Exhibit 99.1

Investor Presentation

November 2014

Safe Harbor Statement

Cautionary Statement Regarding Risks and Uncertainties That May Affect Future Results

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the business, financial condition and prospects of Enova International, Inc. (“Enova” or the “Company”). These forward-looking statements give current expectations or forecasts of future events and reflect the views and assumptions of the Company’s senior management with respect to the business, financial condition and prospects of the Company as of the date of this presentation and are not guarantees of future performance. The actual results of the Company could differ materially from those indicated by such forward -looking statements because of various risks and uncertainties applicable to the Company’s business, including, without limitation, those risks and uncertai nties indicated in the Company’s filings with the Securities and Exchange Commission (“SEC”), especially the Registration Statement on Form 10 f iled with the

SEC on July 31, 2014 (as subsequently amended and declared effective on October 24, 2014) and Forms 8-K. These risks and uncertainties are beyond the ability of the Company to control, and, in many cases, the Company cannot predict all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward -looking statements. When used in this presentation, the words

“believes,” “estimates,” “plans,” “expects,” “anticipates” and similar expressions or variations as they relate to the Company or its management are intended to identify forward-looking statements. The Company cautions you not to put undue reliance on these statements. The Company disclaims any intention or obligation to update or revise any forward -looking statements after the date of this presentation.

Non-GAAP Financial Information

In addition to the financial information prepared in conformity with generally accepted accounting principles in the United S tates (“GAAP”), the Company provides cash flow from operating activities less net consumer loans originated, acquired and repaid and purchases of property and equipment (“free cash flow”) and net income excluding depreciation, amortization, interest, foreign currency transaction gains or losses and taxes (“Adjusted EBITDA”), which are not considered measures of financial performance under GAAP. Management uses these non-GAAP financial measures for internal managerial purposes and believes that their presentation is meaningful and useful in understanding the activities and business metrics of the Company’s operations. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s business that, when viewed with the Company’s GAAP results, provides a more complete understanding of factors and trends affecting the Company’s business.

Management provides such non-GAAP financial information for informational purposes and to enhance understanding of the Company’s

GAAP consolidated financial statements. Readers should consider the information in addition to, but not instead of, the Comp any’s financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes. A table reconciling such non-GAAP financial measures is available in the appendix.

2

Company Highlights

Proven Technology and Analytics with 10 Years of Data

Proprietary Online Model Enables Rapid Expansion at Low Cost

Large Addressable Market with Robust Global Trends

Strong Cash Flow Reinvested in Growth

Superior Financials with Strong Growth in Revenues and Profits

Experienced, Successful Leadership Team

3

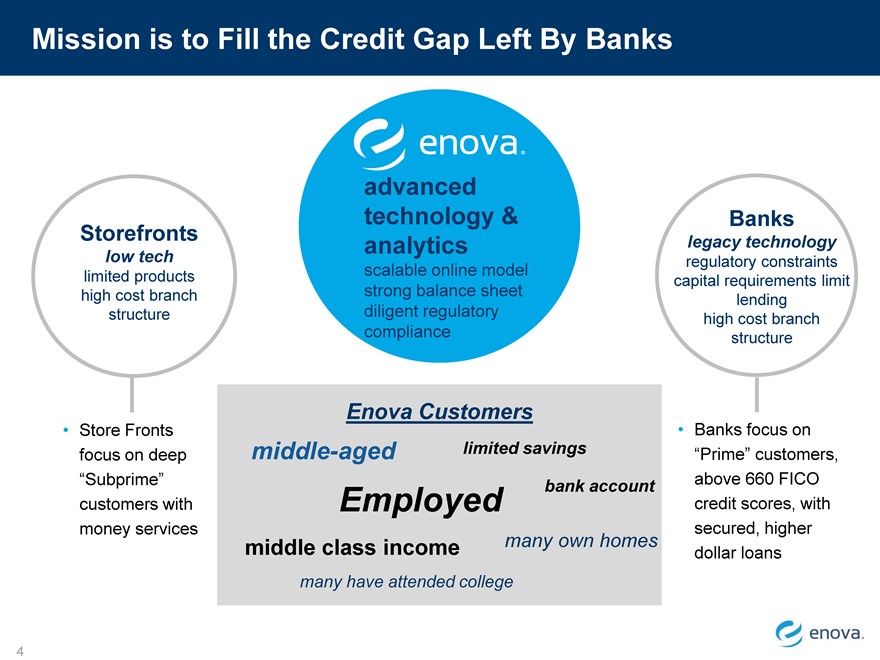

Mission is to Fill the Credit Gap Left By Banks

Storefronts

low tech limited products high cost branch structure

Store Fronts focus on deep

“Subprime” customers with money services

advanced technology & analytics

scalable online model strong balance sheet diligent regulatory compliance

Banks

legacy technology regulatory constraints capital requirements limit lending high cost branch structure

Banks focus on

“Prime” customers, above 660 FICO credit scores, with secured, higher dollar loans

Enova Customers

middle-aged limited savings

Employed bank account

middle class income many own homes

many have attended college

4

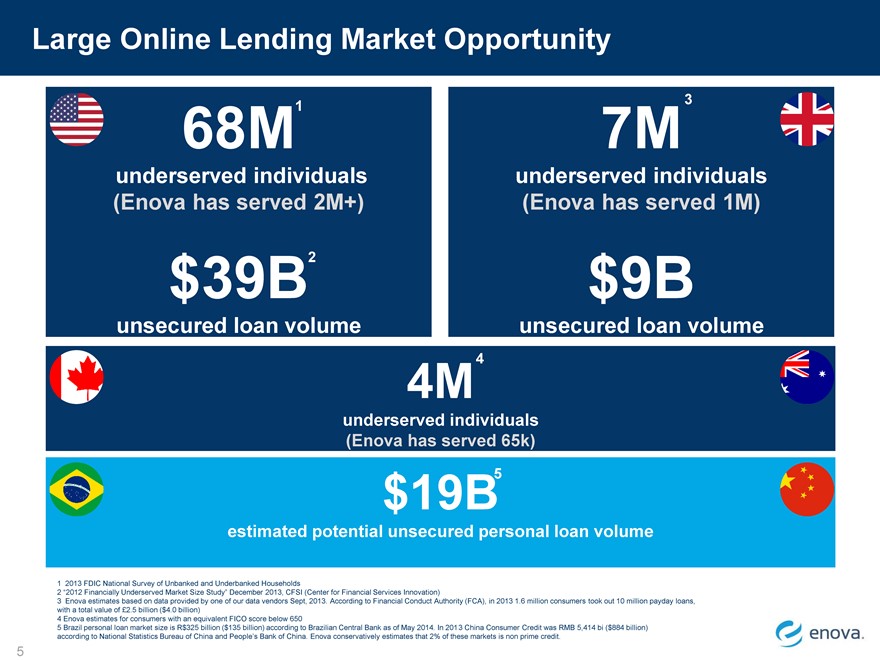

Large Online Lending Market Opportunity

68M1 7M 3

underserved individuals underserved individuals

(Enova has served 2M+) (Enova has served 1M)

$39B2 $9B

unsecured loan volume unsecured loan volume

4M4

underserved individuals

(Enova has served 65k)

$19B5

estimated potential unsecured personal loan volume

1 2013 FDIC National Survey of Unbanked and Underbanked Households

2 “2012 Financially Underserved Market Size Study” December 2013, CFSI (Center for Financial Services Innovation)

3 Enova estimates based on data provided by one of our data vendors Sept, 2013. According to Financial Conduct Authority (FCA), in 2013 1.6 million consumers took out 10 million payday loans, with a total value of £2.5 billion ($4.0 billion)

4 Enova estimates for consumers with an equivalent FICO score below 650

5 Brazil personal loan market size is R$325 billion ($135 billion) according to Brazilian Central Bank as of May 2014. In 2013 China Consumer Credit was RMB 5,414 bi ($884 billion) according to National Statistics Bureau of China and People’s Bank of China. Enova conservatively estimates that 2% of these markets is non prime credit.

5

Three Core Products

Average loan size: $515

Short-Term Loans

Single payment loans Term:Generally 7—90 days

2004 2007 2009 2009

Average loan size: $1,399

Term: Generally 2—12 months 2008 2010 2013

Installment Loans

Fully amortizing installment loan Average _Near-Prime_ loan size: $3,344

Term: Generally 12—36 months, with 2012

certain loans up to 60 months

Average draw size: $273

Lines of Credit Term:

Borrow as often as needed in U.S.: Open 2010 2014

increments up to customers_

available credit limits U.K.: 1 _ 10 months

Note: time period for average loan size, average draw size and term is nine months ended September, 30, 2014.

6

Online Model Has Clear Advantages

For Enova

No Stores

invest in tech and people, not real estate

Centralized Analytics

sophisticated underwriting in seconds

Top Talent

hiring Tech/Analytics in desirable urban center

Product Development

rapid response to market and regulatory changes

For Borrowers

Privacy

no standing in line and applying in public

Convenience

apply anytime and manage account from desktop or mobile

Speed

rapid funding directly into bank account

Flexibility

product choice to draw what_s needed and fit payment to budget

7

Online Lending is Simple for Borrowers

1. Apply

Easy-to-complete identity, employment, income, payroll date, bank account information

Multi-stage Screening to verify identity and prevent fraud

2. Underwrite

Decisioning in 3 to 6 seconds, analytics system pulls data and determines credit worthiness

Advanced Analytics massive parallel processing of 100 algorithms, 1,000 variables, 10 years and 14 TB of data

3. Accept & Fund

Accept agreements reviewed and signed online

Funding via ACH by next business day in U.S., within 10 minutes to debit card in U.K.

4. Service

Multi-Channel Service

U.S. based in-house service center 24/7 for assistance and payment

Proprietary Systems tailored CRM system integrated with analytics engine and marketing channels

8

Focused on Key Strategies

9

Strategy

Drive efficient

Execution

with Technology and Analytics

Diversify

Products and Geographies

Innovate

Products and Internal Functions

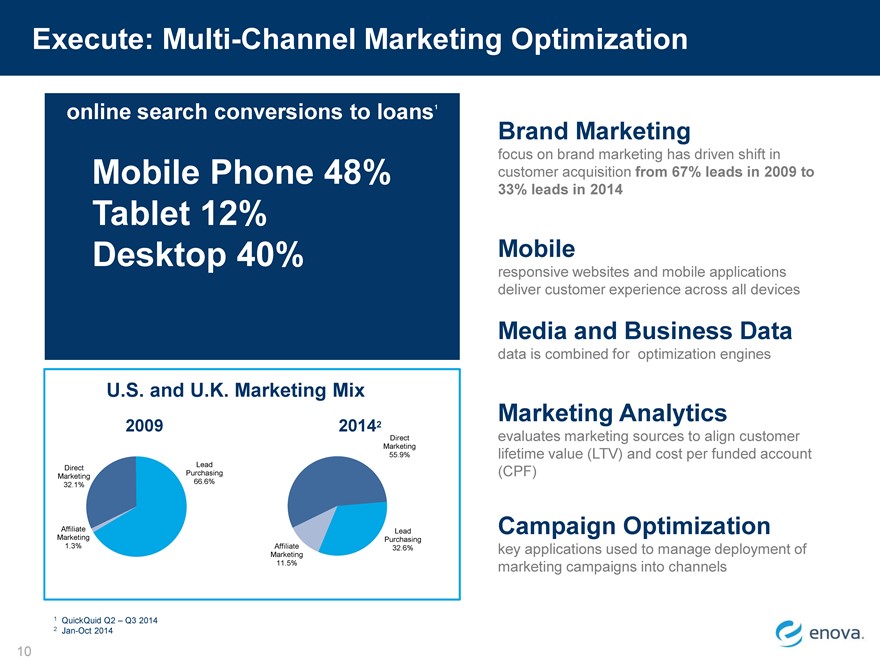

Execute: Multi-Channel Marketing Optimization

online search conversions to loans1

Mobile Phone 48% Tablet 12% Desktop 40%

U.S. and U.K. Marketing Mix

2009 20142

Direct

Marketing

55.9%

Direct Lead

Marketing Purchasing

32.1% 66.6%

Affiliate Lead

Marketing Purchasing

1.3% Affiliate 32.6%

Marketing

11.5%

Brand Marketing

focus on brand marketing has driven shift in customer acquisition from 67% leads in 2009 to 33% leads in 2014

Mobile

responsive websites and mobile applications deliver customer experience across all devices

Media and Business Data

data is combined for optimization engines

Marketing Analytics

evaluates marketing sources to align customer lifetime value (LTV) and cost per funded account (CPF)

Campaign Optimization

key applications used to manage deployment of marketing campaigns into channels

10

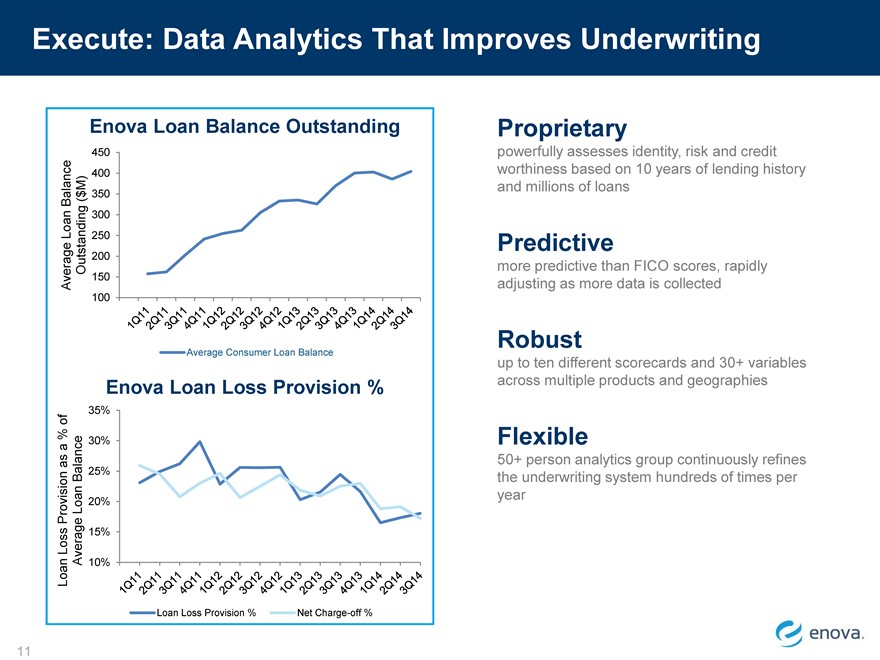

Execute: Data Analytics That Improves Underwriting

Enova Loan Balance Outstanding

450

Enova Customer Service Satisfaction 2013

100%

90%

80%

70%

60%

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Loan Loss Provision %

Net Charge-off %

Proprietary

powerfully assesses identity, risk and credit worthiness based on 10 years of lending history and millions of loans

Predictive

more predictive than FICO scores, rapidly adjusting as more data is collected

Robust

up to ten different scorecards and 30+ variables across multiple products and geographies

Flexible

50+ person analytics group continuously refines the underwriting system hundreds of times per year

11

Execute: Customer Service That Drives Recommendation

Enova Customer Service

Satisfaction 2013

100%

90%

80%

70%

60%

Jan Feb Mar Apr May Jun

Jul

Aug Sep Oct Nov Dec

Satisfied with the overall service received

Customer service rep knowledgeable and quickly identified the key issue(s) Would do business with Enova in the future Would recommend to friend, relatives and colleagues

U.S. based In-House Call

Centers

24/7 multi-channel availability via phone, chat, or email supported by state-of-the-art CRM and telephony technology

High Service Levels

average wait times < 10 seconds 94% < 30 seconds, during 2013

Analytics Drive Results

customer interactions—time of day, contact frequency, contact method and script—optimized for efficiency and effectiveness

Best Practices Sustain Performance

onboarding, soft skills training and continuous education with scorecards, call monitoring and calibration, wait time, first call resolution

12

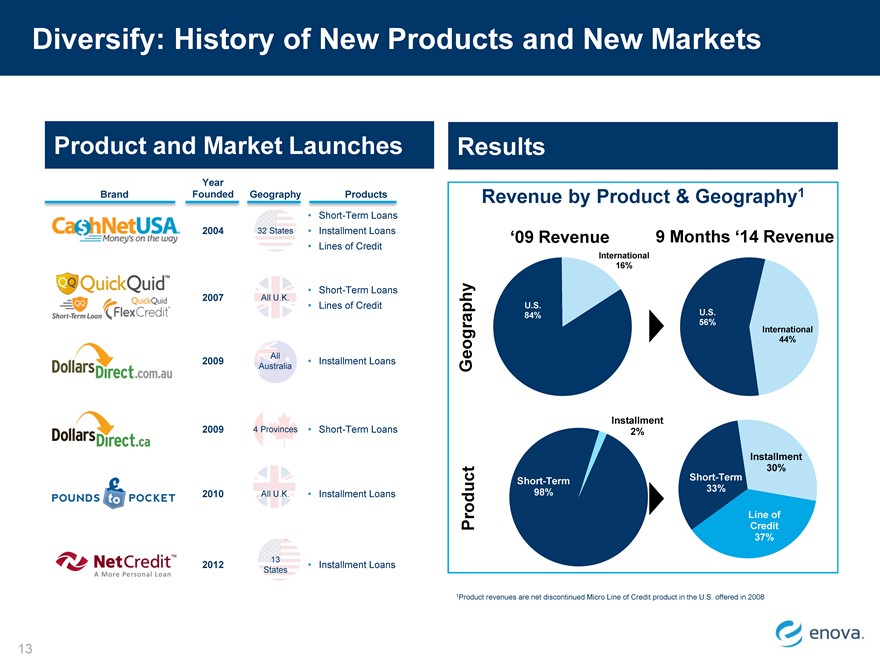

Diversify: History of New Products and New Markets

Product and Market Launches

Year

Brand

Founded

Geography

2004

32 States

2007

All U.K.

2009

All

Australia

20094Provinces

2010

All U.K.

2012

13

States

[Graphic Appears Here]

Short-Term Loans

Installment Loans

Lines of Credit

Short-Term Loans

Lines of Credit

Installment Loans

Short-Term Loans

Installment Loans

Installment Loans

Results

Revenue by Product & Geography1

_09 Revenue

9 Months _14 Revenue

International

16%

U.S.

84%

U.S.

56%

International

Geography

44%

Installment

0%2%

Installment

30%

Short-Term

Short-Term

98%

33%

Line of

Product

Credit

37%

1Product revenues are net discontinued Micro Line of Credit product in the U.S. offered in 2008

13

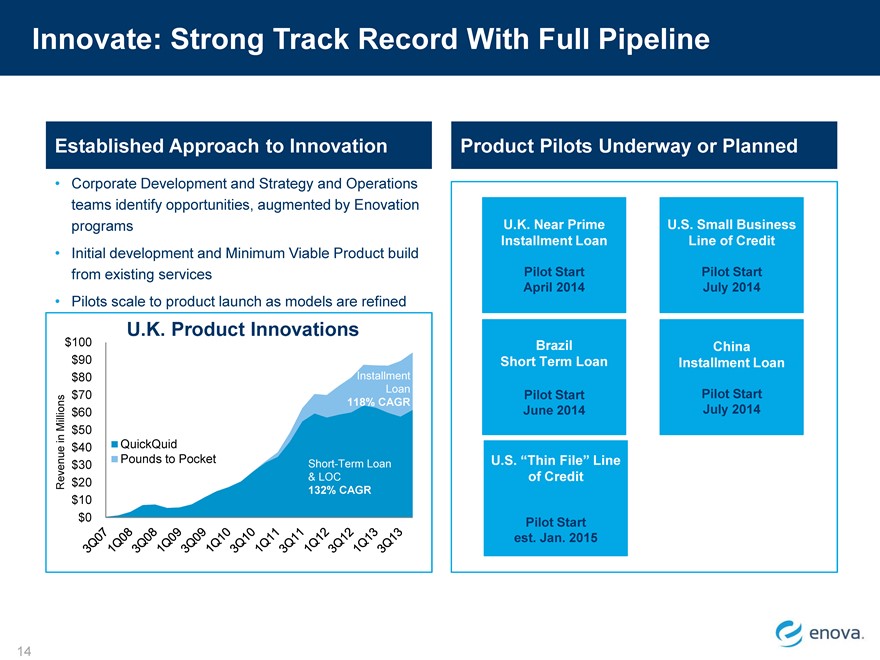

Innovate: Strong Track Record With Full Pipeline

Established Approach to Innovation

U.K. Product Innovations

$100

$90

$80

Installment

Loan

$70

118% CAGR

$60

$50

$40

QuickQuid

$30

Pounds to Pocket

Short-Term Loan

Revenue in Millions

$20

& LOC

132% CAGR

$10

$0

Product Pilots Underway or Planned

14

Corporate Development and Strategy and Operations teams identify opportunities, augmented by Enovation programs Initial development and Minimum Viable Product build from existing services Pilots scale to product launch as models are refined

U.K. Near Prime

U.S. Small Business

Installment Loan

Line of Credit

Pilot Start

Pilot Start

April 2014

July 2014

Brazil

China

Short Term Loan

Installment Loan

Pilot Start

Pilot Start

June 2014

July 2014

U.S. _Thin File_ Lineof Credit

Pilot Startest. Jan. 2015

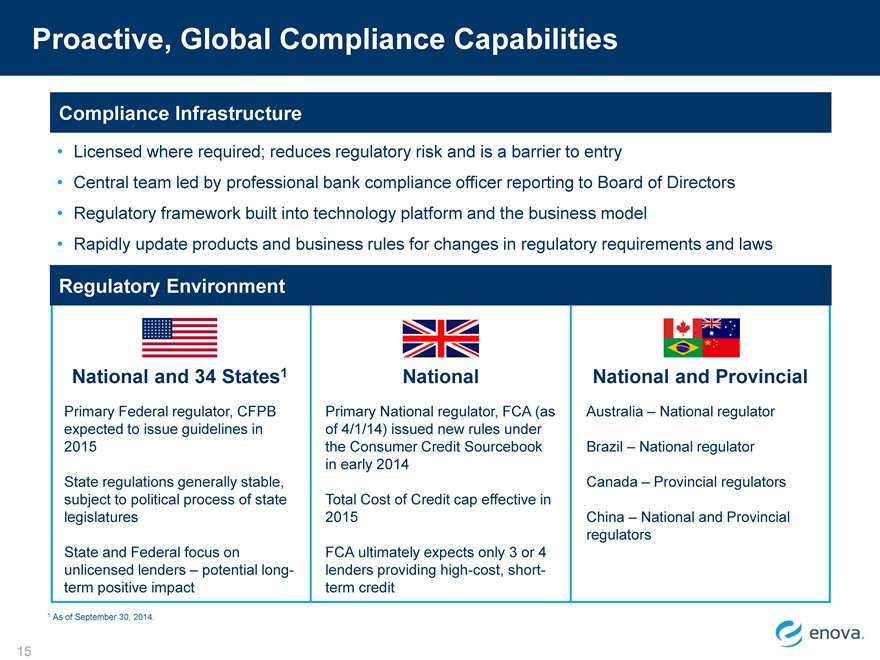

Proactive, Global Compliance Capabilities

Compliance Infrastructure

Regulatory Environment

National and 34 States 1

National

National and Provincial

Primary Federal regulator, CFPB

Primary National regulator, FCA (as

Australia _ National regulator

expected to issue guidelines in

of 4/1/14) issued new rules under

2015

the Consumer Credit Sourcebook

Brazil _ National regulator

in early 2014

State regulations generally stable,

Canada _ Provincial regulators

subject to political process of state

Total Cost of Credit cap effective in

legislatures

2015

China _ National and Provincial

regulators

State and Federal focus on

FCA ultimately expects only 3 or 4

unlicensed lenders _ potential long-

lenders providing high-cost, short-

term positive impact

term credit

1 As of September 30, 2014.

15

Licensed where required; reduces regulatory risk and is a barrier to entry

Central team led by professional bank compliance officer reporting to Board of Directors Regulatory framework built into technology platform and the business model Rapidly update products and business rules for changes in regulatory requirements and laws

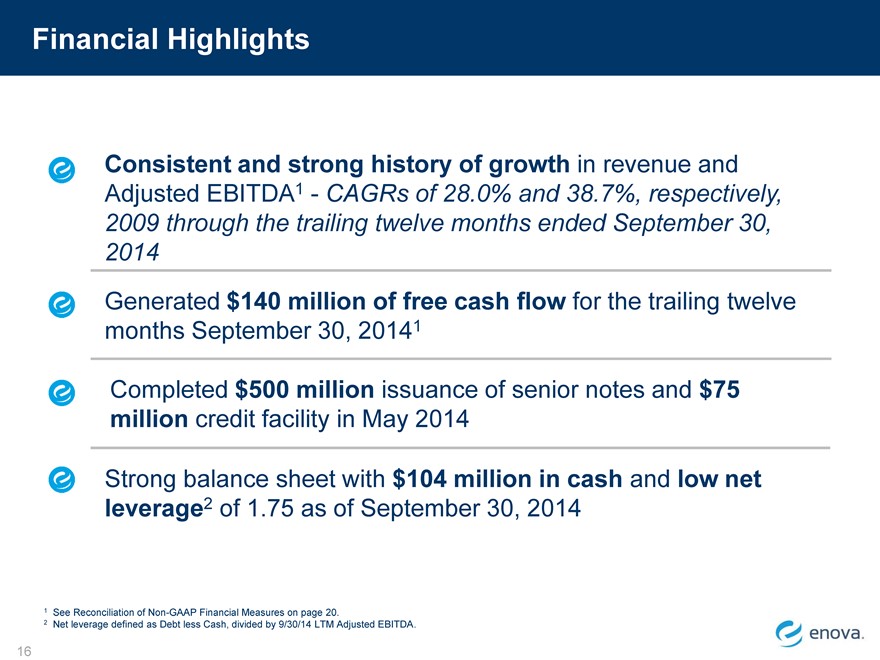

Financial Highlights

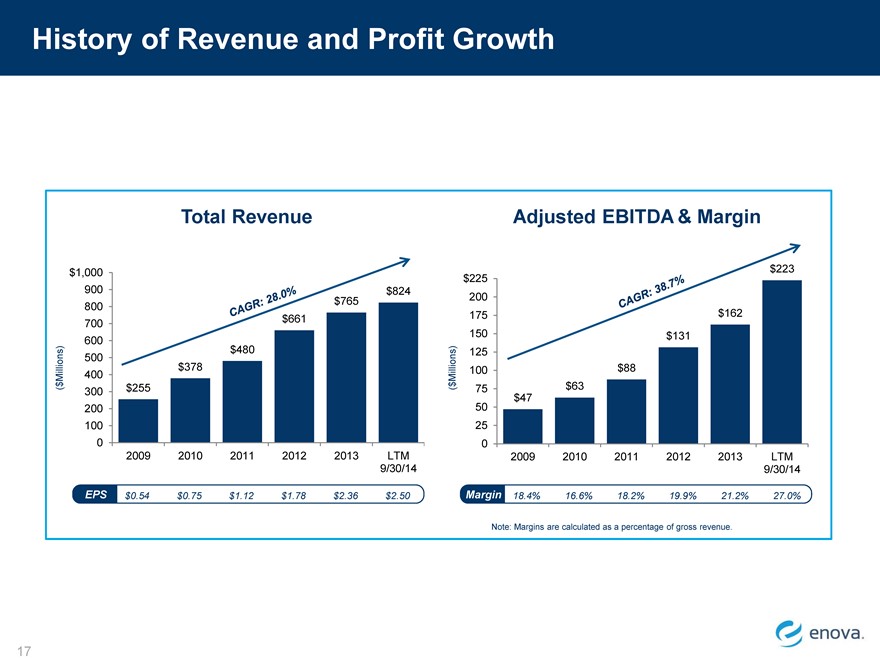

Consistent and strong history of growth in revenue and Adjusted EBITDA1—CAGRs of 28.0% and 38.7%, respectively, 2009 through the trailing twelve months ended September 30, 2014

Generated $140 million of free cash flow for the trailing twelve

months September 30, 20141

Completed $500 million issuance of senior notes and $75 million credit facility in May 2014

Strong balance sheet with $104 million in cash and low net leverage2 of 1.75 as of September 30, 2014

See Reconciliation of Non-GAAP Financial Measures on page 20.

Net leverage defined as Debt less Cash, divided by 9/30/14 LTM Adjusted EBITDA.

16

History of Revenue and Profit Growth

Total Revenue Adjusted EBITDA & Margin

$1,000 $223

$225

900 $824

800 $765 200

$661 175 $162

700

600 150 $131

500 $480 125

Millions) 400 $378 Millions) 100 $88

$

( $ 300 $255 ( 75 $63

$47

200 50

100 25

0 0

2009 2010 2011 2012 2013 LTM 2009 2010 2011 2012 2013 LTM

9/30/14 9/30/14

EPS $0.54 $0.75 $1.12 $1.78 $2.36 $2.50 Margin 18.4% 16.6% 18.2% 19.9% 21.2% 27.0%

Note: Margins are calculated as a percentage of gross revenue.

17

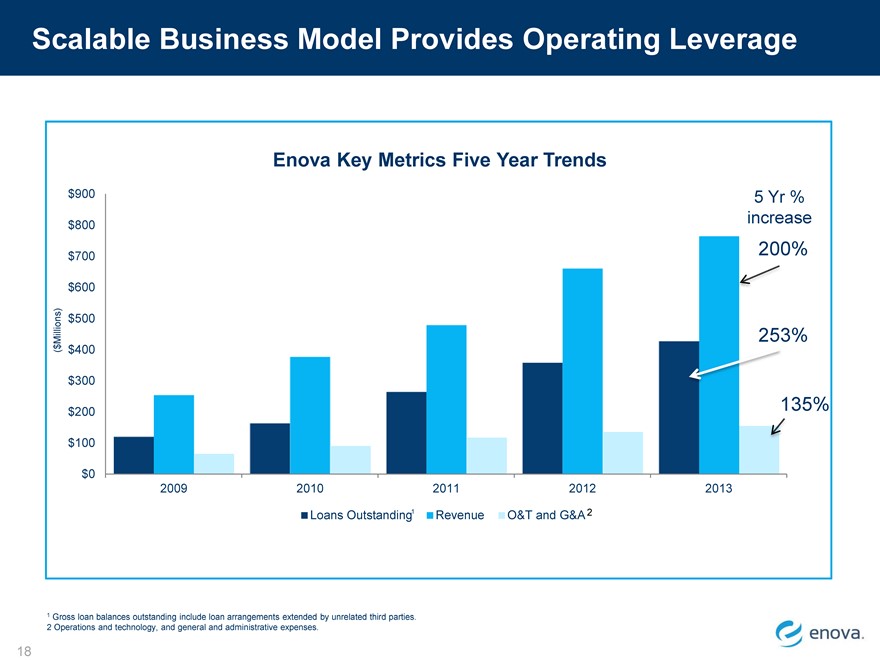

Scalable Business Model Provides Operating Leverage

Enova Key Metrics Five Year Trends

$900 5 Yr %

$800 increase

$700 200%

$600

$500

Millions) 253%

( $ $400

$300

$200 135%

$100

$0

2009 2010 2011 2012 2013

Loans Outstanding1 Revenue O&T and G&A 2

1 Gross loan balances outstanding include loan arrangements extended by unrelated third parties.

2 Operations and technology, and general and administrative expenses.

18

Appendix

19

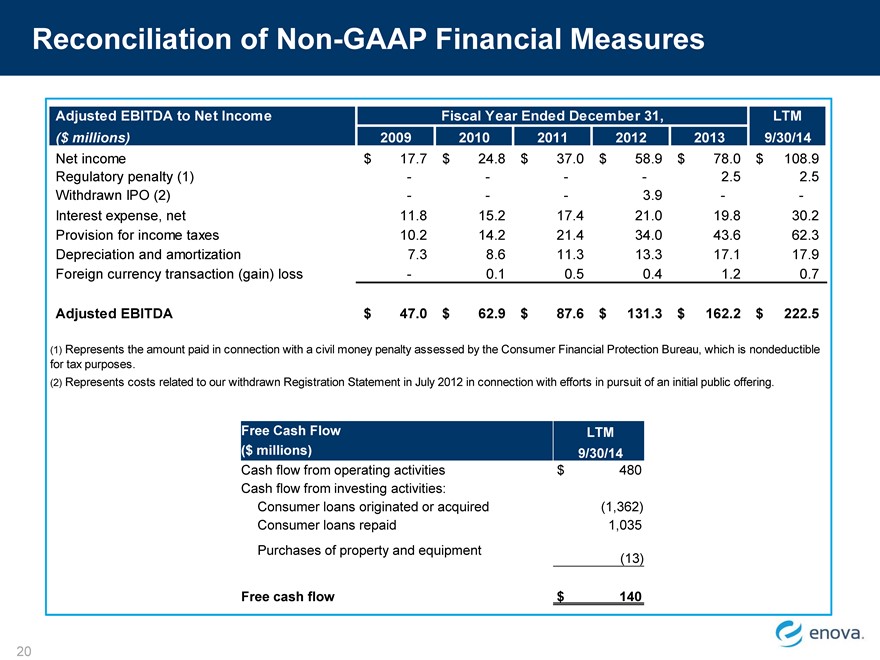

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA to Net Income Fiscal Year Ended December 31, LTM

($ millions) 2009 2010 2011 2012 2013 9/30/14

Net income $ 17.7 $ 24.8 $ 37.0 $ 58.9 $ 78.0 $ 108.9

Regulatory penalty (1) - - - - 2.5 2.5

Withdrawn IPO (2) - - - 3.9 - -

Interest expense, net 11.8 15.2 17.4 21.0 19.8 30.2

Provision for income taxes 10.2 14.2 21.4 34.0 43.6 62.3

Depreciation and amortization 7.3 8.6 11.3 13.3 17.1 17.9

Foreign currency transaction (gain) loss - 0.1 0.5 0.4 1.2 0.7

Adjusted EBITDA $ 47.0 $ 62.9 $ 87.6 $ 131.3 $ 162.2 $ 222.5

(1) Represents the amount paid in connection with a civil money penalty assessed by the Consumer Financial Protection Bureau, which is nondeductible

for tax purposes.

(2) Represents costs related to our withdrawn Registration Statement in July 2012 in connection with efforts in pursuit of an initial public offering.

Free Cash Flow LTM

($ millions) 9/30/14

Cash flow from operating activities $ 480

Cash flow from investing activities:

Consumer loans originated or acquired (1,362)

Consumer loans repaid 1,035

Purchases of property and equipment (13)

Free cash flow $ 140

(1) Represents the amount paid in connection with a civil money penalty assessed by the Consumer Financial Protection Bureau, which is nondeductible for tax purposes.

(2) Represents costs related to our withdrawn Registration Statement in July 2012 in connection with efforts in pursuit of an initial public offering.

20

THANK YOU