UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22613 |

|

Curian Variable Series Trust |

(Exact name of registrant as specified in charter) |

|

7601 Technology Way, Denver, Colorado | | 80237 |

(Address of principal executive offices) | | (Zip code) |

|

Daniel W. Koors Jackson National Asset Management, LLC 225 West Wacker Drive, Suite 1200 Chicago, Illinois 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 338-5800 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2014 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Shareholders.

| ACCESS. STORAGE. SECURITY. |

CHOOSE THE INBOX.

NOT THE MAILBOX.

Less waste. More convenience.

Three easy ways to go paperless:

1. Mail this postage-paid card | | 2. Call 1-866-349-4564 | | 3. Visit jackson.com |

I consent to receive by electronic delivery:

o ALL DOCUMENTS | o Periodic and immediate confirmations | o Prospectuses and prospectus supplements |

| o Annual and semi-annual reports | o Other contract-related correspondence |

This consent will continue unless and until revoked and will cover delivery to you in the form of an e-mail or by notice to you of a document’s availability on Jackson National Life Insurance Company®’s (also referred to as Jackson®) Web site. You may revoke your consent to electronic delivery at any time with respect to any or all of the documents. Paper delivery of such documents will commence after receipt of your revocation of consent to electronic delivery. Please contact the appropriate Jackson Service Center or go to www.jackson.com to update your e-mail address, revoke your consent to electronic delivery, or request paper copies. Certain types of correspondence may continue to be delivered by the United States Postal Service for compliance reasons. Registration on Jackson’s Web site (www.jackson.com) is required for electronic delivery of contract-related correspondence.

Fold Here

Please write legibly.

E-mail address:

I (We) will notify Jackson of any change to this e-mail address.

Name:

Address:

Policy Number:

Phone Number:

The computer hardware and software requirements that are necessary to receive, process and retain electronic communications that are subject to this consent are as follows: To view and download material electronically, you must have a computer with Internet access, an active e-mail account and Adobe Acrobat Reader. If you don’t already have Adobe Acrobat Reader, you can download it free from www.adobe.com. We may need to notify you of a document’s availability through e-mail. You may request paper copies, whether or not you consent or revoke your consent for electronic delivery, at any time and at no charge. There is no charge for electronic delivery, although you may incur the costs of Internet access and of such computer, and related hardware and software, as may be necessary for you to receive, process, and retain electronic documents and communications from Jackson. Please ensure that you have provided Jackson with a current e-mail address. To notify Jackson of any changes to this e-mail address, revoke your consent to electronic delivery or request paper copies, call the Jackson Service Center at 800/644-4565 or visit www.jackson.com. Even if you have given Jackson consent, we are not required to make electronic delivery and we have the right to deliver any document or communication in paper form. Electronic delivery may not be available on all policies. This consent will need to be supplemented by specific electronic consent upon receipt of any of these means of electronic delivery or notice of availability.

ANNUAL REPORT

December 31, 2014

Curian Variable Series Trust®

· Master Feeder Funds and Fund of Funds

· Sub-Advised Funds

This report is for the general information of qualified and nonqualified plan participants, as well as contract/policy owners of Elite Access® and Elite Access (NY). Jackson is the marketing name for Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and Jackson National Life Insurance Company® of New York (Home Office: Purchase, New York).

Issued by Jackson National Life Insurance Company 1 Corporate Way, Lansing, MI 48951 |

|

| | NO POSTAGE

NECESSARY

IF MAILED

IN THE

UNITED STATES |

BUSINESS REPLY MAIL

FIRST-CLASS MAIL PERMIT NO. 600 LANSING MI

POSTAGE WILL BE PAID BY ADDRESSEE

| JACKSON |

| PO BOX 24068 |

| LANSING MI 48909-9979 |

|

|

Fold Here

Curian Variable Series Trust

December 31, 2014

President’s Letter

Dear Investor,

Enclosed is the annual report for the Curian Variable Series Trust covering the year ended December 31, 2014, together with Management’s Discussion of Fund Performance for each of the Funds.

After a challenging start to 2014, the U.S. economy showed signs of continued improvement over the course of the year. After contracting by 2.1% in the 1st quarter due in part to extreme cold weather across much of the nation, U.S. gross domestic product growth accelerated to an annualized rate of 4.6% in the 2nd quarter and 5.0% in the 3rd quarter, a pace of growth not seen since 2003. The unemployment rate dropped to six-year lows, falling from 6.7% to 5.6%, while an estimated 242,000 new jobs were added each month. The housing market continued its rebound, albeit at a slower pace of growth than 2013. As a result of the mostly strong U.S. data, consumer confidence increased to levels not seen since 2007. Amid the improvement in the economic landscape in the U.S., the U.S. Federal Reserve (“Fed”) announced the conclusion of its quantitative easing program, better known as QE3.

Against this backdrop, U.S. equities, as measured by the Russell 3000 Index, gained 12.56% while setting new record highs and marking their sixth consecutive year of gains. All major equity sectors were positive for the year, with the exception of energy. The market’s advance was led by large cap equities, as evidenced by the 13.24% return of the Russell 1000 Index, compared with the 4.89% return for the Russell 2000 Index, a proxy for small cap equities. Value and growth equities posted similar gains for the year, as the Russell 3000 Value Index and Russell 3000 Growth Index gained 12.70% and 12.44%, respectively.

Despite the continued growth in the U.S., most international markets were hampered by slowing growth, geopolitical tensions, falling commodity prices and deflation in some areas, including the Eurozone. Growth was also mixed for emerging market countries. China, now the world’s largest economy, once again produced strong economic growth during the year, as real GDP grew by an estimated 7.3%. Meanwhile, Russia suffered from slowing growth and a sharply weaker currency as a result of lower energy prices and economic sanctions from the U.S. and Europe. International equities, as measured by the MSCI All Country World ex-U.S. Index, returned -3.87%, including -2.19% for emerging markets equities and -4.32% for developed market equities. While the index returned 6.05% in local currency terms, international equities were negatively impacted by a stronger U.S. Dollar resulting from stronger growth in the U.S. and increasing policy divergence between the Fed, European Central Bank, and Bank of Japan.

U.S. fixed income securities, as measured by the Barclays U.S. Aggregate Bond Index, enjoyed a surprisingly strong year, returning 5.97%. Despite near consensus expectations of rising interest rates by economists and market participants, long-term Treasury yields fell sharply due to the convergence of several factors, including collapsing yields in Europe, below-expected inflation and increased pension demand. Most sectors within the fixed income markets produced gains during the year, although high yield bonds underperformed due to rising credit concerns which were exacerbated by a sharp drop in oil prices late in the year. Non-U.S. Dollar denominated strategies significantly underperformed as the U.S. Dollar strengthened against most currencies.

Alternative investments, as measured by the Credit Suisse Hedge Fund Index, gained 4.13% during the year. Among the best performing alternative strategies were managed futures, long/short equity and global macro. Among the worst performing strategies were commodities, event-driven, merger arbitrage and short-biased equities.

Looking ahead to 2015, we expect to see divergent paths in economic growth and monetary policy across the globe. The U.S. and UK recoveries should continue to progress, and we expect monetary policies to begin to normalize in those countries, while the Eurozone and Japan are faced with anemic growth and potential for deflation, likely resulting in an expansion of their quantitative easing programs. We also expect dispersion in emerging markets due to differences in economic reforms and challenging conditions for countries more tied to commodity prices that remain under pressure.

These divergent trends in the macro environment could lead to greater volatility in 2015. While that can cause gyrations in returns over the short term, it could also present opportunities for active managers to take advantage of valuation anomalies.

Thank you for choosing Jackson for your investment needs.

Mark D. Nerud

President and Chief Executive Officer

Curian Variable Series Trust

Curian Guidance Funds

Curian Capital, LLC

(Unaudited)

Market Summary: Most domestic market fundamentals improved throughout the year as the U.S. Federal Reserve ("Fed") brought the monetary easing process to an end in October. An improving job market, earnings growth and gross domestic product ("GDP") growth proved to be ample substitute for the declining stimulus. U.S. large cap stocks posted strong gains in 2014 causing most diversification decisions to detract from overall performance. Small cap equities generally produced less than half the return of large cap equities even with a very strong fourth quarter rally. While value equities and growth equities swapped the leadership position several times throughout the year, they ended the calendar year with similar returns.

U.S. government bonds and investment grade bonds regained the core leadership in the fixed income asset class. A steady interest rate decline in 2014 helped the Barclays U.S. Aggregate Bond Index deliver an attractive positive return for the year. The yield curve experienced a steady flattening as the 10 year U.S. Treasury yield dropped over 87 basis points ("bps") to end the year at 2.17%. The Fed remained inactive on the front of the curve leaving the Fed funds rate near zero. High yield spreads widened in the second half of the year as falling oil prices put pressure on many of the energy dependent issuers.

International investments lagged the U.S. in 2014 as weak currencies and economies hampered returns. European recessionary environment and sporadic Japanese tax policy lead to lower nominal returns among the developed international domains. The weak Euro and Japanese Yen drove U.S. Dollar based returns into negative territory for both the MSCI All Country World ex USA Index and MSCI EAFE Index. Slowing China growth and weak commodity performance translated into negative emerging market performance as well.

The HFRI Fund Weighted Composite Index returned 3.33% for the year as the top contributing categories within this index included Equity Hedge – Technology & Healthcare and Macro – Systematic Diversified. The largest detractors for the year included Equity Hedge – Energy & Basic Materials, Equity Hedge – Short Bias and Event Driven – Distressed & Restructuring. Global real estate investment trusts ("REIT") outperformed the S&P 500 Index during 2014 while broad based commodities suffered a second consecutive negative year, largely driven by weakness in energy markets.

Portfolio Manager Commentary: Curian Guidance – Interest Rate Opportunities Fund, Curian Guidance – Multi-Strategy Income Fund, Curian Guidance – Equity Income Fund, Curian Guidance – Conservative Fund, Curian Guidance – Moderate Fund, Curian Guidance – Growth Fund, Curian Guidance – Moderate Growth Fund, Curian Guidance – Maximum Growth Fund, Curian Guidance – Tactical Moderate Growth Fund, Curian Guidance – Tactical Maximum Growth Fund, Curian Guidance – Institutional Alt 65 Fund, Curian Guidance – Alt 100 Conservative Fund, Curian Guidance – Alt 100 Moderate Fund, and Curian Guidance – Alt 100 Growth Fund, Curian Guidance – International Conservative Fund, Curian Guidance – International Moderate Fund, Curian Guidance – International Growth Fund, Curian Guidance – Equity 100 Fund, Curian Guidance – Fixed Income 100 Fund, Curian Guidance – Real Assets Fund (collectively "Curian Guidance Funds") seek to achieve their investment objectives by investing in shares of a diversified group of affiliated Funds ("Underlying Funds"). The Underlying Funds in which each Fund may invest are a separate series of Curian Variable Series Trust, JNL Series Trust, JNL Variable Fund LLC or JNL Investors Series Trust. Each Curian Guidance Fund's percentage allocation among the Underlying Funds are determined by the Adviser based on long term market and economic conditions, historical and expected long term performance of each Underlying Fund, as well as diversification to control overall portfolio risk exposure. The Schedules of Investments and Financial Statements for the Underlying Funds are available at www.jackson.com or on the SEC's website at www.sec.gov.

Curian Guidance – Interest Rate Opportunities Fund

Portfolio Composition†:

Alternative | | | 67.0 | % | |

Domestic Fixed Income | | | 25.0 | | |

International Fixed Income | | | 8.0 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Interest Rate Opportunities Fund underperformed its primary benchmark by posting a return of 1.05% compared to 5.97% for the Barclays U.S. Aggregate Bond Index and underperformed its other benchmark, the BofA Merrill Lynch U.S. Corporate 1-3 Year Index, which returned 1.19%. The Fund underperformed its blended benchmark return of 1.27% for the 60% HFRX Fixed Income-Credit Index and 40% Barclays U.S. Aggregate Bond Index. The Fund's investment objective is to seek total return primarily through strategies that invest in fixed income oriented securities, as well as other asset classes and strategies through investment in other funds ("Underlying Funds").

The Fund underperformed the Barclays U.S. Aggregate Bond Index for the year due to the reduced duration of the Fund versus this benchmark, which hurt the Fund in a period of falling interest rates. The Fund underperformed the BofA Merrill Lynch U.S. Corporate 1-3 Year benchmark, which is comprised of short term bonds. On the positive side, the Fund benefited from the equity

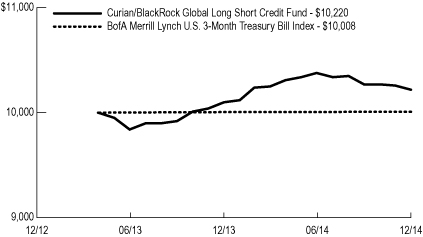

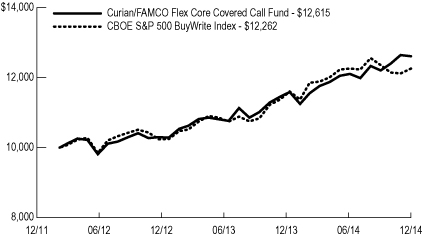

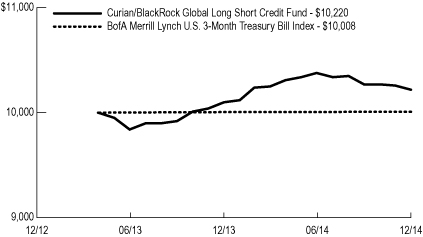

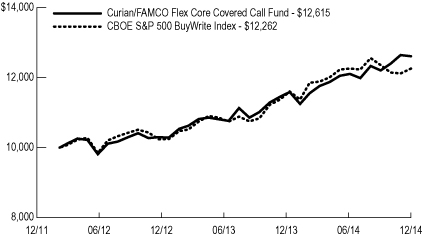

exposure of its investments in underlying REITs, infrastructure and covered call funds; namely, JNL/Invesco Global Real Estate Fund, JNL/Brookfield Global Infrastructure and MLP Fund and Curian/FAMCO Flex Core Covered Call Fund, which posted returns of 15.03%, 7.35% and 8.84%, respectively. Looking at areas of weak performance, the Fund was negatively impacted by emerging market debt and exposure to credit long short funds. Specifically, losses of -4.94%, -1.43% and -4.42% were posted by JNL/Goldman Sachs Emerging Markets Debt Fund, Curian Long Short Credit Fund and Curian/UBS Global Long Short Fixed Income Opportunities Fund, respectively.

Since inception, the Fund's allocation to fixed income was reduced by 8% and was added to alternative strategies. This change was largely as a result of cutting JNL/PIMCO Real Return Fund from a 20% weight to a 10% weight. The mix of alternative strategies was also changed in order to make room for the addition of Curian/UBS Global Long Short Fixed Income Opportunities Fund.

Curian Guidance – Multi-Strategy Income Fund

Portfolio Composition†:

Domestic Fixed Income | | | 46.0 | % | |

Global Fixed Income | | | 24.5 | | |

Alternative | | | 20.1 | | |

International Fixed Income | | | 9.4 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

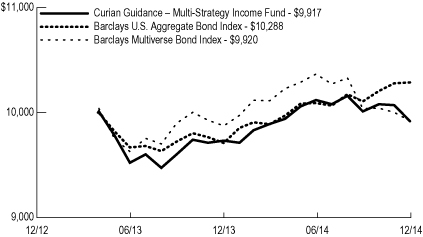

For the year ended December 31, 2014, Curian Guidance – Multi-Strategy Income Fund underperformed its primary benchmark by posting a return of 1.93% compared to 5.97% for the Barclays U.S. Aggregate Bond Index and outperformed its other benchmark, the Barclays Multiverse Bond Index, which returned 0.48%. The Fund's investment objective is to seek total return primarily through strategies that invest in fixed income oriented securities, as well as other asset classes and strategies through investment in other funds (the "Underlying Funds").

The performance of the Fund was negatively impacted by its exposure to emerging market debt and its investments in credit long short funds; namely, Curian Long Short Credit Fund and Curian/UBS Global Long Short Fixed Income Opportunities Fund, which posted returns of -1.43% and -4.42%, respectively. Fixed income Underlying Funds with overweight allocations to junk bonds and/or underweight allocations to duration found 2014 to be a challenging year as long duration and investment grade fixed income delivered relative outperformance. The Fund's largest positions, Curian/DoubleLine Total Return Fund and JNL/Franklin Templeton Global Multisector Bond Fund, returned 6.49% and -0.45%, respectively. Underlying Funds that delivered relative underperformance included JNL/PPM America Floating Rate Income Fund and JNL/PPM America High Yield Bond Fund, which returned 0.12% and 0.13%, respectively. Funds that contributed positively to performance included JNL/Invesco Global

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Real Estate Fund, JNL/Brookfield Global Infrastructure and MLP Fund and Curian/FAMCO Flex Core Covered Call Fund, which posted returns of 15.03%, 7.35% and 8.84%, respectively.

Since inception, the Fund's allocation to fixed income was reduced by 2% and this exposure was added to alternative strategies. This change was largely as a result of cutting JNL/PIMCO Real Return Fund from a 6% weight to a 3% weight. The mix of alternative strategies was also changed in order to make room for the addition of Curian/UBS Global Long Short Fixed Income Opportunities Fund.

Curian Guidance – Equity Income Fund

Portfolio Composition†:

Global Equity | | | 39.9 | % | |

Alternative | | | 35.1 | | |

Domestic Equity | | | 25.0 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

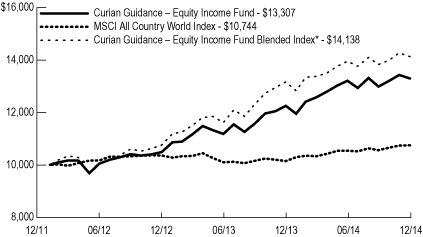

For the year ended December 31, 2014, Curian Guidance – Equity Income Fund outperformed its primary benchmark by posting a return of 8.62% compared to 4.17% for the MSCI All Country World Index. The Fund outperformed its blended benchmark return of 7.31% for the 55% S&P 500 Index, 25% MSCI EAFE Index and 20% Barclays U.S. Aggregate Bond Index. The Fund's investment objective is to seek a potentially rising stream of income by investing in a selection of companies with a multiple year history of increasing their dividend payouts over the long term with some risk control through investment in other funds (the "Underlying Funds").

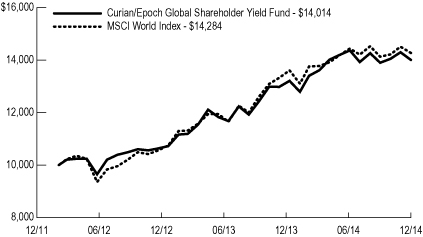

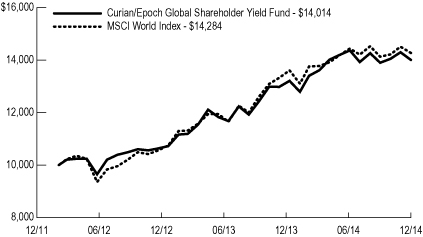

The Fund outperformed the MSCI All Country World Index primarily due to an overweight positioning in U.S. equities relative to the benchmark. The Fund also outperformed its blended benchmark because the blended benchmark has a larger allocation to fixed income (20%) versus the Fund (0%). The Fund's largest position, Curian/Epoch Global Shareholder Yield Fund, posted a return of 6.05%. The next two largest holdings, Curian/FAMCO Flex Core Covered Call Fund and Curian/The Boston Company Equity Income Fund, posted returns of 8.84% and 11.07%, respectively. JNL/Invesco Global Real Estate Fund was the top performing alternative and posted a 15.03% return, while JNL/T. Rowe Price Value Fund was the highest performing traditional equity position and posted a return of 13.24% for the year.

Since inception in 2012, the Fund's allocation to Curian Dynamic Risk Advantage – Diversified Fund was reduced from 30% to 15%, then eliminated in 2014 and was primarily reallocated into domestic equity. Additions to the alternative allocations in real estate and covered call strategies were also made at the expense of eliminating the allocation to risk managed Underlying Funds. These off benchmark allocations to alternatives have been made in order to add an element of diversification to the Fund.

Curian Guidance – Conservative Fund

Portfolio Composition†:

Domestic Fixed Income | | | 35.8 | % | |

Alternative | | | 34.9 | | |

Global Fixed Income | | | 19.5 | | |

International Fixed Income | | | 9.8 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

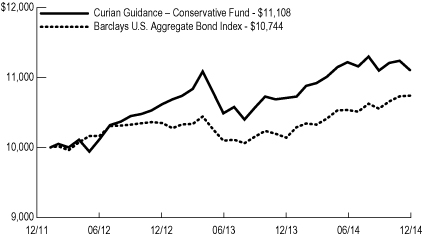

For the year ended December 31, 2014, Curian Guidance – Conservative Fund underperformed its benchmark by posting a return of 3.71% compared to 5.97% for the Barclays U.S. Aggregate Bond Index. The Fund's investment objective is to seek the generation of income through investment in other funds (the "Underlying Funds").

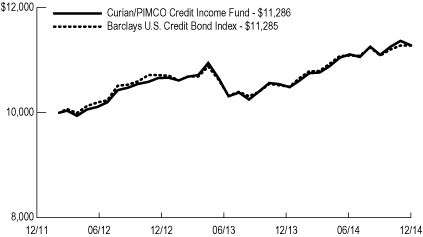

Despite the decrease in interest rates during the year, the Fund underperformed its benchmark due to its allocation to emerging market and international debt. The Fund's largest position, Curian/DoubleLine Total Return Fund returned 6.49%. The top performing fixed income holding was Curian/PIMCO Credit Income Fund, which returned 7.61%. Also contributing positively to performance was JNL/Invesco Global Real Estate Fund, Curian/FAMCO Flex Core Covered Call Fund and Curian Dynamic Risk Advantage – Diversified Fund, posting returns of 15.03%, 8.84%, and 5.17%, respectively. Underlying Funds that delivered relative underperformance included JNL/PPM America Floating Rate Income Fund and JNL/PPM America High Yield Bond Fund, which returned 0.12% and 0.13%, respectively.

During the year, changes were made within fixed income in order to diversify the Fund's geographic allocation by increasing its exposure to international debt. Allocation changes were also made in order to increase the credit quality of the Fund and reduce its exposure to credit. The allocations to JNL/PPM America High Yield Bond Fund and JNL/PPM America Floating Rate Income Fund were reduced in order to allow for a new 10% allocation to JNL/Goldman Sachs Emerging Markets Debt Fund.

Curian Guidance – Moderate Fund

Portfolio Composition†:

Alternative | | | 32.5 | % | |

Domestic Equity | | | 25.0 | | |

Domestic Fixed Income | | | 13.7 | | |

International Equity | | | 12.2 | | |

Global Fixed Income | | | 7.5 | | |

Emerging Markets Equity | | | 5.3 | | |

International Fixed Income | | | 3.8 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

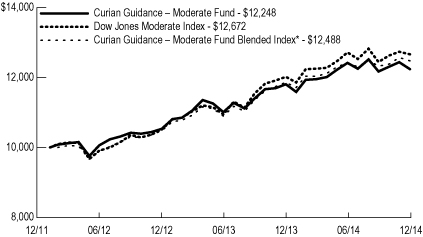

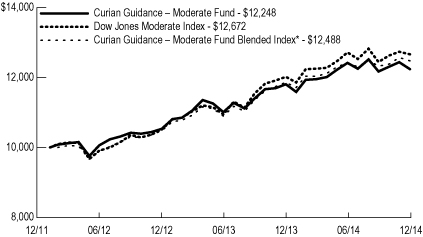

For the year ended December 31, 2014, Curian Guidance – Moderate Fund underperformed its primary benchmark by posting a return of 3.71% compared to 5.35% for the Dow Jones Moderate Index. The Fund underperformed its blended benchmark return of 5.28% for the 25% S&P 500 Index, 20% MSCI EAFE Index, 35%

Barclays U.S. Aggregate Bond Index and 20% Credit Suisse Hedge Fund Index. The Fund's investment objective is to seek a balance between the generation of income and the long term growth of capital through investment in other funds (the "Underlying Funds").

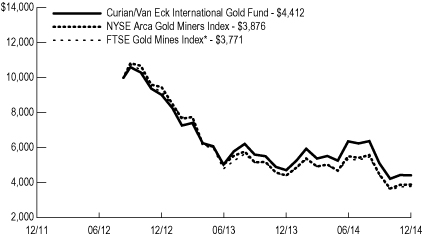

The Fund underperformed the Dow Jones Moderate Index due to the fact that the benchmark has a higher equity allocation (60%) versus the Fund (43%) and equity performed well in 2014. The Fund's relatively larger international exposure also hurt performance as international equities and fixed income lagged their domestic counterparts in 2014. The Fund's largest contributor during the year, the JNL/S&P 4 strategy, includes JNL/S&P Competitive Advantage Fund, JNL/S&P Dividend Income & Growth Fund, JNL/S&P Intrinsic Value Fund and JNL/S&P Total Yield Fund, which returned 10.06%, 13.70%, 18.04% and 15.89%, respectively. Other positive contributors included JNL/PPM America Mid Cap Value Fund and JNL/JPMorgan MidCap Growth Fund, which returned 10.45% and 11.19%, respectively. Alternative allocation performance was mixed. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, the overall asset allocations to global equities were increased at the expense of risk management strategies. Within the equity allocation, changes were made to favor large cap domestic equities and to reduce emerging market equities. Within the fixed income allocation, changes were made in order to shorten duration and reduce the Fund's sensitivity to rising interest rates. Alternative allocations were adjusted in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund.

Curian Guidance – Growth Fund

Portfolio Composition†:

Domestic Equity | | | 36.9 | % | |

Alternative | | | 27.6 | | |

International Equity | | | 17.8 | | |

Emerging Markets Equity | | | 7.7 | | |

Domestic Fixed Income | | | 5.5 | | |

Global Fixed Income | | | 3.0 | | |

International Fixed Income | | | 1.5 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Growth Fund underperformed its primary benchmark by posting a return of 4.16% compared to 5.90% for the Dow Jones Moderately Aggressive Index. The Fund underperformed its blended benchmark return of 4.88% for the 35% S&P 500 Index, 30% MSCI EAFE Index, 15% Barclays U.S. Aggregate Bond Index and 20% Credit Suisse Hedge Fund Index. The Fund's

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

investment objective is to seek long term growth of capital through an allocation in stocks and other asset classes and strategies through investment in other funds (the "Underlying Funds").

The Fund underperformed the Dow Jones Moderately Aggressive Index due to the fact that the benchmark has a higher equity allocation (80%) versus the Fund (63%) and equity performed well in 2014. The Fund's relatively larger international exposure also hurt performance as international equities and fixed income lagged their domestic counterparts in 2014. The Fund's largest contributor during the year, the JNL/S&P 4 strategy, includes JNL/S&P Competitive Advantage Fund, JNL/S&P Dividend Income & Growth Fund, JNL/S&P Intrinsic Value Fund and JNL/S&P Total Yield Fund, which returned 10.06%, 13.70%, 18.04% and 15.89%, respectively. Other positive contributors included, JNL/PPM America Mid Cap Value Fund and JNL/JPMorgan MidCap Growth Fund, which returned 10.45% and 11.19%, respectively. Alternative allocation performance was mixed. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, the overall asset allocations to global equities were increased at the expense of risk management strategies. Within the equity allocation, changes were made to favor large cap domestic equities and to reduce emerging market equities. Within the fixed income allocation, changes were made in order to shorten duration and reduce the Fund's sensitivity to rising interest rates. Alternative allocations were adjusted in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund.

Curian Guidance – Moderate Growth Fund

Portfolio Composition†:

Domestic Equity | | | 33.0 | % | |

Alternative | | | 30.1 | | |

International Equity | | | 15.3 | | |

Domestic Fixed Income | | | 8.2 | | |

Emerging Markets Equity | | | 6.6 | | |

Global Fixed Income | | | 4.5 | | |

International Fixed Income | | | 2.3 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Moderate Growth Fund underperformed its primary benchmark by posting a return of 4.11% compared to 5.35% for the Dow Jones Moderate Index. The Fund underperformed its blended benchmark return of 5.08% for the 30% S&P 500 Index, 25% MSCI EAFE Index, 25% Barclays U.S. Aggregate Bond Index, 20% Credit Suisse Hedge Fund Index. The Fund's investment objective is to seek long term growth of capital by investing in other funds (the "Underlying Funds") that offer a broad array of stock, bond and other

asset classes and strategies.

The Fund underperformed the Dow Jones Moderate Index due to the fact that the benchmark has a higher equity allocation (60%) versus the Fund (55%) and equity performed well in 2014. The Fund's relatively larger international exposure also hurt performance as international equities and fixed income lagged compared to their domestic counterparts in 2014. The Fund's largest contributor during the year, the JNL/S&P 4 strategy, includes JNL/S&P Competitive Advantage Fund, JNL/S&P Dividend Income & Growth Fund, JNL/S&P Intrinsic Value Fund and JNL/S&P Total Yield Fund, which returned 10.06%, 13.70%, 18.04% and 15.89%, respectively. Other positive contributors included JNL/PPM America Mid Cap Value Fund and JNL/JPMorgan MidCap Growth Fund, which returned 10.45% and 11.19%, respectively. Alternative allocation performance was mixed. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, the overall asset allocations to global equities were increased at the expense of risk management strategies. Within the equity allocation, changes were made to favor large cap domestic equities and to reduce emerging market equities. Within the fixed income allocation, changes were made in order to shorten duration and reduce the Fund's sensitivity to rising interest rates. Alternative allocations were adjusted in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund.

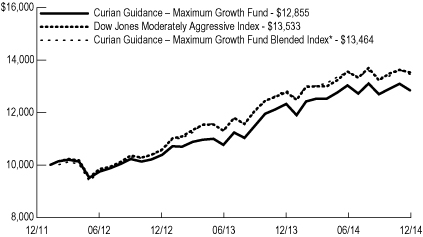

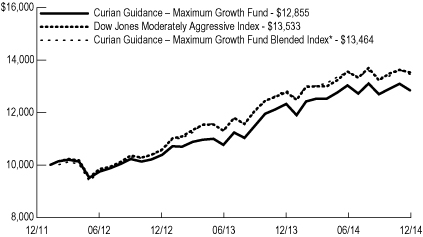

Curian Guidance – Maximum Growth Fund

Portfolio Composition†:

Domestic Equity | | | 47.1 | % | |

International Equity | | | 22.8 | | |

Alternative | | | 20.1 | | |

Emerging Markets Equity | | | 10.0 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Maximum Growth Fund underperformed its primary benchmark by posting a return of 4.26% compared to 5.90% for the Dow Jones Moderately Aggressive Index. The Fund underperformed its blended benchmark return of 4.77% for the 40% S&P 500 Index, 35% MSCI EAFE Index, 10% Barclays U.S. Aggregate Bond Index and 15% Credit Suisse Hedge Fund Index. The Fund's investment objective is to seek long term growth of capital through an allocation in stocks and other asset classes and strategies through investment in other funds (the "Underlying Funds").

The Fund underperformed the Dow Jones Moderately Aggressive Index due to the fact that

the benchmark has a higher fixed income allocation (20%) versus the Fund (0%) and fixed income performed well in 2014. The Fund's relatively larger international exposure also hurt performance as international equities and fixed income lagged their domestic counterparts in 2014. The Fund's largest contributor during the year, the JNL/S&P 4 strategy, includes JNL/S&P Competitive Advantage Fund, JNL/S&P Dividend Income & Growth Fund, JNL/S&P Intrinsic Value Fund and JNL/S&P Total Yield Fund, which returned 10.06%, 13.70%, 18.04% and 15.89%, respectively. Other positive contributors included JNL/PPM America Mid Cap Value Fund and JNL/JPMorgan MidCap Growth Fund, which returned 10.45% and 11.19%, respectively. Alternative allocation performance was mixed. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund decline to return -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund gained 7.35% and 15.03%, respectively.

During the year, the overall allocations to global equity and fixed income were unchanged. Within the equity allocation, changes were made to favor large cap domestic equities and to reduce emerging market equities. Within the alternative allocation, changes were made in order to reduce allocations to long short credit funds in lieu of funds with greater equity market sensitivity such as covered call and convertible arbitrage strategies. Alternative allocations were also adjusted in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund.

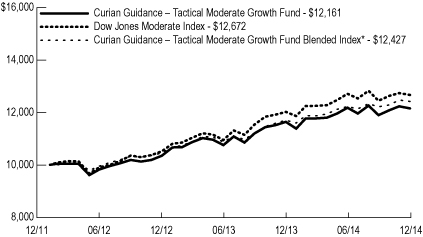

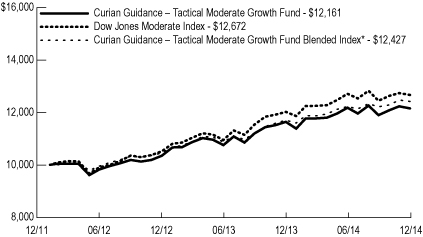

Curian Guidance – Tactical Moderate Growth Fund

Portfolio Composition†:

Domestic Equity | | | 49.9 | % | |

Alternative | | | 35.0 | | |

International Equity | | | 10.8 | | |

Emerging Markets Equity | | | 4.0 | | |

Domestic Fixed Income | | | 0.3 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

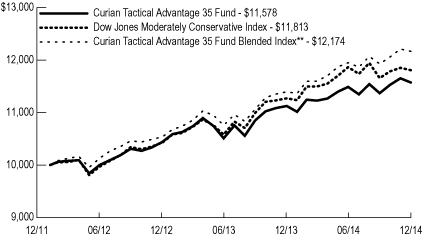

For the year ended December 31, 2014, Curian Guidance – Tactical Moderate Growth Fund underperformed its primary benchmark by posting a return of 4.44% compared to 5.35% for the Dow Jones Moderate Index. The Fund underperformed its blended benchmark return of 6.22% for the 25% S&P 500 Index, 10% MSCI EAFE Index, 35% Barclays U.S. Aggregate Bond Index, 30% Credit Suisse Hedge Fund Index. The Fund's investment objective is to seek long term growth of capital through a broad and flexible allocation in stocks, bonds and other asset classes and strategies through investment in other funds (the "Underlying Funds").

The Fund underperformed the Dow Jones Moderate Index due to the fact that the benchmark had a higher allocation to equity versus the Fund

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

during the year and equity performed well in 2014. The Dow Jones Moderate Index also had a higher allocation to domestic fixed income versus the Fund during the year and domestic fixed income performed well in 2014. The Fund's largest allocations at year end, JNL/Mellon Capital S&P 500 Index Fund and JNL/Mellon Capital S&P 400 Mid Cap Index Fund, were also the largest contributors returning 13.07% and 9.23%, respectively. Alternative allocation performance was mixed. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, the overall allocations to global equity and fixed income were unchanged. Within the equity allocation, changes were made to favor large cap domestic equities and to reduce emerging market equities. Within the alternative allocation, changes were made in order to reduce allocations to long short credit funds in lieu of funds with greater equity market sensitivity such as covered call and convertible arbitrage strategies. Alternative allocations were also adjusted in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund.

Curian Guidance – Tactical Maximum Growth Fund

Portfolio Composition†:

Domestic Balanced | | | 24.9 | % | |

Global Balanced | | | 24.9 | | |

Domestic Equity | | | 22.6 | | |

Alternative | | | 20.1 | | |

International Equity | | | 6.0 | | |

Emerging Markets Equity | | | 1.5 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Tactical Maximum Growth Fund underperformed its primary benchmark by posting a return of 3.78% compared to 5.90% for the Dow Jones Moderately Aggressive Index. The Fund underperformed its blended benchmark return of 6.03% for the 30% S&P 500 Index, 15% MSCI EAFE Index, 25% Barclays U.S. Aggregate Bond Index and 30% Credit Suisse Hedge Fund Index. The Fund's investment objective is to seek long term growth of capital through a flexible, and potentially concentrated, allocation in stocks, bonds and other asset classes and strategies through investment in other funds (the "Underlying Funds").

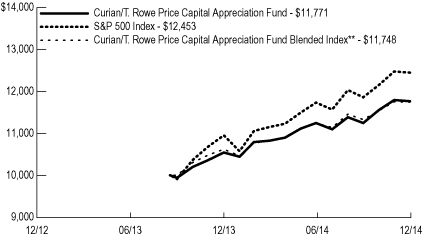

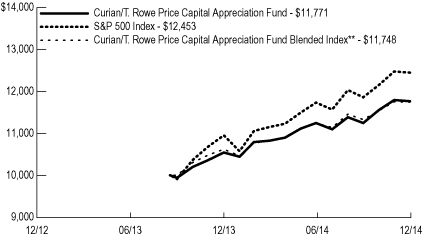

The Fund underperformed the Dow Jones Moderately Aggressive Index due to the fact that the benchmark had a higher allocation to equity versus the Fund during the year and equity performed well in 2014. The tactically managed JNL/Ivy Asset Strategy Fund and Curian/T. Rowe Price Capital Appreciation Fund posted mixed per-

formance returning -4.04% and 11.63%, respectively. The largest allocations to alternatives included JNL/Red Rocks Listed Private Equity Fund and Curian/FAMCO Flex Core Covered Call Fund, which posted returns of 0.62% and 8.84%, respectively. Other alternative allocations delivered mixed performance. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, the overall allocations to global equity and fixed income were unchanged. Within the equity allocation, changes were made to favor mid cap domestic equities and emerging market equities. Within the alternative allocation, changes were made in order to reduce allocations to long short credit funds in lieu of funds with greater equity market sensitivity such as covered call and convertible arbitrage strategies. Alternative allocations were also adjusted in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund.

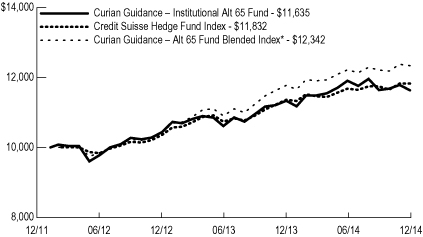

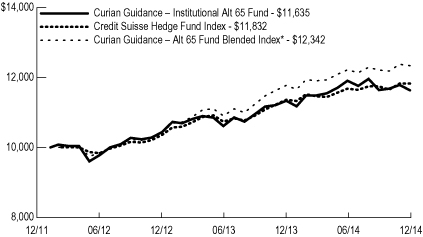

Curian Guidance – Institutional Alt 65 Fund

Portfolio Composition†:

Alternative | | | 64.8 | % | |

Domestic Equity | | | 15.4 | | |

International Equity | | | 7.0 | | |

Domestic Fixed Income | | | 5.5 | | |

Global Fixed Income | | | 3.0 | | |

Emerging Markets Equity | | | 2.9 | | |

International Fixed Income | | | 1.4 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Institutional Alt 65 Fund underperformed its primary benchmark by posting a return of 2.60% compared to 4.13% for the Credit Suisse Hedge Fund Index. The Fund underperformed its blended benchmark return of 4.81% for the 15% S&P 500 Index, 10% MSCI EAFE Index, 10% Barclays U.S. Aggregate Bond Index and 65% Credit Suisse Hedge Fund Index. The Fund's investment objective is to seek long term growth of capital and income through investment in other funds (the "Underlying Funds"). Under normal market conditions, the Fund allocates approximately 35% of its assets to Underlying Funds that invest primarily in traditional asset classes, allocating approximately 0% to 10% in fixed income securities, 15% to 25% in U.S. equity securities and 0% to 10% in international securities. Under normal market conditions, the Fund allocates approximately 65% of its assets to Underlying Funds that invest in the non-traditional asset classes.

The Fund underperformed the Credit Suisse Hedge Fund Index due to the fact that the benchmark had a lower allocation to international equity

(0%) versus the Fund (10%) and international equity performed poorly in 2014. The Fund's largest contributor during the year, the JNL/S&P 4 strategy, includes JNL/S&P Competitive Advantage Fund, JNL/S&P Dividend Income & Growth Fund, JNL/S&P Intrinsic Value Fund and JNL/S&P Total Yield Fund, which returned 10.06%, 13.70%, 18.04% and 15.89%, respectively. The largest allocations to alternatives included JNL/Red Rocks Listed Private Equity Fund and Curian/FAMCO Flex Core Covered Call Fund, which posted returns of 0.62% and 8.84%, respectively. Other alternative allocations delivered mixed performance. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, the overall allocations to global equity and fixed income were changed in order to increase equity exposure and reduce fixed income exposure. Within the equity allocation, changes were made to favor large cap domestic equities and to reduce frontier market equities. Within the alternative allocation, changes were made in order to reduce allocations to long short credit funds in lieu of funds with greater equity market sensitivity such as covered call and convertible arbitrage strategies. Alternative allocations were also adjusted in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund. Alternative asset allocations, such as listed private equity, infrastructure and real estate funds, were increased at the expense of alternative strategy allocations, such as equity hedge and relative value funds.

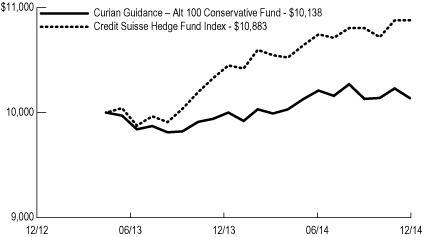

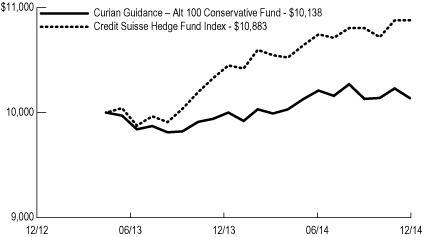

Curian Guidance – Alt 100 Conservative Fund

Portfolio Composition†:

Alternative | | | 100.0 | % | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Alt 100 Conservative Fund underperformed its benchmark by posting a return of 1.38% compared to 4.13% for the Credit Suisse Hedge Fund Index. The Fund's investment objective is to seek long term growth of capital consistent with capital preservation, through investment in other funds (the "Underlying Funds"). Under normal market conditions, the Fund may allocate 100% of its assets to the Underlying Funds that invest in non-traditional asset classes.

The Fund underperformed the Credit Suisse Hedge Fund Index due to the fact that the benchmark had relatively larger weights in macro strategies, such as managed futures and currency strategies, and relatively smaller weights in long only pure play commodity and commodity related equities. The Fund's largest holding at year end,

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

JNL/Boston Partners Global Long Short Equity Fund was added in the fall. The Fund's next largest holdings at year end included JNL/AQR Managed Futures Strategy Fund and Curian/FAMCO Flex Core Covered Call Fund, which returned 9.09% and 8.84%, respectively. Other alternative allocations delivered mixed performance. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, changes were made in order to reduce allocations to long short credit funds in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund. The Curian/Neuberger Berman Risk Balanced Commodity Strategy Fund and JNL/BlackRock Commodity Securities Strategy Fund were both added in order to increase the Fund's allocation to alternative assets. Within the alternative strategy allocation, the Curain/PineBridge Merger Arbitrage Fund and the JNL/Mellon Capital Global Alpha Fund were both removed due to lackluster performance.

Curian Guidance – Alt 100 Moderate Fund

Portfolio Composition†:

Alternative | | | 100.0 | % | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Alt 100 Moderate Fund underperformed its primary benchmark by posting a return of 2.27% compared to 4.13% for the Credit Suisse Hedge Fund Index. The Fund underperformed its blended benchmark return of 3.04% for the 80% Credit Suisse Hedge Fund Index, 10% FTSE EPRA/NAREIT Developed Index and 10% Bloomberg Commodity Index. The Fund's investment objective is to seek long term growth of capital through investment in other funds (the "Underlying Funds"). Under normal market conditions, the Fund may allocate 100% of its assets to the Underlying Funds that invest in non-traditional asset classes.

The Fund underperformed the Credit Suisse Hedge Fund Index due to the fact that the benchmark had relatively larger weights in macro strategies and relatively smaller weights in long only pure play commodity and commodity related equities. The Fund's largest holding at year end, JNL/Boston Partners Global Long Short Equity Fund was added in the fall. The Fund's next largest holdings at year end included JNL/Red Rocks Listed Private Equity Fund and Curian/FAMCO Flex Core Covered Call Fund, which returned 0.62% and 8.84%, respectively. Other alternative allocations delivered mixed performance. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and

Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

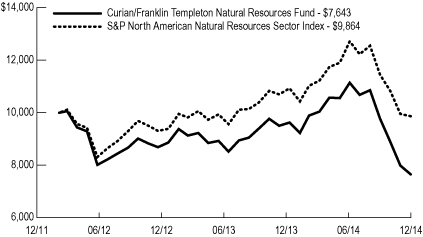

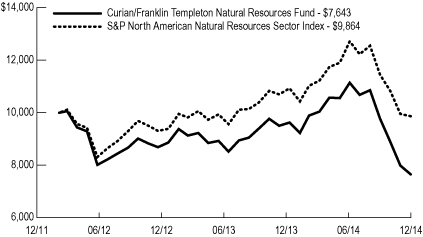

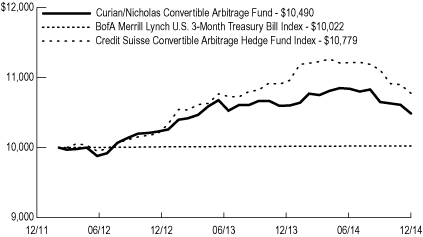

During the year, changes were made in order to reduce allocations to long short credit funds in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund. One of the Fund's macro strategies, JNL/AQR Managed Futures Strategy Fund was reduced in weight in order to supplement the Fund's relative value allocation with an increased allocation to the Curian/Nicholas Convertible Arbitrage Fund. Additionally, changes were made to remove Curian/Franklin Templeton Natural Resources Fund in order to add the Curian/Neuberger Berman Risk Balanced Commodity Fund.

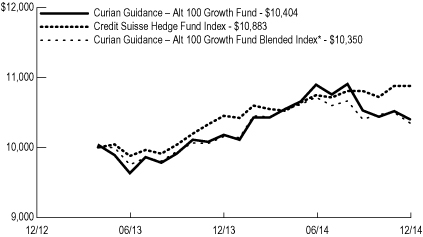

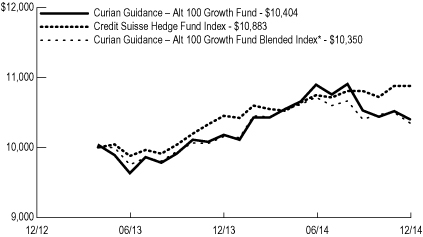

Curian Guidance – Alt 100 Growth Fund

Portfolio Composition†:

Alternative | | | 100.0 | % | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Alt 100 Growth Fund underperformed its primary benchmark by posting a return of 2.20% compared to 4.13% for the Credit Suisse Hedge Fund Index. The Fund outperformed its blended benchmark return of 1.91% for the 60% Credit Suisse Hedge Fund Index, 20% FTSE EPRA/NAREIT Developed Index and 20% Bloomberg Commodity Index. The Fund's investment objective is to seek long term growth of capital through investment in other funds (the "Underlying Funds"). Under normal market conditions, the Fund may allocate 100% of its assets to the Underlying Funds that invest in non-traditional asset classes.

The Fund underperformed the Credit Suisse Hedge Fund Index due to the fact that the benchmark had relatively larger weights in macro strategies and relatively smaller weights in long only pure play commodity and commodity related equities. The Fund's largest holdings at year end included JNL/Red Rocks Listed Private Equity Fund and Curian/FAMCO Flex Core Covered Call Fund, which returned 0.62% and 8.84%, respectively. Other alternative allocations delivered mixed performance. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively.

During the year, changes were made in order to reduce allocations to long short credit funds in order to make room for the addition of JNL/Boston Partners Global Long Short Equity Fund. One of the Fund's macro strategies, JNL/AQR Managed Futures Strategy Fund, was reduced in weight in

order to supplement the Fund's relative value allocation with an increased allocation to the Curian/Nicholas Convertible Arbitrage Fund. Additionally, changes were made to remove Curian/Franklin Templeton Natural Resources Fund in order to add the Curian/Neuberger Berman Risk Balanced Commodity Fund.

Curian Guidance – International Conservative Fund

Portfolio Composition†:

International Fixed Income | | | 60.2 | % | |

International Equity | | | 20.9 | | |

Alternative | | | 14.9 | | |

Emerging Markets Equity | | | 4.0 | �� | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – International Conservative Fund underperformed its primary benchmark by posting a return of -2.03% compared to 4.78% for the Dow Jones Moderately Conservative Index. The Fund outperformed its blended benchmark return of -2.87% for the 20% MSCI All Country World ex U.S. Index and 80% Citigroup World Government Bond ex U.S. Index. The Fund's investment objective is to seek total return, consistent with preservation of capital, through a predominant allocation in international bonds, stocks and other asset classes and strategies through investment in other funds (the "Underlying Funds").

The Fund underperformed the Dow Jones Moderately Conservative Index during the year largely because the index is comprised with a large U.S. equity and fixed income bias, while the Fund has no allocation to domestic securities of any kind during a year when international asset classes lagged their domestic counterparts. The Fund's largest position at year end, Curian/Baring International Fixed Income Fund returned -2.59%. Other holdings posting declines included JNL/Goldman Sachs Emerging Markets Debt Fund, JNL/Lazard Emerging Markets Fund and Curian/Lazard International Strategic Equity Fund, which returned -4.94%, -5.26% and -1.42%, respectively. Within the alternatives, Curian/Neuberger Berman Currency Fund posted a return of 3.37%, while Curian/CenterSquare International Real Estate Securities Fund posted a return of 0.80% during the year.

Since inception, the asset class allocations have remained unchanged.

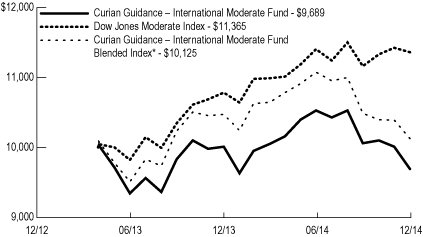

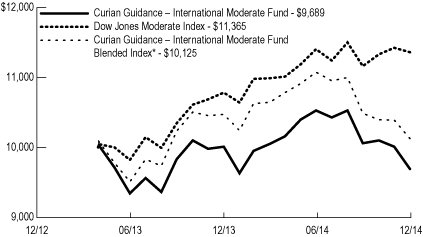

Curian Guidance – International Moderate Fund

Portfolio Composition†:

International Fixed Income | | | 40.1 | % | |

International Equity | | | 32.9 | | |

Emerging Markets Equity | | | 19.0 | | |

Alternative | | | 8.0 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – International Moderate Fund

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

underperformed its primary benchmark by posting a return of -3.20% compared to 5.35% for the Dow Jones Moderate Index. The Fund outperformed its blended benchmark return of -3.32% for the 60% MSCI All Country World ex U.S. Index and 40% Citigroup World Government Bond ex U.S. Index. The Fund's investment objective is to seek total return through a predominant allocation in international stocks, bonds and other asset classes and strategies through investment in other funds (the "Underlying Funds").

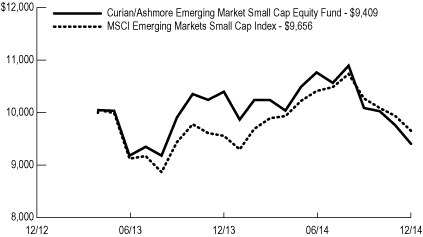

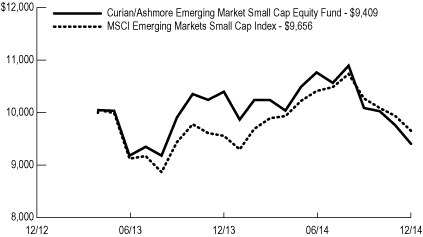

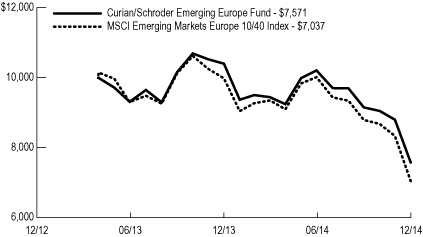

The Fund underperformed the Dow Jones Moderate Index during the year largely because the index is comprised with a large U.S. equity and fixed income bias, while the Fund has no allocation to domestic securities of any kind during a year when international asset classes lagged their domestic counterparts. The Fund's largest position at year end, Curian/Baring International Fixed Income Fund returned -2.59%. Other holdings posting declined returns included JNL/Goldman Sachs Emerging Markets Debt Fund, JNL/Lazard Emerging Markets Fund and Curian/Lazard International Strategic Equity Fund, which returned -4.94%, -5.26% and -1.42%, respectively. The largest detractors in the Fund for the year were Curian/Ashmore Emerging Market Small Cap Equity Fund and Curian/Franklin Templeton Frontier Markets Fund, which returned -9.54% and -14.98%, respectively. Within the alternatives, Curian/Neuberger Berman Currency Fund posted a return of 3.37%, while Curian/CenterSquare International Real Estate Securities Fund posted a return of 0.80% during the year.

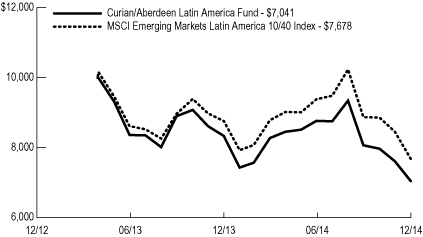

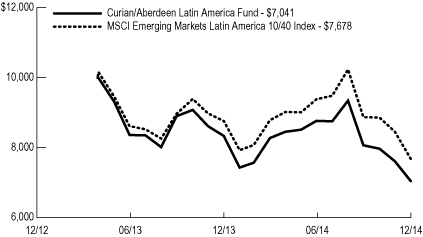

During the year, the removal of esoteric regional equity market exposures from the Fund contributed to performance. Curian/Aberdeen Latin America Fund, Curian/Schroder Emerging Europe Fund and JNL/Eastspring Investments China-India Fund were all removed in the first quarter in favor of allocations in international developed countries.

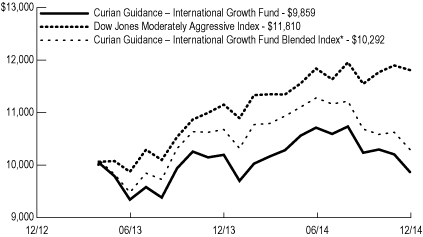

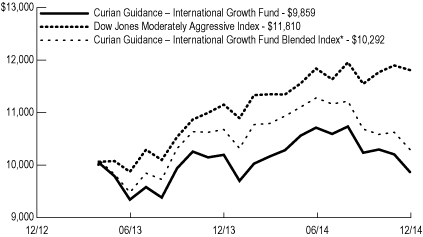

Curian Guidance – International Growth Fund

Portfolio Composition†:

International Equity | | | 44.7 | % | |

Emerging Markets Equity | | | 27.2 | | |

International Fixed Income | | | 20.1 | | |

Alternative | | | 8.0 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – International Growth Fund underperformed its primary benchmark by posting a return of -3.25% compared to 5.90% for the Dow Jones Moderately Aggressive Index. The Fund outperformed its blended benchmark return of -3.58% for the 80% MSCI All Country World ex U.S. Index and 20% Citigroup World Government Bond ex U.S. Index. The Fund's investment objective is to seek long term growth of capital through a predominant allocation in international stocks and other asset classes and strategies through

investment in other funds (the "Underlying Funds").

The Fund underperformed the Dow Jones Moderately Aggressive Index during the year largely because the index is comprised with a large U.S. equity and fixed income bias, while the Fund has no allocation to domestic securities of any kind during a year when international assets classes lagged their domestic counterparts. The Fund's largest positions at year end, JNL/Invesco International Growth Fund and Curian/Lazard International Strategic Equity Fund, posted mixed returns of 0.24% and -1.42%, respectively. Other Underlying Funds posting declined returns included JNL/Goldman Sachs Emerging Markets Debt Fund and JNL/Lazard Emerging Markets Fund, which returned -4.94% and -5.26%, respectively. The largest detractors in the Fund for the year were Curian/Ashmore Emerging Market Small Cap Equity Fund and Curian/Franklin Templeton Frontier Markets Fund, which returned -9.54% and -14.98%, respectively. Within the alternatives, Curian/Neuberger Berman Currency Fund posted a return of 3.37%, while Curian/CenterSquare International Real Estate Securities Fund posted a return of 0.80% during the year.

During the year, the removal of esoteric regional equity market exposures from the Fund contributed to performance. Curian/Aberdeen Latin America Fund, Curian/Schroder Emerging Europe Fund and JNL/Eastspring Investments China-India Fund were all removed in the first quarter in favor of allocations in international developed countries.

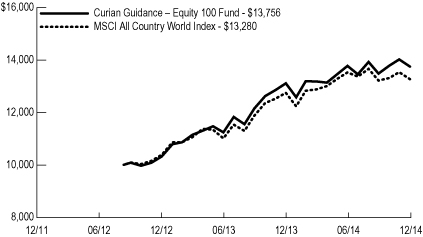

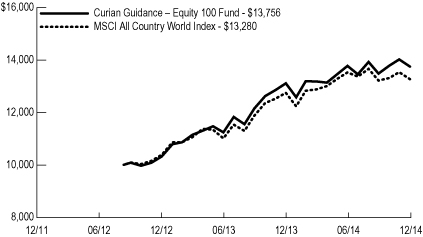

Curian Guidance – Equity 100 Fund

Portfolio Composition†:

Domestic Equity | | | 59.9 | % | |

International Equity | | | 28.0 | | |

Emerging Markets Equity | | | 12.1 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Equity 100 Fund outperformed its benchmark by posting a return of 4.84% compared to 4.17% for the MSCI All Country World Index. The Fund's investment objective is to seek long term growth of capital through investment in other funds (the "Underlying Funds") with an equity orientation.

The Fund outperformed its benchmark during the year due to the strong performance of its domestic Underlying Funds. Performance of the Fund also benefitted from its overweight to domestic equity versus the benchmark, as domestic stocks outperformed non U.S. stocks during 2014. In addition, a bias to large cap stocks also benefitted performance. The Fund's largest contributor during the year, the JNL/S&P 4 strategy, includes JNL/S&P Competitive Advantage Fund, JNL/S&P Dividend Income & Growth Fund, JNL/S&P Intrinsic Value Fund and JNL/S&P Total Yield Fund, which returned 10.06%, 13.70%, 18.04% and 15.89%, respectively. Other positive contributors included, JNL/PPM America Mid Cap Value

Fund and JNL/JPMorgan MidCap Growth Fund, which returned 10.45% and 11.19%, respectively. The largest detractors in the Fund for the year were Curian/Ashmore Emerging Market Small Cap Equity Fund and Curian/Franklin Templeton Frontier Markets Fund, which returned -9.54% and -14.98%, respectively.

During the year, the Fund's domestic equity allocation was reduced to 60% from 74%. The Fund also replaced its investments in passively managed index funds with investments in actively managed equity funds.

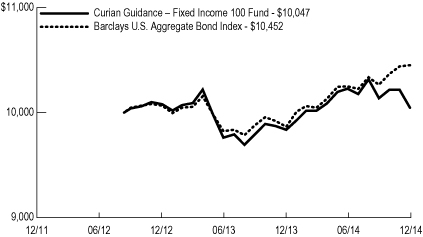

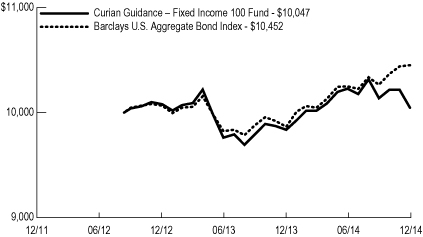

Curian Guidance – Fixed Income 100 Fund

Portfolio Composition†:

Domestic Fixed Income | | | 55.0 | % | |

Global Fixed Income | | | 30.0 | | |

International Fixed Income | | | 15.0 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Fixed Income 100 Fund underperformed its benchmark by posting a return of 2.14% compared to 5.97% for the Barclays U.S. Aggregate Bond Index. The Fund's investment objective is to seek income and total return through investment in other funds (the "Underlying Funds") with a fixed income orientation.

The Fund underperformed its benchmark during the year due to the Fund's allocation to international debt that underperformed its domestic counterparts. The Fund's largest allocation at year end, Curian/DoubleLine Total Return Fund, posted a return of 6.49%. Other positive contributors included Curian/PIMCO Credit Income Fund and JNL/Neuberger Berman Strategic Income Fund, which returned 7.61% and 4.90%, respectively. The Fund's international exposure and detractors to performance, including JNL/Franklin Templeton Global Multisector Bond Fund and JNL/Goldman Sachs Emerging Markets Debt Fund, posted returns of -0.45% and -4.94%, respectively. Other laggards included non-investment grade allocations to JNL/PPM America High Yield Bond Fund and JNL/PPM America Floating Rate Income Fund, which posted returns of 0.13% and 0.12%, respectively.

During the year, a significant portion of the Fund's government exposure was reduced by the elimination of JNL/Mellon Capital Bond Index Fund, JNL/JPMorgan U.S. Government & Quality Bond Fund, JNL/PIMCO Real Return Fund and JNL/T. Rowe Price Short-Term Bond Fund. Sharp increases in international debt allocations were made in JNL/Franklin Templeton Global Multisector Bond Fund and JNL/Goldman Sachs Emerging Markets Debt Fund in order to diversify the Fund's geographical exposure. The Curian/PIMCO Credit Income Fund was also sharply reduced during the year.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

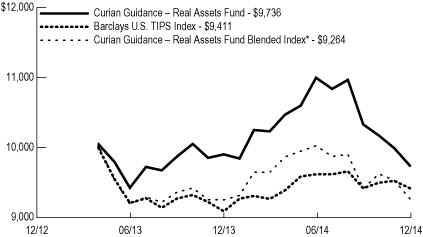

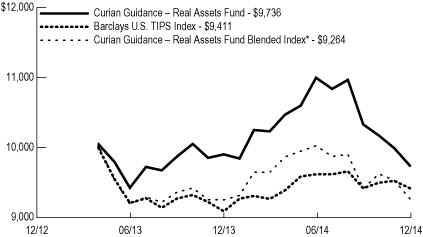

Curian Guidance – Real Assets Fund

Portfolio Composition†:

Alternative | | | 90.0 | % | |

Domestic Fixed Income | | | 10.0 | | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

For the year ended December 31, 2014, Curian Guidance – Real Assets Fund underperformed its primary benchmark by posting a return of -1.65% compared to 3.64% for the Barclays U.S. TIPS Index. The Fund underperformed its blended benchmark return of 0.19% for the 33% FTSE EPRA/NAREIT Developed Index, 33% Bloomberg Commodity Index and 34% Barclays U.S. TIPS Index. The Fund's investment objective is to seek long term real return through an allocation in stocks and other asset classes and

strategies through investment in other funds (the "Underlying Funds").

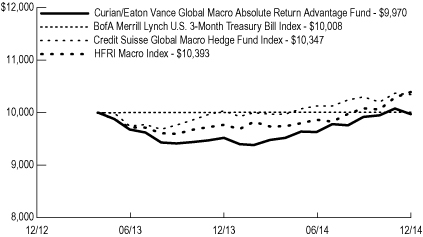

The Fund underperformed the Barclays U.S. TIPS Index during the year due to the Fund's allocation in long only pure play commodity and commodity related equities, which declined in parity with commodity markets. Alternative asset allocation performance was mixed. Commodity related funds such as JNL/BlackRock Commodity Securities Strategy Fund and Curian/Van Eck International Gold Fund returned -14.25% and -6.13%, respectively. Conversely, interest rate sensitive funds such as JNL/Brookfield Global Infrastructure and MLP Fund and JNL/Invesco Global Real Estate Fund returned 7.35% and 15.03%, respectively. On the other hand, alternative strategy performance was strong as

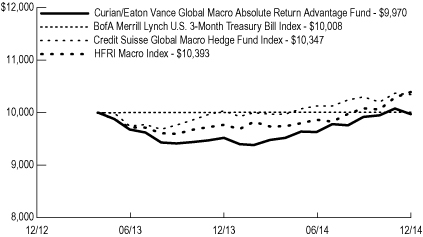

Curian/Eaton Vance Global Macro Absolute Return Advantage Fund and Curian/Neuberger Berman Currency Fund returned 4.73% and 3.37%, respectively.

During the year, Curian/Franklin Templeton Natural Resources Fund was removed in exchange for Curian/Neuberger Berman Risk Balanced Commodity Fund. The Fund's allocations were shifted in order to reduce the Fund's dependency on rising oil prices which was accretive to performance as energy prices collapsed in the second half of the year. The Fund also cut Curian/Neuberger Berman Currency Fund's allocation in half in order to shift the Fund's allocation into more equity related alternative assets.

Curian Guidance – Interest Rate Opportunities Fund

*60% HFRX Fixed Income-Credit Index, 40% Barclays U.S. Aggregate Bond Index

Average Annual Total Returns | |

| 1 Year | | | 1.05 | % | |

Since Inception | | | -0.34 | % | |

(Inception date April 29, 2013) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

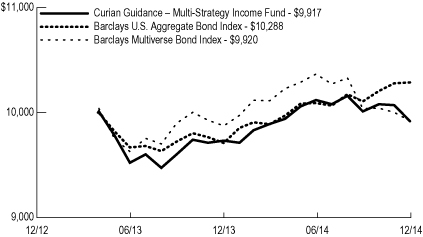

Curian Guidance – Multi-Strategy Income Fund

Average Annual Total Returns | |

| 1 Year | | | 1.93 | % | |

Since Inception | | | -0.49 | % | |

(Inception date April 29, 2013) | |

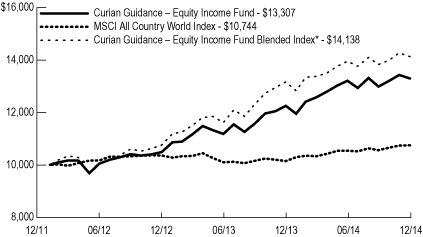

Curian Guidance – Equity Income Fund

*55% S&P 500 Index, 25% MSCI EAFE Index, 20% Barclays U.S. Aggregate Bond Index

Average Annual Total Returns | |

| 1 Year | | | 8.62 | | |

Since Inception | | | 10.35 | | |

(Inception date February 6, 2012) | |

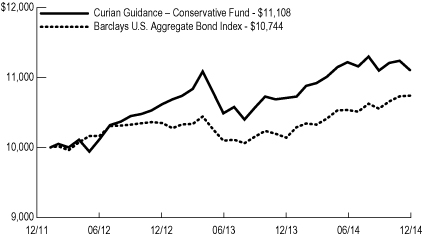

Curian Guidance – Conservative Fund

Average Annual Total Returns | |

| 1 Year | | | 3.71 | % | |

Since Inception | | | 3.69 | % | |

(Inception date February 6, 2012) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Curian Guidance – Moderate Fund

*25% S&P 500 Index, 20% MSCI EAFE Index, 35% Barclays U.S. Aggregate Bond Index, 20% Credit Suisse Hedge Fund Index

Average Annual Total Returns | |

| 1 Year | | | 3.71 | % | |

Since Inception | | | 7.24 | % | |

(Inception date February 6, 2012) | |

Curian Guidance – Growth Fund

*35% S&P 500 Index, 30% MSCI EAFE Index, 15% Barclays U.S. Aggregate Bond Index, 20% Credit Suisse Hedge Fund Index

Average Annual Total Returns | |

| 1 Year | | | 4.16 | % | |

Since Inception | | | 8.11 | % | |

(Inception date April 29, 2013) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Curian Guidance – Moderate Growth Fund

*30% S&P 500 Index, 25% MSCI EAFE Index, 25% Barclays U.S. Aggregate Bond Index, 20% Credit Suisse Hedge Fund Index

Average Annual Total Returns | |

| 1 Year | | | 4.11 | % | |

Since Inception | | | 7.25 | % | |

(Inception date February 6, 2012) | |

Curian Guidance – Maximum Growth Fund

*40% S&P 500 Index, 35% MSCI EAFE Index, 10% Barclays U.S. Aggregate Bond Index, 15% Credit Suisse Hedge Fund Index

Average Annual Total Returns | |

| 1 Year | | | 4.26 | % | |

Since Inception | | | 9.04 | % | |

(Inception date February 6, 2012) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

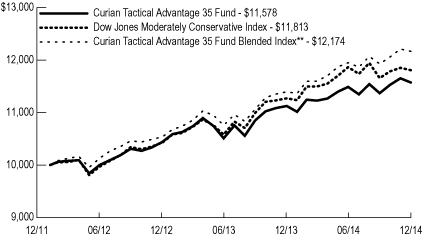

Curian Guidance – Tactical Moderate Growth Fund

*25% S&P 500 Index, 10% MSCI EAFE Index, 35% Barclays U.S. Aggregate Bond Index, 30% Credit Suisse Hedge Fund Index

Average Annual Total Returns | |

| 1 Year | | | 4.44 | % | |

Since Inception | | | 6.98 | % | |

(Inception date February 6, 2012) | |

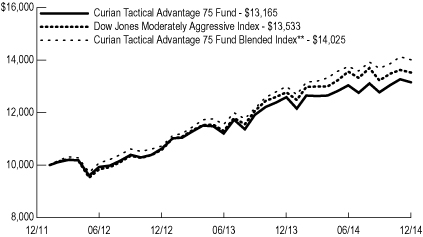

Curian Guidance – Tactical Maximum Growth Fund

*30% S&P 500 Index, 15% MSCI EAFE Index, 25% Barclays U.S. Aggregate Bond Index, 30% Credit Suisse Hedge Fund Index

Average Annual Total Returns | |

| 1 Year | | | 3.78 | % | |

Since Inception | | | 7.34 | % | |

(Inception date February 6, 2012) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Curian Guidance – Institutional Alt 65 Fund

*15% S&P 500 Index, 10% MSCI EAFE Index, 10% Barclays U.S. Aggregate Bond Index, 65% Credit Suisse Hedge Fund Index

Average Annual Total Returns | |

| 1 Year | | | 2.60 | % | |

Since Inception | | | 5.36 | % | |

(Inception date February 6, 2012) | |

Curian Guidance – Alt 100 Conservative Fund

Average Annual Total Returns | |

| 1 Year | | | 1.38 | % | |

Since Inception | | | 0.82 | % | |

(Inception date April 29, 2013) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Curian Guidance – Alt 100 Moderate Fund

*80% Credit Suisse Hedge Fund Index, 10% FTSE EPRA/NAREIT Developed Index, 10% Bloomberg Commodity Index

Average Annual Total Returns | |

| 1 Year | | | 2.27 | % | |

Since Inception | | | 2.91 | % | |

(Inception date February 6, 2012) | |

Curian Guidance – Alt 100 Growth Fund

*60% Credit Suisse Hedge Fund Index, 20% FTSE EPRA/NAREIT Developed Index, 20% Bloomberg Commodity Index

Average Annual Total Returns | |

| 1 Year | | | 2.20 | % | |

Since Inception | | | 2.39 | % | |

(Inception date April 29, 2013) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Curian Guidance – International Conservative Fund

*20% MSCI All Country World ex U.S. Index, 80% Citigroup World Government Bond ex U.S. Index

Average Annual Total Returns | |

| 1 Year | | | -2.03 | % | |

Since Inception | | | -2.34 | % | |

(Inception date April 29, 2013) | |

Curian Guidance – International Moderate Fund

*60% MSCI All Country World ex U.S. Index, 40% Citigroup World Government Bond ex U.S. Index

Average Annual Total Returns | |

| 1 Year | | | -3.20 | % | |

Since Inception | | | -1.87 | % | |

(Inception date April 29, 2013) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Curian Guidance – International Growth Fund

*80% MSCI All Country World ex U.S. Index, 20% Citigroup World Government Bond ex U.S. Index

Average Annual Total Returns | |

| 1 Year | | | -3.25 | % | |

Since Inception | | | -0.85 | % | |

(Inception date April 29, 2013) | |

Curian Guidance – Equity 100 Fund

Average Annual Total Returns | |

| 1 Year | | | 4.84 | % | |

Since Inception | | | 14.83 | % | |

(Inception date September 10, 2012) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian Guidance Funds (continued)

Curian Capital, LLC

(Unaudited)

Curian Guidance – Fixed Income 100 Fund

Average Annual Total Returns | |

| 1 Year | | | 2.14 | % | |

Since Inception | | | 0.20 | % | |

(Inception date September 10, 2012) | |

Curian Guidance – Real Assets Fund

*33% FTSE EPRA/NAREIT Developed Index, 33% Bloomberg Commodity Index, 34% Barclays U.S. TIPS Index

Average Annual Total Returns | |

| 1 Year | | | -1.65 | % | |

Since Inception | | | -1.58 | % | |

(Inception date April 29, 2013) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

Curian/American Funds

Capital Research and Management Company

(Unaudited)

Curian/American Funds® Global Growth Fund

Portfolio Composition†:

Global Equity | | | 100.0 | % | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

Portfolio Manager Commentary: For the year ended December 31, 2014, Curian/American Funds Global Growth Fund underperformed its benchmark by posting a return of 2.06% compared to 4.17% for the MSCI All Country World Index.

The Fund seeks long-term growth of capital through exclusive investment in Class 1 shares of the American Funds Insurance Series® – Global Growth

FundSM (the "Master Fund"). The performance of the Fund is directly related to the performance of the Master Fund. The financial statements of the Master Fund, including the Schedule of Investments and portfolio manager commentary, are provided separately and should be read in conjunction with the Fund's financial statements.

Curian/American Funds® Growth Fund

Portfolio Composition†:

Domestic Equity | | | 100.0 | % | |

Total Investments | | | 100.0 | % | |

†Total Investments as of December 31, 2014.

Portfolio Manager Commentary: For the year ended December 31, 2014, Curian/American Funds Growth Fund underperformed its benchmark by posting a return of 7.98% compared to 13.69% for the S&P 500 Index.

The Fund seeks growth of capital through exclusive investment in Class 1 shares of the American Funds Insurance Series® – Growth FundSM (the

"Master Fund"). The performance of the Fund is directly related to the performance of the Master Fund. The financial statements of the Master Fund, including the Schedule of Investments and portfolio manager commentary, are provided separately and should be read in conjunction with the Fund's financial statements.

Curian/American Funds (continued)

Capital Research and Management Company

(Unaudited)

Curian/American Funds® Global Growth Fund

Average Annual Total Returns* | |

| 1 Year | | | 2.06 | | |

Since Inception | | | 9.38 | | |

(Inception date September 16, 2013) | |

Curian/American Funds® Growth Fund

Average Annual Total Returns* | |

| 1 Year | | | 7.98 | % | |

Since Inception | | | 14.81 | % | |

(Inception date February 6, 2012) | |

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but not do not reflect the deduction of insurance charges.

*The Fund's investment adviser waived certain expenses of the Fund. Performance results shown reflect the waiver, without which they would have been lower.

Curian Variable Series Trust Master Feeder Funds and Fund of Funds

Schedules of Investments (in thousands)

December 31, 2014

Curian Guidance - Interest Rate Opportunities Fund

| | Shares | | Value | |

INVESTMENT COMPANIES - 100.0% | | | | | |

| | | | | |

ALTERNATIVE - 67.0% | | | | | |

Curian Long Short Credit Fund (2.3%) (a) | | 852 | | $ | 8,264 | |

Curian/BlackRock Global Long Short Credit Fund (2.2%) (a) | | 809 | | 8,271 | |

Curian/FAMCO Flex Core Covered Call Fund (1.0%) (a) | | 208 | | 2,572 | |

Curian/UBS Global Long Short Fixed Income Opportunities Fund (4.8%) (a) | | 870 | | 8,279 | |

JNL/Brookfield Global Infrastructure and MLP Fund - Class A (0.2%) (a) | | 202 | | 3,103 | |

JNL/Invesco Global Real Estate Fund - Class A (0.2%) (a) | | 379 | | 4,108 | |

| | | | 34,597 | |

DOMESTIC FIXED INCOME - 25.0% | | | | | |

JNL/PIMCO Real Return Fund - Class A (0.3%) (a) | | 496 | | 5,187 | |

JNL/PPM America Floating Rate Income Fund - Class A (0.5%) (a) | | 728 | | 7,753 | |

| | | | 12,940 | |

INTERNATIONAL FIXED INCOME - 8.0% | | | | | |

JNL/Goldman Sachs Emerging Markets Debt Fund - Class A (0.6%) (a) | | 394 | | 4,128 | |

Total Investment Companies (cost $52,861) | | | | 51,665 | |

Total Investments - 100.0% (cost $52,861) | | | | 51,665 | |

Other Assets and Liabilities - Net - (0.0%) | | | | (12 | ) |

Total Net Assets - 100.0% | | | | $ | 51,653 | |

Curian Guidance - Multi-Strategy Income Fund

INVESTMENT COMPANIES - 100.0% | | | | | |

| | | | | |

ALTERNATIVE - 20.1% | | | | | |

Curian Long Short Credit Fund (0.5%) (a) | | 196 | | $ | 1,907 | |

Curian/BlackRock Global Long Short Credit Fund (0.5%) (a) | | 187 | | 1,907 | |

Curian/FAMCO Flex Core Covered Call Fund (0.2%) (a) | | 48 | | 595 | |

Curian/UBS Global Long Short Fixed Income Opportunities Fund (1.1%) (a) | | 200 | | 1,907 | |

JNL/Brookfield Global Infrastructure and MLP Fund - Class A (0.1%) (a) | | 47 | | 718 | |

JNL/Invesco Global Real Estate Fund - Class A (0.0%) (a) | | 88 | | 952 | |

| | | | 7,986 | |

DOMESTIC FIXED INCOME - 46.0% | | | | | |

Curian/DoubleLine Total Return Fund (0.5%) (a) | | 524 | | 5,565 | |

Curian/PIMCO Credit Income Fund (4.7%) (a) | | 382 | | 4,175 | |

JNL/PIMCO Real Return Fund - Class A (0.1%) (a) | | 114 | | 1,194 | |

JNL/PPM America Floating Rate Income Fund - Class A (0.3%) (a) | | 429 | | 4,569 | |

JNL/PPM America High Yield Bond Fund - Class A (0.1%) (a) | | 418 | | 2,780 | |

| | | | 18,283 | |

GLOBAL FIXED INCOME - 24.5% | | | | | |

JNL/Franklin Templeton Global Multisector Bond Fund - Class A (0.3%) (a) | | 483 | | 5,560 | |