Post Holdings to Acquire Rachael Ray® Nutrish®, Nature’s Recipe® and Other Select Pet Brands from The J.M. Smucker Co. February 8, 2023

Cautionary Statement Regarding Forward-Looking Statements Certain matters discussed in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward- looking statements are made based on known events and circumstances at the time of release, and as such, are subject to uncertainty and changes in circumstances. These forward-looking statements include, among others, statements regarding Post Holdings, Inc.’s (“Post” or the “Company”) prospective performance and opportunities, Post’s expected synergies and benefits from its acquisition of select pet food brands from The J.M. Smucker Co. (the “Pet Food Business”), the forecasted Adjusted EBITDA of the Pet Food Business, expectations about the impact of the acquisition of the Pet Food Business on Post’s cash flows and net leverage, expectations about future business plans, prospective performance and opportunities for the Pet Food Business, regulatory approvals and the expected timing of the completion of the Pet Food Business transaction, Post’s forecasted Adjusted EBITDA outlook for fiscal year 2023 and Post’s forecasted free cash flow illustrative calculation. These forward-looking statements may be identified from the use of forward-looking terminology such as “believe,” “should,” “could,” “potential,” “continue,” “expect,” “project,” “estimate,” “predict,” “anticipate,” “aim,” “intend,” “plan,” “forecast,” “target,” “is likely,” “will,” “can,” “may” or “would” or the negative of these terms or similar expressions, and include all statements regarding future performance, earnings projections, events or developments. There is no assurance that Post’s acquisition of the Pet Food Business will be consummated. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO, THE FOLLOWING: • the ability and timing to consummate the proposed acquisition of the Pet Food Business, including obtaining the required regulatory approvals and the satisfaction of other closing conditions to the purchase agreement; • Post’s ability to promptly and effectively integrate the Pet Food Business after the acquisition has closed, and Post’s ability to obtain expected cost savings and synergies of the acquisition; • operating costs, customer loss and business disruption (including difficulties maintaining relationships with Pet Food Business employees, customers or suppliers) that may be greater than expected following the consummation of the Pet Food Business acquisition; • significant volatility in the cost or availability of inputs to Post’s businesses (including freight, raw materials, energy and other supplies); • Post’s ability to increase its prices to offset cost increases and the potential for such price increases to impact demand for Post’s products; • disruptions or inefficiencies in Post’s supply chain, including as a result of inflation, labor shortages, insufficient product or raw material availability, limited freight carrier availability, Post’s reliance on third parties for the supply of materials for or the manufacture of many of Post’s products, public health crises (including the COVID-19 pandemic), climatic events, agricultural diseases and pests, fires and evacuations related thereto and other events beyond Post’s control; • Post’s high leverage, Post’s ability to obtain additional financing (including both secured and unsecured debt), Post’s ability to service its outstanding debt (including covenants that restrict the operation of Post’s businesses) and a downgrade or potential downgrade in Post’s credit ratings; • Post’s ability to hire and retain talented personnel, increases in labor-related costs, the ability of Post’s employees to safely perform their jobs, including the potential for physical injuries or illness, employee absenteeism, labor strikes, work stoppages and unionization efforts; • changes in economic conditions, the occurrence of a recession, disruptions in the United States (the “U.S.”) and global capital and credit markets, changes in interest rates and fluctuations in foreign currency exchange rates; • Post’s ability to continue to compete in its product categories and Post’s ability to retain its market position and favorable perceptions of its brands; • the impacts of public health crises (including the COVID-19 pandemic), such as negative impacts on demand for Post’s foodservice and on-the-go products, Post’s ability to manufacture and deliver its products, workforce availability, the health and safety of Post’s employees, operating costs, the global economy and capital markets and Post’s operations generally; • Post’s ability to anticipate and respond to changes in consumer and customer preferences and behaviors and introduce new products; • allegations that Post’s products cause injury or illness, product recalls and withdrawals and product liability claims and other related litigation; 2

Cautionary Statement Regarding Forward-Looking Statements (Cont’d) (CONTINUED FROM PRIOR PAGE): • Post’s ability to identify, complete and integrate or otherwise effectively execute acquisitions or other strategic transactions and effectively manage its growth; • risks related to the intended tax treatment of the transactions Post undertook related to divestitures of Post’s interest in BellRing Brands, Inc.; • the possibility that Post Holdings Partnering Corporation (“PHPC”), a publicly- traded special purpose acquisition company in which Post indirectly owns an interest (through PHPC Sponsor, LLC, Post’s wholly-owned subsidiary), may not consummate a suitable partnering transaction within the prescribed two-year time period, that the partnering transaction may not be successful or that the activities for PHPC could be distracting to Post’s management; • conflicting interests or the appearance of conflicting interests resulting from several of Post’s directors and officers also serving as directors or officers of one or more other companies; • Post’s ability to successfully implement business strategies to reduce costs; • impairment in the carrying value of goodwill or other intangibles; • legal and regulatory factors, such as compliance with existing laws and regulations, as well as new laws and regulations and changes to existing laws and regulations and interpretations thereof, affecting Post’s businesses, including current and future laws and regulations regarding tax matters, food safety, advertising and labeling, animal feeding and housing operations, data privacy and climate change and other environmental matters; • the loss of, a significant reduction of purchases by or the bankruptcy of a major customer; • costs, business disruptions and reputational damage associated with information technology failures, cybersecurity incidents or information security breaches; • the failure or weakening of the ready-to-eat (“RTE”) cereal category and consolidations in the retail and foodservice distribution channels; • the ultimate impact litigation or other regulatory matters may have on Post; • costs associated with the obligations of Bob Evans Farms, Inc. (“Bob Evans”) in connection with the sale and separation of its restaurants business in April 2017, including certain indemnification obligations under the restaurants sale agreement and Bob Evans’s payment and performance obligations as a guarantor for certain leases; • Post’s ability to protect its intellectual property and other assets and to continue to use third party intellectual property subject to intellectual property licenses; • the ability of Post’s and its customers’ private brand products to compete with nationally branded products; • the impact of national or international disputes, political instability, terrorism, war or armed hostilities, such as the ongoing conflict in Ukraine, including on the global economy, capital markets, Post’s supply chain, commodity, energy and freight availability and costs and information security; • risks associated with Post’s international businesses; • changes in critical accounting estimates; • losses or increased funding and expenses related to Post’s qualified pension or other postretirement plans; • significant differences in Post’s actual operating results from any of Post’s guidance regarding Post’s future performance; • Post’s and PHPC’s ability to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002; and • other risks and uncertainties described in Post’s and PHPC’s filings with the Securities and Exchange Commission. 3

Additional Information Non-GAAP Financial Measures While Post reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), Post uses Adjusted EBITDA, free cash flow and net leverage, all of which are non-GAAP measures, in this presentation. Adjusted EBITDA is a non-GAAP measure which represents earnings before interest, income taxes, depreciation, amortization and other adjustments. Free cash flow is a non-GAAP measure which represents cash flow from operating activities less capital expenditures. Net leverage is a non-GAAP measure which represents net debt divided by Adjusted EBITDA. Adjusted EBITDA, free cash flow and net leverage are not prepared in accordance with GAAP and may not be comparable to similarly titled measures of other companies. Management uses certain non-GAAP measures, including Adjusted EBITDA, free cash flow and net leverage, as key metrics in the evaluation of underlying company and segment performance, in making financial, operating and planning decisions, and, in part, in the determination of bonuses for executive officers and employees. Additionally, Post is required to comply with certain covenants and limitations that are based on variations of EBITDA in its financing documents. Management believes the use of non-GAAP measures, including Adjusted EBITDA, free cash flow and net leverage, provides increased transparency and assists investors in understanding the underlying operating performance of Post and Post’s segments and in the analysis of ongoing operating trends. Post considers Adjusted EBITDA an important supplemental measure of performance and ability to service debt. Adjusted EBITDA is often used to assess performance because it allows comparison of operating performance on a consistent basis across periods by removing the effects of various items. Adjusted EBITDA has various limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of results as reported under GAAP. In this presentation, Post provides its forecasted Adjusted EBITDA guidance for fiscal year 2023 and discloses its expectations as to the Adjusted EBITDA of the Pet Food Business, and the effect of the acquisition of the Pet Food Business on Post’s Adjusted EBITDA, free cash flow and net leverage, only on a non-GAAP basis. Post does not provide a reconciliation of Post’s forward-looking Adjusted EBITDA, free cash flow and net leverage non-GAAP measures to the most directly comparable GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for income/expense on swaps, net, gain/loss on extinguishment of debt, net, equity method investment adjustment, mark-to-market adjustments on commodity and foreign exchange hedges, warrant liabilities and equity securities, transaction and integration costs and other charges reflected in Post’s reconciliations of historical numbers, the amounts of which, based on historical experience, could be significant. 4

Additional Information (Cont’d) Prospective Financial Information The prospective financial information provided in this presentation regarding Post’s future performance, including Post’s forecasted Adjusted EBITDA for fiscal year 2023, the Pet Food Business’s forecasted Adjusted EBITDA, Post’s expected synergies and other benefits from the Pet Food Business transaction, Post’s forecasted free cash flow, Post’s pro forma net leverage and specific dollar amounts and other plans, expectations, estimates and similar statements, represents Post management’s estimates as of the date of this presentation and are qualified by, and subject to, the assumptions and the other information set forth on the slides captioned “Cautionary Statement Regarding Forward-Looking Statements.” Post’s forecasted Adjusted EBITDA guidance for fiscal year 2023, the Pet Food Business’s forecasted Adjusted EBITDA, Post’s expected synergies and other benefits from the Pet Food Business transaction, Post’s forecasted free cash flow, Post’s pro forma net leverage and the specific dollar amounts and other plans, expectations, estimates and similar statements contained in this presentation are based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond Post’s control, are based upon specific assumptions with respect to future business decisions, some of which will change, and are necessarily speculative in nature. It can be expected that some or all of the assumptions inherent in the estimates will not materialize or will vary significantly from actual results. Accordingly, the information set forth herein is only an estimate as of the date of this presentation, and actual results will vary from the estimates set forth herein. Investors also should recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put Post’s forecasted Adjusted EBITDA guidance for fiscal year 2023, the Pet Food Business’s forecasted Adjusted EBITDA, Post’s expected synergies and other benefits from the Pet Food Business transaction, Post’s forecasted free cash flow, Post’s pro forma net leverage and other prospective financial information in context and not to rely on them. Post’s forecasted Adjusted EBITDA guidance for fiscal year 2023, the Pet Food Business’s forecasted Adjusted EBITDA, Post’s forecasted free cash flow and Post’s pro forma net leverage are not prepared with a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and neither Post’s independent registered public accounting firm nor any other independent expert or outside party compiles or examines these estimates and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. Any failure to successfully implement Post’s operating strategy or the occurrence of any of the events or circumstances set forth under “Cautionary Statement Regarding Forward-Looking Statements” in this presentation could result in the actual operating results being different than the estimates set forth herein, and such differences may be adverse and material. 5

Additional Information (Cont’d) Market and Industry Data This presentation includes industry and trade association data, forecasts and information that were prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to the Company. Some data also is based on Post’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. Post has not independently verified any of the data from third party sources nor has it ascertained the underlying economic assumptions on which such data is based, and Post makes no representation or warranty regarding the accuracy, completeness or reliability of such data. Similarly, Post believes its internal research is reliable, even though such research has not been verified by any independent sources and Post cannot guarantee its accuracy or completeness. Trademarks and Service Marks The logos, trademarks, trade names and service marks mentioned in this presentation, including Post®, Post Consumer Brands®, Honey Bunches of Oats®, Pebbles®, Great Grains®, Post® Bran Flakes, Post® Shredded Wheat, Spoon Size® Shredded Wheat, Golden Crisp®, Alpha-Bits®, Ohs!®, Shreddies™, Post® Raisin Bran, Grape-Nuts®, Honeycomb®, Frosted Mini Spooners®, Golden Puffs®, Cinnamon Toasters®, Fruity Dyno-Bites®, Cocoa Dyno-Bites®, Berry Colossal Crunch®, Oreo O’s®, Chips Ahoy!®, Honeymaid®, Premier Protein®, MOM Brands™, Malt-O-Meal®, Farina™, Dyno-Bites®, Mom’s Best®, Better Oats®, CoCo Wheats®, Peter Pan®, Weetabix®, Barbara’s®, Puffins®, Alpen®, Weetos™, Ready Brek™, Weetabix On The Go™, Oatibix™, Lacka Foods™, UFIT™, Michael Foods™, Papetti’s®, Davidson’s Safest Choice®, Abbotsford Farms®, Better’n Eggs®, Henningsen Foods™, Almark Foods™, Crystal Farms®, Simply Potatoes®, Just® Egg, Diner’s Choice™, Crescent Valley®, Westfield Farms®, David’s Deli®, Bob Evans® (which is used in brands such as Bob Evans® Egg Whites), Bob Evans Farms®, Owens®, Country Creek Farm®, Pineland Farms®, Egg Beaters®, Old El Paso®, Airly® and Oat Clouds® brands, are currently the property of, or are under license by, Post or its consolidated subsidiaries. Other logos, trademarks, trade names and service marks mentioned in this presentation, including Attune™, Attune Foods™, Golden Boy®, Dakota Growers Pasta Co.®, American Blanching Company™ and Ronzoni®, are currently the property of, or are under license by, 8th Avenue Food & Provisions, Inc. (“8th Avenue”) or its subsidiaries. Post or 8th Avenue or one of their respective subsidiaries owns or has rights to use the trademarks, service marks and trade names that are used in conjunction with the operation of Post’s and 8th Avenue’s and their respective subsidiaries’ businesses. Some of the more important trademarks that Post or 8th Avenue or one of their respective subsidiaries owns or has rights to use that appear in this presentation may be registered in the U.S. and other jurisdictions. The Pet Food Business logos, trademarks, trade names and service marks mentioned in this presentation are currently the property of, or are under license by, The J.M. Smucker Co. Solely for convenience, trademarks and trade names referred to in this presentation may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable owner or licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks or trade names. Each trademark, trade name or service mark of any other company appearing in this presentation is owned or used under license by such company. 6

7 Transaction Summary • Post has agreed to acquire Rachael Ray® Nutrish®, Nature’s Recipe® and other select pet brands from The J.M. Smucker Co. for $1.2bn(1) • Key brands include Rachael Ray® Nutrish®, Nature’s Recipe®, 9Lives®, Kibbles ‘n Bits® and Gravy Train® • Purchase price of 8x synergized Adjusted EBITDA of $130mm, net of $120mm in expected tax benefits(2) • Expected closing early in the second calendar quarter of 2023, Post’s third quarter of fiscal year 2023, subject to regulatory approvals and closing conditions • Provides compelling entry point into highly attractive and growing pet food category • Leading dog and cat food brands in the mainstream and entry premium sub-categories • Pet food platform provides opportunities for future investments in the pet food category • Potential to improve margins through portfolio optimization and strategic investments in supply chain • Expected to be immediately accretive to Post’s free cash flow(2)(3) • Will expand Post Consumer Brands’s capabilities and leverage existing infrastructure • Expected synergies of approximately $30mm annually by the third full fiscal year post-closing through benefits of scale across logistics, procurement and administrative services(2) • One-time costs to achieve the synergies are estimated to be approximately $75mm(2) • Transaction is expected to be financed with cash on hand and through borrowings under Post’s existing revolving credit facility and approximately $500mm new common equity issued directly to The J.M. Smucker Co. • Approximately leverage neutral with pro forma net leverage of approximately 5.2x(2) • Efficient transaction financing provides an attractive cost of funding for the acquisition while preserving flexibility to manage our go-forward capital structure 1. On a cash-free, debt-free basis. See Post’s February 8, 2023 press release and Form 8-K for further details. 2. Please refer to “Additional Information – Non-GAAP Financial Measures” and “Additional Information – Prospective Financial Information.” 3. Excluding one-time transaction expenses.

Dedicated Facilities(2)Key Brands(1) 8 Overview of Transaction Perimeter 43% 20% 18% 11% 4% Other 4% Brand Portfolio FY22A Net Revenue: $1.4bn(3) 1. The Rachael Ray trademark is licensed; however, Nutrish is owned. 2. Two dry manufacturing plants, one hybrid wet/dry manufacturing plant and one distribution center. 3. Source: Pet Food Business Management. Total Employees(3) 4 Transaction Perimeter 1,100+

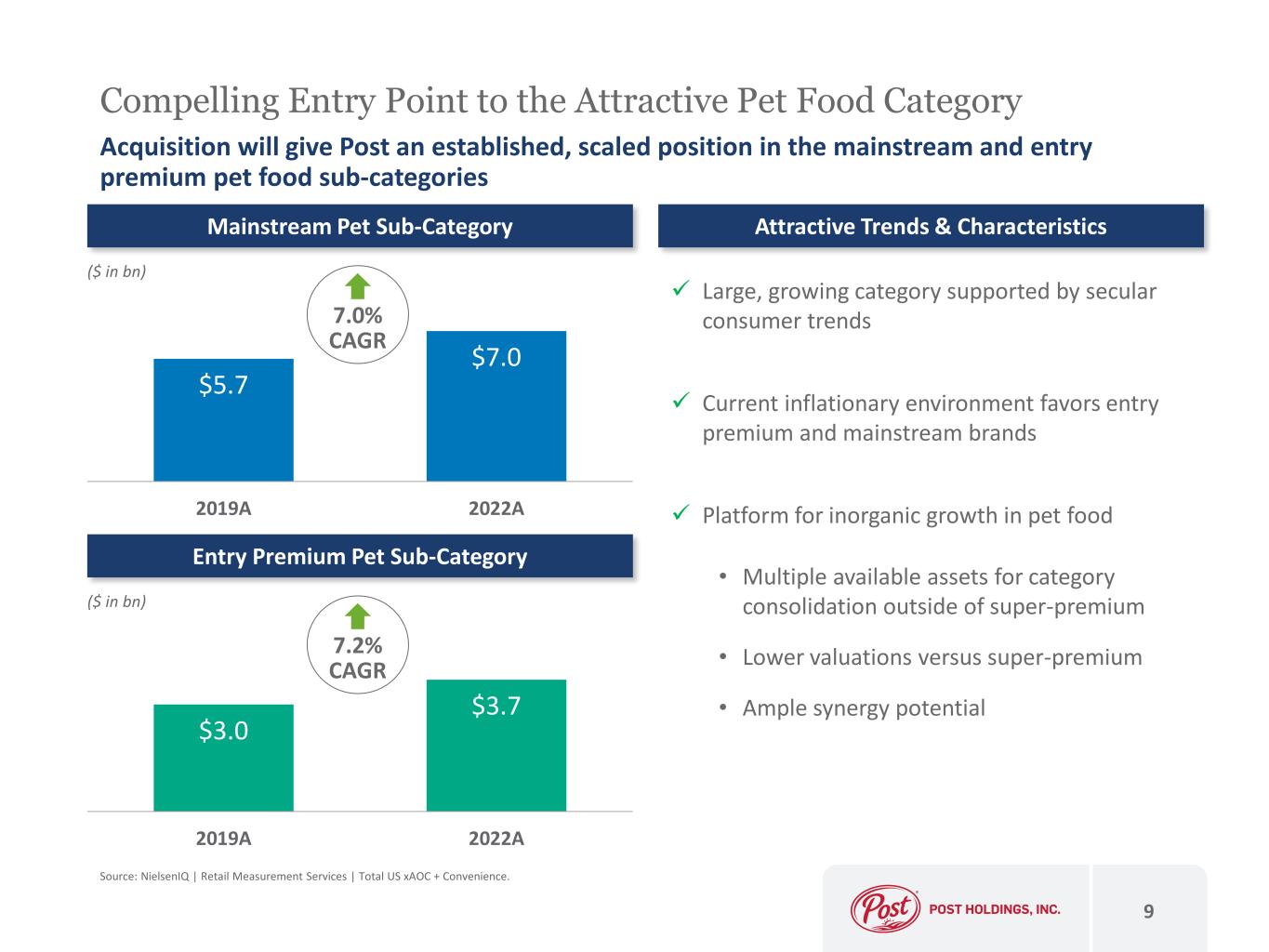

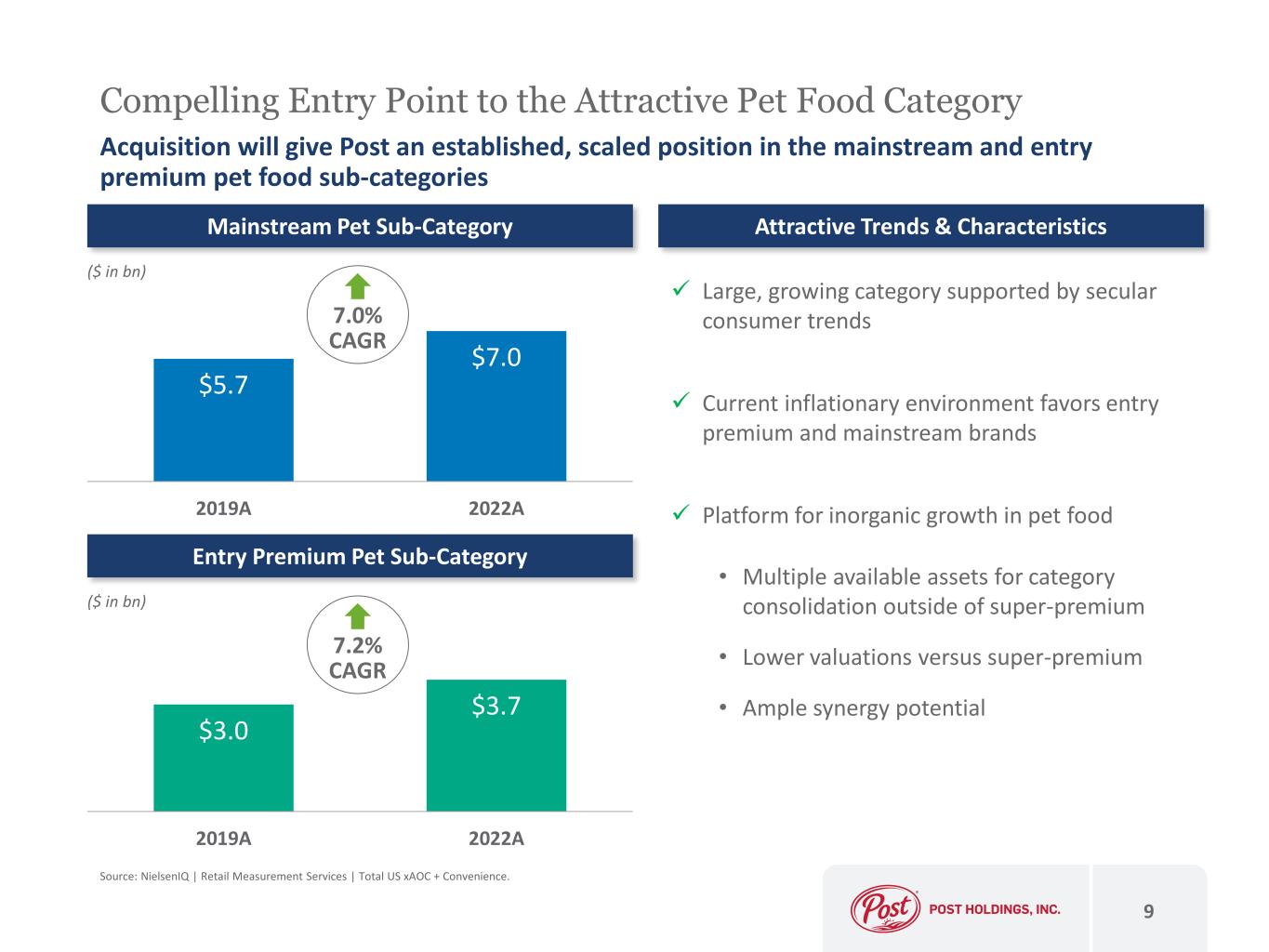

9 Compelling Entry Point to the Attractive Pet Food Category $5.7 $7.0 2019A 2022A 7.0% CAGR Source: NielsenIQ | Retail Measurement Services | Total US xAOC + Convenience. ($ in bn) Mainstream Pet Sub-Category Acquisition will give Post an established, scaled position in the mainstream and entry premium pet food sub-categories Attractive Trends & Characteristics Large, growing category supported by secular consumer trends Current inflationary environment favors entry premium and mainstream brands Platform for inorganic growth in pet food • Multiple available assets for category consolidation outside of super-premium • Lower valuations versus super-premium • Ample synergy potential $3.0 $3.7 2019A 2022A 7.2% CAGR ($ in bn) Entry Premium Pet Sub-Category

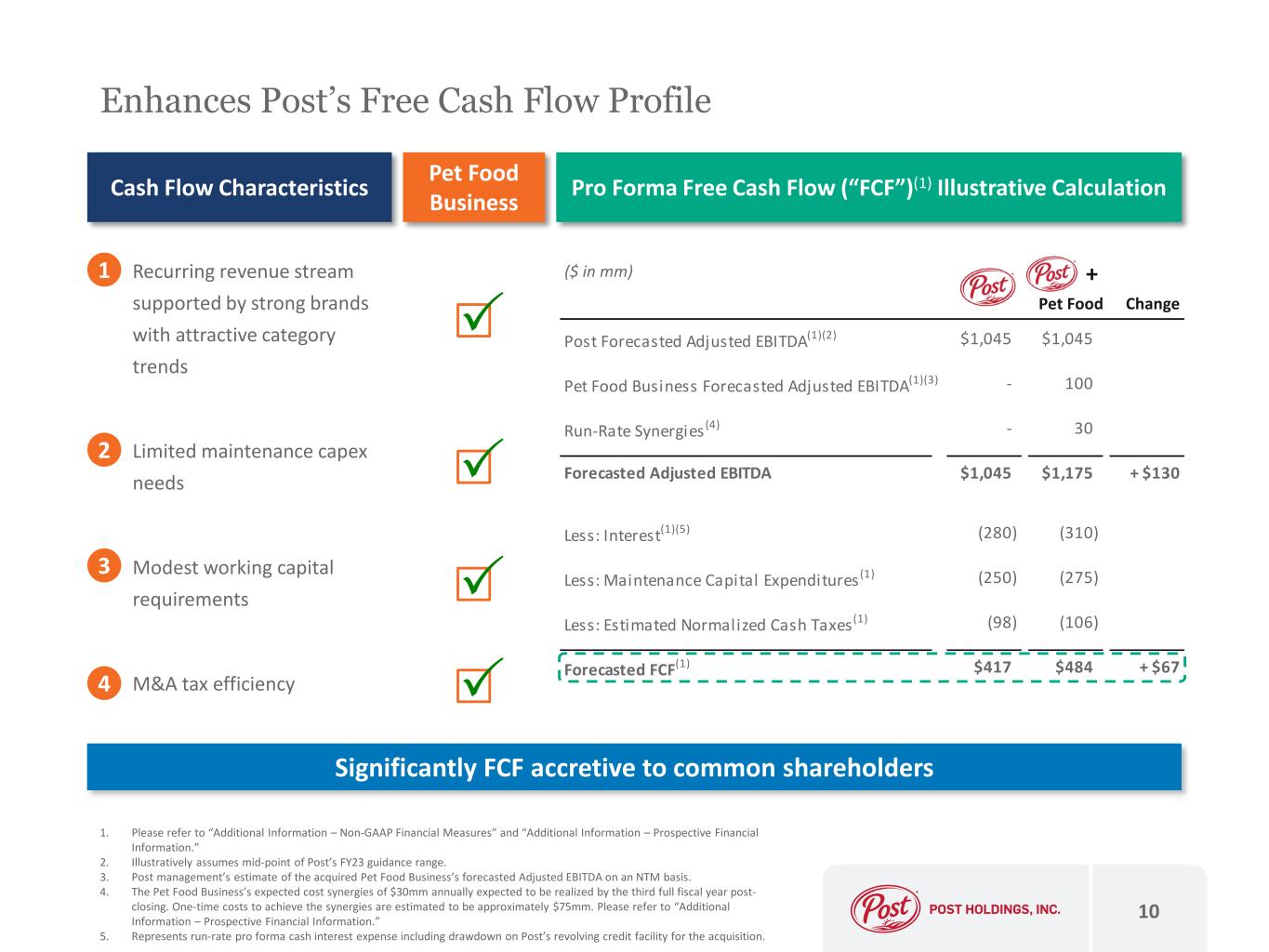

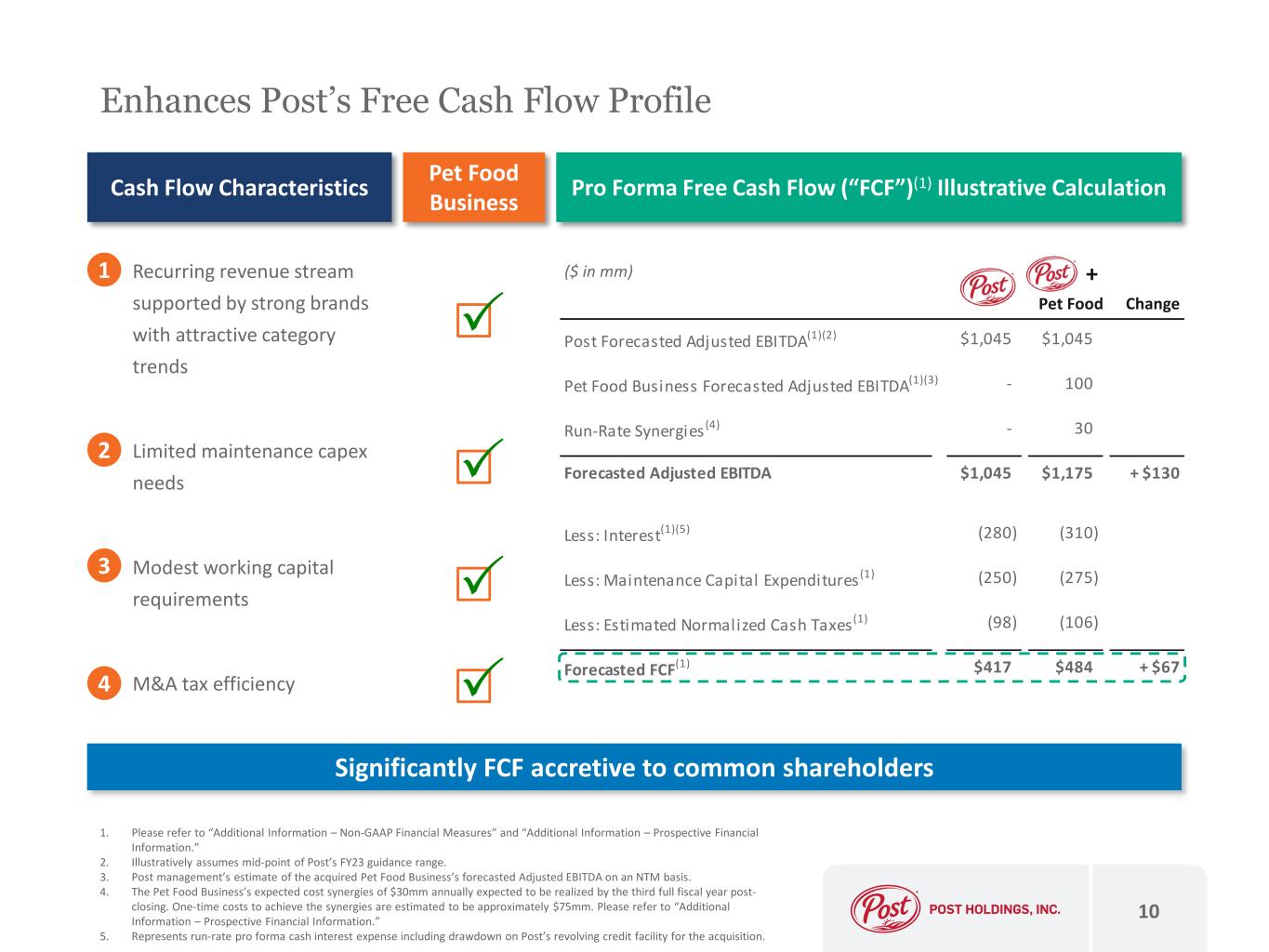

Post Forecasted Adjusted EBITDA(1)(2) $1,045 $1,045 Pet Food Business Forecasted Adjusted EBITDA(1)(3) - 100 Run-Rate Synergies(4) - 30 Forecasted Adjusted EBITDA $1,045 $1,175 + $130 Less: Interest(1)(5) (280) (310) Less: Maintenance Capital Expenditures(1) (250) (275) Less: Estimated Normalized Cash Taxes(1) (98) (106) Forecasted FCF(1) $417 $484 + $67 + Pet Food 10 Enhances Post’s Free Cash Flow Profile ($ in mm)Recurring revenue stream supported by strong brands with attractive category trends Limited maintenance capex needs Modest working capital requirements M&A tax efficiency 1 2 3 4 Cash Flow Characteristics Pet Food Business Pro Forma Free Cash Flow (“FCF”)(1) Illustrative Calculation 1. Please refer to “Additional Information – Non-GAAP Financial Measures” and “Additional Information – Prospective Financial Information.” 2. Illustratively assumes mid-point of Post’s FY23 guidance range. 3. Post management’s estimate of the acquired Pet Food Business’s forecasted Adjusted EBITDA on an NTM basis. 4. The Pet Food Business’s expected cost synergies of $30mm annually expected to be realized by the third full fiscal year post- closing. One-time costs to achieve the synergies are estimated to be approximately $75mm. Please refer to “Additional Information – Prospective Financial Information.” 5. Represents run-rate pro forma cash interest expense including drawdown on Post’s revolving credit facility for the acquisition. Change Significantly FCF accretive to common shareholders

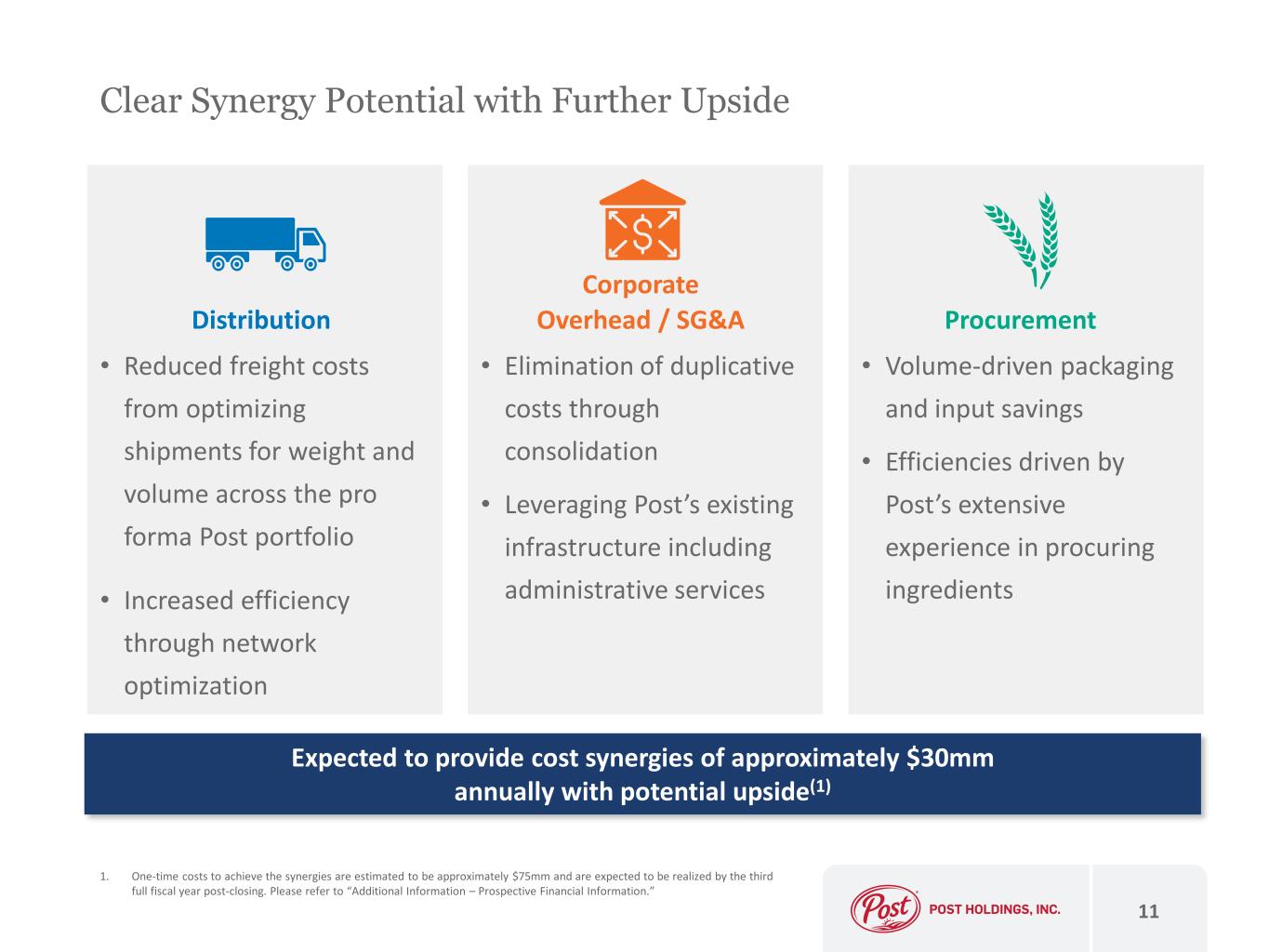

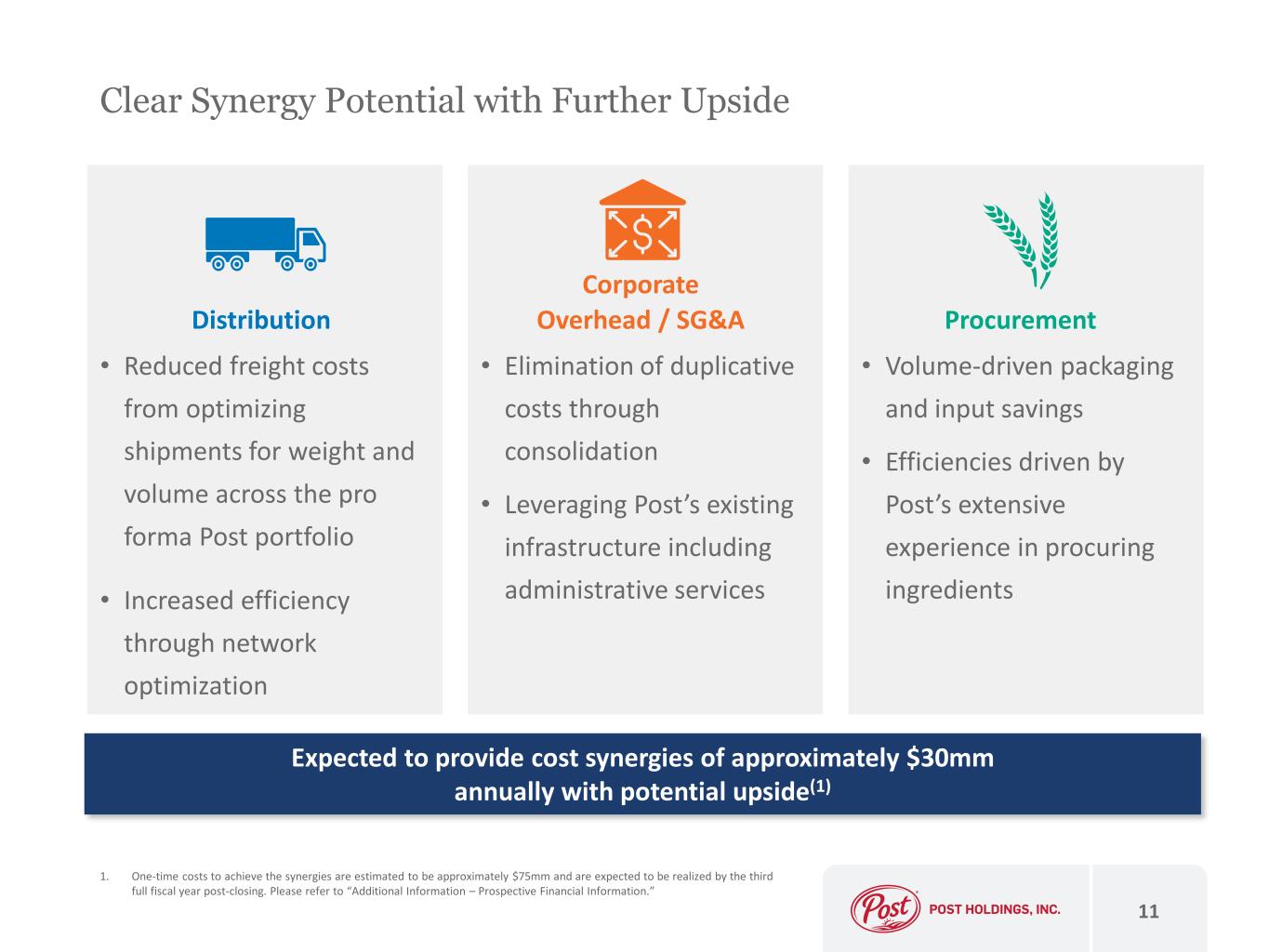

11 Clear Synergy Potential with Further Upside Expected to provide cost synergies of approximately $30mm annually with potential upside(1) 1. One-time costs to achieve the synergies are estimated to be approximately $75mm and are expected to be realized by the third full fiscal year post-closing. Please refer to “Additional Information – Prospective Financial Information.” • Reduced freight costs from optimizing shipments for weight and volume across the pro forma Post portfolio • Increased efficiency through network optimization • Elimination of duplicative costs through consolidation • Leveraging Post’s existing infrastructure including administrative services • Volume-driven packaging and input savings • Efficiencies driven by Post’s extensive experience in procuring ingredients Distribution Corporate Overhead / SG&A Procurement

2023 12 Proven History of Identifying and Executing Value-Enhancing M&A in New, Attractive Categories 2014 2015 2017 2018 2019 / 20222013 – 20142012 – 2013 Foodservice International (UK) Cereal (Value) Refrigerated Retail PetActive Nutrition Private Label New category New category New category New geography New category Opportunistic monetization New category Favorable category dynamics Consumer health mega-trend Category with secular tailwinds Expanding in value Opportunity to expand internationally High growth category Long-term growth tailwinds New segment Select Assets Opportunistic monetization

13 Continues M&A Strategy Focused on Constructing Scaled Platforms WEETABIX Primarily United Kingdom RTE cereal, muesli and protein-based ready-to-drink shakes Primarily egg and potato products FOODSERVICEPOST CONSUMER BRANDS North American RTE cereal and Peter Pan nut butters REFRIGERATED RETAIL Primarily side dish, egg, cheese and sausage products Nut butters, healthy snacks (granola and dried fruit and nuts) and pasta (1) To be acquired from The J.M. Smucker Co. Dry and wet food and treat products for dogs and cats Acquisition will expand Post Consumer Brands’s existing capabilities and leverage existing infrastructure 1. A business separately capitalized by Post and third parties in which Post owns 60.5%, and third parties and members of the 8th Avenue management team collectively own 39.5%, of the common equity of 8th Avenue. Post’s retained ownership interest in 8th Avenue’s common stock is accounted for using equity method accounting. Food Service Private Label RTE Cereal

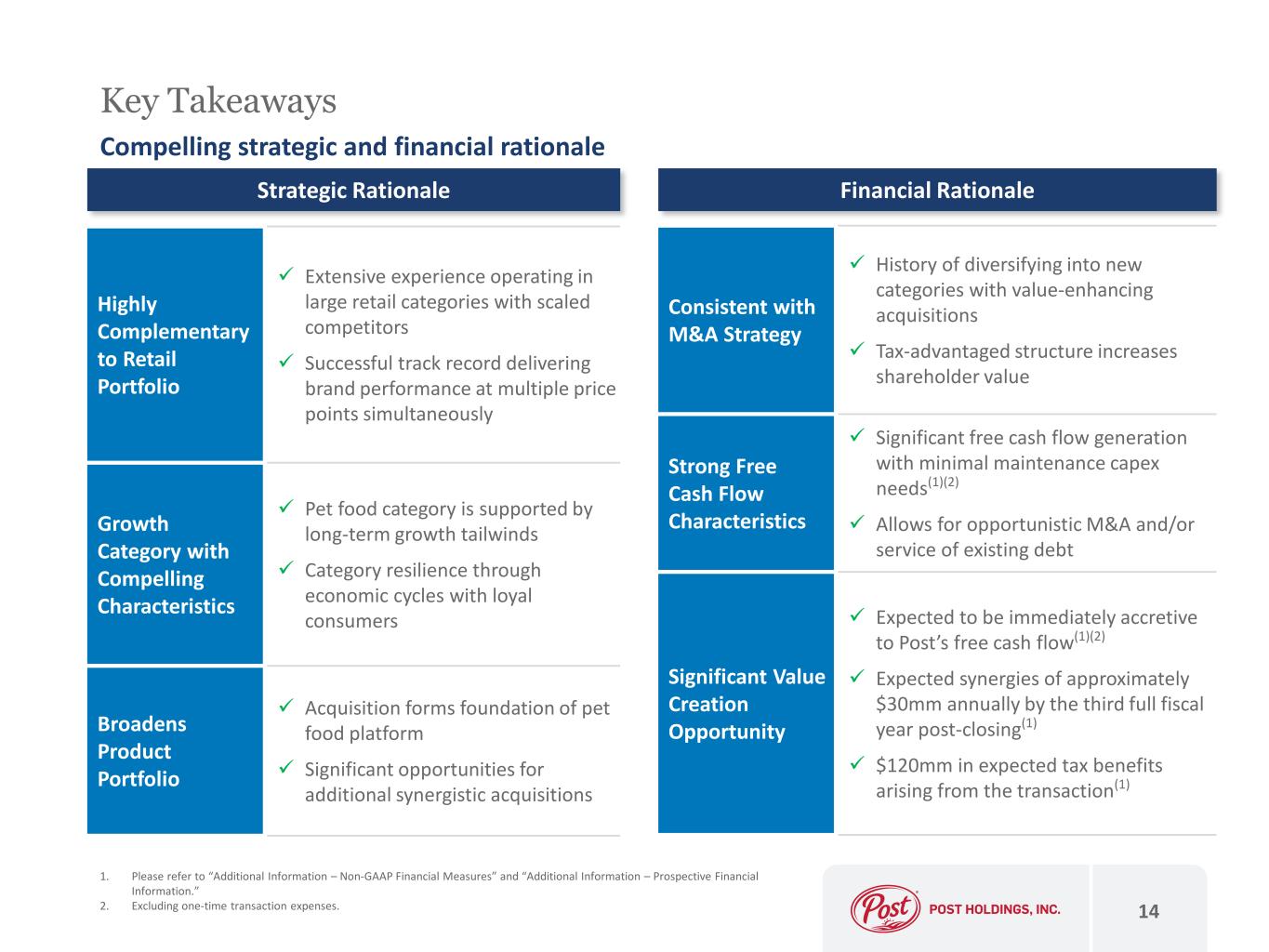

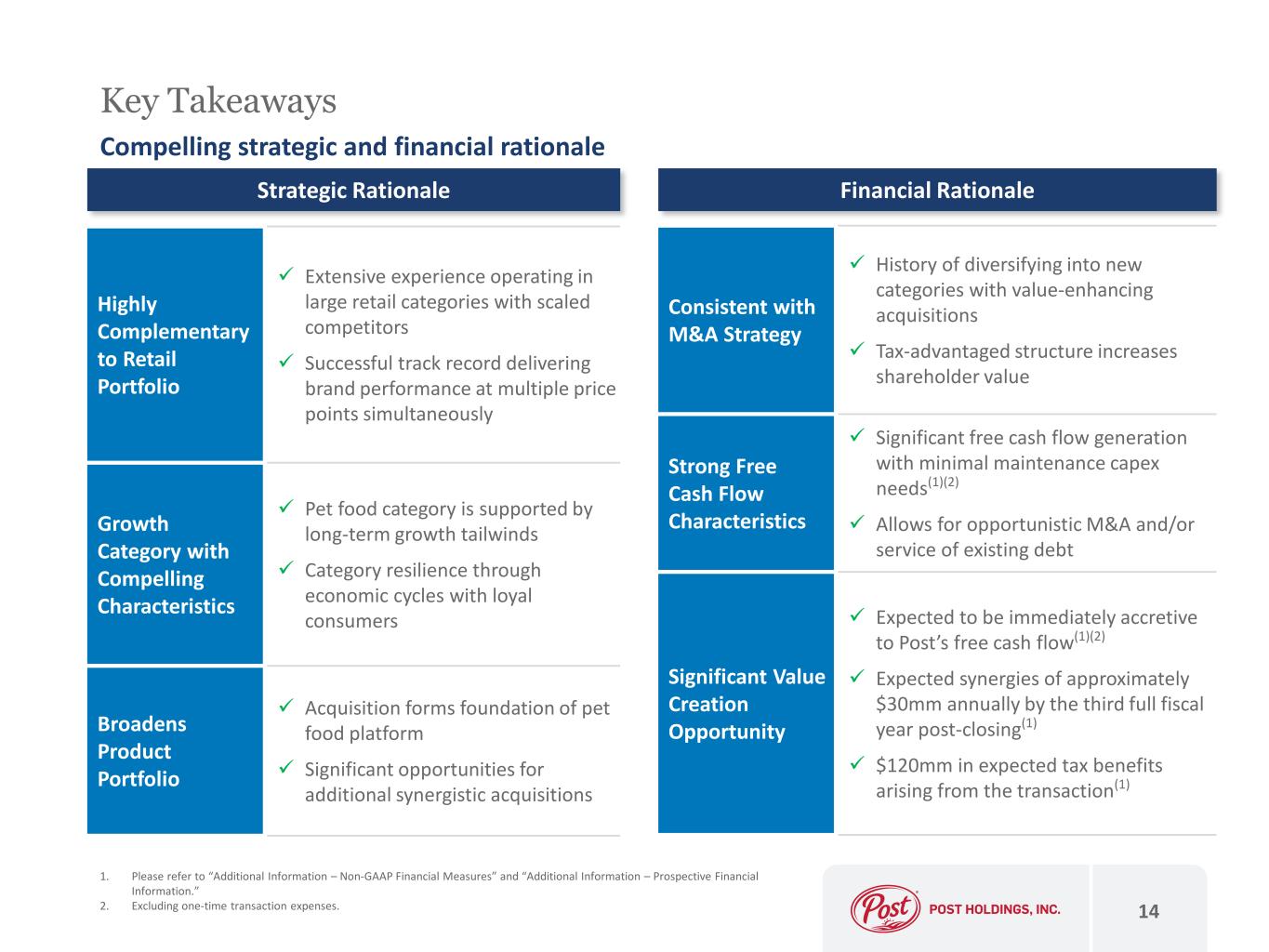

14 Key Takeaways Highly Complementary to Retail Portfolio Extensive experience operating in large retail categories with scaled competitors Successful track record delivering brand performance at multiple price points simultaneously Growth Category with Compelling Characteristics Pet food category is supported by long-term growth tailwinds Category resilience through economic cycles with loyal consumers Broadens Product Portfolio Acquisition forms foundation of pet food platform Significant opportunities for additional synergistic acquisitions 1. Please refer to “Additional Information – Non-GAAP Financial Measures” and “Additional Information – Prospective Financial Information.” 2. Excluding one-time transaction expenses. Strategic Rationale Financial Rationale Consistent with M&A Strategy History of diversifying into new categories with value-enhancing acquisitions Tax-advantaged structure increases shareholder value Strong Free Cash Flow Characteristics Significant free cash flow generation with minimal maintenance capex needs(1)(2) Allows for opportunistic M&A and/or service of existing debt Significant Value Creation Opportunity Expected to be immediately accretive to Post’s free cash flow(1)(2) Expected synergies of approximately $30mm annually by the third full fiscal year post-closing(1) $120mm in expected tax benefits arising from the transaction(1) Compelling strategic and financial rationale