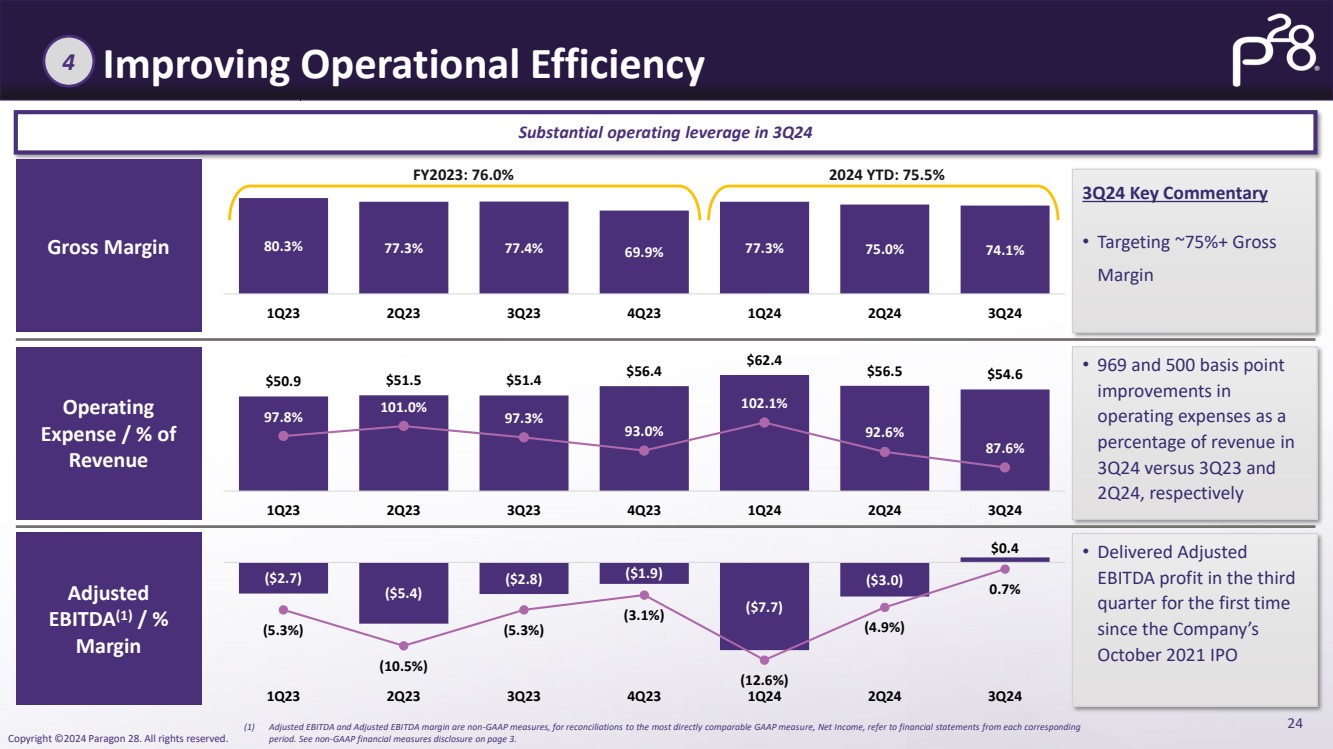

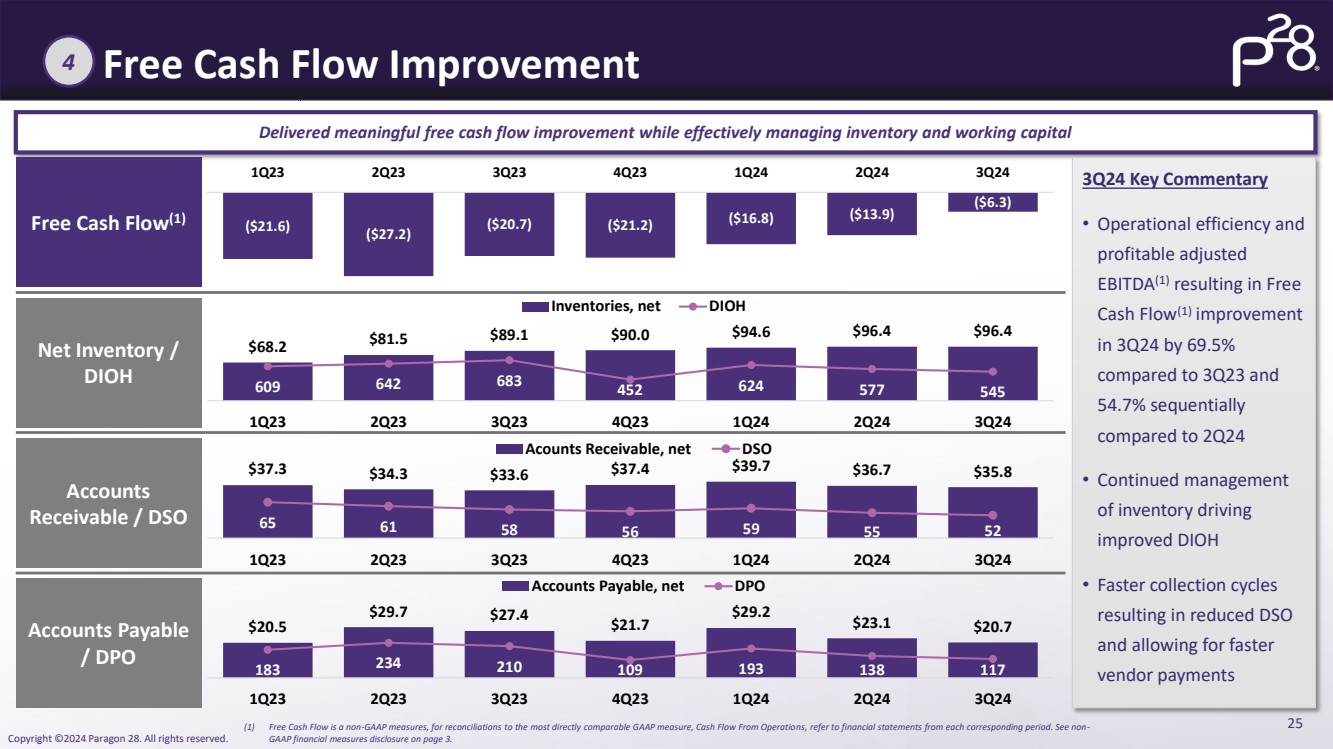

| 3 Copyright ©2024 Paragon 28. All rights reserved. Non-GAAP Financial Measures This presentation includes financial measures that were not prepared in accordance with GAAP. Our non-GAAP financial measures include adjusted EBITDA, adjusted EBITDA margin, adjusted revenue growth and free cash flow. Definitions, explanations, and reconciliations to the most comparable GAAP financial measures can be found in the Appendix. In addition to our results and measures of performance determined in accordance with U.S. GAAP presented in this presentation, we believe that certain non-GAAP financial measures are useful in evaluating and comparing our financial and operational performance over multiple periods, identifying trends affecting our business, formulating business plans and making strategic decisions. Adjusted EBITDA is a key performance measure that our management uses to assess our financial performance and is also used for internal planning and forecasting purposes. We define Adjusted EBITDA as earnings (loss) before interest expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, employee stock purchase plan expense, non-recurring expenses and certain other non-cash expenses. We believe that Adjusted EBITDA, together with a reconciliation to net income, helps identify underlying trends in our business and helps investors make comparisons between our company and other companies that may have different capital structures, tax rates, or different forms of employee compensation. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to a key financial metric used by our management in its financial and operational decision-making. Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider these measures in isolation or as a substitute for analysis of our financial results as reported under U.S. GAAP. Some of these potential limitations include: • other companies, including companies in our industry which have similar business arrangements, may report Adjusted EBITDA, or similarly titled measures but calculate them differently, which reduces their usefulness as comparative measures; • although depreciation and amortization expenses are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditures for such replacements or for new capital expenditure requirements; • Adjusted EBITDA also does not reflect changes in, or cash requirements for, our working capital needs or the potentially dilutive impact of stock-based compensation; and • Adjusted EBITDA does not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt that we may incur. Free Cash Flow is an additional key performance measure that our management uses to assess our financial performance and liquidity. We define Free Cash Flow as net cash provided by operating activities less capital expenditures. The Company’s capital expenditures include amounts related to purchases of property and equipment. Additionally, management believes Free Cash Flow is helpful in assessing our operational efficiency and the effectiveness of our capital expenditures, and that monitoring Free Cash Flow can help us manage financial risk. In addition, management believes Free Cash Flow provides meaningful incremental information to investors to consider when evaluating the performance of the Company. Additionally, we report revenue growth on a constant-currency basis in order to facilitate period-to-period comparisons of results without regard to the impact of fluctuating foreign currency exchange rates. The term foreign currency exchange rates refers to the exchange rates used to translate the company's operating results for all countries where the functional currency is not the U.S. dollar into U.S. dollars. Because we are a global company, foreign currency exchange rates used for translation may have a significant effect on our reported results. References to revenue growth on a constant-currency basis means without the impact of foreign currency exchange rate fluctuations. The company believes disclosure of constant-currency revenue growth rates is helpful to investors because it facilitates period-to-period comparisons. However, constant-currency revenue growth rates are non-GAAP financial measures and are not meant to be considered as an alternative or substitute for comparable measures prepared in accordance with GAAP. Constant-currency growth has no standardized meaning prescribed by GAAP and should be read in conjunction with the our consolidated financial statements prepared in accordance with GAAP. We calculate constant-currency growth rates by translating local currency amounts in the current period at actual foreign exchange rates for the prior period. Because of these and other limitations, you should consider our non-GAAP measures only as supplemental to other GAAP-based financial measures. |