- BJ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BJ's Wholesale Club (BJ) DEF 14ADefinitive proxy

Filed: 9 May 24, 7:01am

| ☒ | | | No fee required. | |||

| ☐ | | | Fee paid previously with preliminary materials. | |||

| ☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| | | |

| | | |

Bob Eddy Chairman and chief executive officer | | |

Date Thursday, June 20, 2024 |

Time 8:00 a.m. Eastern Time |

Place www.virtualshareholdermeeting.com/BJ2024 |

Record date April 29, 2024 |

Availability of materials The proxy statement and our Annual Report for the fiscal year ended February 3, 2024 are available at www.proxyvote.com |

| To make sure your shares are represented, please cast your vote as soon as possible in one of the following ways: | |||

Internet Online at www.proxyvote.com | | |  |

Telephone Call 1 (800) 690-6903 | | |  |

Mail Mark, sign and date your proxy card or voting instruction form and return it in the postage-paid envelope | | |  |

QR code Scan this QR code. Additional software may be required for scanning | | |  |

| PROXY SUMMARY | | | This summary highlights information contained in the Proxy Statement and does not contain all of the information you should consider before casting your vote. We encourage you to read the entire Proxy Statement carefully before voting. |

| Proposal | | | Board recommendation | | | Page reference | |||

| 1. | | | Election of nine director nominees | | | FOR each nominee | | | |

| 2. | | | Approval, on an advisory (non-binding) basis, of compensation of our named executive officers | | | FOR | | | |

| 3. | | | Ratification of appointment of independent registered public accounting firm | | | FOR | | | |

✔ 8 of 10 current directors are independent | | | ✔ Executive and director stock ownership requirements |

✔ Lead (independent) director | | | ✔ Clawback policy |

✔ Independent chairs of board committees | | | ✔ Prohibition on hedging or pledging company stock |

✔ Annual board and committee evaluations | | | ✔ No shareholder rights plan, aka “poison pill” |

✔ Annual election of directors | | | ✔ No supermajority vote requirements in the company’s charter and bylaws |

| | | Chris Baldwin1 | | | Darryl Brown | | | Bob Eddy | | | Michelle Gloeckler | | | Maile Naylor | | | Steve Ortega | | | Ken Parent | | | Chris Peterson | | | Marie Robinson | | | Rob Steele | |

| Current or former public company CEO | | |  | | | | |  | | | | | | | | | | |  | | | | | |||||||

| Financial expert | | | | | | |  | | | | |  | | |  | | |  | | |  | | | | | |||||

| eComm or digital experience | | | | | | | | |  | | | | | | | | | | |  | | | ||||||||

| Information technology experience | | | | | | |  | | | | | | | | |  | | |  | | | | | |||||||

| Marketing, PR or brand management experience | | |  | | |  | | | | |  | | | | | | | | | | | | |  | ||||||

| Human capital, organization development or executive compensation experience | | |  | | | | |  | | |  | | | | |  | | | | |  | | |  | | |  |

| i |

| | | Chris Baldwin1 | | | Darryl Brown | | | Bob Eddy | | | Michelle Gloeckler | | | Maile Naylor | | | Steve Ortega | | | Ken Parent | | | Chris Peterson | | | Marie Robinson | | | Rob Steele | |

| Supply chain experience | | | | | | | | | | | | | | |  | | |  | | |  | | | |||||||

| Credit and payments experience | | | | |  | | |  | | | | |  | | | | | | | | | | | |||||||

| Consumer packaged goods experience | | |  | | |  | | | | |  | | | | |  | | | | |  | | |  | | |  | |||

| Fuel experience | | |  | | | | | | | | | | | | |  | | | | | | | ||||||||

| Retail experience | | |  | | | | |  | | |  | | | | |  | | |  | | |  | | |  | | | |||

| Multi-unit experience | | |  | | | | |  | | |  | | | | |  | | |  | | |  | | |  | | | |||

| Investor relations experience | | |  | | | | |  | | | | |  | | | | | | |  | | | | | ||||||

| Ethnically diverse | | | | |  | | | | | | |  | | |  | | | | | | | | | |||||||

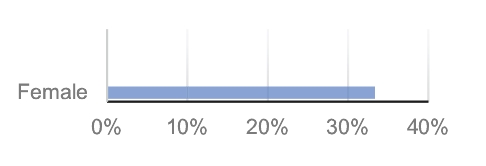

| Female | | | | | | | | |  | | |  | | | | | | | | |  | | | |||||||

| Non-BJ’s public company board experience | | |  | | | | |  | | |  | | |  | | |  | | | | |  | | | | |  |

| (1) | Chris Baldwin has notified the board that he shall not seek re-election at the end of his current term ending in June 2024. |

| | | Name | | | Age(1) | | | Director since | | | Independent | | | Committee memberships | |

| | | Darryl Brown | | | 61 | | | 2021 | | |  | | | Nominating and corporate governance (chair); compensation |

| | | Bob Eddy | | | 51 | | | 2021 | | | - | | | - |

| | | Michelle Gloeckler | | | 57 | | | 2019 | | |  | | | Nominating and corporate governance |

| | | Maile Naylor | | | 50 | | | 2019 | | |  | | | Audit; nominating and corporate governance |

| | | Steve Ortega | | | 62 | | | 2023 | | |  | | | Audit; compensation |

| ii |

| | | Name | | | Age(1) | | | Director since | | | Independent | | | Committee memberships | |

| | | Ken Parent | | | 65 | | | 2011 | | |  | | | Compensation (chair) |

| | | Chris Peterson | | | 57 | | | 2018 | | |  | | | Audit (chair); compensation |

| | | Marie Robinson | | | 56 | | | 2023 | | |  | | | Audit |

| | | Rob Steele(2) | | | 68 | | | 2016 | | |  | | | Audit |

| (1) | Ages of director nominees are as of May 9, 2024 |

| (2) | Lead independent director |

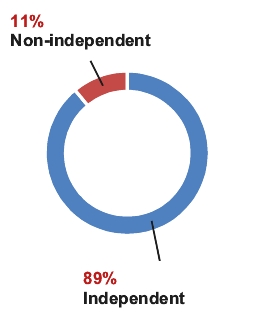

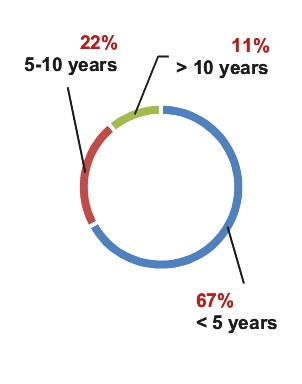

| Supermajority is independent | | | Tenure is well-balanced | ||||||

Shareholder interests are protected Eight of our nine director nominees are independent. Bob Eddy is not independent. An independent board helps to ensure that the directors exercise independent judgment, are willing to question management and are best suited to represent and protect the interest of shareholders. | | |  | | | We believe shareholders benefit from effective board refreshment The board strives to achieve a balance of service on the board through a mix of new members and perspectives and members with longer tenure with institutional knowledge, as reflected by our director nominees. | | |  |

| Board is diverse | |||

| | |  |

| iii |

| Position | | | Stock ownership guidelines |

| Chief executive officer | | | 5x annual base salary |

| Executive vice president | | | 3x annual base salary |

| Senior vice president | | | 1x annual base salary |

| Non-employee director | | | 5x annual cash retainer, excluding committee retainers or retainers paid for service as lead director |

| iv |

| Corporate governance | | | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| Executive compensation | | | |

| | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| Beneficial ownership | | | |

| | | ||

| | | ||

| Certain relationships and related person transactions | | | |

| | | ||

| | | ||

| | | ||

| | | ||

| Additional information | | | |

| | |

| v |

| CORPORATE GOVERNANCE | | | The board is responsible for providing oversight over the company and its senior executives and has adopted policies and processes to enable effective oversight. The following sections provide an overview of our corporate governance structure and other key aspects of our board. |

• Board independence and qualifications • Executive sessions of directors • Board leadership structure • Director qualification standards • Director orientation and continuing education • Limits on board service • Change of principal occupation • Term limits • Director responsibilities • Director compensation • Conflict of interest | | | • Board access to management • Board access to independent advisors • Board and committee self-evaluations • Board meetings • Meeting attendance by directors and non-directors • Meeting materials • Board committees, responsibilities and independence • Succession planning • Risk management • Insider trading |

| 1 |

| Director | | | Audit committee | | | Compensation committee | | | Nominating and corporate governance committee |

| Darryl Brown | | | | | ⬤ | | | Chair | |

| Michelle Gloeckler | | | | | | | ⬤ | ||

| Maile Naylor | | | ⬤ | | | | | ⬤ | |

| Steve Ortega | | | ⬤ | | | ⬤ | | | |

| Ken Parent | | | | | Chair | | | ||

| Chris Peterson | | | Chair | | | ⬤ | | | |

| Marie Robinson | | | ⬤ | | | | | ||

| Rob Steele | | | ⬤ | | | | |

| (1) | Mr. Steele resigned from the board of directors of Newell Brands, Inc. effective May 7, 2024. |

| 2 |

| Audit committee | |||

Members All independent  Chris Peterson (chair) Maile Naylor Steve Ortega Marie Robinson Rob Steele | | | Our audit committee is responsible for, among other things: • assisting the board with its oversight of our accounting and financial reporting process and financial statement audits; • assisting the board with its oversight of our disclosure controls procedures and our internal control over financial reporting; • assessing the independent registered public accounting firm’s qualifications and independence; • engaging the independent registered public accounting firm; • overseeing the performance of our internal audit function and independent registered public accounting firm; • overseeing risk management processes related to cyber security; • assisting with our compliance with legal and regulatory requirements in connection with the foregoing; • assisting the board with its risk oversight, including succession planning; • assisting the board with its oversight of our ESG strategy; and • reviewing related party transactions. |

Oversees the company’s accounting, auditing, financial reporting practices, internal controls and ESG strategy. | | ||

| 3 |

| Compensation committee | |||

Members All independent  Ken Parent (chair) Darryl Brown Steve Ortega Chris Peterson | | | Our compensation committee is responsible for, among other things: • reviewing and approving corporate goals and objectives with respect to the compensation of our chief executive officer, evaluating our chief executive officer’s performance in light of these goals and objectives and setting compensation; • reviewing and setting or making recommendations to the board regarding the compensation of our other executive officers and overseeing an evaluation of the performance of other executive officers; • reviewing and approving employment agreements, consulting arrangements, severance or retirement arrangements or change-in-control agreements; • reviewing and making recommendations to the board regarding director compensation; • reviewing and approving or making recommendations to the board regarding our incentive compensation and equity-based plans and arrangements, and the granting of stock and other equity awards under such plans; • appointing and overseeing any compensation consultants; • reviewing and discussing the results of the most recent shareholder advisory vote on executive compensation and reviewing and recommending to the board for approval the frequency with which the company will conduct such votes, taking into account such results; • periodically considering the adoption of a policy for recovering incentive-based compensation from executive officers; and • periodically reviewing compensation policies and programs and assessing whether they are reasonably likely to have a material adverse effect on the company by encouraging excessive risk-taking. |

| Oversees the company’s compensation policies and programs. | | ||

| | |||

| 4 |

| Nominating and corporate governance committee | | |||

Members All independent  Darryl Brown (chair) Michelle Gloeckler Maile Naylor | | | Our nominating and corporate governance committee oversees and assists the board in reviewing and recommending nominees for election as directors. Our nominating and corporate governance committee is responsible for, among other things: • identifying individuals qualified to become members of the board, consistent with criteria approved by the board, except where the company is otherwise required to provide third parties with the right to designate directors; • recommending to the board the nominees for election to the board at annual meetings of our shareholders; • overseeing the annual self-evaluations of the board and its committees; and • developing and recommending to the board a set of corporate governance guidelines and principles. | |

| Oversees the company’s corporate governance structure and practices. | | | ||

| 5 |

| • | the audit committee holds oversight responsibility for risks and opportunities related to ESG issues; |

| 6 |

| • | at the management level, our executive vice president and general counsel leads our ESG steering committee and regularly updates the broader executive team, the audit committee, and the full board. The ESG steering committee plays a critical role in defining and driving our ESG strategy to ensure it aligns with our business priorities and shareholder imperatives; and |

| • | to deliver on our mandate to communicate transparently on our ESG efforts, we intend to report on material ESG matters annually. Our most recent report is available on our website at: https://www.bjs.com/esg. |

1 | This figure excludes approximately 2,000 contingent workers. |

| 7 |

| 8 |

Proposal 1: Election of nine director nominees | | | Our board currently consists of ten directors, each of whom has a term that expires at the Annual Meeting. Since our 2023 annual meeting of stockholders, the number of directors that constitute our board increased from eight to ten as a result of the appointment of each of Mr. Ortega and Ms. Robinson as directors on June 16, 2023. Mr. Ortega and Ms. Robinson, director nominees who have not previously stood for election, were initially identified as potential candidates for election to the board by a third-party search firm that was retained by our nominating and corporate governance committee to assist in the identification and evaluation of director candidates. |

| Based on an evaluation in accordance with our standard review process for director candidates and the recommendation of the nominating and corporate governance committee, the board has nominated each of the current board members to stand for re-election at the Annual Meeting, except for Christopher Baldwin, who will not be standing for re-election as a member of the board. Upon the expiration of Mr. Baldwin’s term as a director at the Annual Meeting, the number of directors that will constitute the board will be decreased from ten to nine. The individuals elected to the board will serve for a one-year term expiring at the annual meeting of shareholders to be held in 2025 (the “2025 Annual Meeting”) and until the election and qualification of his or her successor or until his or her earlier death, resignation or removal. | |||

| | | The board unanimously recommends that you vote “FOR” the election of each of the director nominees. |

| 9 |

Darryl Brown | |||

Director since 2021 Independent 61 years old Nominating and corporate governance committee (chair) Compensation committee (member) | | | Darryl Brown has been a director of the company since 2021. Mr. Brown is an accomplished senior executive with more than 30 years of experience in consumer-packaged goods and financial services. Currently, he serves as president and chief executive officer of Shadowbrook Investments, LLC, a family-run private equity firm located in southwest Florida. Previously, he served as president, global corporate payments of American Express Company’s Americas division from 2012 to December 2016 and as executive vice president/GM global corporate payments from 2010 to 2012. Prior to joining American Express Company, he held a number of leadership positions at Kraft Foods, where he led the company’s North American retail sales and logistics organization. He holds a Master of Business Administration from Lake Forest Graduate School of Business and a bachelor’s degree of science in accounting from Lincoln University. Mr. Brown currently serves on the board of Atradius Trade Credit Insurance, an insurance company. He previously served as an advisor and board member of Datanomers, an analytics company, from 2015 to January 2021. Specific Expertise: Mr. Brown brings to the board a strong leadership track record from his current role as President and Chief Executive Officer of Shadowbrook Investments, LLC and prior leadership positions at American Express Company and Kraft Foods. The board benefits from his deep knowledge of marketing, brand management and the financial services and consumer packaged goods industries. |

Bob Eddy | |||

Director since 2021 Chairman and CEO 51 years old | | | Bob Eddy currently serves as chairman of the board, president and chief executive officer of the company. Mr. Eddy joined the company in 2007 as senior vice president, finance and was named executive vice president and chief financial officer in 2011 and served as executive vice president, chief financial and administrative officer from 2018 to April 2021 when he joined the board of directors and became president and chief executive officer. Mr. Eddy was named chairman of the board in June 2023. Prior to joining BJ’s, Mr. Eddy served retail and consumer products companies as a member of the audit and business advisory practice of PricewaterhouseCoopers LLP, in Boston and San Francisco. Mr. Eddy is a graduate of Babson College in Wellesley, Massachusetts, and Phillips Academy in Andover, Massachusetts. Mr. Eddy currently serves as a member of the board of directors and Executive Committee of the National Retail Federation and the Boston Children’s Hospital Trust, and as a member of the board of directors of Dick’s Sporting Goods. From 2013 to 2017, Mr. Eddy chaired the Financial Executives Council of the National Retail Federation. He is also a member of the College Advisory Board for Babson College. Specific Expertise: Mr. Eddy brings to the board a strong leadership track record from his previous roles as a member of the company’s senior leadership team. Given his current role as chief executive officer, Mr. Eddy also brings a broad understanding of the company’s business, operations and growth strategy. The board also benefits from his current and prior external executive leadership roles with the National Retail Federation, as well as his multi-unit expertise and significant experience in investor relations and executive compensation. |

| 10 |

Michelle Gloeckler | |||

Director since 2019 Independent 57 years old Nominating and corporate governance committee (member) | | | Michelle Gloeckler has been a director of the company since 2019. Ms. Gloeckler is a retail executive with more than 30 years of experience in retail, consumer-packaged goods, merchandising, sourcing, manufacturing and strategy. Ms. Gloeckler previously served as interim chief executive officer at Holley Inc., a NYSE-listed designer, marketer and manufacturer of high-performance automotive aftermarket products. She was the executive vice president, chief merchant for Academy Sports & Outdoors, a sporting goods retailer, from August 2016 to January 2019. Ms. Gloeckler served as executive vice president of consumables, health and wellness at Walmart Inc., a NYSE-listed general merchandise retailer, from February 2009 to August 2016, where she led their health and wellness unit and U.S. manufacturing initiative. Prior to that, Ms. Gloeckler held leadership roles at The Hershey Company, a global confectionary manufacturer. She holds a bachelor's degree in communication and psychology from the University of Michigan. Ms. Gloeckler has been a director of Duckhorn Portfolio, Inc., an NYSE-listed luxury wine company, since May 2021, of Holley Inc., an NYSE-listed automotive goods company, since July 2021, and of Pairwise Plants LLC, an agriculture technology company, since December 2021. She served on the board of Benson Hill, an agricultural technology company, from February 2019 to February 2021. She served as a member of The University of Michigan Dean’s Advisory Council from 2015-2022. Specific Expertise: Ms. Gloeckler brings to the board significant experience from her service in senior executive and management positions at major corporations in the retail and consumer packaged goods industries. The board benefits from Ms. Gloeckler’s multi-unit expertise and experience in e-commerce, marketing, human capital and executive compensation. Ms. Gloeckler also brings an important perspective from her service as a director of another public company board. |

Maile Naylor | |||

Director since 2019 Independent 50 years old Audit committee (member) Nominating and corporate governance committee (member) | | | Maile Naylor has been a director of the company since 2019. Ms. Naylor has spent 25 years working in the investment management industry analyzing and evaluating global consumer discretionary companies. She previously worked as an investment officer at MFS Investment Management, a global asset management company, from September 2005 until her retirement from the investment management industry in April 2018. Prior to that, Ms. Naylor also held positions at Scudder Kemper Investments and Wellington Management, each investment management firms. She holds a bachelor's degree in finance from Boston University and is a CFA charter holder. Ms. Naylor currently serves on the board of Laird Superfood, Inc., which is listed on the NYSE American, and is a member of the board of advisors of the Boston Ballet. She served as a member of the President’s Council of the Boston Children’s Museum from October 2019 to October 2022. Specific Expertise: Ms. Naylor brings to the board a deep knowledge of the investment management industry based on her 25-year career at prominent investment institutions. The board benefits from Ms. Naylor’s extensive background in finance and her experience serving on the board of another public company. |

| 11 |

Steve Ortega | |||

Director since 2023 Independent 62 years old Audit committee (member) Compensation committee (member) | | | Steve Ortega has been a director of the company since 2023. Mr. Ortega is an accomplished senior executive and board director with decades of deep retail and omnichannel experience. From 2019 through March 2024, he has served as chairman of the board of directors of Leslie’s Inc., a NASDAQ-listed company offering direct-to-consumer pool and spa care products and services. At Leslie’s Inc., Mr. Ortega also served as president and chief executive officer from 2017 to 2020; as president and chief operating officer from 2015 to 2017; as executive vice president, chief financial officer and chief operating officer from 2014 to 2015; and as executive vice president and chief financial officer from 2005 to 2014. Prior to joining Leslie’s Inc., he held a number of leadership positions at BI-LO, LLC, American Stores Company and Lucky Stores, Inc. He holds a bachelor’s degree in accounting from the University of Arizona. Since 2021, Mr. Ortega also has served on the board of James Avery Artisan Jewelry, a multi-channel jewelry retailer. Specific expertise: Mr. Ortega brings to the board significant retail and omnichannel experience. The board benefits from Mr. Ortega’s extensive experience holding leadership roles at multiple large retailers. Mr. Ortega also brings important perspective due to his prior service as the chairman of another public company board and his significant executive compensation experience. |

Ken Parent | |||

Director since 2011 Independent 65 years old Compensation committee (chair) | | | Ken Parent has been a director of the company since 2011. Mr. Parent served as special advisor to the chairman and chief executive officer of Pilot Flying J, the largest travel center operator in North America from January 2021 to April 2023. From 2014 to December 31, 2020, Mr. Parent served as president of Pilot Flying J. In this role, he oversaw all company functions, including human resources, technology, finance, real estate and construction. Mr. Parent also led strategic initiatives on behalf of Pilot Flying J. Prior to becoming president, he served as executive vice president, chief operating officer of Pilot Flying J from 2013 to 2014. Prior to that, Mr. Parent served as Pilot Flying J's senior vice president of operations, marketing and human resources from 2001 to 2013 where he managed store and restaurant operations, marketing, sales, transportation and supply and distribution. Mr. Parent holds a Master of Business Administration and a bachelor's degree in marketing from San Diego State University. Specific Expertise: Mr. Parent brings to the board significant managerial and operational experience as a result of the various senior positions held during his over 20-year tenure at Pilot Flying J, including as President. The board also benefits from Mr. Parent’s multi-unit expertise and deep knowledge of the fuel and retail industries. |

| 12 |

Chris Peterson | |||

Director since 2018 Independent 57 years old Audit committee (chair) Compensation committee (member) | | | Chris Peterson has been a director of the company since 2018. Mr. Peterson is currently president and chief executive officer as well as a director of the board at NASDAQ-listed Newell Brands, Inc., a consumer and commercial products producer. Mr. Peterson previously served as president and chief financial officer and president, business operations at Newell before assuming his current role in May 2023. Prior to this role, he was chief operating officer, operations at Revlon, Inc., a beauty products retail company, where he led the global supply chain, finance and IT functions from April 2017 to July 2018. From 2012 to May 2016, Mr. Peterson was at Ralph Lauren, an apparel manufacturing company, where he was recruited as senior vice president, chief financial officer and later served as president, global brands. Prior to his time at Ralph Lauren, he spent 20 years at The Procter & Gamble Company in various roles of increasing responsibility, the latest of which was vice president and chief financial officer, global household care. Mr. Peterson has a bachelor’s degree from Cornell University in operations research and industrial engineering. Specific Expertise: Mr. Peterson brings to the board significant finance and operations experience in the retail and consumer packaged goods industry through his current chief executive role at Newell Brands, Inc. and his prior positions at Ralph Lauren, Revlon and The Procter & Gamble Company. The board also benefits from Mr. Peterson’s multi-unit expertise and significant experience in investor relations and executive compensation. |

Marie Robinson | |||

Director since 2023 Independent 56 years old Audit committee (member) | | | Marie Robinson has been a director of the company since 2023. Ms. Robinson served as Sysco’s executive vice president and chief supply chain officer from March 2020 to September 2023. Previously she served as senior vice president, chief operations and transformation officer with Capri Holding Limited, the parent holding company of Michael Kors, Versace and Jimmy Choo and from May 2014 to December 2018 served as Senior Vice President, Corporate Strategy & COO for Michael Kors Holdings Limited. Ms. Robinson’s previous roles include senior vice president, chief logistics officer at Toys “R” Us from April 2012 to April 2014; senior vice president, supply, logistics and customer experience at The Great Atlantic & Pacific Tea Company, Inc. from December 2010 to March 2012; senior vice president, supply chain at Smart & Final Stores, LLC from July 2005 to November 2010; regional director at Toys “R” Us from July 2003 to June 2005; and regional vice president, logistics at Wal-Mart Stores, Inc. from January 1993 to April 2003. She began her career as a logistics officer for the U.S. Army and holds a bachelor’s degree in communications from the University of Alabama and a master’s degree in leadership and organizational studies from Azusa Pacific University. She currently also serves as an independent director for Lazer Logistics and Voltera, both of which are EQT properties, and as an independent director and a member of Audit and HR Committees of Dakota Supply Group, an ESOP company. Specific Expertise: Ms. Robinson brings to the board significant retail operations experience due to her 30 plus years at companies such as Wal-Mart Stores, Inc., Toys “R” Us, Inc., and Capri Holding Limited. The board benefits from Ms. Robinson’s deep knowledge in operations, logistics and transformation and significant executive compensation experience. |

| 13 |

Rob Steele | |||

Director since 2016 Lead independent director 68 years old Audit committee (member) | | | Rob Steele has been lead independent director of the company since 2019. He currently serves on an advisory board for CVC, a private equity and investment advisory firm. He also serves on the board of Berry Global and served on the board of Newell Brands from 2018 to May 2024. From 2007 to 2011, Mr. Steele served as vice chairman of global health and well-being at The Procter & Gamble Company, retiring in 2011. Mr. Steele spent 35 years with The Procter & Gamble Company, where he served as group president of global household care, group president of North America, VP North America home care and in a range of brand management and sales positions. Mr. Steele holds a Master of Business Administration from Cleveland State University and a bachelor’s degree in economics from the College of Wooster. Mr. Steele formerly served on the board of Kellogg Company from 2007 to 2012; the board of Beam Co. from 2012 to 2014; the board of Keurig Green Mountain, Inc. from 2013 to 2016; and as trustee of The St. Joseph Home for Handicapped Children from 1995 to 2012. He currently also serves on the board of Berry Global Group, Inc. and previously served on the board of directors of LSI Industries, Inc. from July 2016 to June 2019. Specific Expertise: Mr. Steele brings to the board strong experience in the consumer packaged goods industry, including his long career at The Procter & Gamble Company, where he held several leadership positions. The board also benefits from Mr. Steele’s multi-unit expertise and significant experience in marketing and executive compensation. |

| 14 |

| Director compensation | | | Our non-employee director compensation is intended to attract, retain and appropriately compensate highly qualified individuals to serve on the board. The board and/or the compensation committee review our non-employee director compensation policy annually. |

| Director name | | | Fees earned or paid in cash ($)(1) | | | Stock Awards ($)(2) | | | Total ($) |

| Chris Baldwin | | | 115,499 | | | 149,982 | | | 265,481 |

| Darryl Brown | | | 116,822 | | | 149,982 | | | 266,804 |

| Michelle Gloeckler | | | 103,000 | | | 149,982 | | | 252,982 |

| Maile Naylor | | | 110,558 | | | 149,982 | | | 260,540 |

Steve Ortega(3) | | | 68,193 | | | 149,982 | | | 218,175 |

| Ken Parent | | | 119,724 | | | 149,982 | | | 269,706 |

| Chris Peterson | | | 134,794 | | | 149,982 | | | 284,776 |

Marie Robinson(4) | | | 64,371 | | | 149,982 | | | 214,353 |

| Rob Steele | | | 157,500 | | | 149,982 | | | 307,482 |

| (1) | Represents amounts earned in fiscal year 2023 with respect to cash retainers. Mr. Baldwin earned $55,907 as non-executive chairman from January 29, 2023 through June 14, 2023 and $59,592 as non-employee director from June 15, 2023 through the end of fiscal year 2023. On January 18, 2024, Mr. Baldwin notified company that he has decided not to stand for re-election to the company’s board of directors at the Annual Meeting. |

| (2) | Represents the aggregate grant date fair value of restricted stock unit awards granted during fiscal year 2023, calculated as the closing price per share of our common stock on the NYSE on June 15, 2023 (i.e., $62.13), multiplied by the number of units granted, in accordance with ASC Topic 718. Please see “Executive Compensation—Compensation Discussion and Analysis—Tax and Accounting Considerations—Accounting for Stock-Based Compensation” for further information. As of the end of fiscal year 2023, each of the non-employee directors were granted 2,414 unvested restricted stock unit awards by the company as director compensation. |

| (3) | Represents fees earned from June 16, 2023, the date of Mr. Ortega’s appointment as a director. |

| (4) | Represents fees earned from June 16, 2023, the date of Ms. Robinson’s appointment as a director. |

| 15 |

| | | Annual retainer ($) |

| Board | | | |

| All non-employee directors | | | 95,000 |

| Additional retainer for lead director | | | 50,000 |

| Audit committee | | | |

| Chair | | | 30,000 |

| Members (other than the chair) | | | 12,500 |

| Compensation committee | | | |

| Chair | | | 25,000 |

| Members (other than the chair) | | | 10,000 |

| Nominating and corporate governance committee | | | |

| Chair | | | 18,000 |

| Members (other than the chair) | | | 8,000 |

| 16 |

Proposal 2 Approval, on an advisory (non-binding) basis, of the compensation of our named executive officers | | | As required by Section 14A(a)(1) of the Exchange Act, the below resolution enables our shareholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers (“NEOs”) as disclosed in this Proxy Statement. This proposal (the “Say-on-Pay Vote”), and commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on our NEOs’ compensation. The Say-on-Pay Vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies and practices described in this Proxy Statement. We submit the compensation of our NEOs to our shareholders for a non- binding advisory vote on an annual basis. Based on the non-binding advisory vote regarding the frequency of future |

| executive compensation advisory votes conducted at the 2020 Annual Meeting of Shareholders, the next vote on the non-binding advisory frequency of such non-binding advisory votes will occur no later than our 2025 Annual Meeting of Shareholders. | |||

| | | The board unanimously recommends that you vote “FOR” this advisory proposal. |

| 17 |

| 18 |

| | | Base salary | | | Fixed short-term cash | | | Provides market-competitive fixed cash compensation reflecting role, responsibility and experience. Represents 12% of CEO target compensation and 20% - 25% of other NEO target compensation. | |

| | | Annual Incentive Plan awards(1) | | | Variable mid-term cash | | | Earned based on achievement of a pre-established company financial metrics (adjusted EBITDA and comparable club sales). Designed to align pay to both individual and company performance for the fiscal year. Represents 18% of CEO target compensation and 18% - 21% of other NEO target compensation. | |

| | | Long-term incentive awards(2) | | | Variable long-term equity | | | Designed to drive company performance; align interests with shareholders; and encourage long-term retention of executives. Represents 70% of CEO target compensation and 55% - 60% of other NEO target compensation |

| (1) | 70% of award achievement is based on adjusted EBITDA goal and 30% of award achievement is based on comparable club sales goal. |

| (2) | Annual performance share unit awards represent 50% of long-term incentive awards, vest over a three-year period and are earned based on the achievement of cumulative adjusted EPS growth compared to goals established by the compensation committee. The shares earned pursuant to these awards, if any, will cliff vest as of the end of the performance period, based on continued employment through such date. Annual restricted stock awards represent the remaining 50% of long-term incentive awards and vest ratably over a three-year grant period. |

| 19 |

| | | WHAT WE DO | | | | | WHAT WE DON'T DO | ||

| | | Align the interests of our NEOs with those of our long-term investors by awarding a meaningful percentage of total compensation in the form of equity | | |  | | | Do not allow hedging or pledging of company securities |

| | | Grant annual cash incentive compensation opportunities based on pre-established company goals | | |  | | | Do not provide for “single trigger” payment of cash severance or acceleration of time-based equity upon a change in control |

| | | Have robust equity ownership guidelines for our directors and executive officers (for our CEO, 5x base salary) | | |  | | | Do not provide for Section 280G excise tax gross-up payments |

| | | Have a clawback policy that allows for the recovery of previously paid incentive compensation in the event of a financial restatement | | |  | | | Do not encourage unnecessary or excessive risk-taking as a result of our compensation policies |

| | | Engage an independent compensation consultant to advise the compensation committee | | |  | | | Do not allow for repricing of stock options without shareholder approval |

| • | our view of the strategic importance of the position; |

| • | our evaluation of the competitive market based on the experience of the members of the compensation committee with other companies and market information we may receive from executive search firms retained by us; |

| • | our financial condition and available resources; |

| • | the length of service of an individual; and |

| • | the compensation levels of our other executive officers, each as of the time of the applicable compensation decision. |

| 20 |

| • | increased base salary for all NEOs as further described in “Base salary” below; |

| • | increased target annual cash incentive award opportunities under our Annual Incentive Plan for certain NEOs in accordance with base salary adjustments and/or increased target payout percentage for his or her fiscal year 2023 award, as further described in “Annual Incentive Plan Awards” below; |

| • | increased annual long-term incentive awards (in the form of restricted stock awards and performance-based stock units) as further described in “Long-term incentive awards” below; and |

| • | determined that our NEOs earned 200% of their respective target performance share unit awards granted in fiscal year 2020, which represented 50% of their long-term incentive compensation awards for that year, and were earned on March 31, 2023, for the three-year performance period from February 2, 2020 to January 28, 2023. |

| Company name | | | GICS industry |

| Albertsons Companies, Inc. | | | Food Retail |

Bed Bath & Beyond, Inc.(1) | | | Home Furnishing Retail |

| Big Lots, Inc. | | | General Merchandise Stores |

| Burlington Stores, Inc. | | | Apparel Retail |

| Dick's Sporting Goods, Inc. | | | Specialty Stores |

| Dollar General Corporation | | | General Merchandise Stores |

| Dollar Tree, Inc. | | | General Merchandise Stores |

| Foot Locker, Inc. | | | Apparel Retail |

| Kohl's Corporation | | | Department Stores |

| Petco Health and Wellness Company, Inc. | | | Specialty Stores |

| Sprouts Farmers Market, Inc. | | | Food Retail |

| Target Corporation | | | General Merchandise Stores |

| The TJX Companies, Inc. | | | Apparel Retail |

| Williams-Sonoma, Inc. | | | Home Furnishing Retail |

| (1) | On June 15, 2023, BJ’s approved removal of Bed, Bath & Beyond, Inc. as a peer group company for future compensation determinations after it filed for Chapter 11 bankruptcy protection. |

| (2) | On June 15, 2023, BJ’s approved the addition of Ross Stores, Inc. as a peer group company for future compensation determinations. |

| 21 |

| Named executive officer | | | Fiscal year 2023 base salary ($)(1) | | | Fiscal year 2022 base salary ($)(2) | | | Percentage (%) change |

| Bob Eddy | | | 1,350,000 | | | 1,200,000 | | | 12.5 |

| Laura Felice | | | 750,000 | | | 675,000 | | | 11.1 |

| Paul Cichocki | | | 900,000 | | | 850,000 | | | 5.9 |

| Jeff Desroches | | | 650,000 | | | 625,000 | | | 4.0 |

| Bill Werner | | | 575,000 | | | 539,044 | | | 6.7 |

| (1) | Base salaries were effective April 2, 2023 for fiscal year 2023 and have been annualized based on such amounts. |

| (2) | Base salaries were effective April 3, 2022 for fiscal year 2022 and have been annualized based on such amounts. |

Financial performance metric (weighting) | | | Definition | | | Rationale for selection |

Adjusted EBITDA 70% | | | Income from continuing operations before interest expense, net, provision for income taxes and depreciation and amortization, adjusted for the impact of certain other items, including stock-based compensation expense; acquisition and integration costs; home office transition costs; restructuring and other adjustments, pre-opening expense, non-cash rent expense and specified litigation expense; and, for purposes of setting our performance target under the Annual Incentive Plan, excluding gas profit outside of a specific collar and other adjustments as determined by the compensation committee. | | | • Creates a strong focus on our overall profit goal and underlying drivers of revenue growth, cost control, cash generation and ultimately total shareholder return. • Directly measures the progress we are making on our strategic growth initiatives. |

Comparable club sales 30% | | | Comparable club sales, also known as same-store sales, includes all clubs that were open for at least 13 months at the beginning of the period and were in operation during the entirety of both periods being compared, including relocated clubs and expansions. | | | • Key valuation driver in the retail industry. • Key financial metric in measuring the company’s performance and demonstrates the effectiveness of our core business activities. |

| 22 |

| (dollars in millions) | | | Adjusted EBITDA ($)(1) | | | Comparable club sales ($) | | | Payout (%) |

| Minimum | | | | | 1,058 | | | | | 15,036 | | | | | 0 | | | ||||

| Target | | | | | 1,102 | | | | | 15,996 | | | | | 100 | | | ||||

| Maximum | | | | | 1,191 | | | | | 16,636 | | | | | 200 | | | ||||

| Actual | | | | | 1,088(2) | | | | | 15,457 | | | | | 60 | | | ||||

| Achievement (%) | | | | | 67 | | | | | 44 | | | | | | |

| (1) | The compensation committee determined that adjusted EBITDA for fiscal year 2023 was $1.088B and the comparable club sales was $15.457B which resulted in an achievement level of 60% for total AIP payout. The weighting of the adjusted EBITDA and comparable club sales goals is 70% and 30%, respectively. The total cash incentive award amounts were paid at lower than target payout amounts due to adjusted EBITDA and comparable club sales for fiscal year 2023 being achieved between the minimum and target performance levels. |

| (2) | Additionally, adjusted EBITDA did not include gas profit outside of a specific collar, and such amounts were therefore excluded from the calculation of the achievement level. |

| Named executive officer | | | Annual Incentive Plan target incentive percentage (%)(1) | | | Annual Incentive Plan target incentive ($)(2) | | | Percentage earned (%) | | | Cash incentive award amount ($)(3) |

| Bob Eddy | | | 150 | | | 2,025,000 | | | 60 | | | 1,215,000 |

| Laura Felice | | | 85 | | | 637,500 | | | 60 | | | 382,500 |

| Paul Cichocki | | | 100 | | | 900,000 | | | 60 | | | 540,000 |

| Jeff Desroches | | | 75 | | | 487,500 | | | 60 | | | 292,500 |

| Bill Werner | | | 75 | | | 431,250 | | | 60 | | | 258,750 |

| (1) | Fiscal year 2023 was 53 weeks long. Each executive’s target incentive was a percentage of their base salary as of February 3, 2024. |

| (2) | Calculated as Annual Incentive Plan target incentive percentage multiplied by the NEO’s annual salary. |

| (3) | Cash incentive award amounts earned for fiscal year 2023 were paid in March 2024. |

| 23 |

| Name | | | 2023 ($) | | | 2022 ($) | | | Change (%) |

| Bob Eddy | | | 8,000,000 | | | 7,000,000 | | | 14.3 |

| Laura Felice | | | 1,700,000 | | | 1,500,000 | | | 13.3 |

| Paul Cichocki | | | 2,700,000 | | | 2,500,000 | | | 8.0 |

| Jeff Desroches | | | 1,500,000 | | | 1,400,000 | | | 7.1 |

| Bill Werner | | | 1,300,000 | | | 1,100,000 | | | 18.2 |

| Award type for NEOs | | | Weighting | | | Vesting terms |

| Performance share units | | | 50% | | | Earned based on the achievement of cumulative adjusted EPS growth compared to goals established by the compensation committee and vest over the three-year performance period ending on January 31, 2026. The shares earned, if any, will cliff vest as of the end of the performance period, based on continued employment through such date. |

| Restricted stock | | | 50% | | | Vest in three equal annual installments commencing on April 1, 2024, subject to continued employment through such dates. |

| 24 |

| | | Fiscal year 2023 target amounts | ||||

| Name | | | Grant date fair value ($) | | | Units (#)(1) |

| Bob Eddy | | | 3,999,989 | | | 52,583 |

| Laura Felice | | | 849,930 | | | 11,173 |

| Paul Cichocki | | | 1,349,938 | | | 17,746 |

| Jeff Desroches | | | 749,974 | | | 9,859 |

| Bill Werner | | | 649,942 | | | 8,544 |

| (1) | The target number of units granted to each of our NEOs was determined based on the target dollar value divided by the estimated grant date fair value per unit which was determined by using the fair market value of our common stock on March 31, 2023, the preceding trading day before the grant date (Saturday, April 1, 2023), which was $76.07. |

| Name | | | PSU target shares | | | PSU vested shares |

| Bob Eddy | | | 55,843 | | | 111,686 |

| Laura Felice | | | — | | | — |

| Paul Cichocki | | | 44,874 | | | 89,748 |

| Jeff Descroches | | | 27,921 | | | 55,842 |

| Bill Werner | | | — | | | — |

| 25 |

| | | Fiscal year 2023 restricted stock awards | ||||

| Name | | | Grant date fair value ($) | | | Share (#)(1) |

| Bob Eddy | | | 3,999,989 | | | 52,583 |

| Laura Felice | | | 849,930 | | | 11,173 |

| Paul Cichocki | | | 1,349,938 | | | 17,746 |

| Jeff Desroches | | | 749,974 | | | 9,859 |

| Bill Werner | | | 649,942 | | | 8,544 |

| (1) | The number of shares granted to each of our NEOs was determined based on the target dollar value divided by the estimated grant date fair value per share which was determined by using the fair market value of our common stock on March 31, 2023, the preceding trading day before the grant date (Saturday, April 1, 2023), which was $76.07. |

| Named executive officer | | | Fiscal Year 2023 transition award ($)(1) | | | Fiscal year 2022 transition award ($)(2) | | | Fiscal year 2021 transition award ($)(3) |

| Bob Eddy | | | — | | | 933,333 | | | 466,667 |

| Laura Felice | | | 125,000 | | | 62,500 | | | — |

| Paul Cichocki | | | — | | | — | | | — |

| Jeff Desroches | | | — | | | 466,667 | | | 233,333 |

| Bill Werner | | | 125,000 | | | 62,500 | | | — |

| (1) | The cash transition awards for fiscal year 2023 were paid on April 7, 2023. |

| (2) | The cash transition awards for fiscal year 2022 were paid on April 1, 2022. |

| (3) | The cash transition awards for fiscal year 2021 were paid on April 1, 2021. |

| 26 |

| 27 |

| 28 |

| 29 |

| Fiscal year | | | Salary ($)(1) | | | Bonus ($) | | | Stock Awards ($)(2) | | | Non-equity incentive plan compensation ($)(3) | | | All other Compensation ($)(4) | | | Total ($) |

Bob Eddy(5) President and Chief Executive Officer | ||||||||||||||||||

| 2023 | | | 1,350,005 | | | — | | | 7,999,978 | | | 1,215,000 | | | 293,569 | | | 10,858,552 |

| 2022 | | | 1,200,014 | | | 933,333(7) | | | 6,999,976 | | | 2,844,001 | | | 271,840 | | | 12,249,164 |

| 2021 | | | 1,116,355 | | | 466,667(8) | | | 10,999,934 | | | 3,600,000 | | | 157,590 | | | 16,340,546 |

Laura Felice(10) Executive Vice President, Chief Financial Officer | ||||||||||||||||||

| 2023 | | | 751,448 | | | 125,000(9) | | | 1,699,860 | | | 382,500 | | | 76,769 | | | 3,035,577 |

| 2022 | | | 660,582 | | | 62,500(6) | | | 1,499,898 | | | 746,550 | | | 62,216 | | | 3,031,746 |

| 2021 | | | 550,780 | | | — | | | 1,199,873 | | | 840,000 | | | 43,275 | | | 2,633,928 |

Paul Cichocki(11) Executive Vice President, Chief Commercial Officer | ||||||||||||||||||

| 2023 | | | 908,670 | | | — | | | 2,699,876 | | | 540,000 | | | 24,183 | | | 4,172,729 |

| 2022 | | | 850,013 | | | — | | | 2,499,875 | | | 1,343,001 | | | 13,669 | | | 4,706,558 |

| 2021 | | | 829,816 | | | — | | | 2,499,941 | | | 1,700,000 | | | 7,825 | | | 5,037,582 |

Jeff Desroches Executive Vice President, Chief Operations Officer | ||||||||||||||||||

| 2023 | | | 658,176 | | | — | | | 1,499,948 | | | 292,500 | | | 91,004 | | | 2,541,628 |

| 2022 | | | 620,211 | | | 466,667(7) | | | 1,399,941 | | | 691,250 | | | 90,675 | | | 3,268,744 |

| 2021 | | | 591,357 | | | 233,333(8) | | | 1,399,997 | | | 840,000 | | | 78,084 | | | 3,142,771 |

Bill Werner(12) Executive Vice President, Strategy and Development | ||||||||||||||||||

| 2023 | | | 579,850 | | | 125,000(9) | | | 1,299,884 | | | 258,750 | | | 73,963 | | | 2,337,447 |

| 2022 | | | 534,007 | | | 62,500(6) | | | 1,099,934 | | | 596,183 | | | 74,802 | | | 2,367,426 |

| 2021 | | | 500,484 | | | — | | | 2,599,845 | | | 742,000 | | | 69,267 | | | 3,911,596 |

| (1) | This amount reflects salary earned during the fiscal year, including any salary adjustments made during the fiscal year. Fiscal year 2023 was 53 weeks long. |

| (2) | Amounts set forth in the Stock awards column represent the aggregate grant date fair value of awards granted in the respective fiscal year computed in accordance with ASC Topic 718. Please see “—Compensation Discussion and Analysis—Tax and Accounting Considerations—Accounting for Stock-Based Compensation” for further information regarding the calculation of these awards. The grant date fair value of the restricted stock awards granted during each respective year was calculated as the closing price per share of our common stock on the NYSE on the applicable date of grant multiplied by the number of shares granted. The grant date fair value of PSUs is reported based on the probable outcome of the performance conditions (target) on the grant date. Assuming performance at the maximum (200%) payout level, the value of PSUs granted in fiscal year 2023 was: Mr. Eddy, $7,999,978; Ms. Felice, $1,699,860; Mr. Cichocki, $2,699,876; Mr. Desroches, $1,499,948; and Mr. Werner, $1,299,884. The value of the restricted stock awards and performance stock units granted to our NEOs for fiscal year 2023 is reflected in the Fiscal Year 2023 Grants of plan-based awards table below. |

| (3) | Amounts reported reflect annual cash incentive awards earned by our NEOs pursuant to our Annual Incentive Plan related to the respective year’s performance, which was paid in March of the following year. Please see “—Compensation Discussion and Analysis—Annual Incentive Plan Awards” for further information regarding the Annual Incentive Plan and our annual cash incentive awards. |

| (4) | All other compensation for fiscal year 2023 has been further explained in the table below. |

| (5) | During fiscal year 2020, Mr. Eddy served as our executive vice president, chief financial officer and administrative officer and as our principal financial officer. He was appointed as president and chief executive officer on April 19, 2021. |

| 30 |

| (6) | This amount reflects a cash transition award granted in fiscal year 2021 and paid in fiscal year 2022. Please see “—Compensation Discussion and Analysis – Long Term Incentive Awards” for further information regarding cash transition awards. |

| (7) | This amount reflects a cash transition award granted in fiscal year 2020 and paid in fiscal year 2022. Please see “—Compensation Discussion and Analysis – Long Term Incentive Awards” for further information regarding cash transition awards. |

| (8) | This amount reflects a cash transition award granted in fiscal year 2020 and paid in fiscal year 2021. Please see “—Compensation Discussion and Analysis – Long Term Incentive Awards” for further information regarding cash transition awards. |

| (9) | This amount reflects a cash transition award granted in fiscal year 2021 and paid in fiscal year 2023. Please see “—Compensation Discussion and Analysis – Long Term Incentive Awards” for further information regarding cash transition awards. |

| (10) | Ms. Felice was appointed as executive vice president, chief financial officer on April 18, 2021 and as our principal financial officer. |

| (11) | Mr. Cichocki was appointed as executive vice president, membership, analytics and business transformation effective April 1, 2020. On April 18, 2021, he was appointed as executive vice president, chief commercial officer. |

| (12) | Mr. Werner was appointed executive vice president, strategy and development on April 18, 2021. |

| Name | | | Executive Retirement Plan company contributions ($)(1) | | | Tax gross ups ($)(2) | | | Employer 401(k) matching contributions ($)(3) | | | Executive life insurance contributions ($) | | | Other ($)(4) | | | Total ($) |

| Bob Eddy | | | 61,856 | | | 53,762 | | | 9,900 | | | 10,093 | | | 157,958 | | | 293,569 |

| Laura Felice | | | 34,794 | | | 30,241 | | | 9,900 | | | 1,834 | | | — | | | 76,769 |

| Paul Cichocki | | | — | | | — | | | 9,900(5) | | | 5,298 | | | 8,985 | | | 24,183 |

| Jeff Desroches | | | 32,217 | | | 28,002 | | | 9,900 | | | 5,216 | | | 15,669 | | | 91,004 |

| Bill Werner | | | 27,786 | | | 24,150 | | | 9,900 | | | 3,145 | | | 8,982 | | | 73,963 |

| (1) | We contributed to the Executive Retirement Plan for certain of our NEOs. This amount reflects the company contribution to the Executive Retirement Plan. Under the Executive Retirement Plan, we funded annual retirement contributions of a certain percentage of the designated participant's base salary in contribution accounts, in which participants become vested after four fiscal years of service. As noted previously, the Executive Retirement Plan was terminated in April 2023. |

| (2) | Amounts reflect tax gross-ups provided under our Executive Retirement Plan. |

| (3) | Our 401(k) plan provides for company matching contributions of 50% of the first 6% of an employee’s covered compensation. Company matching contributions vest ratably over an employee’s first four years of employment. |

| (4) | Amounts include use of a private plane (for Mr. Eddy in the amount of $148,973), car allowance (for Mr. Desroches in the amount of $15,669), tax preparation services, financial planning services, estate planning services, and other immaterial miscellaneous income. A family member of an NEO may, on occasion, accompany an NEO on a private plane being used for business travel; there is no aggregate incremental cost associated with such family member travel. |

| (5) | Amount reflects full employer 401(k) contribution, of which $7,425 was vested in fiscal year 2023. The remainder will vest after Mr. Cichocki completes four years of credited service. If the employment of Mr. Cichocki is terminated prior to achieving four years of credited service, he will forfeit any unvested employer contributions made under the plan. |

| 31 |

| Name | | | Grant date | | | Estimated future payouts under non-equity incentive plan awards(1) | | | Estimated future payouts under equity incentive plan awards | | | All other stock awards: number of shares of stock or units(3) (#) | | | Grant date fair value of stock and options awards(2) | ||||||||||||

| | | | | | | | | | | | | ||||||||||||||||

| | Threshold ($) | | | Target ($) | | | Maximum ($) | | | Threshold (#) | | | Target(4) (#) | | | Maximum (#) | | ||||||||||

| Bob Eddy | | | | | — | | | 2,025,000 | | | 4,050,000 | | | — | | | — | | | — | | | — | | | — | |

| | | 4/1/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 52,583 | | | 3,999,989 | |

| | | 4/1/2023 | | | — | | | — | | | — | | | 0 | | | 52,583 | | | 105,166 | | | — | | | 3,999,989 | |

| Laura Felice | | | | | — | | | 637,500 | | | 1,275,000 | | | — | | | — | | | — | | | — | | | — | |

| | | 4/1/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 11,173 | | | 849,930 | |

| | | 4/1/2023 | | | — | | | — | | | — | | | 0 | | | 11,173 | | | 22,346 | | | — | | | 849,930 | |

| Paul Cichocki | | | | | — | | | 900,000 | | | 1,800,000 | | | — | | | — | | | — | | | — | | | — | |

| | | 4/1/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 17,746 | | | 1,349,938 | |

| | | 4/1/2023 | | | — | | | — | | | — | | | 0 | | | 17,746 | | | 35,492 | | | — | | | 1,349,938 | |

| Jeff Desroches | | | | | — | | | 487,500 | | | 975,000 | | | — | | | — | | | — | | | — | | | — | |

| | | 4/1/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 9,859 | | | 749,974 | |

| | | 4/1/2023 | | | — | | | — | | | — | | | 0 | | | 9,859 | | | 19,718 | | | — | | | 749,974 | |

| Bill Werner | | | | | — | | | 431,250 | | | 862,500 | | | — | | | — | | | — | | | — | | | — | |

| | | 4/1/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 8,544 | | | 649,942 | |

| | | 4/1/2023 | | | — | | | — | | | — | | | 0 | | | 8,544 | | | 17,088 | | | — | | | 649,942 |

| (1) | Reflects the possible payouts of annual cash incentive compensation pursuant to the Annual Incentive Plan. The actual amounts that were paid are set forth in the “Non-equity incentive plan compensation” column of the Summary Compensation Table above. See also, “—Compensation Discussion and Analysis—Annual Incentive Plan Awards”. |

| (2) | Amounts represent the grant date fair value of each award granted in fiscal year 2023 computed in accordance with ASC Topic 718. Please see “—Compensation Discussion and Analysis—Tax and Accounting Considerations—Accounting for Stock-Based Compensation” for further information regarding the calculation of these awards. |

| (3) | Represents shares of restricted stock granted as incentive compensation for fiscal year 2023. The shares granted to the NEOs are subject to vesting in equal installments on each of April 1, 2024, 2025 and 2026, subject to continued employment through such dates. |

| (4) | Represents performance share units granted as incentive compensation for fiscal year 2023. The performance share units granted to the NEOs are earned based on performance-based vesting hurdles, which are based on the achievement of cumulative adjusted EPS growth during fiscal years 2023, 2024 and 2025, with the shares earned, if any, also subject to vesting based on continued employment through the end of such three-year performance period. |

| 32 |

| | | Options awards | | | Stock awards | ||||||||||||||||

| Name | | | Number of securities underlying unexercised options (#) exercisable | | | Option exercise price ($) | | | Option expiration date | | | Number of shares or units of stock that have not vested (#) | | | Market value of shares or units of stock that have not vested #(1) | | | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) | | | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($)(1) |

| Bob Eddy | | | 525,000 | | | 17.00 | | | 6/27/2028 | | | 10,500(2) | | | 677,355 | | | 62,992(6) | | | 4,063,614 |

| | 76,114 | | | 27.59 | | | 4/1/2029 | | | 12,110(3) | | | 781,216 | | | 72,660(7) | | | 4,687,297 | ||

| | — | | | — | | | — | | | 34,502(4) | | | 2,225,724 | | | 227,066(8) | | | 14,648,028 | ||

| | — | | | — | | | — | | | 52,583(5) | | | 3,392,129 | | | 103,504(10) | | | 6,677,043 | ||

| | — | | | — | | | — | | | | | — | | | 52,583(11) | | | 3,392,129 | |||

| Laura Felice | | | 19,141 | | | 7.00 | | | 12/8/2026 | | | 4,218(2) | | | 272,103 | | | 8,436(6) | | | 544,206 |

| | 70,315 | | | 17.00 | | | 6/27/2028 | | | 1,704(3) | | | 109,925 | | | 10,216(9) | | | 659,034 | ||

| | 20,387 | | | 27.59 | | | 4/1/2029 | | | 7,393(4) | | | 476,922 | | | 22,178(10) | | | 1,430,703 | ||

| | 22,437 | | | 25.07 | | | 4/1/2030 | | | 11,173(5) | | | 720,770 | | | 11,173(11) | | | 720,770 | ||

| Paul Cichocki | | | 179,497 | | | 25.07 | | | 4/1/2030 | | | 8,437(2) | | | 544,271 | | | 50,618(6) | | | 3,265,367 |

| | — | | | — | | | — | | | 946(3) | | | 61,026 | | | 5,676(9) | | | 366,159 | ||

| | — | | | — | | | — | | | 12,322(4) | | | 794,892 | | | 36,964(10) | | | 2,384,548 | ||

| | — | | | — | | | — | | | 17,746(5) | | | 1,144,794 | | | 17,746(11) | | | 1,144,794 | ||

| | | 103,250 | | | 17.00 | | | 6/27/2028 | | | 5,250(2) | | | 338,678 | | | 31,496(6) | | | 2,031,807 | |

| Jeff Desroches | | ||||||||||||||||||||

| | 38,057 | | | 27.59 | | | 4/1/2029 | | | 6,900(4) | | | 445,119 | | | 20,700(10) | | | 1,335,357 | ||

| | — | | | — | | | — | | | 9,859(5) | | | 636,004 | | | 9,859(11) | | | 636,004 | ||

| Bill Werner | | | 70,315 | | | 17.00 | | | 6/27/2028 | | | 4,218(2) | | | 272,103 | | | 8,436(6) | | | 544,206 |

| | 20,387 | | | 27.59 | | | 4/1/2029 | | | 1,325(3) | | | 85,476 | | | 7,946(9) | | | 512,596 | ||

| | 22,437 | | | 25.07 | | | 4/1/2030 | | | 5,422(4) | | | 349,773 | | | 16,264(10) | | | 1,049,191 | ||

| | — | | | — | | | — | | | 8,544(5) | | | 551,173 | | | 8,544(11) | | | 551,173 | ||

| | — | | | — | | | — | | | 1,726(12) | | | 111,344 | | | 20,696(13) | | | 1,335,099 |

| (1) | Market values reflect the closing price of our common stock on the NYSE on February 2, 2024 (the last business day of fiscal year 2023), which was $64.51. |

| (2) | Represents unvested portion of restricted stock awards granted for fiscal year 2021, with one-third having vested on each of April 1, 2022 and 2023 and one-third scheduled to vest on April 1, 2024, subject to continued employment with us through such dates. |

| (3) | Represents unvested portion of restricted stock awards granted in connection with promotions for Mr. Eddy to president and chief executive officer; Ms. Felice to executive vice president, chief financial officer; Mr. Cichocki to executive vice president, chief commercial officer; and Mr. Werner to executive vice president, strategy and development, with one-third having vested on each of April 1, 2022 and 2023 and one-third scheduled to vest on April 1, 2024, subject to continued employment with us through such dates. |

| (4) | Represents unvested portion of restricted stock award granted for fiscal year 2022, with one-third having vested on April 1, 2023 and one-third scheduled to vest on each of April 1, 2024 and 2025, subject to continued employment with us through such dates. |

| (5) | Represents unvested portion of restricted stock award granted for fiscal year 2023, with one-third scheduled to vest on each of April 1, 2024, 2025 and 2026, subject to continued employment with us through such dates. |

| (6) | Represents performance share units granted in fiscal year 2021, which provided our NEOs the ability to earn and receive shares of common stock equal to between 50% and 200% of the number of performance share units subject to the award after the end of the three-year performance period that began on January 30, 2021 to February 3, 2024, based on the achievement of cumulative adjusted EPS growth over such performance period, with the shares earned, if any, also subject to vesting based on continued employment through the end of such three-year performance period. Assuming our relative performance for the three-year performance period through the end of fiscal year 2023, these awards would have been earned at a level of maximum performance, i.e., 200% of the target amount. In accordance with SEC rules, these awards are reflected in the table as maximum performance (i.e., 200% of the target amount). |

| 33 |

| (7) | Represents performance share units granted to Mr. Eddy in connection with his promotion to president and chief executive officer of the company, which provided Mr. Eddy with the ability to earn and receive shares of common stock equal to between 50% and 200% of the number of performance share units subject to the award after the end of the three-year performance period that began on January 30, 2021 to February 3, 2024, based on the achievement of cumulative adjusted EPS growth over such performance period, with the shares earned, if any. Assuming our relative performance for the three-year performance period through the end of fiscal year 2023, these awards would have been earned at a level of maximum performance, i.e., 200% of the target amount. In accordance with SEC rules, these awards are reflected in the table as maximum performance (i.e., 200% of the target amount). |

| (8) | Represents performance share units granted to Mr. Eddy in connection with his promotion to president and chief executive officer of the company, which provided Mr. Eddy with the ability to earn and receive shares of common stock equal to between 50% and 200% of the number of performance share units subject to the award after the end of the three-year performance period that began on January 30, 2021 to February 3, 2024, based on the achievement of cumulative adjusted EPS growth over such performance period, with the shares earned, if any, also subject to vesting based on continued employment, with one-third of the number of performance share units earned based on the achievement of the performance based vesting hurdles vesting at the end of the fiscal year ending in2024, one-third vesting at the first anniversary of the grant date, and one-third vesting on the second anniversary of the grant date, subject to continued employment through such dates. Assuming our relative performance for the three-year performance period through the end of fiscal year 2023, these awards would have been earned at a level of maximum performance, i.e., 200% of the target amount. In accordance with SEC rules, these awards are reflected in the table as maximum performance (i.e., 200% of the target amount). |

| (9) | Represents performance share units granted in fiscal year 2021 in connection with promotions for Ms. Felice to executive vice president, chief financial officer; Mr. Cichocki to executive vice president, chief commercial officer; and Mr. Werner to executive vice president, strategy and development, which provided them the ability to earn and receive shares of common stock equal to between 50% and 200% of the number of performance share units subject to the award after the end of the three-year performance period that began on January 30, 2021 to February 3, 2024 based on the achievement of cumulative adjusted EPS growth over such performance period, with the shares earned, if any, also subject to vesting based on continued employment through the end of such three-year performance period. Assuming our relative performance for the three-year performance period through the end of fiscal year 2023, these awards would have been earned at a level of maximum performance, i.e., 200% of the target amount. In accordance with SEC rules, these awards are reflected in the table as maximum performance (i.e., 200% of the target amount). |

| (10) | Represents performance share units granted in fiscal year 2022, which provided our NEOs the ability to earn and receive shares of common stock equal to between 0% and 200% of the number of performance share units subject to the award after the end of the three-year performance period that began on January 30, 2022 to February 1, 2025 achievement of cumulative adjusted EPS growth over such performance period, with the shares earned, if any, also subject to vesting based on continued employment through the end of such three-year performance period. Assuming our relative performance for the three-year performance period through the end of fiscal year 2022, these awards would have been earned at a level of between target and maximum performance, i.e., greater than 100%, but less than 200% of the target amount. In accordance with SEC rules, these awards are reflected in the table as maximum performance (i.e., 200% of the target amount). |

| (11) | Represents performance share units granted in fiscal year 2023, which provided our NEOs the ability to earn and receive shares of common stock equal to between 0% and 200% of the number of performance share units subject to the award after the end of the three-year performance period that began on January 29, 2023 to January 31, 2026 achievement of cumulative adjusted EPS growth over such performance period, with the shares earned, if any, also subject to vesting based on continued employment through the end of such three-year performance period. Assuming our relative performance for the three-year performance period through the end of fiscal year 2023, these awards would have been earned at a level of between threshold and target performance, i.e., greater than 0%, but less than 100% of the target amount. In accordance with SEC rules, these awards are reflected in the table as target performance (i.e., 100% of the target amount). |

| (12) | Represents a restricted stock award granted in fiscal year 2021 in connection with Mr. Werner’s leadership with the strategic evaluation of the company’s co-branded credit card program, with one-third having vested each on September 27, 2022 and September 27, 2023 and one-third scheduled to vest on September 27, 2024, subject to continued employment with us through such dates. |

| (13) | Represents performance share units granted in fiscal year 2021 in connection with Mr. Werner’s leadership with the strategic evaluation of the company’s co-branded credit card program. 50% of the performance share units may vest on each of September 27, 2025 or September 27, 2026, subject to continued employment through the end of the applicable performance period and the co-brand spend during such performance period (the “performance target”). The compensation committee will determine the achievement of the performance goals within the ninety-day period following the end of the performance period. If the performance target is not achieved, 50% of the applicable tranche of the performance share units may vest if the co-brand spend during the applicable performance period is at least 90% of the performance target (the “floor”) and up to 200% of the shares subject to the performance share units may vest upon achievement of 100% of the performance target during the applicable performance year (the “maximum”). Achievement of co-brand spend between the floor, performance target and maximum levels are determined by linear interpolation, provided that if co-brand spend is less than the floor, no shares under the applicable performance share unit tranche will vest. These awards are currently expensed at target and are being reflected in the table at target performance (i.e. 100% of the target amount). |

| 34 |

| | | Option awards | | | Stock awards | |||||||

| Name | | | Number of shares acquired on exercise (#) | | | Value realized on exercise ($) | | | Number of shares acquired on vesting (#)(1) | | | Value realized on vesting ($) |

| Bob Eddy | | | — | | | — | | | 170,159 | | | 12,943,995 |

| Laura Felice | | | 20,000 | | | 1,271,295 | | | 17,095 | | | 1,300,417 |

| Paul Cichocki | | | — | | | — | | | 120,248 | | | 9,147,265 |

| Jeff Desroches | | | — | | | — | | | 73,848 | | | 5,617,617 |

| Bill Werner | | | — | | | — | | | 17,455 | | | 1,322,440 |

| (1) | Includes shares withheld to pay taxes on the restricted stock awards and performance share units, if any. |

| Name | | | Executive Contributions in Last Fiscal Year ($) | | | Company Contributions in Last Fiscal Year ($) | | | Aggregate Earnings in Last Fiscal Year ($) | | | Aggregate Withdrawals/ Distributions ($) | | | Aggregate Balance at Last Fiscal Year End ($)(1) |

| Bob Eddy | | | — | | | — | | | — | | | — | | | — |

| Laura Felice | | | — | | | — | | | — | | | — | | | — |

| Paul Cichocki | | | — | | | — | | | — | | | — | | | — |

| Jeff Desroches | | | 1,125 | | | — | | | 20 | | | — | | | 1,145 |

| Bill Werner | | | — | | | — | | | — | | | — | | | — |

| (1) | The balances, if any, shown represent compensation already reported in the “Summary Compensation Table” in the proxy statement for fiscal year 2023. |

| 35 |

| 36 |

| Name | | | Benefit | | | Termination without cause or for good reason, as applicable ($) | | | Termination due to death or disability ($)(1)(2) | | | Change in control ($) | | | Qualifying termination without cause or for good reason, as applicable, in connection with a change in control ($) |

| Bob Eddy | | | Severance benefit(3) | | | 3,375,000 | | | — | | | — | | | 3,375,000 |

| | Continuation of health benefits(4) | | | 23,077 | | | 23,077 | | | — | | | 23,077 | ||

| | Value of accelerated stock awards(5) | | | 7,076,424 | | | 7,076,424 | | | — | | | 7,076,424 | ||

| | Value of accelerated performance stock unit awards | | | — | | | 24,836,519 | | | 13,490,187(6) | | | 13,490,187 | ||

| | Annual incentive(7) | | | — | | | — | | | — | | | — | ||

| | Other(8) | | | — | | | — | | | — | | | — | ||

| Laura Felice | | | Severance benefit(9) | | | 1,500,000 | | | — | | | — | | | 1,500,000 |

| | Continuation of health benefits(10) | | | 23,077 | | | 23,077 | | | — | | | 23,077 | ||

| | Value of accelerated stock awards(5) | | | — | | | 1,579,721 | | | — | | | 1,579,721 | ||

| | Value of accelerated performance stock unit awards | | | — | | | 2,189,074 | | | 1,322,922(6) | | | 1,322,922 | ||

| | Annual incentive(7) | | | — | | | — | | | — | | | — | ||

| | Other(8) | | | — | | | — | | | — | | | — | ||

| Paul Cichocki | | | Severance benefit(9) | | | 1,800,000 | | | — | | | — | | | 1,800,000 |

| | Continuation of health benefits(10) | | | 20,795 | | | 20,795 | | | — | | | 20,795 | ||

| | Value of accelerated stock awards(5) | | | — | | | 2,544,984 | | | — | | | 2,544,984 | ||

| | Value of accelerated performance stock unit awards | | | — | | | 5,260,710 | | | 2,998,912(6) | | | 2,998,912 | ||

| | Annual incentive(7) | | | — | | | — | | | — | | | — | ||

| | Other(8) | | | — | | | 4,763 | | | 180,000 | | | — |

| 37 |

| Name | | | Benefit | | | Termination without cause or for good reason, as applicable ($) | | | Termination due to death or disability ($)(1)(2) | | | Change in control ($) | | | Qualifying termination without cause or for good reason, as applicable, in connection with a change in control ($) |

| Jeff Desroches | | | Severance benefit(9) | | | 1,300,000 | | | — | | | — | | | 1,300,000 |

| | Continuation of health benefits(10) | | | 20,795 | | | 20,795 | | | — | | | 20,795 | ||

| | Value of accelerated stock awards(5) | | | — | | | 1,419,801 | | | — | | | 1,419,801 | ||

| | Value of accelerated performance stock unit awards | | | — | | | 2,942,906 | | | 1,676,758(6) | | | 1,676,758 | ||

| | Annual incentive(7) | | | — | | | — | | | — | | | — | ||

| | Other(8) | | | — | | | — | | | — | | | — | ||

| Bill Werner | | | Severance benefit(9) | | | 1,150,000 | | | — | | | — | | | 1,150,000 |

| | Continuation of health benefits(10) | | | 23,077 | | | 23,077 | | | — | | | 23,077 | ||

| | Value of accelerated stock awards(5) | | | — | | | 1,369,870 | | | — | | | 1,369,870 | ||

| | Value of accelerated performance stock unit awards | | | — | | | 2,491,835 | | | 1,771,499(6) | | | 1,771,499 | ||

| | Annual incentive(7) | | | — | | | — | | | — | | | — | ||

| | Other(8) | | | — | | | — | | | — | | | — |

| (1) | As set forth above under “—Equity Awards”, subsequent to January 30, 2021, the compensation committee determined to modify all applicable award agreements entered into with our NEOs to address the treatment of such awards upon the death of the NEO. |

| (2) | For valuation purposes, we have assumed the closing price of our common stock on the NYSE on February 2, 2024 (the last trading day prior to February 3, 2024) of $64.51, and that the 2021 PSUs would be earned at 200% of target, the 2022 PSUs would be earned at a level between target and 200% of target, and the 2023 PSUs would be earned at a level below target. A pro rata portion of the PSUs shall vest based on the total number of PSUs multiplied by a fraction, the numerator of which shall be the number of calendar days from the first day of the performance period to the date of such termination due to death or disability and the denominator of which shall be the total number of days in the performance period. |

| (3) | Such amount includes 12 months’ base salary and the executive’s target annual cash incentive, payable in substantially equal installments for 12 months after termination and in a single lump sum in respect of a qualifying termination occurring on or following a change in control. This amount is also payable upon Mr. Eddy’s resignation for good reason as defined in Mr. Eddy’s employment agreement. |

| (4) | Such amount includes the difference between the executive’s actual COBRA premium costs and the amount the executive would have paid had he continued coverage as an employee under the company’s applicable health plans for 12 months. This amount is also payable upon a termination by Mr. Eddy for good reason as defined in Mr. Eddy’s employment agreement. |