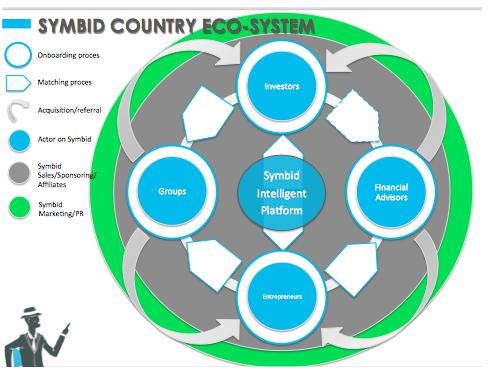

Symbid Country Partners will be responsible for creating the eco-system as shown in the visual above. Symbid has carefully tested and experimented with how to serve a market in an optimal way and this model has evolved from that process. The conditions for setting up a Country partnership are outlined as follows:

Symbid Groups create landing pages with Group functionality on the Symbid platform for partners. Symbid Groups provide the opportunity to offer a full online crowdfunding service to an existing user/client base of entrepreneurs or investors, without having to worry about operating a complete platform by enabling these partners to create a private, dedicated section on the platform for their users. The advantage over offering a white label service is that the partner can still offer a fully managed crowdfunding service, but can still make use of the on-boarding services of Symbid, Symbid support, Symbid’s legal framework, etc. So the partner does not have to create a complete crowdfunding solution by itself but can still offer a crowdfunding service to its user.

Financial advisors play a pivotal role in structuring deals before engaging in the funding process. Symbid, or more specific its Country Partners, will enter into partnerships with several financial advisory companies (and/or accountancy firms) to connect them with the entrepreneurs signing up to the platform to structure those deals together with the entrepreneur. A perfect side benefit of educating this target group of financial advisors and accountants is that, once they are familiar with a specific service like Symbid’s, they have a much higher tendency to promote Symbid towards their clients, entrepreneurs as well as potential investors.

For Symbid, financial advisors are used to create a certain level of validation of the deal flow and additionally are perfect ambassadors towards their own clientele to promote the Symbid service. Symbid identifies them therefore as a separate actor on the platform. Symbid is planning currently to roll-out a training program for financial advisors and accounts. By then this group of actors can also become a direct revenue stream.

Affiliate partners are partners with access to deal flow and/or investors, but who have no interest in engaging in an online crowdfunding service themselves from an operational point of view. By becoming an affiliate partner these parties have the option to refer entrepreneurs and/or investors to the Symbid platform and once these referred users generate fees on the Symbid platform, these fees are shared with the affiliate partner who referred them.

The affiliate program creates incentive for third parties to refer users to the Symbid platform because it results in a financial “cash back” fee per transaction. The affiliate program serves as a no-cure, no-pay marketing approach that dramatically lowers the upfront costs of marketing expenses. Affiliate partners usually can ‘tap into’ an existing clientele or user base (online as well as offline) and since there is a financial incentive, they promote the Symbid platform within their network, saving Symbid the upfront costs of having to market its brand within these networks by itself.

Companies want to engage with the communities of investors and entrepreneurs in the Symbid eco-system. Symbid is offering corporate partnerships for those companies. A Symbid corporate partnership offers large corporations the opportunity to:

Symbid uses these corporate partnerships to increase legitimacy, to sponsor marketing budgets and to get access to special resources of corporate partners.

Symbid’s general strategy is to extend the number of crowdfunding products and services in its portfolio and to eventually make the portfolio of products and services accessible to a worldwide public over time. Symbid’s partner strategy will be the first pillar in creating additional products and services, for example, by partnering with crowdfunding service providers such as Gambitious and Equidam. Symbid does not have any other partnering arrangements at this time. Through partnerships with Country Partners, the reach of all products in the Symbid portfolio will be maximized and synergies can be realized. In striving to build the highest quality crowdfunding infrastructure, Symbid expects that it will acquire certain needed skill set partners rather than building all resources internally. Symbid will maintain high quality standards for take-over targets encompassing the following considerations:

Crowdfunding related services should support Symbid in maintaining the 7.5% revenue fee per transaction.

An acquisition aimed at accelerating the reach and accessibility of Symbid should result in a significant growth of the number of transaction.

Growth in the average value per transaction can result in a net higher gross margin if the costs of the additional service is lower than the additional revenue.

Although the above described product and partnership expansion is a fundamental aspect of our long term growth strategy, Symbid has no specific timetable for the acquisition of additional partners or service offerings at this time.

The Proposed Acquisitions of Gambitious B.V. and Equidam Holding B.V.

In accordance with the terms of the Share Exchange Agreement, we are holding in escrow 8,000,000 shares of our Common Stock that were agreed to be issued to the Symbid Holding B.V. Stockholders named in the Share Exchange Agreement in partial consideration for the Share Exchange. We are holding these shares in connection with the proposed acquisitions (directly and/or through Symbid Holding B.V. or another subsidiary) of 100% ownership of Gambitious B.V. and Equidam Holding B.V. Symbid B.V. currently holds minority interests in these two entities.

3,000,000 of these escrow shares have been assigned to the purchase of Equidam and 5,000,000 of these escrow shares have been assigned to the purchase of Gambitious.

In the event that we acquire Gambitious within the six month period following the Share Exchange closing date, the number of escrow shares that are being held for the Gambitious acquisition equal to the number of shares of our Common Stock to be issued as consideration for the purchase of the remaining interest in Gambitious shall be cancelled, and the remainder of the Gambitious escrow shares shall be distributed pro rata to the Symbid Holding B.V. pre-Share Exchange stockholders after such acquisition is completed.

In the event that we acquire Equidam within the six month period following the Share Exchange closing date, the number of escrow shares that are being held for the Equidam acquisition equal to the number of shares of our Common Stock to be issued as consideration for Equidam will be cancelled, and the remainder of the Equidam escrow shares will be distributed pro rata to the Symbid Holding B.V. pre-Share Exchange stockholders after such acquisition is completed.

If either transaction is not completed within six months after the closing of the Share Exchange, the escrow shares allocated to that transaction will be cancelled, and if both such acquisitions are not completed within six months after the closing of the Share Exchange, all of the 8,000,000 escrow shares will be cancelled.

In February 2014, the Company completed a sale of interests in Gambitious Coöperatie U.A. from Symbid B.V. to Sjoerd Geurts, a member of the management board of Gambitious B.V. and a shareholder of the Company. This sale resulted in the Company’s direct ownership in Gambitious Coöperatie U.A. being reduced from 63% to 46% and its indirect interest in Gambitious B.V. being reduced from 18% to 13.05%. This sale of approximately 17% of Symbid B.V.’s interest in Gambitious Coöperatie U.A. at a price of EUR 1 (approximately US $1.37) was initiated to maintain our professional relationship with Gambitious shareholders and the company’s management team. Although we have reduced our current ownership interest in Gambitious, we expect our acquisition of Gambitious to go forward and to have this acquisition completed within the six month framework established in the Share Exchange Agreement.

Although we do not have any updates to the status of the proposed Equidam acquisition as of the current date, we expect to have this acquisition completed within the six month timeframe as well.

Gambitious is Symbid’s first partner operating in a specific niche industry. Gambitious was organized in 2011 to operate a crowdfunding platform in the video-games industry in The Netherlands under an exclusive Symbid license. Symbid B.V. was a founding partner of Gambitious and this company became a Symbid spin-out in 2012. Symbid believes that Gambitious can become, with sufficient funding, a leading brand in the crowdfunding for video-games industry. Because of this belief, we are planning a proposed acquisition of this niche partner in 2014. To that end, we have set aside in escrow, as agreed upon in the Share Exchange Agreement, shares of our Common Stock, up to 5,000,000 of which we will offer as consideration for the acquisition of Gambitious.

In the meantime, we will continue our collaboration with Gambitious involving the joint development of a crowdfunding infrastructure enabling a roll-out for both Gambitious and Symbid in Europe and the United States. To fund a roll-out of our crowdfunding platform in Europe, we expect that we will need an additional $2 to $3 million over the coming year. There can be no assurance that we will be able to raise these additional funds and a failure to do so will delay a European roll-out.

Although Symbid desires to expand its equity crowdfunding operations to the United States in conjunction with Gambitious, Symbid does not intend that those operations will be introduced until, at the earliest, after final SEC regulations governing equity crowdfunding in the United States are in place. Although we expect that final regulations will be adopted by the SEC by the end of 2014, there can be no assurances that such time table will be met or that the regulations that are adopted will be as currently proposed. In any event, in any future introduction of Symbid’s equity crowdfunding platform in the United States, Symbid will comply with the SEC’s regulations as adopted. Additionally, we would need to raise additional funds to expand our crowdfunding operations to the Unites States and there can be no assurance that we would be successful in those fund raising efforts.

Equidam: added value services for entrepreneurs and investors during and after the funding process

Equidam is one of the first crowdfunding service providers worldwide. Organized as an in-house project of Symbid, Equidam raised its seed funding on the Symbid crowdfunding platform and became a Symbid spin-out in early 2013. Started as an online valuation tool for small private companies, Equidam now also offers monitoring services to investors on the Symbid platform. In addition to Equidam’s relationship with Symbid, this company has entered partnerships with a number of European crowdfunding platforms to provide its services to these platforms as well.

Equidam offers its crowdfunding services to both entrepreneurs and investors. Symbid has been offering the Equidam products to its customers for almost a year. Based on this experience and Symbid’s belief that Equidam offers added value to its crowdfunding activities relating to both entrepreneurs and investors, Symbid desires to effect a more sophisticated integration of the Equidam service offering within the Symbid crowdfunding platform. By doing this, Symbid believes it can increase the added value of the Symbid crowdfunding platform to its customers. Symbid also believes that by integrating Equidam’s services on its crowdfunding platform, it will add value to a combined international roll-out of the Equidam and Symbid services.

To further this strategy, we plan to pursue the acquisition of Equidam before mid-2014. To that end, we have set aside in escrow, as agreed upon in the Share Exchange Agreement, shares of our Common Stock, up to 3,000,000 of which we will offer as consideration for the acquisition of Equidam. There can be no assurance, however, that we will be successful in negotiating the acquisition of Equidam on favorable terms or that the acquisition will be completed.

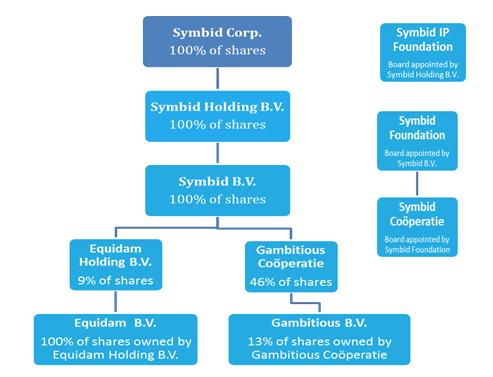

Symbid B.V. also holds the ownership interests in Equidam Holding B.V. (9%) and membership interests in Gambitious Coöperatie U.A. (46%). Through its membership interest in Gambitious Coöperatie U.A., Symbid B.V. has an indirect 13.05% ownership interest in Gambitious B.V., the Gambitious operating company.

As a cooperative, Symbid Coöperatie U.A. is an organization of members rather than stockholders. Symbid Coöperatie U.A. has five classes of members: “A Members” who are equity investors, “B Members” who are entrepreneurs raising capital through equity investments, the “C Member” who is Symbid Foundation, the “D Members” who pledge funds to an entrepreneur and the “E Members” who are entrepreneurs raising capital through pledges. A Dutch cooperative has capital which is divided among its members in accordance with their investments in the cooperative, and all members hold cooperative membership certificates.

Symbid Coöperatie U.A. incurs expenses on behalf of its members including, for example, legal expenses relating to infrastructure improvements, member events and accounting costs. In April 2012, Symbid Coöperatie UA received a one-time subsidy from the Dutch government in the amount of $30,000 (€ 22,996). Symbid Coöperatie U.A. determined that it could recognize this subsidy as revenue earned over the course of its CreditPassport project. Symbid Coöperatie U.A. considered both IFRS and US GAAP guidance in its assessment for this accounting. In the absence of specific guidance surrounding government grants under US GAAP, Symbid Coöperatie U.A. evaluated the government subsidy considering IAS 20 and FASB ASC 605, concluding that the ratable recognition of income related to the grant should be recognized over the period that it was earned.�� Apart from that one-time subsidy, Symbid Coöperatie UA does not have any sources of income other than administrative and success fees which it assigns to Symbid B.V. by agreement. As such, it is expected that Symbid Coöperatie U.A. will not generate any excess net profits.

Net profits of Symbid Coöperatie U.A., if any, are distributable, at the approval of the members’ council, to the cooperative’s members in accordance with their investments on the Symbid Coöperatie U.A. crowdfunding platform. Although Symbid B.V. has a variable economic interest in Symbid Cooperatie U.A., through its ability to appoint the board of Symbid Foundation which, in turn, holds the majority of the voting power within the members’ council of Symbid Coöperatie U.A. and, thus, the financial statements of Symbid Coöperatie U.A. are consolidated with those of Symbid B.V., Symbid B.V. is not entitled to any profit distributions of Symbid Coöperatie U.A. It is not expected, however, because of the license and management agreements between Symbid B.V. and Symbid Coöperatie U.A., that Symbid Coöperatie U.A. will generate any distributable profits.

Symbid determined to operate its crowdfunding platform in The Netherlands through a cooperative structure for the following reasons:

For more detailed information regarding the legal structure of Symbid Cooperatie U.A. including membership classes and voting rights and indicing that Symbid Foundation as the C Member has the right to cast five of the nine votes on the members’ Council (Article 30), please see the English translation of the Symbid Cooperatie U.A. Articles of Association attached hereto as Exhibit 3.4 and incorporated herein by reference.

Although Symbid B.V. determined that for purposes of maximizing its crowfunding operations in The Netherlands as outlined above, it would operate through Symbid Coöperatie U.A. and Symbid Foundation, the Company has not concluded that this organizational structure should be used for the roll out of the Symbid crowfunding platform in other countries.

For more detailed information regarding the legal structure of Symbid Foundation. including rights to designate members of the Board of Directors, please see the English translation of the Symbid Foundation Articles of Association attached hereto as Exhibit 3.5 and incorporated herein by reference.

Because of the Share Exchange and Symbid’s plans to enter various new markets, Symbid determined to restructure the legal organization of its business as described below.

For more detailed information regarding the legal structure of Symbid IP Foundation. including rights to designate members of the Board of Directors (Article 3.1), please see the English translation of the Symbid IP Foundation Articles of Association attached hereto as Exhibit 3.6 and incorporated herein by reference.

No affiliates of Symbid Corp., Symbid Holding B.V. or Symbid B.V. have any ownership interests in Symbid IP Foundation, Symbid Foundation or Symbid Coöperatie U.A.

A schematic of the Company’s current corporate structure is set forth below.

The Competitive Environment

The crowdfunding industry has rapidly emerging since the turn of the century when several NGO’s and companies started raisings funds online. The concept of online fundraising rapidly adapted to all kinds of various forms of collective funding via the Internet, now all being labeled Crowdfunding.

There are numerous different forms of Crowdfunding and platforms, the main categories are:

| | Donation based crowdfunding: Donations made online to a specific project or cause without a prospective return. |

| | Pre-sales crowdfunding: Donations made online to a specific project or cause with the prospective of a return in the form of a product or service, when the project is successful. |

| | Debt/lending crowdfunding: Investments made online in specific loan proposal (business as well as private) with a prospective return in interest and repayment of the initial debt. |

| | Equity crowdfunding: Investments made online in specific investment proposals with a prospective return in dividends and benefits form the value creation. |

Globally, more than 3,000 crowdfunding platforms are active in the marketplace. However, the majority of these platforms are involved in donation or pre-sales crowdfunding. The low barriers to entry in this sector allow many vendors to establish crowdfunding platforms, but, typically, their scope is limited to a specific geography or a specific niche, such as books or movies. Research firm Massolution, in its 2013 “Crowdfunding Industry Report,” estimated that the total market size, worldwide, for crowdfunding in 2012 was $2.7 billion. Massolution predicts that the total market size in 2013 will be approximately $5.1 billion. Debt/lending crowdfunding is expected to grow rapidly in 2013 to a total of more than $2 billion, accounting for 40% of the total crowdfunding market. Many of the existing crowdfunding platforms struggle in this growth environment with respect to their ability to professionalize their systems and legal frameworks and otherwise manage their growth.

The market for Equity crowdfunding is still in its early stages of development, accounting for, according to the Massolution 2013 “Crowdfunding Industry Report,” only $116 million in sales volume in 2012 worldwide. This smaller scale in the equity crowdfunding sector is a result of regulatory and structural problems encountered when operating an equity crowdfunding platform.

Additionally, because unsophisticated, non-accredited investors in the United States have been and are presently prohibited from investing through online equity crowdfunding platforms, rapid growth in the equity crowdfunding sector, particularly in the United States, has been handicapped. The signing of the JOBS Act in 2012 is expected to result in the ability of non-accredited investors in the United States to begin to participate in equity crowdfunding. The SEC has published proposed regulations relating to crowdfunding, to implement the mandate of the JOBS Act, and those proposed regulations are currently in a comment period. At present, only regulations relating to general solicitation in the context of a private placement capital raise have been broadened. It is expected that final SEC regulations will be in place by the end of 2014 enabling non-accredited investors to fully participate in the equity crowdfunding market. There can be no assurances, however, that such regulations will be promulgated by that date or that the regulations that are adopted will be as expected. In any future entry into the US equity crowdfunding market once final SEC regulations are adopted, Symbid will comply with all SEC regulations as so adopted.

Because Symbid has developed products and services that serve all sectors of the crowdfunding industry, we believe that we are in a good position to take advantage of the growth of the entire industry rather than simply relying on sales to one particular sector. Additionally, because of the versatility of Symbid’s proprietary products which have application outside the crowdfunding domain, we believe we will be able to address needs of the online corporate funding industry as a whole, thus strengthening our competitive position.

Employees

As of December 31, 2013, we had twelve employees involved through a contractual relationship with the Company. Our contractual relationship with employees consists of management agreements, service agreements, employee agreements and internship agreements. We have never experienced a work stoppage and believe our relationship with our employees is good.

Description Of Properties

Our principal executive offices are located at Marconistraat 16, 3029 AK Rotterdam, The Netherlands, where we occupy approximately 1,075 square feet (100 square meters). We have signed a two-year lease for this space effective as of January 1, 2014. For the month of December 2013, we were not required to pay any rent for this space. We also have a flexible office space in Utrecht, The Netherlands.

Regulatory Framework

During the development of the Symbid crowdfunding platform in 2010, we were in close contact with the Authority for the Financial Markets in The Netherlands (the “AFM”) to discuss the Symbid crowdfunding model, the structure of our crowdfunding platform and its relationship to the Dutch regulatory framework. In our correspondence with the AFM, we primarily focused on the equity based crowdfunding model rather than the pledge or donation based models which do not implicate securities law considerations. In an email correspondence to Symbid, the AFM acknowledged that, although it is Symbid’s responsibility to identify activities requiring government authorization, as described to the AFM by Symbid, the AFM saw - on the basis of the information provided - no indication that the crowdfunding activities of Symbid would require permission under the Dutch Act on Financial Supervision. Although we did not specifically address our partnering/affiliate programs in our correspondence with the AFM, it is our understanding and belief that the same AFM considerations would apply to these activities to the extent that they make use of Symbid’s legal structure and model. The activities of Symbid have not materially changed in comparison with the information provided to the AFM in 2010. The substantive rules applicable to Symbid's crowdfunding activities have also not materially changed since 2010. In accord with this statement by the AFM, it is our understanding and belief that Symbid’s activities relating to providing equity investments to the public through the Symbid crowdfunding platform are not subject to the Dutch Act on Financial Supervision. We believe that no supervision by, or license from, the AFM is currently required by Symbid for its operations in The Netherlands. We cannot assure you, however, (i) that Dutch law and rules and policy of the AFM will not change and that in the future regulation of Symbid’s crowdfunding platform will not be required and (ii) that the AFM will not change its assessment of our operations if it becomes aware of additional information about our operational structure that would have led the AFM to a different conclusion in their original assessment. We have no reason to believe that we have not provided all relevant information to the AFM at the time of its initial assessment.

Symbid’s restructuring in 2013 in which it established Symbid Holding B.V. as a holding company for its crowdfunding activities and transferred its intellectual property to Symbid IP Foundation did not have an impact on Symbid’s legal structure at the operating level. Symbid established its operational model in The Netherlands such that all crowdfunding activities would be conducted at the Symbid Coöperatie U.A. level with management control exercised by Symbid Foundation. This operational structure was designed to function independently from the legal structure and changes in the ownership structure of Symbid B.V. or Symbid Holding B.V. Because of this operation versus ownership structure, Symbid believes that its corporate reorganization will have no impact on the application of the AFM’s considerations or other aspects of the Dutch regulatory framework.

Our crowdfunding platform encompasses other activities which, in The Netherlands, could require a license or specific regulatory compliance under certain circumstances. These activities relate to (i) the holding of redeemable funds and (ii) securities offerings to the public without a prospectus.

Redeemable funds - Our partner InterSolve (FEET EGI B.V.) holds a license from the Dutch Central Bank as an Electronic Money Institution, is supervised by the AFM and the Dutch Central Bank and is, therefore, allowed to redeem funds to the public. On the Symbid crowdfunding platform, investors can re-claim, i.e., redeem, their electronic money at any time prior to the funding target having been reached of a business idea to which they have allocated their electronic money. InterSolve will exchange upon request by such an investor the amount of electronic money being redeemed into scriptural money on the bank account of the investor. Symbid partners with InterSolve to ensure that Symbid cannot be deemed to hold redeemable funds of investors itself. Because an investor’s funds are held in an electronic wallet with Intersolve and released to a particular project only when that project actually funds, and any funds that an investor allocates to a project that the investor redeems prior to a project funding remain in that investor’s account (electronic wallet) with Intersolve, which, in effect, acts as an escrow agent for the investor’s funds and particular project fundings, Symbid does not record any success fee revenues on its books until a project funding actually closes and Symbid’s earned fees are transferred to it. As a result of this structure, any funds that may be redeemed by an investor prior to a project funding and returned to that investor’s electronic wallet do not appear, and are not reported, on the financial statements of Symbid. If, however, an investor decides to remove funds from his electronic wallet and return them to his personal bank account, effectively taking these funds out of the Symbid crowdfunding system, that investor pays Intersolve a fee of approximately $27 (€20), 25% of which is forwarded to Symbid as administrative fee income.

Offerings to the public without a prospectus – Under Dutch law, as long as the target capital raised for a particular business over a period of 12 consecutive months remains below the USD equivalent of EUR 2.5 million (approximately $3.44 million), there is an exemption from the prospectus delivery requirements. Under the current regulations, a prospectus must be prepared and approved by the AFM for capital raises planned or expected to exceed the USD equivalent of EUR 2.5 million (approximately $3.44 million) within a 12 month period. Currently, none of the entrepreneurs raising capital on the Symbid crowdfunding platform is raising capital in excess of the USD equivalent of EUR 2.5 million. If our entrepreneurs begin to raise capital amounts greater than the current AFM maximum limit or if that maximum is dropped to a lower amount, we will be required to comply with the AFM prospectus regulations for these offerings.

Separately, membership interests in a Dutch cooperative, if not freely tradable, are not considered securities under Dutch law. Symbid has taken the business decision to ensure that all membership interests in Symbid Coöperatie U.A. are not freely tradable; thus Symbid Coöperatie U.A. is not required to be licensed to sell securities under the Dutch Act on Financial Supervision

Because of the considerations discussed above with Symbid’s operational activities being conducted in the Netherlands through a Dutch cooperative structure and with the partnering of Intersolve, Symbid itself is not deemed to be offering or selling securities to the public.

Regulatory Considerations Relating to the European Union

In the European Union (the “EU”), there are a number of EU wide directives that could apply to Symbid’s planned crowdfunding expansion initiative in a number of different ways. These directives include the Markets in Financial Instruments Directive (MiFID), the Prospectus Directive, the Payment Services Directive (PSD), the Undertakings for Collective Investment in Transferable Securities Directives (UCITS), the Alternative Investment Fund Manager’s Directive (AIFMD) and the Anti-Money laundering Directive. In addition, local regulations might apply in each country within the EU. In some European countries (e.g., Italy, France, UK and Spain) local crowdfunding specific regulations have not yet been implemented but are expected to be enacted in the near future. These new crowfunding regulations might affect the roll-out of our operations in the EU in terms of our potential market reach, time to market, legal costs and business model.

The impact of the above listed EU directives and local regulations on the Company's proposed business in Europe is dependent on the legal structure (or structures) we adopt for the roll-out of our business in the various European countries. We are currently in the process of investigating potential legal structures for our crowdfunding roll out in the various EU countries. Since this process is in an early stage and the impact of the EU directives or local crowdfunding regulations may differ from country to country, we believe that it is to speculative at this time to provide a detailed description of the different directives applicable per country to our possible local business models, their potential impact on our business or the different legal structures we may adopt in the future.

Reports to Security Holders

We file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports, statement or other information that we file with the SEC at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at (202) 551-8090 for further information on the public reference room. These SEC filings are also available to the public from commercial document retrieval services and at the Internet site maintained by the SEC at http://www.sec.gov.

ITEM 1A. RISK FACTORS

THIS ANNUAL REPORT ON FORM 10-K CONTAINS CERTAIN STATEMENTS RELATING TO FUTURE EVENTS OR THE FUTURE FINANCIAL PERFORMANCE OF OUR COMPANY. YOU ARE CAUTIONED THAT SUCH STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE RISKS AND UNCERTAINTIES, AND THAT ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS, YOU SHOULD SPECIFICALLY CONSIDER THE VARIOUS FACTORS IDENTIFIED IN THIS ANNUAL REPORT ON FORM 10-K, INCLUDING THE MATTERS SET FORTH BELOW, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING STATEMENTS.

AN INVESTMENT IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISK FACTORS BEFORE DECIDING TO INVEST IN OUR COMPANY. IF ANY OF THE FOLLOWING RISKS ACTUALLY OCCUR, OUR BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND PROSPECTS FOR GROWTH WOULD LIKELY SUFFER. AS A RESULT, YOU MAY LOSE ALL OR PART OF YOUR INVESTMENT IN OUR COMPANY.

General Risks Relating to our Business, Operations of Financial Condition

We have a limited operating history and are subject to the risks encountered by early-stage companies.

Symbid was organized in The Netherlands in April 2011. Because our operating company has a limited operating history, you should consider and evaluate our operating prospects in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. For us, these risks include:

| ● | risks that we may not have sufficient capital to achieve our growth strategy; |

| ● | risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements; |

| ● | risks that our growth strategy may not be successful; and |

| ● | risks that fluctuations in our operating results will be significant relative to our revenues. |

These risks are described in more detail below. Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business would be significantly harmed.

We have a history of net losses, may incur substantial net losses in the future and may not achieve profitability.

Although we have begun to generate revenues, we have incurred significant losses since inception. We expect to incur increased costs to implement our business plan and increase revenues, such as costs relating to expanding our crowd funding platform into additional country markets. If our revenues do not increase to offset these additional expenses or if we experience unexpected increases in operating expenses, we will continue to incur significant losses and will not become profitable. If we are not able to significantly increase our revenues, we will likely not be able to achieve profitability in the future.

Our operating losses and working capital deficiency raise substantial doubt about our ability to continue as a going concern. If we do not continue as a going concern, investors could lose their entire investment.

Our operating losses and working capital deficiency raise substantial doubt about our ability to continue as a going concern. If we do not generate revenues, do not achieve profitability and do not have other sources of financing for our business, we may have to curtail or cease our development plans and operations, which could cause investors to lose the entire amount of their investment.

If we are unable to manage our anticipated post-Share Exchange growth effectively, our business could be adversely affected.

We anticipate that a significant expansion of our operations and addition of operating subsidiaries, including one in the United States, and new personnel will be required in all areas of our operations in order to implement our post-Share Exchange business plan. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. For us to continue to manage such growth, we must put in place legal and accounting systems, and implement human resource management and other tools. We have taken preliminary steps to put this structure in place. However, there is no assurance that we will be able to successfully manage this anticipated rapid growth. A failure to manage our growth effectively could materially and adversely affect our ability to market our crowd funding platform in multiple venues.

Our Management Team Does Not Have Experience In U.S. Public Company Matters, Which Could Impair Our Ability To Comply With Legal And Regulatory Requirements.

Our management team has had no U.S. public company management experience or responsibilities, which could impair our ability to comply with legal and regulatory requirements such as the Sarbanes-Oxley Act of 2002 and applicable U.S. federal securities laws, including filing required reports and other information required on a timely basis. There can be no assurance that our management will be able to implement and affect programs and policies in an effective and timely manner that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and result in the deterioration of our business.

Civil liabilities may not be able to be enforced against us.

Substantially all of our assets and our officers and directors are located outside of the United States. As a result of this, it may be difficult or impossible to effect service of process and enforce judgments awarded by a court in the United States against our assets or those of our officers and directors who are located in The Netherlands.

The implementation of crowdfunding regulations in The Netherlands and in other countries could negatively affect our business.

Other than the Netherlands regulatory framework, rules on redeemable funds and offerings to the public without a prospectus (See “Item 2.01 Completion of Acquisition or Disposition of Assets – Description of Business – Regulatory Framework” in this Form 8-K), there are currently are no laws or regulations that specifically govern crowdfunding activities in The Netherlands or that require us to register with or seek permission from The Netherlands Authority for the Financial Markets (The Netherlands equivalent of the SEC). Changes in local regulations within The Netherlands relating to the offering of securities to the public or specifically to crowdfunding, could negatively affect our operations in The Netherlands. Such changes could result in our having to change our business model, which could negatively impact future revenues. Further, there are various regulators in The Netherlands (e.g., the Authority for Financial Markets, the Dutch Central Bank and the Ministry of Finance) that monitor and regulate financial markets and supervise financial service providers involved in the sale of investments and securities. These regulators monitor crowdfunding activities and could determine that specific laws and regulations that apply to the financial sector should be extended to the crowdfunding arena. Such a determination could negatively affect our operations in The Netherlands and impact our ability to operate our business and generate revenues. Additionally, the implementation of new crowdfunding regulations or the application of existing laws and regulations to crowdfunding in other countries where Symbid may wish to begin crowdfunding operations could result in added operational burdens and new regulatory compliance requirements with added costs, all of which could have a negative impact on our future growth plans and revenue outlook.

Delay in the implementation of the JOBS-act in the United States could negatively affect our business plan and future growth prospects.

President Obama signed the Jumpstart Our Business Startups Act or JOBS Act into law in April 2012. The JOBS Act is a law intended to encourage funding of United States small businesses by easing various securities regulations. Currently, the law is being interpreted and implemented by the SEC. A delay in the implementation of the JOBS Act can delay the introduction of equity based crowd funding in the United States and consequently delay the introduction of Symbid’s equity model crowd funding platform within the United States.

Failure to comply with final United States equity crowdfunding regulations as and when adopted would negatively impact out future business plans and our expected future growth prospects.

We may not be able to structure our crowdfunding platform operations and our organizational and administrative structures to comply with the final crowdfunding regulations as and when adopted by the SEC. If we are not able to comply with these future regulations, we will not be able to operate our crowdfunding business in the United States and, as a result, our future business plans and growth prospects will suffer.

Changes in regulations within the European Union governing our operations, specifically relating to the sale of securities to the public, could negatively affect our business.

Changes in local regulations within the European Union relating to the offering of securities to the public could negatively affect the business operations of Symbid within the European Union. Although we have not yet determined what legal structures we will utilize for our planned crowdfunding platform rollout in Europe, any changes in the law or new regulations relating to the sale of securities in Europe could impinge on our ability to structure our operations such that we would not have to register as brokers or dealers in Europe. Such changes could result in the Company having to change its business model, which could delay or prohibit the Company’s entry into local European markets and negatively impact future revenues.

Inappropriate business behavior of entrepreneurs raising funds via our platforms could result in reputational or financial damages to our business.

Although Symbid’s business is limited to providing a platform for matching investors and entrepreneurs, there is a possibility that inappropriate business behavior exhibited by any of the entrepreneurs raising capital through our platform could result in reputational or financial damages to us. We enforce a thorough due diligence process for all companies raising funds via our products and we require participating entrepreneurs to sign legally binding terms of use releasing Symbid from any responsibility for entrepreneur impropriety or misdeed. Nevertheless, our clients might regard Symbid as being responsible for any improprietous behavior of the entrepreneur and this could result in reputation damage to us that could impact our future revenues.

Our intellectual property is owned by Symbid IP Foundation, a Dutch entity that we do not own.

In October 2013, Symbid B.V. transferred the Symbid crowdfunding platform intellectual property to Symbid IP Foundation, a Dutch foundation with, according to its organizational documents, at least two directors one of whom must always be Symbid B.V. or one of its directors and the other must always be Symbid Corp. or one of its directors. Symbid IP Foundation licenses the Symbid crowdfunding technology on a perpetual, exclusive basis to Symbid Holding B.V. which, in turn, licenses the technology to Symbid B.V. for sublicense to Symbid Coöperatie U.A. Because Symbid does not own Symbid IP Foundation, it cannot assure that the board of directors of the foundation will not be expanded or changed in such a way as to challenge the interests of Symbid Holding B.V. to the crowdfunding platform license. Any such change could negatively impact Symbid’s ability to sublicense its crowdfunding platform and negatively impact Symbid’s results of operations and financial condition.

Our crowdfunding platform in The Netherlands is operated through Symbid Coöperatie U.A., a Dutch entity in which we do not own any interest.

Symbid Coöperatie U.A. is the contractor for all of Symbid’s crowdfunding business in The Netherlands. Symbid B.V. does not own or have any interest in Symbid Coöperatie U.A. Symbid Coöperatie U.A. is a variable interest entity (“VIE”) which Symbid B.V. effectively controls through corporate governance rather than through any other ownership. Because Symbid owns nointerest in Symbid Coöperatie U.A., it has no right to receive any distributions from Symbid Coöperatie U.A. – the revenues to Symbid from Symbid Coöperatie U.A. come from administrative, success and management fees paid by Symbid Coöperatie U.A. to Symbid. Because of the corporate governance control structure, Symbid consolidates the financial statements of Symbid Coöperatie U.A. with its own. If Symbid were to lose control of Symbid Coöperatie U.A. through a loss of its majority vote on the members’ counsel of Symbid Coöperatie U.A., it would not be able to continue to consolidate the financial results of Symbid Coöperatie U.A. and this would have a negative impact on the financial condition and results of operations of the Company. For the fiscal year ended December 31, 2012, approximately 46.7% of Symbid B.V.’s revenues were derived from Symbid Coöperatie U.A.

Our crowd funding platform operates on an online distribution model and is, therefore, subject to internet cyber risk.

Our online crowd funding distribution model could be subject to cyber-attacks aiming to breach our security protocols. We take reasonable and commercial precautions to make our systems as secure as possible, including but not limited to daily back-ups, banking grade hosting solutions, divisions between systems to ensure, for example, that our banking backend cannot be reached via our online distribution network, and continuous monitoring of the systems as well as sequential system checks. However, we cannot fully exclude the possibility of cyber-attacks, third party breaches, software bugs or other forms of internet malfeasance. If any of these events occur, our reputation could be negatively impacted and our future revenues could suffer as a result.

Increasing competition within our emerging industry could have an impact on our business prospects.

The crowd funding market is an emerging industry where new competitors are entering the market frequently. These competing companies may have significantly greater financial and other resources than we have and may have been developing their products and services longer than we have been developing ours. Although our portfolio of products and related revenue stream sources are broad, increasing competition may have a negative impact on our profit margins.

Our business is subject to risks generally associated with fluctuating economic tendencies in the capital markets.

The demand for our products can change over time due to fluctuations in the global and local economies and in the related capital requirements of small and medium-sized enterprises. These fluctuations could negatively impact our future revenue streams.

Fluctuations in interest rates could impair the ability of companies to raise capital on the Symbid platform.

Fluctuations in interest rates could influence the attractiveness for investors to allocate capital to small and medium-sized enterprises raising capital on our crowdfunding platform. This could result in reduced revenues to us.

If we lose the services of our founders or other members of our senior management team, we may not be able to execute our business strategy.

Our success depends in a large part upon the continued service of our senior management team. In particular, the continued service of our founders, Korstiaan Zandvliet, Chief Executive Officer, Robin Slakhorst, Chief Commercial Officer, and Maarten van der Sanden, Chief Financial Officer and Chief Operating Officer, is critical to our vision, strategic direction, culture, products and technology. We do not maintain key-man insurance for any of our founders or other members of our senior management team. The loss of any of our founders, even temporarily, or any other member of senior management could harm our business.

We may not be able to adequately protect our proprietary technology, and our competitors may be able to offer similar products and services, which would harm our competitive position.

Our success depends in part upon our proprietary technology. We rely primarily on trademark, copyright, service mark and trade secret laws, confidentiality procedures, license agreements and contractual provisions to establish and protect our proprietary rights. Despite these precautions, third parties could copy or otherwise obtain and use our technology without authorization, or develop similar technology independently. We also pursue the registration of our domain names, trademarks, and service marks in the United States. We cannot assure you that the protection of our proprietary rights will be adequate or that our competitors will not independently develop similar technology, duplicate our products and services or design around any intellectual property rights we hold.

If third parties claim that we infringe their intellectual property, it may result in costly litigation.

We cannot assure you that third parties will not claim our current or future products infringe their intellectual property rights. Any such claims, with or without merit, could cause costly litigation that could consume significant management time. As the number of product and services offerings in the crowd funding market increases and functionalities increasingly overlap, companies such as ours may become increasingly subject to infringement claims. Such claims also might require us to enter into royalty or license agreements. If required, we may not be able to obtain such royalty or license agreements, or obtain them on terms acceptable to us.

We will need additional financing. Any limitation on our ability to obtain such additional financing could have a material adverse effect on our future business, financial condition and results of operations.

Although we expect that the net proceeds from the PPO will be sufficient to implement our business plan in the Netherlands, including the introduction in The Netherlands of a debt based crowdfunding platform, we will require additional capital of between $2.5 million to $4 million to expand our crowdfunding activities in Europe. The raising of additional capital could result in dilution to our stockholders. In addition, there is no assurance that we will be able to obtain additional capital, or that if available, it will be available to us on favorable or reasonable terms. Any limitation on our ability to obtain additional capital as and when needed could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to register the resale of the shares of Common Stock contained in the Units and the PPO Warrant Shares in a timely manner as required by the Registration Rights Agreement, we may have to pay cash penalties in connection with such failure. Our use of cash to pay such penalties may limit our ability to use such cash for other business purposes, which could have a material adverse effect on our business.

We have agreed, at our expense, to prepare and file a registration statement with the SEC within ninety (90) calendar days after the effective date of the Share Exchange. We have also agreed to use our commercially reasonable efforts to cause such registration statement to be declared effective by the SEC within one hundred eighty (180) calendar days of filing with the SEC. The registration statement will cover the resale of the shares of Common Stock contained in the Units and the PPO Warrant Shares. There are many reasons, including some over which we have little or no control, which could delay our filing of the registration statement beyond ninety (90) days after the effective date of the Share Exchange or which could prevent the registration statement from being declared effective by the SEC, including delays resulting from the SEC review process and comments raised by the SEC during that process. In the event that the registration statement is not filed, or we fail to use our commercially reasonable efforts to have it declared effective within these timeframes, we may be required to pay cash penalties in accordance with the terms of the Registration Rights Agreement. As a result, we may be required to divert cash from other business purposes to pay such cash penalties, which could have a material adverse effect on our business.

If we fail to maintain proper and effective internal controls, our ability to produce accurate and timely financial statements could be impaired, which could harm our operating results, our ability to operate our business and investors’ views of us.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort that will need to be evaluated frequently. Section 404 of the Sarbanes-Oxley Act requires public companies to conduct an annual review and evaluation of their internal controls. Our failure to maintain the effectiveness of our internal controls in accordance with the requirements of the Sarbanes-Oxley Act could have a material adverse effect on our business. We could lose investor confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on the price of our common stock. In addition, if our efforts to comply with new or changed laws, regulations, and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and our business may be harmed.

Risks Relating to our Securities

The Shares of Common stock contained in the Units and the PPO Warrant Shares comprising a component of the Units sold in the PPO will be “restricted securities” and, as such, may not be sold except in limited circumstances.

The Shares of Common Stock contained in the Units and the PPO Warrant Shares comprising a component of the Units sold in the PPO have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) or any state securities law. As a result, the shares will be “restricted securities” under the Securities Act and they may not be sold, transferred, pledged or otherwise disposed of unless they are registered under the Securities Act and applicable state securities laws, except in a transaction which, to our satisfaction and that of our counsel, is exempt from such registration requirements. Although we are required to register the resale of the shares of Common Stock to enable those shares to be freely tradable, we cannot assure you that the SEC will declare the registration statement effective, or that once declared effective, that the SEC will not take action to suspend such effectiveness.

In addition, Rule 144 promulgated under the Securities Act, which permits the resale of the shares of Common Stock, subject to various terms and conditions, will generally not apply to our common stock until one year after we cease to be a “shell company” under SEC regulations and all Form 10 required information has been filed with the SEC. We exited shell company status as of the closing of the Share Exchange and we have filed the required Form 10 information in this Current Report. The one year waiting period before Rule 144 will become available began as of the filing of this Current Report. As a result, your ability to sell your shares may be limited.

Because the Share Exchange will result in a deemed a reverse acquisition, we may not be able to attract the attention of major brokerage firms, which may limit the liquidity of our Common Stock and may make it more difficult for us to raise additional capital in the future.

Additional risks may exist because the Share Exchange will be considered a “reverse acquisition” under accounting and securities regulations. Certain SEC rules are more restrictive when applied to reverse acquisition companies, such as the ability of stockholders to resell their shares of Common Stock pursuant to Rule 144. In addition, securities analysts of major brokerage firms may not provide coverage of our Common Stock following the Share Exchange because there may be little incentive for brokerage firms to recommend the purchase of our Common Stock. As a result, our Common Stock may have limited liquidity and investors may have difficulty selling it. In addition, we cannot assure you that brokerage firms will want to conduct any secondary offerings on our behalf if we seek to raise additional capital in the future. Our inability to raise additional capital may have a material adverse effect on our business.

There is not now, and there may not ever be, an active market for the Company’s Common Stock.

There currently is no public market for our Common Stock. Further, although our Common Stock is currently quoted on the OTC Bulletin Board (the “OTCBB”) and on the OTC Markets QB Tier, trading of our Common Stock has not yet commenced. When our stock does begin to trade, such trading may be extremely sporadic. For example, several days may pass before any shares may be traded. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations of the price of, our Common Stock. Accordingly, investors must assume they may have to bear the economic risk of an investment in our Common Stock for an indefinite period of time. There can be no assurance that a more active market for the Common Stock will develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of our Common Stock, and would likely have a material adverse effect on the market price of our Common Stock and on our ability to raise additional capital.

We cannot assure you that the Common Stock will become liquid or that it will be listed on a securities exchange.

Until our Common Stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq Stock Market, we expect our Common Stock to remain eligible for quotation on the OTCBB and OTC Markets QB Tier. In those venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our Common Stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our Common Stock, which may further affect the liquidity of the Common Stock. This would also make it more difficult for us to raise capital.

Our Common Stock is subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in the stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| ● | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

| ● | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| ● | Obtain financial information and investment experience objectives of the person; and |

| ● | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth:

| ● | the basis on which the broker or dealer made the suitability determination; and |

| ● | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of common stock and cause a decline in the market value of stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The price of our Common Stock may become volatile, which could lead to losses by investors and costly securities litigation.

The trading price of our Common Stock is likely to be highly volatile and could fluctuate in response to factors such as:

| ● | actual or anticipated variations in our operating results; |

| ● | announcements of developments by us or our competitors; |

| ● | announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

| ● | adoption of new accounting standards affecting our Company’s industry; |

| ● | additions or departures of key personnel; |

| ● | sales of our Common Stock or other securities in the open market; and |

| ● | other events or factors, many of which are beyond our control. |

The stock market is subject to significant price and volume fluctuations. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been initiated against the company. Litigation initiated against us, whether or not successful, could result in substantial costs and diversion of our management’s attention and resources, which could harm our business and financial condition.

We do not anticipate dividends to be paid on our Common Stock, and investors may lose the entire amount of their investment.

Cash dividends have never been declared or paid on the Common Stock, and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use future earnings, if any, to fund business growth. Therefore, stockholders will not receive any funds absent a sale of their shares. We cannot assure stockholders of a positive return on their investment when they sell their shares, nor can we assure that stockholders will not lose the entire amount of their investment.

If securities analysts do not initiate coverage or continue to cover our Common Stock or publish unfavorable research or reports about our business, this may have a negative impact on the market price of our common stock.

The trading market for the Common Stock will depend on the research and reports that securities analysts publish about our business and the Company. We do not have any control over these analysts. There is no guarantee that securities analysts will cover the Common Stock. If securities analysts do not cover the Common Stock, the lack of research coverage may adversely affect its market price. If we are covered by securities analysts, and our stock is the subject of an unfavorable report, our stock price and trading volume would likely decline. If one or more of these analysts ceases to cover the Company or fails to publish regular reports on the Company, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline.

You may experience dilution of your ownership interests because of the future issuance of additional shares of the Common Stock.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders and the purchasers of Common Stock offered hereby. We are currently authorized to issue an aggregate of 300,000,000 shares of capital stock consisting of 290,000,000 shares of Common Stock and 10,000,000 shares of preferred stock with preferences and rights to be determined by the our Board of Directors. As of the closing of the Share Exchange, there will be 31,170,000 shares of our Common Stock and no shares of our preferred stock outstanding. These numbers do not include the 3,098,736 shares of our Common Stock sold in the PPO. We may also issue additional shares of our Common Stock or other securities that are convertible into or exercisable for our Common Stock in connection with hiring or retaining employees, future acquisitions, future sales of its securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our Common Stock may create downward pressure on the trading price of the Common Stock. There can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with any capital raising efforts, including at a price (or exercise prices) below the price at which shares of the Common Stock will be initially quoted on the OTCBB and the OTC markets QB Tier.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our principal executive offices are located at Marconistraat 16, 3029 AK Rotterdam, The Netherlands, where we occupy approximately 1,075 square feet (100 square meters). We have signed a two-year lease for this space effective as of January 1, 2014. For the month of December 2013, we were not required to pay any rent for this space. We also have a flexible office space in Utrecht, The Netherlands.

ITEM 3. LEGAL PROCEEDINGS

We know of no materials, active or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any beneficial shareholder are an adverse party or has a material interest adverse to us.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our Common Stock is quoted on the OTC Bulletin Board (OTCBB) and the OTC Markets QB Tier (OTCQB), as of September 25, 2013, under the symbol “SBID.” Prior to that date, our symbol was “HKDZ.”

Shares of our Common Stock began trading on a very limited basis in January 2014.

As of the date of this Annual Report, we have 34,268,736 shares of Common Stock outstanding held by 42 stockholders of record. To date, we have not paid dividends on our Common Stock.

Dividend Policy

We have never paid any cash dividends on our capital stock and do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. We intend to retain future earnings to fund ongoing operations and future capital requirements. Any future determination to pay cash dividends will be at the discretion of our Board of Directors and will be dependent upon financial condition, results of operations, capital requirements and such other factors as the Board of Directors deems relevant.

Securities Authorized for Issuance under Equity Compensation Plans

On December 6, 2013, our Board of Directors of the Company adopted, and on December 6, 2013, our stockholders approved, the 2013 Equity Incentive Plan, which reserves a total of 5,000,000 shares of our Common Stock for issuance under the 2013 Plan. If an incentive award granted under the 2013 Plan expires, terminates, is unexercised or is forfeited, or if any shares are surrendered to us in connection with an incentive award, the shares subject to such award and the surrendered shares will become available for further awards under the 2013 Plan.

In addition, the number of shares of our Common Stock subject to the 2013 Plan, any number of shares subject to any numerical limit in the 2013 Plan, and the number of shares and terms of any incentive award are expected to be adjusted in the event of any change in our outstanding our Common Stock by reason of any stock dividend, spin-off, split-up, stock split, reverse stock split, recapitalization, reclassification, merger, consolidation, liquidation, business combination or exchange of shares or similar transaction.

Administration

The compensation committee of the Board, or the Board in the absence of such a committee, will administer the 2013 Plan. Subject to the terms of the 2013 Plan, the compensation committee or the Board has complete authority and discretion to determine the terms of awards under the 2013 Plan.

Grants

The 2013 Plan authorizes the grant to participants of nonqualified stock options, incentive stock options, restricted stock awards, restricted stock units, performance grants intended to comply with Section 162(m) of the Internal Revenue Code (as amended, the “Code”) and stock appreciation rights, as described below:

| ● | Options granted under the 2013 Plan entitle the grantee, upon exercise, to purchase a specified number of shares from us at a specified exercise price per share. The exercise price for shares of our Common Stock covered by an option generally cannot be less than the fair market value of our Common Stock on the date of grant unless agreed to otherwise at the time of the grant. In addition, in the case of an incentive stock option granted to an employee who, at the time the incentive stock option is granted, owns stock representing more than 10% of the voting power of all classes of stock of the Company or any parent or subsidiary, the per share exercise price will be no less than 110% of the fair market value of our Common Stock on the date of grant. |

| ● | Restricted stock awards and restricted stock units may be awarded on terms and conditions established by the compensation committee, which may include performance conditions for restricted stock awards and the lapse of restrictions on the achievement of one or more performance goals for restricted stock units. |

| ● | The compensation committee may make performance grants, each of which will contain performance goals for the award, including the performance criteria, the target and maximum amounts payable, and other terms and conditions. |

| ● | The 2013 Plan authorizes the granting of stock awards. The compensation committee will establish the number of shares of our Common Stock to be awarded and the terms applicable to each award, including performance restrictions. |

| ● | Stock appreciation rights (“SARs”) entitle the participant to receive a distribution in an amount not to exceed the number of shares of our Common Stock subject to the portion of the SAR exercised multiplied by the difference between the market price of a share of our Common Stock on the date of exercise of the SAR and the market price of a share of our Common Stock on the date of grant of the SAR. |

Duration, Amendment, and Termination

The Board has the power to amend, suspend or terminate the 2013 Plan without stockholder approval or ratification at any time or from time to time. No change may be made that increases the total number of shares of our Common Stock reserved for issuance pursuant to incentive awards or reduces the minimum exercise price for options or exchange of options for other incentive awards, unless such change is authorized by our stockholders within one year. Unless sooner terminated, the 2013 Plan would terminate ten years after it is adopted.

As of the date hereof, no options have been issued under the 2013 Plan.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following management’s discussion and analysis should be read in conjunction with the historical financial statements and the related notes thereto contained in this report. The management’s discussion and analysis contains forward-looking statements, such as statements of our plans, objectives, expectations and intentions. Any statements that are not statements of historical fact are forward-looking statements. When used, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect” and the like, and/or future tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties, including those under “Risk Factors” in this Form 8-K, that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. The Company’s actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors. The Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this report.

As a result of the Share Exchange and the change in business and operations of the Company, from engaging in the business of an e-commerce daily discount marketplace to the business of becoming a global, equity based crowdfunding platform, a discussion of the past, pre-Share Exchange financial results of Symbid Corp., is not pertinent, and under applicable accounting principles, the historical financial results of Symbid B.V., the wholly owned operating subsidiary of Symbid Holding B.V. and the accounting acquirer, prior to the Share Exchange are considered the historical financial results of the Company.

The following discussion highlights the Company’s results of operations and the principal factors that have affected our financial condition, as well as our liquidity and capital resources for the periods described, and provides information that management believes is relevant for an assessment and understanding of the statements of financial condition and results of operations presented herein. The following discussion and analysis are based on the Company’s audited financial statements contained in this Current Report, which we have prepared in accordance with United States generally accepted accounting principles. You should read this discussion and analysis together with such financial statements and the related notes thereto.

Basis of Presentation

The audited financial statements for our fiscal years ended December 31, 2013 and 2012, include a summary of our significant accounting policies and should be read in conjunction with the discussion below. In the opinion of management, all material adjustments necessary to present fairly the results of operations for such periods have been included in these audited financial statements. All such adjustments are of a normal recurring nature.

Overview

Overview 2012

In 2012, we experienced a growth in revenues over 2011, both crowdfunding related and software license fee related. Also other sources of revenues have been explored in 2012, but all were platform software related. Traffic on the platform has increased significantly compared to 2011. Entrepreneurs pitching successfully for capital on the platform followed each other at a fast pace, and in the first quarter of 2012 an additional three entrepreneurs were funded on the platform. Though, as a result of significant investments in further improving and maintaining the platform the operating result remains negative. The revenue directly from the platform activities amounts to some $40,000, consisting of success, registration and administration fees. While the remaining revenue is mainly realized by sub licensing the platform and advise on software development for third parties. Management decided by the end of 2012 to focus on core activities, being offering a crowdfunding platform to entrepreneurs and investors. Most advise on software development activities and related stand-alone license agreements were not extended or renewed in order to be able to focus on our core strategy.

Overview 2013

A new product was introduced to the market at the start of 2013 to balance our product portfolio and strengthen the focus on the core activity of matching online entrepreneurs and investors. Symbid Group licenses were being offered to partners wanting their own crowdfunding Group on the Symbid platform. Fees are typically lower as compared to fees charged for the white label platforms, lowering the barriers for new partners to enter the Symbid eco-system. Refocusing the product strategy to the core activity is the main reason for the total revenue for 2013 being lower compared to the 2012 period. However, we feel comfortable by this shift in the product strategy our product portfolio has become more balanced and focused. In addition to the Group product, we developed new corporate partnership products, with this product category we are taking first steps in offering crowdfunding services to large corporates. A corporate partnership deal consists of several other products being packaged into one deal, which over time, will result in more efficient sales cycles and a focus on building up a portfolio of partners we can scale up our services with. One of those crowdfunding related services is the valuation tool from Equidam Holding B.V. where we became a shareholder in August 2013. In September we raised $143,277 as Symbid B.V. in equity from one new investor, Sharpe Financial Communication, and current shareholders of Symbid B.V. The proceeds from this raise have been used as working capital and for PR services.

Going Concern