UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSRS

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22704

CAMBRIA ETF TRUST

(Exact name of registrant as specified in charter)

________

2321 Rosecrans Avenue

Suite 3225

El Segundo, CA 90245

(Address of principal executive offices) (Zip code)

Corporation Service Company

2711 Centerville Road

Suite 400

Wilmington, DE 19808

(Name and address of agent for service)

With a Copy to:

John McGuire

Morgan Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004-2541

Registrant’s telephone number, including area code: 1-310-683-5500

Date of fiscal year end: April 30, 2019

Date of reporting period: October 31, 2018

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended ( [17 CFR § 270.30e-1], are attached hereto.

Cambria Shareholder Yield ETF (SYLD)

Cambria Foreign Shareholder Yield ETF (FYLD)

Cambria Global Value ETF (GVAL)

Cambria Global Momentum ETF (GMOM)

Cambria Global Asset Allocation ETF (GAA)

Cambria Value and Momentum ETF (VAMO)

Cambria Sovereign Bond ETF (SOVB)

Cambria Emerging Shareholder Yield ETF (EYLD)

Cambria Tail Risk ETF (TAIL)

Cambria Core Equity ETF (CCOR)

Cambria Trinity ETF (TRTY)

Semi-Annual Report

October 31, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds' shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be available on the Funds' website (www.cambriafunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to request to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account.

Cambria Investment Management

Table of Contents

| Schedules of Investments | |

| Cambria Shareholder Yield ETF | 1 |

| Cambria Foreign Shareholder Yield ETF | 5 |

| Cambria Global Value ETF | 9 |

| Cambria Global Momentum ETF | 15 |

| Cambria Global Asset Allocation ETF | 17 |

Cambria Value and Momentum ETF | 19 |

| Cambria Sovereign Bond ETF | 23 |

| Cambria Emerging Shareholder Yield ETF | 27 |

| Cambria Tail Risk ETF | 31 |

| Cambria Core Equity ETF | 33 |

| Cambria Trinity ETF | 37 |

| Statements of Assets and Liabilities | 39 |

| Statements of Operations | 42 |

| Statements of Changes in Net Assets | 44 |

| Financial Highlights | 50 |

| Notes to Financial Statements | 53 |

| Disclosure of Fund Expenses | 68 |

| Approval of Advisory Agreements & Board Considerations | 70 |

| Supplemental Information | 72 |

| Shareholder Voting Results | 79 |

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Cambria Investment Management L.P., the Funds’ investment advisor, uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling (855)-383-4636; and (ii) on the Commission’s website at www.sec.gov.

Cambria Investment Management

Schedule of Investments ● Cambria Shareholder Yield ETF

October 31, 2018 (Unaudited)

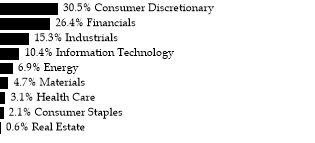

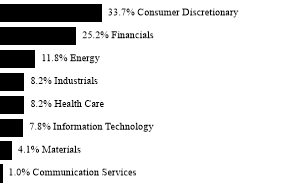

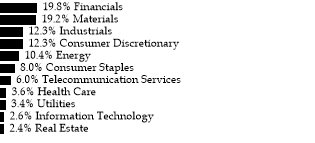

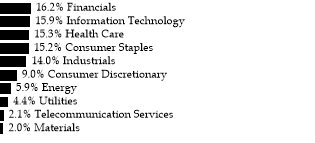

Sector Weightings† | |

| |

† Percentages based on total investments. | |

| |

Description | | Shares | | | Value | |

| | | | | | | | | |

COMMON STOCK — 99.5% | | | | | |

| | | | | | |

Consumer Discretionary — 30.4% | | | | | |

Abercrombie & Fitch, Cl A | | | 35,923 | | | $ | 707,683 | |

Best Buy | | | 22,633 | | | | 1,587,931 | |

BJ's Restaurants | | | 34,555 | | | | 2,114,075 | |

Buckle | | | 72,478 | | | | 1,478,551 | |

CBS, Cl B | | | 18,078 | | | | 1,036,773 | |

Cooper Tire & Rubber | | | 29,814 | | | | 920,955 | |

Deckers Outdoor* | | | 8,085 | | | | 1,028,170 | |

Dillard's, Cl A | | | 8,900 | | | | 626,738 | |

Dollar General | | | 9,108 | | | | 1,014,449 | |

DSW, Cl A | | | 36,608 | | | | 971,942 | |

Express* | | | 88,044 | | | | 775,668 | |

Foot Locker | | | 17,858 | | | | 841,826 | |

Gannett | | | 158,769 | | | | 1,540,059 | |

Gap | | | 38,364 | | | | 1,047,337 | |

Gentex | | | 64,469 | | | | 1,357,073 | |

Group 1 Automotive | | | 13,536 | | | | 781,569 | |

Guess? | | | 59,207 | | | | 1,257,557 | |

Hibbett Sports* | | | 66,143 | | | | 1,155,518 | |

Home Depot | | | 12,530 | | | | 2,203,776 | |

Interpublic Group of | | | 64,566 | | | | 1,495,349 | |

Kohl's | | | 21,145 | | | | 1,601,311 | |

La-Z-Boy, Cl Z | | | 54,113 | | | | 1,504,341 | |

Lear | | | 7,026 | | | | 933,755 | |

Lowe's | | | 21,390 | | | | 2,036,756 | |

Michael Kors Holdings* | | | 13,527 | | | | 749,531 | |

O'Reilly Automotive* | | | 7,024 | | | | 2,252,948 | |

Shoe Carnival | | | 25,806 | | | | 1,051,078 | |

Six Flags Entertainment | | | 25,470 | | | | 1,371,814 | |

Target | | | 12,321 | | | | 1,030,405 | |

Urban Outfitters* | | | 24,775 | | | | 977,622 | |

Visteon* | | | 7,421 | | | | 586,556 | |

| | | | | | | | 38,039,116 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Shareholder Yield ETF

October 31, 2018 (Unaudited)

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Consumer Staples — 2.0% | | | | | | | | |

| Universal | | | 14,418 | | | $ | 978,405 | |

| Walmart | | | 15,831 | | | | 1,587,533 | |

| | | | | | | | 2,565,938 | |

| | | | | | | | | |

| Energy — 6.9% | | | | | | | | |

Arch Coal | | | 15,588 | | | | 1,494,889 | |

CNX Resources* | | | 55,175 | | | | 863,489 | |

ConocoPhillips | | | 12,696 | | | | 887,451 | |

CVR Energy | | | 31,484 | | | | 1,353,812 | |

Marathon Petroleum | | | 21,968 | | | | 1,547,646 | |

Renewable Energy Group* | | | 35,742 | | | | 1,110,861 | |

Valero Energy | | | 15,191 | | | | 1,383,748 | |

| | | | | | | | 8,641,896 | |

| | | | | | | | | |

| Financials — 26.3% | | | | | | | | |

Aflac | | | 32,870 | | | | 1,415,711 | |

Allstate | | | 19,655 | | | | 1,881,377 | |

American Express | | | 12,547 | | | | 1,288,953 | |

American International Group | | | 18,769 | | | | 774,972 | |

Ameriprise Financial | | | 10,357 | | | | 1,317,825 | |

Assured Guaranty | | | 41,339 | | | | 1,652,733 | |

CIT Group | | | 23,030 | | | | 1,091,161 | |

Citizens Financial Group | | | 37,560 | | | | 1,402,866 | |

CNO Financial Group | | | 58,272 | | | | 1,101,341 | |

Discover Financial Services | | | 22,111 | | | | 1,540,473 | |

Fifth Third Bancorp | | | 49,266 | | | | 1,329,689 | |

Hartford Financial Services Group | | | 22,593 | | | | 1,026,174 | |

JPMorgan Chase | | | 10,757 | | | | 1,172,728 | |

Lincoln National | | | 16,943 | | | | 1,019,799 | |

MetLife | | | 16,146 | | | | 665,054 | |

New York Community Bancorp | | | 124,358 | | | | 1,191,350 | |

Old Republic International | | | 68,800 | | | | 1,517,040 | |

PNC Financial Services Group | | | 8,209 | | | | 1,054,775 | |

SunTrust Banks | | | 28,673 | | | | 1,796,650 | |

Synchrony Financial | | | 48,418 | | | | 1,398,312 | |

Synovus Financial | | | 22,531 | | | | 846,264 | |

Travelers | | | 12,840 | | | | 1,606,669 | |

Unum Group | | | 30,843 | | | | 1,118,367 | |

US Bancorp | | | 16,688 | | | | 872,282 | |

Voya Financial | | | 28,894 | | | | 1,264,402 | |

Waddell & Reed Financial, Cl A | | | 81,159 | | | | 1,547,702 | |

| | | | | | | | 32,894,669 | |

| Health Care — 3.1% | | | | | | | | |

Aetna | | | 6,019 | | | | 1,194,170 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Shareholder Yield ETF

October 31, 2018 (Unaudited)

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Mallinckrodt PLC* | | | 33,327 | | | $ | 835,175 | |

| McKesson | | | 6,607 | | | | 824,289 | |

| Mylan* | | | 33,162 | | | | 1,036,312 | |

| | | | | | | | 3,889,946 | |

| | | | | | | | | |

| Industrials — 15.2% | | | | | | | | |

Boeing | | | 3,636 | | | | 1,290,271 | |

Cummins | | | 10,596 | | | | 1,448,367 | |

Delta Air Lines | | | 23,832 | | | | 1,304,325 | |

Eaton | | | 23,057 | | | | 1,652,495 | |

FTI Consulting* | | | 32,965 | | | | 2,278,211 | |

GATX | | | 16,626 | | | | 1,245,786 | |

Huntington Ingalls Industries | | | 4,154 | | | | 907,566 | |

Ingersoll-Rand | | | 10,541 | | | | 1,011,304 | |

ManpowerGroup | | | 13,181 | | | | 1,005,579 | |

Robert Half International | | | 17,802 | | | | 1,077,555 | |

Southwest Airlines | | | 32,870 | | | | 1,613,917 | |

Spirit AeroSystems Holdings, Cl A | | | 14,973 | | | | 1,257,882 | |

United Continental Holdings* | | | 26,271 | | | | 2,246,433 | |

Wabash National | | | 48,626 | | | | 734,253 | |

| | | | | | | | 19,073,944 | |

| | | | | | | | | |

| Information Technology — 10.4% | | | | | | | | |

Apple | | | 12,135 | | | | 2,655,866 | |

Applied Materials | | | 25,400 | | | | 835,152 | |

Avnet | | | 37,224 | | | | 1,491,566 | |

Corning | | | 49,869 | | | | 1,593,314 | |

Hewlett Packard Enterprise | | | 84,749 | | | | 1,292,422 | |

HP | | | 41,912 | | | | 1,011,756 | |

Nanometrics* | | | 26,703 | | | | 856,098 | |

Sanmina* | | | 43,893 | | | | 1,110,493 | |

Texas Instruments | | | 23,253 | | | | 2,158,576 | |

| | | | | | | | 13,005,243 | |

| | | | | | | | | |

| Materials — 4.7% | | | | | | | | |

Eastman Chemical | | | 10,626 | | | | 832,547 | |

Kaiser Aluminum | | | 9,074 | | | | 865,387 | |

LyondellBasell Industries, Cl A | | | 8,935 | | | | 797,628 | |

Steel Dynamics | | | 27,219 | | | | 1,077,872 | |

Warrior Met Coal | | | 51,379 | | | | 1,438,612 | |

Worthington Industries | | | 20,670 | | | | 865,660 | |

| | | | | | | | 5,877,706 | |

| | | | | | | | | |

| Real Estate — 0.5% | | | | | | | | |

Realogy Holdings | | | 35,147 | | | | 670,253 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Shareholder Yield ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

| | | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $117,446,261) | | | $ | 124,658,711 | |

| | | | | | | | | |

| Total Investments - 99.5% | | | | | | | | |

| (Cost $117,446,261) | | | $ | 124,658,711 | |

| Other Assets and Liabilities - 0.5% | | | | 648,052 | |

| Net Assets - 100.0% | | | $ | 125,306,763 | |

Percentages based on Net Assets.

* | Non-income producing security. |

Cl — Class |

PLC — Public Limited Company |

As of October 31, 2018, all of the Fund's investments in securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

There have been no transfers between Level 1, Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Foreign Shareholder Yield ETF

October 31, 2018 (Unaudited)

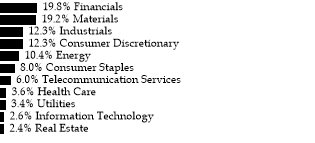

Sector Weightings† | |

| |

† Percentages based on total investments. | |

| |

| Description | | Shares | | | Value | |

| | | | | | | | | |

| COMMON STOCK — 97.7% | | | | | | | | |

| | | | | | | | | |

| Australia — 10.1% | | | | | | | | |

| Alumina | | | 123,819 | | | $ | 223,590 | |

| BHP Billiton | | | 11,224 | | | | 256,014 | |

| BlueScope Steel | | | 11,523 | | | | 117,259 | |

| Crown Resorts | | | 23,031 | | | | 204,031 | |

| Fortescue Metals Group | | | 54,556 | | | | 154,535 | |

| Monadelphous Group | | | 51,886 | | | | 528,733 | |

| Myer Holdings | | | 430,354 | | | | 138,664 | |

| Nine Entertainment Holdings | | | 128,720 | | | | 154,049 | |

| Qantas Airways | | | 55,461 | | | | 214,833 | |

| QBE Insurance Group | | | 34,891 | | | | 279,695 | |

| South32 | | | 78,085 | | | | 200,171 | |

| Whitehaven Coal | | | 71,047 | | | | 244,013 | |

| | | | | | | | 2,715,587 | |

| | | | | | | | | |

| Belgium — 1.3% | | | | | | | | |

| Ageas | | | 6,732 | | | | 337,099 | |

| | | | | | | | | |

| | | | | | | | | |

| Canada — 9.9% | | | | | | | | |

BRP | | | 11,500 | | | | 462,638 | |

Ensign Energy Services | | | 39,100 | | | | 152,367 | |

Genworth MI Canada | | | 8,825 | | | | 289,664 | |

Great-West Lifeco | | | 8,061 | | | | 184,985 | |

IGM Financial | | | 5,505 | | | | 135,194 | |

Labrador Iron Ore Royalty | | | 13,444 | | | | 292,072 | |

Magna International | | | 6,992 | | | | 344,222 | |

Norbord | | | 6,900 | | | | 175,953 | |

Sun Life Financial | | | 9,200 | | | | 336,915 | |

TFI International | | | 8,817 | | | | 293,420 | |

| | | | | | | | 2,667,430 | |

| | | | | | | | | |

| Denmark — 2.0% | | | | | | | | |

Novo Nordisk, Cl B | | | 4,893 | | | | 211,634 | |

Pandora | | | 2,581 | | | | 161,477 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Foreign Shareholder Yield ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Spar Nord Bank | | | 18,469 | | | $ | 153,093 | |

| | | | | | | | 526,204 | |

| | | | | | | | | |

| Finland — 1.2% | | | | | | | | |

Kesko, Cl B | | | 5,432 | | | | 317,593 | |

| | | | | | | | | |

| | | | | | | | | |

| France — 7.5% | | | | | | | | |

AXA | | | 8,339 | | | | 209,115 | |

BNP Paribas | | | 5,251 | | | | 274,359 | |

Casino Guichard Perrachon | | | 4,227 | | | | 186,720 | |

CNP Assurances | | | 14,838 | | | | 331,082 | |

Engie | | | 14,435 | | | | 192,518 | |

Metropole Television | | | 12,722 | | | | 246,546 | |

Natixis | | | 48,760 | | | | 285,306 | |

Neopost | | | 8,832 | | | | 284,100 | |

| | | | | | | | 2,009,746 | |

| | | | | | | | | |

| Germany — 3.0% | | | | | | | | |

Freenet | | | 9,998 | | | | 225,238 | |

Muenchener Rueckversicherungs | | | 1,663 | | | | 357,787 | |

Uniper | | | 7,369 | | | | 212,918 | |

| | | | | | | | 795,943 | |

| | | | | | | | | |

| Hong Kong — 4.6% | | | | | | | | |

Hang Lung Properties | | | 108,896 | | | | 197,186 | |

Shandong Chenming Paper Holdings, Cl H | | | 293,250 | | | | 164,538 | |

Shanghai Industrial Holdings | | | 84,516 | | | | 177,612 | |

Shimao Property Holdings | | | 184,000 | | | | 359,931 | |

Shougang Fushan Resources Group | | | 1,702,000 | | | | 342,920 | |

| | | | | | | | 1,242,187 | |

| | | | | | | | | |

| Italy — 3.0% | | | | | | | | |

Eni | | | 21,804 | | | | 387,878 | |

Saras | | | 99,345 | | | | 193,876 | |

Societa Cattolica di Assicurazioni SC | | | 29,302 | | | | 237,134 | |

| | | | | | | | 818,888 | |

| | | | | | | | | |

| Japan — 16.5% | | | | | | | | |

Astellas Pharma | | | 13,800 | | | | 213,663 | |

Denka | | | 11,500 | | | | 375,061 | |

JFE Holdings | | | 20,700 | | | | 390,940 | |

KDDI | | | 13,800 | | | | 344,220 | |

Leopalace21 | | | 16,100 | | | | 67,205 | |

Mitsubishi Gas Chemical | | | 4,600 | | | | 77,499 | |

Mitsui | | | 13,800 | | | | 230,601 | |

Mixi | | | 4,600 | | | | 100,533 | |

NGK Spark Plug | | | 13,800 | | | | 280,317 | |

NTT DOCOMO | | | 11,870 | | | | 299,235 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Foreign Shareholder Yield ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Showa Shell Sekiyu | | | 16,100 | | | $ | 310,485 | |

Sumitomo | | | 23,000 | | | | 349,276 | |

Sumitomo Osaka Cement | | | 9,200 | | | | 342,447 | |

Taisei | | | 6,900 | | | | 295,666 | |

Toyo Kanetsu | | | 11,500 | | | | 257,243 | |

Toyo Seikan Group Holdings | | | 13,800 | | | | 282,641 | |

Tsugami | | | 23,000 | | | | 206,895 | |

| | | | | | | | 4,423,927 | |

| | | | | | | | | |

| Netherlands — 5.0% | | | | | | | | |

Aegon | | | 57,822 | | | | 355,489 | |

ASR Nederland | | | 5,259 | | | | 239,216 | |

BinckBank | | | 49,522 | | | | 240,069 | |

Koninklijke Ahold Delhaize | | | 16,077 | | | | 368,378 | |

Philips Lighting (A) | | | 5,993 | | | | 147,977 | |

| | | | | | | | 1,351,129 | |

| | | | | | | | | |

| New Zealand — 0.8% | | | | | | | | |

SKY Network Television | | | 140,134 | | | | 204,836 | |

| | | | | | | | | |

| | | | | | | | | |

| Norway — 7.4% | | | | | | | | |

DNB | | | 18,959 | | | | 343,092 | |

Salmar | | | 21,182 | | | | 1,118,175 | |

Subsea 7 | | | 25,829 | | | | 326,164 | |

Telenor | | | 11,618 | | | | 213,139 | |

| | | | | | | | 2,000,570 | |

| | | | | | |

Portugal — 1.0% | | | | | |

EDP - Energias de Portugal | | | 79,207 | | | | 278,470 | |

| | | | | | | | | |

| | | | | | |

Spain — 2.7% | | | | | |

Endesa | | | 10,264 | | | | 214,838 | |

International Consolidated Airlines Group | | | 40,319 | | | | 310,967 | |

International Consolidated Airlines Group (LSE Shares) | | | 25,995 | | | | 200,802 | |

| | | | | | | | 726,607 | |

| | | | | | |

Sweden — 2.9% | | | | | |

JM | | | 10,021 | | | | 190,484 | |

Peab | | | 26,481 | | | | 233,235 | |

Svenska Cellulosa SCA, Cl B | | | 13,087 | | | | 123,875 | |

Telia | | | 53,779 | | | | 242,475 | |

| | | | | | | | 790,069 | |

| | | | | | |

Switzerland — 2.7% | | | | | |

Sunrise Communications Group (A) | | | 1,472 | | | | 129,640 | |

Swiss Re | | | 3,070 | | | | 277,265 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Foreign Shareholder Yield ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Zurich Insurance Group | | | 1,012 | | | $ | 314,708 | |

| | | | | | | | 721,613 | |

| | | | | | |

United Kingdom — 16.1% | | | | | |

Anglo American | | | 9,638 | | | | 206,373 | |

Centamin | | | 116,909 | | | | 148,686 | |

Direct Line Insurance Group | | | 41,961 | | | | 176,726 | |

HSBC Holdings | | | 31,206 | | | | 257,235 | |

Kingfisher | | | 51,853 | | | | 168,811 | |

Legal & General Group | | | 69,882 | | | | 224,648 | |

Man Group | | | 158,148 | | | | 314,234 | |

Pearson | | | 21,362 | | | | 245,362 | |

Persimmon | | | 11,822 | | | | 346,644 | |

Rio Tinto | | | 6,262 | | | | 304,435 | |

Royal Dutch Shell, Cl A | | | 8,096 | | | | 258,759 | |

Royal Dutch Shell, Cl B | | | 11,063 | | | | 362,710 | |

Royal Mail | | | 46,504 | | | | 213,395 | |

South32 | | | 129,697 | | | | 334,873 | |

Tate & Lyle | | | 31,993 | | | | 275,295 | |

Taylor Wimpey | | | 162,541 | | | | 335,532 | |

Vodafone Group | | | 80,710 | | | | 152,496 | |

| | | | | | | | 4,326,214 | |

| | | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $29,460,448) | | | | | | | 26,254,112 | |

| | | | | | | | | |

| | | | | | | | | |

Total Investments - 97.7% | | | | | | | | |

(Cost $29,460,448) | | | | | | $ | 26,254,112 | |

Other Assets and Liabilities - 2.3% | | | | | | | 618,147 | |

Net Assets - 100.0% | | | | | | $ | 26,872,257 | |

Percentages based on Net Assets.

(A) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other "accredited investors." These securities are deemed to be liquid by the Board of Trustees. The total value of such securities at October 31, 2018 was $277,617 and represents 1.0% of Net Assets. |

| Cl — | Class |

As of October 31, 2018, all of the Fund's investments were considered level 1 in accordance with the authoritative guidance of fair value measurements and disclosure under U.S. generally accepted accounting principles.

There have been no transfers between Level 1, Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Value ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

COMMON STOCK — 94.6% | | | | | |

| | | | | | |

Austria — 1.6% | | | | | |

AMAG Austria Metall (A) | | | 57,589 | | | $ | 2,282,974 | |

| | | | | | | | | |

| | | | | | |

Brazil — 8.0% | | | | | |

AMBEV | | | 222,552 | | | | 971,179 | |

Banco do Brasil | | | 170,486 | | | | 1,953,843 | |

Banco Santander Brasil | | | 303,323 | | | | 3,441,980 | |

Cia Siderurgica Nacional | | | 391,047 | | | | 1,000,341 | |

Cosan Industria e Comercio | | | 110,438 | | | | 951,105 | |

JBS | | | 410,446 | | | | 1,128,272 | |

Vale | | | 122,322 | | | | 1,850,525 | |

| | | | | | | | 11,297,245 | |

| | | | | | |

Czech Republic — 6.1% | | | | | |

CEZ | | | 79,782 | | | | 1,898,609 | |

Fortuna Entertainment Group *(B) (C) | | | 279,736 | | | | 1,187,879 | |

Komercni Banka | | | 44,515 | | | | 1,691,063 | |

Pegas Nonwovens * | | | 52,197 | | | | 2,064,942 | |

Philip Morris CR | | | 2,921 | | | | 1,836,658 | |

| | | | | | | | 8,679,151 | |

| | | | | | |

Greece — 8.1% | | | | | |

Alpha Bank AE * | | | 28,967 | | | | 43,800 | |

Athens Water Supply & Sewage | | | 137,795 | | | | 811,578 | |

Bank of Greece | | | 74,676 | | | | 1,048,808 | |

FF Group *(B) (C) | | | 25,407 | | | | 41,439 | |

Hellenic Petroleum | | | 158,369 | | | | 1,259,217 | |

Hellenic Telecommunications Organization | | | 71,926 | | | | 802,446 | |

Holding ADMIE IPTO | | | 157,391 | | | | 287,725 | |

Intralot -Integrated Lottery Systems & Services * | | | 513,969 | | | | 345,211 | |

JUMBO | | | 61,279 | | | | 893,966 | |

Karelia Tobacco | | | 5,250 | | | | 1,510,381 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Value ETF

October 31, 2018 (Unaudited)

| Description | | Shares | | | Value | |

| Motor Oil Hellas Corinth Refineries | | | 117,348 | | | $ | 2,777,892 | |

| Mytilineos Holdings | | | 87,630 | | | | 775,171 | |

| National Bank of Greece * | | | 3,597 | | | | 6,233 | |

| OPAP | | | 71,005 | | | | 667,514 | |

| Piraeus Bank * | | | 818 | | | | 1,205 | |

| Public Power | | | 157,391 | | | | 236,383 | |

| | | | | | | | 11,508,969 | |

| | | | | | | | | |

Israel — 14.4% | | | | | | | | |

Bank Hapoalim | | | 293,343 | | | | 1,987,242 | |

Bank Leumi Le-Israel | | | 338,588 | | | | 2,113,530 | |

Bezeq The Israeli Telecommunication | | | 1,631,921 | | | | 1,876,785 | |

Elbit Systems | | | 16,657 | | | | 1,992,652 | |

Israel Chemicals | | | 459,630 | | | | 2,651,628 | |

Israel Discount Bank, Cl A | | | 710,896 | | | | 2,325,794 | |

Mizrahi Tefahot Bank | | | 107,500 | | | | 1,811,390 | |

Nice * | | | 21,039 | | | | 2,230,677 | |

Teva Pharmaceutical Industries | | | 114,064 | | | | 2,277,079 | |

Tower Semiconductor * | | | 79,658 | | | | 1,235,177 | |

| | | | | | | | 20,501,954 | |

| | | | | | | | | |

Italy — 5.1% | | | | | | | | |

Atlantia | | | 53,270 | | | | 1,071,566 | |

Enel | | | 298,831 | | | | 1,466,925 | |

Eni | | | 65,913 | | | | 1,172,547 | |

Intesa Sanpaolo | | | 419,387 | | | | 927,707 | |

Saipem * | | | 6,782 | | | | 37,140 | |

Telecom Italia * | | | 1,170,479 | | | | 688,322 | |

UniCredit | | | 20,983 | | | | 268,939 | |

Unipol Gruppo | | | 219,837 | | | | 885,932 | |

UnipolSai | | | 321,243 | | | | 702,602 | |

| | | | | | | | 7,221,680 | |

| | | | | | | | | |

Norway — 7.7% | | | | | | | | |

Aker Solutions | | | 199,462 | | | | 1,315,581 | |

DNB | | | 59,362 | | | | 1,074,245 | |

Gjensidige Forsikring | | | 45,479 | | | | 704,591 | |

Norsk Hydro | | | 183,903 | | | | 954,660 | |

Petroleum Geo-Services * | | | 266,227 | | | | 831,861 | |

Statoil | | | 44,995 | | | | 1,170,538 | |

Storebrand | | | 196,599 | | | | 1,636,265 | |

Telenor | | | 46,012 | | | | 844,119 | |

TGS Nopec Geophysical | | | 47,510 | | | | 1,594,413 | |

Yara International | | | 19,318 | | | | 831,175 | |

| | | | | | | | 10,957,448 | |

| | | | | | | | | |

Poland — 7.9% | | | | | | | | |

Alior Bank * | | | 27,329 | | | | 411,308 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Value ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Asseco Poland | | | 33,811 | | | $ | 425,595 | |

Bank Millennium * | | | 300,139 | | | | 690,676 | |

Bank Polska Kasa Opieki | | | 12,385 | | | | 337,936 | |

Bank Zachodni WBK | | | 6,260 | | | | 555,335 | |

CCC | | | 11,592 | | | | 504,506 | |

Cyfrowy Polsat | | | 86,555 | | | | 498,512 | |

Energa | | | 80,153 | | | | 162,932 | |

Eurocash | | | 64,307 | | | | 342,555 | |

Grupa Azoty | | | 24,640 | | | | 166,315 | |

Grupa Lotos | | | 73,691 | | | | 1,330,496 | |

ING Bank Slaski | | | 15,296 | | | | 649,765 | |

KGHM Polska Miedz * | | | 17,964 | | | | 406,737 | |

LPP | | | 295 | | | | 603,508 | |

Lubelski Wegiel Bogdanka | | | 23,774 | | | | 333,331 | |

mBank | | | 4,495 | | | | 438,119 | |

Orange Polska | | | 209,440 | | | | 236,887 | |

PGE Polska Grupa Energetyczna * | | | 95,771 | | | | 262,318 | |

Polski Koncern Naftowy ORLEN | | | 33,674 | | | | 809,478 | |

Polskie Gornictwo Naftowe i Gazownictwo | | | 391,716 | | | | 639,053 | |

Powszechna Kasa Oszczednosci Bank Polski | | | 64,652 | | | | 672,779 | |

Powszechny Zaklad Ubezpieczen | | | 46,647 | | | | 476,299 | |

Tauron Polska Energia | | | 452,628 | | | | 209,968 | |

| | | | | | | | 11,164,408 | |

| | | | | | | | | |

| Portugal — 9.6% | | | | | | | | |

Altri SGPS | | | 64,925 | | | | 569,911 | |

Banco BPI, Cl G * | | | 181,255 | | | | 300,966 | |

Banco Comercial Portugues, Cl R * | | | 63,439 | | | | 17,116 | |

Corticeira Amorim SGPS | | | 411,607 | | | | 4,522,180 | |

CTT-Correios de Portugal | | | 25,804 | | | | 99,079 | |

EDP - Energias de Portugal | | | 411,006 | | | | 1,444,985 | |

Galp Energia SGPS | | | 115,246 | | | | 2,009,551 | |

Jeronimo Martins SGPS | | | 37,898 | | | | 466,165 | |

Mota-Engil SGPS * | | | 74,932 | | | | 149,204 | |

Navigator | | | 61,785 | | | | 307,914 | |

NOS SGPS | | | 38,234 | | | | 214,795 | |

Pharol SGPS * | | | 746,695 | | | | 131,259 | |

REN - Redes Energeticas Nacionais SGPS | | | 94,304 | | | | 251,437 | |

Semapa-Sociedade de Investimento e Gestao | | | 110,363 | | | | 2,110,033 | |

Sonae | | | 890,270 | | | | 891,893 | |

Teixeira Duarte * | | | 1,080,897 | | | | 216,696 | |

| | | | | | | | 13,703,184 | |

| | | | | | |

Russia — 8.8% | | | | | |

Alrosa PJSC | | | 1,542,288 | | | | 2,338,937 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Value ETF

October 31, 2018 (Unaudited)

| Description | | Shares | | | Value | |

| | | | | | | | | |

| Gazprom Neft PJSC | | | 408,940 | | | $ | 2,390,055 | |

| Gazprom PJSC | | | 455,549 | | | | 1,075,151 | |

| Rosneft PJSC | | | 241808 | | | | 1,690,210 | |

| Sberbank of Russia PJSC | | | 351,236 | | | | 1,012,006 | |

| Severstal PJSC | | | 101,346 | | | | 1,584,643 | |

| Unipro PJSC | | | 27,380,692 | | | | 1,125,591 | |

| Uralkali * | | | 360,807 | | | | 461,732 | |

| VTB Bank PJSC | | | 1,578,205,886 | | | | 876,385 | |

| | | | | | | | 12,554,710 | |

| | | | | | | | | |

| Singapore — 5.6% | | | | | | | | |

CapitaLand | | | 355,600 | | | | 806,111 | |

City Developments | | | 114,300 | | | | 652,718 | |

ComfortDelGro | | | 482,600 | | | | 783,922 | |

Golden Agri-Resources | | | 3,670,300 | | | | 675,686 | |

Jardine Cycle & Carriage | | | 25,400 | | | | 555,072 | |

Oversea-Chinese Banking | | | 127,000 | | | | 984,716 | |

SATS | | | 254,000 | | | | 913,201 | |

Sembcorp Industries | | | 419,100 | | | | 853,238 | |

Singapore Airlines | | | 127,000 | | | | 869,191 | |

United Overseas Bank | | | 50,800 | | | | 894,130 | |

| | | | | | | | 7,987,985 | |

| | | | | | |

Spain — 8.2% | | | | | |

Acciona | | | 16,293 | | | | 1,376,312 | |

Banco Bilbao Vizcaya Argentaria | | | 131,747 | | | | 728,952 | |

Banco Santander | | | 183,015 | | | | 869,585 | |

Banco Santander | | | 185,897 | | | | 7,222 | |

CaixaBank | | | 263,314 | | | | 1,068,001 | |

Enagas | | | 43,206 | | | | 1,147,084 | |

Endesa | | | 51,066 | | | | 1,068,876 | |

Ferrovial | | | 58,047 | | | | 1,163,714 | |

Gas Natural SDG | | | 63,405 | | | | 1,559,828 | |

Iberdrola | | | 194,727 | | | | 1,379,801 | |

Mapfre | | | 403,909 | | | | 1,209,590 | |

| | | | | | | | 11,578,965 | |

| | | | | | |

Turkey — 3.5% | | | | | |

Akbank Turk | | | 355,473 | | | | 420,366 | |

Eregli Demir ve Celik Fabrikalari | | | 535,940 | | | | 868,688 | |

Haci Omer Sabanci Holding | | | 318,135 | | | | 405,238 | |

KOC Holding | | | 204,597 | | | | 570,277 | |

Petkim Petrokimya Holding | | | 770,732 | | | | 700,465 | |

Turkiye Halk Bankasi | | | 285,496 | | | | 315,141 | |

Turkiye Is Bankasi, Cl C | | | 486,791 | | | | 347,484 | |

Turkiye Sise ve Cam Fabrikalari | | | 832,428 | | | | 704,412 | |

Turkiye Vakiflar Bankasi TAO, Cl D | | | 557,911 | | | | 341,358 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Value ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Yapi ve Kredi Bankasi | | | 790,194 | | | $ | 229,017 | |

| | | | | | | | 4,902,446 | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $153,218,289) | | | | | | | 134,341,119 | |

| | | | | | | | | |

| PREFERRED STOCK — 2.6% (D) | | | | | | | | |

| Brazil — 2.6% | | | | | | | | |

Banco Bradesco | | | 201,101 | | | | 1,842,683 | |

Cia Energetica de Minas Gerais | | | 277,900 | | | | 825,150 | |

Telefonica Brasil | | | 85,667 | | | | 991,909 | |

| | | | | | | | | |

| | | | | | | | | |

| Total Preferred Stock | | | | | | | | |

(Cost $4,195,473) | | | | | | | 3,659,742 | |

| | | | | | | | | |

| | | | | | | | | |

Total Investments - 97.2% | | | | | | | | |

(Cost $157,413,762) | | | | | | $ | 138,000,861 | |

Other Assets and Liabilities - 2.8% | | | | | | | 4,007,192 | |

Net Assets - 100.0% | | | | | | $ | 142,008,053 | |

Percentages based on Net Assets.

* | Non-income producing security. |

(A) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other "accredited investors." These securities are deemed to be liquid by the Board of Trustees. The total value of such securities at October 31, 2018 was $2,282,974 and represents 1.6% of Net Assets. |

(B) | Level 3 security in accordance with fair value hierarchy. |

(C) | Securities considered illiquid. The total value of such securities as of October 31, 2018 was $1,229,318 and represented 0.9% of Net Assets. See Note 2 in Notes to Financial Statements. |

(D) | There’s currently no stated interest rate or maturity date. |

Cl — Class |

PJSC — Private Joint Stock Company |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Value ETF

October 31, 2018 (Unaudited)

The following is a list of the inputs used as of October 31, 2018, in valuing the Fund’s investments and other financial instruments carried at market value:

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3(1) | | | Total | |

Common Stock | | | | | | | | | | | | | | | | |

Austria | | $ | 2,282,974 | | | $ | — | | | $ | — | | | $ | 2,282,974 | |

Brazil | | | 11,297,245 | | | | — | | | | — | | | | 11,297,245 | |

Czech Republic | | | 7,491,272 | | | | — | | | | 1,187,879 | | | | 8,679,151 | |

Greece | | | 11,467,530 | | | | — | | | | 41,439 | | | | 11,508,969 | |

Israel | | | 20,501,954 | | | | — | | | | — | | | | 20,501,954 | |

Italy | | | 7,221,680 | | | | — | | | | — | | | | 7,221,680 | |

Norway | | | 10,957,448 | | | | — | | | | — | | | | 10,957,448 | |

Poland | | | 11,164,408 | | | | — | | | | — | | | | 11,164,408 | |

Portugal | | | 13,703,184 | | | | — | | | | — | | | | 13,703,184 | |

Russia | | | 12,554,710 | | | | — | | | | — | | | | 12,554,710 | |

Singapore | | | 7,987,985 | | | | — | | | | — | | | | 7,987,985 | |

Spain | | | 11,578,965 | | | | — | | | | — | | | | 11,578,965 | |

Turkey | | | 4,902,446 | | | | — | | | | — | | | | 4,902,446 | |

Total Common Stock | | | 133,111,801 | | | | — | | | | 1,229,318 | | | | 134,341,119 | |

Preferred Stock | | | | | | | | | | | | | | | | |

Brazil | | | 3,659,742 | | | | — | | | | — | | | | 3,659,742 | |

Total Preferred Stock | | | 3,659,742 | | | | — | | | | — | | | | 3,659,742 | |

Total Investments in Securities | | $ | 136,771,543 | | | $ | – | | | $ | 1,229,318 | | | $ | 138,000,861 | |

(1) Included in Level 3 are two securities with total value of $1,229,318. A reconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. Management has concluded that Level 3 investments are not material in relation to net assets.

There have been no transfers between Level 1 and Level 2 assets and liabilities. There were transfers between Level 1 and Level 3 during the period when foreign equity securities were fair valued using other observable market based inputs in place of the closing exchange price due to events occurring after the close of the exchange or market on which the investment was principally traded. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ●Cambria Global Momentum ETF

October 31, 2018 (Unaudited)

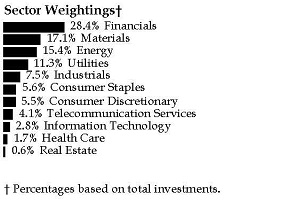

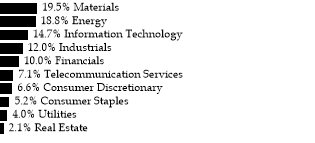

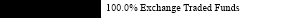

Sector Weightings †: | |

| |

† Percentages based on total investments. | |

| |

Description | | Shares | | | Value | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS — 98.5% | | | | | | | | |

Cambria Shareholder Yield ETF‡ | | | 161,049 | | | $ | 5,855,726 | |

Cambria Value and Momentum ETF‡ | | | 259,036 | | | | 6,183,863 | |

FlexShares Global Upstream Natural Resources Index Fund | | | 186,431 | | | | 5,868,848 | |

Invesco DB Energy Fund | | | 452,630 | | | | 7,472,921 | |

iShares Global Consumer Discretionary ETF | | | 52,424 | | | | 5,639,250 | |

iShares Global Energy ETF | | | 165,778 | | | | 5,666,292 | |

iShares Global Healthcare ETF | | | 100,130 | | | | 5,910,674 | |

iShares Global Tech ETF | | | 49,808 | | | | 7,988,207 | |

iShares Micro-Capital ETF | | | 61,907 | | | | 5,850,831 | |

iShares Mortgage Real Estate ETF | | | 146,383 | | | | 6,249,090 | |

iShares Residential Real Estate ETF | | | 102,380 | | | | 6,416,155 | |

Vanguard Mid-Capital ETF | | | 40,884 | | | | 6,151,815 | |

Vanguard Real Estate ETF | | | 78,295 | | | | 6,132,064 | |

Vanguard Small-Capital ETF | | | 39,415 | | | | 5,759,714 | |

Vanguard Small-Capital Value ETF | | | 47,519 | | | | 6,023,033 | |

Vanguard Total Stock Market ETF | | | 45,900 | | | | 6,359,904 | |

WisdomTree Managed Futures Strategy Fund | | | 153,572 | | | | 6,205,844 | |

| | | | | | | | | |

Total Exchange Traded Funds | | | | | | | | |

(Cost $108,548,936) | | | | | | | 105,734,231 | |

| | | | | | | | | |

Total Investments - 98.5% | | | | | | | | |

(Cost $108,548,936) | | | | | | $ | 105,734,231 | |

Other Assets and Liabilities - 1.5% | | | | | | | 1,626,500 | |

Net Assets - 100.0% | | | | | | $ | 107,360,731 | |

Percentages based on Net Assets.

‡ | Affiliated investment is a registered investment company which is managed by Cambria Investment Management, L.P. (the "Investment Adviser") or an affiliate of the Investment Adviser or which is distributed by an affiliate of the Fund's distributor. |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ●Cambria Global Momentum ETF

October 31, 2018 (Unaudited)

Transactions with affiliated companies during the period ended October 31, 2018 are as follows:

Value of Shares Held as of 04/30/18 | | | Purchases at Cost | | | Proceeds from Sales | | | Unrealized Appreciation (Depreciation) | | | Realized Gain (Loss) | | | Value of Shares Held as of 10/31/18 | | | Dividend Income | |

Cambria Emerging Shareholder Yield ETF | | | | | | | | | | | | | | | | | |

| $ | 12,126,658 | | | $ | 1,057,109 | | | $ | (12,492,777 | ) | | $ | (1,463,575 | ) | | $ | 772,585 | | | $ | - | | | $ | 87,897 | |

Cambria Foreign Shareholder Yield ETF | | | | | | | | | | | | | | | | | |

| | 6,019,500 | | | | 847,565 | | | | (6,405,286 | ) | | | ( 816,082 | ) | | | 354,303 | | | | - | | | | 111,285 | |

Cambria Global Value ETF | | | | | | | | | | | | | | | | | |

| | 11,622,581 | | | | 1,012,082 | | | | (11,847,345 | ) | | | (1,004,243 | ) | | | 216,925 | | | | - | | | | 59,478 | |

Cambria Shareholder Yield ETF | | | | | | | | | | | | | | | | | |

| | 4,581,748 | | | | 1,774,130 | | | | (177,584 | ) | | | (324,892 | ) | | | 2,324 | | | | 5,855,726 | | | | 69,745 | |

Cambria Value & Momentum ETF | | | | | | | | | | | | | | | | | |

| | - | | | | 6,777,996 | | | | (77,952 | ) | | | (516,093 | ) | | | (88 | ) | | | 6,183,863 | | | | 9,764 | |

| $ | 34,350,487 | | | $ | 11,468,882 | | | $ | (31,000,944 | ) | | $ | (4,124,885 | ) | | $ | 1,346,049 | | | $ | 12,039,589 | | | $ | 338,169 | |

ETF — Exchanged Traded Fund |

As of October 31, 2018, all of the Fund's investments in securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

There have been no transfers between Level 1, Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Asset Allocation ETF

October 31, 2018 (Unaudited)

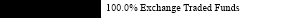

Sector Weightings †: | |

| |

† Percentages based on total investments. | |

| |

Description | | Shares | | | Value | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS — 99.9% | | | | | | | | |

Alpha Architect Value Momentum Trend ETF | | | 45,050 | | | $ | 1,178,058 | |

Cambria Emerging Shareholder Yield ETF‡ | | | 181,277 | | | | 5,324,106 | |

Cambria Foreign Shareholder Yield ETF‡ | | | 113,544 | | | | 2,655,874 | |

Cambria Global Value ETF‡ | | | 140,956 | | | | 3,146,138 | |

Cambria Shareholder Yield ETF‡ | | | 93,479 | | | | 3,398,887 | |

Cambria Sovereign Bond ETF‡ | | | 196,242 | | | | 4,792,033 | |

Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF | | | 263,976 | | | | 4,682,934 | |

iShares Edge MSCI USA Momentum Factor ETF | | | 25,274 | | | | 2,711,142 | |

iShares Short Treasury Bond ETF | | | 11,866 | | | | 1,310,600 | |

Schwab U.S. REIT ETF | | | 47,342 | | | | 1,923,505 | |

Schwab US TIPs ETF | | | 35,515 | | | | 1,884,781 | |

SPDR FTSE International Government Inflation-Protected Bond ETF | | | 34,195 | | | | 1,786,005 | |

VanEck Vectors Emerging Markets High Yield Bond ETF | | | 106,751 | | | | 2,430,720 | |

VanEck Vectors International High Yield Bond ETF | | | 51,158 | | | | 1,219,607 | |

Vanguard FTSE Developed Markets ETF | | | 29,255 | | | | 1,157,035 | |

Vanguard Global ex-U.S. Real Estate ETF | | | 32,459 | | | | 1,718,055 | |

Vanguard Intermediate-Term Corporate Bond ETF | | | 22,457 | | | | 1,853,825 | |

Vanguard Intermediate-Term Treasury ETF | | | 44,022 | | | | 2,727,163 | |

Vanguard Long-Term Treasury ETF | | | 32,666 | | | | 2,284,987 | |

Vanguard Mid-Capital ETF | | | 8,434 | | | | 1,269,064 | |

Vanguard Short-Term Corporate Bond ETF | | | 16,493 | | | | 1,285,299 | |

Vanguard Total Bond Market ETF | | | 64,226 | | | | 4,999,352 | |

Vanguard Total International Bond ETF | | | 60,147 | | | | 3,279,816 | |

Vanguard Total Stock Market ETF | | | 19,029 | | | | 2,636,658 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Global Asset Allocation ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

| | | | | | | | | |

Total Exchange Traded Funds | | | | | | | | |

| (Cost $64,616,068) | | | | | | $ | 61,655,644 | |

| | | | | | | | | |

Total Investments - 99.9% | | | | | | | | |

(Cost $64,616,068) | | | | | | $ | 61,655,644 | |

Other Assets and Liabilities - 0.1% | | | | | | | 48,722 | |

Net Assets - 100.0% | | | | | | $ | 61,704,366 | |

Percentages based on Net Assets.

| ‡ | Affiliated investment is a registered investment company which is managed by Cambria Investment Management, L.P. (the "Investment Adviser") or an affiliate of the Investment Adviser or which is distributed by an affiliate of the Fund's distributor. |

Transactions with affiliated companies during the period ended October 31, 2018 are as follows:

Value of Shares Held as of 04/30/18 | | | Purchases at Cost | | | Proceeds from Sales | | | Unrealized Appreciation (Depreciation) | | | Realized Gain (Loss) | | | Value of Shares Held as of 10/31/18 | | | Dividend Income | |

Cambria Emerging Shareholder Yield ETF | | | | | | | | | | | | | | | | | |

| $ | 6,201,182 | | | $ | 765,475 | | | $ | (432,855 | ) | | $ | (1,280,685 | ) | | $ | 70,989 | | | $ | 5,324,106 | | | $ | 153,585 | |

Cambria Foreign Shareholder Yield ETF | | | | | | | | | | | | | | | | | |

| | 3,089,111 | | | | 207,635 | | | | (251,916 | ) | | | (406,417 | ) | | | 17,461 | | | | 2,655,874 | | | | 75,378 | |

Cambria Global Value ETF | | | | | | | | | | | | | | | | | |

| | 3,746,095 | | | | 223,346 | | | | (273,619 | ) | | | (587,031 | ) | | | 37,347 | | | | 3,146,138 | | | | 65,538 | |

Cambria Shareholder Yield ETF | | | | | | | | | | | | | | | | | |

| | 3,633,898 | | | | 228,355 | | | | (294,749 | ) | | | (216,107 | ) | | | 47,490 | | | | 3,398,887 | | | | 52,203 | |

Cambria Sovereign Bond ETF | | | | | | | | | | | | | | | | | |

| | 5,549,473 | | | | 296,783 | | | | (371,500 | ) | | | (665,594 | ) | | | (17,129 | ) | | | 4,792,033 | | | | 91,359 | |

| $ | 22,219,759 | | | $ | 1,721,594 | | | $ | (1,624,639 | ) | | $ | (3,155,834 | ) | | $ | 156,158 | | | $ | 19,317,038 | | | $ | 438,063 | |

ETF — Exchanged Traded Fund |

FTSE — Financial Times Stock Exchange |

MSCI — Morgan Stanley Capital International |

REIT — Real Estate Investment Trust |

SPDR — Standard & Poor’s Depositary Receipt |

TIPS — Treasury Inflation Protected Security |

As of October 31, 2018, all of the Fund's investments in securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

There have been no transfers between Level 1, Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Value and Momentum ETF

October 31, 2018 (Unaudited)

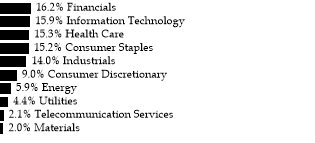

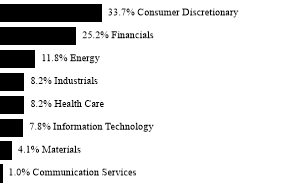

Sector Weightings† | |

| |

† Percentages based on total investments. | |

Description | | Shares | | | Value | |

| | | | | | | | | |

| COMMON STOCK — 89.5% | | | | | | | | |

| | | | | | | | | |

| Communication Services — 0.8% | | | | | | | | |

Liberty TripAdvisor Holdings, Cl A* | | | 20,979 | | | $ | 302,517 | |

| | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 30.2% | | | | | | | | |

Aaron's | | | 6,210 | | | | 292,677 | |

Abercrombie & Fitch, Cl A | | | 17,044 | | | | 335,767 | |

American Eagle Outfitters | | | 13,218 | | | | 304,807 | |

Best Buy | | | 5,670 | | | | 397,807 | |

Brinker International | | | 5,551 | | | | 240,636 | |

Buckle | | | 11,866 | | | | 242,066 | |

Caleres | | | 7,171 | | | | 245,248 | |

Carvana, Cl A* | | | 4,300 | | | | 166,625 | |

Citi Trends | | | 11,043 | | | | 279,719 | |

Conn's* | | | 13,981 | | | | 388,392 | |

Crocs* | | | 36,001 | | | | 739,461 | |

Deckers Outdoor* | | | 3,014 | | | | 383,290 | |

Dick's Sporting Goods | | | 7,222 | | | | 255,442 | |

DSW, Cl A | | | 7,565 | | | | 200,851 | |

Express* | | | 23,368 | | | | 205,872 | |

Foot Locker | | | 6,384 | | | | 300,942 | |

Fossil Group* | | | 21,332 | | | | 463,118 | |

Genesco* | | | 5,428 | | | | 232,264 | |

Guess? | | | 19,596 | | | | 416,219 | |

Hibbett Sports* | | | 10,764 | | | | 188,047 | |

Kohl's | | | 4,162 | | | | 315,189 | |

Macy's | | | 9,060 | | | | 310,667 | |

Marriott Vacations Worldwide | | | 2,098 | | | | 185,652 | |

Michael Kors Holdings* | | | 4,213 | | | | 233,442 | |

Movado Group | | | 12,067 | | | | 464,700 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Value and Momentum ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

New York* | | | 67,789 | | | $ | 268,444 | |

Ralph Lauren, Cl A | | | 2,664 | | | | 345,281 | |

Shoe Carnival | | | 10,317 | | | | 420,210 | |

Signet Jewelers | | | 3,930 | | | | 220,277 | |

Tailored Brands | | | 10,267 | | | | 215,710 | |

Target | | | 2,949 | | | | 246,625 | |

Tilly's, Cl A | | | 19,505 | | | | 346,019 | |

Urban Outfitters* | | | 7,071 | | | | 279,022 | |

Vitamin Shoppe* | | | 25,046 | | | | 194,607 | |

Williams-Sonoma | | | 3,941 | | | | 234,017 | |

Zumiez* | | | 10,810 | | | | 251,441 | |

| | | | | | | | 10,810,553 | |

| | | | | | | | | |

| Energy — 10.6% | | | | | | | | |

| Arch Coal | | | 2,851 | | | | 273,411 | |

Delek US Holdings | | | 9,299 | | | | 341,459 | |

HollyFrontier | | | 6,272 | | | | 422,984 | |

Magnolia Oil & Gas* | | | 17,267 | | | | 214,974 | |

Mammoth Energy Services | | | 8,468 | | | | 211,361 | |

Marathon Petroleum | | | 5,825 | | | | 410,371 | |

PBF Energy, Cl A | | | 7,771 | | | | 325,216 | |

Peabody Energy | | | 7,061 | | | | 250,312 | |

Renewable Energy Group* | | | 19,114 | | | | 594,064 | |

Valero Energy | | | 3,420 | | | | 311,528 | |

W&T Offshore* | | | 62,766 | | | | 423,043 | |

| | | | | | | | 3,778,723 | |

| | | | | | | | | |

| Financials — 22.5% | | | | | | | | |

| American Equity Investment Life Holding | | | 14,039 | | | | 438,298 | |

B. Riley Financial | | | 20,105 | | | | 387,021 | |

Cannae Holdings* | | | 14,082 | | | | 260,095 | |

Enova International* | | | 16,653 | | | | 393,843 | |

FedNat Holding | | | 14,809 | | | | 318,838 | |

First BanCorp* | | | 28,534 | | | | 263,369 | |

Genworth Financial, Cl A* | | | 77,780 | | | | 332,898 | |

Green Dot, Cl A* | | | 7,948 | | | | 601,982 | |

Health Insurance Innovations, Cl A* | | | 13,588 | | | | 664,453 | |

Kemper | | | 4,381 | | | | 329,407 | |

Navigators Group | | | 3,732 | | | | 258,068 | |

OFG Bancorp | | | 23,986 | | | | 409,921 | |

Old Republic International | | | 22,080 | | | | 486,864 | |

On Deck Capital* | | | 46,860 | | | | 323,334 | |

Popular | | | 5,010 | | | | 260,570 | |

Progressive | | | 11,460 | | | | 798,762 | |

Regions Financial | | | 17,162 | | | | 291,239 | |

TCF Financial | | | 13,605 | | | | 284,072 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Value and Momentum ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Universal Insurance Holdings | | | 8,420 | | | $ | 353,472 | |

Voya Financial | | | 5,312 | | | | 232,453 | |

World Acceptance* | | | 3,778 | | | | 383,429 | |

| | | | | | | | 8,072,388 | |

| | | | | | | | | |

| Health Care — 7.3% | | | | | | | | |

Anthem | | | 1,236 | | | | 340,605 | |

Centene* | | | 3,635 | | | | 473,713 | |

Express Scripts Holding* | | | 2,723 | | | | 264,049 | |

HCA Healthcare | | | 1,865 | | | | 249,033 | |

Humana | | | 1,416 | | | | 453,701 | |

Mallinckrodt PLC* | | | 8,825 | | | | 221,155 | |

Premier, Cl A* | | | 5,702 | | | | 256,590 | |

WellCare Health Plans* | | | 1,293 | | | | 356,855 | |

| | | | | | | | 2,615,701 | |

| | | | | | | | | |

| Industrials — 7.4% | | | | | | | | |

ArcBest | | | 10,380 | | | | 385,306 | |

Boeing | | | 1,325 | | | | 470,190 | |

FTI Consulting* | | | 5,550 | | | | 383,560 | |

Greenbrier | | | 4,288 | | | | 203,466 | |

Heidrick & Struggles International | | | 9,462 | | | | 326,534 | |

Korn | | | 8,643 | | | | 390,144 | |

Robert Half International | | | 3,706 | | | | 224,324 | |

United Continental Holdings* | | | 2,921 | | | | 249,775 | |

| | | | | | | | 2,633,299 | |

| | | | | | | | | |

| Information Technology — 7.0% | | | | | | | | |

Cohu | | | 5,210 | | | | 108,368 | |

Comtech Telecommunications | | | 16,026 | | | | 447,446 | |

Electro Scientific Industries* | | | 14,522 | | | | 421,137 | |

HP | | | 17,196 | | | | 415,111 | |

Insight Enterprises* | | | 4,753 | | | | 245,683 | |

KEMET | | | 18,960 | | | | 412,949 | |

Nanometrics* | | | 7,080 | | | | 226,985 | |

Unisys* | | | 12,709 | | | | 233,973 | |

| | | | | | | | 2,511,652 | |

| | | | | | | | | |

| Materials — 3.7% | | | | | | | | |

Louisiana-Pacific | | | 11,973 | | | | 260,652 | |

Resolute Forest Products* | | | 31,084 | | | | 350,317 | |

Verso* | | | 16,398 | | | | 460,948 | |

Warrior Met Coal | | | 9,120 | | | | 255,360 | |

| | | | | | | | 1,327,277 | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $30,898,336) | | | | | | | 32,052,110 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Value and Momentum ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Total Investments - 89.5% | | | | | | | | |

(Cost $30,898,336) | | | | | | $ | 32,052,110 | |

Other Assets and Liabilities - 10.5% | | | | | | | 3,762,238 | |

Net Assets - 100.0% | | | | | | $ | 35,814,348 | |

Percentages based on Net Assets.

* | Non-income producing security. |

Cl — Class |

PLC — Public Limited Company |

S&P — Standard & Poor's |

The open futures contracts held by the Fund at October 31, 2018, is as follows:

Type of

Contract | | Number of

Contracts Short | | Expiration Date | | Notional Amount | | | Value | | | Unrealized

Appreciation | |

S&P 500 Index E-MINI | | | (210 | ) | Dec-2018 | | $ | (29,154,570 | ) | | $ | (28,466,550 | ) | | $ | 688,020 | |

S&P 500 Index E-MINI | | | (30 | ) | Mar-2019 | | | (4,402,851 | ) | | | (4,075,950 | ) | | | 326,901 | |

| | | | | | | | $ | (33,557,421 | ) | | $ | (32,542,500 | ) | | $ | 1,014,921 | |

For the period ended October 31, 2018, the monthly average notional value of the short equity futures contracts held was $(20,759,273) and the ending notional value of short equity futures contracts held was $(33,557,421).

As of October 31, 2018, all of the Fund's investments and other securities were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

There have been no transfers between Level 1, Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Sovereign Bond ETF

October 31, 2018 (Unaudited)

Sector Weightings†: | |

| |

† Percentages based on total investments. | |

Description | | | Face Amount(1) | | | Value | |

| | | | | | | | | | |

| SOVEREIGN DEBT — 82.8% | | | | | | | | | |

| | | | | | | | | | |

| Argentina — 3.4% | | | | | | | | | |

Argentine Bonos del Tesoro | | | | | | | | | |

18.200%, 10/03/21 | ARS | | | 5,576,820 | | | $ | 127,513 | |

16.000%, 10/17/23 | ARS | | | 5,529,360 | | | | 136,120 | |

15.500%, 10/17/26 | ARS | | | 5,297,445 | | | | 122,324 | |

| Argentine Government International Bond | | | | | | | | | |

| 4.625%, 01/11/23 | | | | 277,000 | | | | 234,065 | |

| | | | | | | | | 620,022 | |

| | | | | | | | | | |

| Australia — 4.0% | | | | | | | | | |

Queensland Treasury | | | | | | | | | |

5.750%, 07/22/24 | AUD | | | 435,000 | | | | 358,595 | |

4.750%, 07/21/25 (A) | AUD | | | 465,000 | | | | 369,206 | |

| | | | | | | | | 727,801 | |

| | | | | | | | | | |

| Brazil — 7.6% | | | | | | | | | |

Brazilian Government International Bond | | | | | | | | | |

8.500%, 01/05/24 | BRL | | | 5,250,000 | | | | 1,396,614 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Chile — 2.5% | | | | | | | | | |

Bonos de la Tesoreria de la Republica en pesos | | | | | | | | | |

6.000%, 01/01/24 | CLP | | | 150,000,000 | | | | 236,119 | |

4.500%, 03/01/26 | CLP | | | 150,000,000 | | | | 217,348 | |

| | | | | | | | | 453,467 | |

| | | | | | | | | | |

| Colombia — 4.2% | | | | | | | | | |

Colombian TES | | | | | | | | | |

11.000%, 07/24/20 | COP | | | 741,000,000 | | | | 251,181 | |

7.500%, 08/26/26 | COP | | | 812,500,000 | | | | 260,139 | |

7.000%, 05/04/22 | COP | | | 819,000,000 | | | | 262,901 | |

| | | | | | | | | 774,221 | |

| | | | | | | | | | |

| Croatia — 4.0% | | | | | | | | | |

Croatia Government International Bond | | | | | | | | | |

6.000%, 01/26/24 | HRK | | | 340,000 | | | | 366,219 | |

5.500%, 04/04/23 | HRK | | | 350,000 | | | | 367,128 | |

| | | | | | | | | 733,347 | |

| | | | | | | | | | |

| Greece — 4.6% | | | | | | | | | |

Hellenic Republic Government Bond | | | | | | | | | |

3.650%, 02/24/24 (B) | EUR | | | 747,795 | | | | 833,481 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Sovereign Bond ETF

October 31, 2018 (Unaudited)

Description | | | Face Amount(1) | | | Value | |

| | | | | | | | | | |

| Hungary — 4.6% | | | | | | | | | |

Hungary Government Bond | | | | | | | | | |

6.000%, 11/24/23 | HUF | | | 99,450,000 | | | $ | 404,495 | |

5.500%, 06/24/25 | HUF | | | 101,550,000 | | | | 403,985 | |

3.000%, 06/26/24 | HUF | | | 11,420,000 | | | | 40,051 | |

| | | | | | | | | 848,531 | |

| | | | | | | | | | |

| Indonesia — 3.2% | | | | | | | | | |

Indonesia Treasury Bond | | | | | | | | | |

8.375%, 03/15/24 | IDR | | | 4,476,000,000 | | | | 291,481 | |

7.000%, 05/15/27 | IDR | | | 4,800,000,000 | | | | 284,479 | |

| | | | | | | | | 575,960 | |

| | | | | | | | | | |

| Malaysia — 3.7% | | | | | | | | | |

Malaysia Government Bond | | | | | | | | | |

4.498%, 04/15/30 | MYR | | | 1,563,000 | | | | 373,447 | |

4.392%, 04/15/26 | MYR | | | 110,000 | | | | 26,607 | |

4.181%, 07/15/24 | MYR | | | 1,010,000 | | | | 243,579 | |

Malaysia Government Investment Issue | | | | | | | | | |

4.070%, 09/30/26 | MYR | | | 110,000 | | | | 26,067 | |

| | | | | | | | | 669,700 | |

| | | | | | | | | | |

| Mexico — 4.3% | | | | | | | | | |

Mexican Bonos | | | | | | | | | |

10.000%, 12/05/24 | MXN | | | 5,123,200 | | | | 267,224 | |

8.500%, 05/31/29 | MXN | | | 6,363,700 | | | | 304,741 | |

7.500%, 06/03/27 | MXN | | | 4,925,000 | | | | 223,081 | |

| | | | | | | | | 795,046 | |

| | | | | | | | | | |

| New Zealand — 2.7% | | | | | | | | | |

New Zealand Government Bond | | | | | | | | | |

4.500%, 04/15/27 | NZD | | | 645,000 | | | | 488,656 | |

| | | | | | | | | | |

| Philippines — 2.5% | | | | | | | | | |

Philippine Government Bond | | | | | | | | | |

8.000%, 07/19/31 | PHP | | | 23,858,684 | | | | 450,771 | |

| | | | | | | | | | |

| Poland — 5.2% | | | | | | | | | |

Poland Government Bond | | | | | | | | | |

5.750%, 04/25/29 | PLN | | | 2,130,000 | | | | 679,963 | |

Republic of Poland Government Bond | | | | | | | | | |

3.250%, 07/25/25 | PLN | | | 495,000 | | | | 131,801 | |

2.500%, 07/25/26 | PLN | | | 540,000 | | | | 135,523 | |

| | | | | | | | | 947,287 | |

| | | | | | | | | | |

| Portugal — 4.3% | | | | | | | | | |

Portugal Obrigacoes do Tesouro OT | | | | | | | | | |

4.125%, 04/14/27 (A) | EUR | | | 391,365 | | | | 526,791 | |

3.875%, 02/15/30 (A) | EUR | | | 195,330 | | | | 259,602 | |

| | | | | | | | | 786,393 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Sovereign Bond ETF

October 31, 2018 (Unaudited)

Description | | | Face Amount(1) | | | Value | |

| | | | | | | | | | |

Romania — 4.4% | | | | | |

Romania Government Bond | | | | | | | | | |

5.850%, 04/26/23 | RON | | | 1,050,000 | | | $ | 266,256 | |

5.800%, 07/26/27 | RON | | | 1,050,000 | | | | 268,898 | |

4.750%, 02/24/25 | RON | | | 1,125,000 | | | | 270,321 | |

| | | | | | | | | 805,475 | |

Russia — 4.3% | | | | | |

Russian Federal Bond - OFZ | | | | | | | | | |

7.600%, 04/14/21 | RUB | | | 19,185,000 | | | | 289,200 | |

7.600%, 07/20/22 | RUB | | | 18,690,000 | | | | 279,540 | |

7.000%, 01/25/23 | RUB | | | 15,120,000 | | | | 220,941 | |

| | | | | | | | | 789,681 | |

South Africa — 4.3% | | | | | |

Republic of South Africa Government Bond | | | | | | | | | |

8.250%, 03/31/32 | ZAR | | | 3,183,195 | | | | 187,663 | |

8.000%, 01/31/30 | ZAR | | | 6,838,005 | | | | 406,590 | |

7.000%, 02/28/31 | ZAR | | | 3,570,780 | | | | 192,271 | |

| | | | | | | | | 786,524 | |

Thailand — 3.9% | | | | | |

Thailand Government Bond | | | | | | | | | |

3.625%, 06/16/23 | THB | | | 22,143,000 | | | | 703,697 | |

| | | | | | | | | | |

Turkey — 5.1% | | | | | |

Turkey Government Bond | | | | | | | | | |

10.700%, 02/17/21 | TRY | | | 2,385,000 | | | | 342,202 | |

8.500%, 09/14/22 | TRY | | | 3,315,000 | | | | 427,007 | |

Turkey Government International Bond | | | | | | | | | |

4.250%, 04/14/26 | | | 200,000 | | | | 164,673 | |

| | | | | | | | | 933,882 | |

Total Sovereign Debt | | | | | | | | |

(Cost $17,428,301) | | | | | | | 15,120,556 | |

| | | | | | | | | | |

U.S. TREASURY OBLIGATION — 12.6% | | | | | |

| | | | | | | | | | |

U.S. Treasury Notes | | | | | | | | | |

2.250%, 02/15/27 | | | 2,465,300 | | | | 2,308,137 | |

| | | | | | | | | | |

Total U.S. Treasury Obligations | | | | | | | | |

(Cost $2,315,738) | | | | | | | 2,308,137 | |

| | | | | | | | | | |

Total Investments - 95.4% | | | | | | | | | |

(Cost $19,744,039) | | | | | | $ | 17,428,693 | |

Other Assets and Liabilities - 4.6% | | | | | | | 846,128 | |

Net Assets - 100.0% | | | | | | $ | 18,274,821 | |

Percentages based on Net Assets.

(1) | In U.S. dollars unless otherwise indicated. |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Sovereign Bond ETF

October 31, 2018 (Unaudited)

(A) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other "accredited investors." These securities are deemed to be liquid by the Board of Trustees. The total value of such securities at October 31, 2018 was $1,155,599 and represents 6.3% of Net Assets. |

(B) | Step Bond - Represents the current rate, the step rate, the step date and the final maturity date. |

ARS — Argentine Peso |

AUD — Australian Dollar |

BRL — Brazilian Real |

CLP — Chilean Peso |

COP — Colombian Peso |

EUR — Euro |

HRK — Croatian Kuna |

HUF — Hungarian Forint |

IDR — Indonesian Rupiah |

MXN — Mexican Peso |

MYR — Malaysian Ringgit |

NZD — New Zealand Dollar |

PHP — Philippine Peso |

PLN — Polish Zloty |

RON — Romanian Leu |

RUB — Russian Ruble |

THB — Thailand Baht |

TRY— Turkish Lira |

ZAR — South African Rand |

|

As of October 31, 2018, all of the Fund's investments in securities were considered Level 2, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

There have been no transfers between Level 1, Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Emerging Shareholder Yield ETF

October 31, 2018 (Unaudited)

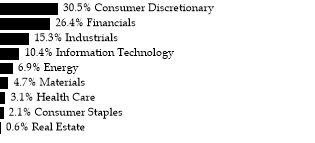

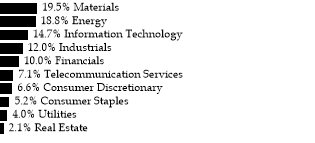

Sector Weightings† |

|

† Percentages based on total investments. |

Description | | Shares | | | Value | |

| | | | | | | | | |

COMMON STOCK — 97.3% | | | | | |

Brazil — 4.3% | | | | | |

Cia de Saneamento de Minas Gerais-COPASA | | | 15,400 | | | $ | 211,292 | |

Mahle-Metal Leve | | | 24,200 | | | | 140,980 | |

SLC Agricola | | | 22,000 | | | | 334,301 | |

| | | | | | | | 686,573 | |

China — 0.9% | | | | | | | | |

China Petroleum & Chemical ADR | | | 1,837 | | | | 148,172 | |

| | | | | | | | | |

Colombia — 2.3% | | | | | | | | |

Banco de Bogota | | | 7,315 | | | | 149,958 | |

Ecopetrol | | | 192,324 | | | | 224,910 | |

| | | | | | | | 374,868 | |

Czech Republic — 1.1% | | | | | | | | |

O2 Czech Republic | | | 16,181 | | | | 170,277 | |

| | | | | | | | | |

Greece — 4.6% | | | | | | | | |

Aegean Airlines | | | 18,051 | | | | 136,575 | |

Hellenic Petroleum | | | 20,064 | | | | 159,532 | |

Motor Oil Hellas Corinth Refineries | | | 9,196 | | | | 217,690 | |

Mytilineos Holdings | | | 24,310 | | | | 215,045 | |

| | | | | | | | 728,842 | |

Hong Kong — 16.1% | | | | | | | | |

Anhui Conch Cement, Cl H | | | 44,000 | | | | 227,239 | |

Asia Cement China Holdings | | | 253,000 | | | | 217,126 | |

China Communications Construction, Cl H | | | 198,000 | | | | 181,034 | |

China Lilang | | | 220,000 | | | | 181,230 | |

China Telecom, Cl H | | | 528,000 | | | | 249,122 | |

CNOOC | | | 132,000 | | | | 226,566 | |

Greatview Aseptic Packaging | | | 275,000 | | | | 182,353 | |

Greenland Hong Kong Holdings | | | 473,000 | | | | 108,570 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Emerging Shareholder Yield ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

Industrial & Commercial Bank of China, Cl H | | | 231,000 | | | $ | 156,122 | |

Maanshan Iron & Steel, Cl H | | | 374,000 | | | | 200,307 | |

PICC Property & Casualty, Cl H | | | 154,000 | | | | 149,249 | |

Sinopec Engineering Group, Cl H | | | 231,000 | | | | 214,741 | |

Sinopec Shanghai Petrochemical ADR | | | 2,783 | | | | 122,035 | |

Sinotruk Hong Kong | | | 110,000 | | | | 157,945 | |

| | | | | | | | 2,573,639 | |

Hungary — 1.4% | | | | | | | | |

MOL Hungarian Oil & Gas | | | 20,790 | | | | 218,017 | |

| | | | | | | | | |

Indonesia — 1.5% | | | | | | | | |

Gudang Garam | | | 51,700 | | | | 245,875 | |

| | | | | | | | | |

Mexico — 2.1% | | | | | | | | |

Nemak (A) | | | 323,400 | | | | 233,556 | |

Rassini, Cl A | | | 59,400 | | | | 94,598 | |

| | | | | | | | 328,154 | |

Russia — 11.5% | | | | | | | | |

Alrosa PJSC | | | 134,200 | | | | 203,519 | |

Center for Cargo Container Traffic TransContainer PJSC | | | 4,590 | | | | 309,722 | |

Gazprom PJSC ADR | | | 38,775 | | | | 182,243 | |

Gazprom Neft PJSC | | | 40,920 | | | | 239,157 | |

Inter RAO UES PJSC | | | 2,585,000 | | | | 156,261 | |

LUKOIL PJSC ADR | | | 3,146 | | | | 234,817 | |

Novolipetsk Steel PJSC | | | 84,040 | | | | 204,660 | |

Severstal PJSC | | | 15,620 | | | | 244,234 | |

Tatneft PJSC | | | 20,460 | | | | 243,630 | |

| | | | | | | | 2,018,243 | |

South Africa — 8.7% | | | | | | | | |

African Rainbow Minerals | | | 27,852 | | | | 235,786 | |

Assore | | | 10,142 | | | | 211,839 | |

BHP Billiton | | | 9,922 | | | | 199,657 | |

Investec | | | 24,420 | | | | 151,908 | |

Kumba Iron Ore | | | 10,868 | | | | 212,903 | |

Nedbank Group | | | 13,585 | | | | 229,221 | |

Reunert | | | 28,886 | | | | 156,154 | |

| | | | | | | | 1,397,468 | |

South Korea — 14.4% | | | | | | | | |

Cheil Worldwide | | | 14,124 | | | | 281,352 | |

Grand Korea Leisure | | | 11,407 | | | | 222,725 | |

Hanmi Semiconductor | | | 26,389 | | | | 212,816 | |

Huchems Fine Chemical | | | 11,473 | | | | 219,483 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Emerging Shareholder Yield ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

KT&G | | | 2,662 | | | $ | 237,105 | |

LG Uplus | | | 16,390 | | | | 232,283 | |

SFA Engineering | | | 6,622 | | | | 226,050 | |

SK Innovation | | | 1,397 | | | | 261,734 | |

S-Oil | | | 1,628 | | | | 177,151 | |

Woori Bank | | | 16,885 | | | | 233,372 | |

| | | | | | | | 2,304,071 | |

Taiwan — 19.1% | | | | | | | | |

Actron Technology | | | 55,000 | | | | 161,927 | |

Asustek Computer | | | 11,000 | | | | 81,408 | |

Aten International | | | 55,000 | | | | 137,753 | |

Chang Wah Electromaterials | | | 33,000 | | | | 135,976 | |

Chong Hong Construction | | | 99,000 | | | | 224,920 | |

Chunghwa Telecom ADR | | | 4,664 | | | | 163,613 | |

CyberPower Systems | | | 33,000 | | | | 76,786 | |

Formosa Chemicals & Fibre | | | 66,000 | | | | 238,891 | |

Formosa Petrochemical | | | 55,000 | | | | 216,850 | |

ITEQ | | | 132,000 | | | | 168,930 | |

Micro-Star International | | | 44,000 | | | | 97,120 | |

Nan Ya Plastics | | | 88,000 | | | | 218,699 | |

Novatek Microelectronics | | | 55,000 | | | | 242,624 | |

Pixart Imaging | | | 66,000 | | | | 173,836 | |

Powertech Technology | | | 55,000 | | | | 120,156 | |

Simplo Technology | | | 22,000 | | | | 127,622 | |

Sitronix Technology | | | 44,000 | | | | 113,758 | |

Thinking Electronic Industrial | | | 55,000 | | | | 109,847 | |

Zhen Ding Technology Holding | | | 110,000 | | | | 251,333 | |

| | | | | | | | 3,062,049 | |

Thailand — 4.1% | | | | | | | | |

Electricity Generating | | | 35,200 | | | | 245,285 | |

Siam Commercial Bank | | | 56,100 | | | | 232,692 | |

Thai Oil | | | 69,300 | | | | 177,170 | |

| | | | | | | | 655,147 | |

Turkey — 4.1% | | | | | | | | |

Enka Insaat ve Sanayi | | | 295,856 | | | | 247,182 | |

Iskenderun Demir ve Celik | | | 108,284 | | | | 134,638 | |

Tekfen Holding | | | 70,895 | | | | 269,395 | |

| | | | | | | | 651,215 | |

| | | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $16,687,018) | | | | | | | 15,562,610 | |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Emerging Shareholder Yield ETF

October 31, 2018 (Unaudited)

Description | | Shares | | | Value | |

| | | | | | | | | |

| | | | | | | | | |

Total Investments - 97.3% | | | | | | | | |

(Cost $16,687,018) | | | | | | $ | 15,562,610 | |

Other Assets and Liabilities - 2.7% | | | | | | | 431,729 | |

Net Assets - 100.0% | | | | | | $ | 15,994,339 | |

Percentages based on Net Assets.

(A) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other "accredited investors." These securities are deemed to be liquid by the Board of Trustees. The total value of such securities at October 31, 2018 was $233,556 and represents 1.5% of Net Assets. |

ADR — American Depositary Receipt

Cl — Class

PJSC — Public Joint Stock Company

As of October 31, 2018, all of the Fund's investments were considered Level 1 in accordance with the authoritative guidance of fair value measurements and disclosure under U.S. generally accepted accounting principles.

There have been no transfers between Level 1, Level 2 or Level 3 assets and liabilities. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Tail Risk ETF

October 31, 2018 (Unaudited)

Sector Weightings† |

|

| |

| |

† Percentages based on total investments. |

Description | | Face Amount | | | Value | |

| | | | | | | | | |

U.S. TREASURY OBLIGATION — 89.4% | | | | | |

| | | | | | | | | |

U.S. Treasury Notes | | | | | | | | |

2.250%, 02/15/27 | | $ | 21,909,800 | | | $ | 20,513,050 | |

| | | | | | | | | |

Total U.S. Treasury Obligations | | | | | |

(Cost $21,169,381) | | | | 20,513,050 | |

| | | | | | | | | |

Total Investments - 89.4% | | | | | | | | |

(Cost $21,169,381) | | | | | | $ | 20,513,050 | |

Other Assets and Liabilities - 0.7% | | | | | | | 177,603 | |

Net Assets - 90.1% | | | | | | $ | 22,944,483 | |

Description | | Contracts | | | Value | |

| | | | | | | | | |

PURCHASED OPTIONS — 9.8%(A)‡* | | | | | |

Total Purchased Options | | | | | | | | |

(Cost $2,236,839) | | | | | | | 2,253,830 | |

Percentages based on Net Assets.

* | Non-income producing securities |

‡ For the period ended October 31, 2018, the average notional value of equity purchased options held was $82,509,702 and the ending notional value of the equity purchased options held was $75,657,546.

(A) | Refer to table below for details on Options Contracts. |

The accompanying notes are an integral part of the financial statements.

Cambria Investment Management

Schedule of Investments ● Cambria Tail Risk ETF

October 31, 2018 (Unaudited)

A list of the exchange traded option contracts held by the Fund at October 31, 2018, is as follows:

| | | Contracts | | | Notional Amount | | | Value | |

| | | | | | | | | | | | | |

PURCHASED OPTIONS - 9.82% | |

Put Options | | | | | | | | | | | | |

SPX, Expires 12/24/2018, Strike Price $2,250 | | | 5 | | | $ | 1,355,870 | | | $ | 3,050 | |

SPX, Expires 12/24/2018, Strike Price $2,325 | | | 5 | | | | 1,355,870 | | | | 4,400 | |

SPX, Expires 12/24/2018, Strike Price $2,400 | | | 11 | | | | 2,982,914 | | | | 14,300 | |

SPX, Expires 12/24/2018, Strike Price $2,500 | | | 2 | | | | 542,348 | | | | 4,540 | |

SPX, Expires 03/18/2019, Strike Price $2,450 | | | 23 | | | | 6,237,002 | | | | 109,365 | |