As filed with the Securities and Exchange Commission on June 2, 2015

Registration No. 333-204175

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RESAAS SERVICES INC.

(Exact name of registrant as specified in its charter)

British Columbia, Canada | | 2834 | | Not Applicable |

(Province or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer

Identification No.) |

#303 – 55 Water Street

Vancouver, British Columbia V6B 1A1

Canada

(Address and telephone number of registrant’s principal executive offices)

Cory Brandolini

Chief Executive Officer

RESAAS Services Inc.

#303 – 55 Water Street

Vancouver, British Columbia V6B 1A1

Canada

(604) 558-2929

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Sanford J. Hillsberg, Esq.

Dietrick L. Miller, Esq.

TroyGould PC

1801 Century Park East, 16th Floor

Los Angeles, California 90067

(310) 553-4441 | | Penny Green, Esq.

Chris Little, Esq.

Bacchus Law Corporation

Suite 1820 Cathedral Place

925 West Georgia Street

Vancouver, British Columbia V6C3L2

Canada

(604) 632-1700 |

Approximate date of commencement of proposed sale to the public:From time to time after the effective date in the United States of this Registration Statement.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

A. | | ¨ | | | | upon filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

B. | | S | | | | at some future date (check the appropriate box below): |

| | | | | | |

| | 1. | | ¨ | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

| | | | | | |

| | 2. | | ¨ | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| | | | | | |

| | 3. | | S | | pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| | | | | | |

| | 4. | | ¨ | | after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box.S

CALCULATION OF REGISTRATION FEE

Title of each class ofsecurities to be registered(3) | | Amountto beregistered(1)(2) | | Proposedmaximumaggregateoffering price(2) | | Amount ofregistration fee(2) |

Common Shares, no par value | | | | | | | — | |

Warrants | | | | | | | — | |

Units | | | | | | | — | |

Total | | | | US$50,000,000 | | US $ | 5,810 | (4) |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registration statement shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This short form base shelf prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any State of the United States in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State.

This short form base shelf prospectus has been filed under legislation in the provinces of British Columbia, Alberta and Ontario that permits certain information about these securities to be determined after this short form base shelf prospectus has become final and that permits the omission from this short form base shelf prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus and each document incorporated by reference herein constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated by reference therein and herein may be obtained on request, without charge, from the Chief Financial Officer of RESAAS Services Inc. at its principal executive offices located at #303 – 55 Water Street, Vancouver, British Columbia V6B 1A1, Canada and are also available electronically at www.sedar.com.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

SHORT FORM BASE SHELF PROSPECTUS

RESAAS Services Inc.

US$50,000,000

Common Shares

Warrants

Units

RESAAS Services Inc. (the “Company”, “we”, “our”, “us” or “RESAAS”) may offer for sale, from time to time, in one or more offerings and on terms that we will determine at the time of each offering, common shares of the Company (the “Common Shares”), and/or warrants to purchase Common Shares (“Warrants”) and/or units comprised of one or more securities described herein in any combination (“Units” and, together with Common Shares and Warrants, “Securities”) up to an aggregate initial offering price of US$50,000,000 during the 25-month period that this short form base shelf prospectus (this “Prospectus”), including any amendments hereto, remains effective. The specific variable terms of any offering of the Securities will be set forth in one or more supplements to this Prospectus (each, a “Prospectus Supplement”), including the number of Securities offered, the currency (which may be United States dollars or any other currency), the issue price and any other specific terms. Where required by statute, regulation or policy, and where the Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to the Securities will be included in the applicable Prospectus Supplement. See “Plan of Distribution” in this Prospectus.

Investing in the Securities involves certain risks. The risks outlined in this Prospectus and in the documents incorporated by reference herein should be carefully reviewed and considered by prospective investors. See “Risk Factors” in this Prospectus.

Any offering under a Prospectus Supplement will be made by a Canadian issuer that is permitted, under a multi-jurisdictional disclosure system adopted by the United States and Canada, to prepare this Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. The audited consolidated annual financial statements incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. Those financial statements are subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of United States companies.

Owning our Securities may subject you to tax consequences both in Canada and the United States. Such tax consequences, including for investors who are resident in, or citizens of, the United States and Canada, are not described in this Prospectus and may not be fully described in any applicable Prospectus Supplement. You should read the tax discussion in any Prospectus Supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated under the laws of the Province of British Columbia, that some or all of its officers and directors are residents of a foreign country, that some of the experts named in the registration statement may be residents of a foreign country, and that all or a substantial portion of the assets of the Company and said persons are located outside of the United States. See “Enforceability of Certain Civil Liabilities” in this Prospectus.

All information that is permitted under applicable securities legislation to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

This Prospectus constitutes a public offering of Securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell the Securities. We may sell the Securities to or through underwriters or dealers purchasing as principals and may also sell the Securities to purchasers directly or through agents. The Prospectus Supplement relating to a particular series or issue of Securities will identify each underwriter, dealer or agent engaged by us, as the case may be, in connection with the offering and sale of that series or issue, and will set forth the terms of the offering of such series or issue, the method of distribution of such series or issue, including, to the extent applicable, the proceeds to the Company and any fees, discounts or any other compensation payable to underwriters, dealers or agents and any other material terms of the plan of distribution such as an intention to stabilize the market or otherwise maintain the market price of the Securities offered. See “Plan of Distribution” in this Prospectus.

In connection with any offering of the Securities (unless otherwise specified in a Prospectus Supplement), the underwriters or agents may, subject to applicable law, over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at levels other than that which might otherwise exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution” in this Prospectus.

Our Common Shares are listed on the Canadian Securities Exchange (the “CSE”) under the symbol “RSS” and quoted on the OTCQX Marketplace under the symbol “RSASF.” We have applied to list our Common Shares on The NASDAQ Capital Market (“NASDAQ”) under the symbol “RSAS.” Listing on The NASDAQ Capital Market will be subject to us fulfilling all of the applicable NASDAQ listing requirements. On June 1, 2015 the most recent day that our Common Shares traded, the closing price of our Common Shares on the CSE and the OTCQX Marketplace was Cnd$4.00 and US$3.00, respectively, per share.

There is no market through which our Securities, other than the Common Shares, may be sold and purchasers may not be able to resell the Securities, other than Common Shares, purchased under this Prospectus and any Prospectus Supplement. This may affect the pricing of such Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities, and the extent of issuer regulation. See “Risk Factors” in this Prospectus.

Our principal executive offices are located at #303 – 55 Water Street, Vancouver, British Columbia V6B 1A1, Canada. Our telephone number is (604) 558-2929. We maintain a website atwww.resaas.com; however, the information on our website is not incorporated by reference into this Prospectus, and is not part of this Prospectus.

TABLE OF CONTENTS

GENERAL

You should only rely on the information contained or incorporated by reference in this Prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this Prospectus or information incorporated by reference in this Prospectus is accurate only as of the date of this Prospectus or the incorporated document, as the case may be. Our business, operating results, financial condition and prospects may have changed since that date. The Company does not undertake to update the information contained or incorporated by reference herein, except as required by law.

In this Prospectus, unless otherwise specified or the context otherwise requires, reference to “we”, “us”, “our”, “its”, the “Company” or “RESAAS” means RESAAS Services Inc. and its subsidiaries. “RESAAS,” “The Real Estate Network,” the RESAAS logo, reblasts and certain other marks are our registered or unregistered trademarks in Canada or the United States.

This Prospectus contains additional trade names, trademarks and service marks of other companies, and such trade names, trademarks and service marks are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

Unless otherwise indicated, all financial information included in this Prospectus and documents incorporated by reference in this Prospectus has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, which are also generally accepted accounting principles for publicly accountable enterprises in Canada.

References to “this Prospectus” include the documents incorporated by reference herein as well as any Prospectus Supplement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus and the documents incorporated by reference herein and therein contain forward-looking statements. All statements other than statements of historical facts contained in this Prospectus, including statements regarding our future results of operations and financial position, business strategy, prospective products, product approvals, research and development costs, timing and likelihood of success, plans and objectives of management for future operations, and future results of current and anticipated products are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Prospectus are only predictions, not guarantees or assurances. We have based the forward-looking statements largely on our current expectations, estimates, assumptions, and projections about future events and financial trends that we believe, as of the date of such statements, may affect our business, financial condition and results of operations. Such expectations, estimates, assumptions, and projections, many of which are beyond our control, include, but are not limited to: the effectiveness and efficiency of our advertising and promotional activities; volatility in the market price of our Common Shares; the continued popularity of current social media models; our ability to retain and attract users of our services; our intention not to pay dividends; claims, lawsuits and other legal proceedings and challenges; competitive conditions in the real estate industry; and our prioritization of product innovation and user experience over short-term operating results.

The forward-looking statements are made only as of the date of this Prospectus and are subject to a number of risks, uncertainties and assumptions described under the sections in this Prospectus entitled “Risk Factors,” “Management’s Discussion and Analysis,” and elsewhere in this Prospectus. Factors that could cause our actual results to differ from the forward-looking statements include, but are not limited to:

• our history of losses from operations;

• our ability to generate sufficient revenues from the commercialization of our platform to fund our operations and become profitable;

i

• our ability to build a user base for our services and adequately develop our technology;

• the pace and degree of technological change;

• our ability to obtain the additional financing that we require to meet our long-term needs;

• our dependence on key personnel, including our executive officers;

• our ability to effectively manage our growth;

• declines in or changes to the real estate industry; and

• our ability to protect our intellectual property and other proprietary information technology.

Because forward-looking statements are subject to inherent risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in a dynamic industry and economy. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties that we may face. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

INDUSTRY DATA

Unless otherwise indicated, information contained in this Prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES

We are a corporation incorporated and existing under the laws of the Province of British Columbia, Canada. All or a substantial portion of our assets are located outside of the United States and some or all of our officers and directors are residents of Canada or otherwise reside outside of the United States, and all or a substantial portion of their assets are located outside of the United States. The Company has appointed an agent for service of process in the United States, but it may be difficult for United States investors to effect service of process within the United States upon those officers or directors who are not residents of the United States, or to realize in the United States upon judgments of courts of the United States predicated upon the Company’s civil liability and the civil liability of such officers or directors under United States federal securities laws or the securities or “blue sky” laws of any state within the United States.

The Company has been advised by its Canadian counsel, Bacchus Law Corporation, that, subject to certain limitations, a judgment of a United States court predicated solely upon civil liability under United States federal securities laws may be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that would be recognized by a Canadian court for the same purposes. The Company has also been advised by Bacchus Law Corporation, however, that there is substantial doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated solely upon United States federal securities laws.

We have filed with the Securities and Exchange Commission (the “SEC”), in relation to the registration statement on Form F-10 relating to the Prospectus, an appointment of agent for service of process on Form F-X. Under the Form F-X, we have appointed J. Chris Morgando as our agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC and any civil suit or action brought against or involving us in a United States court arising out of, related to or concerning an offering of securities.

ii

CURRENCY PRESENTATION

In this Prospectus and documents incorporated by reference in this Prospectus, unless otherwise specified or the context otherwise requires, all references to “$”, “Cnd$” and “dollars” are to Canadian dollars unless otherwise noted. United States (US) dollars are denoted as “US$”. The following table sets forth, for each of the periods indicated, the period end noon exchange rate, the average noon exchange rate and the high and low noon exchange rates of one United States dollar in exchange for Canadian dollars as reported by the Bank of Canada.

| | |

| | | | | | |

| | $ | | $ | | $ |

High | | 1.1643 | | 1.0697 | | 1.0418 |

Low | | 1.0614 | | 0.9839 | | 0.9710 |

Average | | 1.1045 | | 1.0299 | | 0.9996 |

Period End | | 1.1601 | | 1.0636 | | 0.9949 |

The noon exchange rate on May 20, 2015, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US$1.00 equals Cnd$1.2212.

Investors should be aware that foreign exchange rate fluctuations are likely to occur from time to time and that the Company does not make any representation with respect to future currency values. Investors should consult their own advisors with respect to the potential risk of currency fluctuations.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with the securities commission or similar regulatory authority in each of the provinces of Canada in which the Company is a reporting issuer. Copies of the documents incorporated herein by reference may be obtained on request without charge from RESAAS at #303 – 55 Water Street, Vancouver, British Columbia V6B 1A1, Canada, telephone number (604) 558-2929, and are also available electronically at www.sedar.com.

The following documents of RESAAS which have been filed with the securities commission or similar regulatory authority in each of the provinces of Canada in which the Company is a reporting issuer, are specifically incorporated by reference into and form an integral part of this Prospectus:

(a) the management proxy circular dated May 22, 2014 relating to the annual meeting of shareholders of the Company held on June 30, 2014;

(b) the annual information form dated May 11, 2015 for the year ended December 31, 2014;

(c) the audited consolidated financial statements as at and for the years ended December 31, 2014 and December 31, 2013, together with the notes thereto and the report of the auditor thereon (the “Annual Financial Statements”);

(d) the amended and restated management’s discussion and analysis of financial condition and results of operations in respect of the Annual Financial Statements;

(e) the audited consolidated financial statements as at and for the years ended December 31, 2013 and December 31, 2012, together with the notes thereto and the report of the auditor thereon;

(f) the unaudited interim consolidated financial statement for the three month periods ended March 31, 2015 and 2014 (the “Quarterly Financial Statements”); and

(g) the management’s discussion and analysis of financial condition and results of operations in respect of the Quarterly Financial Statements.

Any documents of the type required by National Instrument 44-101Short Form Prospectus Distributions to be incorporated by reference in a short form prospectus, including any material change reports (excluding material change reports filed on a confidential basis), interim financial statements, annual financial statements and the auditor’s report thereon, management’s

iii

discussion and analysis of financial condition and results of operations, information circulars, annual information forms and business acquisition reports filed by us with the securities commission or similar regulatory authority in each of the provinces of Canada in which we are a reporting issuer subsequent to the date of this Prospectus and prior to the termination of an offering are deemed to be incorporated by reference in this Prospectus. In addition, any similar documents filed by us with the SEC in our periodic reports on Form 6-K or annual reports on Form 40-F, registration statements under the United States Securities Act of 1933, as amended (the “Securities Act”) and any other documents filed with or furnished to the SEC pursuant to Section 13(a), 13(c) or 15(d) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), in each case after the date of this Prospectus and prior to the termination of the offering, shall be deemed to be incorporated by reference into this Prospectus and the registration statement of which this Prospectus forms a part if and to the extent expressly provided in such reports. To the extent that any document or information incorporated by reference into this Prospectus is included in a report that is filed with or furnished to the SEC on Form 40-F, 20-F, 10-K, 10-Q, 8-K or 6-K (or any respective successor form), such document or information shall also be deemed to be incorporated by reference as an exhibit to the registration statement of which this Prospectus forms a part.

Any statement contained in this Prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such prior statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement is not to be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been filed with the SEC as part of the registration statement of which this Prospectus forms a part: (i) the documents listed in the second paragraph under “Documents Incorporated by Reference”; (ii) the consent of Saturna Group Chartered Accountants LLP, Chartered Accountants; (iii) the consent of KPMG LLP; (iv) the consent of Bacchus Law Corporation; and (v) powers of attorney from directors and officers of the Company.

iv

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this Prospectus. This summary does not contain all of the information you should consider before investing in our Securities. You should read this entire Prospectus carefully, especially the section entitled “Risk Factors” beginning on page 7 before making an investment decision.

As used in this Prospectus, references to “we,” “us,” “our,” the “Company” or “RESAAS” refer to RESAAS Services Inc. and its subsidiaries.

OVERVIEW

Our Company

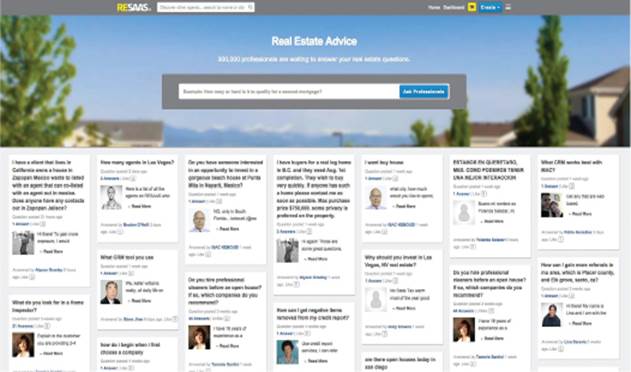

RESAAS has developed a cloud-based social business software platform for the real estate services industry.

We have created a suite of tools which integrate with the platform, including an enterprise social network, a global referral network, lead generation engine, listing management, client engagement modules, customer relationship management (CRM) tools, analytics, file sharing and advertising engine. These tools and functionality are made available exclusively to owners of real estate brokerage firms and brokers, licensed real estate agents, and Realtors (real estate professionals who are members of the National Association of Realtors) and are designed to increase user productivity through better communication and collaboration among users.

Our mission is to enable agents, Realtors and brokers to communicate effectively, connect instantly and engage meaningfully with one another through a platform built for their benefit. Our platform enables instant discussion and debate, both on a local and global scale, facilitating easier and richer communication within the real estate industry. We commenced operations of our website in February 2013 and have had nominal revenue from advertising. We began subscription revenue-generating activities for the RESAAS platform in January 2015. Since commencing operations, we have experienced substantial growth in the number of registered professional users of our platform.

• We had 337,080 registered professional users, which includes agents, brokers and Realtors, as of March 31, 2015, an increase of 60% as compared to 200,878 registered professional users as of March 31, 2014.

• We have a growing international professional user base. As of March 31, 2015, we had 285,254 professional users in North America and 51,826 professional users internationally.

• Our platform generated 65,911 pieces of unique real estate content during the three months ended March 31, 2015.

• We began offering premium service subscriptions in January 2015 and as of March 31, 2015, we had over 3,200 monthly paying subscribers for our premium services.

The RESAAS platform is designed specifically for real estate agents, Realtors and brokers to instantly connect with other industry professionals and potential business leads in a more modern and socially engaging environment. This professional real estate services industry platform, which is accessible through our website, allows professional users to set up public-facing profiles, connect with other registered professionals both inside and outside of their firm, add them to their network, and post “real estate broadcasts,” known as reblasts, to their network as well as to their profiles on other major social networking sites such as Facebook, Twitter and LinkedIn, so as to answer questions and announce new listings, open houses, price changes, sale notifications, market reports and new blog articles.

The RESAAS platform is also accessible via our smart phone and tablet apps (for iPhone and Android) allowing real estate professionals to stay up-to-date with their content on the go.

Our platform is designed with a focus on search engine optimization (SEO) by ensuring that changes to our users’ profile pages are submitted and exposed to major search engines in real time. Users also are able to synchronize their account with Facebook personal pages, Facebook Business pages, Twitter and LinkedIn, allowing each post on RESAAS to automatically be sent out to those networks as well should the user choose to do so.

We also offer professional real estate agents, Realtors or brokers who have registered on our website and have received a profile page the ability to actively market themselves to the public and the ability to create, manage and track the performance of

1

their own highly-targeted social advertisements using our internally-built advertisement engine. Professional users on RESAAS are able to upload their listings, announce open houses and successful sales, create referrals, and generate leads by interacting with professionals in other markets.

With our robust features, RESAAS also is an all-in-one social media platform for real estate professionals that provides them with control over their professional social media experience. Using online technology through our platform can provide faster, easier and more effective industry-specific communication between participants in the real estate industry.

Industry Background and Our Market Opportunity

Industry

Market Opportunities

The residential real estate industry, one of the largest sectors of the U.S. economy, is undergoing a profound transformation. Technology is changing the way that consumers search for homes and the way in which real estate professionals attract clients and build their businesses. As a result, the real estate market is an industry that has become heavily Internet-based. Interested home buyers are able to search and view property listings, photographs and other details online locally as well as in other cities or even internationally. Real estate professionals also have expanded their Internet presence to interface with their clients and to build social networks and referral opportunities with their peers both locally and nationally. Prior to the establishment of RESAAS, there has not been an all-inclusive dedicated platform commercially developed for the purpose of connecting real estate industry professionals.

In addition, as the U.S. housing market continues to recover from its recent unprecedented downturn, real estate professionals are seeking more effective ways to market themselves and achieve a greater return on their marketing investment. These trends present significant opportunities to capitalize on shifts in behavior. Sales of approximately 5.1 million existing and 429,000 new homes in the United States in 2013 had an aggregate transaction value of approximately $1.39 trillion, according to data published in 2014 by the U.S. Census Bureau and the National Association of Realtors. We believe that we are well positioned to service this expansive real estate market with our platform that caters to real estate professionals, helping them connect with other professionals both inside and outside their respective markets.

Fragmented, Local and Complex Market

The market for residential real estate transactions and home-related services is highly fragmented, local and complex. Brokers, Realtors and licensed real estate agents work through a vast network of local, regional and national associations. In North America there are more than 1,300 regional associations, state and provincial associations and national real estate associations, and many of such associations operate their own respective multiple listing services (MLS). Real estate agents generally operate in local markets as independent contractors with different experiences and skills and often need to provide referrals for listings outside of their local market. These conditions create challenges for consumers and real estate professionals alike. Consumers are challenged to find real estate professionals who fit their individual needs and real estate professionals may have limited ability to generate referral sources from outside their immediate areas. Historically, consumers have had minimal access to real estate agents outside of their local markets. The relatively recent consumer access to Internet listings and real estate data has prompted real estate professionals to seek new ways to efficiently advertise their services and identify new clients, and to measure the effectiveness of their marketing efforts. This new-found connectivity has also increased the opportunity for a platform such as RESAAS to assist real estate professionals to seek and give referrals to other professionals operating outside of their respective markets.

Competitive Advantage

We consider our competitive advantage to be our all-in-one platform, which is an integrated technology platform targeted at real estate industry professionals, providing a number of services in one online location to all industry participants. To our knowledge, there is currently no other competitor offering a comparable integrated solution to the real estate industry. We also believe that our integrated service will appeal to real estate industry professionals by allowing them to be more efficient and effective in branding their services, creating and managing their property listings remotely, and communicating with their clients.

2

Our Platform

The main components of our platform, which are accessible on the RESAAS website or from a smartphone or tablet using our apps, are:

• RESAAS Social Network: is a professional social networking platform, which allows real estate industry professionals to set up profile pages, connect with other registered professionals and add them to their network on RESAAS. They post “real estate broadcasts,” known as reblasts, to their own network on RESAAS as well as to their networks on major social networking sites such as Facebook, Twitter and LinkedIn, to announce new listings, open houses, price changes, successful sales, etc.

• RESAAS Referral Network: is a solution provided to brokerages, franchises, associations and other real estate organizations for the purpose of enhancing referrals internally. This can be either a white-labeled, custom branded private system, or kept open to feed off the entire RESAAS user base.

• RESAAS Real-time Notifications: allows premium tier users to receive alerts in real-time to notify them when a new referral is added that matches their location or the location of one of their active listings.

• RESAAS Notifications: allows real estate agents, Realtors and brokers to receive notifications of new activity performed on the RESAAS platform, such as when another user on the platform sends a connection request, makes a comment on their reblast, or makes a comment on a reblast they have also commented on.

• RESAAS ShareCRM: allows real estate professionals to easily stay top-of-mind with prospective and past clients alike, by sharing real estate content directly from the RESAAS platform, and allowing professionals to capture feedback and trends from their client base.

• RESAAS ShareFile: allows professionals to upload, store, browse, search, share and download files securely inside the RESAAS platform, with support for multiple language versions of files.

• RESAAS Analytics: allows professionals to track activity and see exactly who has viewed their profile or their individual listings. This makes capturing interest and leads easier.

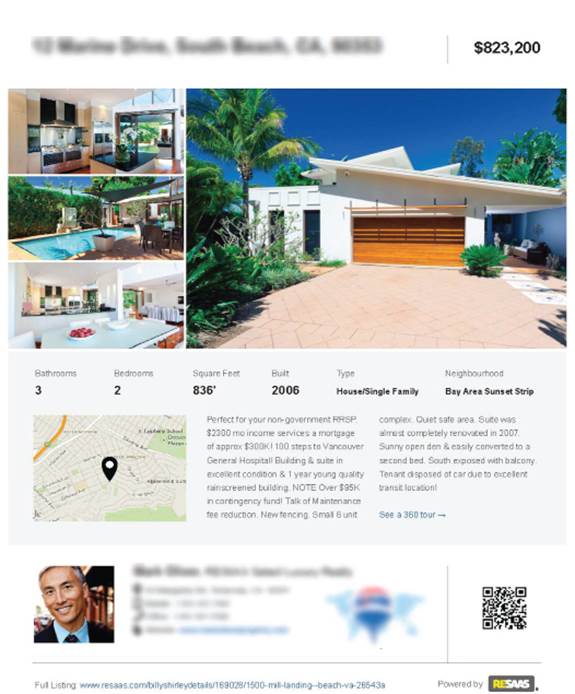

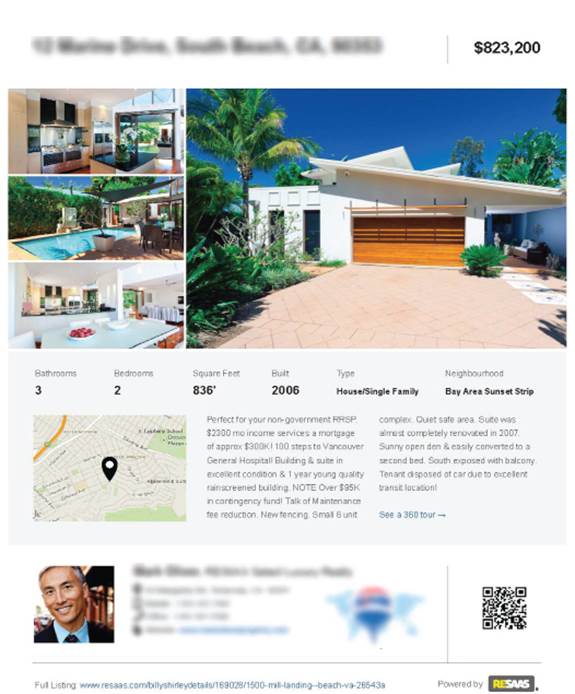

• RESAAS Listing Pages: allows professionals to quickly and easily create marketable listings for the properties they manage. They can upload an unlimited amount of high-quality photos for each listing, as well as attach listing videos (via YouTube and Vimeo), and share them via Facebook, Twitter, LinkedIn and Pinterest. Both professionals and home shoppers who view the listing are able to message the agent directly.

• RESAAS Agent Discovery: allows real estate professionals to discover other real estate professionals either by geographical location, or franchise, brokerage or association membership. Upon search and selection, each agent’s profile page can be viewed, showing a digital biography of the agent’s real estate knowledge and activity on the RESAAS platform.

• RESAAS Dashboard: provides professionals with a secure area to manage their RESAAS profile page and access various services and components of the platform, including property listing pages, connections and contacts, reblasts, and the ability to sync a user’s RESAAS account to other social networks, such as Facebook, Twitter and LinkedIn.

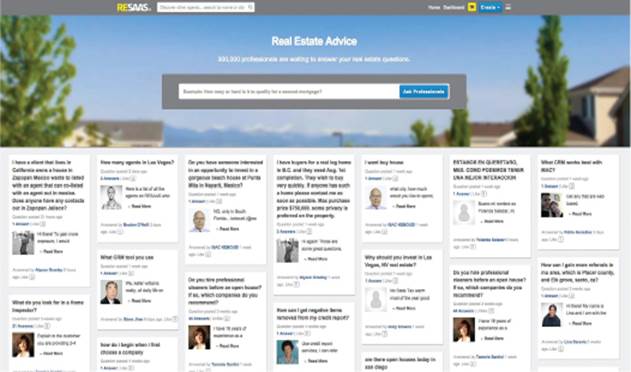

• RESAAS Learn: allows professionals to ask topical questions of other real estate professionals in real time. This is a lead-generation tool that allows professionals to display their knowledge and grow their referral network.

• RESAAS API: allows authorized third parties and select partners to connect to RESAAS, either by providing data to our platform, or extracting data from it.

• AdSAAS: is a proprietary advertisement engine hosted within the platform that allows businesses and services in the real estate industry to reach a highly targeted network of real estate professionals on RESAAS by creating online advertisements with customized design, positioning, geo-targeting and budget, as well as in-depth results and analytics. AdSAAS users have the option to create in-feed advertisements, which professionals can then engage with comments, likes and clicks, or advertisements that appear within the right-side column on the RESAAS website.

3

Value for Real Estate Professionals

Our goal is to empower real estate industry professionals by providing an integrated all-in-one real estate services industry platform, which we believe will significantly impact the business practices of real estate industry professionals in the following ways:

• Connect with Fellow Professionals. The platform provides real estate industry professionals with the ability to connect instantly with the people they do business with by utilizing current online methods of social networking.

• Generate Referrals. Professional real estate agents, Realtors and brokers have the ability to create personalized profile pages to market their services as a real estate professional to other users in different markets.

• Stay Current. Real estate professional users have the ability to view new happenings on the RESAAS platform, such as active listings and price drops, new reblasts activity and other information about listings of interest to their clients, all in real-time.

• Manage Property Listings. Real estate professional users have the ability to add new property listings to our website quickly, with a listing video and an unlimited amount of high-quality photos, and to update their existing listings at any time, which they can do remotely from a mobile or tablet device.

• Brand Marketing. Every professional user on our platform receives a search engine optimized profile page, which is public-facing and can be viewed by both prospective clients and other real estate agents using their unique RESAAS URL. The profile page allows users to advertise their brand and their business in a socially engaging manner to a wide audience online.

• Social Media Synchronization. Real estate professionals have the ability to synchronize their RESAAS account to other social media networks (e.g. Facebook, Twitter and LinkedIn). This enables every reblast they post on RESAAS to automatically be sent out to their other social network accounts as well, dramatically increasing their online social presence.

• Have an Office on the Go. Through our smart phone apps and iPad and tablet-friendly website, professional real estate agents, Realtors and brokers have access to a remote office, allowing them to access the dashboard that includes a number of tools such as a contact list feature, the ability to create and update property listings, answer questions, send out reblasts and message other professionals via the RESAAS platform.

• Enhance Brokerage Offerings. By providing our agent networking system to select partners on a private and white-labeled basis, we allow brokerages to provide their agents with simple tools to enhance internal communication and awareness, thereby allowing their agents to achieve more and increase real estate transactions in which both sides of the deal are under the roof of a single brokerage.

Value for Advertisers

We offer advertisers who are marketing products and services to real estate industry participants the unique combination of an industry-specific target audience and reach:

• Target Audience. Advertisers can offer products and services to our registered real estate agents, Realtors and brokers, as well as other real estate industry participants registered on the RESAAS platform. Examples of such products and services that could be advertised are: home staging, mortgage loans, appraisals and photography. These advertisements will appear either in-feed, within the right-side column of the website or as a reblast. Advertisements will never appear on a user’s public profile page.

• Reach. We currently have initial penetration in major cities in Canada and the United States. We plan to grow our business and platform in a number of metropolitan centers across North America and Europe, which will eventually allow our advertisers to reach a wide audience with a single advertising purchase.

• Sell. Through the RESAAS marketplace, top businesses that service the real estate industry can sell their product or service for an exclusive, discounted price offered to our professional users. Only professional users are given access to these exclusive deals.

4

Revenue Generating Services

In January 2015, we began offering premium subscription services to our professional user base. Prior to 2015, we generated nominal revenue from the sale of advertising. While we continue to look for additional streams of revenue and advertising partners, we expect that our revenue generation will primarily come from conversion of our user base to paid premium service subscriptions.

Premium Services

Premium services revenue is generated through the sale of subscription-based services. We offer three premium service packages: RESAAS Premium, Broker Premium and Enterprise. Each package provides a suite of exclusive business-generating tools, which are accessible to professional users through a subscription-based model, with both monthly and annual payment options available. In combination, these exclusive tools help such users target business-to-business, business-to-consumer, and consumer-to-business revenue sources.

Advertising Revenues

Advertising revenue is generated through AdSAAS, our proprietary advertisement engine hosted within the RESAAS platform, which allows businesses and services in the real estate industry to reach a highly targeted network of professional real estate agents, brokers and Realtors. AdSAAS users are able to create online advertisements with customized design, positioning, geo-targeting and budget, as well as in-depth results and analytics. Advertisements can appear either in-feed, within the right-side column of the website or as a reblast.

Our Growth Strategy

Over the next 12 months, we plan to grow our operations and business as follows.

• Grow and Commercialize the RESAAS Platform. We plan to continue with the commercialization phase of our platform by offering premium services to real estate agents and brokerages and the conversion of our users to paying premium users. By analyzing existing user data we intend to further improve our platform with enhancements to increase user retention. Additionally, we intend to offer enterprise-focused features to the wider audience of general real estate agents who independently use our platform.

• Marketing. We plan to continue implementing our complete integrated marketing plan to enhance awareness of the RESAAS brand and drive new professionals to the site within our target market, particularly in North America. Our marketing plan is to increase awareness across the services side of the real estate industry, including but not limited to press coverage, digital marketing, email marketing, major trade show sponsorship, public speaking opportunities, strategic alliances, ambassador awareness programs, increased community outreach, coaching endorsement and general above-the-line marketing.

• Staffing. We intend to hire additional staff to join our engineering, marketing, sales and customer service departments as well as to hire industry veterans to bolster our immediate outreach into specific sectors of the real estate space. Additional software engineers will be brought in to expedite our speed to market in delivering new benefits and improvements to the existing product and wider platform. Our current customer support team will be expanded to cater for the influx of agents and corporate groups utilizing RESAAS.

• Internationalization and Localization. We plan to further the globalization of the platform and to cater for the increasing interest from European and South American real estate services professionals. Additionally we plan to add at least six new languages, to include Czech, Finnish, Greek, Hungarian, Indonesian and Tagalog.

• Third-party Partnerships. We plan to develop additional partnerships with third-party application developers for our platform by opening up our existing application program interface to select third-party vendors and developers to allow for rich integrations, specifically the flow of inbound content and the push of processed data outbound.

5

Risks Related to Our Business and Industry

Our ability to successfully implement our business strategy is subject to numerous risks, including our ability to obtain financing, such as by the sale of Securities under this Prospectus. These risks are more fully described in the section entitled “Risk Factors” immediately following this Prospectus summary and include, among others:

• We have a history of losses and limited revenue and may not achieve profitability in the future.

• We are dependent upon premium service subscriptions and renewals, the sale of advertising, the addition of new users and the continued growth of the market for our platform.

• If subscription renewal rates decrease, or we do not accurately predict subscription renewal rates, our future revenue and operating results may be harmed.

• If we are unable to maintain a sufficient user base or user interaction, our ability to sell advertising may be diminished thereby adversely affecting our future revenue and operating results.

• We face significant competition from both established and new companies offering Internet-based services for the real estate industry and other related applications, as well as internally developed software, which may harm our ability to add new users, retain existing users and grow our business.

• If we cannot maintain our company culture as we grow, we could lose the innovation, teamwork, passion and focus on execution that we believe contribute to our success and our business may be harmed.

• We rely on our management team and other key employees, and the loss of one or more key employees could harm our business.

• The concentration of our capital stock ownership with insiders as of May 20, 2015 is approximately 30%, and will likely limit your ability to influence corporate matters including the ability to influence the outcome of director elections and other matters requiring shareholder approval.

Corporate Information

We were formed under the Business Corporations Act (British Columbia) on June 4, 2009. Our principal executive offices are located at #303 – 55 Water Street, Vancouver, British Columbia V6B 1A1, Canada. Our telephone number is (604) 558-2929. We maintain a website at www.resaas.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our website is not a part of this Prospectus.

Implications of Being an Emerging Growth Company

As a company with less than US$1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies.

We may take advantage of available reduced reporting obligations until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act, which fifth anniversary will occur in 2020. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenue exceeds US$1.0 billion or we issue more than US$1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company.

Implications of Being a Foreign Private Issuer

Our status as a foreign private issuer also exempts us from compliance with certain laws and regulations of the SEC and certain regulations of The NASDAQ Capital Market, including the proxy rules, the short-swing profits recapture rules and certain governance requirements, such as independent director oversight of the nomination of directors and executive compensation. In addition, we will not be required to file annual, quarterly and current reports and financial statements with the SEC as frequently or as promptly as U.S. companies registered under the Exchange Act.

6

RISK FACTORS

Investing in our Securities involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this Prospectus, including our financial statements and the related notes and “Management’s Discussion and Analysis of Results of Operations and Financial Condition,” before deciding whether to invest in our Securities. The occurrence of any of the events or developments described below could harm our financial condition, results of operations, business and prospects. In such an event, the market price of our Common Shares could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may have similar adverse effects on us.

Risks Related to Our Business

We have a limited operating and revenue generation history, are not profitable and may never become profitable.

We have a limited operating history and are in the process of establishing partnerships, relationships and building brand recognition with real estate professionals and real estate service providers who have registered to use our technology. We were incorporated in June 2009, and spent the following three years in a closed beta program developing our technology. We launched our platform in February 2013 and opened access to the platform to real estate professionals from around the world. In January 2015, after a two-year period of significant user growth, we began to offer premium services to our user base for a monthly or annual fee. As a result, we have a limited history of revenue generation. We have experienced losses in the past and we may not sustain profitability in the future. Additionally, there is no guarantee that the commercialization of our platform will be successful or that our target audience of real estate professionals and real estate service providers will continue to use the platform. We anticipate that it may take several years to achieve positive cash flow from operations. There can be no assurance that there will be continued or increased demand for our products or services or that we will become profitable.

Our ability to build a user base for our services and our future operating success are heavily dependent on real estate professionals’ continued use of our Internet-based service.

Internet usage for commerce, especially by real estate agents, Realtors and other real estate industry participants that have historically relied upon other means of advertising, communicating, updating property listings or storing documents generally requires a willingness to learn and accept new ways of conducting business. In particular, individual real estate agents and Realtors who belong to a brokerage firm may have access to established document management systems, advertising channels and in-house property listing creation services and may be reluctant or slow to adopt new technologies that may result in their existing personnel and infrastructure becoming obsolete. To the extent that real estate agents, Realtors and broker firms do not consider our platform to be a useful or viable commercial medium, we may be unable to develop a revenue-generating user base. The success of our platform and our resulting ability to generate advertising revenues from ads placed within the platform feed are substantially dependent on Internet usage by users on our platform. Even if we are able to establish a user base, there can be no guarantee that professional users will be willing to use any of our subscriber fee-based services, which would also limit our revenue generating abilities.

We require significant expenditures of capital in order to expand our user base and to continue to enhance our technology and may require additional capital to pay for ongoing development costs in the future.

We may not be able to obtain additional funds that we may require. We do not presently have adequate cash from operations to meet our long-term needs under our current operating plans to grow our user base and to continue to enhance our platform. If we are not able to obtain the necessary additional financing through an offering or otherwise, we may be forced to reduce, delay or cancel our planned commercial activities, or curtail or cease our operations. We may not be able to obtain the additional funds that we require on terms acceptable to us, if at all. We do not currently have any established third-party bank credit arrangements. If the additional funds that we may require are not available to us, we may be required to curtail significantly or to eliminate some or all of our development, or sales and marketing programs.

We may seek to obtain additional funds primarily through equity or debt financings. Such additional financing, if available on terms and schedules acceptable to us, if available at all, could result in dilution to our current shareholders and to you.

7

Our independent auditors have expressed their concern as to our ability to continue as a going concern.

As a result of our financial condition, we have received a report from our independent registered public accounting firm for our financial statements for the year ended December 31, 2014 that includes an explanatory paragraph describing the uncertainty as to our ability to continue as a going concern. As at December 31, 2014, we had generated nominal revenue in the amount of $6,707, and had an accumulated deficit of $18,442,456. In order to continue as a going concern, we must effectively use the funds we now have to begin to generate revenue from our platform and raise additional capital from equity financings such as an offering under this Prospectus. If we are not able to do this, we may not be able to continue as an operating company.

Our products and services are dependent upon advanced technologies that are susceptible to rapid technological change.

There can be no assurance that our products and services will not be seriously affected by, or become obsolete as a result of, technological changes. Although we do not believe there is a comparable all-in-one technology platform currently available to provide similar services to the real estate industry, there is a risk that a competitor may develop a similar platform that includes features more appealing to real estate industry participants or that uses more advanced technology not currently supported by our platform. There is also the risk that different platforms might nonetheless prove more appealing than ours. The occurrence of any of these events could decrease the amount of interest and use of our platform.

Some of our products and services are dependent upon social media models that are susceptible to change.

Several of our key products and services utilize a social media model akin to those seen in Facebook, Twitter and LinkedIn (user profiles, news feeds and the like) and one of our tools, reblasts, expressly links to those prominent services. This social media model has proven very popular, as the success of those and other services illustrates. However, there is no guarantee that this model will remain popular. If a different model of interacting with the Internet were to become popular, interest in social media models generally, or our social media model in particular, might decrease, and this could result in decreased usage of our products and services.

Our platform and future changes to the platform could fail to attract or retain users or generate revenue.

Our ability to retain, increase and engage our user base and to increase our revenue will depend heavily on our ability to develop our technology. We may introduce significant changes to our existing platform or develop and introduce new and unproven features. If new or enhanced features fail to engage users, we may fail to attract or retain users or to generate sufficient revenue, operating margin, or other value to justify our investments, and our business may be adversely affected. In the future, we may invest in new technology and initiatives to generate revenue, but there is no guarantee these approaches will be successful. If we are not successful with new approaches to monetization, we may not be able to maintain or grow our revenue as anticipated or recover any associated development costs, and our financial results could be adversely affected.

Defects or disruptions in the rollout of our new products and product enhancements could diminish demand for our service, adversely affect our reputation or subject us to substantial liability.

Like many Internet-based companies, we provide frequent incremental releases of software updates and functional enhancements. Such new versions frequently contain undetected errors when first introduced or released. We have, from time to time, found defects in our platform, and new errors in our existing platform or service may be detected in the future. In addition, our customers may use our platform in unanticipated ways that may cause a disruption in service for other customers. Since our customers use our platform for important aspects of their business, any errors, defects, disruptions in service or other performance problems with our platform could hurt our reputation and may damage our customers’ businesses. Further, if we suffer extended periods of unavailability for our platform, we may be contractually obligated to provide premium users with credits for future service, and there would be a negative impact on our reputation. Although we attempt to limit our liability via our Terms of Use, any errors, defects, disruptions in service or other performance problems with our platform could result in litigation against us, and such litigation could result in substantial, material liability for us, as well as material legal expenses.

Interruptions or delays in service from our third-party cloud storage providers for the RESAAS platform, or the loss or corruption of cloud-based data, would impair the delivery of our service and harm our business.

We currently serve our RESAAS.com users from third-party cloud storage providers based in the U.S. The use of cloud storage providers results in less direct control over our platform and data. Such third parties may also be vulnerable to security breaches and compromised security systems, which could adversely affect our reputation and result in litigation or liability.

8

Additionally, interruptions in our service, or loss or corruption of data, may reduce our revenue, cause us to issue credits or pay penalties, cause professional users to terminate their premium subscriptions and adversely affect our renewal rates and our ability to attract new users. Our business will also be harmed if our users and potential users believe our technology is unreliable.

Spam by users could diminish user experience on our platform, which could damage our reputation and deter our current and potential users from using our products and services.

“Spam” on our platform refers to a range of abusive activities that are prohibited by our terms of use for those accessing our platform and is generally defined as unsolicited actions that negatively impact other users with the general goal of drawing user attention to a given account, site, product or idea. This includes posting large numbers of unsolicited mentions of a user, duplicate feeds, misleading links (e.g., to malware or click-jacking pages) or other false or misleading content, and aggressively following and un-following accounts, adding users to lists, sending unsolicited invitations, reposting feeds and favoriting feeds to inappropriately attract attention. While we actively monitor usage of our platform features, if we are unable to effectively manage spam on our platform, our reputation for delivering relevant content could be damaged, user engagement could decline, and our operational costs could increase.

We prioritize product innovation and user experience over short-term operating results, which may harm our revenues and operating results.

We encourage employees to develop and help us launch new and innovative features. We focus on improving the user experience for our platform and on developing new and improved functionality for the users of our platform. We prioritize innovation and the experience for users over short-term operating results. We frequently make decisions related to our platform that may reduce our short-term operating results if we believe that the decisions are consistent with our goals to improve the user experience and performance for our users, which we believe will improve our operating results over the long term. For example, we began only a limited product release on our platform in January 2013 for proper user testing prior to our full-scale release of our revenue-producing premium products in January 2015. Such long-term development decisions may not be consistent with the short-term expectations of investors and may not produce the long-term benefits that we expect, in which case our user growth and user engagement, our relationships with customers and our business and operating results could be harmed. In addition, our focus on the user experience may negatively impact our relationships with our existing or prospective customers. Delay in further developing our platform or expanding our services increases the risk that competitors may become established and may negatively impact our relationship with both current and prospective users. This could result in a loss of users and platform partners, which would harm our revenues and operating results.

We may face lawsuits or incur liability as a result of content published, made available through, or linked to our social media platform.

Since our platform offers social media features we may face potential liability relating to content that is published, made available through, or linked to our platform. Moreover, our platform is open to registered users for posting user-generated content. Although we require our users to post only legally compliant and inoffensive materials, a third party may still find user-generated content postings on our platform offensive and take action against us in connection with the posting of such information. The nature of our business exposes us to claims related to defamation, intellectual property rights, rights of publicity and privacy, illegal content, content regulation and personal injury torts. Moreover, such claims may increase if and as our user base grows. We could incur significant costs investigating and defending these claims. If we incur costs or liability as a result of these events, our business, financial condition and operating results could be adversely affected.

Federal, state and foreign laws impose certain obligations on the senders of commercial emails, which could minimize the effectiveness of our services, limit our ability to market to prospective users and impose financial penalties for noncompliance.

Canada’s anti-spam legislation (CASL) establishes certain requirements for commercial email, short message service (SMS), social media and instant messaging messages and specifies penalties for the transmission of commercial messages that are intended to deceive the recipient as to source or content. The U.S.’s CAN-SPAM Act establishes certain requirements for commercial email messages and specifies penalties for the transmission of commercial email messages that are intended to deceive the recipient as to source or content. CASL and the CAN-SPAM Act, among other things, obligate the sender to provide recipients with the ability to opt out of receiving future messages from the sender. In addition, some U.S. states have passed laws regulating commercial email practices that are significantly more punitive and difficult to comply with than the CAN-SPAM Act. Other countries, such as those in the European Union and Asia, may have analogous laws and regulations.

9

The ability of recipients of messages from our users of our platform to opt out of receiving messages may minimize the effectiveness of our services for our premium users. In addition, noncompliance with CASL, the CAN-SPAM Act or other applicable laws and regulations carries significant litigation, regulatory investigation, liability and related risks. If our platform or e-mails generated therefrom were found to be in violation of CASL or the CAN-SPAM Act or similar state or international laws regulating the distribution of commercial messages, whether as a result of violations by our users or if we were deemed to be directly subject to and in violation of these requirements, we could incur significant penalties, and significant litigation and investigation-related expenses, and any inquiries might impact the deliverability of our commercial email regardless of outcome. This would adversely affect our operating results and financial condition and significantly harm our business, and our reputation would suffer. We could also be required to change one or more aspects of the way we operate our business, which could impair our ability to attract and retain users or could increase our operating costs.

As Internet commerce develops, federal, state, provincial and foreign governments may propose and implement new taxes and new laws to regulate Internet commerce, which could increase our operating costs and negatively affect our business.

As Internet commerce continues to evolve, increasing regulation by federal, state, provincial or foreign governments becomes more likely. Our business could be negatively impacted by the enforcement of existing laws and regulations or the enactment of new laws applicable to interactive marketing. The cost to comply with such laws or regulations could be significant and would increase our operating expenses, and we may be unable to pass along those costs to our users in the form of increased fees. In addition, federal, state and foreign governmental or regulatory agencies may decide to impose taxes on services (including our services) provided over the Internet. Such taxes could discourage the use of the Internet as a means of commercial marketing, which would adversely affect the viability of our services.

If Internet search engines’ methodologies are modified or search result page rankings for our platform-generated profile pages or URLs decline for other reasons, the value of our reblast tool may be diminished and user engagement in our websites and online communities could decline.

Certain of our platform’s tools, including reblasts, allow for the generation of URL links that can be posted to other social media websites, and our user profile pages are searchable through most search engines. Our competitors’ SEO efforts may result in their websites receiving a higher search engine result page ranking than that of our links or profiles, or Internet search engine companies could revise their search algorithms in ways that are detrimental to the visibility of such links. If we are unable to adapt to these revisions, this could adversely affect the performance of certain functions of our platform and our tools may become less attractive to existing and prospective users.

The future growth and profitability of our business will depend on the effectiveness and efficiency of our advertising and promotional activities.

Our future growth is dependent upon the effectiveness and efficiency of our advertising and promotional expenditures and including our ability to:

• Create greater awareness of our technology and services;

• Determine the appropriate creative message and media mix for future advertising expenditures; and

• Effectively manage advertising and expenditures costs in order to maintain acceptable operating margins.

There can be no assurance that our advertising and promotional expenditures will result in revenues in the future or will generate awareness of our technologies or services. In addition, no assurance can be given that we will be able to manage such expenditures on a cost-effective basis.

If we fail to retain current members of our senior management, or to attract and keep additional key personnel, our business and prospects could be materially adversely impacted.

Our success depends on our continued ability to attract, retain and motivate highly qualified management and technical personnel. We are highly dependent upon our senior management, particularly Cory Brandolini, Thomas Rossiter and Cameron Shippit. The loss of services of any of our key personnel could adversely affect our ability to successfully commercialize our platform.

10

In addition, competition for qualified technical, sales and marketing staff, as well as officers and directors, can be intense and no assurance can be provided that we will be able to attract or retain key personnel in the future, which may adversely impact operations.

If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service or address competitive challenges adequately.

Future growth will place a significant strain on our management, administrative, operational and financial infrastructure. We anticipate this growth will be required to address increases in our platform offerings and continued expansion, including expansion into other countries. We anticipate we may need to open additional physical offices in various countries. Our success will depend in part upon the ability of our management team to manage this growth effectively. To do so, we must continue to recruit, hire, train, manage and integrate a significant number of qualified managers, technical personnel and employees in specialized roles within our company, including in technology, sales and marketing. If our new employees perform poorly, or if we are unsuccessful in recruiting, hiring, training, managing and integrating these new employees and offices, or retaining these or our existing employees, such failures could have a negative impact on our business, results of operations or financial condition.

In addition, to manage the expected growth of our staff, operations and geographic expansion, we will need to continue to improve our information technology infrastructure, operational, financial and management systems and procedures. Our anticipated additional staff and capital investments will increase our costs, which will make it more difficult for us to address any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully manage our growth, we will be unable to successfully execute our business plan, which could have a negative impact on our business, results of operations or financial condition.

Seasonality may cause fluctuations in our traffic, revenue, operating expenses and operating results.

From time to time, we may experience seasonality in premium service revenue and advertising due to fluctuations in traffic to our platform. Based on historic trends affecting the real estate industry, we expect that in the fourth quarter of each year, traffic to our platform will decline and cause our revenue to grow more slowly than in other quarters or decline sequentially.

Declines in, or changes to, the real estate industry could adversely affect our business and financial performance.