| UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM 10/A |

| (Amendment No. 2) |

| |

| GENERAL FORM FOR REGISTRATION OF SECURITIES |

| Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 |

| |

| OCEAN THERMAL ENERGY CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 80-0968237 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 800 South Queen Street, Lancaster PA | 17603 |

| (Address of principal executive offices) | (Zip Code) |

| |

| Registrant’s telephone number, including area code: | Telephone (717) 299-1344 |

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Name of each exchange on which registered |

| n/a | n/a |

| |

| Securities registered pursuant to Section 12(g) of the Act: |

| Common Stock, Par Value $0.0001 |

| (Title of Class) |

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o | Smaller reporting company x |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This registration statement contains statements about the future, sometimes referred to as “forward-looking” statements. Forward-looking statements are typically identified by the use of the words “believe,” “may,” “could,” “should,” “expect,” “anticipate,” “estimate,” “project,” “propose,” “plan,” “intend,” and similar words and expressions. Statements that describe our future strategic plans, goals, or objectives are also forward-looking statements.

Actual results could vary significantly from those expressed or implied in such statements and are subject to a number of risks and uncertainties. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give no assurance that these expectations will prove to be correct. The forward-looking statements involve risks and uncertainties that affect operations, financial performance, and other factors as discussed in this registration statement.

Discussions containing these forward-looking statements may be found, among other places, in this registration statement under the captions “Risk Factors,” “Business,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements. Before deciding to purchase our securities, you should carefully consider the risk factors discussed here or incorporated by reference, in addition to the other information set forth in this registration statement. Forward-looking statements speak only as of the date of the document in which they are contained, and we do not undertake any duty to update our forward-looking statements, except as may be required by law, and we caution you not to rely on them unduly.

WE ARE AN EMERGING GROWTH COMPANY

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies,” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see Risk Factors—We are an “emerging growth company” and as such, our disclosures may be less extensive than the information you receive from other public companies that are not emerging growth companies.

2

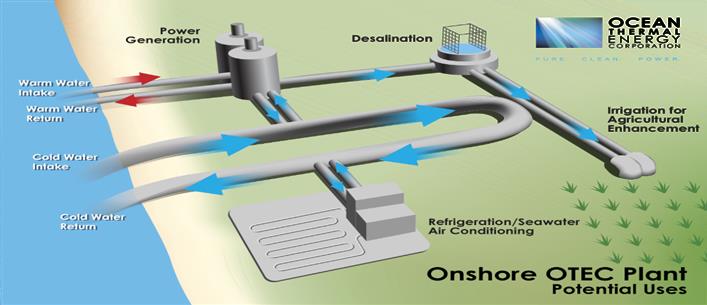

We develop projects for renewable power generation, desalinated water production, and air conditioning using proprietary intellectual property designed and developed by our own experienced oceanographers, engineers, and marine scientists. Plants using our technologies are designed to extract energy from the temperature difference between warm surface ocean water and cold deep seawater at a depth of approximately 3,000 feet. We believe these technologies provide practical solutions to mankind’s fundamental needs for sustainable, affordable energy; desalinated water for domestic, agricultural, and aquaculture uses; and cooling, all without the use of fossil fuels.

| ● | Ocean Thermal Electrical Conversion, known in our industry as OTEC, power plants are designed to produce electricity. In addition, some of the seawater running through an OTEC plant can be desalinated efficiently, producing fresh water for agriculture and human consumption. |

| ● | Seawater Air Conditioning, known in our industry as SWAC, plants are designed to use cold water from ocean depths to provide air conditioning for large commercial buildings or other facilities. This same technology can also use deep cold water from lakes, known as Lake Water Air Conditioning or LWAC. |

Both OTEC and SWAC systems can be engineered to produce desalinated water for potable, agricultural, and fish farming/aquaculture.

Many applications of technologies based on ocean temperature differences between surface and deep seawater have been developed at the Natural Energy Laboratory of Hawaii Authority, or NELHA, test facility (http://nelha.hawaii.gov), including applications for desalinated seawater, fish-farming, and agriculture. We believe our proprietary advances to existing technologies developed by others in the industry enhance their commercialization for the plants we proposed to develop.

We have recruited a scientific and engineering team that includes oceanographers, engineers, and marine scientists who have worked for a variety of organizations since the 1970s on several systems based on extracting the energy from the temperature differences between surface and deep seawater, including projects by NELHA, the Argonne National Laboratory (http://www.anl.gov), and others. Note: All URL addresses in this document are inactive textual references only. Our executive team members have complementary experience in leading engineering and technical companies and projects from start-up to commercialization.

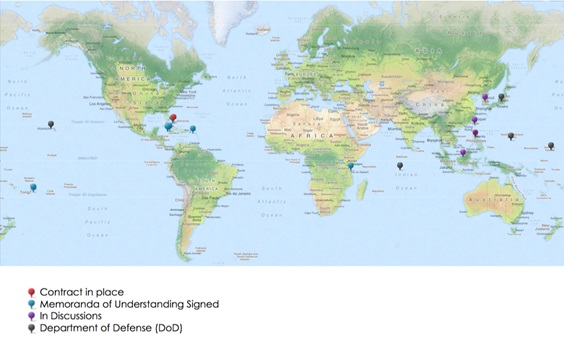

Our management team has led the development of the business since 2010 and has established a noteworthy pipeline of projects resulting in:

| ● | a signed energy services agreement (‘‘ESA’’) for the Baha Mar project, in the Bahamas, to design, build, own, and operate a SWAC plant, which now may not proceed due to the mid-2015 bankruptcy of the project developer; |

| ● | signed memorandum of understanding and general terms agreement to design, build, own, and operate plants using OTEC, SWAC, or a combination of both in the U.S. Virgin Islands and the Cayman Islands; |

| ● | ongoing feasibility analysis and proposals for OTEC and SWAC plants for the U.S. Department of Defense, the U.S. Department of Agriculture, the U.S. Virgin Islands, American Samoa, U.S. Department of Defense Contractors AMERESCO and NORESCO; and |

| ● | other identified prospects under early-stage analysis. |

3

During the past three years or more, our principal efforts have been directed toward completing project design, arranging financing, and initiating construction on our Baha Mar SWAC project, as discussed in greater detail below. We are to earn a $6.0 million development fee when we receive the project equity and debt funding and we instruct our engineering, construction, and contracting partner to start work. When construction was suspended due to a change in ownership of the Baha Mar resort in mid-2015, we re-directed our development efforts to other projects, principally the U.S. Virgin Islands project discussed below. We cannot predict when or whether the Baha Mar project will resume or whether we will be able to recover costs incurred or earn project fees.

Our Vision

Our vision is to bring these technologies to select locations in tropical and subtropical regions of the world that have suitable sea depth, shore configuration, and market need. Our initial markets and potential projects include several U.S. Department of Defense bases situated in the Asia Pacific and other regions where energy independence is crucial. Currently, we have projects in various planning and development stages in the Caribbean, Zanzibar, Guam, and other island locations.

The Technology

OTEC is a self-sustaining energy source, with no supplemental power required to generate continuous (24/7) electricity. It works by converting heat from the sun, which has warmed ocean surface water, into electric power, and then completing the process by cooling the plant with cold water from deep in the ocean. The cold water can also be used for very efficient air conditioning and desalinated to produce fresh water. OTEC has worked in test settings where there exists a natural temperature gradient of 20 degrees Celsius or greater in the ocean. Analyzing data from the table on the following page suggests that OTEC can deliver sustainable electricity in tropical and subtropical regions of the world at rates approximately 20-40% lower than typical costs for electricity produced by fossil fuels in those markets.

Further, we believe that a small, commercial OTEC plant could offer competitive returns even in a market where the cost of electricity is as low as $0.30 per kilowatt-hour, or kWh. For example, the Inter-American Development Bank, an international bank providing development financing in Latin America and the Caribbean, reports that energy prices for hydrocarbon-generated power during 2010-2012 for 15 Caribbean countries averaged $0.33 per kWh, with a high of $0.43 per kWh in Antigua and Barbados. For the U.S. Virgin Islands, the U.S. Information Administration reported that as of January 2016, the average price for electricity was nearly $0.30 per kWh. We believe that we have an opportunity to offer base-load energy (the amount of energy required to meet minimum requirements) pricing that is better than our customer’s next best alternative in the markets where electricity costs are $0.30 or more per kWh.

Technological advances during the prior decade or so have significantly reduced the capital costs of OTEC to make it competitive to traditional energy sources in the energy markets. Technology improvements include larger diameter seawater pipes manufactured with improved materials; increased pumping capabilities from ocean depths; better understanding of material requirements in a deep ocean environment; more experience in deep-water pipeline and cable installation techniques; and accurate sea-bottom mapping technology, which is required for platform positioning and pipe installation.

4

We estimate that a small OTEC plant that delivers 13 million watts (megawatts or MW) per hour for 30 years would currently cost approximately $350 million. This is the plant size that we typically propose for our initial target markets to meet 20% or more of their current demand for electricity and a large portion of their need for fresh drinking water and agricultural water. OTEC has been proven in test settings at NELHA, where a Department of Energy-sponsored OTEC plant operated successfully throughout the 1990s to produce continuous, affordable electricity from the sea without the use of fossil fuels. Spin-off technologies of desalination and seawater cooling, developed from the OTEC plant at NELHA, have also become economically and technical feasible.

Finally, we believe that renewable energy sources, although traditionally more expensive than comparable fossil-fuel plants, have many advantages, including increased national energy security, decreased carbon emissions, and compliance with renewable energy mandates and air quality regulations. We believe these market forces will continue and potentially increase. In remote islands where shipping costs and limited economies of scale substantially increase fossil-fuel-based energy, renewable energy sources may be attractive. Many islands contain strategic military bases with high-energy demands that we believe would greatly benefit from a less expensive, reliable source of energy that is produced locally, such as OTEC.

SWAC is a process that uses cold water from locations such as the ocean or deep lakes to provide the cooling capacity to replace traditional electrical chillers in an air conditioning system. SWAC applications can reduce the energy consumption of a traditional air-conditioning system by as much as 90%. Even when the projected capital cost amortization of building a typically sized SWAC system providing 9,800 tons of cooling ($140-$150 million) are taken into account, SWAC can save the customer approximately 25-40% when compared to conventional systems—we estimate savings can be as high as 50% in locations where air temperatures and electricity costs are high. These are only estimates, however, because neither we nor anyone else has built anywhere a SWAC plant of the size we envision to verify actual construction costs or savings in the cost of energy generation. Therefore, there is significant uncertainty respecting the expected costs and feasibility of building such a system.

Cooling systems using seawater or groundwater for large commercial structures are in use at numerous locations developed and operated by others worldwide, including Heathrow Airport, UK; Finland (Google Data Center); Cornell University, NY; Stockholm, Sweden; and the City of Toronto, Canada.

Below is a table showing our estimate of the savings on a 20-year contract providing cooling from a typical size (62,000 ton hours chilled water) SWAC plant serving five hotels when compared to a conventional system (all amounts, except percentages, in thousands):

| Electricity Cost per kWh | | $0.20 | | $0.25 | | $0.30 | | $0.35 | | $0.40 |

| Conventional cost* | | $497,998 | | $586,026 | | $674,054 | | $762,082 | | $850,111 |

| Total annual SWAC | | 374,010 | | 385,747 | | 397,485 | | 409,222 | | 420,959 |

| Total savings | | $123,988 | | $200,279 | | $276,579 | | $352,860 | | $429,152 |

| Percent Savings | | 25% | | 34% | | 41% | | 46% | | 50% |

_______________

| * | Our estimate of the cost of new cooling capacity using electric centrifugal water cooled chillers at this designed efficiency with maintenance costs escalated at projected local consumer price increases and with electrical costs in current dollars at the current U.S. Virgin Islands hydrocarbon energy cost of $0.30 per kWh noted above, escalated at 4% annually. |

5

How the Technology Works

OTEC uses the natural temperature difference between cooler deep ocean water at a depth of approximately 3,000 feet and warmer shallow or surface water to create energy. An OTEC plant project involves installing about 6.0 feet diameter, deep-ocean intake pipes (which can readily be purchased), together with surface water pipes, to bring seawater onshore. OTEC uses a heat pump cycle to generate power. In this application, an array of heat exchangers transfer the energy from the warm ocean surface water as an energy source to vaporize a liquid in a closed loop, driving a turbine, which in turn drives a generator to produce electricity. The cold deep ocean water provides the required temperature to condense vapor back into a liquid, thus completing the thermodynamic cycle, which is constantly and continuously repeated. The working fluid is typically ammonia, as it has a low boiling point. Its high hydrogen density makes ammonia a very promising green energy storage and distribution media. Among practical fuels, ammonia has the highest hydrogen density, including hydrogen itself, in either its low temperature, or cryogenic, and compressed forms. Moreover, since the ammonia molecule is free of carbon atoms (unlike many other practical fuels), combustion of ammonia does not result in any carbon dioxide emissions. The fact that ammonia is already a widely produced and used commodity with well-established distribution and handling procedures allows for its use as an alternative fuel. This same general principle is used in steam turbines, internal combustion engines, and, in reverse, refrigerators. Rather than using heat energy from the burning of fossil fuels, OTEC power draws on temperature differences of the ocean caused by the sun’s warming of the ocean’s surface, providing an unlimited and free source of energy.

OTEC and SWAC infrastructure offers a modular design that facilitates adding components to satisfy customer requirements and access to a sufficient supply of cold water. These components include reverse-osmosis desalination plants to produce drinkable water, bottling plants to commercialize the drinkable water, and off-take solutions for aquaculture uses (such as fish farms), which benefit from the enhanced nutrient content of deep ocean water. A further advantage of a modular design is that, depending on the patterns of electricity demand and output of the OTEC plant, a desalination plant can be run using the excess electricity capacity.

6

Currently, OTEC requires a minimum temperature difference of approximately 20 degrees Celsius to operate, with each degree greater than this increasing output by approximately 10% to 15%. OTEC has potential applications in tropical and subtropical zones. OTEC is particularly well suited for tropical islands and coastal areas with proximate access to both deep water and warm surface water. These communities are typically subject to high and fluctuating energy costs ranging from $0.28-$0.75 per kWh, as they rely on importing fossil fuels for power generation. Data from the National Renewable Energy Laboratory of the U.S. Department of Energy website indicated that at least 68 countries and 29 territories around the globe appear to meet these criteria.

The world’s largest OTEC power plant to date is operational at the NELHA facility in Hawaii and is connected to the electrical grid. It provides base-load electricity produced by OTEC to about 150 homes. Around the world, a couple of other successful developmental and experimental plants have been built, and the U.S. National Oceanic and Atmospheric Administration, or NOAA, has stated that: “The qualitative analysis of the technical readiness of OTEC by experts at this workshop suggest that a <10 MWe floating, closed-cycle OTEC facility is technically feasible using current design, manufacturing, deployment techniques and materials.” We believe that we have sufficient skill and knowledge to now commercialize 5-MW to 30-MW land-based OTEC plants, using off-the-shelf components, including the cold-water piping.

SWAC (or LWAC) is a significantly more cost-effective and environmentally friendly way to implement air-conditioning using cold water sourced from lakes or, analogous with OTEC, deep ocean water, rather than from an electric chiller. Comparing Federal Energy Management Program engineering efficiency requirements of approximately 0.94 kilowatts of electricity per ton of cooling capacity1 with our own engineering estimates of 0.09 kilowatts of electricity per ton of cooling capacity for our Baha Mar plant, as calculated by DCO Energy, our engineering, procurement, and construction partner for our Baha Mar project, we estimate that SWAC systems can reduce electricity consumption by up to 80-90% when compared to conventional systems. Therefore, we believe such energy reductions may make SWAC systems well-suited for large structures, such as office complexes, medical centers, resorts, data centers, airports, and shopping malls. We believe that other SWAC plants we may develop will likely achieve similar efficiencies. There are examples of proven successful SWAC/LWAC systems in use, including a large 79,000-ton system used to cool buildings in the downtown area of the City of Toronto, Canada; Google’s data center in Finland operates a SWAC system that uses waters from the Baltic Sea to keep servers cool; and a system with more than 18,000 tons of cooling is in operation at Cornell University, Ithaca, New York.

Why OTEC Versus Other Energy Sources

The construction costs of power plants using any technology are much higher in remote locations, such as tropical islands, than on the mainland of the United States, principally due to the need to transport materials, components, and other construction materials, supplies, and labor not available locally. There are also considerations that make those other technologies less attractive in those areas. We believe the consistency of OTEC over its life provides clear advantages over other generation technology in the tropical and subtropical markets, because its base-load power (available at all times and not subject to fluctuations throughout the day) is an important asset to the small transmission grid, which is typical in these regions.

_____________

1 http://energy.gov/eere/femp/covered-product-category-air-cooled-electric-chillers

Combined-cycle natural gas plants typically need to be capable of generating several hundred MWs to attain the lower cost per kW installed values to make the plant economically feasible. Tropical locations do not have large enough grids and market demand to make that plant size reasonable. Further, tropical locations frequently do not have domestic fuel supplies, requiring fuel to be imported. In order to import natural gas, it must be liquefied for shipment and then vaporized at the location. There are initial cost and public safety concerns with such facilities. In addition, gas-fired plants emit undesirable nitrogen oxide, carbon dioxide, and volatile organic compounds.

Solar applications continue to increase as the cost and effectiveness of photovoltaic panels improve. However, we estimate that the cost to install solar panels in tropical regions remains high. Beyond the issues with shipping and labor costs that all construction must overcome, the design and building code requirements are tougher in storm-prone areas subject to potential wind damage from hurricanes, earthquakes, and typhoons than are typically encountered in mainland nontropical installations. Support structures must be more substantial in order to hold the solar panels in place in case of hurricane-force winds. Solar power, like wind power, places substantial stress on an electrical grid. Since the input of both of these sources is subject to weather conditions, they cannot be considered a reliable supply of power, and back-up capacity is necessary. Further, instantaneous changes in output due to sporadic cloud cover create transient power flow to the grid, creating difficulties in maintaining proper voltages and stability. OTEC is a stabilizing source to the grid, providing constant and predictable power, and has no emissions. The ability of OTEC to provide constant, continuous power is a large benefit as compared to any of the other renewable options available.

Our estimated price of OTEC-generated power of approximately $0.30 per kWh under current economic conditions, which can be as low as $0.18 net per kWh with maximum efficiency and revenue from water production, is also constant both throughout the year and over a plant’s life. OTEC’s power price, determined almost entirely by the amortization of its initial cost, is a protection against inflation and rising interest rates, which greatly affect coal and oil. Customers in our target markets currently pay from $0.35 to as high as $0.60 per kWh for power from coal- and oil-fueled power plants. However, imported fuels are subject to price volatility that has a direct impact on the cost of electricity and adds operating risk during the life of a plant. The fuel handling to allow for the shipping, storage, and local transport is expensive, a potential source of damaging fuel spills, and a basis for environmental concerns. Fossil-fuel plants create pollution, emit carbon dioxide, and are visually unappealing, which is of particular concern in tropical areas renowned for their clear, pristine air and beauty. We project OTEC can save these markets up to 40%, compared to their current electrical costs, and when revenues from fresh drinking water, aquaculture, and agriculture production are considered, the justification is even more compelling.

Why OTEC Now

We believe that OTEC is now an economically, technologically, and environmentally competitive power source, especially for developing or emerging countries in certain tropical and subtropical regions contiguous to oceans. Our natural target markets are communities in countries around the Caribbean, Asia, and the Pacific. These locations are typically characterized by limited infrastructure, high-energy costs, mostly imported or expensively generated electricity, and frequently with significant fresh water and food shortages. These are serious limitations on economic development, which we believe our OTEC technology can address.

8

Data presented to the Sustainable Use of Oceans in the Context of the Green Economy and the Eradication of Poverty workshop in Monaco in 2011 by Whitney Blanchard of the Office of Ocean and Coastal Resource Management, National Oceanic and Atmospheric Administration, show that at least 98 nations and territories using an estimated 5 terawatts of potential OTEC net power are candidates for OTEC-power systems. Blanchard specifically notes that Hawaii, Guam, Florida, Puerto Rico, and the U.S. Virgin Islands are suitable for OTEC.2

Over the past decade, there have been substantial changes that we believe have now made the commercialization of OTEC economically, technologically, and environmentally feasible. First and foremost is the price of oil, which until early 2014 traded at prices ranging from approximately $75 to $120 per barrel, since dropping to $50 per barrel or lower. At June 15, 2016, oil traded at approximately $48.97 per barrel, as quoted at Brent, the leading global price benchmark for Atlantic basin crude oils. Even with current relatively low oil prices, developers of oil-fired power plants must model the economic performance of their plants over a useful life of 20 or more years, so they remain vulnerable to future oil price increases. The U.S. Energy Information Administration predicts increasing oil prices as a result of a combination of higher demand for liquid fuels and lower global crude oil supply in nations not included in Organisation for Economic Co-operation and Development. The U.S. Energy Information Administration predicts Brent crude oil prices will rise to between $76 and $252 per barrel (2013 dollars) in 2040 depending on demand and supply. It is generally accepted within the OTEC community that OTEC approaches competitive pricing when oil exceeds $40 per barrel.3 With OTEC power, customers can decouple the price of electricity from the price of oil.

The International Energy Agency’s 2015 World Energy Outlook expects liquid natural gas export capacity to grow rapidly in the short term, with major new sources of supply coming mostly from Australia and the United States.

Liquid natural gas prices have collapsed, in part because demand is turning out to weaker than some previously anticipated.4 Additionally, many rules and regulations are in effect to mitigate the environmental issues associated with liquid natural gas extraction, transportation, and storage, adding significant costs.5

The electric power sector accounted for 31% of total greenhouse gas emissions by the United States in 2013. Greenhouse gas emissions from electricity have increased by about 11% since 1990 as electricity demand has grown and fossil fuels have remained the dominant source for generations.6

Fossil-fuel-fired power plants are a significant source of domestic carbon dioxide emissions, the primary cause of global warming. To generate electricity, fossil-fuel-fired power plants use natural gas, petroleum, coal, or any form of solid, liquid, or gaseous fuel derived from such materials.

The United States, along with many other countries including the United Kingdom and The Netherlands, have agreed or proposed either to shut down or to substantially reduce all of their coal-burning power plants over the next few years.7

2 http://www.stakeholderforum.org/fileadmin/files/E-Blanchard%20potential%20of%20Ocean%20thermal%20 energy%20conversion.pdf

9

Scientific American, a respected U.S. scientific journal, recently reported that scientists have determined that both money and lives would be saved if rising fossil-fuel and biofuel emissions that are warming the planet are stopped and power generation is switched to an entirely renewable energy system.8

Many countries today, including the United States, are concerned with environmental issues caused by fossil-fuel generated power. At the Sustainable Innovation Forum, a business-focused event held in Paris, France, in late 2015, cross-sector participants from business, government, finance, the United Nations, non-governmental organizations, and civil society met to create opportunities to bolster business innovation and bring scale to the emerging green economy.

The international concern about the harmful effects of climate change led to the negotiation of the Paris Agreement in December 2015 as the culmination of the 2015 United Nations Climate Change Conference. The Paris Agreement will become legally binding if joined in by at least 55 countries that together represent 55% of the global greenhouse emissions. The agreement provides for members to reduce their carbon output as soon as possible and to do their best to keep global warming to no more than two degrees Celsius, or 3.6 degrees Fahrenheit. In order to achieve the desired results, there would have to be a worldwide reduction in emissions from fossil fuels and a shift to renewable resources.9

We believe the ongoing concern about environmental issues and the price instability of fossil-fuel prices are motivation for increased commercial interest in OTEC, renewed activity in the commercial sector, and increased interest among communities and agencies that recognize the potential benefits of this technology, including the U.S. Department of Defense and U.S. Department of the Interior territories. In the last four years, several large companies have used their OTEC technology experience to introduce OTEC systems worldwide, supporting the argument that the technology is now at the point where it can be introduced at a commercial level:

| ● | In June 2014, the French companies, Akuo Energy and DCNS, were funded to construct and install a number of OTEC plants adding up to 16 MWs of power generation outside the coastline of Martinique in the Caribbean. This is by far the biggest OTEC project announced to date, and the European Union has allocated €72 million (about $82 million at current exchange rates) for this purpose. DCNS is a teaming partner with us for potential projects in the Caribbean.10 |

| ● | Since early 2014, we have begun working with several industrialized and developing countries for investigating suitable OTEC sites, infrastructural solutions, and funding opportunities. These include the U.S. Virgin Islands, The Bahamas, Cayman Islands, and other countries. |

| ● | Lockheed Martin has designed a 10-MW OTEC plant and has partnered with the China-based Reignwood Group, stated its intent to build the plant.11 According to Lockheed Martin: “Just one 10-megawatt OTEC plant could provide reliable, clean energy for approximately 10,000 people; replace the burning of 50,000 barrels of oil; and eliminate the release of 80,000 tons of carbon dioxide per year into the atmosphere.”12 |

| ● | Two non-governmental organizations promoting OTEC have been created in recent years: OTEC Foundation (based in The Netherlands) and OTEC Africa (based in Sweden). |

____________

8 http://www.scientificamerican.com/article/how-renewable-energy-could-make-climate-treaties-moot

10

| ● | In 2014, the world’s first international conference dedicated to OTEC was held in Borås, Sweden. A conference report was published.13 |

| ● | New technological advances for larger and more robust deep seawater pipes and more efficient and cost-effective heat exchangers, pumps, and other components have, in our opinion, further improved the economics for OTEC. |

| ● | Many countries, including a large number of Caribbean nations, now have renewable energy standards and are looking at ways to reduce their carbon footprint, decouple the price of electricity from the volatile price of oil, and increase energy security. Along with these countries, we are aware that Hawaii, U.S. territories, and the U.S. Department of Defense are looking at OTEC as a possible source of renewable energy and water for drinking, fish farming, and agriculture. |

Global acceptance of man’s influence on climate change may also contribute to a shift in the demand for OTEC. As evidenced by the Paris Agreement reached in December 2015 to combat climate change, 195 nations have expressly recognized that conventional fossil-fuel powered energy technologies affect global climate change and the need to embrace a sustainable future in energy and water.14 Low-lying coastal countries (sometimes referred to as small island developing states) that tend to share similar sustainable development challenges, including small but growing populations, limited resources, remoteness, susceptibility to natural disasters, vulnerability to external shocks, excessive dependence on international trade, and fragile environments, have embraced this recognition and are keenly aware that they are on the frontline of early impact of sea level rise and are aggressively trying to embrace sustainable-energy alternatives. This is a major driving force for OTEC in our primary early markets.

Recent international political instability in fossil-fuel-producing regions and oil price volatility have exposed the criticality of energy security and independence for all countries. The need to have a tighter control of domestic energy requirements is a matter of increasing international concern. Continued reliance on other countries (particularly those in oil-producing regions) is not a favorable option any longer. We believe these considerations will continue to drive renewable research and commercialization efforts that benefit technologies with global potential to replace fossil-fuel-based energy systems and benefit from base-load capabilities like OTEC.

______________

13 http://www.otecnews.org/wp-content/uploads/2013/11/Chino_DCNS.pdf 14 http://unfccc.int/paris_agreement/items/9485.php

The following table represents our belief as to the relative advantages and disadvantages of all electricity-producing technologies:

COMPETITIVE ISSUE & TECHNOLOGY | | NUCLEAR | | COAL, OIL & GAS | | OTEC | | WIND & SOLAR (PV) | | HYDRO | | WAVE | | CURRENT |

| Source of Fuel | | Often imported; inter-nationally restricted trade | | Mostly imported in our target markets | | Local renewable | | Local renewable | | Local, but often not available in our target markets | | Local renewable | | Local renewable |

| | | | | | | | | | | | | | | |

| Is Fuel Accessible? | | Not always; country-specific inter-nationally-restricted trade | | Requires considerable port and storage areas in our target markets | | Yes | | Yes | | Requires flowing rivers and terrain with higher altitudes | | Dependent on wave density and frequency | | Site dependent |

| | | | | | | | | | | | | | | |

| Predictable Energy Supply | | Yes, base-load power | | Yes, base-load power | | Yes, base-load power | | No, unpredictable and usually much lower during nighttime hours | | Yes, base-load power | | Unpredictable | | Usually predictable |

| | | | | | | | | | | | | | | |

| Meeting Load Profile | | Constant generation | | Constant generation | | Constant generation | | Unpredictable source | | Constant generation | | Unpredictable source | | Typically constant |

| | | | | | | | | | | | | | | |

| Land Required | | Buffer zone required | | Fuel handling and storage | | Small area | | Requires large amounts of real estate | | Often impacts watershed areas | | System must be located underwater | | System must be located underwater |

| | | | | | | | | | | | | | | |

| Typical Weather | | Unlikely to be affected by weather | | Unlikely to be affected by weather | | Unlikely to be affected by weather | | Weather changes cause power output to vary | | Rarely affected by weather except by extreme periods of drought | | Weather changes cause power output to vary | | Weather changes cause power output to vary |

| | | | | | | | | | | | | | | |

| Tropical Storms and Hurricanes | | Protected equipment usually unaffected by natural disasters | | Shipping, storage, and port facilities vulnerable to storms, earthquakes, tsunamis, etc. | | Buried and protected pipelines and equipment | | Structures usually exposed and vulnerable | | Protected equipment | | Structures very exposed to storms | | Considerable exposure during storms |

| | | | | | | | | | | | | | | |

| Emissions/Waste | | Problematic waste | | High level of pollution | | No fuel | | No fuel | | No fuel | | No fuel | | No fuel |

Pipeline of Projects and Opportunities

Our current management team has led the development of the business since 2010 and has established a pipeline of projects, in various stages, to design, build, own, and operate OTEC, SWAC, or a combination of both plants in the U.S. Virgin Islands, The Bahamas, Cayman Islands, American Samoa, and East Africa.

12

Our current project pipeline is shown in the chart below with further details of certain projects, in order of each project’s stage of commitment:

Energy Services Agreement—Baha Mar

Our wholly owned Bahamian subsidiary has undertaken the development, construction, and operation of a 9,800-ton SWAC system to supplement conventional air conditioning at the Baha Mar Resort, a new resort on New Providence Island, Nassau, The Bahamas, pursuant to a signed 20-year ESA with Baha Mar Ltd., the developer of the Baha Mar Resort. This 2015 ESA was entered into after a similar 2013 ESA between the same parties was renegotiated due to government permitting delays. Our SWAC plant would service multiple hotels and a 100,000 square foot casino. The overall SWAC project cost is estimated to be $147 million. We estimate that the SWAC system would reduce Baha Mar’s electricity consumption by an equivalent of 50,000-60,000 barrels of oil and an estimated 40,000 tons of carbon dioxide per year, generating estimated cost savings for the resort of approximately $2.0 million per annum and over $40.0 million over the project’s 20-year life, when compared to a traditional air conditioning system, which is an estimated 30% savings in energy costs over the life of the project.

To build and operate this plant, in January 2012 we signed a turnkey engineering, procurement, and contracting arrangement with DCO Bahamas, Ltd., a subsidiary of DCO Energy LLC, Mays Landing, New Jersey. If and when the project resumes, it will be necessary to amend this agreement to accommodate the changes to the project’s commercial operation date caused by the delayed opening of the resort. Both parties are aware of this need and share an understanding of the specific sections that will require amendment.

In February 2012, DCO Energy invested $1.0 million in our company by providing a $1,000,000 promissory note and a related warrant to purchase 3,295,761 shares of common stock at $0.50 per share. In April 2016, DCO Energy agreed to extend the payment date on the note to February 2017. Frank E. DiCola, chief executive officer and managing partner of DCO Energy, is one of our directors.

13

To assist in raising the required senior debt financing for the Baha Mar project, we entered into an agreement in April 2011 with Raymond James & Associates, Inc., to act as our project adviser and sole debt placement agent. Since that time, Raymond James has drafted numerous project-related marketing documents; reviewed our materials; researched the background of related parties; and attended numerous calls and meetings. In late 2013, Raymond James arranged numerous presentations to potential senior debt lenders for the Baha Mar project, and our representatives together with DCO Energy personnel accompanied Raymond James at its banking office in New York City for project financing presentations to potential lending sources. From those presentations, we selected a large European bank as our primary prospective lender for the Baha Mar project and executed a mandate letter with the lender.

During 2013 and 2014, we proceeded, at our own cost, to advance engineering and permitting, with principal construction permits now obtained. In anticipation of closing project funding and to coordinate our construction with the installation of other components by others, we also funded the installation of the seawater feedstock pipeline from the plant site, under a golf course, to the water’s edge. We suspended construction in mid-2015. Through December 31, 2015, we had incurred expenses of $6.9 million associated with this project.

On June 29, 2015, with the resort an estimated 95% complete, Baha Mar Ltd., the developer of the resort, filed for Chapter 11 bankruptcy protection in U.S. Bankruptcy Court in Wilmington, Delaware. Baha Mar Ltd. is the entity with which our subsidiary entered into the ESA to build the SWAC system. The underlying cause of the filing was a commercial dispute between Baha Mar Ltd. and its construction company. Neither we nor our construction company, DCO Energy, is a party to the proceeding. At an early stage of the proceedings, the U.S. Bankruptcy Court in Wilmington, Delaware, dismissed the action on September 15, 2015, agreeing with the Bahamas Supreme Court in finding that the case should properly be decided in Bahamian courts.

The case is proceeding in the Bahamas Supreme Court with the September 2015 appointment of provisional liquidators (Bahamas-based KRyS Global and UK-based AlixPartners) for the specific purpose of preserving the assets of the unfinished resort pending a resolution of the dispute. In November 2015, the Bahamas Supreme Court named Deloitte & Touche LLP, an international accounting and consultancy firm, as a receiver to Baha Mar Ltd. at the request of the Export-Import Bank of China, which is a primary creditor having made a $2.45 billion loan to Baha Mar Ltd. in 2010. In March 2016, the receiver engaged Colliers International, an international real estate firm, to actively market the resort to a new owner.

The June 2015 bankruptcy of the developer constituted an event of default under the ESA, but we have elected not to assert that default in favor of attempting to pursue the project. Under the terms of our ESA, in the event of default of the developer, we have the right to recover damages, including the amount invested in the project ($6.9 million at December 31, 2015), plus any fees earned at the time of breach and other direct damages, limited in aggregate amount to $25.0 million. The ESA is binding on any successor developer that takes over the development and finished construction.

We have elected not to intervene in the Bahamas proceeding, which we believe is in the nature of an equitable proceeding to preserve the project and seek to reorganize so that the project can be completed rather than a liquidation. Our strategy is based on our conclusion that the completion of the resort by a new owner will require it to address the lack of capacity of the current electrical grid to provide air conditioning through conventional means and the projected energy cost savings derived from our SWAC system as compared to conventional electricity at prevailing rates, even if its lack of reliability in the Bahamas is discounted. By relying on this strategy, we believe we are avoiding significant legal representation costs. Further, we believe that we would have no legal position to differentiate us from other unsecured creditors with an aggregate of about $2.0 billion in claims.

14

Our Bar Mar project will be delayed until a new owner takes control of the resort and our ESA is either terminated or assumed by the new owner. We cannot predict when, if ever, the Baha Mar project will resume. If the project does not resume, we may be unable to recover associated expenses we have incurred or earn any project revenues.

Memorandums of Understanding, General Terms Agreement, and Economic Development Term Sheet

U.S. Virgin Islands (OTEC, SWAC, desalination, aquaculture, agriculture):

| ● | In 2010, Governor John P. de Jongh Jr. announced at a workshop at the U.S. Department of Energy’s National Renewable Energy Laboratory that the U.S. Virgin Islands could reduce its reliance on fossil fuels by 60% by within the next 15 years by developing is abundant renewable energy sources. The U.S. Virgin Islands Renewable Energy Act, 12 V.I.C. section 1101(f) includes OTEC in the definition of “renewable energy.” |

| ● | In January 2013, we entered into a memorandum of understanding with DCNS, a Paris, France, alternative energy developer, outlining the terms of the proposed collaboration between us, as developer, and DCNS, which is to provide engineering, procurement, and construction services to jointly build OTEC plants in the U.S. Virgin Islands and mutually selected locations elsewhere. |

| ● | On June 28, 2013, the Thirtieth Legislature of the U.S. Virgin Islands passed legislation for us to start the process to introduce OTEC, SWAC, and other sustainable technologies/opportunities for economic development. |

| ● | On July 8, 2013, The Thirtieth Legislature of the U.S. Virgin Islands enacted Resolution 1795 for us to conduct a feasibility study on the development of OTEC, SWAC, and other ancillary sustainable technologies with opportunities for economic development in the U.S. Virgin Islands. Our feasibility study has been completed. |

| ● | On March 5, 2014, we entered into a Memorandum of Understanding with the Thirtieth Legislature of the U.S. Virgin Islands to conduct a feasibility study to evaluate the preliminary costs for OTEC projects in collaboration with the University of the U.S. Virgin Islands. |

| ● | On October 29, 2015, we signed a term sheet with the University of the U.S. Virgin Islands Research and Technology Park that offers us an incentive program and other advisory and technical services for our U.S. Virgin Islands business operations. The University of the U.S. Virgin Islands Research and Technology Park leverages infrastructure in the U.S. Virgin Islands and serves as an enabler and facilitator to knowledge-based businesses. A distinct advantage of the program is that it can provide businesses based in the U.S. Virgin Islands with significant tax-saving advantages and the opportunity to operate in a favorable near-shore setting, while remaining within the jurisdiction of the United States. The University of the U.S. Virgin Islands Research and Technology Park operates under a legislative mandate and policy guidance from the University of the U.S. Virgin Islands. |

| ● | In March 2016, we submitted to the Legislature of the U.S. Virgin Islands our detailed feasibility study that we had developed jointly with DCNS under our updated July 2014 memorandum of understanding. We conclude in our study that there is strong technical and economic basis for implementing OTEC in the U.S. Virgin Islands. At the invitation of the U.S. Virgin Islands, our executives provided additional information supporting technological and feasibility testimony before the Committee on Energy and Environmental Protection of the Legislature of the U.S. Virgin Islands. |

15

| ● | Pursuant to our memorandum of understanding with DCNS, if the U.S. Virgin Islands determines to proceed with us to develop an OTEC or SWAC plant there, we will negotiate the terms of a definitive engineering, procurement, and construction contract to fulfill the plant construction specifications. |

Cayman Islands (SWAC, desalination):

In December 15, 2011, we entered into a Memorandum of Understanding with Gene Thompson, and in April 2013, we entered into a General Terms Agreement with Ocean Energy Ltd., an unrelated private concern in the Cayman Islands, to build, own, and operate two SWAC systems and to further develop both SWAC and OTEC projects for the Narayana Hrundayalaya Hospital’s new Health City Cayman Islands development and a group of hotels located on the Grand Cayman Seven Mile Beach. Phase 1 of the hospital opened in March 2014. We plan to build and install the SWAC plant with projected service starting in 2017. DCO Energy is to be the lead engineering, procurement, and construction contractor. The project is currently in the design phase. We have commenced negotiations for an ESA.

Phase 1 Study and Submitted Proposal

We are studying the feasibility of the following possible projects. Each of these opportunities is in its early stage, and we cannot assure that it will progress to an actual project meriting development. We devote attention to these projects, listed in no particular order of priority, when material matters warrant and as resources are available because they are not committed to our higher priority Baha Mar, U.S. Virgin Islands, Cayman Islands, and American Samoa projects.

U.S. Department of Defense (multiple options, including 12-MW OTEC system on Diego Garcia):

| ● | We are qualified under U.S. Small Business Research Innovation (SBIR) rules (since 2003) to undertake these kinds of projects. |

| ● | We have successfully completed both SBIR I and SBIR II phases, designing an OTEC plant for the U.S. Navy base at Diego Garcia, British Indian Ocean Territories. Our design was approved by the U.S. Department of Defense. |

| ● | Under SBIR III, we are continuing to discuss a possible, approximately 12-MW OTEC plant for Diego Garcia. |

| ● | The U.S. Navy Base program for renewable energy includes 10 to 12 Navy bases. |

Guam (expected 17-MW OTEC system):

We have submitted a proposal to build, own, and operate a 17-MW OTEC system in Guam, a tropical island in the Western Pacific. We would manage the project with the U.S. Department of Agriculture, which, in 2012, approved a planning grant for an OTEC plant for Guam to include production of desalinated water for drinking, agriculture, and aquaculture. We plan to pursue this project in 2016.

16

American Samoa (feasibility study OTEC plant):

In March 2016, we entered into a Memorandum of Understanding with the American Samoa Government under which we will conduct a feasibility study to evaluate preliminary costs for OTEC projects, including a comprehensive economic development plan using OTEC ancillary products, such as potable/bottled water and high profit aquaculture, mariculture, and agriculture as well as related short- and long-term environmental impacts, costs, funding alternatives, and other matters. After we complete and present our report, targeted for the third quarter of 2017, we intend to seek development of any project that may be warranted.

Discussion Stage Projects

Bahamas Electricity Corporation, or BEC (OTEC, desalination, aquaculture):

We have entered into a Memorandum of Understanding whereby we have agreed to work with BEC in good faith and in the spirit of cooperation and mutual benefit toward the development of OTEC projects in The Bahamas. BEC has agreed to the same spirit of cooperation and mutual benefit to work with us toward the development of OTEC projects in the Bahamas. BEC operates generation, transmission, and distribution systems throughout The Bahamas, serving approximately 85% of all electricity consumers in the islands. A binding agreement has yet to be prepared.

Zanzibar Electricity Corporation (OTEC, desalination):

A signed Memorandum of Understanding with Zanzibar Electricity Corporation seeks to introduce OTEC and ancillary technologies to the island of Zanzibar.

Malaysia (two 20-MW OTEC systems):

The Malaysian government has announced support for a move to renewable energy, as evidenced in the Prime Minister’s 10th Malaysia Plan. This document outlines Malaysia’s target to produce 5.5% of its electricity from renewable means. We are discussing projects located here.

South Korea (10-MW OTEC system, desalination):

We are discussing a project with the Korea Ocean Research & Development Institute to design, build, and operate a 10-MW OTEC system in South Korea as part of its deep-water research center work. The center produces clean deep seawater commercially and uses it for fish farming and related activities.

We will require additional funding to further expand our engineering and technical teams, develop our intellectual property, file patents for several OTEC technical systems, and advance our pipeline of current opportunities to support our growth strategy.

Our Economic Models

We have developed economic models of costs and potential revenue structures that we will seek to implement as we develop OTEC and SWAC projects.

17

OTEC Projects

The estimated construction costs for a 20-MW plant are approximately $445 million, comprised of the following components:

| Project Costs | | Amount (in thousands) | | Percentage of Total |

| Hard and soft costs | | $358,735 | | 82.0% |

| Capitalized interest fund | | 45,773 | | 10.0 |

| Debt service reserve fund | | 14,842 | | 3.0 |

| Transaction costs and fees | | 10,381 | | 2.0 |

| Development fee | | 14,326 | | 3.0 |

| Additional proceeds | | 980 | | |

| Total Project Costs | | $445,037 | | 100.0% |

The hard costs of approximately $301 million consist of the power system and platform construction and piping, which make up 68% of the total. The remaining 32% consists of other construction costs and the deployment of the cold water pipe. The soft costs of approximately $58 million consist of design, permits and licensing, environmental impact assessment, bathymetry, contractor fees, and insurance.

Once operational, the capacity factor, which is the projected percent of time that a power system will be fully operational, considering maintenance, inspections, and estimated unforeseen events, is expected to be 95% annually. This factor is used in our financial calculations, which means the plant will not be generating revenue for 5% of the year. Most fossil-fuel plants have capacity factors around 90%, as a result of the major maintenance for high-temperature boilers, fossil-fuel feed in systems, safety inspections, cleaning, etc. The normal maintenance cycle for the pumps, turbine, and generators used in the OTEC plant is typically every five years. This includes the cleaning of the heat exchangers and installation of new seals.

We currently plan to raise approximately 80% of the project costs through a debt or bond offering and 20% via equity. However, we expect that the first few projects may require a larger percentage of equity. We anticipate that project returns will be comprised of two components: First, as the project developer, we will seek a lump-sum payment as a development fee at the time of closing the project financing for each project. These payments will be allocated toward reimbursement of development costs and perhaps a financial return at the early stage of each project. The development fee will vary, but initially we will seek a fee of approximately 3% of the project cost, payable upon closing project financing, as shown in the chart above. Second, we will retain a percentage of equity in the project, with a goal to retain a minimum of 51% of the equity in any OTEC project in order to participate in operating revenues.

We will seek to generate revenue from OTEC plants from contract pricing charged on an energy-only price per kWh or on the basis of a generating capacity payment priced per kW per month and an energy usage price per kWh. In addition to revenue from power generation, in many of the countries of the world where we intend to build OTEC and SWAC plants, water is in short supply. In some locations, water is considered the more important commodity. Depending on the part of the world in which the plant is built, supplying water for drinking, fish farming, and agriculture would significantly increase plant revenue.

We cannot assure that we can maintain the revenue points noted above, that any fees we receive will offset development costs incurred to date, or that any operating plant will generate revenue for us.

18

SWAC Projects

The estimated construction costs are approximately $150 million comprised of the following components:

| Project Costs | | Amount (in thousands) | | Percentage of Total |

| Hard and soft costs | | $120,574 | | 80.0% |

| Capitalized interest fund | | 12,173 | | 8.0 |

| Debt service reserve fund | | 6,799 | | 5.0 |

| Transaction costs and fees | | 7,050 | | 5.0 |

| Development fee | | 3,000 | | 2.0 |

| Additional proceeds | | 4 | | |

| Total Project Costs | | $149,600 | | 100.0% |

The hard costs of approximately $91 million consist of piping and installation, which make up 60% of the total. The remaining 40% consists of the pump house, central utility plant (CUP), mechanical and engineering equipment, design, and other contingency costs. The soft costs of approximately $30 million consist of the CUP license, permits, environmental impact assessment, bathymetry, and insurance.

Under our economic model, we will seek to raise about 80% of SWAC project costs through a debt or bond offering and 20% via equity. As with OTEC plants, until we have a proven development, construction, and operations track record, we anticipate that a larger percentage of equity financing may be required. Under our economic model, we will seek to generate revenue at two stages of the project. First, as the project developer, we will seek a lump-sum payment of a development fee equal to approximately 3% of the project cost at the time of closing the project financing for each project. Such payments would provide us with income at the early stage of each project. If we are able to negotiate a development fee, we estimate that it will vary but typically will be in the $2,500,000-$3,500,000 range as shown in the chart above. The second component of project returns is based upon the percentage of equity we will retain in the project.

SWAC contract revenue will be based typically on three charges:

| ● | Fixed Price–this is based upon the capital costs of the project paid over the term of the debt and with the intention of covering the costs of debt. |

| ● | Operation and Maintenance–this payment covers the cost of the labor and fixed overhead needed to run the SWAC system, as well as any traditional chiller plant operating to fulfill back-up or peak-load requirements. |

| ● | Chilled Water Payment–this is a variable charge based on the actual chilled water use and chilled water generated both by the SWAC and conventional system at the agreed upon conversion factors of kW/ton and current electricity costs in U.S. dollars per kWh. |

We will seek to structure project financing with the goal of retaining 100% of the equity in any SWAC project. We cannot assure that we will recover project development costs or realize a financial return over the life of the project.

19

Project Timeline

As noted, we have not developed, designed, constructed, and placed into operation any OTEC or SWAC plants. However, based on our planning process and early development experience to date, we estimate that it will take approximately two to four years or more, depending on local conditions, including regulatory and permitting requirements, to take a project from a preliminary memorandum of understanding with a potential power or other product purchaser to completion and commencement of operation.

Strategic Relationships

We have entered into a memorandum of understanding with each of the following parties for potential plant construction and the funding of projects.

| ● | DCO Energy, LLC, Mays Landing, New Jersey, is an American energy development company specializing in the development, engineering, construction, start-up, commissioning, operation, maintenance and management, as well as, ownership of central energy centers, renewable energy projects, and combined heat, chilling, and power-production facilities.15 |

DCO Energy was formed in 2000 and has independently developed and/or operated energy producing facilities of approximately 275 MW of electric, 400 MMBtu/hr of heat recovery, 1,500 MMBtu/hr of boiler capacity, and 130,000 tons of chilled water capacity, totaling over $1 billion of assets.

DCO Energy provides financing, engineering and design, construction management, start-up and commissioning resources, and long-term operating and maintenance services for its own projects as well as third-party clients.

We have contracted with DCO Energy to build our Baha Mar SWAC project.

| ● | DCNS, Paris, France, is a French naval defense company and one of Europe’s largest ship builders. It employs 12,500 people and generates annual revenues of around $3.9 billion. |

In 2009, DCNS set up an incubator dedicated to marine renewable energies and has stated its intention to be a leader in this market, which includes marine turbines, floating wind turbines, OTEC, and tidal stream turbines.

| ● | Kongsberg Devotek AS, Kongsberg, Norway, is a product development and engineering company operating in the maritime, defense, automotive, oil and gas, and industrial sectors. |

Kongsberg Devotek has particular skills in the design and manufacture of offshore and subsea structures and infrastructure, which include development and installation of seabed piping. Further, Kongsberg Devotek has extensive experience in working with the maritime industry, including propulsion systems, deck machinery, loading and off-loading units, and control and guiding systems.16 We plan to continue discussions with Kongsberg Devotek in 2016. Our January 2013 memorandum of understanding with Kongsberg Devotek outlines a proposed business partnership to jointly develop and build OTEC and geothermal energy systems derived from our OTEC proprietary technology.

_____________

15 http://www.dcoenergy.com/ 16 http://www.semcon.com/no/

| ● | Raymond James & Associates, Inc., St. Petersburg, Florida, is a diversified financial services holding company with subsidiaries engaged primarily in investment and financial planning, in addition to investment banking and asset management. Raymond James’ shares (RJF) are traded on the New York Stock Exchange. In the last five years, Raymond James has managed well over 400 debt and equity offerings raising nearly $160 billion and its investment bankers serve the needs of growth companies in the areas of public equity and debt underwriting, private equity and debt placement, and merger and acquisition advisory services. |

In March 2011, we signed a letter agreement with Raymond James under which it agreed to act as exclusive project advisor and sole book-running manager of project senior debt for our Baha Mar project. We agreed to pay Raymond James an advisory fee equal to 1% of the total project costs, plus 3% of project senior debt, for debt financing arranged by Raymond James and 4% of project equity that it arranges. We have also agreed to indemnify Raymond James for losses it incurs in providing its services, including liabilities arising under the securities laws. The 2011 agreement was reaffirmed in March 2014 and remains in effect unless terminated by either party.

Potential Financing Structure

We expect to fund the majority of the capital amount required for each project with senior secured and mezzanine debt. We expect to create a country- or project-specific, wholly owned subsidiary for each project, which will in turn own a special purpose vehicle to own the facility and hold the debt for such project. We expect we will be required to contribute approximately 10% to 25% of the required capital for each project to the special purpose vehicle as an equity investment. We expect to fund our equity ownership in each special purpose vehicle or through additional capital-raising activities, principally through the sale of equity, and after we have completed revenue-generating projects to provide sufficient cash flow, from internally generated cash flow. Our goal is to be the sole or majority equity owner of each special purpose vehicle, but we expect that, at least initially, we may be required to partner with other equity investors, which will reduce the percentage interest in the project that we will be able to retain. We then would procure the remainder of each project’s financing through project debt funding sources.

We have no commitment for any equity or debt financing for any of our projects. As noted above, we have developed a strong relationship with Raymond James & Associates, Inc., through which we would expect to work with on any future financings that may be required for our various projects.

Construction and Components

Once we have designed the system, we will review the design with our engineering, procurement, and construction partner to maximize the chances that the project can be delivered according to plan and on budget. Based on our experience with the Baha Mar project, we expect our construction contracts to be at a fixed price and to include penalties if the construction timetable is missed. We may, but are not obligated to, engage DCO Energy to construct our plants.

In our systems, the two most important components are heat exchangers and deep-water intake pipes. Although there are multiple providers of each of these components, the supply of the best components comes from just a few companies globally. We expect to source our deep-water intake pipes from Pipelife of Norway, the only company we know of that makes pipes of sufficient quality, strength, and diameter (2.5 meters) to support our planned OTEC plants. However, we could work around a lack of supply from Pipelife by using multiple smaller pipes that are widely available on the market, although this would increase our construction costs.

21

We also need the highest quality, large heat exchangers for our systems; heat exchangers represent a large percentage of the projected costs of our OTEC and SWAC systems and also account for a significant portion of the design complexity inherent in commercial OTEC and SWAC designs. Our current relationship with Alfa Laval for heat exchangers provides us with the size and quality heat exchangers that we expect to need, although we believe there are several other companies that could provide us with adequate supply of these devices meeting our specifications if we needed to source from them.

Other major components, such as ammonia turbines, generators, and pumps, are manufactured by several multinational companies, including General Electric and Siemens.

Operation

For OTEC electricity-generating facilities, we intend to enter into 20- to 30-year PPAs, pursuant to which the project would supply fixed-price, baseload electricity to satisfy the minimum demand of the purchaser’s customers. This PPA structure allows customers to plan and budget their energy costs over the life of the contract. For our SWAC systems, we intend to enter into 20- to 30-year ESAs to supply minimum quantities of chilled water for use in a customer’s air conditioning system. Our signed Baha Mar ESA is for a term of 20 years, but can be extended further by written consent of both parties.

We anticipate that operations of OTEC and SWAC plants will be subcontracted to third parties that will take responsibility for ensuring the efficient operation of the plants. These arrangements may reduce our exposure to operational risk, although they may reduce our financial return if actual operating costs are less than the subcontract payments. We cannot assure that any OTEC and SWAC plants will permit the PPAs and ESAs to yield minimum target internal rates of return. Our first projects are likely to have lower returns than our subsequent projects. Variances in internal rates of return may occur due to a range of factors, including availability and structure of project financing and localized issues such as taxes, some of which may be outside of our control.

We expect our OTEC contract pricing will either be charged on an energy-only price per kWh or on the basis of a capacity payment priced per kW per month and an energy usage price per kWh. We cannot assure that this pricing will enable us recoup our funding costs and capital repayments and allow us to earn a profit.

Intellectual Property

We use, or intend to employ in the performance of our material contracts, intellectual property rights in relation to the design and development of OTEC plants. Our intellectual property rights can be categorized broadly as proprietary know-how, technical databases and trade secrets, comprising concept designs, plant design, and economic models. Additionally, we have applied to register the trademark TOO DEEP® at the U.S. Patent and Trade Mark Office for the provision of desalinated deep ocean water for consumption. The trademark has been granted, subject to our using it in commerce.

We may apply for patents for components of our intellectual property for OTEC and SWAC systems, including novel or new methodologies for cold-water piping, heat exchanges, and computer-aided design programs. We cannot assure that any patents we seek will be granted.

Our intellectual property has been developed by our employees and is protected under employee agreements confirming that the rights in the inventions and developments made by the employees are our property. Confidential information is protected by nondisclosure agreements we entered into with our prospective partners or other third parties with which we do business.

22

We have not received any notification from third parties that our processes or designs infringe any third-party rights, and we are not aware of any valid and enforceable third-party intellectual property rights that infringe our intellectual property rights. Currently, there is no patent for any company for the OTEC technology.

Marketing Strategies

Our marketing and sales efforts are managed and directed by our chairman and chief executive officer, Jeremy P. Feakins, who has 35 years’ experience of senior-level sales in both commercial and governmental markets. Our marketing campaign has focused on explaining to potential customers the economic, environmental, and other benefits of OTEC and SWAC through personal contacts, industry interactions, and our website.

Our target markets are comprised of large institutional customers that typically include governments, utilities, large resorts, hospitals, educational institutions, and municipalities. We market to them directly through personal meetings and contact by our chief executive officer and other key members of our team, including through the relationships of our Advisory Board members. We also make extensive use of centers of influence either to heighten awareness of our products in the minds of key customers’ decision-makers or to secure face-to-face meetings and preliminary agreements with our customers and our chief executive officer.

Sales cycles in our business are extremely long and complex and often involve multiple meetings with governmental, regulatory, electric utility, and corporate entities. Therefore, we cannot predict when or if any of the projects we currently have under development will progress to the signed contract or operational phase and generate revenue. We do not expect sales to be seasonal or cyclical.

Material Regulation

Our business and products are subject to material regulation. However, because we contemplate offering our products and services in different countries, the specific nature of the regulation will be wholly dependent on the nation where the project will be located.

For example, our Baha Mar SWAC project is subject to Bahamian law and required a national government approval, which has been obtained. In contrast, the OTEC project contemplated for the U.S. Virgin Islands, a U.S. territory, will be subject to U.S. federal law, which provides that the Department of Commerce shall license all such projects. Therefore, the precise nature of the regulatory requirements for each project is wholly dependent on the specific location, and the national, state, and local regulations apply at that location.

In all cases, we expect the level of regulation will be material and will require significant permitting and ongoing compliance during the life of the project. The most significant regulations will likely be environmental and will include mitigating possible adverse effects during both the construction and operational phases of the project. However, we believe that the limited plant site disturbance of both SWAC and OTEC projects, together with the significantly lower emissions that result from these projects as compared to fossil-fuel electrical generation, will make compliance with all such regulation manageable in the normal course.

23

The second most significant regulations will likely involve coordination with existing infrastructure. In the case of The Bahamas project, for example, the cold water pipe location had to be engineered, reviewed, and approved so that it would not interfere with existing pipes and cables. We believe compliance with this type of regulation is a routine civil engineering coordination process that exists for all new buildings and infrastructure projects of all types. Again, we believe that the design of both SWAC and OTEC projects can readily be modified to avoid interference with existing infrastructure in most cases.

Competition

We compete in the development, construction, and operation of OTEC and SWAC plants with other operators that develop similar facilities powered by other energy sources, primarily oil, natural gas, nuclear energy, and solar power. These traditional energy sources have well-established infrastructures for production, delivery, and supply, with well-known commercial terms. In developing our OTEC and SWAC plants, we will need to satisfy our customers that these technologies are sound and economical, which may be a challenge until and unless we have an established successful operating history. The energy industry is dominated by an array of companies of all sizes that have proven technologies and well-established fuel sources from a number of suppliers.

We expect that we will encounter increasing competition for OTEC and SWAC plants. Other firms with greater financial and technical resources are focusing commercialization of these technologies. This includes, for example, Akuo Energy and DCNS, which were funded to construct and install a number of OTEC plants adding up to 16 MWs of power generation outside the coastline of Martinique in the Caribbean, and Lockheed Martin, which has recently designed a 10-MW OTEC plant and has partnered with China-based Reignwood Group, which intends to build the plant in Hainan, China.

Our competitors may benefit from collaborative relationships with countries, including a large number of Caribbean nations that now have renewable energy standards, and are looking at ways to reduce their carbon footprint, decouple the price of electricity from the volatile price of oil, and increase energy security. Other competitors may have advantageous relationships with authorities such as Hawaii, U.S. territories, and the U.S. Department of Defense, which are looking at OTEC as a possible source of renewable energy and water for drinking, fish farming, and agriculture.

We cannot assure that we will be able to compete effectively as this industry grows and becomes more established and as OTEC and SWAC plants become more accepted as viable and economic energy solutions.

We believe competition in this industry is and will be based on technical soundness and viability, the economics of plant outputs as compared to other energy sources, developmental reputation and expertise, financial capability, and ability to develop relationships with potential customers. All of these factors are outside our control.

Employees

We currently have 10 employees, consisting of two officers, three engineers and technicians, two marketing, and three general and administrative employees. There are no collective-bargaining agreements with our employees, and we have not experienced work interruptions or strikes. We believe our relationship with our employees is good. We provide health and life insurance for all employees.

24

Our History

Our origin dates back to 1998, when our wholly owned subsidiary, Ocean Engineering and Energy Systems International, Inc., or OCEES, sought to promote, improve, and commercialize OTEC technologies. OCEES’ founders had previously assisted in the design and development of the first U.S. land-based operational OTEC test plant--the 250 kW plant operated for six years at the U.S. Department of Energy’s facility at the Natural Energy Laboratory of Hawaii Authority at Keahole Point on the Kona coast of Hawaii. At that time, this was the largest operating OTEC plant, which proved that OTEC could produce electricity continuously without the use of fossil fuel.17