UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-K

__________________________________________________ | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Annual Period Ended December 31, 2024

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ___ to ___

Commission file number 001-37936

__________________________________________________________________________________________________________________________________________________________________________________________

SMART SAND, INC.

(Exact name of registrant as specified in its charter) | | | | | |

| |

| Delaware | 45-2809926 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

| 1000 Floral Vale Boulevard, Suite 225 | |

| Yardley, Pennsylvania 19067 | (281) 231-2660 |

| (Address of principal executive offices) | (Registrant’s telephone number) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | SND | | The Nasdaq Global Select Market |

| | | | |

Securities registered pursuant to Section 12(g) of the Act: None |

| | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer ☐ | Accelerated Filer ☐ | Non-accelerated Filer ý | Smaller reporting company ☒ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2024, the last business day of the registrant’s second fiscal quarter of 2024, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $59,961,260 based on the closing price of $2.11 per share, as reported on NASDAQ on that date.

Number of shares of common shares outstanding, par value $0.001 per share as of February 21, 2025 was 42,876,756.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2025 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2024.

TABLE OF CONTENTS

Certain Definitions

The following definitions apply throughout this annual report unless the context requires otherwise: | | | | | | | | |

| “We”, “Us”, “Company”, “Smart Sand” or “Our” | | Smart Sand, Inc., a company organized under the laws of Delaware, and its subsidiaries. |

| | |

| “shares”, “stock” | | The common stock of Smart Sand, Inc., nominal value $0.001 per share. |

| | |

| “Former ABL Credit Facility”, “Former ABL Credit Agreement”, “Former ABL Security Agreement” | | The five-year senior secured asset-based lending credit facility (the “Former ABL Credit Facility”) pursuant to: (i) a Former ABL Credit Agreement, dated December 13, 2019, between the Company and Jefferies Finance LLC, as amended from time to time (as amended, the “Former ABL Credit Agreement”); and (ii) a Guarantee and Collateral Agreement, dated December 13, 2019, between the Company and Jefferies Finance LLC, as agent, as amended from time to time (as amended, the “Former ABL Security Agreement”). This facility was terminated on September 3, 2024. |

| | |

| “FCB ABL Credit Facility”, “FCB Credit Agreement”, “FCB Security Agreement” | | The five-year senior secured asset-based credit facility entered into on September 3, 2024 (the “FCB ABL Credit Facility”) pursuant to: (i) a credit agreement among the Company, the subsidiary borrowers and guarantors party thereto, First-Citizens Bank & Trust Company, as issuing bank, swingline lender and agent, and certain other lenders from time to time party thereto (the “FCB Credit Agreement”); and (ii) a guarantee and collateral agreement among the Company, the subsidiary borrowers and guarantors party thereto and First-Citizens Bank & Trust Company, as agent (the “FCB Security Agreement”). |

| | |

| “Oakdale Equipment Financing”, “MLA” | | The five-year Master Lease Agreement, dated December 13, 2019, between Nexseer Capital (“Nexseer”) and related lease schedules in connection therewith (collectively, the “MLA”). The MLA was structured as a sale-leaseback of substantially all of the equipment at the Company’s mining and processing facility located near Oakdale, Wisconsin. The Oakdale Equipment Financing was considered a lease under article 2A of the Uniform Commercial Code but was considered a financing arrangement (and not a lease) for accounting or financial reporting purposes. The MLA and all schedules were paid and full and terminated on June 28, 2024. |

| | |

| “VFI Equipment Financing” | | The four-year Master Lease Agreement, dated May 9, 2024, between Varilease Finance, Inc. (“VFI”) and related lease schedule entered into on June 26, 2024 in connection therewith (collectively, the “VFI Equipment Financing”). The VFI Equipment Financing was structured as a sale-leaseback of specific SmartSystemsTM wellsite proppant storage equipment owned by the Company. The VFI Equipment Financing is considered a lease under article 2A of the Uniform Commercial Code but is considered a financing arrangement (and not a lease) for accounting and financial reporting purposes. |

| | |

| | |

| “Exchange Act” | | The Securities Exchange Act of 1934, as amended. |

| | |

| “Securities Act” | | The Securities Act of 1933, as amended. |

| | |

| | |

| | |

| “FASB”, “ASU”, “ASC”, “GAAP” | | Financial Accounting Standards Board, Accounting Standards Update, Accounting Standards Codification, Accounting Principles Generally Accepted in the United States, respectively. |

Disclaimer Regarding Forward-looking Statements and Risk Factor Summary

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate’’, “estimate’’, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those expected, including without limitation:

•fluctuations in demand for frac sand;

•the cyclical nature of our customers’ businesses;

•operating risks that are beyond our control, such as changes in the price and availability of transportation, natural gas or electricity;

•production risks such as unusual or unexpected geological formations or pressures; pit wall failures or rock falls; or unanticipated ground, grade or water conditions at our mines;

•our dependence on our Oakdale mine and processing facility for a significant portion of our current sales;

•decreased usage of rail terminals that we operate;

•the level of activity in the oil and natural gas industries;

•the development of either effective alternative proppants or new processes which reduce or replace the need for frac sand in hydraulic fracturing;

•increased competition from new or existing sources of sand supply, including frac sand mines in areas located close to, or within, the oil and gas basins;

•federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing and the potential for related regulatory action or litigation affecting our customers’ operations, including restrictions on oil and gas development and possible bans on hydraulic fracturing;

•potential negative litigation outcomes;

•scarcity of supplies necessary to run our business;

•barriers to entry in the industrial sand market;

•actions by the Organization of the Petroleum Exporting Countries and/or Russia;

•our rights and ability to mine our properties and process sand and our renewal or receipt of the required permits and approvals from governmental authorities and other third parties;

•our ability to successfully compete in the sand or proppant delivery markets;

•loss of, or reduction in, business from our largest customers;

•increasing costs or a lack of dependability or availability of transportation services and transload network access or infrastructure, including the potential impact of train derailments;

•increases in the prices of, or interruptions in the supply of, natural gas, electricity, diesel fuel, or any other energy sources;

•loss of or diminished access to water;

•our ability to successfully complete acquisitions or integrate acquired businesses;

•our ability to fully protect our intellectual property rights;

•our ability to make capital expenditures to maintain, develop and increase our asset base and our ability to obtain needed capital or financing on satisfactory terms;

•restrictions imposed by our indebtedness on our current and future operations;

•border restrictions;

•global pandemics;

•new or increased tariffs;

•contractual obligations that require us to deliver minimum amounts of frac sand or purchase minimum amounts of products or services;

•the accuracy of our estimates of mineral reserves and resource deposits;

•a shortage of skilled labor and rising costs in the frac sand mining and manufacturing industries;

•our ability to attract and retain key personnel;

•our ability to maintain satisfactory labor relations;

•our ability to maintain effective quality control systems at our mining, processing and production facilities and rail terminals;

•seasonal and severe weather conditions;

•the results of political and civil unrest;

•fluctuations in our sales and results of operations due to seasonality and other factors;

•interruptions or failures in our information technology systems, including cyber-attacks;

•the impact of international or domestic terrorism or an armed conflict, including the conflicts in Ukraine and the Middle East;

•extensive and evolving environmental, mining, health and safety, licensing, reclamation and other regulation (and changes in their enforcement or interpretation);

•silica-related health issues and corresponding litigation;

•our ability to acquire, maintain or renew financial assurances related to the reclamation and restoration of mining property; and

•other factors disclosed in Item I A. “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the effect of known or unknown factors, and it is impossible for us to anticipate all factors that could affect our actual results. The risk factors summarized below could materially harm our business, operating results and/or financial condition, impair our future prospects and/or cause the price of our common stock to decline. These risks are discussed more fully under Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K. Material risks that may affect our business, operating results and financial condition include, but are not necessarily limited to, the following:

•our business and financial performance depend on the level of activity in the oil and natural gas industry;

•a material portion of our revenues have been generated from sales with a limited number of customers;

•we are exposed to the credit risk of our customers;

•our proppant sales are subject to fluctuations in market pricing;

•we face significant competition that may cause us to lose market share;

•we may be required to make substantial capital expenditures to maintain and grow our asset base and we may not realize enough of a return on such capital expenditures to cover their costs;

•the inability to obtain needed capital or financing on satisfactory terms, or at all;

•inaccuracies in estimates of volumes and qualities of our sand reserves could result in lower than expected sales and higher than expected cost of production;

•if we are unable to make acquisitions on economically acceptable terms, our future growth could be limited;

•restrictions in our FCB ABL Credit Facility may limit our ability to capitalize on potential acquisitions and other business opportunities;

•we face distribution and logistical challenges in our business;

•we may be adversely affected by decreased demand for frac sand due to the development of effective alternative proppants or new processes which reduce or replace frac sand in hydraulic fracturing;

•an increase in the supply of frac sand having similar characteristics as the frac sand we produce could make it more difficult for us to renew or replace our existing contracts on favorable terms, or at all;

•our long-term take-or-pay contracts may preclude us from taking advantage of increasing prices for frac sand or mitigating the effect of increased operational costs during the term of those contracts;

•our operations are subject to operational hazards and unforeseen interruptions for which we may not be adequately insured;

•our business relies significantly on railroads to deliver our products, and any delays in rail transportation could adversely impact our business.

•increases in the price or a significant interruption in the supply of natural gas, electricity or any other energy sources, of which our production process consumes large amounts, could adversely impact our production costs;

•increases in the price of diesel fuel could adversely affect our transportation costs;

•a facility closure entails substantial costs, and if we close one of our facilities sooner than anticipated, our results of operations and cash flows may be adversely affected;

•our operations are dependent on our rights and ability to mine our properties and on our having renewed or received the required permits and approvals from governmental authorities and other third parties;

•a shortage of skilled labor together with rising labor costs in the excavation industry, which may further increase operating costs;

•our business may suffer if we lose, or are unable to attract and retain, key personnel;

•failure to maintain effective quality control systems at our mining, processing and production facilities may negatively affect our ability to conduct business;

•seasonal and severe weather conditions may reduce our ability to process and deliver our products;

•our cash flow fluctuates on a seasonal basis, which may limit our ability to operate;

•we do not own the land on which our transload facilities are located, which inherently limits our rights at those facilities;

•a terrorist attack or armed conflict may affect our ability to conduct business;

•diminished access to water may affect our ability to process sand;

•we may be subject to interruptions or failures in our information technology systems, including cyber-attacks;

•if we are unable to fully protect our intellectual property rights, we may suffer a loss in our competitive advantage;

•we may be adversely affected by disputes regarding intellectual property rights of third parties;

•unsatisfactory safety performance may negatively affect our customer relationships and cause us to fail to retain existing customers or attract new customers;

•we may be subject to legal claims, such as personal injury and property damage;

•a financial downturn could negatively affect us;

•our future results will suffer if we do not effectively manage our expanded operations;

•federal, state and local legislative and regulatory initiatives or mandates relating to hydraulic fracturing, such as oil and gas leasing moratoriums, and the potential for related litigation could result in increased costs, additional operating restrictions or delays for our customers, which could cause a decline in the demand for our frac sand or restrict our ability to maximize profits;

•we and our customers are subject to extensive regulations, including environmental and occupational health and safety regulations, that impose, and will continue to impose, significant costs and liabilities, and future regulations, or more stringent enforcement of existing regulations, could increase those costs and liabilities;

•we are subject to the Federal Mine Safety and Health Act of 1977, which imposes stringent health and safety standards on numerous aspects of our operations;

•our inability to acquire, maintain or renew financial assurances related to the reclamation and restoration of mining property may increase cash outlay or limit our ability to operate our processing facilities; and

•climate change legislation and regulatory initiatives could negatively affect our business.

All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our other filings with the Securities and Exchange Commission (the “SEC”) and public communications. You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

We caution users of the financial statements that the important factors referenced above may not contain all of the factors that may be important to every user. In addition, we cannot make assurances that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Additionally, certain information we may disclose either here or elsewhere (such as our website) is informed by certain third-party frameworks or the expectations of various stakeholders and, as such, may not necessarily be material for purposes of our filings with the Securities and Exchange Commission. Particularly in the context of certain ESG matters, there are various approaches to materiality that differ from, and are often more expansive than, the definition under U.S. federal securities laws.

PART I

ITEM 1. — BUSINESS

The Company

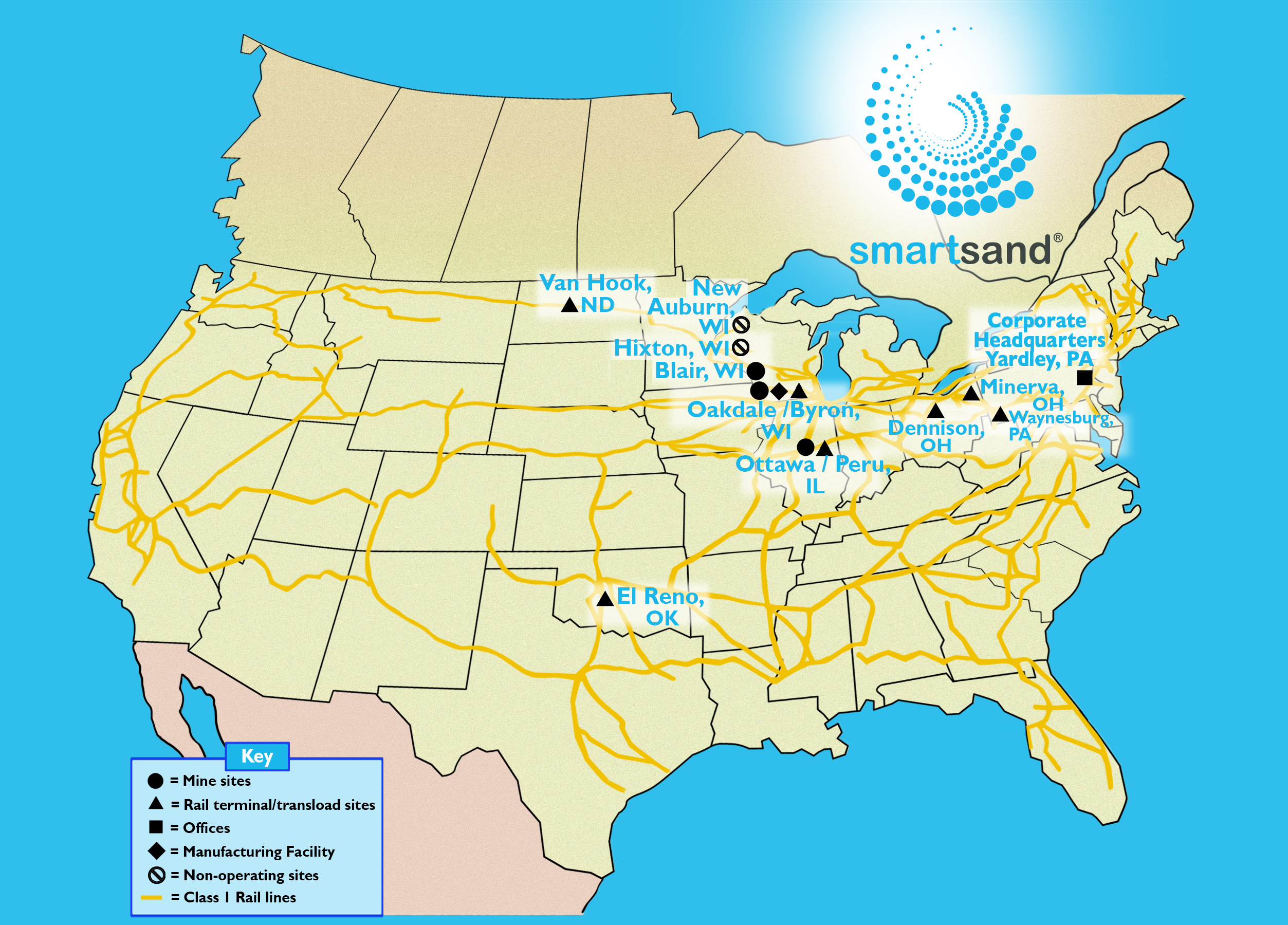

We are a fully integrated frac and industrial sand supply and services company. We offer complete mine to wellsite proppant supply and logistics solutions to our frac sand customers. We produce low-cost, high quality Northern White sand, which is a premium sand used as a proppant to enhance hydrocarbon recovery rates in the hydraulic fracturing of oil and natural gas wells and for a variety of industrial applications. We also offer proppant logistics solutions to our customers through our in-basin transloading terminals and our SmartSystemsTM wellsite proppant storage capabilities. In late 2021, we created our Industrial Products Solutions (“IPS”) business in order to diversify our customer base and markets we serve by offering sand for industrial uses.

We market our products and services to oil and natural gas exploration and production companies, oilfield service companies and industrial manufacturers. We believe that, among other things, the size and favorable geologic characteristics of our sand reserves, the strategic location and logistical advantages of our facilities, our proprietary SmartDepotTM portable wellsite proppant storage silos, our proprietary SmartPath® wellsite proppant management system, SmartBeltTM conveyor system, access to all Class I rail lines, and the industry experience of our senior management team make us as a highly attractive provider of sand and logistics services.

Operating Segments

Sand Segment

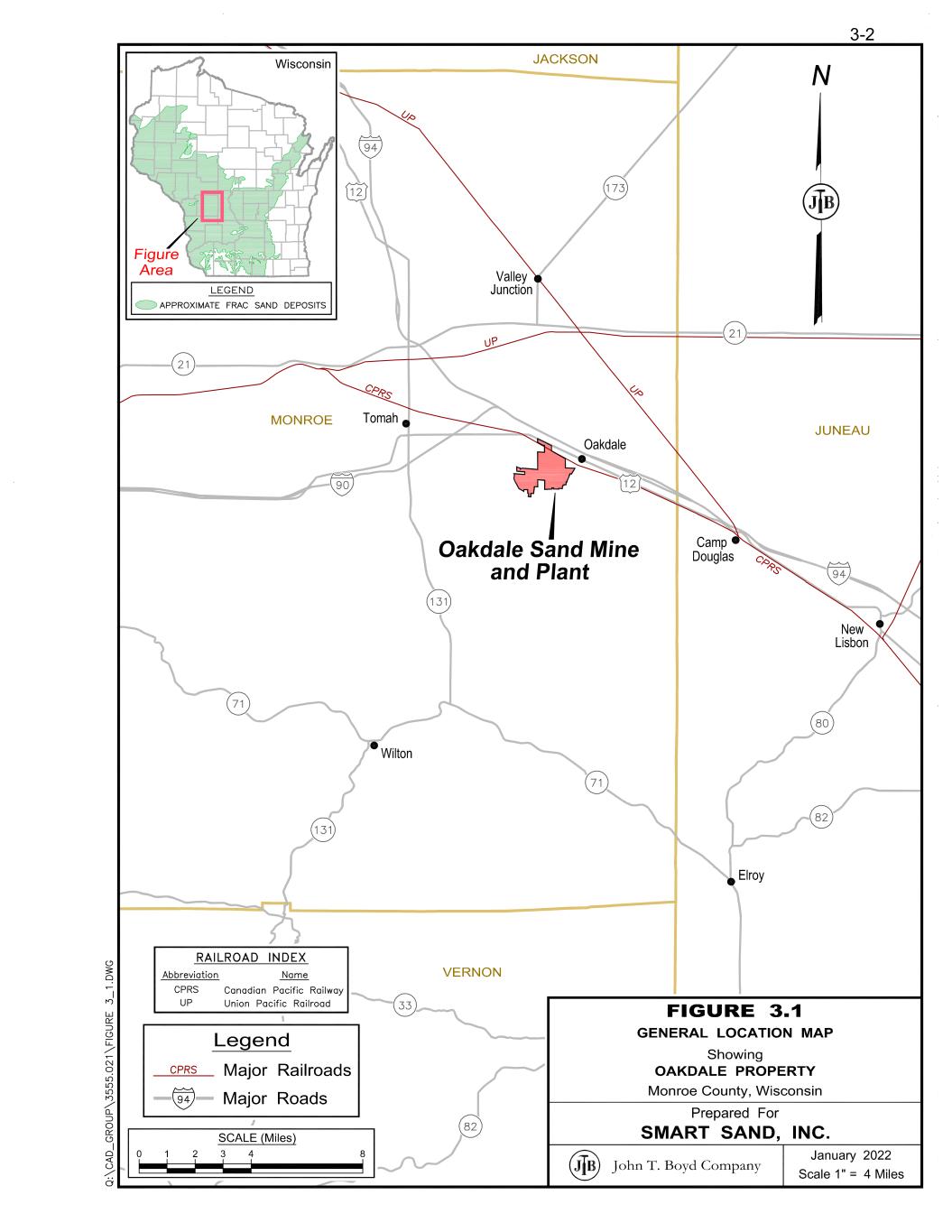

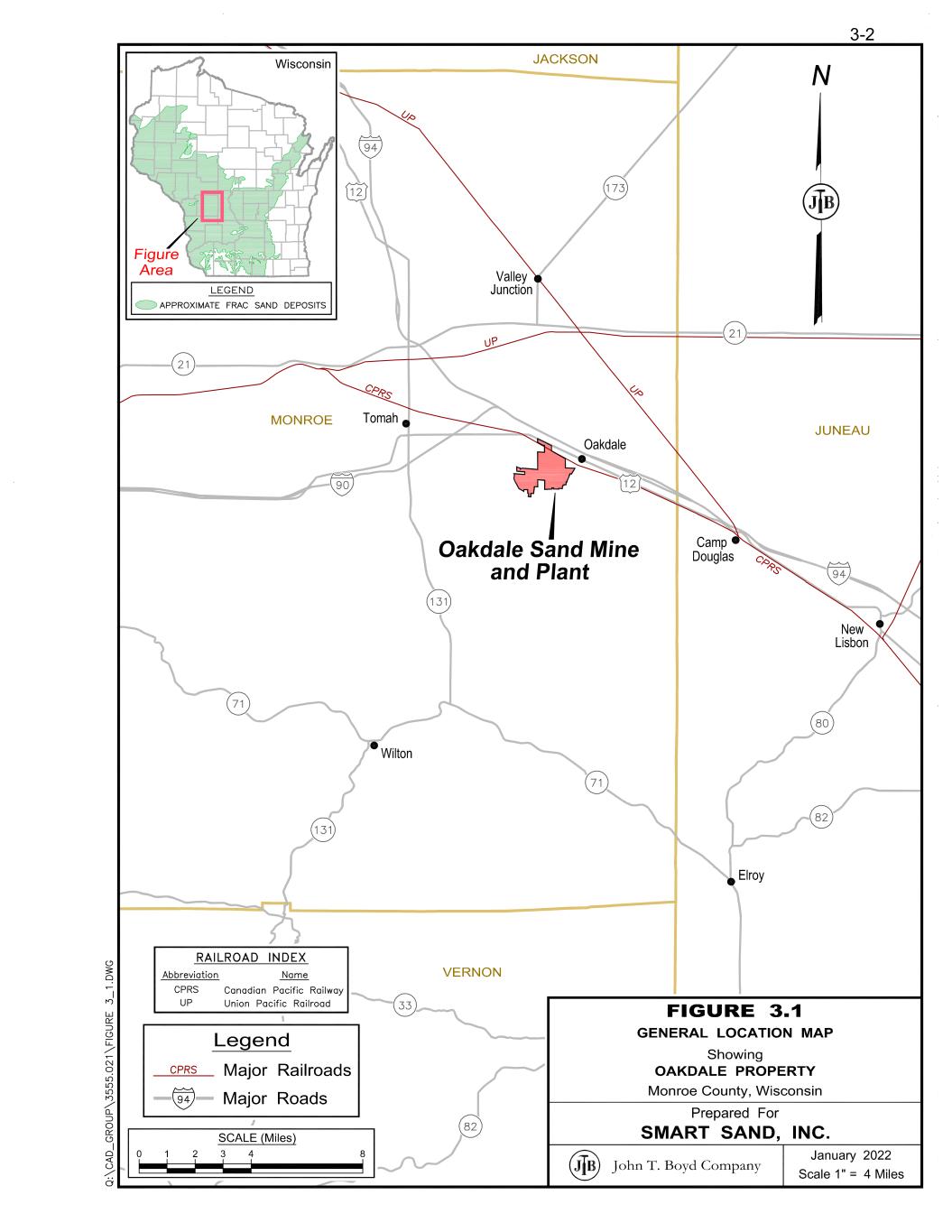

We sell our sand through short-term and long-term contracts or spot sales in the open market. We incorporated in Delaware in July 2011 and began operations at our Oakdale, Wisconsin facility in July 2012 with 1.1 million tons of annual processing capacity. After several expansions our current annual processing capacity at our Oakdale facility is approximately 5.5 million tons. This facility has access to both the Canadian Pacific Class I rail network (through an onsite, unit train capable rail facility) and the Union Pacific Class I rail network (through the Byron, Wisconsin transload facility).

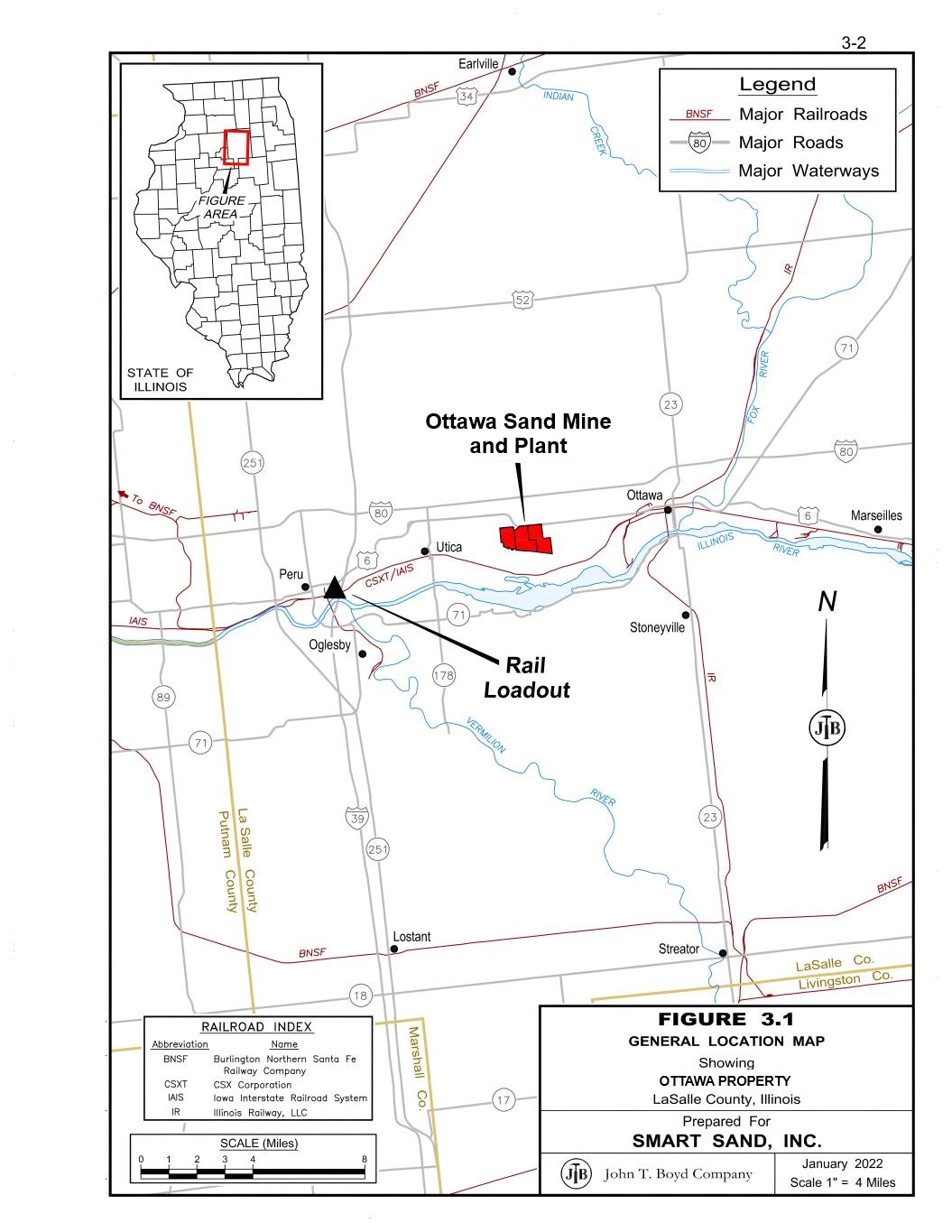

In September 2020, we acquired our Ottawa, Illinois mine and processing facility, which has annual processing capacity of approximately 1.6 million tons and access to the Burlington Northern Santa Fe Class I rail line through the Peru, Illinois transload facility, as well as rights to use a rail terminal located in El Reno, Oklahoma. We began operating the Ottawa facility in October 2020.

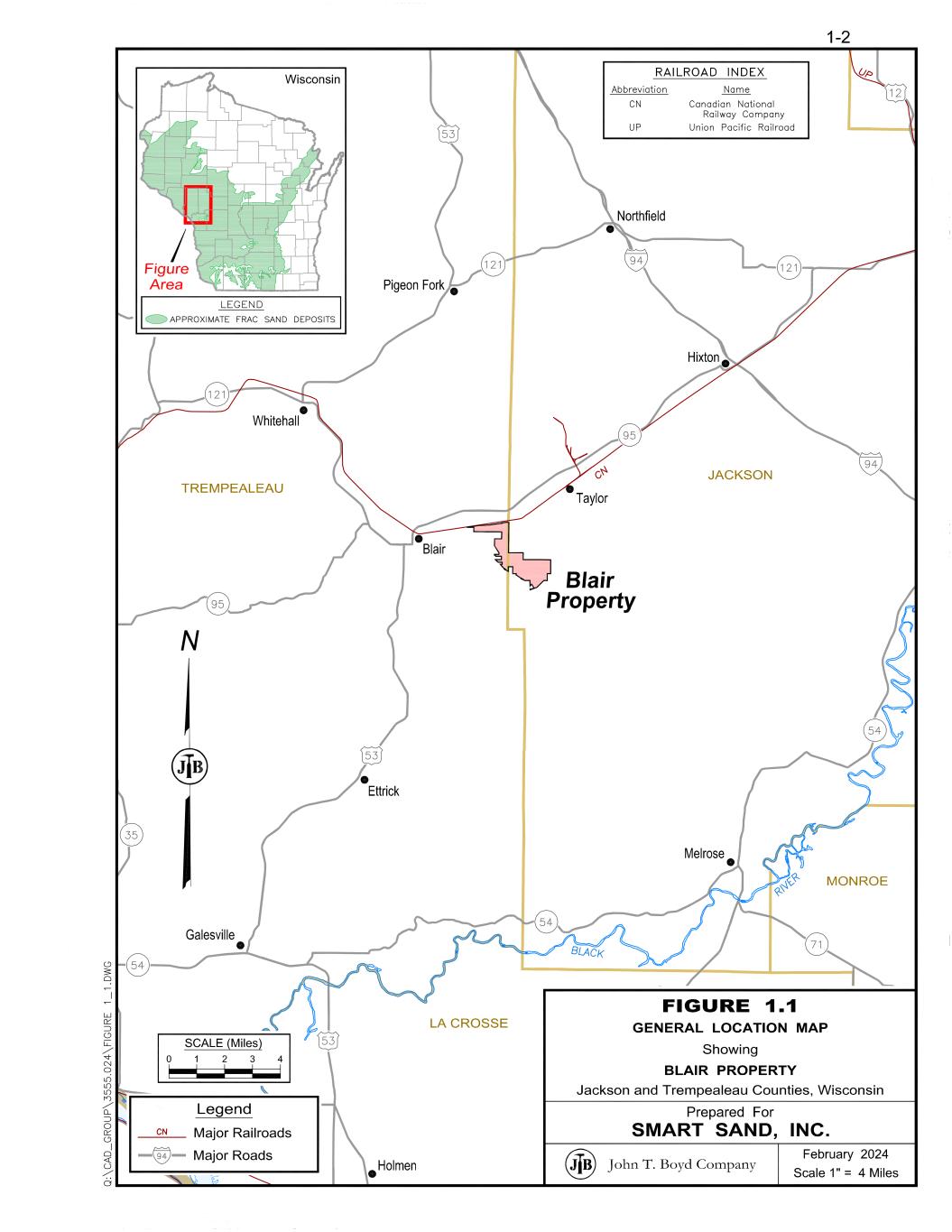

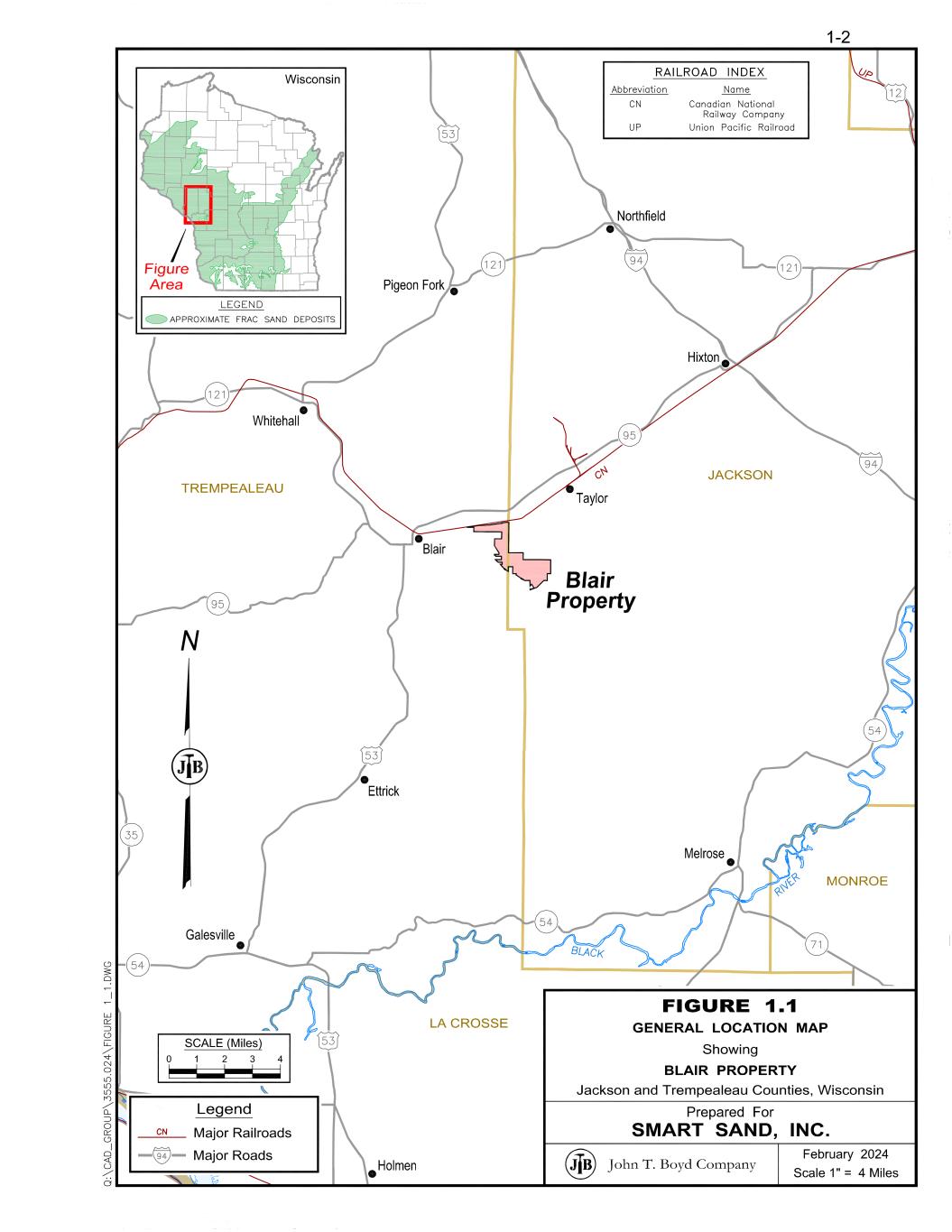

In March 2022, we acquired our Blair, Wisconsin mine and processing facility, which has approximately 2.9 million tons of total annual processing capacity and contains an onsite, unit train capable rail terminal with access to the Class 1 Canadian National Railway. We commenced operations at the Blair facility in the second quarter of 2023.

We sell frac sand through a network of in-basin rail terminals. We directly control five in-basin transloading facilities and have access to third party transloading terminals in all operating basins. We operate a unit train capable transloading terminal in Van Hook, North Dakota to service the Bakken Formation in the Williston Basin. The Van Hook terminal became operational in April 2018. In 2020, as part of our acquisition of the Ottawa, Illinois mining facility, we obtained rights to use a rail terminal located in El Reno, Oklahoma. In January 2022, we began operations at a unit train capable transloading terminal in Waynesburg, Pennsylvania to service the Appalachian Basin, including the Marcellus and Utica Formations. We completed an expansion of this terminal in the fourth quarter of 2023. In December 2023, we acquired the rights to operate a unit train capable transloading terminal in Minerva, Ohio, which became operational in the second quarter of 2024. In January 2024, we acquired the rights to operate a unit train capable transloading terminal in Dennison, Ohio, which became operational in the third quarter of 2024.

In late 2021, we started our IPS business to provide sand to customers for various industrial applications, such as glass, foundry, building products, filtration, geothermal, renewables, ceramics, turf & landscape, retail, and recreation. We believe this business provides us with the ability to diversify some of our sales into more stable, consumer-driven products to help mitigate some of the price volatility we are exposed to in the oil and gas markets that we serve. We completed an expansion of our IPS processing at our Ottawa, Illinois plant in the fourth quarter of 2023 to provide blending and cooling capabilities to increase our product offerings in the industrial marketplace.

SmartSystems Segment

We provide wellsite proppant handling solutions services and equipment under flexible contract terms custom tailored to meet the needs of our customers. We also offer our customers portable wellsite storage and management solutions through our

SmartSystems products and services. Our Smart Systems enable customers to unload, store, and deliver proppant at the wellsite and rapidly set up, take down, and transport the entire system. This capability enhances our customers’ efficiency, safety, and reliability. Through our SmartSystems wellsite proppant storage solutions, we offer the SmartDepot and SmartDepotXL™ silo systems, the SmartBelt conveyor, the SmartPath wellsite proppant management system, and our rapid deployment trailers. The SmartDepot silos feature passive and active dust suppression technology and support gravity-fed operation. Our self-contained SmartPath wellsite proppant management system is a mobile sand transloading solution that works with bottom-dump trailers. These systems include a drive-over conveyor, surge bin, silo storage, bucket elevators, and integrated dust collection.

In 2024, we developed new dual bucket elevators to enhance our vertical material handling capabilities. We also increased our silo storage capacity and streamlined proppant delivery directly to the blender. This addition provides greater flexibility for customers with varying wellsite configurations while maintaining the efficiency, safety, and reliability that define our SmartSystems solutions. Our rapid deployment trailers are designed for quick setup, takedown, and transportation of the entire SmartSystem. They detach from the wellsite equipment, allowing for removal from the wellsite during operations. We believe our SmartSystems help customers reduce trucking and related fuel consumption, reducing the carbon footprint of their daily operations.

Market

Beginning in the first quarter of 2022 and continuing through 2024, supply and demand fundamentals have improved and frac sand prices recovered from previous historic lows. There have been modest pricing fluctuations over the periods presented, but we believe the fluctuation is consistent with other commodities in the oilfield services sector.

The ongoing conflicts in Ukraine and the Middle East, as well as economic actions taken by the United States and other countries in connection with such conflicts, and other economic factors could have a negative impact on global oil and natural gas demand, which may lead to volatility in the oil field service sector. We cannot predict if frac sand prices will increase, decrease or stabilize.

Northern White frac sand, which is found predominantly in Wisconsin and limited portions of Minnesota, Illinois, and Missouri, is considered a premium proppant due to its favorable physical characteristics. We believe that regional sand will continue to affect the demand for Northern White sand in some of the oil and natural gas producing basins in which we market our products. However, we believe there will continue to be demand for our high-quality Northern White frac sand. In particular, we currently believe that Northern White frac sand has logistical advantages in the Marcellus, Utica and Bakken Formations in the shale basins of the United States, and the Montney and Douvernay shale basins in Canada. We expect demand for our frac sand to continue to be supported by customers who are focused on long-term well performance and ultimate recovery of reserves from the oil and natural gas wells they are completing, as well as those interested in the efficiency of their logistics supply chain and delivery of sand to the wellsite. Additionally, we believe market trends continue to support increased proppant usage per well drilled due to operator focus on well efficiencies through increasing lengths of drilling laterals, use of simul-fracking techniques and other well enhancement strategies. Finally, we believe that the adoption of our SmartSystems provides improved efficiencies in shipping and storing sand at the wellsite through reduced trucking requirements, which removes traffic from the roads and lowers diesel fuel consumption, thereby providing incremental value to our customers by reducing their carbon emissions.

Demand in the IPS business is relatively stable as customers are spread over a wide range of industries, including glass, foundry, building products, filtration, geothermal, renewables, ceramics, turf & landscape, retail, recreation and more. The IPS business is primarily influenced by macroeconomic drivers such as consumer demand and population growth. We believe that as this business grows, it will provide us with the ability to diversify some of our sales into more stable, consumer-driven products to help mitigate the price volatility that we are exposed to in the oil and gas industry.

Business Strategies

Our principal business objective is to be the premier provider of sustainable Northern White Sand supply and logistics solutions to our customers. We do this through supporting our existing customers, expanding our market share, being a low-cost producer of high-quality Northern White Sand, maintaining low debt leverage and managing efficient and sustainable supply chain logistics from the mine to the wellsite. In late 2021, we expanded our product line to offer IPS. We believe that by executing these business strategies, we will be able to increase long-term stockholder value. We expect to achieve this objective through the following business strategies:

•Diversifying our customer base to include Industrial Product Solutions. In late 2021, we expanded our product offering to provide IPS for industrial customers. IPS is currently approximately 5% of our business. We expect to continue to expand and diversify to serve the vital industrial markets throughout North America, including glass,

foundry, building products, filtration, geothermal, renewables, ceramics, turf & landscape, retail, recreation and more.

•Expanding and optimizing our existing logistics infrastructure and developing additional origination and destination points. We expect to continue to capitalize on our Oakdale facility’s ability to ship on two Class I rail carriers to maximize our product shipments, increase our railcar utilization and lower our transportation costs. We have the ability to simultaneously accommodate multiple unit trains on-site with the Canadian Pacific rail network while also having the ability to ship our frac sand to our customers on a second Class I rail carrier through our transloading facility located on the Union Pacific rail network approximately three miles from our Oakdale operations. This access to two Class I rail carriers from Oakdale provides increased delivery options for our customers, greater competition between our rail carriers and potentially lower freight costs.

Our mine at Ottawa, Illinois and related transloading terminal in Peru, Illinois added new origination and destination points to our existing capabilities and offers additional capability to ship products on a third Class I rail carrier, the BNSF.

Our Blair, Wisconsin mine with onsite rail infrastructure provides us with direct access to the Class 1 Canadian National Railway, allowing us access to all Class 1 rail lines within the United States and Canada. The Blair facility began operations in the second quarter of 2023.

We also operate several terminals throughout the United States, including a multiple unit train capable transloading terminal in Van Hook, North Dakota, which we believe allows us to be one of the most efficient and low-cost sources of frac sand in the Bakken Formation in the Williston Basin. Our Waynesburg, Pennsylvania terminal, which services the Appalachian Basins, including the Marcellus and Utica Formations, became operational in January 2022 and was expanded in the fourth quarter of 2023. We believe this terminal allows us to be one of the most efficient and low-cost sources of frac sand in the Appalachian Basin. Additionally, we obtained access, through a long term lease, to rail terminals in Minerva, Ohio and Dennison, Ohio, which we believe will broaden our ability to offer sand to our customers in the Utica Formation in an efficient and cost-effective manner. Both of the Ohio terminals became operational in 2024. Our El Reno, Oklahoma terminal provides us with the flexibility to send sand to the Woodford and SCOOP/STACK Basins as it is needed by our customers.

Additionally, our SmartSystems wellsite storage and proppant management systems allow us to offer expanded logistics services to our customers. We believe that our SmartSystems reduce trucking and related fuel consumption for our customers, helping them to reduce their carbon footprint in their daily operations.

The benefits of our long-term growth strategy for in-basin delivery of sand include expanding our customer base by marketing through our own terminals, more opportunity for spot sales by forward deploying sand and the opportunity to capture incremental margin on the sale of sand farther down the supply chain by managing the cost of rail, terminal and wellsite storage operations. Additionally, having a presence in-basin gives us an opportunity to have a base of operations from which to market and support our SmartSystems wellsite storage and proppant management solutions. Through the addition of new origination and destination options, we continue evaluating ways to reduce the landed cost of our products in-basin and to the wellsite for our customers while increasing our customized service offerings to provide our customers with additional delivery and pricing alternatives.

•Focusing on organic growth by increasing the utilization of our mine and frac sand processing facilities. We intend to continue pursuing opportunities to maximize the value and the utilization of our Oakdale, Ottawa, and Blair facilities through the addition of new customers and increased sales volumes. Despite the emergence of regional sand in oil and natural gas producing basins, we believe the proppant market continues to offer attractive long-term growth fundamentals for Northern White frac sand in the key operating basins we currently serve due to the logistics advantages in these basins and its superior well results compared to regional sand alternatives. We believe that coupling our premium proppant with long-term sustainable logistics supply services may mitigate the potential cost savings of using regional sand.

Demand for frac sand has continued to moderately increase during 2024. According to Spears and Associates, Inc. (“Spears”), North America proppant demand increased by 7% in 2024 compared to 2023, mirroring an improving hydraulic fracturing market. The primary drivers for the increase in frac sand usage are increased lateral well lengths and increased volume of sand per linear foot of lateral well. The trend is expected to increase moderately in 2025 as well. Additionally, demand may increase over the next five years, which may be driven by increased export capacity of liquid natural gas (“LNG”) and potential increased power demand for data centers.

•Focusing on being a low-cost provider and continuing to make process improvements. We continue to focus on being a low-cost provider, which we believe will allow us to compete effectively for sales of frac and industrial sand and to achieve attractive operating margins. Our low-cost structure results from a number of key attributes, including, among others, (i) our relatively low royalty rates, (ii) our majority of fine mineral reserve deposits, (iii) our access to all Class I rail lines within the United States and Canada, and (iv) our low levels of debt. We have strategically designed our operations to provide for low-cost production, including having dryers and wet plants enclosed in our Oakdale and Ottawa processing facilities that allow for year-round operation at both facilities. This allows us to more efficiently match our wet sand production with our drying capacity and to better utilize our workforce with a goal to reduce the overall cost of production. We continue to invest in capital projects and consider strategic acquisitions that increase efficiencies and offer the opportunity for a high return on investment. In addition, we seek to maximize our mining yields on an ongoing basis by targeting sales volumes that more closely match our reserve gradation in order to minimize waste in our processing. We also continue to evaluate other mining techniques to reduce the overall cost of our mining operations.

•Creating flexible sales activities. We believe that demand for our products will remain strong in basins where regional sand is not an attractive alternative due to the logistics and performance advantages of Northern White Sand, such as the Bakken in North Dakota, the Marcellus and Utica formations in the Appalachian Basin of the Northeast region of the United States, and the Montney and Duvernay shale basins in Canada. We continue to have discussions with operators in these regions regarding new relationships and growth opportunities. We also believe that the long-term benefits of high quality Northern White sand outweighs the short-term cost savings provided by regional sand in the Permian, Eagle Ford and SCOOP/STACK basins. We believe there are additional opportunities for customers in the Permian and other basins, which have regional supply, who are focused on the long-term performance of their production and on the long-term efficiency of their logistics.

While we continue to look for long-term contract opportunities, we intend to continue to focus on shorter term contracts and increase sales in the spot market given the reluctance of many customers to enter into long-term take-or-pay contracts in the current market environment. Having a greater portion of our activity on spot or short-term contracts allows us the opportunity to take advantage of pricing improvements quickly should market fundamentals improve.

Competitive Strengths

We believe that we will be able to successfully execute our business strategies because of the following competitive strengths:

•Long-lived, strategically located, high-quality reserve base. We believe our three sand mines in Oakdale, Wisconsin, Ottawa, Illinois and Blair, Wisconsin have a uniquely desirable combination of large high-quality reserves of fine mesh sand that is contiguous to their production and primary rail loading facilities that are either on site or are in close proximity to the mines.

As of December 31, 2024, we have an estimated life of mine of approximately 60 years at Oakdale, 105 years at Ottawa, and 56 years at Blair, based on our current expected sales volumes. We have the ability to annually process up to approximately 10.0 million tons of sand and we believe our reserve base positions us well to take advantage of current market trends of increasing demand for finer mesh frac sand. We also believe that having our mines, processing facilities and primary rail loading facilities in close proximity provides us with an overall low-cost structure, which enables us to compete effectively for sales of Northern White frac sand and to achieve attractive operating margins.

•Intrinsic logistics advantage. We believe that we are one of the few frac sand producers with a network of facilities custom-designed for the specific purpose of delivering frac sand to all of the major U.S. oil and natural gas producing basins by having rail facilities that can simultaneously accommodate multiple unit trains on site or in close proximity to our mining and processing operations. Our transportation assets at Oakdale have access to two Class I rail lines owned by Canadian Pacific and Union Pacific. We believe our customized on-site logistical configuration yields lower operating and transportation costs of product to our customers between the mine and in basin destinations.

Our Ottawa mine and nearby Peru transloading terminal in Illinois provides us direct access to another Class I rail line with direct access to the Burlington Northern Santa Fe Class I rail line. Additionally, we believe the location of our Ottawa, Illinois facility in close proximity to Greater Chicago and other major Midwestern metropolitan markets and our ability to truck or rail our products from this location allows us to be able to offer competitive pricing for industrial sand application.

The addition of the Blair frac sand mine and related processing facility located in Blair, Wisconsin, which contains an onsite, unit train capable rail terminal with access to the Class 1 Canadian National Railway, has secured our access to provide sand on all Class I rail lines in the United States and Canada.

•Expanded logistics solutions. Our transloading terminal in Van Hook, North Dakota is capable of handling multiple unit trains simultaneously, and we have been providing in-basin sand at this terminal to our customers since operations began in 2018. This terminal has allowed us to expand our customer base and to offer more efficient delivery options to customers operating in the Bakken Formation in the Williston Basin.

In January 2022 we began operating a terminal in Waynesburg, Pennsylvania to service the Appalachian Basin, including the Marcellus and Utica Formations. We believe the Waynesburg terminal allows us to be one of the most efficient and low-cost sources of frac sand in the Appalachian Basin.

We obtained access, through long term leases, to rail terminals in Minerva, Ohio and Dennison, Ohio, which we believe will broaden our ability to offer sand to our customers in the Utica Formation of the Appalachian Basin in an efficient and cost-effective manner. These terminals became operational in 2024.

We also operate a terminal located in El Reno, Oklahoma, which we acquired in 2020, to serve the Woodford and SCOOP/STACK Basins.

We are capable of delivering sand to substantially all onshore operating basins in the United States and Canada. We have direct access to four Class I rail lines in North America and indirect access to all Class I rail lines, which gives us an advantage over many of our competitors by allowing us to offer more competitive pricing and delivery options to our customers.

Our Smart Systems enable customers to unload, store, and deliver proppant at the wellsite and rapidly set up, take down, and transport the entire system. This capability enhances our customers’ efficiency, safety, and reliability. Through our SmartSystems wellsite proppant storage solutions, we offer the SmartDepot and SmartDepotXL silo systems, the SmartBelt conveyor, the SmartPath wellsite proppant management system, and our rapid deployment trailers. The SmartDepot silos feature passive and active dust suppression technology and support gravity-fed operation. Our self-contained SmartPath wellsite proppant management system is a mobile sand transloading solution that works with bottom-dump trailers. These systems include a drive-over conveyor, surge bin, silo storage, bucket elevators, and integrate dust collection. In 2024, we developed new dual bucket elevators to enhance our vertical material handling capabilities. We also increased our silo storage capacity and streamlined proppant delivery directly to the blender. This addition provides greater flexibility for customers with varying wellsite configurations while maintaining the efficiency, safety, and reliability that define our SmartSystems solutions. Our rapid deployment trailers are designed for quick setup, takedown, and transportation of the entire SmartSystem. They detach from the wellsite equipment, allowing for removal from the wellsite during operations. We believe our SmartSystems help customers reduce trucking and related fuel consumption, reducing the carbon footprint of their daily operations.

•Long-term liquidity and financial flexibility. We believe we have sufficient liquidity to support our operations and pursue our growth initiatives. In September 2024, the Company entered into a $30.0 million five-year senior secured asset-based credit facility with First-Citizens Bank & Trust Company. The FCB ABL Credit Facility provides for non-amortizing revolving loans in an aggregate principal amount of up to $30.0 million, subject to a borrowing base comprised of eligible inventory and accounts receivable. As of December 31, 2024, we had cash on hand of $1.6 million and undrawn availability under the FCB ABL Credit Facility of $30.0 million and no outstanding borrowings. The FCB ABL Credit Facility matures in September 2029. Our total available liquidity among cash and available borrowings was $31.6 million as of December 31, 2024.

•Experienced management team. The members of our senior management team bring significant experience to the market environment in which we operate. Their expertise covers a range of disciplines, including industry-specific operating and technical knowledge and experience managing businesses in a variety of operating conditions.

•Focus on safety and environmental stewardship. We aim to maintain a culture that prioritizes safety, the environment and our relationship with the communities in which we operate, actions we believe are critical to the success of our business. We are a Tier 1 participant in The Wisconsin Department of Natural Resources’ Green Tier program, which encourages, recognizes and rewards companies for voluntarily exceeding environmental, health and safety standards. Since 2016, Smart Sand has maintained International Organization for Standardization (“ISO”) ISO 9001 and ISO 14001 registrations for our quality management system and environmental management system programs, respectively, for our Oakdale facility. We earned initial ISO 9001 registration for our Ottawa, Illinois

facility in 2022. We also have attained Green Professional status in Wisconsin’s Green Master sustainability recognition program. We are also members of the Wisconsin Industrial Sand Association, which promotes safe and environmentally responsible sand mining standards.

Our Customers

Our core customers are oil and natural gas exploration and production companies and oilfield service companies. In late 2021, we began diversifying our sand sales to include IPS to customers. While sales of IPS to customers have been a small portion of our overall sand sales since beginning this business, we intend to continue increasing our expansion of IPS in 2025 and beyond. We sell frac sand under long-term take-or-pay contracts as well as in the spot market, and provide proppant logistics solutions through our in-basin transloading terminals and SmartSystems wellsite proppant storage solutions and other logistics services.

Generally, customers under long-term take-or-pay contracts are required to take minimum volumes of sand or make shortfall payments for a specified period of time. We recognize revenue in our results of operations in the period in which the obligation becomes due.

Currently many customers prefer to source their frac sand supply in the spot market or under short-term contractual arrangements at market prices. Should our customer base continue to limit their exposure to longer term contracts, we will continue to focus on shorter term contracts and increasing sales in the spot market.

Customers renting SmartSystems are able to tailor the contract, including adjusting the number of SmartDepot silos, SmartPath wellsite proppant management systems and SmartBelt conveyors to be supplied, to meet their short-term and long-term needs. We recognize rental revenue when the equipment is made available for the customer to use or other obligations in the contract are met.

For the year ended December 31, 2024, Equitable Gas Corporation, Encino Energy and Liberty Oilfield Services, accounted for 31.9%, 13.8% and 10.2%, respectively, of total revenue, and the remainder of our revenues were from 82 customers. For the year ended December 31, 2023, Equitable Gas Corporation and Liberty Oilfield Services accounted for 30.2% and 11.4%, respectively, of our total revenues, and the remainder of our revenues were from 72 customers. For the year ended December 31, 2022, Equitable Gas Corporation, Halliburton Energy Services, Encino Energy, and Liberty Oilfield Services accounted for 22.3%, 15.4%, 14.4% and 13.7%, respectively, of our total revenues, and the remainder of our revenues were from 63 customers. Please read “Risk Factors—Risks Inherent in Our Business—A substantial majority of our revenues have been generated under contracts with a limited number of customers, and the loss of, material nonpayment or nonperformance by or significant reduction in purchases by any of them could adversely affect our business, results of operations and financial condition.”

Capital Plans

We expect 2025 capital expenditures to be between $13.0 million and $17.0 million, consisting primarily of capital for efficiency projects at our mine and processing facilities and our in-basin terminals, along with investments in our facilities to support incremental IPS activity. We expect to fund these capital expenditures with existing cash, cash generated from operations, or borrowings under the FCB ABL Credit Facility or other financing sources, such as equipment finance providers.

Industry Trends Impacting Our Business

Unless otherwise indicated, the information set forth under this section, including all statistical data and related forecasts, is derived from Spears’ “Hydraulic Fracturing Market - Q4 2024” published in the first quarter of 2025. While we are not aware of any misstatements regarding the proppant industry data presented herein, estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors.”

Demand Trends

Demand for frac sand continued to moderately increase during 2024. According to Spears, North America proppant demand increased by 7% in 2024 compared to 2023, mirroring an improving hydraulic fracturing market. The primary drivers for the increase in frac sand usage are increased lateral well lengths and increased volume of sand per linear foot of lateral well. The trend is expected to increase moderately in 2025 as well. Additionally, demand may increase over the next five years, which may be driven by increased export capacity of LNG and potential increased power demand for data centers.

Supply Trends

There was considerable consolidation activity including mergers, acquisitions, closures of mines and bankruptcy filings among our peers from 2020 to 2024. Supply and demand for Northern white frac sand was relatively in balance in 2023 and 2024 and this is expected to continue in 2025.

Supplies of high-quality Northern White frac sand are limited to select areas, predominantly in western Wisconsin and limited areas of Minnesota and Illinois. We believe the ability to obtain large contiguous reserves in these areas is a key constraint for potential new Northern White frac sand supply and can be an important supply consideration when assessing the economic viability of a potential frac sand processing facility. Further constraining the supply and throughput of Northern White frac sand is that not all of the large reserve mines have on-site excavation, processing or logistics capabilities, which impact the long-term competitiveness of these mines due to lower efficiency and higher cost structures. Historically, much of the capital investment in Northern White frac sand mines was used for the development of coarser deposits in western Wisconsin, which is inconsistent with the increasing demand for finer mesh frac sand in recent years. As such, we’ve seen competitors in the Northern White frac sand market reduce their capacity by shuttering or idling operations as the shift to finer sands in hydraulic fracturing of oil and natural gas wells and to lower cost regional sand sources has eroded the ongoing economic viability of mines with coarser reserve deposits and inefficient mining and logistics facilities.

Environmental, Social & Governance

Smart Sand already has a strong record of environmental performance. In 2014, we joined the Wisconsin Green Tier program, a marquee public/private partnership, under which the Wisconsin Department of Natural Resources worked with us on a plan to meet applicable legal requirements and to improve our facility from an environmental perspective. In addition to documenting 12 years of compliant operations, we have worked on, among other things, protecting wetlands, reducing usage and impact of heavy equipment, reducing fuel usage of equipment and vehicles and defining best practices for onsite water management. We are also a member of Wisconsin’s sustainability initiative, Green Masters. As part of this program, we have completed a detailed survey of our sustainability and social responsibility activities and started the process of completing carbon inventory. As a mining company, we invest and plan for reclamation, so that the land can be returned to beneficial use. Smart Sand has held ISO 9001/14001-2015 environmental and quality management systems for the past nine years. Smart Sand is also a member of the Wisconsin Industrial Sand Association, a select group of mining companies focused on safety, environmental and public policy.

We believe we provide social value through our excellent employment opportunities. Our first priority is keeping our employees safe, which we implement through daily training and inspections. Our business supports hundreds of families and we are proud to offer rewarding and interesting work with competitive compensation and benefits. We look to promote from within, provide continuous training, promote an inclusive work environment where employees have equal opportunity to succeed regardless of background, and provide every employee with the opportunity to participate in retirement plans and ownership of the Company. Smart Sand is an active charitable partner in the communities in which it operates, making both financial and time investments in those communities.

Permits

We operate in a highly regulated environment overseen by many governmental regulatory and enforcement bodies at the local, state and federal levels. To conduct our operations, we are required to obtain permits and approvals that address environmental, land use and health and safety issues at our operating facilities. Our current and planned areas for excavation at our mining facilities are permitted for extraction of our proven reserves. Portions of our facilities lie in areas designated as wetlands, which will require additional local, state and federal permits prior to mining and reclaiming those areas.

We also must meet requirements for certain international standards concerning safety, greenhouse gases and rail operations. We have voluntarily agreed to meet the standards of the Wisconsin Department of Natural Resources’ Green Tier program, the National Industrial Sand Association (“NISA”) and the Wisconsin Industrial Sand Association. Further, for Oakdale, we have agreed to meet the standards required to maintain our ISO 9001-2015 and ISO 14001-2015 quality/environmental management system registrations. At our Ottawa facility, we have had ISO 9001-2015 quality system registration for three years, and plan to register our ISO 14001-2015 environmental management system in 2025. These voluntary requirements are tracked and managed along with our permits.

While resources invested in securing permits are significant, this cost has not had a material adverse effect on our results of operations or financial condition. We cannot ensure that existing environmental, health and safety (“EHS”) laws and regulations will not be reinterpreted or revised or that new EHS laws and regulations will not be adopted or become applicable to us. Revised or additional EHS requirements that result in increased compliance costs or additional operating restrictions could have a material adverse effect on our business.

Competition

The proppant industry is highly competitive. Please read “Risk Factors—Risks Inherent in Our Business—We face significant competition that may cause us to lose market share.” There are numerous large and small producers in all sand producing regions of North America with whom we compete, many of which also offer solutions for unloading, storing and delivering proppant to the wellsite. Our main competitors include Badger Mining Corporation, HC Minerals, Inc., Covia Holdings Corporation, U.S. Silica Holdings, Inc., Capital Sand Company, Source Energy Services and Solaris Energy Infrastructure, Inc.

Although some of our competitors may have greater financial or natural resources than we do, we believe that we are well-positioned competitively due to our low cost of sand production, low debt levels, logistics infrastructure, high-quality, balanced reserve profile and patented SmartSystems wellsite proppant storage solutions, which offer numerous benefits over our competition. The most important factors on which we compete are our service capabilities, product quality, proven performance, sand characteristics, transportation capabilities, reliability of supply, price, logistics services and the performance of patented SmartSystems wellsite proppant storage solutions technology. Demand for frac sand and logistics solutions and the prices that we will be able to obtain for our products, to the extent not subject to a fixed price or take-or-pay contract, are closely linked to proppant consumption patterns for the completion of oil and natural gas wells in North America. These consumption patterns are influenced by numerous factors, including, among other things, the price for oil and natural gas and hydraulic fracturing activity, including the number of stages completed per well, the lateral length of horizontal wells being completed, and the amount of proppant used per stage. Further, these consumption patterns are also influenced by the location, quality, price and availability of frac sand and other types of proppants such as resin-coated sand and ceramic proppant.

Seasonality

Our business is affected to some extent by seasonal fluctuations in weather that impact the production levels for a portion of our wet sand processing capacity. While our dry plants are able to process finished product volumes evenly throughout the year, our excavation and our wet sand processing activities have historically been limited to primarily non-winter months. As a consequence, we have experienced lower cash operating costs in the first and fourth quarter of each calendar year, and higher cash operating costs in the second and third quarter of each calendar year when we overproduced wet sand to meet demand in the winter months. These higher cash operating costs are capitalized into inventory and expensed when these tons are sold, which can lead to us having higher overall costs in the first and fourth quarters of each calendar year as we expense inventory costs that were previously capitalized. However, we have enclosed, indoor wet plants at our Oakdale and Ottawa processing facilities, which allow us to produce wet sand inventory year-round to support a large portion of our dry sand processing capacity, which may reduce certain effects of this seasonality. We may also sell frac sand for use in oil and natural gas producing basins where severe weather conditions may curtail drilling activities and, as a result, our sales volumes to those areas may be reduced during such severe weather periods. Severe weather can also impact the rail lines which we utilize to ship our sand to our customers in the operating basins and as a result could lead to reduced sales volumes during such severe weather periods. Additionally, over the last several years, exploration and production companies have become more disciplined in their spending patterns relative to their budgets, which has led to some of our customers completing their budgeted spending earlier in the year. This spending discipline could potentially lead to a slowdown in activity by our customers and lower sand demand in the fourth quarter of the year. For a discussion of the impact of weather on our operations, please read “Risk Factors—Seasonal and severe weather conditions could have a material adverse impact on our business, results of operations and financial condition” and “Risk Factors—Our cash flow fluctuates on a seasonal basis.”

Intellectual Property

Our intellectual property primarily consists of trade secrets, know-how and trademarks. We own patents and have patent applications pending related to our SmartSystems wellsite proppant storage solutions. All of the issued patents have an expiration date after August 2030. With respect to our other products, we principally rely on trade secrets, rather than patents, to protect our proprietary processes, methods, documentation and other technologies, as well as certain other business information. For a discussion of the impact of our intellectual property, please read “Risk Factors–If we are unable to fully protect our intellectual property rights, we may suffer a loss in our competitive advantage” and “Risk Factors–We may be adversely affected by disputes regarding intellectual property rights of third parties.”

Insurance

We believe that our insurance coverage is customary for the industry in which we operate and adequate for our business. As is customary in the proppant industry, we review our safety equipment and procedures and carry insurance against most, but not all, risks of our business. Losses and liabilities not covered by insurance would increase our costs. To address the hazards inherent in our business, we maintain insurance coverage that includes physical damage coverage, third-party general liability insurance, employer’s liability, business interruption, environmental and pollution and other coverage, although coverage for

environmental and pollution-related losses is subject to significant limitations. For additional discussion regarding our insurance, please read “Risk Factors–Our operations are subject to operational hazards and unforeseen interruptions for which we may not be adequately insured.”

Environmental and Occupational Health and Safety Regulations

We are subject to stringent and complex federal, state, local and international laws and regulations governing the discharge of materials into the environment or otherwise relating to protection of worker health, safety and the environment. Compliance with these laws and regulations may expose us to significant costs and liabilities and cause us to incur significant capital expenditures in our operations. Any failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of remedial obligations, and the issuance of injunctions delaying or prohibiting operations. Private parties may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property damage. In addition, the trend in environmental regulation is to place more restrictions on activities that may affect the environment, and thus, any changes in, or more stringent enforcement of, these laws and regulations that result in more stringent and costly pollution control equipment, the occurrence of delays in the permitting or performance of projects, or waste handling, storage, transport, disposal or remediation requirements could have a material adverse effect on our operations and financial position.

We do not believe that compliance by us with federal, state, local or international environmental laws and regulations will have a material adverse effect on our business, financial position or our results of operations or cash flows. We cannot be assured, however, that future events, such as changes in existing laws or enforcement policies, the promulgation of new laws or regulations or the development or discovery of new facts or conditions adverse to our operations will not cause us to incur significant costs. While we are confident in our compliance with current environmental regulations, we acknowledge the potential for policy shifts that could impact our operations. On January 20, 2025, President Trump issued a series of executive orders and memoranda signaling a shift in environmental and energy policy in the United States, including the revocation of approximately 80 Biden-era executive orders related to public health, the environment, climate change and climate-related financial risks. President Trump also declared a “national energy emergency,” directing agencies to expedite conventional energy projects. While the extent of the Trump Administration’s changes to the environmental regulatory landscape in the United States is unknown at this time, it is possible that additional changes in the future could impact our results of operation and those of our customers. The following is a discussion of environmental and worker health and safety laws, as amended from time to time that relate to our operations or those of our customers that could have a material adverse effect on our business.

Air Emissions

Our operations are subject to the federal Clean Air Act (“CAA”) and related state and local laws, which restrict the emission of air pollutants and impose permitting, monitoring and reporting requirements on various sources. Over the next several years, we may be required to incur certain capital expenditures for air pollution control equipment or to address other air emissions-related issues. Changing and increasingly stringent requirements, future non-compliance, or failure to maintain necessary permits or other authorizations could require us to incur substantial costs or suspend or terminate our operations.

Climate Change

In recent years, the U.S. Congress has considered legislation to reduce emissions of greenhouse gases (“GHG”). We are unable to predict actions that may be taken by the Federal government; however, a number of states are addressing GHG emissions, primarily through the development of emission inventories or regional GHG cap and trade programs. Depending on the particular program, we could be required to monitor, report, or control GHG emissions or to purchase and surrender allowances for GHG emissions resulting from our operations. Independent of Congress, the U.S. Environmental Protection Agency (“EPA”) has adopted regulations controlling GHG emissions under its existing authority. Compliance with new legislation may require us to incur substantial costs or suspend or terminate our operations. In addition, various policymakers, including the states of California, Illinois, and New York, have adopted or are considering adopting requirements for in-scope companies to disclose certain climate-related information, including on GHG emissions and climate risks. For example, the U.S. Securities and Exchange Commission (“SEC”) issued a proposed rule in March 2022 that will mandate extensive disclosure of climate-related data, risks, GHG emissions, for certain public companies. The SEC issued a final in March 2024. Multiple lawsuits have been filed and in April 2024, the SEC voluntarily stayed the rules pending the outcome of the litigation.

Additionally, following the issuance of an executive order by President Trump, the U.S. has initiated the process to withdraw from the Paris Agreement, reverting to the position held during President Trump’s first term. The executive order also mandates ending financial commitments under the United Nations Framework Convention on Climate Change and revokes the U.S. International Climate Finance Plan. It is possible that other climate-related reporting regulations applicable to many U.S. companies will continue to take effect.

Water Discharges

The Clean Water Act (“CWA”) and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into state waters or waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA and regulations implemented thereunder also prohibit the discharge of dredge and fill material into regulated waters, including jurisdictional wetlands, unless authorized by the Army Corps of Engineers (“Corps”) pursuant to an appropriately issued permit. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Compliance with new rules and legislation could require us to face increased costs and delays with respect to obtaining permits for expansion activities. Federal and state regulatory agencies can impose administrative, civil and criminal penalties as well as other enforcement mechanisms for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations.

Hydraulic Fracturing

We supply frac sand to hydraulic fracturing operators in the oil and natural gas industry. Hydraulic fracturing is an industry practice that is used to stimulate production of oil and natural gas from low permeability hydrocarbon bearing subsurface rock formations. The hydraulic fracturing process involves the injection of water, proppants, and chemicals under pressure into the formation to fracture the surrounding rock, increase permeability and stimulate production. Although we do not directly engage in hydraulic fracturing activities, our customers purchase our frac sand for use in their hydraulic fracturing activities.

The adoption of new laws or regulations at the federal or state levels imposing reporting obligations on, or otherwise limiting or delaying, the hydraulic fracturing process could make it more difficult to complete natural gas wells, increase our customers’ costs of compliance and doing business, and adversely affect the hydraulic fracturing services they perform, which could negatively impact demand for our frac sand.

Non-Hazardous and Hazardous Wastes

The Resource Conservation and Recovery Act (“RCRA”) and comparable state laws control the management and disposal of hazardous and non-hazardous waste. These laws and regulations govern the generation, storage, treatment, transfer and disposal of wastes that we generate. In the course of our operations, we generate waste that is regulated as non-hazardous waste and hazardous waste, obligating us to comply with applicable standards relating to the management and disposal of such waste. In addition, drilling fluids, produced waters, and most of the other wastes associated with the exploration, development, and production of oil or natural gas, if properly handled, are currently exempt from regulation as hazardous waste under RCRA and, instead, are regulated under RCRA’s less stringent non-hazardous waste provisions, state laws or other federal laws. However, it is possible that certain oil and natural gas drilling and production wastes now classified as non-hazardous could be classified as hazardous waste in the future. A loss of the RCRA exclusion for drilling fluids, produced waters and related waste could result in an increase in our customers’ costs to manage and dispose of generated wastes and a corresponding decrease in their drilling operations, which developments could have a material adverse effect on our business.

Site Remediation

The Comprehensive Environmental Response, Compensation, and Liability Act, as amended (“CERCLA”) and comparable state laws impose strict, joint and several liability without regard to fault or the legality of the original conduct on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include the owner and operator of a disposal site where a hazardous substance release occurred and any company that transported, disposed of, or arranged for the transport or disposal of hazardous substances released at the site. Under CERCLA, such persons may be liable for the costs of remediating the hazardous substances that have been released into the environment, for damages to natural resources, and for the costs of certain health studies. In addition, where contamination may be present, it is not uncommon for the neighboring landowners and other third parties to file claims for personal injury, property damage and recovery of response costs. We have not received notification that we may be potentially responsible for cleanup costs under CERCLA at any site.

Endangered Species

The Endangered Species Act (“ESA”) restricts activities that may result in a “take” of the habitat of endangered or threatened species and provides for substantial penalties in cases where listed species are being harmed. Harm under the ESA includes acts that actually kill or injure wildlife as well as significant habitat modification or degradation that significantly

impairs essential behavioral patterns, including breeding, feeding or sheltering. Take prohibitions also protect migratory birds under the Migratory Bird Treaty Act (“MBTA”).

The dunes sagebrush lizard is one example of a species that, if listed as endangered or threatened under the ESA, could impact the operations of our customers. The dunes sagebrush lizard is found in the active and semi-stable shinnery oak dunes of southeastern New Mexico and adjacent portions of Texas, including areas where our customers operate and our frac sand facilities may be located. On May 20, 2024, the United States Fish and Wildlife Service (“USFWS”) listed the dunes sagebrush lizard as an endangered species. In turn the operations of our customers in any area that is designated as the dunes sagebrush lizard’s habitat may be limited, delayed or, in some circumstances, prohibited, and our customers could be required to comply with expensive conservation measures intended to protect the dunes sagebrush lizard and its habitat.

The USFWS has approved several Enhancement of Survival Permits that allow operations in designated habitats to continue if the dunes sagebrush lizard is listed provided that qualification criteria and conservation measures required by such permits are met. One such permit is referred to as the Texas Conservation Plan (“TCP”). The TCP was developed as a voluntary conservation plan for the dunes sagebrush lizard by the Texas Comptroller, which served as the permit holder until the transfer of the TCP to a new permit holder in September 2020. Smart Sand is a participant in the TCP and has enrolled 2,713-acres of its land in Winkler, County, Texas. In January 2021, the USFWS issued a second Enhancement of Survival Permit for operations in West Texas that may affect the dunes sagebrush lizard. These permits cover incidental “take” of the habitat of the dunes sagebrush lizard associated with oil and gas exploration and development, sand mining, renewable energy development and operations, pipeline construction and operations, local government activities, agricultural activities, and general construction activities within the permit area that could affect suitable habitat. Smart Sand’s enrollment in the TCP minimizes the potential that new or more stringent conservation measures or land, water, or resource use restrictions beyond the measures and restrictions in the TCP may be required for that property.