| UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 Commission File No. 333-177532 KAYA HOLDINGS,INC. (Exact name of registrant as specified in its charter)

| |

| | Delaware | | 90-0898007 |

| (State of other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | |

915 Middle River Drive, Suite 316

Ft. Lauderdale,Florida 33304

(Address of principal executive offices)

(954)-892-6911

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or emerging growth company. See definition of “large accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

[ ] Large accelerated filer [ ] Accelerated filer

[X] Non-accelerated filer [X] Smaller reporting company

[X] emerging growth company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

The aggregate market value of the voting stock held by non-affiliates of the Registrant was approximately $8,366,235 as of June 28, 2019, based on the closing price on such date of $0.0651 of the Company’s common stock on the OTCQB tier of the over-the-counter market operated by OTC Markets Group, Inc.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. There were 187,503,812 shares of common stock outstanding as of May 12, 2020.

DOCUMENTS INCORPORATED BY REFERENCE: No documents are incorporated by reference into this Annual Report on Form 10-K except those Exhibits so incorporated as set forth in the list of Exhibits set forth in Item 15 of this Annual Report on Form 10-K.

KAYA HOLDINGS, INC.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

| | | Page |

| Part I | | |

| Item 1. | Business. | 1 |

| Item 1A. | Risk Factors. | 68 |

| Item 1B. | Unresolved Staff Comments. | 75 |

| Item 2. | Properties. | 75 |

| Item 3. | Legal Proceedings. | 76 |

| | | |

| Part II | | |

| Item 5. | Market for Registrant’s Common Equity and Related Stockholder Matters. | 78 |

| Item 6. | Selected Financial Data. | 80 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation. | 80 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. | 84 |

| Item 8. | Financial Statements and Supplementary Data. | 84 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 84 |

| Item 9A. | Controls and Procedures. | 84 |

| Item 9B. | Other Information. | 87 |

| | | |

| Part III | | |

| Item 10. | Directors, Executive Officers and Corporate Governance. | 87 |

| Item 11. | Executive Compensation. | 88 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 90 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 91 |

| Item 14. | Principal Accountant Fees and Services. | 92 |

| | | |

| Part IV | | |

| Item 15. | Exhibits, Financial Statement Schedules. | 93 |

| | | |

| Signatures | | 96 |

As used in this Annual Report on Form 10-K (the “Annual Report ”), the terms “KAYS ,” “the Company ,” “we,” “us ” and “our ” refer to Kaya Holdings, Inc. and its owned and controlled subsidiaries, unless the context indicates otherwise.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information contained in this Annual Report contains “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the ‘Exchange Act ”). These forward-looking statements are contained principally in the sectionstitled “Item 1. Business,” “Item 1A. Risk Factors,” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations ” and are generally identifiable by use of the words “may,” “will ,” “should ,” “expect,” “anticipate,” “estimate ,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

The forward-looking statements herein represent our expectations, beliefs, plans, intentions or strategies concerning future events. Our forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that any projections or other expectations included in any forward-looking statements will come to pass. Moreover, our forward-looking statements are subject to various known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements.

Except as required by applicable laws, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

PART I

Item 1. Business.

Kaya Holdings, Inc., “KAYS” or the “Company” a Delaware corporation, is a vertically integrated legal marijuana enterprise that produces, distributes, and/or sells a full range of premium cannabis products including flower, oils, vape cartridges and cannabis infused confections, baked goods and beverages through a fully integrated group of subsidiaries and companies supporting highly distinctive brands.

KAYS is a veteran of the global legal cannabis industry, with more than six years of operational experience. KAYS is the first U.S. publicly traded company to operate a legal marijuana dispensary, as well as the first to vertically integrate by adding cultivation and manufacturing.

The Company’s business strategy seeks to achieve four fundamentals objectives:

| · | maintaining direct access to customers (to own the relationship with end-users); |

| · | effecting vertical integration to control the supply chain (to control cost, selection and quality); |

| · | introducing strong brands in tradition and innovative categories (to control asset development); and |

| · | creating the capacity to expand nationally and internationally as regulations and opportunities permit. |

Kaya Holdings currently operates three majority-owned subsidiaries, each responding to various demands and opportunities in the cannabis industry, to aid in the execution of these objectives:

Marijuana Holdings Americas, Inc.

Marijuana Holdings Americas, Inc. (“MJAI”), incorporated in 2014, operates the Company’s U.S. based cannabis operations including its Kaya Shack™ retail brand and the Kaya Farms™ cultivation brand.

After an evaluation of several factors including reputation for cannabis excellence, costs of entry, learning opportunity, and ease of regulatory structure, the Company selected Oregon as its point-of-entry into the legal cannabis sector where it commenced operations in Oregon in July 2014. Oregon is universally recognized for its excellence in cannabis cultivation and is part of the famed “Green Triangle” of expert cannabis cultivation that also includes Northern California. Having Oregon as the Company’s learning ground has allowed the Company to combine “traditional” methods of cannabis cultivation with modern agriculture techniques.

The Company’s US operations are currently focused in Oregon, where all of the Company’s operations are licensed by the Oregon Liquor Control Commission (the “OLCC’), which has jurisdiction over legal medical and recreational cannabis grow, production and retail operations. The Company has three active OLCC Marijuana Retailer Licenses, each of which allow for one brick-and-mortar physical dispensary location as well as unlimited delivery operations tied to the geographic location of the fixed based licensed operations. KAYS currently operates two Kaya Shack™ retail outlets (one in South Salem and one in Portland), and is in the process of targeting its third license to operate a Kaya Farm Store and Delivery Hub to service the Southern Oregon Market.

The Company has developed its own proprietary Kaya Farms™ strains of cannabis, which it grows and produces (together with edibles and other cannabis products) at its 12,000 square foot Eugene, Oregon Sunstone Farms Indoor Cannabis Grow, Processing & Cannaceutical Facility which KAYS acquired in October 2018 and is presently conducting limited operations under a Management Agreement with Sunstone farms. Pending either transfer of the licenses by the OLCC to the Company, or through the eventual acquisition and transfer of other existing OLCC Marijuana Production and Processing licenses, KAYS intends to build out the facility and ramp up to full production.

Additionally, the Company also owns a 26-acre parcel in Lebanon, Linn County, Oregon, which it purchased in August 2017 on which it intends to construct a cannabis cultivation complex, which will initially consist of an 85,000-square foot Kaya Farms™ Greenhouse Grow and Production Facility. The Company has received county zoning approvals for the complex, and is currently awaiting OLCC Licensure approvals to begin construction of this facility.

Kaya Brands USA

Kaya Brands USA, Inc. (“KBUS”) was recently incorporated to manage and leverage the intellectual property associated with the Kaya family of brands and seek out US based projects and ventures to enhance shareholder value associated with their development.

KBUS presently manages 18 proprietary brands formulated and developed by the Company which includes the Kaya Shack™ retail brand, the Kaya Farms™ cultivation brand, and the Kaya Gear™ apparel brand, as well as a host of carefully developed cannabis and CBD products that include cannabis extracts and concentrates, vape cartridges, chocolates, gummies and chews, topicals and creams, beverages, foods, and cannaceuticals.

Kaya Brands International and International Plans for Expansion

Kaya has recently implemented a strategic shift away from the U.S. cannabis market, its initial intended focus, placing all emphasis on international opportunities and brand extensions. Thus, KAYS has developed an exciting international growth program with the potential for strategic position and growth, all the while remaining prepared for the eventuality of a more inviting U.S. market.

Kaya Brands International, Inc. (“KBI”) was incorporated in late 2019 to serve as the Company’s vehicle for expansion into worldwide cannabis markets. KBI is seeking to leverage the other product brands for development of the Kaya Shack™ retail and Kaya Farms™ brands in Europe and elsewhere as opportunities permit. Projects currently under development include licensing of the Kaya Shack™ retail brand for franchising in Canada and licensing of the Kaya Farms™ brand to develop cultivation projects in Greece, Israel and other potential locations.

This segregation of US and foreign based activities would allow for KAYS to eventually have KBI listed on a recognized securities exchange such as the OTCQX, NASDAQ or NYSE in the US, the Canadian Securities Exchange or “CSE” in Canada (a Canadian Exchange that has proven to be an excellent source of new institutional and retail investment capital and liquidity for both Canadian and U.S.-based OTC cannabis stocks) or other such international exchange that would allow KBI to access additional capital not currently available through US over-the counter (“OTC”) markets.

KAYS intends to maintain a majority ownership of KBI, but is also working on plans to issue a dividend of common shares in KBI to shareholders of record at a date to be determined by the Board of Directors of KAYS

Additionally, KAYS intends to structure KBI’s participation in projects that would lead to these projects eventually seeking their own public company status and corresponding issuance of securities which could potentially significantly enhance the value of KAYS/KBI’s investment and possibly lead to dividends for KAYS/KBI’s shareholders. There can be no assurance given as to whether or when KAYS will be able to do so, or it would ultimately be successful in increasing shareholder value.

Corporate Information

Our corporate office is located at 915 Middle River Drive, Suite 316, Fort Lauderdale, Florida, 33304. Our telephone number is 954-892-6911 and our corporate website is www.kayaholdings.com. Information contained on our corporate website does not constitute part of this Memorandum.

The Global Cannabis Industry

New Frontier Data estimates the existing global demand for cannabis to be $344.4 billion USD, using consumption levels and market prices to reach their estimate. The illicit market, with the exception of the relatively few countries that regulate and license cultivation or importation of cannabis, meets the vast majority of global demand for cannabis.

There are an estimated 263 million people globally who can be classified as cannabis consumers, demonstrating significant demand for the medical, wellness, and recreational uses of cannabis. The strength of demand varies by region and depends heavily on the status of legalization, levels of social acceptance, and access to cannabis. There are an estimated 1.2 billion people worldwide suffering from medical conditions for which cannabis has shown therapeutic value.

There are currently 55 countries with legalized cannabis for medical use. The regulatory framework varies by country and may differ in rules for qualifying conditions, physician participation, production and processing, accepted delivery systems, insurance payment participation, and potency permitted. The stringency of the rules typically has a significant impact on the size, growth, and reach of each program.

Canada and Uruguay are the first two nations with legal recreational cannabis, with a few other nations set to follow, including South Africa, Georgia and Mexico. The aim of the legal programs is to transition the illicit market to the legal, regulated and taxable markets. Canadian companies were the first to create global cannabis infrastructure and are poised to compete with other emerging export centers, including Israel, Greece and Colombia.

The United States has been the global leader in cannabis innovation, including new genetics, cultivation techniques, derivative products, and delivery methods. U.S. based companies are beginning to move into the global arena.

The opportunity represented by legal cannabis is significant, but many countries limit the number of legal participants and have regulatory policies that are still evolving, leading to high overall risk and barriers to entry.

As governments in newly legalized markets lay the foundations for their nascent industries, many lack or do not wish to regulate domestic cultivation and production activity. This forms the foundation for a vibrant international cannabis import-export sector.

North America

North America, according to New Frontier Data, represents a total cannabis demand (legal & illicit) valued at $86 billion USD.

The United States and Canada have been leading the global legal cannabis movement, which in turn impacts the way governments worldwide are structuring the regulation of legal cannabis in their own countries.

Canada

Canada is the first G-7 nation to fully legalize cannabis for medical and recreational use. The legal structure has given rise to large Canadian cannabis companies that have achieved high valuations, which they have leveraged to purchase supply chain companies and invest in infrastructure projects to produce cannabis at costs lower than those in Canada.

To date, Canadian companies report exporting only several thousands of pounds of cannabis to more than 20 different countries, collectively – demonstrating the early stage of development of the global cannabis market, and by extension the remaining opportunities.

The United States

New Frontier Data forecasts that the legal U.S. markets will generate nearly $13 billion in legal sales in 2019, growing to over $20 billion by 2022.

Cannabis remains federally illegal in the United States, even as support for legal recreational cannabis remains above 60% in most reputable polls. Regardless of the federal status of cannabis, currently 33 U.S. states have enacted laws legalizing some form of medical cannabis, and 10 states and the District of Colombia have legalized recreational use cannabis. The United States has been the global leader in cannabis innovation, including new genetics, cultivation techniques, derivative products, and delivery methods.

States with some type of legal medical cannabis laws include Arizona, Arkansas, Connecticut, Delaware, Florida, Hawaii, Illinois, Georgia, Indiana, Iowa, New Hampshire, Louisiana, Rhode Island, Minnesota, Missouri, Maryland, Montana, Michigan, New Mexico, New York, North Dakota, New Jersey, Ohio, Oklahoma, Vermont, Pennsylvania, Rhode Island, Texas, Utah, and West Virginia. States permitted the sales of recreational or “adult-use” cannabis are Alaska, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Nevada, Oregon, Vermont, and Washington. The District of Colombia (Washington D.C.) also permits adult-use cannabis.

Europe

New Frontier Data estimates the European cannabis market (legal & illicit) generates $69 billion USD annually, with France, Italy and Spain having the greatest number of cannabis consumers, and Germany with the most robust medical program to date.

There are almost 30 European countries that permit some form of legal medical cannabis including, France, Italy, Germany, United Kingdom, Spain, Poland, Czech Republic, Croatia, Cyprus, Denmark, Finland, Greece, Israel, Luxembourg, North Macedonia, Malta, Netherlands, Norway, Poland, Romania, Switzerland, Turkey, Ireland, Lithuania and Portugal. The European Union requires its member countries to enforce the European Union Good Manufacturing Practices (GMP), which detail the production standards for medicinal products. These standards are typically stringent and can be costly for cannabis companies.

Israel and Greece

Israel has a small population but a long established history of legal medical cannabis development. It continues as a leader with years in the development of cannabis pharmaceuticals, and together with Greece the 2 are projected to form a “Silicon Valley” network for the development of medical cannabis production to service the European Markets and beyond.

The Kaya™ Family of Brands

Kaya Holdings, Inc., “KAYS” or the “Company” a Delaware corporation, is a vertically integrated legal marijuana enterprise that produces, distributes, and/or sells a full range of premium cannabis products including flower, oils, vape cartridges and cannabis infused confections, baked goods and beverages through a fully integrated group of subsidiaries and companies supporting highly distinctive brands.

Currently Operational Brands (2014-2020)

Next Stage Traditional (2020-2021)

Next Stage Innovative (2020-2021)

Note: The “Next Stage Traditional” and “Next Stage Innovative” brands are all targeted for release over the 6-18 months. The Company is currently awaiting the status of the license transfer at the Kaya Farms Indoor Marijuana Grow, Processing & Cannaceutical Production Facility in Eugene, Oregon, and the pending license issuance of the Kaya Farms Ag Facility in Lebanon, Oregon to finalize the release dates for these brands in Oregon. In the event that the license transfer at the Eugene facility and/or the licensing approval and construction timeline of the Lebanon facility is delayed or experiences difficulties, the Company has sourced other alternatives to expedite the release of the brands and will update shareholders accordingly as to revised brand rollout dates (if any).

The Kaya Shack™ Brand

Kaya Holdings operates the Kaya Shack™ brand of legal medical and recreational retail marijuana retail stores.Kaya Holdings operates two recreational marijuana retail outlets and medical marijuana dispensaries in Oregon under the Kaya Shack™ brand.

Additionally, Kaya Holdings maintains an active third OLCC Marijuana Retail License which it is seeking to move to its Eugene, Oregon Kaya Farms Indoor Production and Processing Facility so that the Company may offer a “Kaya Farm Store” and also serve as a retail delivery hub for Eugene, Oregon.

Dubbed by the mainstream press as the “Starbucks of Marijuana” after our first outlet opened in July 2014, our operating concept is simple: to deliver a consistent customer experience (quality products, fair prices and superior customer service) to a broad and diverse base of customers. Kaya Shack™ meets the quality needs of the “marijuana enthusiast”, the comfort and atmosphere of all including “soccer moms” and the price sensitivities of casual smokers.

The Kaya Shack™ brand communicates positive thinking and joy, with signs adorning the walls that read “It’s a Good Day to have a Good Day,” “Some of our Happiest Days Haven’t Even Happened Yet,” and our signature “Be Kind.”

Kaya Shack™ retail outlets are open 7 days a week- Monday through Saturday from 8:00 am to 10:00 pm, and Sunday 8:00 AM to 9:00 PM. Operations follow an operational manual that details procedures for 18 areas of operation including safety, compliance, store opening, store closing, merchandising, handling of cash, inventory control, product intake, store appearance and employee conduct.

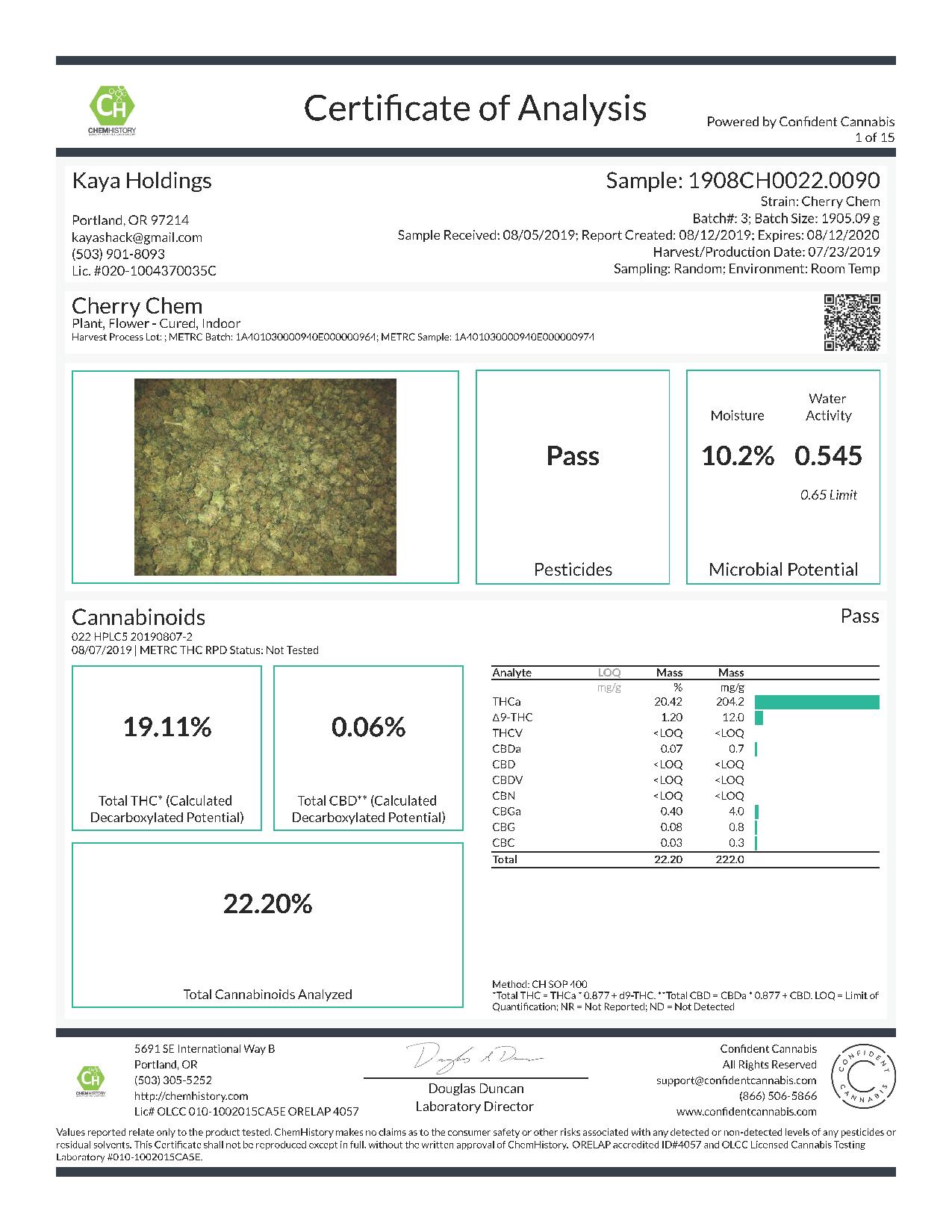

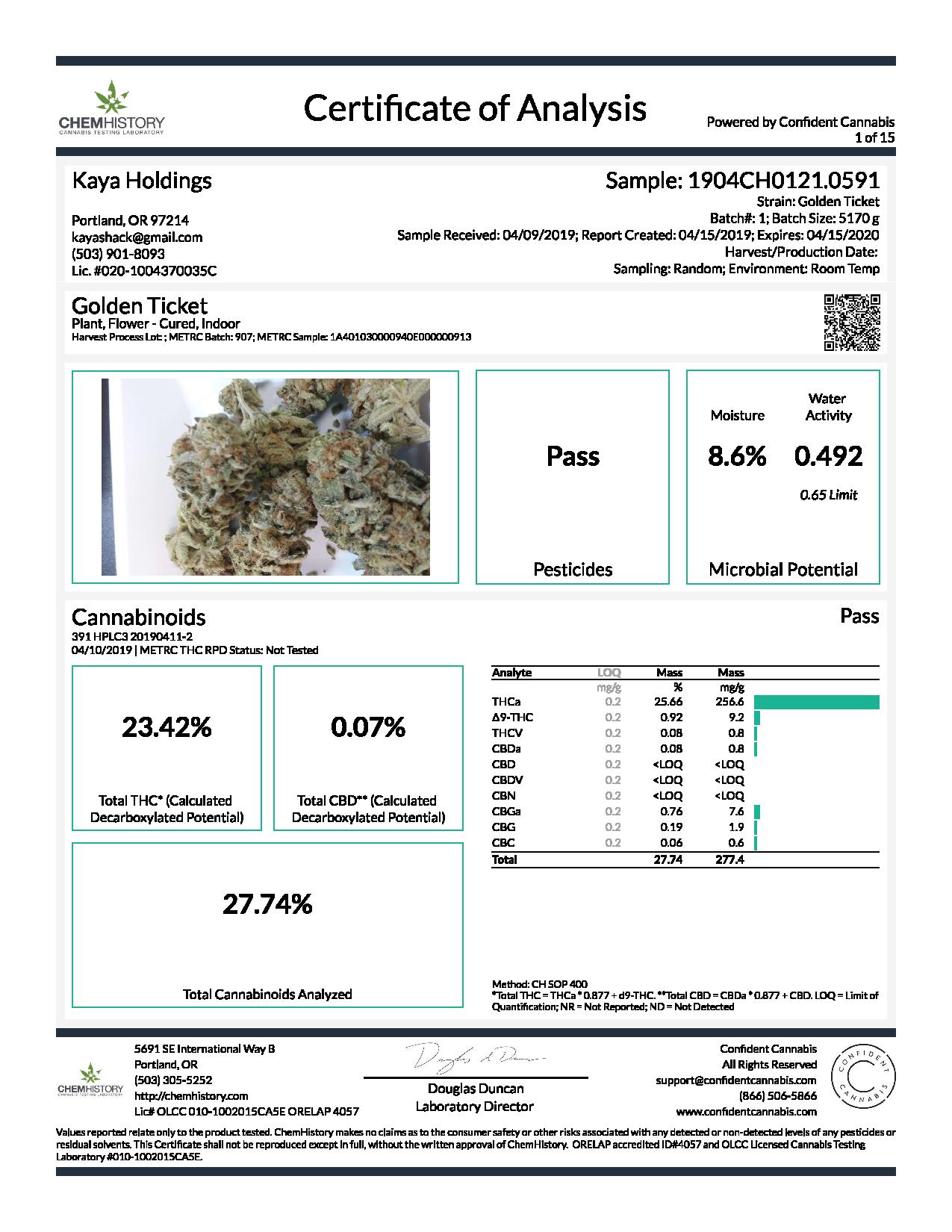

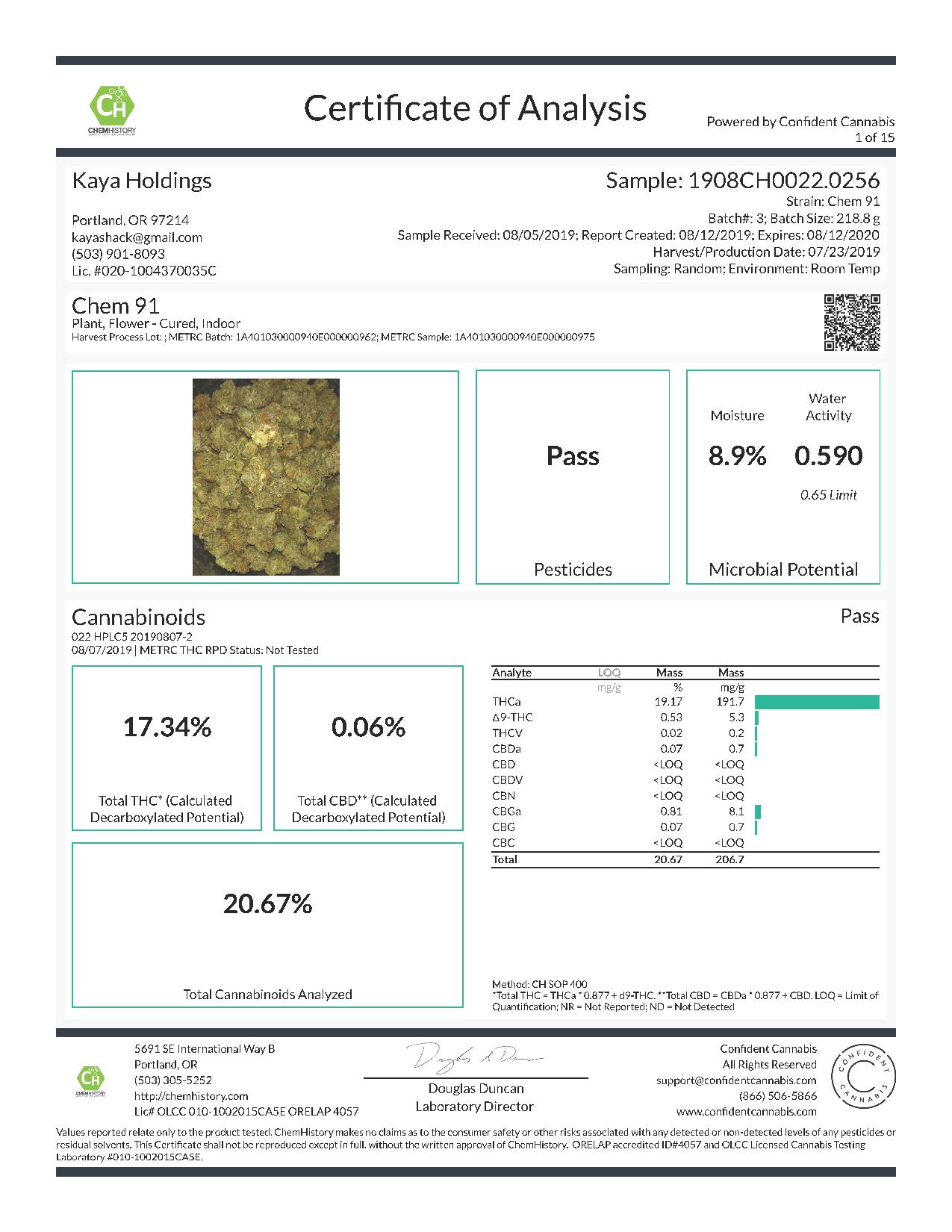

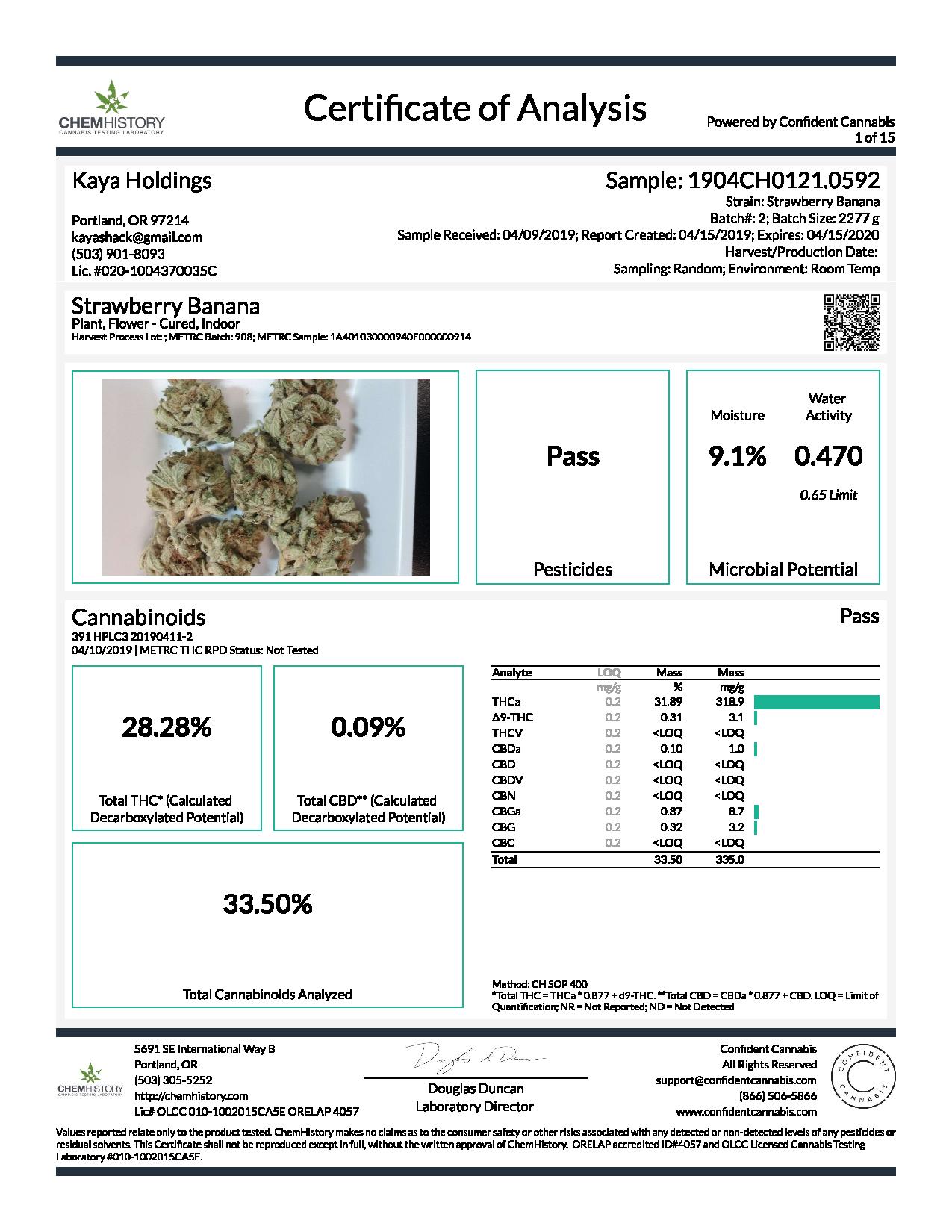

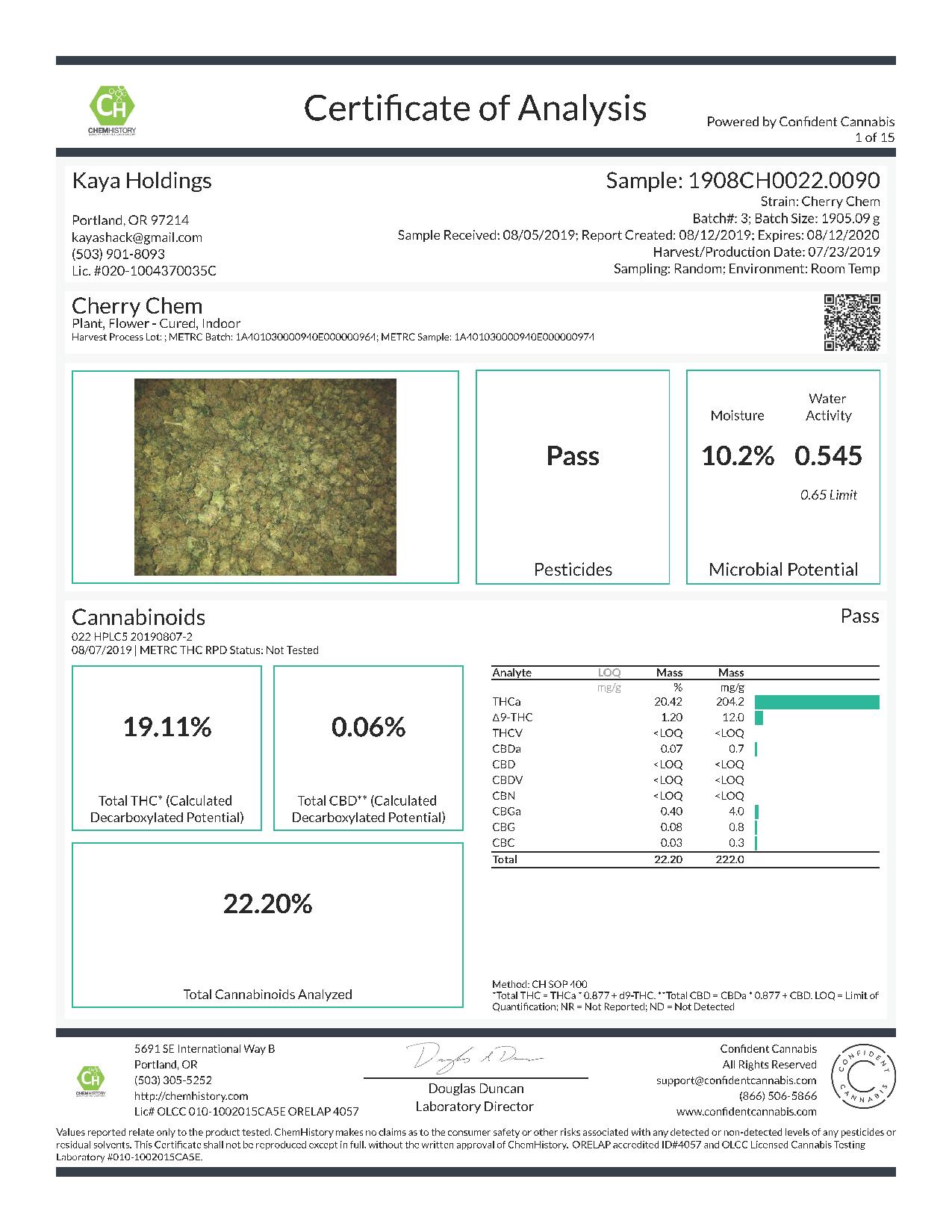

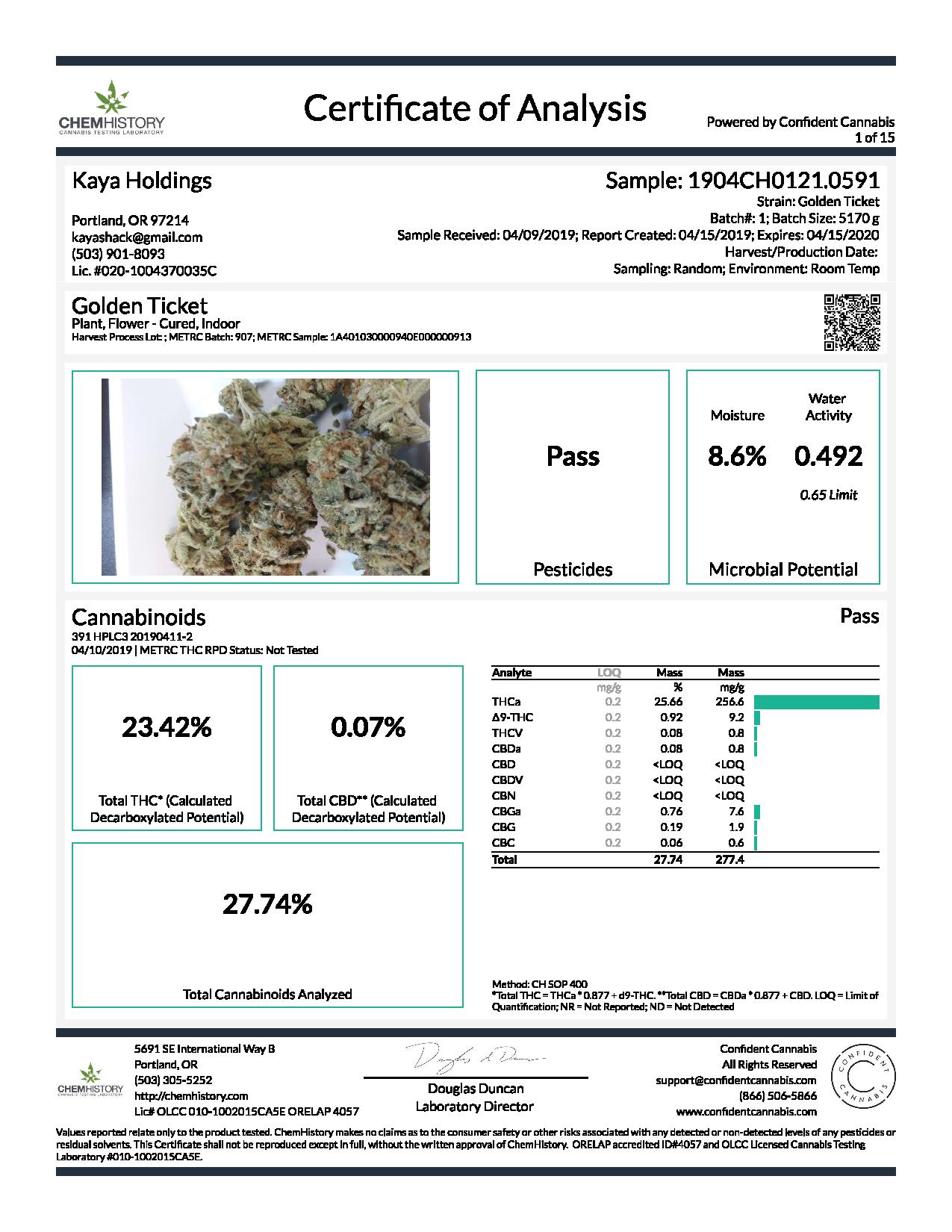

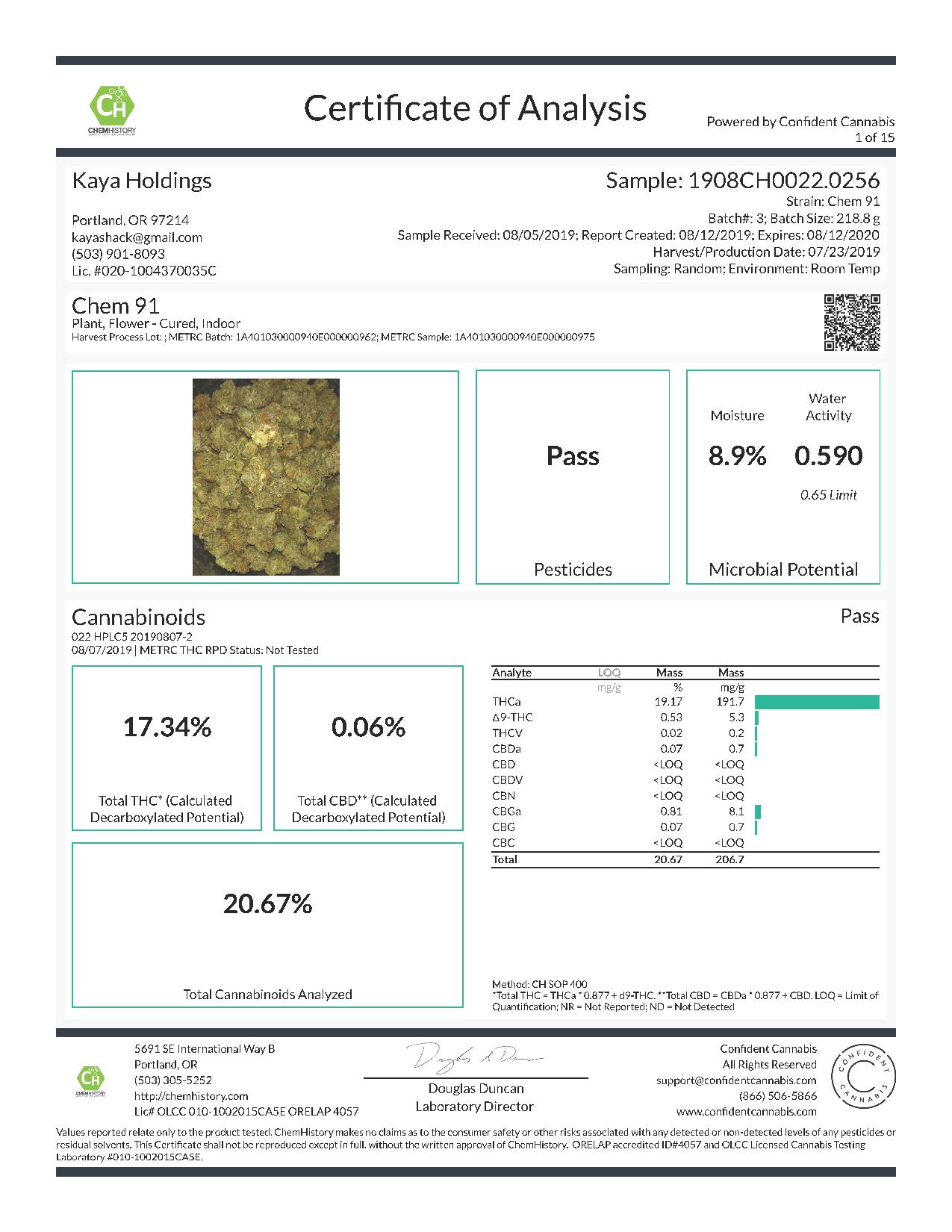

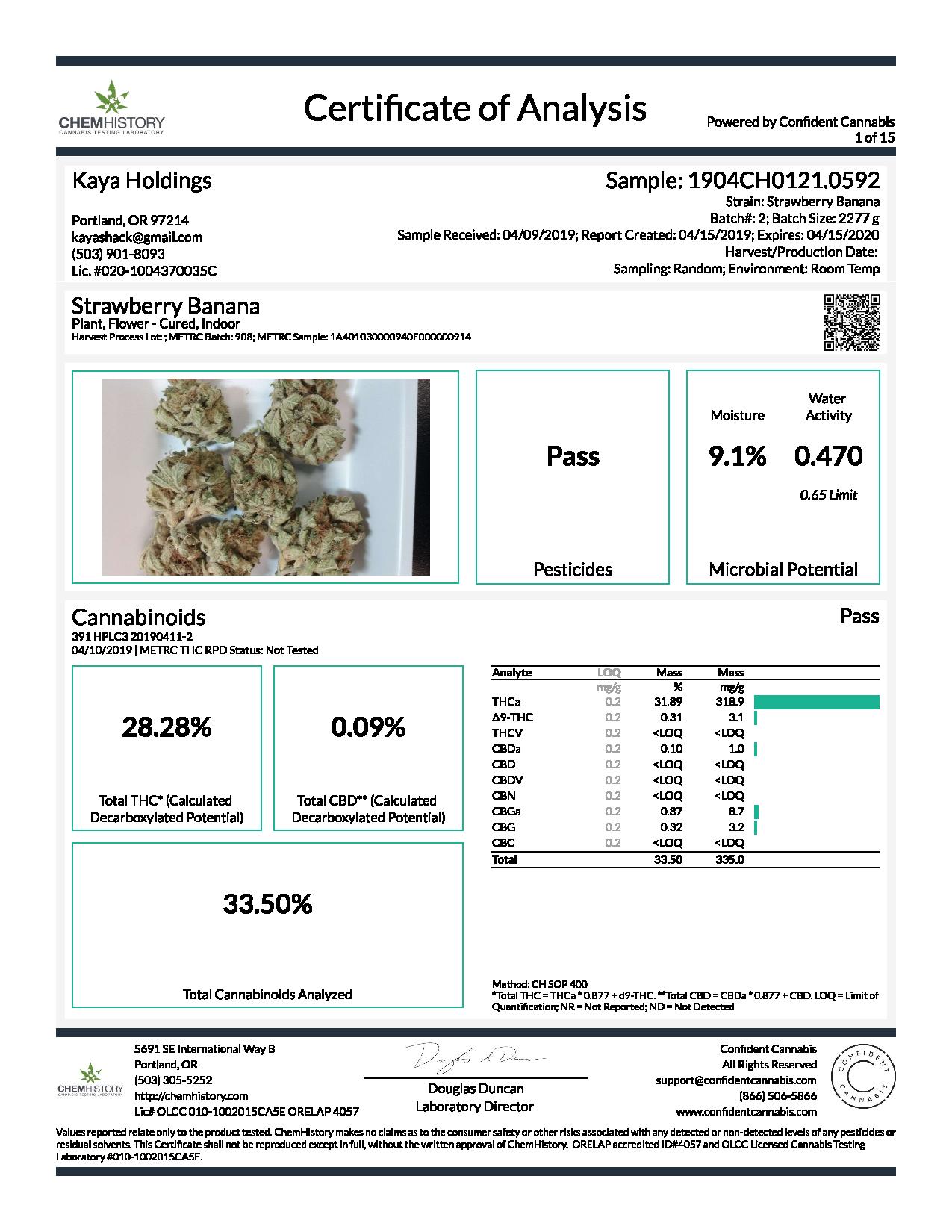

In compliance with regulations, all marijuana and marijuana infused products sold through our stores are quality tested by independent labs to assure adherence to strict quality and OLCC regulations.

The Company is exploring opportunities to expand its operations beyond Oregon by replicating its Kaya Shack™ brand retail outlets through franchising in other states where recreational cannabis use is legal or expected to become legal in the near term, as well as in Canada, where it is legal nationwide. KAYS also is targeting opening corporate owned marijuana production and processing facilities to support the envisioned franchised outlets, and to both maintain quality control and offer customers a consistent customer experience while reducing costs of goods to franchisees.

Kaya Shack™ Retail Outlets

All stores feature a check out stand wrapped to feature the Company’s proprietary brand of pre-rolls, Kaya Buddies. The Buddies program is an exciting and popular pre-roll offering, featuring a wide selection (15-15 strains of pre-rolls) and featuring our special Kaya Saying in each Buddies tube. A glass display case showcases at least 25 strains of marijuana flower, which the stores serve to customers “deli style”, weighing straight from the jar to the customer’s take-out tube. An additional display case with a varied selection of oils, concentrates and topicals rounds out the cannabis product display.

The stores also feature standing display cases with cannabis intended glassware under the Company’s brand Really Happy Glass, as well as a rack of proprietary t-shirt designs marketed under the Company brand Kaya Gear. The store also has a hospitality area that offers free water, coffee, tea and hot cocoa. As required by law, all products containing marijuana are either behind locked glass or behind the counter and out of customer reach.

I. Kaya Shack™ , 1719 SE Hawthorne Blvd., Portland, Oregon.

Our first Kaya Shack™ OLCC licensed marijuana store (located in the heart of the trendy Hawthorne district in southeast Portland, the “Greenwich Village” of the West Coast) opened for business July 03, 2014. The store is located next door to a cell phone repair shop, and near to Devil’s Dill restaurant and No Fun pub. There are also a McMenamins restaurant, tattoo parlor, convenience store, hair/nail salon and a soccer sports bar. The area around the shop is mixed use (commercial and residential) and has a footprint of approximately 700 square feet and is the model for the Company’s small urban shops.

II. Kaya Shack ™ Marijuana Superstore, South Salem, Oregon.

Our second Kaya Shack™ OLCC licensed marijuana store (located in South Salem, Oregon) opened for business on October 17, 2015. The store is located in a strip mall alongside a Caesar’s Pizza, Aaron’s furniture, a convenience store, a tanning salon, and a nail salon. The plaza also has a Subway, a sports bar and a laundromat. The area around the shop is primarily commercial with residential complexes under construction and has a footprint of approximately 2,100 square feet and serves as the model for the Company’s superstores featuring larger display areas and a soon-to-be-opened Pakalolo Juice Company infused fresh fruit smoothies stand.

Kaya Shack™ Car Fleet and Home Delivery

The Company is licensed by the OLCC for home delivery for all three of its retail licenses and has a fleet of 4 Kaya Cars featuring the Company’s branding logos outfitted with safes and security equipment. We have begun to offer deliver within the geographic areas of Portland and Salem, and are looking to expand this offering to Eugene if we are able to get an approval on the transfer of our third retailer license and open up the Kaya Farm Store at our Eugene, Oregon Kaya Farms Indoor Grow, Processing & Cannaceutical Production Facility.

The Company has developed the website www.kayadelivers.com to advance the growth of its delivery service and to offer pre-ordering for curbside pickup in light of the coronavirus pandemic to better serve our customers.

We expect delivery to extend our visibility, assist in building brand awareness, and allow the Company to service a broader geographic territory.

Kaya Farms™

Lebanon, Linn County,Oregon Marijuana Grow and Manufacturing Complex

In early 2015, KAYS commenced its own medical marijuana grow operations for the cultivation and harvesting of legal marijuana thereby becoming the first publicly traded U.S. company to own a majority interest in a vertically integrated legal marijuana enterprise in the United States. Since that time KAYS has operated various grow facilities to feed the Kaya Shack Supply Chain, and in August 2017, KAYS acquired its first property for a large scale facility- a 26-acre parcel in Lebanon, Linn County, Oregon, where we intend to develop an 85,000-square foot Kaya Farms™ facility.

We filed for zoning and land use approval in early 2018, and after numerous regulatory challenges and delays, we finally received zoning and land use approval in early 2019 to build on the property. We are presently in the final planning stages and are awaiting the culmination of the OLCC licensing process to begin construction.

Management believes that the acquisition and development of the property will position the Company for future growth and expansion, including increased Marijuana Canopy production to the maximum extent allowed by law through use of both greenhouse and outdoor grows.

Under present laws the property can easily deliver 6-8,000 pounds of cannabis each year; if future regulations permit this capacity could easily be increased to over 100,000 pounds of cannabis per year.

When Federal Prohibition of marijuana ends and national and international cannabis trade can begin, we believe that Oregon is uniquely positioned to become America’s “pot basket” due to its superior climate and state history involving generations of Oregonian Cannabis Growers; ideal weather + extensive generational knowledge = superior, lower cost cannabis products for export.

Kaya Farms Indoor Marijuana Grow, Processing & Cannaceutical Production Facility

On October 23, 2018 KAYS announced that it had concluded the purchase of the real property and associated equipment utilized by the Eugene, Oregon based Sunstone Farms grow and manufacturing facility, which is licensed by the OLCC for both the production (growing) of medical and recreational marijuana flower and the processing of cannabis concentrates/extracts/edibles.

The purchase includes a 12,000 square foot building housing an indoor grow facility, as well as equipment for growing and extraction activity. The facility can produce in excess of 800 pounds cannabis flower annually as currently outfitted, as well as a substantial amount of manufactured extracts and related cannabis products.

The purchase price of $1.3 million for the OLCC licensed marijuana production and processing facility, consisting of the building and equipment was paid for by the issuance of 12 million shares of KAYS restricted stock to the seller at closing. The shares carry a lock-up-restriction that allows for their staged eligibility for resale over a 61-month period from the date of the purchase of the facility by KAYS. Additionally, the seller purchased 2.5 million restricted shares for $250,000 in cash in a private transaction with the Company. The proceeds from the sale of those shares were and are being used for acquisition related expenses, transitional operating costs and facility capital improvements with respect to the production and processing facility we purchased.

KAYS intends to utilize the processing facilities to grow their own top-shelf, connoisseur-grade marijuana flower, produce various brands of oils, edibles, concentrates

and extracts, and develop medical grade laboratory facilities for the production of a proprietary Kaya Cannaceuticals™ line of both CBD and CBD/THC products for the health, skincare and medical industries.

The Company is presently conducting limited grow and facility maintenance operations under a Management Agreement with Sunstone Farms, the current licensee. Pending either transfer of the licenses by the OLCC to the Company, or through the eventual acquisition and transfer of other existing OLCC Marijuana Production and Processing licenses, KAYS intends to build out the facility and ramp up to full production.

KAYS has initiated initial upgrades to the Eugene property, and pending successful resolution of the licensing associated with the facility intends to complete a full renovation and expansion to improve workflow and increase production capability.

Kaya Farms™ - Cannabis and Cannabis Products

Proprietary Cannabis Strains

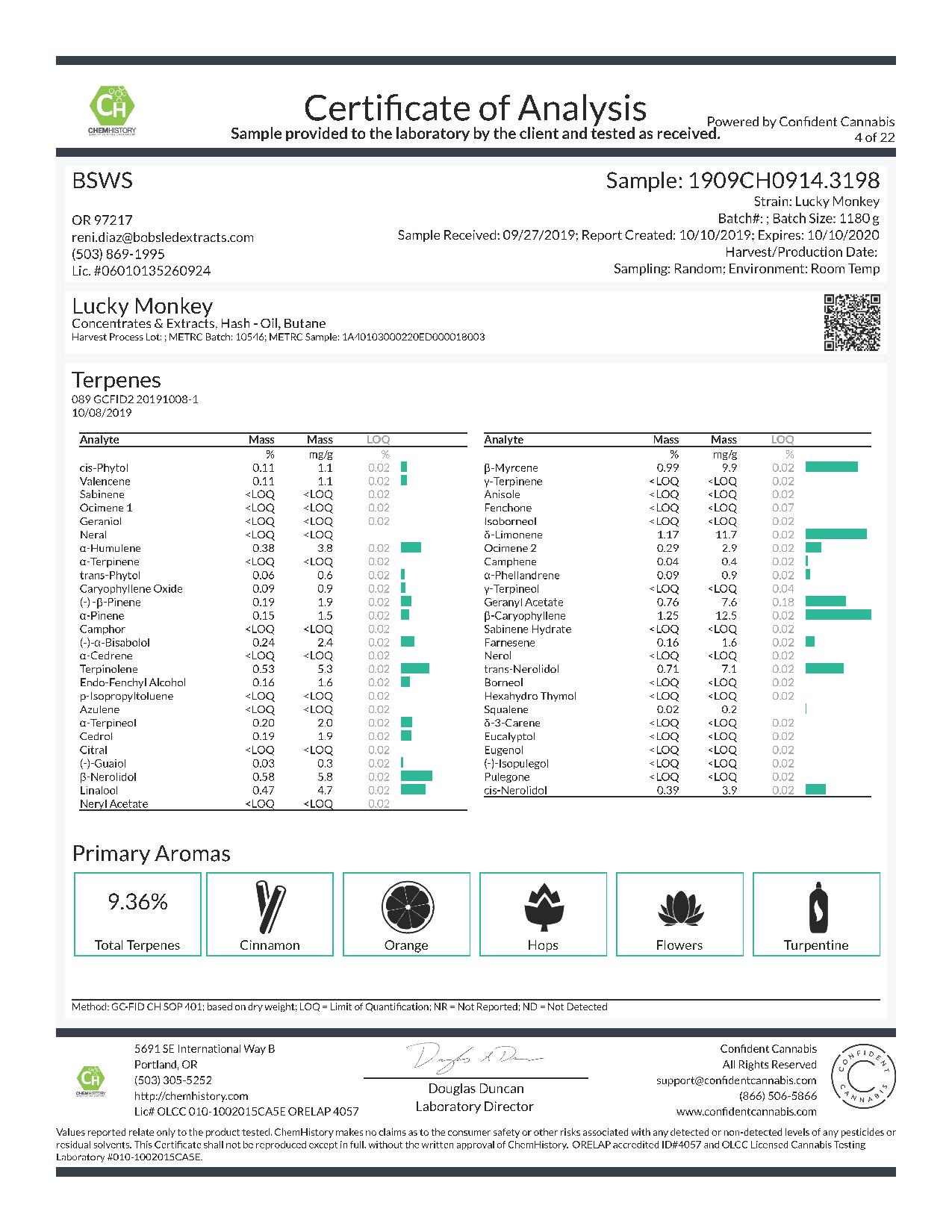

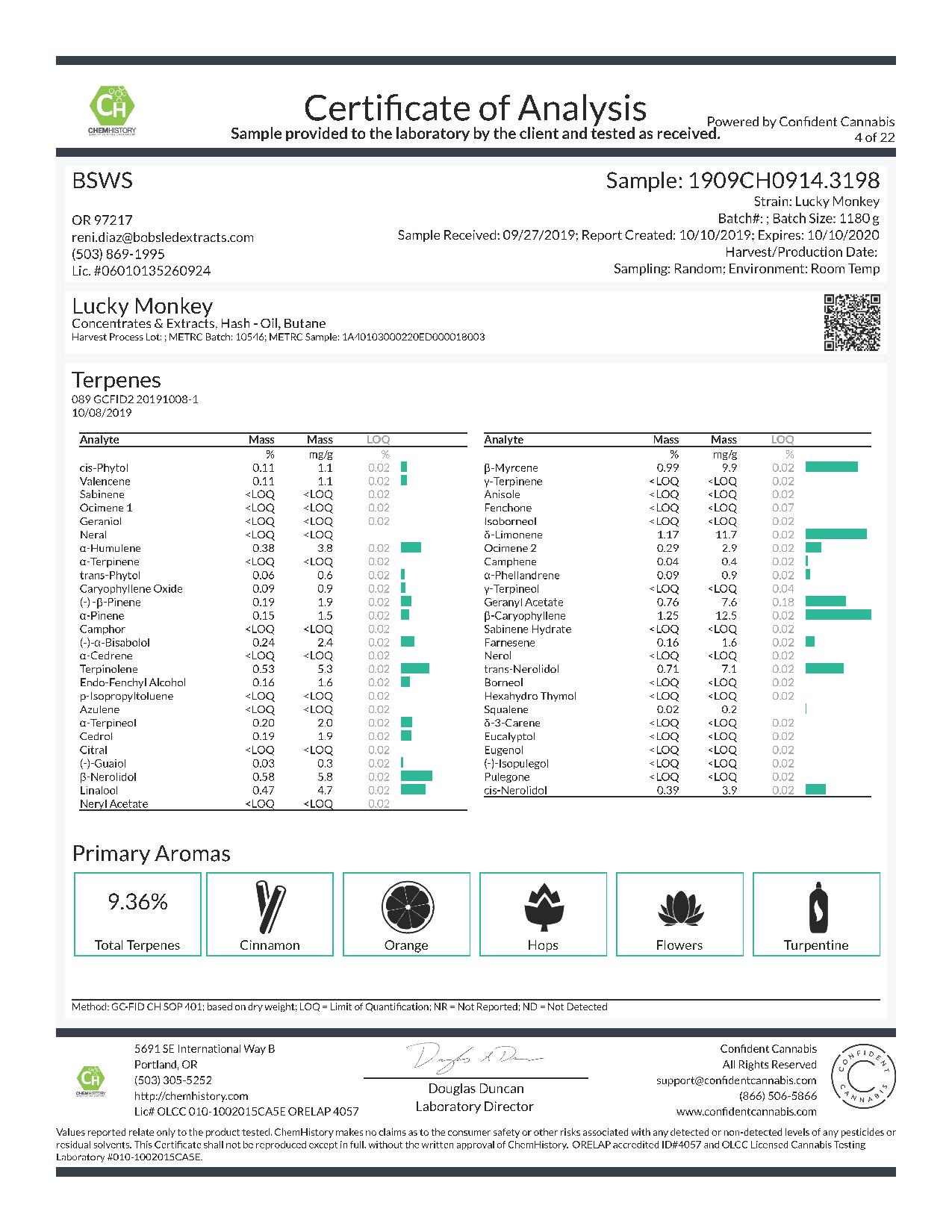

Kaya Farms Proprietary Cannabis Concentrates

Concentrates & Extracts, Hash Oil

(Note: These Concentrates were produced under contract for Kaya Farms by a third party while we await licensure of Production Facilities)

Kaya Buddie™ Strain Specific Cannabis Cigarettes

In 2016 the Company introduced a signature line of strain-specific connoisseur-grade, pre-rolled cannabis cigarettes branded as “Kaya Buddies™”. Kaya Buddies™ cannabis cigarettes have been very well received by medical patients and recreational users, with the Company selling over 100,000 Kaya Buddies™ since launching the brand in January 2016. The brand, marketed under the tagline “Buds with Benefits”, features over 50 different strains of connoisseur-grade, high quality cannabis and proprietary specialty blends. Many cannabis retailers produce prerolls, but none that we know of offer strain specific preroll made from the buds of the flower.

Kaya Brands International

After over five years of conducting “touch the plant” U.S. cannabis operations inside the strict regulatory confines of a public company, KAYS has formed Kaya Brands International, Inc. (“Kaya International” or “KBI”), to leverage its experience and expand into worldwide cannabis markets. KBI’s current operations and initiatives include Canada and Greece, with additional areas under consideration for Israel.

Canada

Canadian Franchising: KAYS has targeted Canada for its first international sale and operation of Kaya Shack™ cannabis store franchises. KAYS has entered into an area representation agreement with The Franchise Academy (a leading Canadian Franchise Development and Sales Group) to implement the Kaya Shack™ Retail Cannabis Store program in Canada (the only G7 country that has legalized both medical and recreational cannabis production, sale and use on a national level). The agreement targets 75-100 Kaya Shack™ Cannabis Retail locations throughout Canada through a multi-year structured rollout, subject to licensing and market conditions.

The Franchise Academy (http://www.franchiseacademy.ca) and its founder Shawn Saraga, is a member and national sponsor of the Canadian Franchise Association. With over 15 years of industry experience and having successfully closed over 700 franchise agreements and leases across Canada, the Franchise Academy has the knowledge, expertise, network and dedication to assist select franchisors enter the Canadian market.

Additionally, KAYS has retained Toronto, Canada based law firm of Garfinkle Biderman, LLP to prepare the Franchise Disclosure Documents and related items for the sale of Kaya Shack™ cannabis store franchises in Canada. We expect the franchise sale and placement effort throughout Canada to progress over the next 3-24 months. KAYS plans to ultimately expand its franchise operations to the U.S., as regulations and laws permit.

Greece

Kaya Kannabis is a joint venture project cultivation-for-export cannabis-farming project of Athens based Greekkannabis PC (“GKC”) and U.S. based Kaya Brands International, Inc (“KBI”), a majority owned subsidiary of Kaya Holdings, Inc. GKC is a recently formed Athens, Greece based cannabis company with deep ties in the Greek business community and a strong presence in the academic and agricultural communities. The alliance is designed to combine the business acumen and extensive European network of GKC with the broad cannabis industry and cannabis cultivation experience of Kaya Holdings.

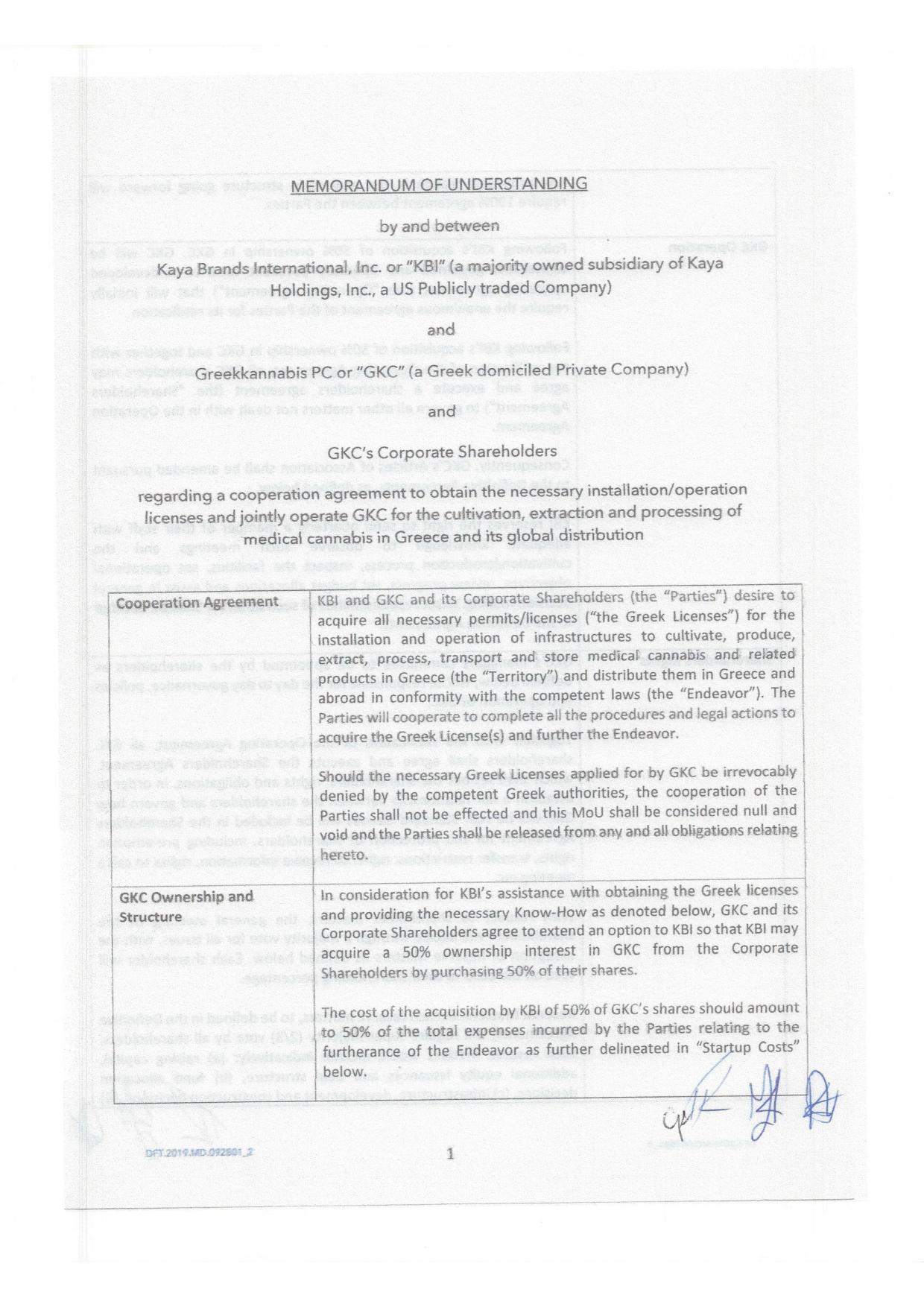

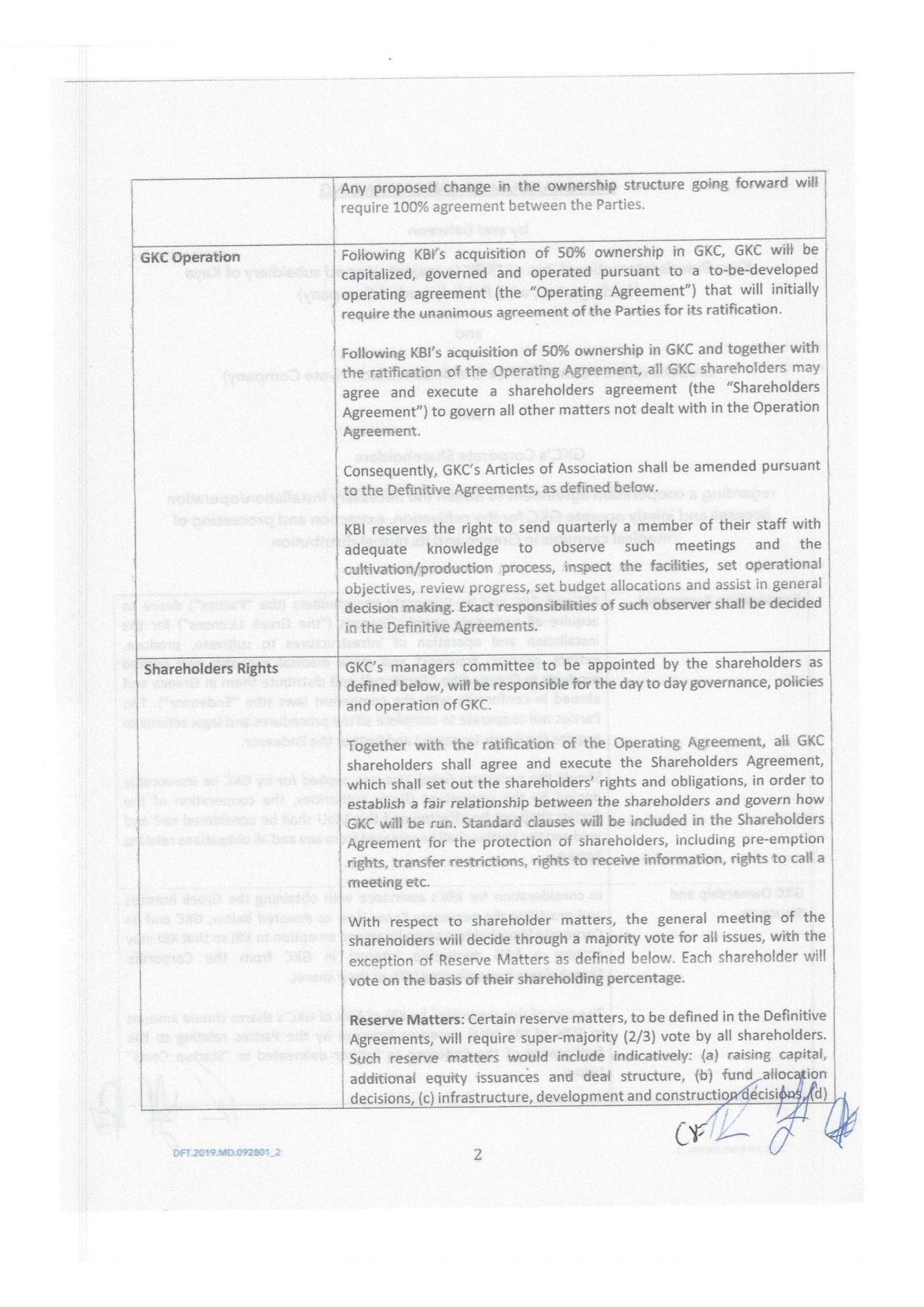

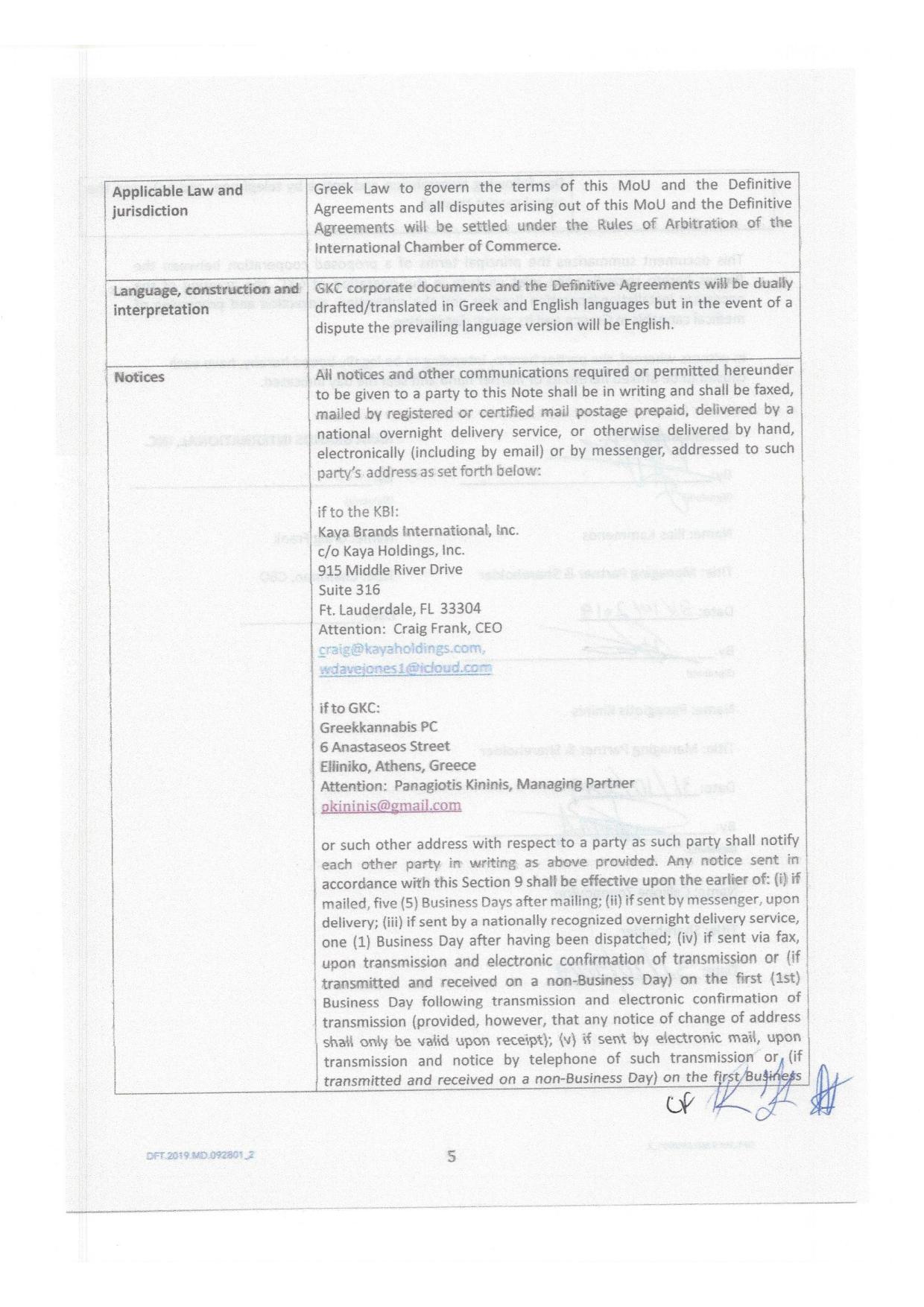

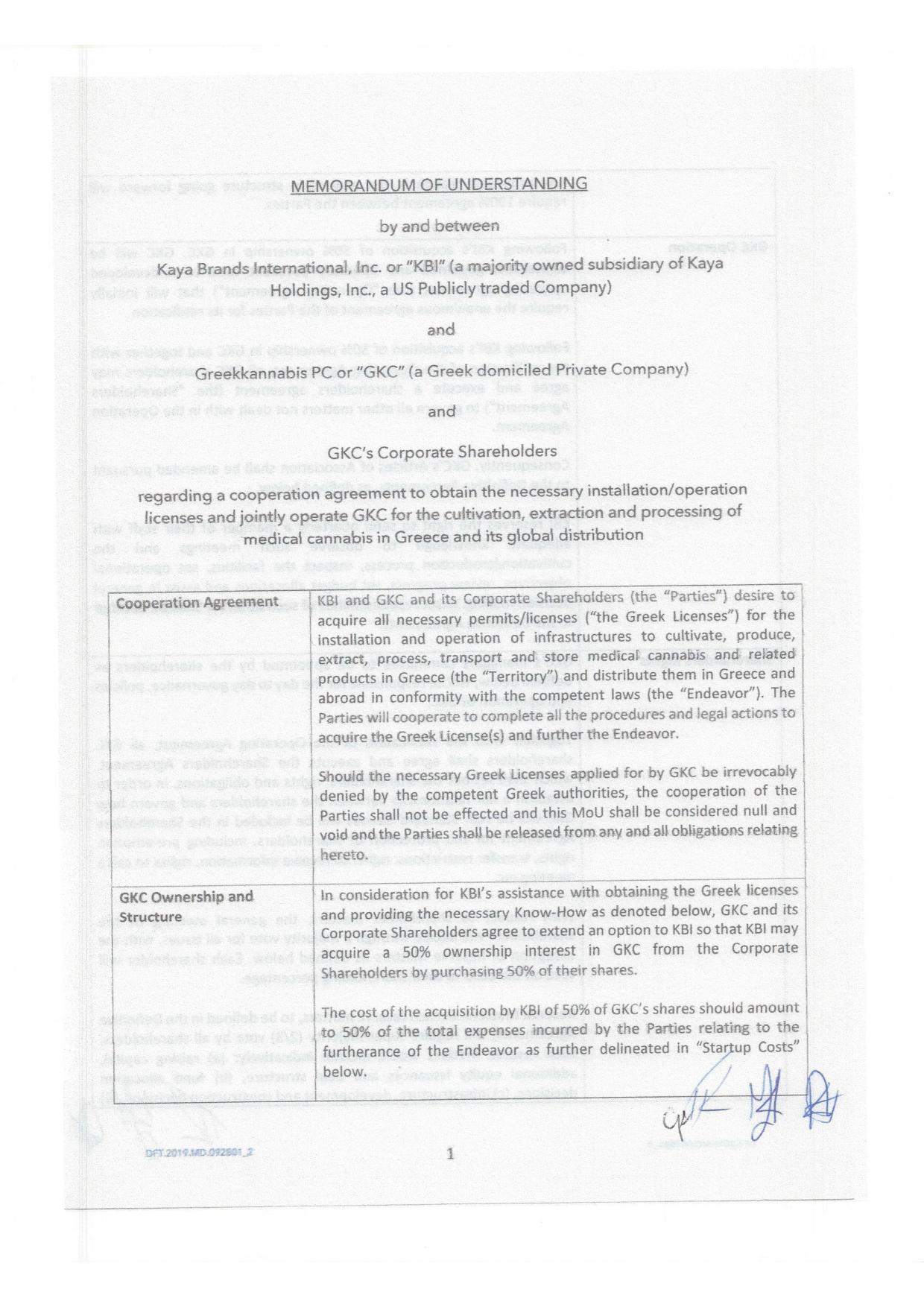

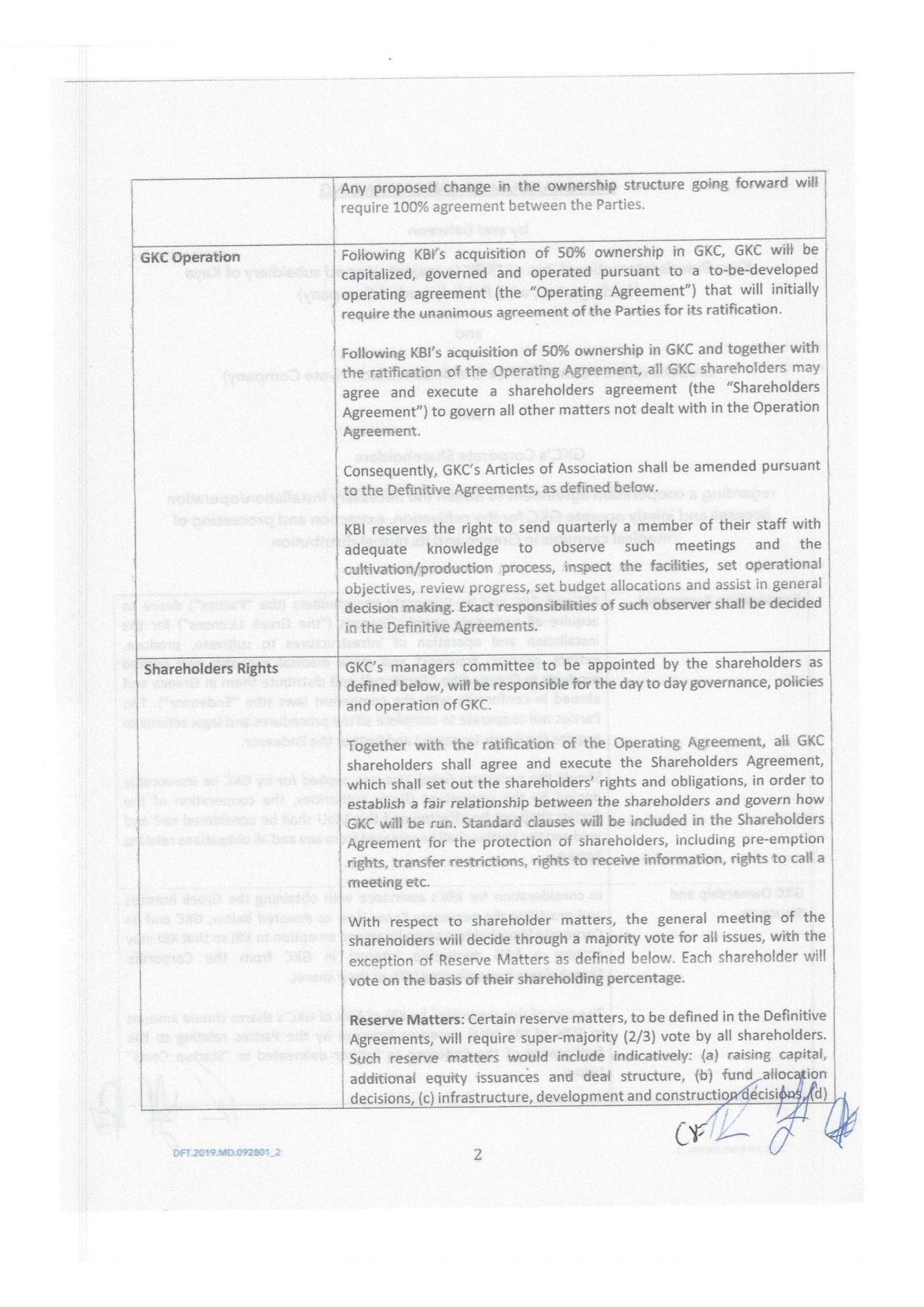

On October 31, 2019 KAYS entered into an initial Memorandum of Understanding (“MOU”) setting forth an agreement in principle for KBI to acquire a 50% ownership interest in GKC. The MOU sets forth an agreement in principle, pursuant to which in consideration for KBI providing the necessary expertise related to cannabis cultivation, processing, brand development and other matters, KBI will have the right to acquire a 50% ownership interest in GKC by reimbursing GKC for 50% of its license application costs (with allowances for KBI’s expenses as well).

There are three licenses required for the Facility- an “Installation License” (which is the equivalent to a license to construct the facility), the “Operating License” (available only after construction is completed), and the “Production & Distribution License” (available from the EOF - the Greek equivalent to the U.S. FDA - once production can be evaluated).

Consummation of the transaction contemplated by the MOU is subject to, among other customary conditions, satisfactory completion by KBI of its due diligence review of GKC, the drafting, execution and delivery of definitive transaction documentation and final license approval and issuance by the Greek government.

Project Description

GKC has entered into an agreement to purchase 15 acres of land outside of Athens in Thebes, Greece, approximately 75 minutes from Athens plans to establish the Kaya Kannabis Cultivation and Processing Facility. The region offers optimal growing conditions for cannabis and will enable the Company to produce exceptional cannabis economically.

The project location provides:

| § | 15 acres of flat land, with additional land available. |

| § | Full exposure to sunlight, without shadows cast. |

| § | Access to sufficient water, with operating wells. |

| § | Access to sufficient electricity. |

| § | Access to logistic routes. |

| § | Proximity to sufficient work force, both professional & labor. |

| § | Easy to secure (for security & safety). |

| § | Zoned for cannabis production. |

| § | Land is completely cleared and ready for construction. |

Project Management envisages twelve 35,000 sq. feet (approximately 3,500 sq. meters) of light deprivation greenhouses situated on fifteen acres of land, and supported by an additional 50,000 sq. feet (approximately 5,000 sq. meters) building for workspace, storage and administrative offices.

Under this model the farm will support 9,360 plants per greenhouse (for a total plant count of 112,320 plants per harvest). There will be four harvests each year for a total of 449,280 cannabis plants harvested annually. The Company estimates total farm production, once completely constructed and operating at full capacity, to be at a minimum of approximately 225,000 pounds of premium grade cannabis annually.

Current Licensing & Project Status

On February 18, 2020 the parties entered into an agreement to extend the date of the option until June 1, 2020 as GKC the first stage of the licensing had not yet been completed and the Parties due diligence process had not yet been completed.

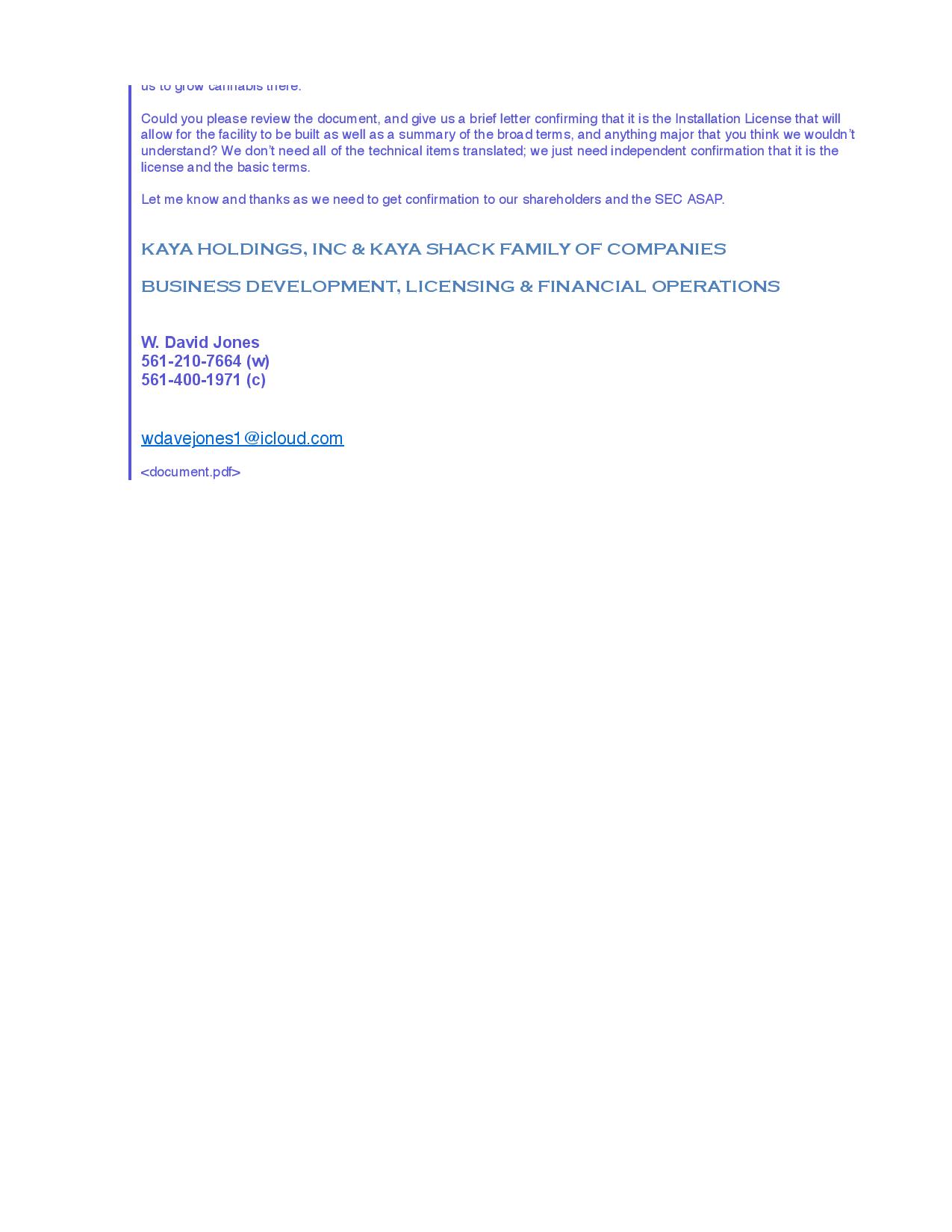

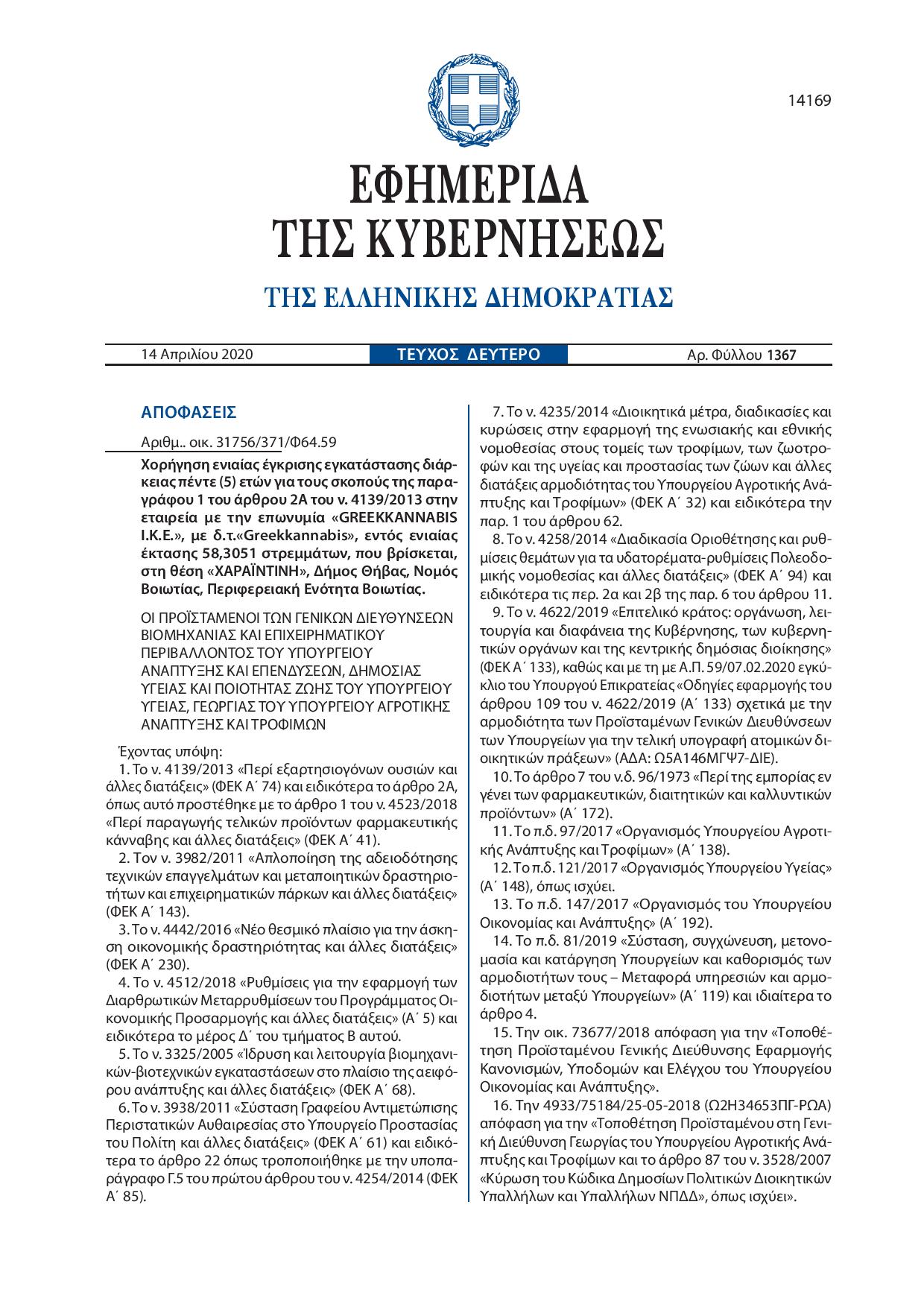

On April 22, 2020 KAYS/KBI received confirmation from their Greek Counsel that the Greek Government had awarded the crucial Installation License for the project.

See the following pages for the initial MOU, the extension of the MOU and a copy of the Greek Licensing Document published by the Greek Government (along with a confirmation in English provided by the Athens based law firm of Dalakos Fassolis Theofanopoulos (https://dftlaw.gr/) who represents KAYS and KBI in Greece). The firm has developed a long established and well-respected commercial legal practice and has developed a wide international network of correspondent relationships with overseas law offices throughout the world.

Government Regulation

We are subject to general business regulations and laws, as well as regulations and laws directly applicable to our operations. As we continue to expand the scope of our operations, the application of existing laws and regulations could include matters such as pricing, advertising, consumer protection, quality of products, and intellectual property ownership. In addition, we will also be subject to new laws and regulations directly applicable to our activities.

Any existing or new legislation applicable to us could expose us to substantial liability, including significant expenses necessary to comply with such laws and regulations, which could hinder or prevent the growth of our business.

Federal, state and local laws and regulations governing legal recreational and medical marijuana use are broad in scope and are subject to evolving interpretations, which could require us to incur substantial costs associated with compliance. In addition, violations of these laws or allegations of such violations could disrupt our planned business and adversely affect our financial condition and results of operations. In addition, it is possible that additional or revised federal, state and local laws and regulations may be enacted in the future governing the legal marijuana industry. There can be no assurance that we will be able to comply with any such laws and regulations and its failure to do so could significantly harm our business, financial condition and results of operations.

Competition

The legal marijuana sector is rapidly growing and the Company faces significant competition in the operation of retail outlets, MMDs and grow facilities. Many of these competitors will have far greater experience, more extensive industry contacts and greater financial resources than the Company. There can be no assurance that we can adequately compete to succeed in our business plan.

Employees

As of the date as of this Report, our Oregon operations have a total of 12-15 part-time store employees including budtenders, trimmers, growers, and4 full-time employees, consisting of the Senior Vice President of Cannabis Operations, the Vice President of Marketing and Brand development, and 2 store managers. Additionally, we engage several consultants to assist with daily duties and business plan implementation and execution. Additional employees will be hired and other consultants engaged in the future as our business expands.

Item 1A. Risk Factors.

We have a limited operating history with our current business.

The Company was incorporated in 1993 and has engaged in a number of businesses as both a private and as a publicly held company, including the online sale of specialty foods, online marketing and website development.

KAYS’s legal marijuana business, which it has focused on since 2014, only commenced generating more than a limited level of revenues subsequent to the commencement of legal recreational marijuana sales in Oregon on October 1, 2015. Accordingly, our operations continue to be subject to all the problems, expenses, difficulties, complications and delays encountered in an early stage business. There can be no assurance that the Company will generate significant revenues or operate at a profit.

The Company will require additional financing to become commercially viable.

The Company’s current legal marijuana operations can be capital intensive.

During the years ended December 31, 2019 and 2018, we raised approximately $770,000 and $1,375,000, respectively, through a series of private debt and equity offerings to finance operations.

The Company incurred net income of $7,790,761 and of $4,747,297 or the years ended December 31, 2019 and 2018, respectively.

All of the net income for the years ended December 31, 2019 and December 31, 2018 were not actual operating gains but were a result of the derivative liabilities from the conversion of debt from the stabilization of our stock prices the reduces the volatility factors used in the derivative calculations.

At December 31, 2019, we had a total stockholders' deficit of $13,491,480 and a working capital deficiency of $9,844,132. There can be no assurance that the Company will become commercially viable without additional financing, the availability and terms of which are uncertain. If the Company cannot secure necessary capital when needed on commercially reasonable terms, its business, condition (financial and otherwise) and commercial viability may be harmed. Although management believes that it will be able to successfully execute its business plan, which includes third party financing and the raising of capital to meet the Company’s future liquidity needs, there can be no assurances in this regard. These matters raise substantial doubt about the Company’s ability to continue as a going concern.

We currently rely on certain key individuals, and the loss of one of these key individuals could have an adverse effect on the Company.

Our success depends to a certain degree upon certain key members of our management and certain key consultants to the company. These individuals are a significant factor in our growth and success. The loss of the services of such members of management could have a material adverse effect on our Company.

The Company’s success will be dependent in part upon its ability to attract qualified personnel and consultants.

The Company’s success will be dependent in part upon its ability to attract qualified creative marketing, sales and development professionals. The inability to do so on favorable terms may harm the Company’s proposed business.

KAYS must effectively meet the challenges of managing expanding operations.

The Company’s business plan anticipates that operations will undergo expansion in 2019 and beyond. This expansion will require the Company manage a larger and more complex organization, which could place a significant strain on our managerial, operational and financial resources. Management may not succeed with these efforts. Failure to expand in an efficient manner could cause expenses to be greater than anticipated, revenues to grow more slowly than expected and could otherwise have an adverse effect on the business, financial condition and results of operations.

Marijuana remains illegal in the United States under federal law.

Notwithstanding its legalization for recreational and/or medical use by a growing number of states, the growing, transport, possession or selling of marijuana continues to be illegal under federal law. Although the Obama administration had made a policy decision to allow implementation of state laws legalizing recreational and/or medical marijuana use and not to federally prosecute anyone operating under state law, the continuance of that policy is not assured under the Trump administration and could change at any time, which might render our marijuana operations illegal and adversely affecting KAYS’s business, financial condition and results of operations.

The marketing and market acceptance of marijuana may not be as rapid as KAYS expects.

The market for legal marijuana is quickly evolving, and activity in the sector is expanding rapidly. Demand and market acceptance for legal marijuana are subject to uncertainty and risk, as changes in the price and possible adverse political efforts could influence and denigrate demand. KAYS cannot predict whether, or how fast, this market will grow or how long it can be sustained. If the market for legal marijuana develops more slowly than expected or becomes saturated with competitors, KAYS’s operating results could be adversely impacted.

KAYS’s marijuana activities are part of an emerging industry.

The Company intends to implement an aggressive plan of growth to enter the legal recreational and medical marijuana industry. The legal marijuana industry is new and emerging, and has yet to fully define competitive, operational, financial and other parameters for successful operations. By pursuing a growth strategy to enter a new and emerging industry, the Company’s operations may be adversely impacted as the industry’s competitive, operational, financial and other parameters take shape. Given the fluidity of the industry, the Company may make errors in implementing its business plan, thereby limiting some or all of its ability to perform in accordance with its expectations.

Our business could be affected by changes in governmental regulation.

Federal, state and local laws and regulations governing legal recreational and medical marijuana use are broad in scope and are subject to evolving interpretations, which could require us to incur substantial costs associated with compliance. In addition, violations of these laws or allegations of such violations could disrupt KAYS’s planned business and adversely affect our financial condition and results of operations. In addition, it is possible that additional or revised federal, state and local laws and regulations may be enacted in the future governing the legal marijuana industry. There can be no assurance that KAYS will be able to comply with any such laws and regulations and its failure to do so could significantly harm our business, financial condition and results of operations.

Our business will be subject to other operating risks which may adversely affect the Company’s financial condition.

Our planned operations will be subject to risks normally incidental to manufacturing operations which may result in work stoppages and/or damage to property. This may be caused by:

| | · | breakdown of the equipment; |

| | · | labor disputes; |

| | · | imposition of new government regulations; |

| | · | sabotage by operational personnel; |

| | · | cost overruns; and |

| | · | fire, flood, or other acts of God. |

We will likely face significant competition.

The legal marijuana industry is in its early stages and is attracting significant attention from both small and large entrants into the industry. KAYS expects to encounter significant competition as it implements its business strategy. The ability of KAYS to effectively compete could be hindered by a lack of funds, poor positioning, management error, and other factors. The inability to effectively compete could adversely affect our business, financial condition and results of operations.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act `Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial office and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| · | | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company |

| | | |

| · | | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and |

| | | |

| · | | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. |

We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. During the course of our testing, we may identity other deficiencies that we may not be able to timely remediate. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 (“Sarbanes Oxley”). Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly

The Jumpstart our Business Startups Act of 2012 (the “Jobs Act”) has reduced the information that the Company is required to disclose.

Under the Jobs Act, the information that the Company will be required to disclose has been reduced in a number of ways.

As a company that had gross revenues of less than $1 billion during the Company’s last fiscal year, the Company is an “emerging growth company,” as defined in the Jobs Act (an “EGC ”). The Company will retain that status until the earliest of (a) the last day of the fiscal year which the Company has total annual gross revenues of $1,000,000,000 (as indexed for inflation in the manner set forth in the Jobs Act) or more; (b) the last day of the fiscal year of following the fifth anniversary of the date of the first sale of the common stock pursuant to an effective registration statement under the Securities Act; (c) the date on which the Company has, during the previous three year period, issued more than $1,000,000,000 in nonconvertible debt; or (d) the date on which the Company is deemed to be a “large accelerated filer ,” as defined in Rule 12b-2 under the Exchange Act or any successor thereto. As an EGC, the Company is relieved from the following:

· | | The Company is excluded from Section 404(b) of Sarbanes-Oxley, which otherwise would have required the Company’s auditors to attest to and report on the Company’s internal control over financial reporting. The Jobs Act also amended Section 103(a)(3) of Sarbanes-Oxley to provide that (i) any new rules that may be adopted by the PCAOB requiring mandatory audit firm rotation or changes to the auditor’s report to include auditor discussion and analysis (each of which is currently under consideration by the PCAOB) shall not apply to an audit of an EGC; and (ii) any other future rules adopted by the PCAOB will not apply to the Company’s audits unless the SEC determines otherwise. |

| · | | The Jobs Act amended Section 7(a) of the Securities Act to provide that the Company need not present more than two years of audited financial statements in an initial public offering registration statement and in any other registration statement, need not present selected financial data pursuant to Item 301 of Regulation S-K for any period prior to the earliest audited period presented in connection with such initial public offering. In addition, the Company is not required to comply with any new or revised financial accounting standard until such date as a private company (i.e., a company that is not an “issuer” as defined by Section 2(a) of Sarbanes-Oxley) is required to comply with such new or revised accounting standard. Corresponding changes have been made to the Exchange Act, which relates to periodic reporting requirements, which would be applicable if the Company were required to comply with them. |

| · | | As long as the Company is an EGC, the Company may comply with Item 402 of Regulation S-K, which requires extensive quantitative and qualitative disclosure regarding executive compensation, by disclosing the more limited information required of a “smaller reporting company .” |

| | | |

| · | | In the event that the Company registers the common stock under the Exchange Act, the Jobs Act will also exempt the Company from the following additional compensationrelated disclosure provisions that were imposed on U.S. public companies pursuant to the Dodd-Frank Act: |

| | | |

| | | (i) | | the advisory vote on executive compensation required by Section 14A(a) of the Exchange Act; |

| | | |

| | | (ii) | | the requirements of Section 14A(b) of the Exchange Act relating to shareholder advisory notes on “golden parachute” compensation; |

| | | |

| | | (iii) | | the requirements of Section 14(i) of the Exchange Act as to disclosure relating to the relationship between executive compensation and our financial performance; and |

| | | (iv) | | the requirement of Section 953(b)(1) of the Dodd-Frank Act, which requires disclosureas to the relationship between the compensation of the Company’s chief executive officer and median employee pay. |

The costs of being a public company could result in us being unable to continue as a going concern.

As a public company, we are required to comply with numerous financial reporting and legal requirements, including those pertaining to audits and internal control. The costs of this compliance could be significant. If our revenues do not increase and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs in the normal course of business that would result in our being unable to continue as a going concern.

Management and the Board of Directors may be indemnified.

The Certificate of Incorporation and Bylaws of KAYS provide for indemnification of directors and officers at the expense of the respective corporation and limit their liability. This may result in a major cost to the corporation and hurt the interests of stockholders because corporate resources may be expended for the benefit of directors and officers. The Company has been advised that, in the opinion of the Securities and Exchange Commission, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

The market for the KAYS Shares is extremely limited and sporadic

KAYS’s common stock is quoted on the OTCQB tier of the over-the-counter market operated by OTC Markets Group, Inc. The market KAYS’s for common stock is limited and sporadic. Trading in stock quoted on the OTCQB is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of KAYS’s common stock for reasons unrelated to operating performance. Moreover, the trading of securities in the OTCQB is often more sporadic than the trading of securities listed on a quotation system like NASDAQ, or a stock exchange like the New York Stock Exchange.

KAYS’s common stock is a penny stock. Trading of KAYS’s common stock may be restricted by the penny stock regulations adopted by the Securities and Exchange Commission (the “SEC”) and FINRA’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our common stock.

KAYS’s common stock is a penny stock. The SEC has adopted Rule 15g-9 which generally defines“penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. KAYS’s common stock is covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, KAYS’s common stock.

In addition to the penny stock rules promulgated by the SEC, FINRA (the Financial Industry Regulatory Authority) has adopted rules that require when recommending an investment to a customer, a broker- dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low -priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker-dealers to recommend that their customers buy KAYS’s common stock, which may limit investor ability to buy and sell KAYS’s common stock.

The market for penny stocks has experienced numerous frauds and abuses that could adversely impact KAYS’s common stock.

Company management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| · | | control of the market for the security by one or a few broker-dealers that are often related to a promoter or issuer; |

| · | | manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| | | |

| · | | boiler room practices involving high pressure sales tactics and unrealistic price projections by sales persons; |

| | | |

| · | | excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| | | |

| · | | wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

The board of directors of KAYS has the authority, without stockholder approval, to issue preferred stock with terms that may not be beneficial to common stockholders and with the ability to adversely affect common stockholder voting power and rights upon liquidation.

KAYS’s Certificate of Incorporation allows us to issue shares of preferred stock without any vote or further action by our stockholders. Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders of preferred stock the rights to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock.

The ability of our principal stockholders, including our CEO, to control our business may limit or eliminate minority stockholders’ ability to influence corporate affairs.

The principal stockholder of KAYS holds 22,996,833 shares of common stock and 50,000 shares of Series C Convertible Stock. Additionally, our CEO owns 8,280,144 shares of common stock and 50,000 shares of Series C Convertible Preferred Stock. These preferred shares can be converted into a total of 43,329,970 shares of KAYS common stock which, added to the common shares of KAYS held by both parties gives them approximately 32.5% of votes on matters presented to stockholders. Accordingly, they are in a position to significantly influence membership of our board of directors as well as all other matters requiring stockholder approval. The interests of our principal stockholders may differ from the interests of other stockholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of other officers and directors and other business decisions. The minority stockholders have no way of overriding decisions made by our principal stockholders. This level of control may also have an adverse impact on the market value of our shares because our principal stockholders may institute or undertake transactions, policies or programs that result in losses and/or may not take any steps to increase our visibility in the financial community and/or may sell sufficient numbers of shares to significantly decrease our price per share.

We do not expect to pay cash dividends in the foreseeable future.

KAYS has not paid cash dividends on its shares of common stock and does not intend to do so at any time in the foreseeable future. The future payment of dividends depends upon future earnings, capital requirements, financial requirements and other factors that the companies’ boards of directors will consider. Since they do not anticipate paying cash dividends on the common stock, return on investment, if any, will depend solely on an increase, if any, in the market value of the common stock.

The conversion of KAYS’ outstanding preferred stock by the CEO and convertible debt held by our principal stockholder would result in the issuance of43,329,970shares of KAYS’ common stock. Additionally, conversion of other convertible debt described in this Annual Report would result in further dilution to KAYS’ stockholders. Accordingly, such market overhang could adversely impact the market price of the common stock.

KAYS has 100,000 shares of Series C Convertible Preferred Stock outstanding, all of which are held by our CEO and our principal stockholder. These preferred shares can be converted into a total of 43,329,970 shares of KAYS common stock. Additionally, the company has other convertible debt described in this Annual Report, which would result in further dilution if converted Such market overhang could adversely impact the market price of KAYS’s common stock as a result of the dilution which would result if such securities were converted into shares of KAYS common stock.

Future sales of shares of KAYS common stock pursuant to Rule 144 under the Securities Act could adversely affect the market price of KAYS’s common stock.

KAYS has a substantial number of shares of common stock which were issued in transactions exempt from the registration requirements of the Securities Act and are now available for public sale pursuant to the Rule 144 under the Securities Act. Such sales could adversely affect the market price of KAYS’s common stock.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protection against interesteddirector transactions, conflicts of interest and similar matters.

Sarbanes-Oxley as well as rule changes proposed and enacted by the SEC, the NYSE/AMEX and the NASDAQ Stock Market as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the NASDAQ Stock Market. Because we are not currently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with voluntary compliance, we have not yet adopted these measures.

We do not currently have independent audit or compensation committees. As a result, directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested- director transactions, conflicts of interest, if any, and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations as a result thereof.

We intend to comply with all corporate governance measures relating to director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley. The enactment of Sarbanes-Oxley has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

Operating Leases

The Company has several operating leases- an office in Fort Lauderdale, Florida and 4 store leases in Oregon under arrangements classified as leases under ASC 842:

Effective June 12, 2017, the Company leased office space in Fort Lauderdale, Florida under a 5-year operating lease expiring June 30, 2022. The lease provides for increases in future minimum annual rental payments based on defined annual increase beginning with monthly payments of $4,017 and culminating in a monthly payment of $4,839. The total amount of rental payments due over the lease term is being charged to rent expense according to the straight-line method over the term of the lease. The lease was terminated on July 3, 2019 and the Company issued the landlord 500,000 shares of common stock as a settlement in lieu of a penalty for early termination.

Effective June 1, 2019, the Company leased its current office space in Fort Lauderdale, Florida under a 2-year operating lease expiring May 31, 2021. The rental payment is $1,802 per month. The total amount of rental payments due over the lease term is being charged to rent expense according to the straight-line method over the term of the lease.

Effective May 15, 2014, the Company leased an unit in Portland, Oregon under a 5-year operating lease expiring May 15, 2019. In May 2019, the lease had been extended to May 15, 2024. The lease provides for increases in future minimum annual rental payments based on defined annual increase beginning with monthly payments of $2,250 and culminating in a monthly payment of $2,632. The total amount of rental payments due over the lease term is being charged to rent expense according to the straight-line method over the term of the lease.

Effective June 1, 2015, the Company leased a unit in Salem, Oregon under a 5-year operating lease expiring May 31, 2020. The lease provides for increases in future minimum annual rental payments based on defined annual increase beginning with monthly payments of $3,584 and culminating in a monthly payment of $4,034. The total amount of rental payments due over the lease term is being charged to rent expense according to the straight-line method over the term of the lease.

Effective April 15, 2016, the Company leased a unit in Salem, Oregon under a 5-year operating lease expiring April 15, 2021. The lease provides for increases in future minimum annual rental payments based on defined annual increase beginning with monthly payments of $4,367 and culminating in a monthly payment of $4,915. The total amount of rental payments due over the lease term is being charged to rent expense according to the straight-line method over the term of the lease. The Company is currently in process of negotiating a termination agreement with the landlord for this space as this store has been closed and the Company intends to utilize the OLCC License at its warehouse Property in Eugene, Oregon to open a “Grow Store” and Delivery Operation to service the Eugene, Oregon market (subject to OLCC approval for license transfer).

Effective April 15, 2016, the Company leased an unit in Salem, Oregon under a 5-year operating lease expiring April 15, 2021. The lease provides for increases in future minimum annual rental payments based on defined annual increase beginning with monthly payments of $4,617 and culminating in a monthly payment of $5,196. The total amount of rental payments due over the lease term is being charged to rent expense according to the straight-line method over the term of the lease. The Company is currently in process of negotiating a termination agreement with the landlord for this landlord as this store has been closed

The Company utilizes the incremental borrowing rate in determining the present value of lease payments unless the implicit rate is readily determinable. The Company used an estimated incremental borrowing rate of 9.32% to estimate the present value of the right of use liability.

The Company has right-of-use assets of $284,042 and operating lease liabilities of $288,899 as of December 31, 2019

Real Property

In August 2017, KAYS we acquired a 26 acre parcel in Lebanon, Linn County, Oregon, which we intend to develop as a Kaya Farms™ legal cannabis cultivation and manufacturing facility.

In 2018, we acquired the Eugene, Oregon based Sunstone Farms grow and manufacturing facility.

Item 3. Legal Proceedings.

From time to time KAYS be party to various legal proceedings in the ordinary course of business. Pleases see paragraphs below for results of legal proceedings during 2019 and 2020; there are no currently pending proceedings:

A. On February 9, 2018 KAYS submitted a site plan review for the Company’s envisioned 101,000 square foot OLCC licensed Kaya Farms™ Marijuana Grow and Manufacturing Complex and an application for a conditional use permit for marijuana processing on the Company owned 26.50-acre property zoned Exclusive Farm Use (EFU) with the Linn County, Oregon Planning and Building Department.

On March 9, 2018 the Company was notified by the Linn County, Oregon Planning and Building Department (the “Department”) that the application was deemed complete and received an official letter of completeness with respect to the application. The formal “Letter of Completeness,” sent March 9, 2018 by a Linn County Senior Planner, confirmed the eligibility of the Company’s 26-acre plot for the purposes of growing legal cannabis, as well as the eligibility of the property for a special purpose exemption for the Company’s proposed manufacturing operations.

On April 20, 2018 the Company was notified by the Department that the site plan review for the indoor and outdoor marijuana operation on the 26.50-acre property (which encompasses approximately 86,000 square feet of the Company’s 101,000 square feet of the Company’s submitted buildings) had been approved. However, the conditional use permit for marijuana processing (which encompasses approximately 15,000 square feet of the Company’s 101,000 square feet of the Company’s submitted buildings) had been denied, largely due to the scale and coverage of the proposed processing operation. Additionally, local residents requested a hearing to appeal the approval of the site plan based on concerns that a portion of the approved site plan that supports the 36,000 square feet of green houses for outdoor growing is not eligible for the Irrigation rights that the Company possesses for the Property.

On June 12, 2018 the Linn County Planning Commission held a hearing and adopted a motion to Deny the previously approved site plan, citing that the proposed site plan does not comply with the odor and waste management standards set forth in Section 940.400 of the Linn County Development Code.

On August 7, 2018 KAYS filed a Notice of Appeal with the State of Oregon Land Use Board of Appeals (LUBA).

On October 9, 2018, Larkins Vacura Kayser LLP (“LVKLAW”), Oregon Counsel, received a letter from Linn County’s Attorney notifying them that Linn County did not intend to file a response brief or appear at the State of Oregon Land Use Board of Appeals (“LUBA”) hearing, and shortly thereafter LUBA cancelled the LUBA Hearing.

On November 13, 2018 LUBA issued its FINAL OPINION AND ORDER (the “Order”). The Order reversed the County’s decision and ordered the County to approve the Company’s Land Use Application for the to-be-built 85,000-square foot Kaya Farms & Greenhouse Facility in Lebanon, Oregon.

On August 16th, 2019 the Land Use Board of Appeals issued an order granting attorney’s fees and costs in the amount of $25,158 be paid to KAYS and the funds were received in September, 2019. The proceeds were recorded net against costs incurred, noting no gain or loss.

B. On December 13, 2019 Siegelaub, Rosenberg, P.A. filed a suit against the Company in Broward County Court seeking payment of $6,000 together with costs, prejudgment interest and attorney’s fees for an unpaid invoice for work that it alleged was performed in preparation of the Company’s 2018 10-K (the “Siegelaub Claim”)

On March 28, 2020 the Company filed a response to the Siegelaub Claim which included a Counterclaim for Breach of Contract for the Plaintiff’s failure and refusal to perform its obligations and is seeking damages in an amount exceeding $30,000.

On April 20, 2020 the Parties reached a settlement in the matter and resolved the final accounting invoice for a payment of $1,500.00 with each Party responsible for their attorney’s fees and executing mutual releases.