- NARI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-C Filing

Inari Medical (NARI) SC TO-CInformation about tender offer

Filed: 6 Jan 25, 8:47pm

Copyright © 2025 Stryker

This presentation contains information that includes or is based on forward-looking statements within the meaning of the federal securities law that are subject to various risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such statements, including statements regarding the anticipated benefits to Stryker of the acquisition of Inari, the anticipated timeline to closing the transaction, Inari’s revenue and revenue growth guidance and the estimated size and projected growth of addressable markets. Such risks and uncertainties include, but are not limited to: uncertainties as to the timing of the offer and the subsequent merger; uncertainties as to how many of Inari’s stockholders will tender their shares in the offer; the failure to satisfy any of the closing conditions to the acquisition of Inari, including the expiration or termination of the Hart-Scott-Rodino Antitrust Improvements Act waiting period (and the risk that such governmental approval may result in the imposition of conditions that could adversely affect the expected benefits of the transaction); delays in consummating the acquisition of Inari or the risk that the transaction may not close at all; unexpected liabilities, costs, charges or expenses in connection with the acquisition of Inari; the effects of the proposed Inari transaction (or the announcement thereof) on the parties’ relationships with employees, customers, other business partners or governmental entities; weakening of economic conditions, or the anticipation thereof, that could adversely affect the level of demand for our products; geopolitical risks, including from international conflicts and elections in the United States and other countries, which could, among other things, lead to increased market volatility; pricing pressures generally, including cost-containment measures that could adversely affect the price of or demand for our products; changes in foreign currency exchange markets; legislative and regulatory actions; unanticipated issues arising in connection with clinical studies and otherwise that affect approval of new products, including Inari products, by the United States Food and Drug Administration and foreign regulatory agencies; inflationary pressures; increased interest rates or interest rate volatility; supply chain disruptions; changes in labor markets; changes in reimbursement levels from third-party payors; a significant increase in product liability claims; the ultimate total cost with respect to recall-related and other regulatory and quality matters; the impact of investigative and legal proceedings and compliance risks; resolution of tax audits; changes in tax laws and regulations; the impact of legislation to reform the healthcare system in the United States or other countries; costs to comply with medical device regulations; changes in financial markets; changes in our credit ratings; changes in the competitive environment; our ability to integrate and realize the anticipated benefits of acquisitions in full or at all or within the expected timeframes, including the acquisition of Inari; our ability to realize anticipated cost savings; potential negative impacts resulting from climate change or other environmental, social and governance and sustainability related matters; the impact on our operations and financial results of any public health emergency and any related policies and actions by governments or other third parties; and breaches or failures of our or our vendors' or customers' information technology systems or products, including by cyber-attack, data leakage, unauthorized access or theft. Additional information concerning these and other factors is contained in our filings with the U.S. Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The foregoing factors should also be read in conjunction with the risks and cautionary statements discussed or identified in Inari’s filings with the SEC, including Inari’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The parties disclaim any intention or obligation to publicly update or revise any forward-looking statement to reflect any change in expectations or in events, conditions or circumstances on which those expectations may be based, or that affect the likelihood that actual results will differ from those contained in the forward-looking statements, except to the extent required by law. Copyright © 2025 Stryker

The tender offer for the outstanding shares of common stock of Inari referenced in this communication has not yet commenced. This communication is for informational purposes only, is not a recommendation and is neither an offer to purchase nor a solicitation of an offer to sell shares of common stock of Inari or any other securities. At the time the tender offer is commenced, Stryker will file with the “SEC” a Tender Offer Statement on Schedule TO, and Inari will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9. INARI STOCKHOLDERS ARE URGED TO READ THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND THE OTHER TENDER OFFER DOCUMENTS), AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS MAY BE AMENDED FROM TIME TO TIME, WHEN SUCH DOCUMENTS BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Inari stockholders and other investors can obtain the Tender Offer Statement, the Solicitation/Recommendation Statement and other filed documents for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Stryker will be available free of charge on Stryker’s website, www.stryker.com, or by contacting Stryker’s Investor Relations department at jason.beach@stryker.com. Copies of the documents filed with the SEC by Inari will be available free of charge on Inari’s website, https://ir.inarimedical.com, or by contacting Inari Investor Relations at IR@inarimedical.com. In addition, Inari stockholders may obtain free copies of the tender offer materials by contacting the information agent for the tender offer that will be named in the Tender Offer Statement. Copyright © 2025 Stryker

Stryker has entered into a definitive agreement to acquire Inari Medical, Inc. in a transaction that values the equity of the company at approximately $4.9 billion Inari’s segment-leading, high-growth and innovative peripheral vascular portfolio is highly complementary to our Neurovascular business and includes mechanical thrombectomy solutions for vascular diseases such as deep vein thrombosis and pulmonary embolism This strategic transaction enhances our leadership in endovascular procedures and delivers clinically compelling solutions that elevate the standard of care and improve the lives of patients Copyright © 2025 Stryker

• Founded in 2011, Inari’s portfolio includes a variety of products, including minimally invasive, novel, catheter-based mechanical thrombectomy systems to treat certain vascular diseases • Headquartered in Irvine, CA with approximately 1,400 employees • Products sold in 30+ countries, with 150,000+ patients treated for venous thromboembolism (VTE) • Consensus estimated revenues of $603 million in 2024, reflecting 20%+ growth from 2023 • Acquisition of a segment leader that is expected to expand our product portfolio to offer differentiated and compelling peripheral vascular solutions in a high-growth adjacency • Mechanical thrombectomy for VTE is an estimated $6 billion segment opportunity in the U.S. and growing 20%+ annually • Stryker’s global presence and world-class commercial execution can accelerate adoption and growth of Inari’s solutions • Agreement to acquire all issued and outstanding common stock at $80 per share, reflecting a fully-diluted equity value of approximately $4.9 billion • Transaction will be funded with cash on hand and debt and is currently expected to close in Q1 2025, subject to timing of the regulatory review and tender offer processes • Impact to 2025 revenue growth, adjusted operating margin and adjusted EPS to be discussed on upcoming Q4 2024 earnings call Copyright © 2025 Stryker

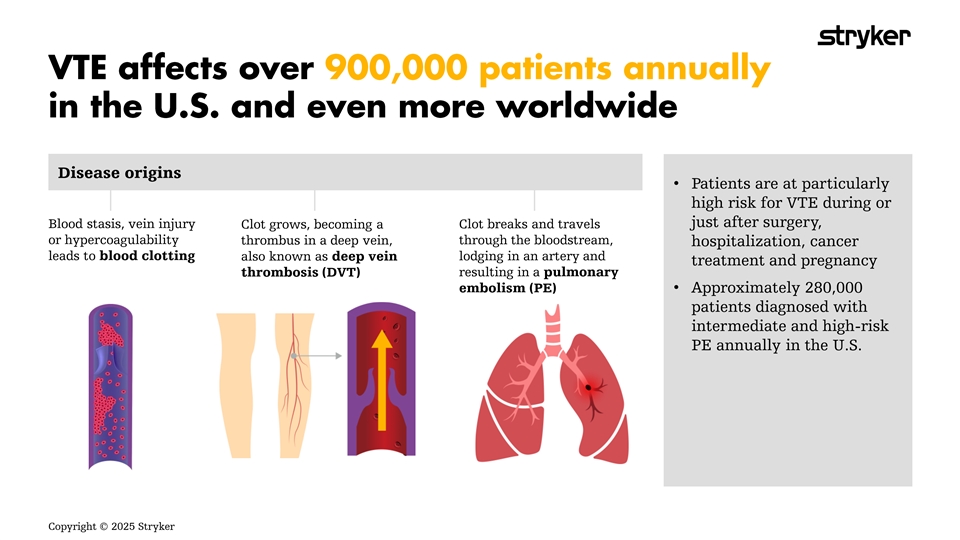

Disease origins • Patients are at particularly high risk for VTE during or just after surgery, Blood stasis, vein injury Clot breaks and travels Clot grows, becoming a or hypercoagulability through the bloodstream, thrombus in a deep vein, hospitalization, cancer leads to blood clotting lodging in an artery and also known as deep vein treatment and pregnancy resulting in a pulmonary thrombosis (DVT) embolism (PE) • Approximately 280,000 patients diagnosed with intermediate and high-risk PE annually in the U.S. Copyright © 2025 Stryker

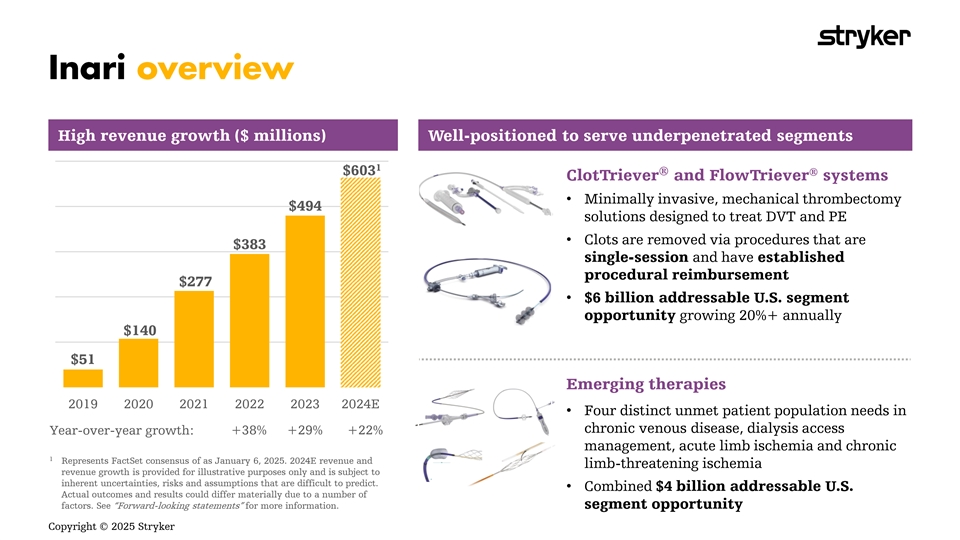

High revenue growth ($ millions) Well-positioned to serve underpenetrated segments 1 ® $603 ® ClotTriever and FlowTriever systems • Minimally invasive, mechanical thrombectomy $494 solutions designed to treat DVT and PE • Clots are removed via procedures that are $383 single-session and have established procedural reimbursement $277 • $6 billion addressable U.S. segment opportunity growing 20%+ annually $140 $51 Emerging therapies 2019 2020 2021 2022 2023 2024E • Four distinct unmet patient population needs in chronic venous disease, dialysis access Year-over-year growth: +38% +29% +22% management, acute limb ischemia and chronic 1 Represents FactSet consensus of as January 6, 2025. 2024E revenue and limb-threatening ischemia revenue growth is provided for illustrative purposes only and is subject to inherent uncertainties, risks and assumptions that are difficult to predict. • Combined $4 billion addressable U.S. Actual outcomes and results could differ materially due to a number of factors. See “Forward-looking statements” for more information. segment opportunity Copyright © 2025 Stryker

• Leader in interventional • Leader in interventional neurovascular procedures peripheral vascular with innovative procedures with a proven technologies history of innovation Comprehensive interventional endovascular portfolio positioned • Global reach and world-• Strong commercial class commercial execution organization with to help customers enhance the to accelerate growth attractive call points quality of care and improve the • Proven M&A track record lives of patients• Clinically compelling and extensive integration solutions that elevate the experience standard of care in the treatment of VTE Copyright © 2025 Stryker

• “Products sold in 30+countries, with 150,000+patients treated for venous thromboembolism (VTE)” – Sources: Inari Medical Investor Update – October 2024: https://ir.inarimedical.com/static-files/80a131bc-e63f-45a1-8dea-363d34437670; LinkedIn: https://www.linkedin.com/posts/inari-medical_inarimedical- patientsfirst-activity-7277005101695733760-8l19/ • “Consensus estimated revenues of $603 million in 2024, reflecting 20%+ growth from 2023” – Source: FactSet consensus • “Mechanical thrombectomy for VTE is an estimated $6 billion segment opportunity in the U.S. and growing 20%+ annually” – Source: Inari Medical Investor Update – October 2024: https://ir.inarimedical.com/static-files/80a131bc-e63f-45a1-8dea-363d34437670; Inari Q3 2024 earnings call • “VTE affects over 900,000 patients annually in the U.S. and even more worldwide” – Source: CDC website: https://www.cdc.gov/blood-clots/data-research/facts- stats/index.html • “Patients are at particularly high risk for VTE during or just after surgery, hospitalization, cancer treatment and pregnancy” – Source: CDC website: https://www.cdc.gov/blood-clots/data-research/facts-stats/index.html • “Approximately 280,000 patients diagnosed with intermediate and high-risk PE annually in the U.S.” – Source: Inari Medical Investor Update – October 2024: https://ir.inarimedical.com/static-files/80a131bc-e63f-45a1-8dea-363d34437670 • Historical and estimated Inari revenues – Sources: Historical revenues through 2023 per public SEC filings of Inari; 2024 revenue consensus per FactSet • “$6 billion addressable U.S. segment opportunity growing 20%+ annually” – Source: Inari Medical Investor Update – October 2024: https://ir.inarimedical.com/static- files/80a131bc-e63f-45a1-8dea-363d34437670; Inari Q3 2024 earnings call • “Combined $4 billion addressable U.S. segment opportunity” – Source: Inari Medical Investor Update – October 2024: https://ir.inarimedical.com/static- files/80a131bc-e63f-45a1-8dea-363d34437670 Copyright © 2025 Stryker