UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period ended June 30, 2019

OR

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from

__________to __________

Commission File No.: 333-177532

KAYA HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 90-0898007 |

| (Stateorother jurisdiction ofincorporation ororganization) | | (I.R.S.Employer Identification Number) |

888 S. Andrews Avenue

Suite 302

Ft. Lauderdale, Florida 33316

(Address of principal executive offices)

(954)-892-6911

(Issuer's telephone number)

Indicatebycheck mark whether the registrant (1) hasfiled all reportsrequired to befiled bySection 13 or 15(d) ofthe Exchange Actduring the past 12months (or forsuch shorter period that theregistrant wasrequired to file such reports), and (2) hasbeen subject to such filing requirements forthe past 90days.Yes[X] No [ ]

Indicatebycheck mark whether the registrant has submitted electronically every Interactive Data File required to besubmittedpursuant toRule 405 ofRegulation ST (§232.405 ofthis chapter) during the preceding 12months(or for suchshorter period that theregistrantwasrequired to submit suchfiles).Yes [X ] No [ ]

Indicatebycheck mark whether the registrant is alarge acceleratedfiler,anacceleratedfiler,anonacceleratedfiler,or asmaller reporting companyoremerging growthcompany.Seethe definitions of“large acceleratedfiler,”“accelerated filer” and “smaller reportingcompany” and“emerging growth company” in Rule 12b-2 of theExchange Act. (Check one):

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-accelerated Filer [ ] | Smaller reporting company [X] |

| | Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicatebycheckmark whether the registrantis ashell company (as defined in Rule 12b-2 ofthe Exchange Act.)Yes [ ] No [X]

As of August 19, 2019, theIssuer had 173,598,080sharesof itscommon stock outstanding.

KAYAHOLDINGS, INC.

INDEXTOQUARTERLYREPORTON FORM 10 Q

Part I –Financial Information Page

| Item1.Condensed Consolidated Financial Statements | Page |

| CondensedConsolidated Balance Sheet | 3 |

| CondensedConsolidated Statements ofOperation | 4 |

| CondensedConsolidated Statements ofCash Flows | 5 |

| StatementofStockholder’s equity forsix months ended June 30, 2019 and 2018 | 6 |

| Notes toCondensedConsolidated Financial Statements | 7 |

| Item2.Management’s Discussion andAnalysis ofFinancial Condition and Results ofOperations | 32 |

| Item3.QuantitativeandQualitative Disclosures AboutMarket Risk | 71 |

| Item4.ControlsandProcedures | 71 |

| | |

| PartIIOther Information | |

| | |

| Item1.Legal Proceedings | 72 |

| Item1A. RiskFactors | 72 |

| Item2.Unregistered Sales ofEquity Securities and Use ofProceeds | 72 |

| Item3.DefaultsUponSenior Securities | 73 |

| Item4.Mine Safety Disclosures | 73 |

| Item5.Other Information | 73 |

| Item6.Exhibits | 73 |

| Signatures | 74 |

Kaya Holdings, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

June 30, 2019 (Unaudited) and December 31, 2018

| ASSETS | | | | |

| | | (Unaudited) | | (Audited) |

| | | June 30, 2019 | | December 31, 2018 |

| CURRENT ASSETS: | | | | | | | | |

| Cash and equivalents | | $ | 120,083 | | | $ | 111,512 | |

| Inventory-net of allowance | | | 123,954 | | | | 131,542 | |

| Prepaid expenses | | | 12,774 | | | | 20,541 | |

| Total current assets | | | 256,811 | | | | 263,595 | |

| | | | | | | | | |

| NON-CURRENT ASSETS: | | | | | | | | |

| Right-of-use asset - operating lease | | | 525,451 | | | | — | |

| Property and equipment, net | | | 2,252,858 | | | | 2,348,780 | |

| Deposits | | | 31,523 | | | | 31,523 | |

| Total other assets | | | 2,809,832 | | | | 2,380,303 | |

| | | | | | | | | |

| Total assets | | $ | 3,066,643 | | | $ | 2,643,898 | |

| | | | | | | | | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY) | | | | | | | | |

| | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | |

| Accounts payable and accrued expense | | $ | 651,958 | | | $ | 562,016 | |

| Accounts payable and accrued expense-related parties | | | 7,737 | | | | 7,737 | |

| Accrued interest | | | 883,814 | | | | 659,169 | |

| Right-of-use liabiliy - operating lease | | | 146,040 | | | | — | |

| Convertible notes payable-net of discount | | | 334,052 | | | | 2,894,294 | |

| Notes payable | | | 9,312 | | | | 9,312 | |

| Derivative liabilities | | | 10,644,017 | | | | 19,783,034 | |

| Total current liabilities | | | 12,676,930 | | | | 23,915,562 | |

| | | | | | | | | |

| LONG TERM LIABILITIES: | | | | | | | | |

| Convertible notes payable-related party-net of discount | | | 500,000 | | | | 500,000 | |

| Convertible notes payable-net of discount | | | 4,557,583 | | | | 1,283,557 | |

| Notes payable-related party | | | 250,000 | | | | 250,000 | |

| Rights-of-use liability-operating lease | | | 383,938 | | | | — | |

| Total long term liabilities | | | 5,691,521 | | | | 2,033,557 | |

| | | | | | | | | |

| Total liabilities | | | 18,368,451 | | | | 25,949,119 | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY (DEFICIT): | | | | | | | | |

| Convertible preferred stock, Series C, par value $.001; 10,000,000 shares authorized; | | | | | | | | |

| 49,900 and 49,900 issued and outstanding at June 30, 2019 and December 31, 2018 | | | 50 | | | | 50 | |

| , respectively | | | | | | | | |

| Common stock , par value $.001; 500,000,000 shares authorized; | | | | | | | | |

| 173,598,080 shares issued as of June 30, 2019 and | | | | | | | | |

| 165,812,128 shares issued as of December 31, 2018 | | | 173,598 | | | | 165,812 | |

| Subscriptions payable | | | 163,630 | | | | 397,209 | |

| Additional paid in capital | | | 17,384,679 | | | | 17,100,137 | |

| Accumulated deficit | | | (31,811,640 | ) | | | (39,924,912 | ) |

| Non-controlling interest | | | (1,212,125 | ) | | | (1,043,517 | ) |

| Net stockholders' equity/(deficit) | | | (15,301,808 | ) | | | (23,305,221 | ) |

| | | | | | | | | |

| Total liabilities and stockholders' equity/(deficit) | | $ | 3,066,643 | | | $ | 2,643,898 | |

The accompanying notes are an integral part of these consolidated financial statements.

Kaya Holdings, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(Unudited)

| | | | | | | | | |

| | | For the three | | For the three | | For the six | | For the six |

| | | months ended | | months ended | | months ended | | months ended |

| | | June 30, 2019 | | June 30, 2018 | | June 30, 2019 | | June 30, 2018 |

| | | | | | | | | |

| Net sales | | $ | 249,121 | | | $ | 291,133 | | | $ | 512,879 | | | $ | 546,498 | |

| | | | | | | | | | | | | | | | | |

| Cost of sales | | | 92,719 | | | | 118,420 | | | | 238,231 | | | | 221,011 | |

| | | | | | | | | | | | | | | | | |

| Gross profit | | | 156,402 | | | | 172,713 | | | | 274,648 | | | | 325,487 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Professional fees | | | 145,119 | | | | 172,331 | | | | 190,969 | | | | 1,358,059 | |

| Salaries and wages | | | 114,415 | | | | 102,192 | | | | 260,870 | | | | 235,632 | |

| General and administrative | | | 217,197 | | | | 175,158 | | | | 460,220 | | | | 339,246 | |

| Total operating expenses | | | 476,731 | | | | 449,681 | | | | 912,059 | | | | 1,932,937 | |

| | | | | | | | | | | | | | | | | |

| Operating loss | | | (320,329 | ) | | | (276,968 | ) | | | (637,411 | ) | | | (1,607,450 | ) |

| | | | | | | | | | | | | | | | | |

| Other income(expense): | | | | | | | | | | | | | | | | |

| Interest expense | | | (132,193 | ) | | | (137,784 | ) | | | (258,395 | ) | | | (283,808 | ) |

| Amortization of debt discount | | | (366,177 | ) | | | (544,357 | ) | | | (713,786 | ) | | | (1,124,122 | ) |

| Derivative liabilities expense | | | (115,253 | ) | | | (356,394 | ) | | | (562,148 | ) | | | (1,913,591 | ) |

| Gain (loss) on extinguishment of debt | | | — | | | | — | | | | (25,000 | ) | | | — | |

| Change in derivative liabilities expense | | | 4,736,220 | | | | (256,374 | ) | | | 10,141,165 | | | | 16,105,145 | |

| Other income (expense) | | | 14 | | | | — | | | | 238 | | | | — | |

| Total other income (expense) | | | 4,122,620 | | | | (1,294,909 | ) | | | 8,582,075 | | | | 12,783,624 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | | 3,802,291 | | | | (1,571,877 | ) | | | 7,944,664 | | | | 11,176,174 | |

| | | | | | | | | | | | | | | | | |

| Net (loss) attributed to non-controlling interest | | | (61,449 | ) | | | (37,909 | ) | | | (168,608 | ) | | | (74,554 | ) |

| | | | | | | | | | | | | | | | | |

| Net income (loss) attributed to Kaya Holdings, Inc. | | | 3,863,740 | | | | (1,533,968 | ) | | | 8,113,272 | | | | 11,250,728 | |

| | | | | | | | | | | | | | | | | |

| Basic net income (loss) per common share | | $ | 0.02 | | | $ | (0.01 | ) | | $ | 0.05 | | | $ | 0.08 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding - Basic | | | 173,598,080 | | | | 139,409,719 | | | | 170,872,997 | | | | 139,251,765 | |

| | | | | | | | | | | | | | | | | |

| Diluted net income (loss) per common share | | $ | 0.01 | | | $ | (0.01 | ) | | $ | 0.02 | | | $ | 0.08 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding - Diluted | | | 423,656,593 | | | | 139,409,719 | | | | 420,931,510 | | | | 139,251,765 | |

The accompanying notes are an integral part of these consolidated financial statements.

Kaya Holdings, Inc. and Subsidiaries

Consolidated Statement of Cashflows

(Unaudited)

| | | For the six | | For the six |

| | | months ended | | months ended |

| | | June 30, 2019 | | June 30, 2018 |

| OPERATING ACTIVITIES: | | | | | | | | |

| Net income/(loss) | | $ | 8,113,272 | | | $ | 11,250,728 | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Net income/(loss) attributable to non-controlling interest | | | (168,608 | ) | | | (74,554 | ) |

| Depreciation | | | 115,590 | | | | 43,149 | |

| Imputed interest | | | 33,749 | | | | 15,000 | |

| Loss (Gain) on Extinguishment of Debt | | | 25,000 | | | | — | |

| Derivative expense | | | 562,148 | | | | 1,913,591 | |

| Change in derivative liabilities | | | (10,141,165 | ) | | | (16,105,145 | ) |

| Amortization of debt discount | | | 713,786 | | | | 1,124,122 | |

| Stock issued for interest | | | — | | | | — | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Prepaid expense | | | 7,767 | | | | (12,904 | ) |

| Inventory | | | 7,588 | | | | (27,809 | ) |

| Right-of-use asset | | | 113,142 | | | | — | |

| Deposits | | | — | | | | 66,974 | |

| Accrued interest | | | 224,645 | | | | 238,881 | |

| Accounts payable and accrued expenses | | | 89,940 | | | | 974,251 | |

| Right-of-use liabilities | | | (108,615 | ) | | | — | |

| | | | | | | | | |

| Net cash used in operating activities | | | (411,761 | ) | | | (593,716 | ) |

| | | | | | | | | |

| INVESTING ACTIVITIES: | | | | | | | | |

| Purchase of property and equipment | | | (19,668 | ) | | | (114,655 | ) |

| Net cash used in investing activities | | | (19,668 | ) | | | (114,655 | ) |

| | | | | | | | | |

| FINANCING ACTIVITIES: | | | | | | | | |

| Proceeds from Common stock subscription | | | — | | | | 50,000 | |

| Proceeds from convertible debt | | | 440,000 | | | | 570,000 | |

| Payments on notes payable | | | — | | | | (51,274 | ) |

| Net cash provided by financing activities | | | 440,000 | | | | 568,726 | |

| | | | | | | | | |

| NET INCREASE IN CASH | | | 8,571 | | | | (139,645 | ) |

| | | | | | | | | |

| CASH BEGINNING BALANCE | | | 111,512 | | | | 318,462 | |

| | | | | | | | | |

| CASH ENDING BALANCE | | $ | 120,083 | | | $ | 178,817 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | | | | | |

| Taxes paid | | | — | | | | — | |

| Interest paid | | | — | | | | — | |

| | | | | | | | | |

| NON-CASH TRANSACTIONS AFFECTING OPERATING, INVESTING | | | | | | | | |

| AND FINANCING ACTIVITIES: | | | | | | | | |

| Reclassification of derivative liability to additional paid in capital | | | — | | | | — | |

| Value of accrued interest payable reclassified as principal | | | — | | | | 7,133 | |

| Adoption of lease standard ASC 842 | | | 638,593 | | | | — | |

| Derivative liability on convertible note payable | | | 440,000 | | | | — | |

| Value of common shares issued for conversion of convertible | | | 233,579 | | | | — | |

| notes payable issued from stock payable | | | | | | | | |

| Value of common shares issued as payment of interest | | | — | | | | 12,499 | |

The accompanying notes are an integral part of these consolidated financial statements.

Kaya Holdings, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Equity

For the six months ended June 30, 2019 and 2018

(Unaudited)

| | | Preferred Stock | | | | Common Stock | | | | Subscription Payable | | Additional Paid-in Capital | | Accumulated Deficit | | Noncontrolling Interest | | Total Stockholders' Equity |

| | | Shares | | Amount | | Shares | | Amount | | Amount | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2017 | | | 49,900 | | | $ | 50 | | | | 138,993,087 | | | $ | 138,992 | | | $ | 152,796 | | | $ | 12,811,671 | | | $ | (44,672,209 | ) | | $ | (833,710 | ) | | $ | (32,402,410 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Imputed interest | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7,500 | | | | — | | | | — | | | | 7,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock issued for debt conversion and interest | | | — | | | | — | | | | 416,632 | | | | 417 | | | | — | | | | 12,082 | | | | — | | | | — | | | | 12,499 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Imputed interest | | | — | | | | — | | | | — | | | | — | | | | — | | | | 57,450 | | | | — | | | | — | | | | 57,450 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Payment on subscriptions payable | | | — | | | | — | | | | — | | | | — | | | | 50 | | | | — | | | | — | | | | — | | | | 50 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (11,250,728 | ) | | | (74,554 | ) | | | (11,176,174 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2018 | | | 49,900 | | | $ | 50 | | | | 139,409,719 | | | $ | 139,409 | | | $ | 152,846 | | | $ | 12,888,703 | | | $ | (33,421,481 | ) | | $ | (908,264 | ) | | $ | (21,148,737 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2018 | | | 49,900 | | | $ | 50 | | | | 165,812,128 | | | $ | 165,812 | | | $ | 397,209 | | | $ | 17,100,137 | | | $ | (39,924,912 | ) | | $ | (1,043,517 | ) | | $ | (23,305,222 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Imputed interest | | | — | | | | — | | | | — | | | | — | | | | — | | | | 33,749 | | | | — | | | | — | | | | 33,750 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss on debt extinguishment | | | — | | | | — | | | | — | | | | — | | | | — | | | | 25,000 | | | | — | | | | — | | | | 25,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock issued for debt conversion and interest | | | — | | | | — | | | | 7,785,952 | | | | 7,786 | | | | (233,579 | ) | | | 225,793 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 8,113,272 | | | | (168,608 | ) | | | 7,944,664 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2019 | | | 49,900 | | | $ | 50 | | | | 173,598,080 | | | $ | 173,598 | | | $ | 163,630 | | | $ | 17,384,679 | | | $ | (31,811,640 | ) | | $ | (1,212,125 | ) | | $ | (15,301,808 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

NOTE 1 – ORGANIZATION AND NATURE OF THE BUSINESS

Organization

Kaya Holdings, Inc. FKA (Alternative Fuels Americas, Inc.) is a holding company. The Company was incorporated in 1993 and has engaged in a number of businesses. Its name was changed on May 11, 2007 to NetSpace International Holdings, Inc. (a Delaware corporation) (“NetSpace”). NetSpace acquired 100% of Alternative Fuels Americas, Inc. (a Florida corporation) in January 2010 in a stock-for-member interest transaction and issued 6,567,247 shares of common stock and 100,000 shares of Series C convertible preferred stock to existing shareholders. Certificate of Amendment to the Certificate of Incorporation was filed in October 2010 changing the Company’s name from NetSpace International Holdings, Inc. to Alternative Fuels Americas, Inc. (a Delaware corporation). Certificate of Amendment to the Certificate of Incorporation was filed in March 2015 changing the Company’s name from Alternative Fuels Americas, Inc. (a Delaware corporation) to Kaya Holdings, Inc.

The Company has three subsidiaries, Alternative Fuels Americas, Inc, a Florida corporation, which is wholly-owned, Marijuana Holdings Americas, Inc., a Florida corporation (“MJAI”), which is majority-owned and 34225 Kowitz Road, LLC, a wholly-owned Oregon limited liability company which holds the Company’s recently acquired 26 acre property in Lebanon, Oregon on which it plans to develop a legal cannabis cultivation and manufacturing facility. MJAI develops and operates the Company’s legal cannabis retail operations in Oregon through controlling ownership interests in five Oregon limited liability companies: MJAI Oregon 1 LLC, MJAI Oregon 2 LLC, MJAI Oregon 3 LLC, MJAI Oregon 4 LLC and MJAI Oregon 5 LLC (Inactive).

Nature of the Business

In January 2014, KAYS incorporated MJAI, a wholly-owned subsidiary, to focus on opportunities in the legal recreational and medical marijuana in the United States. MJAI has concentrated its efforts in Oregon, where through controlled Oregon limited liability companies, it initially secured licenses to operate a medical marijuana dispensary (an “MMD”) and following legalization of recreational cannabis use in Oregon, has secured licenses to operate four retail outlets and purchased 26 acres for development as a legal cannabis cultivation and manufacturing facility. The Company has developed the Kaya Shack™ brand for its retail operations.

On July 3, 2014 opened its first Kaya Shack™ MMD in Portland, Oregon. In April 2015, KAYS commenced its own medical marijuana grow operations for the cultivation and harvesting of legal marijuana thereby becoming the first publicly traded U.S. company to own a majority interest in a vertically integrated legal marijuana enterprise in the United States. In October 2015, concurrent with Oregon commencing legal sales of recreational marijuana through MMDs, KAYS opened its second retail outlet in Salem, Oregon, the Kaya Shack™ Marijuana Superstore. During 2015, the Company also consolidated its grow operations and manufacturing operations into a single facility in Portland, Oregon.

In 2016, Oregon began the process to transition legal marijuana sales from Oregon Health Authority (“OHA”) licensed MMDs and grow operations to Oregon Liquor Control Commission (“OLCC”) licensed recreational marijuana retailers and producer and processing facilities. Effective January 1, 2017, all retailers of recreational marijuana were required to have a recreational marijuana sales license issued by the OLLC for each retail outlet operated.

In 2016 the Company applied for OLLC licenses for its two initial Kaya Shack™ retail outlets (Portland, Oregon and South Salem, Oregon), and also submitted license applications for its two new locations under construction and development at that time.

In late December 2016, we received our OLCC recreational license for the South Salem Kaya Shack™ Marijuana Superstore (Kaya Shack™ OLCC Marijuana Retailer License #1) and recreational and medical sales continued without interruption from 2016 through the present at that location.

On March 21, 2017, we received our North Salem Kaya Shack™ outlet (Kaya Shack™ OLCC Marijuana Retailer License #2) a 2,600-square foot Kaya Shack™ Marijuana Superstore in North Salem, Oregon, whereupon the location opened for business with both recreational and medical sales.

On May 2, 2017, we received our OLCC recreational license for our Portland Kaya Shack™ outlet (Kaya Shack™ OLCC Marijuana Retailer License #3) after a delay of approximately four months. During that period, we were limited to solely medical sales at the Portland location. Upon receipt of Kaya Shack™ OLCC Marijuana Retailer License #3, recreational sales recommenced at that location. Our OLCC License for the Central Salem Kaya Shack™ Marijuana Superstore (Kaya Shack™ OLCC Marijuana Retailer License #4) has been filed and is pending completion, inspection and final licensing.

During August of 2017, we purchased 26 acres in Lebanon, Oregon, for development as a legal cannabis cultivation and manufacturing facility. The company is in the process of planning and permitting.

On February 15, 2018, we received our OLCC recreational, medical and home delivery license for the Central Salem Kaya ShackTMoutlet (Kaya ShackTM OLCC Marijuana Retailer License #4) a 3,100-square foot Kaya ShackTM Marijuana Superstore in Central Salem, Oregon. After various construction and permitting delays, On April 12, 2018, the location opened for business with both recreational and medical sales.

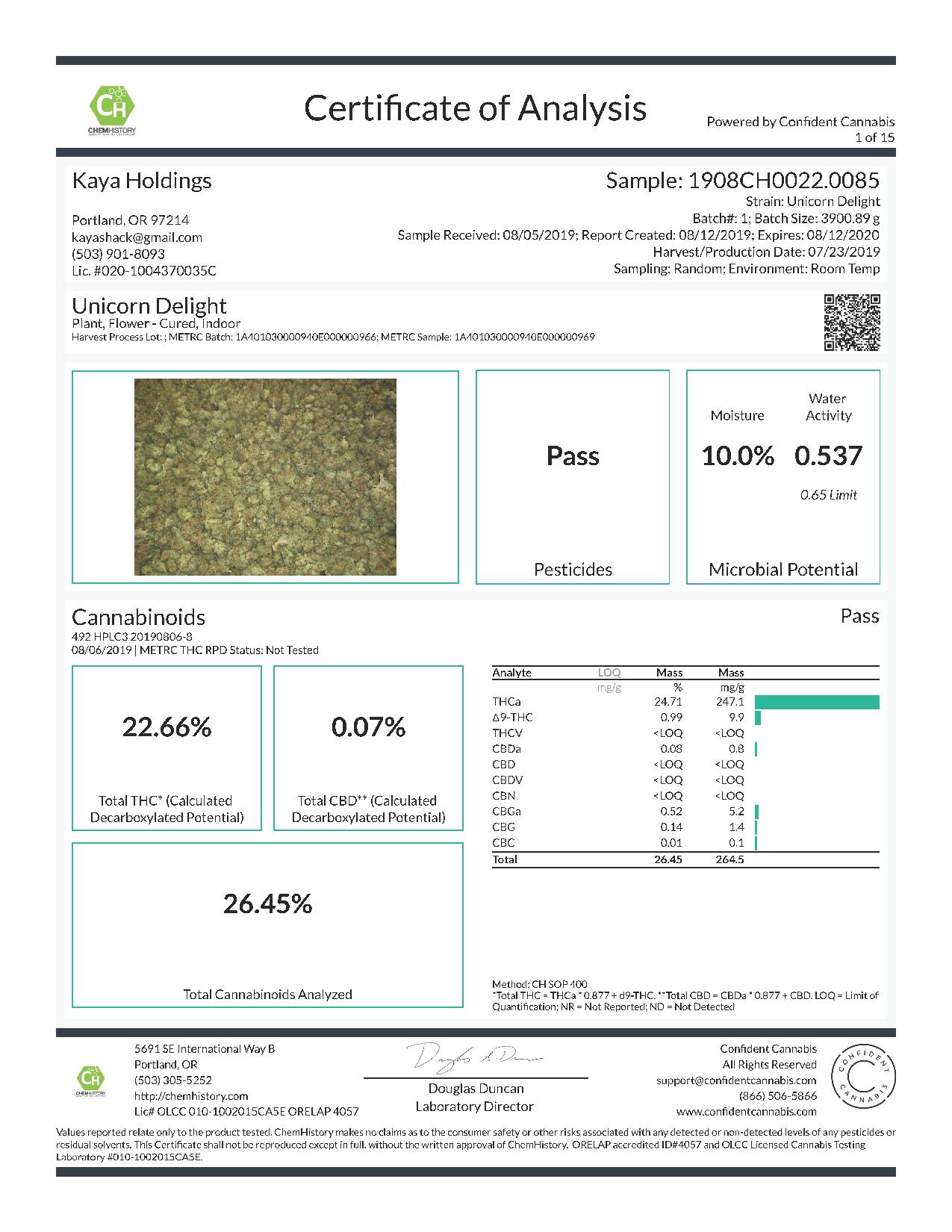

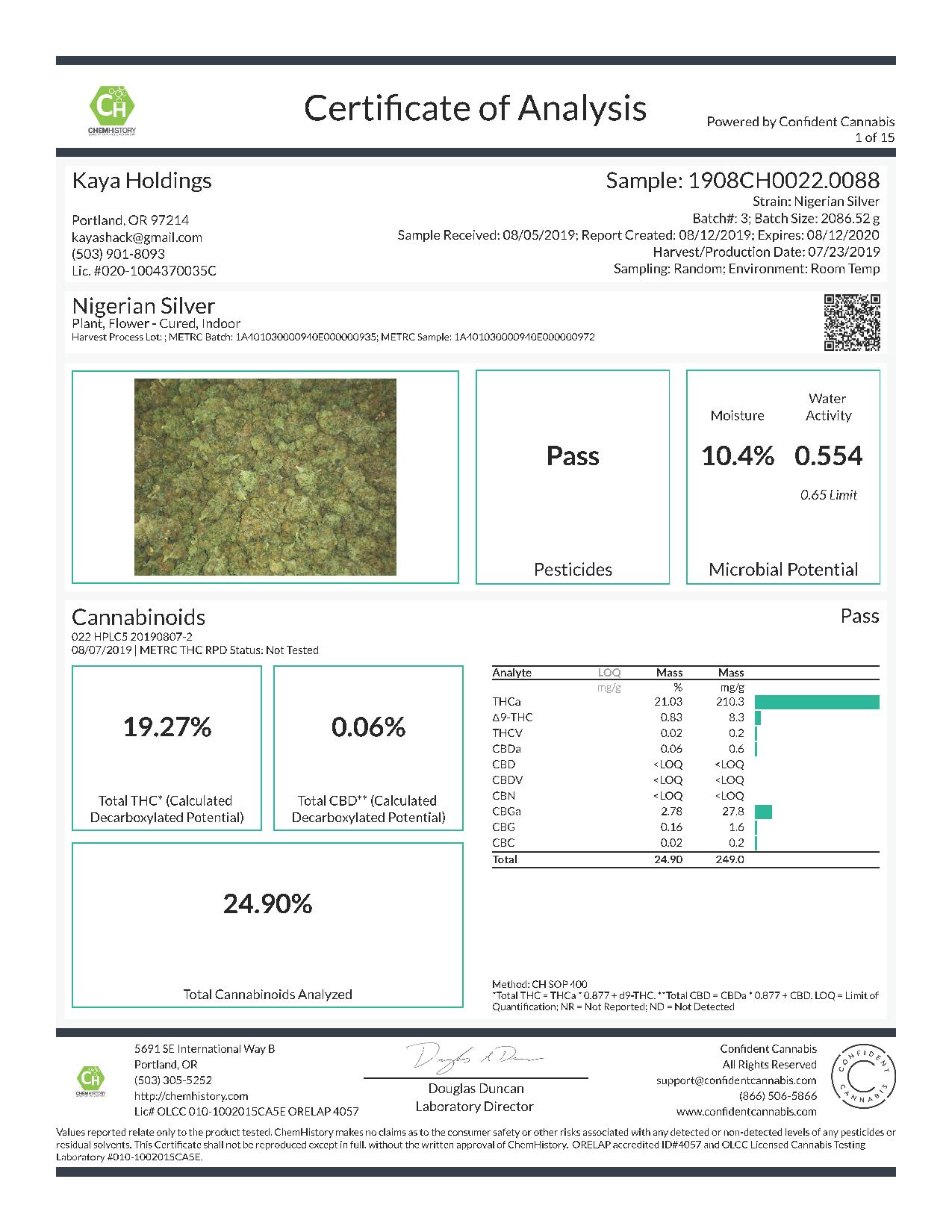

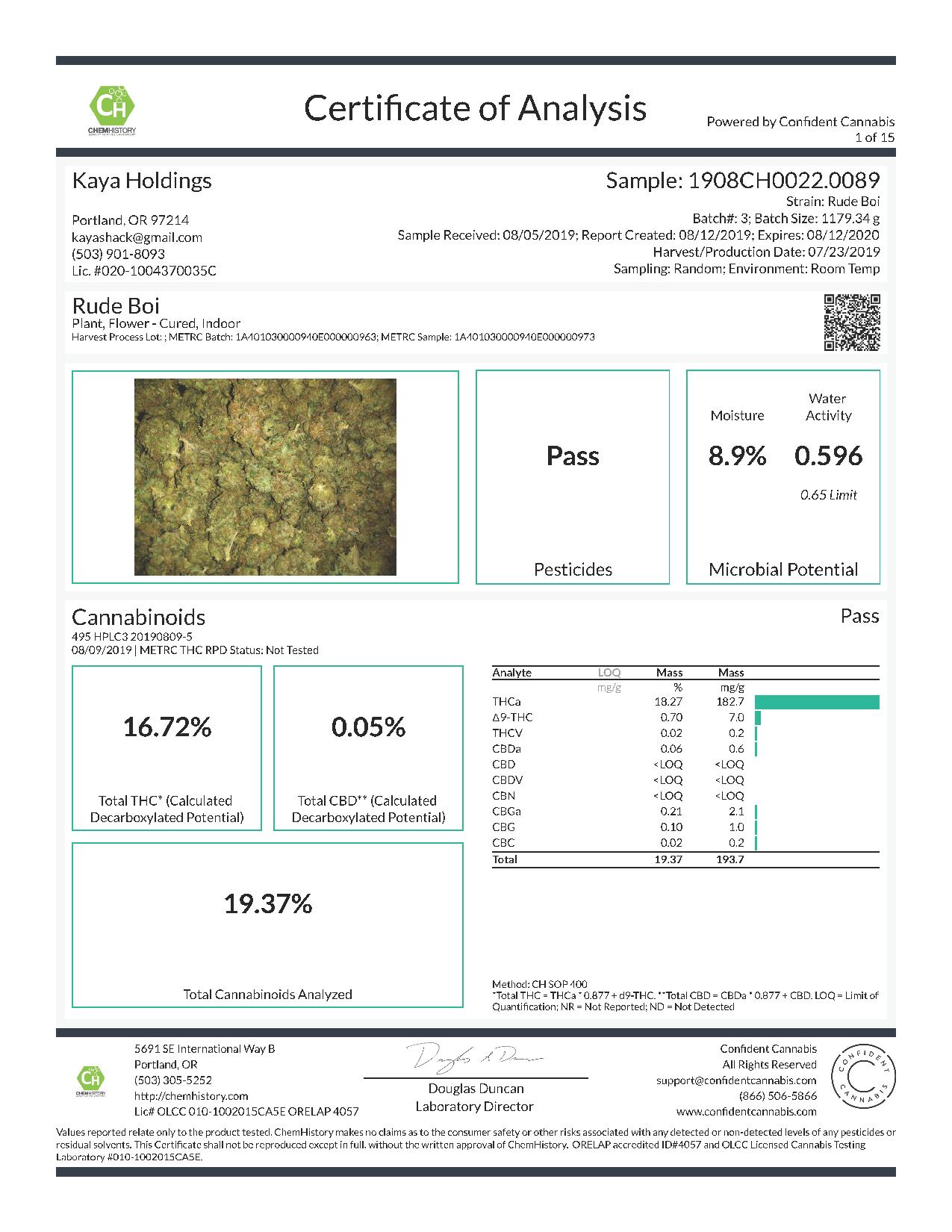

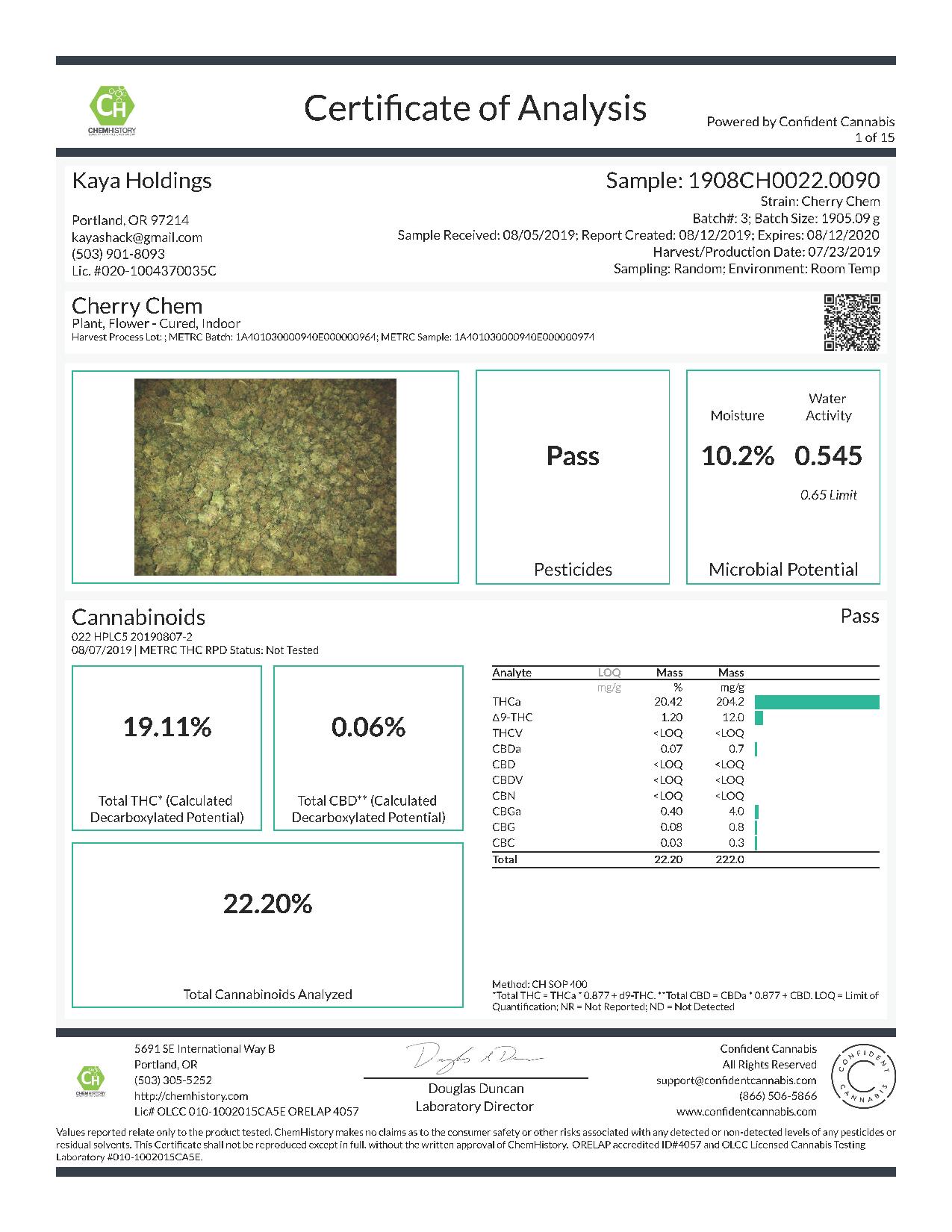

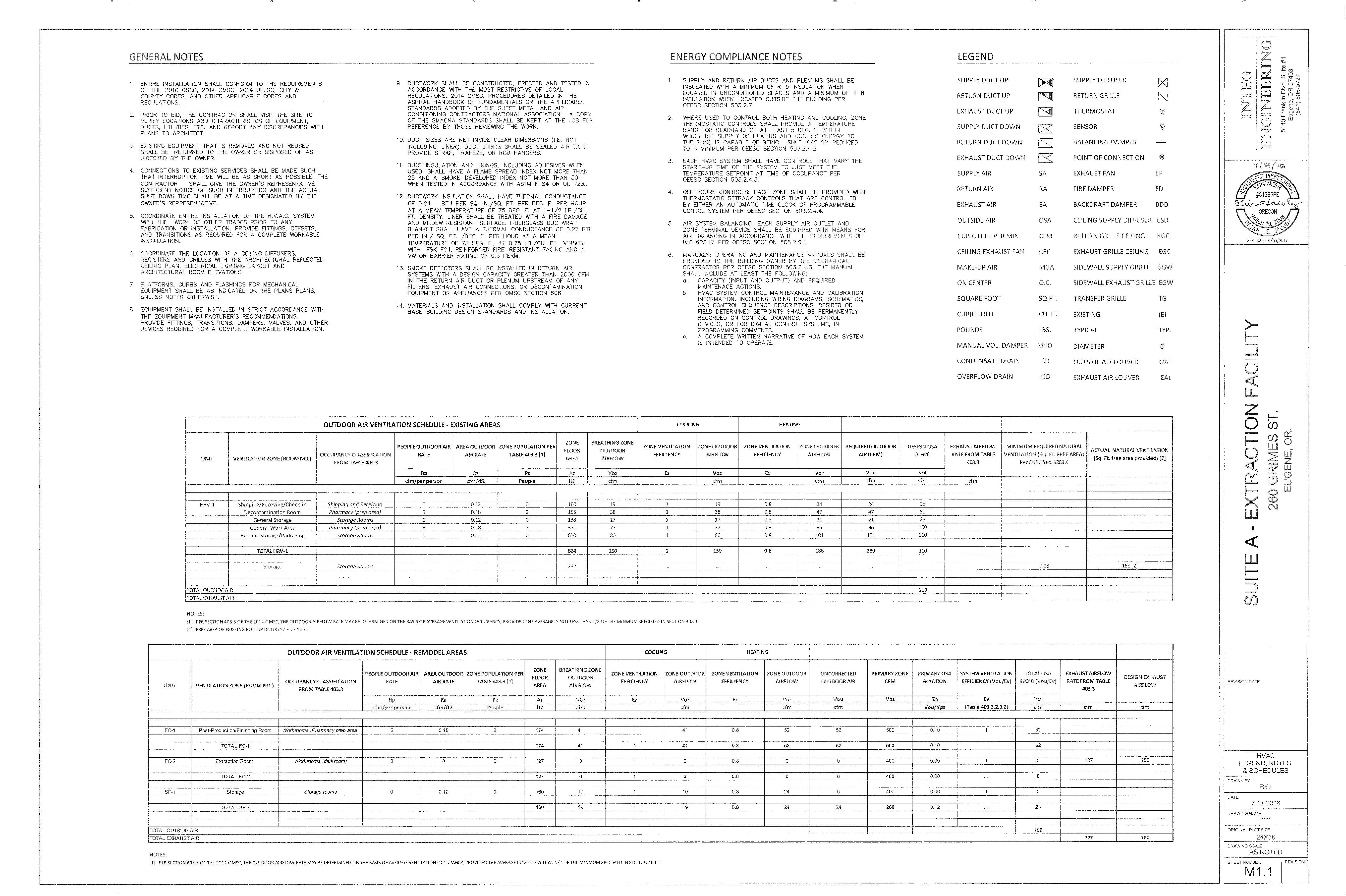

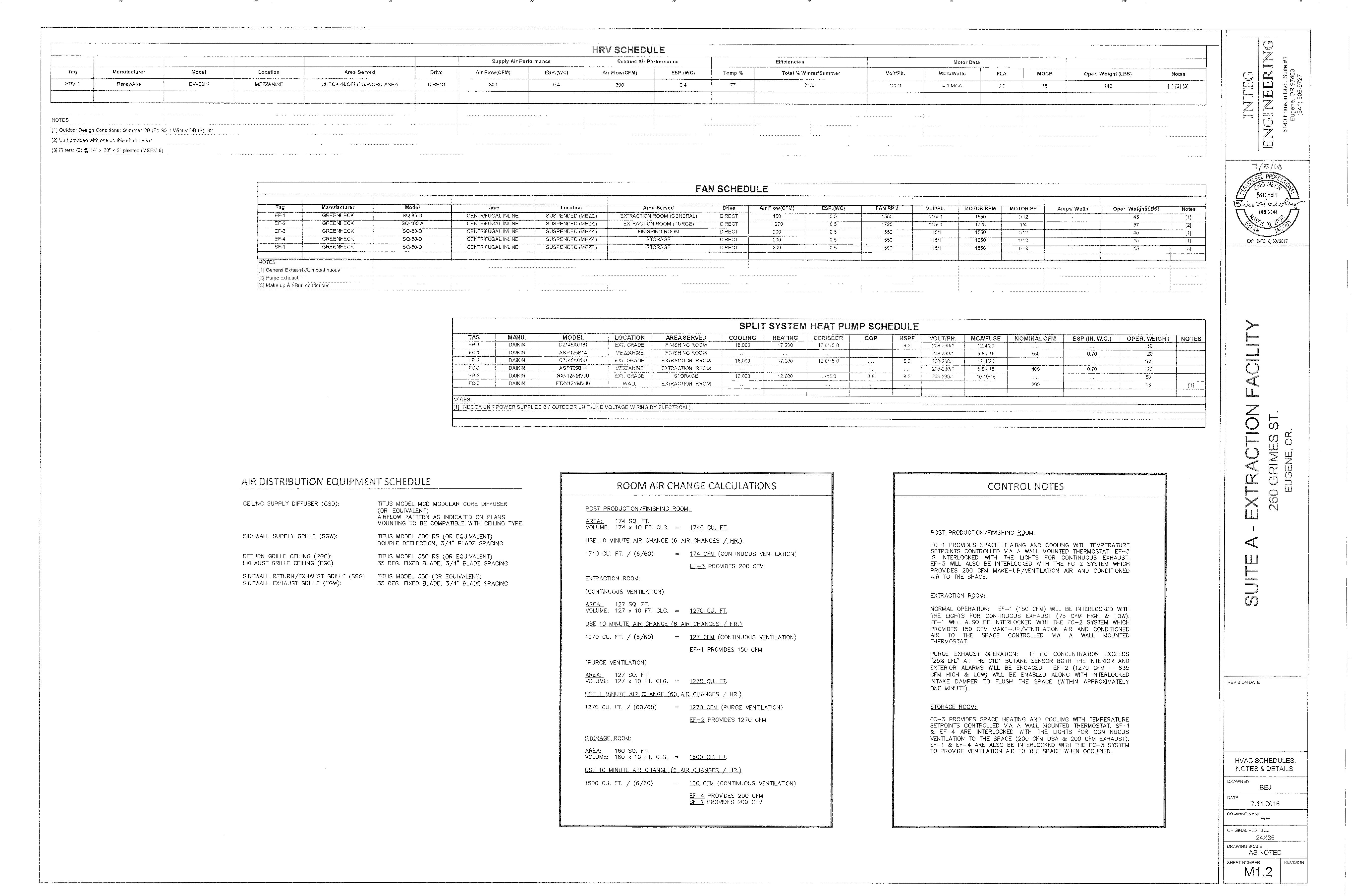

On August 18, 2018, the Company had concluded the purchase of the Eugene, Oregon based Sunstone Farms manufacturing facility, which is licensed by the OLCC for both the production of medical and recreational marijuana flower and the processing of cannabis concentrates/extracts/edibles. The purchase includes a 12,000 square foot building housing and indoor grow facility, as well as equipment for growing and extraction activity. The facility can produce in excess of 800 pounds cannabis flower annually as currently outfitted.

As part of planned expansion and renovations for the facility, the Company has begun the site improvements and is ramping up production to feed the existing four OLCC licensed cannabis retail stores in Oregon.

NOTE 2 – LIQUIDITY AND GOING CONCERN

The Company’s consolidated financial statements as of June 30, 2019 have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. The Company incurred a net income of $8,113,272 for the six months ended June 30, 2019 and a net income of $11,250,728 for the six months ended June 30, 2018. The decrease in net income is due to the changes in derivative liabilities and the company continues to have operating losses. At June 30, 2019 the Company has a working capital deficiency of $12,420,119 and is totally dependent on its ability to raise capital. The Company has a plan of operations and acknowledges that its plans of operations may not result in generating positive working capital in the near future. Even though management believes that it will be able to successfully execute its business plan, which includes third-party financing and capital issuance, and meet the Company’s future liquidity needs, there can be no assurances in that regard. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this material uncertainty. Management recognizes that the Company must generate additional funds to successfully develop its operations and activities. Management plans include:

| • | | the sale of additional equity and debt securities, |

| • | | alliances and/or partnerships with entities interested in and having the resources to support the further development of the Company’s business plan, |

| • | | business transactions to assure continuation of the Company’s development and operations, |

| • | | development of a unified brand and the pursuit of licenses to operate recreational and medical marijuana facilities under the branded name. |

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Basis of Presentation

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP) under the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes.

Such estimates and assumptions impact both assets and liabilities, including but not limited to: net realizable value of accounts receivable and inventory, estimated useful lives and potential impairment of property and equipment, the valuation of intangible assets, estimate of fair value of share based payments and derivative liabilities, estimates of fair value of warrants issued and recorded as debt discount, estimates of tax liabilities and estimates of the probability and potential magnitude of contingent liabilities.

Making estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed at the date of the financial statements, which management considered in formulating its estimate could change in the near term due to one or more future non-conforming events. Accordingly, actual results could differ significantly from estimates.

Risks and Uncertainties

The Company’s operations are subject to risk and uncertainties including financial, operational, regulatory and other risks including the potential risk of business failure.

The Company has experienced, and in the future expects to continue to experience, variability in its sales and earnings. The factors expected to contribute to this variability include, among others, (i) the uncertainty associated with the commercialization and ultimate success of the product, (ii) competition inherent at other locations where product is expected to be sold (iii) general economic conditions and (iv) the related volatility of prices pertaining to the cost of sales.

Fiscal Year

The Company’s fiscal year-end is December 31.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Kaya Holdings, Inc. and all wholly and majority-owned subsidiaries. All significant intercompany balances have been eliminated.

Wholly-owned subsidiaries:

| | · | Alternative Fuels Americas, Inc. (a Florida corporation) |

| | · | 34225 Kowitz Road, LLC (an Oregon LLC) |

Majority-owned subsidiaries:

| | · | Marijuana Holdings Americas, Inc. (a Florida corporation) |

Non-Controlling Interest

The company owns 55% of Marijuana Holdings Americas, Inc.

Cash and Cash Equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less. The Company had no cash equivalents.

Inventory

Inventory consists of finished goods purchased, which are valued at the lower of cost or market value, with cost being determined on the first-in, first-out method. The Company periodically reviews historical sales activity to determine potentially obsolete items and also evaluates the impact of any anticipated changes in future demand. Total Value of Finished goods inventory as of June 30, 2019 is $123,954 and $131,542 as of December 31, 2018. No allowance as necessary as of June 30, 2019 and December 31, 2018.

Property and Equipment

Property and equipment is stated at cost, less accumulated depreciation and is reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Depreciation of property and equipment is provided utilizing the straight-line method over the estimated useful lives, ranging from 5-30 years of the respective assets. Expenditures for maintenance and repairs are charged to expense as incurred.

Upon sale or retirement of property and equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the statements of operations.

Long-lived assets

The Company reviews long-lived assets and certain identifiable intangibles held and used for possible impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In evaluating the fair value and future benefits of its intangible assets, management performs an analysis of the anticipated undiscounted future net cash flow of the individual assets over the remaining amortization period. The Company recognizes an impairment loss if the carrying value of the asset exceeds the expected future cash flows.

Operating Leases

We lease our retail stores under non-cancellable operating leases. Most store leases include tenant allowances from landlords, rent escalation clauses and/or contingent rent provisions. We recognize rent expense on a straight-line basis over the lease term, excluding contingent rent, and record the difference between the amount charged to expense and the rent paid as a deferred rent liability.

Deferred Rent and Tenant Allowances

Deferred rent is recognized when a lease contains fixed rent escalations. We recognize the related rent expense on a straight-line basis starting from the date of possession and record the difference between the recognized rental expense and cash rent payable as deferred rent. Deferred rent also includes tenant allowances received from landlords in accordance with negotiated lease terms. The tenant allowances are amortized as a reduction to rent expense on a straight-line basis over the term of the lease starting at the date of possession.

Earnings Per Share

In accordance with ASC 260, Earnings per Share, the Company calculates basic earnings per share by dividing net income (loss) by the weighted average number of common shares outstanding during the period. Diluted earnings per share are computed if the Company has net income; otherwise it would be anti-dilutive, and would result from the conversion of a convertible note.

Income Taxes

The Company accounts for income taxes in accordance with ASC 740, Accounting for Income Taxes, as clarified by ASC 740-10, Accounting for Uncertainty in Income Taxes. Under this method, deferred income taxes are determined based on the estimated future tax effects of differences between the financial statement and tax basis of assets and liabilities given the provisions of enacted tax laws. Deferred income tax provisions and benefits are based on changes to the assets or liabilities from year to year. In providing for deferred taxes, the Company considers tax regulations of the jurisdictions in which the Company operates, estimates of future taxable income, and available tax planning strategies. If tax regulations, operating results or the ability to implement tax-planning strategies vary, adjustments to the carrying value of deferred tax assets and liabilities may be required. Valuation allowances are recorded related to deferred tax assets based on the “more likely than not” criteria of ASC 740.

ASC 740-10 requires that the Company recognize the financial statement benefit of a tax position only after determining that the relevant tax authority would more likely than not sustain the position following an audit. For tax positions meeting the “more-likely-than-not” threshold, the amount recognized in the financial statements is the largest benefit that has a greater than 50 percent likelihood of being realized upon ultimate settlement with the relevant tax authority.

Fair Value of Financial Instruments

The Company measures assets and liabilities at fair value based on an expected exit price as defined by the authoritative guidance on fair value measurements, which represents the amount that would be received on the sale of an asset or paid to transfer a liability, as the case may be, in an orderly transaction between market participants. As such, fair value may be based on assumptions that market participants would use in pricing an asset or liability. The authoritative guidance on fair value measurements establishes a consistent framework for measuring fair value on either a recurring or nonrecurring basis whereby inputs, used in valuation techniques, are assigned a hierarchical level.

The following are the hierarchical levels of inputs to measure fair value:

| • | | Level 1 – Observable inputs that reflect quoted market prices in active markets for identical assets or liabilities. |

| • | | Level 2 - Inputs reflect quoted prices for identical assets or liabilities in markets that are not active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted prices that are observable for the assets or liabilities; or inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| • | | Level 3 – Unobservable inputs reflecting the Company’s assumptions incorporated in valuation techniques used to determine fair value. These assumptions are required to be consistent with market participant assumptions that are reasonably available. |

| | Fair Value Measurements at June 30, 2019 |

| | | Level 1 | | | | Level 2 | | | | Level 3 | |

| Assets | | | | | | | | | | | |

| Cash | $ | 120,083 | | | $ | | | | $ | | |

| Total assets | | 120,083 | | | | - | | | | - | |

| Liabilities | | | | | | | | | | | |

| Convertible debentures, net of discounts of $917,478 | | - | | | | - | | | | 5,391,635 | |

| Short term debt, net of discounts of $-0- | | - | | | | 259,312 | | | | - | |

| Derivative liability | | - | | | | - | | | | 10,644,017 | |

| Total liabilities | | - | | | | 259,312 | | | | 16,035,652 | |

| | $ | 120,083 | | | $ | (259,312) | | | $ | (16,035,652) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Fair Value Measurements at December 31, 2018 |

| | | Level 1 | | | | Level 2 | | | | Level 3 | |

| Assets | | | | | | | | | | | |

| Cash | $ | 111,512 | | | $ | | | | $ | | |

| Total assets | | 111,512 | | | | - | | | | - | |

| Liabilities | | | | | | | | | | | |

| Convertible debentures, net of discounts of $1,191,264 | | - | | | | - | | | | 4,677,851 | |

| Short term debt, net of discounts of $-0- | | - | | | | 259,312 | | | | - | |

| Derivative liability | | - | | | | - | | | | 19,783,034 | |

| Total liabilities | | - | | | | 259,312 | | | | 24,460,885 | |

| | $ | 111,512 | | | $ | (259,312) | | | $ | (24,460,885) | |

The carrying amounts of the Company’s financial assets and liabilities, such as cash, prepaid expenses, other current assets, accounts payable & accrued expenses, certain notes payable and notes payable – related party, approximate their fair values because of the short maturity of these instruments.

The Company accounts for its derivative liabilities, at fair value, on a recurring basis under level 3. See Note 7.

Embedded Conversion Features

The Company evaluates embedded conversion features within convertible debt under ASC 815 “Derivatives and Hedging” to determine whether the embedded conversion feature(s) should be bifurcated from the host instrument and accounted for as a derivative at fair value with changes in fair value recorded in earnings. If the conversion feature does not require derivative treatment under ASC 815, the instrument is evaluated under ASC 470-20 “Debt with Conversion and Other Options” for consideration of any beneficial conversion feature.

Derivative Financial Instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market, or foreign currency risks. The Company evaluates all of it financial instruments, including stock purchase warrants, to determine if such instruments are derivatives or contain features that qualify as embedded derivatives.

For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported as charges or credits to income. For option-based simple derivative financial instruments, the Company uses the Binomial option-pricing model to value the derivative instruments at inception and subsequent valuation dates. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting period.

In July 2017, the FASB issued ASU 2017-11Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivative and Hedging (Topic 815). The amendments in Part I of this Update change the classification analysis of certain equity-linked financial instruments (or embedded features) with down round features. When determining whether certain financial instruments should be classified as liabilities or equity instruments, a down round feature no longer precludes equity classification when assessing whether the instrument is indexed to an entity’s own stock. The amendment also clarify existing disclosure requirements for equity-classified instruments. As a result, a freestanding equity-linked financial instrument (or embedded conversion option) no longer would be accounted for as a derivative liability at fair value as a result of the existence of a down round feature. For freestanding equity classified financial instruments, the amendments require entities that present earnings per share (“EPS”) in accordance with Topic 260 to recognize the effect of the down round feature when it is triggered. That effect is treated as a dividend and as a reduction of income available to common shareholders in basic EPS. Convertible instruments with embedded conversion options that have down round features are now subject to the specialized guidance for contingent beneficial conversion features (in Subtopic 470-20, Debt-Debt with Conversion and Other Options), including related EPS guidance (in Topic 260). The amendments in Part II of this Update recharacterize the indefinite deferral of certain provisions of Topic 480 that now are presented as pending content in the Codification, to a scope exception. Those amendments do not have an accounting effect.

Prior to this Update, an equity-linked financial instrument with a down round feature that otherwise is not required to be classified as a liability under the guidance in Topic 480 is evaluated under the guidance in Topic 815, Derivatives and Hedging, to determine whether it meets the definition of a derivative. If it meets that definition, the instrument (or embedded feature) is evaluated to determine whether it is indexed to an entity’s own stock as part of the analysis of whether it qualifies for a scope exception from derivative accounting. Generally, for warrants and conversion options embedded in financial instruments that are deemed to have a debt host (assuming the underlying shares are readily convertible to cash or the contract provides for net settlement such that the embedded conversion option meets the definition of a derivative), the existence of a down round feature results in an instrument not being considered indexed to an entity’s own stock. This results in a reporting entity being required to classify the freestanding financial instrument or the bifurcated conversion option as a liability, which the entity must measure at fair value initially and at each subsequent reporting date.

The amendments in this Update revise the guidance for instruments with down round features in Subtopic 815-40, Derivatives and Hedging—Contracts in Entity’s Own Equity, which is considered in determining whether an equity-linked financial instrument qualifies for a scope exception from derivative accounting. An entity still is required to determine whether instruments would be classified in equity under the guidance in Subtopic 815-40 in determining whether they qualify for that scope exception. If they do qualify, freestanding instruments with down round features are no longer classified as liabilities and embedded conversion options with down round features are no longer bifurcated.

For entities that present EPS in accordance with Topic 260, and when the down round feature is included in an equity-classified freestanding financial instrument, the value of the effect of the down round feature is treated as a dividend when it is triggered and as a numerator adjustment in the basic EPS calculation. This reflects the occurrence of an economic transfer of value to the holder of the instrument, while alleviating the complexity and income statement volatility associated with fair value measurement on an ongoing basis. Convertible instruments are unaffected by the Topic 260 amendments in this Update.

The amendments in Part 1 of this Update are a cost savings relative to former accounting. This is because, assuming the required criteria for equity classification in Subtopic 815-40 are met, an entity that issued such an instrument no longer measures the instrument at fair value at each reporting period (in the case of warrants) or separately accounts for a bifurcated derivative (in the case of convertible instruments) on the basis of the existence of a down round feature. For convertible instruments with embedded conversion options that have down round features, applying specialized guidance such as the model for contingent beneficial conversion features rather than bifurcating an embedded derivative also reduces cost and complexity. Under that specialized guidance, the issuer recognizes the intrinsic value of the feature only when the feature becomes beneficial instead of bifurcating the conversion option and measuring it at fair value each reporting period.

The amendments in Part II of this Update replace the indefinite deferral of certain guidance in Topic 480 with a scope exception. This has the benefit of improving the readability of the Codification and reducing the complexity associated with navigating the guidance in Topic 480.

The Company adopted this new standard on January 1, 2019; however, the Company needs to continue the derivative liabilities due to variable conversion price on some of the convertible instruments. As such, it did not have a material impact on the Company’s consolidated financial statements.

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records a "beneficial conversion feature" ("BCF") and related debt discount.

When the Company records a BCF, the relative fair value of the BCF is recorded as a debt discount against the face amount of the respective debt instrument (offset to additional paid in capital) and amortized to interest expense over the life of the debt.

Debt Issue Costs and Debt Discount

The Company may record debt issue costs and/or debt discounts in connection with raising funds through the issuance of debt. These costs may be paid in the form of cash, or equity (such as warrants). These costs are amortized to interest expense over the life of the debt. If a conversion of the underlying debt occurs, a proportionate share of the unamortized amounts is immediately expensed.

Original Issue Discount

For certain convertible debt issued, the Company may provide the debt holder with an original issue discount. The original issue discount would be recorded to debt discount, reducing the face amount of the note and is amortized to interest expense over the life of the debt.

Extinguishments of Liabilities

The Company accounts for extinguishments of liabilities in accordance with ASC 860-10 (formerly SFAS 140) “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities”. When the conditions are met for extinguishment accounting, the liabilities are derecognized and the gain or loss on the sale is recognized.

Stock-Based Compensation - Employees

The Company accounts for its stock-based compensation in which the Company obtains employee services in share-based payment transactions under the recognition and measurement principles of the fair value recognition provisions of section 718-10-30 of the FASB Accounting Standards Codification. Pursuant to paragraph 718-10-30-6 of the FASB Accounting Standards Codification, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur.

If the Company is a newly formed corporation or shares of the Company are thinly traded, the use of share prices established in the Company’s most recent private placement memorandum (based on sales to third parties) (“PPM”), or weekly or monthly price observations would generally be more appropriate than the use of daily price observations as such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market.

The fair value of share options and similar instruments is estimated on the date of grant using a Binomial Option Model option-pricing valuation model. The ranges of assumptions for inputs are as follows:

| • | | Expected term of share options and similar instruments: The expected life of options and similar instruments represents the period of time the option and/or warrant are expected to be outstanding. Pursuant to Paragraph 718-10-50-2(f)(2)(i) of the FASB Accounting Standards Codification the expected term of share options and similar instruments represents the period of time the options and similar instruments are expected to be outstanding taking into consideration of the contractual term of the instruments and employees’ expected exercise and post-vesting employment termination behavior into the fair value (or calculated value) of the instruments. Pursuant to paragraph 718-10-S99-1, it may be appropriate to use the simplified method, i.e., expected term = ((vesting term + original contractual term) / 2), if (i) A company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term due to the limited period of time its equity shares have been publicly traded; (ii) A company significantly changes the terms of its share option grants or the types of employees that receive share option grants such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term; or (iii) A company has or expects to have significant structural changes in its business such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term. The Company uses the simplified method to calculate expected term of share options and similar instruments as the company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term. |

| • | | Expected volatility of the entity’s shares and the method used to estimate it. Pursuant to ASC Paragraph 718-10-50-2(f)(2)(ii) a thinly-traded or nonpublic entity that uses the calculated value method shall disclose the reasons why it is not practicable for the Company to estimate the expected volatility of its share price, the appropriate industry sector index that it has selected, the reasons for selecting that particular index, and how it has calculated historical volatility using that index. The Company uses the average historical volatility of the comparable companies over the expected contractual life of the share options or similar instruments as its expected volatility. If shares of a company are thinly traded the use of weekly or monthly price observations would generally be more appropriate than the use of daily price observations as the volatility calculation using daily observations for such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market. |

| • | | Expected annual rate of quarterly dividends. An entity that uses a method that employs different dividend rates during the contractual term shall disclose the range of expected dividends used and the weighted-average expected dividends. The expected dividend yield is based on the Company’s current dividend yield as the best estimate of projected dividend yield for periods within the expected term of the share options and similar instruments. |

| • | | Risk-free rate(s). An entity that uses a method that employs different risk-free rates shall disclose the range of risk-free rates used. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods within the expected term of the share options and similar instruments. |

Generally, all forms of share-based payments, including stock option grants, warrants and restricted stock grants and stock appreciation rights are measured at their fair value on the awards’ grant date, based on estimated number of awards that are ultimately expected to vest.

The expense resulting from share-based payments is recorded in general and administrative expense in the statements of operations.

Stock-Based Compensation – Non Employees

Equity Instruments Issued to Parties Other Than Employees for Acquiring Goods or Services

The Company accounts for equity instruments issued to parties other than employees for acquiring goods or services under guidance of Sub-topic 505-50 of the FASB Accounting Standards Codification (“Sub-topic 505-50”).

Pursuant to ASC Section 505-50-30, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur. If the Company is a newly formed corporation or shares of the Company are thinly traded the use of share prices established in the Company’s most recent private placement memorandum (“PPM”), or weekly or monthly price observations would generally be more appropriate than the use of daily price observations as such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market.

The fair value of share options and similar instruments is estimated on the date of grant using a Binomial option-pricing valuation model. The ranges of assumptions for inputs are as follows:

| • | | Expected term of share options and similar instruments: Pursuant to Paragraph 718-10-50-2(f)(2)(i) of the FASB Accounting Standards Codification the expected term of share options and similar instruments represents the period of time the options and similar instruments are expected to be outstanding taking into consideration of the contractual term of the instruments and holder’s expected exercise behavior into the fair value (or calculated value) of the instruments. The Company uses historical data to estimate holder’s expected exercise behavior. If the Company is a newly formed corporation or shares of the Company are thinly traded the contractual term of the share options and similar instruments is used as the expected term of share options and similar instruments as the Company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term. |

| • | | Expected volatility of the entity’s shares and the method used to estimate it. Pursuant to ASC Paragraph 718-10-50-2(f)(2)(ii) a thinly-traded or nonpublic entity that uses the calculated value method shall disclose the reasons why it is not practicable for the Company to estimate the expected volatility of its share price, the appropriate industry sector index that it has selected, the reasons for selecting that particular index, and how it has calculated historical volatility using that index. The Company uses the average historical volatility of the comparable companies over the expected contractual life of the share options or similar instruments as its expected volatility. If shares of a company are thinly traded the use of weekly or monthly price observations would generally be more appropriate than the use of daily price observations as the volatility calculation using daily observations for such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market. |

| • | | Expected annual rate of quarterly dividends. An entity that uses a method that employs different dividend rates during the contractual term shall disclose the range of expected dividends used and the weighted-average expected dividends. The expected dividend yield is based on the Company’s current dividend yield as the best estimate of projected dividend yield for periods within the expected term of the share options and similar instruments. |

| • | | Risk-free rate(s). An entity that uses a method that employs different risk-free rates shall disclose the range of risk-free rates used. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods within the expected term of the share options and similar instruments. |

Pursuant to ASC paragraph 505-50-25-7, if fully vested, non-forfeitable equity instruments are issued at the date the grantor and grantee enter into an agreement for goods or services (no specific performance is required by the grantee to retain those equity instruments), then, because of the elimination of any obligation on the part of the counterparty to earn the equity instruments, a measurement date has been reached. A grantor shall recognize the equity instruments when they are issued (in most cases, when the agreement is entered into). Whether the corresponding cost is an immediate expense or a prepaid asset (or whether the debit should be characterized as contra-equity under the requirements of paragraph 505-50-45-1) depends on the specific facts and circumstances.

Pursuant to ASC paragraph 505-50-45-1, a grantor may conclude that an asset (other than a note or a receivable) has been received in return for fully vested, non-forfeitable equity instruments that are issued at the date the grantor and grantee enter into an agreement for goods or services (and no specific performance is required by the grantee in order to retain those equity instruments). Such an asset shall not be displayed as contra-equity by the grantor of the equity instruments. The transferability (or lack thereof) of the equity instruments shall not affect the balance sheet display of the asset. This guidance is limited to transactions in which equity instruments are transferred to other than employees in exchange for goods or services. Section 505-50-30 provides guidance on the determination of the measurement date for transactions that are within the scope of this Subtopic.

Pursuant to Paragraphs 505-50-25-8 and 505-50-25-9, an entity may grant fully vested, non-forfeitable equity instruments that are exercisable by the grantee only after a specified period of time if the terms of the agreement provide for earlier exercisability if the grantee achieves specified performance conditions. Any measured cost of the transaction shall be recognized in the same period(s) and in the same manner as if the entity had paid cash for the goods or services or used cash rebates as a sales discount instead of paying with, or using, the equity instruments. A recognized asset, expense, or sales discount shall not be reversed if a share option and similar instrument that the counterparty has the right to exercise expires unexercised.

Pursuant to ASC paragraph 505-50-30-S99-1, if the Company receives a right to receive future services in exchange for unvested, forfeitable equity instruments, those equity instruments are treated as unissued for accounting purposes until the future services are received (that is, the instruments are not considered issued until they vest). Consequently, there would be no recognition at the measurement date and no entry should be recorded.

Revenue Recognition

Effective January 1, 2018, the Company adopted ASC 606 – Revenue from Contracts with Customers. Under ASC 606, the Company recognizes revenue from the commercial sales of products, licensing agreements and contracts to perform pilot studies by applying the following steps: (1) identifying the contract with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to each performance obligation in the contract; and (5) recognize revenue when each performance obligation is satisfied. For the comparative periods, revenue has not been adjusted and continues to be reported under ASC 605 – Revenue Recognition. Under ASC 605, revenue is recognized when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) the performance of service has been rendered to a customer or delivery has occurred; (3) the amount of fee to be paid by a customer is fixed and determinable; and (4) the collectability of the fee is reasonably assured.

To confirm, all of our OLCC licensed cannabis retail sales operations are conducted and operated on a “cash and carry” basis- product(s) from our inventory accounts are sold to the customer(s) and the customer settles the account at time of receipt of product via cash payment at our retail store; the transaction is recorded at the time of sale in our point of sale software system. Revenue is only reported after product has been delivered to the customer and the customer has paid for the product with cash.

To date the only other revenue we have received is for ATM transactions and revenue from this activity is only reported after we receive payment via check from the ATM service provider company.

Cost of Sales

Cost of sales represents costs directly related to the purchase of goods and third party testing of the Company’s products.

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions.

Pursuant to Section 850-10-20 the related parties include a. affiliates of the Company; b. Entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c. trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d. principal owners of the Company; e. management of the Company; f. other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g. Other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements.

The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, consolidated financial position, and consolidated results of operations or consolidated cash flows.

Uncertain Tax Positions

The Company did not take any uncertain tax positions and had no adjustments to its income tax liabilities or benefits pursuant to the provisions of Section 740-10-25 for the reporting period ended June 30, 2019.

Subsequent Events

The Company follows the guidance in Section 855-10-50 of the FASB Accounting Standards Codification for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements are issued.

Pursuant to ASU 2010-09 of the FASB Accounting Standards Codification, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR.

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies that are adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the effect of recently issued standards that are not yet effective will not have a material effect on its consolidated financial position or results of operations upon adoption.

In February 2016, the FASB issued ASU No. 2016-02,Leases (Topic 842) (ASU 2016-02).Under ASU No. 2016-2, an entity is required to recognize right-of-use assets and lease liabilities on its balance sheet and disclose key information about leasing arrangements. ASU No. 2016-02 offers specific accounting guidance for a lessee, a lessor and sale and leaseback transactions. Lessees and lessors are required to disclose qualitative and quantitative information about leasing arrangements to enable a user of the financial statements to assess the amount, timing and uncertainty of cash flows arising from leases. For public companies, the Company adopted this standard on January 1, 2019 using the modified retrospective method. The new standard provides a number of optional practical expedients in transition. The Company elected the package of practical expedients’, which permitted the Company not to reassess under the new standard its prior conclusions about lease identification, lease classification and initial direct costs; and all of the new standard’s available transition practical expedients.

On adoption, the Company recognized a right of use asset of $638,593, operating lease liabilities of $638,593, based on the present value of the remaining minimum rental payments under current leasing standards for its existing operating lease.

The new standard also provides practical expedients for a company’s ongoing accounting. The Company elected the short-term lease recognition exemption for its leases. For those leases with a lease term of 12 months or less, the Company will not recognize ROU assets or lease liabilities.

In July 2017, the FASB issued ASU 2017-11,Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception” to simply the accounting for certain instruments with down round features. The amendments require companies to disregard the down round feature when assessing whether the instrument is indexed to its own stock, for purposes of determining liability or equity classification. Further, companies that provide earnings per share (“EPS”) data will adjust the basic EPS calculation for the effect of the feature when triggered and will also recognize the effect of the trigger within equity. The standard is effective for public companies for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted. The Company adopted this new standard on January 1, 2019 and did not have a material impact on the Company’s consolidated financial statements.

NOTE 4 – PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following at June 30, 2019 and December 31, 2018:

| | | June 30, 2019 | | December 31, 2018 |

| (Unaudited) | (Audited) |

| ATM Machine | | $ | 11,000 | | | $ | 11,000 | |

| Computer | | | 22,736 | | | | 22,736 | |

| Furniture & Fixtures | | | 49,408 | | | | 49,408 | |

| HVAC | | | 41,768 | | | | 25,000 | |

| Land | | | 697,420 | | | | 697,420 | |

| Leasehold Improvements | | | 333,529 | | | | 333,529 | |

| Machinery and Equipment | | | 408,133 | | | | 405,233 | |

| Sign | | | 43,594 | | | | 43,594 | |

| Structural | | | 1,017,359 | | | | 1,017,359 | |

| Vehicle | | | 79,744 | | | | 79,744 | |

| Total | | | 2,704,691 | | | | 2,685,023 | |

| Less: Accumulated Depreciation | | | (451,833) | | | | (336,243) | |

| Property, Plant and Equipment - net | | $ | 2,252,858 | | | $ | 2,348,780 | |

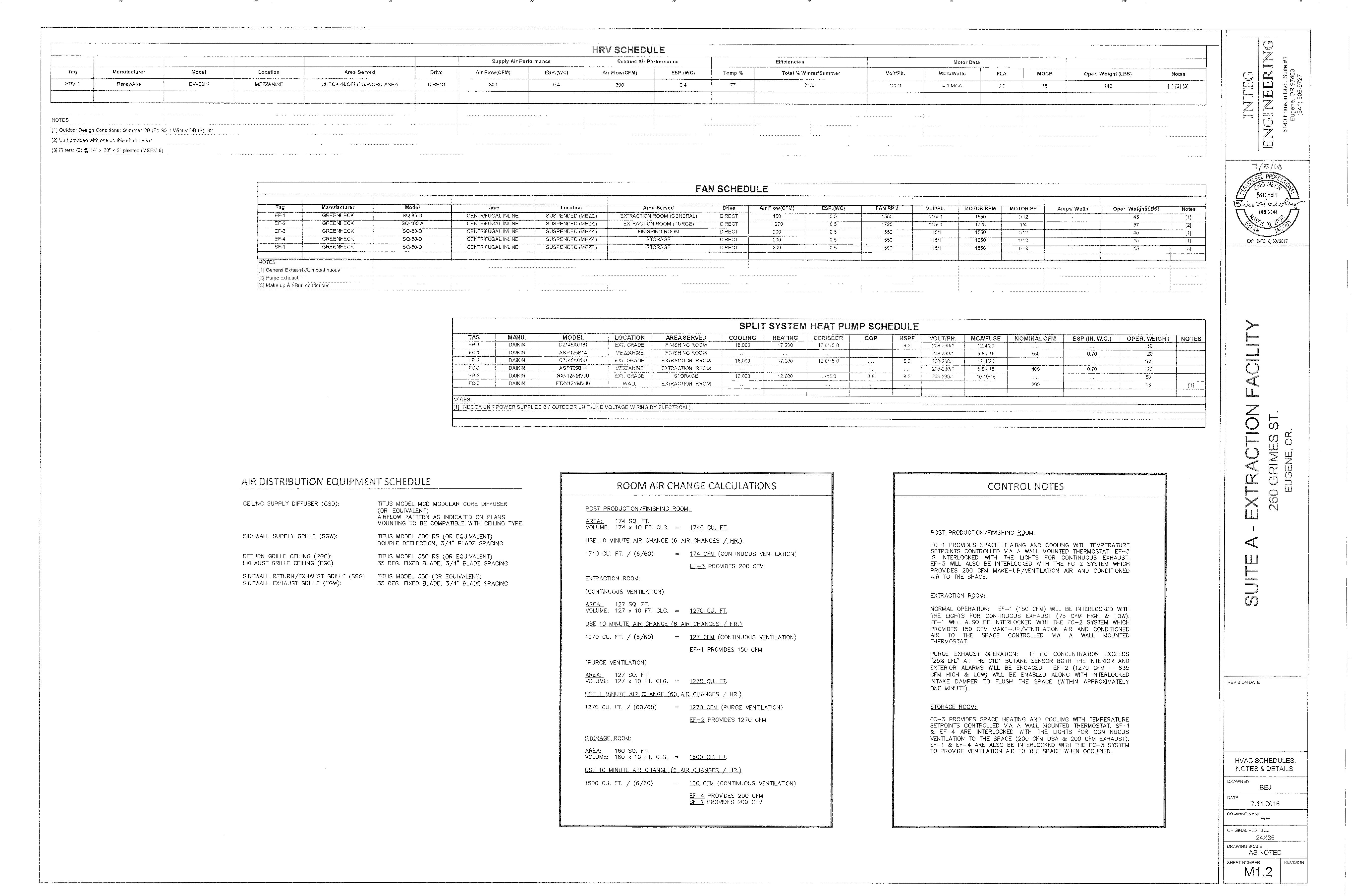

Depreciation expense totaled of $115,590 and $43,149 for the six months ended June 30, 2019 and 2018, respectively.

NOTE 5 – NON-CURRENT ASSETS

Other assets consisted of the following at June 30, 2019 and December 31, 2018:

| | | June 30, 2019 (Unaudited) | | December 31, 2018 (Audited) |

| Construction Deposits | | $ | — | | | $ | — | |

| Rent Deposits | | | 22,032 | | | | 22,032 | |

| Security Deposits | | $ | 9,491 | | | $ | 9,491 | |

| Non-Current Assets | | $ | 31,523 | | | $ | 31,523 | |

NOTE 6 – CONVERTIBLE DEBT

These debts have a price adjustment provision. Therefore, the Company accounted for these Notes under ASC Topic 815-15 “Embedded Derivative.” The derivative component of the obligation are initially valued and classified as a derivative liability with an offset to discounts on convertible debt. Discounts have been amortized to interest expense over the respective term of the related note. In determining the indicated value of the convertible note issued, the Company used the Binomial Options Pricing Model with a risk-free interest rate of ranging from 0.05% to 2.63%, volatility ranging from 84.63% to 243.37%, trading prices ranging from $0.045 per share to $0.41 per share and a conversion price ranging from $0.03 per share to $0.10 per share. The total derivative liabilities associated with these notes were $10,644,017 at June 30, 2019 and $19,783,034 at December 31, 2018.

See Below Summary Table

| Convertible Debt Summary |

| | Debt Type | Debt Classification | Interest Rate | Due Date | Ending |

| CT | LT | 6.30.19 | 12.31.18 |

| | | | | | | | |

| A | Convertible | X | | 10.0% | 1-Jan-17 | 25,000 | $ 25,000 |

| B | Convertible | | X | 8.0% | 1-Jan-21 | 65,700 | 65,700 |

| C | Convertible | | X | 8.0% | 1-Jan-21 | 32,850 | 32,850 |

| D | Convertible | | X | 8.0% | 1-Jan-21 | 209,047 | 209,047 |

| O | Convertible | | X | 8.0% | 1-Jan-21 | 109,167 | 109,167 |

| P | Convertible | | X | 8.0% | 1-Jan-21 | 52,767 | 52,767 |

| Q | Convertible | | X | 8.0% | 1-Jan-21 | 52,050 | 52,050 |

| S | Convertible | | X | 8.0% | 1-Jan-21 | 50,400 | 50,400 |

| T | Convertible | | X | 8.0% | 1-Jan-21 | 250,000 | 250,000 |

| X | Convertible | X | | 8.0% | 1-Jan-19 | 66,800 | 66,800 |

| BB | Convertible | X | | 10.0% | 1-Jan-19 | 50,000 | 50,000 |

| CC | Convertible | X | | 10.0% | 1-Jan-19 | 100,000 | 100,000 |

| EE | Convertible | | X | 0.0% | 31-Dec-21 | 500,000 | 500,000 |

| KK | Convertible | | X | 8.0% | 1-Jan-21 | 150,000 | 150,000 |

| LL | Convertible | | X | 8.0% | 1-Jan-21 | 600,000 | 600,000 |

| MM | Convertible | | X | 8.0% | 1-Jan-21 | 100,000 | 100,000 |

| NN | Convertible | | X | 8.0% | 1-Jan-21 | 500,000 | 500,000 |

| OO | Convertible | | X | 8.0% | 1-Jan-21 | 500,000 | 500,000 |

| PP | Convertible | | X | 8.0% | 1-Jan-21 | 500,000 | 500,000 |

| QQ | Convertible | | X | 8.0% | 1-Jan-21 | 150,000 | 150,000 |

| RR | Convertible | | X | 8.0% | 1-Jan-21 | 500,000 | 500,000 |

| SS | Convertible | | X | 8.0% | 1-Jan-21 | 150,000 | 150,000 |

| TT | Convertible | | X | 8.0% | 1-Jan-21 | 300,000 | 300,000 |

| UU | Convertible | | X | 8.0% | 1-Jan-21 | 150,000 | 150,000 |

| VV | Convertible | | X | 5.0% | 31-Jan-20 | 100,333 | 100,333 |

| XX | Convertible | | X | 8.0% | 1-Jan-21 | 100,000 | 100,000 |

| YY | Convertible | | X | 8.0% | 1-Jan-21 | 155,000 | 155,000 |

| ZZ | Convertible | | X | 8.0% | 1-Jan-21 | 150,000 | 150,000 |

| AAA | Convertible | | X | 8.0% | 1-Jan-21 | 95,000 | 95,000 |

| BBB | Convertible | | X | 8.0% | 1-Jan-21 | 80,000 | 80,000 |

| CCC | Convertible | X | | 8.0% | 1-Jan-20 | 25,000 | 25,000 |

| DDD | Convertible | | X | 8.0% | 1-Jan-21 | 70,000 | - |

| EEE | Convertible | | X | 8.0% | 1-Jan-21 | 150,000 | - |

| FFF | Convertible | | X | 8.0% | 1-Jan-21 | 15,000 | - |

| GGG | Convertible | | X | 8.0% | 1-Jan-21 | 75,000 | - |

| HHH | Convertible | | X | 8.0% | 1-Jan-21 | 35,000 | - |

| III | Convertible | | X | 8.0% | 1-Jan-21 | 25,000 | - |

| JJJ | Convertible | | X | 8.0% | 1-Jan-21 | 50,000 | - |

| KKK | Convertible | | X | 8.0% | 1-Jan-21 | 20,000 | - |

| Total Convertible Debt | | | | | 6,309,114 | 5,869,114 |

| Less: Discount | | | | | (917,479) | (1,191,263) |

| Convertible Debt, Net of Discounts | | | | $ 5,391,635 | $ 4,677,851 |

| Convertible Debt, Net of Discounts, Current | | | $ 334,052 | $ 2,894,294 |

| Convertible Debt, Net of Discounts, Long-term | | | $ 5,057,583 | $ 1,783,557 |

FOOTNOTES FOR CONVERTIBLE DEBT SUMMARY TABLE

(A)

At the option of the holder the convertible note may be converted into shares of the Company’s common stock at the lesser of $0.40 or 20% discount to the market price, as defined, of the Company’s common stock. The Company is currently in discussions with the lender on a payment schedule. The outstanding balance of this note is convertible into a variable number of the Company’s common stock. Therefore the Company accounted for these Notes under ASC Topic 815-15 “Embedded Derivative.” The derivative component of the obligation are initially valued and classified as a derivative liability with an offset to discounts on convertible debt. Discounts have being amortized to interest expense over the respective term of the related note. In determining the indicated value of the convertible note issued, the Company used the Binomial Options Pricing Model with a risk-free interest rate of ranging from 0.18% to 2.63%, volatility ranging from 84.63% to 243.37%, trading prices ranging from $0.065 per share to $0.45 per share and a conversion price ranging from $0.05 per share to $0.41 per share. The balance of the convertible note at June 30, 2019 including accrued interest and net of the discount amounted to $50,576.

A recap of the balance of outstanding convertible debt at June 30, 2019 is as follows:

| Principal balance | | $ | 25,000 | |

| Accrued interest | | | 25,576 | |

| Balance maturing for the period ending: | | | | |

| June 30, 2019 | | $ | 50,576 | |

The Company valued the derivative liabilities at June 30, 2019 at $23,468. The Company recognized a change in the fair value of derivative liabilities for the six months ended June 30, 2019 of $1,606 which were charged (credited) to operations. In determining the indicated values at June 30, 2019, since the debt is in default, the company used the maximum value these embedded options represent, with a trading price of $0.09, and conversion prices of $0.07 per share.

(B), (C), (D)

All these amended debts have a price adjustment provision. Therefore the Company accounted for these Notes under ASC Topic 815-15 “Embedded Derivative.” The derivative component of the obligation is initially valued and classified as a derivative liability with an offset to discounts on convertible debt. Discounts have been amortized to interest expense over the respective term of the related note. In determining the indicated value of the convertible note issued, the Company used the Binomial Options Pricing Model with a risk-free interest rate of ranging from 0.05% to 2.59%, volatility ranging from 84.63% to 243.23%, trading prices ranging from $0.065 per share to $0.14 per share and a conversion price ranging from $0.03 per share to $0.04 per share. In January 2019, the maturity date of the notes had been extended to January 1, 2021. The derivative liability associated with this note as of June 30, 2019 were $550,015.

(O)