UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22613

Jackson Variable Series Trust

(Exact name of registrant as specified in charter)

1 Corporate Way, Lansing, Michigan, 48951

(Address of principal executive offices) (Zip code)

225 West Wacker Drive, Suite 1200, Chicago, Illinois 60606

(Mailing address)

Daniel W. Koors

Jackson National Asset Management, LLC

225 West Wacker Drive, Suite 1200

Chicago, Illinois 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312)338-5800

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Shareholders.

ANNUAL REPORT December 31, 2019 |  |

Jackson Variable Series Trust

• Master Feeder Funds and Funds of Funds

• Sub-Advised Funds

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from Jackson. Instead, the reports will be made available on Jackson’s website (www.jackson.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from Jackson electronically by doing one of the following:

• Mailing in the postage-paid card on the cover of this report;

• Calling 1-866-349-4564; or

• Signing up on www.jackson.com

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. You can inform Jackson that you wish to continue receiving paper copies of your shareholder reports by contacting the appropriate Jackson Service Center. Your election to receive reports in paper will apply to all Funds held in each variable contract you purchased from Jackson.

Please note that if you own more than one variable contract with Jackson, your delivery preferences must be set up for each variable contract separately.

Issued by Jackson National Life Insurance Company 1 Corporate Way, Lansing, MI 48951 |

This report is for the general information of qualified plan participants, as well as contract/policy owners of the PerspectiveSM, Perspective II®, Perspective AdvisorsSM, Perspective AdvisorySM, Perspective Advisors IISM, Perspective Advisory II®, Perspective Advisory II® (New York), Perspective L Series, Perspective Rewards®, CuriangardSM, Perspective AdvantageSM, Perspective Focus®, Fifth Third Perspective, Jackson Private WealthSM, Retirement Latitudes®, Elite Access®, Elite Access AdvisorySM, Elite Access Advisory IISM, Elite Access Advisory IISM (New York), Perspective (New York), Perspective II (New York), Perspective Advisors II (New York), Perspective L Series (New York), Curiangard (New York), Perspective Advisors (New York), Perspective Focus (New York), Perspective Rewards (New York) and Elite Access (New York). Not all the portfolios are available in all of the products. Jackson is the marketing name for Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and Jackson National Life Insurance Company of New York® (Home Office: Purchase, New York).

1 Corporate Way

Lansing, MI 48951

Toll Free: 1-800-873-5654

IMPORTANT NOTICE REGARDING DELIVERY OF SHAREHOLDER DOCUMENTS

Dear Client:

If you are a current member of a household with multiple variable products, and have not instructed Jackson otherwise, you currently receive only one copy of the following general documents: Prospectus, Annual and Semi-Annual Report, and other documents as permitted under applicable federal laws relating to Jackson’s variable products and their underlying investment options.

We will continue to send one such copy of these general documents unless and until we receive contrary instructions from you. This delivery policy does not apply to account statements, confirmation statements, or other documents reflecting transaction activity, which you will continue to receive individually.

You may choose to receive a separate copy of these general documents at any time by contacting us toll-free at 1-800-873-5654. Once we receive your request, we will start sending you separate copies within 30 days of receipt of your request.

If you would rather receive your prospectus and other documents via e-mail, please register for Jackson’s Green Delivery Program by visiting the www.Jackson.com. Our Go Paperless process is quick and easy for policyholders – just have your policy number available when you register.

Jackson appreciates your cooperation as we do our part to aid the environment by reducing the amount of paper we distribute. While we’re committed to providing you with the information you need in the format you prefer, we are always looking for new ways to operate more efficiently.

Variable Products issued by Jackson National Life Insurance Company® and distributed by Jackson National Life Distributors LLC, member FINRA. 800/873-5654

Jackson Variable Series Trust

December 31, 2019

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds including: JNL Conservative Allocation Fund, JNL Institutional Alt 100 Fund, JNL Moderate Allocation Fund, JNL/American Funds® Global Growth Fund, JNL/American Funds® Growth Fund

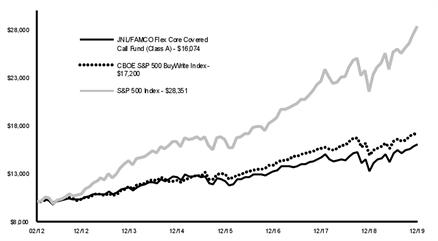

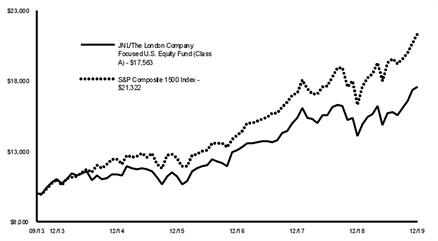

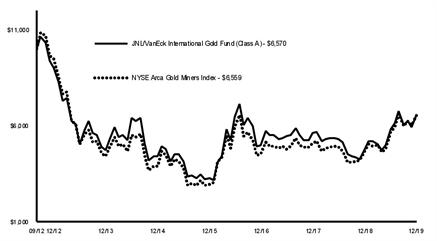

Jackson Variable Series Trust Sub-Advised Funds including: JNL iShares Tactical Growth Fund, JNL iShares Tactical Moderate Fund, JNL iShares Tactical Moderate Growth Fund, JNL/DFA U.S. Small Cap Fund, JNL/DoubleLine® Total Return Fund, JNL/Eaton Vance Global Macro Absolute Return Advantage Fund, JNL/FAMCO Flex Core Covered Call Fund, JNL/Lazard International Strategic Equity Fund, JNL/Mellon Equity Income Fund, JNL/Neuberger Berman Commodity Strategy Fund, JNL/Neuberger Berman Currency Fund, JNL/Nicholas Convertible Arbitrage Fund, JNL/PIMCO Investment Grade Credit Bond Fund, JNL/T. Rowe Price Capital Appreciation Fund, JNL/The London Company Focused U.S. Equity Fund, JNL/VanEck International Gold Fund, JNL/WCM Focused International Equity Fund

Market Summary 2

Management Discussion and Fund Performance 3

Schedules of Investments 20

Statements of Assets and Liabilities 65

Statements of Operations 68

Statements of Changes in Net Assets 71

Financial Highlights 78

Notes to Financial Statements 83

Report of Independent Registered Public Accounting Firm 111

Additional Disclosures 113

Jackson Variable Series Trust Trustees and Officers Information 115

Jackson Variable Series Trust Approval of the Trust’s Investment Advisory and Sub-Advisory Agreements 120

Jackson Variable Series Trust Liquidity Risk Management Program 126

Jackson Variable Series Trust Supplements to Prospectus

Variable Products issued by Jackson National Life Insurance Company® and distributed by Jackson National Life Distributors LLC, member FINRA. 800/873-5654

Jackson Variable Series Trust

December 31, 2019

Dear Investor,

Enclosed is the annual report for the Jackson Variable Series Trust for the year ended December 31, 2019, together with Management’s Discussion of Fund Performance for each of the Funds.

Enclosed is the annual report for the Jackson Variable Series Trust for the year ended December 31, 2019, together with Management’s Discussion of Fund Performance for each of the Funds.

It was a terrific year for investors in 2019. U.S. stocks and bonds posted big gains coming off a significant stock market downswing during the fourth quarter of 2018. The S&P 500 Index finished up 31.5%, book ended by double digit gains in the first quarter and a strong 9.0% fourth quarter gain to finish the year. The rally came early and quickly as equities boasted their best January in more than 30 years as the U.S. Federal Reserve (“Fed”) signaled “patience” regarding further interest rate hikes in what later became known as the “Fed Pivot” towards easier monetary policy. Stocks mostly bumped along during the middle part of the year in the face of uncertainty about global economic growth, trade, Brexit and fears of recession in the U.S. All that doubt went away in the fourth quarter, however, as leading economic indicators bottomed, “Phase One” of a China U.S. trade pact was announced, Boris Johnson won the UK election convincingly and the Fed completed the last of three rate cuts to reignite the rally into year end.

Stocks were not the only risk assets to perform well in 2019, as high yield bonds and emerging market debt put up big numbers during the first quarter as well. When those areas cooled off amid economic and trade turmoil mid year, government bonds benefitted as interest rates plummeted amid an investor flight to safety. All told, the Bloomberg Barclays U.S. Aggregate Bond Index finished up 8.7%, while non core areas such as high yield and emerging market debt earned double digit gains, in what was a strong year overall for fixed income.

Other market trends during the year included U.S. stocks handily beating international equities, large cap stocks besting small caps, and growth beating value. While international stocks (represented by the MSCI ACWI ex USA Index) gained what in any other year would be considered a strong 21.5%, those returns paled in comparison to U.S. stocks. Especially disappointing was the performance of emerging market equities, which lagged despite fully participating in the “risk on” rally during the fourth quarter. The large growth MSCI USA Growth Index gained 37.7% as the standout area of the U.S. market, boosted by a more than 50.0% rise in information technology. U.S. small value stocks lagged the broader market with a little less than a 23.0% gain, though that still was better than international results. Energy was by far the weakest sector in delivering only 11.8% on the year.

Another trend in the industry has been the torrid pace of assets pouring into Index Funds and Exchange Traded Funds, or generally speaking passive investment strategies. The relatively low cost and broad diversification of Index Funds make them suitable investment options for many investors, but they are not perfect. Market cap weighted indexes are subject to a momentum effect wherein strong performers become an ever greater part of the Index on both a security and sector level. Given their structure, market cap weighted index offerings are in effect a subtle bet that what has worked well will continue to work well. While that has been the case of late amid a rising market, when the tide turns that momentum effect can work in the opposite direction, such was the case during the market correction in the fourth quarter of 2018.

The Greek philosopher Aristotle is typically credited with promoting the principle of “moderation in all things.” The investment equivalent of that principle is diversification. Diversification is more than just spreading out investments among different securities and asset classes. Diversification also means balancing out exposure to a wide array of biases and risks, including different investment styles, security selection strategies, portfolio construction techniques and even the asset management firms themselves. At Jackson, we seek to offer investors the building blocks for creating well diversified portfolios and the freedom to do so however they see fit. While it is seldom glamorous or flashy, diversification (moderation) in investing offers a steady construct for managing risk and achieving one’s investment goals.

Geopolitical and macroeconomic forces largely drove market returns in 2019. We think company fundamentals now need to take the baton to deliver on earnings and growth to sustain the global rally. Promising economic data and a strong U.S. consumer are leading markets to believe that can happen, but regardless of what transpires in 2020, moderation and diversification are the tools that can help investors stay focused on their long term goals.

Thank you for choosing Jackson for your investment needs.

Mark D. Nerud

President and Chief Executive Officer

Jackson Variable Series Trust

1

| Jackson Variable Series Trust Master Feeder Funds and Funds of Funds Market Summary (Unaudited) |

Major Indices Returns for the Year Ended December 31, 2019

Domestic Equity | Developed International Equity | ||||||||

S&P 500 Index | 31.49 | % | MSCI All Country World ex-USA Index (Net) | 21.51 | % | ||||

S&P MidCap 400 Index | 26.20 | MSCI EAFE Index (Net) | 22.01 | ||||||

S&P Small Cap 600 Index | 22.78 | ||||||||

MSCI USA Index | 31.64 | ||||||||

MSCI USA Mid Cap Index | 30.84 | Emerging Markets | |||||||

MSCI USA Small Cap Index | 27.38 | MSCI Emerging Markets Index (Net) | 18.42 | % | |||||

Fixed Income | Alternative Assets | ||||||||

Bloomberg Barclays Global Aggregate Bond Index | 6.84 | % | Bloomberg Commodity Index | 7.69 | % | ||||

Bloomberg Barclays U.S. Aggregate Bond Index | 8.72 | MSCI US REIT Index | 24.33 | ||||||

Bloomberg Barclays U.S. Corporate High Yield Bond Index | 14.32 | ||||||||

Alternative Strategy | |||||||||

Wilshire Liquid Alternative Index | 6.65 | % | |||||||

Domestic Equity: It was a terrific year for U.S. equity investors. After a tough end to 2018, stocks rallied hard to start and finish the year with only a few minor hiccups in between. The broad market S&P 500 Index finished 2019 up more than 30%, with most other major indices not far behind. The year began with the “Fed Pivot” that halted a move towards higher interest rates and a “normalized” rate environment, thereby soothing market concerns about slowing global economic growth. Mid-year worries about the impact of Brexit, a trade war with China, and fears of recession were swept aside by three interest rate cuts by the U.S. Federal Reserve (“Fed”), clearing the way for a strong finish to the year. The rally was led by growth stocks, especially large-growth stocks, as technology names climbed more than 50%. But by the end of the year the rally had become more broad-based. Traditionally defensive sectors of the market such as Real Estate and Utilities soared amid the mid-year swoon when economic fears were greatest. Even struggling Financials staged a late rebound buoyed by strong consumer sentiment boosted by continued low unemployment. Only Energy remained a persistent laggard, hampered by a glut of oil and natural gas supply on the market. Markets seem more tied to global events and the news cycle than ever before. Given this dynamic it is difficult for investors to know which way markets may go in the near term.

Fixed Income: Similar to U.S. equities, fixed income markets saw riskier bonds rewarded early and late in the year, with traditional safe havens prospering in between. Corporate credits and high-yield bonds got off to a strong start to the year only for global economic worries and recession fears to weigh on returns after the initial euphoria following the Fed Pivot. Concerns were magnified as massive foreign buying of US Treasuries caused yields to plummet mid-year leading to an inversion of the yield curve (where long-term rates are lower than short-term rates), which some view as a potential sign of an oncoming economic recession. However, the bond market eventually interpreted the conclusion of Fed rate cutting in the Fall as a sign that the economy was in solid shape, and the “risk on” rally resumed. This time, emerging market debt led the market surge into year end, with high-yield and corporate credits not far behind.

Developed International Equity: Although it’s difficult to describe returns that topped 20% as sluggish, foreign equities significantly lagged the U.S. for most of the year. Europe was dogged by poor economic data, centered on Germany, and lingering concerns about Brexit for much of the year. Widespread negative interest rates and the perception that the European Central Bank (ECB) might be out of ammunition in case the region entered recession plagued investor sentiment. The election of Boris Johnson in the UK and the bottoming of leading economic indicators, however, seemed to provide needed clarity to investors that helped drive developed markets to keep pace with the U.S. during the fourth quarter.

Emerging Markets: After struggling in 2018, emerging market equities seemed poised to shine in 2019. It didn’t happen. At least not for the first three quarters of the year. Expectations for a weakening US dollar to boost emerging economies never materialized as the dollar remained stable. Economic weakness in European end markets as well as slowing growth in China also served to dampen expectations and investor sentiment despite relatively attractive valuations. The political and economic clarity that lifted the gloom on developed foreign markets toward the end of the year also boosted emerging markets. Emerging market bonds and equities led the fourth quarter rally, with the latter posting double-digit gains in outpacing the rest of the world.

Alternatives: It was a mixed year for alternatives as real assets mostly soared along with U.S. equities while many alternative strategies struggled to keep pace with fixed income returns. The dispersion in assets was notable as equity-oriented real estate and global infrastructure plays far outgained the modest returns of commodities weighed down by energy woes and a still strong U.S. dollar. While some alternative strategies managed solid double-digit gains, especially in the Hedged Equity and Global Macro segments, others only managed to return single digits. Results from Currency and Managed Futures strategies were especially frustrating. Although the main purpose of alternatives is to serve as low-correlated diversifiers, after failing to meaningfully fulfill that role in 2018, investors may view 2019 as another disappointment.

2

| Funds of Funds Jackson National Asset Management, LLC (Unaudited) |

JNL Conservative Allocation Fund, JNL Moderate Allocation Fund and JNL Institutional Alt 100 Fund (collectively “Funds of Funds”) seek to achieve their investment objectives by investing in shares of a diversified group of affiliated Underlying Funds (“Underlying Funds”). The Schedules of Investments and Financial Statements for the Underlying Funds are available at www.jackson.com or on the SEC’s website at www.sec.gov.

JNL Conservative Allocation Fund

Composition as of December 31, 2019: | ||

Domestic Fixed Income | 61.7 | % |

Domestic Equity | 9.5 | |

Domestic Balanced | 8.2 | |

Emerging Markets Fixed Income | 6.0 | |

Global Fixed Income | 5.0 | |

International Equity | 4.5 | |

Alternative | 3.3 | |

Emerging Markets Equity | 1.8 | |

Total Investments | 100.0 | % |

For the year ended December 31, 2019, JNL Conservative Allocation Fund outperformed its benchmark by posting a return of 12.46% for Class A shares compared to 8.13% for the Dow Jones Conservative Index. The Fund outperformed its blended benchmark return of 12.26% for the 20% MSCI All Country World Index (Net), 80% Bloomberg Barclays U.S. Aggregate Bond Index. Effective June 24, 2019, the Morningstar Conservative Target Risk Index became the Fund’s primary benchmark. The Fund outperformed its new primary benchmark, which posted a return of 11.22%.

The investment objective of the Fund is to seek the generation of income through investment in other funds.

Under normal circumstances, the Fund allocates approximately 0% to 40% of its assets to Underlying Funds that invest primarily in equity securities, 60% to 100% to Underlying Funds that invest primarily in fixed income securities and 0% to 20% of its assets to Underlying Funds that invest primarily in money market securities.

The Fund outperformed its benchmark during the year mainly due to an overweight to equities in general and the performance of international equity sleeve in particular. U.S. equities delivered superb absolute returns, though the domestic equity sleeve trailed the broader market. A quality bias helped JNL/Morningstar Wide Moat Index Fund (+35.11%) outperform but wasn’t enough to offset a core position in the conservative leaning JNL/T. Rowe Price Capital Appreciation Fund (+24.44%) that lagged amid the huge equity rally. Strong stock selection from JNL/WCM Focused International Equity Fund (+35.82%) contributed most of the outperformance internationally.

The fixed income sleeve was a modestly positive relative contributor thanks to credit and non-core exposure from JNL/PIMCO Investment Grade Credit Bond Fund (+14.75%), JNL/DoubleLine Emerging Markets Fixed Income Fund (+11.67%) and JNL/PPM America Total Return Fund (+10.35%). Less interest rate sensitive Funds like JNL/Franklin Templeton Global Multisector Bond Fund (+1.39%) and JNL/DoubleLine Total Return Fund (+5.91%) were detractors. As expected amid a big equity rally, most allocations to alternative strategies lagged stocks—though a core position in JNL Multi-Manager Alternative Fund (+9.47%) did outperform the broader alternative universe and kept pace with bonds.

JNL Institutional Alt 100 Fund

Composition as of December 31, 2019: | ||

Alternative | 100.0 | % |

Total Investments | 100.0 | % |

For the year ended December 31, 2019, JNL Institutional Alt 100 Fund outperformed its primary benchmark by posting a return of 11.17% for Class A shares compared to 6.68% for the Wilshire Liquid Alternative Index.

The investment objective of the Fund is to seek long term growth of capital through investment in other funds.

Under normal circumstances, the Fund typically allocates approximately 0% to 20% of its assets to Underlying Funds investing in fixed income securities; 0% to 20% of its assets to Underlying Funds investing in equity securities; and 80% to 100% of its assets to Underlying Funds investing in alternative securities.

The Fund outperformed its blended benchmark due to strong returns across the alternatives universe. Real assets exposure through JNL/First State Global Infrastructure Fund (27.24%) and JNL/Heitman US Focused Real Estate Fund (+25.67%) contributed positively due to investor preference for steady equity like yield plays. Strategies with more equity exposure such as JNL/JPMorgan Hedged Equity Fund (+13.59%) also generally performed better than other alternative strategies. JNL/Eaton Vance Global Macro Absolute Return Advantage Fund (+14.90%), JNL/Neuberger Berman Commodity Strategy Fund (+12.48%) and JNL/Westchester Capital Event Driven Fund (+12.16%) also delivered strong absolute and relative returns. A core position in JNL Multi-Manager Alternative Fund (+9.47%) outperformed the broad alternatives benchmark and contributed positively to performance. On the negative side, JNL/Neuberger Berman Currency Fund (+0.41%) and JNL/Boston Partners Global Long Short Equity Fund (+5.12%) were the primary underperformers.

JNL Moderate Allocation Fund

Composition as of December 31, 2019: | ||

Domestic Fixed Income | 45.1 | % |

Domestic Equity | 17.9 | |

Domestic Balanced | 10.5 | |

International Equity | 8.4 | |

Emerging Markets Fixed Income | 4.5 | |

Global Fixed Income | 4.0 | |

Alternative | 3.7 | |

Emerging Markets Equity | 3.6 | |

Global Equity | 2.3 | |

Total Investments | 100.0 | % |

For the year ended December 31, 2019, JNL Moderate Allocation Fund outperformed its benchmark by posting a return of 15.67% for Class A shares compared to 14.14% for the Dow Jones Moderately Conservative Index. The Fund underperformed its blended benchmark return of 15.83% for the 40% MSCI All Country World Index (Net), 60% Bloomberg Barclays U.S. Aggregate Bond Index. Effective June 24, 2019, the Morningstar Moderately Conservative Target Risk Index became the Fund’s primary benchmark. The Fund outperformed its new primary benchmark, which posted a return of 15.25%.

The investment objective of the Fund is to seek a balance between the generation of income and the long term growth of capital through investment in other funds.

Under normal circumstances, the Fund allocates approximately 20% to 60% of its assets to Underlying Funds that invest primarily in equity securities, 40% to 80% to Underlying Funds that invest primarily in fixed income securities and 0% to 20% of its assets to Underlying Funds that invest primarily in money market securities.

The Fund outperformed its benchmark during the year mainly due to an overweight to equities in general and the performance of international equity sleeve in particular. U.S. equities delivered superb absolute returns, though the domestic equity sleeve trailed the broader market. A quality bias helped JNL/Morningstar Wide Moat Index Fund (+35.11%) outperform but wasn’t enough to offset a core position in the conservative-leaning JNL/T. Rowe Price Capital Appreciation Fund (+24.44%) that lagged amid the huge equity rally. Strong stock selection from JNL/WCM Focused International Equity Fund (+35.82%) contributed most of the outperformance internationally aided by solid results from JNL Multi-Manager International Small Cap Fund (+32.06%).

The fixed income sleeve was a modestly positive relative contributor thanks to credit and non-core exposure from JNL/PIMCO Investment Grade Credit Bond Fund (+14.75%), JNL/DoubleLine Emerging Markets Fixed Income Fund (+11.67%) and JNL/PPM America Total Return Fund (+10.35%). Less

3

| Funds of Funds Jackson National Asset Management, LLC (Unaudited) |

interest-rate sensitive Funds like JNL/Franklin Templeton Global Multisector Bond Fund (+1.39%) and JNL/DoubleLine Total Return Fund (+5.91%) were detractors. As expected amid a big equity rally, most allocations to alternative strategies lagged stocks—though a core position in JNL Multi-Manager Alternative Fund (+9.47%) did outperform the broader alternative universe and kept pace with bonds.

4

| Funds of Funds Jackson National Asset Management, LLC (Unaudited) |

JNL Conservative Allocation Fund

¹Effective June 24, 2019, the Fund changed its primary benchmark from the Dow Jones Conservative Index to the Morningstar Conservative Target Risk Index to better align the Fund with its benchmark holdings.

††20% MSCI All Country World Index (Net), 80% Bloomberg Barclays U.S. Aggregate Bond Index

Average Annual Total Returns |

| |||||

Class A‡ |

|

|

| Class I† |

|

|

1 Year | 12.46 | % | 1 Year | 12.76 | % | |

5 Year | 3.84 |

|

| 5 Year | N/A |

|

Since Inception | 3.79 |

|

| Since Inception | 4.76 |

|

‡Inception date February 06, 2012 |

| |||||

†Inception date September 25, 2017 |

| |||||

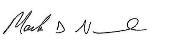

The graph shows the change in value of an assumed $10,000 investment in the Fund's Class A shares over 10 years, or since inception if the inception is less than 10 years, as well as the Fund's benchmark(s) performance for the same period.

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but do not reflect the deduction of insurance charges.

Effective April 27, 2015, Jackson National Asset Management assumed responsibility as investment adviser for the Fund.

JNL Institutional Alt 100 Fund

Average Annual Total Returns |

| |||||

Class A‡ |

|

|

| Class I† |

|

|

1 Year | 11.17 | % | 1 Year | 11.79 | % | |

5 Year | 1.59 |

|

| 5 Year | N/A |

|

Since Inception | 2.07 |

|

| Since Inception | 3.56 |

|

‡Inception date February 06, 2012 |

| |||||

†Inception date September 25, 2017 |

| |||||

The graph shows the change in value of an assumed $10,000 investment in the Fund's Class A shares over 10 years, or since inception if the inception is less than 10 years, as well as the Fund's benchmark(s) performance for the same period.

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but do not reflect the deduction of insurance charges.

Effective April 27, 2015, Jackson National Asset Management assumed responsibility as investment adviser for the Fund.

JNL Moderate Allocation Fund

¹Effective June 24, 2019, the Fund changed its primary benchmark from the Dow Jones Moderately Conservative Index to the Morningstar Moderately Conservative Target Risk Index to better align the Fund with its benchmark holdings.

††40% MSCI All Country World Index (Net), 60% Bloomberg Barclays U.S. Aggregate Bond Index

Average Annual Total Returns |

| |||||

Class A‡ |

|

|

| Class I† |

|

|

1 Year | 15.67 | % | 1 Year | 16.02 | % | |

5 Year | 4.75 |

|

| 5 Year | N/A |

|

Since Inception | 5.66 |

|

| Since Inception | 5.55 |

|

‡Inception date February 06, 2012 |

| |||||

†Inception date September 25, 2017 |

| |||||

The graph shows the change in value of an assumed $10,000 investment in the Fund's Class A shares over 10 years, or since inception if the inception is less than 10 years, as well as the Fund's benchmark(s) performance for the same period.

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but do not reflect the deduction of insurance charges.

Effective April 27, 2015, Jackson National Asset Management assumed responsibility as investment adviser for the Fund.

5

| Master Feeder Funds Capital Research and Management Company (Unaudited) |

JNL/American Funds Global Growth Fund

Composition as of December 31, 2019: | ||

Global Equity | 100.0 | % |

Total Investments | 100.0 | % |

For the year ended December 31, 2019, JNL/American Funds Global Growth Fund outperformed its primary benchmark by posting a return of 34.96% for Class A shares compared to 26.60% for the MSCI All Country World Index (Net).

The Fund seeks long-term growth of capital through exclusive investment in Class 1 shares of American Funds Insurance Series® - Global Growth FundSM (the “Master Fund”). The performance of the Fund is directly related to the performance of the Master Fund. The financial statements of the Master Fund, including the Schedule of Investments and portfolio manager commentary, are provided separately and should be read in conjunction with the Fund’s financial statements.

JNL/American Funds Growth Fund

Composition as of December 31, 2019: | ||

Domestic Equity | 100.0 | % |

Total Investments | 100.0 | % |

For the year ended December 31, 2019, JNL/American Funds Growth Fund underperformed its primary benchmark by posting a return of 30.32% for Class A shares compared to 31.49% for the S&P 500 Index.

The Fund seeks growth of capital through exclusive investment in Class 1 shares of American Funds Insurance Series® - Growth FundSM (the “Master Fund”). The performance of the Fund is directly related to the performance of the Master Fund. The financial statements of the Master Fund, including the Schedule of Investments and portfolio manager commentary, are provided separately and should be read in conjunction with the Fund’s financial statements.

JNL/American Funds Global Growth Fund

Average Annual Total Returns* |

| |||||

Class A‡ |

|

|

| Class I† |

|

|

1 Year | 34.96 | % | 1 Year | 35.39 | % | |

5 Year | 11.43 |

|

| 5 Year | N/A |

|

Since Inception | 11.01 |

|

| Since Inception | 11.95 |

|

‡Inception date September 16, 2013 |

| |||||

†Inception date September 25, 2017 |

| |||||

*The Fund's investment adviser waived/reimbursed certain expenses of the Fund. Performance results shown reflect the waiver, without which performance results would have been lower. |

| |||||

The graph shows the change in value of an assumed $10,000 investment in the Fund's Class A shares over 10 years, or since inception if the inception is less than 10 years, as well as the Fund's benchmark(s) performance for the same period.

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but do not reflect the deduction of insurance charges.

JNL/American Funds Growth Fund

Average Annual Total Returns* |

| |||||

Class A‡ |

|

|

| Class I† |

|

|

1 Year | 30.32 | % | 1 Year | 30.75 | % | |

5 Year | 13.96 |

|

| 5 Year | N/A |

|

Since Inception | 14.27 |

|

| Since Inception | 15.80 |

|

‡Inception date February 06, 2012 |

| |||||

†Inception date September 25, 2017 |

| |||||

*The Fund's investment adviser waived/reimbursed certain expenses of the Fund. Performance results shown reflect the waiver, without which performance results would have been lower. |

| |||||

The graph shows the change in value of an assumed $10,000 investment in the Fund's Class A shares over 10 years, or since inception if the inception is less than 10 years, as well as the Fund's benchmark(s) performance for the same period.

Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, but do not reflect the deduction of insurance charges.

6

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Schedules of Investments (in thousands)

December 31, 2019

Shares | Value ($) | ||||||

JNL Conservative Allocation Fund | |||||||

INVESTMENT COMPANIES 100.0% | |||||||

Domestic Fixed Income 61.7% | |||||||

JNL/Crescent High Income Fund - Class I (4.2%) (a) | 2,018 | 22,096 | |||||

JNL/DoubleLine Core Fixed Income Fund - Class I (1.4%) (a) | 4,082 | 58,126 | |||||

JNL/DoubleLine Total Return Fund - Class I (2.9%) (a) | 6,994 | 78,965 | |||||

JNL/PIMCO Income Fund - Class I (2.8%) (a) | 4,181 | 44,194 | |||||

JNL/PIMCO Investment Grade Credit Bond Fund - Class I (2.9%) (a) | 2,650 | 32,543 | |||||

JNL/PIMCO Real Return Fund - Class I (0.7%) (a) | 877 | 9,300 | |||||

JNL/PPM America Total Return Fund - Class I (3.0%) (a) | 3,297 | 41,843 | |||||

287,067 | |||||||

Domestic Equity 9.5% | |||||||

JNL Multi-Manager Mid Cap Fund - Class I (0.8%) (a) | 654 | 9,310 | |||||

JNL Multi-Manager Small Cap Growth Fund - Class I (0.1%) (a) | 103 | 3,489 | |||||

JNL Multi-Manager Small Cap Value Fund - Class I (0.4%) (a) | 326 | 4,655 | |||||

JNL/DoubleLine Shiller Enhanced CAPE Fund - Class I (0.3%) (a) | 349 | 5,827 | |||||

JNL/Morningstar Wide Moat Index Fund - Class I (2.9%) (a) | 1,677 | 20,919 | |||||

44,200 | |||||||

Domestic Balanced 8.3% | |||||||

JNL/T. Rowe Price Capital Appreciation Fund - Class I (0.6%) (a) | 2,217 | 38,380 | |||||

Emerging Markets Fixed Income 6.0% | |||||||

JNL/DoubleLine Emerging Markets Fixed Income Fund - Class I (4.3%) (a) | 2,392 | 27,910 | |||||

Global Fixed Income 5.0% | |||||||

JNL/Franklin Templeton Global Multisector Bond Fund - Class I (2.1%) (a) | 2,345 | 23,353 | |||||

International Equity 4.5% | |||||||

JNL/Causeway International Value Select Fund - Class I (0.7%) (a) | 672 | 10,502 | |||||

JNL/WCM Focused International Equity Fund - Class I (0.6%) (a) | 623 | 10,467 | |||||

20,969 | |||||||

Alternative 3.2% | |||||||

JNL Multi-Manager Alternative Fund - Class I (1.2%) (a) | 1,407 | 15,123 | |||||

Emerging Markets Equity 1.8% | |||||||

JNL/GQG Emerging Markets Equity Fund - Class I (1.3%) (a) | 754 | 8,179 | |||||

Total Investment Companies (cost $442,348) | 465,181 | ||||||

Total Investments 100.0% (cost $442,348) | 465,181 | ||||||

Other Assets and Liabilities, Net (0.0)% | (113) | ||||||

Total Net Assets 100.0% | 465,068 | ||||||

(a) The Fund's percentage ownership of the underlying affiliated fund at December 31, 2019 is presented parenthetically. The Fund does not invest in the underlying affiliated funds for the purpose of exercising management or control.

JNL Institutional Alt 100 Fund | |||||||

INVESTMENT COMPANIES 100.0% | |||||||

Alternative 100.0% | |||||||

JNL Multi-Manager Alternative Fund - Class I (4.5%) (a) | 5,105 | 54,874 | |||||

JNL/Boston Partners Global Long Short Equity Fund - Class I (8.8%) (a) | 3,454 | 35,434 | |||||

JNL/Eaton Vance Global Macro Absolute Return Advantage Fund - Class I (8.6%) (a) | 1,903 | 19,527 | |||||

JNL/First State Global Infrastructure Fund - Class I (1.9%) (a) | 1,178 | 19,040 | |||||

JNL/Heitman U.S. Focused Real Estate Fund - Class I (5.0%) (a) | 851 | 9,967 | |||||

JNL/JPMorgan Hedged Equity Fund - Class I (7.4%) (a) | 1,983 | 21,081 | |||||

JNL/Neuberger Berman Commodity Strategy Fund - Class I (7.7%) (a) | 762 | 8,419 | |||||

Shares | Value ($) | ||||||

JNL/Neuberger Berman Currency Fund - Class I (9.0%) (a) | 638 | 6,297 | |||||

JNL/Nicholas Convertible Arbitrage Fund - Class I (6.0%) (a) | 822 | 8,966 | |||||

JNL/Westchester Capital Event Driven Fund - Class I (8.9%) (a) | 2,480 | 27,455 | |||||

Total Investment Companies (cost $199,860) | 211,060 | ||||||

Total Investments 100.0% (cost $199,860) | 211,060 | ||||||

Other Assets and Liabilities, Net (0.0)% | (62) | ||||||

Total Net Assets 100.0% | 210,998 | ||||||

(a) The Fund's percentage ownership of the underlying affiliated fund at December 31, 2019 is presented parenthetically. The Fund does not invest in the underlying affiliated funds for the purpose of exercising management or control.

JNL Moderate Allocation Fund | ||||||

INVESTMENT COMPANIES 100.0% | ||||||

Domestic Fixed Income 45.1% | ||||||

JNL/Crescent High Income Fund - Class I (4.0%) (a) | 1,964 | 21,509 | ||||

JNL/DoubleLine Core Fixed Income Fund - Class I (1.3%) (a) | 3,656 | 52,058 | ||||

JNL/DoubleLine Total Return Fund - Class I (3.1%) (a) | 7,303 | 82,456 | ||||

JNL/PIMCO Income Fund - Class I (2.7%) (a) | 3,929 | 41,527 | ||||

JNL/PIMCO Investment Grade Credit Bond Fund - Class I (2.5%) (a) | 2,242 | 27,529 | ||||

JNL/PIMCO Real Return Fund - Class I (1.0%) (a) | 1,298 | 13,771 | ||||

JNL/PPM America Total Return Fund - Class I (2.9%) (a) | 3,130 | 39,722 | ||||

278,572 | ||||||

Domestic Equity 17.9% | ||||||

JNL Multi-Manager Mid Cap Fund - Class I (2.2%) (a) | 1,859 | 26,467 | ||||

JNL Multi-Manager Small Cap Growth Fund - Class I (0.2%) (a) | 185 | 6,273 | ||||

JNL Multi-Manager Small Cap Value Fund - Class I (0.8%) (a) | 656 | 9,374 | ||||

JNL/DoubleLine Shiller Enhanced CAPE Fund - Class I (0.9%) (a) | 1,126 | 18,786 | ||||

JNL/Morningstar Wide Moat Index Fund - Class I (5.1%) (a) | 2,981 | 37,168 | ||||

JNL/T. Rowe Price Established Growth Fund - Class I (0.1%) (a) | 243 | 12,577 | ||||

110,645 | ||||||

Domestic Balanced 10.5% | ||||||

JNL/FPA + DoubleLine Flexible Allocation Fund - Class I (0.8%) (a) | 923 | 12,380 | ||||

JNL/T. Rowe Price Capital Appreciation Fund - Class I (0.8%) (a) | 3,042 | 52,654 | ||||

65,034 | ||||||

International Equity 8.4% | ||||||

JNL Multi-Manager International Small Cap Fund - Class I (2.2%) (a) | 597 | 6,345 | ||||

JNL/Causeway International Value Select Fund - Class I (1.4%) (a) | 1,408 | 21,999 | ||||

JNL/WCM Focused International Equity Fund - Class I (1.4%) (a) | 1,405 | 23,624 | ||||

51,968 | ||||||

Emerging Markets Fixed Income 4.5% | ||||||

JNL/DoubleLine Emerging Markets Fixed Income Fund - Class I (4.3%) (a) | 2,375 | 27,722 | ||||

Global Fixed Income 4.0% | ||||||

JNL/Franklin Templeton Global Multisector Bond Fund - Class I (2.2%) (a) | 2,478 | 24,682 | ||||

Alternative 3.7% | ||||||

JNL Multi-Manager Alternative Fund - Class I (1.5%) (a) | 1,724 | 18,532 | ||||

JNL/Heitman U.S. Focused Real Estate Fund - Class I (2.3%) (a) | 395 | 4,621 | ||||

23,153 | ||||||

Emerging Markets Equity 3.6% | ||||||

JNL/GQG Emerging Markets Equity Fund - Class I (2.4%) (a) | 1,448 | 15,708 | ||||

JNL/Lazard Emerging Markets Fund - Class I (0.8%) (a) | 599 | 6,368 | ||||

22,076 | ||||||

See accompanying Notes to Financial Statements.

Abbreviations, counterparties and additional footnotes are defined on page 9

7

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Schedules of Investments (in thousands)

December 31, 2019

Shares | Value ($) | ||||||

Global Equity 2.3% | |||||||

JNL/Harris Oakmark Global Equity Fund - Class I (1.6%) (a) | 1,286 | 14,161 | |||||

Total Investment Companies (cost $576,765) | 618,013 | ||||||

Total Investments 100.0% (cost $576,765) | 618,013 | ||||||

Other Assets and Liabilities, Net (0.0)% | (145) | ||||||

Total Net Assets 100.0% | 617,868 | ||||||

(a) The Fund's percentage ownership of the underlying affiliated fund at December 31, 2019 is presented parenthetically. The Fund does not invest in the underlying affiliated funds for the purpose of exercising management or control.

JNL/American Funds Global Growth Fund | |||||||

INVESTMENT COMPANIES 100.0% | |||||||

Global Equity 100.0% | |||||||

American Funds Insurance Series - Global Growth Fund - Class 1 (a) | 14,170 | 461,504 | |||||

Total Investment Companies (cost $407,610) | 461,504 | ||||||

Total Investments 100.0% (cost $407,610) | 461,504 | ||||||

Other Assets and Liabilities, Net (0.0)% | (132) | ||||||

Total Net Assets 100.0% | 461,372 | ||||||

(a) Investment in affiliate.

JNL/American Funds Growth Fund | |||||||

INVESTMENT COMPANIES 100.0% | |||||||

Domestic Equity 100.0% | |||||||

American Funds Insurance Series - Growth Fund - Class 1 | 14,968 | 1,215,677 | |||||

Total Investment Companies (cost $1,115,045) | 1,215,677 | ||||||

Total Investments 100.0% (cost $1,115,045) | 1,215,677 | ||||||

Other Assets and Liabilities, Net (0.0)% | (394) | ||||||

Total Net Assets 100.0% | 1,215,283 | ||||||

See accompanying Notes to Financial Statements.

Abbreviations, counterparties and additional footnotes are defined on page 9

8

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Schedules of Investments (in thousands)

December 31, 2019

Abbreviations:

CAPE - Cyclically Adjusted Price Earnings |

U.S. - United States |

Long Term Investments in Affiliates

The Fund of Funds invested solely in shares of other affiliated Funds advised by Jackson National Asset Management, LLC. The following table details each Fund's long term investments in affiliates held during the year ended December 31, 2019.

Affiliate | Value Beginning of Period($) | Purchases($) | Sales Proceeds($) | Distributions from Funds($) | Realized Gain/Loss from Sales($) | Change in Unrealized Appreciation (Depreciation)($) | Value End of Period($) | Percentage of Net Assets(%) | |||||||||||||||||

JNL Conservative Allocation Fund | |||||||||||||||||||||||||

JNL Multi-Manager Alternative Fund - Class I | 11,210 | 4,838 | 2,079 | — | 30 | 1,124 | 15,123 | 3.2 | |||||||||||||||||

JNL Multi-Manager Mid Cap Fund - Class I | 5,303 | 4,136 | 1,916 | — | 196 | 1,591 | 9,310 | 2.0 | |||||||||||||||||

JNL Multi-Manager Small Cap Growth Fund - Class I | 2,708 | 1,005 | 1,154 | — | 115 | 815 | 3,489 | 0.7 | |||||||||||||||||

JNL Multi-Manager Small Cap Value Fund - Class I | 2,648 | 2,361 | 1,110 | — | (139 | ) | 895 | 4,655 | 1.0 | ||||||||||||||||

JNL/Boston Partners Global Long Short Equity Fund - Class I | 2,603 | 378 | 3,034 | — | (202 | ) | 255 | — | — | ||||||||||||||||

JNL/Causeway International Value Select Fund - Class I | 9,589 | 4,381 | 4,448 | 852 | (386 | ) | 1,366 | 10,502 | 2.3 | ||||||||||||||||

JNL/Crescent High Income Fund - Class I | 10,301 | 11,532 | 1,394 | — | (23 | ) | 1,680 | 22,096 | 4.7 | ||||||||||||||||

JNL/DoubleLine Core Fixed Income Fund - Class I | 31,814 | 27,973 | 3,394 | 1,510 | 109 | 1,624 | 58,126 | 12.5 | |||||||||||||||||

JNL/DoubleLine Emerging Markets Fixed Income Fund - Class I | 23,216 | 6,898 | 4,879 | — | (77 | ) | 2,752 | 27,910 | 6.0 | ||||||||||||||||

JNL/DoubleLine Shiller Enhanced CAPE Fund - Class I | 9,720 | 1,395 | 7,352 | — | (416 | ) | 2,480 | 5,827 | 1.3 | ||||||||||||||||

JNL/DoubleLine Total Return Fund - Class I | 46,465 | 33,833 | 4,784 | — | 130 | 3,321 | 78,965 | 17.0 | |||||||||||||||||

JNL/Eaton Vance Global Macro Absolute Return Advantage Fund - Class I | 2,575 | 114 | 2,737 | — | (126 | ) | 174 | — | — | ||||||||||||||||

JNL/FPA + DoubleLine Flexible Allocation Fund - Class I | 12,202 | 2,735 | 16,972 | — | 876 | 1,159 | — | — | |||||||||||||||||

JNL/Franklin Templeton Global Multisector Bond Fund - Class I | 23,981 | 11,481 | 10,048 | 2,254 | (89 | ) | (1,972 | ) | 23,353 | 5.0 | |||||||||||||||

JNL/GQG Emerging Markets Equity Fund - Class I | 6,084 | 3,065 | 2,202 | 31 | (115 | ) | 1,347 | 8,179 | 1.8 | ||||||||||||||||

JNL/Heitman U.S. Focused Real Estate Fund - Class I | 1,715 | 59 | 1,975 | — | 53 | 148 | — | — | |||||||||||||||||

JNL/Morningstar Wide Moat Index Fund - Class I | 12,333 | 11,607 | 6,854 | 82 | 640 | 3,193 | 20,919 | 4.5 | |||||||||||||||||

JNL/Oppenheimer Emerging Markets Innovator Fund - Class I | 4,369 | 1,298 | 6,242 | 63 | (378 | ) | 953 | — | — | ||||||||||||||||

JNL/PIMCO Income Fund - Class I | 22,381 | 22,651 | 2,171 | 970 | 93 | 1,240 | 44,194 | 9.5 | |||||||||||||||||

JNL/PIMCO Investment Grade Credit Bond Fund - Class I | 19,803 | 12,703 | 2,450 | 811 | 61 | 2,426 | 32,543 | 7.0 | |||||||||||||||||

JNL/PIMCO Real Return Fund - Class I | 3,438 | 8,283 | 3,047 | — | 166 | 460 | 9,300 | 2.0 | |||||||||||||||||

JNL/PPM America Total Return Fund - Class I | 26,650 | 15,114 | 3,154 | — | 118 | 3,115 | 41,843 | 9.0 | |||||||||||||||||

JNL/Scout Unconstrained Bond Fund - Class I | 17,232 | 6,372 | 24,733 | — | 545 | 584 | — | — | |||||||||||||||||

JNL/T. Rowe Price Capital Appreciation Fund - Class I | 27,168 | 13,294 | 8,323 | — | 819 | 5,422 | 38,380 | 8.3 | |||||||||||||||||

JNL/WCM Focused International Equity Fund - Class I | 10,583 | 2,676 | 5,329 | 439 | 170 | 2,367 | 10,467 | 2.2 | |||||||||||||||||

346,091 | 210,182 | 131,781 | 7,012 | 2,170 | 38,519 | 465,181 | 100.0 | ||||||||||||||||||

JNL Institutional Alt 100 Fund | |||||||||||||||||||||||||

JNL Multi-Manager Alternative Fund - Class I | 48,042 | 14,172 | 12,022 | — | 317 | 4,365 | 54,874 | 26.0 | |||||||||||||||||

JNL/AQR Large Cap Relaxed Constraint Equity Fund - Class I | 9,562 | — | 10,323 | — | (643 | ) | 1,404 | — | — | ||||||||||||||||

JNL/AQR Managed Futures Strategy Fund - Class I | 12,237 | 4 | 12,211 | — | (722 | ) | 692 | — | — | ||||||||||||||||

JNL/BlackRock Global Long Short Credit Fund - Class I | 4,921 | 449 | 5,062 | 443 | (340 | ) | 32 | — | — | ||||||||||||||||

JNL/Boston Partners Global Long Short Equity Fund - Class I | 41,554 | 26 | 8,105 | — | (527 | ) | 2,486 | 35,434 | 16.8 | ||||||||||||||||

JNL/Eaton Vance Global Macro Absolute Return Advantage Fund - Class I | 25,238 | 436 | 8,772 | 396 | (10 | ) | 2,635 | 19,527 | 9.3 | ||||||||||||||||

JNL/First State Global Infrastructure Fund - Class I | 12,088 | 9,737 | 7,074 | — | 340 | 3,949 | 19,040 | 9.0 | |||||||||||||||||

JNL/Heitman U.S. Focused Real Estate Fund - Class I | 10,476 | 667 | 3,625 | 88 | 379 | 2,070 | 9,967 | 4.7 | |||||||||||||||||

JNL/Invesco Global Real Estate Fund - Class I | 4,820 | — | 5,296 | — | 136 | 340 | — | — | |||||||||||||||||

JNL/JPMorgan Hedged Equity Fund - Class I | 9,837 | 14,416 | 4,975 | 344 | 295 | 1,508 | 21,081 | 10.0 | |||||||||||||||||

JNL/Neuberger Berman Commodity Strategy Fund - Class I | 11,647 | 465 | 4,746 | 186 | (436 | ) | 1,489 | 8,419 | 4.0 | ||||||||||||||||

JNL/Neuberger Berman Currency Fund - Class I | 11,126 | 29 | 4,949 | — | (13 | ) | 104 | 6,297 | 3.0 | ||||||||||||||||

JNL/Nicholas Convertible Arbitrage Fund - Class I | 10,480 | 16 | 2,459 | — | 89 | 840 | 8,966 | 4.2 | |||||||||||||||||

JNL/PPM America Long Short Credit Fund - Class I | 7,337 | 369 | 7,672 | 366 | (428 | ) | 394 | — | — | ||||||||||||||||

JNL/Westchester Capital Event Driven Fund - Class I | 24,744 | 6,841 | 7,121 | — | 418 | 2,573 | 27,455 | 13.0 | |||||||||||||||||

244,109 | 47,627 | 104,412 | 1,823 | (1,145 | ) | 24,881 | 211,060 | 100.0 | |||||||||||||||||

JNL Moderate Allocation Fund | |||||||||||||||||||||||||

JNL Multi-Manager Alternative Fund - Class I | 17,339 | 4,275 | 4,630 | — | 34 | 1,514 | 18,532 | 3.0 | |||||||||||||||||

JNL Multi-Manager International Small Cap Fund - Class I | 6,088 | 734 | 2,130 | 31 | (219 | ) | 1,872 | 6,345 | 1.0 | ||||||||||||||||

JNL Multi-Manager Mid Cap Fund - Class I | 14,603 | 8,952 | 2,131 | — | 248 | 4,795 | 26,467 | 4.3 | |||||||||||||||||

See accompanying Notes to Financial Statements.

9

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Schedules of Investments (in thousands)

December 31, 2019

Affiliate | Value Beginning of Period($) | Purchases($) | Sales Proceeds($) | Distributions from Funds($) | Realized Gain/Loss from Sales($) | Change in Unrealized Appreciation (Depreciation)($) | Value End of Period($) | Percentage of Net Assets(%) | |||||||||||||||||

JNL Multi-Manager Small Cap Growth Fund - Class I | 4,850 | 905 | 1,204 | — | 206 | 1,516 | 6,273 | 1.0 | |||||||||||||||||

JNL Multi-Manager Small Cap Value Fund - Class I | 6,030 | 2,660 | 972 | — | (94 | ) | 1,750 | 9,374 | 1.5 | ||||||||||||||||

JNL/Boston Partners Global Long Short Equity Fund - Class I | 3,685 | 296 | 4,057 | — | (275 | ) | 351 | — | — | ||||||||||||||||

JNL/Causeway International Value Select Fund - Class I | 21,957 | 5,360 | 7,398 | 1,781 | (708 | ) | 2,788 | 21,999 | 3.6 | ||||||||||||||||

JNL/Crescent High Income Fund - Class I | 9,855 | 10,421 | 407 | — | (8 | ) | 1,648 | 21,509 | 3.5 | ||||||||||||||||

JNL/DoubleLine Core Fixed Income Fund - Class I | 33,804 | 17,916 | 1,487 | 1,386 | 45 | 1,780 | 52,058 | 8.4 | |||||||||||||||||

JNL/DoubleLine Emerging Markets Fixed Income Fund - Class I | 24,949 | 3,166 | 3,173 | — | (81 | ) | 2,861 | 27,722 | 4.5 | ||||||||||||||||

JNL/DoubleLine Shiller Enhanced CAPE Fund - Class I | 19,456 | 3,025 | 8,979 | — | (17 | ) | 5,301 | 18,786 | 3.0 | ||||||||||||||||

JNL/DoubleLine Total Return Fund - Class I | 57,872 | 23,447 | 2,749 | — | 45 | 3,841 | 82,456 | 13.4 | |||||||||||||||||

JNL/FPA + DoubleLine Flexible Allocation Fund - Class I | 17,157 | 1,949 | 10,166 | — | 506 | 2,934 | 12,380 | 2.0 | |||||||||||||||||

JNL/Franklin Templeton Global Multisector Bond Fund - Class I | 26,053 | 8,801 | 8,047 | 2,346 | (49 | ) | (2,076 | ) | 24,682 | 4.0 | |||||||||||||||

JNL/GQG Emerging Markets Equity Fund - Class I | 13,915 | 1,733 | 2,635 | 68 | (76 | ) | 2,771 | 15,708 | 2.6 | ||||||||||||||||

JNL/Harris Oakmark Global Equity Fund - Class I | 9,745 | 4,236 | 1,848 | 859 | (224 | ) | 2,252 | 14,161 | 2.3 | ||||||||||||||||

JNL/Heitman U.S. Focused Real Estate Fund - Class I | 2,427 | 1,903 | 448 | 39 | 34 | 705 | 4,621 | 0.8 | |||||||||||||||||

JNL/Lazard Emerging Markets Fund - Class I | 4,943 | 1,227 | 646 | 143 | (58 | ) | 902 | 6,368 | 1.0 | ||||||||||||||||

JNL/Morningstar Wide Moat Index Fund - Class I | 19,496 | 16,893 | 5,632 | 141 | 507 | 5,904 | 37,168 | 6.0 | |||||||||||||||||

JNL/Neuberger Berman Commodity Strategy Fund - Class I | 2,434 | 21 | 2,588 | — | (157 | ) | 290 | — | — | ||||||||||||||||

JNL/Oppenheimer Emerging Markets Innovator Fund - Class I | 8,665 | 1,139 | 10,934 | 112 | (1,020 | ) | 2,150 | — | — | ||||||||||||||||

JNL/PIMCO Income Fund - Class I | 25,032 | 15,952 | 902 | 965 | 40 | 1,405 | 41,527 | 6.7 | |||||||||||||||||

JNL/PIMCO Investment Grade Credit Bond Fund - Class I | 18,831 | 7,487 | 992 | 675 | 13 | 2,190 | 27,529 | 4.5 | |||||||||||||||||

JNL/PIMCO Real Return Fund - Class I | 5,001 | 8,332 | 415 | — | 10 | 843 | 13,771 | 2.2 | |||||||||||||||||

JNL/PPM America Total Return Fund - Class I | 30,074 | 8,548 | 2,332 | — | 85 | 3,347 | 39,722 | 6.4 | |||||||||||||||||

JNL/Scout Unconstrained Bond Fund - Class I | 15,112 | 3,893 | 19,961 | — | 431 | 525 | — | — | |||||||||||||||||

JNL/T. Rowe Price Capital Appreciation Fund - Class I | 40,650 | 4,907 | 2,816 | — | 315 | 9,598 | 52,654 | 8.5 | |||||||||||||||||

JNL/T. Rowe Price Established Growth Fund - Class I | 13,442 | 1,499 | 5,978 | — | 395 | 3,219 | 12,577 | 2.0 | |||||||||||||||||

JNL/WCM Focused International Equity Fund - Class I | 22,187 | 2,790 | 7,077 | 967 | 327 | 5,397 | 23,624 | 3.8 | |||||||||||||||||

495,652 | 172,467 | 122,734 | 9,513 | 255 | 72,373 | 618,013 | 100.0 | ||||||||||||||||||

JNL/American Funds Global Growth Fund | |||||||||||||||||||||||||

American Funds Insurance Series - Global Growth Fund - Class 1 | 225,324 | 169,518 | 8,461 | 23,301 | (19 | ) | 75,142 | 461,504 | 100.0 | ||||||||||||||||

225,324 | 169,518 | 8,461 | 23,301 | (19 | ) | 75,142 | 461,504 | 100.0 | |||||||||||||||||

See accompanying Notes to Financial Statements.

10

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Statements of Assets and Liabilities (in thousands, except net asset value per share)

December 31, 2019

| JNL Conservative Allocation Fund |

| JNL Institutional Alt 100 Fund |

| JNL Moderate Allocation Fund |

| JNL/American Funds Global Growth Fund(a) |

| JNL/American Funds Growth Fund(a) |

|

| ||||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Investments - unaffiliated, at value | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 1,215,677 |

|

| |

Investments - affiliated, at value | 465,181 |

| 211,060 |

| 618,013 |

| 461,504 |

|

| — |

|

| |||||

Receivable from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Investment securities sold |

| — |

|

| 38 |

|

| — |

|

| — |

|

| — |

|

|

| Fund shares sold |

| 1,115 |

|

| 41 |

|

| 448 |

|

| 466 |

|

| 1,232 |

|

|

| Adviser |

| — |

|

| — |

|

| — |

|

| 189 |

|

| 453 |

|

|

Total assets |

| 466,296 |

|

| 211,139 |

|

| 618,461 |

|

| 462,159 |

|

| 1,217,362 |

|

| |

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Payable for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Investment securities purchased |

| 895 |

|

| — |

|

| 243 |

|

| 330 |

|

| 487 |

|

|

| Fund shares redeemed |

| 221 |

|

| 79 |

|

| 205 |

|

| 136 |

|

| 745 |

|

|

| Advisory fees |

| 51 |

|

| 27 |

|

| 63 |

|

| 246 |

|

| 646 |

|

|

| Administrative fees |

| 20 |

|

| 9 |

|

| 26 |

|

| 38 |

|

| 100 |

|

|

| 12b-1 fees (Class A) |

| 30 |

|

| 14 |

|

| 40 |

|

| 30 |

|

| 79 |

|

|

| Board of trustee fees |

| 11 |

|

| 12 |

|

| 15 |

|

| 7 |

|

| 18 |

|

|

| Chief compliance officer fees |

| — |

|

| — |

|

| — |

|

| — |

|

| 1 |

|

|

| Other expenses |

| — |

|

| — |

|

| 1 |

|

| — |

|

| 3 |

|

|

Total liabilities |

| 1,228 |

|

| 141 |

|

| 593 |

|

| 787 |

|

| 2,079 |

|

| |

Net assets | $ | 465,068 |

| $ | 210,998 |

| $ | 617,868 |

| $ | 461,372 |

| $ | 1,215,283 |

|

| |

Net assets consist of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Paid-in capital(b) | $ | 442,235 |

| $ | 199,798 |

| $ | 576,620 |

| $ | 407,478 |

| $ | 1,114,651 |

|

| |

Total distributable earnings (loss)(b) |

| 22,833 |

|

| 11,200 |

|

| 41,248 |

|

| 53,894 |

|

| 100,632 |

|

| |

Net assets | $ | 465,068 |

| $ | 210,998 |

| $ | 617,868 |

| $ | 461,372 |

| $ | 1,215,283 |

|

| |

Net assets - Class A | $ | 461,856 |

| $ | 210,997 |

| $ | 611,892 |

| $ | 454,045 |

| $ | 1,195,026 |

|

| |

Shares outstanding - Class A |

| 35,782 |

|

| 18,921 |

|

| 42,293 |

|

| 26,021 |

|

| 42,971 |

|

| |

Net asset value per share - Class A | $ | 12.91 |

| $ | 11.15 |

| $ | 14.47 |

| $ | 17.45 |

| $ | 27.81 |

|

| |

Net assets - Class I | $ | 3,212 |

| $ | 1 |

| $ | 5,976 |

| $ | 7,327 |

| $ | 20,257 |

|

| |

Shares outstanding - Class I |

| 247 |

|

| — |

|

| 410 |

|

| 417 |

|

| 723 |

|

| |

Net asset value per share - Class I | $ | 12.99 |

| $ | 11.28 |

| $ | 14.56 |

| $ | 17.56 |

| $ | 28.02 |

|

| |

Investments - unaffiliated, at cost | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 1,115,045 |

|

| |

Investments - affiliated, at cost |

| 442,348 |

|

| 199,860 |

|

| 576,765 |

|

| 407,610 |

|

| — |

|

| |

(a) | The Master Funds for the Master Feeder Funds are the Class 1 shares of the corresponding American Fund Insurance Series Fund. These financial statements should be read in conjunction with each Master Fund's shareholder report. |

(b) | For funds structured as partnerships for federal income tax purposes, Paid-in capital represents partners' capital and Total distributable earnings (loss) represents net unrealized appreciation (depreciation) on investments and foreign currency. |

See accompanying Notes to Financial Statements.

11

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Statements of Operations (in thousands)

For the Year Ended December 31, 2019

|

| JNL Conservative Allocation Fund |

| JNL Institutional Alt 100 Fund |

| JNL Moderate Allocation Fund |

| JNL/American Funds Global Growth Fund(b) |

| JNL/American Funds Growth Fund(b) |

|

| ||||||

Investment income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Dividends (a) | $ | 6,037 |

| $ | 1,480 |

| $ | 6,821 |

| $ | — |

| $ | — |

|

| ||

Dividends received from master fund (a) |

| — |

|

| — |

|

| — |

|

| 5,391 |

|

| 10,426 |

|

| ||

Total investment income |

| 6,037 |

|

| 1,480 |

|

| 6,821 |

|

| 5,391 |

|

| 10,426 |

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Advisory fees |

| 555 |

|

| 343 |

|

| 730 |

|

| 2,243 |

|

| 6,187 |

|

| ||

Administrative fees |

| 205 |

|

| 114 |

|

| 279 |

|

| 338 |

|

| 917 |

|

| ||

12b-1 fees (Class A) |

| 1,220 |

|

| 685 |

|

| 1,664 |

|

| 1,000 |

|

| 2,706 |

|

| ||

Legal fees |

| 2 |

|

| 1 |

|

| 3 |

|

| 2 |

|

| 4 |

|

| ||

Board of trustee fees |

| 9 |

|

| 4 |

|

| 13 |

|

| 9 |

|

| 25 |

|

| ||

Chief compliance officer fees |

| 1 |

|

| — |

|

| 1 |

|

| 1 |

|

| 2 |

|

| ||

Other expenses |

| 5 |

|

| 3 |

|

| 6 |

|

| 1 |

|

| 7 |

|

| ||

Total expenses |

| 1,997 |

|

| 1,150 |

|

| 2,696 |

|

| 3,594 |

|

| 9,848 |

|

| ||

Expense waiver |

| (24 | ) |

| — |

|

| (34 | ) |

| (1,779 | ) |

| (4,367 | ) |

| ||

Net expenses |

| 1,973 |

|

| 1,150 |

|

| 2,662 |

|

| 1,815 |

|

| 5,481 |

|

| ||

Net investment income (loss) |

| 4,064 |

|

| 330 |

|

| 4,159 |

|

| 3,576 |

|

| 4,945 |

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized gain (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Net realized gain (loss) on: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

| Investments - unaffiliated |

| — |

|

| — |

|

| — |

|

| — |

|

| (742 | ) |

| |

| Investments - affiliated |

| 2,170 |

|

| (1,145 | ) |

| 255 |

|

| (19 | ) |

| — |

|

| |

| Distributions from unaffiliated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| investment companies |

| — |

|

| — |

|

| — |

|

| — |

|

| 93,415 |

|

|

| Distributions from affiliated investment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| companies |

| 975 |

|

| 343 |

|

| 2,692 |

|

| 17,910 |

|

| — |

|

|

Net change in unrealized appreciation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

| (depreciation) on: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Investments - unaffiliated |

| — |

|

| — |

|

| — |

|

| — |

|

| 134,458 |

|

| |

| Investments - affiliated |

| 38,519 |

|

| 24,881 |

|

| 72,373 |

|

| 75,142 |

|

| — |

|

| |

Net realized and unrealized gain (loss) |

| 41,664 |

|

| 24,079 |

|

| 75,320 |

|

| 93,033 |

|

| 227,131 |

|

| ||

Change in net assets from operations | $ | 45,728 |

| $ | 24,409 |

| $ | 79,479 |

| $ | 96,609 |

| $ | 232,076 |

|

| ||

(a) | Affiliated income | $ | 6,037 |

| $ | 1,480 |

| $ | 6,821 |

| $ | 5,391 |

| $ | — |

|

| |

(b) | The Master Funds for the Master Feeder Funds are the Class 1 shares of the corresponding American Fund Insurance Series Fund. These financial statements should be read in conjunction with each Master Fund's shareholder report. |

See accompanying Notes to Financial Statements.

12

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Statements of Changes in Net Assets (in thousands)

For the Year Ended December 31, 2019

| JNL Conservative Allocation Fund |

| JNL Institutional Alt 100 Fund |

| JNL Moderate Allocation Fund |

| JNL/American Funds Global Growth Fund(a) |

| JNL/American Funds Growth Fund(a) |

|

| ||||||

Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net investment income (loss) | $ | 4,064 |

| $ | 330 |

| $ | 4,159 |

| $ | 3,576 |

| $ | 4,945 |

|

| |

Net realized gain (loss) |

| 3,145 |

|

| (802 | ) |

| 2,947 |

|

| 17,891 |

|

| 92,673 |

|

| |

Net change in unrealized appreciation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| (depreciation) |

| 38,519 |

|

| 24,881 |

|

| 72,373 |

|

| 75,142 |

|

| 134,458 |

|

|

Change in net assets from operations |

| 45,728 |

|

| 24,409 |

|

| 79,479 |

|

| 96,609 |

|

| 232,076 |

|

| |

Share transactions1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Proceeds from the sale of shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| 207,636 |

|

| 9,514 |

|

| 160,373 |

|

| 210,938 |

|

| 624,256 |

|

|

| Class I |

| 4,038 |

|

| — |

|

| 3,858 |

|

| 4,197 |

|

| 11,582 |

|

|

Cost of shares redeemed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| (136,854 | ) |

| (66,964 | ) |

| (120,341 | ) |

| (74,481 | ) |

| (216,073 | ) |

|

| Class I |

| (1,490 | ) |

| — |

|

| (1,035 | ) |

| (1,160 | ) |

| (4,700 | ) |

|

Change in net assets from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| share transactions |

| 73,330 |

|

| (57,450 | ) |

| 42,855 |

|

| 139,494 |

|

| 415,065 |

|

|

Change in net assets |

| 119,058 |

|

| (33,041 | ) |

| 122,334 |

|

| 236,103 |

|

| 647,141 |

|

| |

Net assets beginning of year |

| 346,010 |

|

| 244,039 |

|

| 495,534 |

|

| 225,269 |

|

| 568,142 |

|

| |

Net assets end of year | $ | 465,068 |

| $ | 210,998 |

| $ | 617,868 |

| $ | 461,372 |

| $ | 1,215,283 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Share transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shares sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| 16,760 |

|

| 892 |

|

| 11,681 |

|

| 13,654 |

|

| 25,516 |

|

|

| Class I |

| 329 |

|

| — |

|

| 278 |

|

| 270 |

|

| 470 |

|

|

Shares redeemed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| (11,070 | ) |

| (6,294 | ) |

| (8,800 | ) |

| (4,827 | ) |

| (8,727 | ) |

|

| Class I |

| (119 | ) |

| — |

|

| (77 | ) |

| (74 | ) |

| (189 | ) |

|

Change in shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| 5,690 |

|

| (5,402 | ) |

| 2,881 |

|

| 8,827 |

|

| 16,789 |

|

|

| Class I |

| 210 |

|

| — |

|

| 201 |

|

| 196 |

|

| 281 |

|

|

Purchases and sales of long term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of securities | $ | 210,182 |

| $ | 47,627 |

| $ | 172,467 |

| $ | 169,518 |

| $ | 543,635 |

|

| |

Proceeds from sales of securities | $ | 131,781 |

| $ | 104,412 |

| $ | 122,734 |

| $ | 8,461 |

| $ | 30,004 |

|

| |

(a) | The Master Funds for the Master Feeder Funds are the Class 1 shares of the corresponding American Fund Insurance Series Fund. These financial statements should be read in conjunction with each Master Fund's shareholder report. |

See accompanying Notes to Financial Statements.

13

Jackson Variable Series Trust Master Feeder Funds and Funds of Funds

Statements of Changes in Net Assets (in thousands)

For the Year Ended December 31, 2018

|

| JNL Conservative Allocation Fund |

| JNL Moderate Allocation Fund |

| JNL Institutional Alt 100 Fund |

| JNL/American Funds Global Growth Fund(a) |

| JNL/American Funds Growth Fund(a) |

|

| |||||

Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net investment income (loss) | $ | 4,298 |

| $ | 4,981 |

| $ | 890 |

| $ | 1,215 |

| $ | 1,190 |

|

| |

Net realized gain (loss) |

| 4,698 |

|

| 10,877 |

|

| 4,385 |

|

| 14,176 |

|

| 40,441 |

|

| |

Net change in unrealized appreciation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| (depreciation) |

| (19,167 | ) |

| (41,678 | ) |

| (21,194 | ) |

| (39,555 | ) |

| (64,138 | ) |

|

Change in net assets from operations |

| (10,171 | ) |

| (25,820 | ) |

| (15,919 | ) |

| (24,164 | ) |

| (22,507 | ) |

| |

Distributions to shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

From distributable earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| — |

|

| — |

|

| — |

|

| (4,792 | ) |

| — |

|

|

| Class I |

| — |

|

| — |

|

| — |

|

| (70 | ) |

| — |

|

|

Total distributions to shareholders |

| — |

|

| — |

|

| — |

|

| (4,862 | ) |

| — |

|

| |

Share transactions1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Proceeds from the sale of shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| 154,542 |

|

| 144,013 |

|

| 15,580 |

|

| 123,192 |

|

| 304,201 |

|

|

| Class I |

| 943 |

|

| 2,501 |

|

| — |

|

| 3,565 |

|

| 12,607 |

|

|

Proceeds in connection with acquisition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| 37,915 |

|

| — |

|

| — |

|

| — |

|

| — |

|

|

| Class I |

| 1 |

|

| — |

|

| — |

|

| — |

|

| — |

|

|

Reinvestment of distributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| — |

|

| — |

|

| — |

|

| 4,792 |

|

| — |

|

|

| Class I |

| — |

|

| — |

|

| — |

|

| 70 |

|

| — |

|

|

Cost of shares redeemed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Class A |

| (94,161 | ) |

| (105,517 | ) |

| (89,802 | ) |

| (46,261 | ) |

| (97,931 | ) |

|

| Class I |

| (510 | ) |

| (310 | ) |

| — |

|

| (553 | ) |

| (2,678 | ) |

|

Change in net assets from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| share transactions |

| 98,730 |

|

| 40,687 |

|

| (74,222 | ) |

| 84,805 |

|

| 216,199 |

|

|

Change in net assets |

| 88,559 |

|

| 14,867 |

|

| (90,141 | ) |

| 55,779 |

|

| 193,692 |

|

| |

Net assets beginning of year |

| 257,451 |

|

| 480,667 |