Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on February 27, 2017

Registration No. 333-215998

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FTS International, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 1389 (Primary Standard Industrial Classification Code Number) | 30-0780081 (I.R.S. Employer Identification Number) |

777 Main Street, Suite 2900

Fort Worth, Texas 76102

(817) 862-2000

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Michael J. Doss

Chief Executive Officer

FTS International, Inc.

777 Main Street, Suite 2900

Fort Worth, Texas 76102

(817) 862-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

| Charles T. Haag Jones Day 2727 North Harwood Street Dallas, Texas 75201 (214) 220-3939 | Merritt S. Johnson Shearman & Sterling LLP 599 Lexington Ave. New York, New York 10022 (212) 848-4000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | ||

|---|---|---|---|---|

Common Stock, $0.01 par value per share | $100,000,000 | $11,590 | ||

| ||||

- (1)

- Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933.

- (2)

- Includes the aggregate offering price of additional shares that the underwriters have the option to purchase.

- (3)

- The registration fee was previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED FEBRUARY 27, 2017

P R E L I M I N A R Y P R O S P E C T U S

Shares

FTS International, Inc.

Common Stock

This is the initial public offering of shares of common stock of FTS International, Inc. We are selling shares of our common stock.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After pricing of this offering, we expect that the shares will trade on The New York Stock Exchange, or NYSE, under the symbol "FTSI."

We are an "emerging growth company" under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in our common stock involves risks that are described in the "Risk Factors" section beginning on page 15 of this prospectus.

| | Price to Public | Underwriting Discounts and Commissions | Proceeds, before expenses, to us | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Per share | $ | $ | $ | |||||||

| Total | $ | $ | $ | |||||||

- (1)

- See "Underwriting" for additional information regarding total underwriter compensation.

The underwriters may also exercise their option to purchase up to an additional shares, from the Company and shares from the selling stockholders, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus to cover over-allotments, if any. We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

Each of the selling stockholders in this offering is deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2017.

| Credit Suisse | Morgan Stanley |

| Barclays | Citigroup | Wells Fargo Securities | Evercore ISI |

| Cowen and Company | Guggenheim Securities | Tudor, Pickering, Holt & Co. |

The date of this prospectus is , 2017.

PROSPECTUS SUMMARY | 1 | |||

RISK FACTORS | 15 | |||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 34 | |||

USE OF PROCEEDS | 36 | |||

DIVIDEND POLICY | 37 | |||

CAPITALIZATION | 38 | |||

DILUTION | 40 | |||

SELECTED FINANCIAL DATA | 42 | |||

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 45 | |||

BUSINESS | 56 | |||

MANAGEMENT | 75 | |||

EXECUTIVE COMPENSATION | 84 | |||

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS | 92 | |||

PRINCIPAL AND SELLING STOCKHOLDERS | 95 | |||

DESCRIPTION OF CAPITAL STOCK | 98 | |||

DESCRIPTION OF INDEBTEDNESS | 102 | |||

SHARES ELIGIBLE FOR FUTURE SALE | 105 | |||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS | 108 | |||

UNDERWRITING | 112 | |||

LEGAL MATTERS | 119 | |||

EXPERTS | 119 | |||

WHERE YOU CAN FIND MORE INFORMATION | 119 | |||

INDEX TO FINANCIAL STATEMENTS | F-1 |

We are responsible for the information contained in this prospectus and in any free writing prospectus we may authorize to be delivered to you. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, these securities only in jurisdictions where offers and sales are permitted. The information in this prospectus or in any applicable free writing prospectus is accurate only as of its date, regardless of its time of delivery or any sale of these securities. Our business, financial condition, results of operations and prospects may have changed since that date.

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable and that the information is accurate and complete, we have not independently verified the information.

References to oil prices are to the spot price in U.S. Dollars per barrel of West Texas Intermediate, or WTI, an oil index benchmark used in the United States. References to natural gas prices are to the spot price in U.S. Dollars per one thousand cubic feet of natural gas using the Henry Hub index, a natural gas benchmark used in the United States.

Reverse Stock Split and Conversion

Immediately before this offering (1) we will effect a : reverse stock split and (2) our Series A convertible preferred stock, or our convertible preferred stock, will be converted into issued and outstanding common stock at a fixed exchange ratio of : . Upon filing our amended and restated certificate of incorporation, each share of convertible preferred stock will convert into a number of shares of common stock equal to its accreted value at March 31, 2017, or $2,735 per share, divided by the initial public offering price per share, subject to adjustment based on the aggregate value of our common stock and convertible preferred stock immediately prior to this offering. Assuming an initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, our convertible preferred stock will convert into shares of our common stock. Each $1.00 increase (decrease) in the public offering price would increase (decrease) the number of

(i)

shares of our common stock that our convertible preferred stock will convert into by %. For additional information regarding the conversion of our convertible preferred stock, see "Description of Capital Stock."

Following the reverse stock split and conversion, our authorized capital stock will consist of shares of common stock and shares of preferred stock and shares of common stock will be outstanding. In connection with this offering, we will issue an additional shares of new common stock and, immediately following this offering, we will have total shares of common stock outstanding.

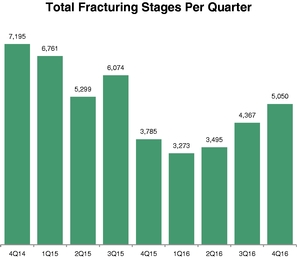

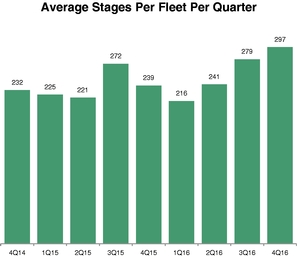

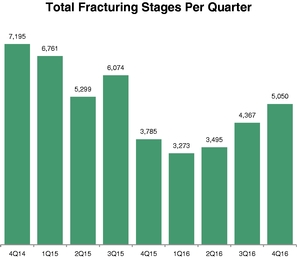

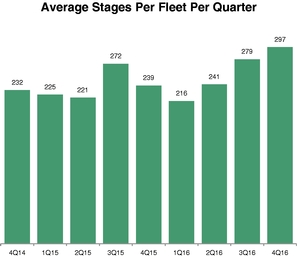

Comparability of Operating and Statistical Metrics

Throughout this prospectus, we refer to "stages fractured" and similar terms, including "stages per fleet" and "revenue per stage." Stages fractured is an operating and statistical metric referring to the number of individual hydraulic fracturing procedures we complete under service contracts with our customers. Likewise, stages per fleet is an operating efficiency measure referring to the stages fractured per fleet over a given time period. Because our customers typically compensate us based on the number of stages fractured, there is a strong correlation between stages fractured and our revenue. We believe stages fractured, stages per fleet and revenue per stage are important indicators of operating activity and operating efficiency because they demonstrate the demand for our services and our efficiency in meeting that demand with our fleets. Because we service a variety of customers in different basins with different formation characteristics, stages fractured, stages per fleet and revenue per stage are subject to a number of material factors affecting their usefulness and comparability. For example, based on customer specifications and formation characteristics, some of our fleets may complete longer stages involving higher pressure job designs or more intense proppant loading, while other fleets may complete shorter stages involving lower pressure job designs or less intense proppant loadings. Our fleets may also vary materially in hydraulic horsepower needed to accomodate the basin characteristics and customer specifications. For these reasons, stages fractured and stages per fleet are not the only measures of activity and efficiency that affect our financial results, however, we believe they are important measures in managing our business. You should carefully read and consider the other information presented in this prospectus, including information under "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

(ii)

This summary provides a brief overview of information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our common stock. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings "Risk Factors," "Cautionary Note Regarding Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical consolidated financial statements and related notes thereto included elsewhere in this prospectus.

Unless the context requires otherwise, references in this prospectus to "FTS International," "Company," "we," "us," "our" or "ours" refer to FTS International, Inc., together with its subsidiaries. References in this prospectus to "selling stockholders" refer to those entities identified as selling stockholders in "Principal and Selling Stockholders."

Our Company

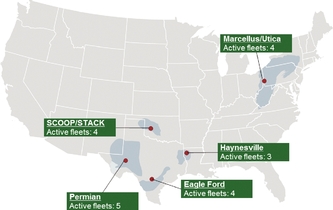

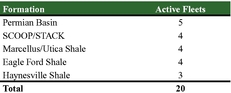

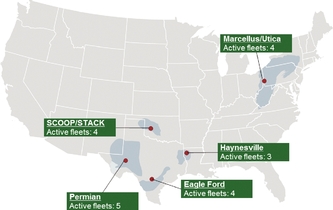

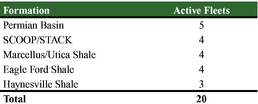

We are one of the largest providers of hydraulic fracturing services in North America based on both active and total horsepower of our equipment. Our services enhance hydrocarbon flow from oil and natural gas wells drilled by exploration and production, or E&P, companies in shale and other unconventional resource formations. Our customers include large, independent E&P companies, such as Devon Energy Corporation, EOG Resources, EP Energy Corporation, EQT Production Company and Newfield Exploration Company, that specialize in unconventional oil and natural gas resources in North America. We are one of the top-three hydraulic fracturing companies in some of the most active basins in the United States, including the SCOOP/STACK Formation, Marcellus/Utica Shale, Eagle Ford Shale and the Haynesville Shale. We also have an extensive, long-standing presence in the Permian Basin and have recently increased our presence in this basin by 50%. The following map shows the basins in which we operate and the number of fleets operated in each basin as of January 2017.

|  |

We currently have 1.6 million total hydraulic horsepower across 32 fleets, of which 20 were active as of January 31, 2017. We have experienced an increase in demand for our services and recently committed three additional fleets which began operations in January 2017. We intend to use a portion of the proceeds from this offering to reactivate additional fleets in 2017 and 2018.

Our industry experienced a significant downturn beginning in late 2014 as oil and natural gas prices dropped significantly. The downturn materially impacted our results in 2015 and 2016, primarily due to reduced activity levels and lower pricing for our services. Recently, however, we have seen a rebound in the demand for our services as oil prices have more than doubled since the 12-year low of $26.19 in February 2016, reaching $53.75 in December 2016. Beginning in the third quarter of 2016, we

were able to obtain higher prices for our services, reversing a downward trend that accompanied the decrease in oil and natural gas prices.

We capitalized on the downturn by implementing measures to reduce our cost of operations and to improve the efficiency of our operations. As a result, we have been able to increase our efficiency by approximately 28% compared to the end of 2014, as measured by average stages per fleet, while maintaining a relatively consistent presence in each operating basin. We believe these cost reductions and efficiency improvements will continue even as activity levels increase.

Our customers typically compensate us based on the number of stages fractured. As a result, we believe the number of stages fractured and the average number of stages completed per fleet in a given period of time are important measures of our activity and efficiency levels. The graphs below show our activity level, as measured by the number of stages completed per quarter, and our efficiency level, as measured by average stages per fleet per quarter. For additional information regarding average stages per fleet per quarter as a measure of efficiency, see "Business—Our Services—Hydraulic Fracturing."

|  |

We manufacture and refurbish many of the components used by our fleets, including consumables, such as fluid-ends. In addition, we perform substantially all the maintenance, repair and servicing of our hydraulic fracturing fleets. Our cost to produce components is significantly less than the cost to purchase comparable quality components from third-party suppliers. For example, we produce fluid-ends and power-ends at a cost that is approximately 50% to 60% less, respectively, than purchasing them from outside suppliers.

The experience we gain from our large scale and basin diversity allows us to provide leading technological solutions to our customers. We are focused on identifying new technologies aimed at: increasing fracturing effectiveness for our customers; reducing the operating costs of our equipment; and enhancing the health, safety and environmental, or HSE, conditions at our well sites. We have a number of ongoing initiatives that build on industry innovations and data analytics to achieve these technology objectives and also conduct research and development activities through a strategic partnership with a third-party technology center. The research and development activities conducted for us at the third-party technology center are conducted by key employees who were previously affiliated with our Company. We have entered into a services agreement with this third-party technology center for a one-year term, with an option for us to renew for additional one-year terms.

Industry Overview and Trends

The principal factor influencing demand for hydraulic fracturing services is the level of horizontal drilling activity by E&P companies in unconventional oil and natural gas reservoirs. Over the last

2

decade, advances in drilling and completion technologies, including horizontal drilling and hydraulic fracturing, have made the development of North America's oil and natural gas shale formations economically attractive. As a result, there was a dramatic increase in the development of oil- and natural gas-producing basins in the United States and a corresponding increase in the demand for hydraulic fracturing services.

The significant decline in oil and natural gas prices that began in the third quarter of 2014 resulted in a reduction in horizontal drilling activity. According to a Baker Hughes, Inc. report dated January 6, 2017, or the Baker Hughes Report, the horizontal rig count dropped approximately 76% from 1,336 at the end of December 2014 to a low of 314 in May 2016. The reduced drilling activity led to a reduction in demand for hydraulic fracturing services and has resulted in increased competition and lower prices for hydraulic fracturing services. As oil and natural gas prices have recovered in 2016, E&P companies in the United States are beginning to increase their level of horizontal drilling, resulting in an uptick in demand for hydraulic fracturing services.

Technological advances in oil and natural gas extraction since 2014 have increased the efficiency of E&P companies. In particular, drilling speeds have increased dramatically, allowing rigs to drill longer laterals in fewer days. The longer lateral lengths increase the demand for pressure pumping services relative to the rig count as evidenced by significant increases in both the number of stages per well and the amount of proppant used per well, particularly in recent years. As a result, E&P companies are able to complete more stages using fewer rigs, and many analysts expect that total stages completed will surpass 2014 levels at a significantly lower corresponding rig count.

In November 2016, certain oil producing nations and the Organization of the Petroleum Exporting Countries, or OPEC, agreed to cut the production of crude oil. These cuts, combined with already falling levels of crude oil production, are expected to result in an increase in crude oil prices. As a result, U.S. E&P companies have begun to increase their level of horizontal drilling and, hence, the demand for hydraulic fracturing services has begun to increase from the lows seen in mid-2016. We believe this increase in demand coupled with industry contraction and the resulting reduction in hydraulic fracturing capacity since late 2014 will particularly benefit us. The financial distress of many other providers of hydraulic fracturing services, we believe, has led to significant maintenance deferrals and the use of idle fleets for spare parts, resulting in a material reduction in total deployable fracturing fleets. We believe all of our inactive fleets can be returned to service.

We believe the foregoing trends and events will further increase demand for and pricing of our hydraulic fracturing services.

Competitive Strengths

We believe that we are well-positioned because of the following competitive strengths:

Large scale and leading market share across the most active major U.S. unconventional resource basins

With 1.6 million total hydraulic horsepower in our fleet, we are one of the largest hydraulic fracturing service providers in North America based on both active and total horsepower of our equipment. We are one of the top-three hydraulic fracturing companies in some of the most active basins in the United States, including the SCOOP/STACK Formation, Marcellus/Utica Shale, the Eagle Ford Shale and the Haynesville Shale. We also have an extensive, long-standing presence in the Permian Basin and have recently increased our presence in this basin by 50%. According to an industry report from December 2016, these basins will account for more than 75% of all new wells drilled in 2017 and 2018.

This geographic diversity reduces the volatility in our revenue due to basin trends, relative oil and natural gas prices, adverse weather and other events. Our five hydraulic fracturing districts enable us to

3

rapidly reposition our fleets based on demand trends among different basins. Additionally, our large market share in each of our operating basins allows us to spread our fixed costs over a greater number of fleets. Furthermore, our large scale strengthens our negotiating position with our suppliers and our customers.

Pure-play, efficient hydraulic fracturing services provider with extensive experience in U.S. unconventional oil and natural gas production

Our primary focus is hydraulic fracturing. For the year ended December 31, 2016, 93% of our revenues came from hydraulic fracturing services. Since 2010, we have completed more than 130,000 fracturing stages across the most active major unconventional basins in the United States. This history gives us invaluable experience and operational capabilities that are at the leading edge of horizontal well completions in unconventional formations.

We designed all of the hydraulic fracturing units and much of the auxiliary equipment used in our fleets to uniform specifications intended specifically for work in oil and natural gas basins requiring high pressures and high levels of sand intensity. In addition, we use proprietary pumps with fluid-ends that are capable of meeting the most demanding pressure, flow rate and proppant loading requirements encountered in the field.

Our focus on hydraulic fracturing provides us the expertise and dedication to run our fleets in 24-hour operations, in contrast to several of our competitors that run their fleets in 12-hour operations. As a result, we have the opportunity to complete more stages per day than such competitors. In addition, rather than perform "spot work," we prefer to dedicate each of our fleets to a specific customer for a set period of time, such as six months, in exchange for specified minimum volume commitments and indexed pricing. These arrangements allow us to increase the number of days per month that our fleet is generating revenue and allow our crews to better understand customer expectations resulting in improved efficiency and safety.

In-house manufacturing, equipment maintenance and refurbishment capabilities

We manufacture and refurbish many of the components used by our fleets, including consumables, such as fluid-ends. In addition, we perform substantially all the maintenance, repair and servicing of our hydraulic fracturing fleets. Our cost to produce components is significantly less than the cost to purchase comparable quality components from third-party suppliers. For example, we produce fluid-ends and power-ends at a cost that is approximately 50% to 60% less, respectively, than purchasing them from outside suppliers. In addition, we perform full-scale refurbishments of our fracturing units at a cost that is approximately half the cost of utilizing an outside supplier. We estimate that this cost advantage saves us approximately $85 million per year at peak production levels. As trends in our industry continue toward increasing proppant levels and service intensity, the added wear-and-tear on hydraulic fracturing equipment will increase the rate at which components need to be replaced for a typical fleet, increasing our long-term cost advantage versus our competitors that do not have similar in-house manufacturing capabilities.

Our manufacturing capabilities also reduce the risk that we will be unable to source important components, such as fluid-ends, power-ends and other consumable parts. During periods of high demand for hydraulic fracturing services, external equipment vendors often report order backlogs of up to nine months. Our competitors may be unable to source components when needed or may be required to pay a much higher price for their components, or both, due to bottlenecks in supplier production levels. We have historically manufactured, and believe we have the capacity to manufacture, all major consumable components required to operate all 32 of our fleets at full capacity.

Additionally, manufacturing our equipment internally allows us to constantly improve our equipment design in response to the knowledge we gain by operating in harsh geological environments

4

under challenging conditions. This rapid feedback loop between our field operations and our manufacturing operations positions our equipment at the leading edge of developments in hydraulic fracturing design.

Uniform fleet of standardized, high specification hydraulic fracturing equipment

We have a uniform fleet of hydraulic fracturing equipment. We designed our equipment to uniform specifications intended specifically for completions work in oil and natural gas basins requiring high levels of pressure, flow rate and sand intensity. The standardized, "plug and play" nature of our fleet provides us with several advantages, including: reduced repair and maintenance costs; reduced inventory costs; the ability to redeploy equipment among operating basins; and reduced complexity in our operations, which improves our safety and operational performance. We believe our technologically advanced fleets are among the most reliable and best performing in the industry with the capabilities to meet the most demanding pressure and flow rate requirements in the field.

Our standardized equipment reduces our downtime as our mechanics can quickly and efficiently diagnose and repair our equipment. Our uniform equipment also reduces the amount of inventory we need on hand. We are able to more easily shift fracturing pumps and other equipment among operating areas as needed to take advantage of market conditions and to replace temporarily damaged equipment. This flexibility allows us to target customers that are offering higher prices for our services, regardless of the basins in which they operate. Standardized equipment also reduces the complexity of our operations, which lowers our training costs. Additionally, we believe our industry-leading safety record is partly attributable to the standardization of our equipment, which makes it easier for mechanics and equipment operators to identify and diagnose problems with equipment before they become safety hazards.

Safety leader

Safety is at the core of our operations. Our safety record for 2016 was the best in our history and we believe significantly better than our industry peer group, based on data provided by reports of the U.S. Bureau of Labor Statistics from 2011 through 2015. For the past three years, we believe our total recordable incident rate was less than half of the industry average. Additionally, we have not had a loss time incident since May 2015, a period of over 10 million man-hours. Many of our customers impose minimum safety requirements on their suppliers of hydraulic fracturing services, and some of our competitors are not permitted to bid on work for certain customers because they do not meet those customers' minimum safety requirements. Because safety is important to our customers, our safety score helps our commercial team to win business from our customers. Our safety focus is also a morale benefit for our crews, which enhances our employee retention rates. Finally, we believe that continually searching for ways to make our operations safer is the right thing to do for our employees and our customers.

Experienced management and operating team

During the downturn, our management team focused on reducing costs, increasing operating efficiency and differentiating ourselves through innovation. The team has an extensive and diverse skill set, with an average of 24 years of professional experience. Our operational and commercial executives have a deep understanding of unconventional resource formations, with an average of 30 years of oil and natural gas industry experience. In addition, as a result of our pure-play focus on hydraulic fracturing and dedicated fleet strategy, our operations teams have extensive knowledge of the geographies in which we operate as well as the technical specifications and other requirements of our customers. We believe this knowledge and experience allows us to service a variety of E&P companies across different basins efficiently and safely.

5

Our Strategy

Our primary business objective is to be the largest pure-play provider of hydraulic fracturing services within U.S. unconventional resource basins. We intend to achieve this objective through the following strategies:

Capitalize on expected recovery and demand for our services

As the demand for oilfield services in the United States recovers, the hydraulic fracturing sector is expected to grow significantly. Industry reports have forecasted that the North American onshore stimulation sector, which includes hydraulic fracturing, will increase at a compound annual growth rate, or CAGR, of 31% from 2016 through 2020. As one of the largest hydraulic fracturing service providers in North America based on the active and total horsepower of our equipment, we believe we are well positioned to capitalize on the recovery of the North American oil and natural gas exploration market. We have 1.6 million total hydraulic horsepower across 32 total fleets, and we believe all of this equipment can be returned to service. As of January 31, 2017, we had 20 active fleets and continue to receive customer interest in reactivating further fleets. We estimate the total cost to reactivate our inactivate fleets to be approximately $44.0 million, which includes capital expenditures, repairs charged as operating expenses, labor costs and other operating expenses. In addition to repaying a portion of our indebtedness, we intend to use a portion of the proceeds from this offering to reactivate additional fleets in 2017 and 2018.

Deepen and expand relationships with customers that value our completions efficiency

We service our customers primarily with dedicated fleets and 24-hour operations. We dedicate one or more of our fleets exclusively to the customer for a period of time, allowing for those fleets to be integrated into the customer's drilling and completion schedule. As a result, we are able to achieve higher levels of utilization, as measured by the number of days each fleet is working per month, which increases our profitability. In addition, we operate our fleets on a 24-hour basis, allowing us to complete our services in less time than our competitors that run their fleets for only 12 hours per day. Accordingly, we seek to partner with customers that have a large number of wells awaiting completion and that value efficiency in the performance of our service. Specifically, we target customers whose completions activity typically involves minimal downtime between stages, a high number of stages per well, multiple wells per pad and a short distance from one well pad site to the next. This strategy aligns with the strategy of many of our customers, who are trying to achieve a manufacturing-style model of drilling and completing wells in a sequential pattern to maximize effective acreage. We plan to leverage this strategy to expand our relationships with our existing customers as we continue to attract new customers.

Capitalize on our uniform fleet, leading scale and significant basin diversity to provide superior performance with reduced operating costs

We primarily serve large independent E&P companies that specialize in unconventional oil and natural gas resources in North America. Because we operate for customers with significant scale in each of our operating basins, we have the diversity to react to and benefit from positive activity trends in any basin. Our uniform fleet allows us to cost-effectively redeploy equipment and fleets among existing operating basins to capture the best pricing and activity trends. The uniform fleet is easier to operate and maintain, resulting in reduced downtime as well as lower training costs and inventory stocking requirements. Our geographic breadth also provides us with opportunities to capitalize on customer relationships in one basin in order to win business in other basins in which the customer operates. We intend to leverage our scale, standardized equipment and cost structure to gain market share and win new business.

6

Rapidly adopt new technologies in a capital efficient manner

We have been a fast adopter of new technologies focused on: increasing fracturing effectiveness for our customers, reducing the operating costs of our equipment and enhancing the HSE conditions at our well sites. We help customers monitor and modify fracturing fluids and designs through our fluid research and development operations that we conduct through a strategic partnership with a third-party technology center. The research and development activities conducted for us at the third-party technology center are conducted by key employees who were previously affiliated with our Company. We have entered into a services agreement with this third-party technology center for a one-year term, with an option for us to renew for additional one-year terms. This partnership allows us to work closely with our customers to rapidly adopt and integrate next-generation fluid breakthroughs, such as our NuFlo® 1000 fracturing fluid diverter, into our product offerings.

Recent examples of initiatives aimed at reducing our operating costs include: vibration sensors with predictive maintenance analytics on our heavy equipment; stainless steel fluid-ends with a longer useful life; high-definition cameras to remotely monitor the performance of our equipment; and proprietary chemical coatings and lubricant blends for our consumables. Recent examples of initiatives aimed at improving our HSE conditions include: dual fuel engines that can run on both natural gas and diesel fuel; electronic pressure relief systems; spill prevention and containment solutions; dust control mitigation; and leading containerized proppant delivery solutions.

Reduce debt and maintain a more conservative capital structure

We believe that our capital structure and liquidity upon completion of this offering will improve our financial flexibility to capitalize efficiently on an industry recovery, ultimately increasing value for our stockholders. Our focus will be on the continued prudent management and reduction of our debt balances during the industry recovery. We believe this focus creates potential for significant operating leverage and strong free cash flow generation during an industry upcycle. As a result, we believe we should be able to not only make the investments necessary to remain a market leader in hydraulic fracturing, but also to continue to strengthen our balance sheet. Additionally, we believe that our growth opportunities will be organic and funded by cash flow from operations.

Selected Risks Associated with Our Business

An investment in our common stock involves risks. You should carefully read and consider the information presented under the heading "Risk Factors" for an explanation of these risks before investing in our common stock. In particular, the following considerations may offset our competitive strengths or have a negative effect on our strategy or operating activities, which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

- •

- The oil and natural gas industry is cyclical and prices are volatile. A further reduction or sustained decline in oil and natural gas industry or prices could adversely affect our business, financial condition and results of operations and our ability to meet our capital expenditure obligations and financial commitments.

- •

- Competition has intensified during the downturn and we rely upon a few customers for a significant portion of our revenues. Decreased demand for our services or the loss of one or more of these relationships could adversely affect our revenues.

- •

- Our operations are subject to operational hazards for which we may not be adequately insured.

- •

- Our operations are subject to various governmental regulations that require compliance that can be burdensome and expensive and may adversely affect the feasibility of conducting our operations.

7

- •

- Any failure by us to comply with applicable governmental laws and regulations, including those relating to hydraulic fracturing, could result in governmental authorities taking actions that could adversely affect our operations and financial condition.

- •

- We have substantial indebtedness and any failure to meet our debt obligations would adversely affect our liquidity and financial condition.

- •

- Our major stockholders, Maju Investments (Mauritius) Pte. Ltd., or Maju, CHK Energy Holdings, Inc., or Chesapeake, and Senja Capital Ltd, or Senja, will continue to exercise significant influence over matters requiring stockholder approval, and their interests may conflict with those of our other stockholders.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last completed fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements that are otherwise applicable generally to public companies. These reduced reporting requirements include:

- •

- an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting;

- •

- an exemption from compliance with any requirement that the Public Company Accounting Oversight Board, or PCAOB, may adopt regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements;

- •

- reduced disclosure about our executive compensation arrangements;

- •

- an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or stockholder approval of any golden parachute arrangements;

- •

- extended transition periods for complying with new or revised accounting standards; and

- •

- the ability to present more limited financial data in this registration statement, of which this prospectus is a part.

We will remain an emerging growth company until the earliest to occur of: (1) the end of the first fiscal year in which our annual gross revenue is $1.0 billion or more; (2) the end of the fiscal year in which the market value of our common stock that is held by non-affiliates is at least $700 million as of the last business day of our most recently completed second fiscal quarter; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; and (4) the end of the fiscal year during which the fifth anniversary of this offering occurs. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act.

We have elected to take advantage of all of the applicable JOBS Act provisions, except that we will elect to opt out of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised accounting standards (this election is irrevocable). Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

Our Principal Stockholders

Upon the conversion of our convertible preferred stock into common stock and the completion of this offering, Maju, Chesapeake and Senja will beneficially own approximately %, % and %, respectively, of our common stock, or %, % and %, respectively, if the

8

underwriters exercise their option to purchase additional shares in full. For more information regarding our beneficial ownership see "Principal and Selling Stockholders."

Maju is an indirect wholly owned subsidiary of Temasek Holdings (Private) Limited, or Temasek. Temasek is an investment company based in Singapore with a net portfolio of S$242 billion as of March 31, 2016. Chesapeake is a wholly owned subsidiary of Chesapeake Energy Corporation, or Chesapeake Parent. Established in 1989, Chesapeake Parent is an oil and natural gas exploration and production company headquartered in Oklahoma City, Oklahoma. Senja is an investment company affiliated with RRJ Capital Limited, or RRJ. RRJ is an Asian investment firm with a total of assets under management of close to $11 billion.

These stockholders will continue to exercise significant influence over matters requiring stockholder approval, including the election of directors, changes to our organizational documents and significant corporate transactions. See "Certain Relationships and Related Party Transactions—Investors' Rights Agreements." Furthermore, we anticipate that several individuals who will serve as our directors upon completion of this offering will be affiliates of Maju, Chesapeake and Senja. See "Risk Factors—Our three largest stockholders control a significant percentage of our common stock, and their interests may conflict with those of our other stockholders."

History and Conversion

We were originally formed in 2000. In 2011, our prior majority owners sold their interest to a newly formed Delaware limited liability company controlled by an investor group comprised mainly of Maju, Chesapeake and Senja. We converted from a limited liability company to a corporation in 2012.

Company Information

Our principal executive offices are located at 777 Main Street, Suite 2900, Fort Worth, Texas 76102, and our telephone number at that address is (817) 862-2000. Our website address is www.ftsi.com. Information contained on our website does not constitute part of this prospectus.

9

Common stock offered by us | shares and shares if the underwriters' option to purchase additional shares is exercised in full. | |

Common stock offered by the selling stockholders | shares if the underwriters' option to purchase additional shares is exercised in full. | |

Over-allotment option | We and the selling stockholders have granted the underwriters an option, exercisable for 30 days, to purchase up to an aggregate of additional shares of our common stock to cover over-allotments, if any. | |

Common stock outstanding after this offering | shares, or shares if the underwriters exercise their option to purchase additional shares in full. | |

Use of proceeds | We expect to receive approximately $ million (or approximately $ million if the underwriters' option to purchase additional shares in this offering is exercised in full) of net proceeds from the sale of the common stock offered by us, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $ million. We will not receive any proceeds from the sale of shares by the selling stockholders. | |

We intend to use the net proceeds from this offering for general corporate purposes, which will include repaying indebtedness under our senior secured floating rate notes due May 1, 2020, or the 2020 Notes, our term loan due April 16, 2021, or the Term Loan, and our 6.250% senior secured notes due May 1, 2022, or the 2022 Notes. Subject to completion of the initial public offering, we have provided notice to the holders for redemption of all of our outstanding 2020 Notes at a redemption price of 103.000% of the principal amount, plus accrued and unpaid interest to, but not including the redemption date. We expect the redemption date to be the closing date of this offering. See "Use of Proceeds." | ||

Dividend policy | After completion of this offering, we intend to retain future earnings, if any, for use in the repayment of our existing indebtedness and in the operation and expansion of our business. Therefore, we do not anticipate paying any cash dividends in the foreseeable future following this offering. See "Dividend Policy." | |

Listing and trading symbol | We intend to apply to list our common stock on the NYSE under the symbol "FTSI." |

10

Directed Share Program | At our request, the underwriters have reserved up to % of the common stock being offered by this prospectus for sale to our directors, executive officers, employees, business associates and related persons at the public offering price. The sales will be made by the underwriters through a directed share program. We do not know if these persons will choose to purchase all or any portion of this reserved common stock, but any purchases they do make will reduce the number of shares available to the general public. To the extent the allotted shares are not purchased in the directed share program, we will offer these shares to the public. These persons must commit to purchase no later than the close of business on the day following the date of this prospectus. Any directors or executive officers purchasing such reserved common stock will be prohibited from selling such stock for a period of 180 days after the date of this prospectus. | |

Risk Factors | You should carefully read and consider the information beginning on page 15 of this prospectus set forth under the heading "Risk Factors" and all other information set forth in this prospectus before deciding to invest in our common stock. |

Immediately before this offering (1) we will effect a : reverse stock split and (2) all shares of our convertible preferred stock will be converted into issued and outstanding common stock at a fixed exchange ratio of : . Upon filing our amended and restated certificate of incorporation, each share of convertible preferred stock will convert into a number of shares of common stock equal to its accreted value at March 31, 2017, or $2,735 per share, divided by the initial public offering price per share, subject to adjustment based on the aggregate value of our common stock and convertible preferred stock immediately prior to this offering. Assuming an initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, our convertible preferred stock will convert into shares of our common stock. Each $1.00 increase (decrease) in the public offering price would increase (decrease) the number of shares of our common stock that our convertible preferred stock will convert into by %. For additional information regarding the conversion of our convertible preferred stock, see "Description of Capital Stock."

Following the reverse stock split and conversion, our authorized capital stock will consist of shares of common stock and shares of preferred stock and shares of common stock will be outstanding. In connection with this offering, we will issue an additional shares of new common stock and, immediately following this offering, we will have total shares of common stock outstanding.

Unless otherwise noted, all information contained in this prospectus:

- •

- Assumes the underwriters do not exercise their option to purchase additional shares;

- •

- Other than historical financial data, reflects (1) our : reverse stock split and (2) the conversion of our convertible preferred stock, into shares of common stock at a fixed exchange ratio of : immediately prior to the consummation of this offering; and

- •

- Excludes shares of common stock reserved for issuance under the FTS International, Inc. 2014 Long-Term Incentive Plan, or the 2014 LTIP and under the FTS International, Inc. 2017 Equity and Incentive Compensation Plan, or the 2017 Plan.

11

The following tables set forth our summary historical consolidated financial data for the periods and the dates indicated. The consolidated statements of operations data for the years ended December 31, 2015 and 2016 the consolidated balance sheet data as of December 31, 2015 and 2016 are derived from our audited consolidated financial statements that are included elsewhere in this prospectus. Our historical results are not necessarily indicative of our results in any future period.

You should read this information together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| (Dollars in millions, except per share amounts and average fracturing revenue per stage) | 2015 | 2016 | |||||

Statements of Operations Data: | |||||||

Revenue | $ | 1,375.3 | $ | 532.2 | |||

Costs of revenue, excluding depreciation and amortization | 1,257.9 | 510.5 | |||||

Selling, general and administrative | 154.7 | 64.4 | |||||

Depreciation and amortization | 272.4 | 112.6 | |||||

Impairments and other charges(1) | 619.9 | 12.3 | |||||

Loss on disposal of assets, net | 5.9 | 1.0 | |||||

Gain on insurance recoveries | — | (15.1 | ) | ||||

| | | | | | | | |

Operating income (loss) | (935.5 | ) | (153.5 | ) | |||

Interest expense, net | 77.2 | 87.5 | |||||

Loss (gain) on extinguishment of debt, net | 0.6 | (53.7 | ) | ||||

Equity in net loss of joint venture affiliate | 1.4 | 2.8 | |||||

| | | | | | | | |

Loss before income taxes | (1,014.7 | ) | (190.1 | ) | |||

Income tax benefit(2) | (1.5 | ) | (1.6 | ) | |||

| | | | | | | | |

Net loss | $ | (1,013.2 | ) | $ | (188.5 | ) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Net loss attributable to common stockholders | $ | (1,158.1 | ) | $ | (370.1 | ) | |

Basic and diluted earnings (loss) per share attributable to common stockholders | $ | (0.32 | ) | $ | (0.10 | ) | |

Shares used in computing basic and diluted earnings (loss) per share (in millions) | 3,589.7 | 3,586.5 | |||||

Balance Sheet Data (at end of period): | |||||||

Cash and cash equivalents | $ | 264.6 | $ | 160.3 | |||

Total assets | $ | 907.4 | $ | 616.8 | |||

Total debt | $ | 1,276.2 | $ | 1,188.7 | |||

Convertible preferred stock(3) | $ | 349.8 | $ | 349.8 | |||

Total stockholders' equity (deficit) | $ | (830.5 | ) | $ | (1,019.0 | ) | |

Pro Forma Data(4): | |||||||

Pro forma net loss | $ | ||||||

Pro forma basic and diluted earnings (loss) per share attributable to common stockholders | $ | ||||||

Pro forma shares used in computing basic and diluted earnings (loss) per share (in millions) | |||||||

Pro forma total debt (at end of period) | $ | ||||||

Pro forma total stockholders' equity (deficit) (at end of period) | $ | ||||||

12

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| (Dollars in millions, except per share amounts and average fracturing revenue per stage) | 2015 | 2016 | |||||

Other Data: | |||||||

Adjusted EBITDA(5) | $ | (62.8 | ) | $ | (50.8 | ) | |

Net debt(6) | $ | 1,011.6 | $ | 1,028.4 | |||

Pro forma net debt (at end of period)(6) | $ | ||||||

Total fracturing stages(7) | 21,919 | 16,185 | |||||

Average fracturing revenue per stage (in thousands) | $ | 59 | $ | 31 | |||

- (1)

- In 2014, this amount related to non-essential equipment and real property we identified to sell. For a discussion of amounts recorded for the years ended December 31, 2015 and 2016, see Note 10—"Impairments and Other Charges" in Notes to Consolidated Financial Statements included elsewhere in this prospectus.

- (2)

- Consists primarily of state margin taxes accounted for as income taxes. The tax effect of our net operating losses has not been reflected in our results because we have recorded a full valuation allowance with regards to the realization of our deferred tax assets since 2012.

- (3)

- The holders of the convertible preferred stock are also common stockholders of the Company and collectively appoint 100% of our board of directors. Therefore, the convertible preferred stockholders can direct the Company to redeem the convertible preferred stock at any time after all of our debt has been repaid; however, we did not consider this to be probable for any of the periods presented due to the amount of debt outstanding. Therefore, we have presented the convertible preferred stock as temporary equity but have not reflected any accretion of the convertible preferred stock in this table or in our Consolidated Financial Statements. At December 31, 2016, the liquidation preference of the convertible preferred stock was estimated to be $906.1 million. See Note 7—"Convertible Preferred Stock" in Notes to Consolidated Financial Statements included elsewhere in this prospectus for more information.

- (4)

- Pro forma data gives effect to (1) the : reverse stock split, (2) the conversion of our convertible preferred stock into issued and outstanding common stock at a fixed exchange ratio of : , (3) the sale of shares of common stock to be issued by us in this offering at an initial public offering price of $ per share, the midpoint of the range set forth on the cover of this prospectus and (4) the use of proceeds therefrom, as if each of these events occurred on January 1, 2016 for purposes of the statement of operations and December 31, 2016, for purposes of the balance sheet. For additional information regarding the conversion of our convertible preferred stock, see "Description of Capital Stock." See Note 17—"Unaudited Pro Forma Information" in Notes to Consolidated Financial Statements included elsewhere in this prospectus for discussion of these pro forma amounts.

- (5)

- Adjusted EBITDA is a non-GAAP financial measure that we define as earnings before interest; income taxes; and depreciation and amortization, as well as, the following items, if applicable: gain or loss on disposal of assets; debt extinguishment gains or losses; inventory write-downs, asset and goodwill impairments; gain on insurance recoveries; acquisition earn-out adjustments; stock-based compensation; and acquisition or disposition transaction costs. The most comparable financial measure to Adjusted EBITDA under GAAP is net income or loss. Adjusted EBITDA is used by management to evaluate the operating performance of our business for comparable periods and it is a metric used for management incentive compensation. Adjusted EBITDA should not be used by investors or others as the sole basis for formulating investment decisions, as it excludes a number of important items. We believe Adjusted EBITDA is an important indicator of operating performance because it excludes the effects of our capital structure and certain non-cash items from our operating results. Adjusted EBITDA is also commonly used by investors in the oilfield services industry to measure a company's operating performance, although our definition of Adjusted EBITDA may differ from other industry peer companies.

13

The following table reconciles our net loss to Adjusted EBITDA:

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| (In millions) | 2015 | 2016 | |||||

Net loss | $ | (1,013.2 | ) | $ | (188.5 | ) | |

Interest expense, net | 77.2 | 87.5 | |||||

Income tax benefit | (1.5 | ) | (1.6 | ) | |||

Depreciation and amortization | 272.4 | 112.6 | |||||

Loss on disposal of assets, net | 5.9 | 1.0 | |||||

Loss (gain) on extinguishment of debt, net | 0.6 | (53.7 | ) | ||||

Inventory write-down | 24.5 | — | |||||

Impairment of assets and goodwill | 572.9 | 7.0 | |||||

Gain on insurance recoveries | — | (15.1 | ) | ||||

Acquisition earn-out adjustments | (3.4 | ) | — | ||||

Stock-based compensation | 1.8 | — | |||||

| | | | | | | | |

Adjusted EBITDA(a)(b) | $ | (62.8 | ) | $ | (50.8 | ) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

- (a)

- In 2015, Adjusted EBITDA has not been adjusted to exclude the following items: employee severance costs of $13.1 million, supply commitment charges of $11.0 million, significant legal costs of $8.1 million, lease abandonment charges of $1.8 million, and profit of $2.4 million from the sale of equipment to our joint venture affiliate.

- (b)

- In 2016, Adjusted EBITDA has not been adjusted to exclude the following items: employee severance costs of $0.8 million, supply commitment charges of $2.5 million and lease abandonment charges of $2.0 million.

- (6)

- Net debt is a non-GAAP financial measure that we define as total debt less cash and cash equivalents. The most comparable financial measure to net debt under GAAP is debt. Net debt is used by management as a measure of our financial leverage. Net debt should not be used by investors or others as the sole basis in formulating investment decisions as it does not represent our actual indebtedness. Pro forma net debt is net debt adjusted as if we received the net proceeds from this offering and we redeemed $ million of our outstanding 2020 Notes as if each of these events occurred on December 31, 2016.

The following table reconciles our total debt to net debt:

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| (In millions) | 2015 | 2016 | |||||

Total debt | $ | 1,276.2 | $ | 1,188.7 | |||

Cash and cash equivalents | $ | (264.6 | ) | $ | (160.3 | ) | |

| | | | | | | | |

Net debt | $ | 1,011.6 | $ | 1,028.4 | |||

The following table reconciles our total debt to pro forma net debt:

| (In millions) | Year Ended December 31, 2016 | |||

|---|---|---|---|---|

Total debt | $ | 1,188.7 | ||

Cash and cash equivalents | $ | (160.3 | ) | |

Net proceeds from this offering | $ | |||

Repayment of 2020 Notes | $ | |||

| | | | | |

Pro forma net debt | $ | |||

- (7)

- See "Business—Our Services—Hydraulic Fracturing" for details regarding fracturing stages and the types of service agreements we use to provide hydraulic fracturing services.

14

An investment in our common stock involves risks. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this prospectus, including the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operation" and our consolidated financial statements and the related notes, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Relating to Our Business

Our business depends on domestic spending by the onshore oil and natural gas industry, which is cyclical and significantly declined in 2015 and 2016.

Our business is cyclical and depends on the willingness of our customers to make operating and capital expenditures to explore for, develop and produce oil and natural gas in the United States. The willingness of our customers to undertake these activities depends largely upon prevailing industry conditions that are influenced by numerous factors over which we have no control, such as:

- •

- prices, and expectations about future prices, for oil and natural gas;

- •

- domestic and foreign supply of, and demand for, oil and natural gas and related products;

- •

- the level of global and domestic oil and natural gas inventories;

- •

- the supply of and demand for hydraulic fracturing and other oilfield services and equipment in the United States;

- •

- the cost of exploring for, developing, producing and delivering oil and natural gas;

- •

- available pipeline, storage and other transportation capacity;

- •

- lead times associated with acquiring equipment and products and availability of qualified personnel;

- •

- the discovery rates of new oil and natural gas reserves;

- •

- federal, state and local regulation of hydraulic fracturing and other oilfield service activities, as well as E&P activities, including public pressure on governmental bodies and regulatory agencies to regulate our industry;

- •

- the availability of water resources, suitable proppant and chemicals in sufficient quantities for use in hydraulic fracturing fluids;

- •

- geopolitical developments and political instability in oil and natural gas producing countries;

- •

- actions of OPEC, its members and other state-controlled oil companies relating to oil price and production controls;

- •

- advances in exploration, development and production technologies or in technologies affecting energy consumption;

- •

- the price and availability of alternative fuels and energy sources;

- •

- weather conditions and natural disasters;

- •

- uncertainty in capital and commodities markets and the ability of oil and natural gas producers to raise equity capital and debt financing; and

- •

- U.S. federal, state and local and non-U.S. governmental regulations and taxes.

15

Volatility or weakness in oil and natural gas prices (or the perception that oil and natural gas prices will decrease or remain depressed) generally leads to decreased spending by our customers, which in turn negatively impacts drilling, completion and production activity. In particular, the demand for new or existing drilling, completion and production work is driven by available investment capital for such work. When these capital investments decline, our customers' demand for our services declines. Because these types of services can be easily "started" and "stopped," and oil and natural gas producers generally tend to be risk averse when commodity prices are low or volatile, we typically experience a more rapid decline in demand for our services compared with demand for other types of energy services. Any negative impact on the spending patterns of our customers may cause lower pricing and utilization for our services, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Oil and natural gas prices have declined significantly since 2014 and remain volatile, which has adversely affected, and may continue to adversely affect, our financial condition, results of operations and cash flows.

The demand for our services depends on the level of spending by oil and natural gas companies for drilling, completion and production activities, which are affected by short-term and long-term trends in oil and natural gas prices, including current and anticipated oil and natural gas prices. Oil and natural gas prices, as well as the level of drilling, completion and production activities, historically have been extremely volatile and are expected to continue to be highly volatile. For example, oil prices have declined significantly since 2014, with WTI crude oil spot prices declining from a monthly average of $105.79 per barrel in June 2014 to $30.32 per barrel in February 2016. The spot price per barrel as of January 31, 2017 was $52.75. In line with this sustained volatility in oil and natural gas prices, we experienced a significant decline in pressure pumping activity levels across our customer base. The volatile oil and natural gas prices adversely affected, and could continue to adversely affect, our financial condition, results of operations and cash flows.

Our customers may not be able to maintain or increase their reserve levels going forward.

In addition to the impact of future oil and natural gas prices on our financial performance over time, our ability to grow future revenues and increase profitability will depend largely upon our customers' ability to find, develop or acquire additional shale oil and natural gas reserves that are economically recoverable to replace the reserves they produce. Hydraulic fractured wells are generally more short-lived than conventional wells. Our customers own or have access to a finite amount of shale oil and natural gas reserves in the United States that will be depleted over time. The production rate from shale oil and natural gas properties generally declines as reserves are depleted, while related per-unit production costs generally increase as a result of decreasing reservoir pressures and other factors. If our customers are unable to replace the shale oil reserves they own or have access to at the rate they produce such reserves, their proved reserves and production will decline over time. Reductions in production levels by our customers over time may reduce the future demand for our services and adversely affect our business, financial condition, results of operations and cash flows.

Our business may be adversely affected by a deterioration in general economic conditions or a weakening of the broader energy industry.

A prolonged economic slowdown or recession in the United States, adverse events relating to the energy industry or regional, national and global economic conditions and factors, particularly a further slowdown in the exploration and production industry, could negatively impact our operations and therefore adversely affect our results. The risks associated with our business are more acute during periods of economic slowdown or recession because such periods may be accompanied by decreased exploration and development spending by our customers, decreased demand for oil and natural gas and decreased prices for oil and natural gas.

16

Competition in our industry has intensified during the industry downturn, and we may not be able to provide services that meet the specific needs of our customers at competitive prices.

The markets in which we operate are generally highly competitive and have relatively few barriers to entry. The principal competitive factors in our markets are price, service quality, safety, and in some cases, breadth of products. We compete with large national and multi-national companies that have longer operating histories, greater financial, technical and other resources and greater name recognition than we do. Several of our competitors provide a broader array of services and have a stronger presence in more geographic markets. In addition, we compete with several smaller companies capable of competing effectively on a regional or local basis. Our competitors may be able to respond more quickly to new or emerging technologies and services and changes in customer requirements. Some contracts are awarded on a bid basis, which further increases competition based on price. Pricing is often the primary factor in determining which qualified contractor is awarded a job. The competitive environment may be further intensified by mergers and acquisitions among oil and natural gas companies or other events that have the effect of reducing the number of available customers. As a result of competition, we have had to lower the prices for our services and may lose market share or be unable to maintain or increase prices for our present services or to acquire additional business opportunities, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Pressure on pricing for our services resulting from the industry downturn has impacted, and may continue to impact, our ability to maintain utilization and pricing for our services or implement price increases. During periods of declining pricing for our services, we may not be able to reduce our costs accordingly, which could further adversely affect our results of operations. Also, we may not be able to successfully increase prices without adversely affecting our utilization levels. The inability to maintain our utilization and pricing levels, or to increase our prices as costs increase, could have a material adverse effect on our business, financial condition and results of operations.

In addition, some E&P companies have begun performing hydraulic fracturing on their wells using their own equipment and personnel. Any increase in the development and utilization of in-house fracturing capabilities by our customers could decrease the demand for our services and have a material adverse impact on our business.

We are dependent on a few customers operating in a single industry. The loss of one or more significant customers could adversely affect our financial condition and results of operations.

Our customers are engaged in the E&P business in the United States. Historically, we have been dependent upon a few customers for a significant portion of our revenues. For the year ended December 31, 2016, our four largest customers generated approximately 52% of our total revenue. In fiscal years 2015 and 2014, our four largest customers generated approximately 44% and 45%, respectively, of our total revenue. For a discussion of our customers that make up 10% or more of our revenues, see "Business—Customers."

Our business, financial condition and results of operations could be materially adversely affected if one or more of our significant customers ceases to engage us for our services on favorable terms or at all or fails to pay or delays in paying us significant amounts of our outstanding receivables. Although we do have contracts for multiple projects with certain of our customers, most of our services are provided on a project-by-project basis.

Additionally, the E&P industry is characterized by frequent consolidation activity. Changes in ownership of our customers may result in the loss of, or reduction in, business from those customers, which could materially and adversely affect our financial condition.

17

We extend credit to our customers. The decline in oil and natural gas prices presents a risk of nonpayment of our accounts receivable.

We extend credit to all our customers. Most, if not all, of our customers are experiencing the same financial and operational challenges that we are experiencing as a result of the decline in oil and natural gas prices. Many of our customers have experienced financial difficulties and some have filed for bankruptcy protection. As a result, we may have difficulty collecting outstanding accounts receivable from, or experience longer collection cycles with, some of our customers, which could have an adverse effect on our financial condition and cash flows.

Decreased demand for proppant has adversely affected, and could continue to adversely affect, our commitments under supply agreements.

We have purchase commitments with certain vendors to supply the proppant used in our operations. Some of these agreements are take-or-pay arrangements with minimum purchase obligations. During the industry downturn, our minimum contractual commitments have exceeded the amount of proppant needed in our operations. As a result, we made minimum payments for proppant that we were unable to use. Furthermore, some of our customers have bought and in the future may buy proppant directly from vendors, reducing our need for proppant. If market conditions do not improve, or our customers buy proppant directly from vendors, we may be required to make minimum payments in future periods, which may adversely affect our results of operations, liquidity and cash flows.

Our operations are subject to inherent risks, including operational hazards. These risks may not be fully covered under our insurance policies.

Our operations are subject to hazards inherent in the oil and natural gas industry, such as accidents, blowouts, explosions, craters, fires and oil spills. These hazards may lead to property damage, personal injury, death or the discharge of hazardous materials into the environment. The occurrence of a significant event or adverse claim in excess of the insurance coverage that we maintain or that is not covered by insurance could have a material adverse effect on our financial condition and results of operations.

As is customary in our industry, our service contracts generally provide that we will indemnify and hold harmless our customers from any claims arising from personal injury or death of our employees, damage to or loss of our equipment, and pollution emanating from our equipment and services. Similarly, our customers agree to indemnify and hold us harmless from any claims arising from personal injury or death of their employees, damage to or loss of their equipment, and pollution caused from their equipment or the well reservoir. Our indemnification arrangements may not protect us in every case. In addition, our indemnification rights may not fully protect us if the customer is insolvent or becomes bankrupt, does not maintain adequate insurance or otherwise does not possess sufficient resources to indemnify us. Furthermore, our indemnification rights may be held unenforceable in some jurisdictions. Our inability to fully realize the benefits of our contractual indemnification protections could result in significant liabilities and could adversely affect our financial condition, results of operations and cash flows.

We maintain customary insurance coverage against these types of hazards. We are self-insured up to retention limits with regard to, among other things, workers' compensation and general liability. We maintain accruals in our consolidated balance sheets related to self-insurance retentions by using third-party data and historical claims history. The occurrence of an event not fully insured against, or the failure of an insurer to meet its insurance obligations, could result in substantial losses. In addition, we may not be able to maintain adequate insurance in the future at rates we consider reasonable. Insurance may not be available to cover any or all of the risks to which we are subject, or, even if available, it may be inadequate.

18

We are subject to laws and regulations regarding issues of health, safety, and protection of the environment, under which we may become liable for penalties, damages, or costs of remediation.

Our operations are subject to stringent laws and regulations relating to protection of natural resources, clean air, drinking water, wetlands, endangered species, greenhouse gases, nonattainment areas, the environment, health and safety, chemical use and storage, waste management, and transportation of hazardous and non-hazardous materials. These laws and regulations subject us to risks of environmental liability, including leakage from an operator's casing during our operations or accidental spills onto or into surface or subsurface soils, surface water, or groundwater.