Delivering the �Power of Sight Investor Presentation August 2023

Forward-Looking Statements This presentation, together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements are subject to considerable risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements other than statements of historical fact, including statements regarding our future results of operations, product development, market opportunity, clinical trial results and timeline, and business strategy and plans. The forward-looking statements in this presentation include, but are not limited to, statements concerning the following: the Company's mission; the Company's projected financial results, including revenue/revenue guidance, operating expenditures and timeframe for achieving cash flow break-even; estimates of the Company’s addressable markets for its products; the Company’s ability to gain share in existing markets and enter into and compete in new markets; the Company’s ability to successfully develop and commercialize its product pipeline; the Company’s ability to compete effectively with existing competitors; the Company’s ability to manage and grow its business by expanding its sales to existing customers or introducing our products to new customers; the Company’s ability to successfully execute its clinical trial roadmap so as to achieve its strategic objectives, including use of clinical data to reimbursed market access; the Company’s ability to successfully execute its strategic initiatives and objectives, including its strategies for penetration and growth of the standalone procedure market; and the Company’s ability to obtain and maintain sufficient reimbursement for its products. These statements often include words such as “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions. Management bases these forward-looking statements on its current expectations, plans and assumptions affecting the Company’s business and industry, and such statements are based on information available as of the time such statements are made. Although management believes these forward-looking statements are based upon reasonable assumptions, it cannot guarantee their accuracy or completeness. Forward-looking statements are subject to and involve risks, uncertainties and assumptions that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance, or achievements predicted, assumed or implied by such forward-looking statements. Some of the risks and uncertainties that may cause actual results to materially differ from those expressed or implied by these forward-looking statements are discussed under the caption “Risk Factors” in the Company’s filings with the U.S. Securities and Exchange Commission, as may be updated from time to time in subsequent filings. These cautionary statements should not be construed by you to be exhaustive and are made only as of the date of this press release. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Certain information contained in this presentation relates to, or is based on, studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its own estimates and research are reliable, such estimates and research have not been verified by any independent source. The Company has proprietary rights to trademarks, trade names and service marks appearing in this presentation that are important to our business. Solely for convenience, the trademarks, trade names and service marks may appear in this presentation without the ® and ™ symbols, but any such references are not intended to indicate that we forgo or will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this presentation are the property of their respective owners. The Company does not intend its use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of the Company by, these other parties. Without limitation, SIGHT SCIENCES™, SIGHT SCIENCES (with design)®, OMNI®, SION™, TEARCARE® , SMARTLIDS™ and DELIVERING THE POWER OF SIGHT ™ are trademarks of Sight Sciences, Inc. in the United States and other countries. RESTASIS® is a registered trademark of Allergan, Inc., and IRIS® is a registered trademark of the American Academy of Ophthalmology. 2

Our Mission Transform treatment of Eye Diseases by treating underlying causes Earlier intervention to help restore the natural functionality of healthy eyes Eyecare Innovation in �Glaucoma and Dry Eye

1 Represents Company analysis of third-party estimates. 2 Source: Market Scope 2022 reports. Large + Underserved Markets $6 billion addressable market1 3.4 million US patients diagnosed with Primary Open-Angle Glaucoma2 Leading cause of irreversible blindness $2.5 billion core addressable market1 >11 million US patients diagnosed with Meibomian Gland Disease1,2 Linked to screen time, age �(postmenopausal women, men 50+), systemic medication use Glaucoma Dry Eye Disease 4 Normal Mild Moderate Severe Normal Mild Moderate Severe

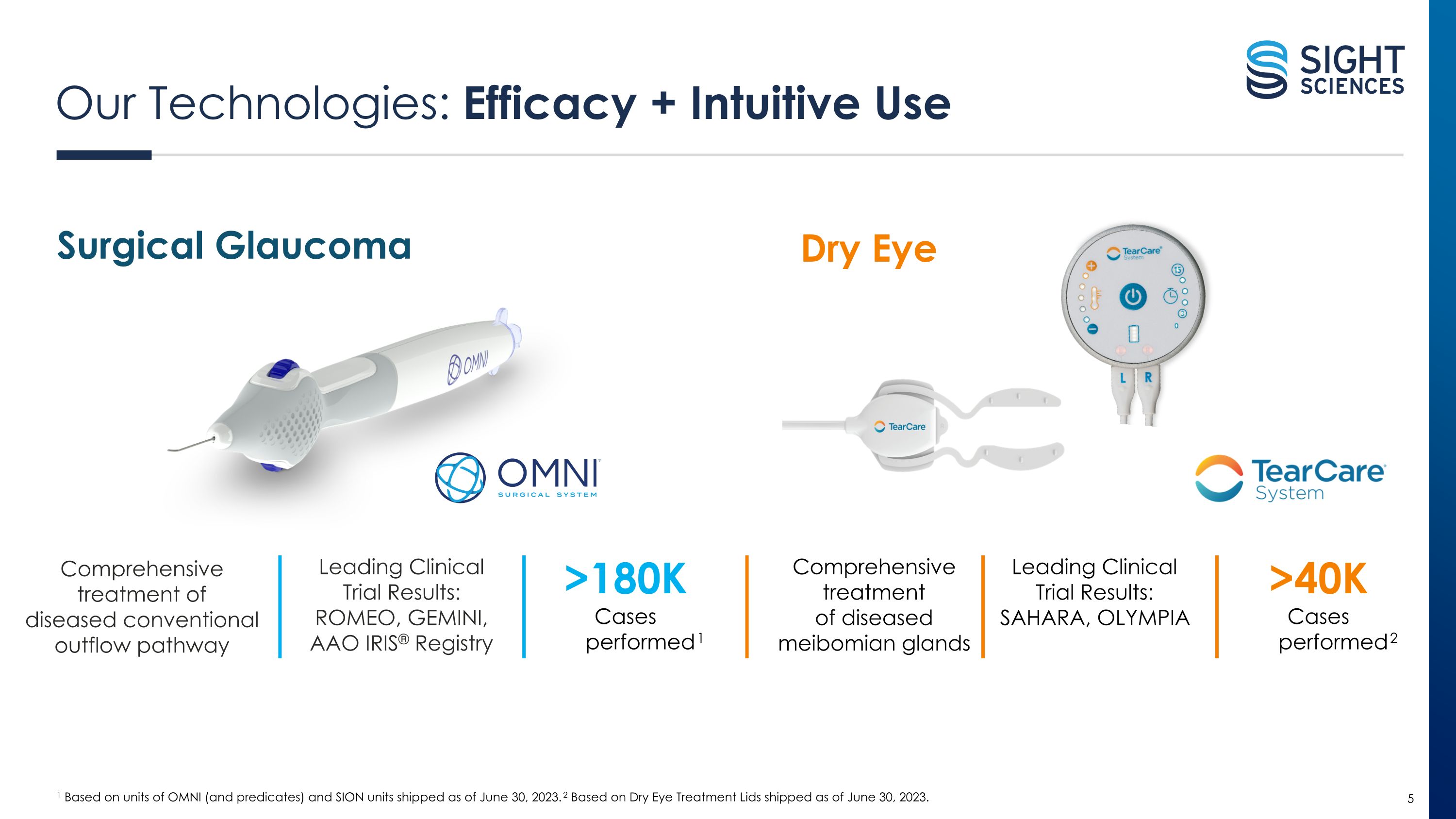

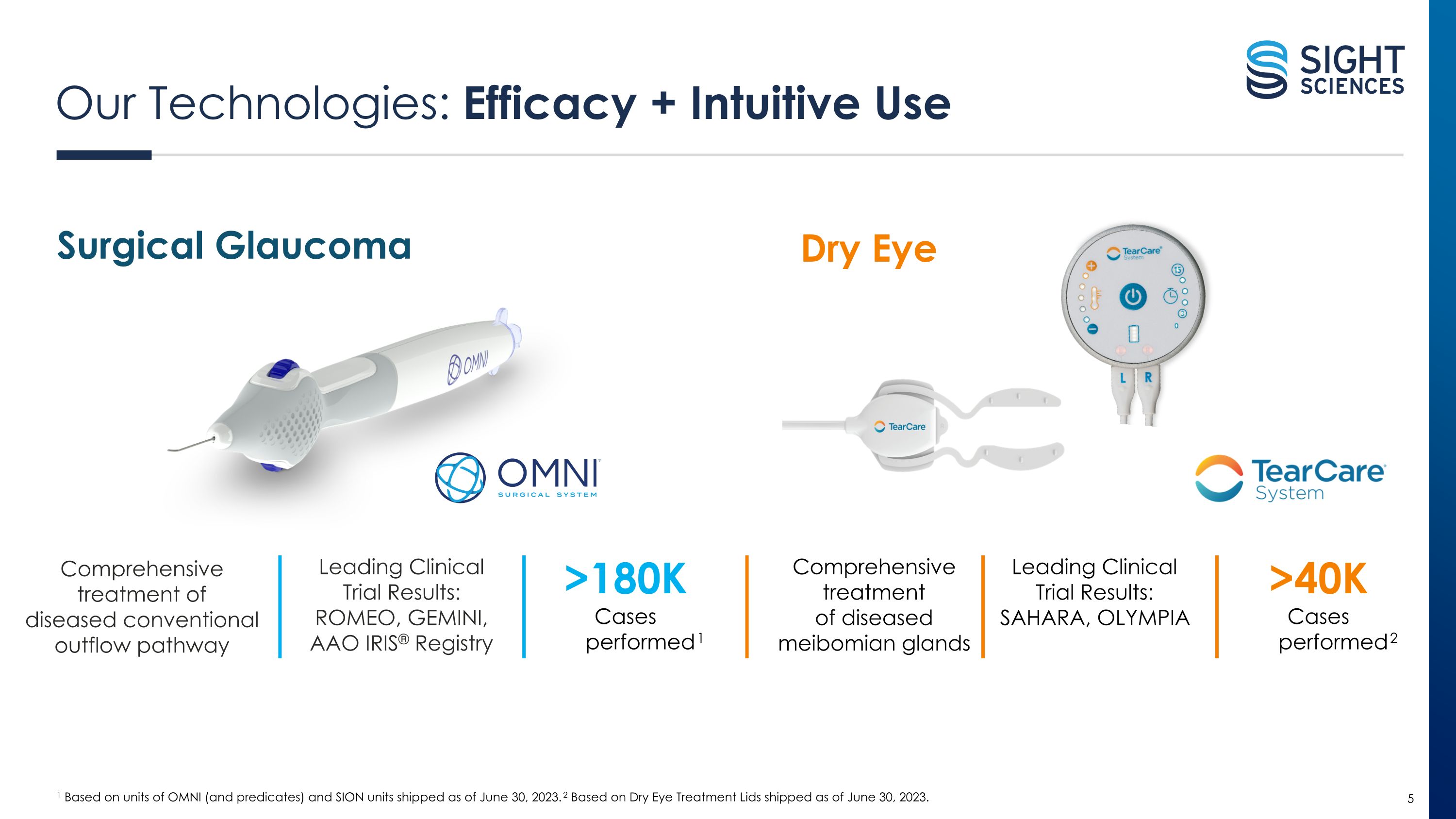

1 Based on units of OMNI (and predicates) and SION units shipped as of June 30, 2023. 2 Based on Dry Eye Treatment Lids shipped as of June 30, 2023. Our Technologies: Efficacy + Intuitive Use Surgical Glaucoma Comprehensive treatment of diseased conventional�outflow pathway Leading Clinical Trial Results: ROMEO, GEMINI, AAO IRIS® Registry >180K Cases performed1 Dry Eye Comprehensive treatment of diseased meibomian glands Leading Clinical Trial Results: SAHARA, OLYMPIA >40K Cases performed2 5

Increase OMNI Utilization Maintain and optimize market access Train new OMNI surgeons Gain share in combination cataract segment Continue penetrating standalone MIGS segment Expand international markets TearCare Access + Acceleration Drive market access Complete phase 2 of SAHARA RCT Expand adoption and usage Strategic Value Creation Initiatives 6

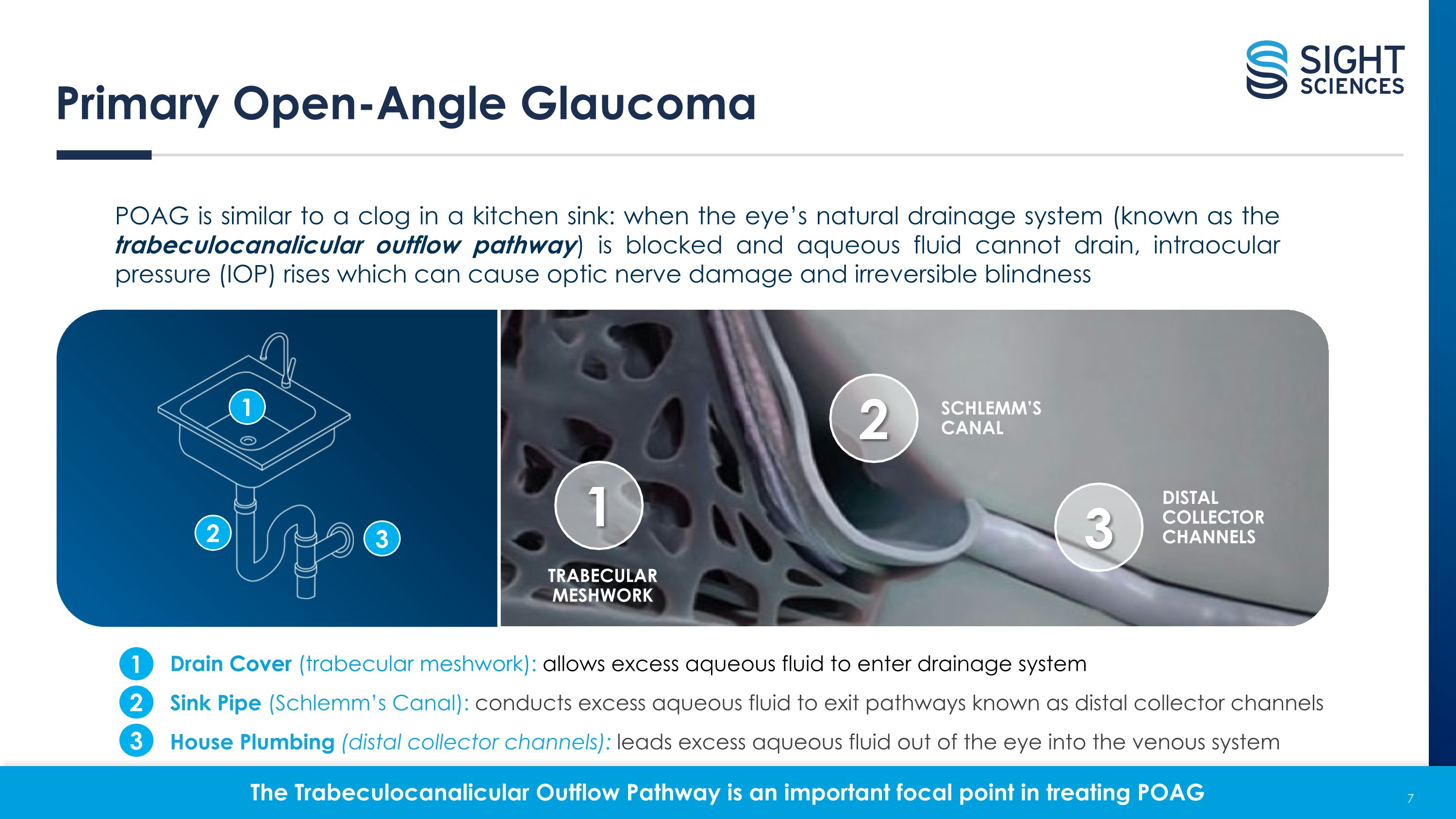

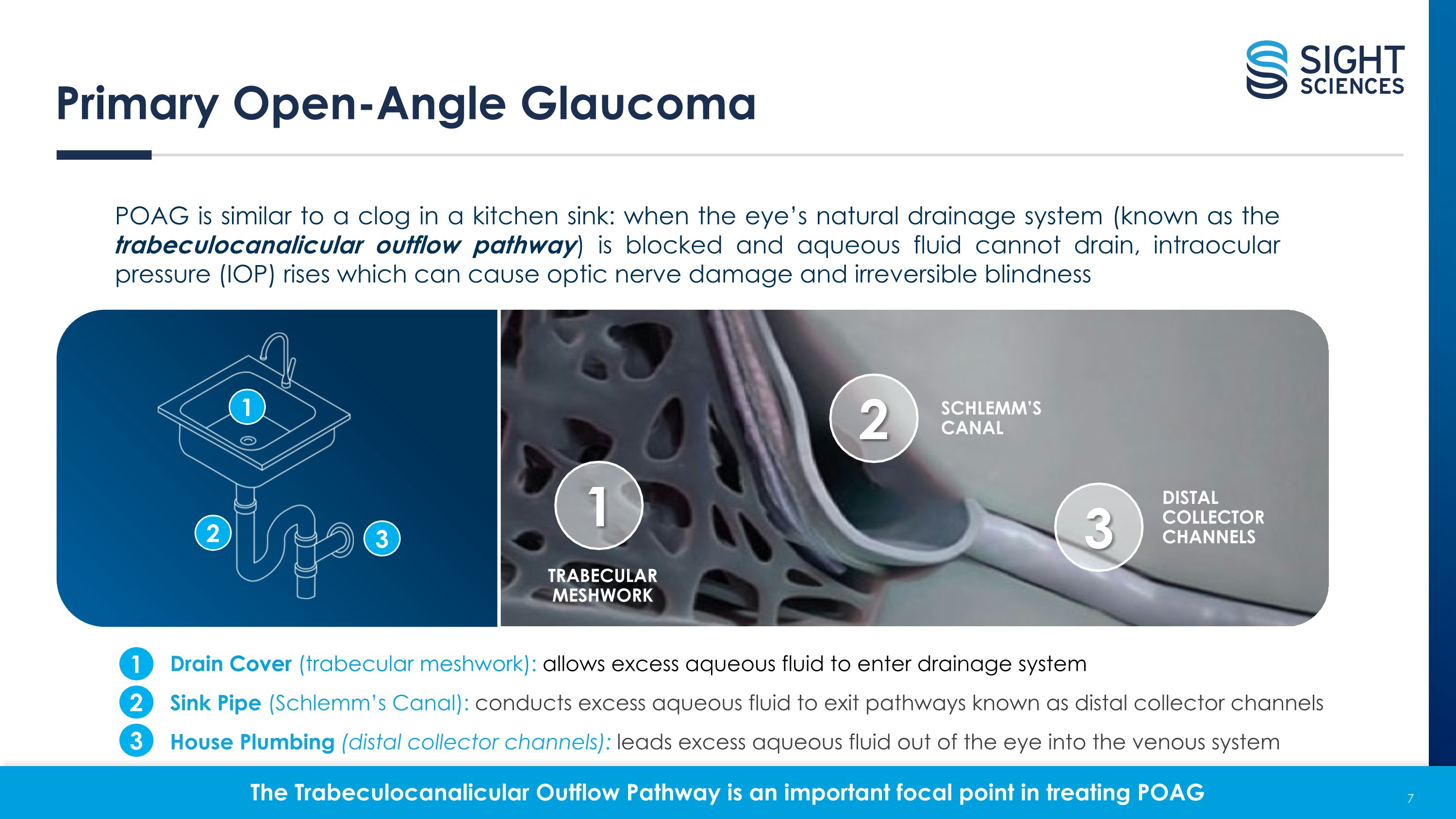

POAG is similar to a clog in a kitchen sink: when the eye’s natural drainage system (known as the trabeculocanalicular outflow pathway) is blocked and aqueous fluid cannot drain, intraocular pressure (IOP) rises which can cause optic nerve damage and irreversible blindness The Trabeculocanalicular Outflow Pathway is an important focal point in treating POAG Primary Open-Angle Glaucoma 1 2 3 Drain Cover (trabecular meshwork): allows excess aqueous fluid to enter drainage system Sink Pipe (Schlemm’s Canal): conducts excess aqueous fluid to exit pathways known as distal collector channels House Plumbing (distal collector channels): leads excess aqueous fluid out of the eye into the venous system 1 2 3 1 TRABECULAR MESHWORK SCHLEMM’S�CANAL DISTAL COLLECTOR�CHANNELS 2 3 7

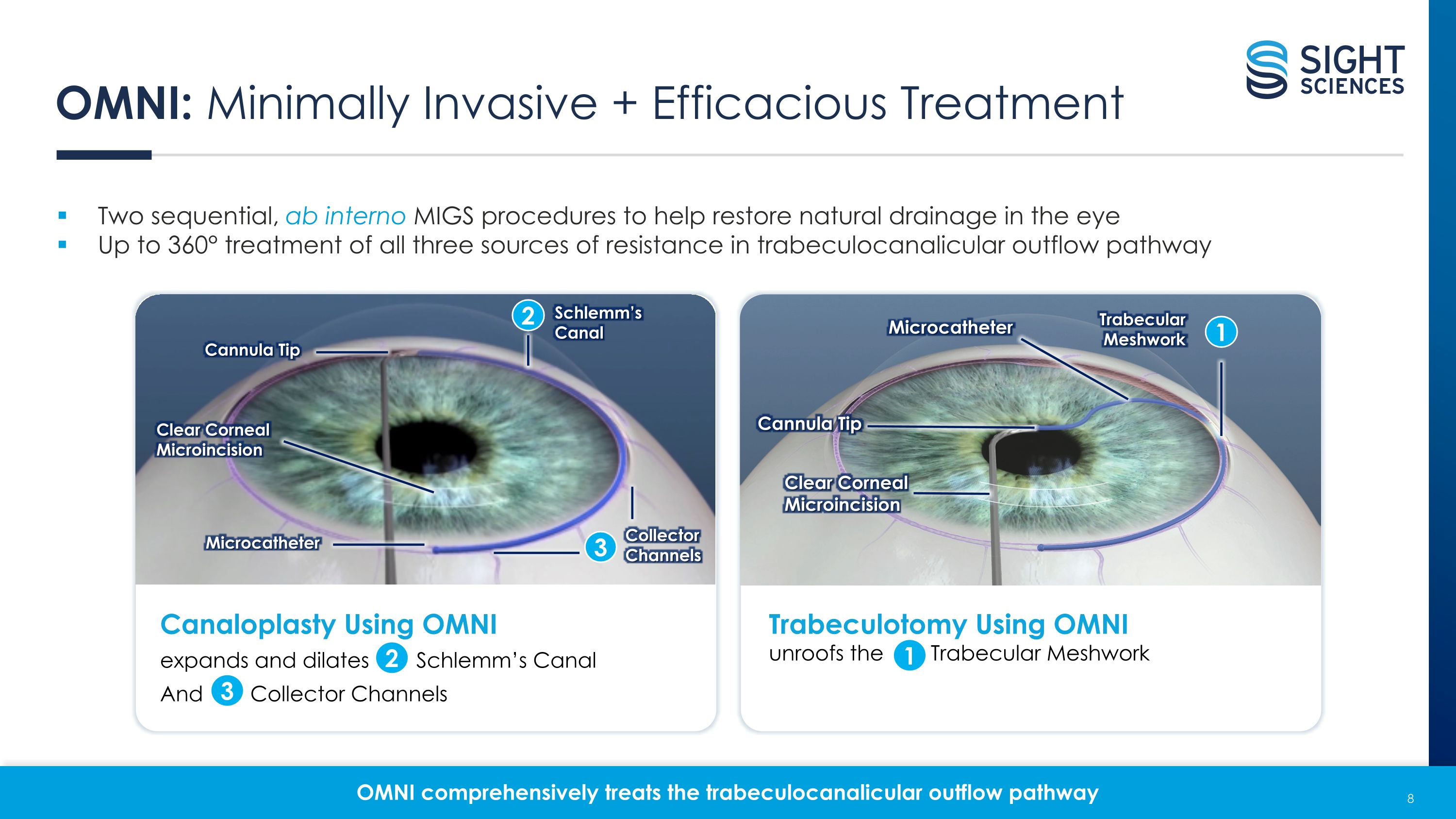

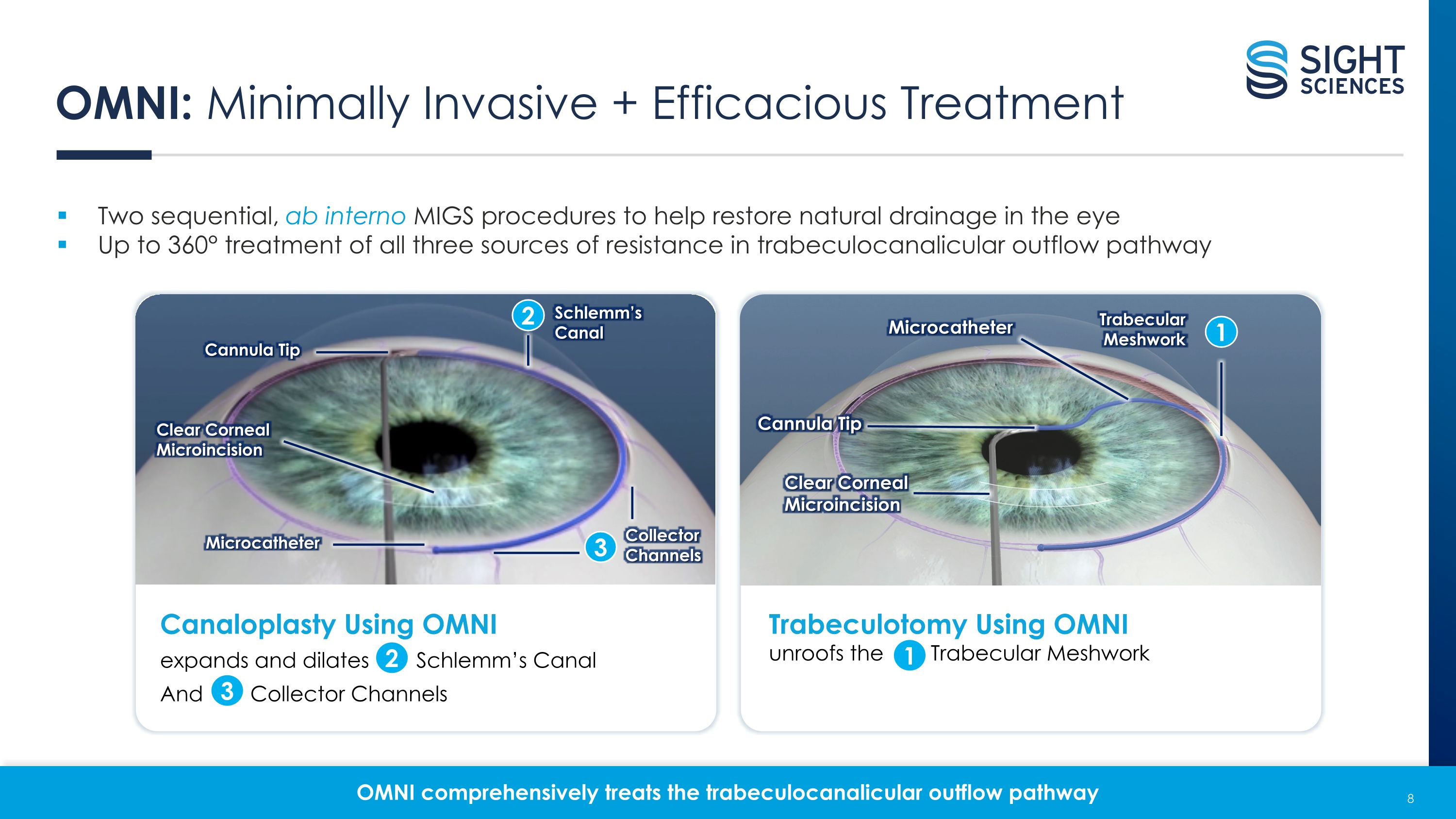

OMNI: Minimally Invasive + Efficacious Treatment Two sequential, ab interno MIGS procedures to help restore natural drainage in the eye Up to 360° treatment of all three sources of resistance in trabeculocanalicular outflow pathway OMNI comprehensively treats the trabeculocanalicular outflow pathway Schlemm’s �Canal Collector Channels Cannula Tip Clear Corneal Microincision Microcatheter Canaloplasty Using OMNI expands and dilates Schlemm’s Canal And Collector Channels 2 3 2 3 Trabecular Meshwork Cannula Tip Microcatheter Clear Corneal Microincision 1 Trabeculotomy Using OMNI�unroofs the Trabecular Meshwork 1 8

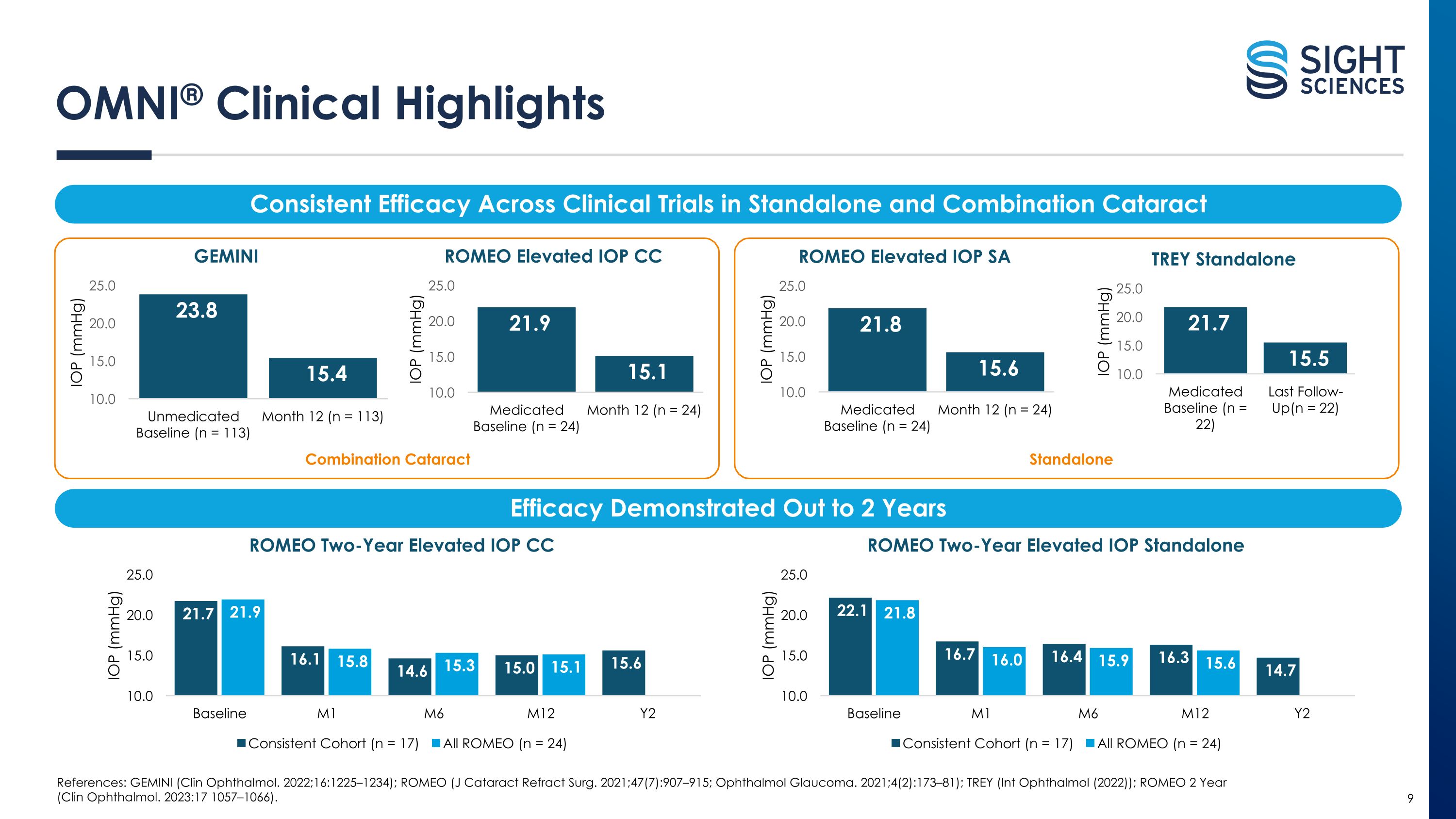

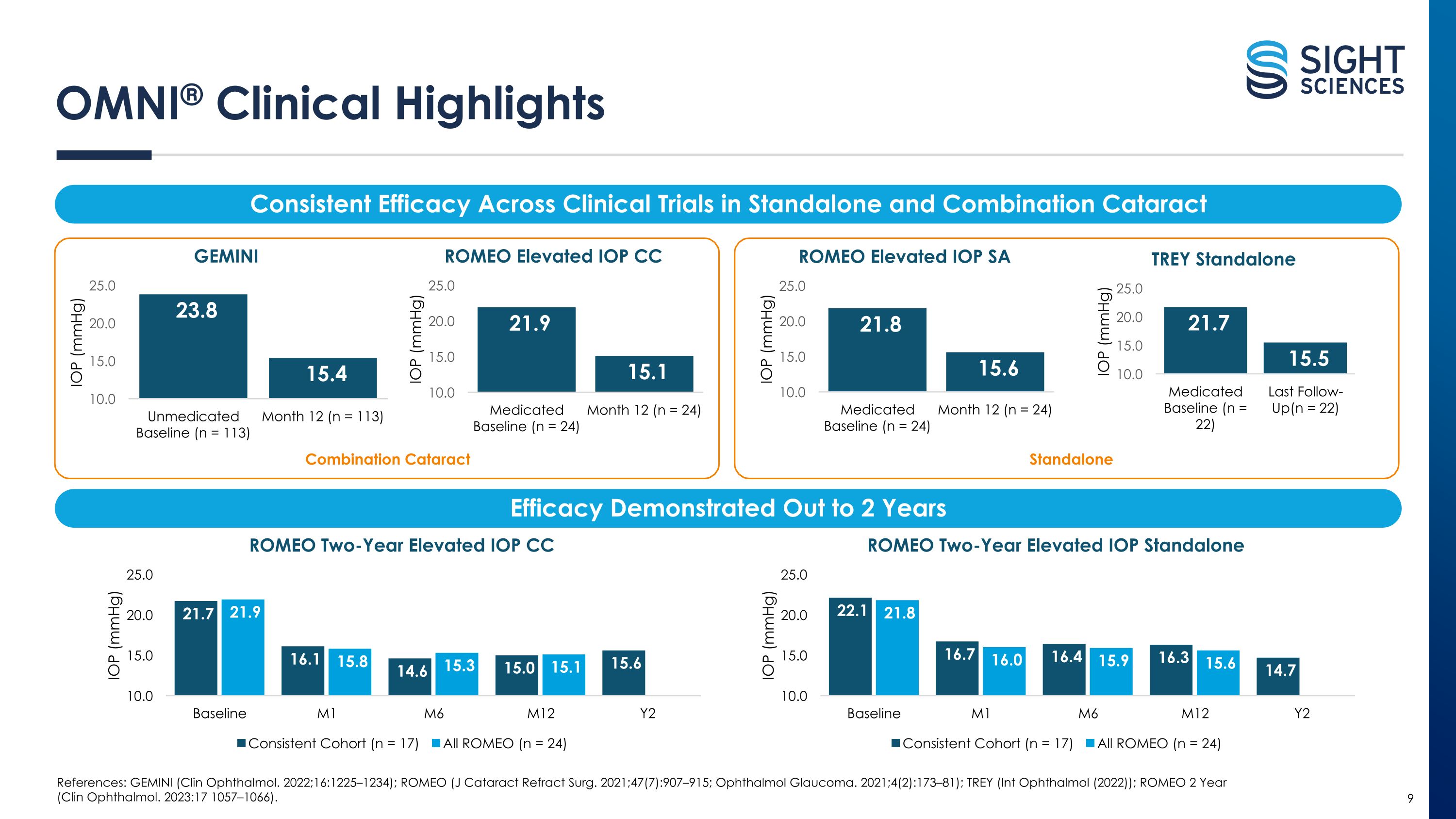

References: GEMINI (Clin Ophthalmol. 2022;16:1225–1234); ROMEO (J Cataract Refract Surg. 2021;47(7):907–915; Ophthalmol Glaucoma. 2021;4(2):173–81); TREY (Int Ophthalmol (2022)); ROMEO 2 Year (Clin Ophthalmol. 2023:17 1057–1066). OMNI® Clinical Highlights Consistent Efficacy Across Clinical Trials in Standalone and Combination Cataract Efficacy Demonstrated Out to 2 Years 9 Combination Cataract Standalone

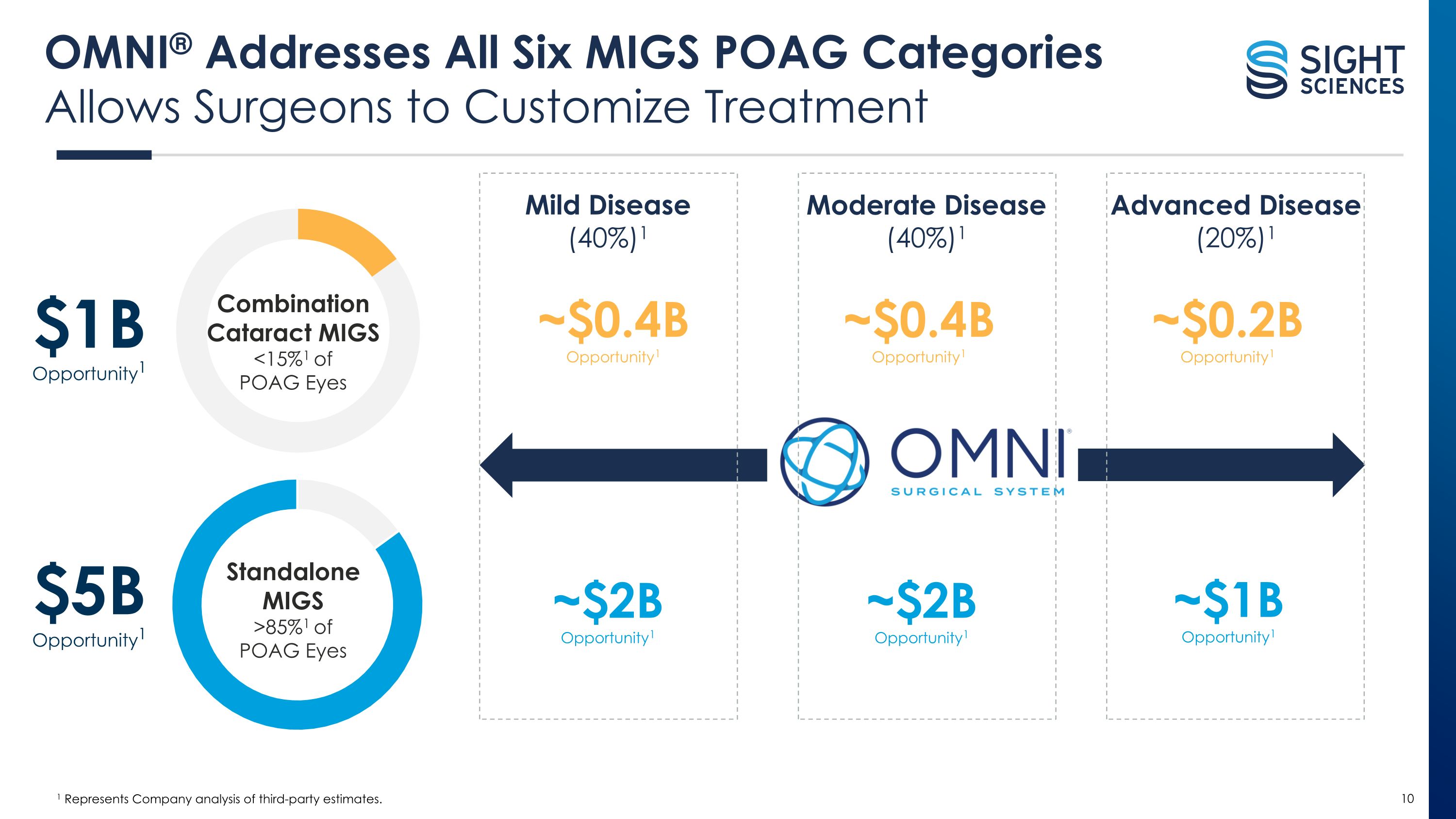

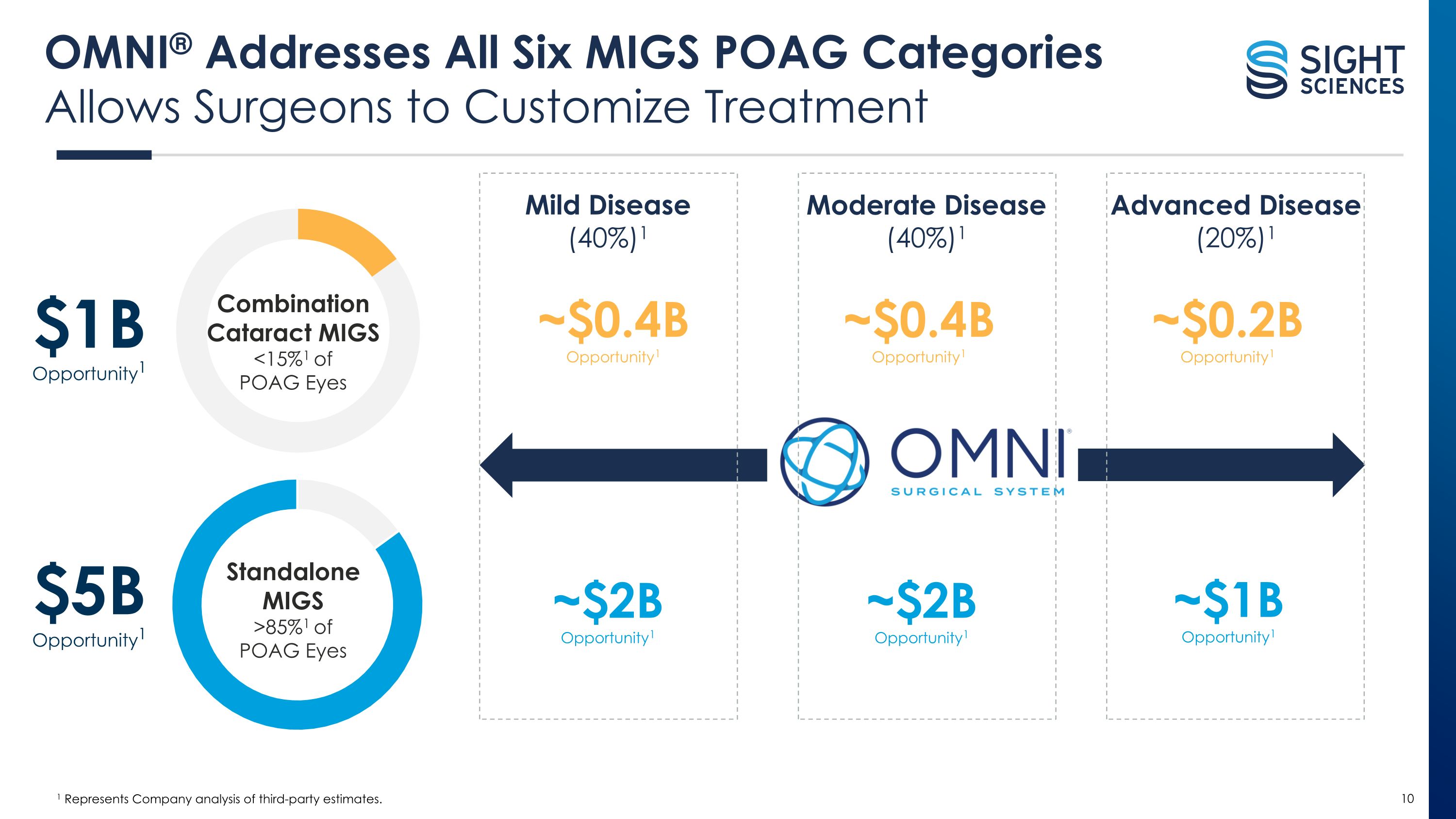

Combination �Cataract MIGS <15%1 of POAG Eyes $1B Opportunity1 1 Represents Company analysis of third-party estimates. Mild Disease �(40%)1 Moderate Disease�(40%)1 Advanced Disease �(20%)1 Standalone MIGS >85%1 of POAG Eyes $5B Opportunity1 ~$0.4B Opportunity1 ~$2B Opportunity1 ~$2B Opportunity1 ~$1B Opportunity1 ~$0.4B Opportunity1 ~$0.2B Opportunity1 OMNI® Addresses All Six MIGS POAG Categories�Allows Surgeons to Customize Treatment 10

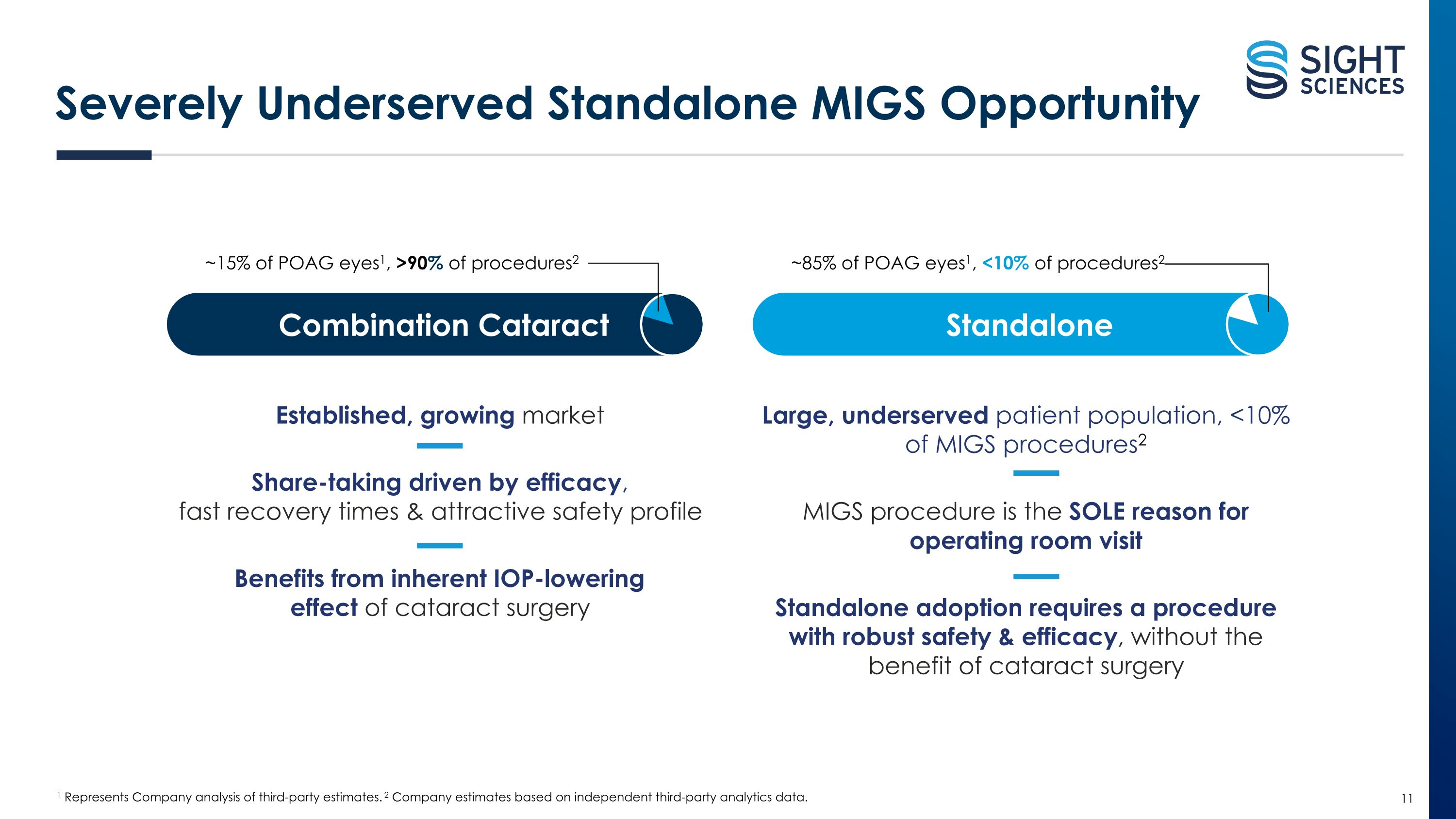

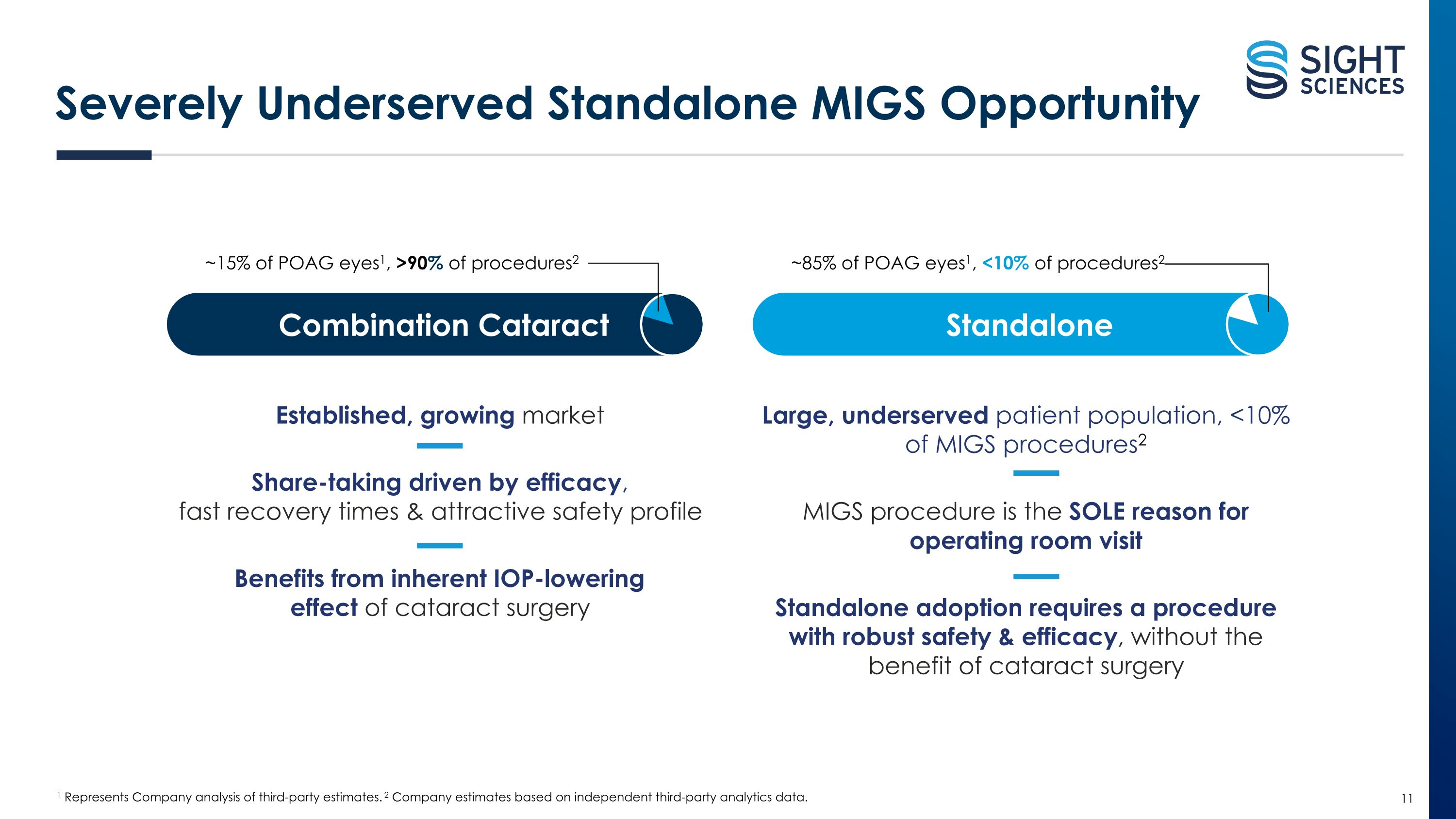

1 Represents Company analysis of third-party estimates. 2 Company estimates based on independent third-party analytics data. Severely Underserved Standalone MIGS Opportunity ~15% of POAG eyes1, >90% of procedures2 Combination Cataract Established, growing market Share-taking driven by efficacy, �fast recovery times & attractive safety profile Benefits from inherent IOP-lowering �effect of cataract surgery ~85% of POAG eyes1, <10% of procedures2 Standalone Large, underserved patient population, <10% of MIGS procedures2 MIGS procedure is the SOLE reason for operating room visit Standalone adoption requires a procedure with robust safety & efficacy, without the benefit of cataract surgery 11

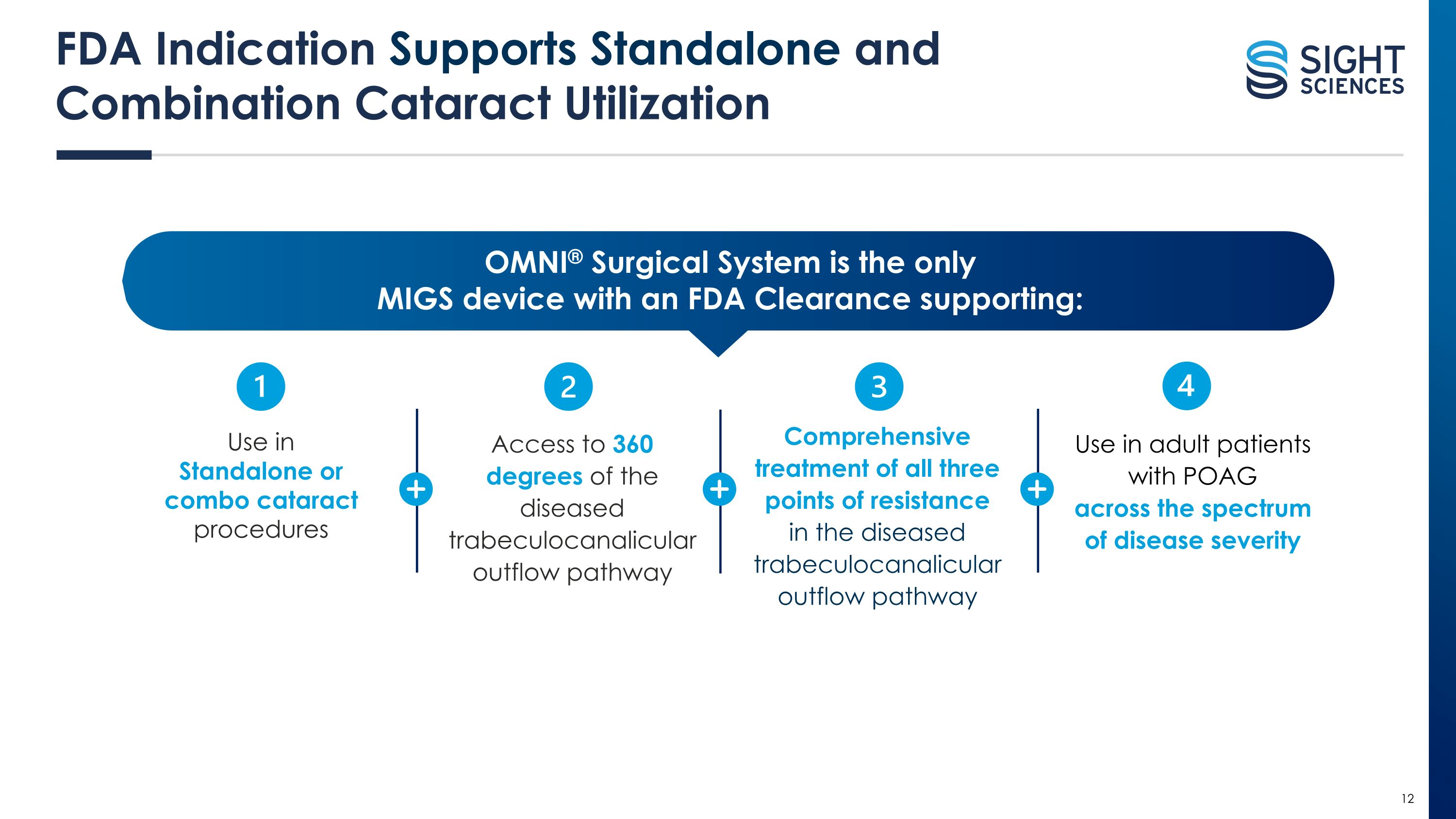

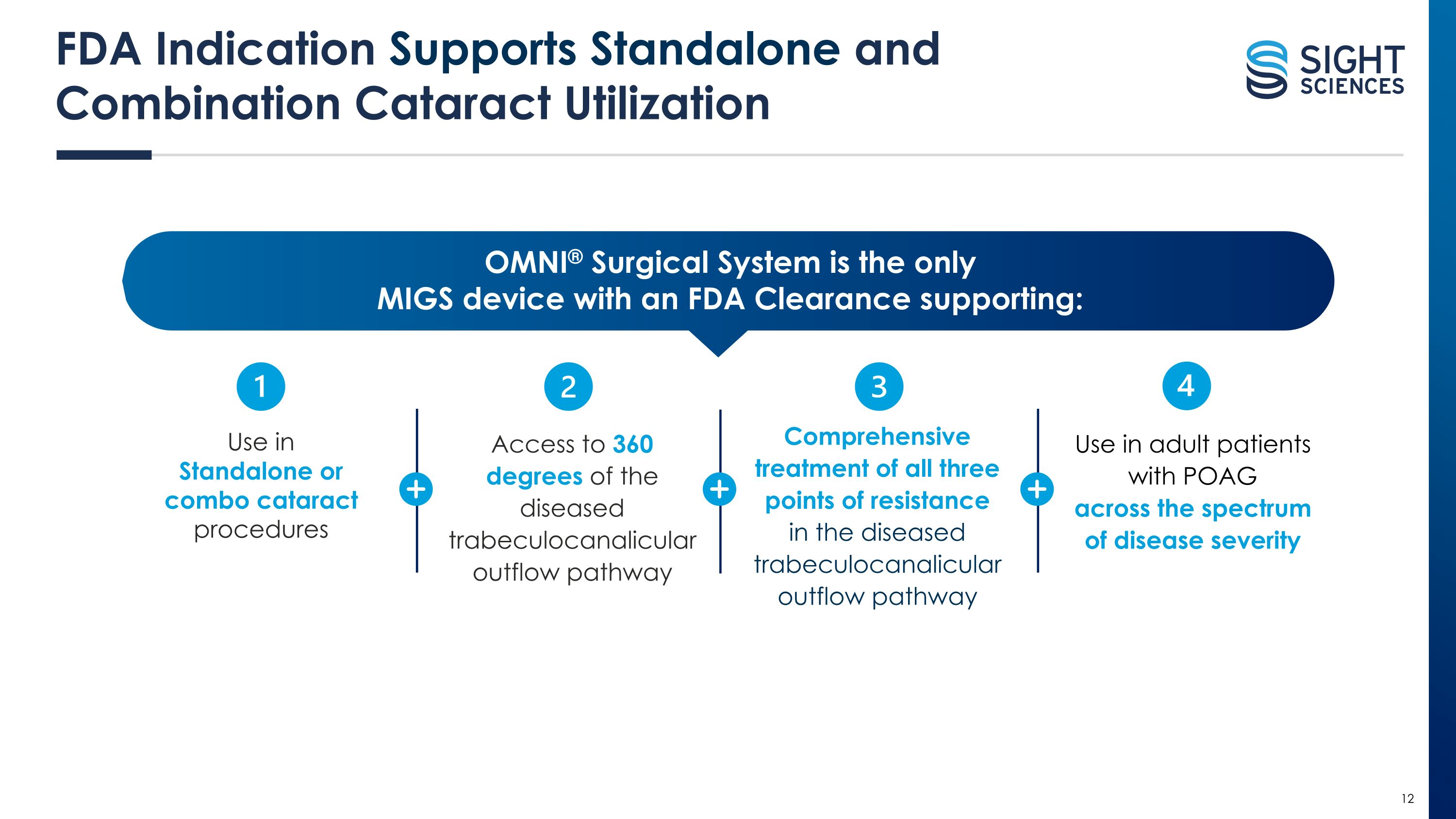

OMNI® Surgical System is the only MIGS device based on clinical data that can: 12 12 FDA Indication Supports Standalone and�Combination Cataract Utilization Use in �Standalone or combo cataract procedures Access to 360 degrees of the diseased trabeculocanalicular outflow pathway Comprehensive treatment of all three points of resistance in the diseased trabeculocanalicular outflow pathway Use in adult patients with POAG �across the spectrum �of disease severity OMNI® Surgical System is the only MIGS device with an FDA Clearance supporting: 12

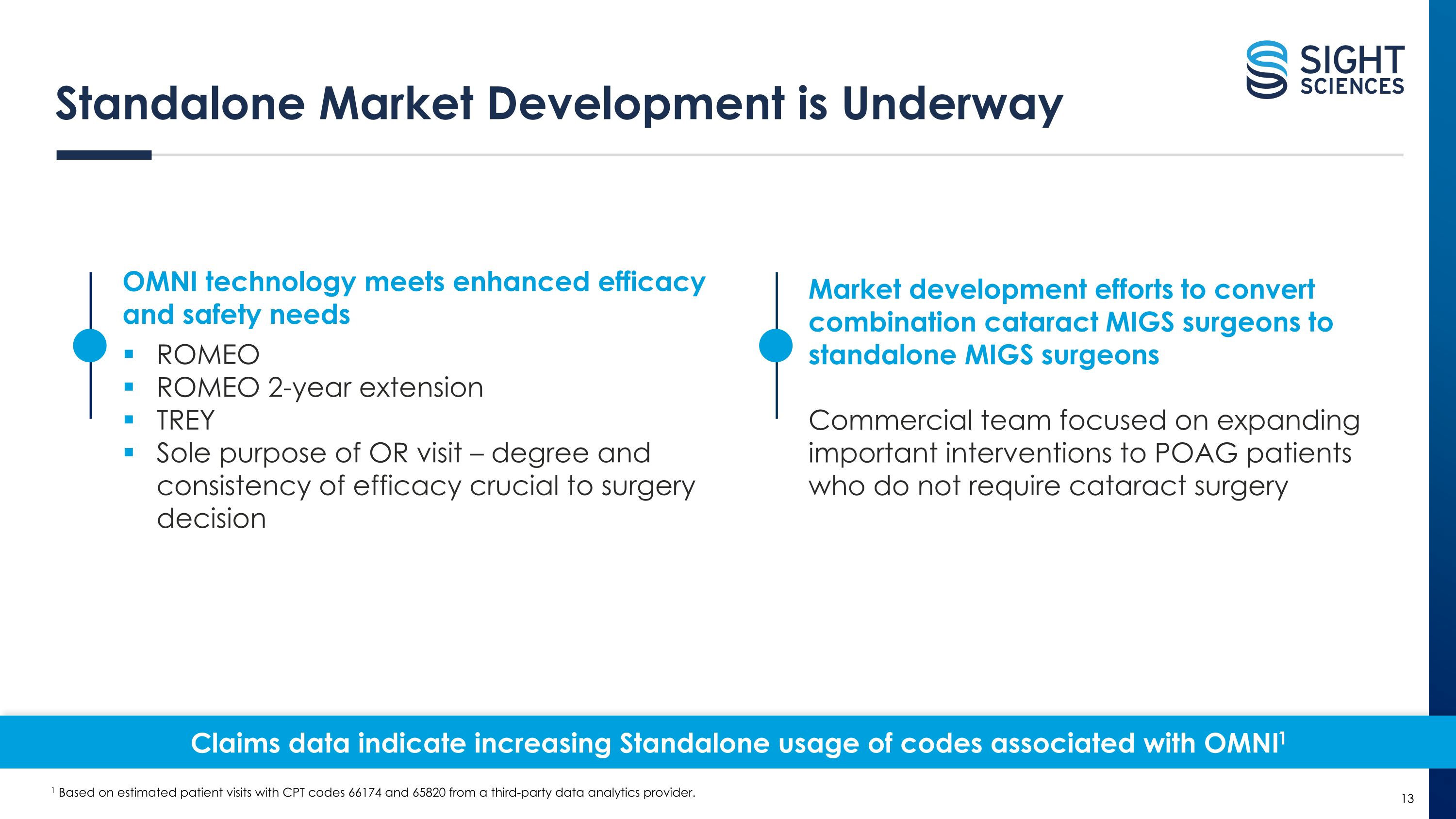

Standalone Market Development is Underway 1 Based on estimated patient visits with CPT codes 66174 and 65820 from a third-party data analytics provider. OMNI technology meets enhanced efficacy �and safety needs ROMEO ROMEO 2-year extension TREY Sole purpose of OR visit – degree and consistency of efficacy crucial to surgery decision Market development efforts to convert �combination cataract MIGS surgeons to standalone MIGS surgeons Commercial team focused on expanding important interventions to POAG patients who do not require cataract surgery Claims data indicate increasing Standalone usage of codes associated with OMNI1 13

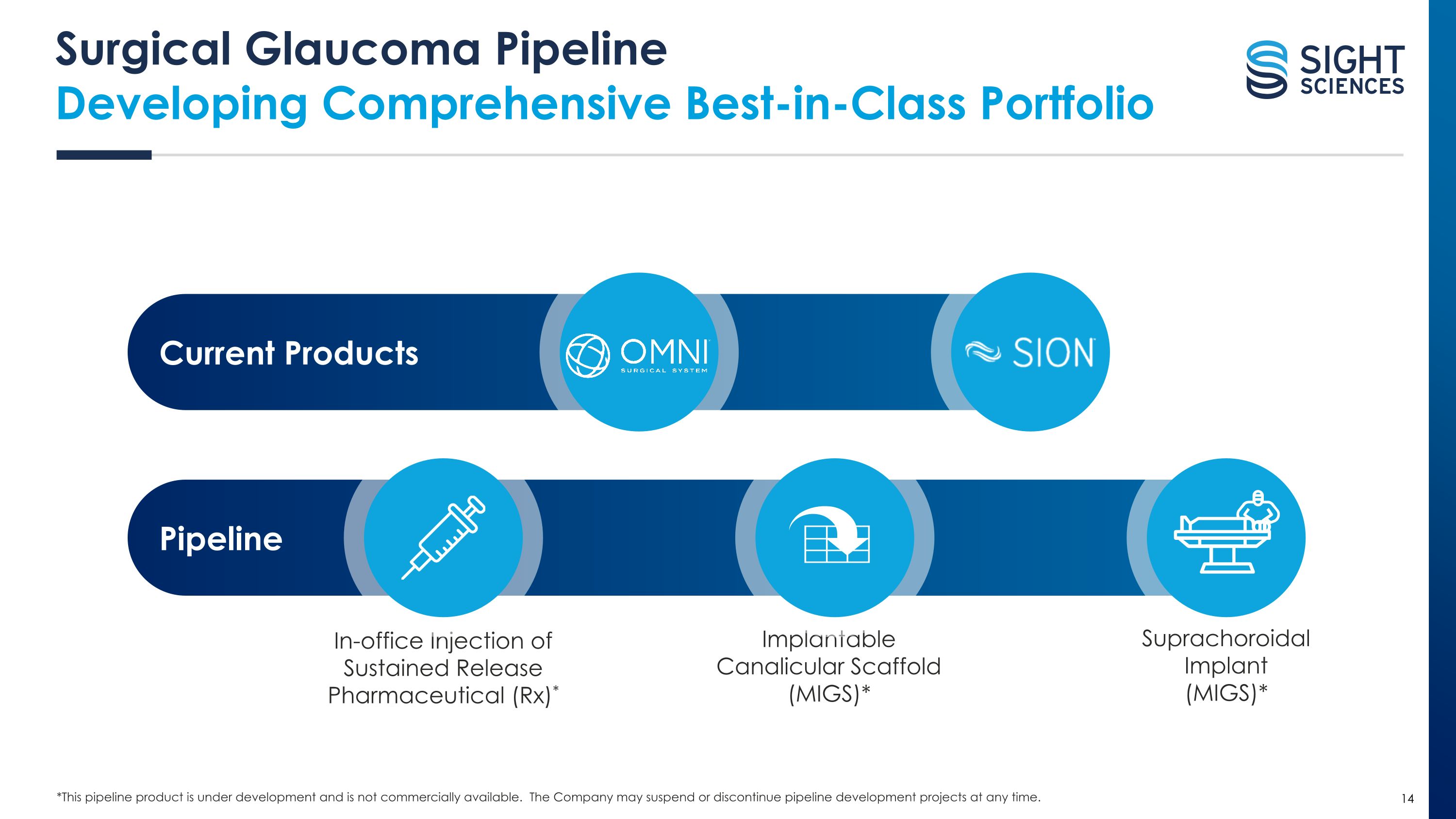

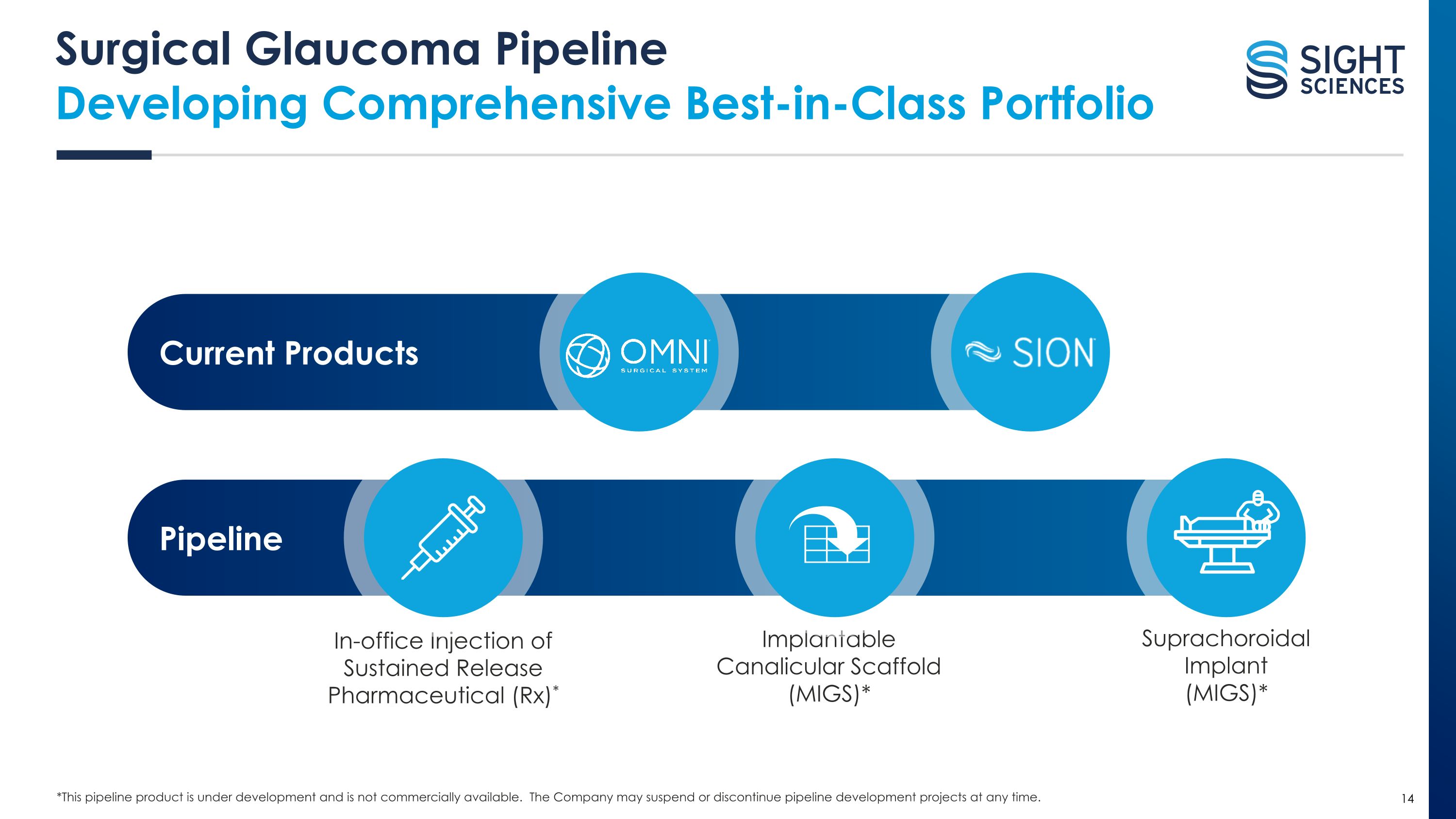

14 *This pipeline product is under development and is not commercially available. The Company may suspend or discontinue pipeline development projects at any time. Surgical Glaucoma Pipeline�Developing Comprehensive Best-in-Class Portfolio Pipeline Current Products In-office Injection of Sustained Release Pharmaceutical (Rx)* Suprachoroidal Implant (MIGS)* Implantable Canalicular Scaffold (MIGS)* 14

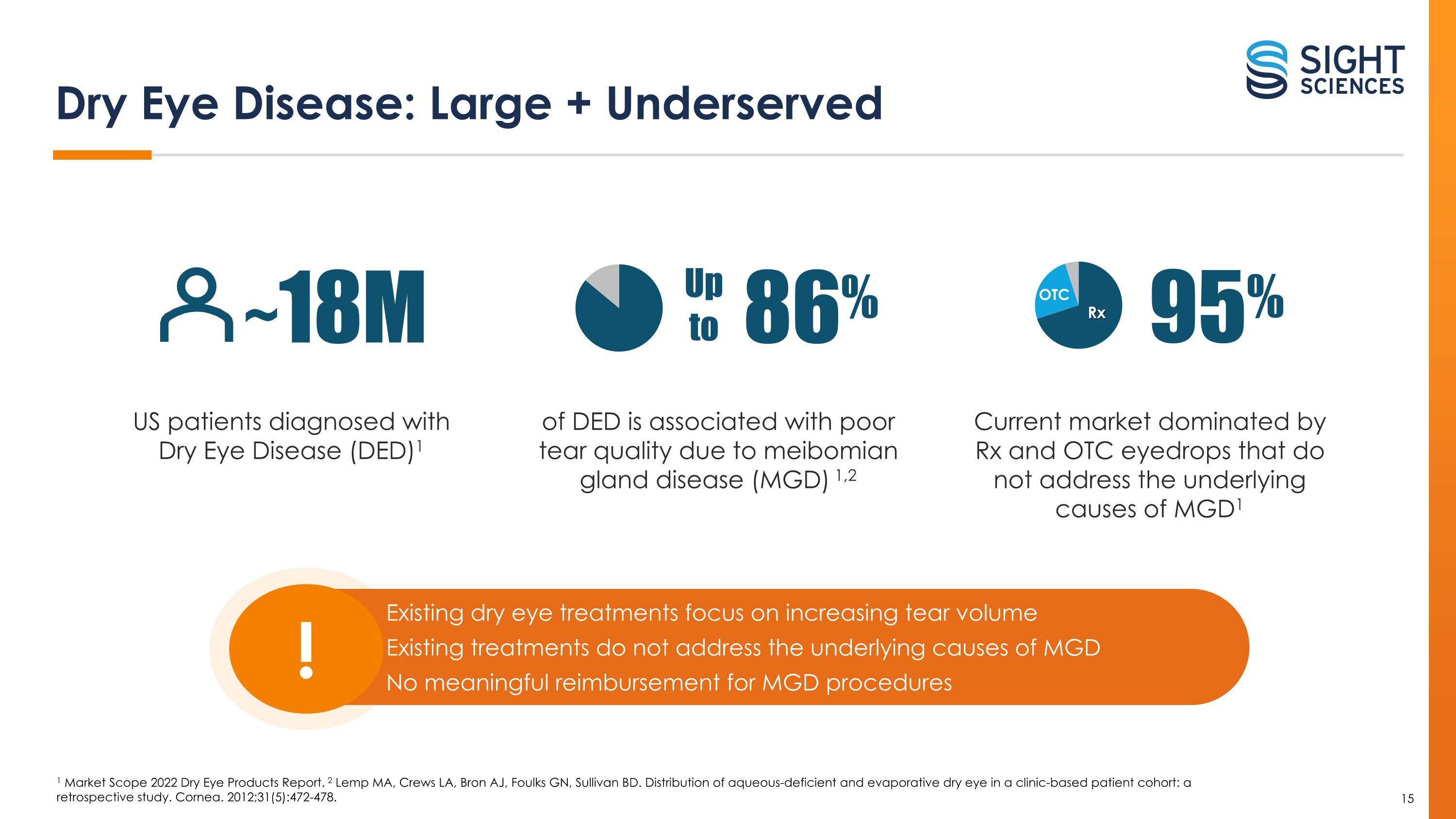

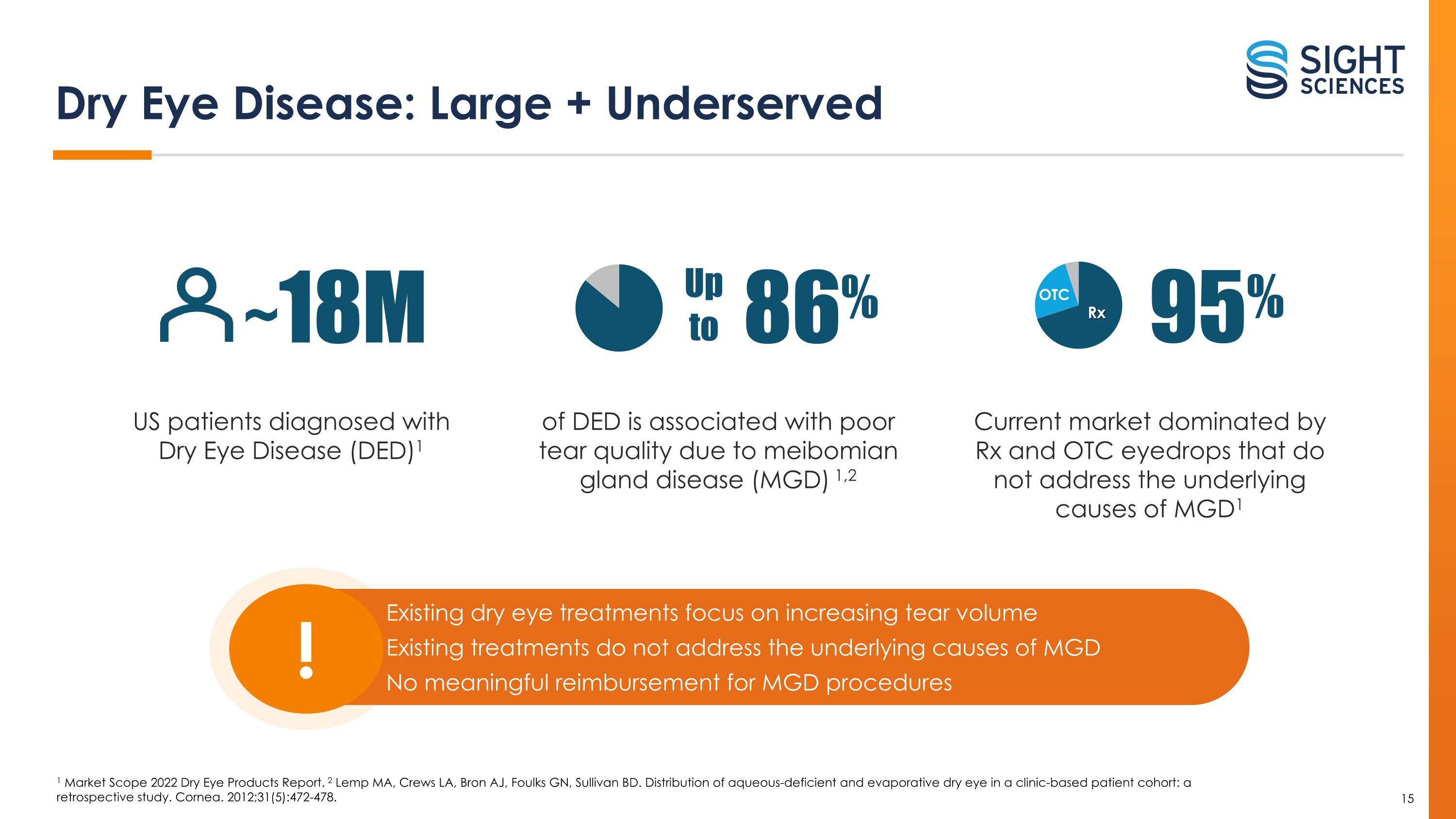

1 Market Scope 2022 Dry Eye Products Report. 2 Lemp MA, Crews LA, Bron AJ, Foulks GN, Sullivan BD. Distribution of aqueous-deficient and evaporative dry eye in a clinic-based patient cohort: a retrospective study. Cornea. 2012;31(5):472-478. Dry Eye Disease: Large + Underserved TRABECULAR MESHWORK US patients diagnosed with Dry Eye Disease (DED)1 ~18M of DED is associated with poor tear quality due to meibomian gland disease (MGD) 1,2 Current market dominated by Rx and OTC eyedrops that do not address the underlying causes of MGD1 95% Existing dry eye treatments focus on increasing tear volume Existing treatments do not address the underlying causes of MGD No meaningful reimbursement for MGD procedures ! 15 Up to 86%

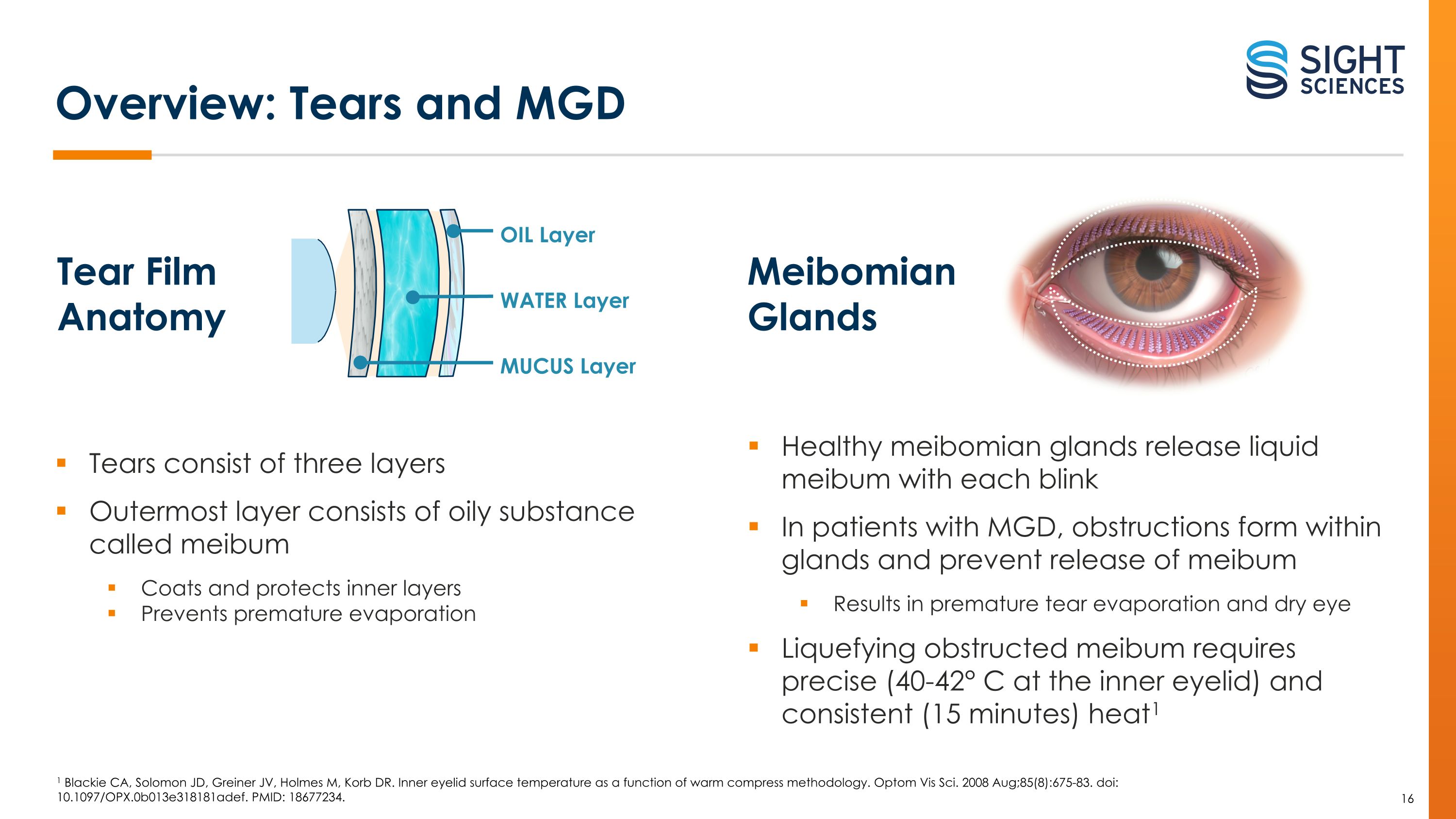

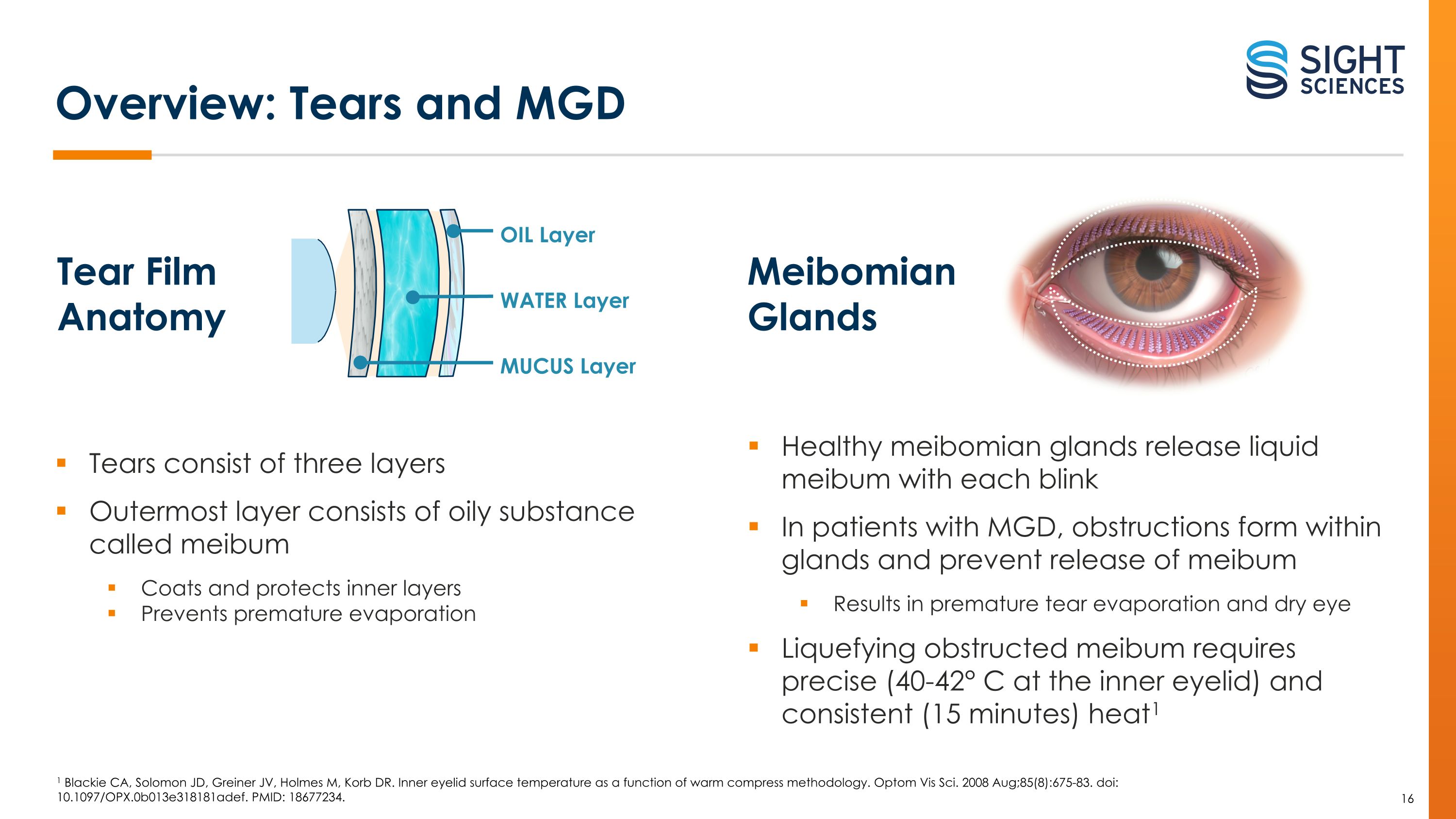

1 Blackie CA, Solomon JD, Greiner JV, Holmes M, Korb DR. Inner eyelid surface temperature as a function of warm compress methodology. Optom Vis Sci. 2008 Aug;85(8):675-83. doi: 10.1097/OPX.0b013e318181adef. PMID: 18677234. Overview: Tears and MGD Meibomian �Glands Healthy meibomian glands release liquid meibum with each blink In patients with MGD, obstructions form within glands and prevent release of meibum Results in premature tear evaporation and dry eye Liquefying obstructed meibum requires precise (40-42° C at the inner eyelid) and consistent (15 minutes) heat1 Tear Film Anatomy Tears consist of three layers Outermost layer consists of oily substance called meibum Coats and protects inner layers Prevents premature evaporation OIL Layer WATER Layer MUCUS Layer 16

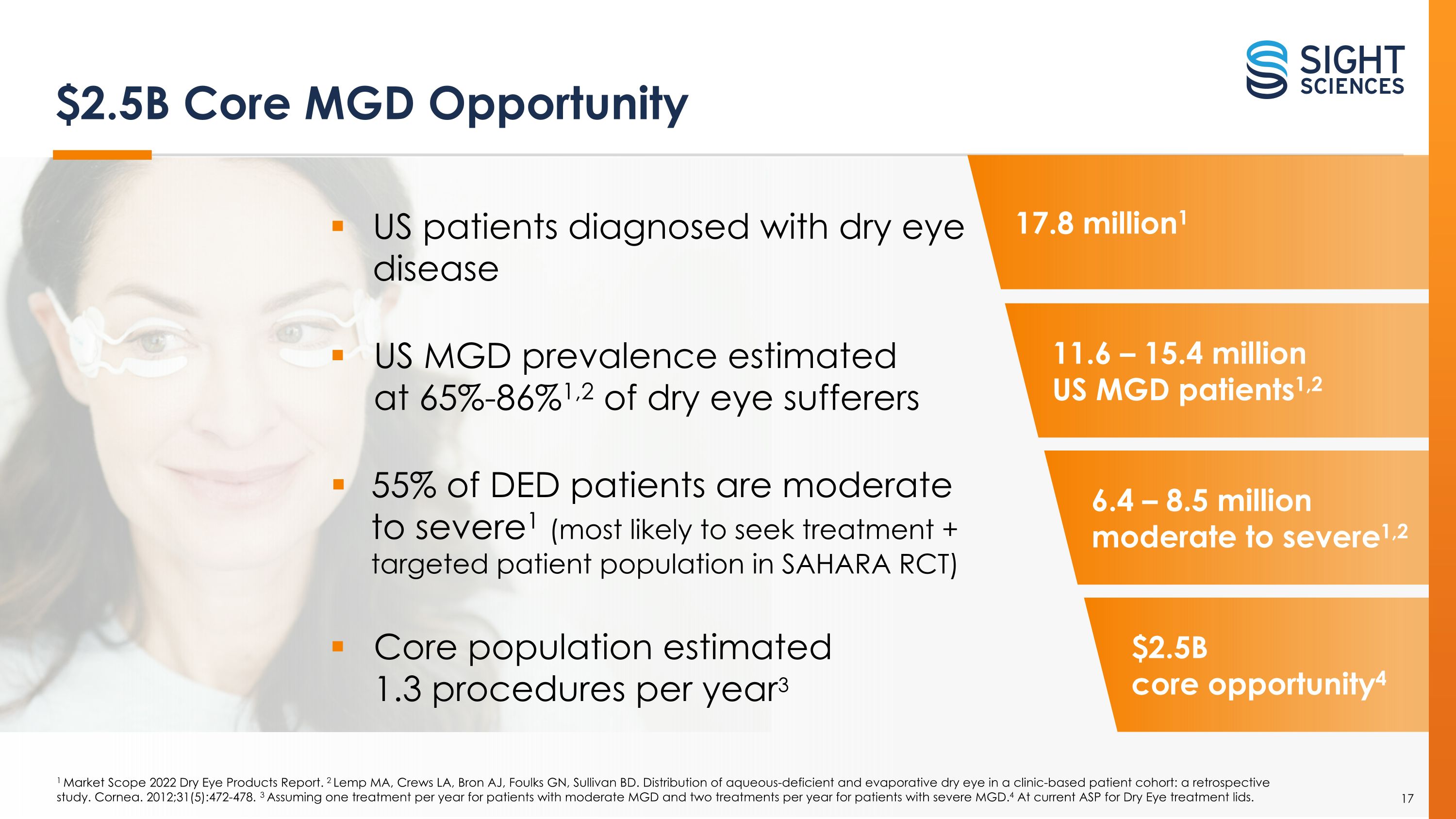

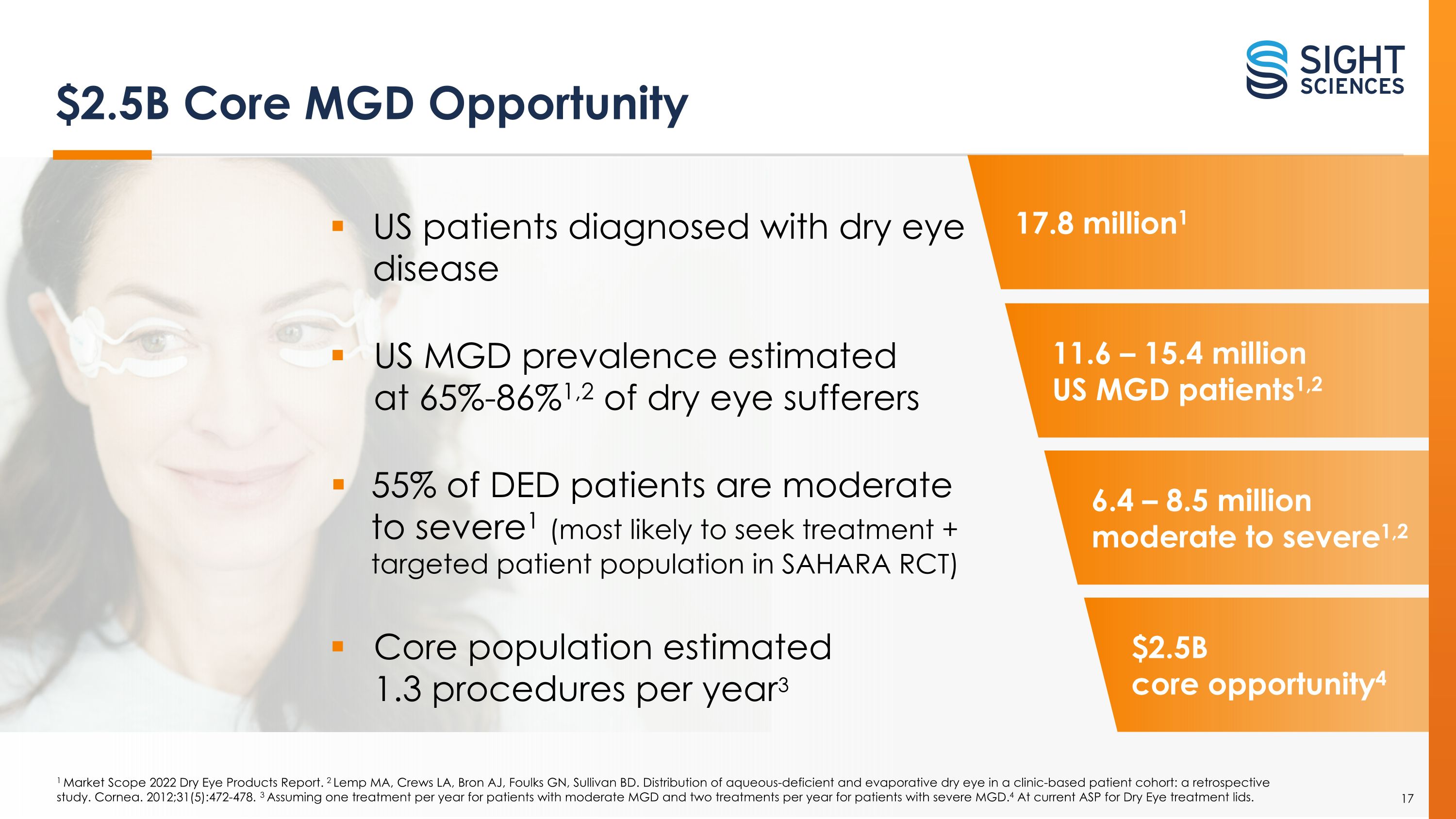

$2.5B Core MGD Opportunity 17.8 million1 11.6 – 15.4 million US MGD patients1,2 6.4 – 8.5 million moderate to severe1,2 $2.5B core opportunity4 1 Market Scope 2022 Dry Eye Products Report. 2 Lemp MA, Crews LA, Bron AJ, Foulks GN, Sullivan BD. Distribution of aqueous-deficient and evaporative dry eye in a clinic-based patient cohort: a retrospective study. Cornea. 2012;31(5):472-478. 3 Assuming one treatment per year for patients with moderate MGD and two treatments per year for patients with severe MGD. 4 At current ASP for Dry Eye treatment lids. US patients diagnosed with dry eye disease US MGD prevalence estimated �at 65%-86%1,2 of dry eye sufferers 55% of DED patients are moderate �to severe1 (most likely to seek treatment + targeted patient population in SAHARA RCT) Core population estimated �1.3 procedures per year3 17

1 Blackie CA, Solomon JD, Greiner JV, Holmes M, Korb DR. Inner eyelid surface temperature as a function of warm compress methodology. Optom Vis Sci. 2008 Aug;85(8):675-83. doi: 10.1097/OPX.0b013e318181adef. PMID: 18677234. TearCare: Custom-Designed to Treat MGD TearCare Technology Engineered to liquefy meibum obstructions1 Delivers precise (40-42° C at the inner eyelid) and consistent (15 minutes) heat1 Manual expression clears glands Single-use SmartLids conform to variable eyelid anatomy while allowing natural blinking Designed for intuitive provider training and comfortable patient experience The only wearable eyelid technology designed to melt and remove meibomian gland obstructions 18

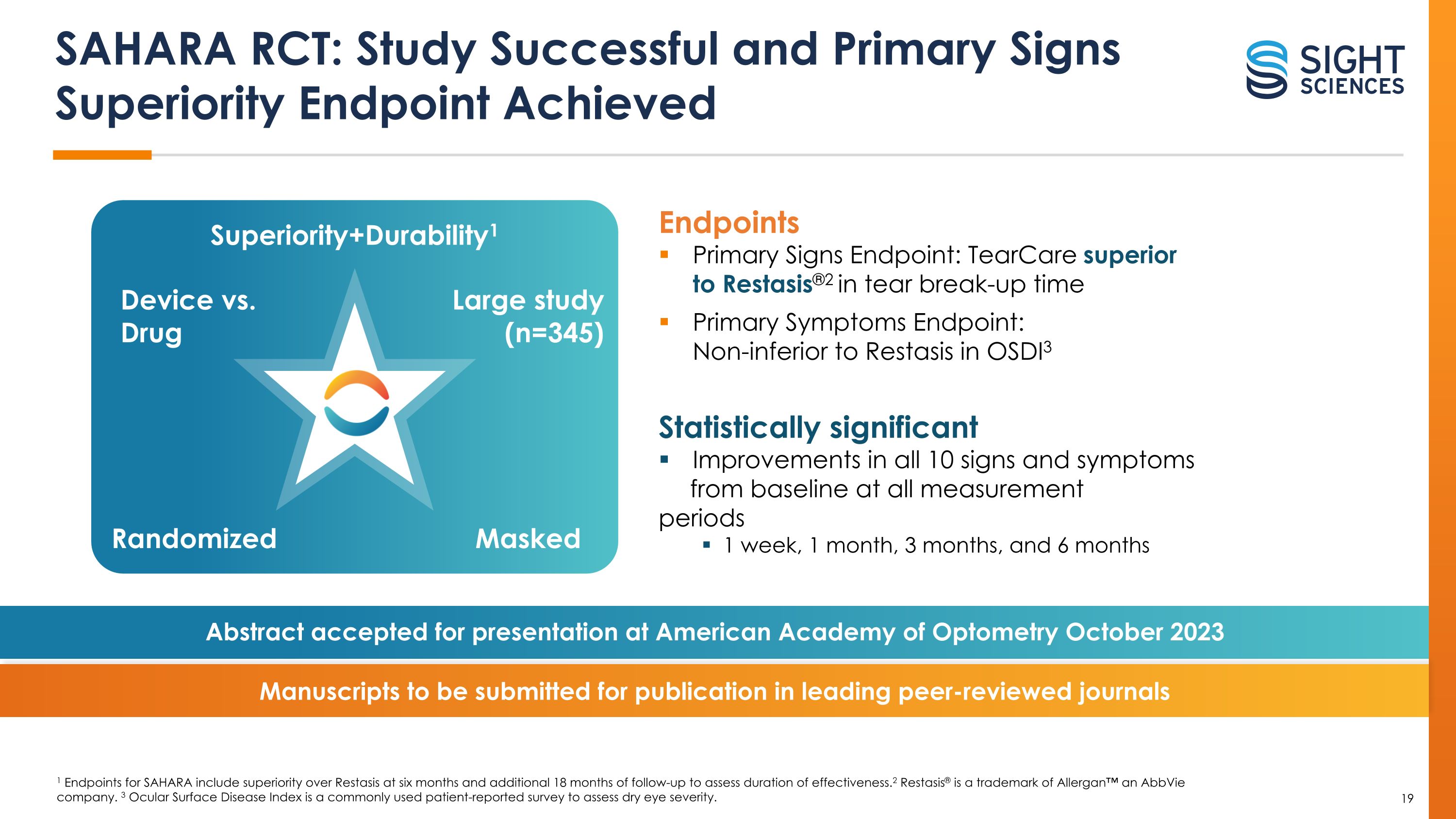

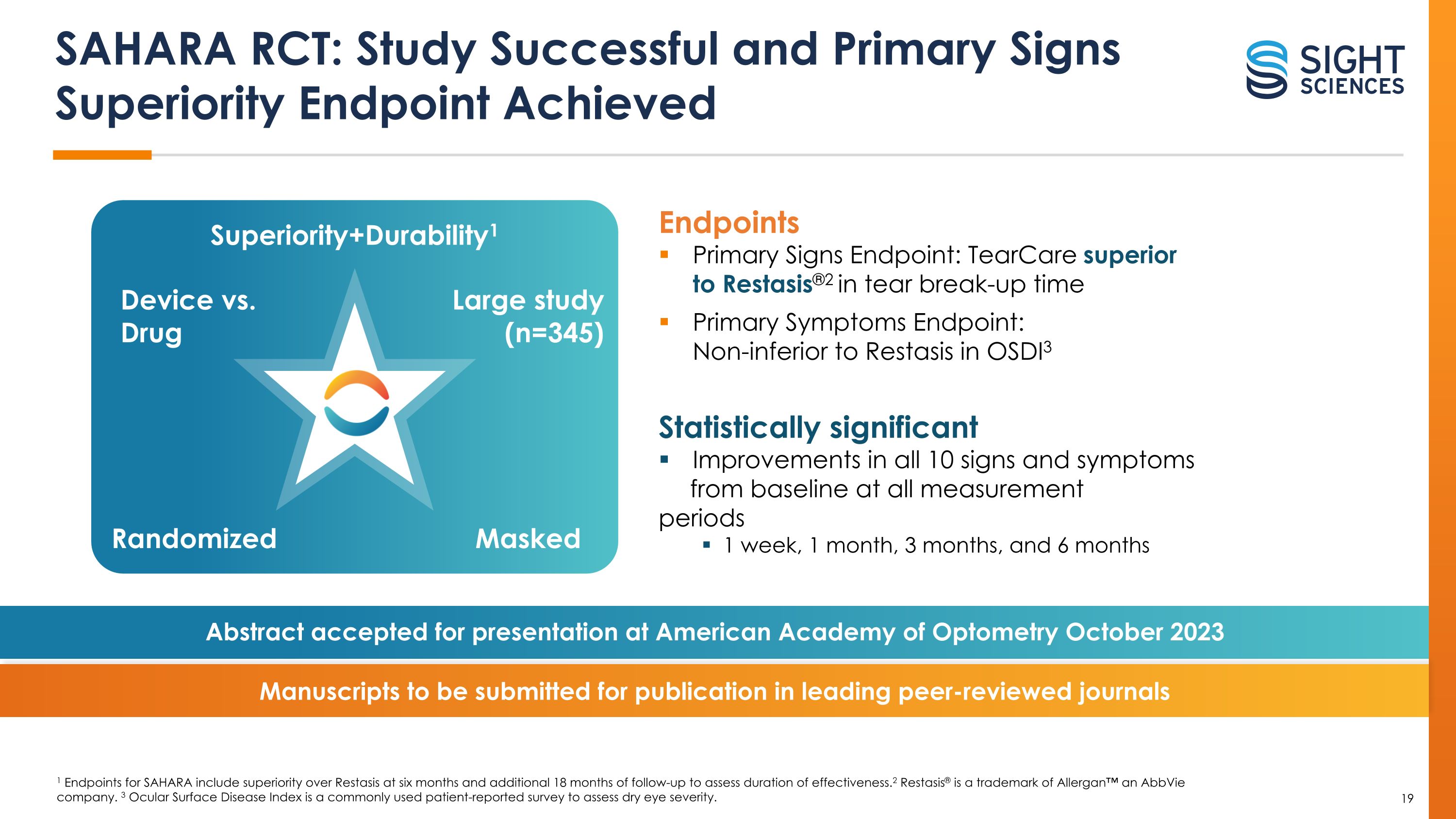

Endpoints Primary Signs Endpoint: TearCare superior �to Restasis®2 in tear break-up time Primary Symptoms Endpoint: �Non-inferior to Restasis in OSDI3 Device vs. Drug Large study (n=345) Superiority+Durability1 Masked Randomized 1 Endpoints for SAHARA include superiority over Restasis at six months and additional 18 months of follow-up to assess duration of effectiveness. 2 Restasis® is a trademark of Allergan™ an AbbVie company. 3 Ocular Surface Disease Index is a commonly used patient-reported survey to assess dry eye severity. SAHARA RCT: Study Successful and Primary Signs Superiority Endpoint Achieved Abstract accepted for presentation at American Academy of Optometry October 2023 Manuscripts to be submitted for publication in leading peer-reviewed journals Statistically significant Improvements in all 10 signs and symptoms from baseline at all measurement periods 1 week, 1 month, 3 months, and 6 months 19

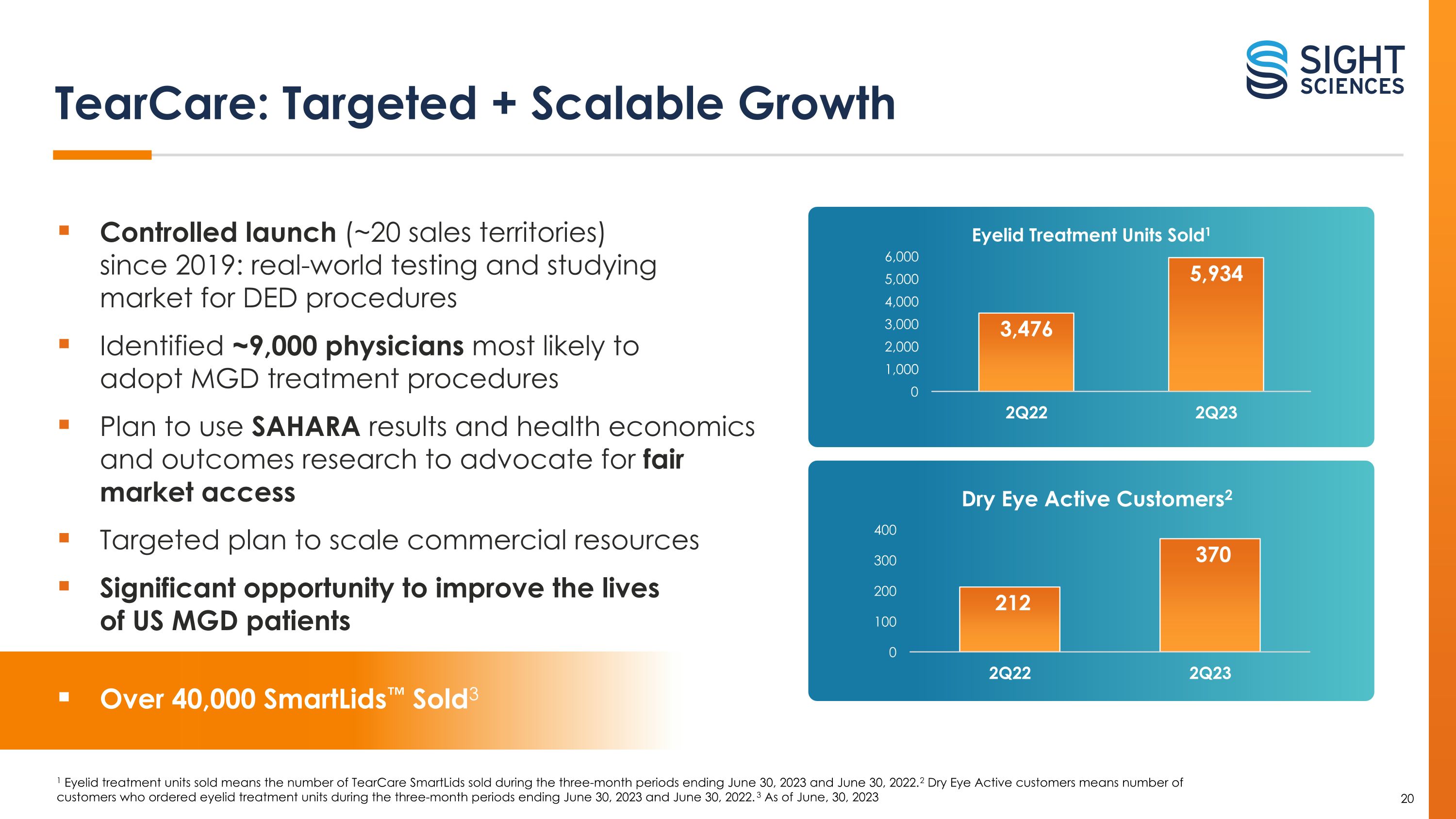

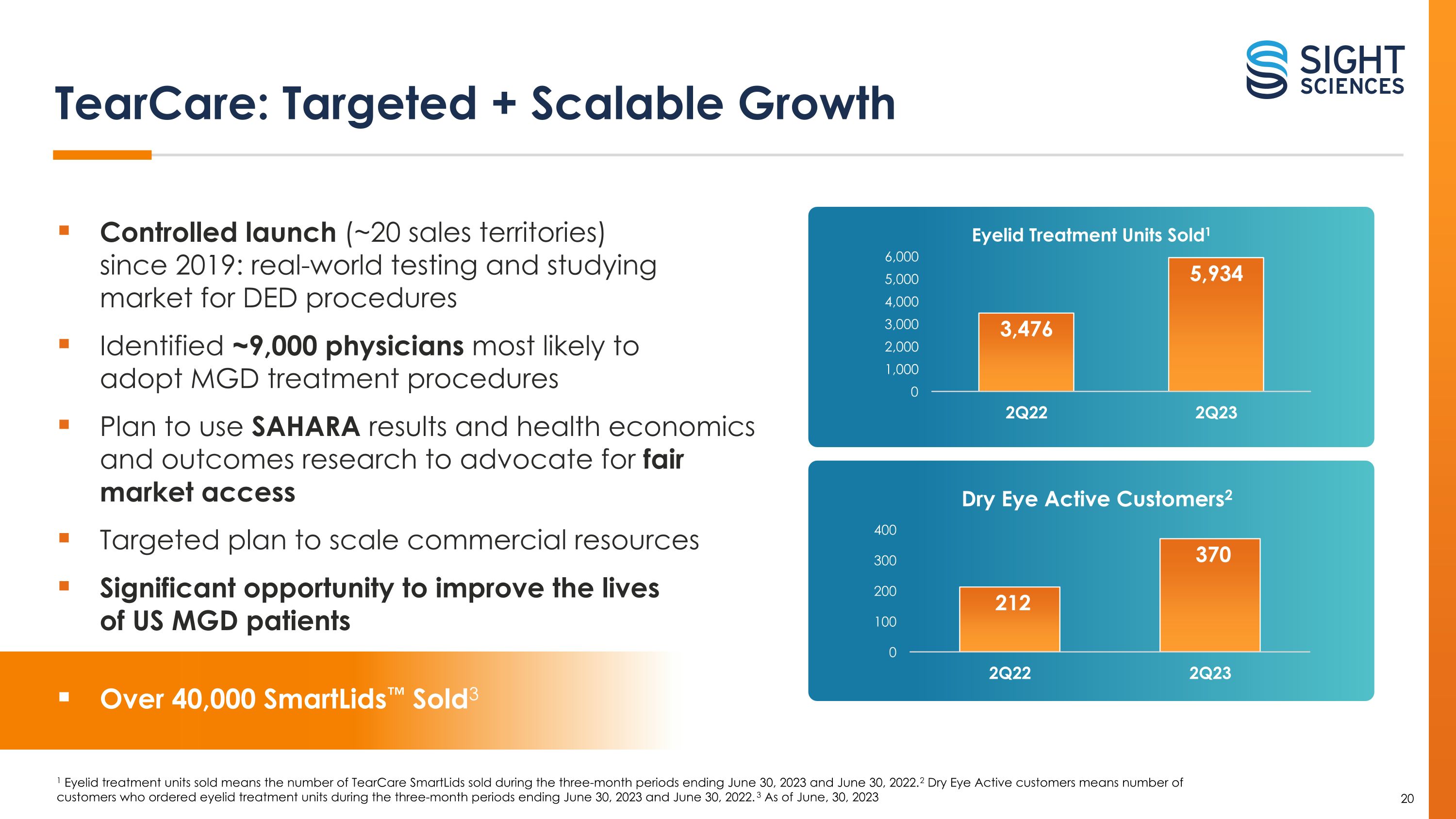

1 Eyelid treatment units sold means the number of TearCare SmartLids sold during the three-month periods ending June 30, 2023 and June 30, 2022. 2 Dry Eye Active customers means number of customers who ordered eyelid treatment units during the three-month periods ending June 30, 2023 and June 30, 2022. 3 As of June, 30, 2023 TearCare: Targeted + Scalable Growth Controlled launch (~20 sales territories)�since 2019: real-world testing and studying�market for DED procedures Identified ~9,000 physicians most likely to�adopt MGD treatment procedures Plan to use SAHARA results and health economics and outcomes research to advocate for fair �market access Targeted plan to scale commercial resources Significant opportunity to improve the lives �of US MGD patients Over 40,000 SmartLids™ Sold3 20

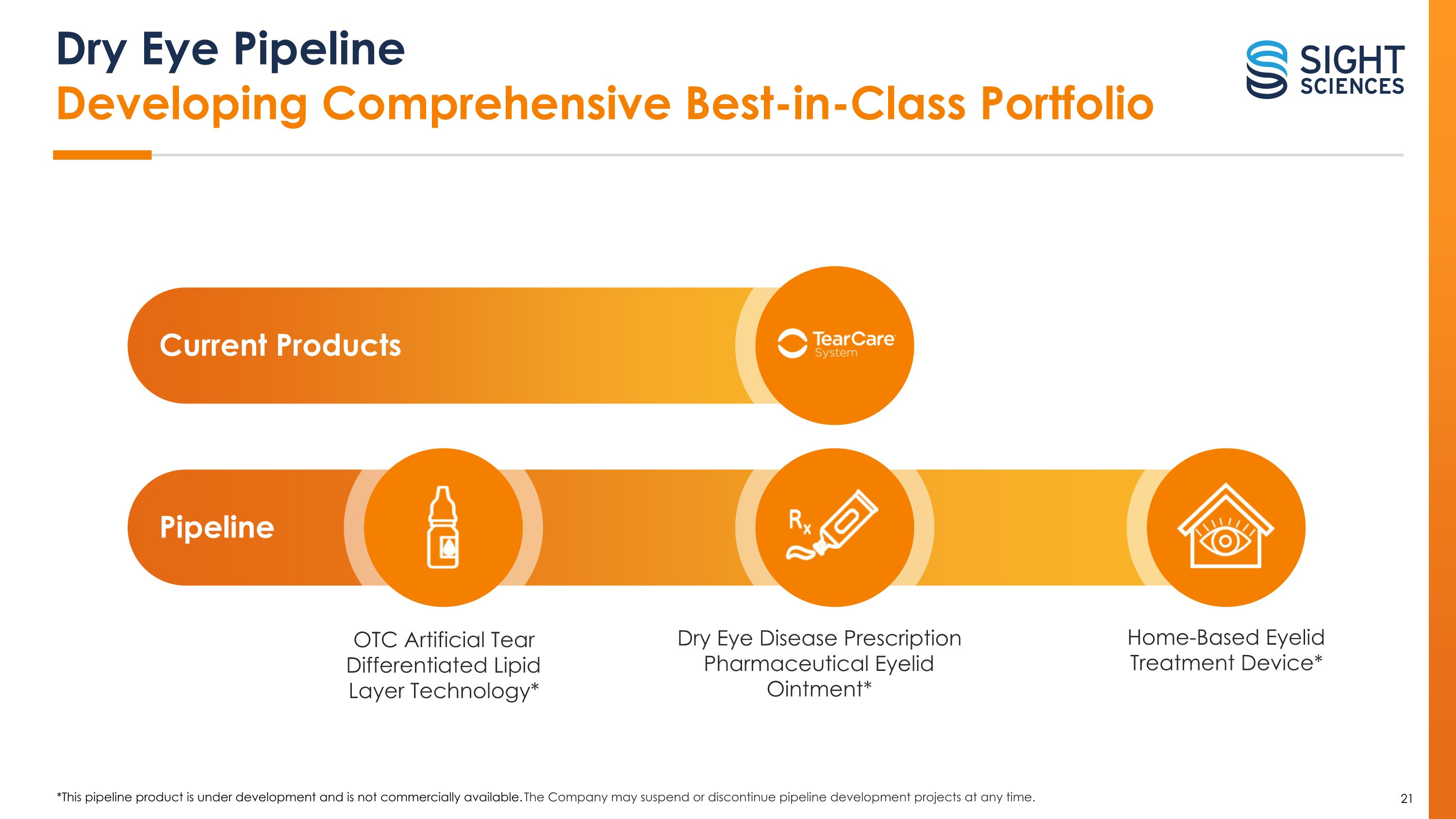

*This pipeline product is under development and is not commercially available. The Company may suspend or discontinue pipeline development projects at any time. Dry Eye Pipeline�Developing Comprehensive Best-in-Class Portfolio Pipeline Current Products OTC Artificial Tear Differentiated Lipid Layer Technology* Home-Based Eyelid Treatment Device* Dry Eye Disease Prescription Pharmaceutical Eyelid Ointment* 21

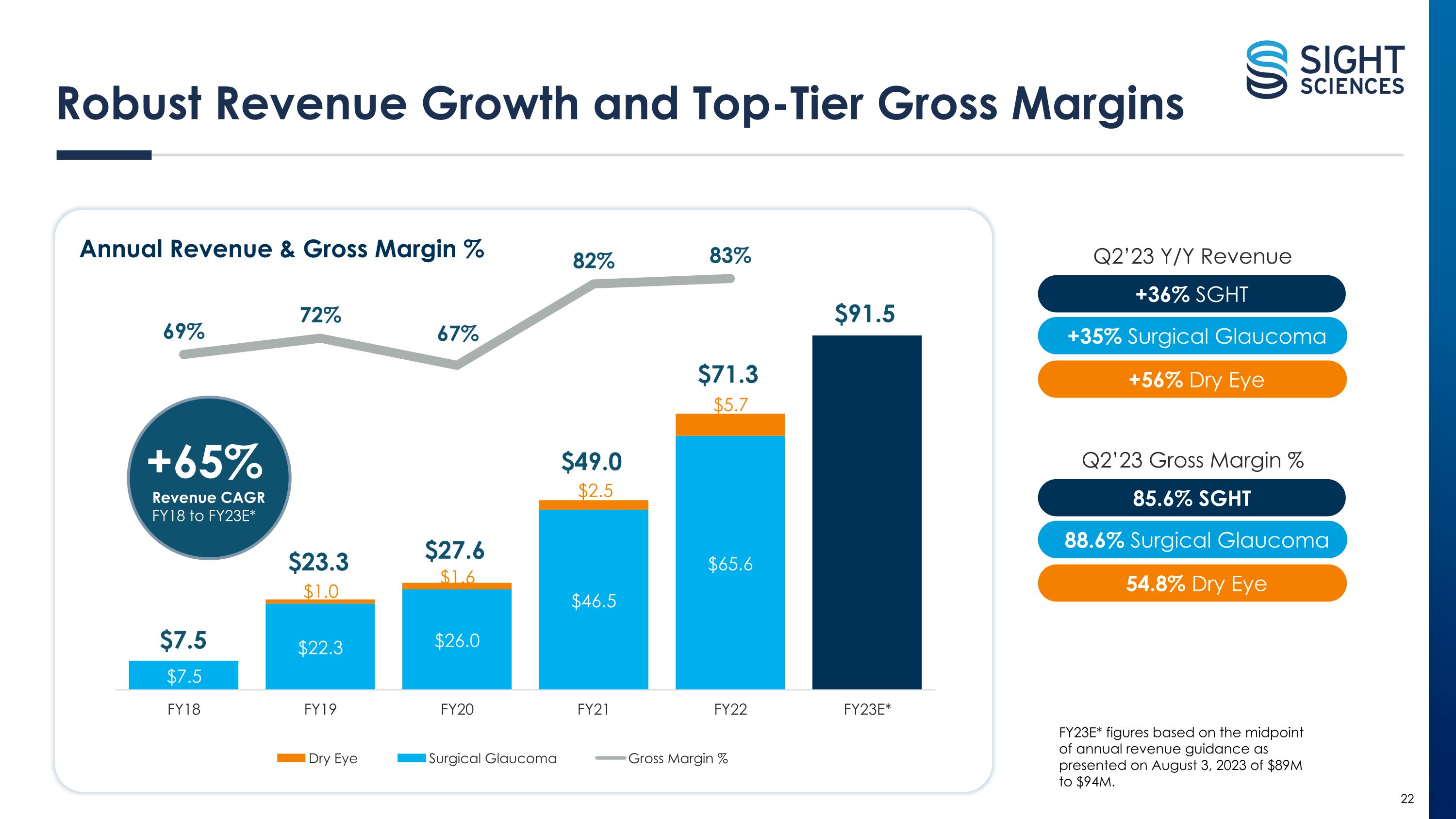

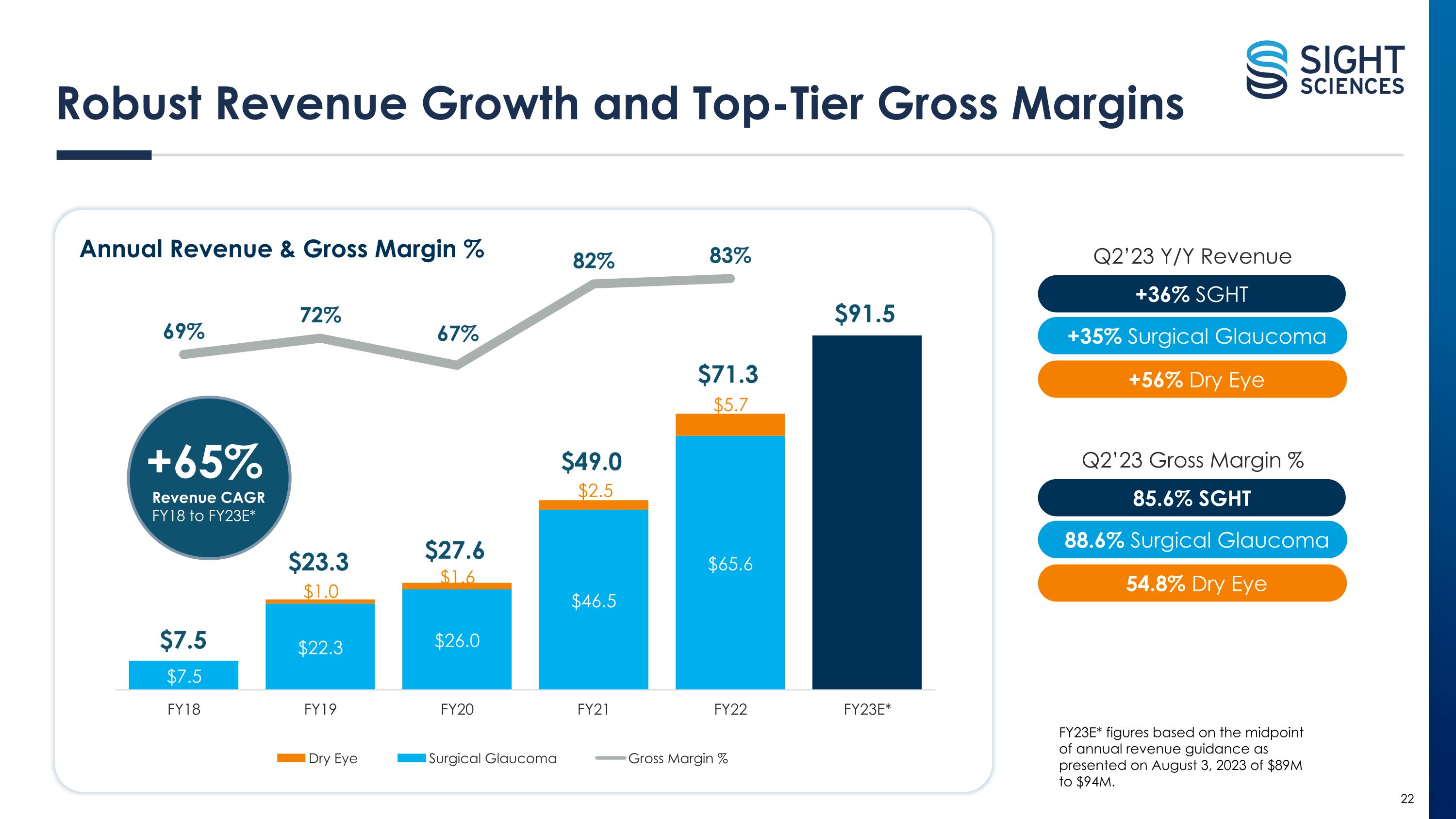

Robust Revenue Growth and Top-Tier Gross Margins $7.5 $23.3 $27.6 $49.0 $71.3 $91.5 Revenue CAGR FY18 to FY23E* +65% Q2’23 Y/Y Revenue +36% SGHT +35% Surgical Glaucoma +56% Dry Eye Q2’23 Gross Margin % 85.6% SGHT 88.6% Surgical Glaucoma 54.8% Dry Eye FY23E* figures based on the midpoint of annual revenue guidance as presented on August 3, 2023 of $89M to $94M. Annual Revenue & Gross Margin % 22

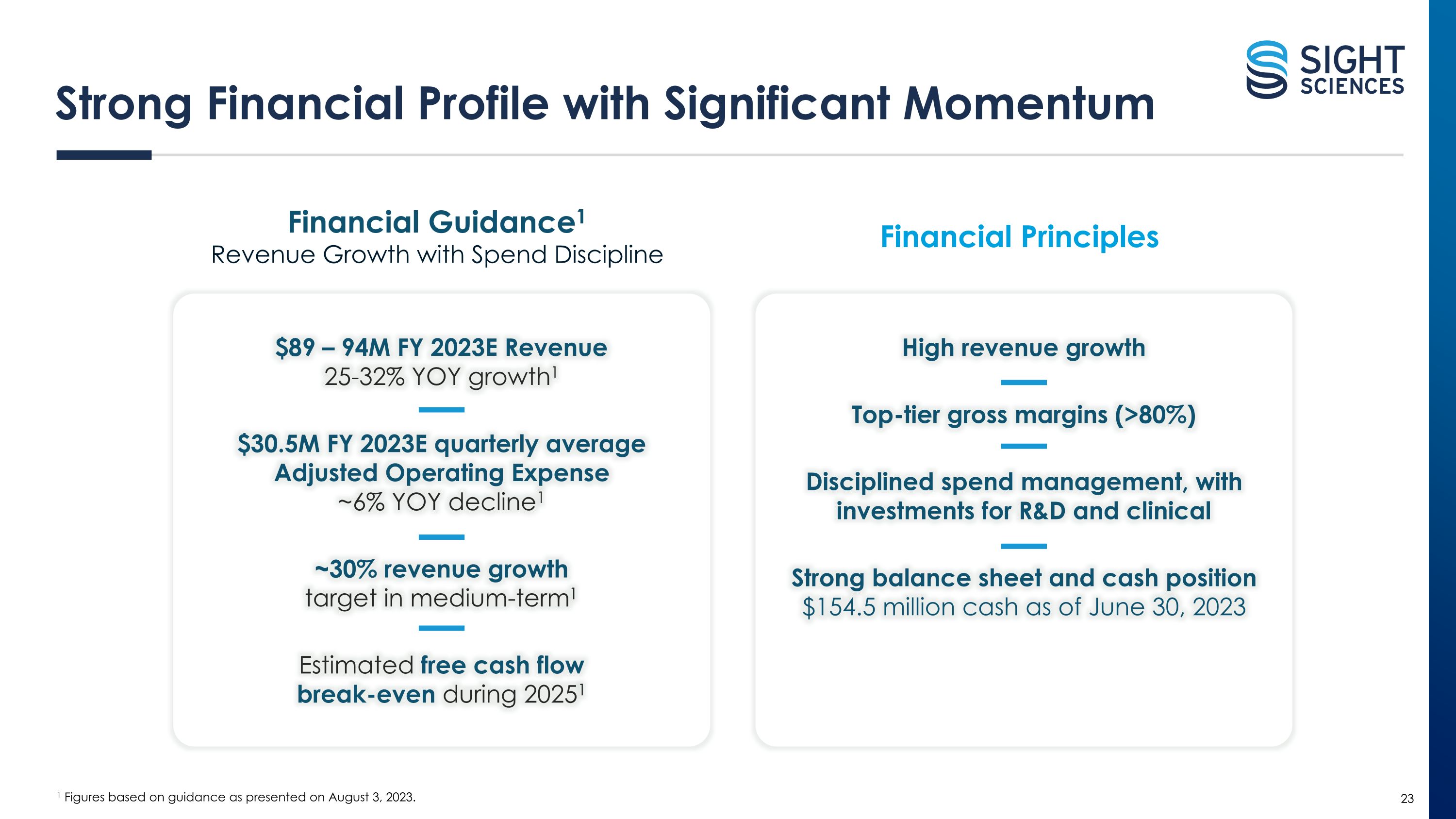

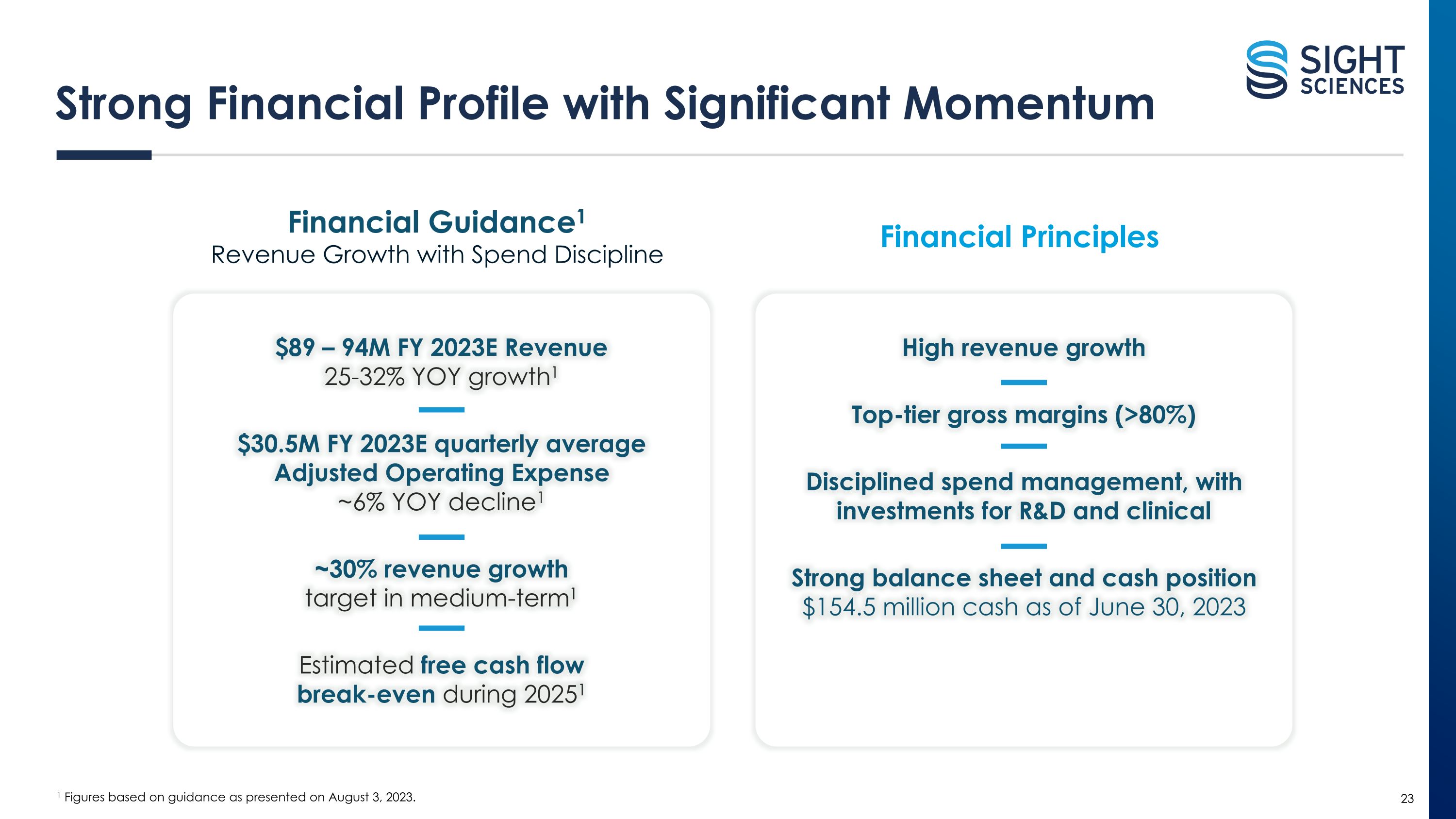

1 Figures based on guidance as presented on August 3, 2023. Strong Financial Profile with Significant Momentum $89 – 94M FY 2023E Revenue �25-32% YOY growth1 $30.5M FY 2023E quarterly average Adjusted Operating Expense �~6% YOY decline1 ~30% revenue growth�target in medium-term1 Estimated free cash flow �break-even during 20251 Financial Guidance1 Revenue Growth with Spend Discipline High revenue growth Top-tier gross margins (>80%) Disciplined spend management, with investments for R&D and clinical Strong balance sheet and cash position $154.5 million cash as of June 30, 2023 Financial Principles 23

Investment Highlights Two Large, Growing, Underserved Markets Competitive Differentiation Driven by Efficacy Compelling Clinical Data Proven Commercial Capabilities Driving High Growth Strong Balance Sheet and Cash Position Experienced Management Team 24