UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22704

CAMBRIA ETF TRUST

(Exact name of registrant as specified in charter)

________

2321 Rosecrans Avenue

Suite 3225

El Segundo, CA 90245

(Address of principal executive offices) (Zip code)

Corporation Service Company

2711 Centerville Road

Suite 400

Wilmington, DE 19808

(Name and address of agent for service)

With a Copy to:

Stacy L. Fuller

K&L Gates LLP

1601 K Street NW

Washington, DC 20006

Registrant’s telephone number, including area code: 1-310-683-5500

Date of fiscal year end: April 30

Date of reporting period: April 30, 2015

The following change was made within Item 1 of the April 30, 2015 Cambria ETF Trust Form N-CSR/A Filing.

The Approval of Advisory Agreements & Board Considerations was updated to include a conclusion paragraph as well as disclosure for the Cambria Global Asset Allocation ETF and the Cambria Global Momentum ETF.

Item 1. Reports to Stockholders.

Cambria Shareholder Yield ETF (SYLD)

Cambria Foreign Shareholder Yield ETF (FYLD)

Cambria Global Value ETF (GVAL)

Cambria Global Momentum ETF (GMOM)

Cambria Global Asset Allocation (GAA)

Annual Report

April 30, 2015

Cambria Investment ManagementTable of Contents

| Manager’s Discussion and Analysis of Fund Performance (Unaudited) | 2 |

| Schedules of Investments | |

| Cambria Shareholder Yield ETF | 11 |

| Cambria Foreign Shareholder Yield ETF | 13 |

| Cambria Global Value ETF | 16 |

| Cambria Global Momentum ETF | 19 |

| Cambria Global Asset Allocation ETF | 20 |

| Statements of Assets and Liabilities | 21 |

| Statements of Operations | 23 |

| Statements of Changes in Net Assets | 25 |

| Financial Highlights | 27 |

| Notes to Financial Statements | 28 |

| Report of Independent Registered Public Accountants | 37 |

| Disclosure of Fund Expenses | 38 |

| Trustees and Officers of the Cambria ETF Trust | 40 |

| Board Consideration of the Investment Advisory Agreement | 42 |

| Notice to Shareholders | 48 |

| Supplemental Information | 49 |

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Cambria Investment Management L.P., the Funds’ investment advisor, uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling (855)-383-4636; and (ii) on the Commission’s website at www.sec.gov.

Cambria Investment Management

Manager’s Discussion and Analysis of Fund Performance

Dear Shareholder:

We are pleased to present the following annual report for the Cambria ETF Trust.

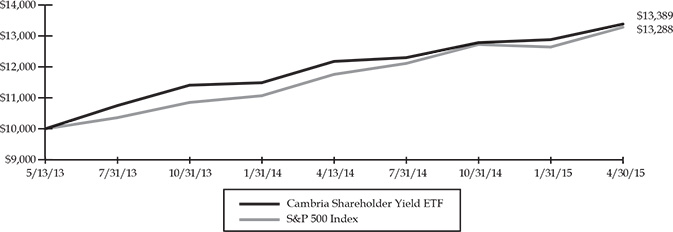

The Trust launched its first series, the Cambria Shareholder Yield ETF (“SYLD”) on May 13, 2013. SYLD seeks income and capital appreciation with an emphasis on income from investments in the U.S. equity market. For the three month quarter ended April 30, 2015, SYLD posted a gain of 3.91%. For the 12 month period ending April 30, 2015, SYLD gained 9.92%. For the period since inception through April 30, 2015, SYLD gained 33.89%.

We believe that the S&P 500 serves as a suitable benchmark for SYLD. The table below shows the performance of the Fund vs. the S&P 500 (a) since inception of SYLD through April 30, 2015, (b) for 12 months ending April 30, 2015, and (c) for the quarter ended April 30, 2015.

| | Vs Benchmark |

| | SYLD | S&P 500 |

| Returns Since Inception | 33.89% | 32.88% |

| 12 Months Ended 4/30/2015 | 9.92% | 12.98% |

| 3 Months Ended 4/30/2015 | 3.91% | 5.07% |

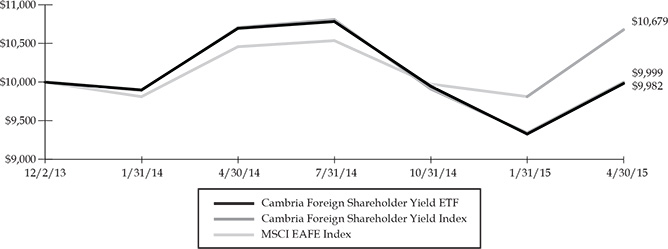

The Trust’s next series, the Cambria Foreign Shareholder Yield ETF (“FYLD”) launched on December 2, 2013. FYLD seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Cambria Foreign Shareholder Yield Index (the ‘‘FYLD Index’’). For the three-month quarter ended April 30, 2015, FYLD posted a gain of 7.01%. For the 12 month period ended April 30, 2015, FYLD posted a loss of 6.67%. From the fund’s launch date through April 30, 2015, FYLD posted a loss of 0.18%.

We believe that the MSCI EAFE Index serves as a suitable benchmark for FYLD. The table below shows the performance of the Fund vs. the MSCI EAFE Index (a) since inception of FYLD through April 30, 2015, (b) for 12 months ending April 30, 2015, and (c) for the quarter ended April 30, 2015.

| | Vs Benchmark |

| | FYLD | MSCI EAFE |

Returns Since Inception | -0.18% | 6.79% |

12 Months Ended 4/30/2015 | -6.67% | 2.10% |

3 Months Ended 4/30/2015 | 7.01% | 8.83% |

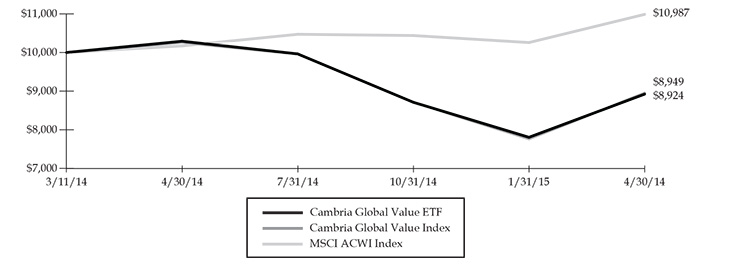

The trust’s third series, the Cambria Global Value ETF (“GVAL”), launched on March 11, 2014, GVAL seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Cambria Global Value Index (the “GVAL Index”). For the three-month quarter ended April 30, 2015, GVAL posted a gain of 14.30%. For the 12 month period ended April 30, 2015, GVAL posted a loss of 13.29%. For the period from launch through April 30, 2015, the Fund posted a 10.76% loss.

Cambria Investment Management

Manager’s Discussion and Analysis of Fund Performance

We believe that the MSCI ACWI Index serves as a suitable benchmark for GVAL. The table below shows the performance of GVAL vs. the ACWI Index (a) since inception of GVAL through April 30, 2015, (b) the 12-month period ended April 30, 2015, and (c) for the quarter ended April 30, 2015.

| | Vs Benchmark |

| | GVAL | MSCI ACWI |

Returns Since Inception | -10.76% | 9.87% |

12 Months Ended 4/30/2015 | -13.29% | 8.01% |

3 Months Ended 4/30/2015 | 14.30% | 7.11% |

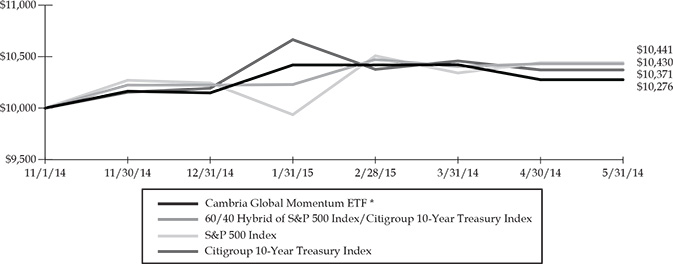

The Cambria Global Momentum ETF (“GMOM”) launched on November 4, 2014 at $25.00 per share. GMOM seeks income and capital appreciation with an emphasis on income from investments in global asset classes. For the three-month quarter ended April 30, 2015, GMOM posted a loss of 1.37%. From the period from inception through April 30, 2015, GMOM posted a gain of 2.76%.

We believe that the suitable benchmark for GMOM is composed of 60% SPTR (S&P 500 Total Return Index) and 40% Citigroup 10 Year Treasury Index and, at the end of the fund’s first complete calendar year, intend to identify this formulation in the prospectus as an appropriate broad-based benchmark for GMOM. We believe the “60-40” portfolio is a suitable benchmark for GMOM because “60-40” is the precursor to most modern asset allocation strategies. The benchmark has long been used by academia and practitioners alike as a guidepost in which to compare broad asset allocation strategies. The table below shows the performance of GMOM vs. the benchmark for the quarter ended April 30, 2015 and from the fund’s inception date through April 30, 2015.

| | Vs Benchmark | | |

| | GMOM | 60/40

Benchmark | S&P 500 | Citi 10-Y

Treasury Index |

Returns Since Inception | 2.76% | 4.30% | 4.41% | 3.71% |

3 Months Ended 4/30/2015 | -1.37% | 1.96% | 5.07% | -2.75% |

The Cambria Global Asset Allocation ETF (“GAA”) launched on December 10, 2014 at $25.00 per share. GAA seeks investment results that correspond (before fees and expenses) generally to the price and yield performance of its underlying index, the Cambria Global Asset Allocation Index (the “GAA Index”). For the three-month quarter ended April 30, 2015, GAA posted a gain of 3.15%. From the fund’s inception through April 30, 2015, GAA also posted a gain of 2.58%.

We believe that the suitable benchmark for GMOM is composed of 60% SPTR (S&P 500 Total Return Index) and 40% Citigroup 10 Year Treasury Index and, at the end of the fund’s first complete calendar year, intend to identify the this formulation in the prospectus as an appropriate broad-based benchmark for GAA. We believe the “60-40” portfolio is a suitable benchmark for GAA because “60-40” is the precursor to most modern asset allocation strategies. The benchmark has long been used by academia and practitioners alike as a comparison to broad asset allocation strategies. The table below shows the performance of GAA vs. the benchmark for the quarter ended April 30, 2015 and from the fund’s inception date through April 30, 2015.

| | Vs Benchmark | | |

| | GAA | 60/40

Benchmark | S&P 500 | Citi 10-Y

Treasury Index |

Returns Since Inception | 2.58% | 2.29% | 1.99% | 2.33% |

3 Months Ended 4/30/2015 | 3.15% | 1.96% | 5.07% | -2.75% |

Cambria Investment Management

Manager’s Discussion and Analysis of Fund Performance

Additional Commentary on Funds’ Performance

With respect to SYLD, Southwest Airlines and O’Reilly Automotive were the top contributors to the fund’s positive performance. For twelve months ending April 30, 2015, Southwest and O’Reilly Automotive were up 69% and 46.4% respectively. Chesapeake Granite Washington Trust and Smith & Wesson Holding Corp. were the most significant drags on performance, returning -43% and -36% respectively.

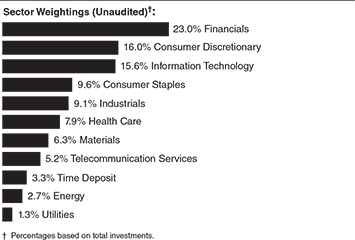

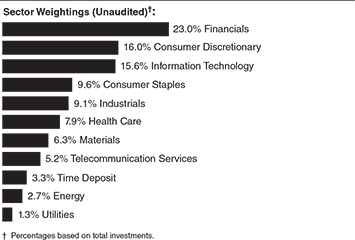

SYLD seeks to achieve its investment objective by investing, under normal market conditions, primarily in equity securities that provide a high “shareholder yield.” Cambria views equity securities as providing a high shareholder yield if they exhibit strong cash flows, as reflected by their payment of dividends to shareholders and their return of capital to shareholders in other forms, such as through net stock buybacks and net debt paydown. These metrics generally result in the Fund’s portfolio holding value stocks (as opposed to growth stocks). For the twelve months ending April 30, 2015, SYLD underperformed the S&P 500 by 3.06%. During the same period, the Russell 1000 Growth Index outperformed the Russell 1000 Value index by 7.35%. Chief drivers of underperformance were underweights in Technology, Healthcare, Energy and Utilities. A significant overweight in Financials also contributed to underperformance. Between inception and April 30, 2015, SYLD outperformed the S&P 500 Index by 1.01%. Over-weights in Consumer, Cyclical, Financials, Industrials, and Materials and a slight underweight in Telecommunications contributed to outperformance.

With regard to FYLD, Metro Inc. and Kyudenko Corp. were the fund’s top performers. For twelve months ending April 30, 2015, Metro Inc. and Kyudenko Corp. were up 41.7% and 27.5% respectively. BC Iron Ltd. and Kvaerner ASA were the largest detractors, returning -90.4% and -50.2% respectively.

For twelve months ending April 30, 2015, FYLD underperformed MSCI EAFE TR Index by 8.77%. There are a few explanations for this underperformance. Here, we focus on strategy, country, sector, and currency allocations as underlying the underperformance. With respect to strategy, FYLD seeks to achieve its investment objective by investing at least 80% of its assets in the components of the Cambria Foreign Shareholder Yield Index, and the Index identifies the 100 issuers in the relevant universe that have exhibited, in the aggregate, the strongest cash flows, the highest dividends paid to shareholders, and net stock buybacks and debt paydown. These metrics generally result in the Fund’s portfolio holding value stocks (as opposed to growth stocks). During the twelve months ending April 30, 2015, the MSCI EAFE TR Growth Index outperformed the MSCI EAFE TR Value Index by 4.87%. With respect to country allocations, over-weights in Australia, Norway, Finland, and Canada; combined with underweight in Japan, United Kingdom, Italy, and Hong Kong contributed to underperformance. Similarly, over-weights in Consumer Discretionary, Energy, Materials, and Industrials; combined with underweights in Healthcare, Consumer Staples contributed to underperformance. Third, large exposure to the Australian Dollar, Norwegian Krone, Danish Krone, and Canadian Dollar; combined with under-exposure to the Japanese Yen, Hong Kong Dollar, and the Euro contributed to underperformance.

As for GVAL, Severstal PAO and JBS SA made the biggest contribution to the fund’s performance. For twelve months ending April 30, 2015, Severstal PAO and JBS SA were up 85.7% and 50.9% respectively. Cimpor Cimentos De Portugal and CIA de Bebidas were the biggest dark spots, returning -65.6 and -26% respectively.

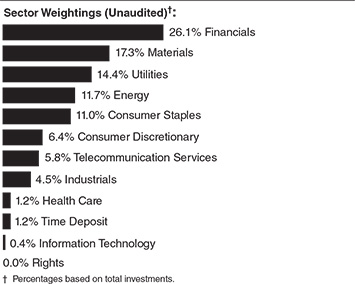

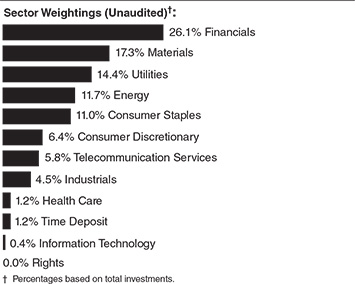

For twelve months ending April 30, 2015, GVAL underperformed the MSCI ACWI TR Index by 21.3%. The chief drivers of this underperformance were a function of the Fund’s strategy, sector and country allocations. With respect to the Fund’s sector allocations, over-weights in Financials, Utilities, and Energy; combined with underweights in Consumer, Non-cyclical, Telecommunications, and Industrials. Analyzing country allocations, we find that underweights in United States, Japan, and China; combined with over-weights in Portugal, Brazil, Greece, and Austria contributed to underperformance. With respect to the Fund’s strategy, GVAL seeks to achieve its investment objective by investing at least 80% of its assets in the components of the Cambria Global Value Index. The GVAL index is a quantitative, value-oriented stock selection methodology that selects up to 11 countries trading at long-term discount (relative to other countries’ equity markets). Within the selected countries, the model then selects stocks trading at most attractive valuations, i.e., value stocks. Such a strategy will face headwinds during growth periods, and will likely underperform. For the period between GVAL’s inception and April 30, 2015, the MSCI ACWI

Cambria Investment Management

Manager’s Discussion and Analysis of Fund Performance

Growth Index significantly outperformed the MSCI ACWI Value Index by 5.67%. The underperformance of the GVAL Index does not necessarily signify shortcomings of the underlying quantitative methodology, but underscores the fact that in times of brisk positive equity performance, such a strategy, especially an equal weighted portfolio, will underperform traditional capitalization-weighted portfolios.

With respect to GMOM, Vanguard FTSE Emerging Markets ETF and Vanguard Global ex-US Real Estate ETF were the top bright spots in the fund’s positive performance since inception, returning 17% and 13.4% respectively. Vanguard Extended Duration Treasuries ETF and iShares 20+ Year Treasury Bond Fund were the largest detractors, returning -1.82% and -0.48% respectively.

For three months ended April 30, 2015, GMOM returned -1.37%. The main drivers of this negative performance were significant positions in long US treasuries and REITs. During this period, long US treasuries and REITs produced negative returns. The Fund held the Vanguard Extended Duration Treasuries Fund, the iShares 20+ Year Treasury Fund, the iShares Residential Real Estate Fund, and the Vanguard REIT ETF.

Finally, as for GAA, the Vanguard FTSE Emerging Markets ETF and Vanguard FTSE Developed ETF were the top holdings contributing to the Fund’s positive performance, returning 17% and 11.5% respectively. The iShares Cohen & Steers REIT ETF and United States Commodity Index Fund were the biggest disappointments, returning -5.9% and -4.6% respectively.

For three months ending April 30, 2015, GAA returned 3.15%. The fund held significant positions in long US treasuries and REITs funds – two asset classes which underperformed the US equity market. Between inception and April 30, 2015, the Fund returned 2.58%. The Fund held significant positions in REITs, commodities, and long US treasuries. All these asset classes underperformed the US equity markets.

Each of GMOM and GAA are designed to provide for an investor’s portfolio a stand-alone, fully diversified investment. Thus, the performance of each of them is expected to be moderate under most market conditions, and the performance of each of them is in line with Cambria’s expectations.

In general, we believe market conditions have been favorable for US and foreign equities. We further believe that US equities may currently be trading at prices that above their fair valuation — although not in “bubble” territory. Nevertheless, we expect valuations to be a headwind in the years ahead and we appreciate your continuing confidence in us as asset managers.

| | Sincerely, |

| | Mebane Faber and Eric Richardson |

The MSCI EAFE Index is a free float-adjusted market capitalization weighted index, designed to measure developed market equity performance excluding the U.S. and Canada, consisting of 21 stock markets in Europe, Australasia, and the Far East.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indexes comprising 23 developed and 23 emerging market country indexes.

The S&P 500 Index is a diverse index that includes 500 American companies that represent over 70% of the total market capitalization of the U.S. stock market.

Cambria Investment Management

(Unaudited)

Comparison of Change in the Value of a $10,000 Investment in the

Cambria Shareholder Yield ETF versus the S&P 500 Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE

PERIODS ENDED APRIL 30, 2015 |

| | One Year Return | Since Inception (Annualized) |

| Cambria Shareholder Yield ETF | 9.92% | 16.01% |

| S&P 500 Index | 12.98% | 15.57% |

The performance data quoted herein represents past performance and the return and value of an investment

in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636). As stated in the Fund’s prospectus, the annual fund operating expenses are 0.59%.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The index is unmanaged and is not available for investment.

There are no assurances that the Fund will meet its stated objectives.

S&P 500 Index is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation, with each stock’s weight in the Index proportionate to its market value.

Cambria Investment Management

(Unaudited)

Comparison of Change in the Value of a $10,000 Investment in the Cambria Foreign Shareholder

Yield ETF versus the Cambria Foreign Shareholder Yield Index and the MSCI EAFE Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE

PERIODS ENDED APRIL 30, 2015 |

| | One Year Return | Since Inception (Annualized) |

| Cambria Foreign Shareholder Yield ETF | (6.67)% | (0.13)% |

| Cambria Foreign Shareholder Yield Index | (6.60)% | (0.01)% |

| MSCI EAFE Index | 2.10% | 4.77% |

The performance data quoted herein represents past performance and the return and value of an investment

in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636). As stated in the Fund’s prospectus, the annual fund operating expenses are 0.59%.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The indexes are unmanaged and are not available for investment.

There are no assurances that the Fund will meet its stated objectives.

Cambria Foreign Shareholder Yield Index represents issuers with strong cash flows, highest dividends paid to shareholders, net stock buybacks and net debt paydowns. The initial screening universe for this Index includes issuers in foreign developed countries with marketing capitalizations of at least $200 million. The Index is comprised of the 100 issuers with high rankings across a composite of the aforementioned factors.

MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following 21 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

Cambria Investment Management

(Unaudited)

Comparison of Change in the Value of a $10,000 Investment in the

Cambria Global Value ETF versus the Cambria Global Value Index and the MSCI ACWI Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE

PERIODS ENDED APRIL 30, 2015 |

| | One Year Return | Since Inception (Annualized) |

| Cambria Global Value ETF | (13.29)% | (9.53)% |

| Cambria Global Value Index | (12.81)% | (9.31)% |

| MSCI ACWI Index | 8.01% | 8.63% |

The performance data quoted herein represents past performance and the return and value of an investment in

the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future

results of the Fund. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636). As stated in the Fund’s prospectus, the annual fund operating expenses are 0.69%.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The indexes are unmanaged and are not available for investment.

There are no assurances that the Fund will meet its stated objectives.

Cambria Global Value Index consists of equity securities of issuers that are domiciled in, trade in, or have exposure to a market that is undervalued according to various valuation metrics. The initial screening universe for this Index includes issuers having a market capitalization of at least $200 million.

MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 45 country indices comprising 24 developed and 21 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Cambria Investment Management

(Unaudited)

Comparison of Change in the Value of a $10,000 Investment in the

Cambria Global Momentum ETF versus the 60/40 Hybrid of S&P 500/Citigroup 10-year Treasury Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED APRIL 30, 2015 | |

| | Cumulative Inception Date* | |

| Cambria Global Momentum ETF | 2.76% | |

| 60/40 Hybrid of S&P 500/Citigroup 10-year Treasury Index | 4.30% | |

| S&P 500 Index | 4.41% | |

| Citigroup 10-Year Treasury Index | 3.71% | |

* The Fund commenced operations on November 3, 2014.

The performance data quoted herein represents past performance and the return and value of an investment

in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund.

Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636). As stated in the Fund’s prospectus, the annual fund operating expenses are 0.59%,

not including acquired fund fees and expenses.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The index is unmanaged and is not available for investment.

There are no assurances that the Fund will meet its stated objectives.

60/40 Hybrid of S&P 500/Citigroup 10-year Treasury Index the S&P 500 focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also represents the market. The Citigroup 10-Year US Treasury Benchmark (On-the-Run) Index measures total returns for the current ten-year on-the-run Treasuries that have been in existence for the entire month.

Cambria Investment Management

(Unaudited)

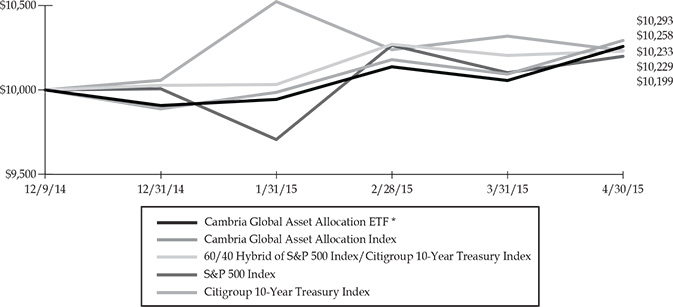

Comparison of Change in the Value of a $10,000 Investment in the

Cambria Global Asset Allocation ETF versus the Cambria Global Asset Allocation Index

and 60/40 Hybrid of S&P 500/Citigroup 10-year Treasury Index

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED APRIL 30, 2015 | |

| | Cumulative Inception to Date* | |

| Cambria Global Asset Allocation ETF | 2.58% | |

| Cambria Global Asset Allocation Index | 3.24% | |

| 60/40 Hybrid of S&P 500/Citigroup 10-year Treasury Index | 2.29% | |

| S&P 500 Index | 1.99% | |

| Citigroup 10-Year Treasury Index | 2.33% | |

* The Fund commenced operations on December 9, 2014.

The performance data quoted herein represents past performance and the return and value of an investment

in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance information please call 855-ETF-INFO (383-4636).

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s performance assumes the reinvestment of all dividends and all capital gains.

Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. The indexes are unmanaged and are not available for investment.

There are no assurances that the Fund will meet its stated objectives.

Cambria Global Asset Allocation Index is designed to model absolute positive returns with reduced volatility, and manageable risk and drawdowns, by identifying an investable portfolio of equity and fixed income securities, real estate, commodities and currencies.

60/40 Hybrid of S&P 500/Citigroup 10-year Treasury Index the S&P 500 focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also represents the market. The Citigroup 10-Year US Treasury Benchmark (On-the-Run) Index measures total returns for the current ten-year on-the-run Treasuries that have been in existence for the entire month.

Cambria Investment Management

Schedule of Investments • Cambria Shareholder Yield ETF

April 30, 2015

| Description | | Shares | | | Value | |

| COMMON STOCK — 99.9% | | | | |

| Consumer Discretionary — 16.5% | | | | | | |

| Big Lots | | | 52,378 | | | $ | 2,386,866 | |

| Cato, Cl A | | | 36,832 | | | | 1,448,971 | |

| CBS, Cl B | | | 37,728 | | | | 2,344,041 | |

| Dillard's, Cl A | | | 15,060 | | | | 1,981,745 | |

| Gap | | | 50,283 | | | | 1,993,218 | |

| Home Depot | | | 26,153 | | | | 2,797,848 | |

| Kohl's | | | 39,644 | | | | 2,840,493 | |

| Liberty Interactive, Cl A* | | | 85,454 | | | | 2,457,657 | |

| Lowe's | | | 44,640 | | | | 3,073,910 | |

| Macy's | | | 41,486 | | | | 2,681,240 | |

| Magna International | | | 32,717 | | | | 1,649,918 | |

| Newell Rubbermaid | | | 36,843 | | | | 1,404,823 | |

| O'Reilly Automotive* | | | 14,647 | | | | 3,190,556 | |

| Six Flags Entertainment | | | 53,118 | | | | 2,497,609 | |

| Time Warner | | | 8,243 | | | | 695,791 | |

| Visteon* | | | 12,251 | | | | 1,242,252 | |

| Wendy's | | | 279,153 | | | | 2,825,028 | |

| | | | | | | | 37,511,966 | |

| Consumer Staples — 9.8% | | | | | | | | |

| Archer-Daniels-Midland | | | 46,656 | | | | 2,280,545 | |

| Coca-Cola Enterprises | | | 47,952 | | | | 2,129,548 | |

| CVS Health | | | 30,816 | | | | 3,059,721 | |

| Dr Pepper Snapple Group | | | 36,432 | | | | 2,717,099 | |

| General Mills | | | 40,631 | | | | 2,248,520 | |

| Ingredion | | | 32,121 | | | | 2,550,407 | |

| Kimberly-Clark | | | 18,857 | | | | 2,068,424 | |

| Medifast* | | | 85,397 | | | | 2,561,910 | |

| Reynolds American | | | 37,728 | | | | 2,765,462 | |

| | | | | | | | 22,381,636 | |

| Energy — 2.8% | | | | | | | | |

| Hess | | | 18,773 | | | | 1,443,644 | |

| HollyFrontier | | | 39,985 | | | | 1,550,618 | |

| Kinder Morgan | | | 1 | | | | 43 | |

| Description | | | Shares | | | | Value | |

| Marathon Petroleum | | | 22,032 | | | $ | 2,171,694 | |

| Phillips 66 | | | 14,622 | | | | 1,159,671 | |

| | | | | | | | 6,325,670 | |

| Financials — 23.8% | | | | | | | | |

| Aflac | | | 34,285 | | | | 2,161,326 | |

| Allstate | | | 41,003 | | | | 2,856,269 | |

| American International Group | | | 39,158 | | | | 2,204,204 | |

| Ameriprise Financial | | | 21,607 | | | | 2,706,925 | |

| Aspen Insurance Holdings | | | 46,368 | | | | 2,166,777 | |

| Assurant | | | 32,455 | | | | 1,994,684 | |

| Axis Capital Holdings | | | 51,152 | | | | 2,662,973 | |

| Chubb | | | 23,497 | | | | 2,310,930 | |

| CIT Group | | | 51,799 | | | | 2,332,509 | |

| Comerica | | | 47,520 | | | | 2,252,923 | |

| Everest Re Group | | | 15,178 | | | | 2,715,496 | |

| Fifth Third Bancorp | | | 102,816 | | | | 2,056,320 | |

| Huntington Bancshares | | | 217,682 | | | | 2,364,027 | |

| KeyCorp | | | 149,520 | | | | 2,160,564 | |

| Legg Mason | | | 56,432 | | | | 2,971,145 | |

| LPL Financial Holdings | | | 48,056 | | | | 1,944,826 | |

| Montpelier Re Holdings | | | 75,160 | | | | 2,864,348 | |

| PartnerRe | | | 19,152 | | | | 2,451,456 | |

| State Street | | | 32,829 | | | | 2,531,772 | |

| Travelers | | | 26,763 | | | | 2,706,007 | |

| Unum Group | | | 64,368 | | | | 2,198,811 | |

| Voya Financial | | | 49,391 | | | | 2,091,215 | |

| WR Berkley | | | 26,275 | | | | 1,287,212 | |

| | | | | | | | 53,992,719 | |

| Health Care — 8.2% | | | | | | | | |

| Anthem | | | 20,916 | | | | 3,156,852 | |

| Chemed | | | 27,598 | | | | 3,180,669 | |

| Cigna | | | 13,125 | | | | 1,635,900 | |

| Eli Lilly | | | 37,977 | | | | 2,729,407 | |

| Express Scripts Holding* | | | 30,134 | | | | 2,603,578 | |

| Omnicare | | | 34,020 | | | | 2,993,080 | |

| Pfizer | | | 67,315 | | | | 2,283,998 | |

| | | | | | | | 18,583,484 | |

| Industrials — 9.4% | | | | | | | | |

| 3M | | | 12,047 | | | | 1,884,030 | |

| AGCO | | | 51,156 | | | | 2,635,046 | |

| General Dynamics | | | 9,971 | | | | 1,369,218 | |

| Ingersoll-Rand | | | 28,472 | | | | 1,874,597 | |

| Joy Global | | | 21,235 | | | | 905,460 | |

| L-3 Communications Holdings | | | 21,456 | | | | 2,465,509 | |

| Northrop Grumman | | | 18,333 | | | | 2,824,015 | |

| Raytheon | | | 27,530 | | | | 2,863,120 | |

| Southwest Airlines | | | 68,570 | | | | 2,781,199 | |

| SPX | | | 22,918 | | | | 1,764,686 | |

| | | | | | | | 21,366,880 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Shareholder Yield ETF

April 30, 2015 (Concluded)

| Description | | Shares/Face Amount | | | Value | |

| Information Technology — 16.1% | | | | | | |

| Apple | | | 25,308 | | | $ | 3,167,296 | |

| CA | | | 64,800 | | | | 2,058,696 | |

| Computer Sciences | | | 36,036 | | | | 2,322,520 | |

| Corning | | | 104,030 | | | | 2,177,348 | |

| Flextronics International* | | | 236,882 | | | | 2,730,065 | |

| Hewlett-Packard | | | 65,820 | | | | 2,170,085 | |

| Intel | | | 69,961 | | | | 2,277,231 | |

| Juniper Networks | | | 95,365 | | | | 2,520,497 | |

| Lexmark International, Cl A | | | 59,616 | | | | 2,646,354 | |

| NetApp | | | 58,977 | | | | 2,137,916 | |

| NVIDIA | | | 119,560 | | | | 2,653,634 | |

| SanDisk | | | 27,538 | | | | 1,843,394 | |

| Texas Instruments | | | 48,528 | | | | 2,630,703 | |

| Western Digital | | | 29,621 | | | | 2,895,157 | |

| Xerox | | | 203,035 | | | | 2,334,903 | |

| | | | | | | | 36,565,799 | |

| Materials — 6.5% | | | | | | | | |

| Avery Dennison | | | 47,978 | | | | 2,667,097 | |

| Clearwater Paper* | | | 37,405 | | | | 2,392,798 | |

| Dow Chemical | | | 46,320 | | | | 2,362,320 | |

| E.I. du Pont de Nemours | | | 32,976 | | | | 2,413,843 | |

| International Paper | | | 45,063 | | | | 2,420,784 | |

| PPG Industries | | | 11,808 | | | | 2,616,181 | |

| | | | | | | | 14,873,023 | |

| Telecommunication Services — 5.4% | | | | | | | | |

| AT&T | | | 60,077 | | | | 2,081,067 | |

| CenturyLink | | | 70,869 | | | | 2,548,449 | |

| Frontier Communications | | | 421,604 | | | | 2,892,204 | |

| Spok Holdings | | | 131,904 | | | | 2,483,093 | |

| TELUS | | | 62,792 | | | | 2,173,859 | |

| | | | | | | | 12,178,672 | |

| Utilities — 1.4% | | | | | | | | |

| Ameren | | | 49,824 | | | | 2,039,795 | |

| Atlantic Power | | | 327,273 | | | | 1,063,637 | |

| | | | | | | | 3,103,432 | |

| Total Common Stock | | | | | | | | |

| (Cost $198,826,648) | | | | | | | 226,883,281 | |

| | | | | | | | | |

| TIME DEPOSIT — 3.4% | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 05/01/2015 | | | | | | | | |

| (Cost $7,651,778) | | $ | 7,651,778 | | | | 7,651,778 | |

| | | | | | | | | |

| Total Investments — 103.3% | | | | | | | | |

| (Cost $206,478,426) | | | | | | | 234,535,059 | |

| Other Assets and Liabilities — (3.3)% | | | | | | | (7,439,314 | ) |

| Net Assets — 100.0% | | | | | | $ | 227,095,745 | |

Percentages based on Net Assets.

| * | Non-income producing security. |

Cl — Class

The following is a summary of the inputs used as of April 30, 2015 in valuing the Fund’s investments carried at value:

Investments

in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 226,883,281 | | | $ | — | | | $ | — | | | $ | 226,883,281 | |

| Time Deposit | | | — | | | | 7,651,778 | | | | — | | | | 7,651,778 | |

| Total Investments in Securities | | $ | 226,883,281 | | | $ | 7,651,778 | | | $ | — | | | $ | 234,535,059 | |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been no transfers between Level 1 & Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Foreign Shareholder Yield ETF

April 30, 2015

| Description | | Shares | | | Value | |

| COMMON STOCK — 98.1% | | | | |

| Australia — 14.3% | | | | | | |

| Bradken | | | 149,834 | | | $ | 271,529 | |

| Cabcharge Australia | | | 170,542 | | | | 611,363 | |

| Decmil Group | | | 478,657 | | | | 437,498 | |

| GUD Holdings | | | 119,999 | | | | 753,994 | |

| Metcash | | | 217,142 | | | | 227,683 | |

| Mineral Resources | | | 78,002 | | | | 401,226 | |

| Myer Holdings | | | 348,135 | | | | 380,186 | |

| OZ Minerals | | | 207,248 | | | | 769,189 | |

| Premier Investments | | | 85,188 | | | | 862,896 | |

| Rio Tinto | | | 12,727 | | | | 575,588 | |

| Seven Group Holdings | | | 99,579 | | | | 579,983 | |

| Skilled Group | | | 7,888 | | | | 8,084 | |

| SMS Management & Technology | | | 168,043 | | | | 434,848 | |

| Toll Holdings | | | 118,796 | | | | 844,205 | |

| Woodside Petroleum | | | 18,962 | | | | 525,947 | |

| Woolworths | | | 23,875 | | | | 556,981 | |

WorleyParsons (A) | | | 46,577 | | | | 422,033 | |

| | | | | | | | 8,663,233 | |

| Belgium — 2.1% | | | | | | | | |

| Ageas | | | 14,908 | | | | 561,107 | |

| Umicore | | | 14,451 | | | | 719,881 | |

| | | | | | | | 1,280,988 | |

| Canada — 11.7% | | | | | | | | |

| Celestica* | | | 62,375 | | | | 761,528 | |

| Genworth MI Canada | | | 19,549 | | | | 569,538 | |

| IGM Financial | | | 12,197 | | | | 461,292 | |

| Labrador Iron Ore Royalty | | | 29,796 | | | | 355,626 | |

| Magna International | | | 15,504 | | | | 781,304 | |

| Metro, Cl A | | | 31,848 | | | | 920,728 | |

| National Bank of Canada | | | 16,170 | | | | 653,367 | |

| Rogers Sugar | | | 125,778 | | | | 474,339 | |

| Suncor Energy | | | 17,968 | | | | 585,133 | |

| Teck Resources, Cl B | | | 25,784 | | | | 390,874 | |

| Description | | | Shares | | | | Value | |

| Transcontinental, Cl A | | | 40,633 | | | $ | 625,745 | |

| WestJet Airlines, Cl A | | | 23,540 | | | | 532,064 | |

| | | | | | | | 7,111,538 | �� |

| Denmark — 4.5% | | | | | | | | |

| FLSmidth | | | 12,401 | | | | 531,337 | |

| TDC | | | 74,102 | | | | 565,013 | |

| Topdanmark* | | | 23,782 | | | | 713,888 | |

| Tryg | | | 8,305 | | | | 902,398 | |

| | | | | | | | 2,712,636 | |

| Finland — 1.5% | | | | | | | | |

| Fortum | | | 27,263 | | | | 541,838 | |

| Ramirent | | | 48,954 | | | | 377,630 | |

| | | | | | | | 919,468 | |

| France — 6.8% | | | | | | | | |

| CNP Assurances | | | 32,924 | | | | 592,794 | |

| GDF Suez | | | 23,759 | | | | 485,670 | |

| Metropole Television | | | 28,232 | | | | 589,626 | |

| Orange | | | 37,493 | | | | 620,540 | |

| Total | | | 10,310 | | | | 561,291 | |

| Vinci | | | 10,476 | | | | 644,847 | |

| Vivendi | | | 24,755 | | | | 623,052 | |

| | | | | | | | 4,117,820 | |

| Germany — 4.2% | | | | | | | | |

| E.ON | | | 32,771 | | | | 513,686 | |

| Freenet | | | 22,150 | | | | 722,880 | |

| Muenchener Rueckversicherungs | | | 3,679 | | | | 722,506 | |

| RWE | | | 22,756 | | | | 569,545 | |

| | | | | | | | 2,528,617 | |

| Hong Kong — 3.1% | | | | | | | | |

| Belle International Holdings | | | 531,120 | | | | 683,212 | |

| Li & Fung | | | 518,115 | | | | 528,774 | |

| Television Broadcasts | | | 100,407 | | | | 654,866 | |

| | | | | | | | 1,866,852 | |

| Israel — 0.7% | | | | | | | | |

| Harel Insurance Investments & Financial Services | | | 95,164 | | | | 444,818 | |

| | | | | | | | | |

| Italy — 0.9% | | | | | | | | |

| Cairo Communication | | | 90,709 | | | | 529,125 | |

| | | | | | | | | |

| Japan — 7.6% | | | | | | | | |

| Autobacs Seven | | | 41,806 | | | | 654,751 | |

| Kirin Holdings | | | 40,174 | | | | 533,635 | |

| Kyokuto Securities | | | 33,842 | | | | 511,598 | |

| Marusan Securities Ltd. | | | 74,470 | | | | 753,432 | |

| Sanki Engineering | | | 101,784 | | | | 816,659 | |

| Sanshin Electronics | | | 87,190 | | | | 723,662 | |

| Yamato Holdings | | | 28,453 | | | | 640,788 | |

| | | | | | | | 4,634,525 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Foreign Shareholder Yield ETF

April 30, 2015 (Continued)

| Description | | | Shares | | | | Value | |

| Netherlands — 2.0% | | | | | | | | |

| BinckBank | | | 61,508 | | | $ | 618,678 | |

| Koninklijke Ahold | | | 31,763 | | | | 617,007 | |

| | | | | | | | 1,235,685 | |

| New Zealand — 2.6% | | | | | | | | |

| SKYCITY Entertainment Group | | | 201,566 | | | | 646,148 | |

Tower (A) | | | 543,129 | | | | 914,066 | |

| | | | | | | | 1,560,214 | |

| Norway — 7.3% | | | | | | | | |

| Gjensidige Forsikring | | | 43,996 | | | | 766,017 | |

| Kvaerner | | | 436,876 | | | | 342,320 | |

| Salmar | | | 46,948 | | | | 763,793 | |

| Statoil | | | 27,569 | | | | 582,157 | |

| Telenor | | | 25,784 | | | | 583,159 | |

| TGS Nopec Geophysical | | | 24,343 | | | | 618,783 | |

| Yara International | | | 14,755 | | | | 757,179 | |

| | | | | | | | 4,413,408 | |

| Portugal — 2.4% | | | | | | | | |

| Portucel | | | 118,458 | | | | 581,390 | |

| Sonaecom - SGPS* | | | 368,298 | | | | 905,661 | |

| | | | | | | | 1,487,051 | |

| South Korea — 1.1% | | | | | | | | |

| Macquarie Korea Infrastructure Fund | | | 86,610 | | | | 639,072 | |

| | | | | | | | | |

| Spain — 1.2% | | | | | | | | |

| Duro Felguera | | | 98,571 | | | | 398,450 | |

| Endesa | | | 17,784 | | | | 354,146 | |

| | | | | | | | 752,596 | |

| Sweden — 4.4% | | | | | | | | |

| Dios Fastigheter | | | 97,296 | | | | 758,907 | |

| Duni | | | 50,688 | | | | 778,566 | |

| JM | | | 22,201 | | | | 662,033 | |

| TeliaSonera | | | 75,039 | | | | 468,242 | |

| | | | | | | | 2,667,748 | |

| Switzerland — 3.3% | | | | | | | | |

| Adecco | | | 8,354 | | | | 686,802 | |

| Swiss Re | | | 6,820 | | | | 607,473 | |

| Zurich Insurance Group | | | 2,244 | | | | 696,567 | |

| | | | | | | | 1,990,842 | |

| United Kingdom — 16.4% | | | | | | | | |

| Amlin | | | 86,170 | | | | 606,855 | |

| Aviva | | | 159,106 | | | | 1,287,072 | |

| BHP Billiton | | | 26,281 | | | | 629,724 | |

| BP | | | 79,213 | | | | 571,600 | |

| Cape | | | 144,350 | | | | 587,176 | |

| Carillion | | | 131,031 | | | | 656,492 | |

| Centrica | | | 114,593 | | | | 449,246 | |

| De La Rue | | | 42,112 | | | | 355,205 | |

| HSBC Holdings | | | 69,174 | | | | 688,162 | |

| Intermediate Capital Group | | | 94,181 | | | | 762,590 | |

| Kingfisher | | | 114,965 | | | | 619,940 | |

| Description | | | | Shares/Face Amount(1) | | | | Value | |

| Ladbrokes | | | | 217,558 | | | $ | 342,632 | |

| Phoenix Group Holdings | | | | 50,463 | | | | 653,377 | |

| Rio Tinto | | | | 13,878 | | | | 614,580 | |

| Vodafone Group | | | | 178,982 | | | | 633,403 | |

| WM Morrison Supermarkets | | | | 179,836 | | | | 515,655 | |

| | | | | | | | | 9,973,709 | |

| Total Common Stock | | | | | | | | | |

| (Cost $63,608,529) | | | | | | | | 59,529,945 | |

| | | | | | | | | | |

| TIME DEPOSITS — 2.1% | | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 05/01/2015 | | | | 550,861 | | | | 550,861 | |

| Brown Brothers Harriman, 1.460%, 05/01/2015 | AUD | | | 37,375 | | | | 29,577 | |

| Brown Brothers Harriman, 0.150%, 05/01/2015 | CAD | | | 527,126 | | | | 436,905 | |

Brown Brothers Harriman, (1.00.%) (B), 05/01/2015 | CHF | | | 49,445 | | | | 52,999 | |

Brown Brothers Harriman, (0.195%) (B), 05/01/2015 | EUR | | | 166,940 | | | | 187,448 | |

| Brown Brothers Harriman,0.005%, 05/01/2015 | JPY | | | 328 | | | | 3 | |

| Brown Brothers Harriman, 0.365%, 05/01/2015 | NOK | | | 219,542 | | | | 29,157 | |

| | | | | | | | | | |

| Total Time Deposits | | | | | | | | | |

| (Cost $1,286,950) | | | | | | | | 1,286,950 | |

| | | | | | | | | | |

| Total Investments — 100.2% | | | | | | | | | |

| (Cost $64,895,479) | | | | | | | | 60,816,895 | |

| Other Assets and Liabilities — (0.2)% | | | | | | | | (122,974 | ) |

| Net Assets — 100.0% | | | | | | | $ | 60,693,921 | |

Percentages based on Net Assets.

| * | Non-income producing security. |

| (1) | In U.S. Dollars unless otherwise noted. |

| (A) | Security is fair valued by the Fund’s investment adviser using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such security as of April 30, 2015 was $1,336,099 and represents 2.2% of Net Assets. |

| (B) | Rate is negative due to the decrease in value of the Swiss Franc and Euro, respectively, against the U.S. Dollar. |

AUD — Australian Dollar

CAD — Canadian Dollar

Cl — Class

CHF — Swiss Franc

EUR — Euro

JPY — Japanese Yen

Ltd. — Limited

NOK — Norwegian Krone

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Foreign Shareholder Yield ETF

April 30, 2015 (Concluded)

The following is a summary of the inputs used as of April 30, 2015 in valuing the Fund’s investments carried at value:

Investments

in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 58,193,846 | | | $ | 1,336,099 | | | $ | — | | | $ | 59,529,945 | |

| Time Deposits | | | — | | | | 1,286,950 | | | | — | | | | 1,286,950 | |

| Total Investments in Securities | | $ | 58,193,846 | | | $ | 2,623,049 | | | $ | — | | | $ | 60,816,895 | |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been transfers into Level 2 due to changes in availability of observable inputs to determine fair value. There have been no transfers into or out of Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Global Value ETF

April 30, 2015

| Description | | Shares | | | Value | |

| COMMON STOCK — 94.1% | | | | |

| Austria — 9.5% | | | | | | |

| Agrana Beteiligungs | | | 7,696 | | | $ | 699,959 | |

| AMAG Austria Metall | | | 27,650 | | | | 993,499 | |

| Erste Group Bank | | | 26,344 | | | | 750,750 | |

| EVN | | | 62,678 | | | | 715,393 | |

| Lenzing | | | 15,135 | | | | 1,029,008 | |

| OMV | | | 20,646 | | | | 689,676 | |

| Raiffeisen Bank International | | | 28,416 | | | | 478,285 | |

| UNIQA Insurance Group | | | 70,374 | | | | 694,581 | |

| Vienna Insurance Group Wiener Versicherung Gruppe | | | 18,944 | | | | 755,982 | |

| Voestalpine | | | 20,942 | | | | 879,922 | |

| | | | | | | | 7,687,055 | |

| Brazil — 6.2% | | | | | | | | |

| AMBEV | | | 127,650 | | | | 803,281 | |

| Banco do Brasil | | | 97,810 | | | | 850,211 | |

| Banco Santander Brasil | | | 173,981 | | | | 940,079 | |

| Cia Siderurgica Nacional | | | 224,294 | | | | 611,924 | |

| Cosan Industria e Comercio | | | 63,344 | | | | 610,534 | |

| JBS | | | 235,440 | | | | 1,200,272 | |

| | | | | | | | 5,016,301 | |

| Czech Republic — 7.4% | | | | | | | | |

| CEZ | | | 35,076 | | | | 911,943 | |

| Fortuna Entertainment Group | | | 141,784 | | | | 574,254 | |

| Komercni Banka | | | 3,848 | | | | 858,130 | |

| O2 Czech Republic | | | 144,449 | | | | 1,186,052 | |

| Pegas Nonwovens | | | 30,414 | | | | 905,582 | |

| Philip Morris CR | | | 1,702 | | | | 725,414 | |

| Unipetrol* | | | 122,840 | | | | 772,424 | |

| | | | | | | | 5,933,799 | |

| Greece — 9.7% | | | | | | | | |

| Alpha Bank AE* | | | 1,257,849 | | | | 439,249 | |

| Description | | | Shares | | | | Value | |

| Athens Water Supply & Sewage | | | 80,290 | | | $ | 450,769 | |

| Bank of Greece | | | 43,512 | | | | 464,146 | |

| Eurobank Ergasias* | | | 3,978,863 | | | | 603,136 | |

| FF Group | | | 12,471 | | | | 376,683 | |

| Hellenic Petroleum | | | 92,278 | | | | 460,048 | |

| Hellenic Telecommunications Organization | | | 41,928 | | | | 381,339 | |

| Intralot -Integrated Lottery Systems & Services* | | | 299,478 | | | | 548,119 | |

| JUMBO | | | 35,733 | | | | 368,729 | |

| Karelia Tobacco | | | 3,108 | | | | 792,015 | |

| Metka | | | 51,060 | | | | 475,862 | |

| Motor Oil Hellas Corinth Refineries | | | 68,376 | | | | 598,853 | |

| National Bank of Greece* | | | 314,463 | | | | 441,369 | |

| OPAP | | | 39,624 | | | | 353,710 | |

| Piraeus Bank* | | | 963,519 | | | | 428,428 | |

| Public Power | | | 91,724 | | | | 616,924 | |

| | | | | | | | 7,799,379 | |

| Hungary — 4.5% | | | | | | | | |

| Magyar Telekom Telecommunications* | | | 547,007 | | | | 818,754 | |

| MOL Hungarian Oil & Gas | | | 15,836 | | | | 880,820 | |

| OTP Bank | | | 43,698 | | | | 969,795 | |

| Richter Gedeon Nyrt | | | 56,240 | | | | 948,005 | |

| | | | | | | | 3,617,374 | |

| Ireland — 9.2% | | | | | | | | |

| Aer Lingus Group | | | 305,304 | | | | 798,749 | |

| CPL Resources | | | 93,610 | | | | 587,565 | |

| CRH | | | 32,116 | | | | 901,656 | |

| FBD Holdings | | | 37,666 | | | | 416,589 | |

| Fyffes | | | 595,638 | | | | 786,297 | |

| Glanbia | | | 40,311 | | | | 751,370 | |

| Kingspan Group | | | 37,997 | | | | 761,570 | |

| Origin Enterprises PLC | | | 93,610 | | | | 869,786 | |

| Smurfit Kappa Group | | | 23,830 | | | | 733,157 | |

| Total Produce | | | 687,608 | | | | 849,654 | |

| | | | | | | | 7,456,393 | |

| Israel — 0.0% | | | | | | | | |

| Harel Insurance Investments & Financial Services | | | 1 | | | | 5 | |

| | | | | | | | | |

| Italy — 9.3% | | | | | | | | |

| Atlantia | | | 31,063 | | | | 876,861 | |

| Enel | | | 174,122 | | | | 828,194 | |

| Eni | | | 38,406 | | | | 740,874 | |

| Intesa Sanpaolo | | | 244,381 | | | | 827,601 | |

| Pirelli & C. | | | 48,341 | | | | 838,622 | |

| Saipem | | | 39,590 | | | | 527,221 | |

| Telecom Italia | | | 682,031 | | | | 811,003 | |

| UniCredit | | | 115,840 | | | | 838,958 | |

| Unipol Gruppo Finanziario | | | 128,094 | | | | 675,428 | |

| UnipolSai | | | 187,206 | | | | 526,772 | |

| | | | | | | | 7,491,534 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Global Value ETF

April 30, 2015 (Continued)

| Description | | Shares | | | Value | |

| Poland — 9.8% | | | | | | |

| Alior Bank* | | | 13,962 | | | $ | 341,307 | |

| Asseco Poland | | | 19,713 | | | | 332,233 | |

| Bank Millennium | | | 174,900 | | | | 356,131 | |

| Bank Pekao | | | 6,327 | | | | 329,545 | |

| Bank Zachodni WBK | | | 3,372 | | | | 348,267 | |

| CCC | | | 6,360 | | | | 336,564 | |

| Cyfrowy Polsat | | | 46,617 | | | | 325,297 | |

| Energa | | | 46,710 | | | | 324,518 | |

| Eurocash | | | 35,526 | | | | 361,097 | |

| Grupa Azoty | | | 14,358 | | | | 327,057 | |

| Grupa Lotos* | | | 42,951 | | | | 367,365 | |

| ING Bank Slaski | | | 8,502 | | | | 335,371 | |

| KGHM Polska Miedz | | | 9,693 | | | | 340,481 | |

| LLP SA | | | 165 | | | | 350,640 | |

| Lubelski Wegiel Bogdanka | | | 13,863 | | | | 338,849 | |

| mBank* | | | 2,640 | | | | 342,041 | |

| Orange Polska | | | 122,043 | | | | 345,803 | |

| PGE Polska Grupa Energetyczna | | | 55,809 | | | | 321,690 | |

| Polski Koncern Naftowy Orlen | | | 19,629 | | | | 373,403 | |

| Polskie Gornictwo Naftowe i Gazownictwo | | | 211,470 | | | | 381,837 | |

| Powszechna Kasa Oszczednosci Bank Polski | | | 34,209 | | | | 343,054 | |

| Powszechny Zaklad Ubezpieczen | | | 2,379 | | | | 310,571 | |

| Tauron Polska Energia | | | 263,736 | | | | 353,128 | |

| | | | | | | | 7,886,249 | |

| Portugal — 9.3% | | | | | | | | |

| Altri SGPS | | | 37,842 | | | | 162,358 | |

| Banco BPI, Cl G* | | | 105,624 | | | | 173,156 | |

| Banco Comercial Portugues, Cl R* | | | 1,569,714 | | | | 157,044 | |

Banco Espirito Santo*(A)(B) | | | 318,087 | | | | — | |

| BANIF - Banco Internacional do Funchal* | | | 60,167,772 | | | | 452,648 | |

| CIMPOR Cimentos de Portugal SGPS* | | | 254,264 | | | | 385,426 | |

| Corticeira Amorim SGPS | | | 239,834 | | | | 1,087,963 | |

| CTT-Correios de Portugal | | | 15,045 | | | | 170,200 | |

| EDP - Energias de Portugal | | | 210,234 | | | | 843,212 | |

| Description | | | Shares | | | | Value | |

| Galp Energia SGPS | | | 57,499 | | | $ | 787,021 | |

| Jeronimo Martins SGPS | | | 12,837 | | | | 187,743 | |

| Mota-Engil SGPS | | | 43,662 | | | | 151,392 | |

| NOS SGPS | | | 22,281 | | | | 162,618 | |

| Portucel | | | 36,027 | | | | 176,820 | |

| Portugal Telecom SGPS | | | 435,108 | | | | 279,946 | |

| REN - Redes Energeticas Nacionais SGPS | | | 54,978 | | | | 172,232 | |

| Semapa-Sociedade de Investimento e Gestao | | | 64,306 | | | | 923,516 | |

| Sonae | | | 518,740 | | | | 723,425 | |

| Teixeira Duarte | | | 629,814 | | | | 485,130 | |

| | | | | | | | 7,481,850 | |

| Russia — 10.0% | | | | | | | | |

| Alrosa AO | | | 898,656 | | | | 1,193,149 | |

| E.ON Russia JSC | | | 15,954,104 | | | | 975,644 | |

| Gazprom Neft OAO | | | 238,280 | | | | 673,994 | |

| Gazprom OAO | | | 265,438 | | | | 791,006 | |

| Rosneft OAO | | | 140,896 | | | | 701,608 | |

| Sberbank of Russia | | | 409,294 | | | | 611,041 | |

| Severstal OAO | | | 118,104 | | | | 1,326,520 | |

| Uralkali* | | | 210,234 | | | | 616,499 | |

| VTB Bank | | | 919,584,532 | | | | 1,169,341 | |

| | | | | | | | 8,058,802 | |

| Spain — 9.2% | | | | | | | | |

| Acciona* | | | 9,073 | | | | 689,702 | |

| Banco Bilbao Vizcaya Argentaria | | | 73,411 | | | | 741,867 | |

| Banco Santander | | | 101,984 | | | | 773,649 | |

| CaixaBank | | | 146,444 | | | | 737,654 | |

| Enagas | | | 24,018 | | | | 742,042 | |

| Endesa | | | 27,972 | | | | 557,028 | |

| Ferrovial | | | 32,294 | | | | 736,106 | |

| Gas Natural SDG | | | 35,594 | | | | 877,470 | |

| Iberdrola | | | 108,644 | | | | 729,141 | |

| Mapfre | | | 226,070 | | | | 843,266 | |

| | | | | | | | 7,427,925 | |

| Total Common Stock | | | | | | | | |

| (Cost $83,608,485) | | | | | | | 75,856,666 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Global Value ETF

April 30, 2015 (Concluded)

| Description | | | Shares/

Number of Rights/Face Amount (1) | | | Value | |

| PREFERRED STOCK — 3.7% | | | | | | | |

| Brazil — 3.7% | | | | | | | |

| Banco Bradesco | | | | 86,669 | | | $ | 925,674 | |

| Cia Energetica de Minas Gerais | | | | 159,396 | | | | 769,748 | |

| Telefonica Brasil | | | | 49,136 | | | | 806,444 | |

| Vale | | | | 76,294 | | | | 455,290 | |

Total Preferred Stock

(Cost $3,831,000) | | | | | | | | 2,957,156 | |

| | | | | | | | | | |

| RIGHTS — 0.0% | | | | | | | | | |

| Italy — 0.0% | | | | | | | | | |

UnipolSai*

(Cost $–) | | | | 374,412 | | | | — | |

| | | | | | | | | | |

| TIME DEPOSITS — 1.2% | | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 05/01/2015 | | | | 772,309 | | | | 772,309 | |

| Brown Brothers Harriman, 0.080%, 05/01/2014 | GBP | | | 108,922 | | | | 167,193 | |

| | | | | | | | | | |

| Total Time Deposits | | | | | | | | | |

| (Cost $939,502) | | | | | | | | 939,502 | |

| | | | | | | | | | |

| Total Investments — 99.0% | | | | | | | | | |

| (Cost $88,378,987) | | | | | | | | 79,753,324 | |

| Other Assets and Liabilities — 1.0% | | | | | | | | 827,113 | |

| Net Assets — 100.0% | | | | | | | $ | 80,580,437 | |

Percentages based on Net Assets.

| * | Non-income producing security. |

| (1) | In U.S. Dollars unless otherwise noted. |

| (A) | Security is fair valued by the Fund’s investment adviser using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such security as of April 30, 2015 was $0 and represents 0.0% of Net Assets. |

| (B) | Security is considered illiquid. The total value of such security as of April 30, 2015 was $0 and represents 0.0% of Net Assets. |

Cl — Class

GBP — Great British Pound

PLC — Public Limited Company

The following is a summary of the inputs used as of April 30, 2015 in valuing the Fund’s investments carried at value:

Investments

in Securities | | Level 1 | | | Level 2 | | | Level 3(1) | | | Total | |

| Common Stock | | $ | 75,856,666 | | | $ | — | | | $ | — | | | $ | 75,856,666 | |

| Preferred Stock | | | 2,957,156 | | | | — | | | | — | | | | 2,957,156 | |

| Rights | | | — | | | | — | | | | — | | | | — | |

| Time Deposits | | | — | | | | 939,502 | | | | — | | | | 939,502 | |

| Total Investments in Securities | | $ | 78,813,822 | | | $ | 939,502 | | | $ | — | | | $ | 79,753,324 | |

| (1) | Included in Level 3 is one security with total value of $0. A reconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. Management has concluded that Level 3 investments are not material in relation to net assets. |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been no transfers between Level 1 & Level 2 assets and liabilities. There were transfers into Level 3 due to changes in the availability of observable inputs to determine fair value. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Global Momentum ETF

April 30, 2015

| Description | | Shares/Face Amount | | | Value | |

| EXCHANGE TRADED FUNDS — 99.7% | | | | |

| Cambria Shareholder Yield ETF‡ | | | 76,608 | | | $ | 2,416,983 | |

| iShares 20+ Year Treasury Bond ETF | | | 19,648 | | | | 2,474,666 | |

| iShares Global Consumer Discretionary ETF | | | 20,645 | | | | 1,891,082 | |

| iShares Global Consumer Staples ETF | | | 23,321 | | | | 2,165,355 | |

| iShares Global Healthcare ETF | | | 23,712 | | | | 2,553,783 | |

| iShares Global Tech ETF | | | 25,920 | | | | 2,559,859 | |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 19,712 | | | | 2,364,257 | |

| iShares Mortgage Real Estate Capped ETF | | | 191,136 | | | | 2,221,001 | |

| iShares Residential Real Estate Capped ETF | | | 41,984 | | | | 2,482,094 | |

| PowerShares Emerging Markets Sovereign Debt Portfolio | | | 80,928 | | | | 2,321,824 | |

| Vanguard Extended Duration Treasury ETF | | | 20,512 | | | | 2,513,130 | |

| Vanguard Mid-Capital ETF | | | 19,712 | | | | 2,526,881 | |

| Vanguard REIT ETF | | | 30,240 | | | | 2,400,451 | |

| Vanguard Small-Capital Value ETF | | | 21,486 | | | | 2,320,058 | |

| Vanguard Total International Bond ETF | | | 44,992 | | | | 2,406,172 | |

| Vanguard Total Stock Market ETF | | | 22,944 | | | | 2,475,887 | |

| WisdomTree Managed Futures Strategy Fund | | | 54,656 | | | | 2,384,641 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $40,290,019) | | | | | | | 40,478,124 | |

| | | | | | | | | |

| TIME DEPOSIT — 0.3% | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 05/01/2015 | | | | | | | | |

| (Cost $103,386) | | $ | 103,386 | | | | 103,386 | |

| | | | | | | | | |

| Total Investments — 100.0% | | | | | | | | |

| (Cost $40,393,405) | | | | | | | 40,581,510 | |

| Other Assets and Liabilities — 0.0% | | | | | | | (19,975 | ) |

| Net Assets — 100.0% | | | | | | $ | 40,561,535 | |

| ‡ | Affiliated investment is a registered investment company which is managed by Cambria Investment Management, L.P. (the “Investment Adviser”) or an affiliate of the Investment Adviser or which is distributed by an affiliate of the Fund’s distributor (see Note 4). |

ETF — Exchange-Traded Fund

REIT — Real Estate Investment Trust

The following is a summary of the inputs used as of April 30, 2015 in valuing the Fund’s investments carried at value:

Investments

in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Exchange Traded Funds | | $ | 40,478,124 | | | $ | — | | | $ | — | | | $ | 40,478,124 | |

| Time Deposit | | | — | | | | 103,386 | | | | — | | | | 103,386 | |

| Total Investments in Securities | | $ | 40,478,124 | | | $ | 103,386 | | | $ | — | | | $ | 40,581,510 | |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been no transfers between Level 1 & Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments • Cambria Global Asset Allocation ETF

April 30, 2015

| Description | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS — 98.8% | | | | |

| Cambria Foreign Shareholder Yield ETF‡ | | | 26,775 | | | $ | 634,567 | |

| Cambria Global Value ETF‡ | | | 58,500 | | | | 1,275,300 | |

| Cambria Shareholder Yield ETF‡ | | | 29,450 | | | | 929,147 | |

| iShares 20+ Year Treasury Bond ETF | | | 5,150 | | | | 648,642 | |

| iShares 7-10 Year Treasury Bond ETF | | | 8,875 | | | | 954,329 | |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 7,850 | | | | 941,529 | |

| iShares MSCI USA Momentum Factor ETF | | | 18,275 | | | | 1,271,300 | |

| Market Vectors Emerging High Yield Bond ETF | | | 51,150 | | | | 1,241,922 | |

| Market Vectors Emerging Markets Local Currency Bond ETF | | | 55,925 | | | | 1,148,699 | |

| Market Vectors International High Yield Bond ETF | | | 24,225 | | | | 608,290 | |

| SPDR Barclays High Yield Bond ETF | | | 16,000 | | | | 631,040 | |

| SPDR Barclays International Corporate Bond ETF | | | 17,850 | | | | 575,662 | |

| SPDR Barclays TIPS ETF | | | 16,650 | | | | 949,549 | |

| SPDR DB International Government Inflation-Protected Bond ETF | | | 17,133 | | | | 974,868 | |

| United States Commodity Index Fund* | | | 41,025 | | | | 1,939,252 | |

| Vanguard Emerging Markets Government Bond ETF | | | 19,925 | | | | 1,570,489 | |

| Vanguard FTSE All World ex-US Small-Capital ETF | | | 6,375 | | | | 668,100 | |

| Vanguard FTSE Developed Markets ETF | | | 31,600 | | | | 1,307,292 | |

| Vanguard FTSE Emerging Markets ETF | | | 52,850 | | | | 2,318,530 | |

| Vanguard Global ex-U.S. Real Estate ETF | | | 16,700 | | | | 987,471 | |

| Vanguard Mid-Capital ETF | | | 10,125 | | | | 1,297,924 | |

| Vanguard REIT ETF | | | 11,675 | | | | 926,762 | |

| Vanguard Short-Term Bond ETF | | | 7,775 | | | | 624,877 | |

| Vanguard Short-Term Corporate Bond ETF | | | 7,800 | | | | 625,014 | |

| Vanguard Total Bond Market ETF | | | 30,275 | | | | 2,510,100 | |

| Vanguard Total International Bond ETF | | | 29,600 | | | | 1,583,008 | |

| Vanguard Total Stock Market ETF | | | 11,825 | | | | 1,276,036 | |

| Description | | | Shares/Face Amount | | | | Value | |

| WisdomTree Emerging Markets Equity Income Fund | | | 6,925 | | | $ | 328,314 | |

| WisdomTree Emerging Markets SmallCap Dividend Fund | | | 14,025 | | | | 655,529 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $30,835,497) | | | | | | | 31,403,542 | |

| | | | | | | | | |

| TIME DEPOSIT — 1.2% | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 05/01/2015 | | | | | | | | |

| (Cost $382,955) | | $ | 382,955 | | | | 382,955 | |

| | | | | | | | | |

| Total Investments — 100.0% | | | | | | | | |

| (Cost $31,218,452) | | | | | | | 31,786,497 | |

| Other Assets and Liabilities — 0.0% | | | | | | | – | |

| Net Assets — 100.0% | | | | | | $ | 31,786,497 | |

| * | Non-income producing security. |

| ‡ | Affiliated investment is a registered investment company which is managed by Cambria Investment Management, L.P. (the “Investment Adviser”) or an affiliate of the Investment Adviser or which is distributed by an affiliate of the Fund’s distributor (see Note 4). |

ETF — Exchange-Traded Fund

FTSE — Financial Times Stock Exchange

MSCI — Morgan Stanley Capital International

REIT — Real Estate Investment Trust

SPDR — Standard & Poor’s Depository Receipts

TIPS — Treasury Inflation Protected Security

The following is a summary of the inputs used as of April 30, 2015 in valuing the Fund’s investments carried at value:

Investments

in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Exchange Traded Funds | | $ | 31,403,542 | | | $ | — | | | $ | — | | | $ | 31,403,542 | |

| Time Deposit | | | — | | | | 382,955 | | | | — | | | | 382,955 | |

| Total Investments in Securities | | $ | 31,403,542 | | | $ | 382,955 | | | $ | — | | | $ | 31,786,497 | |

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

There have been no transfers between Level 1 & Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Assets and Liabilities

April 30, 2015

| | | Cambria Shareholder

Yield ETF | | | Cambria Foreign Shareholder Yield ETF | | | Cambria

Global Value ETF | |

| Assets: | | | | | | | | | |

| Investments at Fair Value | | $ | 234,535,059 | | | $ | 60,816,895 | | | $ | 79,753,324 | |

| Foreign Currency at Value | | | — | | | | 69,362 | | | | 10,375,934 | |

| Securities Sold Receivable | | | — | | | | — | | | | 421,449 | |

| Dividends Receivable | | | 124,435 | | | | 257,729 | | | | 319,798 | |

| Reclaims Receivable | | | — | | | | 88,846 | | | | 82,499 | |

| Total Assets | | | 234,659,494 | | | | 61,232,832 | | | | 90,953,004 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Securities Purchased Payable | | | 7,452,359 | | | | — | | | | — | |

| Payable Due to Custodian | | | — | | | | 510,092 | | | | 10,308,261 | |

| Payable Due to Investment Adviser | | | 111,390 | | | | 28,819 | | | | 64,306 | |

| Total Liabilities | | | 7,563,749 | | | | 538,911 | | | | 10,372,567 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 227,095,745 | | | $ | 60,693,921 | | | $ | 80,580,437 | |

| | | | | | | | | | | | | |

| Net Assets Consist of: | | | | | | | | | | | | |

| Paid-in Capital | | $ | 198,355,666 | | | $ | 65,806,897 | | | $ | 89,268,053 | |

| Undistributed (Distributions in Excess of) Net Investment Income | | | — | | | | (238,942 | ) | | | 328,231 | |

Accumulated Net Realized Gain (Loss) on Investments and

Foreign Currency Transactions | | | 683,446 | | | | (799,808 | ) | | | (159,393 | ) |

| Net Unrealized Appreciation (Depreciation) on Investments | | | 28,056,633 | | | | (4,078,584 | ) | | | (8,625,663 | ) |

Net Unrealized Appreciation (Depreciation) on Foreign

Currency Translation | | | — | | | | 4,358 | | | | (230,791 | ) |

| Net Assets | | $ | 227,095,745 | | | $ | 60,693,921 | | | $ | 80,580,437 | |

| | | | | | | | | | | | | |

| Outstanding Shares of Beneficial Interest | | | | | | | | | | | | |

| (unlimited authorization — no par value) | | | 7,200,000 | | | | 2,550,010 | | | | 3,700,010 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 31.54 | | | $ | 23.80 | | | $ | 21.78 | |

| | | | | | | | | | | | | |

| Investments at Cost | | $ | 206,478,426 | | | $ | 64,895,479 | | | $ | 88,378,987 | |

| Cost of Foreign Currency | | | — | | | | 58,956 | | | | 10,115,878 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Assets and Liabilities

April 30, 2015

| | | Cambria Global Momentum ETF | | | Cambria Global Asset Allocation ETF | |

| Assets: | | | | | | |

| Investments at Fair Value | | $ | 38,164,527 | | | $ | 28,947,483 | |

| Affiliated Investments at Fair Value | | | 2,416,983 | | | | 2,839,014 | |

| Total Assets | | | 40,581,510 | | | | 31,786,497 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable Due to Investment Adviser | | | 19,975 | | | | — | |

| Total Liabilities | | | 19,975 | | | | — | |

| | | | | | | | | |

| Net Assets | | $ | 40,561,535 | | | $ | 31,786,497 | |

| | | | | | | | | |

| Net Assets Consist of: | | | | | | | | |

| Paid-in Capital | | $ | 40,563,977 | | | $ | 31,181,876 | |

| Undistributed Net Investment Income | | | 23,018 | | | | 34,418 | |

| Accumulated Net Realized Gain (Loss) on Investments | | | (213,565 | ) | | | 2,158 | |

| Net Unrealized Appreciation on Investments and Affiliated Investments | | | 188,105 | | | | 568,045 | |

| Net Assets | | $ | 40,561,535 | | | $ | 31,786,497 | |

| | | | | | | | | |

| Outstanding Shares of Beneficial Interest | | | | | | | | |

| (unlimited authorization — no par value) | | | 1,600,001 | | | | 1,250,001 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 25.35 | | | $ | 25.43 | |

| | | | | | | | | |

| Investments at Cost | | $ | 37,980,468 | | | $ | 28,500,883 | |

| Affiliated Investments at Cost | | | 2,412,937 | | | | 2,717,569 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Operations

For the year ended April 30, 2015

| | | Cambria Shareholder Yield ETF | | | Cambria Foreign Shareholder Yield ETF | | | Cambria

Global Value ETF | |

| Investment Income: | | | | | | | | | |

| Dividend Income | | $ | 5,861,866 | | | $ | 3,397,653 | | | $ | 2,488,972 | |

| Interest Income | | | 600 | | | | 107 | | | | 155 | |

| Less: Foreign Taxes Withheld | | | (49,457 | ) | | | (376,435 | ) | | | (303,103 | ) |

| Total Investment Income | | | 5,813,009 | | | | 3,021,325 | | | | 2,186,024 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Management Fees | | | 1,280,939 | | | | 410,672 | | | | 339,890 | |

| Custodian Fees | | | — | | | | — | | | | 57,608 | |

| Total Expenses | | | 1,280,939 | | | | 410,672 | | | | 397,498 | |

| | | | | | | | | | | | | |

| Net Investment Income | | | 4,532,070 | | | | 2,610,653 | | | | 1,788,526 | |

| | | | | | | | | | | | | |

| Net Realized and Unrealized Gains (Losses) on Investments: | | | | | | | | | | | | |

Net Realized Gain (Loss) on Investments(1) | | | 4,743,704 | | | | (1,611,044 | ) | | | (302,694 | ) |

| Net Realized Loss on Foreign Currency Transactions | | | (454 | ) | | | (339,687 | ) | | | (155,462 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 10,157,816 | | | | (6,946,132 | ) | | | (8,797,323 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Foreign Currency Translation | | | — | | | | 1,617 | | | | (229,134 | ) |

| Net Realized and Unrealized Gain (Loss) on Investments | | | 14,901,066 | | | | (8,895,246 | ) | | | (9,484,613 | ) |

| | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 19,433,136 | | | $ | (6,284,593 | ) | | $ | (7,696,087 | ) |

| (1) | Includes realized gain as a result of in-kind transactions. (See Note 4 in Notes to Financial Statements). |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Operations

For the period ended April 30, 2015

| | | Cambria

Global

Momentum

ETF(1) | | | Cambria

Global Asset

Allocation

ETF(2) | |

| Investment Income: | | | | | | |

| Dividend Income from Unaffiliated Investments | | $ | 421,548 | | | $ | 124,102 | |

| Dividend Income from Affiliated Investments | | | 15,511 | | | | 7,351 | |

| Interest Income | | | 4 | | | | 18 | |

| Total Investment Income | | | 437,063 | | | | 131,471 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Management Fees | | | 85,799 | | | | — | |

| Total Expenses | | | 85,799 | | | | — | |

| | | | | | | | | |

| Net Investment Income | | | 351,264 | | | | 131,471 | |

| | | | | | | | | |

| Net Realized and Unrealized Gains (Losses) on Investments: | | | | | | | | |

| Net Realized Gain (Loss) on Unaffiliated Investments | | | (218,302 | ) | | | 568 | |

| Capital Gain Distributions Received from Unaffiliated Investments | | | 4,519 | | | | 2,199 | |

| Capital Gain Distributions Received from Affiliated Investments | | | 36,596 | | | | 5,153 | |

| Net Change in Unrealized Appreciation on Unaffiliated Investments | | | 184,059 | | | | 446,601 | |

| Net Change in Unrealized Appreciation on Affiliated Investments | | | 4,046 | | | | 121,444 | |

| Net Realized and Unrealized Gain (Loss) on Investments | | | 10,918 | | | | 575,965 | |

| | | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 362,182 | | | $ | 707,436 | |

| (1) | Commenced operations on November 3, 2014. |

| (2) | Commenced operations on December 9, 2014. |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Statements of Changes in Net Assets

| | | Cambria Shareholder Yield ETF | | | Cambria Foreign Shareholder

Yield ETF | |

| | | Year Ended

April 30, 2015 | | | Period Ended April 30,

2014(1) | | | Year Ended

April 30, 2015 | | | Period Ended April 30,

2014(2) | |

| Operations: | | | | | | | | | | | | |

| Net Investment Income | | $ | 4,532,070 | | | $ | 2,326,992 | | | $ | 2,610,653 | | | $ | 733,797 | |

| Net Realized Gain (Loss) on Investments | | | 4,743,704 | (3) | | | 4,972,765 | (3) | | | (1,611,044 | )(3) | | | (14,347 | ) |

| Net Realized Loss on Foreign Currency Transactions | | | (454 | ) | | | — | | | | (339,687 | ) | | | (803 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 10,157,816 | | | | 17,898,817 | | | | (6,946,132 | ) | | | 2,867,548 | |

Net Change in Unrealized Appreciation