SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK | | |

| | x | |

| | : | |

| MICHAEL RUBIN, on Behalf of Himself and All | : | Index No. 652450/2012 |

| Others Similarly Situated, | : | |

| | : | |

| | : | |

| Plaintiff, | : | |

| | : | Hon. Jeffrey K. Oing, J.S.C. |

| vs. | : | |

| | : | |

| FX ALLIANCE, INC., PHILIP Z. WEISBERG, | : | |

| KATHLEEN CASEY, CAROLYN CHRISTIE, | : | |

| JAMES L. FOX, GERALD D. PUTNAM, JR., | : | |

| JOHN C. ROSENBERG, PETER TOMOZAWA, | : | |

| ROBERT TRUDEAU, THOMSON REUTERS | : | |

| CORPORATION, THOMCORP HOLDINGS | : | |

| INC., and CB TRANSACTION CORP., | : | |

| | : | |

| Defendants. | : | |

| | : | |

| | x | |

AMENDED CLASS ACTION COMPLAINT

Michael Rubin (“Plaintiff”) respectfully submits this amended class action complaint by and through his undersigned counsel and makes the following allegations predicated upon the investigation undertaken by Plaintiff’s counsel:

NATURE OF THE ACTION

1. This is a shareholder class action brought by Plaintiff on behalf of himself and all other similarly situated public shareholders of FX Alliance Inc. (“FX” or the “Company”) to enjoin the proposed buyout through an all-cash tender offer (the “Proposed Transaction”) of the publicly owned shares of FX’s common stock by Thomcorp Holdings Inc. (“Thomcorp”) through its wholly owned subsidiary CB Transaction Corp. (“CB” or “Merger Sub”), and their parent, Thomson Reuters Corporation (“Thomson Reuters”). In pursuing the Proposed Transaction, each of the Defendants (defined infra) violated applicable law by directly breaching and/or aiding breaches of fiduciary duties owed to Plaintiff and the other public shareholders of FX.

2. On July 9, 2012, FX and Thomson Reuters jointly announced that they had entered into an Agreement and Plan of Merger the previous day (the “Merger Agreement”) pursuant to which Thomson Reuters, through its wholly-owned subsidiaries, will acquire FX in the Proposed Transaction for $22 cash per share (the “Merger Consideration”), for a total consideration of approximately $616 million.

3. The Proposed Transaction is the product of a flawed process designed to ensure the sale of FX to Thomson Reuters on terms preferential to Thomson Reuters, but detrimental to Plaintiff and the other public shareholders of FX.

4. Thomson Reuters and FX’s directors (the Individual Defendants herein) agreed to enter into the Merger Agreement through a sham negotiation process. The Individual Defendants failed to conduct a legitimate auction or perform a real market check. What is more, the Individual Defendants then agreed to an array of buyer-friendly terms in the Merger Agreement designed to fend off any other competing bidders. These preclusive measures are critical because all of the Defendants know that FX is a leader in its field – so much so that the merging of FX’s foreign exchange platform with Thomson Reuters’ will create the largest electronic trading pool in foreign exchange trading. In one fell swoop, Thomson Reuters is eliminating a strong competitor and taking its business prospects for itself.

5. More specifically, Thomson Reuters had an intense strategic interest in FX that predated the Company’s February 8, 2012 initial public offering (“IPO”). Thomson Reuters first approached FX to discuss the potential for a “joint marketing arrangement” with the Company in December of 2011, which shortly thereafter led to a non-disclosure agreement between the two companies, exchange of non-public information, and multiple high-level discussions. Instead of consummating a joint marketing arrangement, however, Thomson Reuters made an all-cash offer to purchase FX on May 18, 2012. Weeks of private negotiations between the two companies ensued, but it was not until a month later, on June 18 and 19, that J.P. Morgan contacted eight other parties to “solicit their interest in pursuing a possible transaction with the Company.”

6. Unsurprisingly, the Company was unable to secure a firm offer from any of the other parties. It is evident that market was aware of the Company’s engagement with Thomson Reuters in some fashion since at least the end of 2011 and that the other parties viewed the Thomson Reuters transaction with the Company as a fait accompli. The “auction process” was not undertaken in good faith and was, in essence, a single-bidder process with no subsequent market check. As a result, the Proposed Transaction undervalues FX shares and their value to FX shareholders. Indeed, FX shareholders and the market generally have indicated their skepticism with the price associated with the Proposed Transaction by bidding the market price of FX shares as high as $22.50 per share after the Proposed Transaction was announced on July 9, 2012.

7. Moreover, the deal is virtually locked up and certain to close without further shareholder approval because Thomson Reuters demanded a concurrent tender and support agreement (“Support Agreement”) whereby Chairman and Chief Executive Officer (“CEO”) Philip Z. Weisberg (“Weisberg”), Chief Financial Officer (“CFO”) John W. Cooley (“Cooley”) and FX’s largest shareholder, Technology Crossover Ventures (through its TCV VI and TCV Member Fund) (“TCV”) have agreed to tender to Thomson Reuters the 9,252,943 FX shares they own or control, which represents approximately 32.5% of outstanding shares. In addition, the Company has also granted Thomson Reuters a “Top Up Option,” which in turn would allow Thomson Reuters to complete the transaction via a short form merger without shareholder approval, as more fully described infra. Thus, although ostensibly at least a majority of FX’s 28,474,998 outstanding shares must be tendered in order to trigger the Top Up Option, the reality is Defendants require less than 5,000,000 of the remaining outstanding shares (which equals 18% of the total outstanding shares and a little more than 25% of the outstanding public shares not subject to the Support Agreement) to tender in order to consummate the merger without shareholder approval.

8. The shortcomings in the sales process are further compounded by the July 18, 2012 solicitation/recommendation statement filed by FX on Schedule 14D-9 (the “14D-9”) with the United States Securities and Exchange Commission (“SEC”), which is deficient and fails to provide FX’s shareholders with adequate information to decide whether to elect to tender their shares into the Proposed Transaction. The 14D-9 omits and/or misrepresents material information concerning, among other things: (a) the sales process for the Company; (b) the data and inputs underlying the financial valuation exercises that purport to support the so-called fairness opinion (“Fairness Opinion”) provided by the Company’s financial advisor, J.P. Morgan Securities LLC (“J.P. Morgan”); and (c) details concerning J.P. Morgan’s potential conflict of interest.

9. For example, the disclosures regarding the financial projections for FX, which are among the most important disclosures to shareholders faced with a decision whether to divest ownership of their Company, are inadequate and appear to be misleading. Critically, the 14D-9 fails to adequately disclose in a useful and meaningful way the financial projections provided to the FX Board of Directors (the “Board”) by management on May 29 and used by its financial advisor, J.P. Morgan. While the 14D-9 includes management projections that (without elaboration) describe three “cases” in which FX continues as a stand-alone company, the 14D-9 does not provide or disclose projections based upon a potential “joint marketing agreement” with Thomson Reuters that would provide shareholders the basis for determining whether it was in the best interest of shareholders to remain a stand-alone and partnering with Thomson Reuters. This is critical since, as discussed above, the primary strategic alternative for the two companies prior to the merger was the “joint marketing” process that led to Thomson Reuters’ May 18 initial bid of $19.50 and multiple meetings and telephone calls between May 23 and 29, during which the main topic was the “complementary aspects” of the companies’ businesses (including expanding global distribution network in emerging markets). During this time management prepared the projections and presented them to the Board on May 29. It is obvious that assumptions regarding FX’s potential going forward as a stand-alone with a marketing agreement in place with Thomson Reuters should have been included in projections, should have been considered by management and the Board, and should be disclosed to shareholders so they can decide whether they would be better off reaping the benefit of the joint marketing arrangement rather than being shut out and Thomson Reuters reaping the benefit solely for itself.

10. The 14D-9 should have been drafted to fulfill the purpose for which it is intended: to provide FX’s shareholders with the material information they need to make an informed decision on the Proposed Transaction. Instead, the 14D-9 appears to have been drafted solely with an eye towards defending the unfair cash out agreed to through the sham negotiation process.

11. For these reasons and the reasons set forth in more detail herein, Plaintiff seeks to enjoin Defendants from consummating the Proposed Transaction or, in the event the Proposed Transaction is consummated, recover damages resulting from the Individual Defendants’ violations of their fiduciary duties of good faith, due care, and full and fair disclosure.

12. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class (as defined below) be fully protected from the immediate and irreparable injury which Defendants’ actions threaten to inflict.

JURISDICTION AND VENUE

13. This Court has personal jurisdiction over Defendants pursuant to C.P.L.R. §301, as FX and Thomson Reuters are headquartered in the State of New York, and because certain of the Defendants conduct business in and/or have sufficient minimum contacts with New York. The exercise of jurisdiction by this New York Court is permissible under traditional notions of fair play and substantial justice. This Court further possesses personal jurisdiction over the Defendants pursuant to C.P.L.R. §302.

14. Venue is proper in this Court pursuant to N.Y. C.P.L.R. §503 because, upon information and belief, at least one of the Individual Defendants resides in New York County.

THE PARTIES

15. Proposed Co-Lead Plaintiff, Michael Rubin, is, and has been at all relevant times hereto, a holder of FX common stock.

16. Defendant FX is a Delaware corporation with its executive offices located at 909 Third Avenue, Third Floor, New York, New York 10022. FX is an independent global provider of electronic foreign exchange trading solutions. The Company touts itself as being the global leader of its industry with over 1,000 institutional clients worldwide, serving the needs of active traders, asset managers, corporate treasurers, banks, broker-dealers and prime brokers. The Company’s stock trades on the New York Stock Exchange under the ticker symbol “FX.”

17. Defendant Weisberg has served as Chairman and CEO of FX since its inception in 2000. Holding approximately 1.04 million FX shares and 1.14 million unexercised options, he is expected to net $35 million upon the consummation of the Proposed Transaction.

18. Defendant Kathleen Casey (“Casey”) has served as an FX director since March 2012. She is Chair of the Corporate Governance and Nominating Committee, and a member of the Audit Committee.

19. Defendant Caroline Christie (“Christie”) has served as an FX director since March 2012 and is a member of the Audit Committee.

20. Defendant James L. Fox (“Fox”) has served as an FX director since March 2012 and is Chair of the Audit Committee.

21. Defendant Gerald D. Putnam, Jr. (“Putnam”) has served as an independent FX director since July 2008 and is a member of both the Compensation Committee and the Corporate Governance and Nominating Committee.

22. Defendant John C. Rosenberg (“Rosenberg”) has served as an FX director since October 2009 and is a member of the Board’s Audit Committee. Rosenberg is also a general partner with TCV, the Company’s largest shareholder.

23. Defendant Peter Tomozawa (“Tomozawa”) has served as an FX director since March 2012 and is a member of both the Compensation Committee and the Corporate Governance and Nominating Committee.

24. Defendant Robert Trudeau (“Trudeau”) has served as an FX director since August 2006 and chairs the Board’s Compensation Committee. Trudeau is also a general partner with TCV, the Company’s largest shareholder.

25. Defendant Thomson Reuters maintains its principal place of business at 3 Times Square, New York, New York 10036. Thomson Reuters is an international news agency and information delivery business. Thomson Reuters trades on both the New York Stock Exchange and the Toronto Stock Exchange under the ticker symbol “TRI.”

26. Defendant Thomcorp is a Delaware corporation and a subsidiary of Thomson Reuters and is the actual party to the Merger Agreement with FX dated July 8, 2012.

27. Defendant CB is a Delaware corporation and a wholly-owned subsidiary of Thomcorp formed for the sole purpose of effectuating the Proposed Transaction. All references herein to Defendant Thomson Reuters include Defendants Thomcorp and Merger Sub.

28. The Defendants listed in paragraphs 17 through 24 are collectively referred to herein as the “Board” or “Individual Defendants.”

29. Each Individual Defendant owed and owes FX and its public shareholders fiduciary obligations and were and are required to: use their ability to control and manage FX in a fair, just, and equitable manner; act in furtherance of the best interests of FX and its public shareholders, including, but not limited to, obtaining a fair and adequate price for FX’s shares; refrain from abusing their positions of control; disseminate complete and accurate information material to a shareholder’s decision whether to approve the Proposed Transaction; and not to favor their own interests at the expense of public shareholders.

FIDUCIARY DUTIES OF THE INDIVIDUAL DEFENDANTS

30. By reason of their positions as officers and/or directors of the Company and because of their ability to control the business and corporate affairs of the Company, the Individual Defendants owe the Company and its shareholders the fiduciary obligations of good faith, trust, loyalty, candor, and due care, and were and are required to use their utmost ability to control and manage the Company in a fair, just, honest, and equitable manner. The Individual Defendants were and are required to act in furtherance of the best interests of the Company and its shareholders so as to benefit all shareholders equally and not in furtherance of their personal interest or benefit.

31. Each director and officer of the Company owes to the Company and its shareholders the fiduciary duty to exercise good faith and diligence in the administration of the affairs of the Company and in the use and preservation of its property and assets, and the highest obligations of fair dealing.

32. The Individual Defendants, because of their positions of control and authority as directors and/or officers of the Company, were able to and did, directly and/or indirectly, exercise control over the wrongful acts complained of herein.

33. At all times relevant hereto, each of the Individual Defendants was the agent of each of the other Individual Defendants and of FX, and was at all times acting within the course and scope of such agency.

34. To discharge their duties, the officers and directors of the Company were required to exercise reasonable and prudent supervision over the management, policies, practices and controls of the Company. By virtue of such duties, the officers and directors of the Company were required to, among other things:

a. exercise good faith in ensuring that the affairs of the Company were conducted in an efficient, business-like manner so as to make it possible for the Company to provide the highest level of performance;

b. exercise good faith in ensuring that the Company was operated in a diligent, honest and prudent manner and complied with all applicable federal and state laws, rules, regulations and requirements, including acting only within the scope of its legal authority;

c. when placed on notice of illegal or imprudent conduct committed by the Company or its employees, exercise good faith in taking appropriate measures to prevent and correct such conduct; and

d. exercise good faith in supervising the preparation, filing and/or dissemination of financial statements, press releases, audits, reports or other information required by law, and in examining and evaluating any reports or examinations, audits, or other financial information concerning the financial condition of the Company.

CLASS ACTION ALLEGATIONS

35. Plaintiff brings this action on behalf of himself and as a class action, pursuant to C.P.L.R. §901 et. seq., on behalf of all public shareholders of FX, and their successors in interest, who are or will be threatened with injury arising from Defendants’ actions as more fully described herein (the “Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any of the Defendants.

36. This action is properly maintainable as a class action for the following reasons:

a. The Class is so numerous that joinder of all members is impracticable. According to the Company’s filings with the SEC, as of July 12, 2012, there were 28,474,998 shares of FX common stock validly issued and outstanding, held by hundreds, if not thousands, of record and beneficial shareholders. The actual number of public shareholders of FX will be ascertained through discovery.

b. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff has the same interests as the other members of the Class. Plaintiff is an adequate representatives of the Class and will fairly and adequately protect the interests of the Class.

c. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for Defendants, or adjudications with respect to individual members of the Class that would, as a practical matter, be dispositive of the interests of the other members not parties to the adjudications or substantially impede their ability to protect their interests.

d. To the extent Defendants take further steps to effectuate the Proposed Transaction, preliminary and final injunctive relief on behalf of the Class as a whole will be entirely appropriate because Defendants have acted, or refused to act, on grounds generally applicable and causing injury to the Class.

37. There are questions of law and fact which are common to the Class and which predominate over questions affecting any individual Class member. The common questions include, inter alia, the following:

a. Whether Defendants have engaged in and are continuing to engage in conduct which unfairly benefits Defendants at the expense of the members of the Class;

b. Whether the Individual Defendants, as officers and/or directors of the Company, are violating their fiduciary duties to Plaintiff and the other members of the Class;

c. Whether Plaintiff and the other members of the Class would be irreparably damaged were Defendants not enjoined from the conduct described herein;

d. Whether the Individual Defendants have breached and continue to breach their fiduciary duties of loyalty, care, good faith, and candor to FX’s shareholders; and

e. Whether FX and Thomson Reuters have aided and abetted the Individual Defendants’ breaches of fiduciary duties.

SUBSTANTIVE ALLEGATIONS

Background of the Company

38. FX is the leading independent global provider of electronic foreign exchange trading solutions, with over 1,000 institutional clients worldwide. With its proprietary technology platform, the Company provides institutional clients with 24-hour direct access, five days per week, to the foreign exchange market and delivers efficient and reliable foreign price discovery, trade execution, and automation of pre-trade and post-trade transaction workflow for more than 400 currency pairs with access to liquidity from the world’s leading banks and other liquidity providers.

39. In 2011, the Company was named, among other things, “Best Online Foreign Exchange Trading System” in Global Finance Best Foreign Exchange Providers, “Best Professional Electronic Trading Venue” in FX Week Best Banks Awards, “Best Foreign Exchange Trading Platform” in Financial News Awards Europe 2011, and “Best Trading Platform for Asset Managers” in 2011 in Profit & Loss Digital Market Awards. Thus far in 2012, the Company has been named, among other things, “Best Platform for Asset Managers” at the Profit & Loss Readers’ Choice Digital Markets Awards, “Best Independent Multibank Platform” for the eleventh consecutive year in Euromoney FX Poll.

40. FX became a publicly traded company recently, on February 8, 2012, when it completed its IPO of 5,980,000 shares of common stock, at the offered price of $12.00 per share. All of the shares were sold in the IPO. However, unlike most IPOs, the Company did not receive any proceeds from the sale of shares by the selling shareholders.

41. Since its IPO, the Company has continued to expand its business, with great promise. For example, FX just announced on July 2, 2012 that it launched a multibank options trading platform by which the Company’s clients can, in a single platform, trade spot, forwards, swaps, non-deliverable forwards, precious metals and money markets, as well as price and trade options.

Background to the Proposed Transaction

42. According to the 14D-9, the first steps that led to the Proposed Transaction occurred in December 2011 when Andrew Hausman, Managing Director, Fixed Income & Foreign Exchange of Thomson Reuters, contacted James Kwiatkowski, Global Head of Sales of the Company, to discuss the potential for a joint marketing arrangement between Thomson Reuters and the Company.

43. These talks eventually turned serious enough for Thomson Reuters and the Company to enter into a mutual non-disclosure agreement with respect to such a joint marketing arrangement in January 2012.

44. Between January and May of 2012 (which included the time during which FX was preparing for its IPO), the Company and Thomson Reuters held various meetings and discussions relating to the potential for a joint marketing arrangement, and at the same time, exchanged non-public information. In essence, Thomson Reuters had the benefit of a five month long due diligence process on the Company.

45. On or about May 18, 2012 a meeting was held at the Company's principal office in New York ostensibly to discuss “the potential for a joint marketing arrangement and other strategic matters.” The meeting was attended by various executives of Thomson Reuters, Defendants Weisberg and Trudeau, and John W. Cooley, the Company's Chief Financial Officer (“CFO”), on behalf of the Company. At the meeting, representatives of Thomson Reuters indicated verbally that Thomson Reuters would be prepared to make an all-cash offer for 100% of the outstanding shares of the Company at a price of $19.50 per share. Weisberg responded by noting that the Company had recently undergone an IPO and informed the representatives of Thomson Reuters that the Company was not prepared to engage in a sale process, but that he would discuss the Thomson Reuters proposal with the Company Board.

46. The following day J.P. Morgan was chosen as the Company’s financial advisor with respect to Thomson Reuters’ proposal.

47. On May 21, 2012, a full meeting of the Board was held along with executive officers of the Company at which the Board rejected Thomson Reuters’ proposal and authorized the Company’s management to prepare projections for the Company. Significantly, none of the projections disclosed in the 14D-9 take into account the assumption of the potential for a joint marketing arrangement with Thomson Reuters.

48. Between May 23, 2012 and June 8, 2012 there were various meeting and discussions between the Company, its advisors, and Thomson Reuters and its advisors, until on June 8, 2012 Thomson Reuters stated its “best and final” offer of $22.00 per share.

49. It was not until June 13, 2012, after the Company had in essence, if not actually, accepted Thomson Reuters’ offer, that the Board established a Transaction Committee to oversee the “situation.” Subsequently, it was not until June 18 and 19 that the Company’s financial advisor contacted eight other parties to “solicit their interest in pursuing a possible transaction with the Company.” Between that time and the announcement of the Proposed Transaction on July 9, 2012, there were indications of interest from other parties even in the “low 20s.” However, the Company was not able to obtain a firm offer from any of the other parties. It is evident that the market was aware of the Company’s engagement with Thomson Reuters in some fashion since at least the end of 2011 and that the other parties viewed the Thomson Reuters transaction with the Company as a done deal. The “auction process” was not undertaken in good faith and this was, in essence, a single-bidder process with no subsequent market check.

The Proposed Transaction

50. On July 9, 2012, FX announced that it had entered into the Merger Agreement with Thomson Reuters whereby the latter will acquire 100% of the Company’s outstanding stock for $22.00 per share in cash. The Proposed Transaction is expected to close in the third quarter of 2012.

51. Under the terms of the Merger Agreement, Thomson Reuters will launch a tender offer for the Proposed Transaction, subject to regulatory approval. Pursuant to the Merger Agreement, Thomson Reuters did, in fact, launch a tender offer on July 18, 2012, a scant ten days after the proposed acquisition was announced. The tender offer will expire on August 14, 2012, only 20 business days after the tender offer was commenced. The Board recommends that all FX shareholders tender their shares in favor of the Proposed Transaction. Shares not tendered will be converted into the right to receive cash equal to the Merger Consideration.

52. Moreover, the Company’s largest shareholder, TCV, along with Defendant Weisberg and FX’s CFO Cooley, who collectively own approximately 32.5% of the Company, have all tendered their shares into the offer so that Thomson Reuters now owns approximately over 32.5% of FX.

53. Under the terms of the Merger Agreement, upon consummation of the Proposed Transaction, Merger Sub will merge with and into FX, whereupon the corporate existence of Merger Sub will terminate and the Company will continue as the surviving company in the Merger.

54. The Company press release announcing the Merger Agreement stated, in pertinent part:

This transaction brings together two leading companies in their respective segments of the dynamic foreign exchange marketplace, one of the largest and most liquid asset classes. [FX] and Thomson Reuters have complementary customer bases and long standing relationships with bank liquidity providers.

Thomson Reuters is a key provider of access to market liquidity and workflow solutions to the inter-bank electronic FX markets. Participants in the FX market use Thomson Reuters to access content and pre-trade analytics, connect to their counterparties, find liquidity and trade in regulatory compliant and secure environments.

* * *

“[FX] will now have a bigger stage from which to drive greater innovation and growth, with access to Thomson Reuters global reach, standing in the FX community and focus on client solutions,” said Phil Weisberg, chairman and chief executive officer, [FX]. “The combined platform allows us to deliver greater value to our clients and employees, building upon the foundation that we have established over the past twelve years. In addition, we believe this is a compelling transaction for our shareholders.”

55. FX has said that its own platform aimed at servicing companies and investors will merge with Thomson Reuters’ traditional platform focused on bank-to-bank currency-trading systems, though the Company has declined to give its shareholders additional details until after the completion of the Proposed Transaction.

56. According to a Thomson Reuters representative: “The details of the combined organization will be reviewed as part of the integration planning activities and any announcements will be made after the close of the transaction.”

The Proposed Transaction Undervalues the Company

57. The Merger Consideration offered to FX shareholders in the Merger Agreement does not represent the true value of the Company and is unfair and inadequate, particularly at a time when FX’s business is steadily strengthening and growing.

58. By selling the Company at this inopportune time for the inadequate price of $22 per share, Defendants are wresting away the opportunity for public shareholders to enjoy the benefits of their investment. In fact, within the brief five months as a publicly traded company, FX’s stock reached a pre-deal high of $18.72 per share, 56% more than its IPO price. Furthermore, FX has significantly outperformed the New York Stock Exchange Composite Index, which tracks all common stock listed on the New York Stock Exchange, as illustrated by the chart below:

59. Shares in the Company have been in record demand despite the volatility of the markets. On July 6, 2012, the last pre-announcement trading date, the Company reported that its total daily average trading volume of FX shares for June 2012 was a record $98.6 billion, a 10% increase from both the previous month and from June 2011.

60. The inadequacy of the Merger Consideration is obvious when the Proposed Transaction is viewed in light of other comparable transactions. For example, even the median multiple for the precedent transactions examined by the Company’s financial advisor results in a value of $27 per share, much higher than the $22 per share Merger Consideration being offered here.

61. Furthermore, the Company’s shares have been mostly trading at, or above, the offer price since the Proposed Transaction was announced, reaching an all-time high of $22.50 on July 18th. There have even been days where the lowest traded price for the day was above $22 per share Merger Consideration. Obviously, the market believes that $22 is not a fair price and there is some expectation that a higher price could be on the way.

62. The gross inadequacy and unfairness of the Merger Consideration is further demonstrated by FX’s strong financial condition and business prospects.

63. As recently as May 3, 2012, in announcing FX’s financial results for the first quarter of 2012, Defendant Weisberg touted the Company’s value: “Our first quarter results reflect the continued strength of our platform and the investments we are making to maintain our leadership in the electronic institutional foreign exchange market.”

64. Weisberg elaborated further: “The increase in our volumes during the quarter amidst a volatile market environment highlights the depth of our relationships globally and the quality of our product. I would also like to recognize the entire team at [FX] following the successful completion of our recent IPO.”

65. Recently reported developments are perhaps most indicative of the Company’s promising future for long-term growth. Among the highlights of the reported financials, the Company announced that total revenues for the first quarter of 2012 had increased 10%, to $30 million, compared to the same period for the previous year. The report attributed the increased revenues to stronger transaction fees, as well as to user, settlement and license fees.

66. FX further reported increases in earnings per share and total average daily trading volume. The Company, which for purposes of gauging trading volume counts only one side per trade, saw its average daily trading volume swell to $86.8 billion, up 13% from the first quarter of 2011.

67. These announcements foreshadow FX’s bright future. In its Form 10-Q filed with the SEC on May 8, 2012, the Company stated, in pertinent part:

Key Operating Metrics

We believe that there are two key variables that impact the revenues earned by us:

● | the volumes that are transacted on our plaform; and |

● | the amount of transaction fees that we collect for trades executed through the platform (which are a result of our pricing tiers and the mix of contracts that we transact). |

68. Thus, given the ballooning trading volume and the resulting increase in transaction fees, the Company is, by its own metrics, currently strong and poised for immediate and substantial future growth. However, FX shareholders are being deprived, through the wholly inadequate Merger Consideration, of the true value of their investments in the Company.

69. Thomson Reuters is poised to reap immediate and substantial benefits from the FX acquisition. The acquisition will remove one of Thomson Reuters’ competitors and is also expected to expand Thomson Reuters’ share of the electronic foreign exchange market and add to the company’s revenue at a time when Thomson Reuters’ core business is declining. Thomson Reuters is a leading provider of information and trading services in the sell-side interbank foreign exchange market. FX focuses on the buy-side market, such as asset managers, corporations, and hedge funds. On July 11, 2012, Thomson Reuters reported that its average daily foreign exchange trading volume fell more than 9% in June 2012 compared to June 2011. The decline was attributed to investor concern about the Euro Zone debt crisis and a corresponding lag in interbank trading. Securities analysts have commented on the substantial benefits of the proposed acquisition to Thomson Reuters. For example, on July 9, 2012, Reuters reported that Howard Tai, a senior analyst with the Aite Group commented that “[e]ach entity is missing a segment of liquidity, so combining the two is essential to stay competitive in the very fragmented FX market,” and noted that “Thomson Reuters’ FX matching is mostly an interbroker electronic platform, whereas [FX] is predominantly an electronic platform for corporates and the buy-side community.” The same Reuters article also stated that UBS analyst Philip Huang estimated that the acquisition could add $145 million in revenue, or more than 23% of the acquisition price, and complement Thomson Reuters’ existing $1.7 billion foreign exchange business.

The Buyer Friendly Terms of the Merger Agreement

70. The Proposed Transaction is inadequate, unreasonable, unfair and not in the best interest of the Company’s public shareholders. While the press release announcing the Proposed Transaction suggests that the Merger Consideration and premium provided is generous, Thomson Reuters’ offer of $22.00 per share does not adequately reflect FX’s true value as a takeover candidate, for the reasons discussed above. The inadequate consideration agreed to in the Merger Agreement calls into question the effectiveness of the Individual Defendants and their ability to secure a transaction that adequately captures the true value of the Company for its shareholder.

71. Moreover, to the detriment of the Company’s shareholders, the terms of the Merger Agreement substantially favor Thomson Reuters and are calculated to unreasonably dissuade potential suitors from making competing offers.

72. Among other things, the Merger Agreement does this by failing to include a reasonable “go shop” period. In fact, Section 5.2(a) of the Merger Agreement requires the Company and its agents to “immediately cease any and all existing discussion or negotiations” with any other potential acquiror. Section 5.2 also expressly prohibits the Company and its representatives from directly or indirectly (i) soliciting, initiating, knowingly facilitating or knowingly inducing the making, submission or announcement of, or knowingly encouraging or assisting any alternative sales proposal; (ii) furnishing any potential bidder with any non-public information relating to the Company or any of its subsidiaries that could lead to an alternative sales proposal; (iii) engaging in, continuing or otherwise participating in any discussions or negotiations with regarding any alternative sales proposal with a potential bidder; (iv) approving, endorsing or recommending an alternative sales proposal; or (v) entering into any contract contemplating or otherwise relating to an alternative sales proposal.

73. Before the Company may furnish confidential information or enter into substantive discussions with an unsolicited bidder, Section 5.2(c) requires the following to occur: (i) the Company Board must determine in good faith (after consultation with its financial advisor and outside legal counsel) that the unsolicited bidder’s offer is either superior to the Proposed Transaction (a “Superior Offer”) or could reasonably be expected to result in a Superior Offer and that failure to take action would be reasonably be expected to be inconsistent with the Company Board’s fiduciary duties; (ii) the unsolicited bidder must provide the Company with an executed confidentiality agreement; (iii) the Company must notify Thomson Reuters within 48 hours following receipt of an unsolicited bid written notice of the identity of the bidder and, if applicable, provide Thomson Reuters with any acquisition proposal and draft agreement; and (iv) promptly after furnishing non-public information to an unsolicited bidder, the Company must provide Thomson Reuters any information that the Company had not already provided. Section 5.2(d) provides that if the Company becomes aware of the receipt of any alternative proposal, or the receipt of any request for information or inquiry that may lead to an alternative proposal, the Company must notify Thomson Reuters within 48 hours of such a proposal or request, and thereafter keep Thomson Reuters informed of any material change in the status or terms such a proposal or inquiry within 24 hours after receipt or delivery thereof.

74. Further, a competing bidder will need to negotiate with a management team participating in the Proposed Transaction, the members of which already are heavily biased in favor of consummating the Proposed Transaction. If tenacious enough to navigate this obstacle course, that bidder will be further discouraged by the onerous termination fee that the Company (and by extension, the “successful” competing bidder) will be forced to pay of $14,500,000, as provided by Section 8.3 of the Merger Agreement. The termination fee is approximately 2.1% of the total value of the Proposed Transaction.

75. Pursuant to the Merger Agreement, almost a third of the Company’s shares have already been pledged in favor of the Proposed Transaction. FX’s largest shareholder, Technology Crossover Ventures (of which Individual Defendants Rosenberg and Trudeau serve as general partners), along with Individual Defendant Weisberg and FX’s chief financial officer, collectively own approximately 32.5% of the Company, have all agreed to tender their shares into the tender offer. A condition of the Merger Agreement is that the number of shares validly tendered, plus any shares owned by Thomcorp and Merger Sub, equal at least a majority of the Company’s outstanding common stock. The 32.5% stake in the Company held by Weisberg and Cooley, which they have agreed to tender, will virtually ensure that the tender offer will be successful.

76. The Company also has granted Merger Sub an option to purchase a number of newly issued shares of the Company’s stock at a price equal to the offer price, equal to at least the number of shares that, when added to the number of shares of common stock owned by Thomcorp and Merger Sub at the time of exercise, shall constitute one share more than 90% of the common shares outstanding after exercise of the option (the “Top Up Option”). Upon acquisition of 90% of the Company’s outstanding shares via the Top Up Option, the acquisition may be expedited by a simple short-form merger that does not require further shareholder action. Moreover, as the parties agreed, the tender offer was commenced on July 18, 2012, just ten days after the Proposed Transaction was announced. The timing of the Proposed Transaction indicates a rush to complete the transaction and deny shareholders the opportunity to conduct any meaningful challenge to its terms and conditions.

77. The Proposed Transaction lacks fundamental hallmarks of fairness. As discussed above, both FX and Thomson Reuters have delayed informing shareholders as to the planned structure of the merged platforms until after consummation of the Proposed Transaction, despite the obvious importance of such information to FX’s shareholders’ process in deciding whether to tender their shares. These acts, combined with other defensive measures the Company has in place, effectively preclude any other bidders who might be interested in paying more than Thomson Reuters for the Company, and have the effect of limiting the ability of the Company’s shareholders to obtain the best price for their shares.

78. The buy-out of FX public shareholders by Thomson Reuters on the terms offered will deny class members their right to share proportionately and equitably in the true value of FX’s valuable and profitable business, and further growth in profits and earnings, at a time when the Company is reporting robust financial results and is poised for substantial future growth.

The 14D-9 Fails to Disclose Material Information

79. In addition to the flawed sale process and inadequate Merger Consideration, the Proposed Transaction is also unfair because the 14D-9 fails to provide the Company’s shareholders with material information and/or provides them with materially misleading information, thereby precluding FX’s public shareholders from making an informed decision whether to tender their shares into the Proposed Transaction.

80. The 14D-9 is materially incomplete and fails to adequately inform FX’s shareholders of material information critical to shareholders concerning the background of the merger, the sales process, and information regarding the financial prospects for FX and the financial analyses performed by its financial advisor in support of the Proposed Transaction. This information is necessary for shareholders to evaluate and properly assess the credibility of the various analyses performed by the Company’s financial advisor, J.P. Morgan.

81. Specifically, with respect to the Background of the Offer, the 14D-9 must disclose:

a. What was being contemplated in the five months of due diligence and the various meetings and discussions related to the ��potential for a joint marketing arrangement” with Thomson Reuters?

b. In light of J.P. Morgan’s potential conflicts of interest in the Proposed Transaction due to their preexisting relationship with Thomson Reuters, why was J.P. Morgan chosen as the Company’s financial advisor? Furthermore, were any other advisors considered?

c. What were the possible synergies or “complementary aspects” of Thomson Reuters and the Company’s businesses that were discussed between Weisberg and representatives of Thomson Reuters? Were cost savings, efficiencies, public company costs etc. considered?

d. What is the basis for the Transaction Committee to include Defendant Weisberg, who is CEO of FX, and Defendant Trudeau, who is a General Partner of Technology Crossover Ventures, the Company’s largest shareholder, individuals that would not be expected to analyze the Proposed Transaction in an impartial manner?

e. Additional details regarding the constitution of the Transaction Committee (e.g., powers, duties, limitations, restrictions, etc.).

82. Additionally, the 14D-9 fails to disclose other relevant information on which J.P. Morgan based its opinion. Such information, which includes assumptions and projections, is material to the shareholders’ voting decision. The 14D-9 should provide the following regarding J.P. Morgan’s analysis:

a. The Company must disclose more information about the Public Trading Multiples utilized by J.P. Morgan. Specifically:

i. Why did J.P. Morgan take the unusual step of comparing the Company to five different sub/peer groups, with multiple companies within each sub/peer group?

ii. What were J.P. Morgan’s assumptions and what were the factors for choosing the sub/peer groups and the companies within them?

iii. What were the selection criteria for the companies within the Public Trading Multiples analysis?

iv. What does the term “firm value” mean and is it different, and if so, how, from “enterprise value?”

v. What date did J.P. Morgan use in calculating the “firm value?”

vi. What are the company-by-company multiples utilized in creating the table on page 34 of the 14D-9?

vii. What are the “financial and operating metrics” that J.P. Morgan considered “appropriate” to consider in determining “a Price/EPS of 14.0x-16.5x for 2013?” Furthermore, what are the 2012 Price/EPS and FV/EBITDA multiples and why were they not disclosed by J.P. Morgan?

b. With respect to the Selected Transaction Analysis, the 14D-9 must disclose:

i. What is the basis for J.P. Morgan utilizing three broad categories for the Selected Transaction Analysis while using five for the Public Trading Multiples analyses?

ii. What multiples, if any, other than Transaction Value/NTM EBITDA were examined by J.P. Morgan in the Selected Transaction Analysis?

iii. What is the Company’s Transaction Value/NTM EBITDA multiple at the Offer Price?

iv. What are the “factors that J.P. Morgan considered appropriate” in determining a Transaction Value/NTM EBITDA multiple of 9.0x-13.0x? Specifically, indicate why, given the Company’s outstanding performance, J.P. Morgan chose (a) as the lower end of its selected range a figure that lies below every observed multiple of the peer group, and (b) as the upper end of its selected range only the peer group median multiple.

c. With respect to the Discounted Cash Flow Analysis, the 14D-9 must disclose:

i. Are the numbers for the years 2016 through 2022 in the “Unlevered Free Cash Flows Calculated from Management Cases” based on J.P. Morgan’s analyses or on Managements projections? If they are based on J.P. Morgan’s analysis, what are the underlying assumptions utilized?

ii. What is the basis (including underlying assumptions) for using a range of discount rates from 11.0% to 13.0% to discount the unlevered free cash flows and the range of terminal values to present values?

d. With respect to the Financial Projections utilized by the Company the 14D-9 must disclose:

i. What portion of the “Case 2” projections was provided to bidders during the sales process and what was the basis for that?

ii. What is the basis for providing only a part of one of management’s projections?

iii. What is the basis for management providing to J.P. Morgan and bidders three cases of Financial Projections based upon the assumption of FX continuing as a stand-alone company that did not take into account the potential impact of the “joint marketing agreement,” or so called “synergistic assumptions,” being negotiated with Thomson Reuters?

83. The 14D-9 also fails to disclose information concerning the nature and scope of the financial advisory and other services that J.P. Morgan has performed for the parties in the Proposed Transaction, or their affiliates, if any, in the last two years, as well as the amount of compensation J.P. Morgan has received for rendering such services.

84. These types of selective omissions of information are materially misleading, preclusive and indicative of a 14D-9 drafted to achieve a desired outcome in favor of the Proposed Transaction rather than to provide shareholders with a fair and accurate description of the financial advisor’s work.

85. If the Board fails to remedy these disclosure deficiencies sufficiently in advance of the expiration of the tender offer, the Company’s public shareholders will be irreparably harmed and will be unable to make an informed decision about whether to tender their shares. And, because appraisal rights are not available in connection with the tender offer, FX shareholders cannot petition a court to determine the fair value of their shares.

The Proposed Transaction Provides Special Benefits To Insiders

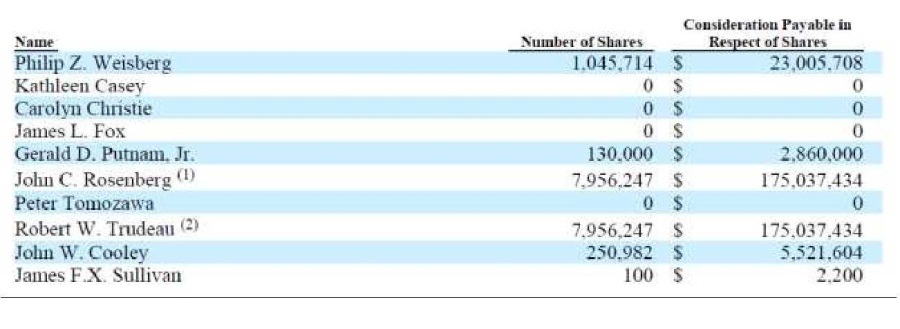

86. Each of the Individual Defendants and the Company’s executive officers are conflicted and in breach of their fiduciary duties because they will receive benefits from the Proposed Transaction not available to Plaintiff and the other public shareholders of FX. The table below sets for the cash consideration each executive officer and director will receive when they tender their shares into the Proposed Transaction:

87. Furthermore, the Merger Agreement provides for various additional benefits for the Individual Defendants and the Company’s executive officers. For example:

a. Section 3.3(a) of the Merger Agreement provides that each Company stock option outstanding and not exercised at the time that the Proposed Transaction is consummated, whether or not vested, will be canceled in exchange to receive cash equal to the product of (i) the excess (if any) of the Merger Consideration over the exercise price of the option, and (ii) the total number of shares underlying the option, less applicable taxes.

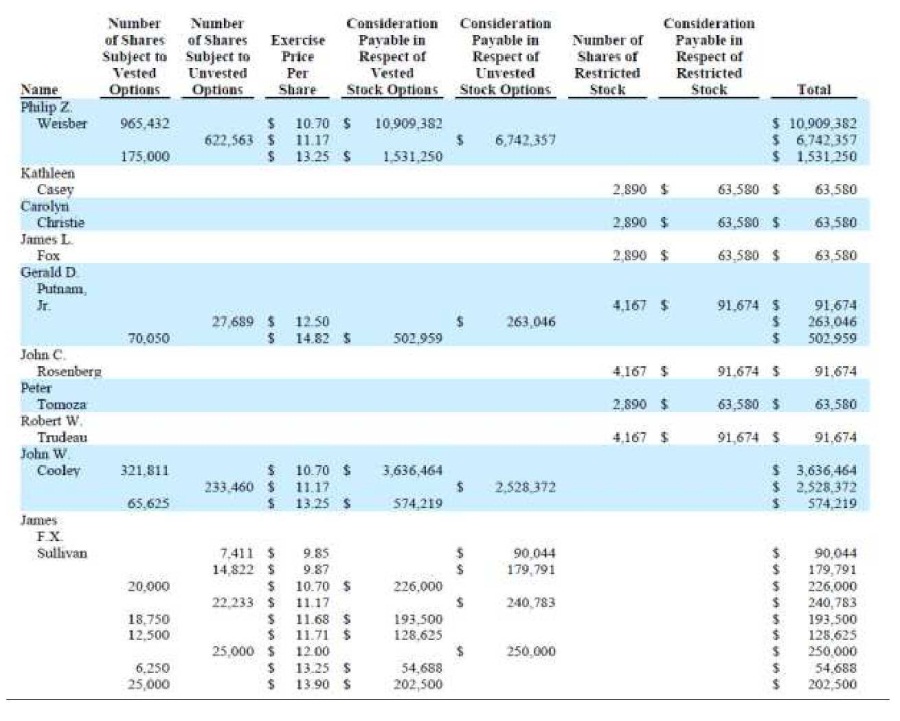

b. Section 3.3(b) of the Merger Agreement provide for “accelerated vesting,” i.e., all stock options and restricted stock units (“RSU”) will become fully vested upon consummation of the Proposed Transaction, thereby allowing the Individual Defendants and certain Company insiders to receive compensation in the form of Merger Consideration for restricted securities that would otherwise be unmarketable. The table below sets forth the cash consideration each executive officer and director will be entitled to receive in respect to their outstanding stock options and RSUs:

c. Section 6.3(a) of the Merger Agreement requires the surviving company to pay any continuing employee any applicable change in control bonus or retention bonus.

d. Section 6.4 of the Merger Agreement requires the surviving company to indemnify the Company’s directors and employees for a period of six years after the close of the Proposed Transaction for all liabilities and claims related to their service or employment with FX or its subsidiaries occurring prior to the consummation of the Proposed Transaction. This covenant further provides that the Company may obtain and pay for a “tail” policy with respect to the Company’s directors’ and officers’ liability insurance policies (“D&O Insurance”) with benefits and levels of coverage at least as favorable as the Company’s policies existing at the date of the Merger Agreement, and if the Company fails to do so, the surviving company must continue to maintain the D&O Insurance in place as of the date of the Merger Agreement for a period of at least six years from the consummation of the Proposed Transaction or purchase comparable coverage for the same period of time.

88. Accordingly, the Proposed Transaction is wrongful, unfair and harmful to the Company’s public stockholders, and represents an attempt to deny Plaintiff and the other members of the Class their right to obtain their fair proportionate share of the Company’s valuable assets, future growth in profits, earnings and dividends.

89. As a result of Defendants’ unlawful actions, Plaintiff and the other members of the Class will be damaged in that they will not receive their fair portion of the value of the Company’s assets and business and will be prevented from obtaining the intrinsic value of their equity ownership of the Company.

90. Unless the Proposed Transaction is enjoined by the Court, the Individual Defendants will continue to breach their fiduciary duties owed to Plaintiff and the other members of the Class, aided and abetted by Thomson Reuters, to the irreparable harm of Plaintiff and the Class.

91. Plaintiff and the other members of the Class are immediately threatened by the wrongs complained of herein, and lack an adequate remedy at law.

FIRST CAUSE OF ACTION

Claim for Breaches of Fiduciary Duties Against All Defendants

92. Plaintiff repeats and re-alleges each allegation set forth herein.

93. The Individual Defendants have violated their fiduciary duties of care, loyalty, good faith, and fair dealing owed to the public shareholders of FX by agreeing to the Proposed Transaction and the Merger Agreement, to the detriment of Plaintiff and the Company’s public shareholders. By the acts, transactions and courses of conduct alleged herein, the Individual Defendants, individually and acting as a part of a common plan, are attempting to unfairly deprive Plaintiff and other members of the Class of the value of their investment in FX.

94. As demonstrated by the allegations above, the Individual Defendants have failed to exercise the necessary care required, and breached their duties of loyalty, good faith and fair dealing because, among other reasons:

a. they have failed to properly value the Company;

b. they have failed to take steps to maximize the value of FX to its public shareholders;

c. they have employed efforts to unfairly coerce FX’s public shareholders to approve the deal; and

d. they have favored their own interests over those of FX’s public shareholders.

95. Unless enjoined by this Court, the Individual Defendants will continue to breach their fiduciary duties owed to Plaintiff and the other members of the Class, and may consummate the Proposed Transaction, which will deprive Plaintiff and the Class of their fair proportionate share of FX’s valuable business, to the irreparable harm of the Class.

96. Plaintiff and the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury which the Individual Defendants’ actions threaten to inflict.

SECOND CAUSE OF ACTION

Against FX and Thomson Reuters for Aiding and Abetting Breaches of Fiduciary Duties

97. Plaintiff repeats and re-alleges each allegation set forth herein.

98. Defendants FX and Thomson Reuters by reason of their status as parties to the Merger Agreement, and their possession of non-public information, have aided and abetted the Individual Defendants in the aforesaid breach of their fiduciary duties.

99. Such breaches of fiduciary duties could not and would not have occurred but for the conduct of Defendants FX and Thomson Reuters who have aided and abetted such breaches in the possible sale of FX to Thomson Reuters.

100. As a result of the unlawful actions of Defendants FX and Thomson Reuters, Plaintiff and other members of the Class will be irreparably harmed in that they will not receive material information concerning the Proposed Transaction that is necessary to determine whether to approve the Proposed Transaction and they will be deprived of the fair value of their investment in FX. Unless the actions of Defendants FX and Thomson Reuters are enjoined by the Court, they will continue to aid and abet the Individual Defendants’ breaches of their fiduciary duties owed to Plaintiff and members of the Class.

101. Plaintiff and the Class have no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands judgment and preliminary and permanent relief, including injunctive relief, in his favor and in favor of the Class and against Defendants as follows:

A. Declaring that this action is properly maintainable as a class action, and certifying Plaintiff as class representative;

B. Enjoining Defendants, their agents, counsel, employees and all persons acting in concert with them from consummating the Proposed Transaction, unless and until the Company makes full and adequate disclosure to shareholders and adopts and implements a procedure or process to obtain the highest possible price for shareholders and, if the transaction is consummated, rescinding the transaction;

C. Directing the Individual Defendants to exercise their fiduciary duties to obtain a transaction that is in the best interests of FX’s shareholders and to refrain from entering into any transaction until the process for the sale or auction of the Company is completed and the highest possible price is obtained;

D. Imposing a constructive trust, in favor of the Class, upon any benefits improperly received by Defendants as a result of their wrongful conduct;

E. Awarding Plaintiff and the Class compensatory damages and/or rescissory damages;

F. Awarding Plaintiff the costs and disbursements of this action, including a reasonable allowance for Plaintiff’s attorneys’ fees, expenses and experts’ fees; and

G. Granting such other and further relief as this Court may deem to be just and proper.

JURY DEMAND

Plaintiff demands a trial by jury.

Dated: July 24, 2012

| | WEISS & LURIE |

| | |

| | s/Joseph H. Weiss |

| | Joseph H. Weiss Richard A. Acocelli 1500 Broadway 16th Floor New York, New York 10036 Tel.: (212) 682-3025 Fax: (212) 682-3010 |

| | |

| | Counsel for Plaintiff and Proposed Co-Lead Counsel for the Class |