- FNA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DFAN14A Filing

Paragon 28 (FNA) DFAN14AAdditional proxy materials by non-management

Filed: 28 Jan 25, 6:35pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 28, 2025

ZIMMER BIOMET HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 001-16407 | 13-4151777 | ||

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

345 East Main Street Warsaw, Indiana | 46580 | |||

| (Address of Principal Executive Offices) | (Zip Code) |

(574) 373-3333

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock, $0.01 par value | ZBH | New York Stock Exchange | ||

| 2.425% Notes due 2026 | ZBH 26 | New York Stock Exchange | ||

| 1.164% Notes due 2027 | ZBH 27 | New York Stock Exchange | ||

| 3.518% Notes due 2032 | ZBH 32 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure |

On January 28, 2025, Zimmer, Inc. (“Parent” or “Zimmer”), a Delaware corporation and wholly owned subsidiary of Zimmer Biomet Holdings, Inc. (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Paragon 28, Inc., a Delaware corporation (“Paragon”), Gazelle Merger Sub I, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Merger Sub”) and, for certain provisions of the Merger Agreement, the Company. Subject to the terms and conditions of the Merger Agreement, Merger Sub will be merged with and into Paragon (the “Merger”), with Paragon continuing as the surviving corporation and a wholly owned subsidiary of Parent. Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each outstanding share of Paragon common stock, par value $0.01 per share (other than shares owned by Paragon, Parent, Merger Sub or any of their respective subsidiaries (which shares will be canceled) and shares with respect to which appraisal rights are properly exercised and not withdrawn under Delaware law), will automatically be converted into the right to receive (i) $13.00 in cash, without interest and (ii) one contractual contingent value right pursuant to the Contingent Value Rights Agreement, to be entered into at or immediately prior to the Effective Tim, among Parent, a rights agent and, for certain provisions, the Company. The material terms of the Merger Agreement, including the conditions of the proposed Merger, will be described in a subsequent filing on Form 8-K.

A copy of the press release jointly issued by the Company and Paragon on January 28, 2025 announcing the execution of the Merger Agreement is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

In addition, on January 28, 2025, the Company posted an investor presentation to its investor website related to the transactions contemplated by the Merger Agreement and provided information regarding the proposed transaction to analysts and investors. A copy of the investor presentation is furnished hereto as Exhibit 99.2 and is hereby incorporated by reference herein.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information or exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This communication, and any documents to which the Company refers in this communication, contain not only historical information, but also forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often include the words “forecast,” “expect,” “believe,” “will,” “intend,” “plan,” and words of similar substance. Such forward-looking statements include the expected completion and timing of the proposed transaction and other information relating to the proposed transaction. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or performance to differ materially from those expressed in or contemplated by the forward-looking statements, including the following: (i) risks related to the satisfaction of the conditions to closing the Merger (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including uncertainties as whether the stockholders of Paragon will approve the acquisition and the possibility that the acquisition does not close; (ii) risks related to the possibility that competing offers or acquisition proposal for Paragon will be made; (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (iv) risks related to the ability to realize the anticipated benefits of the Merger, including the possibility that the expected benefits from the Merger will not be realized or will not be realized within the expected time period; (v) the risk that the businesses will not be integrated successfully; (vi) risks relating to the achievement, in part or at all, of the revenue milestone necessary for the payment of any contingent value rights; (vii) disruption from the pending Merger making it more difficult to maintain business and operational relationships, including with customers, vendors, service providers, independent sales representatives, agents or agencies; (viii) risk related to the pending Merger diverting Company management’s attention from the ongoing business operations of its business; (ix) negative effects of the announcement of the Merger or the consummation of the Merger on the market price the Company’s common stock and on the Company’s operating results; (x) significant transaction costs; (xi) unknown liabilities; (xii) the risk of litigation, including shareholder litigation,

and/or regulatory actions, including any conditions, limitations or restrictions placed on approvals by any applicable governmental entities, related to the Merger; and (xiii) (A) other risks and uncertainties discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the Company’s subsequent Quarterly Reports on Form 10-Q (in particular, the risk factors set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in such Annual Report and Quarterly Reports), and (B) other risk factors identified from time to time in other filings with the U.S. Securities and Exchange Commission (the “SEC”).

The list of factors that may affect actual results and the accuracy of forward-looking statements is illustrative and is not intended to be exhaustive. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. The Company undertakes no obligation to update any of these forward-looking statements as the result of new information or to reflect events or circumstances after the date of this communication or to reflect actual outcomes, expect as required by law, and expressly disclaims any obligation to revise or update any forward-looking statement to reflect future events or circumstances.

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed transaction, Paragon will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Paragon’s stockholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, and on Paragon’s website at www.paragon28.com. In addition, the proxy statement and other documents may be obtained free of charge by directing a request to Paragon 28, Inc., Robert McCormack, 14445 Grasslands Drive, Englewood, Colorado, telephone: (720) 912-1332.

Participants in the Solicitation

The Company and Paragon and their respective directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of Paragon in connection with the proposed transaction. Information regarding the Company’s directors and executive officers can be found in the Company’s definitive proxy statement filed with the SEC on March 27, 2024. Information regarding Paragon’s directors and executive officers can be found in Paragon’s definitive proxy statement filed with the SEC on April 5, 2024. Additional information regarding the interests of Paragon’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov, on the Company’s website at www.zimmerbiomet.com and on Paragon’s website at www.paragon28.com.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit Number | Description | |

| 99.1 | Joint Press Release, dated January 28, 2025 | |

| 99.2 | Investor Presentation, dated January 28, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Zimmer Biomet Holdings, Inc. | ||||||

| Date: January 28, 2025 | By: | /s/ Chad F. Phipps | ||||

| Chad F. Phipps | ||||||

| Senior Vice President, General Counsel and Secretary | ||||||

Exhibit 99.1

|  |

Zimmer Biomet:

| Media | Investors | |

Heather Zoumas-Lubeski 445-248-0577 heather.zoumaslubeski@zimmerbiomet.com

Kirsten Fallon 781-779-5562 kirsten.fallon@zimmerbiomet.com | David DeMartino 646-531-6115 david.demartino@zimmerbiomet.com

Zach Weiner 908-591-6955 zach.weiner@zimmerbiomet.com | |

| Paragon 28: | ||

Media and Investors: Matt Brinckman 720-912-1332 mbrinckman@paragon28.com | ||

Zimmer Biomet Announces Definitive Agreement to Acquire Paragon 28

Demonstrates Zimmer Biomet’s Commitment to Investing in Higher Growth

End-Markets, with Expansion into ~$5 Billion Foot and Ankle Segment

Expected to Enhance Zimmer Biomet’s Financial Profile; Immediately Accretive to

Revenue Growth and Accretive to Adjusted EPS within 24 Months of Deal Close

(WARSAW, Ind. and ENGLEWOOD, Colo.) January 28, 2025 — Zimmer Biomet Holdings, Inc. (NYSE and SIX: ZBH), a global medical technology leader, and Paragon 28, Inc. (NYSE: FNA), a leading medical device company focused exclusively on the foot and ankle orthopedic segment, today announced they have entered into a definitive agreement for Zimmer Biomet to acquire all outstanding shares of common stock of Paragon 28 for an upfront payment of $13.00 per share in cash, corresponding to an equity value of approximately $1.1 billion and an enterprise value of approximately $1.2 billion. Paragon 28 shareholders will also receive a non-tradeable contingent value right (CVR) entitling the holder to receive up to $1.00 per share in cash if certain revenue milestones are achieved. The CVR will be payable in whole or in part if net sales exceed $346 million up to $361 million (with the CVR payments calculated linearly between $0.00 and $1.00 if net sales are between $346 million and $361 million) during Zimmer Biomet’s fiscal year 2026. The board of directors of each of Zimmer Biomet and Paragon 28 has unanimously approved the proposed transaction.

Established in 2010, Paragon 28 has an extensive suite of surgical offerings and product systems spanning all major foot and ankle segments, including fracture and trauma, deformity correction and joint replacement. Since its inception, Paragon 28 has been singularly focused on bringing to market innovative solutions to address areas of unmet need in the foot and ankle segment.

“This proposed transaction further diversifies Zimmer Biomet’s portfolio outside of core orthopedics and positions us well in one of the highest growth specialized segments in musculoskeletal care, while creating cross-selling opportunities in the rapidly growing ASC space,” said Ivan Tornos, President and Chief Executive Officer of Zimmer Biomet. “Paragon 28’s broad and innovative foot and ankle portfolio, robust product pipeline and dedicated and highly trained sales force, combined with Zimmer Biomet’s global reach and capabilities, will uniquely position us to address the unmet patient needs of this highly complex anatomy.”

“We are incredibly proud of the legacy we have built at Paragon 28 as an industry leader committed to continuously improving the outcomes and experiences of patients suffering from foot and ankle conditions,” said Albert DaCosta, Chairman and CEO of Paragon 28. “Joining Zimmer Biomet is an exciting new chapter for Paragon 28 and an incredible opportunity to advance our mission and continue to deliver groundbreaking solutions in the foot and ankle segment.”

Benefits of the Proposed Transaction

Strengthens and expands Zimmer Biomet’s foot and ankle offerings through Paragon 28’s leading technology platform while bolstering existing fracture & trauma and joint replacement portfolios.

Complements Zimmer Biomet’s global footprint and existing infrastructure with Paragon 28’s expansive portfolio, which is expected to drive adoption and accelerate U.S and international growth.

2

Accelerates Zimmer Biomet’s WAMGR given significant opportunity across a ~$5 billion foot and ankle industry growing high-single digits.

Expedites penetration opportunities in the fast-growing ASC space.

Proposed Transaction Highlights

The proposed transaction is expected to immediately accelerate Zimmer Biomet’s revenue growth. Paragon 28 has announced net revenue for the full year of 2024 to be in a range of $255.9 to $256.2 million, representing 18.2% to 18.4% reported growth over the prior fiscal year. Zimmer Biomet expects the proposed transaction, considering the impact of financing, to be approximately 3% dilutive to adjusted earnings per share in 2025, about 1% dilutive to 2026 adjusted earnings per share and accretive to adjusted earnings per share within 24 months of deal close.

Zimmer Biomet plans to fund the proposed transaction through a combination of cash on the balance sheet and other available debt financing sources. Zimmer Biomet expects to maintain a strong balance sheet and to continue to support its stated capital allocation priorities.

Closing of the proposed transaction is subject to receipt of required regulatory approvals, approval by Paragon 28 stockholders and other customary closing conditions, and is anticipated to close in the first half of 2025. Expected impacts to 2025 financial results will be discussed on Zimmer Biomet’s upcoming fourth quarter 2024 earnings call scheduled for February 6, 2025.

Advisors

Goldman Sachs & Co. LLC is serving as exclusive financial advisor to Zimmer Biomet and Hogan Lovells US LLP is serving as legal advisor.

Piper Sandler & Co. is serving as exclusive financial advisor to Paragon 28 and Cravath, Swaine & Moore LLP is serving as legal advisor.

3

About Zimmer Biomet

Zimmer Biomet is a global medical technology leader with a comprehensive portfolio designed to maximize mobility and improve health. We seamlessly transform the patient experience through our innovative products and suite of integrated digital and robotic technologies that leverage data, data analytics and artificial intelligence.

With 90+ years of trusted leadership and proven expertise, Zimmer Biomet is positioned to deliver the highest quality solutions to patients and providers. Our legacy continues to come to life today through our progressive culture of evolution and innovation.

For more information about our product portfolio, our operations in 25+ countries and sales in 100+ countries or about joining our team, visit www.zimmerbiomet.com or follow on LinkedIn at www.linkedin.com/company/zimmerbiomet or X/ Twitter at www.twitter.com/zimmerbiomet.

About Paragon 28

Based in Englewood, CO., Paragon 28 is a leading medical device company exclusively focused on the foot and ankle orthopedic segment and is dedicated to improving patient lives. From the onset, Paragon 28 has provided innovative orthopedic solutions, procedural approaches and instrumentation that cover a wide range of foot and ankle ailments including fracture fixation, forefoot, ankle, progressive collapsing foot deformity (PCFD) or flatfoot, Charcot foot and orthobiologics. The company designs products with both the patient and surgeon in mind, with the goal of improving outcomes, reducing ailment recurrence and complication rates, and making the procedures simpler,

consistent, and reproducible.

4

Cautionary Statement Regarding Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding Zimmer Biomet and Paragon 28, which involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “are confident that,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “would” or the negative of these terms or other comparable terms. Forward-looking statements in this release include, among other things, statements about the potential benefits of the proposed transaction; anticipated accretion and growth rates; plans, objectives, beliefs, expectations and intentions of the board of directors of Zimmer Biomet, Zimmer Biomet management, the board of directors of Paragon 28 and Paragon 28 management; the financial condition, results of operations and businesses of Zimmer Biomet and Paragon 28; the possibility that the milestone associated with the contingent value rights are achieved in part or at all; and the anticipated timing of closing of the proposed transaction.

These forward-looking statements are based on certain assumptions and analyses made by Zimmer Biomet and Paragon 28 in light of Zimmer Biomet and Paragon 28’s experience and Zimmer Biomet and Paragon 28’s perception of historical trends, current conditions and expected future developments, as well as other factors Zimmer Biomet and Paragon 28 believe are appropriate in the circumstances. These forward-looking statements also are based on the current expectations and beliefs of the respective managements of Zimmer Biomet and Paragon 28 and are subject to certain known and unknown risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Risks and uncertainties include, among other things, (i) risks related to the satisfaction of the conditions to closing the proposed transaction (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including uncertainties as whether the stockholders of Paragon 28 will approve the proposed transaction and the possibility that the proposed transaction does not close; (ii) risks related to the possibility that competing offers or acquisition proposals for Paragon 28 will be made; (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction, including in circumstances which would require Paragon 28 to pay a termination fee; (iv) risks related to the ability to realize the anticipated benefits of the proposed transaction, including the

5

possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; (v) the risk that the businesses will not be integrated successfully; (vi) risks relating to the achievement, in part or at all, of the revenue milestone necessary for the payment of any contingent value rights; (vii) disruption from the proposed transaction making it more difficult to maintain business and operational relationships, including with customers, vendors, service providers, independent sales representatives, agents or agencies, and Paragon 28’s ability to attract, motivate or retain key executives, employees and other associates; (viii) risk related to the proposed transaction diverting Zimmer Biomet’s and/or Paragon 28’s managements’ attention from the ongoing business operations of their respective business; (ix) negative effects of this announcement or the consummation of the proposed transaction on the market price of Zimmer Biomet and/or Paragon 28’s common stock and on Zimmer Biomet and/or Paragon 28’s operating results; (x) significant transaction costs; (xi) unknown liabilities; (xii) the risk of litigation, including shareholder litigation, and/or regulatory actions, including any conditions, limitations or restrictions placed on approvals by any applicable governmental entities, related to the proposed transaction; and (xiii) (A) other risks and uncertainties discussed in Zimmer Biomet’s and Paragon 28’s respective Annual Reports on Form 10-K or Form 10-K/A, as applicable, for the fiscal year ended December 31, 2023 and their subsequent Quarterly Reports on Form 10-Q (in particular, the risk factors set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in such Annual Reports and Quarterly Reports), and (B) other risk factors identified from time to time in other filings with the U.S. Securities and Exchange Commission (the “SEC”). Filings with the SEC are available on the SEC’s website at www.sec.gov.

The list of factors that may affect actual results and the accuracy of forward-looking statements is illustrative and is not intended to be exhaustive. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. Zimmer Biomet and Paragon 28 undertake no obligation to update any of these forward-looking statements as the result of new information or to reflect events or circumstances after the date of this communication or to reflect actual outcomes, expect as required by law, and expressly disclaim any obligation to revise or update any forward-looking statement to reflect future events or circumstances.

6

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed transaction, Paragon 28 intends to file relevant materials with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Paragon 28’s stockholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF PARAGON 28 ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ALL RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of these documents (if and when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, and on Paragon 28’s website at www.paragon28.com. In addition, the proxy statement and other documents may be obtained free of charge by directing a request to Paragon 28, Inc., Robert McCormack, 14445 Grasslands Drive, Englewood, Colorado, telephone: (720) 912-1332.

Participants in the Solicitation

Zimmer Biomet and Paragon 28 and their respective directors and executive officers and other members of management and employees, under SEC rules, may be deemed participants in the solicitation of proxies from the stockholders of Paragon 28 in connection with the proposed transaction. Information regarding Zimmer Biomet’s directors and executive officers can be found in Zimmer Biomet’s definitive proxy statement on Schedule 14A for the 2024 Annual Meeting of Stockholders, filed with the SEC on March 27, 2024 and subsequent statements of beneficial ownership on file with the SEC. Information regarding Paragon 28’s directors and executive officers can be found in Paragon 28’s definitive proxy statement on Schedule 14A for the 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 5, 2024 and subsequent statements of beneficial ownership on file with the SEC. These documents are available free of charge at the SEC’s web site at www.sec.gov, on Zimmer Biomet’s website

7

at www.zimmerbiomet.com and on Paragon 28’s website at www.paragon28.com. Additional information regarding the interest of Paragon 28’s participants in the solicitation of Paragon 28’ stockholders, which may, in some cases, be different than those of Paragon 28’s stockholders generally, will be set forth in the proxy statement related to the proposed transaction described above and other relevant materials to be filed with the SEC if and when they become available.

###

8

Exhibit 99.2 ZIMMER BIOMET MOVING YOU MOVING YOU F FO OR RW WA AR RD D ZBH Acquisition of Paragon 28 2024 Investor Day January 28, 2025

Disclaimer Cautionary Note Regarding Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including any statements about us; Paragon 28, Inc. (“Paragon 28”); forecasts; expectations; plans; intentions; strategies; prospects; goals; priorities; financial guidance; products; markets; technologies; partnerships; and services. Forward-looking statements in this presentation also include, among other things, statements about the potential benefits of the proposed acquisition; anticipated accretion and growth rates; Zimmer Biomet's and Paragon 28's plans, objectives, expectations and intentions; the financial condition, results of operations and businesses of Zimmer Biomet and Paragon 28; the possibility that the milestones associated with the contingent value rights are achieved in part or at all; and the anticipated timing of closing of the acquisition. All statements other than statements of historical or current fact are, or may be deemed to be, forward- looking statements. Such statements are based upon the current beliefs, expectations and assumptions of our management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual outcomes and results to differ materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to: risks related to the satisfaction of the conditions to closing the acquisition (including the failure to obtain necessary regulatory approvals) in the anticipated timeframe or at all, including uncertainties as whether the stockholders of Paragon 28 will approve the acquisition and the possibility that the acquisition does not close; risks related to the ability to realize the anticipated benefits of the acquisition, including the possibility that the expected benefits from the proposed acquisition will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; risks relating to the achievement, in part or at all, of the commercial milestones necessary for the payment of any contingent value rights; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of this announcement or the consummation of the proposed acquisition on the market price of Zimmer Biomet common stock and on Zimmer Biomet's operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed acquisition; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange rates and interest rates; changes in tax and other laws, regulations and policies; future business combinations or disposals; the uncertainties inherent in research and development; competitive developments; our ability to attract, retain and develop the highly skilled employees and distributors we need to support our business; the effect of mergers and acquisitions on our relationships with customers, suppliers and lenders and on our operating results and businesses generally; challenges relating to changes in and compliance with governmental laws and regulations affecting our U.S. and international businesses, including regulations of the U.S. Food and Drug Administration and other government regulators, such as more stringent requirements for regulatory clearance of products; the outcome of government investigations; the impact of healthcare reform and cost containment measures, including efforts sponsored by government agencies, legislative bodies, the private sector and healthcare purchasing organizations through reductions in reimbursement levels, repayment demands and otherwise; and the success of our quality and operational excellence initiatives. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. A further list and description of these risks and uncertainties and other factors can be found in our Annual Report on Form 10-K for the year ended December 31, 2023, including in the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and our subsequent filings with the Securities and Exchange Commission (“SEC”). Copies of these filings are available online at www.sec.gov and www.zimmerbiomet.com or on request from us. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our filings with the SEC. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Recipients of this presentation are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary note is applicable to all forward-looking statements contained in this presentation. Non-GAAP Financial Measures: This presentation refers to certain financial measures that differ from financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These non- GAAP financial measures may not be comparable to similar measures reported by other companies and should be considered in add ition to, and not as a substitute for, or superior to, other measures prepared in accordance with GAAP. Management uses non-GAAP financial measures internally to evaluate the performance of the business. Additionally, management believes these non-GAAP measures provide meaningful incremental information to investors to consider when evaluating our performance and the transaction. Management believes these measures offer the ability to make period-to-period comparisons that are not impacted by certain items that can cause dramatic changes in reported income but that do not impact the fundamentals of our operations. The non-GAAP measures enable the evaluation of operating results and trend analysis by allowing a reader to better identify operating trends that may otherwise be masked or distorted by these types of items that are excluded from the non-GAAP financial measures. In addition, certain of these non-GAAP financial measures are used as performance metrics in our incentive compensation programs. Forward looking information is not adjusted to give effect to accounting requirements for discontinued operations. Unless otherwise noted, all measures in this presentation are on an adjusted and constant currency basis. Additional Information about the Proposed Transaction and Where to Find It: In connection with the proposed transaction, Paragon 28 will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Paragon 28’s stockholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, and on Paragon 28’s website at www.paragon28.com. In addition, the proxy statement and other documents may be obtained free of charge by directing a request to Paragon 28, Inc., Robert McCormack, 14445 Grasslands Drive, Englewood, Colorado, telephone: (720) 912-1332. Participants in the Solicitation: Zimmer Biomet and Paragon 28 and their respective directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of Paragon 28 in connection with the proposed transaction. Information regarding Zimmer Biomet’s directors and executive officers can be found in Zimmer Biomet’s definitive proxy statement filed with the SEC on March 27, 2024. Information regarding Paragon 28’s directors and executive officers can be found in Paragon 28’s definitive proxy statement filed with the SEC on April 5, 2024. Additional information regarding the interests of Paragon 28’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site atwww.sec.gov, on Zimmer Biomet’s website atwww.zimmerbiomet.com and on Paragon 28’s website at www.paragon28.com 2 2

Zimmer Biomet has entered into a definitive agreement to acquire all of the outstanding shares of Paragon 28, Inc. (NYSE:FNA), a leading medical device company focused exclusively on the foot and ankle orthopedic segment. The 1 transaction values Paragon 28 at approximately $1.2 billion Paragon 28’s industry leading foot and ankle solutions portfolio is highly complementary to our lower extremities business, adding key products in categories such as bunion correction, lower extremity fracture and total ankle replacement, while creating cross selling opportunities and Summary amplifying our leadership position in the ASC This strategic transaction will further solidify our leadership position across musculoskeletal health and specifically lower extremities 1. Represents enterprise value and excludes an up to $1 per share Contingent Value Right (CVR) 3

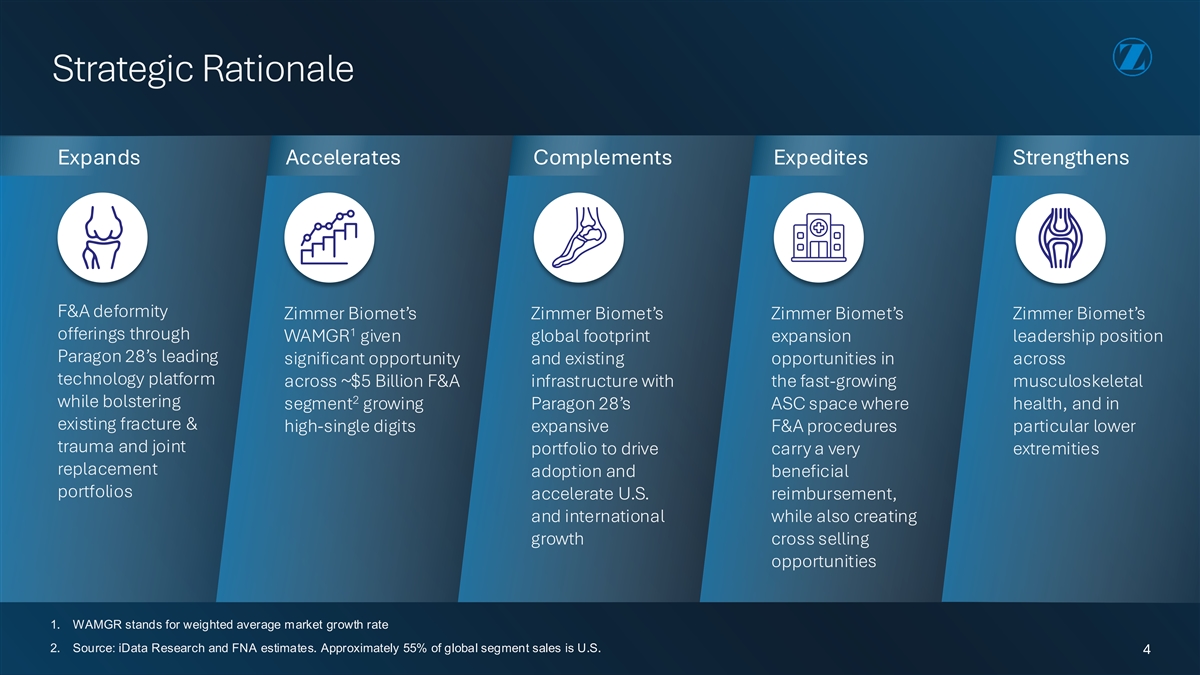

Strategic Rationale Expands Accelerates Complements Expedites Strengthens F&A deformity Zimmer Biomet’s Zimmer Biomet’s Zimmer Biomet’s Zimmer Biomet’s 1 offerings through WAMGR given global footprint expansion leadership position Paragon 28’s leading significant opportunity and existing opportunities in across technology platform across ~$5 Billion F&A infrastructure with the fast-growing musculoskeletal 2 while bolstering segment growing Paragon 28’s ASC space where health, and in existing fracture & high-single digits expansive F&A procedures particular lower trauma and joint portfolio to drive carry a very extremities replacement adoption and beneficial portfolios accelerate U.S. reimbursement, and international while also creating growth cross selling opportunities 1. WAMGR stands for weighted average market growth rate 2. Source: iData Research and FNA estimates. Approximately 55% of global segment sales is U.S. 4

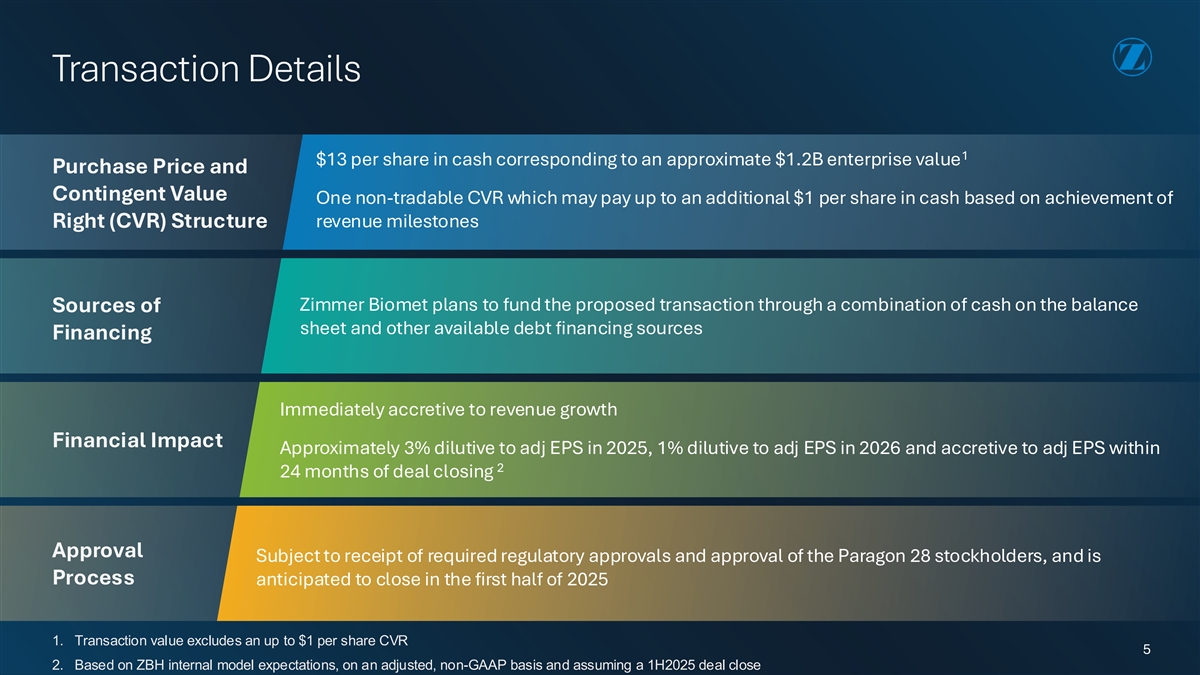

Transaction Details 1 $13 per share in cash corresponding to an approximate $1.2B enterprise value Purchase Price and Contingent Value One non-tradable CVR which may pay up to an additional $1 per share in cash based on achievement of Right (CVR) Structure revenue milestones Zimmer Biomet plans to fund the proposed transaction through a combination of cash on the balance Sources of sheet and other available debt financing sources Financing Immediately accretive to revenue growth Financial Impact Approximately 3% dilutive to adj EPS in 2025, 1% dilutive to adj EPS in 2026 and accretive to adj EPS within 2 24 months of deal closing Approval Subject to receipt of required regulatory approvals and approval of the Paragon 28 stockholders, and is Process anticipated to close in the first half of 2025 1. Transaction value excludes an up to $1 per share CVR 5 2. Based on ZBH internal model expectations, on an adjusted, non-GAAP basis and assuming a 1H2025 deal close

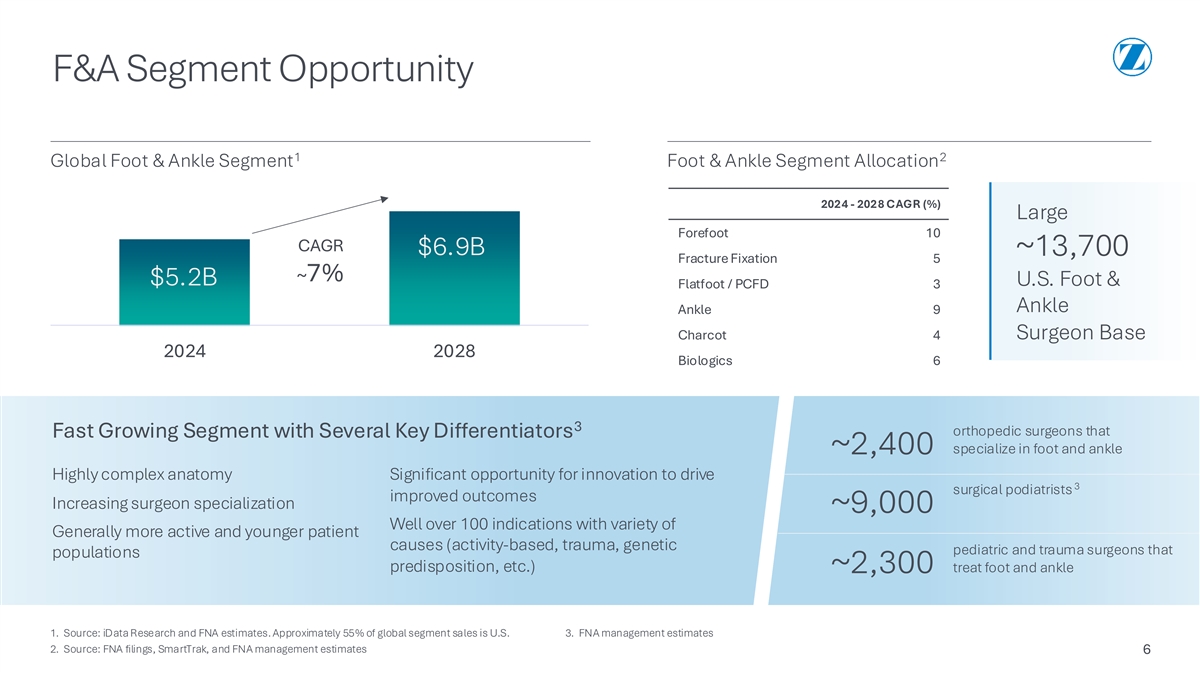

F&A Segment Opportunity 1 2 Global Foot & Ankle Segment Foot & Ankle Segment Allocation 2024 - 2028 CAGR (%) Large Forefoot 10 CAGR $6.9B ~13,700 Fracture Fixation 5 ~7% $5.2B U.S. Foot & Flatfoot / PCFD 3 Ankle Ankle 9 Charcot 4 Surgeon Base 2024 2028 Biologics 6 3 orthopedic surgeons that Fast Growing Segment with Several Key Differentiators specialize in foot and ankle ~2,400 Highly complex anatomy Significant opportunity for innovation to drive 3 surgical podiatrists improved outcomes Increasing surgeon specialization ~9,000 Well over 100 indications with variety of Generally more active and younger patient causes (activity-based, trauma, genetic pediatric and trauma surgeons that populations predisposition, etc.) treat foot and ankle ~2,300 1. Source: iData Research and FNA estimates. Approximately 55% of global segment sales is U.S. 3. FNA management estimates 2. Source: FNA filings, SmartTrak, and FNA management estimates 6

Paragon 28 Overview 1 Product Portfolio Annual Revenue Fracture & Trauma Deformity Correction Joint Replacement Bun-Yo-Matic Lapidus Gorilla® R3con Plating System APEX 3D Total $256 Clamp Ankle Replacement 19% CAGR System $216 $181 Monkey Rings External Fixation System $147 Phantom® Hindfoot TTC/TC System $111 $106 Internal / External Addressing muscular Anterior Total Ankle Bone Fixation imbalances and Replacement structural abnormalities Comprehensive plating Accommodates surgeon system with solutions for preferences and addresses Offer a comprehensive, many fracture type and anterior approach offering minimally-invasive 2019 2020 2021 2022 2023 2024 deformity correction correction deformity Designed to address implant portfolio to address varying Pin to bar external fixation loosening, pathological wear, severities and each patient's for charcot and lower instability and pain unique needs extremity reconstruction 1. 2024 revenue based on FNA pre-announcement 1/13/2025 7

A Reminder on Our M&A Strategy Criteria Paragon 28 Transaction Value Less than $2bn✓ Immediately Accretive to Revenue Growth✓ Adj. EPS Neutral by the End of Year 2✓ High-Single Digit ROIC by Year 5✓ Path to Category Leadership✓ Differentiated Protected Solutions✓ Improve Safety, Efficiency, Best-in-Class Outcomes✓ Site of Care✓ 8 Strategic Financial