- NARI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC 14D9/A Filing

Inari Medical (NARI) SC 14D9/ATender offer solicitation (amended)

Filed: 14 Feb 25, 4:31pm

Exhibit (a)(5)(K)

Stryker Acquisition: Purchase of Inari Shares

FAQs

| 1. | What will happen to my stock at the close of the acquisition? |

See below chart for the different equity vehicles and how they will be processed.

| Owned or Purchased Shares (i.e. shares previously received upon settlement of equity awards or purchased under the ESPP) | Unvested RSUs and PSUs will be cancelled in exchange for cash | Unexercised Options (whether vested or unvested) will be cancelled in exchange for cash | ||

$80/share, no immediate tax withholding, proceeds will be deposited where the shares reside. (e.g., Shareworks or another brokerage account) | $80/share that is subject to the award (based on deemed maximum performance for PSUs), minus applicable tax withholding, paid through payroll | $80/share that is subject to the award, minus exercise price and applicable tax withholding, paid through payroll |

| * | Restricted Stock Units (RSUs), Employee Stock Purchase Plan (ESPP) and Performance Share Units (PSUs) |

| 2. | When will I receive my payout from this transaction? |

| • | Shares you own outright (including shares acquired through the exercise of options, the settlement of RSUs and the ESPP) will be purchased at $80 per share shortly after the transaction closes, with proceeds deposited into your brokerage account (Shareworks or another brokerage account) |

| • | Unvested RSUs and PSUs will be cancelled in exchange for the cash amounts described above, which will be included in your payroll check within 5 business days of closing in the US and Costa Rica, and by the end of March 2025 for all other countries (assuming a February closing) |

| • | Unexercised (vested or unvested) stock options will be cancelled in exchange for the cash amounts described above, which will be included in your payroll check within 5 business days of closing in the US and Costa Rica, and by the end of March 2025 for all other countries (assuming a February closing) |

| 3. | Why did the payout timing change for countries outside of the US versus what was stated in the Tender Information Offer email sent on February 6th? |

This change occurred due to limitations on payroll processing timelines with external vendors

| 4. | Can I defer the payout into next year or transfer the balance into my 401(k)? |

No, you will not be able to defer the payout or transfer the balance into your 401(k)

Inari Medical, Inc. | 6001 Oak Canyon, Suite 100 | Irvine, California 92618 | www.inarimedical.com

| 5. | How do I check how many shares or stock options I have? |

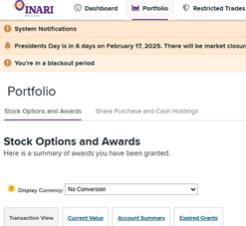

| • | Before the transaction closes, log into Shareworks at https://shareworks.solium.com/ |

| • | On the main page, you will see what is listed as available and unavailable |

| • | Alternatively, you can also go to the Portfolio section and look at all award grants and details. The Navigating Shareworks document (linked) will also provide helpful information on navigating your account |

| 6. | What will I see in Shareworks after the transaction closes? |

In the Activity section within Shareworks you will be able to view the following by grant:

| • | The pre-tax amount paid for each unvested RSU and PSU award |

| • | The pre-tax amount paid for unexercised (vested or unvested) stock options |

| • | The total cash available from the sales of your shares owned outright (including shares acquired through the exercise of options, the settlement of RSUs and the ESPP) |

| 7. | What happens to shares owned outright that I did not tender my shares? |

Shortly after the close of the transaction, you’ll receive $80 per share you own.

| 8. | Will tax withholding occur on shares owned outright (including shares acquired through the exercise of options, the settlement of RSUs and the ESPP)? |

No, Inari will not withhold taxes. However, you will be responsible for making any required estimated tax payments on the income attributable to these proceeds. These payments may need to be made prior to when 2025 tax returns are due. Please consult with a tax advisor/consultant or local tax office to understand your tax obligation as Inari will not remit any taxes for these shares.

Inari Medical, Inc. | 6001 Oak Canyon, Suite 100 | Irvine, California 92618 | www.inarimedical.com

| 9. | How will shares be taxed? Will tax withholding occur for unvested RSUs and PSUs, and stock options? |

| • | For shares owned outright (including shares acquired through the exercise of options, the settlement of RSUs and the ESPP), taxes will not be deducted through payroll. However, you may be subject to taxes when filing your tax return. Please consult with a tax advisor/consultant or local tax office to understand your tax obligation. |

| • | Unvested RSUs and PSUs – Taxes will be paid through payroll; Inari will withhold taxes at the minimum statutory required rate, however personal tax rates may be different from this amount. Please consult with a tax advisor to ensure you are remitting the appropriate amount of tax for your personal situation. |

| • | Unexercised (whether vested or unvested) stock options – Taxes will be paid through payroll; Inari will withhold taxes at the minimum statutory required rate, however personal tax rates may be different from this amount. Please consult with a tax advisor to ensure you are remitting the appropriate amount of tax for your personal situation. |

| 10. | Can I have zero taxes withheld from the RSUs, PSUs, or Stock Options being paid through payroll? |

No, taxes are required to be withheld based on country and/or personal tax rates

| 11. | Is there anything I need to do to prepare for the share purchase/acquisition close? |

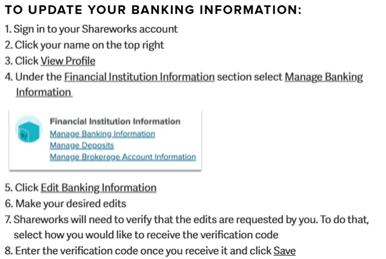

You should update and/or add your personal banking information in Shareworks. See screenshot below as a guide for how to do this.

| 12. | What happens if I leave Inari after the transaction closes but before the payout for stock? |

You will still receive your payout for any shares owned outright (including shares acquired through the exercise of options, the settlement of RSUs and the ESPP), unvested RSUs and PSUs and stock options.

| 13. | How can I see the net amount I received for all the share purchases after the transaction closes? |

Your payroll statement will show the amount paid, taxes withheld, and net amount received

Inari Medical, Inc. | 6001 Oak Canyon, Suite 100 | Irvine, California 92618 | www.inarimedical.com

Forward-Looking Statements

This communication may contain “forward-looking statements” that are subject to substantial risks and uncertainties. Forward-looking statements contained in this communication may be identified by the use of words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including all statements regarding the intent, belief or current expectation of Inari and members of its management team. Forward-looking statements may include, without limitation, statements about the closing of the proposed acquisition of Inari and the expected benefits of such transaction. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and are cautioned not to place undue reliance on these forward-looking statements.

Actual results may differ materially from those currently anticipated due to a number of risks and uncertainties. Risks and uncertainties that could cause the actual results to differ from expectations contemplated by forward-looking statements include: uncertainties as to the timing of the tender offer and merger; uncertainties as to how many of Inari’s stockholders will tender their stock in the tender offer; the possibility that competing offers will be made; the possibility that various closing conditions for the transaction may not be satisfied or waived on the anticipated timeframe or at all, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction; the effects of the transaction on relationships with employees, other business partners or governmental entities; the difficulty of predicting the timing or outcome of regulatory approvals or actions, if any; the impact of competitive products and pricing; other business effects, including the effects of industry, economic or political conditions outside of Inari’s control; transaction costs; the risk of litigation and/or regulatory actions related to the proposed transaction; actual or contingent liabilities; and other risks and uncertainties detailed from time to time in Inari’s periodic and other reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K.

All forward-looking statements contained in this communication are based on information available to Inari as of the date hereof and are made only as of the date of this release. Inari undertakes no obligation to update such information except as required under applicable law. These forward-looking statements should not be relied upon as representing Inari’s views as of any date subsequent to the date of this communication. In light of the foregoing, investors are urged not to rely on any forward-looking statement in reaching any conclusion or making any investment decision about any securities of Inari.

Additional Information and Where to Find It

This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Inari. On January 17, 2025, Stryker Corporation (“Stryker”) and Eagle 1 Merger Sub, Inc., a wholly owned subsidiary of Stryker, filed a Tender Offer Statement on Schedule TO with the SEC in connection with Stryker’s pending acquisition of Inari, and, on January 17, 2025, Inari filed a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The offer to purchase shares of Inari common stock is being made only pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the Schedule TO. INARI’S STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE TENDER OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, THE RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS AMENDED FROM TIME TO TIME, BECAUSE THEY CONTAIN IMPORTANT INFORMATION WHICH SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO

Inari Medical, Inc. | 6001 Oak Canyon, Suite 100 | Irvine, California 92618 | www.inarimedical.com

THE TENDER OFFER. The Tender Offer Statement and the Solicitation/Recommendation Statement are available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting Stryker or Inari. Copies of the documents filed with the SEC by Inari will be available free of charge under the “Company Information—Investors” section of Inari’s website at inarimedical.com.

Inari files annual, quarterly and current reports, proxy statements and other information with the SEC. Inari’s filings with the SEC are available for free to the public from commercial document-retrieval services and at the website maintained by the SEC at www.sec.gov.

Inari Medical, Inc. | 6001 Oak Canyon, Suite 100 | Irvine, California 92618 | www.inarimedical.com