Nets Assets.

| * | Non-income producing security. |

| (1) | In U.S. Dollars unless otherwise noted. |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Foreign Shareholder Yield ETF

April 30, 2014 (Concluded)

CAD — Canadian Dollar

Cl — Class

CHF — Swiss Franc

DKK — Danish Krone

EUR — Euro

GBP — Great British Pound

JPY — Japanese Yen

Ltd. — Limited

NZD — New Zealand Dollar

The following is a summary of the inputs used as of April 30, 2014 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | |

Common Stock | | $ | 65,043,443 | | | $ | — | | | $ | — | | | $ | 65,043,443 | |

Time Deposits | | | — | | | | 1,144,043 | | | | — | | | | 1,144,043 | |

Total Investments in Securities | | $ | 65,043,443 | | | $ | 1,144,043 | | | $ | — | | | $ | 66,187,486 | |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been no transfers between Level 1 & Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

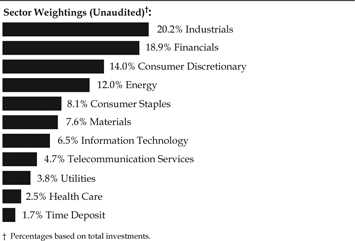

Schedule of Investments • Cambria Global Value ETF

| | | | | | |

| COMMON STOCK — 95.3% | | | | |

| Austria — 9.8% | | | | | | |

Agrana Beteiligungs | | | 1,872 | | | $ | 216,599 | |

AMAG Austria Metall (A) | | | 6,876 | | | | 236,482 | |

Erste Group Bank | | | 6,408 | | | | 215,052 | |

EVN | | | 15,246 | | | | 212,573 | |

Lenzing | | | 3,780 | | | | 241,232 | |

OMV | | | 5,022 | | | | 234,901 | |

Raiffeisen Bank International | | | 6,912 | | | | 218,158 | |

UNIQA Insurance Group | | | 17,118 | | | | 218,487 | |

| Vienna Insurance Group Wiener Versicherung Gruppe | | | 4,608 | | | | 245,647 | |

Voestalpine | | | 5,094 | | | | 232,509 | |

| | | | | | | | 2,271,640 | |

| Brazil — 7.5% | | | | | | | | |

AMBEV | | | 31,050 | | | | 226,287 | |

Banco do Brasil | | | 25,200 | | | | 265,477 | |

Banco Santander Brasil | | | 45,918 | | | | 306,429 | |

Cia Siderurgica Nacional | | | 54,558 | | | | 210,916 | |

Cosan Industria e Comercio | | | 15,408 | | | | 262,518 | |

JBS | | | 69,444 | | | | 240,122 | |

Vale | | | 18,558 | | | | 220,391 | |

| | | | | | | | 1,732,140 | |

| Czech Republic — 6.8% | | | | | | | | |

CEZ | | | 8,532 | | | | 256,526 | |

Fortuna Entertainment Group | | | 34,488 | | | | 229,519 | |

Komercni Banka | | | 936 | | | | 215,677 | |

Pegas Nonwovens | | | 7,398 | | | | 222,543 | |

Philip Morris CR | | | 414 | | | | 218,615 | |

Telefonica Czech Republic | | | 15,030 | | | | 227,696 | |

Unipetrol* | | | 29,880 | | | | 208,214 | |

| | | | | | | | 1,578,790 | |

| Greece — 8.4% | | | | | | | | |

Athens Water Supply & Sewage | | | 19,530 | | | | 251,982 | |

Bank of Greece | | | 10,584 | | | | 218,200 | |

Eurobank Ergasias* | | | 360,252 | | | | 204,916 | |

| | | | | | | | | |

| Description | | | Shares | | | | Value | |

Hellenic Petroleum | | | 22,446 | | | $ | 192,136 | |

| Intralot -Integrated Lottery Systems & Services | | | 72,846 | | | | 211,221 | |

Karelia Tobacco | | | 756 | | | | 220,308 | |

Metka | | | 12,420 | | | | 222,278 | |

Motor Oil Hellas Corinth Refineries | | | 16,632 | | | | 209,515 | |

Public Power* | | | 14,274 | | | | 215,655 | |

| | | | | | | | 1,946,211 | |

| Hungary — 4.0% | | | | | | | | |

Magyar Telekom Telecommunications | | | 153,864 | | | | 219,204 | |

MOL Hungarian Oil & Gas | | | 3,852 | | | | 221,254 | |

OTP Bank | | | 12,582 | | | | 239,628 | |

Richter Gedeon Nyrt | | | 13,680 | | | | 234,182 | |

| | | | | | | | 914,268 | |

| Ireland — 9.9% | | | | | | | | |

Aer Lingus Group | | | 96,930 | | | | 205,075 | |

CPL Resources | | | 22,770 | | | | 238,188 | |

CRH | | | 7,812 | | | | 226,335 | |

FBD Holdings | | | 9,162 | | | | 220,851 | |

Fyffes | | | 176,256 | | | | 293,125 | |

Glanbia | | | 15,066 | | | | 224,590 | |

Kingspan Group | | | 11,196 | | | | 210,469 | |

Origin Enterprises PLC* | | | 22,770 | | | | 249,213 | |

Smurfit Kappa Group | | | 8,190 | | | | 181,798 | |

Total Produce | | | 167,256 | | | | 241,556 | |

| | | | | | | | 2,291,200 | |

| Israel — 9.6% | | | | | | | | |

CLAL Insurance Enterprise | | | 11,412 | | | | 222,634 | |

Elbit Systems | | | 3,852 | | | | 227,191 | |

Gazit Globe Ltd. | | | 16,992 | | | | 218,262 | |

| Harel Insurance Investments & Financial Services | | | 36,756 | | | | 209,351 | |

Israel Chemicals | | | 26,712 | | | | 236,668 | |

Melisron | | | 8,424 | | | | 224,153 | |

Migdal Insurance & Financial Holding | | | 133,938 | | | | 219,263 | |

Paz Oil Ltd. | | | 1,458 | | | | 227,558 | |

Strauss Group | | | 12,402 | | | | 224,351 | |

Teva Pharmaceutical Industries | | | 4,500 | | | | 224,317 | |

| | | | | | | | 2,233,748 | |

| Italy — 10.2% | | | | | | | | |

Atlantia | | | 8,892 | | | | 231,306 | |

Enel | | | 42,354 | | | | 239,387 | |

Eni | | | 9,342 | | | | 242,493 | |

Gtech Spa | | | 6,840 | | | | 200,607 | |

Intesa Sanpaolo | | | 71,640 | | | | 244,498 | |

Pirelli & C. | | | 13,248 | | | | 222,025 | |

Saipem* | | | 9,630 | | | | 257,851 | |

Telecom Italia | | | 191,718 | | | | 245,632 | |

UniCredit | | | 28,026 | | | | 250,399 | |

Unipol Gruppo Finanziario | | | 31,158 | | | | 224,996 | |

| | | | | | | | 2,359,194 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Global Value ETF

April 30, 2014 (Concluded)

| Description | | | Shares | | | | Value | |

| Portugal — 10.1% | | | | | | | | |

Banco Espirito Santo* | | | 112,266 | | | $ | 198,739 | |

| BANIF - Banco Internacional do Funchal* | | | 14,635,404 | | | | 211,166 | |

Cimpor Cimentos de Portugal SGPS | | | 61,848 | | | | 271,915 | |

Corticeira Amorim SGPS | | | 58,338 | | | | 249,280 | |

EDP - Energias de Portugal | | | 51,138 | | | | 248,312 | |

Galp Energia SGPS | | | 13,590 | | | | 235,393 | |

Portugal Telecom SGPS | | | 50,436 | | | | 209,917 | |

| Semapa-Sociedade de Investimento e Gestao | | | 15,642 | | | | 234,695 | |

Sonae | | | 126,180 | | | | 237,025 | |

Teixeira Duarte | | | 153,198 | | | | 235,705 | |

| | | | | | | | 2,332,147 | |

| Russia — 8.8% | | | | | | | | |

Alrosa AO | | | 218,592 | | | | 225,875 | |

E.ON Russia JSC | | | 3,880,728 | | | | 271,994 | |

Gazprom Neft OAO | | | 57,960 | | | | 225,365 | |

Gazprom OAO | | | 64,566 | | | | 233,380 | |

Rosneft OAO | | | 34,272 | | | | 214,165 | |

Sberbank of Russia | | | 99,558 | | | | 202,609 | |

Severstal | | | 28,728 | | | | 200,713 | |

Uralkali | | | 51,138 | | | | 226,084 | |

VTB Bank | | | 223,682,724 | | | | 242,676 | |

| | | | | | | | 2,042,861 | |

| Spain — 10.2% | | | | | | | | |

Acciona | | | 2,844 | | | | 230,819 | |

Banco Bilbao Vizcaya Argentaria | | | 17,915 | | | | 219,836 | |

Banco Santander | | | 24,984 | | | | 248,419 | |

CaixaBank | | | 35,190 | | | | 214,323 | |

Enagas | | | 7,560 | | | | 232,841 | |

Endesa | | | 6,804 | | | | 257,840 | |

Ferrovial | | | 10,548 | | | | 234,140 | |

Gas Natural SDG | | | 8,658 | | | | 248,221 | |

Iberdrola | | | 33,930 | | | | 237,011 | |

Mapfre | | | 54,990 | | | | 231,541 | |

| | | | | | | | 2,354,991 | |

| Total Common Stock | | | | | | | | |

(Cost $21,939,249) | | | | | | | 22,057,190 | |

| | | | | | | | | |

| PREFERRED STOCK — 3.6% | | | | | | | | |

| Brazil — 3.6% | | | | | | | | |

Banco Bradesco | | | 19,314 | | | | 286,711 | |

Cia Energetica de Minas Gerais | | | 38,772 | | | | 291,952 | |

Telefonica Brasil | | | 11,952 | | | | 251,503 | |

| | | | | | | | | |

| Total Preferred Stock | | | | | | | | |

(Cost $776,452) | | | | | | | 830,166 | |

| | | | | | |

| RIGHT — 0.0% | | | | | | |

| Brazil — 0.0% | | | | | | |

| Ambev SA* | | | | | | |

06/02/14 | | 39 | | | $ | 5 | |

| | | | | | | | |

Total Right (Cost $–) | | | | | | 5 | |

| | | | | | | | |

| TIME DEPOSITS — 0.7% | | | | | | | |

| Brown Brothers Harriman, 0.054%, 05/01/2014 | EUR | 4,486 | | | | 6,223 | |

| Brown Brothers Harriman, 0.030%, 05/01/2014 | | 166,419 | | | | 166,419 | |

| | | | | | | | |

| Total Time Deposits | | | | | | | |

(Cost $172,642) | | | | | | 172,642 | |

| | | | | | | | |

| Total Investments — 99.6% | | | | | | | |

(Cost $22,888,343) | | | | | $ | 23,060,003 | |

Other Assets and Liabilities — 0.4% | | | | | | 100,215 | |

Net Assets — 100.0% | | | | | $ | 23,160,218 | |

Percentages based on Nets Assets.

| (A) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “accredited investors.” These securities have been determined to be liquid under guidelines established by the board of Trustees. |

| * | Non-income producing security. |

| (1) | In U.S. Dollars unless otherwise noted. |

EUR — Euro

Ltd. — Limited

PLC — Public Limited Company

The following is a summary of the inputs used as of April 30, 2014 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | |

Common Stock | | $ | 22,057,190 | | | $ | — | | | $ | — | | | $ | 22,057,190 | |

Preferred Stock | | | 830,166 | | | | — | | | | — | | | | 830,166 | |

Right | | | 5 | | | | — | | | | — | | | | 5 | |

Time Deposits | | | — | | | | 172,642 | | | | — | | | | 172,642 | |

Total Investments in Securities | | $ | 22,887,361 | | | $ | 172,642 | | | $ | — | | | $ | 23,060,003 | |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been no transfers between Level 1 & Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Assets and Liabilities

| | | Cambria Shareholder Yield ETF | | | Cambria Foreign Shareholder Yield ETF | | | | |

| Assets: | | | | | | | | | |

Investments at Cost | | $ | 183,634,023 | | | $ | 63,319,938 | | | $ | 22,888,343 | |

Cost of Foreign Currency | | | — | | | | 60,695 | | | | 7,330 | |

Investments at Fair Value | | $ | 201,532,840 | | | $ | 66,187,486 | | | $ | 23,060,003 | |

Foreign Currency at Value | | | — | | | | 61,897 | | | | 7,364 | |

Receivable for Investment Securities Sold | | | 10,984,806 | | | | 308,557 | | | | 8,712 | |

Dividends Receivable | | | 88,722 | | | | 299,606 | | | | 37,425 | |

Receivable for Capital Shares Sold | | | — | | | | — | | | | 619,972 | |

Unrealized Appreciation on Foreign Currency Spot Contracts | | | — | | | | 708 | | | | — | |

Reclaims Receivable | | | — | | | | 25,179 | | | | 4,707 | |

Total Assets | | | 212,606,368 | | | | 66,883,433 | | | | 23,738,183 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

Payable for Investment Securities Purchased | | | 7,350,942 | | | | 280,436 | | | | 568,845 | |

Payable Due to Investment Adviser | | | 99,225 | | | | 30,775 | | | | 6,488 | |

Unrealized Depreciation on Foreign Currency Spot Contracts | | | — | | | | — | | | | 2,047 | |

Other Accrued Expenses | | | — | | | | — | | | | 585 | |

Total Liabilities | | | 7,450,167 | | | | 311,211 | | | | 577,965 | |

| | | | | | | | | | | | | |

Net Assets | | $ | 205,156,201 | | | $ | 66,572,222 | | | $ | 23,160,218 | |

| | | | | | | | | | | | | |

| Net Assets Consist of: | | | | | | | | | | | | |

Paid-in Capital | | $ | 183,246,450 | | | $ | 63,201,384 | | | $ | 22,945,250 | |

Undistributed Net Investment Income | | | — | | | | 514,896 | | | | 44,732 | |

Accumulated Net Realized Gain (Loss) on Investments | | | 4,010,934 | | | | (14,347 | ) | | | 233 | |

Net Unrealized Appreciation on Investments | | | 17,898,817 | | | | 2,867,548 | | | | 171,660 | |

| Net Unrealized Appreciation (Depreciation) on Foreign Currency Translations | | | — | | | | 2,741 | | | | (1,657 | ) |

Net Assets | | $ | 205,156,201 | | | $ | 66,572,222 | | | $ | 23,160,218 | |

| | | | | | | | | | | | | |

| Outstanding Shares of Beneficial Interest | | | | | | | | | | | | |

(unlimited authorization — no par value) | | | 6,850,000 | | | | 2,500,010 | | | | 900,010 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 29.95 | | | $ | 26.63 | | | $ | 25.73 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Operations

For the period ended April 30, 2014

| | | Cambria Shareholder Yield ETF(1) | | | Cambria Foreign Shareholder Yield ETF(2) | | | Cambria Global Value ETF(3) | |

| Investment Income: | | | | | | | | | |

Dividend Income | | $ | 3,182,219 | | | $ | 932,300 | | | $ | 64,232 | |

Interest Income | | | 196 | | | | 25 | | | | 1 | |

Less: Foreign Taxes Withheld | | | (31,826 | ) | | | (87,694 | ) | | | (6,129 | ) |

Total Investment Income | | | 3,150,589 | | | | 844,631 | | | | 58,104 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

Management Fees | | | 823,597 | | | | 110,834 | | | | 7,137 | |

Custodian Fees | | | — | | | | — | | | | 1,210 | |

Total Expenses | | | 823,597 | | | | 110,834 | | | | 8,347 | |

| | | | | | | | | | | | | |

Net Investment Income | | | 2,326,992 | | | | 733,797 | | | | 49,757 | |

| | | | | | | | | | | | | |

| Net Realized and Unrealized Gains (Losses) on Investments: | | | | | | | | | | | | |

Net Realized Gain (Loss) on Investments | | | 4,972,765 | (4) | | | (14,347 | ) | | | 235 | |

Net Realized Loss on Foreign Currency Transactions | | | — | | | | (803 | ) | | | (5,027 | ) |

Net Change in Unrealized Appreciation on Investments | | | 17,898,817 | | | | 2,867,548 | | | | 171,660 | |

| Net Change in Unrealized Appreciation (Depreciation) on Foreign Currency Translation | | | — | | | | 2,741 | | | | (1,657 | ) |

Net Realized and Unrealized Gain on Investments | | | 22,871,582 | | | | 2,855,139 | | | | 165,211 | |

| | | | | | | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 25,198,574 | | | $ | 3,588,936 | | | $ | 214,968 | |

| (1) | Commenced operations on May 13, 2013. |

| (2) | Commenced operations on December 2, 2013. |

| (3) | Commenced operations on March 11, 2014. |

| (4) | Includes realized gain as a result of in-kind transactions. (See Note 4 in Notes to Financial Statements). |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Changes in Net Assets

For the period ended April 30, 2014

| | | Cambria Shareholder Yield ETF | | | Cambria Foreign Shareholder Yield ETF | | | | |

| | | Period Ended April 30, 2014(1) | | | Period Ended April 30, 2014(2) | | | Period Ended April 30, 2014(3) | |

| Operations: | | | | | | | | | |

Net Investment Income | | $ | 2,326,992 | | | $ | 733,797 | | | $ | 49,757 | |

Net Realized Gain (Loss) on Investments | | | 4,972,765 | (4) | | | (14,347 | ) | | | 235 | |

Net Realized Loss on Foreign Currency Transactions | | | — | | | | (803 | ) | | | (5,027 | ) |

Net Change in Unrealized Appreciation on Investments | | | 17,898,817 | | | | 2,867,548 | | | | 171,660 | |

| Net Change in Unrealized Appreciation (Depreciation) on Foreign Currency | | | — | | | | 2,741 | | | | (1,657 | ) |

Net Increase in Net Assets Resulting from Operations | | | 25,198,574 | | | | 3,588,936 | | | | 214,968 | |

| | | | | | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | | | | | |

Investment Income | | | (2,098,524 | ) | | | (218,964 | ) | | | — | |

Net Realized Gains | | | (721,770 | ) | | | — | | | | — | |

Total Distributions to Shareholders | | | (2,820,294 | ) | | | (218,964 | ) | | | — | |

| | | | | | | | | | | | | |

| Capital Share Transactions: | | | | | | | | | | | | |

Issued | | | 188,121,501 | | | | 63,202,250 | | | | 22,945,250 | |

Redeemed | | | (5,443,580 | ) | | | — | | | | — | |

Increase in Net Assets from Capital Share Transactions | | | 182,677,921 | | | | 63,202,250 | | | | 22,945,250 | |

| | | | | | | | | | | | | |

Total Increase in Net Assets | | | 205,056,201 | | | | 66,572,222 | | | | 23,160,218 | |

| | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | |

Beginning of Period | | | 100,000 | | | | — | | | | — | |

End of Period (Includes Undistributed Net Investment Income of

$0, $514,896 and $44,732) | | $ | 205,156,201 | | | $ | 66,572,222 | | | $ | 23,160,218 | |

| | | | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | | | |

Beginning of Period | | | 4,000 | | | | — | | | | — | |

Issued | | | 7,050,000 | | | | 2,500,010 | | | | 900,010 | |

Redeemed | | | (204,000 | ) | | | — | | | | — | |

Net Increase in Shares Outstanding from Share Transactions | | | 6,850,000 | | | | 2,500,010 | | | | 900,010 | |

| (1) | The Fund commenced operations on May 13, 2013. |

| (2) | The Fund commenced operations on December 2, 2013. |

| (3) | The Fund commenced operations on March 11, 2014. |

| (4) | Includes realized gain as a result of in-kind transactions. (See Note 4 in Notes to Financial Statements). |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| Net Asset Value, Beginning of Period | | Net Realized and Unrealized Gain on Investments | | Distributions from Investment Income | Distributions from Net Realized Capital Gains | | Net Asset Value, End of Period | | Net Assets End of Period (000) | Ratio of Expenses to Average Net Assets | Ratio of Net Investment Income to Average Net Assets | Portfolio Turnover(1),(2) |

| Cambria Shareholder Yield ETF | | | | | | | | | | |

2014(3) | $25.00 | $0.45 | $4.98 | $5.43 | $(0.36) | $(0.12) | $(0.48) | $29.95 | 21.81% | $205,156 | 0.59%(4) | 1.67%(4) | 83% |

| Cambria Foreign Shareholder Yield ETF |

2014(5) | $25.00 | $0.41 | $1.33 | $1.74 | $(0.11) | $— | $(0.11) | $26.63 | 6.96% | $66,572 | 0.59%(4) | 3.91%(4) | 15% |

| Cambria Global Value ETF | | | | | | | |

2014(6) | $25.00 | $0.14 | $0.59 | $0.73 | $— | $— | $— | $25.73 | 2.92% | $23,160 | 0.69%(4) | 4.11%(4) | —% |

| * | Per share data calculated using average shares method. |

| (1) | Returns and portfolio turnover rates are for the period indicated and have not been annualized.Returns do not reflect the deduction of taxes the shareholder would pay on fund distributions or redemption of Fund shares. |

| (2) | Portfolio turnover rate does not include securities received or delivered from processing creations or redemptions. |

| (3) | Inception date May 13, 2013. |

| (5) | Inception date December 2, 2013. |

| (6) | Inception date March 11, 2014. |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Notes to the Financial Statements

1. ORGANIZATION

Cambria ETF Trust (the “Trust”), a Delaware statutory trust, was formed on September 9, 2011 as a diversified, open-end registered management investment company under the Investment Company Act of 1940, as amended. The Trust is comprised of eight Exchange Traded Funds (ETFs): Cambria Global Income and Currency Strategies ETF, Cambria Shareholder Yield ETF, Cambria Foreign Shareholder Yield ETF, Cambria Emerging Shareholder Yield ETF, Cambria Sovereign High Yield Bond ETF, Cambria Global Value ETF, Cambria Global Momentum ETF, and Cambria Value and Momentum ETF. These financial statements relate only to Cambria Shareholder Yield ETF, Cambria Foreign Shareholder Yield ETF, and the Cambria Global Value ETF (each a “Fund” and collectively, the “Funds”). Cambria Investment Management, L.P. (the “Investment Adviser”) serves as the investment adviser to the Funds. The assets of each Fund are segregated, and a shareholder’s interest is limited to the Fund in which shares are held. Each Fund is diversified.

The investment objective of the Cambria Shareholder Yield ETF is to seek income and capital appreciation with an emphasis on income from investments in the U.S. equity market. The Fund commenced operations on May 13, 2013.

The investment objective of Cambria Foreign Shareholder Yield ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Cambria Foreign Shareholder Yield Index. The Fund commenced operations on December 2, 2013.

The investment objective of Cambria Global Value ETF is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Cambria Global Value Index. The Fund commenced operations on March 11, 2014.

Shares of the Funds are listed and traded on the NYSE Arca, Inc. Market prices for the Shares may be different from their net asset value (“NAV”). The Funds will issue and redeem Shares on a continuous basis at NAV only in large blocks of Shares, typically 50,000 Shares, called “Creation Units.” Creation Units are issued and redeemed principally in kind for a basket of securities and a balancing cash amount. Shares generally will trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the Significant Accounting Policies followed by the Funds.

Use of Estimates— The preparation of financial statements in conformity with U.S. generally accepted accounting principles (‘‘GAAP’’) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates, and could have a material impact to the Funds.

Security Valuation — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent quoted bid.

Cambria Investment Management

Notes to the Financial Statements

April 30, 2014 (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. Debt securities are priced based upon valuations provided by independent, third-party pricing agents, if available. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value. Prices for most securities held in the Funds are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Funds seeks to obtain a bid price from at least one independent broker.

Securities for which market prices are not “readily available” are valued in accordance with Fair Value Procedures established by the Board. The Funds’ Fair Value Procedures are implemented through a Fair Value Committee (the ”Committee”) designated by the Board. Some of the more common reasons that may necessitate that a security be valued using Fair Value Procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Funds disclose fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | • | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| | • | Level 2 – Quoted prices which are not active, or inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | • | Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

For the period ended April 30, 2014, there have been no significant changes to the Funds’ fair valuation methodologies.

Foreign Currency Translation— The books and records of the Funds are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains and losses on investments on the Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions represent net foreign exchange gains or losses from foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent amounts actually received or paid.

Cambria Investment Management

Notes to the Financial Statements

April 30, 2014 (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Federal Income Taxes — The Funds intend to qualify as a “regulated investment companies” under Sub-chapter M of the Internal Revenue Code of 1986, as amended. If so qualified, the Funds will not be subject to U.S. federal income tax to the extent they distribute substantially all of their net investment income and net capital gains to their shareholders.

The Funds evaluate tax positions taken or expected to be taken in the course of preparing the Funds’ tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50 percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Funds did not record any tax provisions in the current period. However, management’s conclusions regarding tax positions may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last three tax year ends, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the period ended April 30, 2014, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Funds did not incur any interest or penalties.

Master Limited Partnerships — Entities commonly referred to as “MLPs” are generally organized under state law as limited partnerships or limited liability companies. The Fund intends to primarily invest in MLPs receiving partnership taxation treatment under the Internal Revenue Code of 1986 (the “Code”), and whose interests or “units” are traded on securities exchanges like shares of corporate stock. To be treated as a partnership for U.S. federal income tax purposes, an MLP whose units are traded on a securities exchange must receive at least 90% of its income from qualifying sources such as interest, dividends, real estate rents, gain from the sale or disposition of real property, income and gain from mineral or natural resources activities, income and gain from the transportation or storage of certain fuels, and, in certain circumstances, income and gain from commodities or futures, forwards and options with respect to commodities. Mineral or natural resources activities include exploration, development, production, processing, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide. An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the partnership. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions. The MLPs themselves generally do not pay U.S. federal income taxes. Thus, unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends). Currently, most MLPs operate in the energy and/or natural resources sector.

Organizational Expenses — All organizational and offering expenses of the Trust were borne by the Investment Adviser and are not subject to future recoupment. As a result, organizational and offering expenses are not reflected in the statement of assets and liabilities.

Security Transactions and Investment Income — Security transactions are accounted for on trade date. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis.

Dividends and Distributions to Shareholders — The Funds generally pay out dividends from their net investment income, and distributes their net capital gains, if any, to shareholders at least annually. All distributions are recorded on ex-dividend date.

Cambria Investment Management

Notes to the Financial Statements

April 30, 2014 (Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Creation Units — The Funds issue and redeem shares on a continuous basis at NAV in groups of 50,000 shares called ‘‘Creation Units.’’ Purchasers of Creation Units (“Authorized Participants”) must pay a creation transaction fee per transaction. The fee is typically a single charge and will be the same regardless of the number of Creation Units purchased by an investor on the same day. An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a Redemption Fee per transaction to the custodian on the date of such redemption, regardless of the number of Creation Units redeemed that day.

Except when aggregated in Creation Units, shares are not redeemable securities of a Fund. Shares of the Funds may only be purchased or redeemed by Authorized Participants. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Funds. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

If a Creation Unit is purchased or redeemed for cash, a higher transaction fee will be charged. The following table discloses Creation Unit breakdown for the period ended April 30, 2014:

| | | | | | | | | | |

Cambria Shareholder Yield ETF | | 50,000 | | $ | 700 | | $ | 1,497,500 | | $ | 700 | | None |

Cambria Foreign Shareholder Yield ETF | | 50,000 | | | 2,000 | | | 1,331,500 | | | 2,000 | | Up to 2.0% |

Cambria Global Value ETF | | 50,000 | | | 2,500 | | | 1,286,500 | | | 2,500 | | Up to 2.0% |

3. RELATED PARTIES

Investment Advisory Agreement — The Investment Adviser is responsible for overseeing the management and business affairs of the Funds, and has discretion to purchase and sell securities in accordance with the Funds’ objectives, policies, and restrictions. The Investment Adviser reviews, supervises, and administers the Funds’ investment program. The Investment Adviser has entered into an investment advisory agreement (“Management Agreement”) with respect to the Funds. Pursuant to that Management Agreement, the Funds pay the Investment Adviser an annual advisory fee based on its average daily nets assets for the services and facilities it provides payable at an annual rate of 0.59%. In addition the Cambria Global Value ETF may pay up to 0.10% in custody fees.

With the respect to the Cambria Shareholder Yield ETF and Cambria Foreign Shareholder Yield ETF, the Investment Adviser bears all of the costs of the Funds except for the advisory fee, payments under the Funds’ 12b-1 plan, brokerage expenses, acquired fund fees and expenses, taxes, interest (including borrowing costs and dividend expenses on securities sold short), litigation expenses and other extraordinary expenses. With respect to the Cambria Global Value ETF, the Investment Adviser bears all of the costs of the Fund except for the advisory fee, payments under the Fund’s 12b-1 plan, brokerage expenses, custodial expenses, acquired fund fees and expenses, taxes, interest (including borrowing costs and dividend expenses on securities sold short), litigation expenses and other extraordinary expenses. The Management Agreement for the Funds provides that it may be terminated at any time, without the payment of any penalty, by the Board of Trustees or, with respect to the Funds, by a majority of the outstanding shares of the Funds, on 60 days’ written notice to the Investment Adviser, and by the Investment Adviser on 60 days’ written notice to the Trust and that it shall be automatically terminated if it is assigned.

Cambria Investment Management

Notes to the Financial Statements

April 30, 2014 (Continued)

3. RELATED PARTIES (continued)

Administrator, Custodian and Transfer Agent — SEI Investments Global Fund Services (the “Administrator”) serves as the Funds’ Administrator pursuant to an administration agreement. Brown Brothers Harriman (the “Custodian” and “Transfer Agent”) serves as the Funds’ Custodian and Transfer Agent pursuant to a Custodian Agreement and a Transfer Agency Services Agreement.

Distribution Agreement — SEI Investments Distribution Co., a wholly-owned subsidiary of SEI Investments and an affiliate of the Administrator (the “Distributor”), serves as the Funds’ distributor of Creation Units pursuant to a distribution agreement. The Distributor does not maintain any secondary market in Fund shares.

The Trust has adopted a Distribution and Service Plan (“Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940 (the “1940 Act”). In accordance with its Plan, the Funds are authorized to pay an amount up to 0.25% of its average daily net assets each year for certain distribution-related activities. However, no such fee is currently paid by the Funds, and the Board of Trustees has not currently approved the commencement of any payments under the Plan.

4. INVESTMENT TRANSACTIONS

For the period ended April 30, 2014, the purchases and sales of investments in securities excluding in-kind transactions, long-term U.S. Government and short-term securities were:

| | | | | | | |

Cambria Shareholder Yield ETF (1) | | $ | 123,834,838 | | | $ | 127,893,648 | |

Cambria Foreign Shareholder Yield ETF (2) | | | 7,556,999 | | | | 7,806,709 | |

Cambria Global Value ETF (3) | | | 3,810,480 | | | | 35,620 | |

| (1) | The Fund commenced operations on May 13, 2013. |

| (2) | The Fund commenced operations on December 2, 2013. |

| (3) | The Fund commenced operations on March 11, 2014. |

For the period ended April 30, 2014, in-kind transactions associated with creations and redemptions were:

| | | | | | | | | | |

Cambria Shareholder Yield ETF (1) | | $ | 187,742,848 | | | $ | 5,305,998 | | | $ | 429,395 | |

Cambria Foreign Shareholder Yield ETF (2) | | | 62,429,952 | | | | — | | | | — | |

Cambria Global Value ETF (3) | | | 18,940,606 | | | | — | | | | — | |

| (1) | The Fund commenced operations on May 13, 2013. |

| (2) | The Fund commenced operations on December 2, 2013. |

| (3) | The Fund commenced operations on March 11, 2014. |

5. PRINCIPAL RISKS

As with all exchange traded funds (‘‘ETFs’’), a shareholder of the Funds is subject to the risk that his or her investment could lose money. The Funds are subject to the principal risks noted below, any of which may adversely affect the Fund’s net asset value (‘‘NAV’’), trading price, yield, total return and ability to meet its investment objective. A more complete description of principal risks is included in the prospectus under the heading ‘‘Principal Risks’’.

Cambria Investment Management

Notes to the Financial Statements

April 30, 2014 (Continued)

5. PRINCIPAL RISKS (continued)

Dividend Paying Security Risk — Securities that pay high dividends as a group can fall out of favor with the market, causing these companies to underperform companies that do not pay high dividends. Also, changes in the dividend policies of companies owned by the Funds and the capital resources available for these companies’ dividend payments may adversely affect the Funds.

Equity Investing Risk — An investment in the Funds involves risks similar to those of investing in any Fund holding equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices. The values of equity securities could decline generally or could underperform other investments. In addition, securities may decline in value due to factors affecting a specific issuer, market or securities markets generally.

Management Risk — The Cambria Shareholder Yield ETF is actively managed using proprietary investment strategies and processes. The Cambria Foreign Shareholder Yield ETF and Cambria Emerging Shareholder Yield ETF are passively-managed, meaning that they are designed to track the performance of an underlying index. There can be no guarantee that these strategies and processes will produce the intended results and no guarantee that the Fund will achieve its investment objective. This could result in the Fund’s underperformance compared to other funds with similar investment objectives.

Foreign Investment Risk — Returns on investments in foreign securities and currencies could be more volatile than, or trail the returns on, investments in U.S. denominated investments. Investments in or exposures to foreign securities or currencies are subject to special risks, including risks associated with foreign markets generally, including differences in information available about issuers of securities and investor protection standards applicable in other jurisdictions; capital controls risks, including the risk of a foreign jurisdiction imposing restrictions on the ability to repatriate or transfer currency or other assets; currency risks; political, diplomatic and economic risks; regulatory risks; and foreign market and trading risks, including the costs of trading and risks of settlement in foreign jurisdictions.

Non-Correlation Risk — Each Fund’s return may not match the return of its Underlying Index for a number of reasons. For example, each Fund incurs operating expenses not applicable to the Underlying Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of its Underlying Index. In addition, the performance of each Fund and its Underlying Index may vary due to asset valuation differences and differences between each Fund’s portfolio and its Underlying Index resulting from legal restrictions, cost or liquidity constraints.

Index Risk — Unlike many investment companies, the Funds do not utilize an investing strategy that seeks returns in excess of each Fund’s respective Underlying Index. Therefore, a Fund would not necessarily buy or sell a security unless that security is added or removed, respectively, from its respective Underlying Index, even if that security generally is underperforming.

6. GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Funds enter into contracts with third-party service providers that contain a variety of representations and warranties and that provide general indemnifications. Additionally, under the Funds’ organizational documents, the officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Funds. The Funds’ maximum exposure under these arrangements is unknown, as it involves possible future claims that may or may not be made against the Funds. Based on experience, the Investment Adviser is of the view that the risk of loss to the Funds in connection with the Funds’ indemnification obligations is remote; however, there can be no assurance that such obligations will not result in material liabilities that adversely affect the Funds.

Cambria Investment Management

Notes to the Financial Statements

April 30, 2014 (Continued)

7. INCOME TAXES

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to undistributed net investment income (loss), accumulated net realized gain (loss) or paid-in capital, as appropriate, in the period that the differences arise.

Accordingly, the following permanent differences which are primarily attributable to partnership adjustments, reclassification of distributions, non-deductible excise tax, certain foreign currency related transactions, utilization of earnings and profits on shareholder redemptions and REIT adjustments, have been reclassified to/from the following accounts.

| | | Undistributed Net Investment Income Gain/(Loss) | | | Accumulated Realized Gain/(Loss) | | | | |

Cambria Shareholder Yield ETF | | $ | (228,468 | ) | | $ | (240,061 | ) | | $ | 468,529 | |