Board has approved an additional company discretionary contribution of 6% of pay for 2014 and 2013. During 2012, the discretionary contribution was 7.5% of pay. The discretionary contribution is subject to approval each year by the Board. Our matching contribution to the SIP vests immediately; however, our discretionary contribution is subject to vesting conditions that must be satisfied over a three year vesting period. Contributions under SIP, including our match, are invested in accordance with the investment options elected by plan participants. Compensation expense associated with our matching contribution to the SIP was $4 million, $3 million, and $2 million during 2014, 2013, and 2012, respectively, which was included in “Selling, general and administrative expenses” in the Consolidated Statements of Operations. Compensation expense associated with our discretionary contribution was $4 million, $4 million, and $4 million during 2014, 2013, and 2012, respectively, which was included in “Selling, general and administrative expenses” in the Consolidated Statements of Operations.

U.S. Savings Restoration Plan

In 2006, we established the U.S. Savings Restoration Plan (the “SRP”), a nonqualified defined contribution plan, for employees whose eligible compensation is expected to exceed the IRS compensation limits for qualified plans. Under the SRP, participants can contribute up to 20% of their annual compensation and incentive. Our matching contribution under the SRP is the same as the SIP. Our matching contribution under this plan vests immediately to plan participants. Contributions under the SRP, including our match, are invested in accordance with the investment options elected by plan participants. Compensation expense associated with our matching contribution to the SRP was $1 million, less than $1 million, and $1 million during 2014, 2013, and 2012, respectively, which was included in “Selling, general and administrative expenses” in the Consolidated Statements of Operations.

24. Related Party Transactions

Prior to the Transaction Date, Tronox Incorporated conducted transactions with Exxaro Australia Sands Pty Ltd, Tronox Incorporated’s 50% partner in the Tiwest Joint Venture. Tronox Incorporated purchased, at open market prices, raw materials used in its production of TiO2, as well as Exxaro Australia Sands Pty Ltd’s share of TiO2 produced by the Tiwest Joint Venture. Tronox Incorporated also provided administrative services and product research and development activities, which were reimbursed by Exxaro. During 2012, Tronox Incorporated made payments of $173 million and received payments of $9 million. Subsequent to the Transaction Date, such transactions are considered intercompany transactions and are eliminated in consolidation.

We have service level agreements with Exxaro for services such as tax preparation and research and development, both of which expire during 2015, as well as information technology services, which expired during 2014. Such service level agreements amounted to $3 million, $5 million and $7 million of expense during 2014, 2013 and 2012, respectively. Additionally, we have a professional service agreement with Exxaro related to the Fairbreeze construction project. During 2014 and 2013, we paid $3 million and $3 million, respectively, to Exxaro, which was capitalized in “Property, plant and equipment, net” on our Consolidated Balance Sheets.

25. Segment Information

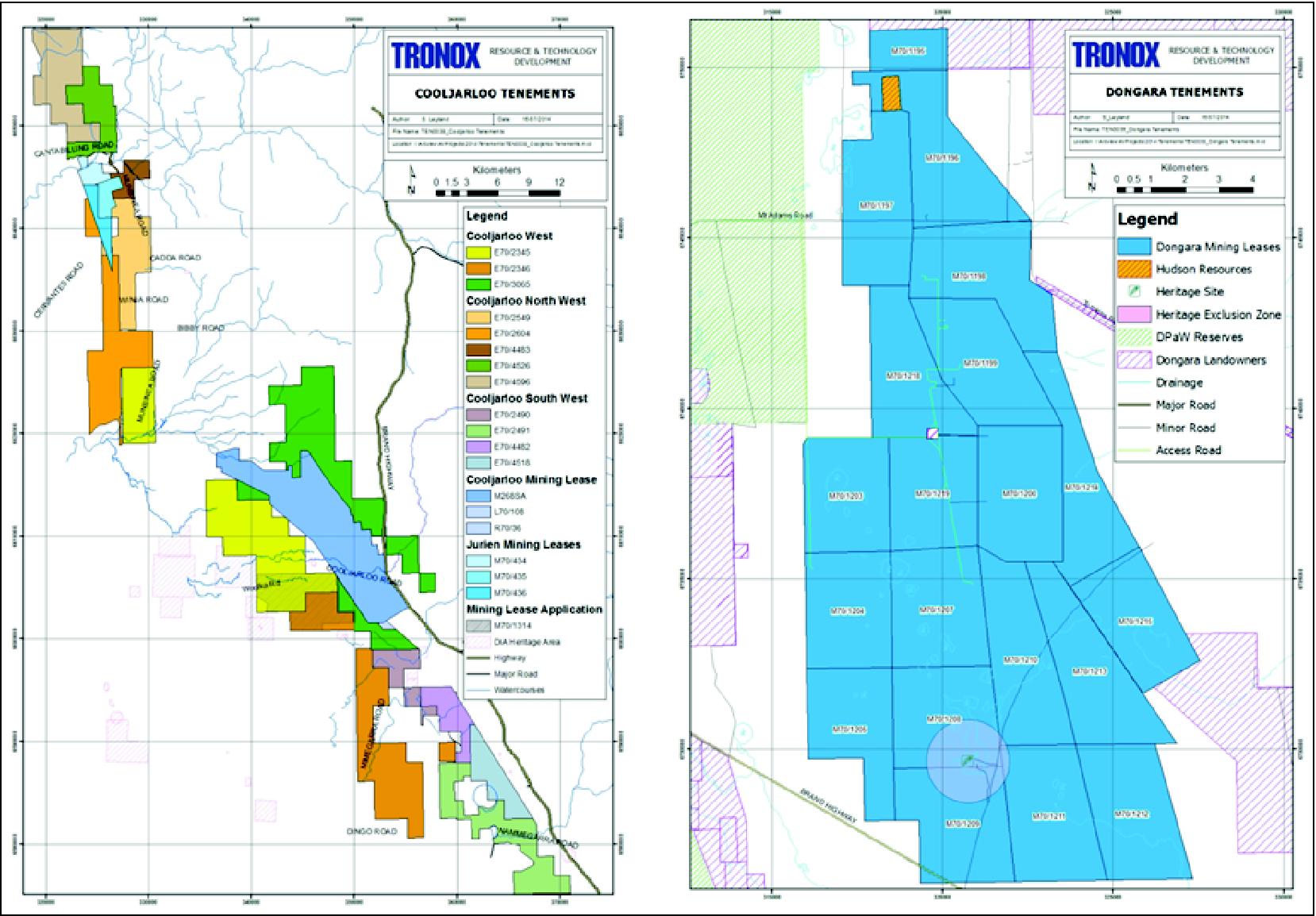

The reportable segments presented below represent our operating segments for which separate financial information is available and which is utilized on a regular basis by our chief operating decision maker to assess performance and to allocate resources. In identifying our reportable segments, we also considered the nature of services provided by our operating segments. We have two reportable segments, Mineral Sands and Pigment. Our Mineral Sands segment includes the exploration, mining, and beneficiation of mineral sands deposits, as well as heavy mineral production, and produces titanium feedstock, including chloride slag, slag fines, and rutile, as well as pig iron and zircon. Our Pigment segment primarily produces and markets TiO2. Corporate and Other is comprised of our electrolytic operations, all of which are located in the United States, as well as our corporate activities.

Segment performance is evaluated based on segment operating profit (loss), which represents the results of segment operations before unallocated costs, such as general corporate expenses not identified to a specific segment, interest expense, other income (expense), and income tax expense or benefit. Sales between segments are generally priced at market. Any resulting profit remaining in the inventory of the acquiring segment is eliminated in consolidation.