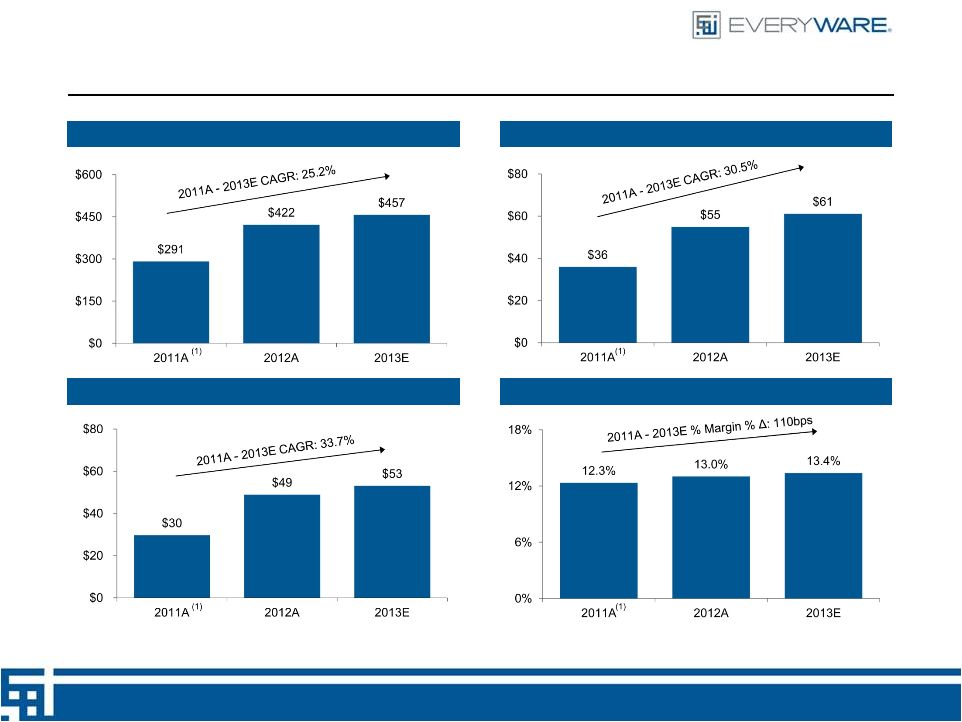

1 Forward Looking Statements This presentation includes "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "anticipate", "believe", "expect", "estimate", "plan", "outlook", “target”, and "project" and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects, product launches and other aspects of the business of EveryWare Global, Inc., formerly known as ROI Acquisition Corp. (“EveryWare”), are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the ability of EveryWare to meet its financial and strategic goals, due to, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with suppliers and obtain adequate supply of products and retain its key employees; (2) changes in applicable laws or regulations; (3) the possibility that EveryWare may be adversely affected by other economic, business, and/or competitive factors; (4) EveryWare’s ability to maintain its listing on Nasdaq; (5) EveryWare’s ability to successfully integrate recent acquisitions and realize anticipated synergies (6) other risks and uncertainties indicated from time to time in EveryWare’s filings with the Securities and Exchange Commission (“SEC”), including those under the heading “Risk Factors” in ROI’s proxy statement/prospectus filed with the SEC on May 10, 2013. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and EveryWare undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Financial Presentation This presentation includes non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow. EBITDA is calculated as earnings before interest and taxes (“EBIT”) plus depreciation and amortization (“EBITDA”). Adjusted EBITDA is calculated as EBITDA plus restructuring expenses, certain historical acquisition/merger-related transaction fees, inventory writedown, management fees and reimbursed expenses paid to our equity sponsor, certain other adjustments that management believes are not representative of its core operating performance, adjustments for the full-year impact of certain cost improvements implemented within the fiscal year, the cost in 2012 related to out-of-the-money natural gas hedges and the estimated increased expenses of operating as a public company. A reconciliation of net income to Adjusted EBITDA is set forth on page 24. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales. Free Cash Flow is defined as Adjusted EBITDA less maintenance capital expenditures. Wherever referenced, unless otherwise noted, 2011 results include financial results for the two months ended December 31, 2011 for Oneida and 12 months ended December 31, 2011 for Anchor. EveryWare believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to EveryWare’s financial condition and results of operations. EveryWare’s management uses these non-GAAP measures to compare EveryWare’s performance to that of prior periods for trend analyses, for purposes of determining management incentive compensation, and for budgeting and planning purposes. These measures are used in monthly financial reports prepared for management and EveryWare’s board of directors. EveryWare believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing EveryWare’s financial measures with other consumer products companies, many of which present similar non-GAAP financial measures to investors. Management of EveryWare does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in EveryWare’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. You should review EveryWare’s audited financial statements, as presented in ROI’s proxy statement/prospectus (which was filed with the SEC on May 10, 2013), and not rely on any single financial measure to evaluate EveryWare’s business. |