Exhibit 10.1

Execution Version

THIS RESTRUCTURING SUPPORT AGREEMENT IS PROTECTED BY RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND ANY OTHER APPLICABLE STATUTES OR DOCTRINES PROTECTING THE USE OR DISCLOSURE OF CONFIDENTIAL SETTLEMENT DISCUSSIONS.

THIS RESTRUCTURING SUPPORT AGREEMENT IS NOT AN OFFER WITH RESPECT TO ANY SECURITIES OR A SOLICITATION OF VOTES WITH RESPECT TO A PLAN OF REORGANIZATION. ANY SUCH OFFER OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE.

ATLAS RESOURCE PARTNERS, L.P.

RESTRUCTURING SUPPORT AGREEMENT

July 25, 2016

This Restructuring Support Agreement (together with the exhibits attached hereto, which includes the Term Sheets (as defined below), as may be amended, restated, supplemented, or otherwise modified from time to time in accordance with the terms hereof, this “Agreement”), dated as of July 25, 2016, is entered into by and among: (i) Atlas Resource Partners, L.P., a Delaware limited partnership (“ARP”) and certain of its direct and indirect subsidiaries (each a “Debtor” and, collectively, the “Debtors” or the “Company”),1 (ii) Atlas Energy Group, LLC (“ATLS”), its general partner, solely with respect toSections 1,6(b),16(b),21 through29,31,32,35,38, and39 (iii) certain lenders (collectively, the “Consenting First Lien Lenders”) party to the certain Second Amended and Restated Credit Agreement, dated as of July 31, 2013 (as amended, supplemented, or otherwise modified from time to time, the “First Lien Credit Agreement”), by and among ARP, Wells Fargo Bank, National Association, as administrative agent (in such capacity, the “First Lien Agent”), the lenders from time to time party thereto (the “First Lien Lenders”) and other parties party thereto, (iv) certain Consenting First Lien Lenders or Affiliates (as defined in the First Lien Credit Agreement) thereof that are party to a Secured Swap Agreement (as defined in the First Lien Credit Agreement) (the “Consenting Secured Swap Providers”); (v) certain hedge providers (the “Consenting Hedge Providers”) party to that certain Secured Hedging Facility Agreement, dated as of March 5, 2012 (as amended, supplemented, or otherwise modified from time to time, the “Drilling Partnership Secured Hedging Facility Agreement”), by and among Atlas Resources LLC, as master general partner (“Atlas Resources”), the Participating Partnerships (as defined in the Drilling Partnership Secured Hedging Facility Agreement), each hedge provider party thereto, and Wells Fargo Bank, National Association, as collateral agent (in such capacity, the “Collateral Agent”); (vi) certain of

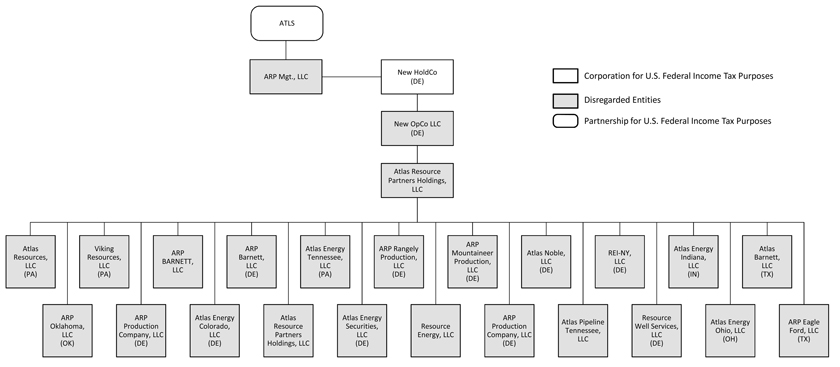

| 1 | The proposed Debtors and the last four digits of their taxpayer identification numbers (as applicable) are as follows: Atlas Resource Partners, L.P. (1625), ARP Barnett Pipeline, LLC (2295), ARP Barnett, LLC (2567), ARP Eagle Ford, LLC (6894), ARP Mountaineer Production, LLC (9365), ARP Oklahoma, LLC (5193), ARP Production Company, LLC (9968), ARP Rangely Production, LLC (1625), Atlas Barnett, LLC (4688), Atlas Energy Colorado, LLC (0015), Atlas Energy Indiana, LLC (0546), Atlas Energy Ohio, LLC (5198), Atlas Energy Securities, LLC (5987), Atlas Energy Tennessee, LLC (0794), Atlas Noble, LLC (5139), Atlas Pipeline Tennessee, LLC (4919), Atlas Resource Finance Corporation (2516), Atlas Resource Partners Holdings, LLC (5285), Atlas Resources, LLC (2875), ATLS Production Company, LLC (0124), REI-NY, LLC (5147), Resource Energy, LLC (5174), Resource Well Services, LLC (5162), and Viking Resources, LLC (5124). |

the lenders party to that certain Second Lien Credit Agreement, dated as of February 23, 2015 (as amended, supplemented, or otherwise modified from time to time, the “Second Lien Credit Agreement”), by and among ARP, each of the guarantors party thereto, Wilmington Trust, National Association, and/or its duly appointed successor, in its capacity as administrative agent and collateral agent (the “Second Lien Agent”, and the lenders party thereto (the “Second Lien Lenders”) that are signatories hereto (collectively, the “Consenting Second Lien Lenders”); and (vii) certain holders party hereto from time to time (together with their respective successors and permitted assigns, the “Consenting Noteholders”) of the Senior Notes (as defined below) issued under (a) that certain Indenture, dated as of January 23, 2013 (the “7.75% Senior Notes Indenture”) providing for the issuance of 7.75% Senior Notes due 2021 (the “7.75% Senior Notes”), by and among Atlas Resource Partners Holdings, LLC (“Holdings”) and Atlas Resource Finance Corporation (“FinCo”), as issuers, ARP, certain subsidiary guarantors named therein, and US Bank National Association and/or its duly appointed successor, in its capacity as indenture trustee (“7.75% Senior Notes Indenture Trustee”) and (b) that certain Indenture, dated as of July 30, 2013 (the “9.25% Senior Notes Indenture,” and together with the 7.75% Senior Notes Indenture, the “Senior Notes Indentures”) providing for the issuance of 9.25% Senior Notes due 2021(the “9.25% Senior Notes,” and together with the 7.75% Senior Notes, the “Senior Notes”), by and among Holdings and FinCo, as issuers, ARP, certain subsidiary guarantors named therein, and US Bank National Association and/or its duly appointed successor, in its capacity as indenture trustee (the “9.25% Senior Notes Indenture Trustee”);provided,however, that as used herein, “Consenting First Lien Lender,” “Consenting Secured Swap Provider,” “Consenting Hedge Provider,” “Consenting Second Lien Lender,” “Consenting Noteholder,” and “Restructuring Support Party” shall not include any distinct business unit of a Restructuring Support Party other than the business unit expressly identified on the signature pages hereto unless such other business unit is or becomes party to this Agreement. “Restructuring Support Parties” shall mean the Consenting First Lien Lenders, the Consenting Secured Swap Providers, the Consenting Hedge Providers, the Consenting Second Lien Lenders, and the Consenting Noteholders. This Agreement collectively refers to the Debtors, the Restructuring Support Parties, and each other person that becomes a party to this Agreement in accordance with its terms as the “Parties” and each individually as a “Party.”

RECITALS

WHEREAS, the Parties have engaged in good faith, arm’s-length negotiations regarding a restructuring transaction (the “Restructuring”) pursuant to the terms and conditions set forth in this Agreement, including the proposed joint prepackaged chapter 11 plan of reorganization for the Debtors on terms consistent with (i) the First Lien Exit Facility Term Sheet attached hereto asExhibit A, (ii) the Second Lien Exit Facility Term Sheet attached hereto asExhibit B, and (iii) the Term Sheet For 7.75% and 9.25% Senior Notes attached hereto asExhibit C (Exhibits A,B, andC, together, the “Term Sheets”) and incorporated by reference pursuant toSection 2 hereof (as may be amended, restated, supplemented, or otherwise modified from time to time in accordance with this Agreement, the “Plan”);

WHEREAS, (i) to the extent indicated on their signature pages hereto, certain Consenting First Lien Lenders (together with certain of their affiliates, the “Hedging Lenders”), and the Debtors have agreed to enter into commodity hedging transactions pursuant to ISDA Master Agreements and Schedules, in the form attached hereto asExhibit D (the “Hedging Agreements”), during the pendency of the Chapter 11 Cases pursuant to the terms of an interim

2

hedging order in the form attached hereto asExhibit E (the “Interim Hedging Order”) and a final order, substantially in the form of the Interim Hedging Order, with such modifications thereto as are acceptable to the First Lien Agent and the Hedging Lenders (the “Final Hedging Order” and, together with the Interim Hedging Order, the “Hedging Orders”) and (ii) the First Lien Agent and the Second Lien Agent (subject to the terms of the Intercreditor Agreement, dated as of February 23, 2015, among certain of the Debtors, the First Lien Agent and the Second Lien Agent (the “Intercreditor Agreement”)) have consented to the use of cash collateral during the pendency of the Chapter 11 Cases pursuant to the terms of the Interim Cash Collateral Order in the form attached hereto asExhibits F and a final cash collateral order substantially similar to the Interim Cash Collateral Order, with such modifications thereto as are acceptable to the First Lien Agent and the Second Lien Agent (subject to the Intercreditor Agreement) and consistent with this Agreement (together, the “Cash Collateral Orders”);

WHEREAS, it is contemplated that the Restructuring will be implemented through a voluntary case commenced by the Debtors (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101–1532 (as amended, the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”), pursuant to the Plan;

WHEREAS, it will constitute an event of default under the Drilling Partnership Secured Hedging Facility Agreement and under the Approved Master Agreements (as defined in the Drilling Partnership Secured Hedging Facility Agreement) if Atlas Resources voluntarily commences a case under the Bankruptcy Code (the “Secured Hedging Facility Defaults”);

WHEREAS, the Consenting Hedge Providers have agreed to enter into a limited waiver of the Secured Hedging Facility Defaults pursuant to the Limited Waiver Agreement attached hereto asExhibit G;

WHEREAS, the Parties have agreed to the form of omnibus agreement (the “Omnibus Agreement”) attached hereto asExhibit H;

WHEREAS, this Agreement is not intended to be and shall not be deemed to be a solicitation for acceptances of any chapter 11 plan;

NOW, THEREFORE, in consideration of the promises and mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each of the Parties, intending to be legally bound, hereby agrees as follows:

AGREEMENT

1.RSA Effective Date. This Agreement shall become effective (the “RSA Effective Date”), and the obligations contained herein shall become binding upon the Parties, upon the execution and delivery of counterpart signature pages to this Agreement by and among (a) the Company, (b) ATLS, (c) Consenting First Lien Lenders holding, in aggregate, at least two thirds in principal amount outstanding and more than one half in number of all claims on account of the First Lien Credit Agreement (the “First Lien Claims”), (d) Consenting Secured Swap Providers holding, as of the RSA Effective Date (as defined below), outstanding hedge transactions under Secured Swap Agreements representing at least two thirds of the aggregate notional volume of

3

oil and natural gas under all outstanding Secured Swap Agreements; (e) the Consenting Hedge Providers comprising the Hedge Provider Majority (as defined in the Drilling Partnership Secured Hedging Facility Agreement); (f) Consenting Second Lien Lenders holding, in aggregate, at least two thirds in principal amount outstanding and more than one half in number of all claims against the Debtors arising on account of the Second Lien Credit Agreement (the “Second Lien Claims”), and (g) Consenting Noteholders holding, in aggregate, at least 67% in principal amount of notes outstanding under the Senior Notes Indentures (the “Notes Claims”);provided,however, that as used herein, “First Lien Claim,” “Second Lien Claim” and “Notes Claim” shall not include any claim held in a fiduciary capacity or held by any other distinct business unit of a Restructuring Support Party other than the business unit expressly identified on the signature pages hereto unless such other business unit is or becomes party to this Agreement.

2.Exhibits and Schedules. Each of the exhibits and schedules attached hereto (collectively, the “Exhibits and Schedules”) is expressly incorporated herein and made a part of this Agreement, and all references to this Agreement shall include the Exhibits and Schedules. Subject to the following sentence, in the event of any inconsistencies between the terms of this Agreement and the Plan, (i) prior to the Effective Date (as defined below), this Agreement shall govern, and (ii) on and after the Effective Date, the Plan shall govern according with its terms. In the event of any inconsistency between this Agreement (without reference to the Exhibits and Schedules) and the Exhibits and Schedules, this Agreement (without reference to the Exhibits and Schedules) shall govern;provided,however, that the Term Sheets shall govern in the event of any inconsistency between the Term Sheets and the Agreement. The First Lien Exit Facility Term Sheet shall govern to the extent that the express terms of the First Lien Exit Facility Term Sheet conflict with the express terms of the other Term Sheets.

3.Definitive Documentation. The definitive documents and agreements (the “Definitive Documentation”) governing the Restructuring shall include: (a) the Plan, all supplements thereto, all of the schedules, documents, and exhibits contained therein (including, without limitation, the MIP (as defined in the Term Sheet For 7.75% and 9.25% Senior Notes attached asExhibit C), (b) the new executive employment agreements for Edward E. Cohen, Jonathan Z. Cohen, Daniel C. Herz, and Mark Schumacher (each of which shall be in form and substance consistent with theExhibit I attached hereto), (c) the proposed order approving and confirming the Plan, including the settlements described therein (the “Joint Disclosure Statement and Plan Confirmation Order”); (d) the disclosure statement (and all exhibits thereto) with respect to the Plan (the “Disclosure Statement”); (e) the solicitation materials with respect to the Plan (collectively, the “Solicitation Materials”); (f) any “first-day” motions and orders; (g) the Cash Collateral Orders and the motion seeking approval thereof; (h) any documents or agreements governing (i) the exit facility described in, and in all material respects consistent with, the First Lien Exit Facility Term Sheet (the “First Lien Exit Facility”) and (ii) the exit facility described in, and in all material respects consistent with, the Second Lien Exit Facility Term Sheet (the “Second Lien Exit Facility” and, collectively with the First Lien Exit Facility, the “Exit Facilities”); (i) the Hedging Agreements, the Hedging Orders and the motion to approve the Hedging Orders; and (j) an order authorizing the Debtors to assume and perform their obligations under this Agreement (the “RSA Assumption Order”). The Definitive Documentation identified in the foregoing sentence (i) remains subject to negotiation and completion, (ii) shall upon completion, contain terms, conditions, representations, warranties, and covenants consistent with the terms of this Agreement and the Term Sheets, and (iii) shall be in all material respects acceptable to the Required Consenting Creditors, which consent shall not

4

be unreasonably withheld;provided,however, that (a) the First Lien Exit Facility shall be (x) acceptable to the First Lien Agent, the Required Consenting First Lien Lenders (as defined below), and the Hedging Lenders, and (y) deemed acceptable to the other Restructuring Support Parties so long as the First Lien Exit Facility is in all material respects consistent with the First Lien Exit Facility Term Sheet and (b) the Second Lien Exit Facility shall be (x) acceptable to the Second Lien Agent and the Required Consenting Second Lien Lenders, (y) reasonably acceptable to the First Lien Agent, and (z) deemed acceptable to the other Restructuring Support Parties so long as the Second Lien Exit Facility is in all material respects consistent with the Second Lien Exit Facility Term Sheet, and (c) the Restructuring Support Parties shall be deemed to consent to the (i) Hedging Agreements, the Interim Hedging Order attached asExhibit E and the Final Hedging Order, which shall be in a substantially similar form with such changes as agreed to by the First Lien Agent and the Hedging Lenders;provided,however, that the Required Consenting Second Lien Lenders shall have consent rights with respect to any modifications or amendments from the Interim Hedging Order to the Final Hedging Order reasonably anticipated to have a material adverse effect on the Second Lien Claims, which consent shall not be unreasonably withheld, and (ii) Interim Cash Collateral Order attached asExhibit F and the Final Cash Collateral Order, which shall be in a substantially similar form with such changes as agreed to by the First Lien Agent and the Hedging Lenders, and, solely to the extent, if any, that they pertain to the Hedging Agreements, reasonably acceptable to the Hedging Lenders; provided,however, that the Required Consenting Second Lien Lenders and the Required Consenting Noteholders shall have consent rights with respect to any modifications or amendments from the Interim Cash Collateral Order to the Final Cash Collateral Order reasonably anticipated to have a material adverse effect on the Second Lien Claims (including adequate protection) or Notes Claims, as applicable, which consent shall not be unreasonably withheld. The Debtors will provide draft copies of any Definitive Documentation that the Debtors intend to file with the Bankruptcy Court to counsel to the Restructuring Support Parties at least two (2) business days before the date on which the Debtors intend to file, execute or otherwise finalize such documents. The Company shall not amend the Hedging Agreements in any way that affects or is likely to affect the legality, validity or enforceability of the Hedging Agreements or the ability of the Company to perform its obligations thereunder without the prior written consent of the Consenting First Lien Lenders and the Consenting Second Lien Lenders.

4.Milestones. The Company shall implement the Restructuring on the following timeline (in each case, a “Milestone”):

| | (a) | on or before July 26, 2016, the Company shall commence a solicitation of the First Lien Lenders, Second Lien Lenders and holders of the Senior Notes seeking the approval and acceptance of the Plan (the “Solicitation Commencement Date”); |

| | (b) | on or before August 23, 2016, (i) the Company shall receive the approval and acceptance of the Plan by (a) First Lien Lenders constituting more than half of the current lenders under the First Lien Credit Agreement and holding at least two thirds of the total First Lien Claims outstanding as of such date, (b) Second Lien Lenders collectively constituting more than half of the current lenders under the Second Lien Credit Agreement and holding at least two thirds of the total loans outstanding under the Second Lien Credit Agreement as of such date, and (c) holders of Senior Notes |

5

| | collectively holding at least two thirds in principal amount outstanding of all claims against the Debtors arising on account of Senior Notes Indentures, in each such case taking into account only holders of claims that have submitted a ballot as of such date, and (ii) the full solicitation periods with respect to such class shall have expired and voting shall no longer be permitted; |

| | (c) | each existing Secured Swap Agreement shall, before the Petition Date (as defined below), have been terminated and the net proceeds thereof (less $25 million) shall be used, subject to the sharing provisions contained in the First Lien Credit Agreement, to indefeasibly repay the outstanding obligations under the First Lien Credit Agreement down to $440 million (including outstanding letters of credit under the First Lien Credit Agreement), or such other amounts as mutually agreed to by the First Lien Agent and ARP; |

| | (d) | the Debtors shall commence the Chapter 11 Cases (the “Petition Date”) on or before July 27, 2016 and after the Debtors have sent solicitations to each of the First Lien Lenders, Second Lien Lenders, and holders of the Senior Notes seeking the approval and acceptance of the Plan; |

| | (e) | no later than two (2) business days after the Petition Date, the Debtors shall file with the Bankruptcy Court the Plan, the Disclosure Statement, and motions seeking (i) entry of the Cash Collateral Orders, (ii) entry of the Hedging Orders, (iii) entry of the RSA Assumption Order, and (iv) a joint hearing to consider the adequacy of the Disclosure Statement, approval of the Company’s prepetition solicitation of the First Lien Lenders, the Second Lien Lenders, and the holders of Senior Notes, and confirmation of the Plan (the “Joint Disclosure Statement and Plan Confirmation Hearing”); |

| | (f) | no later than five (5) business days after the Petition Date, the Bankruptcy Court shall have entered an order scheduling the Joint Disclosure Statement and Plan Confirmation Hearing; |

| | (g) | no later than five (5) business days after the Petition Date, the Bankruptcy Court shall have entered (i) the Interim Cash Collateral Order and (ii) the Interim Hedging Order, in each case in the form attached hereto or in such other form as is reasonably acceptable to the Company, the First Lien Agent and the Hedging Lenders;provided,however, that (a) the Required Consenting Second Lien Lenders shall have consent rights with respect to any modifications or amendments to the forms of Interim Cash Collateral Order and Interim Hedging Order attached hereto, as applicable, reasonably anticipated to have a material adverse effect on the Second Lien Claims (including adequate protection) and (b) the Required Consenting Noteholders shall have consent rights with respect to any modifications or amendments to the forms of Interim Cash Collateral Order and Interim Hedging Order attached hereto reasonably anticipated to have a material adverse effect on the Notes Claims, in each case which consent shall not be unreasonably withheld; |

6

| | (h) | no later than 45 calendar days after the Petition Date, the Bankruptcy Court shall have entered the Final Cash Collateral Order and the Final Hedging Order, each in a form acceptable to the First Lien Agent and the Hedging Lenders;provided,however, that (i) the Required Consenting Second Lien Lenders shall have consent rights with respect to any modifications or amendments from the Interim Cash Collateral Order to the Final Cash Collateral Order and from the Interim Hedging Order to the Final Hedging Order, as applicable, reasonably anticipated to have a material adverse effect on the Second Lien Claims (including adequate protection) and (ii) the Required Consenting Noteholders shall have consent rights with respect to any modifications or amendments to the forms of Interim Cash Collateral Order to the Final Cash Collateral Order and from the Interim Hedging Order to the Final Hedging Order, as applicable, reasonably anticipated to have a material adverse effect on the Notes Claims, in each case which consent shall not be unreasonably withheld; |

| | (i) | no later than 30 calendar days after the Petition Date, the Bankruptcy Court shall have entered the RSA Assumption Order; |

| | (j) | no later than 45 calendar days after the Petition Date, the Bankruptcy Court shall have commenced the Joint Disclosure Statement and Plan Confirmation Hearing; |

| | (k) | no later than five (5) business days after the conclusion of the Joint Disclosure Statement and Plan Confirmation Hearing, the Bankruptcy Court shall have entered an order (i) approving the adequacy of the Disclosure Statement and the Company’s prepetition solicitation of the First Lien Lenders, the Second Lien Lenders, and the holders of Senior Notes and (ii) confirming the Plan (the “Joint Disclosure Statement and Plan Confirmation Order”); and |

| | (l) | no later than the earlier to occur of (i) 15 calendar days after the date the Bankruptcy Court has entered the Joint Disclosure Statement and Plan Confirmation Order and (ii) the earlier of (A) the first business day immediately following the date on which the Company receives all necessary regulatory and other required approvals and consents to consummate the Restructuring in accordance with the Joint Disclosure Statement and Plan Confirmation Order (including, but not limited to, notice from the respective lenders and/or the agents under the Exit Facility that the conditions to the closing of such facility have been satisfied or waived) and (B) September 30, 2016, the effective date of the Plan (the “Effective Date”) shall occur. |

7

Notwithstanding the above, a specific Milestone may be extended or waived with the express prior written consent of the Company and (i) Consenting First Lien Lenders holding a majority in amount of the Consenting First Lien Lenders’ First Lien Claims (“Required Consenting First Lien Lenders”), (ii) Consenting Second Lien Lenders holding a majority in amount of the Consenting Second Lien Lenders’ Second Lien Claims (“Required Consenting Second Lien Lenders”), and (iii) Consenting Noteholders holding a majority in amount of the Consenting Noteholders’ Notes Claims (the “Required Consenting Noteholders,” and together with the Required Consenting First Lien Lenders and the Required Consenting Second Lien Lenders, the “Required Consenting Creditors”); provided,however, that the Milestones set forth in (c), (g) and (h) above may only be modified with the additional express written consent of the Hedging Lenders, such consent not to be unreasonably withheld.

5.Commitment of Restructuring Support Parties.

(a) Subject to compliance in all material respects by the other Parties with the terms of this Agreement, each of the Consenting First Lien Lenders agrees that it shall enter the First Lien Exit Facility consistent with the First Lien Exit Facility Term Sheet with a commitment amount for such Consenting First Lien Lender equal to their pro rata amount of First Lien Claims under the First Lien Credit Agreement.

(b) Subject to entry of the Interim Cash Collateral Order and the Interim Hedging Order, each of the Hedging Lenders agrees to enter into Hedging Agreements with ARP during the Chapter 11 Cases pursuant to the Hedging Orders to the extent set forth on such Hedging Lenders’ signature page hereto.

(c) Subject to compliance in all material respects by the other Parties with the terms of this Agreement, from the RSA Effective Date and until the occurrence of a Termination Date, each Restructuring Support Party shall:

| | (i) | support and take all commercially reasonable actions necessary or reasonably requested by the Company to facilitate consummation of the Restructuring in accordance with the Plan and the Term Sheets, including without limitation, to (A) if applicable, timely vote to accept the Plan, in accordance with the applicable procedures set forth in the Disclosure Statement and the solicitation materials with respect to the Plan, with respect to each and all of its claims (as defined in section 101(5) of the Bankruptcy Code) against, and interests in, the Company, now or hereafter owned by such Restructuring Support Party or for which it now or hereafter serves as the nominee, investment manager, or advisor for holders thereof, and (B) to the extent such election is available, not elect on its ballot to preserve claims, if any, that each Restructuring Support Party may own or control that may be affected by any releases contemplated by the Plan; |

| | (ii) | not withdraw, amend, or revoke (or cause to be withdrawn, amended, or revoked) its vote with respect to the Plan;provided,however, that nothing in this Agreement shall prevent any Restructuring Support Party from withholding, amending, or revoking (or causing the same) its timely consent or vote with respect to the Plan if this Agreement is terminated with respect to such Restructuring Support Party; |

8

| | (iii) | (A) use commercially reasonable efforts to support the confirmation of the Plan and approval of the Disclosure Statement and the solicitation procedures and (B) not (1) object to, delay, interfere, impede, or take any other action to delay, interfere or impede, directly or indirectly, with the Restructuring, confirmation of the Plan, or approval of the Disclosure Statement or the solicitation procedures (including, but not limited to, joining in or supporting any efforts to object to or oppose any of the foregoing), or (2) propose, file, support, or vote for, or encourage or assist another person in (x) filing, supporting or voting for, any restructuring, workout, or chapter 11 plan for the Company other than the Restructuring and the Plan or (y) otherwise initiating or joining in any legal proceeding, that is inconsistent with this Agreement, or delay, impede, appeal, or take any other action, that could reasonably be expected to interfere with the approval, acceptance, confirmation, consummation, or implementation of the Restructuring or the Plan, as applicable; |

| | (iv) | not commence any proceeding to oppose or alter any of the terms of the Plan or any other document filed by the Debtors in connection with the confirmation of the Plan (subject to Section 3 hereof); |

| | (v) | not object to the “first-day” motions and other motions consistent with this Agreement filed by the Debtors in furtherance of the Restructuring (subject to Section 3 hereof); |

| | (vi) | not encourage any other person or entity to, take any action, including, without limitation, initiating or joining in any legal proceeding, that is materially inconsistent with this Agreement, or delay, impede, appeal, or take any other negative action, that could reasonably be expected to interfere with the approval, acceptance, confirmation, consummation, or implementation of the Restructuring or the Plan, as applicable; |

| | (vii) | use commercially reasonable efforts to execute any document and give any notice, order, instruction, or direction necessary or reasonably requested by the Company to support, facilitate, implement, consummate, or otherwise give effect to the Restructuring;provided, for the avoidance of doubt, that no Restructuring Support Party shall be required to make any such effort if prohibited by applicable law or government regulation; |

| | (viii) | not object to the Company’s efforts to enter into the Exit Facilities, and not object to, or support the efforts of any other Person to oppose or object to, the Exit Facilities; |

| | (ix) | not take any action (or encourage or instruct any other party to take any action) in respect of any potential, actual, or alleged occurrence of any “Default” or “Event of Default” under the First Lien Credit Agreement, Second Lien Credit Agreement, or the Senior Notes Indentures; ;provided, for the avoidance of doubt, that in the event of termination of this Agreement, all Parties rights are reserved with respect to the accrual of default interest in periods before and after the RSA Effective Date; and |

9

| | (x) | not instruct (or join in any direction requesting that) the First Lien Agent, the Second Lien Agent, the 7.75% Senior Notes Indenture Trustee, or the 9.25% Senior Notes Indenture Trustee to take any action, or refrain from taking any action, that would be inconsistent with this Agreement or the Restructuring. |

Notwithstanding the foregoing, nothing in this Agreement and neither a vote to accept the Plan by any Restructuring Support Party nor the acceptance of the Plan by any Restructuring Support Party shall (t) be construed as preventing a Hedging Lender from exercising any rights and remedies under any Hedging Agreements, (u) be construed to prohibit any Restructuring Support Party from contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement, (v) be construed to prohibit any Restructuring Support Party from appearing as a party-in-interest in any matter to be adjudicated in the Chapter 11 Cases, so long as such appearance and the positions advocated in connection therewith are not materially inconsistent with this Agreement and are not for the purpose of delaying, interfering, impeding, or taking any other action to delay, interfere or impede, directly or indirectly, with the Restructuring, confirmation of the Plan, or approval of the Disclosure Statement or the solicitation procedures, (w) affect the ability of any Restructuring Support Party to consult with any other Restructuring Support Parties or the Debtors, (x) impair or waive the rights of any Restructuring Support Party to assert or raise any objection permitted under this Agreement in connection with any hearing on confirmation of the Plan or in the Bankruptcy Court, (y) impair or waive the rights of any Restructuring Support Party under any applicable credit agreement, indenture, other loan document, including the Intercreditor Agreement, or applicable law except as contemplated by this Agreement, or (z) prevent any Restructuring Support Party from enforcing this Agreement against the Debtors or any Restructuring Support Party;provided,however, that any delay or other impact on consummation of the Restructuring caused by a Restructuring Support Party’s opposition to (i) any relief that is inconsistent with the Restructuring, (ii) a motion by the Debtors to enter into a material executory contract, lease, or other arrangement outside of the ordinary course of its business without obtaining the prior written consent of the Required Consenting Creditors, or (iii) any relief not provided for in this Agreement and that is adverse to interests of any of the Restructuring Support Parties, in each case whether sought by the Debtors or any other party, shall not constitute a violation of this Agreement.

6.Commitment of the Company and ATLS.

(a)The Company. Subject to compliance in all material respects by the Restructuring Support Parties with the terms of this Agreement, from the RSA Effective Date and until the occurrence of a Termination Date (as defined below), the Company hereby acknowledges and agrees to each of the following:

| | (i) | Subject to paragraph (ii) immediately below, each of the Debtors (A) agree to (1) support and complete the Restructuring and all transactions set forth in the Plan and this Agreement, (2) complete the Restructuring and all transactions set forth or described in the Plan in |

10

| | accordance with the Milestones set forth inSection 4 of this Agreement, (3) negotiate in good faith with the Restructuring Support Parties all Definitive Documentation that is subject to negotiation as of the RSA Effective Date, (4) take any and all necessary actions in furtherance of the Restructuring, this Agreement, and the Plan, (5) make commercially reasonable efforts to obtain any and all required regulatory and/or third-party approvals for the Restructuring, and (6) operate their business in the ordinary course, taking into account the Restructuring, and (B) shall not undertake any actions materially inconsistent with the adoption and implementation of the Plan and confirmation thereof. For the avoidance of doubt, the Debtors shall not file any motion to reject this Agreement and, from and after the Petition Date, shall comply with their obligations hereunder unless otherwise ordered by the Bankruptcy Court; |

| | (ii) | Notwithstanding anything to the contrary herein, (1) the Company’s obligations hereunder are subject at all times to the fulfillment of their respective fiduciary duties and (2) nothing in this Agreement shall require the Company, ATLS, or any Debtor to take any action, or to refrain from taking any action, that, after consultation with counsel, is determined to be necessary to comply with such party’s fiduciary obligations under applicable law; |

| | (iii) | The Company shall timely file a formal objection, in form and substance reasonably acceptable to the Required Consenting Creditors, to any motion filed with the Bankruptcy Court by a third party seeking the entry of an order (1) directing the appointment of a trustee or examiner (with expanded powers beyond those set forth in section 1106(a)(3) and (4) of the Bankruptcy Code), (2) converting the Chapter 11 Cases to cases under chapter 7 of the Bankruptcy Code, or (3) dismissing the Chapter 11 Cases; |

| | (iv) | The Company shall timely file a formal objection, in form and substance reasonably acceptable to the Required Consenting Creditors, to any motion filed with the Bankruptcy Court by a third party seeking the entry of an order modifying or terminating the Debtors’ exclusive right to file and/or solicit acceptances of a plan of reorganization, as applicable; |

| | (v) | Timely file a formal objection, in form and substance reasonably acceptable to the Required Consenting Creditors, to any motion filed with the Bankruptcy Court by a third party seeking the formation of an official committee of equity interest holders; |

| | (vi) | Terminate on the Effective Date the existing employment agreements between ATLS, ARP, and each of Edward E. Cohen, Jonathan Z. Cohen, Daniel C. Herz and Mark Schumacher as to Company, which terminations shall be at no cost to the Company; and |

| | (vii) | Enter into on the Effective Date the new executive employment agreements for Edward E. Cohen, Jonathan Z. Cohen, Daniel C. Herz, and Mark Schumacher (each of which shall be in form and substance consistent with theExhibit H attached hereto). |

11

(b)ATLS. Subject to compliance in all material respects by the Restructuring Support Parties with the terms of this Agreement, from the RSA Effective Date and until the occurrence of a Termination Date (as defined below), ATLS shall:

| | (i) | take all commercially reasonable actions necessary to consummate the Restructuring in accordance with the Plan and the Term Sheets; |

| | (ii) | not (1) object to, delay, interfere or impede the Restructuring, confirmation of the Plan, or approval of the Disclosure Statement or the solicitation procedures (including, but not limited to, joining in or supporting any efforts to object to or oppose any of the foregoing), or (2) propose, file, support, or vote for, or encourage or assist another person in filing, supporting or voting for, any restructuring, workout, or chapter 11 plan for the Company other than the Restructuring and the Plan; |

| | (iii) | not (1) commence any proceeding to oppose or alter any of the terms of the Plan or any other document filed by the Debtors in connection with the confirmation of the Plan or (2) object to the “first-day” motions and other motions consistent with this Agreement filed by the Debtors in furtherance of the Restructuring; |

| | (iv) | not, nor encourage any other person or entity to, take any action, including, without limitation, initiating or joining in any legal proceeding that is inconsistent with this Agreement, or delay, impede, appeal, or take any other negative action that could reasonably be expected to interfere materially with the approval, acceptance, confirmation, consummation or implementation of the Restructuring or the Plan as applicable; |

| | (v) | form ARP Mgt LLC in accordance with the Term Sheet For 7.75% and 9.25% Senior Notes attached hereto asExhibit C; |

| | (vi) | terminate on the Effective Date the existing employment agreements between ATLS, ARP, and each of Edward E. Cohen, Jonathan Z. Cohen, Daniel C. Herz and Mark Schumacher as to the Company, which terminations shall be at no cost to the Company; and |

| | (vii) | cause its applicable subsidiaries to enter into the Omnibus Agreement in accordance withExhibit H attached hereto and use commercially reasonable efforts to execute any other document and give any notice, order, instruction, or direction necessary or reasonably requested by the Company to support, facilitate, implement, consummate, or otherwise give effect to the Restructuring. |

12

7.Restructuring Support Party Termination Events. Each of the (a) Consenting First Lien Lenders holding, in aggregate, at least two thirds in principal amount outstanding of the First Lien Claims held by the Consenting First Lien Lenders, (b) Consenting Second Lien Lenders holding, in aggregate, at least two thirds in principal amount outstanding of the Second Lien Claims held by the Consenting Second Lien Lenders, and (c) Consenting Noteholders holding, in aggregate, at least two thirds in principal amount outstanding of the Notes Claims held by the Consenting Noteholders (each such group, a “Terminating Support Group”) shall have the right, but not the obligation, upon five (5) business days’ prior written notice to the other Parties (other than with respect to subsections (d), (e), or (f) below, in which case such written notice shall be immediately effective), to terminate the obligations of their respective Restructuring Support Parties under this Agreement upon the occurrence of any of the following events (each, a “Restructuring Support Party Termination Event”), unless waived, in writing, by each such Supermajority Support Group on a prospective or retroactive basis:

| | (a) | the failure to meet any Milestone inSection 4 unless (i) such failure is the result of any act, omission, or delay on the part of any Restructuring Support Parties whose Supermajority Support Group is seeking termination in violation of its obligations under this Agreement or (ii) such Milestone is extended in accordance withSection 4; |

| | (b) | the occurrence of a material breach of this Agreement by the Company or ATLS that has not been cured (if susceptible to cure) by the earlier of (i) five (5) business days after the receipt by the Company or ATLS, applicable, of written notice of such breach and (ii) one (1) calendar day prior to any proposed Effective Date; |

| | (c) | any other Terminating Support Group terminates its obligations under and in accordance with this Section 7; |

| | (d) | filing of a motion by the Debtors seeking an order or entry of an order by the Bankruptcy Court converting any of the Chapter 11 Cases to a case under chapter 7 of the Bankruptcy Code; |

| | (e) | filing of a motion by the Debtors seeking an order or entry of an order by the Bankruptcy Court appointing a trustee, receiver, or examiner with expanded powers beyond those set forth in section 1106(a)(3) and (4) of the Bankruptcy Code in any of the Chapter 11 Cases; |

| | (f) | filing of a motion by the Debtors seeking an order or entry of an order by the Bankruptcy Court terminating any Debtor’s exclusive right to file a plan of reorganization under section 1121 of the Bankruptcy Code; |

| | (g) | any Debtor amends or modifies, or files a pleading seeking authority to amend or modify, the Definitive Documentation, unless such amendment or modification is (i) consistent in all material respects with this Agreement (including the Term Sheets annexed hereto) or (ii) reasonably acceptable to the Required Consenting Creditors; |

| | (h) | entry of an order by the Bankruptcy Court amending or modifying the Definitive Documentation, unless such amendment or modification is (i) consistent in all material respects with this Agreement (including the Term Sheets annexed hereto) or (ii) reasonably acceptable to the Required Consenting Creditors; |

13

| | (i) | if any of the Cash Collateral Orders, the Hedging Orders, the Joint Disclosure Statement and Plan Confirmation Order or the order approving this Agreement are reversed, stayed, dismissed, vacated, reconsidered, modified, or amended without the consent of the Required Consenting Creditors (and in the case of (x) the Cash Collateral Orders, the consent of the First Lien Agent;provided,however, that the Required Consenting Second Lien Lenders and the Required Consenting Noteholders shall have consent rights with respect to any modifications or amendments reasonably anticipated to have a material adverse effect on the Second Lien Claims (including adequate protection) or Notes Claims, as applicable, which consent shall not be unreasonably withheld, and (y) the Hedging Orders, the consent of the First Lien Agent and the Hedging Lenders;provided,however, that the Required Consenting Second Lien Lenders and the Required Consenting Noteholders shall have consent rights with respect to any modifications or amendments reasonably anticipated to have a material adverse effect on the Second Lien Claims or Notes Claims, as applicable, which consent shall not be unreasonably withheld) or a motion for reconsideration, re-argument, or rehearing with respect to such orders has been filed and the Debtors have failed to timely object to such motion; |

| | (j) | either (i) any Debtor determines to pursue any Alternative Transaction (as defined below), including any plan of reorganization (other than the Plan), or (ii) any Debtor files, propounds, or otherwise publicly supports or announces that any Debtor will support any Alternative Transaction, including any plan of reorganization other than the Plan, or files any motion or application seeking authority to sell any material assets, without the prior written consent of the Required Consenting Creditors; |

| | (k) | either (i) any Debtor or any Restructuring Support Party files with the Bankruptcy Court a motion, application, or adversary proceeding (or any Debtor supports any such motion, application, or adversary proceeding filed or commenced by any third party) (A) challenging the amount, validity, enforceability, priority or extent of, or perfection, if applicable, or seeking avoidance or subordination of, the claims of any Restructuring Support Party, or (B) asserting any other claim or cause of action against any Restructuring Support Party and/or with respect or relating to such claims or the liens securing such claims; or (ii) the Bankruptcy Court (or any court with jurisdiction over the Chapter 11 Cases) enters an order providing relief adverse to the interests of any Restructuring Support Party with respect to any of the foregoing causes of action or proceedings; |

| | (l) | upon any default under the Cash Collateral Orders that is not cured within the requisite cure period, if any, provided by the applicable Cash Collateral Order; |

14

| | (m) | any debtor-in-possession financing is entered into, or the Debtors file a motion seeking approval of debtor-in-possession financing, on terms that are not acceptable to the Required Consenting Creditors; |

| | (n) | any Debtor exercises any rights available to it under Section 6(a)(ii) of this Agreement that are inconsistent with the Restructuring as contemplated by the Term Sheets; |

| | (o) | the Bankruptcy Court denies the motion seeking entry of the RSA Assumption Order; |

| | (p) | the issuance by any governmental authority, including the Bankruptcy Court, any regulatory authority, or any other court of competent jurisdiction, of any ruling or order enjoining the substantial consummation of the Restructuring;provided,however, that the Company shall have five (5) business days after issuance of such ruling or order to obtain relief that would allow consummation of the Restructuring in a manner that (i) does not prevent or diminish in a material way compliance with the terms of the Plan and this Agreement or (ii) is reasonably acceptable to the Required Consenting Creditors; |

| | (q) | a breach by any Debtor of any representation, warranty, or covenant of such Debtor set forth in this Agreement that could reasonably be expected to have a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured by the earlier of (i) five (5) business days after the receipt by the Company of written notice of such breach and (ii) one (1) calendar day prior to any proposed Effective Date; |

| | (r) | a breach by any Debtor or ATLS of any of its obligations under this Agreement that could reasonably be expected to have a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured by the earlier of (i) five (5) business days after the receipt by the Company or ATLS, as applicable, of written notice of such breach and (ii) one (1) calendar day prior to any proposed Effective Date; |

| | (s) | the Bankruptcy Court grants relief terminating or modifying the automatic stay (as provided in section 362 of the Bankruptcy Code) with regard to one or more assets with an aggregate value in excess of $5 million; |

| | (t) | upon the commencement of any case under the Bankruptcy Code regarding any Debtor prior to the Solicitation Commencement Date; |

| | (u) | any Debtor terminates its obligations under and in accordance with Section 8 of this Agreement; |

15

| | (v) | if any of the Debtors has entered into a material executory contract, lease, or other arrangement outside of the ordinary course of its business without obtaining the prior written consent of the Required Consenting Creditors; |

| | (w) | if any of the Debtors has transferred, outside the ordinary course of business, any of their assets (as of the RSA Effective Date), including cash on hand, to any non-Debtors without the consent of the Required Consenting Creditors; or |

| | (x) | the Bankruptcy Court enters an order denying confirmation of the Plan. |

Further, prior to the entry of the Interim Hedging Order, any Hedging Lender, in such capacity, shall have the right to terminate its obligations, in such capacity, under this Agreement upon the occurrence of any Restructuring Support Party Termination Event. Notwithstanding anything to the contrary herein, following the commencement of the Chapter 11 Cases and unless and until there is an unstayed order of the Bankruptcy Court providing that the giving of notice under and/or termination of this Agreement in accordance with its terms is not prohibited by the automatic stay imposed by section 362 of the Bankruptcy Code, the occurrence of any of the Termination Events in this Section 7 shall result in termination of this Agreement five (5) business days following such occurrence unless such termination event is waived in writing by the Required Consenting Creditors.

8.Company’s Termination Events. The Company may, in its sole discretion, terminate this Agreement as to all Parties upon five (5) business days’ prior written notice to the Restructuring Support Parties following the occurrence of any of the following events (each a “Company Termination Event” and, together with the Restructuring Support Party Termination Events, the “Termination Events”):

| | (a) | a breach by a Restructuring Support Party of any of the representations, warranties, or covenants of such Restructuring Support Party set forth inSection 16 of this Agreement that that could reasonably be expected to have a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured for a period of five (5) business days after the receipt by such Restructuring Support Party of written notice of such breach; |

| | (b) | a breach by any Restructuring Support Party of any of its obligations under this Agreement that has a material adverse impact on the Restructuring or the consummation of the Restructuring that (if susceptible to cure) remains uncured for a period of five (5) business days after the receipt by all Restructuring Support Parties of written notice of such breach; |

| | (c) | the Company determines that, in accordance withSection 6(a)(ii) above, continued pursuit or support of the Restructuring (including, without limitation, the Plan or the solicitation of the Plan) would be inconsistent with the exercise of its fiduciary duties; |

| | (d) | any Terminating Support Group terminates its obligations under and in accordance withSection 7 of this Agreement; |

16

| | (e) | any Hedging Lender terminates its obligations under the Hedging Agreements; or |

| | (f) | the issuance by any governmental authority, including the Bankruptcy Court or any other regulatory authority or court of competent jurisdiction, of any injunction, judgment, decree, charge, ruling, or order preventing the consummation of a material portion of the Restructuring;provided,however, that the Debtors have made commercially reasonable good faith efforts to cure, vacate, or have overruled such ruling or order prior to terminating this Agreement. |

9.Mutual Termination; Automatic Termination. This Agreement, and the obligations of all Parties hereunder, may be terminated by mutual written agreement by and among ARP, on behalf of itself and each other Debtor, and the Required Consenting Creditors. Notwithstanding anything in this Agreement to the contrary, this Agreement and the obligations of all Parties hereunder shall terminate automatically on the Effective Date (an “Effective Date Termination”).

10.Effect of Termination.

(a) The earliest date on which a Party’s termination of this Agreement is effective in accordance withSection 7,Section 8, orSection 9 of this Agreement shall be referred to as a “Termination Date.” Upon the occurrence of a Termination Date, all Parties’ obligations under this Agreement shall be terminated effective immediately, and all Parties hereto shall be released from their respective commitments, undertakings, and agreements, and, except upon the occurrence of an Effective Date Termination, any vote in favor of the Plan delivered by such Party or Parties shall be immediately revoked and deemed voidab initio;provided,however, that each of the following shall survive such termination and all rights and remedies with respect to such claims shall not be prejudiced in any way: (i) subject to Section 22 of this Agreement, any claim for breach of this Agreement that occurs prior to such Termination Date, (ii) the Company’s obligations underSection 14 of this Agreement accrued up to and including the Termination Date, and (iii) thisSection 10(a) andSections 15,19,20,21,23,24,26,30, and36. Termination shall not relieve any Party from liability for its breach or non-performance of its obligations hereunder prior to the Termination Date. Upon any Party’s termination of this Agreement in accordance with its terms prior to the date on which the Joint Disclosure Statement and Plan Confirmation Order is entered by the Bankruptcy Court, such Party shall have the immediate right, without further order of the Bankruptcy Court, and without the consent of the Company, to withdraw or change any vote previously tendered by such Party, irrespective of whether any voting deadline or similar deadline has passed, provided that such Party is not then in material breach of its obligations under this Agreement; provided further that, for the avoidance of doubt, the foregoing shall not be construed to prohibit any Party from contesting whether such terminating Party’s termination of this Agreement (and subsequent withdrawal or change of its vote, as applicable) is in accordance with the terms of this Agreement. Any Restructuring Support Party withdrawing or changing its vote(s) pursuant to thisSection 10 shall promptly provide written notice of such withdrawal or change to each other Party and, if such withdrawal or change occurs on or after the Petition Date, file notice of such withdrawal or change with the Bankruptcy Court.

17

(b) Except with respect to Section 8(c) of this Agreement, no occurrence shall constitute a Termination Event if such occurrence is the result of the action or omission of the Party seeking to terminate this Agreement in violation of the terms hereof.

11.Cooperation and Support. The Parties agree to negotiate in good faith the Definitive Documentation that is subject to negotiation and completion.

12.Transfers of Claims and Interests.

(a) Each Restructuring Support Party shall not (i) sell, transfer, assign, hypothecate, pledge, grant a participation interest in, or otherwise dispose of, directly or indirectly, its right, title, or interest in respect of any of such Restructuring Support Party’s claims against, or interests in, any Debtor, as applicable, in whole or in part, or (ii) deposit any of such Restructuring Support Party’s claims against, or interests in, any Debtor, as applicable, into a voting trust, or grant any proxies, or enter into a voting agreement with respect to any such claims or interests (the actions described in clauses (i) and (ii) are collectively referred to herein as a “Transfer” and the Restructuring Support Party making such Transfer is referred to herein as the “Transferor”), unless such Transfer is to another Restructuring Support Party or any other entity that first agrees, in writing, to be bound by the terms of this Agreement by executing and delivering to the Company, and counsel to the Restructuring Support Parties, at least three (3) business days prior to effectiveness of the relevant Transfer, a Transferee Joinder substantially in the form attached hereto asExhibit J (the “Transferee Joinder”). With respect to claims against, or interests in, a Debtor held by the relevant transferee upon consummation of a Transfer in accordance herewith, such transferee shall be deemed to make all of the representations, warranties, and covenants of a Restructuring Support Party, as applicable, set forth in this Agreement, and shall be deemed to be a Party and a Restructuring Support Party for all purposes under the Agreement. Upon compliance with the foregoing, the Transferor shall be deemed to relinquish its rights under this Agreement solely to the extent of such transferred rights and obligations but shall otherwise remain party to this Agreement as a Restructuring Support Party with respect to any First Lien Claims, Second Lien Claims or Notes Claims not so transferred. Any Transfer made in violation of thisSection 12 shall be deemed null and void and of no force or effect.

(b) NotwithstandingSection 12(a), (i) a Restructuring Support Party may transfer (by purchase, sale, assignment, participation or otherwise) its right, title, and/or interest in respect of any of such Restructuring Support Party’s claims against, or interests in, any Debtor, as applicable, to an entity that is acting in its capacity as a Qualified Marketmaker without the requirement that the Qualified Marketmaker be or become a Restructuring Support Party, provided that such transfer shall only be valid if such Qualified Marketmaker transfers (by purchase, sale, assignment, participation or otherwise) such right, title and/or interest within five (5) [business] days of its receipt thereof to a transferee that is, or concurrent with such transfer becomes, a Restructuring Support Party, and (ii) to the extent that a party to this Agreement is acting in its capacity as a Qualified Marketmaker, it may transfer (by purchase, sale, assignment, participation or otherwise) any right, title, or interest in respect of any claims against, or interests in, any Debtor, as applicable, that the Qualified Marketmaker acquires from a holder of such interests who is not a Restructuring Support Party without the requirement that the transferee be

18

or become a Restructuring Support Party. For these purposes, a “Qualified Marketmaker” means an entity that (x) holds itself out to the market as standing ready in the ordinary course of its business to purchase from customers and sell to customers claims against the Debtors (including debt securities or other debt) or enter with customers into long and short positions in claims against the Debtors (including debt securities or other debt), in its capacity as a dealer or market maker in such claims against the Debtors, and (y) is in fact regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

(c) Except as set forth inSections 12(a) and(b) above, nothing in this Agreement shall be construed as precluding any Restructuring Support Party or any of its affiliates from acquiring additional claims or interests in the Debtors;provided,however, that any such additional claims or interests, or interests in the underlying instruments, shall automatically be subject to the terms and conditions of this Agreement.

13.Releases and Indemnification. To the fullest extent permitted by applicable law, the Plan shall provide for comprehensive mutual release, indemnification and exculpation provisions from and for the benefit of the Debtors, the First Lien Lenders, the First Lien Agent, the Secured Swap Providers, the Hedge Providers, the Collateral Agent, the Hedging Lenders, the Consenting Second Lien Lenders, the Second Lien Agent, the Consenting Noteholders, the advisors to the Ad Hoc Group (as defined below), the 7.75% Senior Notes Indenture Trustee, the 9.25% Senior Notes Indenture Trustee, and all individuals or entities serving, or who have served as a manager, director, managing member, officer, partner, shareholder, or employee of any of the foregoing, and the attorneys and other advisors to each of the foregoing, from any claims, causes of action and liabilities related to or in connection with the Debtors, the Debtors’ out-of-court restructuring efforts, the Restructuring, this Agreement, the Chapter 11 Cases or the Plan arising on or prior to the Effective Date.

14.Fees and Expenses. Fees and expenses shall be paid according to the terms and conditions set forth in the Term Sheets. For the avoidance of doubt, the Debtors shall obtain Bankruptcy Court approval of the payment of the Restructuring Support Parties’ professional fees and expenses in accordance with the Term Sheets under the RSA Assumption Order and the Cash Collateral Orders and the Hedging Orders.

15.Acknowledgments and Consents.

(a) No securities of the Company are being offered or sold hereby and this Agreement neither constitutes an offer to sell nor a solicitation of an offer to buy any securities of the Company. Each Party irrevocably acknowledges and agrees that this Agreement is not, and shall not be deemed to be, a solicitation of a vote for the acceptance of the Plan. The acceptance of the Plan by each of the Restructuring Support Parties will not be solicited until such Parties have received the Disclosure Statement and related ballots in accordance with applicable law (including as provided under sections 1125(g) and 1126(b) of the Bankruptcy Code) and will be subject to sections 1125, 1126, and 1127 of the Bankruptcy Code.

(b) By executing this Agreement, each Restructuring Support Party (including, for the avoidance of doubt, any entity that may execute this Agreement or a Transferee Joinder after the RSA Effective Date) consents to the Debtors’ use of cash collateral authorized by the Cash Collateral Orders and the Debtors’ entry into the Hedging Agreements pursuant to the Hedging Orders.

19

16.Representations and Warranties.

| | (a) | Each Restructuring Support Party hereby represents and warrants on a several and not joint basis for itself and not any other person or entity that the following statements are true, correct, and complete, to the best of its knowledge following reasonable inquiry, as of the date hereof: |

| | (i) | it is duly organized, validly existing, and in good standing under the laws of the jurisdiction of its organization, and it has the requisite corporate power and authority to enter into this Agreement and to carry out the transactions contemplated by, and perform its respective obligations under, this Agreement; |

| | (ii) | the execution and delivery of this Agreement and the performance of its obligations hereunder have been duly authorized by all necessary corporate or other organizational action on its part and no other proceedings on its part are necessary to authorize and approve this Agreement or any of the transactions contemplated herein; |

| | (iii) | this Agreement has been duly executed and delivered by the Restructuring Support Party and constitutes the legal, valid, and binding agreement of the Restructuring Support Party, enforceable against the Restructuring Support Party in accordance with its terms; |

| | (iv) | the execution, delivery, and performance by it of this Agreement does not and shall not, in any material respect, (A) violate any provision of law, rule, or regulation applicable to it, or its certificate of incorporation or bylaws or other organizational documents, or (B) conflict with, result in a breach of, or constitute (with due notice or lapse of time or both) a default under any material contractual obligation to which it is a party; |

| | (v) | subject to the provisions of sections 1125 and 1126 of the Bankruptcy Code, this Agreement is the legally valid and binding obligation of it, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, or other principles relating to enforceability; |

| | (vi) | it has been represented by legal counsel of its choosing in connection with this Agreement and the transactions contemplated by this Agreement, has had the opportunity to review this Agreement with its legal counsel, and has not relied on any other statements made by any Party or its legal counsel as to the meaning of any term or condition contained herein or in deciding whether to enter into this Agreement or the transactions contemplated hereof; |

| | (vii) | the principal amount of its First Lien Claims, Second Lien Claims, and Notes Claims listed on its signature page of each Restructuring Support Party is correct as of the date hereof; and |

20

| | (viii) | either is (A) the sole beneficial owner of the principal amount of such First Lien Claims, Second Lien Claims, and Notes Claims indicated on its respective signature page hereto, or (B) has sole investment or voting discretion with respect to the principal amount of such First Lien Claims, Second Lien Claims, and Notes Claims, as applicable, and as indicated on its respective signature page hereto and has the power and authority to bind the beneficial owner of such First Lien Claims, Second Lien Claims, and Notes Claims to the terms of this Agreement. |

| | (b) | Each of the Debtors and ATLS hereby represent and warrant on a several and not joint basis for itself and not any other person or entity that the following statements are true, correct, and complete as of the date hereof: |

| | (i) | it is duly organized, validly existing, and in good standing under the laws of the jurisdiction of its organization, and it has the requisite corporate power and authority to enter into this Agreement and to carry out the transactions contemplated by, and perform its respective obligations under, this Agreement; |

| | (ii) | the execution and delivery of this Agreement and the performance of its obligations hereunder have been duly authorized by all necessary corporate or other organizational action on its part; |

| | (iii) | the execution, delivery, and performance by it of this Agreement does not and shall not (A) violate any provision of law, rule, or regulation applicable to it, or its certificate of incorporation or bylaws or other organizational documents, (B) conflict with, result in a breach of, or constitute (with due notice or lapse of time or both) a default under any material contractual obligation to which it is a party (other than, for the avoidance of doubt, a default that would be triggered as a result of the Chapter 11 Cases or any Debtor’s undertaking to implement the Restructuring through the Chapter 11 Cases) or (C) breach any fiduciary duty of the Debtors or ATLS; |

| | (iv) | this Agreement has been duly executed and delivered by each of the Debtors and ATLS and constitutes the legal, valid, and binding agreement of the Debtors, enforceable against each of the Debtors in accordance with its terms; |

| | (v) | the execution, delivery, and performance by it of this Agreement does not and shall not require any registration or filing with, consent or approval of, notice to, or any other action to, with, or by any federal, state or other governmental authority or regulatory body, except (A) any of the foregoing as may be necessary and/or required for disclosure by applicable federal or state securities or “blue sky” laws, (B) any of the foregoing as |

21

| | may be necessary and/or required in connection with the Chapter 11 Cases, including the approval of the Disclosure Statement and confirmation of the Plan, (C) filings of amended certificates of incorporation or articles of formation or other organizational documents with applicable state authorities, and other registrations, filings, consents, approvals, notices, or other actions that are reasonably necessary to maintain permits, licenses, qualifications, and governmental approvals to carry on the business of the Company, and (D) any other registrations, filings, consents, approvals, notices, or other actions, the failure of which to make, obtain or take, as applicable, would not be reasonably likely, individually or in the aggregate, to materially delay or materially impair the ability of any Party hereto to consummate the transactions contemplated hereby; |

| | (ix) | it has been represented by legal counsel of its choosing in connection with this Agreement and the transactions contemplated by this Agreement, has had the opportunity to review this Agreement with its legal counsel, and has not relied on any other statements made by any Party or its legal counsel as to the meaning of any term or condition contained herein or in deciding whether to enter into this Agreement or the transactions contemplated hereof; and |

| | (vi) | subject to the provisions of sections 1125 and 1126 of the Bankruptcy Code, this Agreement is the legally valid and binding obligation of it, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, or other similar laws relating to or limiting creditors’ rights generally, or by equitable principles relating to enforceability. |

17.Right to Solicit Alternative Transactions. The Company shall not solicit, encourage, and initiate any offer or proposal from, enter into any agreement with, or engage in any discussions or negotiations with, any person or entity concerning any actual or proposed transaction involving any or all of (i) another financial and/or corporate restructuring of any Debtor, (ii) a merger, consolidation, business combination, liquidation, recapitalization, refinancing, or similar transaction involving any Debtor, or (iii) any chapter 11 plan of reorganization other than the Plan (each, an “Alternative Transaction”);provided,however, that the Company may respond to any proposal or offer for an Alternative Transaction to the extent that the board of directors of the Company determines in good faith, and consistent with its fiduciary duties, in consultation with counsel, that such a response is necessary;provided,further,however, that the Company shall promptly provide copies of all such documentations and materials received by the Company concerning such an Alternative Transaction to the advisors to the Restructuring Support Parties, and in any event within one (1) business day.

18.Drilling Partnership Secured Hedging Facility Agreement.

(a) The Drilling Partnership Secured Hedging Facility Agreement shall be assumed pursuant to the Plan.

22

(b) Upon the RSA Effective Date, the Consenting Hedge Providers and Atlas Resources shall, and Atlas Resources shall cause the Participating Partnerships to, enter into the Limited Waiver Agreement attached hereto asExhibit G.

19.Enforceability/Automatic Stay. Each of the Parties acknowledges and agrees that this Agreement is being executed by sophisticated parties represented by competent counsel in connection with negotiations concerning a possible financial restructuring of the Company and in contemplation of possible chapter 11 filings by the Company and the rights granted in this Agreement are enforceable by each signatory hereto without approval of any court, including the Bankruptcy Court, and notwithstanding section 362 of the Bankruptcy Code.

20.No Waiver or Admissions. If the transactions contemplated herein are not consummated, or if this Agreement is terminated for any reason, nothing herein shall be construed as a waiver by any Party of any or all of such Party’s rights, remedies, or interests, and the Parties expressly reserve any and all of their respective rights, remedies, and interests. This Agreement shall in no event be construed as or be deemed to be evidence of an admission or concession on the part of any Party of any claim or fault or liability or damages whatsoever. Each of the Parties denies any and all wrongdoing or liability of any kind and does not concede any infirmity in the claims or defenses which it has asserted or could assert. No Party shall have, by reason of this Agreement, a fiduciary relationship in respect of any other Party or any person or entity, and nothing in this Agreement, expressed or implied, is intended to or shall be so construed as to impose upon any Party any obligations in respect of this Agreement except as expressly set forth herein. This Agreement and the Restructuring are part of a proposed settlement of a dispute among the Parties. Pursuant to Federal Rule of Evidence 408 and any applicable state rules of evidence, and any other applicable law, foreign or domestic, this Agreement and all negotiations relating thereto shall not be admissible into evidence in any proceeding, or used by any party for any reason whatsoever, other than a proceeding involving enforcement of the terms of this Agreement.

21.Relationship Among Parties. Notwithstanding anything herein to the contrary, the duties and obligations of the Restructuring Support Parties under this Agreement shall be several, not joint. Furthermore, it is understood and agreed that no Restructuring Support Party has any duty of trust or confidence in any form with any other Restructuring Support Party, and there are no commitments among or between them, except as expressly stated in this Agreement. In this regard, it is understood and agreed that any Restructuring Support Party may trade in the Senior Notes or other debt or equity securities of the Debtors without the consent of Debtors or any other Restructuring Support Party, subject toSection 12 of this Agreement. No Restructuring Support Party shall have any responsibility for any such trading by any other entity by virtue of this Agreement. No prior history, pattern, or practice of sharing confidences among or between Restructuring Support Parties shall in any way affect or negate this understanding and Agreement.

22.Specific Performance. It is understood and agreed by the Parties that money damages may not be a sufficient remedy for any breach of this Agreement by any Party, and that each non-breaching Party shall be entitled to seek specific performance and injunctive or other equitable relief as a remedy of any such breach, including, without limitation, an order of the Bankruptcy Court or other court of competent jurisdiction requiring any Party to comply promptly with any of its obligations hereunder.

23

23.Governing Law and Jurisdiction. This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, without regard to such state’s choice of law provisions which would require the application of the law of any other jurisdiction, except where preempted by the Bankruptcy Code. By its execution and delivery of this Agreement, each of the Parties irrevocably and unconditionally agrees for itself that any legal action, suit, or proceeding against it with respect to any matter arising under, arising out of, or in connection with this Agreement or for recognition or enforcement of any judgment rendered in any such action, suit, or proceeding, shall be brought in either the United States District Court for the Southern District of New York or any New York State court sitting in the Borough of Manhattan, New York City, and by execution and delivery of this Agreement, each of the Parties irrevocably accepts and submits itself to the exclusive jurisdiction of such court, generally and unconditionally, with respect to any such action, suit or proceeding. Notwithstanding the foregoing, if the Chapter 11 Cases are commenced, each Party agrees that the Bankruptcy Court shall have exclusive jurisdiction of all matters arising under, arising out of, or in connection with this Agreement. By execution and delivery of this Agreement, and upon commencement of the Chapter 11 Cases, each of the Parties irrevocably and unconditionally submits to the personal jurisdiction of the Bankruptcy Court solely for purposes of any action, suit, or proceeding or other contested matter arising under, arising out of, or in connection with this Agreement, or for recognition or enforcement of any judgment rendered or order entered in any such action, suit, proceeding, or other contested matter.

24.Waiver of Right to Trial by Jury. Each of the Parties waives any right to have a jury participate in resolving any dispute, whether sounding in contract, tort, or otherwise, between any of them arising out of, arising under, in connection with, relating to, or incidental to the relationship established between any of them in connection with this Agreement. Instead, any disputes resolved in court shall be resolved in a bench trial without a jury.

25.Successors and Assigns. This Agreement shall inure to the benefit of and be binding upon each of the Parties and their respective successors, assigns, heirs, transferees, executors, administrators, and representatives, in each case solely as such parties are permitted under this Agreement;provided,however, that nothing contained in thisSection 25 shall be deemed to permit any transfer, tender, vote, or consent of any claims other than in accordance with the terms of this Agreement.

26.No Third-Party Beneficiaries. This Agreement shall be solely for the benefit of the Parties hereto (or any other party that may become a Party to this Agreement pursuant toSection 12 of this Agreement), and no other person or entity shall be a third-party beneficiary of this Agreement.

27.Consideration. The Parties acknowledge that, other than the agreements, covenants, representations, and warranties set forth herein and to be included in the Definitive Documentation, no consideration shall be due or paid to the Restructuring Support Parties in exchange for their obligations in this Agreement.