Investor Presentation November 2015 Exhibit 99.1

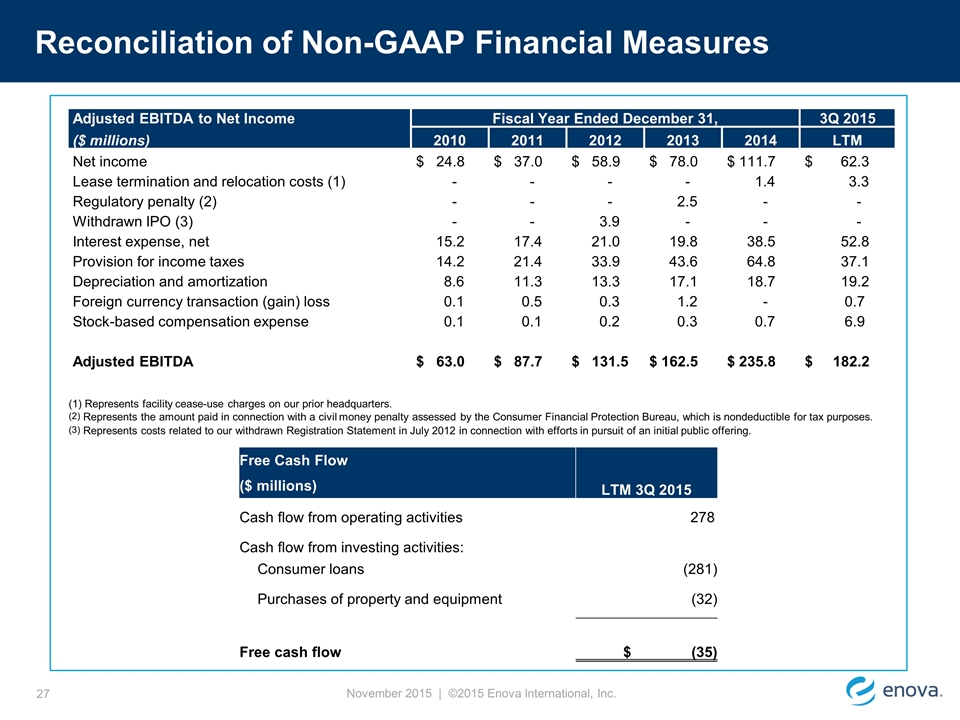

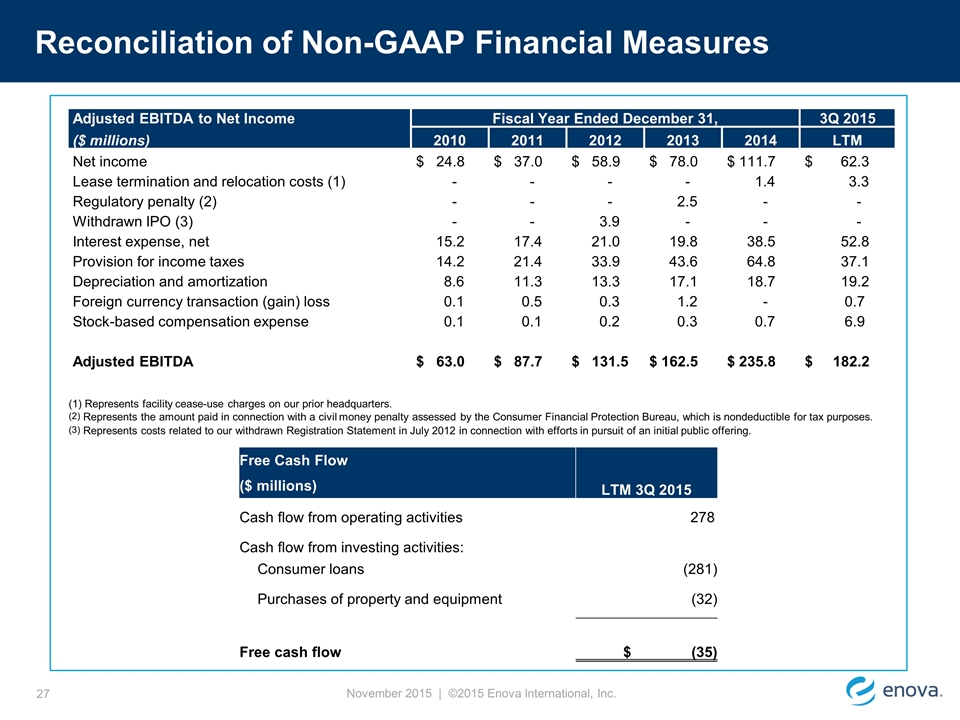

Cautionary Statement Regarding Risks and Uncertainties That May Affect Future Results This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the business, financial condition and prospects of Enova. These forward-looking statements give current expectations or forecasts of future events and reflect the views and assumptions of Enova's senior management with respect to the business, financial condition and prospects of Enova as of the date of this release and are not guarantees of future performance. The actual results of Enova could differ materially from those indicated by such forward-looking statements because of various risks and uncertainties applicable to Enova's business, including, without limitation, those risks and uncertainties indicated in Enova's filings with the Securities and Exchange Commission ("SEC"), including our annual report on Form 10-K, quarterly reports on Forms 10-Q and current reports on Forms 8-K. These risks and uncertainties are beyond the ability of Enova to control, and, in many cases, Enova cannot predict all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. When used in this release, the words "believes," "estimates," "plans," "expects," "anticipates" and similar expressions or variations as they relate to Enova or its management are intended to identify forward-looking statements. Enova cautions you not to put undue reliance on these statements. Enova disclaims any intention or obligation to update or revise any forward-looking statements after the date of this release. Non-GAAP Financial Information In addition to the financial information prepared in conformity with generally accepted accounting principles in the United States (“GAAP”), the Company provides cash flow from operating activities less net consumer loans originated, acquired and repaid and purchases of property and equipment (“free cash flow”) and net income excluding depreciation, amortization, interest, foreign currency transaction gains or losses, taxes, and stock-based compensation expense (“Adjusted EBITDA”), which are not considered measures of financial performance under GAAP. Management uses these non-GAAP financial measures for internal managerial purposes and believes that their presentation is meaningful and useful in understanding the activities and business metrics of the Company’s operations. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s business that, when viewed with the Company’s GAAP results, provides a more complete understanding of factors and trends affecting the Company’s business. Management provides such non-GAAP financial information for informational purposes and to enhance understanding of the Company’s GAAP consolidated financial statements. Readers should consider the information in addition to, but not instead of, the Company’s financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes. A table reconciling such non-GAAP financial measures is available in the appendix. Safe Harbor Statement November 2015 | ©2015 Enova International, Inc.

Investment Highlights Proven Tech and Analytics with 11 Years of Data and Experience Large Market with Growing Demand for Non-Bank Credit Strong Pipeline of New Growth Initiatives Superior Financials with Strong Growth in Revenues and Profits Experienced, Successful Leadership Team Proprietary Online Model Enables Rapid Expansion at Low Cost November 2015 | ©2015 Enova International, Inc.

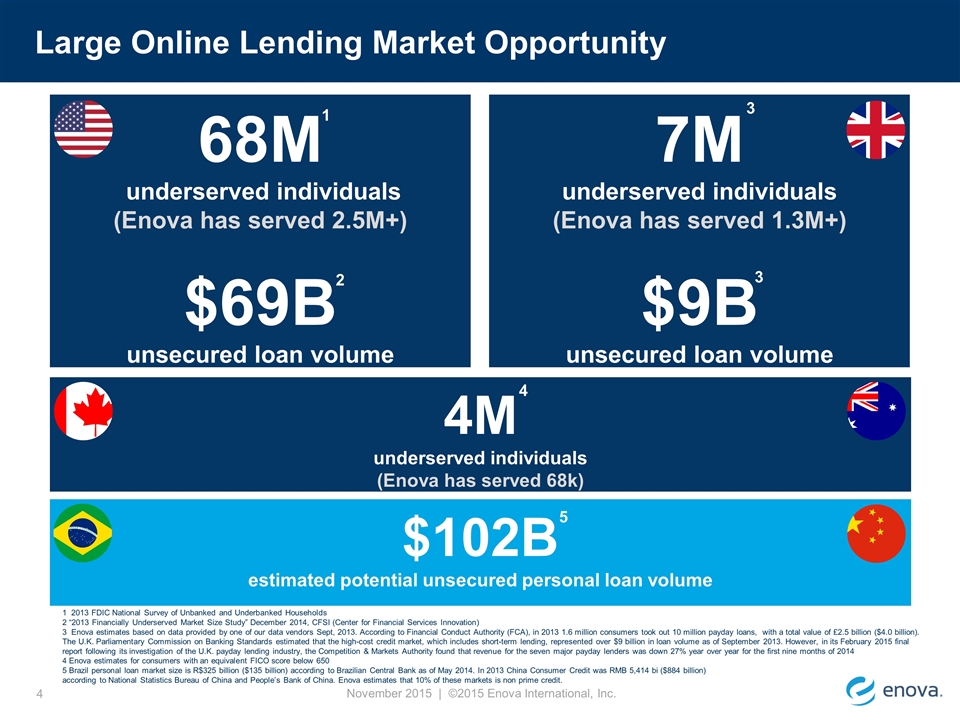

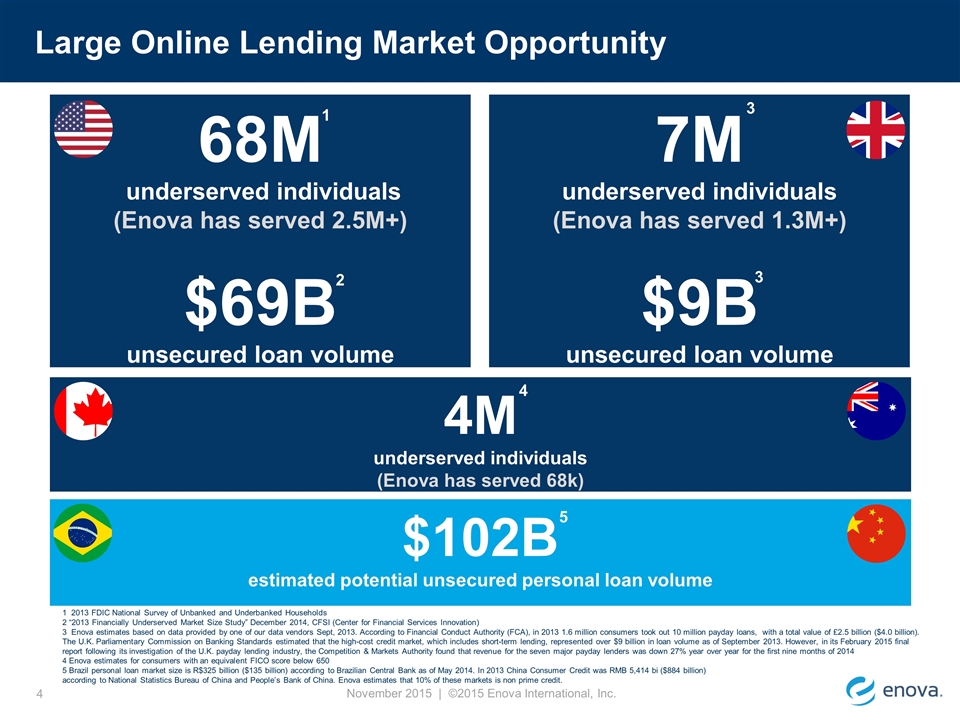

Large Online Lending Market Opportunity November 2015 | ©2015 Enova International, Inc. $102B estimated potential unsecured personal loan volume 4M underserved individuals (Enova has served 68k) 68M underserved individuals (Enova has served 2.5M+) $69B unsecured loan volume 1 2013 FDIC National Survey of Unbanked and Underbanked Households 2 “2013 Financially Underserved Market Size Study” December 2014, CFSI (Center for Financial Services Innovation) 3 Enova estimates based on data provided by one of our data vendors Sept, 2013. According to Financial Conduct Authority (FCA), in 2013 1.6 million consumers took out 10 million payday loans, with a total value of £2.5 billion ($4.0 billion). The U.K. Parliamentary Commission on Banking Standards estimated that the high-cost credit market, which includes short-term lending, represented over $9 billion in loan volume as of September 2013. However, in its February 2015 final report following its investigation of the U.K. payday lending industry, the Competition & Markets Authority found that revenue for the seven major payday lenders was down 27% year over year for the first nine months of 2014 4 Enova estimates for consumers with an equivalent FICO score below 650 5 Brazil personal loan market size is R$325 billion ($135 billion) according to Brazilian Central Bank as of May 2014. In 2013 China Consumer Credit was RMB 5,414 bi ($884 billion) according to National Statistics Bureau of China and People’s Bank of China. Enova estimates that 10% of these markets is non prime credit. 7M underserved individuals (Enova has served 1.3M+) $9B unsecured loan volume 2 1 4 5 3 3

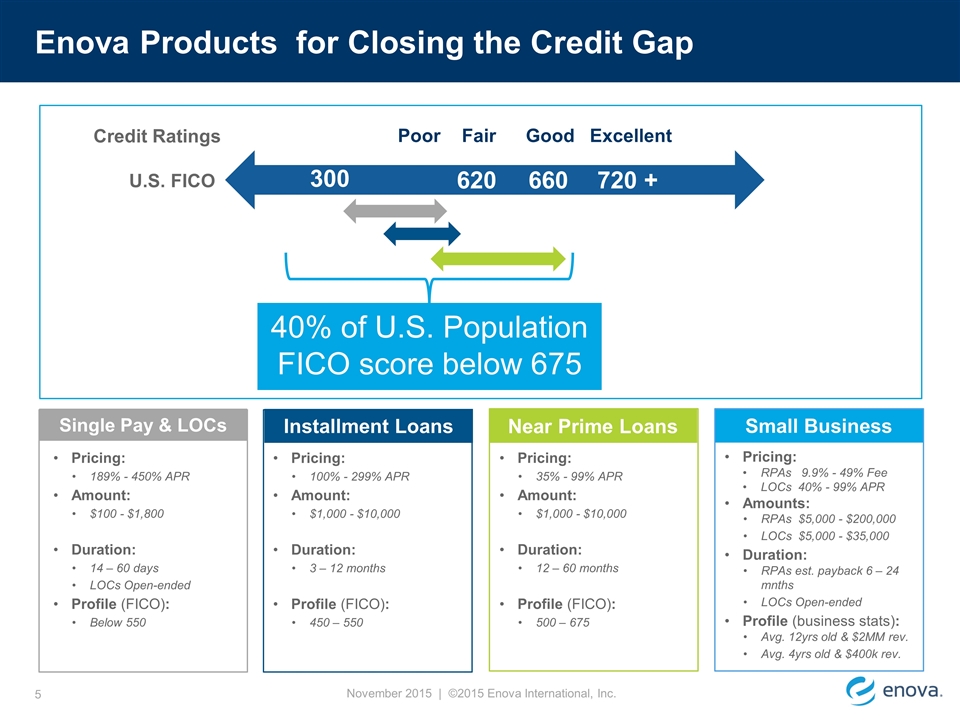

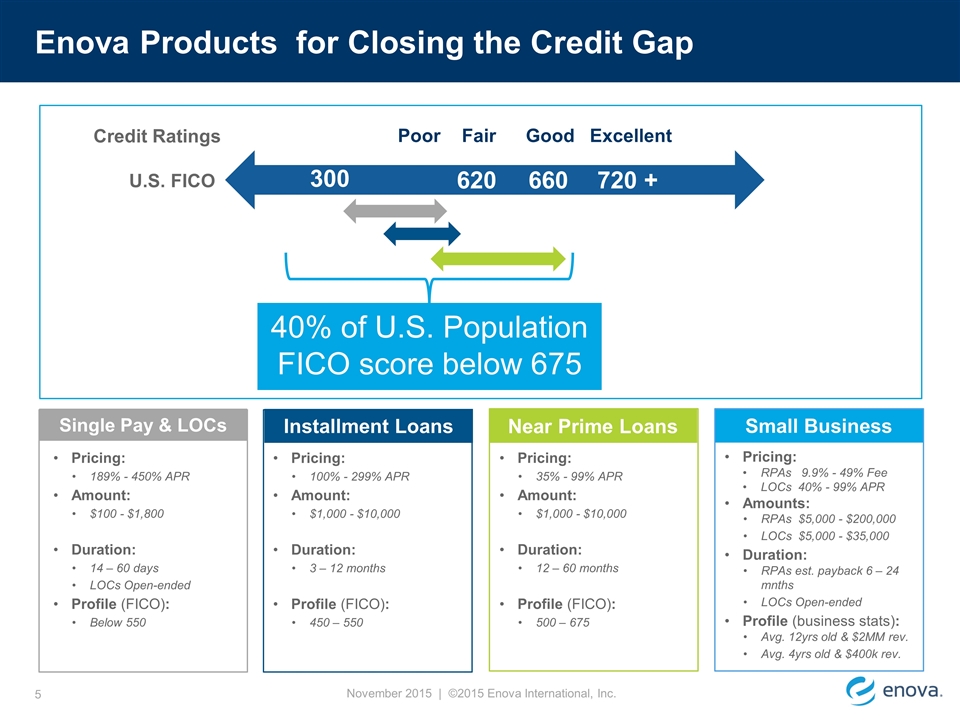

Single Pay & LOCs Enova Products for Closing the Credit Gap Near Prime Loans Pricing: 100% - 299% APR Amount: $1,000 - $10,000 Duration: 3 – 12 months Profile (FICO): 450 – 550 Pricing: 35% - 99% APR Amount: $1,000 - $10,000 Duration: 12 – 60 months Profile (FICO): 500 – 675 Pricing: 189% - 450% APR Amount: $100 - $1,800 Duration: 14 – 60 days LOCs Open-ended Profile (FICO): Below 550 Installment Loans Small Business Pricing: RPAs 9.9% - 49% Fee LOCs 40% - 99% APR Amounts: RPAs $5,000 - $200,000 LOCs $5,000 - $35,000 Duration: RPAs est. payback 6 – 24 mnths LOCs Open-ended Profile (business stats): Avg. 12yrs old & $2MM rev. Avg. 4yrs old & $400k rev. 720 + 40% of U.S. Population FICO score below 675 Poor Good Fair Excellent 660 620 U.S. FICO Credit Ratings 300 November 2015 | ©2015 Enova International, Inc.

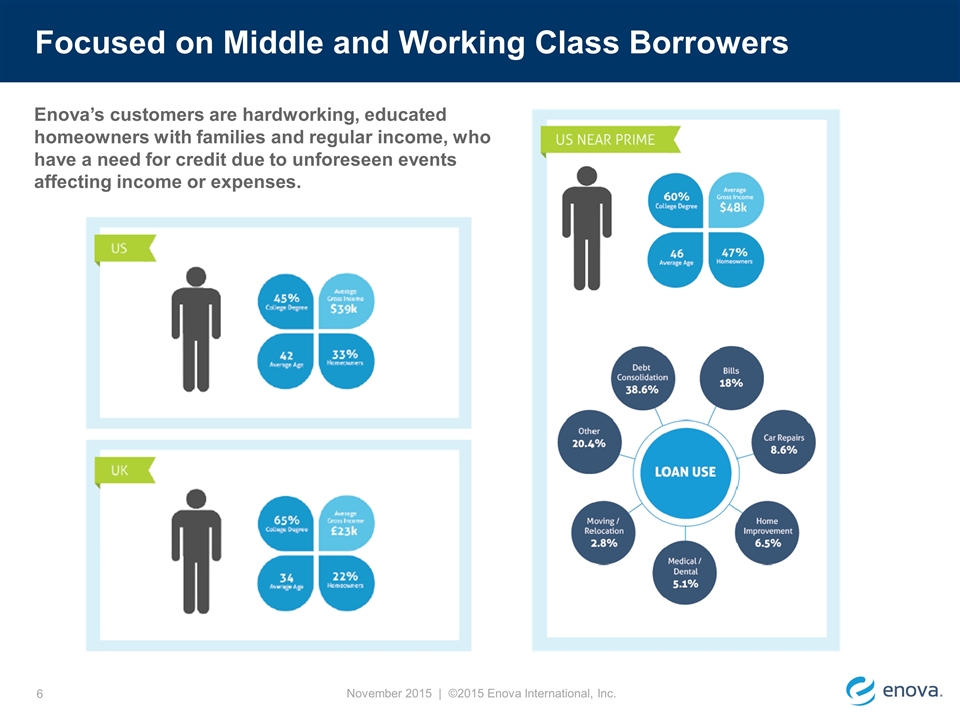

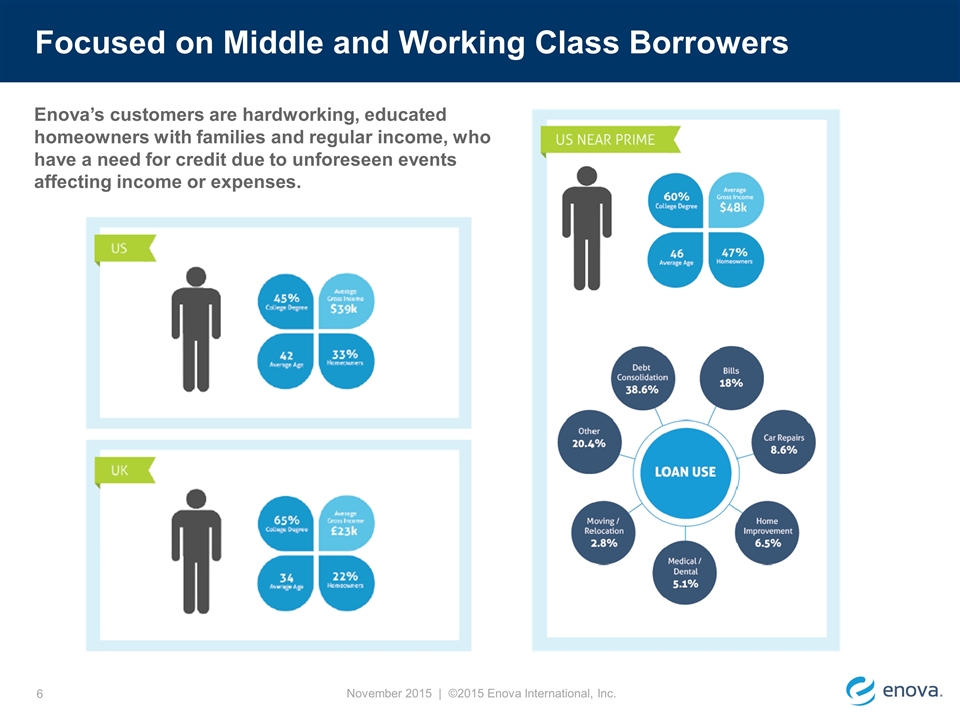

Focused on Middle and Working Class Borrowers Enova’s customers are hardworking, educated homeowners with families and regular income, who have a need for credit due to unforeseen events affecting income or expenses. November 2015 | ©2015 Enova International, Inc.

For Borrowers For Enova Online Model has Clear Advantages No Stores invest in tech and people, not real estate Centralized Analytics sophisticated underwriting in seconds Product Development rapid response to market and regulatory changes Top Talent hiring in desirable urban center Privacy no standing in line and applying in public Convenience apply anytime anywhere and manage account from desktop or mobile Flexibility product choice to draw what’s needed and fit payment to budget Speed rapid funding directly into bank account November 2015 | ©2015 Enova International, Inc.

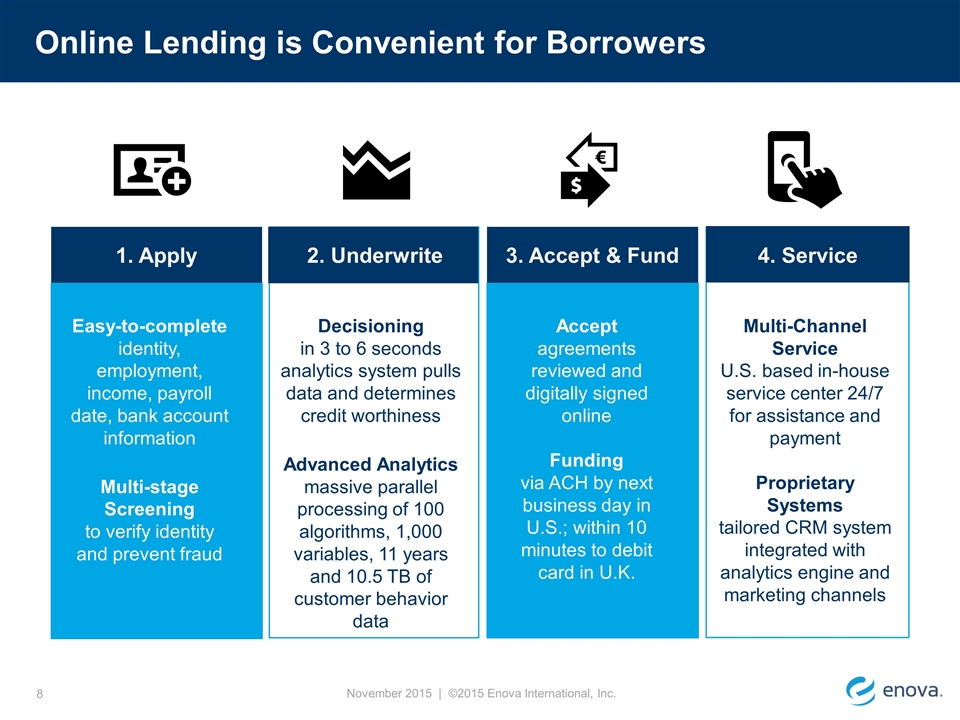

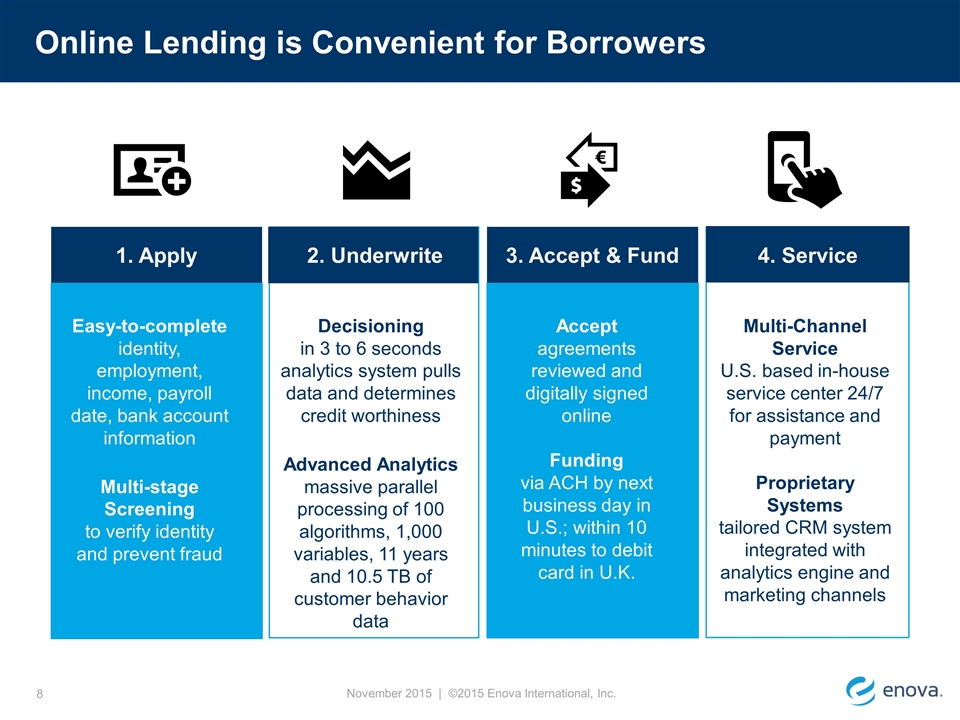

Online Lending is Convenient for Borrowers 1. Apply 2. Underwrite Easy-to-complete identity, employment, income, payroll date, bank account information Multi-stage Screening to verify identity and prevent fraud Decisioning in 3 to 6 seconds analytics system pulls data and determines credit worthiness Advanced Analytics massive parallel processing of 100 algorithms, 1,000 variables, 11 years and 10.5 TB of customer behavior data 3. Accept & Fund 4. Service Accept agreements reviewed and digitally signed online Funding via ACH by next business day in U.S.; within 10 minutes to debit card in U.K. Multi-Channel Service U.S. based in-house service center 24/7 for assistance and payment Proprietary Systems tailored CRM system integrated with analytics engine and marketing channels November 2015 | ©2015 Enova International, Inc.

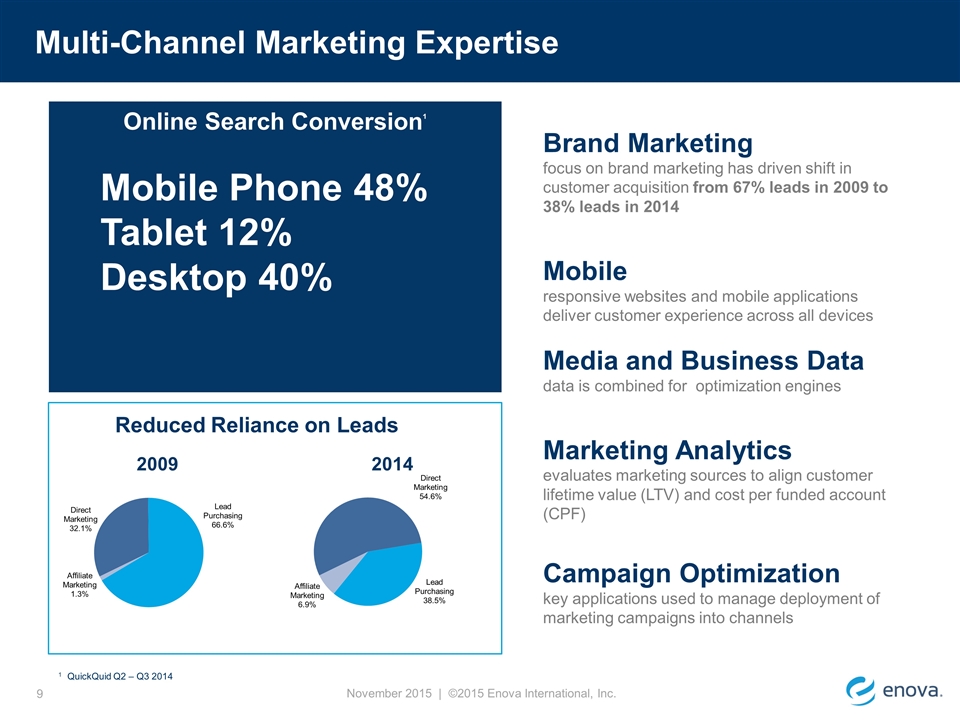

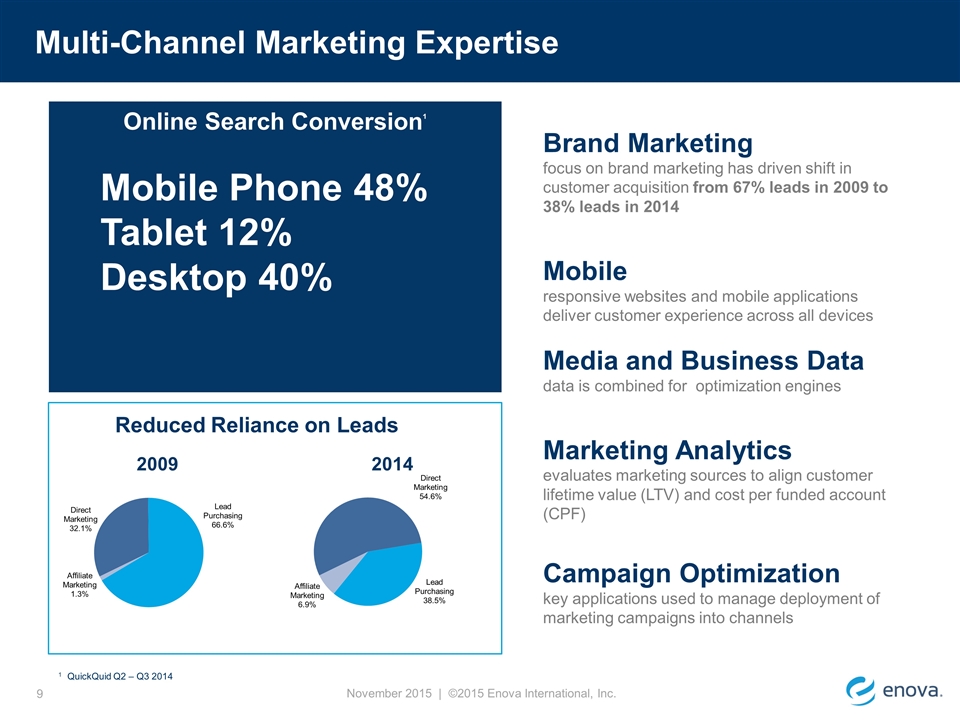

Multi-Channel Marketing Expertise Brand Marketing focus on brand marketing has driven shift in customer acquisition from 67% leads in 2009 to 38% leads in 2014 Mobile responsive websites and mobile applications deliver customer experience across all devices Media and Business Data data is combined for optimization engines Marketing Analytics evaluates marketing sources to align customer lifetime value (LTV) and cost per funded account (CPF) Campaign Optimization key applications used to manage deployment of marketing campaigns into channels 2009 2014 1 QuickQuid Q2 – Q3 2014 Online Search Conversion1 Mobile Phone 48% Tablet 12% Desktop 40% Reduced Reliance on Leads November 2015 | ©2015 Enova International, Inc.

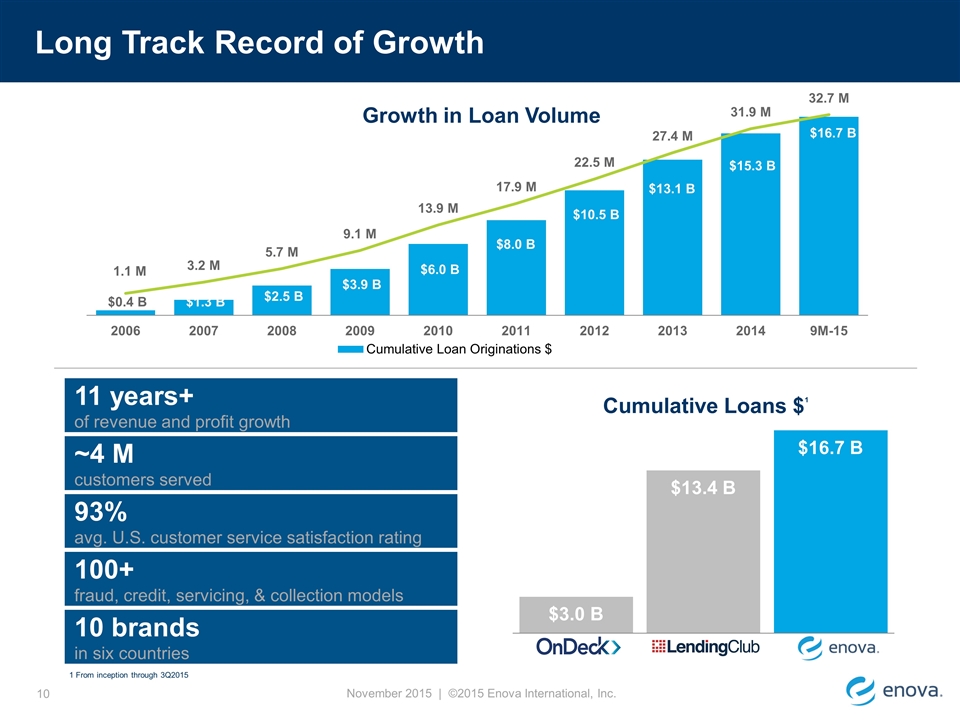

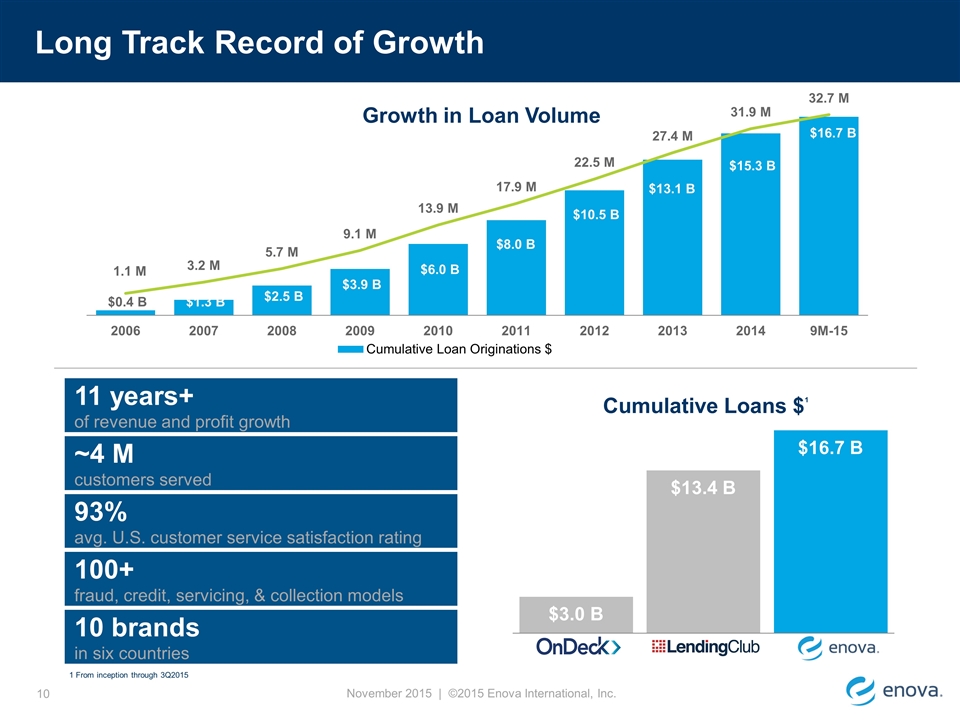

Long Track Record of Growth 1 From inception through 3Q2015 11 years+ of revenue and profit growth 100+ fraud, credit, servicing, & collection models ~4 M customers served 93% avg. U.S. customer service satisfaction rating 10 brands in six countries November 2015 | ©2015 Enova International, Inc. Growth in Loan Volume

Diversify Products and Geographies Innovate New opportunities and Internal Functions Drive efficient Execution with Technology and Analytics Three Pronged Strategy Drives Growth and Reduces Risk Strategy November 2015 | ©2015 Enova International, Inc.

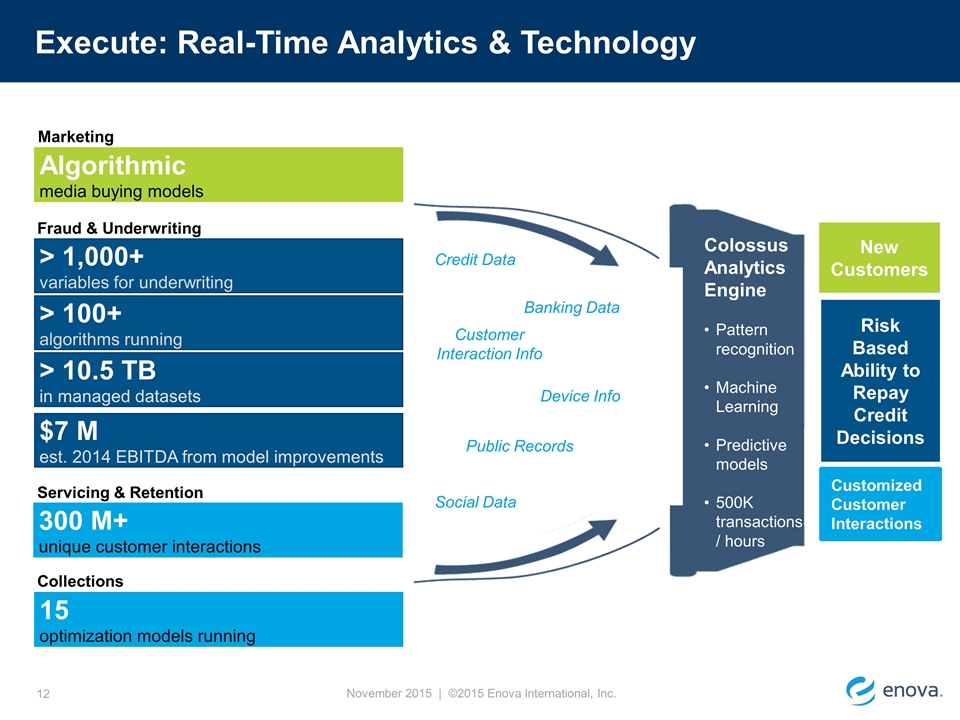

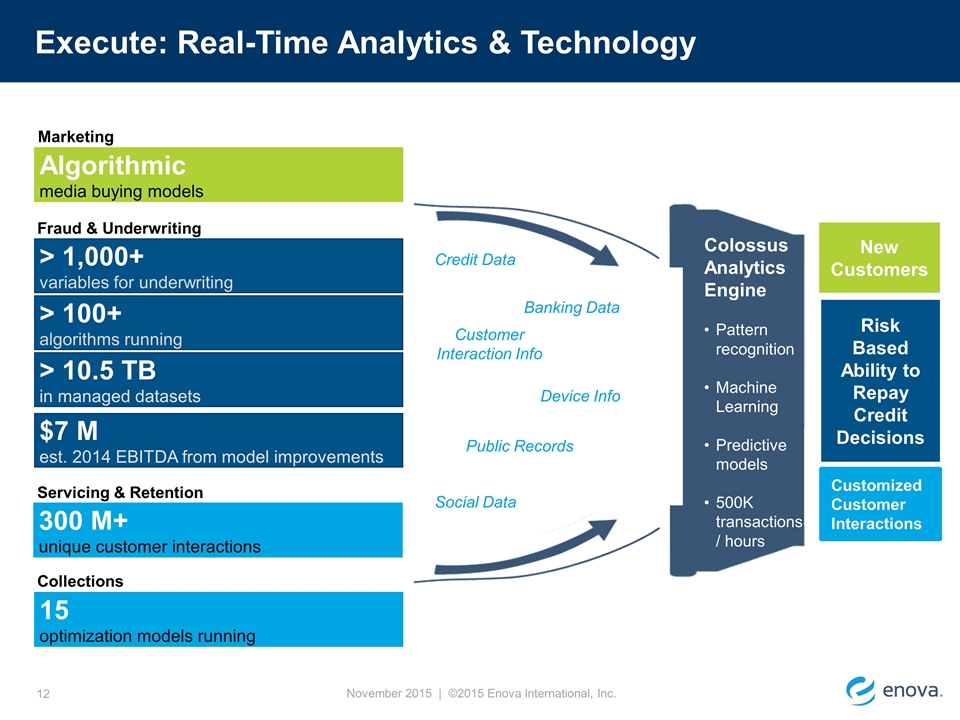

Execute: Real-Time Analytics & Technology Marketing Fraud & Underwriting Servicing & Retention Collections > 1,000+ variables for underwriting > 100+ algorithms running Algorithmic media buying models > 10.5 TB in managed datasets $7 M est. 2014 EBITDA from model improvements 15 optimization models running 300 M+ unique customer interactions Colossus Analytics Engine Pattern recognition Machine Learning Predictive models 500K transactions / hours Social Data Public Records Customer Interaction Info Device Info Banking Data Credit Data Risk Based Ability to Repay Credit Decisions New Customers Customized Customer Interactions November 2015 | ©2015 Enova International, Inc.

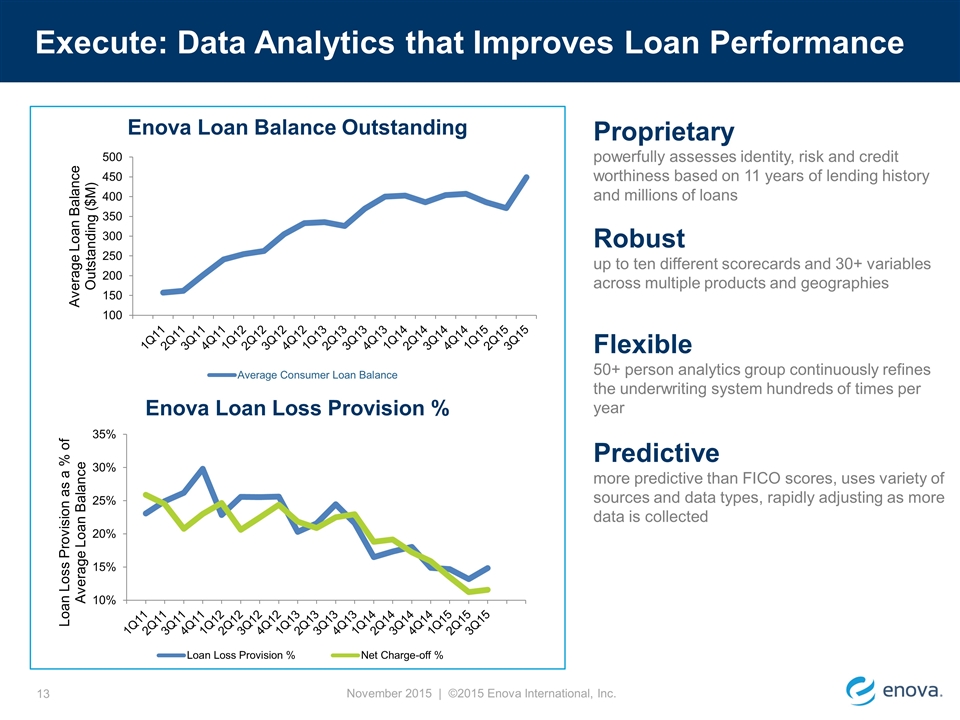

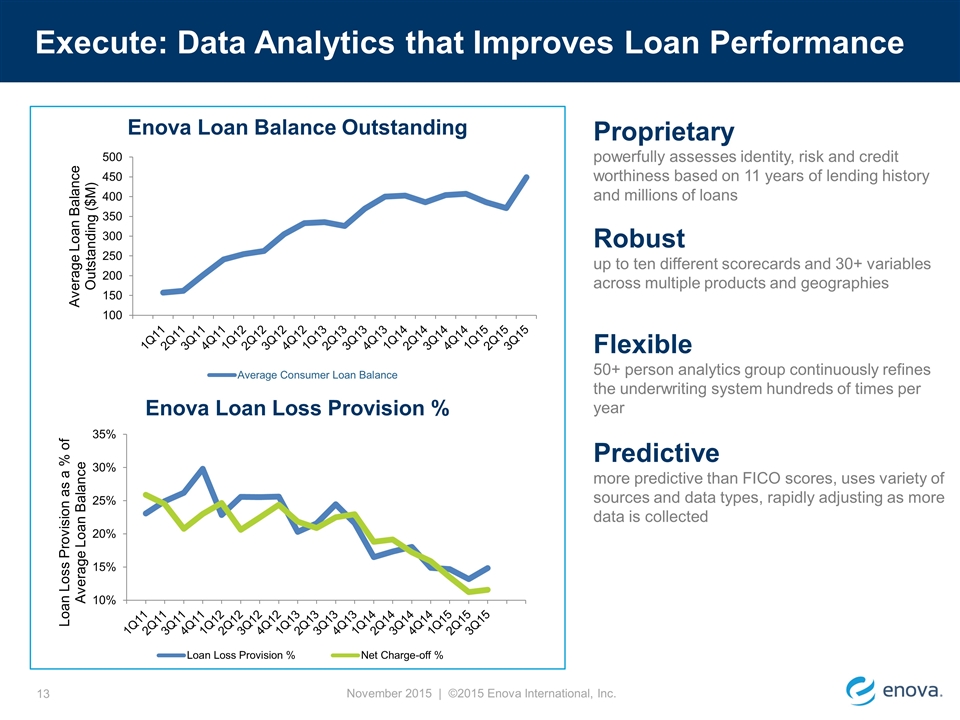

Execute: Data Analytics that Improves Loan Performance Proprietary powerfully assesses identity, risk and credit worthiness based on 11 years of lending history and millions of loans Robust up to ten different scorecards and 30+ variables across multiple products and geographies Flexible 50+ person analytics group continuously refines the underwriting system hundreds of times per year Predictive more predictive than FICO scores, uses variety of sources and data types, rapidly adjusting as more data is collected Enova Loan Balance Outstanding Enova Loan Loss Provision % November 2015 | ©2015 Enova International, Inc.

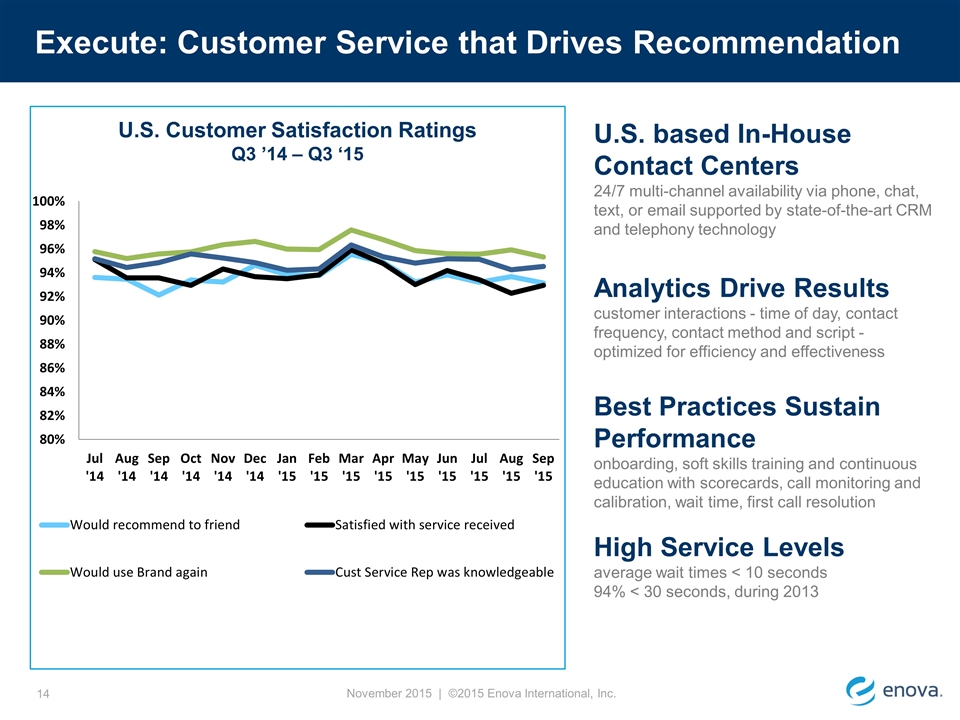

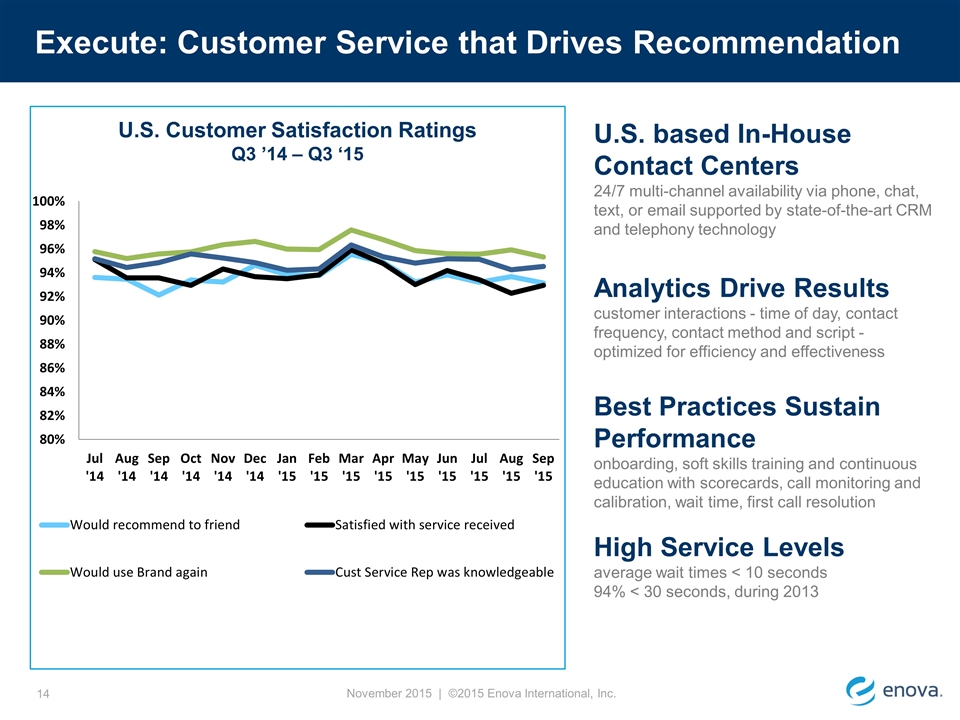

U.S. based In-House Contact Centers 24/7 multi-channel availability via phone, chat, text, or email supported by state-of-the-art CRM and telephony technology Analytics Drive Results customer interactions - time of day, contact frequency, contact method and script - optimized for efficiency and effectiveness Best Practices Sustain Performance onboarding, soft skills training and continuous education with scorecards, call monitoring and calibration, wait time, first call resolution High Service Levels average wait times < 10 seconds 94% < 30 seconds, during 2013 U.S. Customer Satisfaction Ratings Q3 ’14 – Q3 ‘15 Execute: Customer Service that Drives Recommendation November 2015 | ©2015 Enova International, Inc.

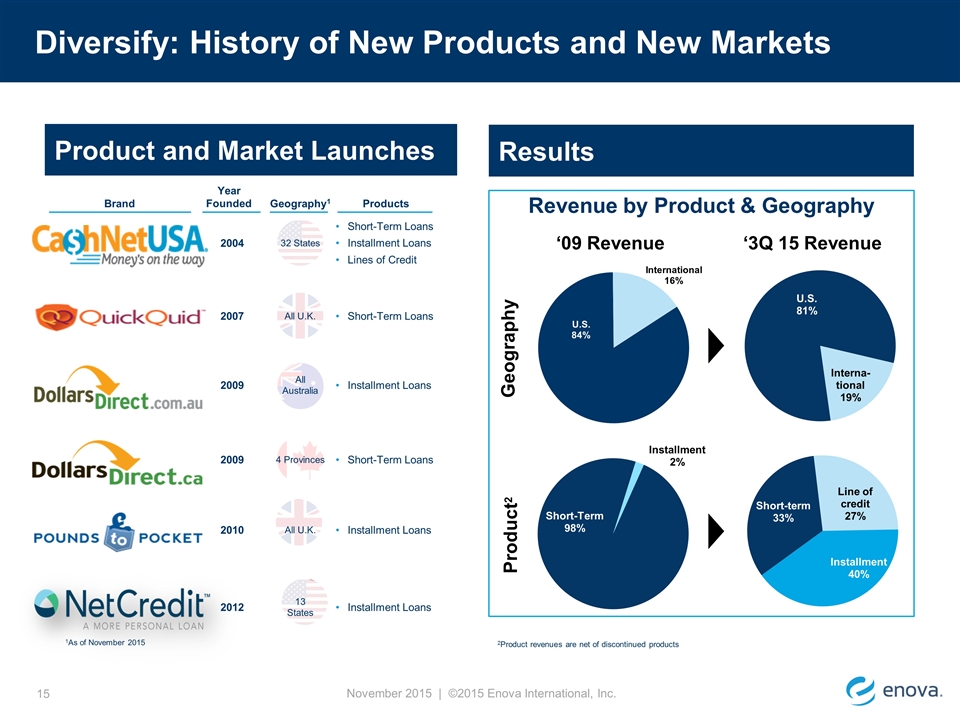

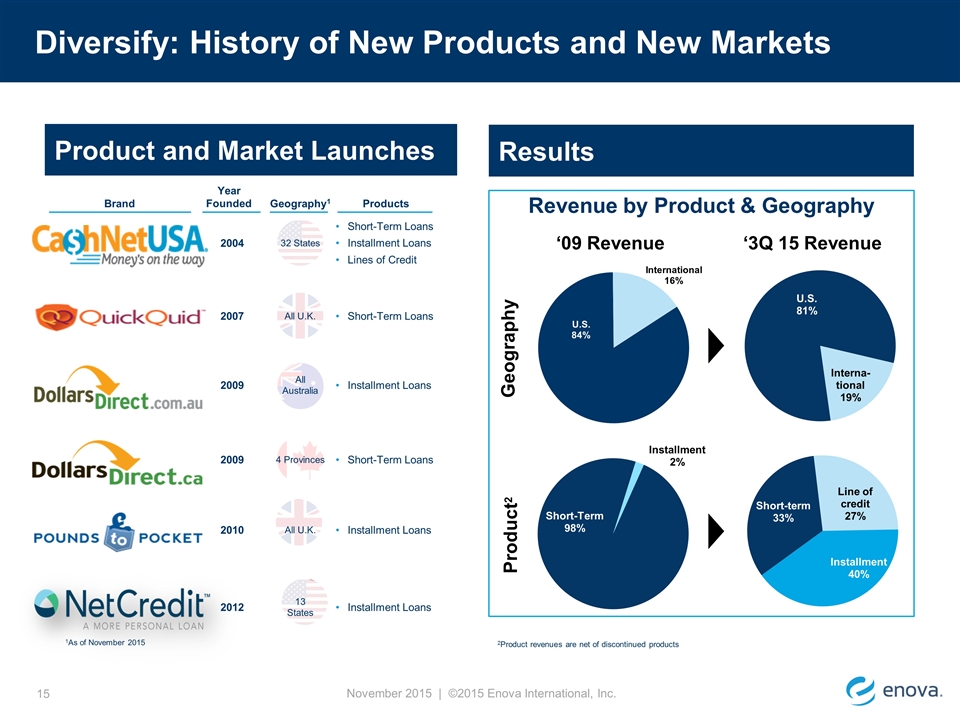

Diversify: History of New Products and New Markets Product and Market Launches Geography Product2 ‘3Q 15 Revenue ‘09 Revenue Results Revenue by Product & Geography 32 States 13 States All U.K. All Australia 4 Provinces All U.K. 2004 2007 2009 2009 2010 2012 Short-Term Loans Installment Loans Lines of Credit Short-Term Loans Installment Loans Short-Term Loans Installment Loans Installment Loans Brand Year Founded Geography1 Products 1As of November 2015 November 2015 | ©2015 Enova International, Inc. 2Product revenues are net of discontinued products

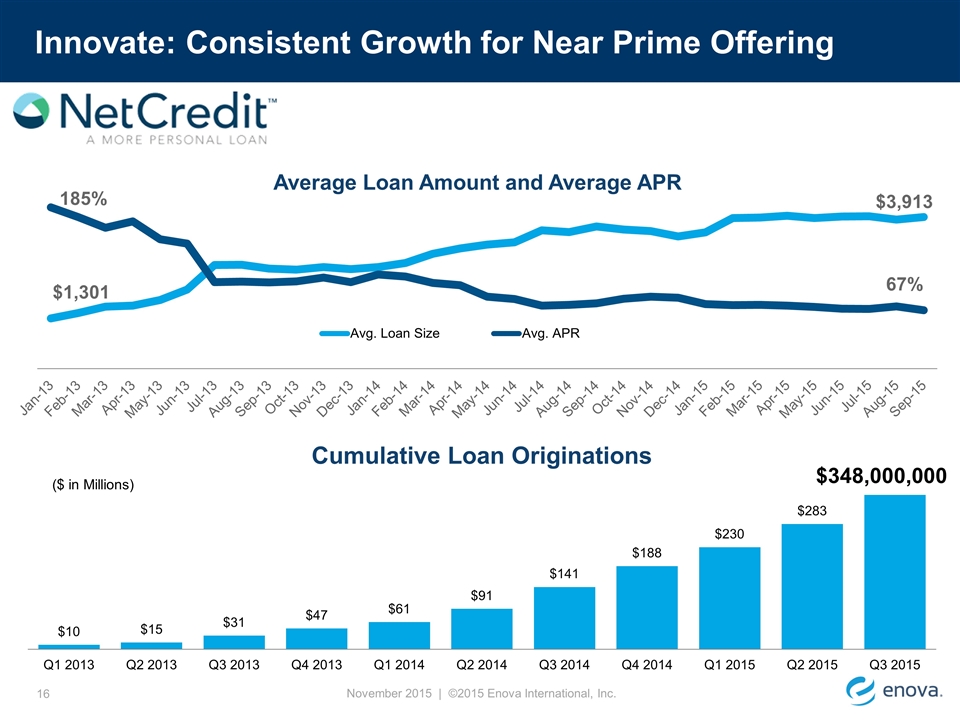

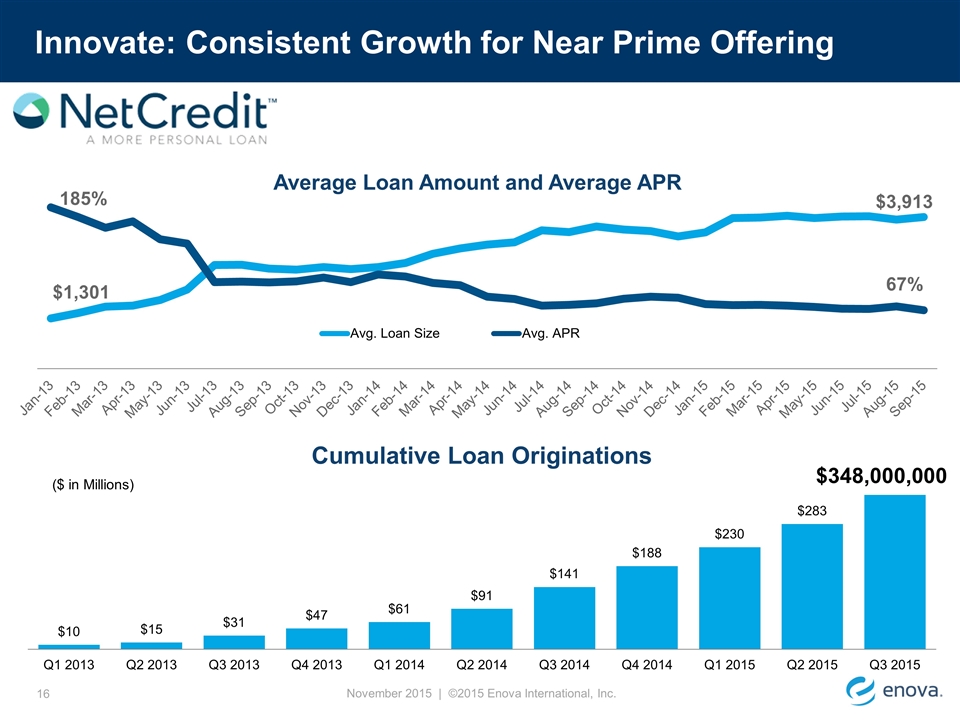

Innovate: Consistent Growth for Near Prime Offering November 2015 | ©2015 Enova International, Inc. ($ in Millions)

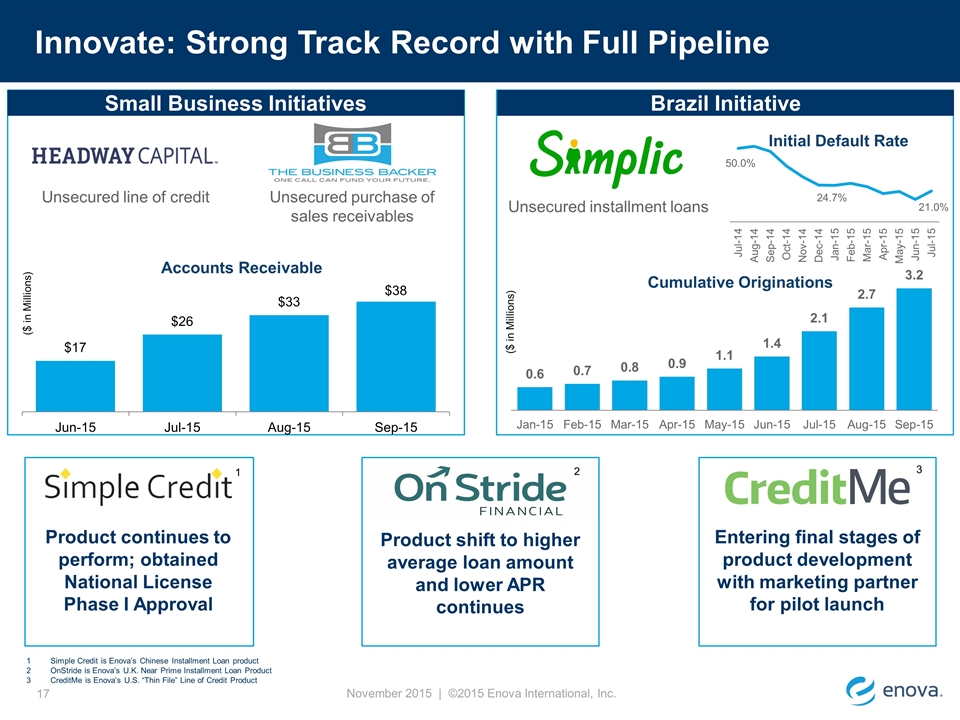

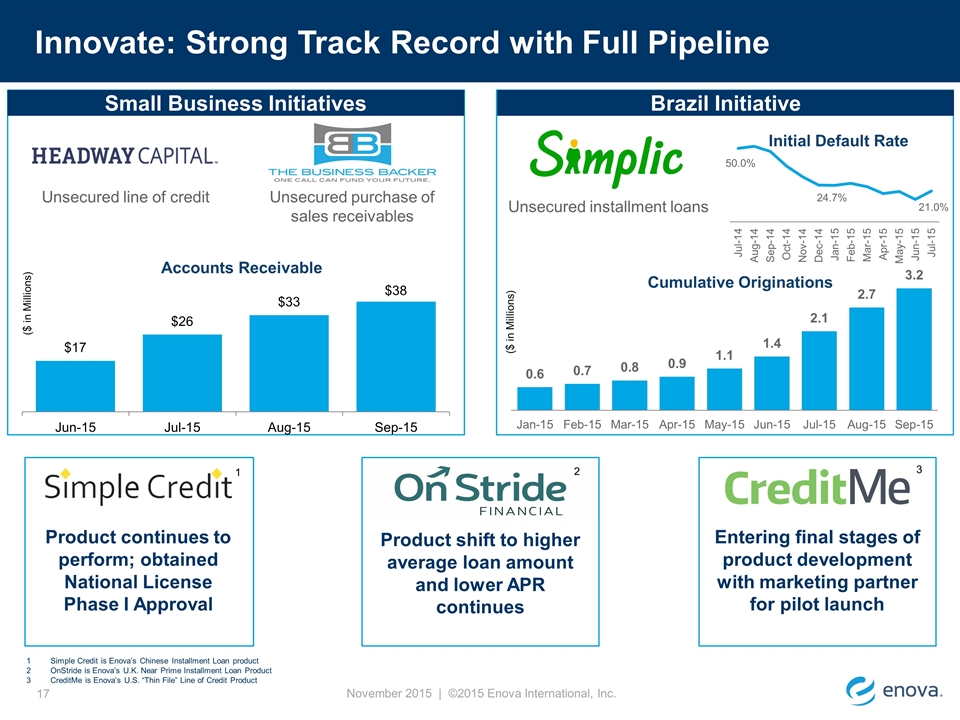

Innovate: Strong Track Record with Full Pipeline Installment Loan 118% CAGR November 2015 | ©2015 Enova International, Inc. Small Business Initiatives Brazil Initiative Unsecured purchase of sales receivables Unsecured line of credit Unsecured installment loans Simple Credit is Enova’s Chinese Installment Loan product OnStride is Enova’s U.K. Near Prime Installment Loan Product CreditMe is Enova’s U.S. “Thin File” Line of Credit Product Product continues to perform; obtained National License Phase I Approval Product shift to higher average loan amount and lower APR continues Entering final stages of product development with marketing partner for pilot launch Accounts Receivable ($ in Millions) Cumulative Originations ($ in Millions) 1 2 3 Initial Default Rate

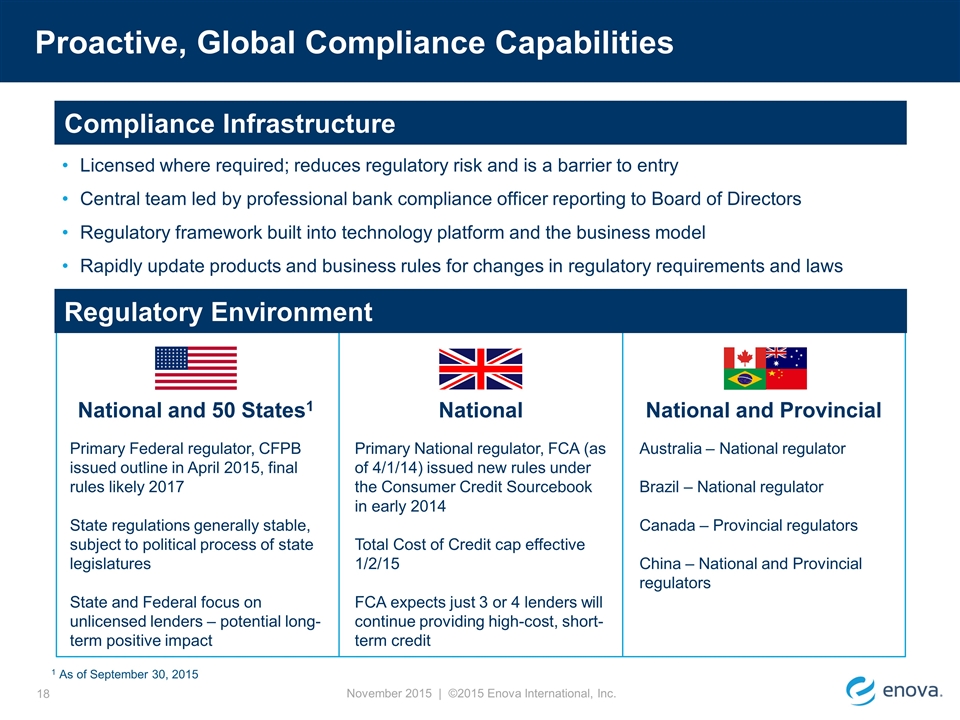

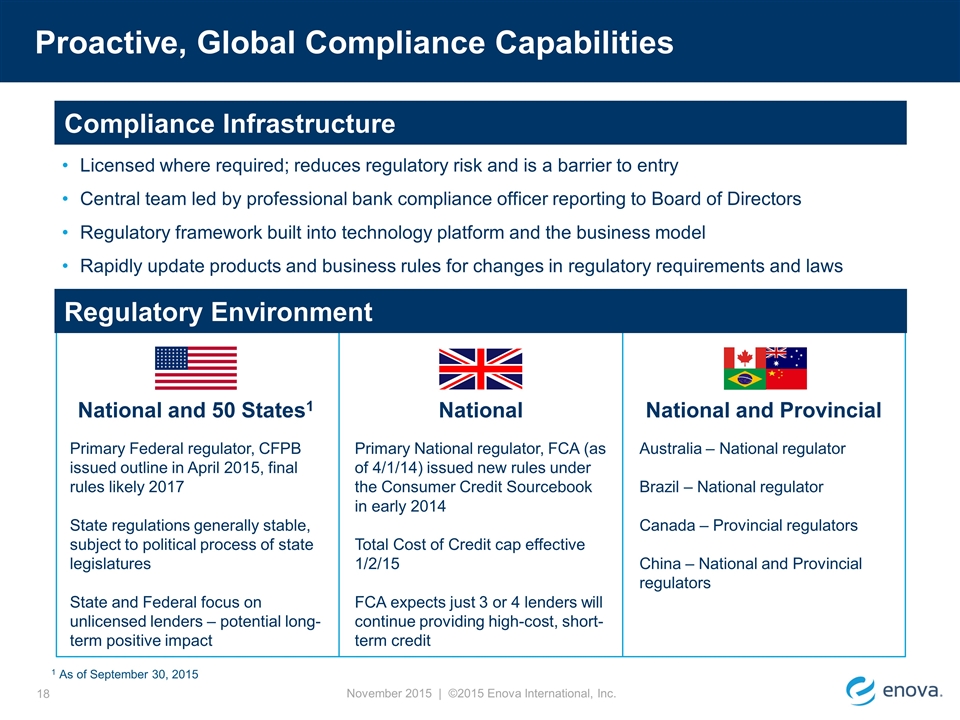

Licensed where required; reduces regulatory risk and is a barrier to entry Central team led by professional bank compliance officer reporting to Board of Directors Regulatory framework built into technology platform and the business model Rapidly update products and business rules for changes in regulatory requirements and laws Proactive, Global Compliance Capabilities National and 50 States1 National 1 As of September 30, 2015 National and Provincial Primary Federal regulator, CFPB issued outline in April 2015, final rules likely 2017 State regulations generally stable, subject to political process of state legislatures State and Federal focus on unlicensed lenders – potential long-term positive impact Primary National regulator, FCA (as of 4/1/14) issued new rules under the Consumer Credit Sourcebook in early 2014 Total Cost of Credit cap effective 1/2/15 FCA expects just 3 or 4 lenders will continue providing high-cost, short-term credit Australia – National regulator Brazil – National regulator Canada – Provincial regulators China – National and Provincial regulators Compliance Infrastructure Regulatory Environment November 2015 | ©2015 Enova International, Inc.

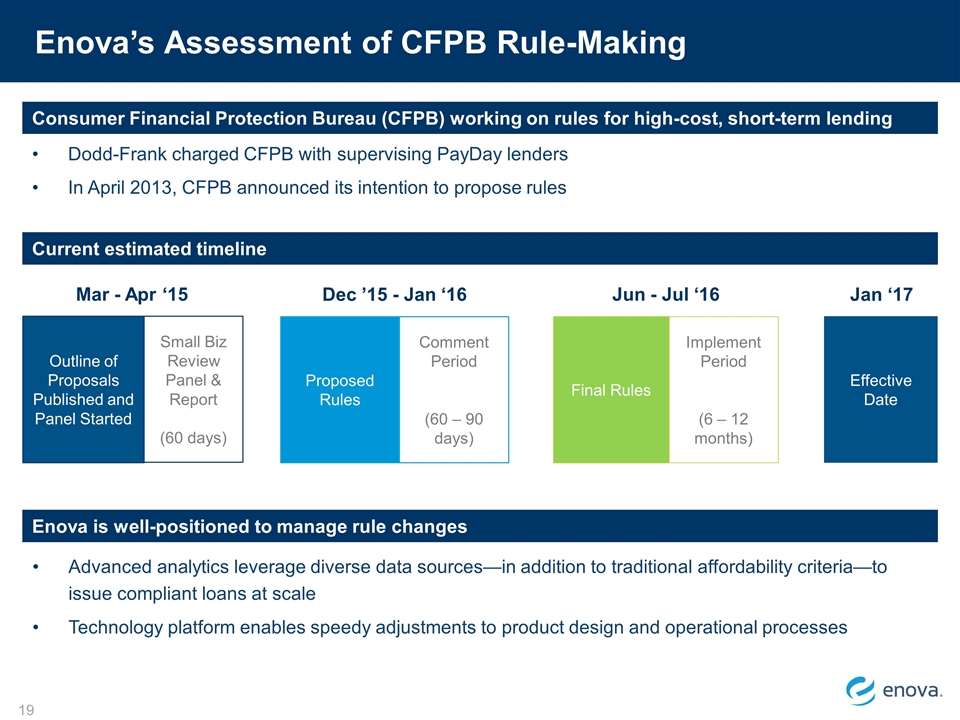

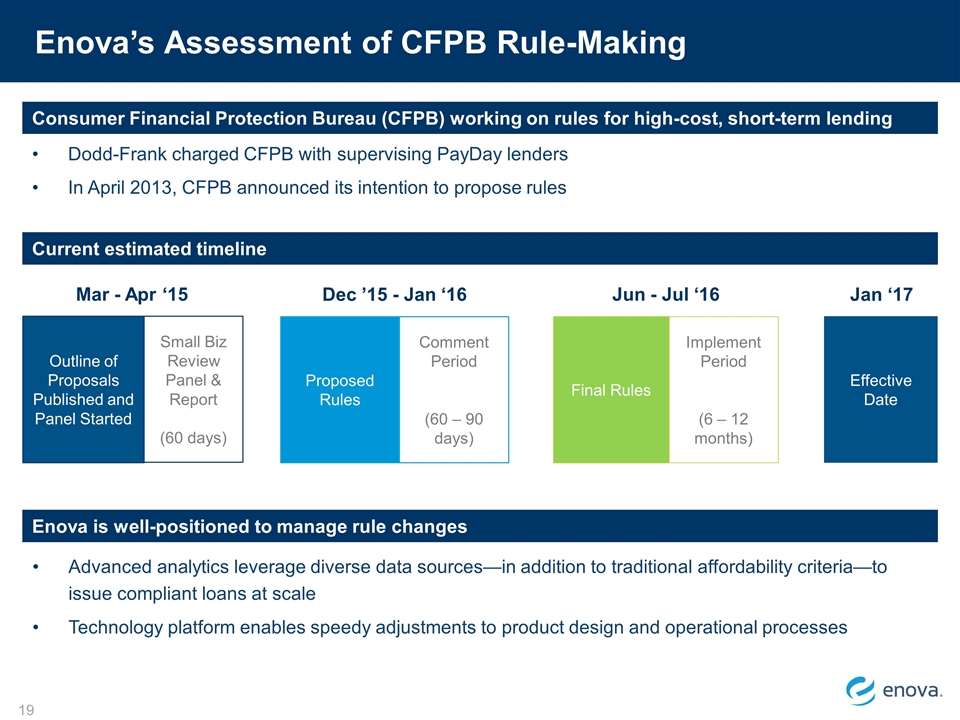

Enova’s Assessment of CFPB Rule-Making Dodd-Frank charged CFPB with supervising PayDay lenders In April 2013, CFPB announced its intention to propose rules Advanced analytics leverage diverse data sources—in addition to traditional affordability criteria—to issue compliant loans at scale Technology platform enables speedy adjustments to product design and operational processes Small Biz Review Panel & Report (60 days) Proposed Rules Final Rules Mar - Apr ‘15 Dec ’15 - Jan ‘16 Jun - Jul ‘16 Outline of Proposals Published and Panel Started Comment Period (60 – 90 days) Implement Period (6 – 12 months) Current estimated timeline Effective Date Jan ‘17 Enova is well-positioned to manage rule changes Consumer Financial Protection Bureau (CFPB) working on rules for high-cost, short-term lending

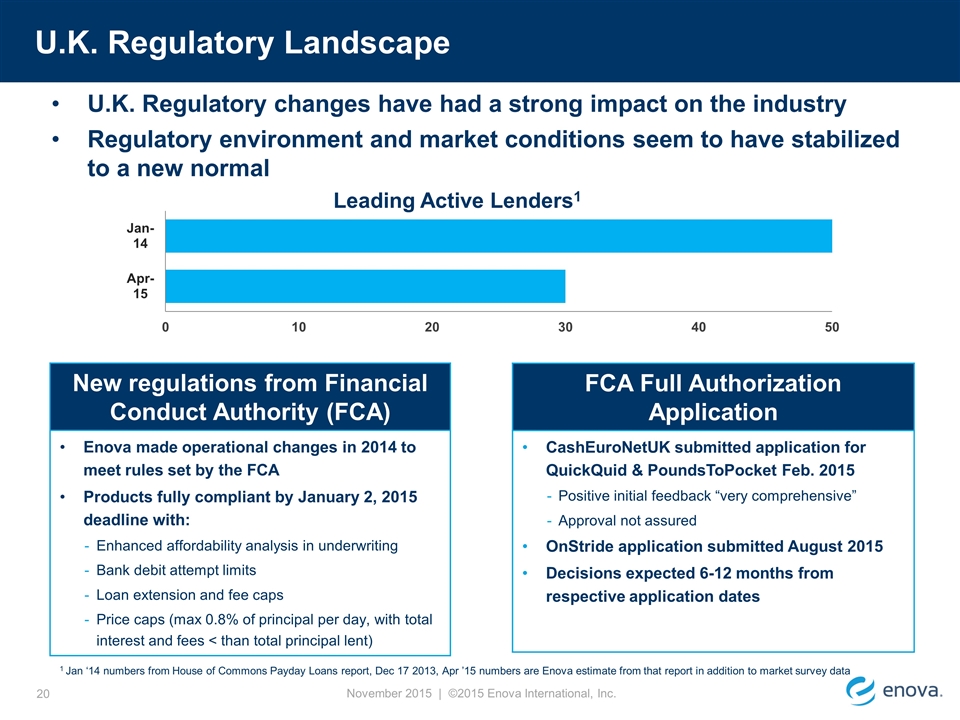

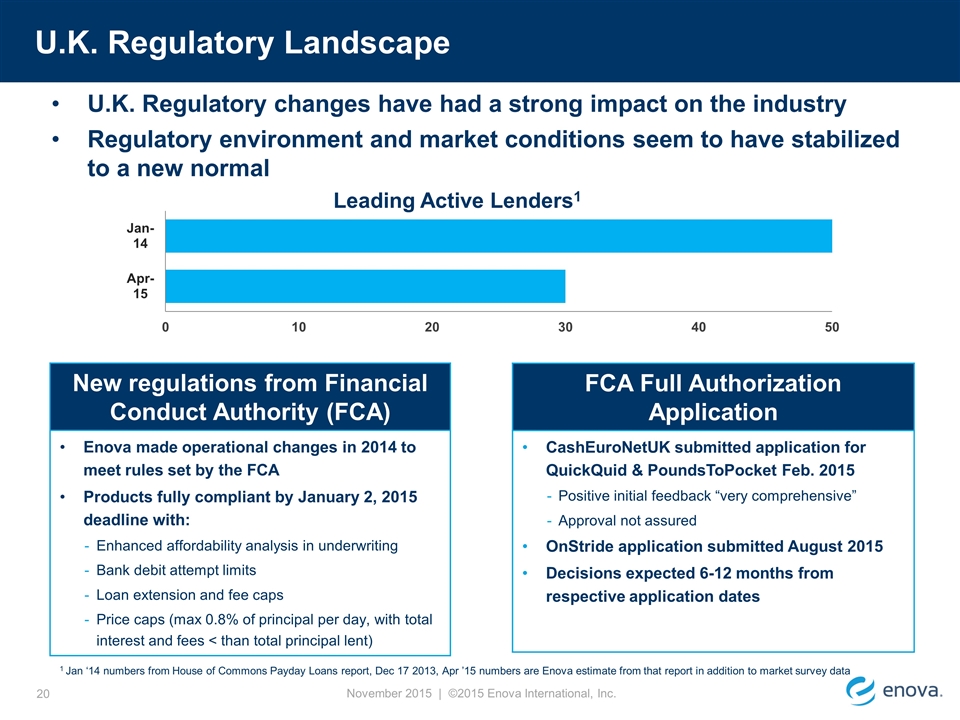

FCA Full Authorization Application CashEuroNetUK submitted application for QuickQuid & PoundsToPocket Feb. 2015 Positive initial feedback “very comprehensive” Approval not assured OnStride application submitted August 2015 Decisions expected 6-12 months from respective application dates U.K. Regulatory Landscape New regulations from Financial Conduct Authority (FCA) Enova made operational changes in 2014 to meet rules set by the FCA Products fully compliant by January 2, 2015 deadline with: Enhanced affordability analysis in underwriting Bank debit attempt limits Loan extension and fee caps Price caps (max 0.8% of principal per day, with total interest and fees < than total principal lent) 1 Jan ‘14 numbers from House of Commons Payday Loans report, Dec 17 2013, Apr ’15 numbers are Enova estimate from that report in addition to market survey data November 2015 | ©2015 Enova International, Inc. U.K. Regulatory changes have had a strong impact on the industry Regulatory environment and market conditions seem to have stabilized to a new normal

Consistent history of strong growth in revenue and Adjusted EBITDA1 Financial Highlights Generated $71 million of operating cash flow in Q3 15 Solid balance sheet with total liquidity of $92 million, including $34 million in cash and $58 million in revolver November 2015 | ©2015 Enova International, Inc. U.S. revenue increased 6.4% to $366.1 million in 9M15 Adjusted EBITDA margin of 26.7% in 9M15 1 See Reconciliation of Non-GAAP Financial Measures on page 27.

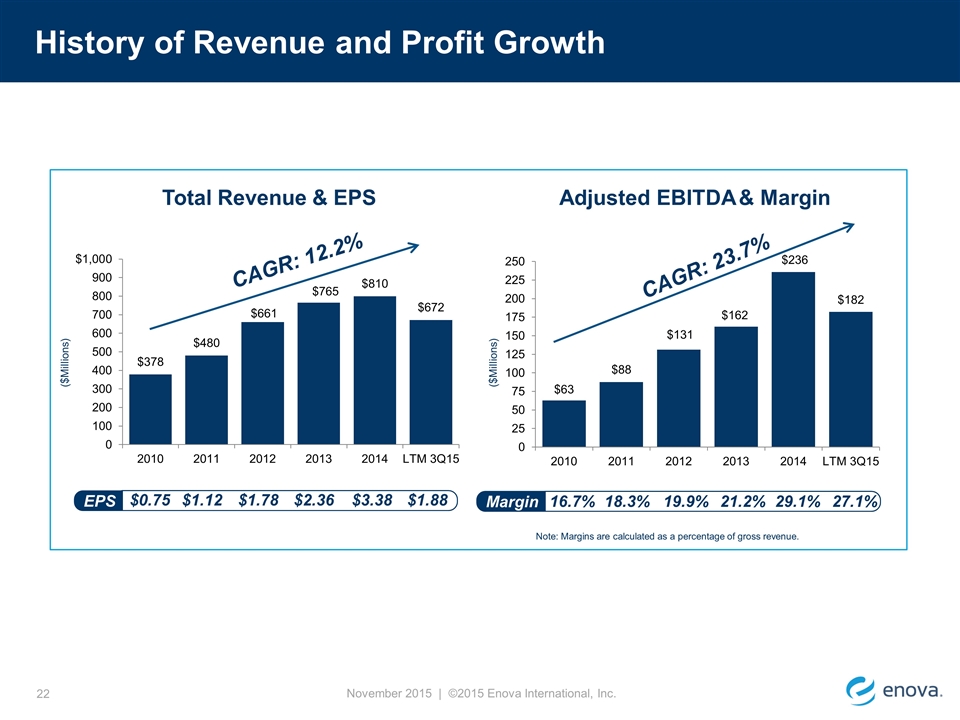

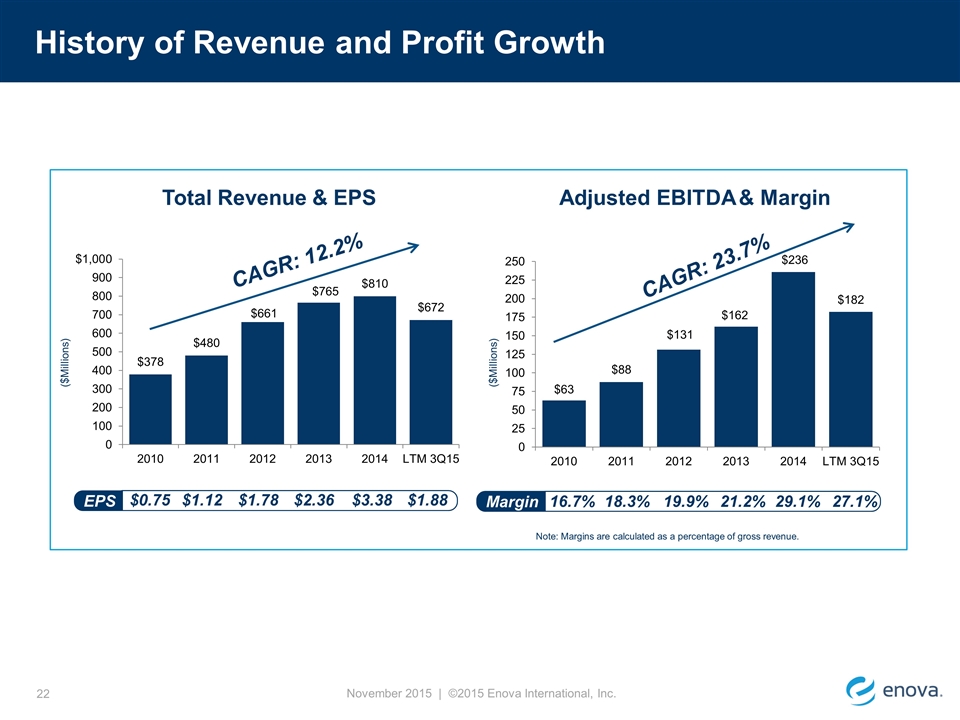

History of Revenue and Profit Growth November 2015 | ©2015 Enova International, Inc. ($Millions) CAGR: 12.2% Total Revenue & EPS Note: Margins are calculated as a percentage of gross revenue. Adjusted EBITDA & Margin CAGR: 23.7% ($Millions) 16.7% 18.3% 19.9% 21.2% 29.1% Margin $0.75 $1.12 $1.78 $2.36 $3.38 EPS $1.88 27.1%

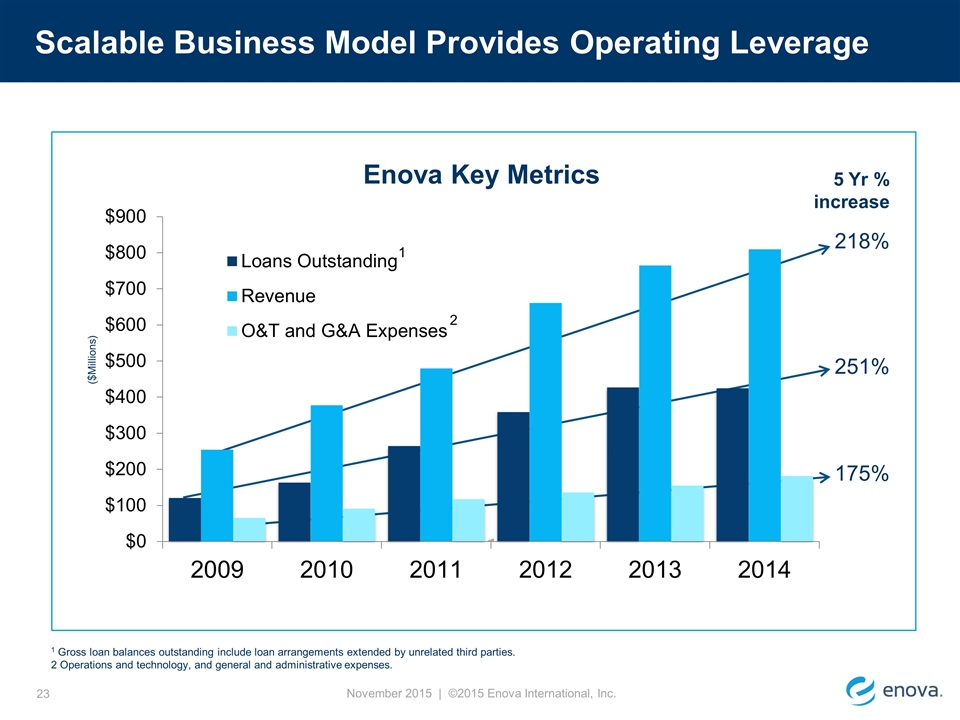

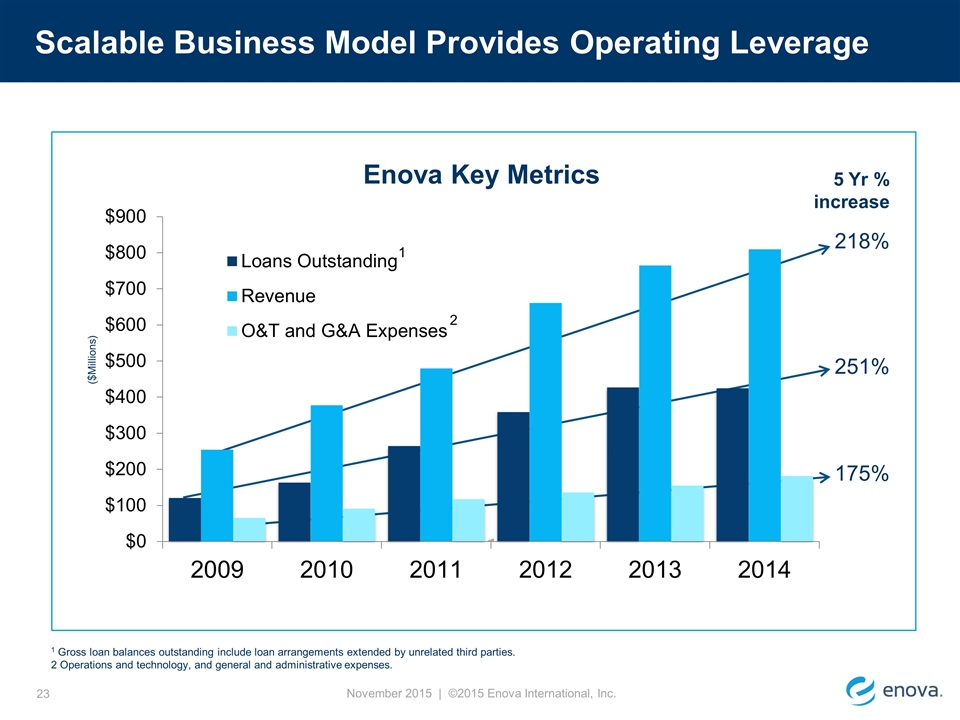

Scalable Business Model Provides Operating Leverage 1 Gross loan balances outstanding include loan arrangements extended by unrelated third parties. 2 Operations and technology, and general and administrative expenses. 5 Yr % increase Enova Key Metrics ($Millions) 218% 251% 175% November 2015 | ©2015 Enova International, Inc. 1 2

Appendix November 2015 | ©2015 Enova International, Inc.

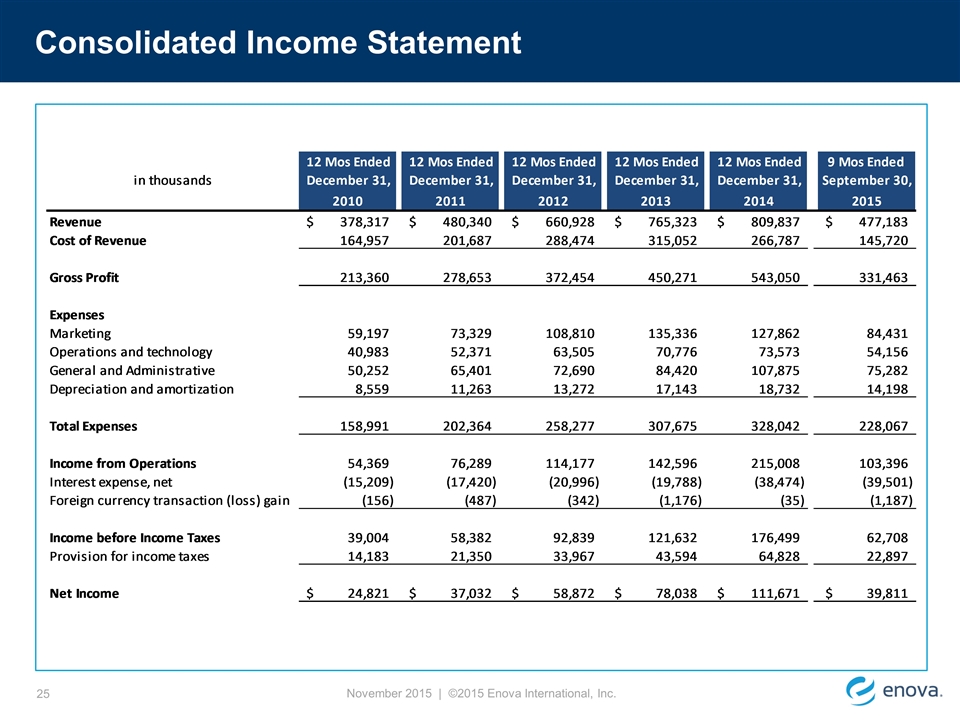

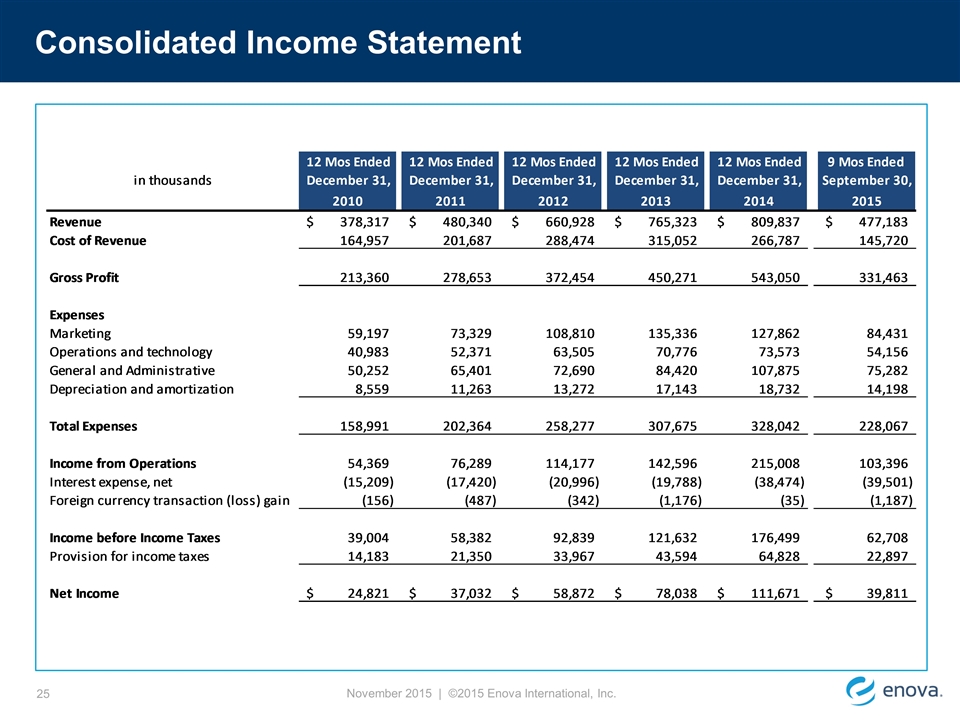

Consolidated Income Statement November 2015 | ©2015 Enova International, Inc.

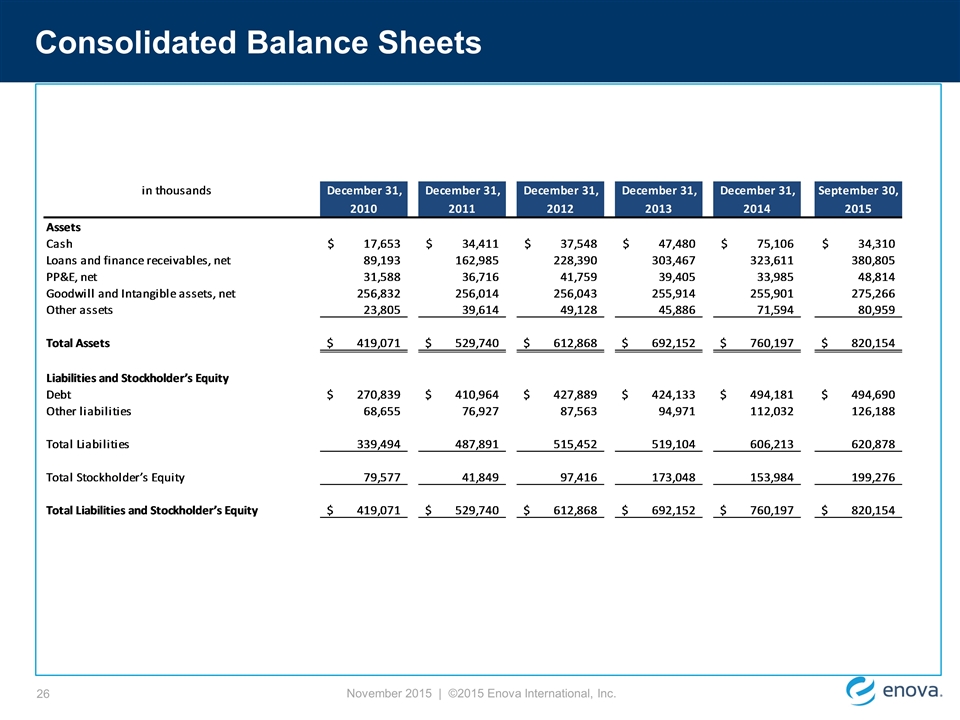

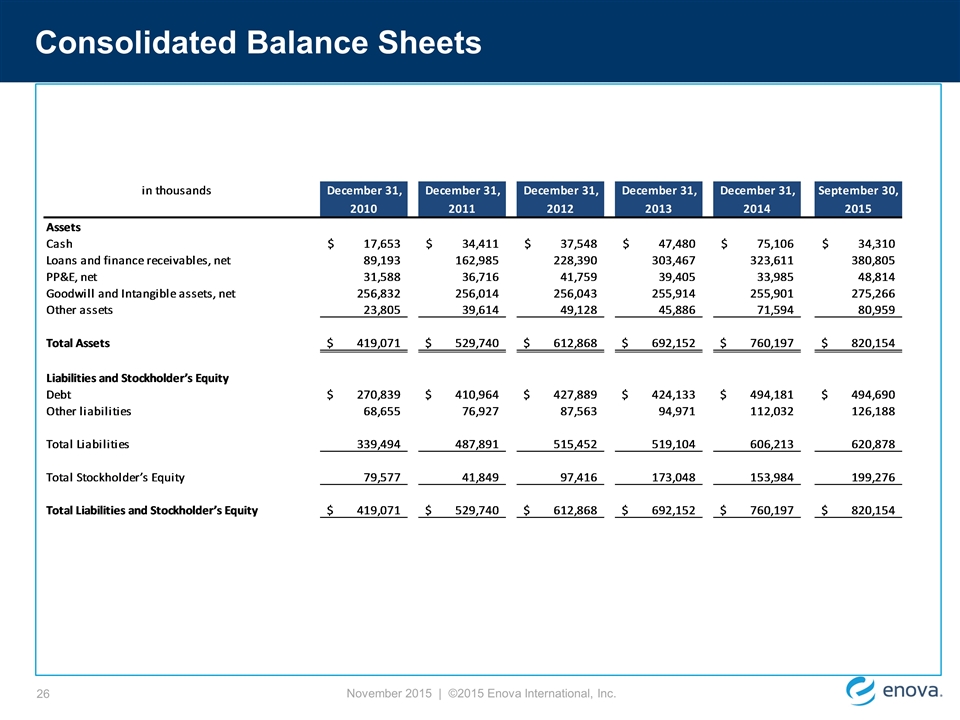

Consolidated Balance Sheets November 2015 | ©2015 Enova International, Inc.

Reconciliation of Non-GAAP Financial Measures Free Cash Flow ($ millions) LTM 3Q 2015 Cash flow from operating activities 278 Cash flow from investing activities: Consumer loans (281) Purchases of property and equipment (32) Free cash flow $ (35) Adjusted EBITDA to Net Income Fiscal Year Ended December 31, 3Q 2015 ($ millions) 2010 2011 2012 2013 2014 LTM Net income $ 24.8 $ 37.0 $ 58.9 $ 78.0 $ 111.7 $ 62.3 Lease termination and relocation costs (1) - - - - 1.4 3.3 Regulatory penalty (2) - - - 2.5 - - Withdrawn IPO (3) - - 3.9 - - - Interest expense, net 15.2 17.4 21.0 19.8 38.5 52.8 Provision for income taxes 14.2 21.4 33.9 43.6 64.8 37.1 Depreciation and amortization 8.6 11.3 13.3 17.1 18.7 19.2 Foreign currency transaction (gain) loss 0.1 0.5 0.3 1.2 - 0.7 Stock-based compensation expense 0.1 0.1 0.2 0.3 0.7 6.9 Adjusted EBITDA $ 63.0 $ 87.7 $ 131.5 $ 162.5 $ 235.8 $ 182.2 (1) Represents facility cease-use charges on our prior headquarters. (2) Represents the amount paid in connection with a civil money penalty assessed by the Consumer Financial Protection Bureau, which is nondeductible for tax purposes. (3) Represents costs related to our withdrawn Registration Statement in July 2012 in connection with efforts in pursuit of an initial public offering. November 2015 | ©2015 Enova International, Inc.