Joel S. Lawson IV (“Mr. Lawson”) intends to make a preliminary filing with the Securities and Exchange Commission of a proxy statement and an accompanying proxy card to be used to solicit votes for his election to the Board of Directors of Anchor Bancorp, a Washington corporation (the “Company”), at the Company’s upcoming 2015 annual meeting of shareholders, or any other meeting of shareholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof.

On September 21, 2015, Mr. Lawson issued the following open letter to shareholders:

Dear Fellow Anchor Bancorp Shareholder:

I am the beneficial owner of 225,000 shares of Anchor Bancorp (“Anchor” or the “Company”), representing approximately 8.9% of the Company’s outstanding shares, and I am writing to inform you that I have nominated myself to be elected to the Company’s Board of Directors (the “Board”) at the upcoming 2015 annual meeting of shareholders.

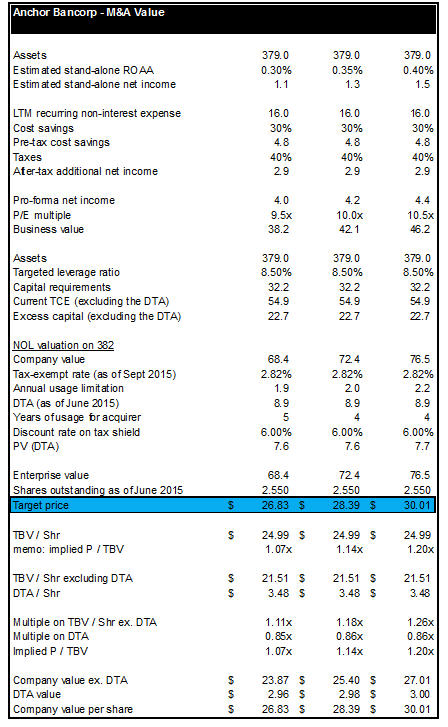

Anchor is at a turning point in its lifecycle as a company and it is necessary that shareholders have a direct representative on the Board at this critical time. Since completing its conversion from mutual to stock form of organization in January 2011, the Company has been able to resolve non-performing and classified assets; however, now the Company is facing a long, difficult journey to attempt to earn its cost of capital. I believe that this path is a long and uncertain one, and that the Company must evaluate all strategic options in order to maximize value for shareholders, including a possible sale of the Company, in which case I believe the Company would be worth between $27 and $30 per share1. Given the incumbent Board’s history of being dismissive of shareholders and resisting actions that may upset the status quo, as explained below, how can we as shareholders trust them to open-mindedly consider all options necessary, including a sale of the Company to the highest bidder, in order to maximize shareholder value?

As one of Anchor’s largest shareholders, I am concerned by the Board’s apparent unwillingness to allow for meaningful input from shareholders, the true owners of the Company. In 2013, the Company spent shareholder capital to fight my non-binding proposal seeking to allow shareholders to voice their opinions as to whether the Company should consider hiring an investment banking firm to evaluate potential strategic alternatives. This proposal would have allowed shareholders of the Company to weigh in on an extremely important decision - whether the Company has earned the right to remain independent or should seek a stronger, more profitable partner. The Company’s perceived disregard for shareholder input and resistance to exploring strategic alternatives has me concerned that the members of the incumbent Board (which has seen only two additions since 1998) are more concerned with maintaining the status quo than evaluating options to maximize value for shareholders, including a sale of the Company to the highest bidder. The Board is in need of a direct shareholder representative who is capable and willing to properly evaluate all opportunities available to the Company from an owner’s perspective.

Given the Company’s performance, I am also concerned by Anchor’s recently announced 2015 Equity Incentive Plan (the “Plan”), which provides for the issuance of up to 193,800 shares, representing approximately 7.7% of the Company’s outstanding shares. While I agree that equity incentive plans play an important role in aligning manager and director interests with shareholders, I do not believe that the Company’s cumulative net income of approximately $237,000 since the beginning of 2011 warrants equity grants potentially worth over 17 times such cumulative net income2. Considering that only one of the five members of the Compensation Committee joined the Board after 1998, I have serious concerns regarding the administration of the Plan and believe that a truly independent outside director must be added to the Compensation Committee immediately to represent shareholders’ interests.

1 See Exhibit 1 for supporting calculations. 2 Based on the Company’s disclosure in its proxy statement that the fair market value of the 193,800 shares is $4.1 million as of the record date for the 2015 Annual Meeting.

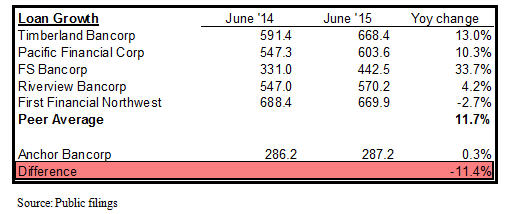

Given the expense base and recent trends in loan growth, where Anchor has significantly trailed its peers on a year-over-year basis as shown below, I do not believe there is a path to improve profitability to anywhere close to the Company’s cost of capital over a reasonable time frame.

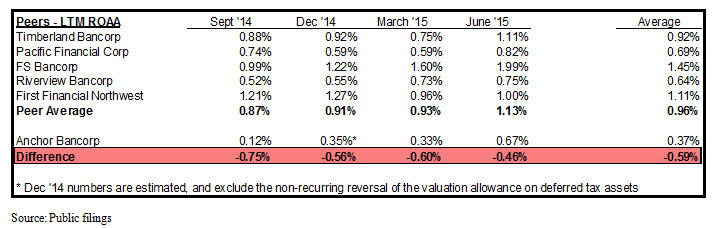

Further, as demonstrated by the chart below, the Company’s Return on Average Assets (ROAA) has consistently lagged behind its peers each quarter since September 2014. Based on my analysis, I believe that the Company’s core earnings power to be in the range of only 30-40bps on a fully-taxed basis.

For these reasons, I believe that the Company is in need of a truly independent director who is fully committed to exploring all opportunities to unlock shareholder value, including a potential sale of the Company. As a significant long-term shareholder of Anchor, my interests are directly aligned with those of my fellow shareholders, the true owners of the Company, and I will continue to seek to protect the best interests of all shareholders. To be clear, while I am open to a constructive engagement with the Board, I believe that it is necessary to give shareholders an opportunity to elect a direct representative to the Board in the event that no agreement can be reached.

I look forward to more fully detailing my concerns with the Company in an upcoming proxy statement and stress once again the need for a direct shareholder representative on the Board who will consider all strategic options available to maximize shareholder value, including a sale of the Company to the highest bidder.

Thank you,

/s/ Joel S. Lawson IV

Joel S. Lawson IV

Exhibit 1

Joel S. Lawson IV (“Mr. Lawson”) intends to file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for his election at the 2015 annual meeting of shareholders of Anchor Bancorp, a Washington corporation (the “Company”).

MR. LAWSON STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, MR. LAWSON WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE UPON REQUEST.

The participant in the proxy solicitation is anticipated to be Mr. Lawson. As of the date hereof, Mr. Lawson directly beneficially owned 225,000 shares of common stock, $0.01 par value per share, of the Company.