Cindy LimFlow Patient Inari Medical Investor Update November 2023 Exhibit 99.2

This presentation (together with any other statements or information that we may make in connection therewith) may contain are forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including anticipated closing of the LimFlow Acquisition (as defined below), potential strategic benefits of the LimFlow Acquisition, and potential operating performance of LimFlow (as defined below); total addressable market, future results of operations, financial position, research and development costs, capital requirements and our needs for additional financing; our business model and strategic plans for our products, technologies and business, including our implementation thereof; competitive companies and technologies and our industry; the impact on our business, financial condition and results of operation from the ongoing and global COVID-19 pandemic, or any other pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide; our ability to commercialize, manage and grow our business by expanding our sales and marketing organization and increasing our sales to existing and new customers; third-party payor reimbursement and coverage decisions; commercial success and market acceptance of our products; our ability to accurately forecast customer demand for our products and manage our inventory; our ability to establish and maintain intellectual property protection for our products or avoid claims of infringement; FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the United States; the timing or likelihood of regulatory filings and approvals; our ability to hire and retain key personnel; our ability to obtain additional financing; and our expectations about market trends. Without limiting the foregoing, the words “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. On October 31, 2023, Lombardi Sub, LLC, an indirect wholly-owned subsidiary of Inari Medical ("Inari Medical Sub"), recently entered into a definitive agreement (the "Purchase Agreement") to acquire LimFlow S.A. ("LimFlow"), a privately held medical device company focused on limb salvage for patients with chronic limb-threatening ischemia (the "LimFlow Acquisition"). Under the terms of the Purchase Agreement, we will pay $250 million in cash at closing and LimFlow will be eligible to receive additional payments based on certain reimbursement and commercial milestones for aggregate potential consideration of up to $165 million. The LimFlow Acquisition is expected to close in Q4 2023 and is subject to certain customary closing conditions set forth in the Purchase Agreement. There is no financing condition for the LimFlow Acquisition. The Purchase Agreement may be terminated and the LimFlow Acquisition abandoned at any time prior to the closing thereof by the mutual written consent of Inari Medical Sub and LimFlow's seller representative and in certain other circumstances, including if closing has not occurred on or prior to January 31, 2024. Forward-looking statements are based on and reflect management’s current expectations, assumptions, estimates and projections that may or may not prove to be correct. These forward-looking statements are subject to a number of known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond our control. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement, which may be due to a number of factors, including: if we fail to complete the LimFlow Acquisition; if we fail to successfully integrate the business and operations or effect the commercial launch of LimFlow's product in the expected timeframe or at all; if we continue to incur, substantial expenses related to the LimFlow Acquisition and the related integration of the LimFlow Acquisition, if consummated; if we underestimated certain liabilities of LimFlow or failed to discover certain liabilities in the course of performing our due diligence investigation of LimFlow; if, as a private company, LimFlow may not have in place an adequate system of internal control over financial reporting that we will need to manage that business effectively as part of a public company; and if we write-off certain intangible assets, such as goodwill. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this presentation may not occur and our actual results, results, levels of activity, performance or achievements could differ materially and adversely from those anticipated or implied by any forward-looking statements. These and other known risks, uncertainties and factors are described in detail under the caption “Risk Factors” and elsewhere in our filings with the Securities and Exchange Commission (“SEC”), including our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. These filings are available in the Investor Relations section of our website at https://ir.inarimedical.com/ or at www.sec.gov. The forward-looking statements in this presentation are made only as of the date hereof. Except to the extent required by law, we assume no obligation and do not intend to update any of these forward-looking statements after the date of this presentation or to conform these statements to actual results or revised expectations. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these forward-looking statements. This presentation is not an offer to sell securities of Inari Medical and it is not soliciting offers to buy securities of Inari Medical nor will there be any sales of securities of Inari Medical in any state or jurisdiction where the offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Disclaimer

Today’s Announcements 1 2 Our markets and business continue to demonstrate strong growth Continues our mission of offering differentiated solutions for large, underpenetrated markets with a significant unmet need Announced Strong Third Quarter Financial Results Announced Acquisition of LimFlow, a Company Focused on Limb Salvage for Patients Suffering from CLTI Key Takeaway

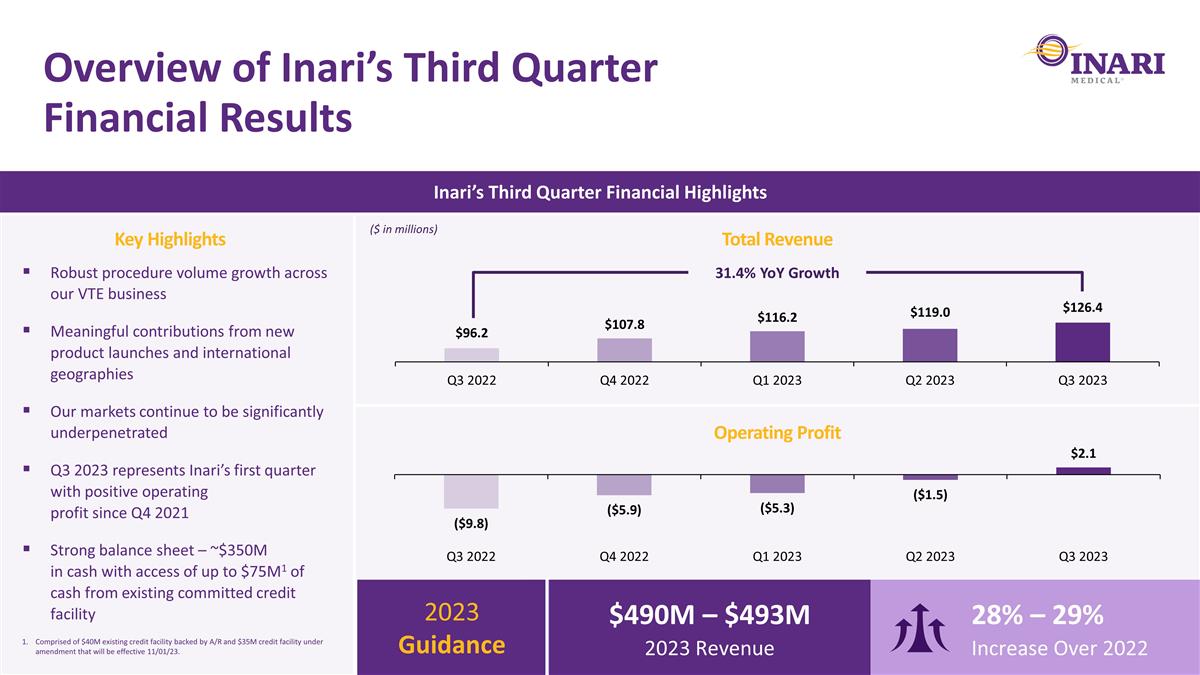

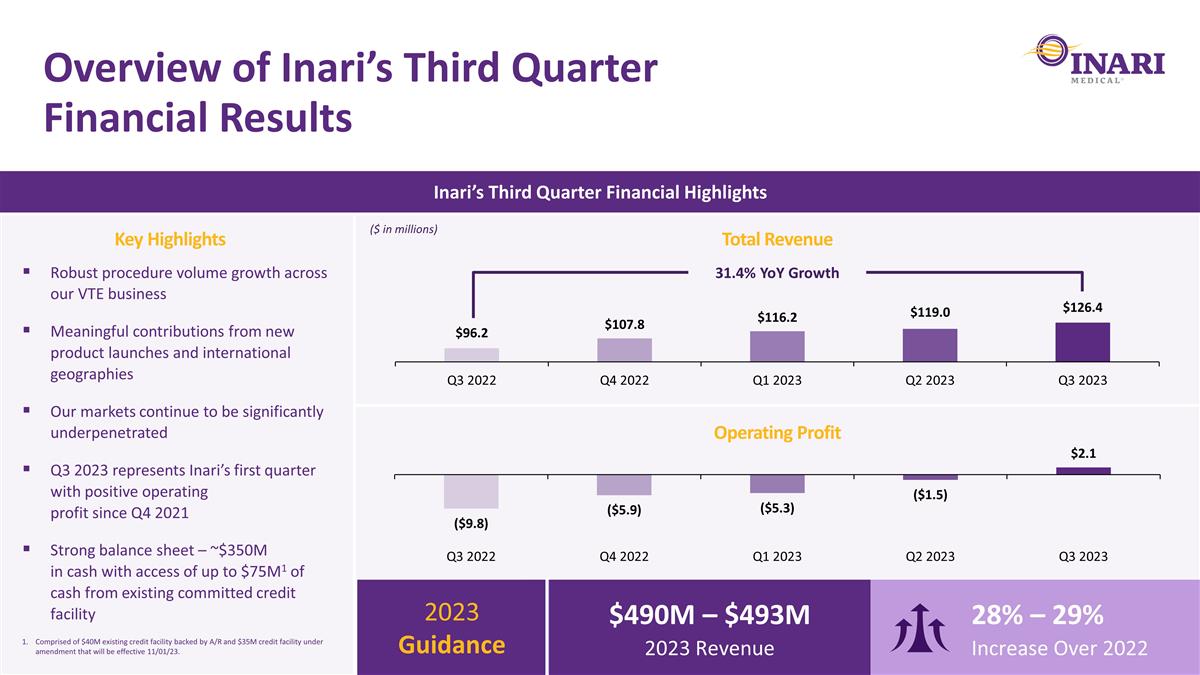

Overview of Inari’s Third Quarter Financial Results Inari’s Third Quarter Financial Highlights Key Highlights $490M – $493M 2023 Revenue 28% – 29% Increase Over 2022 2023 Guidance Robust procedure volume growth across our VTE business Meaningful contributions from new product launches and international geographies Our markets continue to be significantly underpenetrated Q3 2023 represents Inari’s first quarter with positive operating profit since Q4 2021 Strong balance sheet – ~$350M in cash with access of up to $75M1 of cash from existing committed credit facility Total Revenue ($ in millions) 31.4% YoY Growth Operating Profit Comprised of $40M existing credit facility backed by A/R and $35M credit facility under amendment that will be effective 11/01/23.

cx Strongly Aligns with Our Core Mission Expands TAM and Enhances Long-Term Financial Profile Leverages Our Core Competencies Separate But Complementary Commercial Activities Serves patients first Addresses major unmet clinical needs No incrementalism Adds an attractive ~$1.5B initial US TAM with upside Immediate strategic adjacency with first mover advantage Diversifies revenue base and accelerates growth profile Leverages our expertise building a best-in-class VTE business Commercialize game-changing technology Generate clinical evidence Build patient pathways and programs Refine novel technology procedure Focused CLTI sales team, independent of VTE sales team Narrow and deep commercial strategy focuses on high volume CLTI sites Highly complementary with CVD market development initiatives Compelling Strategic Rationale Underpinning Our Acquisition of LimFlow

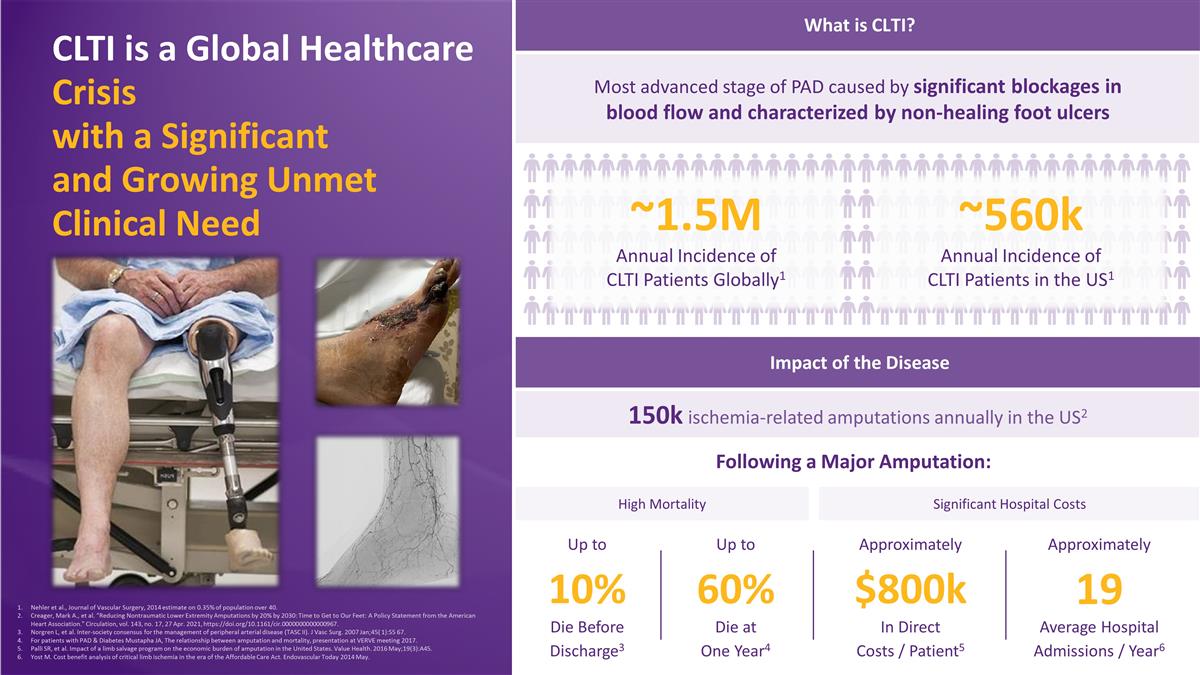

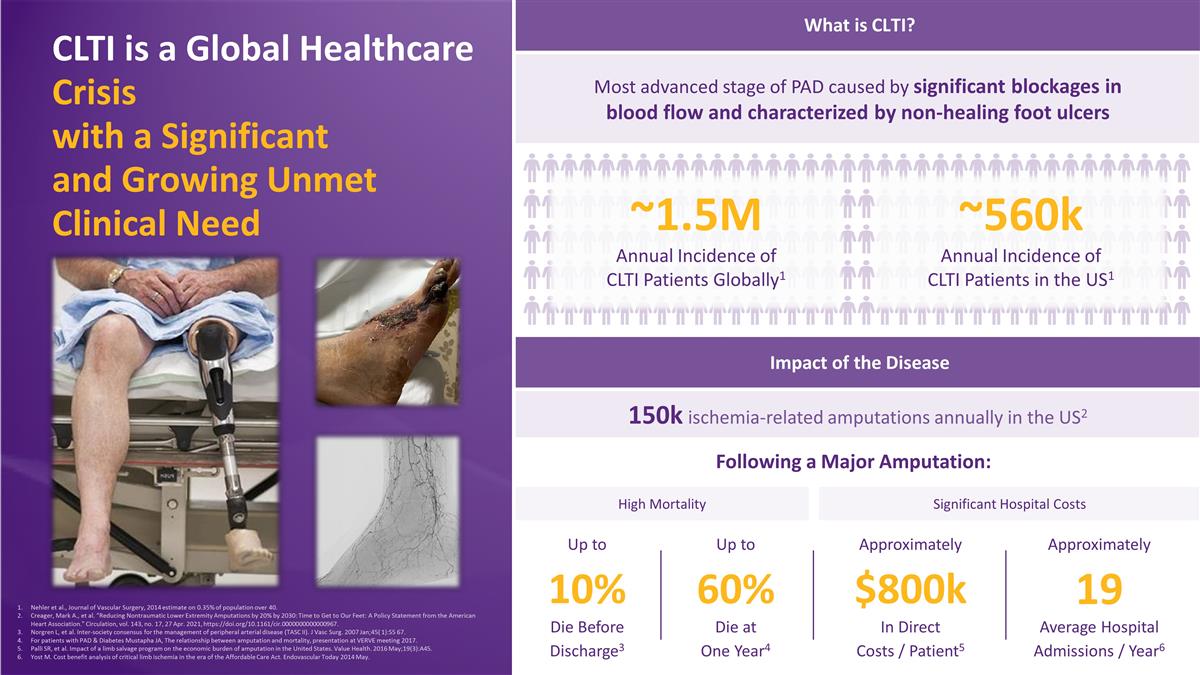

What is CLTI? 150k ischemia-related amputations annually in the US2 Following a Major Amputation: Impact of the Disease CLTI is a Global Healthcare Crisis with a Significant and Growing Unmet Clinical Need 10% Die Before Discharge3 Up to 60% Die at One Year4 Up to $800k In Direct Costs / Patient5 Approximately 19 Average Hospital Admissions / Year6 Approximately Most advanced stage of PAD caused by significant blockages in blood flow and characterized by non-healing foot ulcers High Mortality Significant Hospital Costs ~1.5M Annual Incidence of CLTI Patients Globally1 ~560k Annual Incidence of CLTI Patients in the US1 Nehler et al., Journal of Vascular Surgery, 2014 estimate on 0.35% of population over 40. Creager, Mark A., et al. “Reducing Nontraumatic Lower Extremity Amputations by 20% by 2030: Time to Get to Our Feet: A Policy Statement from the American Heart Association.” Circulation, vol. 143, no. 17, 27 Apr. 2021, https://doi.org/10.1161/cir.0000000000000967. Norgren L, et al. Inter-society consensus for the management of peripheral arterial disease (TASC II). J Vasc Surg. 2007 Jan;45( 1):S5 67. For patients with PAD & Diabetes Mustapha JA, The relationship between amputation and mortality, presentation at VERVE meeting 2017. Palli SR, et al. Impact of a limb salvage program on the economic burden of amputation in the United States. Value Health. 2016 May;19(3):A45. Yost M. Cost benefit analysis of critical limb ischemia in the era of the Affordable Care Act. Endovascular Today 2014 May.

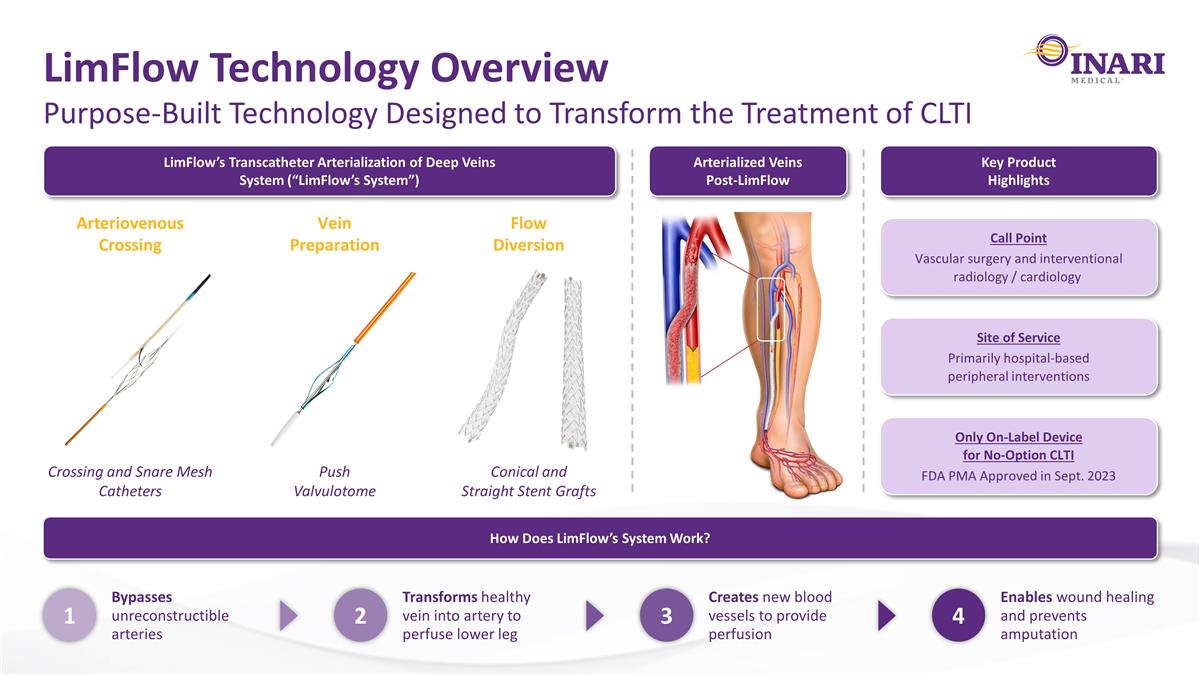

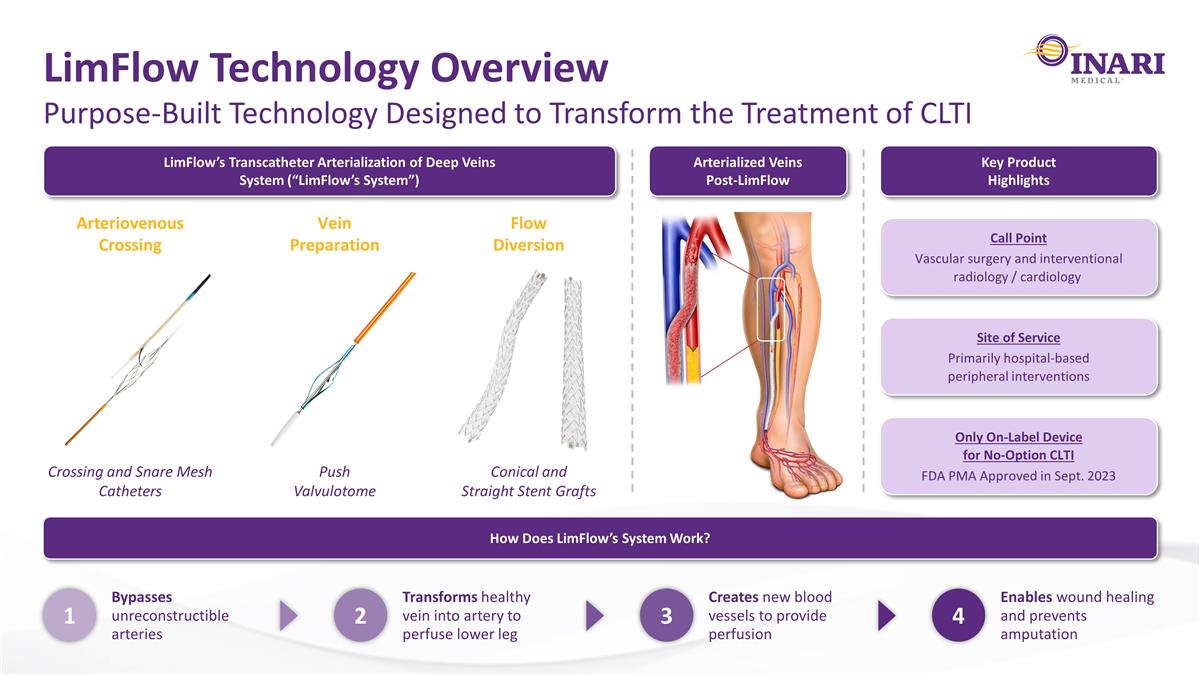

Purpose-Built Technology Designed to Transform the Treatment of CLTI LimFlow Technology Overview LimFlow’s Transcatheter Arterialization of Deep Veins System (“LimFlow’s System”) How Does LimFlow’s System Work? 1 Bypasses unreconstructible arteries 2 Transforms healthy vein into artery to perfuse lower leg 3 Creates new blood vessels to provide perfusion 4 Enables wound healing and prevents amputation Key Product Highlights Arteriovenous Crossing Crossing and Snare Mesh Catheters Vein Preparation Push Valvulotome Flow Diversion Conical and Straight Stent Grafts Call Point Vascular surgery and interventional radiology / cardiology Site of Service Primarily hospital-based peripheral interventions Only On-Label Device for No-Option CLTI FDA PMA Approved in Sept. 2023 Arterialized Veins Post-LimFlow

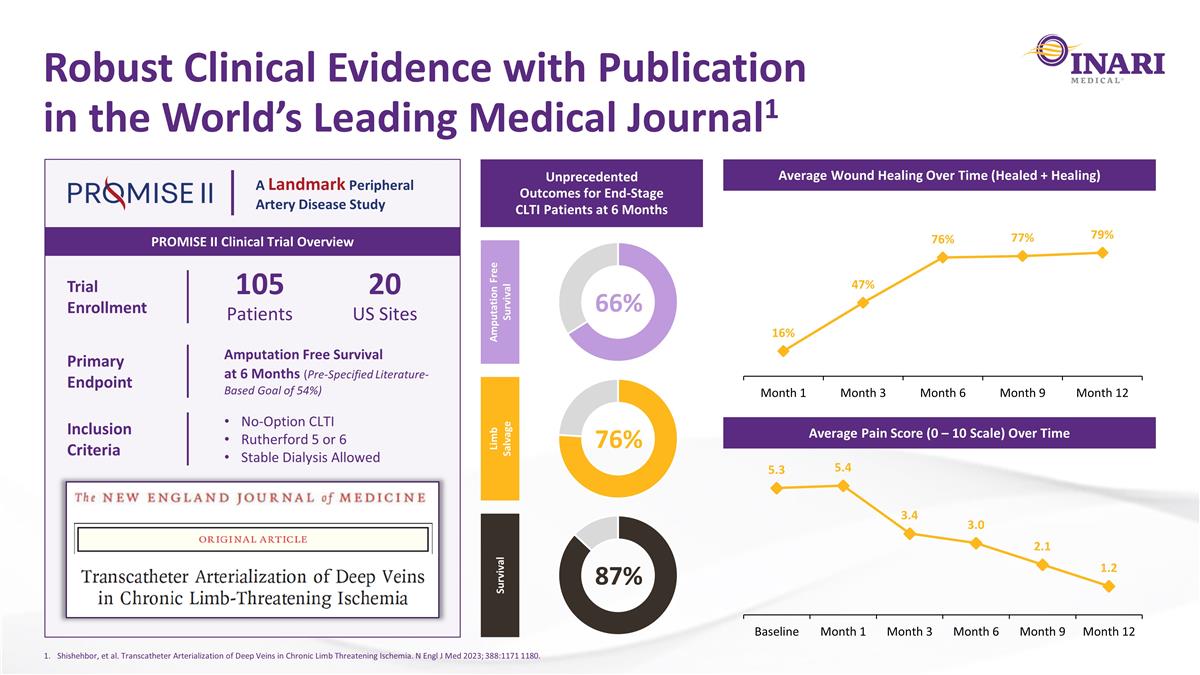

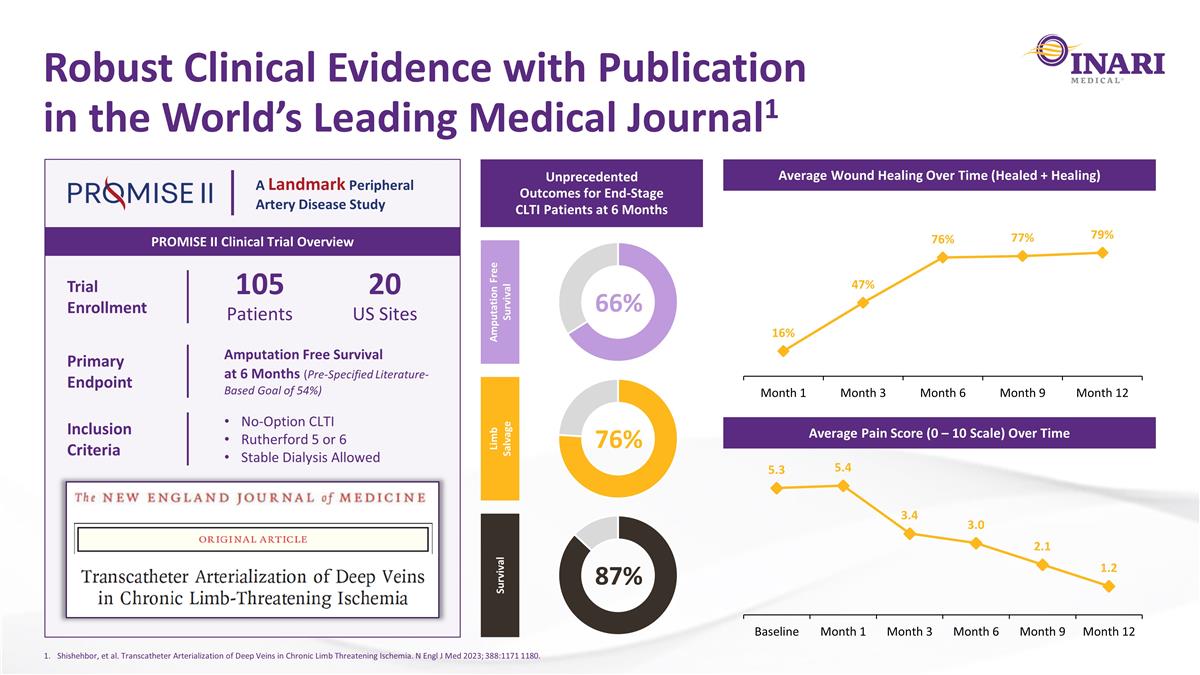

Robust Clinical Evidence with Publication in the World’s Leading Medical Journal1 PROMISE II Clinical Trial Overview A Landmark Peripheral Artery Disease Study Trial Enrollment 105 Patients 20 US Sites Primary Endpoint Amputation Free Survival at 6 Months (Pre-Specified Literature-Based Goal of 54%) Inclusion Criteria No-Option CLTI Rutherford 5 or 6 Stable Dialysis Allowed Unprecedented Outcomes for End-Stage CLTI Patients at 6 Months Average Wound Healing Over Time (Healed + Healing) Average Pain Score (0 – 10 Scale) Over Time Amputation Free Survival Limb Salvage Survival 66% 76% 87% Shishehbor, et al. Transcatheter Arterialization of Deep Veins in Chronic Limb Threatening Ischemia. N Engl J Med 2023; 388:1171 1180.

Large Addressable Market with Potential for Meaningful Expansion Nehler et al., Journal of Vascular Surgery, 2014 estimate on 0.35% of population over 40. Management estimate for serviceable number of R5 and R6 patients based on epidemiology literature, independent market research and recent publications. R5 and R6 classifications represent Rutherford’s classification for chronic limb ischemia. R5 defined as minor tissue loss (nonhealing ulcer, focal gangrene with diffuse pedal ischemia). R6 defined as major tissue loss (extending above tarsometatarsal level, functional foot no longer salvageable). Mustapha, Jihad A., et al. “Determinants of Long‐Term Outcomes and Costs in the Management of Critical Limb Ischemia: A Population‐Based Cohort Study.” Journal of the American Heart Association, vol. 7, no. 16, 21 Aug. 2018, https://doi.org/10.1161/jaha.118.009724. Azuma N. The Diagnostic Classification of Critical Limb Ischemia. Ann Vasc Dis. 2018 Dec 25;11(4):449-457. doi: 10.3400/avd.ra.18-00122. PMID: 30636998; PMCID: PMC6326054. Keyuree Satam, Edouard Aboian, Joshua Huttler, Haoran Zhuo, Yawei Zhang, Britt Tonnessen, Jonathan Cardella, Raul J. Guzman, Cassius Iyad Ochoa Chaar, Eligibility of Patients with Chronic Limb Threatening Ischemia for Deep Venous Arterialization, Annals of Vascular Surgery, Volume 86, 2022, Pages 260-267, ISSN 0890-5096, https://doi.org/10.1016/j.avsg.2022.04.051. Management estimate based on assumption for % of serviceable R5 and R6 patients with bilateral disease. Highly Concentrated Customer Base With Significant Overlap Between Our Existing Accounts And Top US High Volume CLTI Accounts Path to Expanding LimFlow’s Global TAM to $4B+ Actionable Opportunities to Significantly Expand LimFlow’s Global TAM LimFlow’s Immediate US Market Opportunity ~560k Annual Incidence of CLTI Patients in the US1 Patients ~55k CLTI Patients with No Option Other Than Amputation in the US2 Patients ~70k Immediately Addressable Limbs in the US3 Limbs ~$1.5B LimFlow’s Immediate Addressable Market in the US OUS Commercialization of LimFlow’s System ~$2.0B Expansion to Less Severe CLTI Patients in the US ~$0.5B

Highly innovative, purpose-built, full toolkit system designed specifically to treat no-option CLTI patients On the cusp of US launch (sales reps hired, fully trained and beginning to sell) with ability to efficiently drive adoption (high procedure volume concentration among top accounts) Strong base of clinical evidence across multiple trials, including a recent publication in the world’s leading medical journal (New England Journal of Medicine) LimFlow is a Highly Attractive Asset in a Market with High Barriers to Entry that is Poised to Change the Game in CLTI Before “Desert Foot” After Flow Restored A key addition for all limb salvage / CLTI centers of excellence to potentially differentiate and grow their programs ~$1.5B annual TAM in the US, with significant unmet clinical need and potential for expansion Key elements of reimbursement in place with established path to enhanced payment Fully PMA approved product and is the only on-label device for no-option CLTI

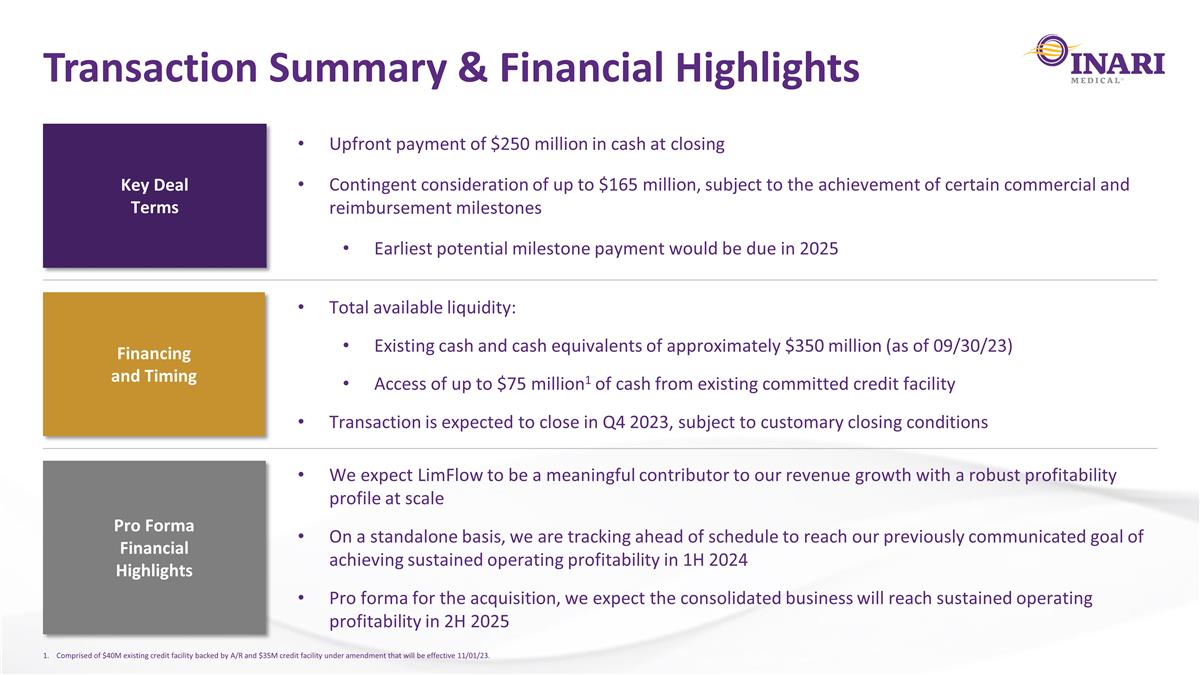

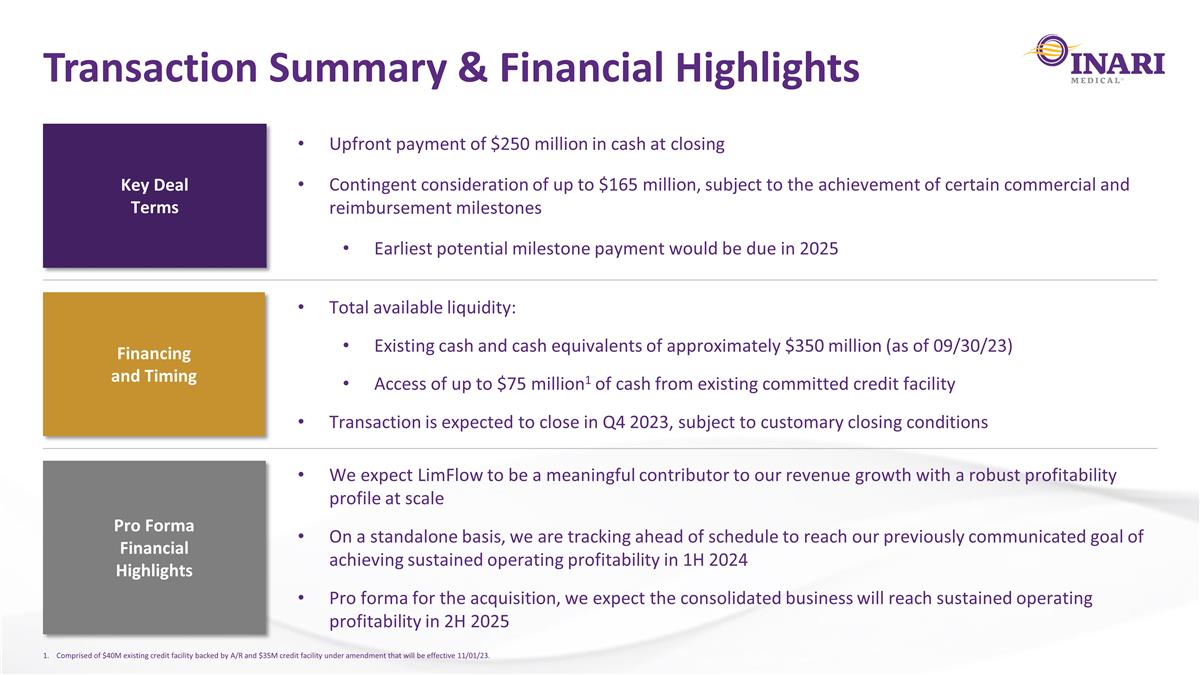

Transaction Summary & Financial Highlights Key Deal Terms Upfront payment of $250 million in cash at closing Contingent consideration of up to $165 million, subject to the achievement of certain commercial and reimbursement milestones Earliest potential milestone payment would be due in 2025 Financing and Timing Total available liquidity: Existing cash and cash equivalents of approximately $350 million (as of 09/30/23) Access of up to $75 million1 of cash from existing committed credit facility Transaction is expected to close in Q4 2023, subject to customary closing conditions Pro Forma Financial Highlights We expect LimFlow to be a meaningful contributor to our revenue growth with a robust profitability profile at scale On a standalone basis, we are tracking ahead of schedule to reach our previously communicated goal of achieving sustained operating profitability in 1H 2024 Pro forma for the acquisition, we expect the consolidated business will reach sustained operating profitability in 2H 2025 Comprised of $40M existing credit facility backed by A/R and $35M credit facility under amendment that will be effective 11/01/23.

9 Appendix

Acronym Guide CLTI: Chronic Limb-Threatening Ischemia CVD: Chronic Venous Disease PAD: Peripheral Artery Disease VTE: Venous Thromboembolism